- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 19-03-2023

- WTI portrays corrective bounce from the lowest levels since December 2021.

- Oversold RSI favors recovery but convergence of 10-DMA, previous support line from late 2021 probe buyers.

- 19-month-old ascending support line lures sellers amid bearish MACD signals.

WTI crude oil picks up bids to consolidate recent losses around $67.15 during Monday’s Asian session. In doing so, the black gold bounces off the 15-month low marked the previous day amid oversold RSI conditions.

However, the energy benchmark remains well below the previous key support confluence comprising the 10-DMA and an upward-sloping support line from December 2021, now resistance near $71.20-30.

It should be noted, however, that the latest rebound could aim for $70.00.

That said, a horizontal area comprising multiple levels marked since early January, around $72.70, appears the key hurdle for the WTI bulls to cross to retake control.

Following that, the mid-month high of around $77.55 could lure the WTI crude oil buyers.

Alternatively, a fresh downside could aim for the latest bottom surrounding $65.45 before aiming for the December 2021 low of around $62.30.

It’s worth mentioning that an upward-sloping trend line from August 2021, around 62.30, also appears the key downside filter to watch for the Oil bears.

Should the quote remains bearish past $62.30, a slump towards the August 2021 bottom of $61.80, as well as to the $60.00 round figure, can’t be ruled out.

WTI: Daily chart

Trend: Further downside expected

- USD/CHF prints mild gains after two-day losing streak, grinds higher of late.

- Market sentiment dwindles as UBS-Credit Suisse deal struggle to please traders amid fears of more banking fallouts.

- Fed’s 0.25% rate hike appears given but SNB may surprise markets.

- Preliminary readings of March PMIs, baking sector headlines also appear important for fresh impulse.

USD/CHF struggles to defend the first daily gains in three as it seesaws around 0.9270 during early Monday morning in Asia. It should be noted that the Swiss Franc (CHF) pair posted the first weekly gain in the last three even as the US Dollar marked broad losses.

The reason could be linked to the speculations surrounding the Swiss National Bank’s (SNB) refrain from tighter monetary policy measures amid the latest Credit Suisse fallout. However, the news that the UBS is up for buying the troubled Credit Suisse also offered a sigh of relief to the market sentiment and helps the US Treasury bond yields to recover, which in turn allows the USD/CHF to remain mildly bid.

On the contrary, news shared by Reuters suggesting two more banks are struggling in Europe seemed to have also favored the USD/CHF bulls. On the same line could be the market’s cautious mood ahead of the key monetary policy meeting of the US Federal Reserve (Fed) and the Swiss National Bank (SNB).

The banking sector rout drowned the market sentiment in the last week but the US Dollar and the Swiss Franc had to fall amid downbeat Treasury bond yields, as well as the SNB’s role in defending the Credit Suisse. It should be noted that the downbeat US data added strength to the greenback’s south-run the previous week.

During the last week, the US Consumer Price Index (CPI) for February matched 6.0% YoY market expectations versus 6.4% prior while the Retail Sales also marked -0.4% MoM figure versus -0.3% expected and 3.2% previous readings. Further, US Consumer Confidence per the University of Michigan's (UoM) Consumer Confidence Index dropped to 63.4 for March versus 67.0 expected and prior. The details suggest that the year-ahead inflation expectations receded from 4.1% in February to 3.8%, the lowest reading since April 2021, while the 5-year counterpart dropped to 2.8% from 2.9% previous reading. Furthermore, US Industrial Production remained unchanged in February versus 0.2% expected and January's 0.3% (revised from 0%) expansion.

Against this backdrop, Wall Street closed with losses and the US two-year Treasury bond yields dropped the most in three years.

Moving forward, a light calendar could restrict USD/CHF moves on Monday but the bulls are likely to keep the reins amid hopes of that the SNB may cite the banking sector fallout to disappoint markets. That said, the Fed is expected to announce 0.25% rate hike while the SNB is up for another 0.50% increase in the benchmark rate during their upcoming monetary policy meetings on Wednesday and Thursday respectively.

Technical analysis

Sustained bounces off the 50-DMA, close to 0.9260 at the latest, could help USD/CHF to challenge a one-week-old descending resistance line, around 0.9295 by the press time.

- NZD/USD is struggling in extending its upside above 0.6280 ahead of the PBoC policy.

- To provide assistance to the economic recovery agenda, PBoC might remain dovish on interest rates.

- Rising expectations for a steady monetary policy by the Fed are restoring the confidence of investors in US equities.

The NZD/USD pair is facing barriers in extending its upside above the immediate resistance of 0.6280 in the early Asian session. The Kiwi asset is expected to remain on the tenterhooks as investors are awaiting the release of the interest rate decision by the People’s Bank of China (PBoC) for further action.

To provide assistance to the economic recovery agenda in the Chinese economy, PBoC might remain dovish on interest rates. Economist at UOB Group suggests that the PBoC could reduce the Loan Prime Rate (LPR) at its next meeting on March 20. They further added, “With the need for further support measures toward the real economy and for 5Y loan prime rate (LPR) to fall further to boost demand for homes, we see the possibility for the 1Y LPR to fall to 3.55% and 5Y LPR to 4.20% in Mar, following the National People’s Congress (NPC).”

It is worth noting that New Zealand is one of the leading trading partners of China and a dovish policy by the PBoC would also be supportive of the New Zealand Dollar.

Meanwhile, the position of NZ current account deficit is impacting its long-term worthiness. Data released last week showed that the current account deficit blew out to 8.9% of Gross Domestic Product (GDP) in 2022 as the nation imported more goods and services than it exported. While S&P had forecast the deficit would be 6.7% in June last year and ease to 5.8% by mid-2023.

Bloomberg reported, "New Zealand’s credit grades with S&P Global Ratings could come under pressure if the nation’s current account deficit remains too big."

S&P500 futures are showing decent gains in the early Tokyo session after settling last week with significant losses, portraying a minor optimism in the overall risk-aversion theme. Rising expectations for a steady monetary policy by the Federal Reserve (Fed) are restoring the confidence of investors in United States equities. The US Dollar Index (DXY) has also attempted a recovery move from 103.65, however, the upside looks capped led by the banking sector’s debacle.

- USD/JPY bulls cheer as UBS set to take over Credit Suisse.

- Global central banks unite to offer liquidity via US Dollar swap lines.

- Two major banks in Europe are examining scenarios of contagion.

USD/JPY looks to consolidate just above the 131.50 mark amid a jittery environment fueled by the Credit Suisse fallout during the weekend. Finally, Credit Suisse is going to be taken over by UBS as the Swiss authorities persuaded the latter on Sunday to make a bid for a takeover.

The news came just after some of the world's top central banks started to offer daily loans in US dollars to their banks to reduce any stress in the financial system.

In this globally coordinated response, the Federal Reserve (Fed) has also stepped in along with the Bank of Canada (BoC), Bank of Japan (BoJ), Swiss National Bank (SNB), and the European Central Bank (ECB).

The liquidity injection will be done through swap lines, where central banks can offer US Dollar operations with seven-day maturity. The emergency swap line was first introduced during the COVID pandemic to ease US Dollar availability.

Prior to this joint effort, the Fed had already opened the discount window for commercial banks, and the banks have borrowed nearly $164 billion amid this liquidity crisis. As a result, we have seen a slight spike in the Fed balance sheet despite the ongoing Quantitative Tightening (QT) program. One can attribute this as a mini version of QE, which is contrary to the ongoing QT. We have seen the same scenario with the BoE a while ago during the pension fund crisis.

It seems contagion in the global banking sectors is not looking to be tamed yet, citing some Reuters reports. At least two major banks in Europe are examining scenarios of contagion in the region's banking sector and are looking to the Federal Reserve and the ECB for stronger signals of support.

It's important to note how the Fed will address this entire situation in their upcoming FOMC meeting this week and whether are they able to deliver the expected 25 basis point rate hike.

Levels to watch

“At least two major banks in Europe are examining scenarios of contagion in the region's banking sector and are looking to the Federal Reserve and the ECB for stronger signals of support,” two senior executives close to the discussions told Reuters.

“The fallout from the crisis of confidence in Credit Suisse Group AG and the failure of two U.S. banks could ripple through the financial system next week, the two executives separately told Reuters on Sunday,” reported Reuters.

The news also quotes the two anonymous people saying that the two banks have held their internal deliberations on how soon the European Central Bank should weigh in to highlight banks' resilience, specifically their capital and liquidity positions, per Reuters.

Key quotes

A focus of these internal discussions is whether such statements might create even more alarm if they are made too soon.

The executives said their banks and the sector are well capitalized and their liquidity is strong, but they fear the crisis of confidence will sweep up more lenders.

One of the executives said the Federal Reserve might have to move first as the failures of Silicon Valley Bank and Signature Bank in the United States earlier this month triggered concerns in Europe.

A third executive at another major European bank separately told Reuters they thought the ECB would be reluctant to make a public statement before markets reopen, questioning whether they would judge it necessary at this time and adding that the main focus was still on talks in Switzerland.

In a sign of further strain, a coalition of midsize US banks, Mid-Size Bank Coalition of America (MBCA), has asked regulators to extend FDIC insurance to all deposits for the next two years, Bloomberg News reported on Saturday citing an MBCA letter to regulators.

The letter said that extending insurance will stop the exodus of deposits from smaller banks, in turn helping to stabilize the banking sector.

Market implications

The news joins the pre-Fed anxiety to tame the market’s risk-on mood, which in turn allows the risk-barometer pair AUD/USD to grind higher past 0.6700, around 0.6715 by the press time.

Also read: AUD/USD grinds higher past 0.6700 on Credit Suisse news, comments from RBA’s Kent, Fed eyed

- USD/CAD is expressing volatility contraction ahead of Fed inflation and Canada’s inflation.

- The USD Index has corrected further to 103.65 as the Fed is expected to go light on interest rates.

- A 40.00-60.00 range oscillation by the RSI (14) indicates that investors are awaiting a fresh trigger for further action.

The USD/CAD pair has found a cushion around 1.3700 after a marginal correction in the Asian session. The Loonie asset is showing an expression of volatility contraction as investors are awaiting the release of Canada’s Consumer Price Index (CPI) data and the interest rate decision by the Federal Reserve (Fed), which will release on Tuesday and Wednesday respectively.

The option for an unchanged monetary policy decision by the Federal Reserve (Fed) is gaining the limelight as banking shakedown in the United States has impacted the confidence of investors dramatically.

Meanwhile, the US Dollar Index (DXY) has corrected further to 103.65 as the Fed is expected to go light on interest rates. S&P500 futures have shown a recovery move after a bearish Friday’s settlement, however, investors’ risk appetite for US equities is extremely weak.

On the Canadian Dollar front, investors are awaiting Tuesday’s Canada inflation data. As per the consensus, the headline Consumer Price Index (CPI) is expected to accelerate by 0.4%, lower than the former release of 0.5%. This might drag the annual headline CPI further to 5.5%. Also, the annual core CPI is expected to trim to 4.6% from the former release of 5.0%.

USD/CAD is auctioning in a Symmetrical Triangle chart pattern on an hourly scale, which indicates a sheer volatility contraction followed by an expansion in the same. The downward-sloping trendline of the chart pattern is plotted from March 10 high at 1.3862 while the upward-sloping trendline is placed from March 14 low at 1.3657.

Overlapping 20-period Exponential Moving Average (EMA) at 1.3724 with the asset price indicates a consolidation ahead.

Adding to that, a 40.00-60.00 range oscillation by the Relative Strength Index (RSI) (14) indicates that investors are awaiting a new trigger for further action.

A decisive breakdown of March 14 low at 1.3652 would drag the loonie asset toward March 07 low at 1.3600, followed by March 03 low at 1.3555.

In an alternate scenario, a confident recovery above March 14 high at 1.3773 would drive the major toward March 09 high at 1.3835 and the round-level resistance at 1.3900.

USD/CAD hourly chart

- AUD/USD cheers risk-on mood, cautiously optimistic comments from RBA’s Kent.

- RBA’s Kent conveys soundness of Aussie banks, defends rate hike moves.

- Hopes that UBS buyout of Credit Suisse could tame bond market rout favor the sentiment.

- RBA Meeting Minutes, preliminary PMIs for March and FOMC Meeting are the week’s key events to watch for clear directions.

AUD/USD remains mildly bid above 0.6700, around 0.6715 by the press time, as upbeat comments from the Reserve Bank of Australia (RBA) Official joins the market’s cautious optimism over the UBS-Credit Suisse deal during early Monday. However, fears of more banking sector rout and anxiety ahead of this week’s top-tier data/events probe the Aussie pair buyers of late.

Christopher Kent, Assistant Governor (Financial Markets), gave a speech on "Long and Variable Monetary Policy Lags" at the KangaNews Debt Capital Market Summit, in Sydney, early Monday morning in Asia-Pacific. The policymaker initially followed the suit of global central bankers while trying to rule out fears of the US and European banking sector fallout. More importantly, RBA’s Kent said that RBA is very conscious of the challenges facing borrowers from rapid rate rises.

Also read: RBA’s Kent: Australian banks are unquestionably strong

Apart from the cautious optimism spread by comments from RBA’s Kent, news that the UBS is up for buying the troubled Credit Suisse also offered a sigh of relief to the market sentiment and propelled the risk-barometer AUD/USD pair.

It should, however, be noted that the news shares by Reuters suggesting two more banks are struggling in Europe seemed to have poked the AUD/USD bulls. On the same line could be the market’s cautious mood ahead of the key Federal Reserve (Fed) Monetary Policy meeting.

During the last week, the fallout of the US and European banks propelled the market’s move towards the US bond and Gold, which in turn drowned the US Dollar while fuelling the AUD/USD prices. In addition to the downbeat yields, the US Dollar also had to bear the burden of downbeat US inflation and Retail Sales data.

On Friday, US Consumer Confidence per the University of Michigan's (UoM) Consumer Confidence Index dropped to 63.4 for March versus 67.0 expected and prior. The details suggest that the year-ahead inflation expectations receded from 4.1% in February to 3.8%, the lowest reading since April 2021, while the 5-year counterpart dropped to 2.8% from 2.9% previous reading. Furthermore, US Industrial Production remained unchanged in February versus 0.2% expected and January's 0.3% (revised from 0%) expansion.

Amid these plays, Wall Street closed with losses and the US two-year Treasury bond yields dropped the most in three years.

Having witnessed the initial market reaction to comments from RBA’s Kent, AUD/USD traders may have to rely on the risk catalysts amid a light calendar on Monday, as well as a cautious mood ahead of the key Federal Open Market Committee (FOMC) monetary policy meeting. It's worth noting that Tuesday’s RBA Meeting Minutes and Thursday’s preliminary readings of Australia’s March month S&P Global PMIs will also be important to observe for fresh impulse.

Technical analysis

A clear upside break of six-week-old descending resistance line, now immediate support around 0.6630, directs AUD/USD buyers towards the 200-DMA hurdle of near 0.6765.

“US regulators were in touch with Swiss counterparts on UBS-Credit Suisse deal,” said an anonymous US Official during Sunday per Reuters.

Additional comments

US bank deposits have stabilized, with outflows either slowing, stopping or in some cases reversing.

US banks have limited exposure to credit suisse after reducing exposure in recent months.

Market sentiment remains fragile

The news fails to improve market’s mood, even if the traders begin the key week on a firmer footing after weekend news of the UBS-Credit Suisse deal. The reason could be linked to Reuters’ headlines suggesting more banking fallouts in Europe.

Also read: UBS to take over Credit Suisse

“Capital, liquidity positions well above APRA’s regulatory requirements,” said Christopher Kent, Reserve Bank of Australia’s (RBA) Assistant Governor (Financial Markets).

“Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent also said the full impact of increases in interest rates was taking longer to filter through to the economy due to a higher share of fixed-rate mortgages and the savings amassed by households during the pandemic,” reported Reuters.

More comments

RBA is very conscious of the challenges facing borrowers from rapid rate rises.

Household savings amassed during pandemic adding to lag in monetary policy.

A wide range of borrowers appear to have built up sizeable mortgage buffers.

This means that it's likely to take longer than usual to see the full effect of higher interest rates on household cash flows and household spending.

The bank will continue to closely monitor the transmission of monetary policy and its impact on household spending, the labour market and inflation.

The Board will respond as necessary to bring inflation back to target in a reasonable time.

Volatility in Australian financial markets has picked up but markets are still functioning and, most importantly, Australian banks are unquestionably strong - the banks' capital and liquidity positions are well above regulatory requirements.

Australian banks were also well-positioned to repay loans made to them by the RBA during the pandemic, with the first tranche of A$76 billion due between April and September.

AUD/USD retreats from intraday high

Despite the positive comments, AUD/USD pares intraday gains as it drops from near the daily top surrounding 0.6720 to 0.6705 by the press time.

- Gold price has printed a fresh 11-month high at $1,988.33 as it is being treated as a safe-haven amid the banking fiasco.

- Fed policymakers are tied to go extremely hawkish as they are required to restore investors’ confidence.

- Gold price is further approaching the horizontal resistance plotted around $2,070.54.

Gold price (XAU/USD) printed a fresh 11-month high at $1,988.33 on Friday. The precious metal is approaching the psychological resistance of $2,000.00 and is expected to test soon as the odds of an unchanged interest rate policy by the Federal Reserve (Fed) have accelerated dramatically.

The odds of a steady monetary policy have got more limelight as January’s inflation data has resulted in a one-time blip, February’s Consumer Price Index (CPI) has shown that it is in a declining trend, and now Fed policymakers have a responsibility of restoring investors’ confidence in the United States economy after the commercial banks’ fiasco.

As per the CME Fedwatch tool, investors are now expecting the possibility of an unchanged monetary policy with 38% chances while the rest are favoring a 25 basis point (bps) interest rate hike by Fed chair Jerome Powell to 4.75-5.00%.

S&P500 futures were heavily beaten on Friday as investors are worried about banking sector turmoil. In times of banking shakedown, investors are considering Gold as a safe-haven asset. The US Dollar Index (DXY) found intermediate support around 103.65, however further downside looks solid as Fed policymakers are tied to go extremely hawkish in the interest rate decision to be delivered on Wednesday.

In a recent poll by Reuters, 76 of 82 economists believe that the US Federal Reserve (Fed) would raise its policy rate by 25 basis points to the range of 4.75-5% following the March FOMC meeting

Gold technical analysis

Gold price has delivered a breakout of the horizontal resistance plotted from the February 02 high at $1,959.80, which has turned support on a daily scale. The asset is riding the Bollinger Bands (20,2), which indicates a sheer strength in the Gold bulls.

The precious metal is further approaching the horizontal resistance plotted from the 08 March 2022 high at $2,070.54.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which indicates that the upside momentum is extremely solid.

Gold daily scale

- GBP/USD bulls move in at the start of the week.

- Markets look ahead to this week´s BoE and Fed.

The US Dollar fell on Friday sending GBP/USD to test 1.22 the figure although further declines in the shares of Credit Suisse and First Republic Bank rattled markets and weighed on the pair later in the day. However, UBS is said to take over Credit Suisse in a deal aimed at stemming what was fast becoming a global crisis of confidence which is putting a bid back into the pair. GBP/USD is up by some 0.2% and trading back in the 1.22s.

The UBS and Credit Suisse deal is expected to be closed by the end of this year. Colm Kelleher, chairman of UBS Group, said the agreement "represents enormous opportunities". He also said that his bank's long-term aim would be to downsize Credit Suisse's investment banking business and align it with the "conservative risk culture" of UBS.

Meanwhile, markets will look ahead to this week´s events in the Federal Reserve and Bank of England interest rate decisions. The BoE is expected to hike by 25bp on 23 March bringing it to 4.25%.

´´Markets are currently pricing around 15bp for the meeting, thus close to an equal implied probability for an increase of 25bp in the Bank Rate and an unchanged decision,´´ analysts at Danske Bank said. ´´While the latest UK economic data releases, in our view, still support a 25bp hike on Thursday, we acknowledge that the probability of the BoE keeping the policy rate unchanged has risen considerably amid rising systemic risk fears. This risk is only supported by what we consider to be a fairly cautious Monetary Policy Committee (MPC).´´

As for the Fed, analysts at TD Securities expect a 25bp rate hike, taking the Fed Funds rate to 4.75%-5.00%. ´´Post-meeting communication is likely to emphasize that the Fed is not done yet in terms of tightening (also reflected in a slightly more hawkish dot plot), with officials also flagging the more uncertain economic environment, resulting in an even larger emphasis on data dependence.´´

UBS is said to take over Credit Suisse in a deal aimed at stemming what was fast becoming a global crisis of confidence. Credit Suisse, the 167-year-old embattled lender had been brought to the brink of financial calamity last week, despite securing a $54bn (£44bn) credit line from Switzerland's central bank.

çSKy News reported that that takeover was announced on Sunday evening - UBS will pay 3bn Swiss francs (£2.6bn) to acquire Credit Suisse, it has agreed to assume up to 5bn francs (£4.4bn) in losses, and 100bn Swiss francs (£88.5bn) in liquidity assistance will be available to both banks.

The deal is expected to be closed by the end of this year.

Meanwhile, European Central Bank (ECB) supervisors do not expect contagion for euro zone banks from the market turmoil, a source familiar with the content of an ad hoc supervisory board meeting this week told Reuters.

- EUR/USD has popped higher in the open and eyes 1.0700.

- UBS is said to take over Credit Suisse in a deal aimed at stemming what was fast becoming a global crisis of confidence.

EUR/USD has started out the day on the bid following the news that Switzerland's UBS has reached a deal to buy struggling rival Credit Suisse after an intense weekend of negotiations. EUR/USD is up 0.2% at the start of trade, reaching a high of 1.0689.

The 50 bps move from the European Central Bank on March 16 was accompanied by a risk-on the environment which has been weighing on the US Dollar as investors see the light at the end of the tunnel with respect to the banking crisis. Credit Suisse's chief executive said on Friday the bank was working hard to stem customer outflows and on Sunday UBS is said to take over Credit Suisse in a deal aimed at stemming what was fast becoming a global crisis of confidence.

Credit Suisse, the 167-year-old embattled lender had been brought to the brink of financial calamity last week, despite securing a $54bn (£44bn) credit line from Switzerland's central bank. Meanwhile, European Central Bank (ECB) supervisors do not expect contagion for euro zone banks from the market turmoil, a source familiar with the content of an ad hoc supervisory board meeting this week told Reuters.

´´In our view prevailing uncertainties suggest that USD strength is unlikely to fade too much in the weeks ahead. We have not (yet) made any adjustments to our EUR/USD forecasts due to recent market events,´´ analysts at Rabobank said. ´´We are forecasting EUR/USD at 1.06 on a 1 month and 1.05 in 3 months. We continue to expect the USD to give up some ground later in the year.´´

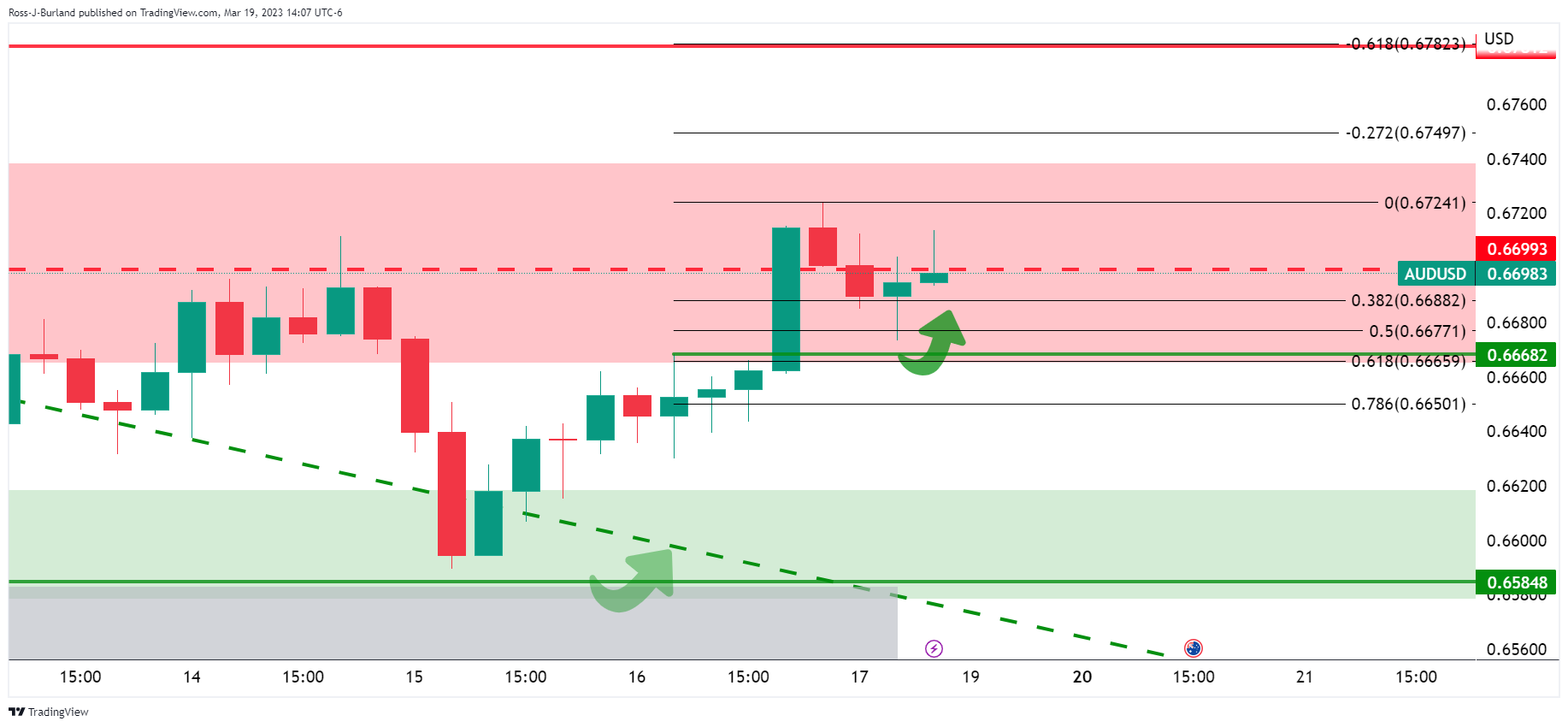

- AUD/USD bulls are in the market with the 0.67s eyed.

- AUD/USD is taking on a key resistance area.

The Australian Dollar edged higher and continued to correct from the four-month lows as a rescue package for First Republic Bank eased market concerns.

AUD/USD remains on the backside of the prior bear trend and breaking out as the following illustrates:

AUD/USD daily chart

With below 0.6900, the outlook is bearish but a correction is playing out.

H1 chart

The bulls stepped in again on the correction in resistance which leaves a bullish bias for the open for an additional test in the 0.67s.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.