- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 17-03-2023

On Wednesday, the Federal Reserve will announce its decision on monetary policy. Analysts at Danske Bank see the Fed raising rates by 25 basis points despite recent turmoil amid banking sector jitters.

Fed cannot afford to stop tightening monetary policy

“This week, the ECB emphasized that there is no trade-off between inflation and financial stability risks, and we expect Fed to deliver a similar message next week. The new Bank Term Funding Program, allowing banks to tap liquidity from the Fed against collateral valued at par, provided banks with USD11.9 billion during its first three days of use.”

“So far, short-term real rates and broader financial conditions have remained relatively stable. Our in-house 'growth tax' measure is at modestly restrictive territory, as the tightening in credit and equity components has compensated for the lower yields and mortgage rates. This suits Fed well as long as macro data remains strong, and for the time being, we like our call of a 25bp rate hike next week and a terminal rate at 5.00-5.25% in May. Hence, we see modest upside risks to short-term rates from current levels.”

Next Thursday, the Bank of England (BoE) will announce its decision on monetary policy. A 25 basis point rate hike to 4.25% is expected. Analysts at Rabobank also see a quarter-point rate increase and warn that such scenario is not fully priced in the interest market, “which indicate that the chance of a hold has increased following the collapse of SVB.”

Fear, uncertainty and doubt

“The 2007-2008 financial crisis taught us that even small failures can lead to significant problems. While SVB's poor liquidity risk management was the underlying cause of its downfall, the shift from a 'lower for longer' to a 'higher, possibly for longer' interest rate regime acted as the trigger. This raises the question of whether other financial institutions could eventually face a similar situation, fuelling the infamous trio of fear, uncertainty and doubt.”

“We would therefore expect the hiking cycle to continue at a more moderate pace of 25bp at next week’s meeting. That would lift Bank rate to 4.25%. With external members Tenreyro and Dhingra surely not voting for an increase, five out of seven remaining policy makers would have to vote for such a hike. Indeed, it wouldn’t even come as a surprise if we’d see a three-waysplit, with Tenreyro and/or Dhingra even voting for a cut.”

- Gold price surged on Friday, extending weekly gains to over $100.

- New context of lower yields and banking jitters boost gold’s demand.

- XAU/USD eye best week in years.

Gold price moved further to the upside during the American sessions, breaking above $1,980. Late on Friday, XAU/USD stands at $1,982 the highest level since April 2022 and on its way to the third-highest weekly close on record.

From the level it had a week ago, the yellow metal is up by 6.3%. A sharp reversal in Treasury yields is driving the rally in Gold price. Bonds are having the week in years. Financial turmoil weighed on monetary policy expectations and the economic outlook.

Next week the Federal Reserve will announce its decision. A 25 basis point rate hike is expected. A few days ago analysts were asking 25 or 50 after US inflation and employment data. The new scenario includes the odds of a pause at the upcoming meeting. Things have changed dramatically, triggering an impressive rally in XAU/USD.

Seen Gold price above $2,000 next week looks likely. Even when price moves consistently to the upside, it makes sharp corrections. In the current context, traders should take extra caution.

Technical levels

Here is what you need to know for next week

Wall Street indexes ended higher a volatile week as traders sail in rough waters. The Nasdaq gained more than 4%, on a bumpy trip. The VIX moderated, rising around 2% over the week, but is up 25% from the level it had a months ago. Banking concerns again dominated price action across financial markets. European and Asian indices closed with weekly losses.

What it started a week ago with the Silicon Valley Bank (SVB), continued with Signature Bank, Credit Suisse (that stays on the lookout) and the First Republic Bank. Financial market turbulences will remain centre-stage over the next days.

Next Wednesday, the Fed will likely raise interest rates by 25 bps, despite market tensions. If the US central stays on hold afraid of the current context, it could trigger a shock in markets that could offset the positive news of a pause of the tightening cycle. The clues about the future will be watched closely. China on Monday is seen leaving rates unchanged.

US Treasuries had the biggest weekly gains in years. Yields across the globe collapse as investors fly to quality amid rising odds of interest rate cuts before year-end. The Japanese Yen was the main winner among currencies of this context. USD/JPY lost almost 300 pips.

The US Dollar Index (DXY) posted the lowest weekly close in five weeks. The deterioration in market sentiment did not boost the Greenback enough. If systemic risk fears start to dominate price action the DXY could make a strong comeback.

The European Central Bank (ECB) raised interest rates by 50 basis points as expected and dropped forward guidance. Economic data is being overshadowed by current developments; however, next week’s PMIs will gather attention. French President Emmanuel Macron will face a non-confidence vote next week. The banking crisis weighed on the Euro. EUR/GBP posted the lowest close since mid-January. EUR/USD ended the week flat looking at the 1.0700 area, after holding above critical 1.0500.

Better-than-expected economic data from the UK offered support to the Pound. GBP/USD had the best weekly performance since mid-January, rising toward 1.2200. Next week, Bank of England’s Monetary Policy Committee will met. Market participants expect a final 25 basis points rate hike.

The Swiss franc was hit by the banking chaos, that included the Credit Suisse. The situation forced the Swiss National Bank (SNB) to take action. The SNB will announce its monetary policy decision on Thursday. February’s inflation in Switzerland surprised on the upside, but the current turmoil could keep the SNB away from another hike. Again USD/CHF rebounded sharply from near 0.9000, to the 20-week Simple Moving Average. EUR/CHF rose from four-week lows past 0.9900.

USD/CAD finished the week lower around 1.3700 but far from the bottom. Next week, the key report from the Canadian economy will be February’s Consumer Price Index (CPI) on Tuesday. The kiwi was among the biggest gainers despite weak New Zealand Q4 GDP data. The

AUD/USD had the best week in months, helped by a weaker US Dollar and also by upbeat Australian employment data.

Gold is another major winner rising more than a hundred dollar during the week, approaching $2,000. The yellow metal is also benefiting from risk aversion and the reversal in bond yields.

Bitcoin keeps moving north and is back above $26,500 after rising more than 20% during the week.

It was a wild week for emerging market currencies. USD/MXN jumped for the second week in a row. The pair erased a 10% YTD loss but failed to hold above 19.00.

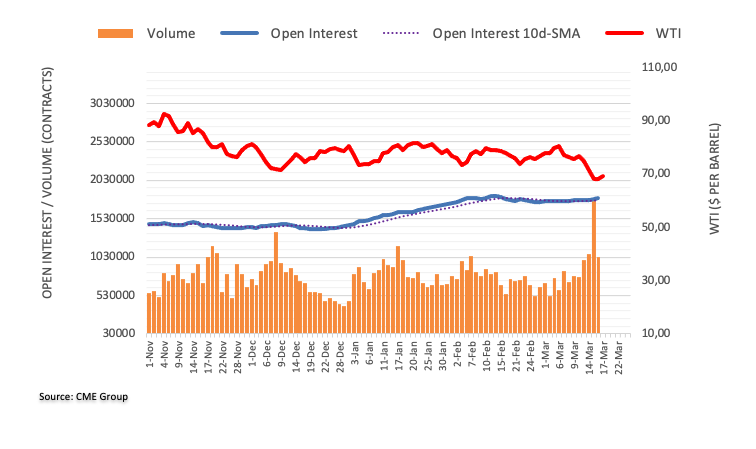

- Financial turmoil weighs on investors’ mood and drags black gold lower.

- WTI bounced modestly after posting a fresh 2023 low of $65.22 a barrel.

The barrel of West Texas Intermediate fell to $65.22 on Friday, its lowest since November 2022. It currently trades at around $67.30 a barrel, breaking lower amid financial turmoil weighing on the market mood.

The banking crisis triggered by Silicon Valley Bank (SVB) and Signature Bank last week escalated, with Credit Suisse under siege after its top shareholder ruled out providing financial assistance to the company. Stock markets collapsed despite authorities’ efforts to ensure the banking sector was strong enough to bare with the situation.

Nevertheless, concerns remained after SVB officially announced its bankruptcy on Friday, while yet another bank came under scrutiny, First Republic. European and US indexes trade in the red and are poised to finish the week in negative territory.

WTI, in the meantime, is down for a fifth consecutive day, with daily technical readings hinting at continued declines ahead. Once below the aforementioned low, the slump could extend to $62.41, December 2021 monthly low. A break below the latter will likely attract speculative buying, with $60.00 acting as a major psychological barrier. The black gold is currently finding sellers at around $70.00, with gains above the level unlikely to prosper.

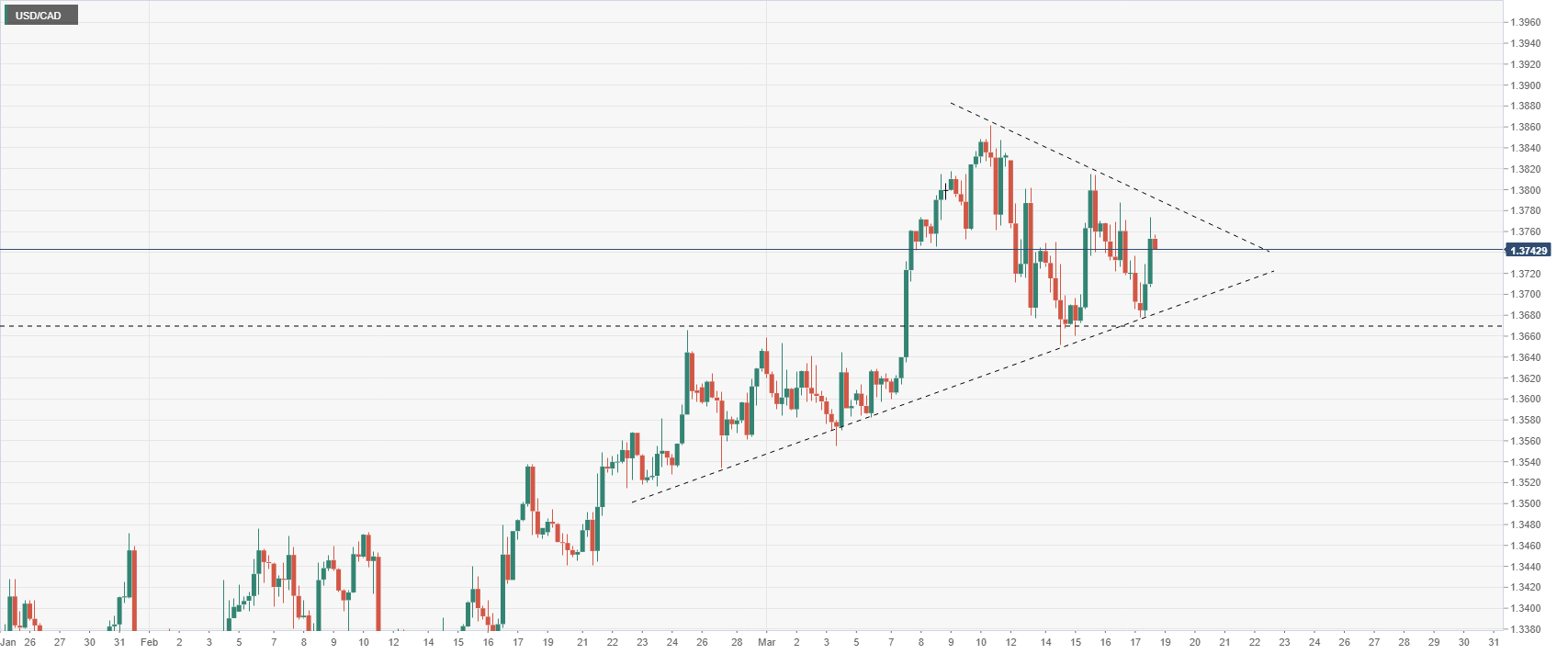

- USD/CAD still down for the week and pointing to the upside.

- US Dollar mixed on Friday between lower US yields and risk aversion.

- Key events for next week: Canada CPI (Tuesday) and FOMC meeting (Wednesday).

The USD/CAD printed a fresh daily high on Friday at 1.3772, amid a weaker Loonie and a mixed Greenback. After moving away from the bottom, the pair is about to post a small weekly loss.

The bad and the ugly

Data released on Friday showed the Canadian Industrial Product Price Index dropped 0.8%, a surprise considering market expectations of a 1.6% increase. The Raw Material Price Index fell 0.4%, below the estimate 0%. The economic figures did not help the Loonie, that is among the worst performers on Friday.

Next week, the key report from the Canadian economy will be February’s Consumer Price Index (CPI) on Tuesday. It is expected to show an increase of 0.4% MoM, and the annual rate slowing from 5.9% in January to 5.5%.

The US Dollar is mixed on Friday, attempting a recovery as stocks in Wall Street deepen losses. US yields are down by 4% on average, with the 10-year at 3.41%, slightly above March lows.

Markets remain anxious with the banking turmoil and next week is the FOMC meeting. The consensus is still for a 25bps rate hike but the end of the tightening cycle is seen sooner than previously thought. The change in expectations weighed on the Greenback.

Higher lows, lower highs

The USD/CAD has been making higher lows and lower highs during the last sessions. On Friday, it reversed from a two-day low at 1.3676 and jumped to 1.3763. The short-term direction is not clear.

The pair remains above the 20-day Simple Moving Average (1.3655) and also above the 1.3660/70 key support area. While above that two supports, the outlook looks constructive for the USD/CAD.

USD/CAD 4-hour chart

Technical levels

Repricing of the Fed’s terminal rate will drive the Gold price in the short-term. Economists at ANZ Bank expect the Fed to pause its interest rate hiking cycle this year. This should lower the USD and leave US real yields intact, then lifting XAU/USD in the second half of 2023.

A weakening greenback will be a key tailwind for Gold prices

“Improving fundamentals across other major economies could limit the greenback’s upside. Our DXY forecast trajectory remains unchanged, and has the index falling to 98 by end of the year. This will be a tailwind for the Gold market.”

“We believe recalibration of market expectations around the FFR could keep gold prices volatile in the short-term. Nevertheless, we still expect the Fed to pause and for yields to trend lower towards year-end, which should support Gold prices in H2 2023.”

“We see last year’s monetary tightening starting to show up in slowing economic growth later this year. This could have a dual impact: slowing economic growth could trigger monetary policy easing, and Gold could attract haven flows.”

- GBP/USD continues to trade in positive territory at around 1.2150.

- US Dollar stays on the back foot after UoM Consumer Sentiment Survey.

- The pair remains on track to post weekly gains.

GBP/USD declined toward 1.2100 during the European trading hours but regained its traction amid renewed US Dollar (USD) weakness. The pair seems to have stabilized at around 1.2150 in the American session and remains on track to end the week in positive territory.

Plunging US yields weigh on USD

Despite the negative shift witnessed in risk sentiment, the USD is having a difficult time finding demand ahead of the weekend. The benchmark 10-year US Treasury bond yield is down nearly 5% on the day at around 3.4%, forcing the US Dollar Index (DXY) to stay in the red near 104.00.

The data published by the University of Michigan (UoM) revealed on Friday that the Consumer Confidence Index declined to 63.4 in early March from 67 in February. More importantly, "year-ahead inflation expectations receded from 4.1% in February to 3.8%, the lowest reading since April 2021," UoM Surveys of Consumers Director, Joanne Hsu, said.

Ahead of next week's critical Federal Reserve policy meeting, this report seems to be causing investors to reassess their positions. According to the CME Group FedWatch Tool, the probability of a 25 basis points Fed rate hike next week currently stands at 68%, down from nearly 80% earlier in the day.

Technical levels to watch for

In a risk-averse environment, the Canadian Dollar is likely to find it difficult to hold its ground against the US Dollar, in the opinion of economists at Commerzbank.

Limited CAD recovery potential against the USD

“The jitters on the financial markets led to increased risk aversion recently. In such an environment, it is difficult for the Canadian Dollar to hold its ground against the USD.”

“We have adjusted our forecasts, but continue to see limited CAD recovery potential in the medium term.”

Source: Commerzbank Research

The economic outlook has just become more uncertain. Economists at Wells Fargo expect the US Dollar to stay strong in the short term. Nevertheless, the greenback is set to weaken later this year.

Fed to cut rates in late 2023

“Given resilient growth and further monetary tightening in early 2023, we see a brief period of USD strength for now.”

“However, our longer-term outlook remains for gradual US Dollar depreciation later this year, as the US falls into recession and the Fed cuts rates in late 2023.”

Gold price rose further on Friday reaching the highest level in eleven months, rising above $1,960/oz. XAU/USD is rising by more than $40, adding to weekly gains.

Risk aversion amid the banking crisis and lower US Treasury bond yields continue to boost the demand for the yellow metal. Since March 9, XAU/USD has risen more than $150 or 8%.

The rally gained speed last Friday, following the Nonfarm Payroll report and then accelerated following the collapse of Silicon Valley Bank (SVB). The ongoing turmoil softened central banks tightening expectations, pushing government bond yields lower.

Gold at $2,000 now looks like an achievable goal in the short term. Prior to the mark, a strong resistance area is seen around the $1,980 zone.

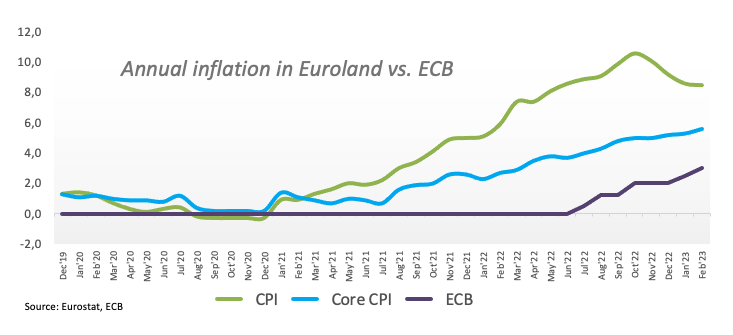

Is the credibility of the Federal Reserve and the ECB suffering? Analysts at Natixis have looked at different measurements of expected inflation, in the short and medium and long term, to analyse changes in central bank credibility.

How can central bank credibility be measured?

“If central bank credibility is affected by the recent inflation episode, medium and long-term expected inflation is increased.”

We see a slight increase in all medium and long-term inflation expectations (3-year, 5-year and 10-year) of 50 to 100 basis points. So there is a slight loss of central bank credibility associated with their weak response to inflation in 2021-2022-2023.”

- EUR/USD gives away part of the initial bull run to 1.0670.

- EMU Final Inflation Rate rose 8.5% YoY in February.

- US advanced Consumer Sentiment worsens to 63.4 in March.

EUR/USD maintains the bid bias well in place around the 1.0640 region at the end of the week. Despite the bounce in the last couple of sessions, the pair’s weekly performance falls into the negative territory.

EUR/USD: Weekly upside appears capped around 1.0760

The recovery in the risk complex – mainly on the back of alleviated concerns surrounding the banking system on both sides of the ocean – keeps the buying pressure unchanged around EUR/USD, which adds to Thursday’s advance past 1.0600 the figure at the end of the week.

On the USD-side of the equation, the knee-jerk in the buck comes amidst the resumption of the downtrend in US and German yields, all following the 50 bps rate hike by the ECB on Thursday and conviction of a 25 bps rate raise at the Fed’s gathering on March 22.

Data wise in the euro area, final inflation figures showed the CPI rose 8.5% in the year to February and 5.6% when it came to the Core inflation.

In the US, Industrial Production came flat on a monthly basis in February and contracted 0.2% vs. the same month of 2022. In addition, Manufacturing Production expanded 0.1% MoM and contacted 1.0% over the last twelve months. Finally, the CB Leading Index dropped 0.3% MoM during last month and the advanced Michigan Consumer Sentiment is expected to have deflated to 63.4 in March.

What to look for around EUR

EUR/USD manages to leave behind some of the recent weakness and retakes the 1.0600 hurdle and above at the end of the week. The rebound seen so far in the second half of the week faltered near 1.0670.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB in a context still dominated by elevated inflation, although amidst dwindling recession risks.

Key events in the euro area this week: EMU Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.20% at 1.0629 and the breakout of 1.0759 (monthly high March 15) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the other hand, the next support emerges at 1.0516 (monthly low March 15) seconded by 1.0481 (2023 low January 6) and finally 1.0324 (200-day SMA).

Gold is profiting from the market turmoil. But if the Fed sees an additional need for action to combat inflation, Gold is likely to shed some of its latest gains again, economists at Commerzbank report.

Market should once again start betting on rate cuts in H2

“The market now only expects the Fed to hike rates to 5% by May, after which rate cuts are envisaged until the end of the year. That said, we believe that the Fed will raise interest rates to 5.5% by mid-year and will only start lowering them again next year. This could trigger another fall in the Gold price towards the $1,800 mark in the second quarter, followed by a rise to $1,950 by year’s end.”

“After all, the market should once again start betting on rate cuts in the second half of the year. The week that is now drawing to a close has demonstrated how much the Gold price can profit from this.”

- UoM Consumer Confidence Index declined in March's flash estimate.

- US Dollar Index stays in negative territory but holds above 104.00.

Consumer sentiment in the US weakened in early March with the University of Michigan's (UoM) Consumer Confidence Index declining to 63.4 from 67 in February. This reading came in worse than the market expectation of 67.

"Year-ahead inflation expectations receded from 4.1% in February to 3.8%, the lowest reading since April 2021, but remain well above the 2.3-3.0% range seen in the two years prior to the pandemic," the publication further read. "Long-run inflation expectations edged down to 2.8%, falling below the narrow 2.9-3.1% range for only the second time in the last 20 months."

Surveys of Consumers Director Joanne Hsu "with ongoing turbulence in the financial sector and uncertainty over the Fed’s possible policy response, inflation expectations are likely to be volatile in the months ahead."

Market reaction

The US Dollar Index edged lower with the initial reaction and was last seen losing 0.35% on the day at 104.10.

- NZD/USD climbs back closer to the weekly high, though struggles to capitalize on the move.

- The risk-off mood seems to cap the risk-sensitive Kiwi near the 0.6250-0.6260 confluence.

- A break back below the 0.6100 mark will shift the near-term bias back in favour of bears.

The NZD/USD pair builds on the previous day's goodish rebound from the 0.6140-0.6135 area and gains strong follow-through traction for the second successive day on Friday. The pair maintains its bid tone through the early North American session, albeit seems to struggle to capitalize on the move and remains below the 0.6260-0.6270 confluence hurdle, or the weekly high.

The said barrier comprises the 200-day Exponential Moving Average (EMA) and the 38.2% Fibonacci retracement level of the February-March downfall. Given that oscillators on the daily chart have just started gaining positive traction, a sustained move beyond will be seen as a fresh trigger for bullish traders and set the stage for an extension of the NZD/USD pair's recent recovery from the YTD low touched last week.

The subsequent move-up could then allow spot prices to reclaim the 0.6300 round-figure mark, which coincides with the 50% Fibo. level. The momentum could get extended further and lift the NZD/USD pair towards the 61.8% Fibo. level, around the 0.6360 region, en route to the next relevant hurdle just ahead of the 0.6400 round-figure mark.

A fresh wave of the global risk-aversion trade, however, holds back bulls from placing aggressive bets around the risk-sensitive Kiwi and capping the NZD/USD pair. Nevertheless, the technical setup supports prospects for some meaningful upside. Hence, any pullback towards the 0.6200 round-figure mark, or the 23.6% Fibo. level might still be seen as a buying opportunity and is more likely to remain limited, at least for now.

That said, a convincing break below the latter might negate the positive outlook and shift the near-term bias back in favour of bearish traders. The NZD/USD pair might then accelerate the fall towards the 0.6135-0.6125 intermediate support before eventually dropping to the 0.6100 mark. Some follow-through selling below the 0.6085 area, or the YTD low, could make spot prices vulnerable to challenge the 0.6000 psychological mark.

NZD/USD daily chart

-638146582194046826.png)

Key levels to watch

USD loses ground as risk appetite rebounds. But the greenback is unlikely to fall significantly, in the view of economists at Scotiabank.

Investors are embracing risk and feeling a bit more confident

“Improving risk appetite and focus on peak Fed policy represent headwinds for the USD broadly; intraday patterns reflect this, with the USD down against all its major currency peers on the session.”

“Losses for the big Dollar seem unlikely to extend significantly until investors get a sense of the Fed policy outlook at next week’s FOMC decision, however.”

- Japanese Yen gains momentum as US Yields and Wall Street futures drop.

- US Industrial Production stagnates in February against expectations of a 0.2% increase.

- USD/JPY heads for the third weekly loss in a row, and to the lowest daily close in a month.

The USD/JPY dropped further as Treasury Bond printed fresh highs, falling to as low as 131.99. The 132.00 area is a critical support for the US Dollar.

Optimism fades, yen emerges

US yields are falling on Friday. The US 10-year yield dropped to 3.45% while the 2-year yield stands at 4.06%, down 2.40%, for the day. The decline in yields takes place as US stocks opened lower as markets remain anxious.

Data released in the US showed Industrial Production rose 0% in February against expectations of a 0.2% increase. January’s numbers were revised higher from 0% to 0.3%. Capacity Utilization remains at 78%. Later on Friday, the University of Michigan will release its Consumer Sentiment report.

Lower yields and a decline in stocks in boosting the Japanese Yen across the board. USD/JPY lost more than a hundred pips during the last three hours. The pair fell from above 133.00 to 131.99.

As of writing, USD/JPY trades at 132.30, under pressure and looking at the 132.00 mark. A consolidation below would point to further weakness. The next strong barrier is seen at 130.60.

Technical levels

- Gold price regains strong positive traction on Friday and rallies to its highest level since February.

- Fears of a global banking crisis weigh on investors’ sentiment and lift the safe-haven XAU/USD.

- Bets for a less hawkish Fed, tumbling US bond yields, a weaker USD provide an additional boost.

Gold price catches fresh bids following the previous day's directionless price action and builds on its intraday positive move through the early North American session. The XAU/USD spikes to a fresh six-week high, around the $1,946 region, in the last hour and remains on track to register its biggest weekly gain since mid-November.

A fresh wave of the global risk-aversion trade - as depicted by renewed selling around the equity markets - boosts demand for traditional safe-haven assets and benefits Gold price. Despite multi-billion-dollar lifelines for troubled banks in the United States (US) and Europe, investors are still trying to determine whether the risk of a full-blown global banking crisis has been tamed and remain concerned about the widespread contagion. Adding to this, looming recession risks take a toll on the risk sentiment and drive haven flows towards the precious metal.

Furthermore, a steep decline in the US Treasury bond yields is seen as another factor that benefits the non-yielding Gold price and remains supportive of the strong intraday rally. The anti-risk flow, along with rising bets for a smaller 25 basis points (bps) rate hike at the upcoming Federal Open Market Committee (FOMC) meeting on March 21-22, drag the US bond yields lower. Investors now seem convinced that the Fed will adopt a less hawkish stance in the wake of last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank.

Meanwhile, diminishing odds for more aggressive policy tightening by the US central bank, along with tumbling US bond yields, keep the US Dollar (USD) depressed for the second straight day. A weaker Greenback provides an additional boost to the US Dollar-denominated Gold price, taking along some short-term trading stops near the previous weekly/monthly high around the $1,937 area. This might have already set the stage for a further near-term appreciating move towards the $1,959-$1,960 region, or the multi-month top touched in February.

Technical levels to watch

- Industrial Production in the US remained unchanged on a monthly basis in February.

- US Dollar Index stays in negative territory slightly above 104.00.

Industrial Production in the US unchanged in February following January's 0.3% (revised from 0%) expansion, the US Federal Reserve reported on Friday. This reading came in weaker than the market expectation for an increase of 0.2%.

The Fed noted that manufacturing output edged up 0.1% in the same period and said Capacity Utilization remained steady at 78.0%.

Market reaction

The US Dollar Index stays on the back foot after this report and was last seen losing 0.23% on the day at 104.20.

The Canadian Dollar underperforms despite risk appetite recovery. Economists at Scotiabank expect the Loonie to struggle to post gains.

Choppy range trading between 1.35-1.38 for now

“The improvement in risk appetite is a modest tailwind for the CAD versus the USD while US-Canada yield spreads across the curve are less onerous for the CAD following this week’s turmoil, they remain a drag.”

“Compelling reasons to push the CAD higher are scant and that likely means more, choppy range trading between 1.35-1.38 for now.”

- AUD/USD continues with its struggle to find acceptance above the 0.6700 mark on Friday.

- The risk-off mood revives demand for the safe-haven USD and caps the risk-sensitive Aussie.

- Expectations for a less hawkish Fed act as a headwind for the buck and lend some support.

The AUD/USD pair trims a part of its intraday gains to a nearly two-week high and retreats below the 0.6700 round-figure mark heading into the North American session on Friday.

A fresh leg down in the equity markets helps the safe-haven US Dollar to bounce off the daily low and acts as a headwind for the risk-sensitive Australian Dollar. Despite multi-billion-dollar lifelines for troubled banks in the US and Europe, investors remain worried about widespread contagion and the possibility of a full-blown global banking crisis. This, along with looming recession fears, takes its toll on the global risk sentiment and drives some haven flows towards the Greenback.

That said, declining US Treasury bond yields continue to weigh on the USD and remain supportive of the intraday bid tone surrounding the AUD/USD pair. Against the backdrop of the global flight to safety, expectations that the Fed will adopt a less hawkish stance amid the worsening economic conditions drag the US bond yields lower. In fact, the markets are now pricing in a greater chance of a smaller 25 bps rate hike at the upcoming FOMC policy meeting on March 21-22.

This comes on the back of last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - and warrants some caution for the USD bulls. Traders, however, might prefer to move to the sidelines ahead of next week's key central bank event risk. In the meantime, the Reserve Bank of Australia's (RBA) recent dovish shift, signalling that it might be nearing the end of its rate-hiking cycle, might continue to cap the upside for the AUD/USD pair, at least for the time being.

Next on tap is the release of the Michigan US Consumer Sentiment Index. This, along with the US bond yields and the broader risk sentiment, might influence the USD price dynamics and provide some impetus to the AUD/USD pair. Nevertheless, spot prices manage to hold in the positive territory for the second successive day and remain on track to end the week on a positive note, reversing a major part of last week's losses to its lowest level since November 2022.

Technical levels to watch

The Indian Rupee has been stable since the start of the year. INR will continue to be supported by strong growth and hawkish RBI, economists at Commerzbank report.

RBI to hike rates

“We expect USD weakness, solid growth, and tight monetary policy to lead to a stable to slightly lower USD/INR by the end of the year.”

“USD/INR has held within a narrow range since the start of the year, between the 80.50-82.50 range. We project a slightly lower USD/INR by year-end to 81.50.”

Source: Commerzbank Research

- EUR/USD extends the rebound north of 1.0600 on Friday.

- The next up-barrier emerges at the March top near 1.0760.

EUR/USD gathers extra pace and climbs to 2-day highs near 1.0670 following Thursday’s positive price action.

If the recovery gathers impulse, then the pair could confront the March high at 1.0759 (March 15) - which remains underpinned by the proximity of the 55-day SMA – prior to the weekly peak at 1.0804 (February 14).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0324.

EUR/USD daily chart

EUR/USD edges off earlier highs above the 1.0650 area. Economists at Scotiabank expect the world's most popular currency pair to tick down.

Risks tilted towards a push to the mid/upper 1.04s

“At this point, gains look corrective ahead of another push lower (weaker EUR intraday below 1.06).”

“Trend momentum signals are leaning bearish on the short-term (intraday and daily) studies, which should limit the EUR’s ability to rally for now.”

“We spot support at 1.0510/15.”

“Risks are tilted towards a push to the mid/upper 1.04s.”

- DXY remains under pressure and adds to Thursday’s losses.

- There is decent contention around the March lows near 103.50.

DXY keeps the bearish tone well and sound in the second half of the week.

Further loss of momentum could prompt the dollar to revisit the area of recent lows near 103.50, which appears propped up by the temporary 55-day SMA. South from here, the index could challenge the weekly low at 102.58 (February 14).

Looking at the broader picture, while below the 200-day SMA (106.64), the outlook for the greenback is expected to remain negative.

DXY daily chart

- EUR/JPY comes under pressure and fades Thursday’s advance.

- Extra weakness remains on the cards below the 200-day SMA.

EUR/JPY resumes the downside and returns to the sub-141.00 region at the end of the week.

The cross looks side-lined in the second half of the week in the lower end of the weekly range. Occasional bullish attempts should initially clear the provisional 100-day SMA near 142.80 to allow for a test of the 2023 high at 145.56 (March 2).

In the meantime, extra losses remain on the cards while the cross trades below the 200-day SMA. If losses accelerate, then a potential visit to the March low at 139.11 (March 16) should start emerging on the horizon.

EUR/JPY daily chart

Economist at UOB Group Enrico Tanuwidjaja reviews the latest trade balance figures in Indonesia.

Key Takeaways

“Trade surplus in Feb widened to a high of USD5.5bn from USD3.9bn in Jan on the back of imports’ contraction of 4.3% y/y (vs. consensus of a 9.1% gain and a reversal of Jan’s +1.3%) and growth in exports of 4.5% despite a marked slowdown from 16.4% in Jan.”

“Oil & gas (OG) exports’ growth slowed to slightly less than 20% y/y viz. a whopping 65.1% in Jan, driven mainly by slowdown in mineral fuel exports but offset by respectable gains in machinery and electrical equipment exports. Non-OG exports’ growth also slowed to 3.8% y/y in Feb vs. 14% growth in Feb.”

“Meanwhile, OG imports contracted by 17.1% y/y in Feb, a marked turnaround from Jan’s growth of 30.4% while the non-OG imports contracted at a lesser pace of 1.6% in Feb vs. Jan’s contraction of 2.8%.”

EUR/USD preserves its recovery momentum. Economists at Wells Fargo expect the shared currency to gain ground against the US Dollar amid further European Central Bank tightening.

ECB's Deposit Rate to peak at 3.50% by June this year

“We expect a further 25 basis points rate hike in May followed by a final 25 bps rate hike in June, which would see the ECB's Deposit Rate for the current cycle peak at 3.50%. In that context, market pricing, which currently implies a peak policy rate of around 3.09%, appears light to us.”

“Our more forceful outlook for ECB policy is an important factor supporting our outlook for medium term strength in the Euro versus the US Dollar.”

- USD/CAD recovers early lost ground amid a modest USD recovery from the daily low.

- Fears of a full-blown banking crisis drive some haven flows and benefit the Greenback.

- An intraday move up in Oil prices could underpin the Loonie and cap any further gains.

The USD/CAD pair attracts some dip-buying near the 1.3680-1.3675 region on Friday and has now reversed a major part of its intraday losses. The pair climbs back above the 1.3700 round-figure mark during the mid-European session, though the intraday uptick lacks bullish conviction.

Crude Oil prices regain positive traction on the last day of the week and move away from a 15-month low touched on Thursday amid hopes for a strong recovery in Chinese fuel demand. This, in turn, is seen underpinning the commodity-linked Loonie and acting as a headwind for the USD/CAD pair amid a modest US Dollar weakness. Expectations that the Fed will adopt a less aggressive hawkish stance in the wake of worsening economic conditions weigh on the USD.

Last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - forced investors to scale back bets for more aggressive policy tightening by the US central bank. In fact, the markets are now pricing in a greater chance of a smaller 25 bps lift-off at the upcoming FOMC monetary policy meeting on March 21-22. This is evident from a fresh leg down in the US Treasury bond yields and turns out to be a key factor exerting downward pressure on the buck.

That said, a generally weaker risk tone drives some haven flows towards the Greenback and assists the USD/CAD pair to reverse the early lost ground. Despite multi-billion-dollar lifelines for troubled banks in the US and Europe, investors remain worried about widespread contagion and the possibility of a full-blown global banking crisis. This, along with looming recession fears, takes its toll on the global risk sentiment and benefits traditional safe-haven currencies.

Furthermore, the fact that the Bank of Canada (BoC) became the first major central bank to pause its rate-hiking cycle last week could undermine the Canadian Dollar. This, in turn, suggests that the path of least resistance for the USD/CAD pair is to the upside and supports prospects for a move back towards reclaiming the 1.3800 mark. Traders now look to the release of the Michigan US Consumer Sentiment Index to grab short-term opportunities heading into the weekend.

Technical levels to watch

76 of 82 economists polled by Reuters said that they expect the US Federal Reserve (Fed) to raise its policy rate by 25 basis points to the range of 4.75-5% following the March FOMC meeting. 5 economists expected the US central bank to hold its key rate unchanged while one saw a rate cut.

Moreover, the majority of participants noted that they see the fed funds rate reaching 5-5.25% in the second quarter.

Market reaction

This headline doesn't seem to be having a significant impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was down 0.22% on the day at 104.20.

US Dollar struggles to find demand. Economists at MUFG Bank expect the greenback to remain under pressure if the Federal Reserve hikes by 25 basis points next week.

A 25 bps hike next week is priced at about an 80% probability

“Essentially, we have had close to a $300 bn expansion of the Fed’s balance sheet in a week and that could see the Fed wanting to pursue continued rate hikes if conditions into the meeting next week allow.

“A 25 bps hike next week is priced at about an 80% probability. We see that as reasonable at this juncture and if no further episodes of bank stress emerge that probability will drift higher into the meeting next week. In circumstances of that scenario, we would expect the Dollar to remain on a weaker footing given that a hike would in our view probably be the last.”

- A combination of factors prompts fresh selling around the USD/JPY pair on Friday.

- Expectations for a less hawkish Fed and sliding US bond yields weigh on the buck.

- Banking crisis woes benefit the safe-haven JPY and contribute to the intraday slide.

- The BoJ’s dovish outlook could cap gains for the JPY and lend support to the major.

The USD/JPY pair fails to capitalize on the previous day's solid recovery of over 200 pips from its lowest level since February 14 and comes under some renewed selling pressure on Friday. The pair, however, manages to rebound a few pips from the daily low touched during the early European session and now trades above the 133.00 mark, still down nearly 0.40% for the day.

Growing acceptance that the Federal Reserve will adopt a less hawkish stance at its upcoming meeting on March 21-22 exerts fresh downward pressure on the US Dollar, which, in turn, is seen weighing on the USD/JPY pair. In fact, the markets are now pricing in a greater chance of a smaller 25 bps lift-off in the wake of last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank. This leads to a fresh leg down in the US Treasury bond yields and continues to undermine the Greenback.

Apart from this, the global flight to safety benefits the Japanese Yen (JPY) and further contributes to the offered tone around the USD/JPY pair. Despite multi-billion-dollar lifelines for troubled banks in the US and Europe, investors are still trying to determine whether the risk of a full-blown global banking crisis has been tamed and remain concerned about widespread contagion. This, along with looming recession fears, takes its toll on the risk sentiment, which is evident from a softer tone around the equity markets.

That said, a more dovish stance adopted by the Bank of Japan (BoJ) should keep a lid on any further gains for the JPY and help limit losses for the USD/JPY pair, at least for the time being. In fact, the outgoing BoJ Governor Haruhiko Kuroda said earlier this Friday that there is room to cut interest rates further into negative territory from the current -0.1%. This, in turn, warrants some caution for aggressive bearish traders and positioning for an extension of the recent downward trajectory witnessed over the past two weeks or so.

Market participants now look forward to the release of the Michigan US Consumer Sentiment Index, due later during the early North American session, for short-term trading opportunities. The focus, however, will remain glued to the outcome of the highly-anticipated FOMC monetary policy meeting, scheduled to be announced next Wednesday. Nevertheless, the USD/JPY pair remains on track to register a third successive week of losses and should continue to take cues from the broader sentiment surrounding the Greenback.

Technical levels to watch

Brent Crude Oil has drifted towards 2020 high of $71. Next potential objectives are located at $65/63, economists at Société Générale report.

50-DMA at $83 should cap upside

“Brent has given a break below the sideways consolidation since December denoting resumption in downtrend.”

“Daily MACD is at a higher level as compared to previous lows. However, it is anchored within negative territory denoting lack of upward momentum.”

“Signals of a large bounce are not yet visible; the 50-DMA at $83 should cap upside.”

“Next potential objectives are located at $65/63, the 61.8% retracement of the whole up move during 2020 and 2022.”

The prospects for the continuation of the decline in USD/CNH seems to have lost momentum as of late according to UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia.

Key Quotes

24-hour view: “We highlighted yesterday that ‘while the underlying tone has firmed somewhat, the price movements still appear to be consolidative’ and we expected USD to trade between 6.8750 and 6.9100. Our view for consolidation was not wrong, even though USD traded in a narrower range than expected (6.8885/6.9135). Further consolidation appears likely, expected to be between 6.8850 and 6.9100.”

Next 1-3 weeks: There is not much to add to our update from yesterday (16 Mar, spot at 6.8920). As highlighted, while the downside risk has decreased, only a break of 6.9300 (no change in ‘strong resistance’ level) would indicate that USD is not weakening further. Looking ahead, support level is at 6.8350.”

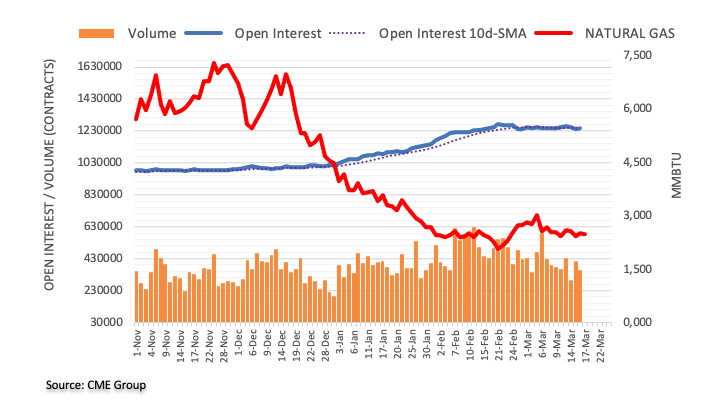

Considering advanced prints from CME Group for natural gas futures markets, open interest rose by around 6.2K contracts on Thursday after two consecutive daily pullbacks. On the opposite direction, volume kept the choppiness well in place and went down by around 54.8K contracts.

Natural Gas: Upside capped by $3.00 so far

Thursday’s small uptick in prices of the natural gas was amidst rising open interest and a moderate retracement in volume. Against that, the continuation of the consolidative phase is expected to remain unchanged for the time being, with occasional bullish attempts still limited by the $3.00 mark per MMBtu.

There is still some chances that USD/JPY could weaken further in the near term, comment UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia.

Key Quotes

24-hour view: “We highlighted yesterday that the outlook is mixed and we expected USD to trade in a choppy manner between 132.30 and 134.30. We did not anticipate the sharp drop to 131.71 and the strong bounce from the low (USD closed higher by 0.24% at 133.72). The outlook remains mixed and today, we expect USD to trade in a broad range between 132.50 and 134.50.”

Next 1-3 weeks: “We continue to hold the same view as yesterday (16 Mar, spot at 133.40) where while there is scope for USD to weaken further, the major support at 131.50 is unlikely to come into view so soon. Note that USD dropped briefly to 131.71 in early NY trade before rebounding strongly. Overall, only a breach of 135.10 (no change in ‘strong resistance’) would indicate that 131.50 is not coming into view.’

- GBP/USD gains positive traction for the second straight day, though lacks follow-through.

- Bets for less aggressive Fed rate hikes weigh heavily on the USD and remain supportive.

- Banking crisis woes, expectations that the BoE will pause its rate-hiking cycles cap gains.

The GBP/USD pair builds on the previous day's strong move up and scales higher for the second successive day on Friday. The pair, however, retreats a few pips from the daily peak touched during the early part of the European session and is currently placed around the 1.2135-1.2130 region, still up over 0.20% for the day.

Expectations that the Federal Reserve will adopt a less hawkish stance in the wake of worsening economic conditions exert heavy downward pressure on the US Dollar, which, in turn, lends support to the GBP/USD pair. Last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - forced investors to scale back bets for more aggressive policy tightening by the US central bank. In fact, the markets are now pricing in a nearly 90% chance of a smaller 25 bps lift-off the upcoming FOMC meeting on March 21-22, which, along with signs of stability in the financial markets, weigh on the safe-haven Greenback.

Multi-billion-dollar lifelines for troubled banks in the US and Europe ease fears about widespread contagion. This, in turn, boosts investors' confidence, which is evident from a modest recovery in the equity markets. That said, persistent worries about a full-blown global banking crisis keep a lid on the optimism. Furthermore, the Bank of England's (BoE) quarterly survey showed that the median UK public's expectations for inflation for the coming year dropped sharply in February. This reaffirms bets that the Bank of England (BoE) will pause its rate-hiking cycle next week and contributes to capping the GBP/USD pair.

Market participants now look to the release of the Michigan US Consumer Sentiment Index for short-term opportunities later during the early North American session on Friday. The focus, however, will remain on the key central bank event risks next week - the outcome of the highly-anticipated FOMC policy meeting, scheduled to be announced next Wednesday, followed by the BoE policy meeting on Thursday. Nevertheless, the GBP/USD pair seems poised to register modest weekly gains and remains at the mercy of the USD price dynamics.

Technical levels to watch

CME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the second day in a row on Thursday, this time by nearly 14K contracts. On the other hand, volume trimmed part of the previous marked build and dropped by around 724.8K contracts.

WTI appears supported near $65.00

Prices of the WTI charted an irresolute session amidst marginal gains, all after bottoming out near the $65.00 mark once again on Thursday. The move was on the back of rising open interest, which suggests the probability of a bounce in the very near term. So far, the commodity appears well underpinned around the $65.00 region per barrel.

- EUR/USD revisits the 1.0660/70 band on Friday

- The greenback extends the corrective decline amidst risk-on mood.

- EMU Final inflation figures next of note in the euro docket.

The optimism around the European currency – and the risk complex in general – remains well and sound on Friday and now lifts EUR/USD to the 1.0665/70 band, or 2-day highs at the end of the week.

EUR/USD stronger on USD-selling, risk appetite improvement

EUR/USD advances for the second session in a row and keeps the upbeat tone well in place in the second half of the week against the backdrop of a firmer recovery in the appetite for the risk-associated assets.

Indeed, recent positive news surrounding the US and European banking sectors helped mitigate concerns over a potential banking crisis, putting to rest at the same time bouts of risk aversion.

Following Thursday’s hike by the ECB, Board member Simkus suggested that the terminal rate has not been reached yet, while his colleague Villeroy noted that inflation in the euro area should be around 3% at some point by year end.

Later in the domestic calendar comes the final inflation figures in the Euroland, whereas Industrial Production, Manufacturing Production, the CB Leading Index and the preliminary Michigan Consumer Sentiment are all due across the Atlantic.

What to look for around EUR

EUR/USD manages to leave behind some of the recent weakness and retakes the 1.0600 hurdle and above at the end of the week.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB in a context still dominated by elevated inflation, although amidst dwindling recession risks.

Key events in the euro area this week: EMU Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.36% at 1.0646 and the breakout of 1.0759 (monthly high March 15) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the other hand, the next support emerges at 1.0516 (monthly low March 15) seconded by 1.0481 (2023 low January 6) and finally 1.0324 (200-day SMA).

The Swiss National Bank’s (SNB) decision is due on Thursday. In any case, the Franc is unlikely to weaken significantly, economists at Commerzbank report.

Not an easy decision for the SNB next week

“We will have to wait and see whether the situation on the markets might ease over the course of the next week anyway. If that was to be the case the SNB might be able to follow suit and hike the key rate like the ECB.”

“After the CHF was able to benefit from its role as a safe haven at the start of the week this unsurprisingly changed when the focus turned onto Switzerland itself. The Franc’s depreciation potential is limited though as the SNB signalled clearly that it wants to avoid a significant weakening of the CHF due to high inflation rates and that if necessary, it would be prepared to intervene again.”

The quarterly survey conducted by the Bank of England (BoE)/ Ipsos showed on Friday that the median UK public's expectations for inflation for the coming year dropped sharply in February.

Key takeaways

Median public inflation expectation for coming year 3.9% in Feb vs. 4.8% in Nov.

Median public inflation expectation for 1-2 years 3.0% in Feb vs. 3.4% in Nov.

Median public inflation expectation for 5 years 3.0% in Feb vs. 3.3% in Nov.

Market reaction

The Pound Sterling is hit by the BOE survey findings, as GBP/USD is paring back gains to trade at 1.2135, as of writing. The pair is still up 0.23% on the day.

- Silver regains positive traction on Friday, though remains in a multi-day-old trading range.

- Acceptance above the $21.65-$21.70 confluence supports prospects for additional gains.

- A convincing break below the $21.00 mark is needed to negate the near-term positive bias.

Silver attracts fresh buying on the last day of the week and maintains its bid tone through the first half of the European session, though struggles to capitalize on the move beyond the $22.00 round-figure mark.

From a technical perspective, the two-way price moves in a familiar range witnessed over the past few sessions constitute the formation of a rectangle. Against the backdrop of the recent strong recovery from sub-$20.00 levels, or a four-month low touched last week, this might still be categorized as a bullish consolidation phase. Furthermore, acceptance above the $21.65-$21.70 confluence adds credence to the positive outlook and supports prospects for a further near-term appreciating move for the XAG/USD.

The aforementioned area comprises the 200-period Simple Moving Average (SMA) on the 4-hour chart and the 38.2% Fibonacci retracement level of the downfall from the $24.65 area, or a multi-month peak touched in February. This should now act as a strong base for the XAG/USD and help limit the immediate downside. That said, some follow-through selling, leading to a break below the trading range support near the mid-$21.00s, might negate the positive outlook and pave the way for a slide towards the $21.00 mark.

The latter coincides with the 23.6% Fibo. level, which if broken decisively will shift the near-term bias back in favour of bearish traders. The XAG/USD might then turn vulnerable to accelerate the slide towards the $20.55-$20.50 intermediate support en route to the $20.00 psychological mark. The downward trajectory could get extended further and drag spot prices to the next relevant support near the $19.60 region. The white metal could eventually drop to the $19.00 mark for the first time since early November 2022.

On the flip side, momentum back above the $22.00 round figure might confront stiff resistance near the $22.25-$22.35 region, marking the 50% Fibo. level and the overnight swing high. The subsequent move up could push the XAG/USD beyond the $22.55-$22.60 supply zone, towards testing the 61.8% Fibo. level, just ahead of the $23.00 mark. A sustained strength beyond the latter will be seen as a fresh trigger for bullish traders and should pave the way for a meaningful upside for the white metal in the near term.

Silver 4-hour chart

Key levels to watch

The People’s Bank of China (PBOC) announced on Friday that it cut banks’ Reserve Requirement Ratio (RRR) by 25 basis points (bps), effective from March 27.

Additional takeaways

Weighted average RRR for financial institutions at around 7.6% after the new cut.

RRR cut will exclude financial institutions that have implemented 5% RRR.

Will not resort to flood-like stimulus.

Will keep liquidity reasonably ample.

Will better supply key areas, weak links.

Will make prudent monetary policy precise and forceful.

Will keep money supply, total social financing basically in line with nominal economic growth.

Will keep total credit appropriate.

Market reaction

AUD/USD is finding support just above the 0.6700 level on the PBOC rate cut announcement. The pair stalled its retreat from 0.6725, now adding 0.80% on the day.

Willem Sels, Global Chief Investment Officer, HSBC Global Private Banking and Wealth, addresses market fears. In his view, once markets grow more comfortable that a credit or banking crisis will be averted, equities should rebound.

Risk appetite should recover

“We think the current market turmoil is a consequence of rate volatility triggered by SVB, but not a harbinger of a credit crisis or a banking crisis.”

“Investors should not be panic but remain invested with a sharp focus on quality across asset classes.”

“Investment grade has seen positive returns since the start of the turmoil. Equities should rebound once markets grow more comfortable that a credit or banking crisis will be averted.”

European Central Bank (ECB) policymaker Peter Kazimir said on Friday that “I don't think we are at the finish line.”

Additional comments

“Need to continue with rate hikes.”

“But no need to speculate about the May decision.”

“Core inflation is sticky and upside risks to inflation are dominating.”

Market reaction

The Euro fails to benefit from the hawkish commentary from the ECB policymakers, having stalled its advance at 1.0670. At the time of writing, the pair is trading at 1.0657, still 0.51% higher on the day.

- AUD/USD scales higher for the second straight day and climbs to a nearly two-week high.

- Expectations for a less hawkish Fed weigh heavily on the USD and lend support to the pair.

- Fears of a full-blown global banking crisis and the RBA’s dovish shift could cap the upside.

The AUD/USD pair gains strong follow-through traction for the second successive day on Friday and climbs to a nearly two-week high during the first half of the European session. The pair currently trades just above the 0.6700 round-figure mark and is drawing support from a combination of factors.

Multi-billion-dollar lifelines for troubled banks in the US and Europe ease fears about widespread contagion, which, in turn, boosts investors' confidence. This is evident from a modest recovery in the equity markets, which undermines the safe-haven US Dollar and benefits the risk-sensitive Aussie. Apart from this, expectations that the Federal Reserve will adopt a less hawkish stance in the wake of worsening economic conditions weigh on the buck and provide a goodish lift to the AUD/USD pair.

Last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - forced investors to scale back their bets for more aggressive interest rate hikes by the Fed. In fact, the markets are now pricing in a nearly 90% chance of a smaller 25 bps lift-off at the upcoming FOMC meeting on March 21-22. This leads to a modest downtick in the US Treasury bond yields, which is seen as another factor dragging the USD lower and contributing to the strong bid tone surrounding the AUD/USD pair.

Investors, however, remain worried about the possibility of a full-blown global banking crisis. This, along with looming recession risks, should keep a lid on any optimism in the markets and cap the upside for the AUD/USD pair. Furthermore, the Reserve Bank of Australia's (RBA) recent dovish shift, signalling that it might be nearing the end of its rate-hiking cycle, warrants some caution for aggressive bullish traders and before positioning for any meaningful near-term appreciating move for the major.

Nevertheless, the AUD/USD pair remains on track to end the week on a positive note and reverse a major part of last week's losses to its lowest level since November 2022. Market participants now look to the release of the Michigan US Consumer Sentiment Index for short-term opportunities later during the early North American session on Friday. The focus, however, will remain on the outcome of the highly-anticipated FOMC policy meeting, scheduled to be announced next Wednesday.

Technical levels to watch

The Bank of England takes its rate decision next Thursday. Economists at Commerzbank expect a hesitant BoE to weigh on the British Pound.

The situation for Sterling remains difficult

“Even if the BoE takes a 25 basis points rate step next week it is likely to still seem hesitant. This would apply even more so if inflation data were to surprise on the upside.”

“We stick to our view and expect Sterling to principally trend weaker against the Euro over the coming months.”

Japan’s top currency diplomat Masato Kanda said on Friday that the government and Bank of Japan (BoJ) must take seamless response to market moves.

Additional comments

World economy faces various risks.

Risk aversion seen in markets.

Closely watching market moves.

Japan's financial system remains stable as a whole.

Holding discussion with G7 partners on financial markets.

Always in touch with G7 partners

European Central Bank (ECB) Governing Council Gediminas Šimkus said on Friday, “the terminal rate hasn't been reached yet.”

“I still believe that yesterday was not the last rate hike,” he added.

Additional quotes

The February core inflation dynamics are worrying.

Wage pressures are gaining more strength on core prices.

Related reads

- Forex Today: US Dollar struggles to find demand as mood improves

- ECB’s Villeroy: We sent a strong message of confidence

AUD firmed on signs of sustained risk-on momentum as fears of banking stresses eased. Economists at OCBC Bank expect the Aussie to enjoy further gains.

Bias for upside play

“We see room for AUD to rise should broad market confidence stabilise further. No more negative news of bank fall outs and a tamer Fed tightening trajectory will be pre-requisites for AUD to stay supported.”

“Daily momentum shows signs of turning mild bullish while RSI rose. Bias for upside play.”

“Resistance at 0.6710 and 0.6760/80 levels (38.2% fibo, 21, 50, 200-DMAs).”

“Support at 0.6660 (50% fibo), 0.6550 (61.8% fibo retracement of Oct low to Feb high) and 0.64 levels (76.4% fibo).”

- GBP/JPY oscillates in a narrow range and is influenced by a combination of diverging forces.

- Fears of a full-blown global banking crisis benefit the safe-haven JPY and act as a headwind.

- The BoJ's dovish outlook should continue to lend support and limit any meaningful downfall.

The GBP/JPY cross struggles to capitalize on the previous day's strong recovery move of over 350 pips from a fresh one-month low and oscillates in a narrow trading band through the early part of the European session on Friday. The cross remains below the 162.00 mark and the recent price action warrants some caution for aggressive traders or before positioning for a firm near-term direction.

The market sentiment remains fragile amid persistent worries about a full-blown global banking crisis, which continues to drive some haven flows towards the Japanese Yen (JPY) and acts as a headwind for the GBP/JPY cross. Adding to this, expectations that the Bank of England (BoE) will pause its rate-hiking cycle sooner rather than later also contribute to capping the upside for the cross. In fact, interest rate futures suggest a 50% chance that the BoE will leave interest rates unchanged next week and an equal possibility of a smaller 25 bps lift-off.

That said, the emergence of heavy selling around the US Dollar benefits the British Pound and lends support to the GBP/JPY cross. Moreover, multi-billion-dollar lifelines for troubled banks in the US and Europe might have eased concerns about widespread contagion, which should keep a lid on any meaningful gains for the JPY and help limit any meaningful slide for the cross. It is worth mentioning that large US banks came to the rescue of troubled First Republic Bank and injected $30 billion into the California, San Francisco-based lender on Thursday.

The development followed Credit Suisse's announcement that it will exercise an option to borrow up to $54 billion from the Swiss National Bank (SNB) to shore up liquidity. Apart from this, growing acceptance that the Bank of Japan (BoJ) will stick to its dovish stance to support the domestic economy supports prospects for some meaningful appreciating move for the GBP/JPY cross. In fact, the outgoing BoJ Governor Haruhiko Kuroda said earlier this Friday that there is room to cut interest rates further into negative territory from the current -0.1%.

In the absence of any relevant market-moving economic releases on Friday, the aforementioned fundamental backdrop suggests that the path of least resistance for the GBP/JPY cross is to the upside. That said, this week's repeated failures near the 164.00 mark and the lack of any meaningful buying warrants caution before positioning for any meaningful appreciating move in the near term.

Technical levels to watch

“We sent a strong message of confidence,”European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Friday.

Additional quotes

“Our priority is to fight inflation.”

“French and European banks are 'very solid'.”

“European banks are not in the same situation as the US banks.”

Market reaction

The Euro remains on the front foot, as EUR/USD is extending its recovery to near 1.0665, at the time of writing.

The Euro did not appreciate following the ECB decision. However, economists at Commerzbank expect to see higher EUR/USD levels.

Why did we not see EUR strength following the ECB decision?

“The market is clearly more concerned about the ECB not being sufficiently sensitised to the risks rapid rate hikes might involve following years of zero and negative interest rates, which make a hard landing of the financial system and the real economy more likely, than it is about the immediate carry a EUR position benefits from today.”

“This concern is not likely to be overcome quickly. However, with every day the market distortions of the past few days are not repeated these concerns are likely to abate a little. As a result, the Euro is unlikely to return to its old strength again soon, but will only appreciate again slowly.”

Here is what you need to know on Friday, March 17:

As the market mood continues to improve on easing concerns over a deepening financial crisis toward the end of the week, the US Dollar is having a tough time staying resilient against its major rivals. Eurostat will release February inflation data (revision) in the European session. Later in the day, the University of Michigan's Consumer Sentiment Survey and the US Federal Reserve's (Fed) Industrial Production data for March will be looked upon for fresh impetus.

The European Central Bank (ECB) raised its key rates by 50 basis points (bps) following its March policy meeting as expected. Although ECB President Christine Lagarde refrained from committing to additional big rate hikes in the near futures, she reassured markets that the banking sector in the Eurozone was in good condition.

ECB Quick Analysis: Lagarde banks on show of confidence, Euro set to resume uptrend.

Meanwhile, the Fed announced late Thursday that 11 banks deposited $30 billion into First Republic Bank to help it resolve the liquidity issues. Wall Street's main indexes gathered bullish momentum on this development and registered decisive daily gains. Following Wednesday's sharp decline, the benchmark 10-year US Treasury bond yield rose more than 3%.

Early Friday, US stock index futures cling to modest daily gains and the US Dollar Index stays deep in negative territory slightly below 104.00 while the 10-year US T-bond yield fluctuates above 3.5%.

EUR/USD fluctuated during the ECB event on Thursday but managed to keep its footing in the American session. The pair preserves its recovery momentum early Friday and was last seen trading above 1.0650.

GBP/USD posted gains on Thursday and continued to push higher early Friday. Supported by the renewed US Dollar weakness, the pair trades above 1.2150 in the European morning.

Following Thursday's indecisive action, USD/JPY came under modest bearish pressure and declined toward 133.00 on Friday. Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Friday that it would be possible to further lower short-term interest rate from minus 0.1% but added that he cannot comment on to what extent. During the Asian trading hours, the Nikkei Asian Review reported that the Japanese Government, the BoJ and the Financial Services Authority (FSA) will meet later this evening to assess the financial market situation in Japan.

The Reserve Bank of New Zealand (RBNZ) said in a statement early Friday that all New Zealand banks are currently operating above their minimum regulatory requirements. NZD/USD gathered bullish momentum on this headline and advanced toward 0.6250.

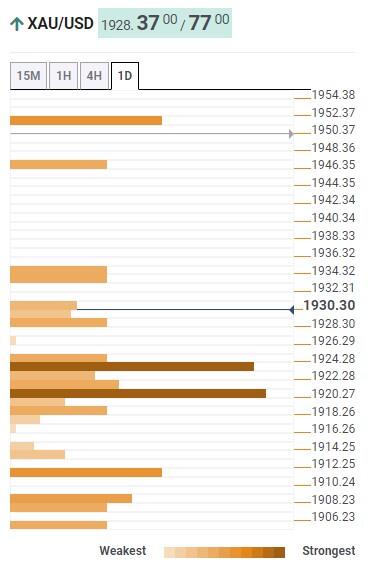

Gold price closed virtually unchanged on Thursday as rising US Treasury bond yields didn't allow XAU/USD to capitalize on the renewed US Dollar weakness. Nevertheless, the pair seems to have turned north early Friday, trading near $1,930.

Bitcoin benefits from the risk-positive market environment and trades at around $26,000 early Friday, rising nearly 4% on the day. On the back of Thursday's rebound, Ethereum continues to stretch higher and trades above $1,700 in the European morning.

Economists at ANZ Bank expect Platinum to enjoy gains this year and hit the $1,250 mark by the end of 2023.

Long-term negative view on Palladium

“Improving auto sector growth, higher loadings and substitution away from Palladium are likely to benefit Platinum.”

“Auto catalyst demand is likely to grow by 5% YoY. Constrained supply and robust demand could shift the market into deficit by 145 koz. A tighter market should encourage stronger investor activity.”

“We expect ETF holdings to rise by 300 koz this year after two consecutive years of outflows. This should push Platinum prices to $1,250 towards the end of this year. However, we hold a long-term negative view on Palladium due to weakening auto catalyst demand.”

- Gold price catches fresh bids on Friday and steadily climbs back closer to a multi-week top.

- Concerns about a full-blown global banking crisis seem to benefit the safe-haven commodity.

- Bets for a less aggressive Federal Reserve, a weaker US Dollar also lend support to the metal.

Gold price regains some positive traction following the previous day's good two-way price moves and maintains its bid tone through the early European session on Friday. The XAU/USD is currently placed just above the $1,930 level, up over 0.60% for the day, and remains well within the striking distance of a six-week high touched on Monday.

Banking crisis woes continue to benefit Gold price

Despite multi-billion-dollar lifelines for troubled banks in the United States (US) and European, concerns about widespread contagion continue to drive some haven flows and benefit Gold price. It is worth mentioning that large US banks came to the rescue of troubled First Republic Bank and injected $30 billion into the California, San Francisco-based lender on Thursday. This followed Credit Suisse's announcement that it will exercise an option to borrow up to $54 billion from the Swiss National Bank (SNB) to shore up liquidity. The developments, however, fail to boost investors' confidence or ease fears of a full-blown global banking crisis, which is evident from the prevalent cautious market mood.

Bets for less hawkish Federal Reserve, weaker US Dollar also lend support

Furthermore, last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - forced traders to scale back expectations of more aggressive interest rate hikes by the Federal Reserve (Fed). In fact, the markets are now pricing in a nearly 90% chance of a smaller 25 bps lift-off at the upcoming Federal Open Market Committee (FOMC) meeting on March 21-22. This, in turn, leads to a modest downtick in the US Treasury bond yields and lends additional support to the non-yielding Gold price. Meanwhile, expectations for a less hawkish Fed prompt fresh selling around the US Dollar, which turns out to be another factor acting as a tailwind for the US Dollar-denominated commodity.

Gold price is poised for the biggest weekly gains since mid-November

The aforementioned supportive fundamental backdrop suggests that the path of least resistance for Gold price is to the upside. Nevertheless, the XAU/USD remains on track to register its biggest weekly gain since mid-November and seems poised to prolong the recent appreciating move witnessed over the past two weeks or so. Market participants now look to the release of the Michigan US Consumer Sentiment Index for some impetus later during the early North American session on Friday. The focus, however, will remain on the two-day FOMC meeting, starting next Tuesday.

Gold price technical outlook

From a technical perspective, any subsequent move beyond the $1,937-$1,938 region, or the weekly swing high, is likely to confront some resistance near the multi-month top, around the $1,959-$1,960 area touched in February. Some follow-through buying will be seen as a fresh trigger for bullish traders and allow Gold price to aim towards reclaiming the $2,000 psychological mark.

On the flip side, immediate support is pegged near the $1,920-$1,918 horizontal zone, ahead of the overnight swing low, around the $1,908-$1,907 region. This is followed by the $1,900 round figure, which if broken might prompt some technical selling and drag the XAU/USD to the $1,886-$1,885 area en route to the $1,872-$1,871 support, or the weekly low set on Monday.

Key levels to watch

In the opinion of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, AUD/USD is likely to extend the range bound theme for the time being.

Key Quotes

24-hour view: “AUD traded sideways between 0.6612 and 0.6669 yesterday, narrower than our expected range of 0.6585/0.6680. Further sideways trading appears likely, expected to be in a range of 0.6630/0.6690.”

Next 1-3 weeks: “Three days ago (14 Mar, spot at 0.6665), we highlighted that AUD appears to have moved into a consolidation phase and that it is likely to trade in a range between 0.6570 and 0.6770. While we continue to expect AUD to trade within its consolidation range, in view of the decreased volatility, we have narrowed the expected range to 0.6570/0.6735.”

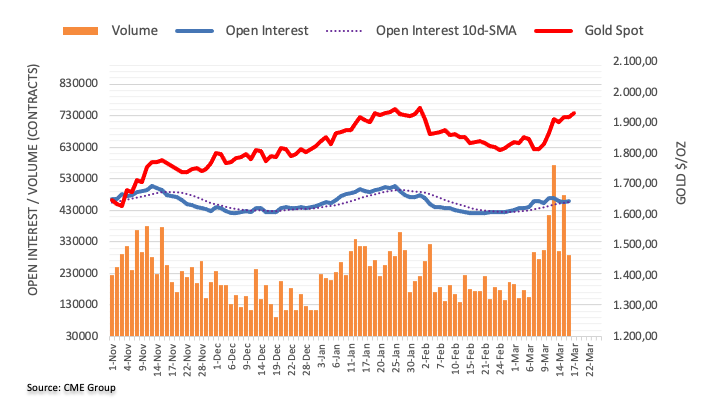

Open interest in gold futures markets increased by nearly 3K contracts after three consecutive daily pullbacks on Thursday according to preliminary readings from CME Group. Volume, instead, remained choppy and shrank by almost 191K contracts.

Gold: Further gains not ruled out

Gold prices advanced marginally amidst an inconclusive session on Thursday. That price action was in tandem with rising open interest and a marked drop in volume, which suggests that further indecision could lie ahead and at the same time does not rule out the continuation of the underlying upside bias. The immediate resistance for the yellow metal comes at the 2023 high at $1959 per ounce troy (February 2).

- USD/CHF retreats to 0.9250 amid broad-based US Dollar weakness and softer US Treasury yields.

- Swiss National Bank's decisive action alleviates Credit Suisse's liquidity concerns.

- Market uncertainty looms as questions on the liquidity front remain unresolved.

USD/CHF retreated from the 0.9300 mark in early Asian trading hours on Friday. The broad-based US Dollar weakness has led the pair to erase some of the previous day's gains and head toward Thursday's low at 0.9230. Improved risk appetite has pushed the US Dollar lower amid slightly softer US Treasury yields.

The Swiss Franc has strengthened due to an improvement in the situation regarding the troubled Swiss bank Credit Suisse.

The Swiss National Bank (SNB) quickly stepped in and provided support for Credit Suisse after pressure from international counterparts, according to some reports. Thereafter, SNB showed a willingness to provide a covered loan facility to Credit Suisse to help them escape the liquidity trap.

Credit Suisse said it would borrow up to 50 billion Swiss Francs ($53.7 billion) from the Swiss National Bank. The bank called the loan a "decisive action to preemptively strengthen its liquidity."

On the United States front, we have seen a cumulative effort to revive First National Bank by key market players like JPMorgan, Citibank, Bank of America, and many others, which provided a pool of liquidity totaling around $30 billion.

The key question still remains unresolved, as the market doesn't know how many chapters are yet to be disclosed on the liquidity front. USD/CHF could become volatile if we see some escalation of liquidity problems.

Levels to watch

- USD/CAD picks up bids to pare intraday losses during two-day losing streak.

- Oil price fades the previous day’s bounce off the lowest levels since December 2021.

- Market sentiment dwindles amid light calendar, pre-Fed concerns and lack of confidence in global banking system.

- US, Canada Industrial Production, US consumer-centric data to entertain Loonie traders ahead of next week’s FOMC.

USD/CAD consolidates weekly losses as it reverses from the intraday low of 1.3683 to 1.3710 during early Friday morning in Europe. The Loonie pair’s latest rebound could be linked to the WTI crude oil’s pullback, Canada’s key export earner. In doing so, the quote struggles to justify the US Dollar’s second consecutive daily loss amid sluggish trading in the last day of the volatile week.

WTI crude oil fades bounce off multi-month low to drop back below $69.00 as the Asian session risk-on mood eases ahead of the European traders’ arrivals. The reason could be linked to the mixed headlines suggesting the market’s fears of global banking system.

Among the key headline is Reuters’ analysis suggesting the British firms’ withdrawal of funds after the latest banking chaos surrounding the Silicon Valley Bank and the Credit Suisse. On the same line is the hedge funds’ rush towards securing positions via the traditional safe-haven Yen as Bloomberg said, “Hedge funds held the biggest yen-bearish positions in six months last week, a painful trade as the collapse of Silicon Valley Bank suddenly boosted demand for Japan’s currency as a haven.”

Furthermore, receding hawkish calls for the European central bank’s next move and the doubts over the Fed’s rate hikes past the next week’s 0.25% lift also weigh on the sentiment and allow the US Dollar to remain firmer.

Alternatively, the mildly positive sentiment could be linked to the global policymakers’ and bankers’ efforts to avoid the return of 2008’s financial crisis, as well as comments from rating agencies suggesting no more challenges for the baking sector.