- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 20-10-2021

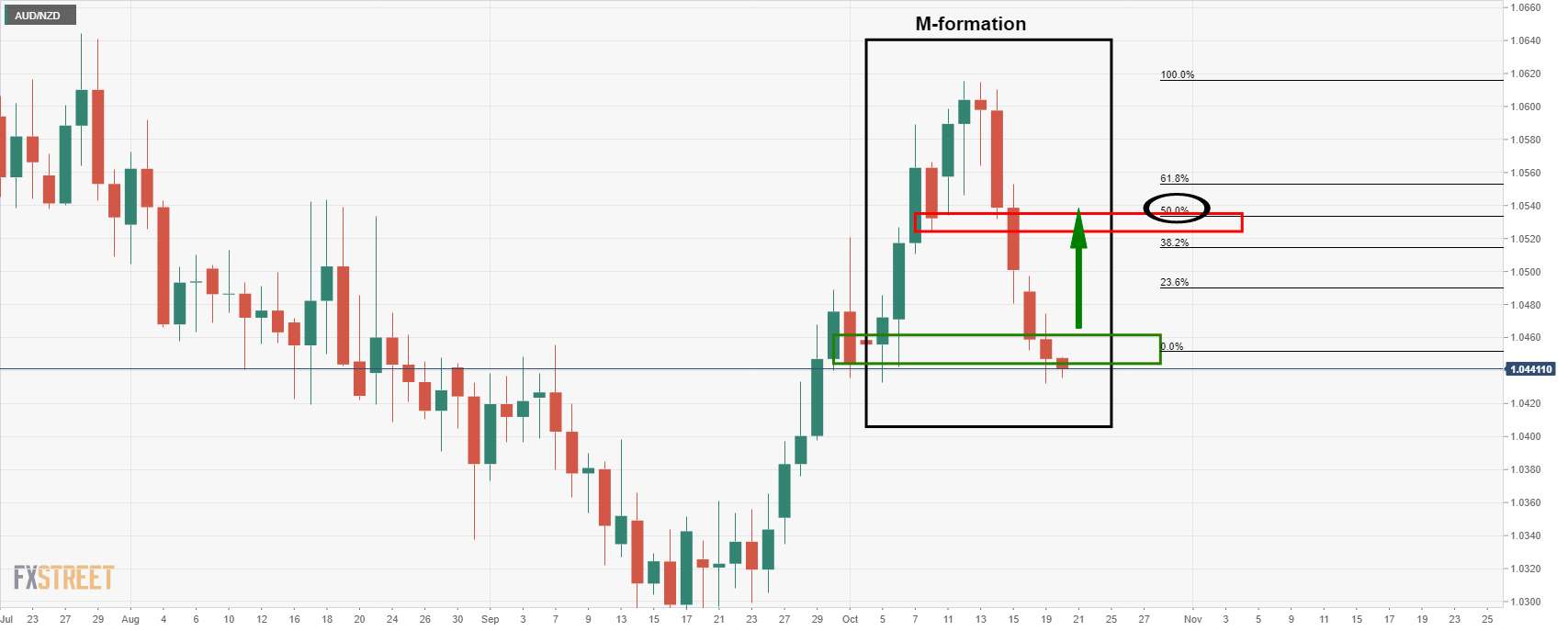

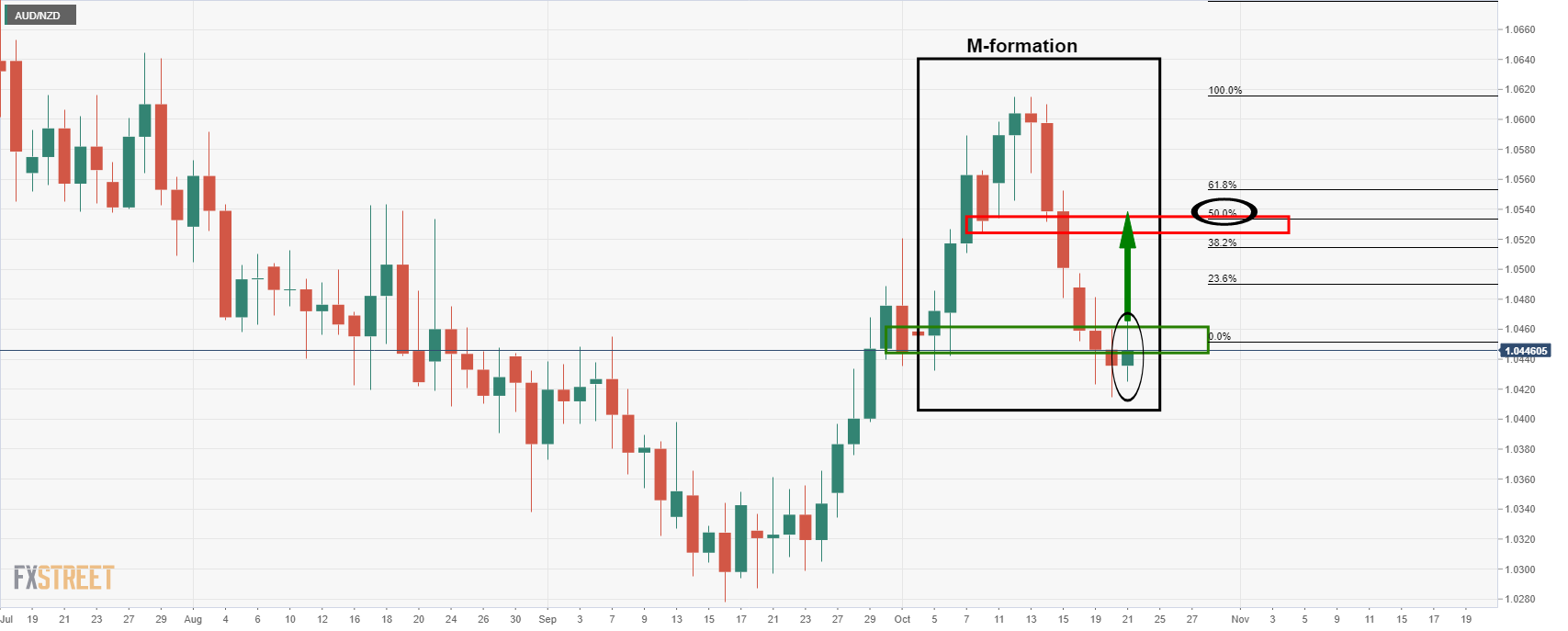

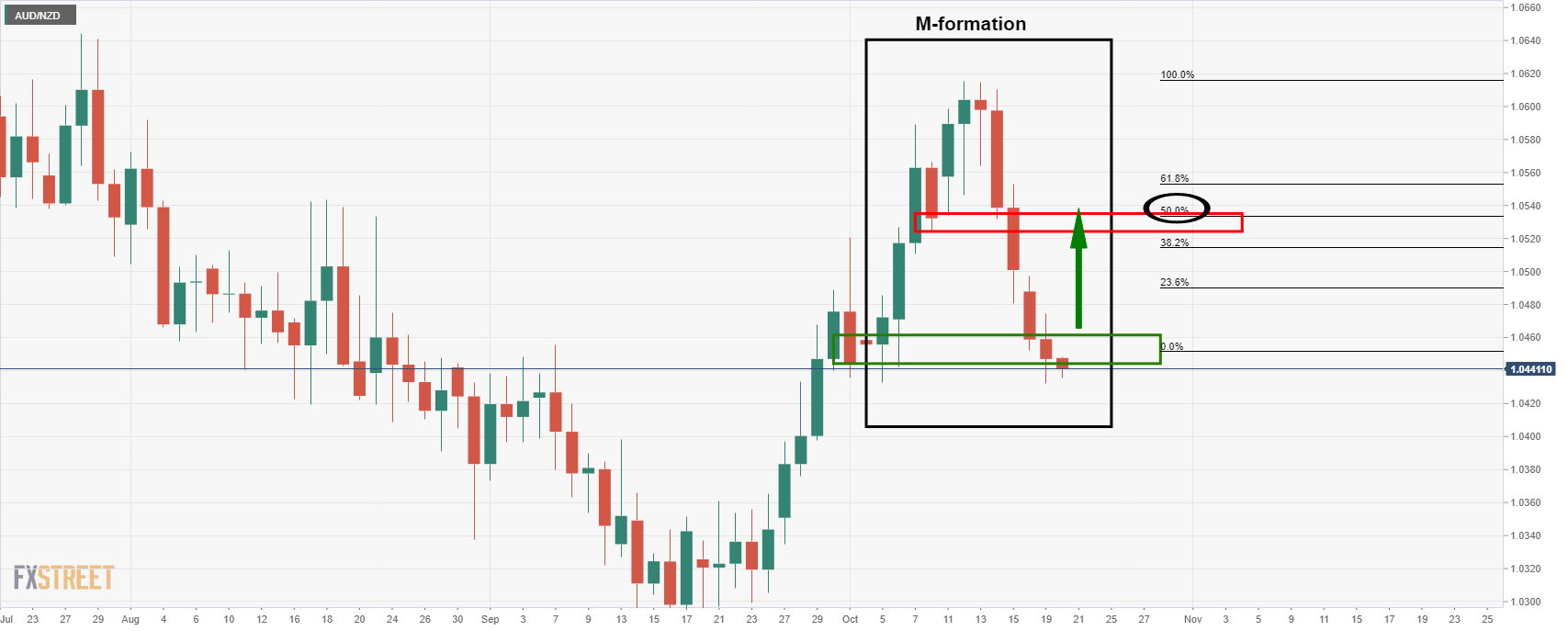

- AUD/NZD M-formation on the daily chart is compelling.

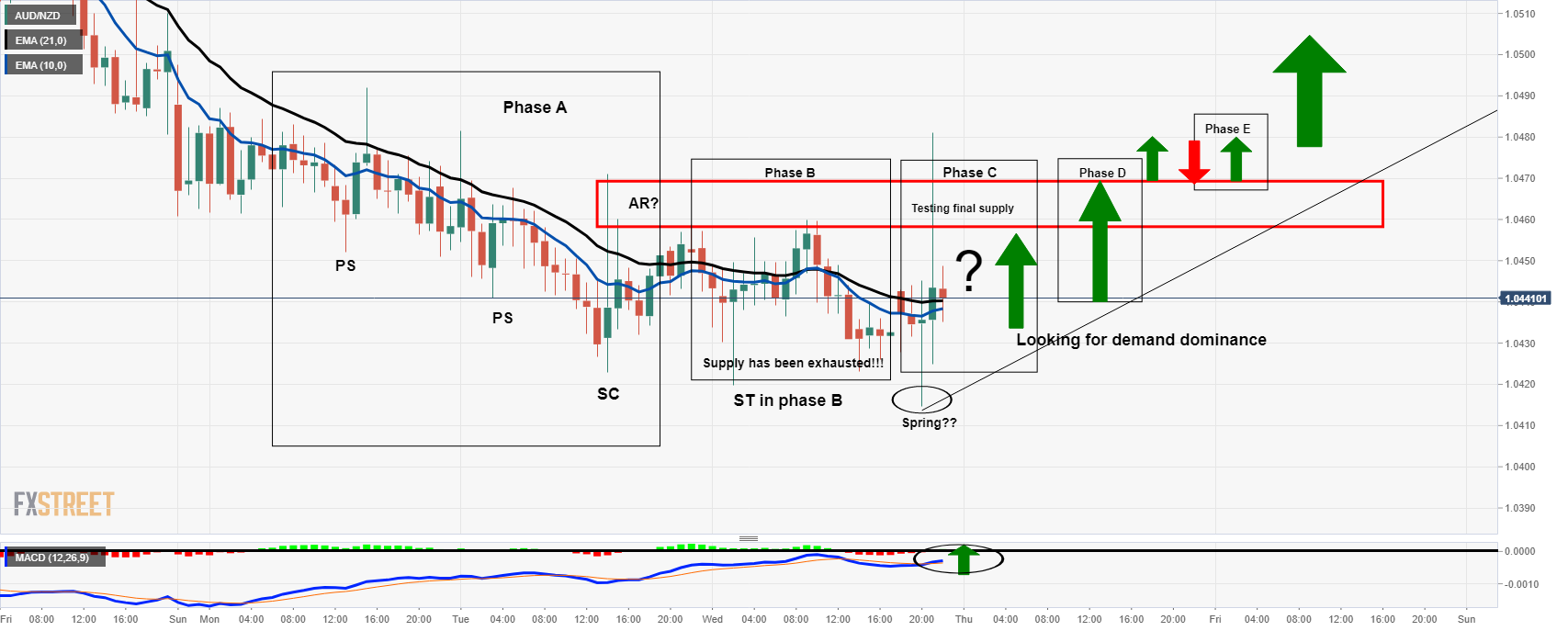

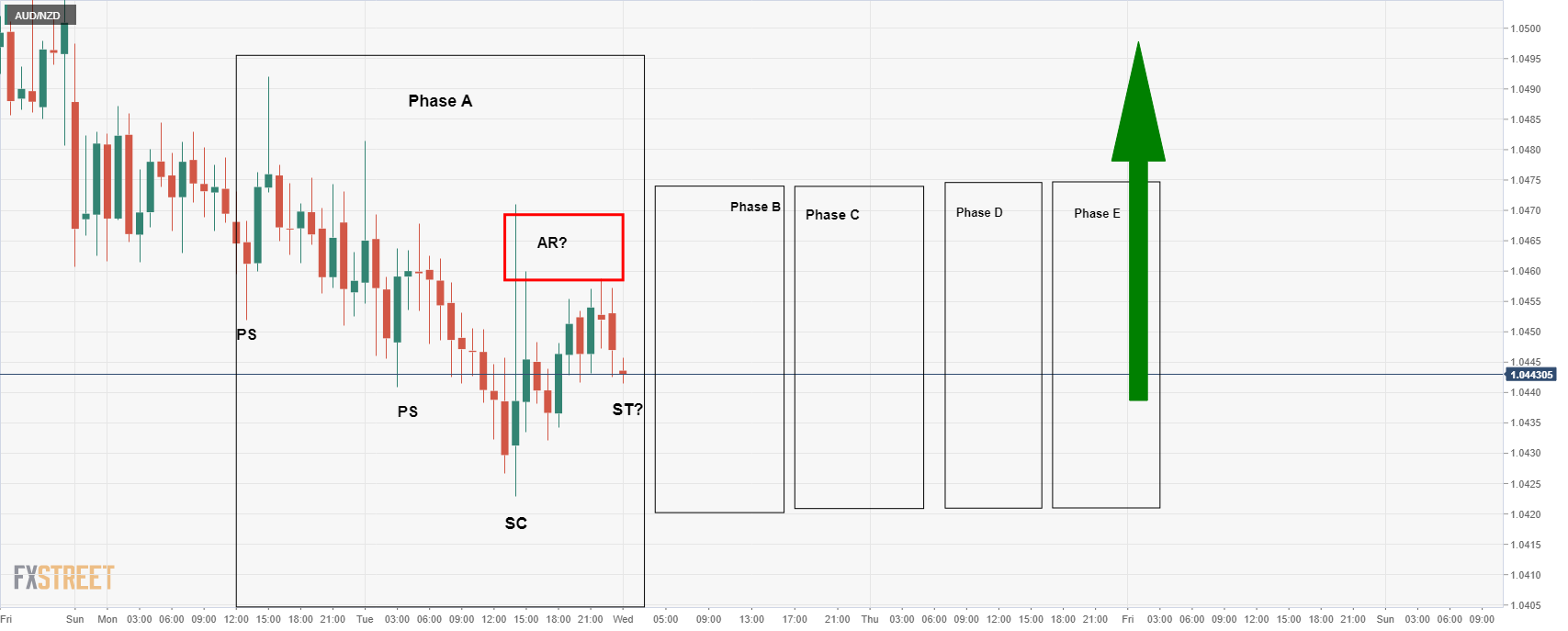

- Wycoff Methodology is playing out on the 1-hour chart.

As per the prior analysis, ''AUD/NZD Price Analysis: Bulls waiting to pounce'', the price is representing much of the Wycoff accumulation theory in the recent consolidation of the bear trend on the daily chart.

The daily chart is compelling given the harmonic M-formation. This is a reversion pattern as follows:

This chart was from the prior day's analysis where it was explained that ''the pattern that would be expected to draw in the price for a test of the formation's neckline. In this case, that level is the 8 Oct low at 1.0524.''

Since that analysis, we have seen the price start to correct, as expected:

Meanwhile, traders can approach the reversion from an hourly perspective and taking into consideration the Wycoff method can help traders keep out of bull and bear traps throughout the prolonged accumulation phase. This phase of accumulation is renowned for its whipsaw price action as demand outstrips supply in a battle between the bears and bulls, aka, the barroom brawl. In applying the thesis, it can assist traders to be patient and wait for signals that supply is exhausted before committing to the market long.

Wycoff 1HR chart

In the above analysis from yesterday, it was illustrated that Phase A was playing out. This was intended to help traders to stay patient and wait for the accumulation to play out through stages as follows:

In this updated version in today's live market analysis, we can see how well this theory is playing out. At this juncture, traders can expect demand to dominate while investors buy up the cross one chunk at a time as sellers move to the sidelines and exit their long positions, propelling the price even higher towards the resistance.

How to know when accumulation is going to lead to a breakout?

Traders can read both the price action, looking for higher lows and higher highs, as well as useful indicators. One way to identify bullish territory is to apply MACD and a moving average crossover as follows:

When MACD, blue line, crosses above the zero line, black horizontal, then this is regarded as indicating that buyers indeed have control and that the environment is turning bullish. When applying a moving average crossover, such as the 10 moving up through the 21 EMA, this is a powerful combination to help identify buying conditions. At such a point that this occurs, bulls can look to engage, depending on price action and market structure, and target towards the daily M-formation's neckline.

Traders will look to price action for engulfing candles and/or momentum candles that are breaking short-term resistances. Once the resistance is broken, a classic way to engage is to wait for a pullback to restest the old resistance that would be expected to act as support and lead to a bull rally.

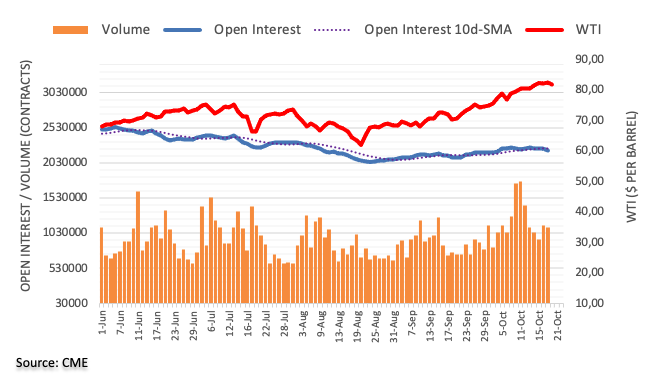

- WTI holds the head high at seven-year top even as bulls recently take a breather.

- EIA inventories, brighter mood and US dollar weakness add to the bullish bias.

- Supply outage, demand forecasts favor upside momentum going forward.

WTI stays on the front foot around $83.50, the highest level since October 2014, during Thursday’s Asian session. The oil benchmark rose during the last two days to refresh the multi-day high.

The latest run-up could be linked to the lower-than-anticipated weekly inventory data from the Energy Information Administration (EIA), as well as US dollar weakness and risk-on mood.

That said, the EIA Crude Oil Stocks Change for the week ended on October 15 dropped below +1.857M forecast and +6.088M prior to -0.431M reading at the latest.

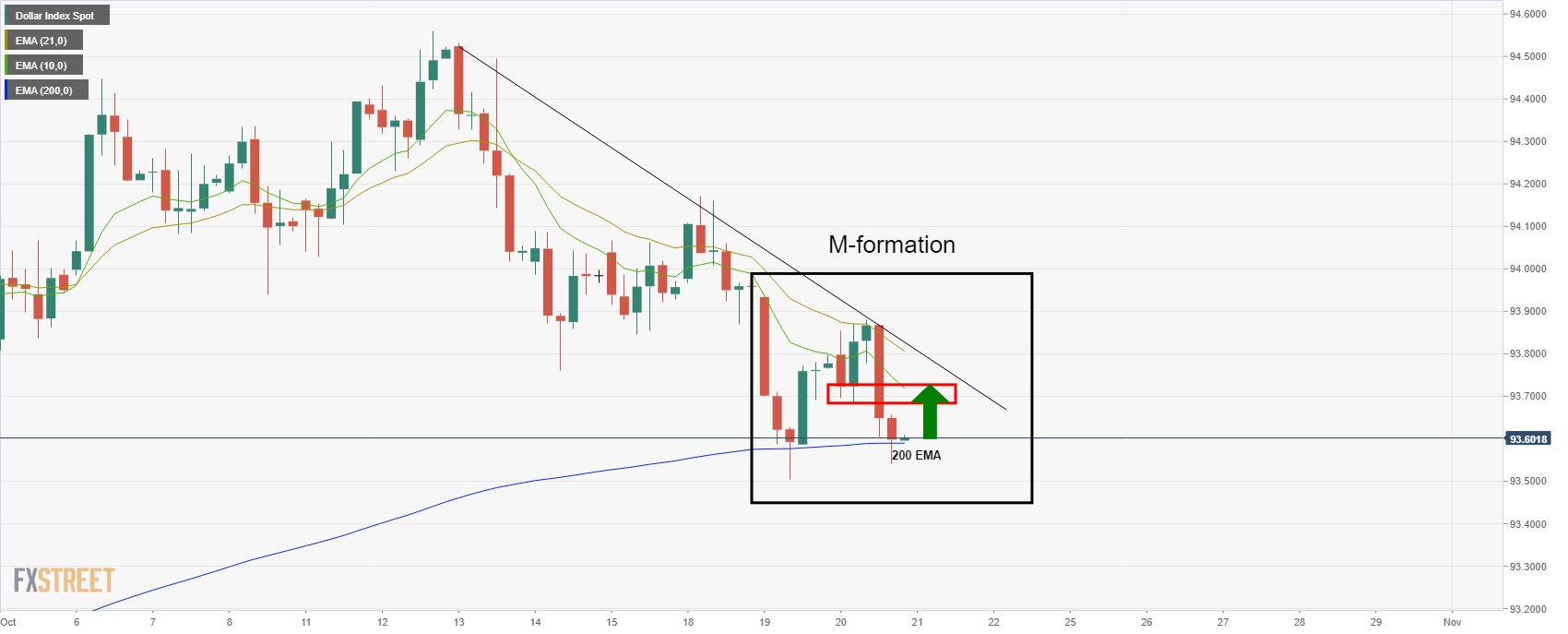

The US Dollar Index (DXY) printed a six-day south-run near the lowest levels in three weeks, pressured around 93.60 by the press time. In doing so, the greenback gauge failed to benefit from the tapering signals from Federal Reserve Governor Randal Quarles and Cleveland Fed President Loretta Mester as equities rallied on firmer earnings and the Treasury yields also softened after refreshing the multi-day top.

The risk-on mood could be witnessed by strong equities and a pullback in the US Treasury yields, following its run-up to the fresh five-month high. That said, the 10-year Treasury yields around 1.66%, up 2.6 basis points (bps), following the bond yields’ run-up to the five-month high.

It’s worth noting that China’s recent crackdown on energy production and expectations of strong oil demand going forward, as the global economies overcome the pandemic-led activity restrictions, adds to the bullish bias for the WTI crude oil prices.

However, Fed tapering concerns highlight the incoming US data, like today’s US Weekly Jobless Claims and monthly housing figures, for fresh impulse, in addition to the risk catalysts.

Technical analysis

November 2012 low near $84.10 remains on the WTI bull’s radar until the quote stays beyond the year 2018 top of $76.80.

- The British pound extends its three-day rally, relying on hawkish comments of BoE’s Governor Bailey.

- UK’s softer than expected inflation will not change the Bank of England intention of hiking rates.

- The US Dollar Index has fallen almost 1% in the current week, despite higher US T-bond yields.

The GBP/USD advances as the New York session ends and the Asian session begins, up a minimal 0.02% exchanges hands at 1.3824 during the day at the time of writing. The North American session positive sentiment has carried onto the Asian session. The major Asian equity futures indices rise between 0.01% and 1.45%, except the Japanese Topix, which drops 0.25%.

The British pound has rallied in the last three days on the back of hawkish comments by Bank of England members. However, on the same days, the pound stalled around 1.3845, it seems due to higher US T-bond yields, with the 10-benchmark note rate being just ten basis points short of the 2021 year high, currently at 1.66%.

Despite the rising US bond yields, the greenback has been falling throughout the week 0.71%, with the US Dollar Index sitting at 93.60 at press time.

UK’s softer than expected inflation will not deter the Bank of England from raising rates

On the macroeconomic front, inflation in the United Kingdom for September slowed surprisingly, but it would not stop the Bank of England from hiking interest rates as soon as the next month.

The headline Consumer Price Index (CPI) for the UK rose by 3.1% on an annual basis, lower than the August 3.2% increase, as reported by the Office for National Statistics. The so-called Core CPI, excluding food and energy prices, expanded by 2.9% shorter than the 3% estimated by economists.

Overall the market expectations that the BoE will be the first among the major central banks to raise rates stills, due to investors betting it will do it by the November meeting.

In the last monetary policy meeting, the BoE said it expected inflation to rise above 4% in the Q4 of 2021, but energy prices have risen sharply since then.

On Sunday, BoE Governor Andrew Bailey said that the central bank would “have to act” to curb inflationary forces. Furthermore, he noted that inflation “will last longer, and it will, of course, get into the annual numbers for longer as a consequence.” Moreover, he reiterated that “we, at the Bank of England, have signaled, and this is another signal that we will have to act.”

Federal Reserve policymakers, ready to announce the bond tapering by FOMC’s November meeting

The US economic docket is absent except for the EIA Crude Oil inventories and Federal Reserve speakers.

On Wednesday, the Federal Reserve Vice-chairman Randal Quarles said that the test for a bond taper has been met and supports the decision at the November meeting to reduce the QE asset purchases by the first half of 2022.

Later on the same day, Cleveland’s Federal Reserve President Loretta Mester said that “The Federal Reserve should begin tapering its asset purchases soon, but the US central bank is not likely to raise interest rates in the near term.” She added that “So far medium and longer-run inflation expectations are consistent with 2% inflation goal.”

Morgan Stanley (MS) reiterates its bearish bias for the EUR/USD in the latest analytical note published on Wednesday.

The US bank highlights the European Central Bank’s (ECB) ‘transitory’ consideration to the inflation fears exerting downside pressure on the Eurozone nominal and real yields and weighing on the regional currency.

“At the same time, Eurozone data have also been missing market expectations lately, consistent with our economists' projection of growth momentum in the bloc moderating in 4Q,” said Morgan Stanley.

The MS adds, “This stands in contrast with the acceleration in US growth that our economists are expecting, which should also put downward pressure on EUR/USD.”

Read: EUR/USD Price Analysis: Further upside hinges on 1.1670 breakout

- USD/CHF holds lower ground at mid-September lows, sidelined of late.

- Descending RSI line, weekly falling trend line favor sellers.

- 200-DMA, ascending trend line from early June offer strong support.

USD/CHF remains on the back foot around 0.9185, taking rounds to a five-week low flashed during the early week amid Thursday’s Asian session.

The Swiss currency (CHF) pair dropped the most in a week the previous day while printing a two-day south-run backed by a downward sloping RSI line, also taking a u-turn from the one-week-old resistance line.

Hence, the USD/CHF bears are all set to attack the nearby support, namely the 100-DMA level of 0.9177.

However, any further weakness past 100-DMA will be challenged by a convergence of 200-DMA and a four-month-long support line, close to 0.9140, a break of which will give way to the USD/CHF sellers targeting mid-August lows near the 0.9100 threshold.

Alternatively, the 0.9200 round figure and stated immediate resistance line, close to 0.9240, will question the short-term upside momentum of the pair.

In a case where USD/CHF bulls manage to cross 0.9240, July’s top and September 20 peak, respectively around 0.9275 and 0.9335, will be crucial levels to watch.

USD/CHF: Daily chart

Trend: Further weakness expected

- USD/JPY trades virtually unchanged on Wednesday in the initial Asia session.

- The US dollar trades below 94.00 despite higher US T-bond yields.

- Mixed Fed’s officials and data weighs on the US dollar.

USD/JPY remains muted on Thursday after testing the fresh four year high in the previous session’s. The pair stays in a relatively narrow price band, after hovering near the daily highs in the US session. At the time of writing, USD/JPY is trading at 114.37, up 0.02% for the day.

The US benchmark 10-year Treasury bond yields trade at 1.65%, the highest in the two years. Investors continue to anticipate the Fed’s tapering next month amid rising inflationary pressure and soaring energy prices.

US Cleveland Fed’s President Loretta Mester remained bullish on Fed’s tapering but refrained from the interest rate hike timeline.

On the other hand, the Japanese yen surrenders its gains on improved risk sentiment. It is worth noting that, S&P 500 Future is trading at 4,524, up 0.02% for the day.

As for now, traders are waiting for the US Initial Jobless Claims and Fed’s Offical’s speeches to gauge the market sentiment.

USD/JPY additional levels

- USD/CAD awaits fresh clues to extend two-day downtrend.

- Firmer inflation at home joins strong WTI crude oil prices to favor bears.

- Risk-on mood, broad USD weakness adds strength to the bearish bias.

- US data, risk catalysts will be in focus amid a light calendar in Canada.

USD/CAD licks its wounds around three-month low, sidelined near 1.2320 during Thursday’s Asian session.

The Loonie pair refreshed the multi-day bottom during a two-day fall the previous day after the Canadian inflation data came out better-than-expected. Further, firmer prices of Canada’s main export item WTI crude oil and US dollar weakness added to the downside pressure.

In addition to Canada’s headlines Consumer Price Index (CPI) for September, the Bank of Canada’s (BOC) CPI Core figures also rose past YoY forecasts and prior readings. The same hints at the BOC’s further tightening of monetary policy and favor for the USD/CAD bulls.

Elsewhere, oil prices cheered lower-than-anticipated weekly inventory data from the Energy Information Administration (EIA), as well as US dollar weakness and risk-on mood. That said, WTI crude oil jumped to the fresh high since October 2014 of $83.55, around $83.40 by the press time.

That said, the US Dollar Index (DXY) prints a six-day south-run near the lowest levels in three weeks, flashing 93.60 level by the end of Wednesday’s North American session. The greenback gauge failed to benefit from the tapering signals from Federal Reserve Governor Randal Quarles as equities rallied on firmer earnings and the Treasury yields also softened after refreshing the multi-day top.

While portraying the mood, Wall Street benchmarks gained upside momentum amid strong Q3 reports from the industry leaders like Tesla and chatters over US stimulus passage. The same exerted pressure on the 10-year Treasury yields around 1.66%, up 2.6 basis points (bps), following the bond yields’ run-up to the five-month high.

Given the lack of major data/events, USD/CAD traders need to pay close attention to the risk catalysts and the second-tier US economics for fresh impulse.

Technical analysis

A clear downside break of 61.8% Fibonacci retracement of June-August upside, near 1.2365, directs USD/CAD towards late June’s low surrounding 1.2250 should the quote manage to conquer the 1.2300 immediate support.

- EUR/USD bulls take a breather following six-day uptrend.

- Bullish MACD, 21-DMA cross keeps buyers hopeful to overcome two-month-old upside hurdle.

- 23.6% Fibonacci retracement adds strength to the downside support.

EUR/USD remains sidelined below the 1.1670 key hurdle, around 1.1650 during the initial Asian session on Thursday. The currency major pair poked the crucial horizontal resistance during the early week but failed to provide a follow-though on Wednesday.

Even so, bullish MACD signals and a clear run-up beyond 21-DMA, as well as 23.6% Fibonacci retracement (Fibo.) of July-October upside, near 1.1615, favor the buyers to aim for further advances.

However, a daily closing beyond 1.1670, comprising August lows, becomes necessary. Also adding to the upside filter is the September 22 swing bottom around 1.1685 and 50% Fibo. level near 1.1715.

Should the quote manage to clear the 1.1715 resistance, the late September high near 1.1755 will return to the chart.

Meanwhile, pullback moves remain less problematic until staying beyond 1.1615 support confluence.

Following that, the 1.1600 and 1.1550 may entertain EUR/USD bears before dragging them to the yearly bottom near 1.1525.

EUR/USD: Daily chart

Trend: Further upside expected

“The Federal Reserve should begin tapering its asset purchases soon, but the US central bank is not likely to raise interest rates in the near term,” said Cleveland Federal Reserve Bank President Loretta Mester during Wednesday’s interview with CNBC, per Reuters.

Fed’s Mester adds “The thought about raising interest rates is not a near-term consideration at all.”

Key quotes

A lot of the increase inflation is tied to COVID-19, whether it's to demand or supply.

As asset purchases wind down, will have time to assess inflation, employment.

Revised up inflation forecast for this year.

Expects bottlenecks to last longer than originally expected.

Will see inflation readings come back down next year.

If we don't see inflation coming down next year, will need to reassess.

Baseline forecast is for inflation to come down, but there are upside risks.

So far medium and longer run inflation expectations are consistent with 2% inflation goal.

Some house price increases are a covid effect; not a reason to change monetary policy.

We've met test for taper.

Fed policy is well-calibrated to outlook.

Very comfortable with where policy is right now.

Banking system is quite healthy.

Q3 GDP will be weaker than 1h, but still expect US GDP to grow 5% to 6% this year.

Market’s reaction

Given the lack of key catalysts and attention on equity rallies, traders paid little heed to the news.

- Positive market sentiment favors risk-sensitive currencies, like the AUD.

- AUD/JPY: The prevailing trend still tilted to the upside on the back of the interest rate differentials.

- AUD/JPY: Closes to 86.00, on the back of a risk-on environment.

The AUD/JPY advances as the Asian session begins, barely up 0.02%, trading at 85.93 at the time of writing. The market sentiment is upbeat, as the Asian sessions follow through the New York footsteps, with Asian equity futures rising between 0.02% and 1.45%, except for the Japanese Topix, which drops 0.25% at press time.

The positive market sentiment has gained follow-through since Monday. Robust third-quarter US corporate earnings remain the main driver of the financial markets, as companies have printed numbers better than expected, despite the ongoing elevated energy costs and rising raw materials around the globe.

AUD/JPY Price Forecast: Technical outlook

Daily chart

The AUD/JPY is trading at fresh five-month highs, trading above the May 10 high of 85.80, on the doors of 86.00. In the case of a daily close above the latter, December 5, 2017, high at 86.84 would be the first resistance. A sustained break of that level would expose crucial supply areas towards an 89.00 challenge. Firstly January 10, 2018, low at 87.20, followed by January 31, 2018, high at 88.49.

On the other hand, failure at 86.00 could send the AUD/JPY tumbling lower. A daily close below the 84.27 level could spur a downward move towards 83.80. A breach of the latter would expose the 200-day moving average (DMA) at 82.47.

The Relative Strength Index (RSI), a momentum indicator, is at 82, in overbought levels, indicating that the AUD/JPY might consolidate. That outcome could open the door to a “buy the dip” narrative, as the upward bias is confirmed by the daily moving averages (DMA’s), which are located well below the spot price.

- NZD/USD grinds higher after refreshing four-month peak, six-day uptrend.

- Carry trade, firmer equities and US Treasury yields’ retreat favor pair buyers.

- ANZ rate change, UK-NZ free trade deal add to the bullish bias.

- Risk catalysts remain on the driver’s seat amid a light calendar.

NZD/USD edges higher around multi-day top close to 0.7200 during early Thursday morning in Asia. Alike other major currency pairs, the quote also cheers broad US dollar weakness, in addition to the carry trade opportunity that has been applauded of late.

The US Dollar Index (DXY) prints a six-day south-run near the lowest levels in three weeks, flashing 93.60 level by the end of Wednesday’s North American session. The greenback gauge failed to benefit from the tapering signals from Federal Reserve Governor Randal Quarles as equities rallied on firmer earnings and the Treasury yields also softened after refreshing the multi-day top.

That said, Wall Street benchmarks gained upside momentum amid strong Q3 reports from the industry leaders like Tesla and chatters over US stimulus passage. The same exerted pressure on the 10-year Treasury yields around 1.66%, up 2.6 basis points (bps), following the bond yields’ run-up to the five-month high.

On the other hand, the Fed policymaker Quarles said, per Reuters, “Fed to begin dialing down its bond-buying program, it would be "premature" to start raising interest rates in the face of high inflation that is likely to recede next year.”

It’s worth observing that Evergrande’s failure to seal the asset sale deal with Hopson Development Holdings and fears that China’s economy is gradually losing momentum probe NZD/USD bulls, despite being ignored so far.

Above all, the Reserve Bank of New Zealand’s (RBNZ) rate hike gives rise to the carry and backs the NZD/USD bulls. Though, fears surrounding the virus-led activity restrictions’ impact on the jobs seem to poke the RBNZ hawks even as the September inflation figures came in strong earlier in the week.

Additionally, the recent news suggesting higher interest rates for the housing loan consumers, raised by the Australia and New Zealand Banking Group (ANZ) also propelled the RBNZ towards another rate hike. Furthermore, the news relating to the UK and New Zealand’s (NZ) agreement over a free trade deal adds to the NZD/USD strength.

“NZ stands a better chance than most to be able to keep inflation expectations anchored. That in turn speaks to FX markets focusing on carry, not high inflation. A higher NZD will also help tame inflation; that reward “should” go to those who are proactive,” said the ANZ.

Moving on, a lack of major data/events will highlight risk catalysts as crucial factors to watch for fresh impulse ahead of the US session when the weekly jobless claims and monthly housing data may entertain traders.

Technical analysis

A clear upside break of September’s top surrounding 0.7170 enables NZD/USD bulls to aim for May’s peak near 0.7320. However, overbought RSI conditions may probe the advances with intermediate pullbacks.

- The S&P 500 added 17.14 points, or 0.38%, to end at 4,536.77.

- The Nasdaq Composite dropped 6.25 points, or 0.05%, to 15,121.68.

- The Dow Jones Industrial Average climbed 157.95 points, or 0.45%, to 35,615.26.

The S&P 500 and the Dow were moving towards record highs on Wednesday following strong forecasts from healthcare companies Anthem and Abbott. However, the Nasdaq was unable to match form and wilted below =the prior days closing level which likely spurred some additional profit-taking as US yields tried to rebound mid-day.

The S&P 500 did close up for a sixth-straight session. The Dow hit a new intraday high but moved lower later in the day and it failed to set a record close. According to preliminary data, the S&P 500 added 17.14 points, or 0.38%, to end at 4,536.77 points, while the Nasdaq Composite dropped 6.25 points, or 0.05%, to 15,121.68. The Dow Jones Industrial Average climbed 157.95 points, or 0.45%, to 35,615.26.

US yields in focus

This as the US 10-Year Treasury yield rallied to 1.6730% to score a fresh five-month high before it sank to 1.62% on Wednesday from a high of 1.673%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

A rise in yields could put pressure on the benchmarks as investors fret about inflation and rising borrowing costs.

- AUD/USD has been in a parabolic daily rally that could face headwinds.

- US yields are trying to make a comeback and that should support US dollar.

AUD/USD has been an impressive show mid-week, rallying from a low of 0.7465 and reaching a high of 0.7522. It was a US dollar story to start the day with risk sentiment upbeat and as investors focused on rising commodity prices which supported the Aussie. Into the Wall Street close, the bulls are trying and have shied away from the 0.7532 target as the April 1 lows. Instead, the price is levelling out near 0.7520.

The US dollar fell from a one-year high against a basket of other currencies last week with other central banks also sounding the alarm with regards to inflation and a need to act. Both the Reserve Bank of New Zealand and the bank of England are expected to lift off immanently which has stolen the greenback's thunder of late. However, the Federal Reserve is also expected to raise rates sooner than expected to quell rising price pressures, so the Us dollar remains a strong contender for the leader board in the forex space also.

AUD/USD vs US yields

There is also a technical case for a rebound in the 10-year US yield which sank to 1.62% on Wednesday from a high of 1.673%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

Should the US yields break higher and take the US dollar for a ride to the upside as well. This could prove a major headwind for commodity currencies for the end of the week's sessions.

Meanwhile, the markets are going to be watchful of Reserve Bank of Australia's governor, Phillip Lowe tomorrow who is making a speech, but he is unlikely to reference Australia's monetary policy specifically at the Conference on Central Bank Independence, Mandates and Policies. Next week's RBA’s November statement is the next key AUD risk event for this cross.

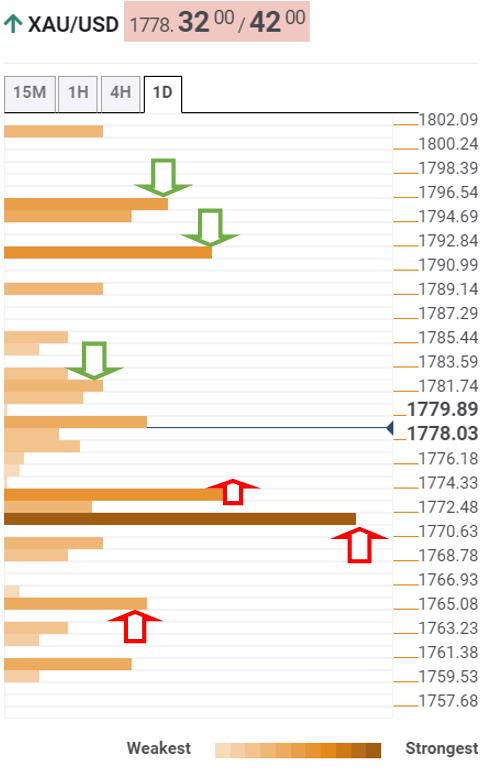

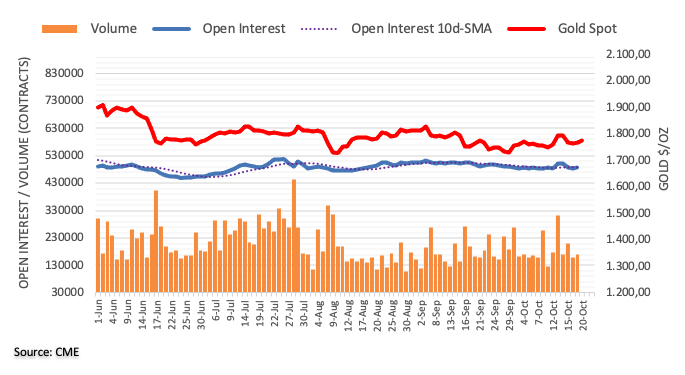

- Despite higher US T-bond yields, gold advances during the New York session.

- Risk-on market sentiment weakened the safe-haven status of the greenback, favoring flows towards the non-yielding metal.

- XAU/USD: For buyers, strong resistance lies ahead at $1,800.00.

Gold (XAU/USD) climbs during the New York session, up 0.91%, trading at $1,785.38 at the time of writing. The market mood is in risk-on mode due to robust US corporate earnings, which eases concerns about labor shortages and elevated prices for raw materials.

Meanwhile, gold extended its two-day rally after the last Friday’s collapse that witnessed the yellow metal tumbling $32.00 on the back of a good US Retail Sales Report.

In the meantime, the US Dollar Index, which correlates inversely to the non-yielding metal, sinks 0.21%, sitting at 93.59, contrarily to the US T-bond 10-year yield, which is advancing one basis point, currently at 1.645%, at press time

XAU/USD Price Forecast: Technical outlook

Daily chart

In the daily chart, XAU/USD is trading above the 50-day moving average (DMA) at $1,779.05, approaching the $1,800.00 area. Around this level lies the confluence of a downward slope trendline, coupled with the convergence of the 100 and the 200 DMA would add selling pressure on the precious metal.

In the outcome of an upside break of the abovementioned could exert upward pressure on XAU/USD. The first resistance level on the way up would be the September 3 high at $1,834.02, followed by the June 11 high at $1,903.33.

On the flip side, failure at the latter could send gold tumbling towards the October 6 low at $1,765.09. A breach of the latter would expose crucial support levels, as the September 29 low at $1,745.56, followed by the August 9 low at $1,687.78

The Relative Strenght Index (RSI), a momentum indicator, is at 55, aiming higher, suggesting that buying pressure could may help a gold rally towards a $1,800.00 test.

Tesla (TSLA) released earnings after the close on Wednesday, October 20. Earnings Per Share (EPS) were $1.86 versus the estimate of $1.57.

Revenue for the quarter came in at $13.76 versus the estimate of $13.63 billion.

Tesla (TSLA) shares are trading $858.74 in the after market, a change of -0.81% on Wednesdays close.

See more here on why the earnings beat may not be enough to keep the recent rally in Tesla (TSLA) stock going.

What you need to know on Thursday, October 21:

The greenback remained under selling pressure and shed ground against all of its major rivals, including that considered safe-haven. The American dollar enjoyed from some temporal demand early in the European session, as US government bond yields jumped to fresh multi-month highs, with the yield on the 10-year Treasury note peaked at 1.673%, but retreated toward 1.64%. Earlier in the year, the yield moving past 1.70% used to trigger sharp dollar’s demand.

The EUR/USD pair trades around 1.1650, posting a modest intraday advance. European Central Bank policymaker Francois Villeroy repeated that current inflation spikes are expected to be temporary. The EU released the final version of the September Consumer Price Index, which was confirmed at 3.4% YoY in September, while the core annual reading printed at 1.9%, validating the European Central Bank’s wait-and-see stance.

GBP/USD finished the day above 1.3800 despite mixed UK inflation data. The Consumer Prices Index came in at 3.1% YoY in September when compared to 3.2% recorded in August. The core reading fell to 2.9% YoY last month from 3.1% registered in August, falling short of the consensus forecast of 3.0%. The BOE is anyway expected to raise rates sooner rather than later, which helped to keep the pound afloat.

Commodity-linked currencies reached fresh multi-month highs versus the greenback. AUD/USD trades around 0.7520, while USD/CAD pressures the 1.2300 mark. The USD/JPY pair ticked lower and settled at 114.26.

Gold posted a third consecutive higher high on a daily basis and settled at around $1.784 a troy ounce. Crude oil prices dipped ahead of the US opening but ended the day at fresh multi-year highs. WTI settled at $83.25 a barrel.

Bitcoin price targets $125,000 as next major all-time high

Like this article? Help us with some feedback by answering this survey:

- GBP/JPY stalls around 158.00 on a softer than expected UK inflation reading.

- A risk-on market mood boosts the prospects of the risk-sensitive British pound.

- GBP/JPY: The pair is tilted to the upside, but any lower corrections might be good opportunities for buyers.

The GBP/JPY stalls its upward trend around 158.00, either way, it climbs 0.10% during the New York session, trading at 157.95 at the time of writing. The market sentiment remains positive, even though central banks are looking to normalize monetary policy conditions, higher energy prices, and the Federal Reserve bond taper announcement.

The British pound slid on Wednesday following the UK CPI release, which showed that the Consumer Price Index for September rose by 3.1% annually, lower than the 3.2% foreseen by analysts. Furthermore, the UK Core CPI, which excludes volatile food and energy prices, decelerated to 2.9% on a yearly basis, lower than the August reading of 3.1%.

Despite the lower inflation reading, the market still expects the Bank of England (BoE) to hike interest rates before the year's end, ultimately giving a lift to the GBP/JPY as the pair tumbled below 158.00.

That said, and if the Bank of England hiking rates prospects remain on investors' minds, the British pound could appreciate more in the following days.

GBP/JPY Price Forecast: Technical outlook

Daily chart

The GBP/JPY upward trend is overextended, as depicted by the Relative Strength Index (RSI), a momentum indicator at 78 within the overbought area, indicating that the pair might correct before resuming the ongoing trend. However, as long as the daily moving averages (DMA's) remain well below the spot price, this favors the British pound.

In case of a correction lower, there could be some dip buyers around the October 18 low at 156.60, immediately followed by the May 27 high at 156.07.

On the other hand, if the GBP/JPY rally extends, a daily close above the 157.00 psychological level could open the way for a 158.00 test.

- The euro returns above 1.1600 to approach Octpober's top at 1.1670.

- US dollar weakness allows for further euro appreciation.

- EUR/USD: On a recovery mood, heading towards 1.1741 – Commerzbank.

The euro keeps crawling higher against a somewhat softer US dollar on Wednesday, on track to complete a three-day recovery. The pair has confirmed above 1.1600 earlier today to ease negative pressure, before hitting resistance right below October’s peak, at 1.1670.

The euro takes advantage of a weaker US dollar

The common currency has been buoyed by a weaker greenback again on Wednesday, with the US dollar is losing ground on the back of upbeat quarterly earnings in the Healthcare sector. Better than expected earnings reported by Anthem and Abbott Laboratories have eased investors’ fears about surging inflation and supply chain disruptions.

In this background, the US Dollar Index has retreated further from the one-year high at 94.50 hit last week, reaching session lows at 93.50 area, 1% below last week’s top. The positive market sentiment has been reflected on moderate advances in Wall Street, with the S&P 500 Index rallying for the sixth consecutive day to test year-to-date highs at 4,545. The Dow Jones Index is 0.45% up, while the Nasdaq has dipped into negative territory halfway through the session to trade nearly flat at the moment of writing.

EUR/USD: Seen appreciating beyond 1.1700 – Commerzbank

Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, sees the pair in a recovery mood, targeting 1.1741: “EUR/USD is in recovery mode near-term. The intraday Elliott wave counts remain positive and we would allow for a deeper retracement to the 1.1741 four-month downtrend.”

Technical levels to watch

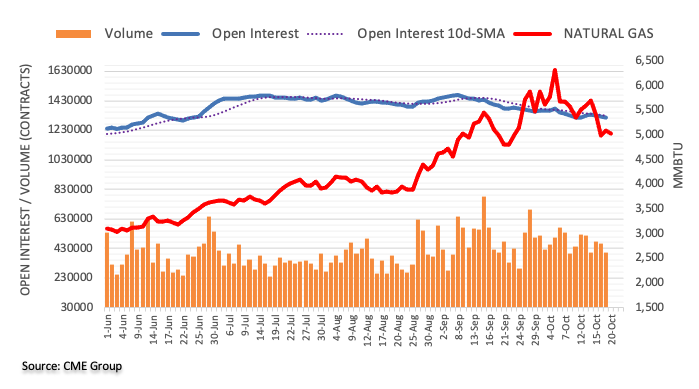

- WTI bulls step back in on inventories and demand outlook.

- Oil markets continue to benefit as delta-variant risks have proved benign.

Oil prices edged higher on Wednesday, with West Texas Intermediate shaking off early weakness following the Energy Information Administration report on an unexpected draw on US oil inventories. At the time of writing, WTI is trading 0.38% higher at $83.35 and has travelled between a low of $80.81 and a high of $83.45.

WTI climbed on the back the EIA reporting US oil inventories falling by 0.4-million barrels last week, while analysts, on average, expected a 1.9-million-barrel rise, according to a Reuters poll. The American Petroleum Institute's weekly survey on Tuesday reported a 3.3-million-barrel rise.

US crude stocks fell by 431,000 barrels in the most recent week, the US Energy Information Administration said, against expectations for an increase, and gasoline stocks plunged by more than 5 million barrels as refiners cut processing due to maintenance.

US stocks at the Cushing, Oklahoma delivery hub hit their lowest level since October 2018. Gasoline stocks are now at their lowest since November 2019, the EIA said.

Additionally, the Organization of the Petroleum Exporting Countries maintains a slow increase in supply rather than intervening to add more barrels to the market. This has occurred at the same time that US demand has ramped up.

Oil prices hit on China coal move

Oil prices have enjoyed a combination of factors, one of which is China's switch from coal to oil to prove electricity. However, overnight, the market had softened overnight after the Chinese government seeks to ensure coal mines operate at full capacity as Beijing moved to ease a power shortage.

''Saudi Arabia's minister of energy said users switching from gas to oil could account for the demand of 500,000-600,000 barrels per day, depending on winter weather and prices of other sources of energy,'' Reuters reported.

Covid risks benign, supporting energy prices

Meanwhile, ''oil markets continue to benefit as delta-variant risks have proved benign while growing departure levels suggest air traffic will continue to support jet fuel demand across both APAC and the US,'' analysts at TD Securities explained.

''This supports a tight supply-demand outlook that is particularly fueling upside momentum in Brent crude and heating oil, which can be exacerbated by up to 1 million bpd of incremental winter demand due to natural gas switching for crude and fuel oils. This informs our long-short heating oil-gasoline trade.''

- The euro remains capped below 0.8460, with YTD low, at 0.8420 under pressure.

- Further decline towards 0.8400 and 0.8325 should not be discarded.

The euro’s recovery attempt from year-to-date lows at 0.8420 has been capped again on Wednesday at 0.8460 previous support turned resistance, and the pair pulled back again, to retest the mentioned 0.8420 low, which is under pressure at the time of writing.

Technical indicators show the pair biased lower with hourly chart still far from oversold levels, which could help to break below 0.8420 (October 15,18, and 19 lows) on track to 0.8400 trendline support, and below there, with the next potential target at 0.8325 (late February 2020 lows).

On the upside, the pair should return above 0.8460/65 (August, 12 low, October 18, 19 highs) before extending recovery towards 0.8520 (October 8 and 12 highs) ahead of 0.8660 (September 29 high).

EUR/GBP daily chart

Technical levels to watch

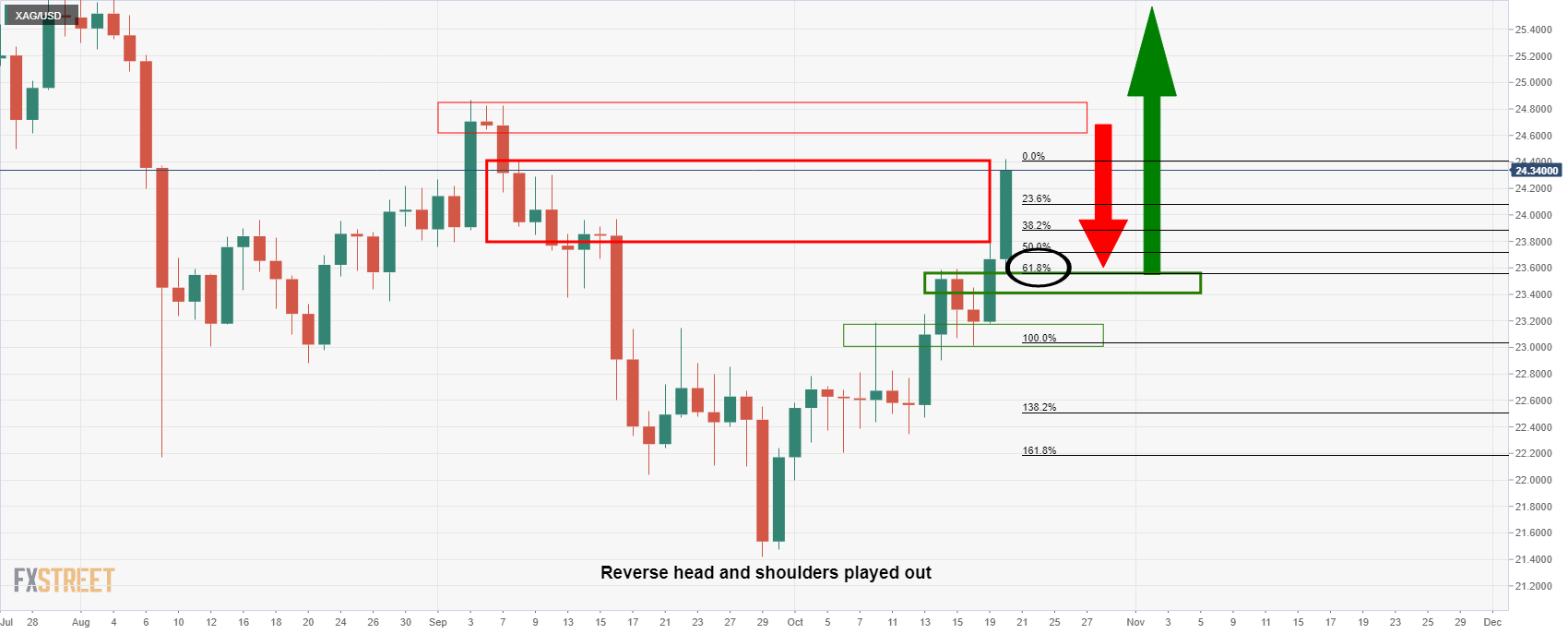

- Silver bulls are in control but are facing a wall of resistance.

- The US dollar is moving into support near 93.50 and yields could pick up as a headwind for precious metals.

Silver has continued with its northerly projection, testing deeper into daily resistance territory. At the time of writing, XAG/USD is trading 2.8% higher on the day so far and has travelled from a low of $23.57 to a high of $24.42. Meanwhile, the greenback has suffered a sell-off from 93.879 to a low of 93.541 as measured against a basket of currencies in the DXY index.

Also boosting precious metals, US benchmark 10-year Treasury yields pulled back after hitting a five-month peak earlier in the session. The 10-year yield fell from a high of 1.673% to a low of 1.621%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

Should the US yields break higher and take the US dollar for a ride to the upside as well, this could prove a major headwind for silver for the end of the week's sessions, as illustrated below in the technical analysis. Meanwhile, investors are starting to consider where the Federal Reserve is reacting too little too late to the threat of inflation.

In the global supply crunch, inflation issues make precious metals attractive as a hedge. However, analysts at TD Securities have argued that the ''market pricing for Fed hikes remains far too hawkish, as it fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response.''

''The market is increasingly pricing in a policy mistake which is unlikely to take place, considering that central banks are likely to look past these disruptions as their reaction functions have been historically more correlated to growth than inflation,'' the analysts said.

Silver technical analysis

The price of silver has rallied into resistance and a pullback to restest the old resistance as new support could be expected at this juncture, especially o the US dollar bounces back into action. There is a 61.8% Fibonacci retracement level that aligns with the old resistance anear 23.60.

- The kiwi appreciates for the sitch day in a row to reach levels past 0.7200.

- A higher appetite for risk buoys the NZD and hurts the US dollar.

- NZD/USD: Seen appreciating to 0.7462/07569 – Commerzbank.

The New Zealand dollar has appreciated further on Wednesday, breaching the previous four-months high, at 0.7170, to explore prices above 0.7200 for the first time since June. The pair is extending its rally for the sixth consecutive day favored by a somewhat weaker US dollar.

The kiwi appreciates on a risk-on session

A string of positive quarterly earnings, with better-than-expected quarterly earnings figures in the Healthcare sector, following upbeat results in the banking sector last week, have buoyed market mood and offset concerns about inflation and supply-chain bottlenecks.

The S&P 500 Index is rallying for the sixth day in a row on Wednesday, pushing against year-to-date highs at 4.545 buoyed by better-than-expected quarterly earnings of the insurance company Anthem and the pharmaceutical Abbott Laboratories, with all eyes on Tesla’s results, which are expected to release record-high earnings in spite of supply-chain restrictions.

Furthermore, US Treasury yields’ rally, boosted by expectations of an imminent announcement of QE tapering by the Federal Reserve, seems to have taken a breather. Other major central banks, namely the Bank of England and the Bank of Canada, are suggesting the possibility of accelerating their monetary normalization plans to tackle high inflation and are pushing the Fed out of the limelight.

In this backdrop, the US Dollar Index, which measures the value of the dollar against the most traded currencies, has extended its retreat to 93.50 area, 1% below the one-year high, at 94.50, hit last week.

NZD/USD is aiming towards 0.7462/0.7559 – Westpac

From a technical perspective, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank sees further upside potential on the pair and points out to the 0.7462/0.7559 area: “NZD/USD yesterday broke above the 2021 downtrend and its 200-day ma and its 55-week ma at 0.7101/04, this was one tough nut to crack and the break above here should lead to some further dollar weakness (…) Target 0.7462/0.7559 long-term pivot.”

Technical levels to watch

- Risk-on market sentiment weighs on the USD versus the CHF.

- The USD/CHF falls on the back of overall US dollar weakness.

- USD/CHF: To enjoy considerable gains on a break above 0.9274 – Credit Suisse.

The USD/CHF slides during the New York session, down 0.42%, trading at 0.9191 at the time of writing. Investors' appetite is in risk-on mode, depicted by US stock indices rising between 0.27% and 0.85%, except for the Nasdaq 100, which drops 0.34% at press time.

Meanwhile, the US Dollar Index, which tracks the greenback's performance versus a basket of six peers, drops 0.21%, sits at 93.58, whereas the US T-bond 10-year yield rises one basis point, up to 1.644%, reinforcing the Fed's bond tapering thesis.

USD/CHF Price Forecast: Technical outlook

Daily chart

In the daily chart, the USD/CHF shows the pair has been under intense selling pressure around the 0.9250 area, which was unsuccessfully tested four times before driving prices lower. However, the upward bias remains in place, as the 100 and 200-day moving averages (DMA's) remain below the spot price, while the Relative Strenght Index (RSI) at 41 suggests that downward pressure remains in place.

For USD/CHF buyers to resume the upward trend, they need a daily close above the 50-DMA at 0.9213. In that outcome, the pair could push towards the October 18 high at 0.9274 resistance level. A break above the latter would expose crucial resistance zones like the October 12 high at 0.9312, followed by the September 30 high at 0.9368.

On the flip side, Wednesday's price action confirms that sellers remain in charge, but they will need a daily close below 0.9200. Once the break is accomplished, the 100-DMA at 0.9172 would be the first support, immediately followed by the 200-DMA at 0.9139.

USD/CHF: To enjoy considerable gains on a break above 0.9274 – Credit Suisse

According to Credit Suisse Analysts, an upside break above 0.9274, could pave the way for further gains on the USD/CHF:

"With trend-following indicators all still generally pointing to the upside, with the 200-day average still rising and weekly MACD still outright bullish, we look for an eventual break above short.term resistance at 0.9274 to negate the recently highlighted top."

"Whilst our core outlook stays bullish, we cannot rule out further corrective weakness whilst below 0.9274 and more important support if the market does manage to close below 0.9214 is at the 200-day average at 0.9139, which is expected to hold if reached."

- Gold regains bullish momentum to approach $1,800.

- Risk appetite and sideways US treasury yields hurt the USD.

- XAU/USD pushing against $1,780/85 resistance area.

Gold futures have bounced higher on Wednesday, favored by broad-based US dollar pullback, amid a higher appetite for risk. The yellow metal has appreciated about $20 so far today, after having remained flat, near $1.760, during the previous two days.

The dollar falters with investors focusing on quarterly earnings

Bullion has regained upside traction on Wednesday, amid a weaker US dollar, with upbeat earnings from the Healthcare sector buoying appetite for risk and easing concerns about supply chain disruptions and surging inflation. Wall Street is trading with moderate advances, while the US Dollar Index, which measures the greenback's value against the most traded currencies has extended its retreat to 93.50 area, 1% below the one-year high, at 94.50 reached last week.

Furthermore, the recent US Treasury bonds' rally fuelled by increasing expectations of imminent QE tapering, seems to have paused. Other major central banks, namely the Bank of England and the Bank of Canada, are coming under increasing pressure to protect their economy against the impact of surging consumer prices and are forcing the Federal Reserve away from the limelight.

XAU/USD is pushing against the $1.770/80 resistance area

The pair has appreciated about 1% so far today and is trying to confirm above $1,780/85 resistance area (September 22 and October 8 highs) ahead of $1,807 (Sept. 15 high) which would expose July and September’s peak. At $1.830,

On the downside, immediate support lies at $1.760 area (October 18 low). Below here, the pair might extend losses to $1,745 (October 6 low), to face, then, a key support area at $1,725 (September 29, 30 low).

Technical levels to watch

Reuters has reported that Federal Reserve Governor Randal Quarles on Wednesday said that while it's time for the Fed to begin dialing down its bond-buying program, it would be "premature" to start raising interest rates in the face of high inflation that is likely to recede next year.

Key comments

It's clear we've met test for taper.

Supports decision at November meeting to reduce fed's asset purchases, end taper by mid-2022.

Fed remains patient to allow more recovery in jobs.

Fed is not behind the curve on inflation fight.

Inflation likely will decline considerably next year, but upside risks 'significant'.

Constraining demand now would be premature.

Monitoring how additional fiscal programs could further boost demand.

Will wait to see further improvements in employment, evolution of inflation in coming months.

If inflation does not recede next year, or if expectations become unanchored, fed's tools can bring inflation down.

Own focus is turning to inflation, from labor market.

Sees strong economic growth for rest of 2021 and 2022.

Strong demand for labor outpacing supply, pushing up wages.

Labor force participation unlikely to return to pre-pandemic level.

Market implications

The market has priced in earlier Fed hikes and tapering to start imminently and the US dollar is giving back some initial speculative gains since the Fed started to turn hawkish over the last couple of meetings. The dollar index, DXY, was last down 0.23% at 93.57 as risk sentiment on the day has improved.

The Bank of Canada (BoC) is set to taper QE purchases further to C$1bn per week with the programme likely concluded in December as the market increasingly prices in 2022 rate hike, explained analysts at ING. They expect a neutral impact on the loonie (CAD) which seems to have most of the positives in the price and may experience corrections in the near term.

Key Quotes:

“USD/CAD is finding some consolidation in the 1.23/1.24 area after a marked correction from the 1.27 level where it used to trade at the end of September. The move has been in line with the rally in other commodity currencies, which was exacerbated by the sharp rise in energy prices.”

“Domestic factors have also contributed, as the data flow has proven particularly supportive for the loonie, as a tighter jobs market and rising inflation kept strengthening the case for more Bank of Canada tapering.”

“We expect the BoC to taper asset purchases again next week and in December, formally ending QE by the end of 2021. We think this is very much in the price, and we doubt CAD can receive any significant lift from the tapering announcement next week.”

“Any material FX impact from the BoC announcement will likely rely on the degree by which the BoC will address the current market expectations that see a first 25bp rate hike almost fully priced in for the April 2024 meeting.”

- The dollar takes a breather after reaching fresh five-year highs at 114.70.

- A higher appetite for risk and a pause on US yield's rally are weighing on the US dollar.

- USD/JPY remains positive and might reach 117.80/118.60 – SocGen.

The US dollar has pulled pack after hitting fresh five-year highs at 114.70 pm Wednesday, to consolidate in the lower range of 114.00. The pair has turned negative on daily charts, although the near-term trend remains positive, after having rallied nearly 5% over the last four weeks.

The USD loses steam on higher appetite for risk

The JPY is taking advantage of a somewhat softer US dollar on Wednesday, weighed by a positive market sentiment. Wall Street’s indexes are trading with moderate advances for the second consecutive day; the Dow Jones is 0.49% up, the S&P 500 appreciates 0.39% and the Nasdaq Technical Index advances 0.66%, on the back of the release of upbeat quarterly earnings results on the Healthcare sector.

Investors’ optimism and the pause on US bond yields' rally have dented demand for the dollar, allowing most majors to post moderate recoveries. The US Dollar Index is trading about 1% down from the 94.50, one-year high, reached last week, as investor’s expectations about monetary tightening by the Federal Reserve have faded somewhat as other major central banks start to anticipate the possibility of accelerating their monetary normalization plans to tackle inflationary pressures.

The Japanese yen, on the other hand, remains heavy on the back of an adverse monetary policy differential. Federal Reserve’s hints towards QE tapering have been widening the treasury yield gap between the US and Japan -whose central bank maintains the 10-year note near zero through a yield control curve- and has squeezed the yen’s attractiveness for the investors.

USD/JPY: Still heading towards 117.80/118.60 – SocGen

The FX Analysis team at Société Générale maintains their bullish bias on the pair, with a potential target at 117.80/118.60: “Signals of a pullback are still not visible; 110.80 should cushion (…) Next potential objectives are at 115.50 and 2016 high of 117.80/118.60.”

Technical levels to watch

- The Loonie rises on the back of broad US dollar weakness across the board.

- The market sentiment is in risk-on mode, as witnessed by the oil-commodity linked CAD.

- Higher crude oil prices boost the Canadian dollar.

- Canada’s CPI for September rose by 4.4%, higher than the 4.1% in August.

The USD/CAD slides to fresh weekly lows during the New York session, down 0.24%, trading at 1.2326 at the time of writing. Despite the Federal Reserve bond taper announcement in November’s meeting and higher energy prices, the market sentiment is upbeat, boosted by robust US third-quarter corporate earnings.

The Dow Jones, the S&P 500, and the Nasdaq rise between 0.10% and 0.50%, whereas the CBOE Volatility Index (VIX), also known as the “fear index,” slid to 15.7, near the lowest since February 2020, spurring the stocks rally in the week.

In the meantime, the US Dollar Index, which measures the buck’s performance against a basket of its peers, slumps 0.15%, sits at 93.64. On the contrary, the US 10-year Treasury yield, rises one basis point, is currently at 1.635%, failing to boost the greenback.

High crude oil prices boost the CAD

Western Texas Intermediate (WTI), the US crude oil benchmark, is rising almost half percent, trading at $82.80 per barrel, weighing on the USD/CAD pair, as depicted by the 0.24% fall.

On the macroeconomic front, the US economic docket featured the EIA Crude Oil Stocks change for the week ending in October the 15. Inventories slump by 0.4 million barrels, spurring a slight jump in WTI prices.

As data published by Statistics Canada, the Canadian economic docket unveiled the Consumer Price Index (CPI) for September, which rose by 4.4% from 4.1% in August. Meanwhile, the Bank of Canada (BoC) Core CPI, excluding food and energy, increased by 3.7%, higher than the 3.6%.

Analysts at Scotiabank expect eight rate hikes by the end of 2023

According to analysts at Scotiabank, they expect eight Bank of Canada rate hikes by the end of 2023, starting on July 2022. The forecast came after Canada’s inflation was reported, which is the highest reading since February 2003.

Analysts at Wells Fargo expect the Bank of England to raise its policy rate by 15 bps at its November announcement. They expected more rate hikes during 2022 but below what is priced into interest rate markets, so they explain the pound could face some mild downside risks.

Key Quotes:

“Growth and inflation trends don't offer an open-and-shut case for an imminent rate hike. However, in the context of increasingly hawkish comments from Bank of England (BoE) policymakers, we think today's CPI will be enough for a November interest rate lift-off, and a gradual pace of rate hikes thereafter.”

“Looking beyond November we expect a relatively gradual pace of rate increases. We believe economic growth could remain somewhat choppy which could limit the speed at which policymakers move, while CPI inflation should also ease back gradually as 2022 progress. Following the initial November hike, we expect another 25 bps increase in May 2022 and a further 25 bps in November 2022, meaning we see the Bank of England's policy rate ending next year at 0.75%—a bit less than currently priced into interest rate markets. As a result, the pound could face some downside for now, and there may also be some mild downside risk to our forecast of GBP/USD appreciation over the medium-term.”

The Federal Reserve will probably have enacted rate lift-off twelve months from now according to analysts at Danske Bank. They expect to see continuing upward pressure on long-term yields. They see the 10Y US Treasury yields reaching 2% on a twelve-month horizon.

Key Quotes:

“We now expect two rate hikes, against previously only one, from the US Federal Reserve in 2022 (September and December).”

“We still do not expect the ECB to hike rates for the next few years. However, as inflation is proving to be less transitory than previously expected, and given the latest signals from the BoE, markets look likely to continue to price rate hikes into the yield curve. This has led to upward pressure on 2Y-5Y EUR swap rates.”

“We expect the market focus for the remainder of the year to shift between the factors supporting higher long yields and those pointing to lower yields. In other words, the outlook has remained quite muddy. Looking 6 and 12 months ahead, we still expect the global economy, and particularly the US economy, to continue to grow. And with an initial rate hike having moved closer and a reduced volume of bond buybacks from both the ECB and the Fed, this should tend to push long yields higher in both the US and Europe. We continue to expect US 10Y Treasury yields to rise to 2% on a 12M horizon, while 10Y Bund yields look set to increase to 0.25%.”

Data released on Wednesday showed inflation in September rose more than expected, but not boosting the loonie. According to analysts at the National Bank of Canada, inflation could continue to surprise the Bank of Canada (BoC) on the upside.

Key Quotes:

“The Canadian CPI print for September surprised on the upside, clocking in with higher inflation than consensus expectations for the fifth time over the last 6 months. As a result, annual inflation reached 4.4%, its highest level in 18 years. The month over month variation would have been stronger it was not from the sharp decline in airfares in September (-14.8%) following last month's surge (+37.5%). Again this month, gains are widespread with no less than six of the eight major components ticking up, which is also confirmed by the central bank's three preferred measures annual inflation accelerating to an average of 2.7%.”

“When the BoC makes its rate decision and releases its Monetary Policy Report next week, we expect that it will maintain its view that this is largely due to transitory factors, while acknowledging that these factors are more persistent than expected.”

“We still believe that inflation could continue to surprise the central bank on the upside. With continued supply chain disruptions and the rise in food commodity prices (historically impacting the food CPI with a 7-month lag), price pressures could persist for some time. Additionally, labor shortage indicators are currently pointing to potential wage push inflation in the coming months as workers appear to have the bargaining power to demand compensation.”

- Sterling's reversal finds support at 1.3745 before bouncing back above 1.3800.

- The pair faltered after weaker than expected UK inflation data.

- GBP/USD approaching key resistance at 1.3910/30 – SocGen.

The British pound has resumed its uptrend on Wednesday, to resume the last two weeks’ rally after a corrective reversal seen during the European session. The pair has found buyers at 1.3745, to bounce up again during the US trading time and return above 1.3800, a few pips below one-month highs at 1.3835.

UK inflation figures weigh on the GBP

According to data from National Statistics released earlier today, UK CPI accelerated at a 3.1% yearly pace, and 0.3% on the month in September, missing expectations of 3.2% and 0.4% increments respectively. These figures have dampened expectations of higher consumer inflation, which would add pressure on the Bank of England to accelerate its monetary normalization plan.

The surging energy prices have boosted consumer prices well above the Bank’s target for price stability prompting BoE officials, namely the Bank Governor, Andrew Bailey, to suggest the possibility of accelerating the monetary policy normalization plan, and thus boosting the pound’s rally from late September.

Sterling's weakness, however, has been short-lived, with the risk-sensitive GBP has buoyed by positive market sentiment. Upbeat quarterly earnings from the healthcare sector have extended the risk-on mood seen on Tuesday, fading concerns higher prices and supply chain disruptions, ultimately weighing on demand for the safe-haven US dollar.

GBP/USD should breach 1.3910/30 to see further appreciation – SocGen

From a technical perspective, the FX analysis team at Société Générale warn about a key resistance area at 1.3910/30: “The GBP/USD pair is approaching potential hurdle of 1.3910/1.3930 representing the recent peak and the 61.8% retracement from June. Overcoming this resistance zone would be crucial for the next leg of rebound (...) Failure to reclaim the 1.3910/1.3930 zone can lead to a short-term pullback. 1.3670 and last week's trough of 1.3570 are near-term supports.”

Technical levels to watch

- US dollar tumbles across the board amid risk appetite.

- Euro turns positive versus the dollar and negative against the pound.

The EUR/USD is rising modestly on Wednesday after making a rebound from 1.1615. During the American session, the pair climbed to 1.1651, slightly below the daily highs. The euro remains unable to break the 1.1650 barrier.

DXY drops as EUR/USD rebounds

The EUR/USD erased daily losses amid a decline of the greenback across the board. A risk-on mood across financial markets weighs on the dollar. The DXY is falling by 0.15% even as US yields hold around monthly highs.

On Wall Street stocks are rising. The Dow Jones gains 0.35% and the Nasdaq 0.08%. Crude oil prices are up, with WTI rising 0.60%. Gold gains more than 10$. Positive corporate results contribute to optimism. Later on Wednesday, the Federal Reserve will release the Beige Book.

From a technical perspective, the recovery of EUR/USD remains capped by the 1.1650 area. A break higher should clear the way to more gains, exposing Monday’s high of 1.1669. On the flip side, 1.1615 is the daily low, a support area and also the 20-day moving average. A daily close clearly below should weaken the euro.

Technical levels

- AUD/USD soars to fresh four-month highs above 0.7500.

- Risk-on market appetite boosts risk-sensitive currencies like the AUD and hurts safe-haven peers like the USD and the JPY.

- High Australian 10-year bond yields boost the AUD, despite RBA signals to not hike rates until 2024.

The AUD/USD climbs to four-month fresh highs, up 0.54%, trading at 0.7514 during the New York session at the time of writing. Positive market sentiment surrounds the financial market, even though the Federal Reserve’s imminent bond taper announcement and higher energy prices.

Major European and US stocks indices soar, while the CBOE Volatility Index (VIX) dropped to 15.7, near the lowest since February 2020. Meanwhile, the US Dollar Index that measures the greenback’s performance against a basket of six rivals edged lower 0.13%, sits at 93.66, contrarily to the US 10-year Treasury yield, rises one basis point, is currently at 1.635%.

The AUD/USD pair has risen more than 1% since the beginning of the week, in line with investors’ risk appetite. Although the Reserve Bank of Australia (RBA) signaled that a rate hike would not come until 2024, the market expectations are others. On Tuesday, the New Zealand CPI reading reached a 10-year high, triggering a jump on the New Zealand 10-year yield up to 2.40%, whereas the Australian 10-year coupon rose to 1.86%.

Furthermore, positive news on the COVID-19 front is that Melbourne welcomes vaccinated Sydney residents without quarantine, so as the country eases lockdowns, the economic recovery would not be jeopardized.

On the macroeconomic front, the Australian economic docket is absent. Concerning the US economic docket, the EIA Crude Oil Stocks change for the week ending in October the 15, stockpiles declined by 0.4 million barrels, triggering a slight jump in WTI prices. Moreover, Federal Reserve Vice-chair Randal Quarles will cross the wires, offering fresh impetus for AUD/USD traders.

AUD/USD Price Forecast: Technical outlook

Daily chart

The AUD/USD pair broke the resistance at 0.7477, closing to the 200-day moving average (DMA) lying at 0.7563. However, as the Relative Strength Index (RSI) is at 72 in overbought levels, the AUD/USD might consolidate before resuming the upward trend.

As the pair heads north, the first resistance would be the 200-DMA at 0.7563. A break of the latter could open the door for a test of the confluence of a downward slope trendline coupled with the June 25 high around the 0.7616 area, followed by the June 11 high at 0.7775.

On the flip side, failure at 0.7500, AUD/USD traders will find 0.7477 as its first support. A breach of that level could push the pair towards the 100-DMA at 0.7404, immediately followed by the October 13 low at 0.7323.

Commercial crude oil inventories in the US decreased by 0.4 million barrels in the week ending October 15, the weekly report published by the US Energy Information Administration (EIA) revealed on Wednesday. This reading came in much lower than the market expectation for an inventory build of 1.8 million barrels.

Market reaction

Crude oil prices started to edge higher after this report. The barrel of West Texas Intermediate, which touched a daily low of $80.77 earlier in the session, was last seen trading at $82.45, where it was still down 0.7% on the day.

Additional takeaways

"Total motor gasoline inventories decreased by 5.4 million barrels last week and are about 3% below the five year average for this time of year."

"US crude oil refinery inputs averaged 15.0 million barrels per day during the week ending October 15, 2021."

"US crude oil imports averaged 5.8 million barrels per day last week, down by 169,000 barrels per day from the previous week."

"Total products supplied over the last four-week period averaged 20.9 million barrels a day, up by 14.0% from the same period last year."

Citing the speech prepared to be delivered at the WTO trade review policy of China, Reuters reported that the US will note that they cannot ignore reports of China’s use of forced labour in several sectors.

"China’s industrial policies skew the playing field against imported goods and services, foreign manufacturers and services suppliers," the US will say. "China's other unfair trade practices include preferential treatment for state enterprises, data restrictions, inadequate enforcement of intellectual property rights and cyber theft."

Market reaction

This headline doesn't seem to be having an impact on market sentiment. As of writing, the S&P 500 Index was up 0.3% on the day at 4,530.

Alfred Kammer, the Director of the European Department at the International Monetary Fund, said on Wednesday that they are not expecting an inflation spiral in Europe, as reported by Reuters.

Additional takeaways

"Inflation driven by energy prices is expected to fade."

"Not expecting second-round inflationary effects in Europe due to slack in the European labour market."

"European Central Bank can react to deeper inflation concerns."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen rising 0.12% on the day at 1.1645.

- USD/TRY loses further momentum and tests 9.2000.

- The offered stance in the dollar weighs on the pair.

- The CBRT meets on Thursday and is likely to reduce rates.

The Turkish lira adds to Tuesday’s gains and drags USD/TRY to new 3-day lows in the boundaries of the 9.2000 yardstick on Wednesday.

USD/TRY focuses on CBRT decision

USD/TRY loses ground for the second session in a row midweek against the persistent corrective downside in the greenback. Indeed, the dollar faded the initial optimism and now the US Dollar Index (DXY) slipped back into the negative territory for yet another session.

The softer note in the buck, in the meantime, allows the risk complex – and the beleaguered lira - to extend gains for an extra session on Wednesday ahead of the CBRT event on Thursday.

It is worth noting that consensus among traders remains largely tilted towards another 100 bps interest rate cut, taking the One-Week Repo Rate to 17.00%.

Other than the CBRT meeting, the Turkish calendar will see the release of the Consumer Confidence for the current month.

USD/TRY key levels

So far, the pair is losing 0.46% at 9.2518 and a drop below 9.1234 (10-day SMA) would aim for 8.9881 (20-day SMA) and finally 8.8317 (monthly low Oct.4). On the other hand, the next up barrier lines up at 9.3699 (all-time high Oct.19) followed by 10.0000 (round level).

The UK released a raft of price data this morning, with weaker than expected results clearly weighing on the GBP. Economists at Scotiabank expect the GBP/USD pair to extend its decline towards 1.3675 after breaking below the 1.3785 support.

GBP weakens on softer than expected inflation data

“CPI rose 0.3% MoM in September, against expectations of a 0.4% gain, pushing the YoY rate of inflation down to 2.9% (from 3.0% in August). Core inflation eased to 2.9% from 3.1%. PPI data showed a 0.4% rise in input prices, well below forecasts of a 1.0% rise.”

“Cable has cracked minor support at 1.3785 (now resistance intraday) and should edge lower towards key support at 1.3675.”

- Wall Street's main indexes continue to edge higher.

- Energy stocks underperform amid falling crude oil prices.

Major equity indexes opened in the positive territory for the sixth straight day on Wednesday as risk flows remain in control of financial markets in the absence of high-tier data releases. Reflecting the upbeat market mood, the CBOE Volatility Index is down 2% on the day.

As of writing, the S&P 500, which set an all-time high of 4,545 on September 2, was up 0.15% on the day at 4,525. The Dow Jones Industrial Average was rising 0.1% at 35,487 and the Nasdaq Composite was gaining 0.08% at 15,142.

Among the 11 major S&P 500 sectors, the Energy Index is down nearly 1% pressured by the 2% decline witnessed in US crude oil prices. On the other hand, the Healthcare Index is rising 0.9% as the biggest gainer after the opening bell.

S&P 500 chart (daily)

Concerns about the UK’s growth outlook were highlighted last week by the IMF, which warned of more longer-lasting damage to the UK economy than any other country in the G7. Consequently, economists at Rabobank see a bumpy road ahead for the pound.

EUR/GBP still seen at 0.85 on a three-month view

“The IMF’s forecasts indicated that while most other advanced nations were on track to return to their pre-pandemic growth trends next year, and to exceed it by 2024, the UK’s economy would still be 3% smaller in 2024. This warning may be feeding concerns about the medium-term outlook for GBP.”

“Although the hawkishness of the BoE has pushed EUR/GBP moderately lower, both the Bank and GBP will be judged harshly if the UK recovery shows signs of faltering in the new year.”

“Despite the hawkish tone of the BoE, we retain a three-month EUR/GBP forecast of 0.85.”

USD/CAD holds in mid 1.23s. Economists at Scotiabank expect the pair to see further gains on a break above 1.2380.

Initial support seen at 1.2340

“We spot key resistance intraday at 1.2380 and would look for USD gains to pick up above here in the short run.”

“Support is 1.2340 and 1.2310/20.”

- A combination of factors assisted gold to regain positive traction on Wednesday.

- Retreating US bond yields weighed on the USD and extended support to the metal.

- The cautious market mood further benefitted the commodity’s safe-haven status.

- Gold Price Forecast: XAU/USD’s bullish potential appears limited amid bear cross

Gold gained positive traction for the second successive day and shot to fresh weekly tops, closer to the $1,790 level during the early North American session. The US dollar struggled to capitalize on the previous day's bounce from three-week lows, instead met with some fresh supply on Wednesday. This was seen as a key factor that acted as a tailwind for the dollar-denominated commodity. Apart from this, the cautious market mood further extended some support to the safe-haven precious metal.

Meanwhile, the latest leg of a sudden spike over the past hour or so could be attributed to a modest pullback in the US Treasury bond yields, which benefitted the non-yielding gold. In fact, the yield on the benchmark 10-year US government bond witnessed an intraday turnaround from the highest level since May amid moderation of Fed hike expectations. This week's dismal US macro releases – Industrial Production and housing market data – pointed to weakening economic activity and tempered market expectations for an early policy tightening by the Fed.

That said, worries that the recent widespread rally in commodity prices will stoke inflation might force the Fed to adopt a more aggressive policy response in 2022. This, in turn, might hold investors from placing aggressive bullish bets around gold and cap the upside, at least for the time being. In the absence of any major market-moving economic releases from the US, traders might take cues from a scheduled speech by Fed Governor Randal Quarles. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the commodity. Apart from this, the broader market risk sentiment might provide some impetus to the XAU/USD.

Technical outlook

From a technical perspective, any subsequent positive move is likely to confront stiff resistance near the $1,800 level. The mentioned handle marks a confluence hurdle comprising technically significant 100/200-day SMAs and should act as a key pivotal point for short-term traders. A sustained breakthrough, leading to a subsequent strength beyond the $1,808-10 region, should pave the way for a move towards challenging the $1,832-.34 heavy supply zone.

On the flip side, immediate support is pegged near the $1,775 level, below which gold prices could slide back towards the $1,763-60 region. Some follow-through selling will negate any near-term positive bias and prompt some technical selling, exposing the $1,750 support zone. The downward trajectory has the potential to drag the XAU/USD further towards September monthly swing lows, around the $1723-21 area.

Gold daily chart

Levels to watch

Gold continues to see signs of recovery. In the view of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, XAU/USD will need to regain the 200-day moving average at $1794 to confirm upside scope to the July highs.

XAU/USD looking for a deeper rally

“The bounce has yet to clear moving average resistance at $1794 and only above here will allow for a rally towards $1834.16/21, which are the highs since July and we look for rallies to struggle on moves to here. The 55-week ma also is found at $1815.

“We are relatively neutral but only a close above the $1845 2020-2021 resistance line would regenerate upside interest for a recovery to $1856/57 4th June low. Above here lies the $1917 May 2021 peak.”

“Below $1721, support is found at $1679.80/$1677.83 and is reinforced by the $1670 June 2020 low. Below $1670 would target the 2018-2021 uptrend at $1608.”

See – Gold Price Forecast: XAU/USD to suffer further weakness on a dip below $1691/77 – Credit Suisse

Economist Enrico Tanuwidjaja and Yari Mayaseti at UOB Group comment on the latest trade balance results in Indonesia.

Key Takeaways

“Indonesia’s trade surplus narrowed slightly to USD4.4bn in September vs. USD4.7bn in the previous month (albeit less than expectations of USD3.8bn), amidst slower pace of imports, notably for capital goods. Imports slowed to 40.3% y/y in September vs. 55.3% in August, vs. 50.0% forecast. Meanwhile, exports slowed to 47.6% y/y in September vs. 64.1% in the previous month, vs. market consensus of 51.6% due to the slower exports in manufacturing sector as well as lower exports in agriculture.”

“From January to September this year, Indonesia booked USD25.1bn of trade surplus which was significantly higher than the USD13.4bn surplus recorded over the same period last year. If the commodity prices remain high, exports could sustain their solid expansion to keep the trade surplus at an elevated level. This certainly will help to push the current account deficit (CAD) to a narrower position this year despite the rebound in imports (due to higher domestic demand) and higher primary income deficit. This should provide more support to Indonesia external resiliency. It also remains a possibility for Indonesia to even run current account surplus in the third quarter of 2021 (or even this year). Indonesia has been recording a trade surplus since May 2020 (17-month running and may continue so), and for 2021 to-date, a cumulative trade surplus of USD21.85bn already exceeded 2020 total trade surplus of USD21.74bn.”

- EUR/USD keeps the bid bias unchanged above 1.1600.

- The 55-day SMA at 1.1715 comes next on the upside.

EUR/USD manages well to leave behind the initial pessimism and regains the upper hand near 1.1650 on Wednesday.

That said, the pair could now attempt to take out the round level at 1.1700 the figure ahead of the interim hurdle at the 55-day SMA, today at 1.1715. Further north comes the short-term resistance line around 1.1740. A breakout of the latter should see the selling pressure mitigated and therefore allow for extra gains to the next relevant resistance in the mid-1.1700s.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1921.

EUR/USD daily chart

- Inflation in Canada rose at a stronger pace than expected in September.

- USD/CAD stays in the negative territory around 1.2350.

Annual inflation in Canada, as measured by the Consumer Price Index (CPI), advanced to 4.4% in September from 4.1% in August, the data published by Statistics Canada revealed on Wednesday. This reading came in higher than the market expectation of 4.3%.

Moreover, the Bank of Canada's (BoC) Core CPI, which excludes volatile food and energy prices, rose to 3.7% in the same period, compared to analysts' estimate of 3.6%.

Market reaction

These readings don't seem to be having a significant impact on USD/CAD, which was last seen losing 0.1% on a daily basis at 1.2350.

- EUR/GBP staged a modest bounce after dropping to fresh 18-month lows earlier this Wednesday.

- Softer UK CPI weighed on the British pound and prompted a short-covering move around the cross.

- BoE rate hike expectations, the emergence of some selling around the common currency capped gains

The EUR/GBP cross edged higher through the mid-European session and climbed back above mid-0.8400s, refreshing daily tops in the last hour.

The cross quickly reversed an intraday dip to the 0.8420 region, or the lowest level since February 2020 and inched back closer to the top end of its weekly trading range. Softer-than-expected UK CPI print turned out to be one of the key factors behind the British pound's relative underperformance and prompted some short-covering around the EUR/GBP cross.

The UK Office for National Statistics reported that the headline CPI decelerated to 0.3% MoM in September as against expectations for a fall to 0.4% from 0.7% reported in the previous month. Adding to this, the yearly rate unexpectedly edged lower from 3.2% in August to 3.1% during the reported month, still well above the Bank of England's 2% target.