- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 21-11-2011

Expect Q4 growth in neighborhood of 3%, perhaps better US economy growing at very moderate pace

Inflationary pressures weakening after period of excess inflation

Economy may slow but no small risk of recession

The euro rose against the U.S. dollar against the backdrop of media reports that a special committee ("supercommittee") of the U.S. Congress, designed to reduce the budget deficit will soon announce the failure to reach a compromise solution. Before November 23 "supercommittee" must submit a plan to reduce the budget deficit ($ 1.2 trillion. For 10 years), however, to the present moment, the consensus between Republicans and Democrats on the structure of public spending cuts was not found until. Despite the fact that the costs would be cut in any case (after the "dip" in the negotiations the country will face automatic "sequestering" the budget for the same amount), the inability of the major parties to take a decision on the consolidated fiscal policy could provoke a new round of concerns about reducing the country's sovereign rating international agencies (Fitch and Moody's).

Earlier, the euro fell against the dollar and the yen amid growing profitability of French, Spanish and Belgian bonds. Bonds in France today showed growth after rating agency Moody's said that the increase in the cost of borrowing for France could negatively affect its credit rating, which is now at AAA. As a result, the yield on 10-year French bond rose 8 basis points to 3.53%. Bond Fund Global Sovereign Open Fund, owned by Kokusai Asset Management, sold November 17, Spanish and Belgian government bonds. This has contributed to the profitability of Spanish and Belgian bonds also showed growth.

The Swiss franc rose most of its major counterparts as investors sought refuge.

The British pound fell to a month low against the U.S. dollar after British Prime Minister Cameron today announced that next week the government will present an ambitious scheme of credit easing, as the UK must tackle its own debt. Sterling fell against the dollar and euro as home sellers in the U.K. cut asking prices.

Decision on 6th trance expected next week

All institutions must do all they can to support Greece

Еuropean stocks dropped the most in three weeks amid signs U.S. lawmakers may fail to reach an agreement on budget cuts, raising the prospect the world’s largest economy could face another credit downgrade.

The U.S. deficit-cutting congressional supercommittee will probably announce that it has failed to agree on $1.2 trillion of federal budget savings, a Democratic aide said in an e-mail. The aide, who wasn’t authorized to discuss internal matters publicly and requested anonymity, said that it was highly unlikely that the talks could be salvaged. Today is the deadline for the Congressional Budget Office to receive a plan that it can analyze before the committee’s Nov. 23 target date for reaching an agreement. S&P downgraded the U.S. on Aug. 5 to AA+ from AAA.

In Spain, Mariano Rajoy won the biggest parliamentary majority in an election in almost 30 years, and told Spaniards to brace for difficult times as the nation fights to avoid being overwhelmed by the sovereign-debt crisis.

Shares also fell as Moody’s Investors Service warned that rising French bond yields increased the fiscal challenges facing the nation with “negative credit implications.” The rating company declined to comment on a report in Le Figaro newspaper that France’s AAA credit rating is at risk.

National benchmark indexes retreated in all 18 markets in western Europe. France’s CAC 40 Index and Germany’s DAX Index lost 3.4 percent. The U.K.’s FTSE 100 Index dropped 2.6 percent. Greece’s ASE Index sank 3.7 percent as the country’s new Prime Minister Lucas Papademos met European Union President Herman Van Rompuy and European Commission President Jose Barroso in Brussels today.

KBC led bank shares lower, slumping 13 percent to 9.46 euros in Brussels, as the three-month cross-currency basis swap, the rate banks pay to convert euro payments into dollars, widened for a sixth day and bond yields climbed in Spain, Italy and Belgium. Commerzbank AG plunged 6.8 percent to 1.36 euros, BNP Paribas SA slid 4.3 percent to 26.85 euros and Barclays Plc dropped 5.4 percent to 157.5 pence.

Rio Tinto Group slid 5.9 percent to 3,083 pence and Total SA lost 2.9 percent to 36.02 euros, pacing gauges of mining and energy companies lower. Copper and oil fell for a third day as Japan’s exports dropped and Singapore warned its economy may grow 1 percent to 3 percent in 2012 after expanding 5 percent this year.

Carrefour SA slipped 3.2 percent after the retailer’s largest shareholders were said to consider replacing its chairman and chief executive officer.

Adidas AG declined 3.2 percent to 48.69 euros after Welt am Sonntag reported the world’s second-largest sporting-goods maker will increase prices in 2012 because of higher raw-material prices and wage costs.

Statoil ASA slid 3.1 percent to 140.90 kroner even after Norway’s national oil company agreed to sell stakes in fields to Centrica Plc for $1.6 billion. Statoil will dispose of stakes in eight fields on the Norwegian continental shelf, it said. Centrica’s shares lost 1 percent to 286.1 pence.

To conduct term deposit quick tender Tuesday at 10:30GMT

ECB term deposit tender at variable rate with 1.25% maximum bid

ECB to conduct another term deposit ternder next week.

U.S. stocks slumped, giving the Standard & Poor’s 500 Index its longest losing streak since September, amid concern the government will be forced to submit to $1.2 trillion in automatic spending cuts if lawmakers fail to agree on a deficit plan.

Financial stocks posted the second-biggest decline among 10 industries in the S&P 500, dropping 2.9 percent, as 493 out of 500 companies retreated. The Dow Jones Industrial Average declined 292.94 points, or 2.5 percent, to 11,503.22 today after a Democratic aide said the supercommittee that was supposed to dissolve congressional gridlock in Washington is instead on the brink of failure.

The decline pushed the S&P 500 below levels representing the top of a price range that prevailed in the two months after the U.S. was stripped of its AAA credit rating by S&P on Aug. 5. Rallies after the downgrade brought the S&P 500 to closing highs of 1,204.49 on Aug. 15, 1,218.89 on Aug. 31 and 1,216.01 on Sept. 16, according to data compiled by Bloomberg.

Today is the deadline for the Congressional Budget Office to receive information for scoring a proposal in advance of the supercommittee’s Nov. 23 target date for reaching a deal. The 12-member bipartisan supercommittee likely will announce today that it can’t reach agreement on deficit savings, according to a Democratic aide.

U.S. shares joined European equities in retreating. France’s rising financing costs are increasing the nation’s fiscal challenges, according to report issued by Moody’s Investors Service. Germany’s Finance Ministry said the country’s expansion is “noticeably slower” this quarter.

Citigroup Inc. plunged 5.4 percent, while Hewlett-Packard Co., Boeing Co. and Caterpillar Inc. slumped more than 3.8 percent.

Pharmasset soared 85 percent to $134.26. Gilead Sciences, the world’s largest maker of HIV medicines, agreed to buy Pharmasset, betting that its experimental hepatitis C treatments will lead the next generation of therapies in a market that may reach $20 billion by 2020. Gilead Sciences slid 11 percent to $35.37.

Research In Motion Ltd. fell 6.5 percent to $17.01 after analysts at RBC Capital Markets and JMP Securities LLC cut their profit estimates, citing increased competition, and the smartphone maker said some customers couldn’t turn on their BlackBerry Bold devices.

Gold prices down on Monday against the desire of investors to bail out cash to cover losses on other financial markets. Exchange Asia today closed lower amid concerns the indices associated with the possibility of solving the debt crisis in the eurozone. Exchanges in Europe are also in negative territory, as U.S. stock indexes started trading with a sharp fall in the context of heightened concerns about unsustainable debt burden both domestically and abroad, which further increased the level of uncertainty in the markets.

A debt-reduction committee with special powers that was supposed to dissolve congressional gridlock in Washington is instead on the brink of failure, setting the stage for $1.2 trillion in automatic spending cuts. U.S. Senator Jon Kyl of Arizona, a Republican on the 12- member panel, said on CNBC today that the supercommittee’s Republican and Democratic co-chairmen, Representative Jeb Hensarling of Texas and Senator Patty Murray of Washington, would make a formal announcement “toward the end of the day.” They are expected to say that the panel can’t reach agreement on determining deficit reductions of at least $1.2 trillion.

Today is the deadline for the Congressional Budget Office to receive information for analyzing how a proposal would affect the U.S. budget deficit, in advance of the supercommittee’s Nov. 23 target date for reaching a deal. Senate Republican leader Mitch McConnell of Kentucky has declared over the past few months that failure is “not an option” for the panel, which was created in August after rancorous debate over raising the nation’s borrowing limit that plunged congressional approval ratings to lows of between 9 percent and 14 percent.

Today, December gold futures during the trading session on Comex in New York fell to 1689.1 dollars per troy ounce.

Eurogroup Nov. 29 meeting to decide on 6th aid tranche

Greece aims to complete debt deal before March bond redemptions

Oil dropped for a third day in New York on signs that U.S. lawmakers won’t agree on cutting the budget deficit and on concern that Europe’s debt crisis will send the region’s economy into a recession.

Futures fell as much as 2.1 percent on speculation that a debt-reduction committee’s inaction will set the stage for $1.2 trillion in automatic cuts. The 12-member bipartisan supercommittee will probably announce today that it can’t reach agreement on deficit savings, according to a Democratic aide. Today is the deadline for the Congressional Budget Office to receive information for scoring a proposal in advance of the supercommittee’s Nov. 23 target date for reaching a deal.

Growth in Germany, Europe’s largest economy, may slow next year, the Bundesbank said today. The Frankfurt-based Bundesbank cut its 2012 growth forecast to a range of 0.5 percent to 1 percent from a June prediction of 1.8 percent. It said a “pronounced” period of economic weakness can’t be ruled out if the crisis worsens.

Crude oil for January delivery fell to $95.52 a barrel on the New York Mercantile Exchange. Futures are up 5.2 percent this year.

Brent oil for January settlement dropped 86 cents, or 0.8 percent, to $106.70 a barrel on the London-based ICE Futures Europe exchange.

Resistance 2:1208 (session high, the top border of downchannel from Nov 16)

Resistance 1:1200 (intraday high)

Current price: 1189,75

Support 1 : 1185 (session low, Oct 13 and 18 lows)

Support 2 : 1180 (Oct 11-12 lows, the bottom border of downchannel, 50,0 % FIBO 1068-1188)

Support 3 : 1152/55 (area of Oct 10 low and 61,8 % FIBO 1068-1188)

EUR/USD $1.3590, $1.3600

USD/JPY Y76.25, Y77.50, Y78.00AUD/USD $1.0000, $0.9900

GBP/USD $1.5600, $1.5745, $1.5800

Today is the deadline for the Congressional Budget Office to receive information for scoring a proposal in advance of the supercommittee’s Nov. 23 target date for reaching a deal.

Crude oil: $96.32 (-1,2%).

Gold: $1710,50 (-0,9%).

Data:

09:00 EU(17) Current account (September) adjusted, bln 0.5

The dollar rallied versus major counterparts as a Democratic Party aide said a U.S. congressional committee is likely to announce it failed to agree on deficit cuts, boosting the bid for safety.

The euro dropped against the yen following last week’s biggest loss since September as Spain’s Socialists became the fifth European government to be ejected as a result of the region’s debt crisis.

The pound fell for the first time in three days against the dollar as home sellers cut asking prices.

EUR/USD: the pair has fallen in $1.3430 area. Later the rate restored.

GBP/USD: the pair has fallen below $1.5650, come nearer to support in $1,5630 area.

USD/JPY: the pair was in Y76,75-Y76,95 area.

EUR/USD

Offers $1.3560, $1.3515/25, $1.3490/500, $1.3465

Bids $1.3420, $1.3400, $1.3385/80

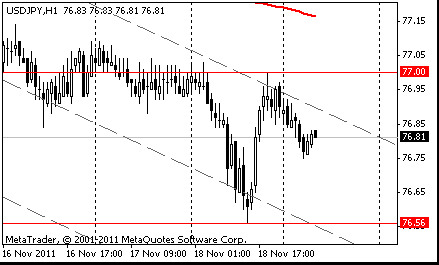

Resistance 3: Y77.70 (Nov 11 high)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.00 (Nov 18 high)

Current price: Y76.86

Support 1:Y76.75 (session low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.30 (area of Nov 25-26 highs)

Resistance 3: Chf0.9315 (high of October)

Resistance 2: Chf0.9230 (Nov 17 high)

Resistance 1: Chf0.9210 (session high)

Current price: Chf0.9202

Support 1: Chf0.9190 (intraday low)

Support 2: Chf0.9155 (session low)

Support 3: Chf0.9110 (МА(200) for Н1)

Resistance 3: $ 1.5790 (session high, 61,8 % FIBO of falling from $1,5890)

Resistance 2: $ 1.5730 (38,2 % FIBO of falling from $1,5890)

Resistance 1: $ 1.5690 (earlier support, Nov 17 low)

Current price: $1.5641

Support 1 : $1.5630 (Oct 18 low)

Support 2 : $1.5610 (61,8 % FIBO $1,5270-$ 1,6165)

Support 3 : $1.5540 (Oct 12 low)

Resistance 3: $ 1.3575 (МА(200) for Н1)

Resistance 2: $ 1.3540 (session high)

Resistance 1: $ 1.3470 (intraday high)

Current price: $1.3440

Support 1 : $1.3420 (Nov 17 low)

Support 2 : $1.3370 (Oct 10 low)

Support 3 : $1.3240 (Oct 6 low)

EUR/USD $1.3590, $1.3600

USD/JPY Y76.25, Y77.50, Y78.00AUD/USD $1.0000, $0.9900

GBP/USD $1.5600, $1.5745, $1.5800

Nikkei 225 8,348 -26.64 -0.32%

Hang Seng 18,226 -265.38 -1.44%

S&P/ASX 4,163 -13.94 -0.33%

Shanghai Composite 2,415 -1.43 -0.06%

00:01 United Kingdom Rightmove House Price Index (YoY) November +1.2%

04:30 Japan All Industry Activity Index, m/m September -0.9%

The yen and the dollar rose against most of their major counterparts on demand for safer assets after a Democratic aide said a U.S. congressional committee is likely to announce today it failed to agree on deficit cuts.

The euro held last week’s biggest loss versus the yen since September after Spain’s opposition won a parliamentary majority, making the ruling Socialists the fifth European government to be ejected amid the region’s debt crisis.

Today is the deadline for the U.S. Congressional Budget Office to receive a plan that it can analyze before the supercommittee’s Nov. 23 target date for reaching an agreement. It was highly unlikely that the panel’s talks could be salvaged, the Democratic aide, who requested anonymity, said in an e-mail yesterday.

Australia’s dollar fell to a five- week low as U.S. lawmakers may announce today they failed to reach an agreement on budget cuts, raising the prospect the world’s largest economy will face another credit downgrade. The so-called Aussie also slid versus the yen after a Democratic aide said in an e-mail it was highly unlikely that the supercommittee talks were salvageable.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair dropped.

USD/JPY: on Asian session the pair fell.

A fairly quiet session on both sides of teh Atlantic this week. At 0900GMT, the ECB Sep current account data is set for release. At

1245GMT ECB Executive Board member Juergen Stark is slated to give a speech on economic adjustment, in Dublin.Over the pond, and 1330GMT sees the release of Canada's Sept 2011 Wholesale sales and inventories data.At 1930GMT, Atlanta Federal Reserve Bank President Dennis Lockhart is scheduled to make remarks on the work of the Fed to the Getulio Vargas Business School, Sao Paulo, Brazil.

Breaks support at $1.5720 and extends the corrective pullback to $1.5711. Minor support seen into $1.5700 with better interest reported toward Nov17 lows at $1.5692. Larger stops noted on a break of $1.5690. A break and clear here exposes $1.5630.

On Monday the euro dropped more than 1 percent versus the dollar and yen as Italy’s borrowing costs increased at a five-year note sale, stoking concern its new government will struggle to contain debt turmoil. Italy’s Treasury auctioned 3 billion euros ($4.1 billion) of September 2016 notes, the maximum target. The yield was 6.29 percent, up from 5.32 percent at the previous auction and the highest since June 1997. Demand rose to 1.47 times the amount on offer, from 1.34 times last month. The franc snapped a two-day gain versus the dollar, sliding to 90.86 centimes versus the dollar, after the Federal Statistics Office said producer and import prices decreased 1.8 percent last month from a year earlier. Swiss National Bank President Philipp Hildebrand is proving intervention in foreign-exchange markets can succeed as speculators bow to his decision to cap the franc against the euro as he seeks to stave off the threat of deflation.

On Tuesday the euro fell to a one-month low against the yen as European bond yields surged at auctions and Mario Monti, Italy’s premier-in-waiting, faced resistance to forming a cabinet. The 17-nation currency slid below $1.35 as Italy’s 10-year yields surpassed the 7 percent threshold that prompted other nations to seek bailouts. Italian 10-year yields climbed as high as 7.07 percent after rising to a euro-era record of 7.48 percent on Nov. 9. The dollar got a boost as Federal Reserve Bank of Dallas President Richard Fisher said he sees decreasing odds the central bank will need to ease policy further on signs the U.S. economy is poised for growth. U.S. retail sales rose in October more than forecast, and manufacturing in the New York region unexpectedly expanded this month, reports showed.

On Wednesday the euro against the dollar shows a high volatility. The euro reached a five-week low against the dollar and the yen amid growing fears of investors about the ability of European countries to cope with the debt crisis. Yields on ten-year Italy at auction on Wednesday fell by 29 basis points - to 6.79%, the papers in Spain - 9 points - to 6.25%. The British pound fell against the dollar after the Bank of England lowered forecasts for economic growth and inflation, as expected, signaling the introduction of a new fiscal stimulus in coming months. As the market was ready for such statements, the pound was able to hold their positions.

On Thursday the euro rose against the majority of its most-traded counterparts as Italian bond yields reversed course and fell, easing concern the region’s third-largest economy will be unable to handle its debt crisis.The 17-nation currency gained from the lowest in five weeks versus the dollar and the yen as two people with knowledge of the trades said the European Central Bank bought more Italian government bonds, following purchases earlier. The euro fell earlier as Spanish and French borrowing costs rose at auctions.The pound strengthened against the dollar, snapping a three-day decline, after British retail sales unexpectedly rose in October.

On Friday the euro strengthened for the first time in a week against the dollar and yen amid speculation European Central Bank buying of Italian and Spanish bonds will stem surging borrowing costs in the region.Europe’s shared currency rose from yesterday’s five-week low versus the yen amid reports the ECB may start talks to lend to the International Monetary Fund for sovereign bailouts. Italian bonds rose. ECB President Mario Draghi today slammed governments for failing to implement policy commitments as holders of Greek debt began talks in Athens on structuring a 50 percent writeoff that was the cornerstone of a deal reached last month. The accord, which finance ministers aim to implement next month, was at least the fourth plan billed as a comprehensive strategy to end the crisis born in Greece in 2009, none of which provided a lasting fix.

Resistance 3: Y77.90 (Nov 9-10 high)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.00 (session high)

The current price: Y76.81

Support 1: Y76.55 (Nov 18 low)

Support 2: Y76.20 (support line of Nov)

Support 3: Y75.60 (historical low)

Comments: the pair is on downtrend. In focus support Y76.55.

Resistance 3: Chf0.9300 (a psychological mark)

Resistance 2: Chf0.9225/35 (area of Nov 16-18 high)

Resistance 1: Chf0.9185 (session high)

The current price: Chf0.9165

Support 1: Chf0.9160 (session low)

Support 2: Chf0.9085 (Nov 18 low)

Support 3: Chf0.9020 (76.4% FIBO Chf0.9235-Chf0.8950)

Comments: the pair is on uptrend. In focus support Chf0.9185.

Resistance 3 : $1.5930 (Nov 15 high)

Resistance 2 : $1.5850 (resistance line from Nov 14)

Resistance 1 : $1.5800 (session high)

The current price: $1.5745

Support 1 : $1.5730 (session low)

Support 2 : $1.5690 (Nov 17 low)

Support 3 : $1.5630 (Oct 18 low)

Comments: the pair is on downtrend. In focus support $1.5730.

Resistance 2: $1.3600 (MA (233) H1, resistance line from Nov 16)

Resistance 1: $1.3540 (session high)

The current price: $1.3514

Support 1 : $1.3495 (low of the American session on Nov 18)

Support 2 : $1.3435/45 (area of Nov 17-18 low)

Support 3 : $1.3360 (Oct 7 low)

Comments: the pair is on uptrend. In focus resistance $1.3540.

00:01 United Kingdom Rightmove House Price Index (MoM) November -3.1%

00:01 United Kingdom Rightmove House Price Index (YoY) November +1.2%

04:30 Japan All Industry Activity Index, m/m September -0.9%

09:00 Eurozone Current account, adjusted, bln September -5.0 -3.4

13:30 Canada Wholesale Sales, m/m September +0.2% +0.6%

15:00 U.S. Existing Home Sales October 4.91 4.82

19:30 U.S. FOMC Member Dennis Lockhart Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.