- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 22-11-2011

The euro gained versus the yen as appetite for safety declined amid speculation officials were tackling Europe’s sovereign-debt crisis. The 17-nation currency rose against the dollar after the International Monetary Fund revamped its credit-line program to help countries facing outside shocks. It fluctuated earlier as the U.S. economy grew less than estimated and ratings companies affirmed U.S. credit grades. The dollar remained lower after the Federal Reserve released minutes of its last meeting. Canada’s dollar climbed on a rise in oil, the nation’s biggest export.

Europe’s shared currency gained as European Commission President Jose Barroso said he expected the Italian government under Prime Minister Mario Monti to succeed in narrowing its budget deficit and bolstering the economy. Michel Barnier, the European Union’s financial-services chief, said he was putting finishing touches on a draft law on creditor writedowns at failing banks.

The Washington-based IMF said its new Precautionary and Liquidity Line can be tapped by countries with strong economies currently facing short-term liquidity needs. Countries with potential needs can also apply, it said.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, retreated 0.3 percent to 78.170. The gauge, which is weighted 57.6 percent to movements in the euro, jumped 0.4 percent yesterday.

U.S. gross domestic product grew at a 2 percent annual rate from July through September, less than projected and down from a 2.5 percent prior estimate, Commerce Department figures showed today in Washington.

The Federal Reserve on Nov 2 held interest rates unchanged and decided to continue its "Twist" program. Fed members also discussed the possibility of setting a formal target for inflation.

European stocks declined, extending their biggest drop in three weeks, as borrowing costs rose in the euro area, outweighing rating companies’ reaffirmation of America’s credit grades. The Stoxx 600 slumped the most yesterday since Nov. 1 amid signs U.S. lawmakers would fail to reach an agreement on budget cuts, increasing the likelihood that the country would face another credit downgrade. Banks sank as dollar funding costs and euro-area bond yields surged. S&P and Moody’s maintained their U.S. credit ratings even as Congress’s special debt-reduction committee failed to reach an agreement, setting the stage for $1.2 trillion in automatic spending cuts. Spain’s three-month borrowing costs more than doubled at auction today, sending two-year yields toward the highest level since 2003, while Belgium’s 10-year bond yields rose to more than 5 percent, adding to concern the euro crisis is spreading.

National benchmark indexes retreated in all of the 18 markets in western Europe. France’s CAC 40 Index slipped 0.8 percent, Germany’s DAX Index lost 1.2 percent and the U.K.’s FTSE 100 Index slipped 0.3 percent.

Dexia led a selloff in banks, tumbling 8.1 percent to 23.9 euro cents in Brussels. UniCredit SpA fell 4.2 percent to 70.05 euro cents in Milan, while BNP Paribas SA lost 4.9 percent to 25.53 euros in Paris.

Commerzbank dropped 15 percent to 1.15 euros after Reuters reported that Germany’s second-biggest lender may need about about 5 billion euros ($6.8 billion) in additional capital if the European Banking Authority toughens its requirements for lenders. The newswire cited unidentified people familiar with the bank’s own estimates.

Danske Bank A/S still advanced, rising 1.4 percent to 75 kroner after Cevian Capital AB, a Swedish investment company, bought a 5.02 percent stake in Denmark’s largest lender on behalf of itself and Carl Icahn.

Nokia dropped 8.8 percent to 4.19 euros as Pacific Crest Securities Ltd. said in a report that the Finnish phone maker shipped fewer devices running Windows Phone 7 than predicted, while sales for the company’s Lumia product were “disappointing.”

Thomas Cook Group Plc plunged 75 percent to 10.2 pence as Europe’s second-largest tour operator said it has held talks with banks on financing. The company agreed to relaxed loan conditions a month ago. Rival TUI Travel Plc slid 9.2 percent to 136.7 pence.

Pandora A/S jumped 10 percent to 55.05 kroner for the biggest jump on the Stoxx 600 after the Danish jewelry maker reported a third-quarter profit of 341 million kroner ($62 million), beating most analysts’ estimates.

Zodiac Aerospace rallied 4.6 percent to 55.29 euros after the maker of aeronautical equipment forecast about 20 percent growth in sales on a like-for-like basis in its first quarter, as the company supplies parts to new aircraft programs at Boeing Co. and Airbus SAS. Zodiac also plans to increase its dividend payment by 20 percent to 1.20 euro apiece.

British Land Co. rose 1.5 percent to 461 pence after Bank of America Corp. upgraded the U.K.’s second-largest REIT to “buy” from “neutral.” Separately, UBS AG cited British Land as the “most defensive of the U.K. majors.”

Fed still has tools to aid economy

Options include communications, asset buying

Global currency system should be multi-polar

ECB can't apply 'everyday methods' to handle crisis

Key is to save Euro zone, methods less important

Economic environment 'clearly deteriorated' in recent months

U.S. stocks fell earlier after the Commerce Department said U.S. gross domestic product expanded at a 2 percent rate in the third quarter, slower than previously reported. The S&P 500 rebounded after the IMF announced changes to the credit line, enabling countries the pre-qualify to request IMF funds without having to make as many policy changes.

Published today, macroeconomic statistics was of a negative nature - according to revised data, GDP in the third quarter increased by 2% instead of 2.5% mentioned in the preliminary assessment. A day earlier, the committee members of the U.S. Congress failed to agree on measures to reduce the budget deficit of the country, and the resolution of this issue may be very prolonged. Nevertheless, the news that the major rating agencies affirmed the credit rating of the United States, limited the bearish on the market. In particular, the agency S & P affirms rating at AA +, Moody's - at AAA with a negative outlook. Fitch Ratings noted that the failure of "supercommittee" to cope with the task of developing measures to reduce the budget deficit could lead to a lowering of the forecast credit rating or even the ranking. The external background for the U.S. session today mostly negative - Asian indices showed mixed dynamics, and Europe were closed in the red.

Chevron Corp. and Kraft Foods Inc. added more than 1 percent, leading gains in the Dow Jones Industrial Average.

Hewlett-Packard Co. (HPQ) had the biggest retreat in the Dow Jones Industrial Average, slumping 3.3 percent. The largest computer maker gave a first-quarter profit forecast and full-year earnings outlook that missed analysts’ estimates.

Netflix video rental operator has lost 2.5% on the news about the placement of shares and convertible bonds worth $ 400 million

Gilead Sciences Inc. rose the most in the S&P 500, climbing 5.5 percent. The world’s largest maker of HIV medicines was boosted to “outperform” from “Market Perform” at BMO Capital Markets, which said the company’s acquisition of Pharmasset Inc.

Medtronic Inc. climbed 3.5 percent for the second-biggest gain in the S&P 500. The world’s biggest maker of heart-rhythm devices reported second-quarter earnings that beat analysts’ expectations on rising international sales of cardiovascular and spinal products.

One new IMF credit line can be used to `break chains of contagion'

New IMF credit line could be used to help European countries

Countries can borrow up to 10 times their IMF contributions

Gold futures rebounded from the lowest in almost four weeks after mounting debt woes in the U.S. and Europe spurred demand for the metal as a store of value.

A U.S. congressional committee failed to reach agreement on reducing the budget deficit. Global equities have tumbled this month as Europe’s credit crisis escalated. Holdings in exchange- traded products backed by gold climbed to a record yesterday.

Gold futures for December delivery gained to $1,705.60 an ounce on the Comex in New York. Yesterday, the metal touched $1,667.10, the lowest since Oct. 25.

Oil rose for the first time in four days as new sanctions against Iran and protests in Egypt raised concern that supplies will be disrupted.

Crude advanced as much as 1.8 percent after the U.S., the U.K. and Canada expanded measures aimed at thwarting Iran’s nuclear program. In Egypt, protesters gathered in Tahrir Square for a fifth day after deadly clashes between security forces and demonstrators spurred the Cabinet to offer to quit.

The U.S., the U.K. and Canada targeted Iran’s central bank and oil industry yesterday with sanctions aimed at cutting the regime off from international financial transactions. The actions are in response to a Nov. 8 United Nations atomic agency report concluding that previous efforts have not stopped the regime from clandestine nuclear-bomb work.

The new sanctions target companies that provide goods or services to Iran’s oil and gas industries. Existing U.S. laws have forced most international oil companies out of Iran. The new measures aim to stop it from obtaining technology and money from smaller foreign companies.

Iran is the second-largest oil producer in the Organization of Petroleum Exporting Countries, pumping 4.25 million barrels a day last year, according to the BP Statistical Review. Saudi Arabia is the top producer.

Crude for January delivery gained to $98.70 a barrel on the New York Mercantile Exchange. Prices have increased 7.5 percent this year. Brent oil for January settlement on the London-based ICE Futures Europe exchange increased $1.73, or 1.6 percent, to $108.61 a barrel.

More attention to growth and structural reforms

Resistance 3:1215/18 (area of 38,2 % FIBO 1270-1185 and close prices of the last week)

Resistance 2:1208 (Nov 21 high)

Resistance 1:1200 (session high)

Current price: 1190,50

Support 1 : 1183 (session low)

Support 2 : 1180 (Oct 11-12 lows and Nov 21 low, 50,0 % FIBO 1068-1188)

Support 3 : 1152/55 (area of Oct 10 low and 61,8 % FIBO 1068-1188, the bottom border of the downchannel from Nov 16)

EUR/USD $1.3500, $1.3450, $1.3400, $1.3300, $1.3600

USD/JPY Y76.25, Y76.50, Y76.65, Y76.75, Y77.00, Y77.25AUD/USD $0.9850, $0.9900, $1.0000

USD/CAD C$1.0345

Gross domestic product climbed at a 2 percent annual rate from July through September, less than projected and down from a 2.5 percent prior estimate, revised Commerce Department figures showed today in Washington. The median forecast was for no revision.

The congressional supercommittee’s failure to reach a deal means several tax programs, including a payroll tax holiday, risk expiring at the beginning of next year, weighing on the household spending that accounts for about 70 percent of the world’s largest economy.

S&P reaffirmed it would keep the U.S. credit rating at AA+ after stripping the government of its top AAA grade on Aug. 5. Moody’s Investors Service reaffirmed its AAA rating with a negative outlook. Fitch Ratings noted in a statement that it said in August that a supercommittee failure would probably result in a “negative rating action,” likely a revision of its outlook to negative, and that a review would be concluded by the end of this month.

Cride oil: $97.66 (+0,8%).

Gold: $1690,70 (+0,7%).

Data:

09:30 UK PSNCR (October), bln -0.6

09:30 UK PSNB (October), bln 3.3

09:30 UK PSNBX (October), bln 6.5

The yen weakened against most of its major counterparts after ratings companies affirmed the U.S.’s credit grades, reducing demand for safer investments.

S&P said the failure of the so-called supercommittee doesn’t affect the U.S.’s AA+ rating and the negative outlook for the debt. The company stripped the U.S. of its top AAA credit grade on Aug. 5. Moody’s affirmed the Aaa credit rating and maintained its negative outlook. Fitch Ratings said the failure would likely lead to a revision of the U.S. rating outlook to negative.

Yesterday was the deadline for the Congressional Budget Office to receive information for analyzing how a proposal would affect the deficit, in advance of the supercommittee’s Nov. 23 deadline. The failure to agree sets the stage for $1.2 trillion in automatic spending cuts.

The pound weakened for a third day against the euro on speculation U.K. central-bank minutes tomorrow will signal policy makers are leaning toward further monetary stimulus as growth slows.

Sterling dropped to a three-week low versus the shared currency even after a report showed Britain’s budget deficit narrowed in October as Chancellor of the Exchequer George Osborne slashed government spending. Prime Minister David Cameron said yesterday Britain is “well behind” where it needs to be on economic growth. The Debt Management Office sold 3.5 billion pounds ($5.5 billion) of index-linked gilts.

EUR/USD: the pair has grown above $1.3500, showed high in $1,3560 area.

GBP/USD: the pair was trading in $1,5620-$ 1,5690 area.

USD/JPY: the pair returned below Y77,00.

At 1330GMT, the Canadian September retail sales numbers are out.The main US release is at 1330GMT, with teh release of the US Q3 GDP second reading. Third quarter GDP is forecast to be revised down to a 2.4% rate of growth. The key factors are expected to be upward revision to PCE, nonresidential fixed investment, and residential fixed investment that should be offset by downward revisions to inventories and net exports. The chain price index is expected to be unrevised at +2.5%. At 1355GMT, the Nov 19 week Redbook Average data is released.At 1800GMT, Minneapolis Federal Reserve Bank President Narayana Kocherlakota speaks to CFA Winnipeg, Canada.

EUR/USD

Offers $1.3640/50, $1.3615, $1.3575/80, $1.3570

Bods $1.3520, $1.3510/00, $1.3430/20

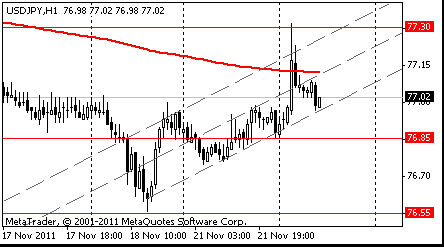

Resistance 2: Y77.50 (Nov 15 high)

Resistance 2: Y77.30 (session high)

Resistance 1: Y77.10 (МА(200) for Н1)

Current price: Y76.88

Support 1:Y76.80 (session low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.30 (area of Nov 25-26 high)

Resistance 3: Chf0.9210 (Nov 21 high)

Resistance 2: Chf0.9190 (session high)

Resistance 1: Chf0.9140 (Nov 21 low)

Current price: Chf0.9114

Support 1: Chf0.9090 (50,0 % FIBO Chf0,8950-Chf0,9230)

Support 2: Chf0.9060 (61,8 % FIBO Chf0,8950-Chf0,9230)

Support 3: Chf0.9040 (support line from Nov 9)

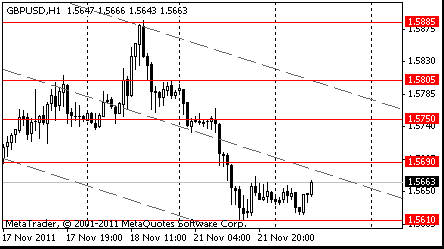

Resistance 3: $ 1.5750 (50,0 % FIBO $1,5890-$ 1,5610)

Resistance 2: $ 1.5720 (38,2 % FIBO $1,5890-$ 1,5610)

Resistance 1: $ 1.5690 (earlier support, Nov 17 low, session high)

Current price: $1.5677

Support 1 : $1.5620/10 (area of session low, Oct 21 low and 61,8 % FIBO $1,5270-$ 1,6165)

Support 2 : $1.5540 (Oct 12 low, the bottom border of downchannel from Nov 14)

Support 3 : $1.5380 (support line from May’2010)

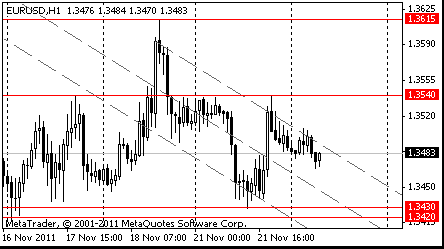

Resistance 3: $ 1.3800 (area of Nov 14 high)

Resistance 2: $ 1.3660 (61,8 % FIBO $1,3800-$ 1,3420)

Resistance 1: $ 1.3610 (50.0 % FIBO $1,3800-$ 1,3420, Nov 18 high)

Сurrent price: $1.3562

Support 1 : $1.3540 (line of resistance from Oct 27)

Support 2 : $1.3510 (intraday low)

Support 3 : $1.3470 (session low)

- UK GDP new 4% below pre-crisis peak in 2007;

- econ to return normal growth rate, maybe slowly;

- as econ normalises rates to return normal settings.

EUR/USD $1.3500, $1.3450, $1.3400, $1.3300, $1.3600

USD/JPY Y76.25, Y76.50, Y76.65, Y76.75, Y77.00, Y77.25AUD/USD $0.9850, $0.9900, $1.0000

USD/CAD C$1.0345

- Fiscal Consolidation In Germany Is Remarkable

- External Climate To Weaken German Economic Prospects In 2012

- Some Countries Must Continue Strict Consolidation

- Greece Must Make Decisive Progress In Transformation

- Ireland Shows Conditional Financial Assistance Works

- Irish Economy On Path To Recovery

- Portugal Making Good Progress

- Italy Need Deliver On Fiscal Consolidation

- Italy Can Overcome Loss Of Market Confidence

- New Commission Proposals Remind Of Debt Brake

- Euro Bonds Could Help Alleviate Crisis

- Euro Bonds Must Be Reinforced By Fiscal Surveillance

- Euro Bonds Would Have Implication On National Sovereignty

- Deeper Econ Policy Integration Precondition For Euro Bonds

- New Commission Proposals Are For Econ Governance And Stability

- New Proposals Are Next Stage For Closer Economic Union

- Must Work Together Or Lose Achievements Of European Integration

Spanish 6-Month Treasury Bill Maximum Yield Set At 5.328%. Cover Ratio 4.92

Nikkei 225 8,315 -33.53 -0.40%

Hang Seng 18,252 +25.74 +0.14%

S&P/ASX 4,133 -30.03 -0.72%

Shanghai Composite 2,413 -2.50 -0.10%

The yen weakened against most major counterparts after ratings companies affirmed the U.S. credit grades, sapping demand for Japan’s currency as a haven. The yen was bought earlier after a U.S. Congress budget supercommittee failed to reach agreement on reducing the budget deficit. The U.S.’s credit ratings and outlook aren’t affected by the supercommittee’s failure, Standard & Poor’s said. The rating company stripped the U.S. of its top AAA credit rating on Aug. 5, cutting the rating to AA+ after months of political gridlock about deficit cuts.

The euro gain after Moody’s affirmed the Aaa credit rating of the U.S. and maintained its negative outlook. Fitch Ratings reiterated that the talks failure would likely lead to a revision of the U.S. rating outlook to negative.

Today was the deadline for the Congressional Budget Office to receive information for analyzing how a proposal would affect the U.S. budget deficit, in advance of the supercommittee’s Nov. 23 target date for reaching a deal. The failure to agree sets the stage for $1.2 trillion in automatic spending reductions.

The Federal Reserve will today release minutes of its Nov. 1-2 meeting when central bank officials lowered their U.S. economic-growth projections.

EUR/USD: on Asian session the pair grows.

GBP/USD: on Asian session the pair is restored.

USD/JPY: on Asian session the pair showed a new week’s high, but has lost the positions later.

On Tuesday at 0930GMT, UK data sees the release of the October public sector finances. The bulk of data releases is on the other side of the pond. At 1145GMT, the ICSC-Goldman Store Sales data for the November 19 week are released. At 1330GMT, the Canadian September retail sales numbers are out.The main US release is at 1330GMT, with teh release of the US Q3 GDP second reading. Third quarter GDP is forecast to be revised down to a 2.4% rate of growth. The key factors are expected to be upward revision to PCE, nonresidential fixed investment, and residential fixed investment that should be offset by downward revisions to inventories and net exports. The chain price index is expected to be unrevised at +2.5%. At 1355GMT, the Nov 19 week Redbook Average data is released.At 1800GMT, Minneapolis Federal Reserve Bank President Narayana Kocherlakota speaks to CFA Winnipeg, Canada.

Asian stocks fell for a fifth day, the longest streak in almost four months, amid concern economic growth in Asia is slowing and U.S. lawmakers may fail to agree on measures to cut the nation’s budget deficit.

The deficit-cutting U.S. congressional supercommittee is expected to announce today that it has failed to reach agreement on at least $1.2 trillion in federal budget savings, a Democratic aide said. The aide, who wasn’t authorized to discuss internal matters publicly and requested anonymity, said in an e- mail that it was highly unlikely that the talks could be salvaged.

Deutsche Bank AG Chief Executive Officer Josef Ackermann said Europe needs a “firewall” to prevent its debt crisis from spreading and should increase the size of its rescue fund. In Spain, conservative Mariano Rajoy swept the Socialists out of power with the biggest parliamentary majority in an election in almost 30 years. He told Spaniards to brace themselves as the nation fights to avoid being overwhelmed by the debt crisis.

“Weakness” in China’s stocks may last until the end of the year as the government is unlikely to introduce more “powerful” measures to fine-tune economic policies, according to Citic Securities Co. Sentiment will be negative as investors begin to worry about slumping property sales and the pace of new share sales, Liu Haobo, an analyst at the brokerage, wrote in a report today.

Singapore’s Straits Times Index (FSSTI) declined 1.2 percent, the lowest close in a month. Hong Kong’s Hang Seng Index sank 1.4 percent and Japan’s Nikkei 225 Stock Average slipped 0.3 percent.

Longfor Properties Co., the developer controlled by China’s richest woman, Wu Yajun, tumbled 5.4 percent to HK$7.89. China State Construction International Holdings Ltd. sank 9 percent to HK$4.97.

Genting Singapore, which operates casinos, slumped 2.6 percent to S$1.50. CapitaLand, a developer that gets about 36 percent of its revenue from the city-state, fell 2.3 percent to S$2.56.

Singapore’s economy will grow 1 percent to 3 percent in 2012, the trade ministry said in a statement. Non-oil domestic exports will probably rise 2 percent to 3 percent in 2011, lower than a previous forecast for shipments to grow 6 percent to 7 percent, the trade promotion agency said in a separate statement today.

Fanuc declined 2.1 percent to 12,180 yen. Japan’s export shipments dropped 3.7 percent in October from a year earlier, the Ministry of Finance said today in Tokyo. The median estimate of 29 economists surveyed by Bloomberg News was for a 0.3 percent decline.

Osaka Securities Exchange Co. climbed 1.8 percent to 421,000 yen. The company and the Tokyo Stock Exchange, the nation’s two largest bourses, agreed to merge and are set to announce the deal tomorrow, the Nikkei newspaper reported.

Elpida tumbled 7.3 percent to 319 yen. Advantest Corp., the world’s biggest maker of memory-chip testers, lost 4.5 percent to 810 yen. Japan’s October chip-equipment orders declined 33 percent from a year ago to 81.2 billion yen ($1 billion), according to a Nov. 18 statement from the Semiconductor Equipment Association of Japan.

European stocks dropped the most in three weeks amid signs U.S. lawmakers may fail to reach an agreement on budget cuts, raising the prospect the world’s largest economy could face another credit downgrade.

The U.S. deficit-cutting congressional supercommittee will probably announce that it has failed to agree on $1.2 trillion of federal budget savings, a Democratic aide said in an e-mail. The aide, who wasn’t authorized to discuss internal matters publicly and requested anonymity, said that it was highly unlikely that the talks could be salvaged. Today is the deadline for the Congressional Budget Office to receive a plan that it can analyze before the committee’s Nov. 23 target date for reaching an agreement. S&P downgraded the U.S. on Aug. 5 to AA+ from AAA.

In Spain, Mariano Rajoy won the biggest parliamentary majority in an election in almost 30 years, and told Spaniards to brace for difficult times as the nation fights to avoid being overwhelmed by the sovereign-debt crisis.

Shares also fell as Moody’s Investors Service warned that rising French bond yields increased the fiscal challenges facing the nation with “negative credit implications.” The rating company declined to comment on a report in Le Figaro newspaper that France’s AAA credit rating is at risk.

National benchmark indexes retreated in all 18 markets in western Europe. France’s CAC 40 Index and Germany’s DAX Index lost 3.4 percent. The U.K.’s FTSE 100 Index dropped 2.6 percent. Greece’s ASE Index sank 3.7 percent as the country’s new Prime Minister Lucas Papademos met European Union President Herman Van Rompuy and European Commission President Jose Barroso in Brussels today.

KBC led bank shares lower, slumping 13 percent to 9.46 euros in Brussels, as the three-month cross-currency basis swap, the rate banks pay to convert euro payments into dollars, widened for a sixth day and bond yields climbed in Spain, Italy and Belgium. Commerzbank AG plunged 6.8 percent to 1.36 euros, BNP Paribas SA slid 4.3 percent to 26.85 euros and Barclays Plc dropped 5.4 percent to 157.5 pence.

Rio Tinto Group slid 5.9 percent to 3,083 pence and Total SA lost 2.9 percent to 36.02 euros, pacing gauges of mining and energy companies lower. Copper and oil fell for a third day as Japan’s exports dropped and Singapore warned its economy may grow 1 percent to 3 percent in 2012 after expanding 5 percent this year.

Carrefour SA slipped 3.2 percent after the retailer’s largest shareholders were said to consider replacing its chairman and chief executive officer.

Adidas AG declined 3.2 percent to 48.69 euros after Welt am Sonntag reported the world’s second-largest sporting-goods maker will increase prices in 2012 because of higher raw-material prices and wage costs.

Statoil ASA slid 3.1 percent to 140.90 kroner even after Norway’s national oil company agreed to sell stakes in fields to Centrica Plc for $1.6 billion. Statoil will dispose of stakes in eight fields on the Norwegian continental shelf, it said. Centrica’s shares lost 1 percent to 286.1 pence.

U.S. stocks slumped, giving the Standard & Poor’s 500 Index its longest decline since September, amid concern the U.S. government will be forced to submit to $1.2 trillion in automatic spending cuts. Today is the deadline for the Congressional Budget Office to receive information for scoring a proposal in advance of the supercommittee’s Nov. 23 target date for reaching a deal. The 12-member bipartisan supercommittee likely will announce today that it can’t reach agreement on deficit savings, according to a Democratic aide.

U.S. shares joined European equities in retreating. France’s rising financing costs are increasing the nation’s fiscal challenges, according to report issued by Moody’s Investors Service. Germany’s Finance Ministry said the country’s expansion is “noticeably slower” this quarter.

Dow 11,547.31 -248.85 -2.11%, Nasdaq 2,523.14 -49.36 -1.92%, S&P 500 1,192.98 -22.67 -1.86%

All 10 industries in the benchmark measure declined as 468 out of 500 companies retreated. Financial, industrial and technology shares had the biggest losses in the S&P 500 among 10 groups today, slumping at least 1.9 percent. Bank of America Corp. tumbled 5 percent to pace losses in financial shares. Hewlett-Packard Co. (HPQ) and Caterpillar Inc. (CAT) dropped at least 2.9 percent.

Gilead Sciences tumbled 9.1 percent to $36.26, while Pharmasset soared 85 percent to $134.14. Gilead agreed to buy Pharmasset, betting that its experimental hepatitis C treatments will lead the next generation of therapies in a market that may reach $20 billion by 2020.

Focus Media Holding Ltd. plummeted 39 percent to $15.43 after Muddy Waters LLC, the short-selling firm known for prompting Sino-Forest Corp.’s retreat, recommended betting against the digital advertising company. Today’s report said Focus Media has fewer television screens in its ad network than it says and may have overpaid for takeovers to mask losses.

The euro rose against the U.S. dollar against the backdrop of media reports that a special committee ("supercommittee") of the U.S. Congress, designed to reduce the budget deficit will soon announce the failure to reach a compromise solution. Before November 23 "supercommittee" must submit a plan to reduce the budget deficit ($ 1.2 trillion. For 10 years), however, to the present moment, the consensus between Republicans and Democrats on the structure of public spending cuts was not found until. Despite the fact that the costs would be cut in any case (after the "dip" in the negotiations the country will face automatic "sequestering" the budget for the same amount), the inability of the major parties to take a decision on the consolidated fiscal policy could provoke a new round of concerns about reducing the country's sovereign rating international agencies (Fitch and Moody's).

Earlier, the euro fell against the dollar and the yen amid growing profitability of French, Spanish and Belgian bonds. Bonds in France today showed growth after rating agency Moody's said that the increase in the cost of borrowing for France could negatively affect its credit rating, which is now at AAA. As a result, the yield on 10-year French bond rose 8 basis points to 3.53%. Bond Fund Global Sovereign Open Fund, owned by Kokusai Asset Management, sold November 17, Spanish and Belgian government bonds. This has contributed to the profitability of Spanish and Belgian bonds also showed growth.

The Swiss franc rose most of its major counterparts as investors sought refuge.

The British pound fell to a month low against the U.S. dollar after British Prime Minister Cameron announced that next week the government will present an ambitious scheme of credit easing, as the UK must tackle its own debt. Sterling fell against the dollar and euro as home sellers in the U.K. cut asking prices.

EUR/USD: yesterday the pair was under pressure.

GBP/USD: yesterday the pair has lost one and a half figure.

USD/JPY: yesterday the pair holds in range Y76.75-Y76.95.

On Tuesday at 0930GMT, UK data sees the release of the October public sector finances. The bulk of data releases is on the other side of the pond. At 1145GMT, the ICSC-Goldman Store Sales data for the November 19 week are released. At 1330GMT, the Canadian September retail sales numbers are out.The main US release is at 1330GMT, with teh release of the US Q3 GDP second reading. Third quarter GDP is forecast to be revised down to a 2.4% rate of growth. The key factors are expected to be upward revision to PCE, nonresidential fixed investment, and residential fixed investment that should be offset by downward revisions to inventories and net exports. The chain price index is expected to be unrevised at +2.5%. At 1355GMT, the Nov 19 week Redbook Average data is released.At 1800GMT, Minneapolis Federal Reserve Bank President Narayana Kocherlakota speaks to CFA Winnipeg, Canada.

Resistance 3: Y77.90 (Nov 9-10 high)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.30 (session high)

The current price: Y77.02

Support 1: Y76.85 (session low)

Support 2: Y76.55 (Nov 18 low)

Support 3: Y75.30 (Oct 12 low)

Comments: the pair is on uptrend. In focus resistance Y77.30.

Resistance 3: Chf0.9300 (psychological level)

Resistance 2: Chf0.9225/35 (area of Nov 16-18 high)

Resistance 1: Chf0.9185 (session high)

The current price: Chf0.9159

Support 1: Chf0.9140 (session low)

Support 2: Chf0.9085 (Nov 18 low)

Support 3: Chf0.9020 (76.4% FIBO Chf0.9235-Chf0.8950)

Comments: the pair is on uptrend. In focus resistance Chf0.9185.

Resistance 3 : $1.5805 (Nov 21 high)

Resistance 2 : $1.5750 (50.0% FIBO $1.5610-$1.5885)

Resistance 1 : $1.5690 (middle line from Nov 14)

The current price: $1.5663

Support 1 : $1.5610 (session low)

Support 2 : $1.5540 (Oct 12 low)

Support 3 : $1.5485 (76.4% FIBO $1.6160-$1.5270)

Comments: the pair is on downtrend. In focus support $1.5610.

Resistance 3: $1.3665 (61.8% FIBO $1.3810-$1.3422)

Resistance 2: $1.3615 (Nov 18 high)

Resistance 1: $1.3540 (Nov 21 high)

The current price: $1.3483

Support 1 : $1.3420/30 (area of Nov 16-21 high)

Support 2 : $1.3400 (psychological level)

Support 3 : $1.3360 (Oct 7 low)

Comments: the pair is on downtrend. In focus support $1.3420.

Change % Change Last

Nikkei 225 8,348 -26.64 -0.32%

Hang Seng 18,226 -265.38 -1.44%

S&P/ASX 200 4,163 -13.94 -0.33%

Shanghai Composite 2,415 -1.43 -0.06%

FTSE 100 5,223 -140.34 -2.62%

CAC 40 2,895 -102.07 -3.41%

DAX 5,606 -194.24 -3.35%

Dow 11,547.31 -248.85 -2.11%

Nasdaq 2,523.14 -49.36 -1.92%

S&P 500 1,192.98 -22.67 -1.86%

10 Year Yield 1.96% -0.05 --

Oil $97.45 -1.19 -1.21%

Gold $1,677.90 -0.70 -0.04%

02:00 New Zealand Expected Annual Inflation 2y from now IV quarter +2.9%

07:00 Switzerland Trade Balance October 1.85 2.06

09:30 United Kingdom PSNCR, bln October 19.9 -2.0

09:30 United Kingdom PSNB, bln October 11.4

13:30 U.S. PCE price index, q/q Quarter III +2.4

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.1%

13:30 Canada Retail Sales, m/m September +0.5% +0.5%

13:30 Canada Retail Sales ex Autos, m/m September +0.4% +0.4%

13:30 U.S. GDP revised Y/Y Quarter III +2.5% +2.5%

13:30 U.S. PCE price index, q/q Quarter III +2.4%

15:00 Eurozone Consumer Confidence November -19.9 -21.0

15:00 U.S. Richmond Fed Manufacturing Index November -6 -2

18:00 U.S. FOMC Member Narayana Kocherlakota 0

19:00 U.S. FOMC meeting minutes 0

23:00 Australia Conference Board Australia Leading Index September -0.1%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.