- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 23-01-2022

- WTI begins the Fed week on a positive note, extends Friday’s rebound from weekly low.

- Three-day-old resistance line holds the key to further upside.

- Bullish MACD signals, firmer RSI line keep buyers hopeful.

- Seven-day-long support line adds to the downside filters.

WTI takes the bids to refresh intraday high near $85.50, up 1.0% daily, during early Asian morning on Monday.

In doing so, the black gold extends the previous day’s recovery moves from the 200-HMA amid firmer RSI and MACD signals.

However, oil bulls need validation from a downward sloping resistance line from Thursday, near $86.00. Also acting as an upside filter is the recently flashed multi-month top near $86.93.

During the quote’s run-up beyond $86.93, the $87.00 threshold and the $90.00 psychological magnet may act as buffers before direct WTI crude oil buyers towards September 2014 high near $95.00.

Alternatively, pullback moves may retest the 200-HMA level of $83.40 whereas any further downside will be challenged by a short-term ascending trend line near $82.90.

If at all the WTI crude oil prices drop below $82.90, the 61.8% Fibonacci retracement of January 10-20 upside, around $81.00, will be crucial for traders to watch before welcoming sellers.

WTI: Hourly chart

Trend: Further upside expected

- Gold flirts with the key Fibonacci retracement support after bulls stepped back from yearly resistance.

- Pre-Fed caution, Omicron woes join geopolitics to challenge gold buyers, downbeat yields defend bulls.

- January PMIs, US Q4 GDP may entertain traders but FOMC will be crucial as traders await clues of March rate hike.

- Gold Weekly Forecast: XAU/USD could turn south on a hawkish Fed surprise

Gold (XAU/USD) begins the Fed week on a slightly positive note around $1,834, following a two-week uptrend, during the initial Asian session on Monday.

Gold prices rose during the last two weeks before reversing from the yearly resistance line on Thursday.

That said, the market’s cautious sentiment ahead of this week’s crucial Federal Open Market Committee (FOMC) joined downbeat US Treasury yields and the US Dollar Index (DXY) performance to underpin the yellow metal’s safe-haven demand in the recent days. In addition to the Fed-linked fears, geopolitical concerns relating to the Ukraine-Russia war and Omicron chatters, not to forget inflation woes, also directed market players towards the traditional risk-safety.

Even as the last week’s US data was mostly mixed, the latest Fedspeak has been hawkish, suggesting that the US central bank is on the way to chart March’s rate hike on Wednesday. Adding to the bullish bias were the chatters concerning Omicron-linked supply chain damage and inflation woes. It’s worth noting that comments from US President Joe Biden and International Monetary Fund Managing Director Kristalina Georgieva were both in support of the Fed’s hawkish bias, which in turn reinforced Fed rate hike concerns.

“Markets have been trading cautiously ahead of this week’s FOMC statement, which is expected to be hawkish and potentially outline the case for interest rate rises starting in March. We are doubtful that the Fed will end QE next week, as some in the market speculate. We are also doubtful that the Fed would begin to tighten policy with a 50 bps rate rise. Markets may stabilize if the Fed is not as hawkish as some worst-case fears suggest,” said ANZ.

Elsewhere, the South African covid variant, namely Omicron, pushes more areas of Japan towards quasi emergency whereas New Zealand is also up for more activity controls, if not the complete lockdowns, due to the stated virus strain. Further, reports of Russia’s preparations to invade Ukraine also take rounds of late, which in turn keep gold in demand.

Against this backdrop, the US 10-year Treasury yields rose 1.8 basis points (bps) to 1.767%, after posting the first weekly decline in five, whereas the S&P 500 Futures rise 0.30% while licking the previous week’s wounds amid the mostly quiet session.

Moving on, preliminary readings of January PMIs will offer intraday directions to the gold traders. However, major attention will be given to Wednesday’s Fed meeting and Treasury yields.

Technical analysis

Having reversed from a year-long resistance line, gold prices eye further losses towards 50 and 100-SMA levels, respectively around $1,825 and $1,816, currently poking 61.8% Fibonacci retracement (Fibo.) of November-December downside.

However, the metal’s further downside will be challenged by an ascending support line from mid-December 2021 near $1,812, a break of which will confirm rising wedge bearish chart formation.

Should bears keep reins past $1,812, theory suggests a gradual south-run towards September 2021 low surrounding $1,721. Though, the monthly bottom and December 2021 lows near $1,780 and $1,755 in that order will offer intermediate halts.

Alternatively, recovery moves will initially aim to defy the rising wedge formation by a clear upside break of the pattern’s resistance line, close to $1,842.

Following that, the previously mentioned yearly resistance line near $1,848 will regain the market’s attention as a break of which will be an open invitation for the bulls to aim for $1,900 and above during the days to come.

To sum up, gold buyers stepped back from the key resistance line but that doesn’t give a warm welcome to the sellers until the quote drops below $1,812.

Gold: Four-hour chart

Trend: Pullback expected

Early Monday morning in Asia, the US State Department released a slew of statements/orders confirming fears of Russian invasion of Ukraine.

Key quotes

The voluntary departure of US Direct Hire Personnel has been approved, and qualified family members have been instructed to leave the embassy in Kyiv.

Due to growing fears of Russian military intervention and Covid-19, we advise against traveling to Ukraine.

FX implications

Although the news should ideally drown antipodeans and commodities, prices of AUD/USD, NZD/USD and gold have largely been unaffected by the news. However, WTI crude oil seems to benefit from the fears of supply outage, up 0.60% intraday near $85.15 by the press time.

Read: Russia/Ukraine tensions rising: British gov says it has uncovered a plot by Moscow to install a pro-Russian leader in Kiev

“The government of Prime Minister Fumio Kishida is expected to place more prefectures under a COVID-19 quasi-state of emergency as the number of cases continues surging, government sources said Sunday,” Japanese media Kyodo News.

The news reports the latest covid infections as more than 50,000 on Sunday after the country reported the highest daily cases of around 54,000 on Saturday.

It’s worth noting that Japan’s Yomiuri News signaled that Japan will put around 16 more areas under quasi-emergency.

Key quotes

Tokyo and 12 other prefectures were added to regions subject to the quasi-emergency measures on Friday after three prefectures -- Hiroshima, Yamaguchi and Okinawa -- were placed under the measures from Jan. 9 following a spike in infections that local officials linked to nearby U.S. military bases.

The COVID-19 restrictions are slated to be in place until Feb. 13 in Tokyo and the 12 prefectures, including Saitama, Chiba, Kanagawa, Aichi, Nagasaki and Kumamoto.

The number of cases increased 100 times in three weeks since the start of this year, rising to 54,576 cases on Saturday from 534 logged on Jan. 1.

FX implications

Even with the pre-Fed sentiment weighing on the risk appetite, in addition to the Omicron fears from Japan, USD/JPY prints mild gains around 113.75 while consolidating the previous week’s losses by the press time of pre-Tokyo trading on Monday.

- EUR/USD struggles to extend corrective pullback from the key support.

- Bearish MACD signals suggest further downside, 50-DMA acts as immediate support.

- Bulls need a clear break of 61.8% Fibonacci retracement for confirmation.

EUR/USD remains pressured below 20-DMA, around 1.1340 amid Monday’s initial Asian session, following the biggest weekly fall in five.

In addition to the major currency pair’s failures to cross the short-term key moving average, bearish MACD signals also suggest the bear’s firm determination to break an upward sloping trend line from late November, which has been defending buyers of late.

Ahead of the stated key support line, near 1.1300 by the press time, the 50-DMA level of 1.1315 will test the EUR/USD sellers.

Also acting as a downside filter is the 23.6% Fibonacci retracement (Fibo.) level of October-November 2021 downside, near 1.1300, a break of which will direct the quote towards 2021 bottom of 1.1186 with 1.1230 likely acting as a buffer.

Meanwhile, a clear upside break of the 20-DMA level surrounding 1.1350 won’t be a green signal for the EUR/USD bulls as 50% Fibo. and the monthly high, respectively around 1.1435 and 1.1480, will challenge the pair’s recovery.

Even if the pair rises past 1.1480, the 61.8% Fibonacci retracement level of 1.1500 will be a crucial resistance for the pair traders to watch.

To sum up, the EUR/USD prices are at a critical support juncture as traders await the Fed verdict.

EUR/USD: Daily chart

Trend: Further declines expected

- NZD/USD remains pressured around yearly bottom following two consecutive daily declines.

- Market sentiment worsened on pre-Fed, inflation and Ukraine concerns.

- NZ PM Ardern refrained from Omicron-led lockdowns but verdict on traffic lights awaited.

- FOMC’s rate hike hints, New Zealand CPI are the week’s key events.

NZD/USD portrays the market’s sour mood around 0.6710 during early Monday morning in Asia, following the heaviest weekly fall in two months.

In doing so, the kiwi pair flirts with the year 2021 bottom, flashed in December, as traders await crucial events scheduled for release during the week. Other than the market fears concerning this week’s Federal Open Market Committee (FOMC) and New Zealand’s Q4 Consumer Price Index (CPI), up for publication on Wednesday and Thursday, geopolitical concerns relating to Ukraine-Russia tussles also weigh on NZD/USD prices.

Although the last week’s US data was mostly mixed, the latest Fedspeak has been hawkish, suggesting that the US central bank is on the way to chart March’s rate hike on Wednesday. Adding to the bullish bias were the chatters concerning Omicron-linked supply chain damage and inflation woes. It’s worth noting that comments from US President Joe Biden and International Monetary Fund Managing Director Kristalina Georgieva were both in support of the Fed’s hawkish bias, which in turn reinforced Fed rate hike concerns.

At home, New Zealand Prime Minister (PM) Jacinda Ardern will decide on the nation’s traffic light system and has already rejected lockdown fears. However, surging cases in Auckland do pose a serious threat to the working styles as New Zealand will witness Omicron spread.

Elsewhere, geopolitical tussles between Russia and Ukraine escalate as Moscov braces for Keiv’s invasion. Recently, UK’s Deputy Prime Minister Dominic Raab told the BBC's Sunday Morning program that there was "a very serious risk" of invasion but there would be "severe economic consequences", including sanctions if Russia took that step.

Amid these plays, the US Treasury yields and equities were down but commodities had a mixed performance, with crude gaining from supply outage fears and gold from softer yields. The same risk-off mood pressured Antipodeans towards the last year’s low.

Moving on, New Zealand has very few important data to release ahead of Thursday’s NZ Q4 CPI, expected 5.6% versus 4.9% prior. However, monthly PMIs from the rest of the world and Fed meetings will be crucial to watch before then. Among them, the Fed’s verdict on rate hike and balance sheet normalization, which is highly expected, becomes critical.

Read: Fed Preview: Three ways Powell could out-dove markets, dealing a blow to the dollar

Technical analysis

Unless breaking the weekly resistance line near 0.6755, NZD/USD prices are likely to conquer the year 2021 bottom surrounding 0.6700, which in turn open doors for the pair’s further declines towards the 61.8% Fibonacci Expansion (FE) of the pair’s moves between November 15 and December 24, near 0.6650.

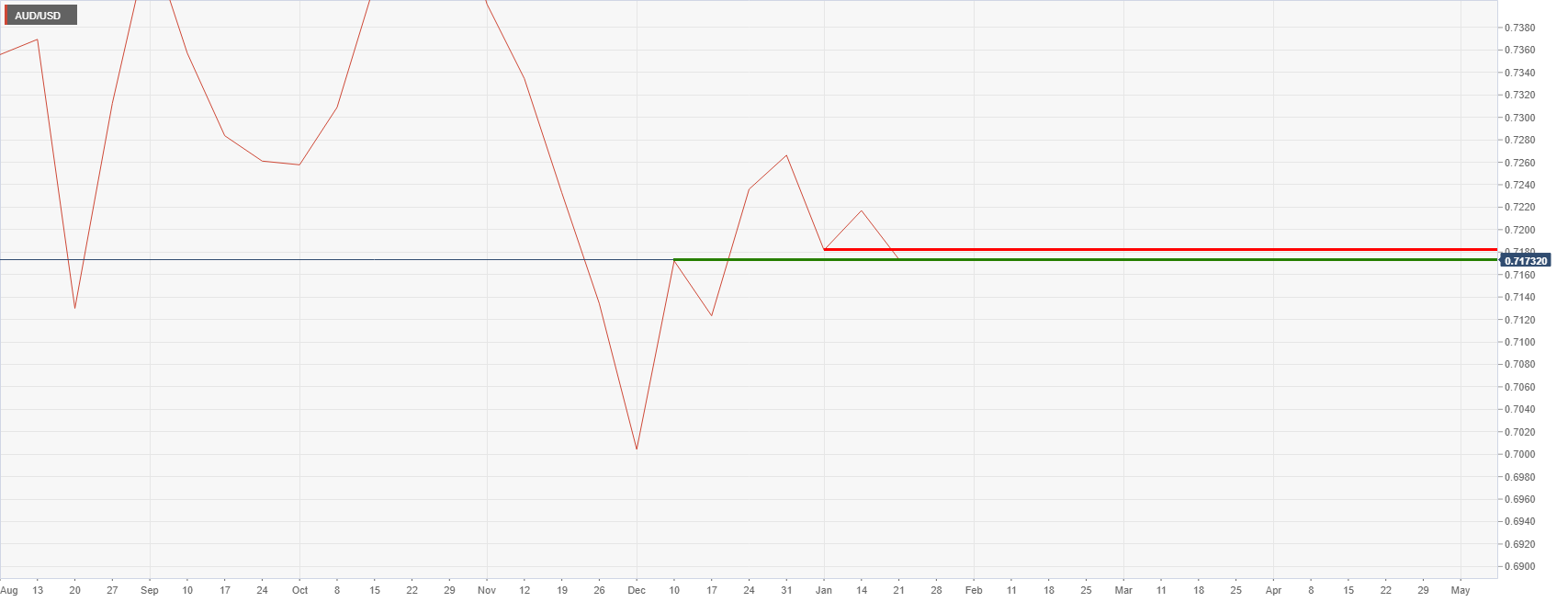

- AUD/USD bears testing critical support for the open.

- Bears will look for a break below the 0.7160s.

As per the prior analysis, AUD/USD Price Analysis: Bears taking charge and testing critical support, the price, despite a brief liquidity hunt, has continued to test critical support. The following illustrates the prospects for the opening sessions and week ahead from a technical perspective.

AUD/USD daily charts

The bears would argue that last week's Unemployment Rate fuelled spike was just the ticket for instigating the breakout of this critical level of support into month-end. The risk-off setting could see some follow-through over the opening sessions with markets in Asia yet to digest the rout in Friday's stock markets as well.

On the flipside, if there is a catalyst for a reversal in risk appetite or a hawkish bias towards the Reserve bank of Australia sentiment, then the Aussie would be expected to base around these levels. However, last week's bearish close leans more towards a test of the 0.7160s than the 0.7180s for the open:

The above line chart represents the weekly W and M formation's necklines. These are considered to be key support and resistance levels. A break of either would indicate the bias for the days ahead.

The BBC reports that ''the UK has accused Russia’s President Vladimir Putin of plotting to install a pro-Moscow figure to lead Ukraine's government.''

The news was reported on Sunday after the Deputy Prime Minister Dominic Raab told the BBC's Sunday Morning programme that there was "a very serious risk" of invasion but there would be "severe economic consequences", including sanctions, if Russia took that step.

Geo-politics has been present in the markets again as Russia-Ukraine tensions continue.

The US dollar is renowned for benefitting from such angst in geopolitics and markets, so such an escalation should be a clear dollar positive for the open this week.

This would be a double whammy for the euro due to the view that Europe’s dependence on Russia’s energy exports would be exposed even more.

Key notes

The BBC article stated the following:

''Russia has moved 100,000 troops near to its border with Ukraine but denies it is planning an invasion.

UK ministers have warned that the Russian government will face serious consequences if there is an incursion.

In a statement, Foreign Secretary Liz Truss said: "The information being released today shines a light on the extent of Russian activity designed to subvert Ukraine, and is an insight into Kremlin thinking.

"Russia must de-escalate, end its campaigns of aggression and disinformation, and pursue a path of diplomacy."

Deputy Prime Minister Dominic Raab said there was "a very serious risk" of invasion but there would be "severe economic consequences", including sanctions if Russia took that step.

However, he told the BBC's Sunday Morning programme it was "extremely unlikely" British troops would be sent to defend Ukraine, adding that the country was not a Nato ally.''

DXY daily chart

As per the DXY index, which measures the US dollar vs a basket of currencies, the greenback declined on Friday, along with US Treasury yields. Despite the risk-off price action displayed in the US stock market and concerns over Russia, the US dollar was pressured as investors looked through the headlines and instead towards this week's Federal Reserve meeting for more clarity on the outlook for rate hikes. However, a close eye will be paid to this type of escalation for today's open and the support could be expected to hold around the 61.8% Fibonacci level if safe haven flows dominate.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.