- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 24-12-2015

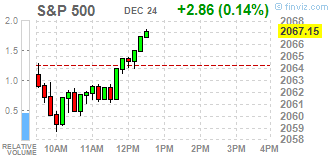

Major U.S. stock-indexes little changed on Thursday as a fall in energy stocks dampened spirits in a shortened trading session on Christmas eve. Crude prices were up marginally, with U.S. crude set for gains for the fourth straight day.

Dow stocks mixed (15 in positive area, 15 in negative area). Top looser - NIKE, Inc. (NKE, -1,61%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0.62%).

S&P sectors also mixed. Top looser - Basic Materials (-0.3%). Top gainer - Financial (+0,2%).

At the moment:

Dow 17500.00 +28.00 +0.16%

S&P 500 2058.25 +5.25 +0.26%

Nasdaq 100 4629.25 +22.50 +0.49%

Oil 37.93 +0.43 +1.15%

Gold 1076.00 +7.70 +0.72%

U.S. 10yr 2.25 -0.02

U.S. stock-index futures were little changed before the Christmas holiday.

Global Stocks:

Nikkei 18,789.69 -97.01 -0.51%

Shanghai Composite 3,612.88 -23.21 -0.64%

FTSE 6,254.64 +13.66 +0.22%

CAC 4,663.18 -11.35 -0.24%

Crude oil $37.77 (+0.72%)

Gold $1070.00 (+0.35%)

(company / ticker / price / change, % / volume)

| Nike | NKE | 64.47 | 100.36% | 41.7K |

| Yandex N.V., NASDAQ | YNDX | 16.15 | 0.75% | 15.0K |

| Barrick Gold Corporation, NYSE | ABX | 7.68 | 0.26% | 2.0K |

| Amazon.com Inc., NASDAQ | AMZN | 664.90 | 0.18% | 2.6K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7.46 | 0.13% | 80.6K |

| Verizon Communications Inc | VZ | 46.98 | 0.06% | 0.1K |

| JPMorgan Chase and Co | JPM | 66.73 | 0.00% | 5.1K |

| UnitedHealth Group Inc | UNH | 118.69 | 0.00% | 0.8K |

| Hewlett-Packard Co. | HPQ | 11.75 | 0.00% | 5.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 229.70 | 0.00% | 0.2K |

| Apple Inc. | AAPL | 108.60 | -0.01% | 7.2K |

| Microsoft Corp | MSFT | 55.81 | -0.02% | 0.2K |

| International Business Machines Co... | IBM | 138.50 | -0.03% | 0.8K |

| Pfizer Inc | PFE | 32.55 | -0.03% | 0.2K |

| AT&T Inc | T | 34.75 | -0.09% | 0.1K |

| Twitter, Inc., NYSE | TWTR | 22.65 | -0.09% | 6.0K |

| Facebook, Inc. | FB | 104.51 | -0.11% | 2.5K |

| Caterpillar Inc | CAT | 69.80 | -0.13% | 0.3K |

| Ford Motor Co. | F | 14.34 | -0.14% | 0.5K |

| Boeing Co | BA | 143.85 | -0.15% | 3.0K |

| Exxon Mobil Corp | XOM | 80.00 | -0.24% | 10.1K |

| General Electric Co | GE | 30.86 | -0.29% | 3.8K |

| Wal-Mart Stores Inc | WMT | 60.90 | -0.31% | 0.4K |

| Chevron Corp | CVX | 93.48 | -0.35% | 0.4K |

| General Motors Company, NYSE | GM | 34.60 | -0.52% | 2.5K |

| Walt Disney Co | DIS | 105.00 | -0.53% | 0.2K |

| Visa | V | 78.11 | -0.57% | 2.8K |

| Cisco Systems Inc | CSCO | 27.22 | -0.66% | 0.8K |

| ALCOA INC. | AA | 10.11 | -0.79% | 5.8K |

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

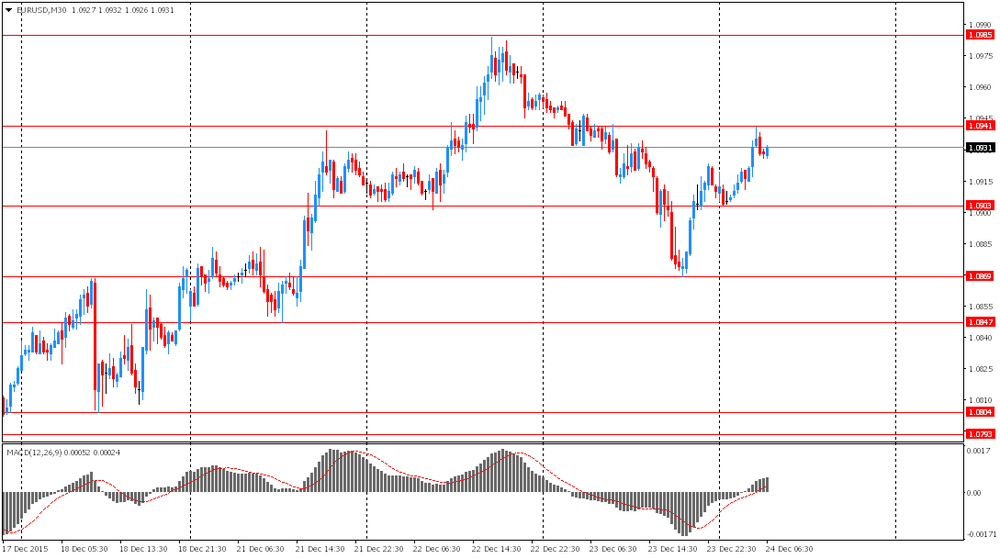

EUR/USD

Offers 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0850-55 1.0830 1.0800 1.0780-85 1.0750

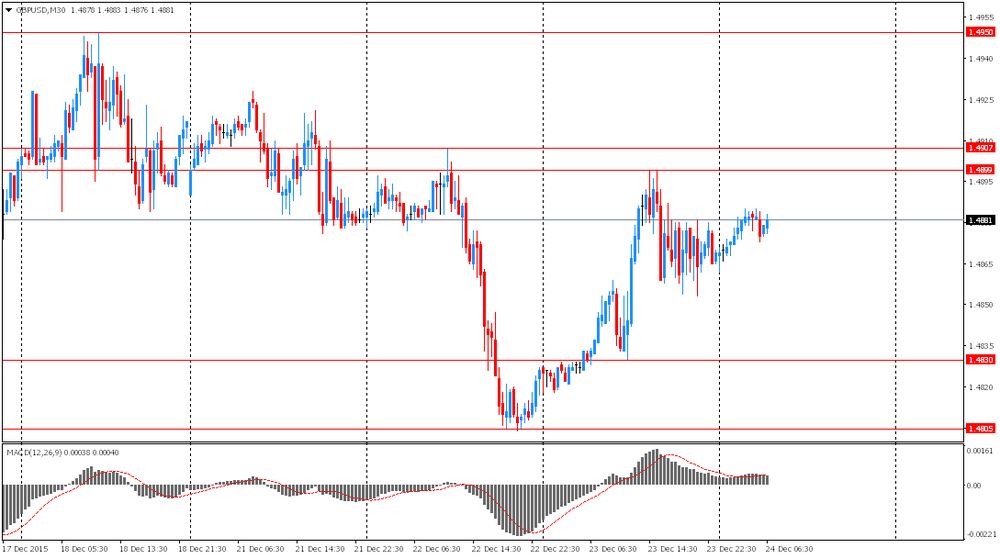

GBP/USD

Offers 1.4925-30 1.4950-55 1.4980-85 1.5000

Bids 1.4850 1.4820-25 1.4800 1.4785 1.4765 1.4750 1.4730 1.4700

EUR/GBP

Offers 0.7380 0.7400 0.7420 0.7450 0.7474 0.7500

Ордера на покупку 0.7320 0.7300 0.7275-80 0.7250

EUR/JPY

Offers 132.00 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.00 121.15 121.30 121.50-55 121.80 122.00 122.20 122.50

Bids 120.00 119.85 119.50

AUD/USD

Offers 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7220 0.7200 0.7180 0.7150 0.7120-25 0.7100

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

EUR / USD

Resistance levels (open interest**, contracts)

$1.1126 (7457)

$1.1054 (4750)

$1.1002 (5551)

Price at time of writing this review: $1.0935

Support levels (open interest**, contracts):

$1.0860 (1954)

$1.0802 (3056)

$1.0766 (6075)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56734 contracts, with the maximum number of contracts with strike price $1,1100 (7457);

- Overall open interest on the PUT options with the expiration date January, 8 is 73419 contracts, with the maximum number of contracts with strike price $1,0450 (8014);

- The ratio of PUT/CALL was 1.29 versus 1.30 from the previous trading day according to data from December, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1155)

$1.5102 (2596)

$1.5004 (432)

Price at time of writing this review: $1.4891

Support levels (open interest**, contracts):

$1.4794 (1706)

$1.4697 (1092)

$1.4598 (612)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19031 contracts, with the maximum number of contracts with strike price $1,5100 (2596);

- Overall open interest on the PUT options with the expiration date January, 8 is 18994 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from December, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The yen rose after the release of minutes of November 18-19 Bank of Japan meeting. Minutes did not signal that the bank intends to take new steps at the next meeting. Most Board members noted underlying trend in inflation had been improving steadily. The minutes supported the yen.

The Australian dollar rose on gains in commodity prices. Declines in U.S. crude oil inventories intensified hopes for a return to a balanced market after the supply glut triggered sharp declines in oil prices.

Trading is not expected to be dynamic in the coming days. Many traders have already closed their positions ahead of the end of the year, which increases market volatility. Today markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

EUR/USD: the pair rose to $1.0940 in Asian trade

USD/JPY: the pair fell to Y120.50

GBP/USD: the pair rose to $1.4885

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom BBA Mortgage Approvals November 45.43 46.2

13:30 U.S. Continuing Jobless Claims December 2238 2210

13:30 U.S. Initial Jobless Claims December 271 270

23:30 Japan Household spending Y/Y November -2.4% -2.4%

23:30 Japan Unemployment Rate November 3.1% 3.2%

23:30 Japan Tokyo Consumer Price Index, y/y December 0.2% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y December 0% 0.1%

23:30 Japan National Consumer Price Index, y/y November 0.3% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y November -0.1% 0.0%

West Texas Intermediate futures for February delivery climbed to $37.75 (+0.67%), while Brent crude advanced to $37.71 (+0.94%) after sharp gains in the previous session. The Energy Information Administration reported on Wednesday that U.S. crude oil inventories fell by 5.9 million barrels in the week ending December 18. Economists had expected a 1.1 million barrels gain.

Nevertheless fundamentals remain unfavorable for oil, because the market is still oversupplied and a one-week decline in U.S. crude inventories does not change the general situation.

Gold climbed to $1,073.20 (+0.46%) on a softer dollar and gains in crude oil prices after the Energy Information Administration unexpectedly reported a decline in U.S. crude oil inventories. Gold is often seen as a hedge asset against oil-driven inflation. Low trading volume ahead of holidays makes bullion sensitive to market movements.

Nevertheless fundamentals remain bearish. The Federal Reserve is expected to continue raising its interest rates gradually and this would support the dollar. Some analysts say that prices may fall below $1,000 key level in 2016.

U.S. stock indices rose on Wednesday as energy stocks rebounded.

The Dow Jones Industrial Average rose 185.34 points, or 1.1%, to 17,602.61. The S&P 500 gained 25.32 points, or 1.2%, to 2,064.29 (all of its 10 sectors closed higher; the energy sector rose 4.2%). The Nasdaq Composite added 44.82 points, or 0.9% to 5,045.93.

Oil prices rose boosting stocks of energy companies after the Energy Information Administration reported an unexpected 5.9 million barrel decline in U.S. crude oil inventories.

Data from the Department of Commerce showed that durable goods orders were unchanged in November, but the business investment indicator improved. Economists had expected durable goods orders to decline by 0.6% after the 2.9% increase in October.

Another report by the Department of Commerce showed that personal income rose by 0.3% in November after a 0.4% rise in October. Meanwhile personal spending rose by 0.3% after being unchanged in the previous month. Economists had expected income to grow by 0.2% and spending by 0.3%.

This morning in Asia Hong Kong Hang Seng rose 0.44%, or 97.54, to 22,138.13. China Shanghai Composite Index dropped 1.22%, or 44.40, to 3,591.69. The Nikkei declined 0.46%, or 86.03, to 18,800.67.

Asian stock indices traded mixed with China leading declines after authorities introduced tighter disclosure requirements for companies buying stakes in listed companies.

The yen's strength weighed on Japanese exporters.

(raw materials / closing price /% change)

Oil 37.84 +0.91%

Gold 1,071.40 +0.29%

(index / closing price / change items /% change)

HANG SENG 22,009.28 +179.26 +0.82%

S&P/ASX 200 5,141.78 +25.09 +0.49%

SHANGHAI COMP 3,637.28 -14.48 -0.40%

FTSE 100 6,240.98 +157.88 +2.60 %

CAC 40 4,674.53 +106.93 +2.34 %

Xetra DAX 10,727.64 +238.89 +2.28 %

S&P 500 2,064.29 +25.32 +1.24 %

NASDAQ Composite 5,045.93 +44.82 +0.90 %

Dow Jones 17,602.61 +185.34 +1.06 %

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0911 -0,41%

GBP/USD $1,4869 +0,29%

USD/CHF Chf0,9906 +0,37%

USD/JPY Y120,91 -0,12%

EUR/JPY Y131,93 -0,54%

GBP/JPY Y179,78 +0,17%

AUD/USD $0,7233 -0,01%

NZD/USD $0,6792 -0,19%

USD/CAD C$1,3848 -0,51%

(time / country / index / period / previous value / forecast)

06:00 Germany Bank Holiday

09:30 United Kingdom BBA Mortgage Approvals November 45.43 46.2

13:30 U.S. Continuing Jobless Claims December 2238 2210

13:30 U.S. Initial Jobless Claims December 271 270

23:30 Japan Household spending Y/Y November -2.4% -2.4%

23:30 Japan Unemployment Rate November 3.1% 3.2%

23:30 Japan Tokyo Consumer Price Index, y/y December 0.2% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y December 0% 0.1%

23:30 Japan National Consumer Price Index, y/y November 0.3% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y November -0.1% 0.0%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.