- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 28-12-2015

(time / country / index / period / previous value / forecast)

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October 5.5% 5.4%

15:00 U.S. Consumer confidence December 90.4 92.9

Major U.S. stock-indexes began the last trading week of the year in the red, dragged down by energy stocks, as oil prices resumed a slide brought on by a global oversupply. Trading volumes are expected be subdued through the week.

Global stocks ticked lower on Monday over fresh worries about Chinese growth after data showed profits at industrial companies in the world's second-largest economy fell in November for the sixth month in a row.

Most of Dow stocks 15 in negative area (22 of 30). Top looser - Chevron Corporation (CVX, -1,65%). Top gainer - The Walt Disney Company (DIS, +1.11%).

All S&P sectors also red. Top looser - Conglomerates (-1.9%).

At the moment:

Dow 17372.00 -77.00 -0.44%

S&P 500 2040.00 -11.25 -0.55%

Nasdaq 100 4586.25 -24.75 -0.54%

Oil 36.75 -1.35 -3.54%

Gold 1069.50 -6.40 -0.59%

U.S. 10yr 2.22 -0.02

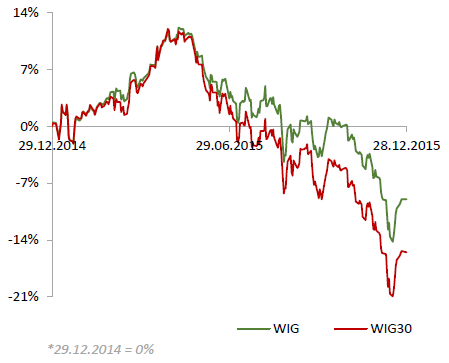

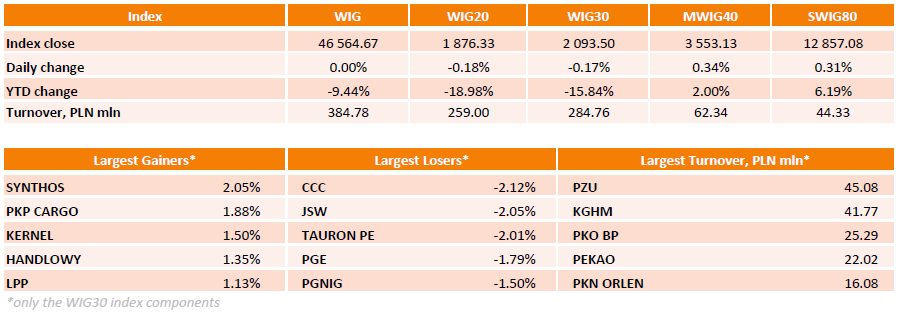

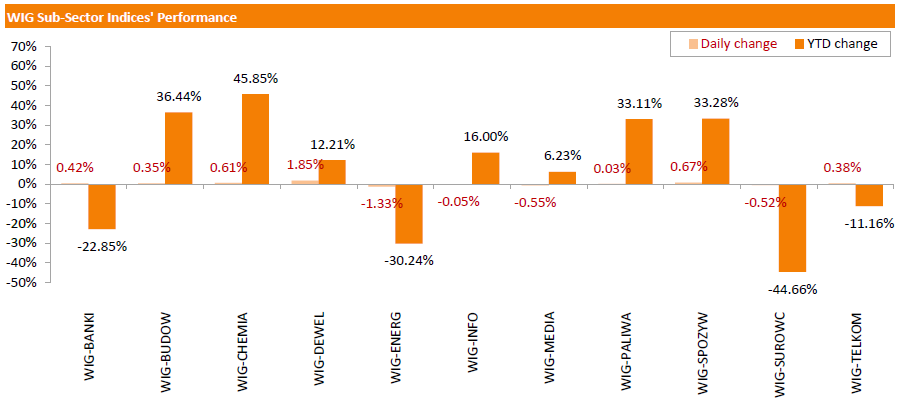

Polish equity market closed unchanged on Monday. Sector-wise, utilities stocks (-1.33%) fared the worst, while developing sector names (+1.85%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 0.17%. The decliners were led by footwear retailer CCC (WSE: CCC), which tumbled by 2.12%. Other biggest laggards included coking coal producer JSW (WSE: JSW) and two gencos TAURON PE (WSE: TPE) and PGE (WSE: PGE), which plunged by 2.05%, 2.01% and 1.79% respectively. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) recorded the strongest daily result, climbing by 2.05% on analyst upgrade. It was followed by railway freight transport operator PKP CARGO (WSE: PKP) and agricultural producer KERNEL (WSE: KER), advancing 1.88% and 1.5% respectively.

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 18,873.35 +104.29 +0.56%

Hang Seng 21,919.62 -218.51 -0.99%

Shanghai Composite 3,534.76 -93.16 -2.57%

CAC 4,624.73 -38.45 -0.82%

DAX10,655.11 -72.53 -0.68%

Crude oil $37.13 (-2.60%)

Gold $1070.40 (-0.50%)

(company / ticker / price / change, % / volume)

| Walt Disney Co | DIS | 106.25 | 0.37% | 1.2K |

| Amazon.com Inc., NASDAQ | AMZN | 665.00 | 0.33% | 4.1K |

| Google Inc. | GOOG | 748.59 | 0.03% | 1.9K |

| Hewlett-Packard Co. | HPQ | 11.72 | -0.09% | 0.2K |

| Verizon Communications Inc | VZ | 46.64 | -0.15% | 0.3K |

| McDonald's Corp | MCD | 118.37 | -0.17% | 1.0K |

| Facebook, Inc. | FB | 104.83 | -0.18% | 31.3K |

| Starbucks Corporation, NASDAQ | SBUX | 60.19 | -0.22% | 0.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 230.07 | -0.22% | 5.8K |

| Nike | NKE | 63.03 | -0.24% | 13.5K |

| Microsoft Corp | MSFT | 55.50 | -0.31% | 1.0K |

| AMERICAN INTERNATIONAL GROUP | AIG | 61.51 | -0.31% | 0.5K |

| Apple Inc. | AAPL | 107.68 | -0.32% | 32.2K |

| Visa | V | 78.00 | -0.33% | 0.3K |

| Intel Corp | INTC | 34.86 | -0.34% | 1.0K |

| Pfizer Inc | PFE | 32.50 | -0.37% | 1.5K |

| Ford Motor Co. | F | 14.25 | -0.42% | 1.0K |

| American Express Co | AXP | 69.86 | -0.43% | 0.1K |

| JPMorgan Chase and Co | JPM | 66.30 | -0.45% | 30.3K |

| AT&T Inc | T | 34.50 | -0.46% | 5.4K |

| Cisco Systems Inc | CSCO | 27.25 | -0.47% | 0.4K |

| General Electric Co | GE | 30.67 | -0.52% | 6.6K |

| Twitter, Inc., NYSE | TWTR | 22.85 | -0.52% | 13.4K |

| International Business Machines Co... | IBM | 137.52 | -0.53% | 0.4K |

| Citigroup Inc., NYSE | C | 52.42 | -0.55% | 2.5K |

| Wal-Mart Stores Inc | WMT | 60.47 | -0.59% | 0.2K |

| E. I. du Pont de Nemours and Co | DD | 66.00 | -0.60% | 0.3K |

| Caterpillar Inc | CAT | 68.80 | -0.84% | 1.3K |

| Yahoo! Inc., NASDAQ | YHOO | 33.81 | -0.88% | 11.5K |

| ALCOA INC. | AA | 10.01 | -1.09% | 34.2K |

| FedEx Corporation, NYSE | FDX | 147.66 | -1.33% | 0.7K |

| Exxon Mobil Corp | XOM | 78.18 | -1.45% | 13.1K |

| Barrick Gold Corporation, NYSE | ABX | 7.69 | -1.66% | 3.1K |

| Chevron Corp | CVX | 90.50 | -1.68% | 10.4K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7.36 | -2.77% | 92.0K |

| Yandex N.V., NASDAQ | YNDX | 15.64 | -2.86% | 15.6K |

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

Upgrades:

Downgrades:

Other:

Intel (INTC) target raised to $38 from $37 at Deutsche Bank

NIKE (NKE) target raised to $77 from $75 at Argus

Amazon (AMZN) target raised to $797 from $727 at Axiom Capital

Alphabet A (GOOGL) target raised to $1000 from $900 at Axiom Capital

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m November -3.0%

05:00 Japan Leading Economic Index (Finally) October 101.6 102.9 104.2

05:00 Japan Coincident Index (Finally) October 112.3 114.3 113.8

The U.S. dollar declined against the euro and the pound after recent gains, which were generated by the Federal Reserve's rate hike. Expectations of higher rates and the 25 basis points hike supported the greenback earlier. Nevertheless investors have already taken advantage of this event and now market participants are focused on further increases in 2016. Most analysts don't expect the Federal Reserve to raise rates again before April 2016.

The yen fell against the greenback amid weaker-than-expected data. Japanese retail sales fell by 2.5% m/m in November. The index declined 1.0% on an annualized basis. Meanwhile industrial production declined 1.0% m/m in November, but gained 1.6% on a y/y basis. Industrial production declined because of weak demand from emerging markets.

Trading volumes are still low after catholic Christmas and ahead of New Year. Market participants close their orders and try not to open new ones ahead of the holiday. That's why liquidity declines and volatility rises.

EUR/USD: the pair rose to $1.0975 in Asian trade

USD/JPY: the pair rose to Y120.55

GBP/USD: the pair rose to $1.4935

West Texas Intermediate futures for February delivery fell to $37.73 (-0.97%), while Brent crude declined to $37.74 (-0.40%). Analysts say that the WTI's newly gained premium over Brent is the most important factor in the market these days, when trading is thin due to holidays. This week is going to be shorter due to New Year too with markets in many countries still closed for Christmas. This week will not be data-rich, that's why the Energy Information Administration's inventories report due on Wednesday will attract more attention.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1130 (7538)

$1.1065 (4731)

$1.1021 (5506)

Price at time of writing this review: $1.0973

Support levels (open interest**, contracts):

$1.0855 (3112)

$1.0819 (2981)

$1.0779 (6103)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56525 contracts, with the maximum number of contracts with strike price $1,1100 (7538);

- Overall open interest on the PUT options with the expiration date January, 8 is 72972 contracts, with the maximum number of contracts with strike price $1,0450 (7997);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from December, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1156)

$1.5103 (2592)

$1.5006 (432)

Price at time of writing this review: $1.4921

Support levels (open interest**, contracts):

$1.4796 (1722)

$1.4698 (1085)

$1.4599 (612)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19022 contracts, with the maximum number of contracts with strike price $1,5100 (2592);

- Overall open interest on the PUT options with the expiration date January, 8 is 18985 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Gold slid to $1,072.80 (-0.29%) despite a softer dollar as oil prices failed to sustain recent gains, which were triggered by the latest report on U.S. crude oil inventories. This week trading is likely to remain thin. Markets in many countries are still closed today and will be closed on Friday too due to New Year celebrations.

Some analysts expect gold to trade lower and decline to $1,000 an ounce at the beginning of 2016 amid prospects of further rate hikes by the Federal Reserve.

U.S. stock indices mostly edged down in a holiday-shortened session on Thursday. Markets were closed on Friday.

The Dow Jones Industrial Average lost 50.44 points, or 0.3%, to 17,552.17 (+2.5% over the week). The declined 3.32 points, or 0.2%, to 2,060.97 (+2.8% over the week). The Nasdaq Composite added 2 points, or less than 0.1% to 5,048.49 (+2.6% over the week).

This morning in Asia Hong Kong Hang Seng fell 0.38%, or 83.39, to 22,054.74. China Shanghai Composite Index lost 0.51%, or 18.52, to 3,609.39. The Nikkei gained 0.81%, or 151.97, to 18,921.03.

Asian stock indices outside Japan declined amid lack of hints for direction as markets in many countries were closed for Christmas on Friday. Japanese stocks were supported by recent gains in oil prices.

(raw materials / closing price /% change)

Oil 38.12 +0.05%

Gold 1,075.80 -0.01%

(index / closing price / change items /% change)

Nikkei 225 18,769.06-20 .63 -0.11 %

Hang Seng 22,138.13 +97.54 +0.44 %

Shanghai Composite 3,628 +15.52 +0.43 %

FTSE 100 6,254.64 +13.66 +0.22 %

CAC 40 4,663.18 -11.35 -0.24 % 16.82m

Xetra DAX 10,727.64+238.89 +2.28 %

S&P 500 2,060.99-3.30 -0.16 %

NASDAQ Composite 5,048.49 +2.56 +0.05 %

Dow Jones 17,552.17 -50.44 -0.29 %

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0959 +0,44%

GBP/USD $1,4889 +0,13%

USD/CHF Chf0,986 -0,47%

USD/JPY Y120,34 -0,47%

EUR/JPY Y131,87 -0,05%

GBP/JPY Y179,16 -0,35%

AUD/USD $0,7272 +0,54%

NZD/USD $0,6815 +0,34%

USD/CAD C$1,3852 +0,03%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.