- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 26-04-2018

| raw materials | closing price | % change |

| Oil | 68.16 | +0.16% |

| Gold | 1,317.80 | -0.38% |

| index | closing price | change items | % change |

| Nikkei | +104.29 | 22319.61 | +0.47% |

| TOPIX | +4.40 | 1772.13 | +0.25% |

| Hang Seng | -320.47 | 30007.68 | -1.06% |

| CSI 300 | -73.21 | 3755.49 | -1.91% |

| Euro Stoxx 50 | +20.20 | 3506.03 | +0.58% |

| FTSE 100 | +42.11 | 7421.43 | +0.57% |

| DAX | +78.17 | 12500.47 | +0.63% |

| CAC 40 | +40.28 | 5453.58 | +0.74% |

| DJIA | +238.51 | 24322.34 | +0.99% |

| S&P 500 | +27.54 | 2666.94 | +1.04% |

| NASDAQ | +114.94 | 7118.68 | +1.64% |

| S&P/TSX | +127.84 | 15637.59 | +0.82% |

| Pare | Closed | % change |

| EUR/USD | $1,2104 | -0,48% |

| GBP/USD | $1,3915 | -0,13% |

| USD/CHF | Chf0,98936 | +0,64% |

| USD/JPY | Y109,30 | -0,08% |

| EUR/JPY | Y132,31 | -0,55% |

| GBP/JPY | Y152,102 | -0,21% |

| AUD/USD | $0,7553 | -0,17% |

| NZD/USD | $0,7060 | -0,09% |

| USD/CAD | C$1,28684 | +0,22% |

| Time | Region | Event | Period | Previous | Forecast |

| 01:45 | New Zealand | Trade Balance, mln | March | 217 | 270 |

| 02:01 | United Kingdom | Gfk Consumer Confidence | April | -7 | -7 |

| 02:30 | Japan | Tokyo CPI ex Fresh Food, y/y | April | 0.8% | 0.8% |

| 02:30 | Japan | Tokyo Consumer Price Index, y/y | April | 1% | 0.8% |

| 02:30 | Japan | Unemployment Rate | March | 2.5% | 2.5% |

| 02:50 | Japan | Retail sales, y/y | March | 1.6% | 1.7% |

| 02:50 | Japan | Industrial Production (MoM) | March | 0% | 0.5% |

| 02:50 | Japan | Industrial Production (YoY) | March | 1.6% | 2% |

| 04:30 | Australia | Producer price index, q / q | I quarter | 0.6% | 0.4% |

| 04:30 | Australia | Producer price index, y/y | I quarter | 1.7% | |

| 06:00 | Japan | BoJ Interest Rate Decision | | -0.1% | -0.1% |

| 06:00 | Japan | BOJ Outlook Report | | | |

| 08:00 | Japan | Construction Orders, y/y | March | 19.2% | |

| 08:00 | Japan | Housing Starts, y/y | March | -2.6% | -5.4% |

| 08:30 | France | GDP, q/q | I quarter | 0.7% | 0.4% |

| 09:00 | United Kingdom | Nationwide house price index, y/y | April | 2.1% | 2.6% |

| 09:00 | United Kingdom | Nationwide house price index | April | -0.2% | 0.2% |

| 09:30 | Japan | BOJ Press Conference | | | |

| 09:45 | France | CPI, m/m | April | 1% | 0.1% |

| 09:45 | France | Consumer spending | March | 2.4% | 0.5% |

| 09:45 | France | CPI, y/y | April | 1.6% | |

| 10:55 | Germany | Unemployment Rate s.a. | April | 5.3% | 5.3% |

| 10:55 | Germany | Unemployment Change | April | -19 | -15 |

| 11:00 | Eurozone | ECB's Yves Mersch Speaks | | | |

| 11:00 | Eurozone | ECOFIN Meetings | | | |

| 11:00 | Eurozone | Eurogroup Meetings | | | |

| 11:00 | Switzerland | SNB Chairman Jordan Speaks | | | |

| 11:30 | United Kingdom | GDP, y/y | I quarter | 1.4% | 1.4% |

| 11:30 | United Kingdom | GDP, q/q | I quarter | 0.4% | 0.3% |

| 12:00 | Eurozone | Consumer Confidence | April | 0.1 | -0.1 |

| 12:00 | Eurozone | Industrial confidence | April | 6.4 | 5.8 |

| 12:00 | Eurozone | Economic sentiment index | April | 112.6 | 112.0 |

| 12:00 | Eurozone | Business climate indicator | April | 1.34 | 1.27 |

| 12:00 | Eurozone | ECB's Yves Mersch Speaks | | | |

| 15:30 | USA | PCE price index ex food, energy, q/q | I quarter | 1.9% | 2.5% |

| 15:30 | USA | PCE price index, q/q | I quarter | 2.7% | 2.6% |

| 15:30 | USA | GDP, q/q | I quarter | 2.9% | 2% |

| 17:00 | United Kingdom | BOE Gov Mark Carney Speaks | | | |

| 17:00 | USA | Reuters/Michigan Consumer Sentiment Index | April | 101.4 | 98 |

| 17:15 | United Kingdom | MPC Member Andy Haldane Speaks | | | |

| 20:00 | USA | Baker Hughes Oil Rig Count | April | 820 |

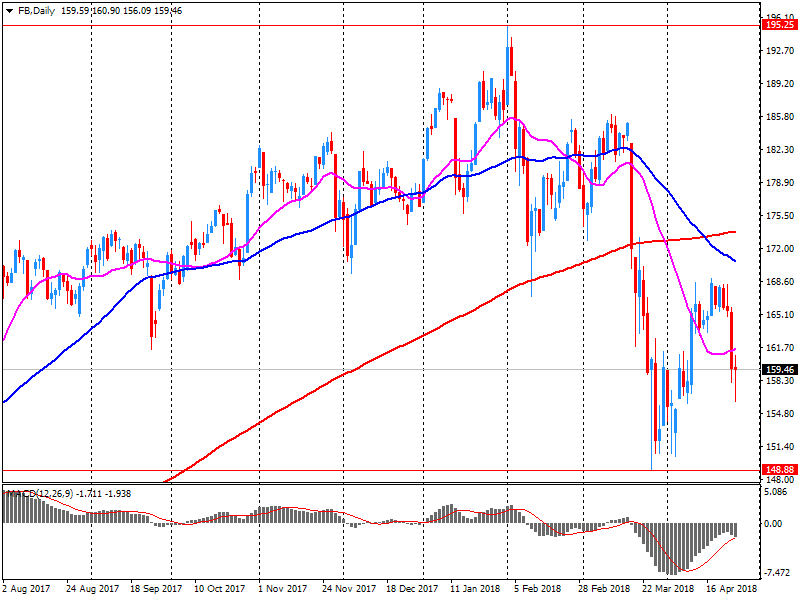

The main US stock indices increased noticeably due to a rise in the price of Facebook shares (FB) after the publication of quarterly results, and against the backdrop of declining yield on US bonds, which improved the mood on Wall Street.

Investors also estimated the statistics on the United States. Demand for durable goods in the US rose in March due to increased orders for aircraft, but the main sensor of business investment fell. Orders for durable goods - manufactured goods designed for a lifetime of at least three years, for example, furnaces and industrial robots - increased seasonally by 2.6% compared to February. Economists had expected growth of 1.6%.

Meanwhile, the number of Americans applying for unemployment benefits has fallen to the lowest level since 1969, the last sign that the labor market is strengthening after years of stable employment growth. Initial applications for unemployment benefits, a measure of layoffs in all US states, fell by 24,000 to 209,000, seasonally adjusted for the week before April 21, the Ministry of Labor said. It was the lowest level since December 6, 1969, at the beginning of the Nixon administration. Economists had expected 230,000 initial hits.

Oil prices rose slightly on Thursday, supported by expectations of the resumption of US sanctions against Iran, the reduction in production in Venezuela and the continued high demand. Over the past four weeks, oil quotations have risen 15% on expectations that the United States will reintroduce sanctions against Iran, a major oil producer and a member of the Organization of Petroleum Exporting Countries (OPEC).

Most components of the DOW index recorded a rise (25 out of 30). Leader of growth - Visa Inc. (V, + 4.79%). Outsider - The Walt Disney Company (DIS, -1.19%).

Almost all sectors of S & P completed the auction in positive territory. The technological sector grew most (+ 1.7%). Decrease showed only the conglomerate sector (-2.2%). and the sector of industrial goods (-0.2%)

At closing:

Dow 24,322.27 +238.44 +0.99%

S&P 500 2,666.95 +27.55 +1.04%

Nasdaq 100 7,118.68 +114.94 +1.64%

U.S. stock-index futures rose on Thursday, as a slew of strong company earnings helped overshadow worries over growing U.S. Threasury yields and corporate costs.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,319.61 | +104.29 | +0.47% |

| Hang Seng | 30,007.68 | -320.47 | -1.06% |

| Shanghai | 3,075.85 | -42.12 | -1.35% |

| S&P/ASX | 5,910.80 | -10.80 | -0.18% |

| FTSE | 7,385.16 | +5.84 | +0.08% |

| CAC | 5,447.90 | +34.60 | +0.64% |

| DAX | 12,465.91 | +43.61 | +0.35% |

| Crude | $68.69 | | +0.94% |

| Gold | $1,324.20 | | +0.11% |

-

Says didn't discuss monetary policy per se

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 199.25 | 0.41(0.21%) | 1666 |

| ALCOA INC. | AA | 51.59 | -0.36(-0.69%) | 606 |

| ALTRIA GROUP INC. | MO | 56 | 0.16(0.29%) | 16343 |

| Amazon.com Inc., NASDAQ | AMZN | 1,492.04 | 31.87(2.18%) | 61034 |

| American Express Co | AXP | 99.24 | 0.46(0.47%) | 165 |

| Apple Inc. | AAPL | 164.33 | 0.68(0.42%) | 143663 |

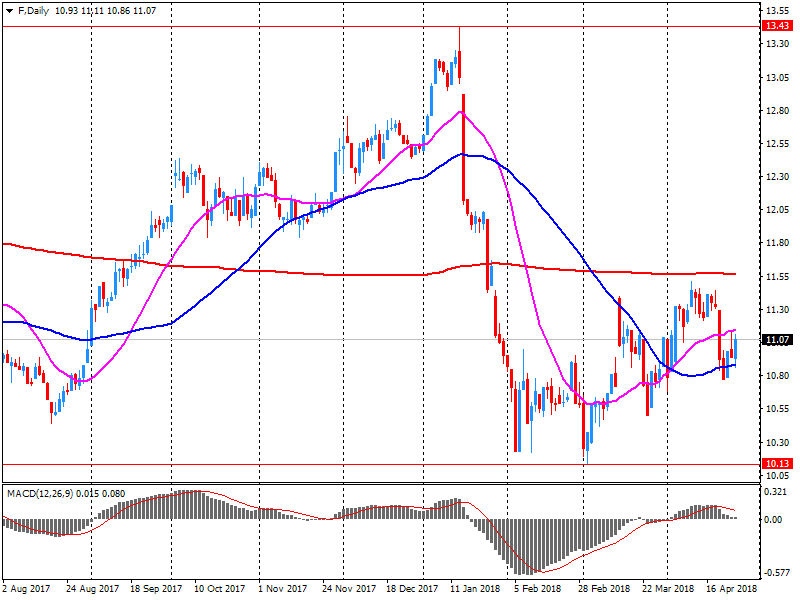

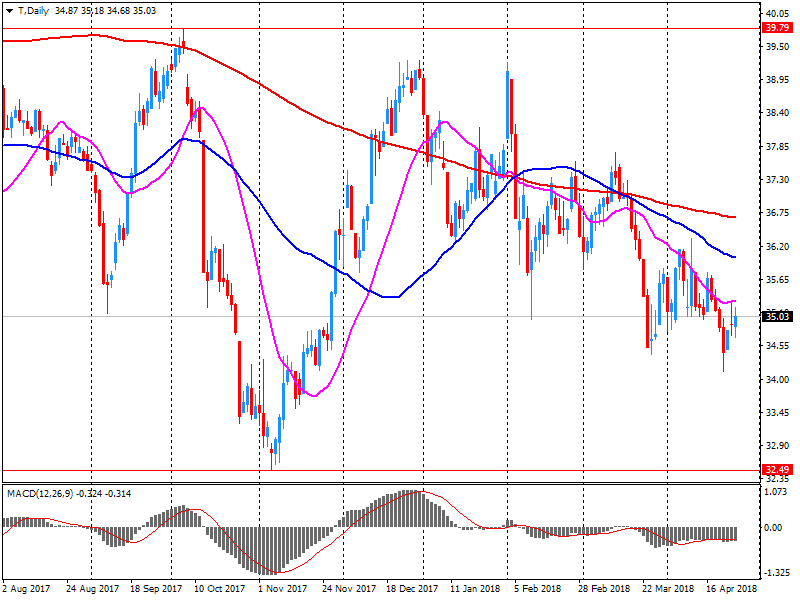

| AT&T Inc | T | 33.59 | -1.61(-4.57%) | 1133605 |

| Barrick Gold Corporation, NYSE | ABX | 13.55 | 0.06(0.44%) | 2890 |

| Boeing Co | BA | 344.5 | 1.64(0.48%) | 20809 |

| Caterpillar Inc | CAT | 146.4 | 1.21(0.83%) | 5968 |

| Cisco Systems Inc | CSCO | 44.05 | 0.34(0.78%) | 6241 |

| Citigroup Inc., NYSE | C | 69.4 | 0.04(0.06%) | 8369 |

| Exxon Mobil Corp | XOM | 79.9 | 0.40(0.50%) | 12133 |

| Facebook, Inc. | FB | 171.35 | 11.66(7.30%) | 2013780 |

| Ford Motor Co. | F | 11.34 | 0.23(2.07%) | 297574 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.5 | 0.13(0.85%) | 23626 |

| General Electric Co | GE | 14.16 | 0.11(0.78%) | 112984 |

| General Motors Company, NYSE | GM | 37.75 | -0.36(-0.94%) | 315932 |

| Goldman Sachs | GS | 240 | 0.77(0.32%) | 2723 |

| Google Inc. | GOOG | 1,031.99 | 10.81(1.06%) | 4656 |

| Intel Corp | INTC | 52.53 | 1.15(2.24%) | 88628 |

| International Business Machines Co... | IBM | 146.35 | 0.41(0.28%) | 1475 |

| Johnson & Johnson | JNJ | 126.63 | -0.13(-0.10%) | 359 |

| JPMorgan Chase and Co | JPM | 110.15 | 0.16(0.15%) | 10407 |

| McDonald's Corp | MCD | 156.3 | 0.36(0.23%) | 1097 |

| Merck & Co Inc | MRK | 59.67 | 0.04(0.07%) | 100 |

| Microsoft Corp | MSFT | 93.91 | 1.60(1.73%) | 213558 |

| Nike | NKE | 66.86 | 0.19(0.29%) | 860 |

| Pfizer Inc | PFE | 36.72 | 0.04(0.11%) | 3283 |

| Procter & Gamble Co | PG | 72.37 | 0.07(0.10%) | 3122 |

| Starbucks Corporation, NASDAQ | SBUX | 58.01 | 0.30(0.52%) | 531 |

| Tesla Motors, Inc., NASDAQ | TSLA | 279 | -1.69(-0.60%) | 35632 |

| The Coca-Cola Co | KO | 42.56 | 0.13(0.31%) | 2158 |

| Twitter, Inc., NYSE | TWTR | 30.46 | 0.71(2.39%) | 347016 |

| United Technologies Corp | UTX | 120 | -1.45(-1.19%) | 106 |

| Verizon Communications Inc | VZ | 49.8 | -0.30(-0.60%) | 7116 |

| Visa | V | 124.51 | 3.30(2.72%) | 29132 |

| Wal-Mart Stores Inc | WMT | 87.35 | 0.18(0.21%) | 1390 |

| Walt Disney Co | DIS | 101.63 | 0.48(0.47%) | 973 |

| Yandex N.V., NASDAQ | YNDX | 33.14 | 0.13(0.39%) | 6060 |

In the week ending April 21, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 24,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 229,250, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 231,250 to 231,500.

-

Inflation likely to hover around 1.5 pct for rest of the year

-

Underlying inflation to rise only gradually

-

Risks to growth relate to global factors

Twitter (TWTR) upgraded to Neutral from Underweight at Atlantic Equities

Twitter (TWTR) upgraded to Outperform from Neutral at Macquarie

Boeing (BA) upgraded to Buy from Hold at Societe Generale

-

Has confidence that inflation will converge with target

-

Need to monitor fx

-

Ample degree of monetary stimulus still needed

-

Underlying trends continue to support confidence

-

Moderation of growth

New orders for manufactured durable goods in March increased $6.4 billion or 2.6 percent to $254.9 billion, the U.S. Census Bureau announced today. This increase, up four of the last five months, followed a 3.5 percent February increase. Excluding transportation, new orders were virtually unchanged. Excluding defense, new orders increased 2.8 percent. Transportation equipment, also up four of the last five months, drove the increase, $6.4 billion or 7.6 percent to $91.4 billion.

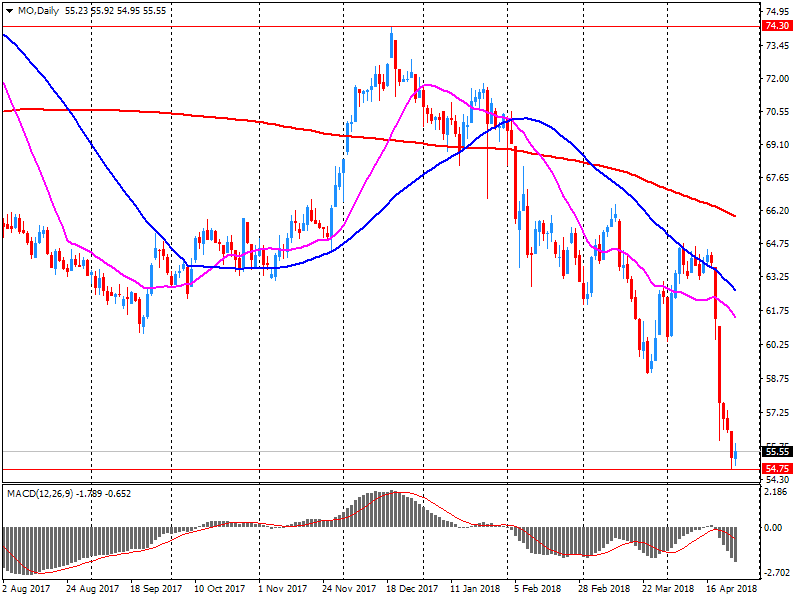

Altria (MO) reported Q1 FY 2018 earnings of $0.95 per share (versus $0.73 in Q1 FY 2017), beating analysts' consensus estimate of $0.91.

The company's quarterly revenues amounted to $4.670 bln (+1.8% y/y), generally in-line with analysts' consensus estimate of $4.627 bln.

The company reaffirmed guidance for FY 2018, projecting EPS of $3.90-4.03 versus analysts' consensus estimate of $3.97.

MO fell to $55.50 (-0.61%) in pre-market trading.

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases".

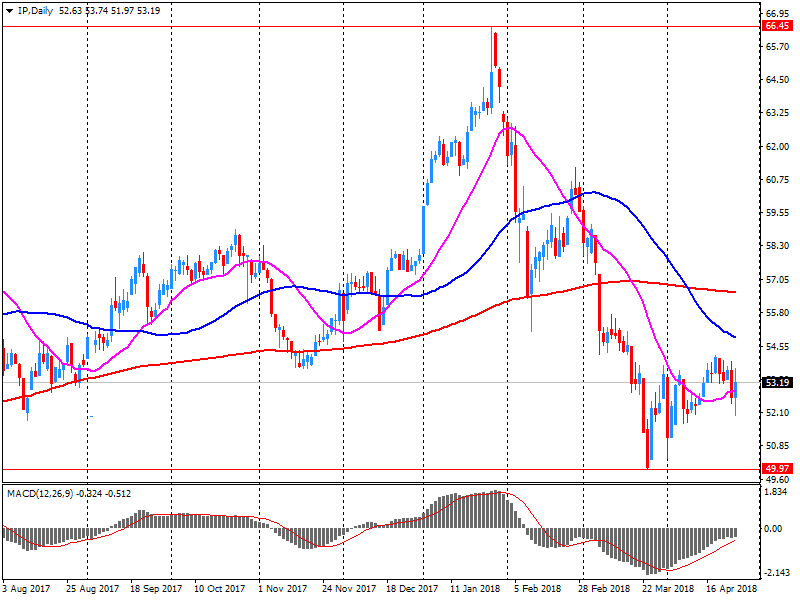

Int'l Paper (IP) reported Q1 FY 2018 earnings of $0.94 per share (versus $0.60 in Q1 FY 2017), beating analysts' consensus estimate of $0.89.

The company's quarterly revenues amounted to $5.621 bln (+9.5% y/y), beating analysts' consensus estimate of $5.483 bln.

IP closed Wednesday's trading session at $53.48 (+1.36%).

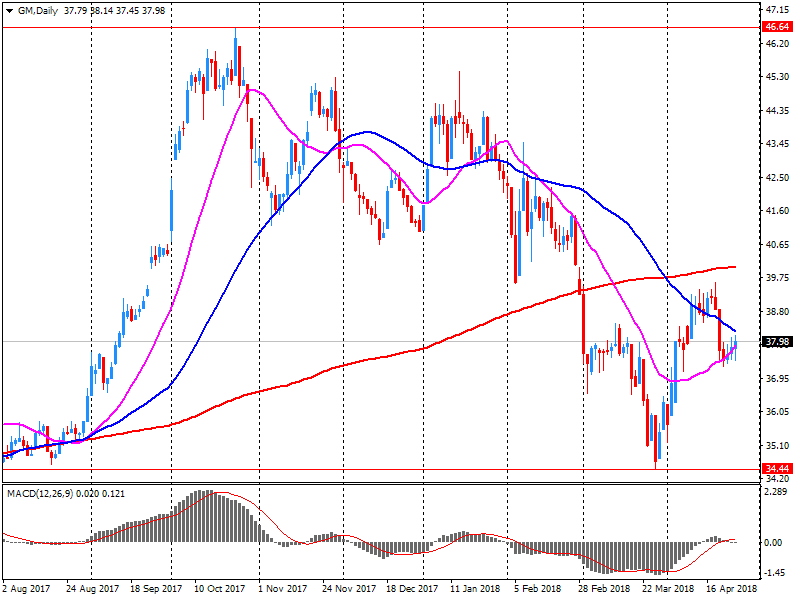

General Motors (GM) reported Q1 FY 2018 earnings of $1.43 per share (versus $1.70 in Q1 FY 2017), beating analysts' consensus estimate of $1.27.

The company's quarterly revenues amounted to $36.100 bln (-12.4% y/y), beating analysts' consensus estimate of $34.672 bln.

GM fell to $37.89 (-0.58%) in pre-market trading.

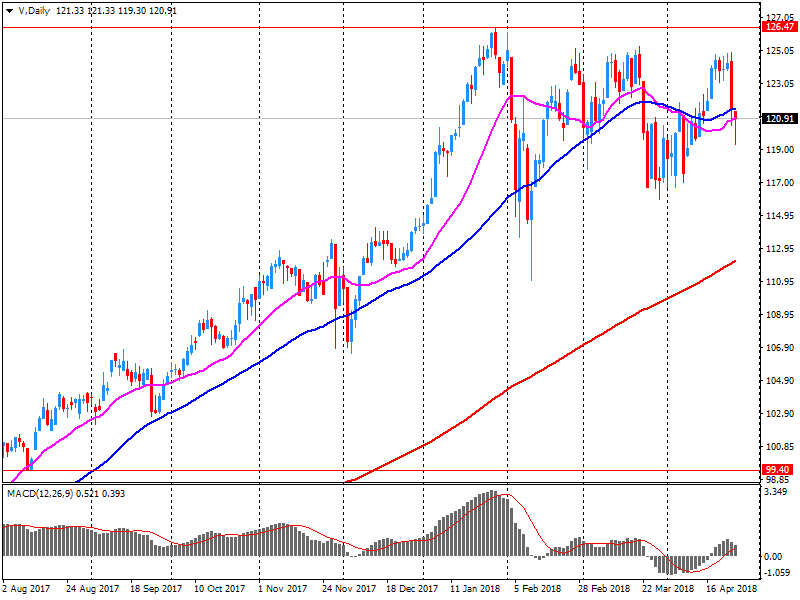

Visa (V) reported Q2 FY 2018 earnings of $1.11 per share (versus $0.86 in Q2 FY 2017), beating analysts' consensus estimate of $1.01.

The company's quarterly revenues amounted to $5.073 bln (+13.3% y/y), beating analysts' consensus estimate of $4.820 bln.

V rose to $123.83 (+2.16%) in pre-market trading.

Ford Motor (F) reported Q1 FY 2018 earnings of $0.43 per share (versus $0.39 in Q1 FY 2017), beating analysts' consensus estimate of $0.41.

The company's quarterly revenues amounted to $41.959 bln (+7.2% y/y), beating analysts' consensus estimate of $37.057 bln.

The company reaffirmed FY 2018 EPS guidance at $1.45-1.70 versus analysts' consensus estimate of $1.58. It also said it forecast FY 2018 revenues to be modestly higher than in 2017 versus flat to modestly higher prior.

F rose to $11.27 (+1.44%) in pre-market trading.

Facebook (FB) reported Q1 FY 2018 earnings of $1.69 per share (versus $1.04 in Q1 FY 2017), beating analysts' consensus estimate of $1.33.

The company's quarterly revenues amounted to $11.966 bln (+49.0% y/y), beating analysts' consensus estimate of $11.411 bln.

FB rose to $170.70 (+6.89%) in pre-market trading.

AT&T (T) reported Q1 FY 2018 earnings of $0.85 per share (versus $0.74 in Q1 FY 2017), missing analysts' consensus estimate of $0.88.

The company's quarterly revenues amounted to $38.038 bln (-3.4% y/y), missing analysts' consensus estimate of $39.356 bln.

T fell to $33.84 (-3.86%) in pre-market trading.

The survey of 100 firms showed that, in the year to April, retail sales volumes were broadly unchanged. Sales were below average for the time of year for the second month in a row, albeit at to a lesser extent than in the year to March. Meanwhile, orders placed on suppliers fell slightly, but are expected to pick up again in the year to May.

Within the retail sector, falls in sales volumes in the clothing, footwear & leather, non-store, and furniture & carpets sub-sectors were offset by sales growth among grocers, hardware & DIY, and recreational goods stores.

Card spending was 1.2 per cent lower than in March 2017 with repayments outstripping new lending in the first quarter of 2018. Outstanding levels of credit card borrowing have grown by 5.8 per cent over the year.

Gross mortgage lending in March is estimated to have been £20.5bn, 2.3 per cent lower than a year earlier. The number of total mortgage approvals has also fallen and is 15 per cent lower, with house purchase approvals falling by almost 21 per cent, compared to a year earlier.

Growth in personal deposits has grown by 1.8 per cent over the year, slightly down on the previous six-month average of 2 per cent.

-

Says risks of too low inflation merit particular attention, as at prevailing interest rate levels this is more difficult to manage than inflation that is too high

-

If inflation is to remain close to target going forward, continued support is needed from monetary policy

-

Says monetary policy needs to proceed cautiously

EUR/USD

Resistance levels (open interest**, contracts)

$1.2298 (592)

$1.2274 (282)

$1.2244 (218)

Price at time of writing this review: $1.2176

Support levels (open interest**, contracts):

$1.2118 (2535)

$1.2080 (3081)

$1.2038 (1756)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 4 is 77918 contracts (according to data from April, 25) with the maximum number of contracts with strike price $1,2650 (4233);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4090 (906)

$1.4059 (657)

$1.4015 (414)

Price at time of writing this review: $1.3942

Support levels (open interest**, contracts):

$1.3888 (1178)

$1.3857 (1655)

$1.3821 (2220)

Comments:

- Overall open interest on the CALL options with the expiration date May, 4 is 22442 contracts, with the maximum number of contracts with strike price $1,4400 (3262);

- Overall open interest on the PUT options with the expiration date May, 4 is 24485 contracts, with the maximum number of contracts with strike price $1,3850 (2220);

- The ratio of PUT/CALL was 1.09 versus 1.07 from the previous trading day according to data from April, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Much more encouraged by economy compared to previous testimony in november

-

There is no near-term prospect of benchmark status of us dollar and us treasury market being undermined

-

Affirmation of U.S.' rating reflects exceptional economic strength, very high strength of institutions, very low exposure to credit-related shocks

-

It sees little prospect of U.S.' economic strength diminishing materially in the foreseeable future

-

Would consider changing outlook & ultimately moving U.S.' rating if it concluded over coming years policymakers do not have capacity to respond decisively to mitigate adverse fiscal dynamics over medium term

The Import Price Index rose 2.1% in the March quarter 2018. This follows a rise in the December quarter 2017 of 2.0%.

The rise was driven by higher prices paid for Petroleum, petroleum products and related materials (+8.7%), Road vehicles (+1.5%), Inorganic chemicals (+19.7%) and Plastics in primary forms (+14.7%).

Through the year to the March quarter 2018, the Import Price Index rose 2.3%, driven by Petroleum, petroleum products and related materials (+15.9%).

The Export Price Index rose 4.9% in the March quarter 2018. This follows a rise in the December quarter 2017 of 2.8%.

The rise was driven by higher prices received for Metalliferous ores and metal scrap (+6.1%), Coal, coke and briquettes (+6.5%), Gas, natural and manufactured (+13.8%), Petroleum, petroleum products and related materials (+9.6%), Non-ferrous metals (+4.8%) and Live animals (+22.2%).

Through the year to the March quarter 2018, the Export Price Index fell 1.4%, driven by Metalliferous ores and metal scrap (-10.9%).

The increasingly insecure state of geopolitics now also seems to be influencing the mood of consumers. There is a tangible drop in economic expectations in April, while income expectations fell only slightly by comparison. In contrast, propensity to buy is still at a very high level. GfK forecasts a decrease in consumer climate for May of 0.1 points in comparison to the previous month to 10.8 points. The West's confrontation with Russia in the Syria conflict is escalating and is clearly causing increasing anxiety among consumers in terms of Germany's future economic prospects. Economic expectations suffered a considerable setback in April. In the wake of this, income expectations also fell, but to a much smaller extent. In contrast, propensity to buy maintained its already very high level.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.