- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 28-03-2023

- USD/JPY bears are in the market and take on key support.

- US Dollar bulls are still out there, eyeing a significant correction in due course.

USD/JPY on Tuesday fell by -0.60% as the US Dollar came under pressure in mixed risk sentiment. The yen moved higher Tuesday after Japan's cabinet approved the use of 2.2 trillion yen of reserve funds from the fiscal 2022 budget for measures to cushion the impact of inflation. At the time of writing, USD/JPY is trading at 131.04 and between the Asian range of 130.75 and 131.07.

The yen is also higher as Japanese companies repatriate yen ahead of their fiscal-year end at the end of March. The yen is the best performer despite the Bank of Japan seen on hold for the foreseeable future and banking sector tensions easing.

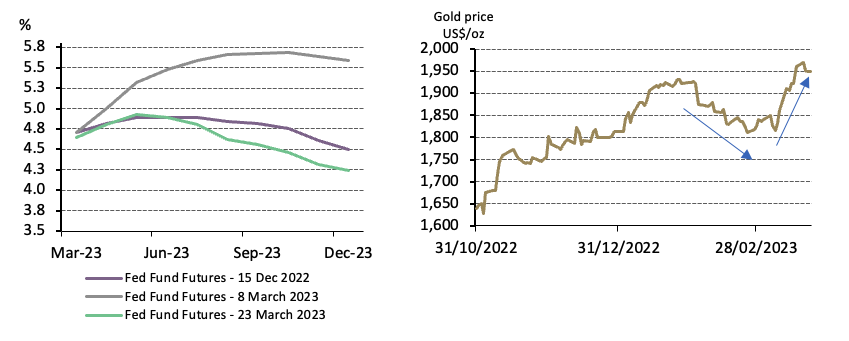

The US Dollar, as measured by the DXY, is down for the second straight day and the break below 102.466 exposes the week’s low near 101.915. ´´We believe that markets are overestimating the Fed’s capacity to ease and so the dollar should eventually recover when expectations are repriced,´´ analysts at Brown Brothers Harriman stated. ´´We expect the dollar rally to resume after this current bout of market turmoil fades and markets are one again able to focus on the fundamentals.´´

Looking to the Fed expectations, the next meeting is May 2-3 and WIRP suggests around 55% odds of 25 bp hike then. After that, it’s all about the cuts, the analysts at BBH said. ´´Nearly two cuts by year-end are priced in. While down from 4-5 cuts priced in during the height of the banking crisis earlier this month, even two cuts seems very unlikely. In that regard, Powell said after the March 22 decision that Fed officials “just don’t see” any rate cuts this year´´

USD/JPY technical analysis

The price could be on the verge of a forming a W-pattern, a bullish pattern in an uptrend, with eyes on the 133´s.

- Oil price is oscillating near its two-week high around $73.90.

- The USD Index has tumbled to near 102.40 as investors are split about Fed’s interest rate outlook.

- An upside break of the triangle chart pattern resulted in wider ticks and heavy volume.

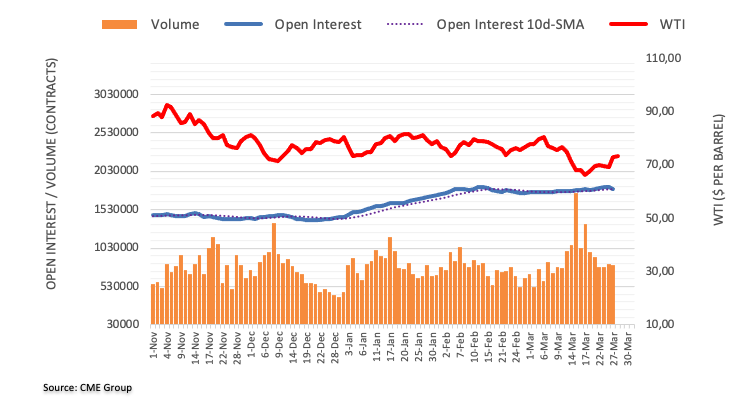

West Texas Intermediate (WTI), futures on NYMEX, is hovering near its two-week high around $73.90 in the early Asian session. The oil price has shown a solid run in the past two trading sessions amid weakness in the US Dollar and expectations of more sanctions on Russia.

The US Dollar Index (DXY) has tumbled to near 102.40 as investors are split about the interest rate outlook of the Federal Reserve (Fed). As per the CME Fedwatch tool, more than 50% of investors are favoring a steady monetary policy by the Fed for its May meeting.

The execution of bases for nuclear weapons in Belarus by Russia has mounted global tensions. The street is discussing that the decision from Russian President Vladimir Putin will attract more sanctions from G7 countries, which might hinder the oil supply further.

On Wednesday, investors’ entire focus will remain on oil inventories data, which will be reported by the United States Energy Information Administration (EIA). As per the consensus, the US EIA will report a small build-up in oil stockpiles by 0.187 million barrels for the week ending March 24.

WTI has witnessed a sharp upside after a breakout of the Symmetrical Triangle chart pattern formed on an hourly scale. An upside break of the triangle chart pattern resulted in wider ticks and heavy volume. The 20-period Exponential Moving Average (EMA) at $73.30 is providing support to the oil bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that upside momentum is already active.

Going forward, a decisive move above the immediate resistance of $74.00 will drive the oil price towards the horizontal resistance plotted from March 03 high at $76.00. A break above the latter would expose the asset to March 02 high at $78.65.

On the flip side, a slippage below March 23 high at $71.39 would drag the asset toward March 17 high at $69.83 followed by March 24 low at $66.88.

WTI hourly chart

-638156433028426976.png)

Overview

Australia’s Monthly Consumer Price Index (CPI) for February, scheduled for publishing on early Wednesday around 00:30 GMT, appears the crucial data for the AUD/USD pair traders to watch. The reason could be linked to the Reserve Bank of Australia’s (RBA) recent hesitance in defending the hawkish monetary policy, not to forget the downbeat Aussie Retail Sales and upbeat employment figures.

Forecasts suggest that the headline CPI is expected to ease to 7.1% YoY versus 7.4%, confirming policymakers’ latest claims of easing inflation pressure due to higher rates.

Ahead of the release, Analysts at the ANZ said,

Our expectation for the monthly CPI of a 6.8% yearly increase would imply a monthly outcome of 0.3%, which while solidly above the pre-2022 February averages would represent a step down from the February 2022 result. A monthly CPI result weaker than our expectation would present a challenge to our view that the RBA will tighten again in April.

On the other hand, National Australia Bank (NAB) said

We expect the Monthly CPI Indicator to fall to 7.2% from 7.4% YoY, in line with consensus, but what the services subcomponents say about inflation trends will be as important as the headline given the limitations of the monthly indicator.

TD Securities further elaborated the Aussie inflation impact while saying,

February CPI print will grab attention after the Bank flagged it as a key data point for its April decision. Our dovish forecast (7.0% YoY) is due to the large seasonal decline from recreational services, partly offset by firm price increase rises for education and transport. We still retain a 25 bps hike for the April meeting as inflation is still far above the RBA's inflation target.

How could AUD/USD react to the news?

AUD/USD retreats from intraday high to 0.6705 ahead of the day, probing the two-day uptrend, while portraying the pre-data anxiety. Adding strength to the pair’s pullback moves could be the looming financial market check in Australia and the market’s indecision about the much-debated $5.4 million Credit Default Swap (CDS) trade of Deutsche Bank. However, overall optimism about overcoming the banking crisis keeps the Aussie pair buyers hopeful.

Even so, Tuesday’s downbeat Australia Retail Sales and the previously cautious commentary from the Reserve Bank of Australia (RBA) officials keep the sellers on the lookout for a softer Australia Monthly Consumer Price Index (CPI) below the 7.2% YoY forecast. In that case, the RBA’s policy pivot could gain the market’s attention and weigh on the AUD/USD price.

Alternatively, a positive surprise may join the risk-on mood and broader USD weakness to underpin the bullish bias surrounding the AUD/USD pair.

Technically, A two-week-old bullish channel keeps AUD/USD buyers hopeful unless the quote breaks the 0.6765-6645 zone.

Key notes

AUD/USD bulls attack 0.6700 with eyes on Australia inflation data, banking news

AUD/USD Forecast: Looking bullish while above 0.6645, tough resistance ahead

About Aussie Consumer Price Index

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

Markets remain dicey during early Wednesday as traders await more clues to overcome the mixed sentiment backed by hopes of overcoming the banking crisis and indecision about the global central banks’ next moves amid the light calendar.

However, the cautious optimism and recently firmer US data put a bit under the US inflation expectations, as per the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED). The same underpins the US Treasury bond yields and allows the Fed bets to remain firmer.

That said, the US 10-year and two-year Treasury bond yields grind higher after rising in the last two consecutive days while the CME’s FedWatch Tool suggests market players placing near 65% bets on another 0.25% rate hike for May 03 meeting.

It should be noted that the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED) recently flashed a three-day and two-day winning streak respectively while posting the 2.31% and 2.34% level in that order. With this, the inflation precursors rose to the highest levels in a fortnight.

Given the latest run-up in inflation expectations, as well as the rebound in the US Treasury bond yields, the US Dollar should witness a corrective bound. However, it all depends upon Friday’s key inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index, also known as the Fed’s preferred inflation index.

Also read: Forex Today: Dollar keeps moving south as markets settle down

- AUD/NZD struggles for clear directions after posting a trend-changing candlestick.

- Downbeat expectations from Australia Monthly CPI, 21-DMA hurdle challenge recovery moves.

- Nearly four-month-old horizontal support appears a tough nut to crack for the bears.

AUD/NZD portrays the pre-data anxiety by making rounds to 1.0700 during early Wednesday, waiting for Monthly Consumer Price Index (CPI).

In addition to the cautious mood ahead of the key Aussie data, mixed technical signals also test the pair traders.

That said, the quote’s sustained bounces off a horizontal area comprising multiple levels marked since early December 2022 join bullish MACD signals to tease buyers. However, the 21-DMA and the previous day’s Doji candlestick challenge the upside momentum. Furthermore, the steadily rising RSI (14) adds strength to the recovery.

It should be noted that a clear break of the 21-DMA hurdle, around 1.0760 by the press time, could defy the bearish candlestick and can propel the price towards the previous weekly top of 1.0805.

On the contrary, a downside break of the 1.0660-75 zone won’t hesitate to revisit the late December lows near 1.0625.

It’s worth observing that the AUD/NZD pair’s upside past 1.0805 appears difficult while the weakness below 1.0625 has a comparatively smoother road to accepting bears.

As a result, the AUD/NZD pair is likely to decline further if backed by the downbeat Aussie inflation data, expected 7.2% YoY for February versus 7.4% prior.

Also read: AUD/USD bulls attack 0.6700 with eyes on Australia inflation data, banking news

AUD/NZD: Daily chart

Trend: Further downside expected

- USD/CHF has shown a recovery above 0.9200 despite the further correction in the US Dollar.

- The reputation of the Swiss Franc as a safe-haven has been significantly dented after the Credit Suisse collapse.

- It seems that stubborn US inflation would be handled by tight credit conditions from US banks ahead.

The USD/CHF pair has recovered after a minor correction below 0.9200 in the early Tokyo session. The Swiss Franc asset has shown a recovery despite a firm correction in the US Dollar Index (DXY). The demise of Credit Suisse has dented the reputation of the Swiss Franc as a safe-haven.

The Swiss Franc used to be the first choice of investors if the US Dollar went through turbulent times. US banking shakedown resulted in a sheer demand for the Japanese Yen and the Gold while Swiss Franc weakened further against the mighty US Dollar after the Credit Suisse collapse. Money managers ditched the Swiss franc at the fastest rate in two years last week in the run-up to the dramatic takeover of Credit Suisse by UBS, as reported by Reuters.

Meanwhile, correction in the USD Index has extended to near 102.40 as the Federal Reserve (Fed) is expected to take the route of steady monetary policy in times when the US banking system is going through major headwinds. While stubborn inflation would be handled by tight credit conditions from US banks. Disbursement of advances to households and businesses will go through more filters as banks are required to remain precautions in times of higher interest obligations.

Going forward, the release of the Quarterly Bulletin (Q1) by the Swiss National Bank (SNB) will be keenly watched. The Quarterly Bulletin will be filled with monetary policy report and business cycle trends in the Swiss region. Inflationary pressures in the Swiss region are beyond the control of the SNB. And, SNB Chairman Thomas J. Jordan has already confirmed more rates head to contain higher Consumer Price Index (CPI).

- AUD/JPYretrats from daily highs, on risk-off impulse.

- AUD/JPY correction fails to shake bearish bias, resistance at 20-day EMA.

- AUD/JPY is on the rise as the 4-hour chart shows bullish momentum

AUD/JPY edges down as the Asian session begins, but Tuesday’s gains opened the door for further upside in the pair. However, the AUD/JPY is still downward pressured, but resistance at the 20-day Exponential Moving Average (EMA) at 88.77 could be challenged. At the time of writing, the AUD/JPY is trading at 87.70.

AUD/JPY Price action

After printing back-to-back bullish candles, the AUD/JPY corrected upwards, yet a bearish bias remains. To change the pair’s preference to neutral, AUD/JPY buyers must conquer the 20-day EMA at 88.77 before reclaiming 89.00. Once achieved, the next resistance would be the 50-day EMA at 89.99, around 90.00. Conversely, the AUD/JPY would continue its downtrend if the pair stumbles below the March 28 low of 87.15, which could open the door for further losses.

In the near term, the AUD/JPY 4-hour chart portrays the pair’s testing of the 50-EMA at 87.91. The Relative Strength Index (RSI) in bullish territory favors upside price action, the same as the Rate of Change (RoC). Therefore, the AUD/JPY path of least resistance is upwards.

The AUD/JPY first resistance would be the confluence of the R1 pivot and the 88.00 figure. A breach of the latter will expose the R2 pivot at 88.34 before testing the 100-EMA at 88.71. On the flip side, the AUD/JPY first support would be the daily pivot at 87.61, followed by the 20-EMA At 87.49, ahead of testing the S1 pivot at 87.34.

AUD/JPY 4-hour chart chart

AUD/JPY Technical levels

- Australian Treasury bond yields remain firmer two-day rebound from the lowest levels since August 2022.

- Downbeat Aussie Retail Sales contrast, review of how global banking crisis affects Australia prods bond buyers.

- Australia's Monthly CPI is expected to ease to 7.2% YoY in February, suggesting more hardships for RBA hawks.

Australia bond markets continue witnessing the week-start buying as traders brace for the key Aussie Monthly Consumer Price Index (CPI) data for February on early Wednesday.

That said, the benchmark 10-year Australia Treasury bond yields seesaw around 3.53% after posting a two-day recovery from the lowest levels since August 2022, marked on the last Friday. On the same line, the two-year counterpart pokes the 3.10% level during its third consecutive day of rebound.

While tracing the clues of the latest recovery in the Aussie bond coupons the looming fears of a financial market check in Australia and downbeat Retail Sales gain major attention. However, the macro risk-on mood supersedes the woes amid the month-end positioning.

Talking about the Aussie data, the seasonally adjusted Retail Sales growth for February came in at 0.2% versus 0.4% market forecasts and 1.9% prior.

Alternatively, news that Australian Treasurer Jim Chalmers will convene a meeting of the country's top financial regulators to check how the latest volatility in global financial markets could affect the country, an official in the treasurer's office said on Tuesday per Reuters, prod the optimism. On the same line could be the much-debated $5.4 million Credit Default Swap (CDS) trade of Deutsche Bank.

Moving on, Aussie bond traders will keep their eyes on the Monthly CPI for February, expected 7.2% YoY versus 7.4% prior, as downbeat Retail Sales and recently softer talks of the Reserve Bank of Australia (RBA) suggest a pause in the rate hike trajectory.

Also read: AUD/USD bulls attack 0.6700 with eyes on Australia inflation data, banking news

- USD/CAD remains depressed around fortnight low after two-day downtrend.

- Bears remain hopeful as Loonie pair’s U-turn from six-month-old horizontal resistance gains support from downbeat oscillators.

- Ascending trend line from June 2022 gains bear’s attention.

- Buyers need validation from 1.3865 to retake control.

USD/CAD bears struggle to keep the reins during early Wednesday as the 50-day Exponential Moving Average (EMA) probes the Loonie pair’s two-day downtrend near 1.3600 at the latest.

It’s worth noting that the quote’s failure to cross the key horizontal resistance surrounding 1.3845-65, established since September 2022, joins the bearish MACD signals and downbeat RSI (14), not oversold, to keep the Loonie pair sellers hopeful.

That said, a downside break of the immediate 50-EMA support near 1.3590 could quickly drag the USD/CAD price towards an ascending support line from early June 2022, around 1.3450.

However, the RSI is declining below the 50 level and suggests weaker momentum supporting the quote’s further downside. Hence, the Loonie pair may reverse from the stated key support line, if not then the 200-EMA level surrounding 1.3370 can act as the last defense of the USD/CAD buyers.

Alternatively, recovery moves may initially aim for the last December’s peak of around 1.3700 ahead of challenging the previous weekly high of near 1.3805.

Above all, the USD/CAD remains on the bear’s radar unless crossing the aforementioned six-month-old horizontal resistance area between 1.3845 and 1.3865.

USD/CAD: Daily chart

-29032023-638156397624235823.png)

Trend: Further downside expected

- GBP/USD is oscillating below 1.2350 as expectations of a steady policy by the Fed have improved risk sentiment.

- S&P500 futures remained choppy on Tuesday despite the widening US Goods Trade Deficit.

- More rates would be welcomed by the BoE if there would be evidence of persistent inflation.

The GBP/USD pair is demonstrating a back-and-forth action below 1.2350 in the early Asian session. The Cable has turned sideways after a bumper rally and is expected to stretch its upside journey further amid improved sentiment for risk-sensitive assets. The major has been underpinned as the market participants are not expecting bold decisions on interest rates from the Federal Reserve (Fed) ahead.

S&P500 futures remained choppy on Tuesday despite the widening United States Goods Trade Deficit (Feb). Exports of goods witnessed a decline led by weak outgo of motor vehicles and parts along with consumer goods and capital goods, as reported by Reuters. Further imports of goods also slipped by 2.3%.

The US Dollar index (DXY) corrected firmly to near 102.40 as investors anticipate continuous pressure on US Consumer Price Index (CPI) through tight credit conditions from US banks amid a turbulent environment, which is prone to further financial instability.

Going forward, the release of the US Gross Domestic Product (GDP) (Q4) data will remain in focus. Tuesday’s annualized GDP is expected to remain steady at 2.7%. Apart from that, quarterly core Personal Consumption Expenditures (PCE) (Q4) might also remain anchored at 4.3%.

On the United Kingdom front, the Pound Sterling remained solid as Bank of England (BoE) Governor Andrew Bailey has remained doors open for further policy-tightening after hiking rates by 25 basis points (bps) last week to 4.25%. More rates would be welcomed by the BoE if there would be evidence of persistent inflation.

Meanwhile, overall shop inflation in the UK economy has climbed to 8.9% from the prior release of 8.4%, the highest reading in 18 years as reported by the British Retail Consortium (BRC). Rising food inflation has been a major catalyst behind stubborn UK shop inflation.

Analysts at Bank of America (BoA) are of the view that the BoE won’t hike rates further and will keep rates steady until 2024.

- USD/JPY gives up some of Monday’s gains as investors brace for safety.

- The USD/JPY needs to tumble below 130.49 for a bearish continuation.

- Conversely, a bullish scenario is likely if the USD/JPY climbs toward 131.76.

USD/JPY pares some of Monday’s gains and drops below the 131.00 figure after Wall Street closed with losses. At the time of writing, the USD/JPY is trading at 130.91, registering minuscule gains as the Asian session begins.

USD/JPY Price action

The USD/JPY is neutral to downward biased, and Tuesday’s close below 131.00 could exacerbate a fall toward the last week’s lows of 129.64. For a bearish continuation, the USD/JPY needs to tumble below 130.49, which could open the door toward 130.00, ahead of 129.64. Contrarily, a bullish scenario is likely if the USD/JPY climbs toward 131.76. Hence. The USD/JPY first resistance would be 132.00, followed by 133.00. Once cleared, the 50-day EMA would be tested at 133.27, followed by the 200-day EMA at 133.81.

Short term, the USD/JPY 4-hour chart is consolidating after Tuesday’s low of 130.40. additionally, the Relative Strength Index (RSI) shifted flat, in bearish territory, while the Rate of Change (RoC) is almost unchanged. Therefore, the USD/JPY might continue to be range-bound before resuming upwards/downwards.

If the USD/JPY breaks above the 20-EMA at 131.00, that will open the door for further upside. The next resistance would be the R1 daily pivot point at 131.44, followed by the 50-EMA at 131.67, ahead of challenging 132.00. On the other hand, the USD/JPY first support would be the S1 daily pivot at 130.29, followed by 130.00, ahead of testing the YTD low at 129.64.

USD/JPY 4-hour chart

USD/JPY Technical levels

- AUD/USD grinds higher after rising the most in two weeks.

- Softer Australia Retail Sales fail to push back buyers amid broadly softer US Dollar, risk-on mood.

- Receding fears of banking crisis, mixed US data weigh on the greenback.

- Softer Australia Monthly CPI can challenge RBA’s rate hike and probe the Aussie pair buyers.

AUD/USD pokes 0.6700 mark as bulls await the key Australian inflation data on early Wednesday, after a two-day uptrend. It’s worth noting that the market’s reassessments of the baking risk and the broad US Dollar weakness allowed the Aussie pair to ignore downbeat Australia Retail Sales while posting the biggest daily gain in two weeks the previous day.

That said, Australia’s seasonally adjusted Retail Sales growth for February came in at 0.2% versus 0.4% market forecasts and 1.9% prior.

On the other hand, the US Conference Board (CB) Consumer Confidence rose to 104.2 in March, versus 101.0 expected and an upwardly revised prior figure of 103.4. Further, US Housing Price Index rose 0.2% MoM in January versus -0.6% expected and -0.1% prior while the S&P/Case-Shiller Home Price Indices matched 2.5% YoY forecasts for the said month compared to 4.5% previous readings.

It’s worth noting, however, that Wall Street closed with mild losses and the US Treasury bond yields managed to recover but the US Dollar Index (DXY) failed to improve as hawkish Fed bets eased. That said, CME’s FedWatch Tool suggests market players placing near 65% bets on another 0.25% rate hike for May 03 meeting.

Talking about the risks, the US and EU policymakers’ rush to defend respective banks supersede the criticism by some of their diplomats as well as the much-debated $5.4 million Credit Default Swap (CDS) trade of Deutsche Bank.

At home, Australia’s Assistant Treasurer and Minister for Financial Services Stephen Jones tried to restore the market sentiment in the Aussie banks early Tuesday while speaking on local radio. The policymaker said, “Australia’s banking system is resilient,” while also adding that Australia's financial system is well-equipped to deal with challenges in the global economy.

In an interview with CNBC on Tuesday, US House Speaker Kevin McCarthy said that there was no need for blanket insurance on all bank deposits "at this moment in time," as reported by Reuters. On the same line, Jose Manuel Campa, Chairman of the European Banking Authority (EBA), warned in the German Handelsblatt newspaper, "The risks in the financial system remain very high." The policymaker also added that the rising interest rates continued to weigh on financial markets.

Moving on, the firmer sentiment may help the AUD/USD pair grind higher ahead of Australia’s Monthly Consumer Price Index (CPI), expected 7.2% YoY versus 7.4% prior, but a likely disappointment from the data can weigh on the Aussie pair.

Technical analysis

A two-week-old bullish channel keeps AUD/USD buyers hopeful unless the quote drops below the 0.6645 support.

- EUR/USD has refreshed its four-day high near 1.0850 amid rising expectations for an unchanged Fed policy.

- Upbeat US Consumer Confidence data failed to provide support to the USD Index.

- The annual German HICP will soften firmly to 7.5% from the former release of 9.3%.

The EUR/USD pair has stretched its north-side journey to near the critical resistance of 1.0850 in the early Asian session. The absence of exhaustion signals indicates that the major currency pair is gathering strength to add more gains. Improved market sentiment after easing United States banking jitters and rising expectations for a steady monetary policy by the Federal Reserve (Fed) led to a solid rally in the shared currency pair.

S&P500 futures remained choppy on Tuesday amid the absence of potential triggers, portraying a quiet market mood. The US Dollar Index (DXY) corrected further to near 102.40 as the Fed would look to keep rates unchanged. Also, US inflation would remain under pressure due to tight credit conditions by US banks. The demand for US government bonds remained weak as the absence of bad news about US banking was considered good news by the market participants. This led to a further rise in 10-year US Treasury yields to 3.57%.

Upbeat US Consumer Confidence data failed to provide support to the USD Index. The sentiment data improved to 104.2 from the former release of 103.4. The economic data rose after a three-month losing trend despite potential fears of a banking fiasco and higher rates by the Fed, which are denting households’ sentiment as they are struggling to offset the impact of inflated prices of goods and services.

On the Eurozone front, the release of the German Harmonized Index of Consumer Prices (HICP) data will be of significant importance. As per the projections, the annual German HICP will soften firmly to 7.5% from the former release of 9.3%. An expected decline in German inflation would relieve some pressure from the European Central Bank (ECB).

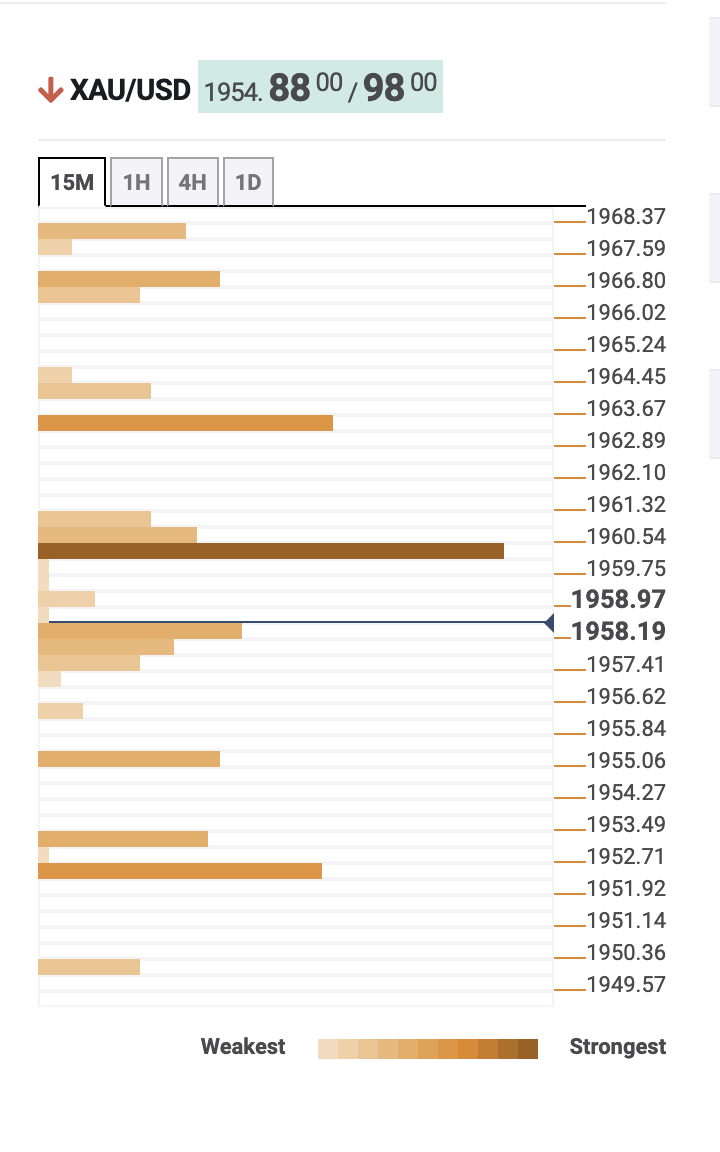

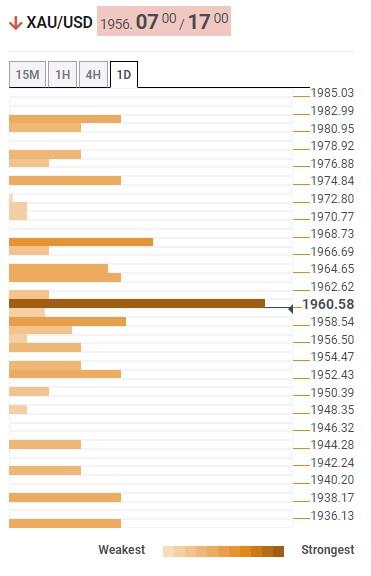

- Gold price is moving in on key resistance.

- Federal Reserve prospects are weighing on sentiment.

Gold price was higher on Tuesday following two sessions of declines with support from a weaker US Dollar even as bond yields climbed. Wall Street's major indexes lost ground as investors grew concerned again that the Federal Reserve would keep interest rates higher for longer as fears of further banking sector failures faded. At the time of writing, the Gold price is trading at $1,973 and has traveled between a low of $1,949 and $1,975.

The US Dollar was losing ground vs. a number of currencies for a second straight day as easing worries about the banking system revived investors' appetite for riskier currencies. There have been no new signs of bank failures over the weekend which is supporting risk appetite and weighing on the US Dollar. Risk appetite improved due to First Citizens BancShares' agreement to buy all of the failed lender Silicon Valley Bank's deposits and loans. US regulators said on Monday they would backstop a deal for regional lender First Citizens BancShares to acquire failed Silicon Valley Bank, triggering an estimated $20 billion hit to a government-run insurance fund. First Citizens shares jumped more than 53% during Monday trading on Wall Street.

US lawmakers quizzed top US bank regulators on Tuesday during testimony in Washington D.C. Michael Barr, the Federal Reserve's top bank regulator told a Senate panel that Silicon Valley Bank did a "terrible" job of managing risk before its collapse as he fended off criticism from lawmakers who blamed bank watchdogs for missing warning signs.

All eyes back on the Federal Reserve

While the testimony suggested that the bank's problems may be isolated, investors' focus moved back to inflation risks and the implications of higher interest rates from the Fed. ´´The next FOMC meeting is May 2-3 and WIRP suggests around 55% odds of 25 bp hike then. After that, it’s all about the cuts. Nearly two cuts by year-end are priced in. While down from 4-5 cuts priced in during the height of the banking crisis earlier this month, even two cuts seem very unlikely. In that regard, Jerome Powell said after the March 22 decision that Fed officials “just don’t see” any rate cuts this year,´´ analysts at Brown Brothers said.

Meanwhile, US Treasuries benchmark 10-year yields moved higher on Tuesday but pared gains after the Treasury Department saw solid demand for an auction of five-year notes. The benchmark 10-year notes were higher by 3.6 basis points to 3.564%, from 3.528% late on Monday.

Gold technical analysis

Gold price is testing the $1,980s resistance but the W-formation is a bearish pattern and this could see a pull on the Gold price. If the bears break the lows of the W, then the Gold price would be expected to head to the prior support near the $1,930s.

Markets continued to settle down on Tuesday, despite the red in Wall Street. Banking concerns ease as attention turns to inflation data. The US Dollar remained weak and fell for the second day in a row, even as US yields rebounded. Inflation numbers from Australia will be critical on Wednesday ahead of the next RBA meeting. On Thursday, Eurozone countries will release CPI numbers and the US will publish the core PCE on Friday.

Here is what you need to know on Wednesday, March 29:

Wall Street ended lower, with the S&P 500 falling by 0.2% and the Nasdaq Composite losing 0.5%. This time it wasn’t the bank sector but tech what drove US equities lower. The banking crisis eased further and financial markets continued to settle down.

The DXY dropped 0.40%, posting the lowest close since early February below 102.50. Not even higher US yields helped the Greenback. The US 10-year Treasury yield settled at 3.56% and the 2-year above 4.05%.

US Consumer Confidence (CB) improved in February, with the main index rising from 103.4 to 104.2. The key report is due on Friday with the Core Personal Consumption Expenditure Price Index.

EUR/USD held firm above 1.0800 and is about to test 1.0850. Expectations that the European Central Bank (ECB) will continue raising rates are offering support to the Euro. Inflation data from Eurozone countries will be released on Thursday.

GBP/USD is consolidating above 1.2300 after failing to do so last week. UK credit data on Wednesday will show how the tightening cycle is affecting lending.

AUD/USD is testing levels above 0.6700, trading at the highest level since last Thursday. Australian Retail Sales rose 0.2% in February, below the 0.4% of market consensus. On Wednesday, the Monthly Consumer Price Index is due (consensus: 7.1% YoY). The numbers will be a key input for next week’s Reserve Bank of Australia (RBA) meeting, which could raise rates further or pause. The numbers are also relevant for the Kiwi. NZD/USD it at 0.6250.

USD/CHF remains sideways unable to rise above 0.9200. The Swiss Franc was among the worst performers on Tuesday. EUR/CHF rose a hundred pips, approaching parity. The Swiss National Bank (SNB) will release its Quarterly Bulletin on Wednesday.

Gold found support above $1,950 and rose to $1,975, while Silver posted the highest close in almost two months above $23.30. WTI gained 0.85%, advancing to the highest level in two weeks above $73.30.

Like this article? Help us with some feedback by answering this survey:

- Safe havens send Silver Prices surging above $23.00.

- Mixed US economic data, and higher US Treasury bond yields, could not dent demand for Silver.

- XAG/USD Price Analysis: To test $24.00, once buyers reclaim $23.52.0

Silver price rises sharply late in the New York session, up 0.34% due to overall US Dollar (USD) weakness, amidst a risk-off impulse in the financial markets. Investors seeking safety moved funds toward the precious metals segment. At the time of typing, the XAG/USD is trading at $23.30 after hitting a low of $22.83.

XAG/USD underpinned by sentiment and a weaker US Dollar

Wall Street’s shifted gears as it approaches Tuesday’s close. Even though sentiment changed after First Citizens BancShares acquired Silicon Valley Bank (SVB), traders expect another rate hike by the US Federal Reserve (Fed) in the summer. Reflection of that is US T-bond yields are climbing, with 2s above the 4% threshold.

Data-wise, the US economic docket featured the Conference Board (CB) Consumer Confidence for March, which rose to 104.2 from 103.4 in February. “Driven by an uptick in expectations, consumer confidence improved somewhat in March but remains below the average level seen in 2022,” said Ataman Ozyildirim, senior director of economics at the Conference Board.

Early data revealed that before Wall Street opened, the House Price Index climbed 0.2% MoM in January vs. a fall of 0.6% estimated, data from the US Federal Housing Finance Agency showed on Tuesday. At the same time, the S&P/Case-Shiller Home Price Index arrived at 2.5% YoY in January, down from 4.6% in the prior month.

In the meantime, the US Dollar Index, which tracks the buck’s value vs. six currencies, extended its losses for two straight days, falling to three-day lows at 102.407, down 0.42%.

XAG/USD Technical analysis

Silver’s daily chart suggests the XAG/USD is neutral to upward biased, with the 20-day Exponential Moving Average (EMA) crossing above the 50-day EMA. At bullish territory, the Relative Strength Index (RSI) resumed its upward trajectory, while the Rate of Change (RoC) is neutral. That said, mixed signals warrant caution. For XAG/USD to test the YTD highs, th white metal needs to reclaim $23.52. Once done, XAG/USD could rally toward the $24.00 figure before testing the YTD high at $24.63.

- NZD/USD bears eye a break of 0.6190 that could open significant risks to the downside.

- 0.6270 is key resistance on the daily chart.

NZD/USD is in a grind and making hard work of the upside near 0.6270s resistance. The pair moved up from 0.6195 and reached a high of 0.6253 on the day, climbing higher by some 0.9%. However, the price is failing to convince as it is contained by the horizontal resistance.

Risk appetite improved due to First Citizens BancShares' agreement to buy all of the failed lender Silicon Valley Bank's deposits and loans. US regulators said on Monday they would backstop a deal for regional lender First Citizens BancShares to acquire failed Silicon Valley Bank, triggering an estimated $20 billion hit to a government-run insurance fund. First Citizens shares jumped more than 53% during Monday trading on Wall Street.

´´The Kiwi recovered from yesterday’s sub-0.62 levels overnight as the USD came under pressure and commodity prices bounced. There was no real catalyst for overnight moves but markets continue to fiercely debate the outlook for Fed policy, and cuts priced in beyond May seem to be really weighing on the dollar,´´ analysts at ANZ Bank said.

´´Locally there’s very little in the calendar until next week’s MPR, so we’ll likely go with the ebb and flow of global sentiment as in recent weeks,´´ the analysts added. ´´As we noted yesterday, we continue to ask; will NZ’s remoteness to all this deliver NZD strength if the RBNZ can get the OCR to 5¼%? Will a hawkish tone (they’re hardly going to throw the towel in and be dovish) give the Kiwi a boost next week? It might.´´

NZD/USD technical analysis

NZD/USD has been sliding out of the dynamic trendline support in what has been a sideways grind for the best part of the month. Failures to hold 0.6190 could open significant risks to the downside while below 0.6270.

Analysts at the National Bank of Canada see the USD/CAD moving in the 1.36-1.39 range during the next months, before the Loonie makes a comeback. Their year-end target is 1.32 for the pair.

Key Quotes:

“The Canadian dollar remains relatively weak against the greenback, as it continues to hover near its cyclical high. While many investors fear a tightening of global credit conditions, some believe that Canadian banks could face a very difficult environment due to their exposure to residential real estate in a much higher interest rate environment. Combined with weakening commodity prices, the short-term outlook does not support a stronger loonie.”

“USD/CAD should remain in the 1.36-1.39 range in the first half of 2023, before making a comeback in the second half of the year when more central banks finally end their tightening cycle.”

- Bulls are in the market and a break of the equal highs near 1.2450 opens risk to the 1.2670's.

- GBP/USD bulls press up against neckline resistance.

GBPUSD increased to a 7-week high of 1.2349, a key area of resistance as the following charts will illustrate.

GBP/USD weekly charts

The inverse head and shoulders pattern is bullish but the price is yet to break the neckline resistance and could easily reverse course and head lower.

On the other hand, if the bulls can get above the neckline and break the 1.2500 area, they will be in the runnings for an extended move toward the 1.3150s:

AUD/USD daily chart

Bulls are in the market and a break of the equal highs near 1.2450 opens risk to the 1.267's and should bulls commit above 1.2200, then there will be prospects of a move towards 1.3150.

- AUD/USD supported on the approach to 0.6720s resistance.

- Traders will turn to the Aussie CPI event as a potential catalyst.

AUD/USD is higher on the day by some 0.75% after rising from a low of 0.6644 to score a high of 0.6710 on Tuesday. A risk on appetite is supporting the high beta currencies such as the Aussie. Investors have taken solace from First Citizens BancShares' agreement to buy all of the failed lender Silicon Valley Bank's deposits and loans.

US regulators said on Monday they would backstop a deal for regional lender First Citizens BancShares to acquire failed Silicon Valley Bank, triggering an estimated $20 billion hit to a government-run insurance fund. First Citizens shares jumped more than 53% during Monday trading on Wall Street.

The package includes the purchase of approximately $72 billion of SVB assets at a discount of $16.5 billion, but around $90 billion in securities and other assets will remain “in receivership for disposition by the FDIC.” “In addition, the FDIC received equity appreciation rights in First Citizens BancShares, Inc., Raleigh, North Carolina, common stock with a potential value of up to $500 million,” the FDIC said in a release.

Eyes on Aussie CPI

Meanwhile and domestically, Australia's February Consumer Price Index print will grab attention after the Reserve Bank of Australia flagged it as a key data point for its April monetary policy decision, as analysts at TD Securities explained.

´´We expect CPI inflation to ease further to 7% YoY in February (cons: 7.2%) from 7.4% last month and further affirm the RBA's view that inflation likely peaked in Q4 last year. Our below consensus forecast is due to the large seasonal decline from recreational services (e.g., travel prices), partly offset by firm price increases for education and transport. We still retain a 25bps hike forecast for the April meeting as inflation is still far above the RBA's inflation target and central banks such as ECB and Fed have pushed through with hikes despite recent financial volatility.´´

- After a Kurdistan/Baghdad arbitrage decision, supply risks halted 450K barrels of exports through Turkey.

- A soft US Dollar underpins US crude oil benchmark prices.

- WTI shows neutral to downward bias, but oscillators turned bullish, suggesting further upside.

Western Texas Intermediate (WTI), the US crude oil benchmark, climbs in the mid-North American session, spurred by crude oil supply issues. In addition, a risk-on impulse weakened safe-haven assets, like the greenback. At the time of writing, WTI exchanges hands at $73.55 a barrel.

WTI experienced a $3 jump after a halt of 450K barrel exports from Iraq Kurdistan region through Turke, spurred by an arbitration ruling that validated that Baghdad’s approval was necessary to transport the oil.

Meanwhile, sentiment shifted after First Citizens BancShares acquired Silicon Valley Bank (SVB) deposits and loans. That propelled a recovery in global bank shares as a banking system crisis waned.

Therefore, safe-haven assets, like the US Dollar (USD), tumble across the board. The US Dollar Index (DXY) drops 0.38% to 102.449. A weaker greenback makes oil cheaper for international buyers and lifts WTI’s price.

Russian President Vladimir Putin’s announcement to deploy tactical nuclear weapons in Belarus to intimidate the West increased oil prices due to its support for Ukraine. NATO described Putin’s comments as “dangerous and irresponsible.”

At the same time, Russia’s Deputy Prime minister Alexander Novak commented that Moscow is close to achieving its 500K crude output, to about 9.5 million bpd.

WTI Technical analysis

WTI is still neutral to downward biased, though it has cleared the 20-day EMA. Oscillators turned bullish, with the Relative Strength Index (RSI) above 50, which could pave the way for further upside. That said, WTI could rally to $80.00. Hence, WTI’s first resistance would be the 50-day EMA at $74.93, followed by the 100-day EMA at $78.06, before testing the $80.00 mark.

- Risk appetite is returning and supporting the Euro.

- EUR/USD bulls are climbing their way towards 1.09´s.

EUR/USD climbed to a five-day high at 1.0846 as euro zone government bond yields rose on Tuesday and after a deal backed by the US regulator for First Citizens BancShares to buy up Silicon Valley Bank helped alleviate concerns in the banking sector. At the time of writing, EUR/USD is trading at 1.0841 and is 0.4% higher having rallied from the day´s low of 1.0795.

The US Dollar fell against a basket of currencies for a second straight day on Tuesday with the DXY, which measures the currency against six rivals, falling to a low of 102.41, not far now from the seven-week low of 101.91 hit last Thursday.

Last week, the Federal Reserve's Federal Open Market Committee raised interest rates by 25 basis points, as expected, but took a cautious stance due to the banking sector crisis at hand. Nonetheless, Fed Chair Jerome Powell kept the door open for further rate rises if necessary which stalled the drop in the US Dollar.

´´We believe that markets are overestimating the Fed’s capacity to ease and so the dollar should eventually recover when expectations are repriced,´´ analysts at Brown Brothers Harriman argued.

´´Fed officials continue to view the banking crisis as a regulatory failure. If this turns out to be so, the impact on monetary policy is likely to end up being not too significant,´´ the analysts added.

´´The next FOMC meeting is May 2-3 and WIRP suggests around 55% odds of 25 bp hike then. After that, it’s all about the cuts. Nearly two cuts by year-end are priced in. While down from 4-5 cuts priced in during the height of the banking crisis earlier this month, even two cuts seems very unlikely. In that regard, Powell said after the March 22 decision that Fed officials “just don’t see” any rate cuts this year.´´

EUR/USD technical analysis

Meanwhile, EUR/USD has broken out of the falling wedge resistance and is eyeing a run to test prior highs in the 1.09´s. However, a break of the micro trendline support will open the risk of a significant drop as illustrated above.

- USD/CHF gains momentum, signaling a possible bullish trend in coming sessions.

- Double bottom in the 4-hour chart could pave the USD/CHF way to 0.9300.

- USD/CHF Price Analysis: Daily close above 0.9220 would confirm the double bottom.

The USD/CHF bounces off weekly lows of 0.9136 and climbs toward testing 0.9200 in the North American session. After hitting a daily high of 0.9226, the USD/CHF is trading at 0.9199, above its opening price.

USD/CHF Price action

Early, the USD/CHF tested last week’s low of 0.9118; since then, it has not looked back. However, as long as the USD/CHF pair achieves a daily close below 0.9200, that would keep the major trading sideways, awaiting a fresh catalyst. On the other hand, the USD/CHF could resume upwards, and it might test the 20 and 50-day EMAs, each at 0.9240 and 0.9272, respectively. Upside risks lie at 0.9300, followed by the 100-day EMA at 0.9343.

Short term, the USD/CHF 4-hour chart portrays a double bottom formed. However, the exchange rate must clear the March 24 high at 0.9216 to confirm its validity. That would pave the way toward the March 21 high of 0.9317, but the pair needs to hurdle some resistance levels on its way north.

The USD/CHF first resistance would be 0.9216. A breach of the latter wand the USD/CHF will face the 100-EMA at 0.9233, followed by the 200-EMA at 0.9255. Once broken, the 0.9300 figure would be up for grabs.

USD/CHF 4-hour chart

USD/CHF Technical levels

- USD/MXN falls as the US Dollar weakens across the board.

- US Consumer confidence improved but failed to underpin the US Dollar.

- USD/MXN Price Analysis: Remains downward biased but could shift neutral above 18.50.

USD/MXN dropped and extended its losses to a three-week low in early trading during the New York session. US equities are mixed, while the greenback continues to tumble as market expectations for a rate cut in 2023 persist. Therefore, the USD/MXN s trading at 18.2631 after hitting a high of 18.3573.

CB Consumer Confidence exceeded estimates, but the US Dollar didn’t blink

Traders’ sentiments remain fragile. Economic data in the United States (US) was mixed, with the Conference Board (CB) Consumer Confidence rising to 104.2 from 103.4 in February. “Driven by an uptick in expectations, consumer confidence improved somewhat in March but remains below the average level seen in 2022,” said Ataman Ozyildirim, senior director of economics at the Conference Board.

Further details of the survey revealed that the Present Situation Index declined to 151.1 from 153, and the Consumer Expectations Index rose to 74 from 70.4

In early data, the House Price Index rose 0.2% MoM in January vs. a drop of 0.6% estimated, data showed from the US Federal Housing Finance Agency showed on Tuesday. At the same time, the S&P/Case-Shiller Home Price Index arrived at 2.5% on a yearly basis in January, down from 4.6% in the prior month.

USD/MXN traders ignored most US data. Consumer confidence improvement barely moved the pair, which is still pushing lower, with sellers eyeing 18.20. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of peers, tumbles 0.30%, at 102.518

US Treasury bond yields are recovering some ground, with 2s gaining four bps at 4.039%. The 10-year benchmark note rate is at 3.556%.

On the Mexican front, the lack of data keeps traders leaning on sentiment and expectations for a 25 bps rate hike by Banxico (Bank of Mexico) on March 30. That would lift rates from 11% to 11.25%.

USD/MXN Technical analysis

The USD/MXN remains downward biased after briefly testing the 19.00 mark after the banking crisis in the US. Since then, the USD/MXN pair dropped below the 50 and 20-day Exponential Moving Averages (EMAs), setting the stage for further downside. The Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that sellers gather momentum. That said, the USD/MXN first support would be 18.0000, followed by the YTD low at 17.8967. In an alternate scenario, and the less likely to occur, if buyers reclaim 18.5000, that would exacerbate a rally to 19.0000.

In a report published on Tuesday, the Federal Reserve Bank of New York said that the expected rent price increase for next year was at 8.2%, down from 11.5% last year, as reported by Reuters.

Additional takeaways

"Expected home price increase over next year at 2.6% vs 7% a year ago."

"Expected home price increase stands at lowest in survey history."

"A large majority of Americans still see housing as a good investment."

Market reaction

This headline doesn't seem to be impacting the US Dollar's performance against its rivals. At the time of press, the US Dollar Index was down 0.35% on the day at 102.48.

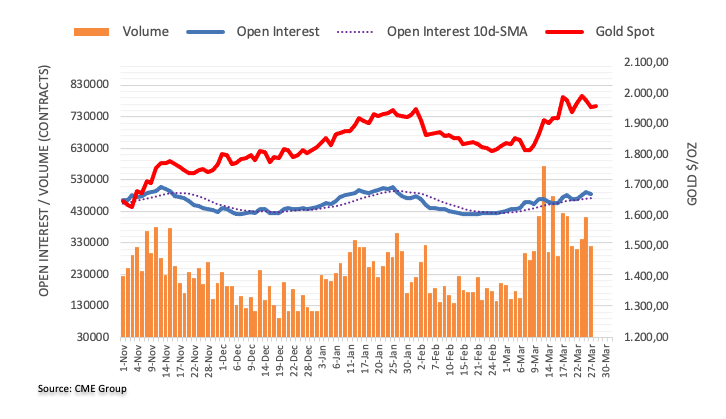

Concerns over the banking sector have led to a move towards safe haven assets and Fold has clearly benefited from this. While economists at ING see a short-term pullback in prices, we expect these to strengthen over the second half of the year.

Fed policy should support Gold later in the year

“Fed policy is likely to be key for Gold over the medium term. We see a final 25 bps hike in May, which would leave the Fed funds range at 5-5.25%. Rate cuts will likely then become the theme for 2H23, and we see the Fed cutting by 75 bps in the fourth quarter. We would expect real yields to follow policy rates lower later in the year, which should prove supportive for Gold prices.”

“Whilst we expect a pullback in prices in the short term, we see Gold prices moving higher over 2H23 and expect spot Gold to average $2,000 over 4Q23. The assumptions around this are that we do not see further deterioration in the banking sector and that the Fed starts cutting rates towards the end of this year.”

Economists at Scotiabank expect the US Dollar Index to sustain losses in April, which could extend into the third quarter.

April is the worst month of the year for the DXY over the last 20 years

“The DXY could drop a little more and broader USD losses to extend to 2-3% more (and perhaps as much as 5%) from current levels in the next few months. Those losses may be concentrated in Q2-Q3 before a year-end rebound if seasonal patterns are any guide.”

“Seasonal trends are just about to turn less favourable for the USD. Over the last 20 years, the DXY has weakened 70% of the time through April, kicking off a soft run in the USD’s broader performance that typically extends into Q3. The DXY has weakened an average of -1% through April since 2002.”

It has been quite a turbulent ride in EUR/USD lately. Economists at Nordea expect the pair to grind higher.

USD could be stronger if we get a new global turndown

“While the USD usually benefits during turbulent times, it has been hurt by the lower rate differential.”

“Given our latest views on the Fed and ECB, we believe the ECB needs to do more from here to bring inflation under control, pointing to a higher EUR/USD ahead. Uncertainty is markedly high though, if we get a new global turndown, the USD could be stronger than we expect.”

- Consumer confidence in the US improved slightly in March.

- US Dollar Index recovers above 102.50 with the initial reaction.

Consumer sentiment in the US improved modestly in March with the Conference Board's Consumer Confidence Index edging higher to 104.2 from 103.4 in February (revised from 102.9).

Further details of the publication revealed that the Present Situation Index declined to 151.1 from 153 and the Consumer Expectations Index rose to 74 from 70.4

Finally, the one-year consumer inflation expectations ticked up 6.3% in March from 6.2% in February (revised from 6.2%).

Market reaction

The US Dollar Index edged slightly higher with the initial reaction and was last seen losing 0.18% on the day at 102.65.

- USD/JPY drops to the 130.40 region earlier in the session.

- The selling interest in the dollar weighs on the pair so far.

- US Consumer Confidence surprised to the upside in March.

The continuation of the weak fashion around the greenback put USD/JPY under renewed downside pressure and forced it to revisit the 130.40 region earlier on Thursday.

USD/JPY looks at banking jitters, US yields

The noticeable downtick in USD/JPY eroded part of Monday’s auspicious start of the new trading week on the back of further retracement in the greenback and some safe haven demand in response to still unabated concerns around the banking system.

The daily advance in spot comes in contrast to another positive session in US yields across the curve, which manage to add to gains recorded at the beginning of the week, while the JGB 10-year yield remain within a consolidative phase below the 0.40% level.

No data releases in Japan on Tuesday left the attention to the US data releases, where the preliminary Goods Trade deficit is seen at $91.63B in January, the House Price Index gauged by the FHFA rose 0.2% MoM in January and the Consumer Confidence measured by the Conference Board surpassed expectations at 104.2 for the current month.

USD/JPY levels to consider

As of writing the pair is retreating 0.38% at 131.01 and the break below 129.63 (monthly low March 24) would open the door to 128.08 (monthly low February 2) and finally 127.21 (2023 low January 16). On the other hand, the immediate hurdle comes at 132.38 (55-day SMA) seconded by 133.00 (weekly high March 22) and then 135.11 (weekly high March 15).

- USD/CAD lacks any firm intraday direction and is influenced by a combination of factors.

- The Fed’s less hawkish outlook, easing fears of a banking crisis weigh on the Greenback.

- Rallying US bond yields limits the USD losses and lends support amid subdued Oil prices.

The USD/CAD pair struggles to gain any meaningful traction and seesaws between tepid gains/minor losses through the early North American session on Tuesday. The pair is currently placed just above mid-1.3600s, nearly unchanged for the day and is influenced by a combination of diverging forces.

The US Dollar (USD) drifts lower for the second successive day and keeps a lid on USD/CAD pair's modest intraday bounce to the 1.3700 neighbourhood. The Federal Reserve's less hawkish outlook, signalling that a pause to interest rate hikes was on the horizon, along with easing fears of a full-blown banking crisis, continue to weigh the safe-haven Greenback. That said, a modest pullback in Crude Oil prices, from a two-week high touched earlier this Tuesday, undermines the commodity-linked Loonie and acts as a tailwind for the major, at least for the time being.

Despite the latest optimism over a strong recovery in China and worries about supply disruptions in Turkey, worries that a deeper global economic downturn will dent fuel demand act as a headwind for the black liquid. This, along with expectations that the Bank of Canada (BoC) will refrain from raising interest rates any further, supports prospects for some meaningful appreciating move for the USD/CAD pair. That said, a convincing break below the 1.3630 horizontal support will negate the positive outlook and pave the way for a deeper corrective pullback.

Moving ahead, the focus now shifts to the release of the final US Q4 GDP print on Thursday, which will be followed by the monthly Canadian GDP and the Fed's preferred inflation gauge - the Core PCE Price Index - on Friday. In the meantime, the US bond yields and the broader risk sentiment will drive the USD demand. Apart from this, traders will take cues from Oil price dynamics to grab short-term opportunities around the USD/CAD pair. Nevertheless, the fundamental backdrop suggests that the path of least resistance for spot prices is to the upside.

Technical levels to watch

Economists at UBS move bonds to most preferred relative to equities.

Global stocks to deliver limited returns

“Given the headwinds to growth, we now see a higher probability that central bank hiking cycles will end sooner. We, therefore, think it’s time to increase exposure to bonds, which we upgraded this month to most preferred.”

“While equities should remain a key component of long-term portfolios, we expect global stocks to deliver limited returns and exhibit high volatility over the remainder of the year. In this light, we downgraded equities this month to least preferred.”

In reaction to the banking turmoil, markets have been pricing in larger Fed rate cuts for this year. However, the options market shows that the uncertainty about the Fed’s rate path has jumped, which means that markets have become less clear about the exact rate path, economists at Rabobank report.

It gets cloudy after the pivot

“The banking turmoil has strengthened the market’s belief that the Fed is going to cut rates before the end of the year. However, the implied policy rate path should be taken with a grain of salt, as the uncertainty about the rate path has increased substantially.”

“So markets are pricing in a stronger pivot, but the exact rate path has become less clear.”

The Russian central bank’s (CBR) Gold reserves have increased. Nonetheless, strategists at Commerzbank do not expect CBR to continue purchasing the yellow metal.

Russian central bank announces Gold purchases

“CBR announced last week that it has topped up its Gold reserves by 1 million ounces since the Ukraine war began 13 months ago. This is equivalent to 31 tons.”

“Originally, the CBR was not planning to buy any further Gold. However, it has clearly seen itself forced to do so in order to support the domestic Gold industry, as Russian Gold producers are having problems selling their Gold. Russian banks, which previously were the most important buyers, have been hit by the West’s sanctions.”

“What is more, re-routing exports to Asia does not appear to be happening as quickly as with Crude Oil. Hence, a longer stretch of Gold purchases by the Russian central bank cannot be expected.”

- GBP/USD scales higher for the second straight day and climbs back closer to the monthly peak.

- The Fed’s less hawkish outlook, easing fears of a banking crisis weigh on the USD and lend support.

- Rallying US bond yields could limit losses for the USD and cap any meaningful upside for the pair.

The GBP/USD pair builds on the previous day's positive move and gains some follow-through traction for the second successive day on Tuesday. The momentum pushes spot prices to the 1.2330 region, back closer to the monthly peak touched last week and is sponsored by the prevalent selling bias surrounding the US Dollar (USD).

Against the backdrop of the Federal Reserve's less hawkish outlook, receding fears of a full-blown banking crisis turn out to be a key factor weighing on the safe-haven Greenback and lending support to the GBP/USD pair. It is worth recalling that the Fed last week toned down its aggressive approach to reining in inflation and signalled that a pause to interest rate hikes was on the horizon. Furthermore, the takeover of Silicon Valley Bank by First Citizens Bank & Trust Company helped calm market nerves about the contagion risk and reverse the recent negative sentiment.

The British Pound, on the other hand, draws support from the fact that the Bank of Governor Andrew Bailey, in his speech last night, stressed that interest rates may have to move higher if there were signs of persistent inflationary pressure. This turns out to be another factor acting as a tailwind for the GBP/USD pair. That said, the ongoing rally in the US Treasury bond yields limits losses for the buck and caps the major, making it prudent to wait for some follow-through buying beyond the 1.2340-1.2345 area, or the monthly peak before placing fresh bullish bets.

Nevertheless, the fundamental backdrop supports prospects for a further near-term appreciating move, suggesting that any pullback might be seen as a buying opportunity and is more likely to remain limited. Next on tap is the US macro data - the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index. Traders will further take cues from the US bond yields, which, along with the broader risk sentiment, might influence the USD price dynamics and produce short-term opportunities around the GBP/USD pair.

Technical levels to watch

- House prices in the US increased marginally in January.

- US Dollar Index stays in negative territory near 102.50.

House prices in the US rose by 0.2% on a monthly basis in January, the monthly data published by the US Federal Housing Finance Agency showed on Tuesday. This reading came in better than the market expectation for a decrease of 0.6%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at 2.5% on a yearly basis in January, down from 4.6% in December and in line with the market expectation.

Market reaction

These data don't seem to be having an impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was down 0.27% on the day at 102.55.

The USD continues to trade on a softer footing since banking fears emerged. A tentative improvement in global investor risk sentiment is set to continue undermining the greenback, economists at MUFG Bank report.

Yield spreads have moved against the USD this month

“The US rate market remains much more confident now that the Fed is close to ending their hiking cycle with only 12 bps of further hikes priced in for this year, and then expects around 60 bps of cuts in anticipation that the US economy will slow sharply/fall into recession later this year.”

“The tentative improvement in global investor risk sentiment at the start of this week leaves the US Dollar vulnerable to further weakness on the back of the recent sharp adjustment lower in US yields.”

In an interview with CNBC on Tuesday, US House Speaker Kevin McCarthy said that there was no need for blanket insurance on all bank deposits "at this moment in time," as reported by Reuters.

Market reaction

There seems to be a negative reaction from markets to this comment. As of writing, US stock index futures were down between 0.1% and 0.2%.

Meanwhile, the US Dollar Index, which measures the US Dollar's performance against a basket of six major currencies, was last seen losing 0.3% on the day at 102.50.

- EUR/USD extends the upside bias beyond 1.0800.

- Further gains could see the monthly high near 1.0930 revisited.

EUR/USD adds to the promising start of the week and surpasses the key 1.0800 hurdle on Tuesday.

The continuation of the bullish move appears favoured for the time being. Against that, the pair could now set sail to the March peak at 1.0929 (March 23) prior to a potential test of the 2023 high at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0335.

EUR/USD daily chart

- NZD/USD catches fresh bids on Tuesday and draws support from a modest USD weakness.

- Easing fears of a banking crisis, the Fed’s less hawkish outlook weighs on the Greenback.

- Rallying US bond yields could act as a tailwind for the buck and cap the upside for the pair.

The NZD/USD pair regains positive traction on Tuesday, following the previous day's directionless price moves, and sticks to its strong intraday gains, around the 0.6230-0.6235 area heading into the North American session.

Receding fears of a full-blown banking crisis, along with the Federal Reserve's less hawkish outlook, drags the US Dollar (USD) lower for the second successive day and turns out to be a key factor lending support to the NZD/USD pair. The market nerves about the contagion risk calmed following the takeover of Silicon Valley Bank by First Citizens Bank & Trust Company. Adding to this, regulators reassured that they stood ready to address any liquidity shortfalls further boosted investors' confidence and helped reverse the recent negative sentiment.

The US central bank, meanwhile, toned down its aggressive approach to reining in inflation and signalled last week that a pause to interest rate hikes was on the horizon. This further contributes to the underlying bearish sentiment surrounding the Greenback and acts as a tailwind for the NZD/USD pair. That said, a strong follow-through rally in the US Treasury bond yields could limit deeper losses for the USD, which might hold back traders from placing aggressive bullish bets around the major and keep a lid on any further gains, at least for the time being.

Even from a technical perspective, the recent two-way price moves witnessed over the past two weeks or so, within a familiar trading range, point to indecision over the near-term trajectory for the NZD/USD pair. Moreover, last week's failure to find acceptance above the 200-day Simple Moving Average (SMA) further warrants some caution before placing aggressive bullish bets and positioning for a further appreciating move. Market participants now look forward to the US macro data to grab short-term trading opportunities.

Tuesday's US economic docket features the release of the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index. This, along with the US bond yields and the broader risk sentiment, might influence the USD price dynamics and provide some impetus to the NZD/USD pair. The focus, however, will remain glued to the Fed's preferred inflation gauge, the US Core PCE Price Index, due on Friday.

Technical levels to watch

Cable dipped in European trade but found firm support on weakness to the upper 1.22s. Economists at Scotiabank expect GBP/USD to test the mid 1.24s on a break past 1.2340.

Firm trend persists

“Short-term trends suggest firm resistance in the 1.2330/40 zone but there is a fair degree of GBP-bullish momentum under this market and firm support under Cable in the 1.2255/60 zone.”

“Gains through 1.2340 target a retest of the mid 1.24s.”

See: GBP/USD can head towards the key 1.2426 December high and 1.2500 resistances – ING

Loonie underperforms after USD/CAD losses base in the low 1.36s. Nevertheless, Loonie is unlikely to suffer a substantial drop, Shaun Osborne, Chief FX Strategist at Scotiabank, reports.

Broader range trading seems likely to persist for now

“Material gains in the CAD still look a struggle but I also feel that the CAD is unlikely to fall too far at the moment, with a lot of bad news already factored in.”

“While the CAD is finding it very hard to make material gains, the pattern of short-term trade since mid-March has been one of (very) mild improvement in the CAD tone. Still, broader range trading seems likely to persist for now.”

“Support is 1.3625/30. Resistance is 1.3725/50.”

EUR/USD has gained steadily from last week’s low near 1.0720 and looks set to drive a little higher still in the short run, Shaun Osborne Chief FX Strategist at Scotiabank, reports.

EUR retains a steady bid tone

“EUR found solid support on minor weakness to the low 1.07 area over the past few days – a little below where I thought demand would emerge – but the broader trend remains constructive, supported by the incremental improvement in economic data and the leeway that affords the ECB to ratchet up policy a little more in the coming months.”

“We spot minor resistance at 1.0875/80 and 1.0920/25.”

“Broader trends continue to point to a test of the 1.10+ area.”

- Silver is seen oscillating in a narrow trading band around the $23.00 mark on Tuesday.

- The setup favours bullish traders and supports prospects for additional near-term gains.

- A convincing break below the $22.00 mark is needed to negate the constructive outlook.

Silver struggles for a firm intraday direction on Tuesday and seesaws between tepid gains/minor losses through the first half of the European session. The white metal is currently placed around the $23.00 round-figure mark, nearly unchanged for the day, and seems poised to prolong its recent upward trajectory witnessed over the past three weeks or so.

The intraday downtick finds some support near the 61.8% Fibonacci retracement level of the recent pullback from a multi-month peak. Furthermore, oscillators on the daily chart are holding comfortably in the positive territory and are still far from being in the overbought zone. This, in turn, favours bullish traders and suggests that the path of least resistance for the XAG/USD is to the upside.

That said, it will still be prudent to wait for some follow-through buying beyond the overnight swing high, near the $23.25 area, before positioning for any further gains. The XAG/USD might then surpass the $23.50 hurdle (the multi-week top set last Friday) and accelerate the momentum towards the $24.00 mark en route to the multi-month peak, around the $24.65 region touched in February.

On the flip side, weakness below the $22.80 zone is likely to find some support near the $22.50 area. Some follow-through selling has the potential to drag the XAG/USD towards the $22.20 region. This is followed by the $22.00 mark and the $21.75-$21.70 support (38.2% Fibo. level). Failure to defend the said support levels will negate the positive outlook and shift the near-term bias in favour of bears.

Silver daily chart

Key levels to watch

Maintaining confidence in the banking system is essential. Economists at ANZ Bank think central banks have acted appropriately, but it is taking time for markets to settle. The very early evidence is that real economic activity has proved resilient.

Caution warranted, but very early data resilient

“The very early evidence shows the real economy in the US and EA has held up well during recent banking volatility. That may reflect the quick and comprehensive response by policymakers, aimed at underwriting bank liquidity and assuring depositors’ money is safe. However, it will take time before a comprehensive assessment can be made.”

“A healthy banking system is central to economic stability. If interventions are successful in allaying a widespread and disinflationary tightening in credit conditions, central bank tightening will have further to run.”

- DXY extends the decline further south of the 102.00 support.

- The next support level of note emerges at the monthly low near 101.90.

DXY adds to Tuesday’s losses and approaches the 102.50 region on turnaround Tuesday.

If bulls fail to regain control of the sentiment – ideally in the very near term - the index could lose the grip and challenge recent lows in the sub-102.00 zone (March 23). Extra losses from here could put a visit to the 2023 low around 100.80 (February 2) back on the investors’ radar

Looking at the broader picture, while below the 200-day SMA, today at 106.58, the outlook for the index is expected to remain negative.

DXY daily chart

Enrico Tanuwidjaja, Economist at UOB Group, assesses the outlook for the economic growth in Indonesia for the current year.

Key Takeaways

“Economic growth in 2022 in all regions of Indonesia posted an increase from the previous year. The highest economic growth was recorded in the Sulawesi-Maluku-Papua (Sulampua) region with growth at 7.49% (y/y), followed by Java at 5.31% (y/y), Bali-Nusa Tenggara (Balinusra) at 5.08% (y/y), Kalimantan at 4.94% (y/y), and Sumatra at 4.69% (y/y).”

“Sumatra's economy is estimated to grow within the range of 4-4.8% in 2023; Java’s economy within the range of 4.8-5.6%; Kalimantan's economy in the range of 3.5-4.3%, lower than previous growth; Balinusra’s economy in the range of 4.5-5.3%; Sulampua’s economy within the range of 7.2-8%.”

“Indonesia's economic growth in 2023 is estimated to be within Bank Indonesia’s (BI) target of 4.5-5.3%. Nevertheless, there are a number of risks that could potentially inhibit growth this year such as the cumulative impact of aggressive global monetary policy tightening, slower than expected economic recovery in China, and rising global uncertainty that might hold back foreign investment and render inflation to remain high and elevated due to prolonged supply chain disruptions.”

EUR/HUF has pulled back after challenging the 200-DMA near 399/402. A break below would open up more losses toward 372, then 367, analysts at Société Générale report.

399/402 must be overcome to affirm an extended bounce

“The 200-DMA around 399/402 remains a crucial resistance zone and must be overcome to affirm an extended bounce.”

“The pair is drifting towards interim support of 379, the 76.4% retracement from the low formed earlier this month. Failure to defend could mean a deeper down move towards 372 and perhaps even towards the lower limit of a multi-month channel at 367.”

- EUR/JPY keeps the erratic performance well in place on Tuesday.

- Further range bound trade seems the name of the game.

EUR/JPY fades part of the auspicious start of the week and probes the 141.00 neighbourhood on Tuesday.

The cross keeps hovering around the key 200-day SMA near 141.80, and a sustainable surpass of this region should open the door to further upside in the short-term horizon. Moving forward, the consolidation theme is expected to remain unchanged as long as the March peaks around 145.50 continue to cap the upside.

In the meantime, extra losses remain on the table while the cross trades below the 200-day SMA.

EUR/JPY daily chart

Senior Economist at UOB Group Alvin Liew comments on the release of Industrial Production readings in Singapore.

Key Takeaways

“Singapore’s industrial production (IP) extended its weakness with a -11.7% m/m SA, -8.9% y/y decline in Feb, from a revised -0.4% m/m, -3.1% y/y in Jan. The Feb contraction was way worse than Bloomberg’s median forecast of +1.1% m/m, 1.8% y/y but close to our forecast of -10.7% y/y. This was the fifth consecutive month of y/y decline and the worst streak since 2015. Excluding the volatile biomedical manufacturing, IP contracted by a smaller -4.9% y/y in Feb (from 7.1% y/y in Jan).”

“The Feb IP was weighed lower by sharper declines in electronics (-10% y/y from -4.8% in Jan) and chemicals (-14.9% y/y from -13.1% in Jan), while biomedical manufacturing output crashed heavily by -33.6% y/y, solely due to a -59% y/y plunge in pharmaceuticals output, its worst contraction since Jul 2008 (-69.6% y/y).”

“IP Outlook – Even if we excluded the volatility brought by the biomedical manufacturing component, the latest Feb IP print continues to affirm our downbeat manufacturing outlook, and thus, we maintain our forecast for Singapore 2023 manufacturing to contract by 5.4% due to the worsening electronics downcycle and weaker external demand. Cracks in the export outlook also became more pronounced with non-oil domestic exports (NODX) recording consecutive, deeper y/y contractions since Aug 2022. We are likely to see a few more months of y/y declines in NODX before improving in the 2H. We expect full year NODX to contract by -5.5% in 2023. In line with the negative trade and manufacturing projections, we also keep our modest 2023 GDP growth forecast of 0.7% (closer to the lower end of the official forecast range of 0.5-2.5%).”

- AUD/USD struggles to capitalize on its modest intraday uptick to the 0.6700 neighbourhood.

- The ongoing rally in the US bond yields helps revive the USD demand and acts as a headwind.

- The RBA’s dovish tilt continues to cap ahead of the key Australian CPI report on Wednesday.

The AUD/USD pair regains some positive traction on Tuesday, albeit struggles to capitalize on the move and fails just ahead of the 0.6700 round-figure mark. The pair, however, sticks to modest intraday gains through the first half of the European session and is currently trading around the 0.6670-0.6675 area, still up over 0.35% for the day.

Receding fears of a full-blown banking crisis remain supportive of a generally positive risk tone, which, in turn, continues to weigh on the safe-haven US Dollar (USD) and benefits the risk-sensitive Australian Dollar. The takeover of Silicon Valley Bank by First Citizens Bank & Trust Company calmed market nerves about the contagion risk. Furthermore, regulators reassured that they stood ready to address any liquidity shortfalls helped reverse the recent negative sentiment and boosted investors' confidence.

This, along with the fact that the Federal Reserve toned down its aggressive approach to reining in inflation, keeps the USD bulls on the defensive and acts as a tailwind for the AUD/USD pair. It is worth recalling that the US central bank sounded cautious about the outlook and signalled last week that a pause to interest rate hikes was on the horizon. The Aussie further draws support from mostly in-line domestic data, which showed that Retail Sales grew 0.2% MoM in February and indicated some economic resilience.

The aforementioned fundamental backdrop supports prospects for some meaningful appreciating move for the AUD/USD pair. That said, expectations that the Reserve Bank of Australia (RBA) will refrain from raising interest rates at its April policy meeting might hold back bulls from placing aggressive bets or positioning for further gains. Traders also seem reluctant and might prefer to move to the sidelines ahead of the release of the Australian consumer inflation figures, due during the Asian session on Wednesday.

In the meantime, Tuesday's US economic docket - featuring the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index - might provide some impetus to the AUD/USD pair. This, along with the US bond yields and the broader risk sentiment, might influence the USD and allow traders to grab short-term trading opportunities. The focus will then shift to the final US Q4 GDP print on Thursday and the Fed's preferred inflation gauge - the US Core PCE Price Index on Friday.

Technical levels to watch