- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 29-11-2022

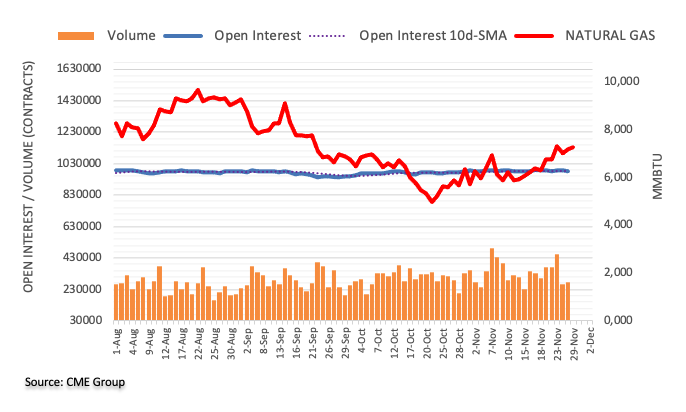

- WTI crude oil bulls struggle to defend the latest two-day uptrend.

- Short-term key EMA, descending trend line challenge further upside amid retreat in MACD signals.

- Six-week-old horizontal area holds the key to buyer’s conviction.

WTI crude oil fades upside momentum as it prints mild gains around $78.70 during early Wednesday. In doing so, the black gold seesaws around a convergence of the 50-Exponential Moving Average (EMA) and a downward-sloping trend line from November 07.

In addition to the key EMA and resistance line, the receding bullish bias of the Moving Average Convergence and Divergence (MACD) indicator also keeps the WTI sellers hopeful.

That said, pullback moves may aim for the $77.00 as immediate support before challenging the recently flashed yearly low surrounding $73.65.

In a case where the energy benchmark stays bearish past $73.65, the odds of witnessing a south-run towards the $70.00 psychological magnet can’t be ruled our before highlighting the late 2021 low near $62.35 for sellers.

On the flip side, recovery moves may initially confront the aforementioned trend line near $79.10 before attacking the 50-EMA level near $79.25. Also acting as a nearby upside hurdle is the latest swing high near $79.70.

Above all, a broad resistance area comprising levels marked since October 18, between $81.30 and $82.30, appears the key hurdle for the WTI bulls.

WTI: Four-hour chart

Trend: Pullback expected

- USD/CHF pauses four-day uptrend as traders await the key data/events.

- Market sentiment dwindles despite China-linked optimism, softer US data.

- Powell’s first speech since November FOMC will be crucial for pair bulls amid hawkish hopes.

- Second-tier Swiss data and early signals for Friday’s US NFP are important too.

USD/CHF treads water at a one-week high surrounding 0.9550 as traders await the key data/events scheduled for publishing on Wednesday. That said, the Swiss Franc (CHF) pair rose during the last four days amid the market’s cautious optimism even as the US Dollar Index (DXY) managed to rebound of late.

The latest positives for the market are from China as the dragon nation announced multiple measures to ease the strict lockdown in the key areas after witnessing a retreat in the daily Covid infections from a record high. Even so, the world’s second-largest economy kept its Zero-Covid policy intact. Bloomberg reported the reopening of some city buildings in the greater Zhengzhou region, the home of a key iPhone plant. Earlier on Tuesday, the news broke that China's Guangdong province will allow the close contacts of Covid cases to quarantine at home.

Even so, Wall Street closed mixed and the US 10-year Treasury bond yields ended Tuesday on a firmer footing, up six basis points (bps) to 3.748. The same helped the US Dollar Index (DXY) to print a three-day uptrend around 106.80 despite softer statistics from the United States. The reason could be linked to the hawkish comments supporting the US Federal Reserve’s steadily high-interest rates, even if a mild cut in the aggression is expected.

New York Federal Reserve Bank President John Williams and St. Louis Fed President James "Jim" Bullard were the latest supporters of higher rates. On the other hand, the US Conference Board (CB) Consumer Confidence Index dropped to 100.2 in November versus 102.2 prior (revised down from 102.5).

At home, Swiss Gross Domestic Product (GDP) for the third quarter (Q3) eased to 0.5% YoY versus 1.0% market forecasts and 2.2% prior (revised down from 2.8%).

Moving on, Federal Reserve (Fed) Chairman Jerome Powell’s first public appearance since November Federal Open Market Committee (FOMC) meeting will be crucial for the USD/CHF pair traders amid hopes of witnessing a hawkish message. Additionally, an early signal for Friday’s United States Nonfarm Payrolls (NFP), namely the ADP Employment Change for November, expected 200K versus 239K prior, will also be important to watch. Furthermore, the second reading of the United States Gross Domestic Product (GDP) for the third quarter (Q3), expected to confirm 2.6% Annualized growth, will populate the economic calendar too.

That said, the Swiss KOF Leading Indicator and Zew Survey for November are some of the second-tier data from home that can keep the USD/CHF pair traders busy.

Technical analysis

A convergence of the 50-day and 100-day Exponential Moving Average (EMA), around 0.9700-05 appears a tough nut to crack for the USD/CHF bulls.

- AUD/JPY has slipped after facing hurdles around 92.80 as investors await Australian inflation data.

- An increment in Aussie CPI could force the RBA to return to a 50 bps rate hike culture.

- Chatters of unwinding of BOJ’s monetary easing have strengthened the Japanese yen.

The AUDJPY pair has dropped after the short-lived rebound near 92.48 terminated around 92.80 in the Tokyo session. The risk barometer has remained extremely volatile in a couple of trading sessions led by public protests in China against the rollback of lockdown measures to restrict the epidemic.

The cross is expected to continue its volatile gyrations after the release of the monthly Australian Consumer Price Index (CPI) data. As per the estimates, the monthly CPI data is expected to escalate to 7.4% vs. the prior release of 7.3%.

An increment in inflationary pressures could be followed by hawkish commentaries from Reserve Bank of Australia (RBA) policymakers. It is worth noting that Australian inflation has not displayed signs of exhaustion yet nor a peak has been formed, which will continue to create havoc for the RBA. This might force RBA Governor Philip Lowe to ditch the smaller rate hike culture and to return to 50 basis points (bps) rate hike structure in its December monetary policy meeting in order to chain the roaring inflation.

Meanwhile, the Chinese city of Zhengzhou, home to Apple Inc.’s largest manufacturing site in China, said that it was lifting a lockdown of its main urban areas put in place five days ago as Covid cases climbed. The headline could infuse optimism in the cautious market mood ahead.

On the Tokyo front, chatters over the unwinding of the Bank of Japan (BOJ)’s monetary easing are strengthening the Japanese yen. According to an economists’ poll by Reuters, more than 90% of economists have supported the view of phasing out monetary easing in the latter half of CY2023.

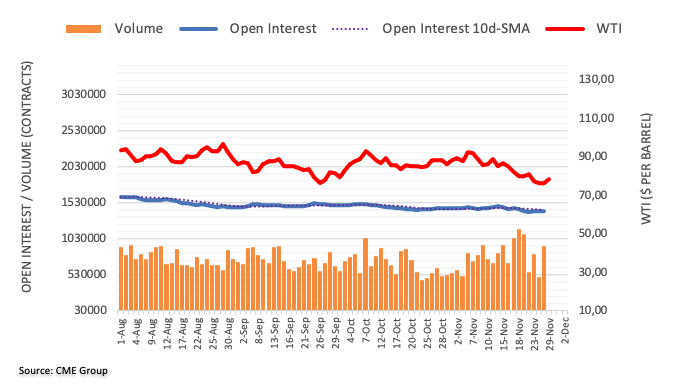

- USD/CAD struggles to extend three-day uptrend near the highest levels in three weeks.

- Break of two-month-old horizontal support, bearish MACD signals favor buyers.

- 50-DMA, seven-week-long descending trend line restrict immediate upside.

USD/CAD remains sidelined around 1.3585-90, recently picking up bids, as traders struggle with the key hurdle during early Wednesday morning in Asia. In doing so, the Loonie pair probes the three-day uptrend around a multi-day top marked the previous day.

Even so, the USD/CAD pair’s sustained trading beyond the previous key resistances and the 100-DMA joins the bullish MACD signals to keep the buyers hopeful.

That said, a downward-sloping trend line from October 13 and the 50-DMA restrict immediate USD/CAD moves between 1.3600 and 1.3580, a break of which could quickly propel the quote towards the monthly top near 1.3810.

However, multiple hurdles around 1.3840 and 1.3860 could challenge the USD/CAD bulls past 1.3810, which if ignored will highlight the yearly top marked in October surrounding 1.3980.

Alternatively, pullback moves remain elusive unless the quote stays beyond the horizontal support established since early October, near 1.3490 by the press time.

Following that, an upward-sloping trend line from August 11, currently at 1.3340, will precede the 100-DMA support of 1.3287 to challenge the USD/CAD bears.

Overall, USD/CAD is likely to remain firmer but the road to the north appears bumpy.

USD/CAD: Daily chart

Trend: Further upside expected

- GBP/USD is looking to test weekly lows at 1.1940 as the risk-off impulse has remained solid.

- The US Treasury yields have accelerated as Fed policymakers see no halt in rate hike culture in the near term.

- The speech from Andrew Bailey failed to provide cushion to Pound bulls.

The GBP/USD pair is seeking a cushion around the immediate hurdle of 1.1950 in the early Tokyo session. The Cable displayed volatile moves on Tuesday after failing to sustain above the psychological resistance of 1.2000 as the FX domain turned currency-specific. The further road is still favoring a bumpy ride for the Pound Sterling as a speech from Federal Reserve (Fed) chair Jerome Powell could infuse adrenaline rush into the US Dollar index (DXY).

The Cable is expected to test the weekly low at 1.1940 amid a cautious market mood. Meanwhile, the US Dollar Index (DXY) is aiming to shift its business above 106.80 as the risk-aversion theme has improved safe-haven’s appeal. The 10-year US Treasury yields have accelerated to 3.75% as Fed policymakers see no halt in rate hike culture in the near term.

The speech from Fed chair Jerome Powell is expected to weaken obscurity over the extent of an interest rate hike for December monetary policy. Apart from that, minutes of the Fed’s Beige Book will remain under the radar, which will provide regional status of employment, consumer spending, and the extent of economic activities.

This week, the US Nonfarm Payrolls (NFP) is the show-stopper event. But before that, investors will focus on US Automatic Data Processing (ADP) Employment data doe meaningful cues. As per the consensus, the United States economy has added fresh 200k jobs in the labor market lower than the prior release of 239k.

On the UK front, the speech from Bank of England (BOE) Governor Andrew Bailey on Tuesday failed to provide a cushion to Pound bulls. Testifying at the Lord's Economic Affairs Committee, BOEE Governor cited that "There has been no discussion with the government on the pace and timing of BoE asset sales." He believes that the “UK labor market has turned out to be much more constrained than we thought, different to other countries."

- Deteriorated market sentiment, weighed on the Pound Sterling, bolstered the Japanese Yen.

- GBP/JPY’s failure to hold around 168.00 exacerbated a fall to 165.00.

The Pound Sterling (GBP) extends its losses against the Japanese Yen (JPY) amid a risk-off impulse as traders get to the sidelines ahead of the Federal Reserve (Fed) Chairman Jerome Powell’s speech on Wednesday. In the FX space, risk-perceived currencies like the GBP were defensive against the safe-haven status of the JPY. At the time of writing, the GBP/JPY is trading at 165.71.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY plummeted 300 pips on Monday towards the 165.00 region, but the pair attempted to trim some of its losses. Albeit the GBP/JPY printed a daily high of 166.67, the cross dived to fresh weekly lows at 165.52. Even though the cross’s path of least resistance in the near term is downwards, the GBP/JPY will face solid support levels at the 50 and 100-day Exponential Moving Averages (EMAs) at 165.34 and 164.27, respectively. Once those two support levels are broken, that could pave the way to test November’s low at 163.03.

The GBP/JPY 4-hour chart portrays the pair in a downtrend, trading within the boundaries of a descending channel, with a 150 pip width. And due to the proximity of GBP/JPY’s price action to the channel’s top trendline, a correction downwards is suggested. Further cementing the case is the Exponential Moving Averages (EMAs) above the spot price, with a bearish slope, alongside the Relative Strength Index (RSI) at bearish territory.

Therefore, the GBP/JPY first support would be the S1 daily pivot at 165.21. Break below will expose the 165.00 psychological level, followed by the S2 pivot at 164.83, ahead of the bottom-trendline of the descending channel at 164.00.

GBP/JPY Key Technical Levels

- AUD/USD fails to extend the previous day’s corrective bounce, treads water of late.

- Easing of lockdown conditions in China fails to cheer the buyers amid firmer US Dollar.

- US Treasury bond yields stay upbeat ahead of Fed Chairman Jerome Powell’s first speech since November meeting.

- China’s PMIs, Aussie inflation will be eyed for immediate directions.

AUD/USD portrays the typical pre-data anxiety as it seesaws near 0.6685-90 during the early hours of Wednesday’s Asian session. In doing so, the Aussie pair fails to cheer the risk-positive headlines from Australia’s major customer China amid the recently firmer US Dollar.

That said, Chinese authorities took a sigh of relief and announced multiple measures to ease the strict lockdown in the key areas after witnessing a retreat in the daily Covid infections from a record high. However, the dragon nation kept its Zero-Covid policy intact.

Recently, Bloomberg reported the reopening of some city buildings in the greater Zhengzhou region, the home of a key iPhone plant. Earlier on Tuesday, the news broke that China's Guangdong province will allow the close contacts of Covid cases to quarantine at home.

Elsewhere, US 10-year Treasury bond yields ended Tuesday on a firmer footing, up six basis points (bps) to 3.748% by the end of the North American trading session. The same helped the US Dollar Index (DXY) to print a three-day uptrend around 106.80 despite softer statistics from the United States. The reason could be linked to the hawkish comments supporting the US Federal Reserve’s steadily high-interest rates, even if a mild cut in the aggression is expected.

New York Federal Reserve Bank President John Williams and St. Louis Fed President James "Jim" Bullard were the latest supporters of higher rates. On the other hand, the US Conference Board (CB) Consumer Confidence Index dropped to 100.2 in November versus 102.2 prior (revised down from 102.5).

Amid these plays, Wall Street closed mixed even as equities in the Asia-Pacific and Europe/UK were mildly positive.

Looking forward, AUD/USD traders will pay attention to the latest version of Australia’s Monthly Consumer Price Index for October, expected 7.4% YoY versus 7.3% prior. Although the inflation numbers are likely to print a firmer outcome and may offer an immediate uptick in matching the forecasts, the Reserve Bank of Australia’s (RBA) dovish mood can continue favoring the Aussie pair bears. Other than the Aussie inflation data, China’s NBS Manufacturing PMI for November, expected 49.0 versus 49.2 prior, will also be important for immediate directions.

Above all, Federal Reserve (Fed) Chairman Jerome Powell’s first public appearance since November Federal Open Market Committee (FOMC) meeting will be crucial for the AUD/USD pair traders amid hopes of witnessing a hawkish message. The same could weigh on the pair in case Powell keeps liking bulls. Ahead of the meeting, Analysts at the ANZ said, “We expect Powell to reaffirm the Fed’s unwavering commitment to tackling inflation, the need for more measured rate rises taking account of increased two-way economic risks as policy becomes restrictive, and a degree of optimism that the Fed will be able to pull off a soft landing.”

Technical analysis

AUD/USD stays on the bear’s radar unless breaking 0.6770 level comprising the previous support line from early November, an 11-week-old descending trend line and a 61.8% Fibonacci retracement of the pair’s August-October downturn.

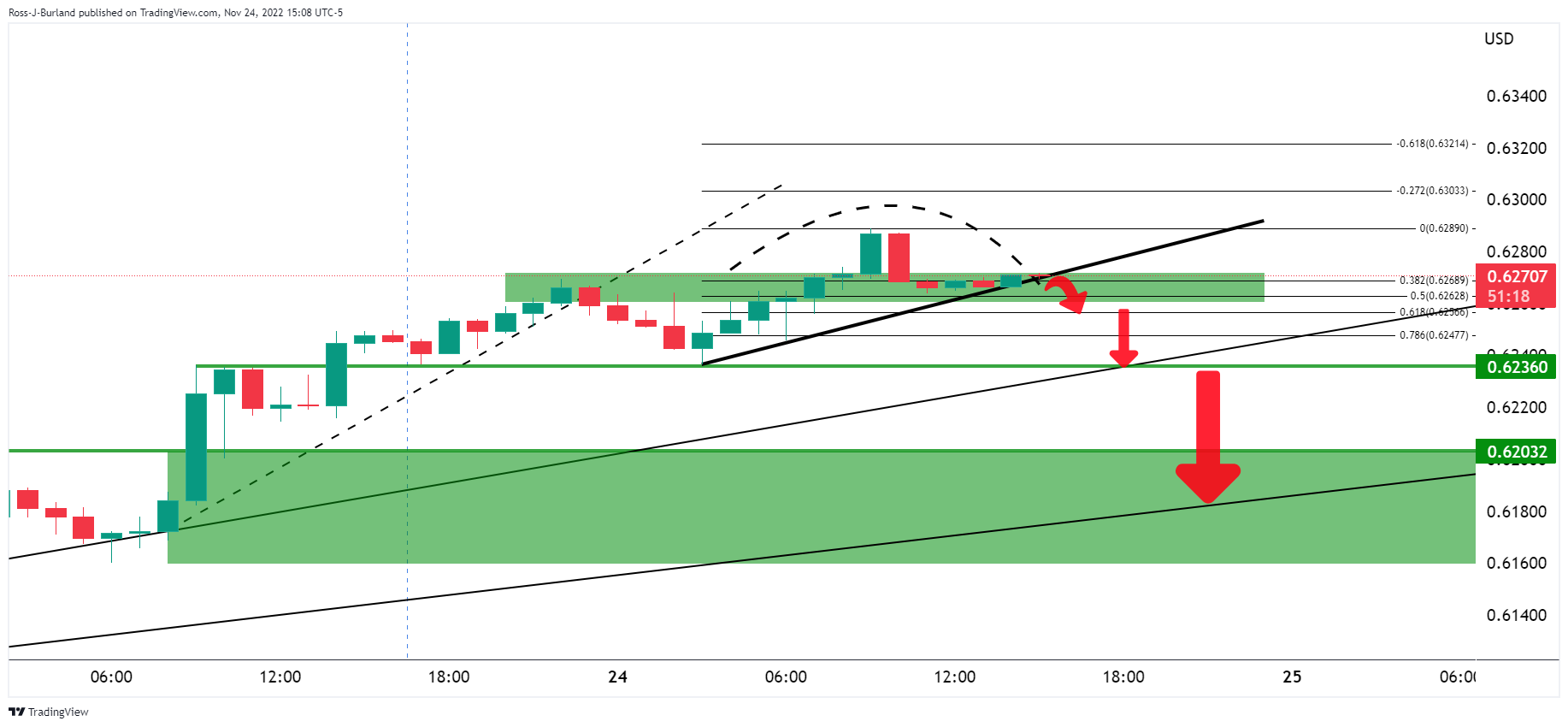

- NZD/USD is facing hurdles around 0.6200 as anxiety soars ahead of Fed Powell’s speech.

- Fed’s higher interest rates are responsible for weaker projections for US employment data.

- The reopening of a few manufacturing sites in the Chinese city of Zhengzhou may infuse optimism into risk impulse.

The NZD/USD pair is displaying a sideways auction profile near the round-level hurdle of 0.6200 in the early Asian session. The kiwi asset has turned rangebound after a vertical drop from the 0.6250 hurdle. The major is expected to remain on tenterhooks as investors are awaiting the speech from Federal Reserve (Fed) chair Jerome Powell to get clarity over rate hike deceleration chatters.

Meanwhile, the risk impulse has turned asset-specific as a few risk-sensitive currencies are still solid. The US Dollar index (DXY) is facing barriers in sustaining above the critical hurdle of 106.80. The 10-year US Treasury yields have recovered dramatically above 3.75%. The recovery in the US yields could be linked to a speech from Jerome Powell ahead as it will trim ambiguity over interest rate projections for December monetary policy meeting.

Apart from Fed Powell’s speech, the economic data will be crucial for the market participants in the United States Automatic Data Processing (ADP) Employment data. As per the projections, the US economy has added fresh 200k jobs in the labor market lower than the prior release of 239k. This has been the outcome of accelerating interest rates by the Fed, which has forced firms to postpone their expansion plans to dodge higher interest obligations.

Also, the Gross Domestic Product (GDP) data will be crucial for investors. The annualized GDP for the third quarter is seen unchanged at 2.6%. A decline in the growth rate would cement expectations of a slowdown in inflation.

On the New Zealand front, the Kiwi Dollar is still in the havoc of China’s unrest, being one of the leading trading partners. Public protest against the rollback of Covid-19 lockdown measures by Chinese authorities is expected to make the epidemic situation more vulnerable ahead.

Late Tuesday, the Chinese city of Zhengzhou, home to Apple Inc.’s largest manufacturing site in China, said that it was lifting a lockdown of its main urban areas put in place five days ago as Covid cases climbed. The headline is expected to infuse optimism in the cautious market mood ahead.

- EUR/USD pares the biggest monthly gains since September 2010.

- Recently hawkish comments from Federal Reserve officials underpinned United States Treasury Yields and US Dollar.

- Softer statistics, easing Covid fears from China and looming concerns over Eurozone recession keeps traders on their toes.

- Firmer Eurozone inflation may help EUR/USD to grind but Federal Reserve Chairman Jerome Powell could favor the month-end consolidation.

EUR/USD remains pressured around 1.0330, after printing a two-day downtrend, as it prepares for the big day during early Wednesday in Asia. Even so, the major currency pair stays on the way to posting the biggest monthly run-up in 12 years as Federal Reserve’s (Fed) signals for easy rate hikes got appreciation, even if the latest hawkish Fed talks allowed the United States Treasury bond yields and the US Dollar to consolidate monthly losses.

United States Treasury bond yields, US Dollar lick their wounds

US 10-year Treasury bond yields ended Tuesday on a firmer footing, up six basis points (bps) to 3.748% by the end of the North American trading session. The same helped the US Dollar Index (DXY) to print a three-day uptrend around 106.80 even as statistics from the United States weren’t so upbeat. The reason could be linked to the hawkish comments supporting the US Federal Reserve’s steadily high-interest rates, even if a mild cut in the aggression is expected.

It’s worth noting, however, that the stated bond yields remain negative on a monthly basis, posting the first monthly loss in four, whereas the US Dollar Index stays on the way to printing the biggest monthly loss since September 2010.

That said, New York Federal Reserve Bank President John Williams and St. Louis Fed President James "Jim" Bullard were the latest supporters of higher rates. On the other hand, the US Conference Board (CB) Consumer Confidence Index dropped to 100.2 in November versus 102.2 prior (revised down from 102.5).

Optimism surrounding China contrasts with fears from Eurozone to weigh on EUR/USD

Easing tensions from China contrasts with looming economic fears from the Eurozone and challenge the EUR/USD buyers of late.

After witnessing a retreat in the daily Covid infections from a record high, Chinese authorities took a sigh of relief and announced multiple measures to ease the strict lockdown in the key areas.

Recently, Bloomberg reported the reopening of some city buildings in the greater Zhengzhou region, the home of a key iPhone plant. Earlier on Tuesday, the news broke that China's Guangdong province will allow the close contacts of Covid cases to quarantine at home.

On the other hand, mixed statistics from Eurozone and comments from the officials failed to push back the chatters surrounding the bloc’s economic slowdown.

That said, the Euro area Economic Sentiment Indicator improved to 93.7 in November versus 93.5 expected and 92.7 prior (revised). However, the bloc’s Business Climate gauge eased to 0.54 from 0.74 previous readings while the Consumer Confidence reprinted -23.9 figures for the said month. Further, Germany’s preliminary inflation, as per the Harmonized Index of Consumer Prices (HICP) indicator, eased to 11.3% YoY while matching the market forecasts versus 11.6% prior. Additionally, inflation as measured by the Consumer Price Index (CPI), declined to 10% YoY during November from 10.4% previous readings. Following the data, Germany’s Economy Minister Robert Habeck said on Tuesday that “We will be and remain a strong land.”

It’s worth mentioning that the bloc is in consultation with the Group of Seven (G7) nations to announce a price cap on Russian Oil exports and teases another round of geopolitical tension with Moscow as Deputy Prime Minister Alexander Novak said on Tuesday that Russia won't supply Oil under price cap in any case. The same could amplify recession concerns in the bloc and can weigh on the regional currency even if the European Central Bank (ECB) officials appear hawkish. Recently, European Central Bank (ECB) Vice President Luis de Guindos anticipated a decline in headline inflation during the first half of the next year while speaking at a virtual event XIII Encuentro Financiero on Tuesday.

All eyes on Federal Reserve Chairman Jerome Powell

Although a lot is at stake and in the line, market players will pay more attention to the speech from Federal Reserve (Fed) Chairman Jerome Powell’s first public appearance since November Federal Open Market Committee (FOMC) meeting. The event should exert more downside pressure on the EUR/USD price if the Fed boss meets the hawkish expectations of the market.

Ahead of the meeting, Analysts at the ANZ said, “We expect Powell to reaffirm the Fed’s unwavering commitment to tackling inflation, the need for more measured rate rises taking account of increased two-way economic risks as policy becomes restrictive, and a degree of optimism that the Fed will be able to pull off a soft landing.”

Also important will be the preliminary inflation data from Eurozone. As per the Harmonized Index of Consumer Prices (HICP) indicator, the inflation in the bloc is likely to ease to 10.4% YoY versus 10.6% prior, which in turn could weigh on the EUR/USD. The reason could be linked to the impending recession fears and the European Central Bank’s (ECB) readiness to ease if needed, per the latest comments from the officials.

Other than Fed Chair Powell’s speech and Eurozone inflation, an early signal for Friday’s United States Nonfarm Payrolls (NFP), namely the ADP Employment Change for November, will also be closely watched by the EUR/USD traders. The private employment gauge is likely to register downbeat figures of 200K versus 239K prior.

Furthermore, the second readings of the United States Gross Domestic Product (GDP) for the third quarter (Q3), expected to confirm 2.6% Annualized growth, will also be crucial for the EUR/USD pair if posting a change.

EUR/USD technical analysis

EUR/USD bulls faced rejection from a 3.5-month-old ascending resistance line, as well as the 200-Day Moving Average (DMA).

The following pullback took clues from the Moving Average Convergence and Divergence (MACD) indicator and the Relative Strength Index (RSI) line, placed at 14.

The reason could be linked to a bearish divergence on the RSI and an impending bear cross on the MACD. That said, the higher high on price joins the lower tops on RSI (14) to portray the bearish RSI divergence while the MACD line’s piercing of the signal line from below teases bear cross.

As a result, the EUR/USD bears are all set to approach an 11-week-old horizontal support area surrounding 1.0220-200. However, the quote’s further downside needs validation from the October peak near 1.0095 before directing the sellers toward July’s low of 0.9952.

Alternatively, the 200-DMA and an upward-sloping resistance line from August 10, respectively near 1.0380 and 1.0510, could restrict the immediate upside of the EUR/USD pair.

Following that, the 61.8% Fibonacci retracement level of the EUR/USD’s south-run trajectory from late March to September 28, close to 1.0555, will precede the June 27 swing high near 1.0615 to challenge the pair buyers.

Overall, EUR/USD bulls run out of steam as traders await the key events.

EUR/USD: Daily chart

Trend: Further downside expected

“The Chinese city of Zhengzhou shuttered hundreds of buildings and apartment blocks hours after lifting broader lockdown measures, as officials strive to make their Covid controls more targeted in line with Beijing’s directives,” reported Bloomberg.

Earlier on Tuesday, the news broke that China's Guangdong province will allow the close contacts of the Covid cases to quarantine at home.

Key quotes

The city, home to Apple Inc.’s largest manufacturing site in China, said late Tuesday that it was lifting a lockdown of its main urban areas put in place five days ago as Covid cases climbed.

Authorities then issued a lengthy list of buildings that would be declared high risk spanning the greater Zhengzhou region.

Markets remain jittery

Although the news should have ideally helped AUD/USD, the Aussie pair remains inactive around 0.6690, fading the previous day’s corrective bounce ahead of the key data/events.

Also read: Forex Today: All eyes on Federal Reserve's Powell, Aussie CPI and China PMIs

- Despite a risk-off mood, the New Zealand Dollar recovered some ground vs. the Japanese Yen.

- The double-top formation in the NZD/JPY daily chart remains in play.

- Short term, the NZD/JPY is headed downwards, eyeing the 85.00 psychological figure.

The New Zealand Dollar (NZD) remains bid against the Japanese Yen (JPY) even though a risk-off impulse surrounds the financial market, except for the FX space, with risk-perceived currencies rising. That said, high beta currencies like the NZD are appreciating. Hence, the NZD/JPY is recovering, trading at 85.98, above its opening price by 0.42%.

NZD/JPY Price Analysis: Technical outlook

The NZD/JPY daily chart suggests a double top formation emerged of late, sparked by Monday’s plunge of more than 130 pips, driving the exchange rate towards its weekly lows of 85.42, reached on Tuesday. However, the cross-currency pair bounced toward its daily high of 86.29, and its later retracement below 86.00 could exacerbate a fall to the 200-day Exponential Moving Average (EMA) at 84.10, ahead of the November low of 83.84.

In the near term, the NZD/JPY 4-hour chart portrays the pair tested the 100-EMA around 86.17 three times before diving to the 200-EMA at 85.68. However, the NZD/JPY bounced to the daily pivot point at 85.94, shy of the 86.00 figure, which, once broken, could open the door for a re-test of the 100-EMA. But the Relative Strength Index (RSI) is in bearish territory, and possible deterioration in market mood suggests the path of least resistance is downwards.

Therefore, the NZD/JPY first support will be the 200-EMA at 85.69, which, once cleared, will send the pair diving to the S1 daily pivot at 85.52, followed by the S2 pivot at 85.04.

NZD/JPY Key Technical Levels

US President Joe Biden crossed wires late Tuesday while speaking at SKI Siltron CSS's semiconductor facility in Bay City, Michigan. The US leader cheered the easing prices for gasoline, clothes and appliances as "good news for the holiday season," while also stating that it would take time for inflation to return to normal levels.

Key quotes

Inflation at the grocery stores, thank God, is beginning to slow. Prices for things like clothes, televisions and appliances are going down. That's good news for the holiday season.

While gasoline prices had returned to their pre-war levels, having dropped $1.50 per gallon from their peak this summer and continuing to fall.

While these prices are lower, they're not low enough.

It's going to take time to get inflation back to normal levels, We're laser-focused on this.

Prices could spike again if unions reject a potential contract deal with U.S. railways, the White House has warned, but Biden did not raise the issue during his remarks.

Market implications

The news failed to gain any major reaction amid the late hours of the day, as well as anxiety ahead of the key data/events scheduled for publishing on Wednesday.

Also read: Forex Today: All eyes on Federal Reserve's Powell, Aussie CPI and China PMIs

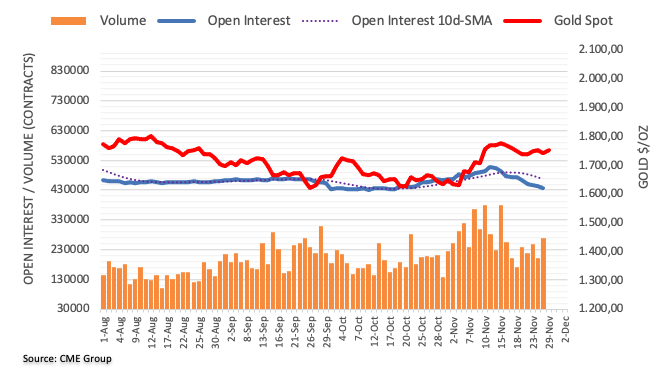

- Gold price is facing immense pressure in holding itself above the crucial hurdle of $1,750.00.

- The US Treasury yields have rebounded firmly amid anxiety ahead of Fed Powell’s speech.

- Apart from a speech from Jerome Powell, investors are awaiting GDP, core PCE, and Employment data.

Gold price (XAU/USD) is facing hurdles in sustaining above the critical hurdle of $1,750.00 in the early Tokyo session. The precious metal is highly likely to deliver a sideways auction as investors are awaiting the speech from Federal Reserve (Fed) chair Jerome Powell. Also, the release of other triggers such as United States Automatic Data Processing (ADP) Employment, Gross Domestic Product (GDP), core Personal Consumption Expenditure (PCE), and Fed’s Beige Book.

Meanwhile, the US Dollar Index (DXY) has shifted its business above the crucial barricade of 106.75 as the risk-off impulse remained active for some specific risky assets. The market has become currency specific as a cautious market mood is not impacting the entire gamut of risk-perceived assets. S&P500 remained subdued on Tuesday as investors await multiple triggers for making an informed decision.

While the 10-year US Treasury yields roared back dramatically above 3.75% as Fed policymakers are expecting no slowdown in the pace of interest rate hikes as one good monthly inflation report is not sufficient to infuse confidence. Going forward, the US ADP data will be very crucial. As per the estimates, the US economy has created additional 200k jobs in November vs. the prior release of 239k.

Gold technical analysis

On an hourly scale, Gold price is displaying a sideways performance in a range of $1,740-1,760 ahead of the release of key economic catalysts. The 20-period Exponential Moving Average (EMA) at $1,751.35 is overlapping with the asset, which indicates a consolidation ahead.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which states that investors have been sidelined ahead of key events.

Gold hourly chart

Here is what you need to know for Wednesday, November 30:

Risk markets were touch and go as month end approached ahead of Fed Chairman Powell’s address on the economy on Wednesday and US Nonfarm Payrolls on Friday. Risk appetite had worsened on Monday after protesters and police clashed over the stringent COVID restrictions, supporting the US Dollar index, DXY, that had otherwise fallen to 106.82 from a 20-year high of 114.78 on Sept. 28.

Jerome Powell will be expected to reaffirm the Fed’s unwavering commitment to tackling inflation, analysts at ANZ Bank said. The analysts also highlighted the prospects of Powell mentioning the ''need for more measured rate rises taking account of increased two-way economic risks as policy becomes restrictive and a degree of optimism that the Fed will be able to pull off a soft landing.''

Meanwhile, the US central bank is expected to hike rates by an additional 50 basis points when it meets on Dec. 13-14, though the odds of a 75-basis-point increase have risen over the past several weeks and now stand at a 37% probability. WIRP suggests that is fully priced in, with around 15% odds of a larger 75 bp move. The swaps market is still pricing in a peak policy rate of 5.0%, with small odds of a 5.25% peak.

In markets, Wall Street was mixed on Tuesday, with losses in Apple and Amazon. At the time of writing, the S&P 500 was down 0.14% and is headed for its second straight month of gains in November amid bets that recent inflation readings showing a slight cooling in prices will lead the Fed to scale back. The Nasdaq declined 0.70% while the Dow Jones Industrial Average was flat. In Europe, the Euro Stoxx 50 was broadly unchanged and the FTSE 100 up 0.5%.

The US 10-year yield was up 6bp to 3.74%, weighing on the euro which was down some 0.1% to 1.0330. The inflation rate in Germany slowed to 10% in November from 10.4% in October but remained close to high levels not seen since the reunification. The sentiment remains supportive of the Euro in that the European Central Bank remains committed to raising interest rates to dampen high inflation. The British pound hovered at 1.1950 and down 0.1% on the day, meeting recent lows in what could turn out to be a double bottom on the hourly timeframe.

The Aussie was better bid as the sentiment improved on hopes that China would reopen from COVID shutdowns. AUD/USD rallied to a high of 0.6748 and was ending around 0.5% higher on the day. WTI was higher despite some speculation that OPEC will leave quotas unchanged, falling some 1.5% into channel resistance. Gold fell 0.3% to below $1,750 reaching a low of $1,747 while Bitcoin rallied over 1.5% after re-testing its yearly lows yesterday.

For the day ahead, Aussie Consumer Price Index and Chinese PMIs will be key in the Asian sessions.

- WTI bears are moving in at a critical juncture.

- A break of horizontal support leaves the downside exposed.

West Texas Intermediate is higher on the day so far, up over 2.45% at the time of writing, having ranged between a low of $76.03 and $79.61 so far. The price has been consolidating at the top of a channel and the prior day's short squeeze. Risk markets were soft amid light activity as month-end approaches.

Meanwhile, West Texas Intermediate was bid on the hopes China is easing its strict zero-Covid policies while OPEC+ decided to meet virtually for its Dec.4 meeting to set production quotas. The good news came for markets when China's government announced that it will boost Covid-19 vaccination while stepping back from its quarantine policies.

Elsewhere, and despite market rumours, OPEC has not indicated it plans further cuts in its meeting as European sanctions on Russian oil imports take effect on December 5. Nevertheless, negotiations on a price cap for Russian oil go on.

Analysts at ANZ Bank said that ''Germany warned it can’t rule out temporary supply bottlenecks when a ban on imports on Russian crude starts next month. OPEC also appears to be reducing output in line with its agreement to cut production.''

For the week ahead, the focus is on Federal Reserve Chairman Jerome Powell’s address on the economy and the US labour market in Friday's Nonfarm Payrolls event.

WTI technical analysis

As illustrated, the price is meeting the channel top, on the front side of the trendline resistance, breaking horizontal structure and posied for a downside continuation.

- Mixed sentiment was no excuse for the Australian Dollar to appreciate against the US Dollar.

- Investors continue to assess the latest Federal Reserve hawkish commentary.

- Fed Williams commented that the path of rates is higher than September’s projections.

- Chinese officials urged local governments to avoid lockdowns and committed to vaccinating older adults.

The Australian Dollar (AUD) is erasing some of Monday’s losses against the US Dollar (USD) even though market sentiment deteriorated, as shown by Wall Street, set to end in the red. Latest Federal Reserve (Fed) officials’ hawkish comments, China’s Covid-19 woes, and weak retail sales data in Australia are the main drivers of the day. At the time of writing, the AUD/USD is trading at 0.6684, above its opening price b 0.50%, but off the day’s high of 0.6748.

Hawkish Fed commentary deteriorated investors’ mood as Fed Chair Jerome Powell is eyed

The equity markets in the United States (US) wavered by a slide in mega-cap equities. Federal Reserve policymakers led by the St. Louis Fed President James Bullard said the central bank has “ways to go to a restrictive policy.” Bullard added that the Fed needs to increase rates until 2023 and foresees the Federal Funds rate (FFR) to peak at around 5% to 7%. Echoing some of his remarks was the New York Fed President John Williams, adding that the strong economy in the US “suggests a modestly higher path for policy relative to September. Not a massive change, but somewhat higher.” Williams added that inflation could fall to 5.0%-5.5% by the end of 2022 and 3.0%-3.5% by late 2023.

Given that the Federal Reserve Open Market Committee (FOMC) November minutes opened the door to slow the pace of borrowing cost increases, Wednesday’s speech of the Federal Reserve Chair Jerome Powell is eyed ahead of the last meeting of 2022.

Consumer Confidence in the United States falls to a 4-month low

Data-wise, the US economic calendar revealed that Consumer Confidence or November, reported by the Conference Board (CB), dropped to a four-month low of 100.2, weighed by the combination of inflation and interest rate hikes, posing a challenge to consumers, threatening to slow the economic growth in 2023.

Elsewhere, the US Dollar Index (DXY), a measure of the greenback value against a basket of six currencies, bounced off daily lows around 106.058 and climbed to 106.795, registering moderate gains of 0.12%, capping the AUD/USD gains.

China’s Covid-19 riots waned, but weak Australian retail sales weighed on the AUD

Aside from this, the Covid-19 riots in China appeared to wane as cases edged lower. On Monday, China reported 38,421 new local cases, down from the 40,052 record high reported for Sunday, with no deaths for two straight days. Health officials urged local governments to avoid unnecessary and lengthy lockdowns. Chinese health officials said the Omicron variant is less severe while committed to vaccinating elder people aged 80 or older.

Also, Australia’s weaker-than-expected October Retail Sales report put a lid on Tuesday’s AUD/USD rally. Figures showed that sales plunged 0.2% MoM against a 0.5% expansion estimate.

Australia and US economic calendar

Australia’s economic calendar will feature Housing Data and the Reserve Bank of Australia (RBA) Governor Kearns’s speech. On the US front, the docket would be busy with employment figures to be released, GDP, the Goods Trade Balance, Wholesales Inventories, the Chicago PMI, Pending Home Sales, and Fed speaking, led by the Federal Reserve Chairman Jerome Powell.

AUD/USD Price Analysis: Technical outlook

The AUD/USD remains neutral-to-upward biased, though failure to crack 0.6750 caused a 70-pip retracement on the pair, back below 0.6700. Albeit the inverted head-and-shoulders is still in play, Tuesday’s candlestick printed a sizeable upper wick, suggesting that sellers stepped in around the 23.6% Fibonacci level around 0.6703. Therefore, the AUD/USD path of least resistance near term is downwards.

The AUD/USD key support levels are the 38.2% Fibonacci retracement at 0.6643, followed by the figure at 0.6600 and the 61.8% Fibonacci retracement at 0.6546.

- GBP/USD is below a key trendline resistance and neckline of the H&S pattern.

- The bias remains firmly to the downside with eyes on 1.1900.

As per the prior analysis, GBP/USD continues to slide below 1.2000 and the coil, GBP/USD remains on the backfoot while gathering bearish momentum and leaning against a bearish structure below the psychological 1.2000 level. The short-term dynamic support was broken in prior sessions as fears of a lengthy UK recession are still seen weighing on sentiment.

GBP/USD, prior analysis

It was stated that the bears were moving on the trendline support and were breaking out of a coil. A 100% measured move of the range was to target the prior structure at 1.1900 and then a 200% measure move aligns with 1.1800.

GBP/USD H4 charts, update

The price broke the trendline, corrected and is now forming a bearish continuation structure:

GBP/USD H1 chart

Meanwhile, a micro correction on the hourly chart is underway. However, while below the trendline resistance and neckline of the H&S pattern, the bias remains firmly to the downside.

- Silver price advances and faces resistance at the 200-day EMA.

- US Dollar got bid as of late, courtesy of sentiment deterioration.

- Silver Price Analysis: Downward biased after breaking below a one-month upslope trendline.

Silver price is recovering some ground against the US Dollar (USD), rising some 1.50% on Tuesday, as sentiment continues to deteriorate, with US equities tumbling while US Treasury yields advanced. Nevertheless, the XAG/USD erased some of its Monday losses, trading at $21.27, above its opening price, after hitting a daily low of $20.92.

Investors’ mood shifted sour, weighed by a big US tech company slide. Data revealed by the US Conference Board (CB) showed that consumer confidence dropped to a four-month low of 100.2. “The combination of inflation and interest rate hikes will continue to pose challenges to confidence and economic growth into early 2023,” said Lynn Franco, senior director of economic indicators at the Conference Board.

Elsewhere, Federal Reserve officials remained hawkish, led by the St. Louis Fed President James Bullard saying that the US central bank has “ways to go to a restrictive policy.” The New York Fed President John Williams echoed some of his comments, adding that the strong economy in the US “suggests a modestly higher path for policy relative to September. Not a massive change, but somewhat higher.” Meanwhile, money market futures have priced in a 50 bps hike in December, with odds of a 75 jumbo increase at 15%.

In the meantime, the Covid-19 riots in China appeared to wane as health officials urged local governments to avoid unnecessary and lengthy lockdowns. Chinese health officials said the Omicron variant is less severe while committed to vaccinating elder people aged 80 or older.

Aside from this, the US 10-year Treasury bond yield continued to climb five bps, at 3.735%, capping XAG/USD gains. Of note, Silver rested the 200-day Exponential Moving Average (EMA) at $21.32, though failure to break it could pave the way for a re-test of the $20.00 psychological level.

Meanwhile, the US Dollar Index (DXY), a measure that tracks the greenback’s value against a basket of peers, is gaining 0.05% up at 106.705, putting a lid on XAG/USD prices.

The US docket would be busy with the release of ADP figures, GDP, the Goods Trade Balance, Wholesales Inventories, the Chicago PMI, JOLTs report, Pending Home Sales, and Fed speaking, led by the Federal Reserve Chairman Jerome Powell.

Silver Price Analysis (XAG/USD): Technical outlook

Even though Silver reclaimed $21.00, the white metal broke below a one-month-old upslope trendline drawn since the beginning of November, which, intersects with the 200-day EMA around $21.32, a difficult resistance to surpass. The Relative Strength Index (RSI) at bullish territory suggests buyers are in charge, though lacking the strength to break the latter. Tuesday’s candle, with a long upper wick, portrays sellers stepping in; therefore, the XAG/USD might consolidate.

XAG/USD key resistance levels lie at the 200-day EMA at $21.30, followed by November’s 24 high of $21.67, ahead of $22.00. On the flip side, XAG/USD first support would be $21.00, which, once cleared, could send the white metal sliding to the 50-day EMA at $20.00.

- EUR/USD bulls are being pushed back in a switch on Wall Street.

- Eyes will be on the Federal Reserve chairman Jerome Powell.

EUR/USD is back to flat as the North American session heads into the late afternoon trading. EUR/USD fell from a high of 1.0394 to a low of 1.0325 on the day so far and sits near 1.0340 at the time of writing. Growth stocks on Wall Street have extended declines, overshadowing a rise in energy shares after oil prices pared back gains on OPEC+ output concerns, overall weighing on riskier currencies as the US Dollar rebounds.

The euro was initially buoyed earlier on Tuesday due to the hopes of a potential easing in China's strict pandemic restrictions following an unprecedented episode of unrest in the country. Consequently, DXY fell 0.4% to 106.19. Nevertheless, two economic indicators sauntered through the door on Tuesday, missing expectations, and potentially weighing on risk sentiment.

The Conference Board's (CB) index shaved off 2 points to come in at 100.2, a hair above the 100 consensus. Additionally, the S&P DJI Case-Shiller home price data showed monthly declines across the board in its 20-city composite. Year-over-year, the composite added 10.4%, vs. August's 13.1% reading. Eyes will now be on the November employment report in Nonfarm Payrolls which is expected on Friday.

Fed's Powell coming up

Meanwhile, flash euro zone inflation figures for November are due on Wednesday, with economists polled by Reuters expecting inflation to come in at 10.4% year-on-year. The key event, however, for Wednesday will be in the comments from Fed Chair Jerome Powell. These will be scrutinised for new signals on further tightening. The Fed is widely expected to hike rates by an additional 50 basis points when it meets on Dec. 13-14. WIRP suggests that is fully priced in, with around 15% odds of a larger 75 bp move. The swaps market is still pricing in a peak policy rate of 5.0%, with small odds of a 5.25% peak.

However, St Louis Fed CEO James Bullard said the Fed has “a ways to go to get to” restrictive policy, adding that the first 250 bp of tightening was just enough to get to neutral. He added that the Fed needs to move further into a restrictive territory and may need to keep rates higher through 2023 and 2024. Additionally, Bullard stressed that markets are underpricing the risks that the Fed may be more aggressive.

''Bullard and the hawks have been right the whole time,'' analysts at Brown Brothers Harriman said. ''We think the less hawkish ones at the Fed are pushing back a bit now but will likely be forced to capitulate once again if inflation remains sticky, as we expect.''

- The Japanese Yen strengthened against the US Dollar amid a deteriorated mood.

- USD/JPY Price Analysis: Downward biased, but failure to reclaim 137.50 could exacerbate a rally to 140.00.

The US Dollar (USD) falls against the Japanese Yen (JPY) amid a risk-off sentiment as shown by US equities trading in the red, while US Treasury yields rise and the USD remains on the back foot. At the time of writing, the USD/JPY is trading at 138.39 after hitting a daily high of 139.35.

USD/JPY Price Analysis: Technical outlook

Following Monday’s price action that formed a hammer with an extended bottom wick, the USD/JPY registered moderate losses though stays above the psychological 138.00 figure. It should be noted that the 50 and 100-day Exponential Moving Averages (EMAs) slopes are getting flat, meaning the pair is trendless, stuck within the 137.00-139.50 area. Furthermore, the Relative Strength Index (RSI) at 34.20 turned flat.

Short-term, the USD/JPY 4-hour chart is downward biased, trading below the 50, 100, and 200 (EMAs) ordered in a perfectly bearish way. The USD/JPY faces solid support at the S1 daily pivot point at 137.80. Traders should be aware that a five-month-old upslope trendline passes around 137.50, which, once cleared, could open the door towards the 137.00 figure, followed by the S2 daily pivot at 136.68 and the S3 pivot level at 135.87.

On the flip side, the USD/JPY first resistance would be the daily pivot at 138.61. Break above will expose the confluence of the R1 daily pivot and the 50-EMA at 139.73/85, followed by the 140.00 psychological level, ahead of the R3 daily pivot point at 140.55.

USD/JPY Key Technical Levels

Growth data released on Tuesday showed the Canadian economy expanded 0.1% in September on a monthly basis and at a 0.7% rate in the third quarter, surpassing expectations of a 0.4% rate. Analysts at CIBC, point out that while headline growth was stronger than expected in the third quarter it shouldn’t change the trajectory for Bank of Canada policy. They continue to expect a final 50bp rate hike to a peak of 4.25%.

Key Quotes:

“On the surface, the Canadian economy performed much better than expected in Q3, with GDP rising by 2.9% (consensus +1.5%) and representing only a modest cooling relative to the prior quarter. However, the more you dig into the detail, the weaker the economy looks, with growth driven largely by exports and inventory building.”

“Domestic demand was actually lower than in the prior quarter, with that drop including an unexpected decline in consumer spending. Because of this, the stronger headline growth figure shouldn’t be a concern for the Bank of Canada, and we continue to see only a further 50bp of tightening to a peak interest rate of 4.25%.”

Preliminary data released on Tuesday showed a larger-than-expected decline in annual inflation in Germany to 10%. According to Sebastian Becker, Senior Economist at Deutsche Bank, the downward surprise is largely explained by the unexpected energy price drop. He warns that core inflation dynamics might remain strong for now.

Key Quotes:

“Today's downward CPI surprise has further nourished hopes that the inflation peak might be near (or could already be behind us). However, we reckon that the lower-than-expected November print for the year-over-year CPI inflation rate can be largely attributed to the unexpected drop in the CPI energy price component (and not ebbing core inflation dynamics). Although lower crude oil prices and a stronger EUR exchange rate might help further to tame energy price inflation in the near to medium term, we believe that electricity and gas prices might still climb considerably further – and hence might be only dampened more substantially once the "energy price brakes" take effect in early 2023.”

“Moreover, in our opinion core inflation dynamics might remain strong in the foreseeable future as companies might still have to pass over significant parts of their higher input costs to their customers.”

“Overall, we expect the CPI inflation rate (annual average) to reach a high 8.1% in 2022 before easing to around 7.5% in 2023 and 3.8% in 2024. That said, we expect that the introduction of the "energy price brakes" for gas, district heating and electricity in early 2023 are set to considerably dampen household energy prices and hence headline inflation.”

Citing five sources familiar with the matter, Reuters reported on Tuesday that OPEC and its allies including Russia, known collectively as OPEC+, was likely to stick with the existing oil output policy at the December 4 meeting.

Two other sources, however, told Reuters that the group could consider further reducing the oil output.

Market reaction

Crude oil prices came under modest selling pressure following this headline. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $77.75, where it was still up 1.6% on a daily basis.

Silver posted a disappointing performance this year as it moved from a high of just over $26.40 in March to a low of $17.81 in early September. Strategists at TD Securities expect XAG/USD to extend its correction lower before staging a recovery phase in late 2023 and 2024.

Pending sell-off will be more severe than that of Gold

“As the Fed keeps on tightening into early 2023, we expect Silver to trend down to below the Q1-2023 average of $18. Its higher volatility and sensitivity to the industrial economy prompts us to believe that the pending sell-off will likely be more severe than that of Gold.”

“Silver is projected to reach $21+ by Q4-2023 and over $23 in late 2024.”

- US Dollar falls again versus Emerging Market currencies.

- USD/MXN hits lowest level since February 2020 and the rebounds.

The USD/MXN broke below 19.25 and fell to 19.03, reaching the lowest level since February 2020. During the beginning of the American session, the dollar started to recover ground. As of writing, the pair is hovering around 19.17, far from the lows, still on its way to the lowest daily close in years.

The area around 19.00/05 is a major support. A break lower would open the doors to more losses. As long as it remains above, a consolidation between 19.00/05 and 19.25/30 seems likely.

The decline took place amid a rally of emerging market currencies. USD/BRL is falling by 1.20%, USD/KRW by 1.05% and USD/ZAR by 1.05%.

Key data ahead

US Q3 GDP data is due on Wednesday. The critical report of the week will be on Friday with the numbers from the US official employment report. Non-farm payrolls are expected to rise by 200K and the unemployment rate to remain at 3.7%.

In Mexico, the central bank will release on Wednesday its quarterly inflation report. The November CPI is due December 8. While inflation headline have been trading lower, the core is at multi-year highs.

“At the last policy meeting November 10, the bank hiked rates 75 bp to 10.0% and said “In its next meetings, the Board will assess the magnitude of the upward adjustments to the reference rate based on the prevailing conditions.” This suggests a potential downshift to 50 bp at the next meeting December 15. Indeed, there was one dissent in favor of a smaller 50 bp move and others may follow if inflation pressures ease”, explained analyst at BBH.

Technical levels

- Federal Reserve’s hawkish commentary failed to underpin the US Dollar.

- Improvement in risk appetite linked to China’s Covid-19 outbreak bolstered the British Pound.

- US Conference Board Consumer Confidence fell to a four-month low, weighed on the USD.

The GBP/USD advances as the North American session begins, amid a mixed sentiment, due to US Federal Reserve (FED) officials’ hawkish comments and no escalation in China’s riot linked to the recent Covid-19 outbreak. Data from the United States (US) was largely ignored by market players, with most focused on Wednesday’s crowded docket and Fed Chairman Jerome Powell’s speech. At the time of writing, the GBP/USD is trading at 1.2010.

Market mood remains positive, weighing on the USD

US equities wavered as Wall Street opened. On Monday, the St. Louis Fed President James Bullard said the Fed has “a ways to go to get to restrictive policy,” adding that the first 250 bps was to get rates neutral. He emphasized that rates need to be at around 5% to 7% through 2023 and 2024. Echoing some of his comments was the New York Fed John Williams, who said that the strong economy in the US “suggests a modestly higher path for policy relative to September. Not a massive change, but somewhat higher.” Meanwhile, money market futures have priced in a 50 bps hike in December, with odds of a 75 jumbo increase at 15%.

Aside from this, the Covid-19 outbreak in China has not escalated as initially thought, as global equities remained mixed but tilted to the upside. According to the Wall Street Journal, the National Health Commission urged local governments to avoid unnecessary and lengthy lockdowns. Chinese health officials said the Omicron variant is less severe while committed to vaccinating elder people aged 80 or older.

Meanwhile, the US Dollar Index (DXY), a measure that tracks the greenback’s value against a basket of six currencies, is losing 0.26%, down at 106.393, a tailwind for the GBP/USD pair. Of note, US Treasury yields are rising, even though the buck remains defensive.

Data-wise, the US economic calendar featured the Conference Board (CB) Consumer Confidence, which decreased to 100.2 to a 4-month low. Lynn Franco, senior director of economic indicators at the Conference Board, said, “The combination of inflation and interest rate hikes will continue to pose challenges to confidence and economic growth into early 2023.”

As of writing, the Bank of England (BoE) Governor Andrew Bailey said that the “scale of QE hasn’t blurred the distinction between monetary and fiscal policy.”

What to watch

The UK economic calendar will feature the Bank of England Huw Pill crossing wires. The US docket would be busy with the release of ADP figures, GDP, the Goods Trade Balance, Wholesales Inventories, the Chicago PMI, JOLTs report, Pending Home Sales, and Fed speaking, led by the Federal Reserve Chairman Jerome Powell.

GBP/USD Key Technical Levels

Eurostat will release the Eurozone Harmonised Index of Consumer Prices (HICP) data for November on Wednesday, November 30 at 10:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of six major banks regarding the upcoming EU inflation print.

The headline annualized HICP is expected to slow to 10.4% in November vs. 10.6% in October, with the core figure seen steady at 5.0%. On a monthly basis, the HICP in the old continent is expected to stay unchanged at 1.5% in the reported period while the core HICP is also seen flat at 0.6%.

Commerzbank

“The development of energy prices is likely to have pushed down the inflation rate by around 0.4 percentage points in November. This contrasts with the continued sharp rise in food prices, which was largely responsible for the increase in the inflation rate in recent months. And the inflation rate excluding energy, food and beverages is also likely to have risen slightly further in November, from 5.0% to 5.1%. Overall, the inflation rate is therefore likely to fall only slightly from 10.6% to 10.4%. Moreover, the inflation rate could mark a new record high as early as December. Nevertheless, the slight decline in the inflation rate in November is likely to play into the doves' hands, who are in favor of a more moderate key rate hike of only 50 basis points in December.”

Danske Bank

“We look for euro inflation to rise to 10.8% YoY from 10.6% YoY but that core inflation holds steady at 5.0% YoY.”

Nomura

“We forecast headline HICP inflation to accelerate by 0.2pp to 10.8% YoY, whereas we expect core HICP inflation to accelerate by 0.1pp to 5.1% YoY. In our view, this will be pivotal for the ECB in deciding whether to hike by 75 bps at its December meeting versus hiking by 50 bps.”

TDS

“We now look for aggregate euroarea headline inflation to come down to 10.3% YoY. We think energy will be the big story this month, as the sharp drop in wholesale natural gas prices passes through to weaker energy inflation; however, uncertainty is high in this regard, which leaves both upside and downside risks to our forecast. Market focus should mainly be on the core number, which we think ticked down to 4.9% YoY, as ECB officials have deemed it a deciding factor in shaping their views for the December decision. While a big upside surprise could further skew risks towards a third consecutive 75 bps hike, anything else will likely further cement calls for a pivot to a 50 bps increase.”

SocGen

“We think HICP could decrease for the first time since mid-2021, falling from 10.6% to 10.2% in November. However, inflation has consistently surprised to the upside and there is a risk it could end up being higher than we expect. Due to negative base effects, we also see core inflation temporarily falling from 5% to 4.7%.”

Citibank

“The November HICP reading is a key data release likely influencing the outcome of the December ECB meeting, between a 50 bps and a 75 bps hike. Headline inflation could post the first decline since mid-2020, driven by falling energy inflation. Uncertainty though remains on the energy HICP forecast, as retail gas prices may have dropped more than expected in some countries. Core dynamics however should stay strong. Euro Area: HICP Inflation, November: Citi Forecast 10.4% YoY, Prior 10.7% YoY (first decline since mid-2020); Core Inflation, November: Citi Forecast 5.0% YoY, Prior 5.0% YoY (still strong 0.4% MoM).”

Bank of England Governor (BOE) Andrew Bailey is testifying on policy and inflation outlook before the Lords Economic Affairs Committee.

Key takeaways via Reuters

"I do not think the scale of QE has blurred the distinction between monetary and fiscal policy."

"There has been no discussion with the government on the pace and timing of BOE asset sales."

"UK labour market has turned out to be much more constrained than we thought, different to other countries."

"QE was never intended to raise revenue for the UK government."

"Paying bank rate on boe reserves is the simplest way to pin down interest rates in line with BOE goals."

"No monetary policy reason to change reserve remuneration."

Market reaction

GBP/USD edged higher in the last hour and was last seen gaining 0.45% on the day at 1.2010.

The Reserve Bank of Australia (RBA) has slowed the speed of its tightening measures. An upside surprise on inflation data could raise concerns about the RBA’s stance and weigh on the Aussie, economists at Commerzbank report.

Is the RBA overly cautious?

“Price pressure in Australia remains high as inflation data tonight is likely to illustrate. As a result, the FX market might be of the view that RBA is not acting decisively enough against inflation.”

“If inflation were to surprise on the upside the market might get concerned that the RBA might underestimate inflation dynamics. Even though the RBA signalled that future rate decisions would be data dependent, the surprise slowing of the rate hike speed in October is likely to have caused doubts about the RBA’s determination.”

“The situation in China, Australia’s most important trade partner, might fuel additional concerns on that front. That means it might get difficult for the AUD to gain further ground against the USD.”

See: Australian CPI Preview: Forecasts from three major banks, inflation to accelerate further

The data published by the Conference Board showed on Tuesday that the Consumer Confidence Index declined to 100.2 in November from (revised from 102.5) 102.2 in October.

The Present Situation Index edged lower to 137.4 from 138.9 and the Expectations Index fell to 75.4 from 78.1 in the same period. Finally, the one-year inflation rate expectations rose to 7.2% from 6.9% in October.

Market reaction

These figures don't seem to be having a noticeable impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was virtually unchanged on the day at 106.58.

EUR/CAD has regained the 1.40 handle for the first time since March. Solid trend points to more gains, economists at Scotiabank report.

Key support seen around the 1.3750/1.3850 zone

“There is sufficient momentum behind this move to lift the target to 1.44 (50% Fib at 1.4427).”

“Trend momentum signals are aligned and strongly EUR-bullish across short-, medium- and long-term timeframes. This will not only support additional gains in the EUR but it should also limit corrective losses significantly moving forward.”

“We expect firm support on minor dips to the high 1.39s from here and see key support around the 1.3750/1.3850 congestion zone.”

- EUR/USD fails to extend the recovery beyond 1.0400.

- The 9-month resistance line still caps the upside.

EUR/USD alternates gains with losses in the low-1.0300s following another failed attempt to retake the 1.0400 barrier earlier on Tuesday.

So far, the 9-month resistance line, today around 1.0430, continues to cap occasional bullish attempts.

A sustained breakout of this region is needed to allow for the continuation of the uptrend to, initially, 1.0481 (November 15) ahead of 1.0496 (November 28).

EUR/USD daily chart

- The index struggles to continue the rebound around 106.70.

- The dollar keeps the positive outlook above the 200-day SMA.

DXY reverses the initial downside and looks to extend the move further north of the 106.00 mark on Tuesday.

In case the recovery becomes more serious, then the US Dollar could attempt to retest the weekly high at 107.99 (November 21) ahead of the temporary 100-day Simple Moving Average (SMA), today at 109.12.

While above the 200-day SMA, the outlook for the index should remain positive.

DXY daily chart

Gold posted a disappointing performance this year, moving from a high of just over $2,050 in March to a low of $1,617 in early-November. Economists at TD Securities expect the yellow metal to move below $1,600 in the coming months.

Gold to post a sustainable rally above $1,800 in the latter part of 2023

“Notwithstanding the recent rally, a continued sharp increase in US real and nominal rates along the short end of the curve is projected to drive Gold toward $1,575 in Q1-2023. “

“The yellow metal may well start to trend up toward $1,800+ after Q1, as it becomes clear that the Fed is approaching the end of its tightening cycle and the market starts to look toward cuts on the horizon.”

Australian Monthly Consumer Price Index (CPI) figures are due on Wednesday, November 30 at 00:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers of three major banks regarding the upcoming inflation data.

Headline is expected at 7.4% year-on-year in October vs. 7.3% in September.

Westpac

“Considering the partial indicators we have, and making reference to the timing of the surveys for the various components of the CPI, we are forecasting the Monthly Indicator to lift 0.6% in October holding the annual rate flat at 7.3%. We are nearing the peak in the annual pace of inflation but given the timing of the various surveys, we don’t expect to see it until December. From there we expect to moderate as we move through 2023 with the usual monthly volatility.”

ING

“We think the outcome will probably be close to the recent month-on-month rate of increase, which would keep it roughly in line with the same period last year and leave inflation at about 7.3%. That could be interpreted as the peak, so markets may respond positively to that.”

NAB

“Fuel prices, airfares, and rents suggest we should expect a high print and we pencil in a lift to 7.7% YoY (1.0% MoM) from 7.3% YoY in September based on the limited data that we have for the month. The RBA no doubt will take notice of the data, but the lack of updates on many of the market services categories likely limits interpretation. We expect the data to further solidify the need for the RBA to continue hiking in the near-term and see the RBA hiking rates by 25 bps in December, February, and March to 3.60%. Thereafter the key for the RBA outlook is whether wages growth remains consistent with a return of inflation to target as we assume – Governor Lowe has previously cited WPI wages growth of around 3½-4.0% as being consistent assuming a 1% productivity assumption. In coming months, the market services components of CPI will be watched closely given its sensitivity to wage outcomes and the tendency for services inflation to be stickier than for goods.”

Ho Woei Chen, Economist at UOB Group, reviews the recent move by the PBoC.

Key Takeaways

“The People’s Bank of China (PBoC) announced on Fri (25 Nov) that it will lower banks’ reserve requirement ratio (RRR) by 25 bps, effective from 5 Dec. This is the second RRR cut this year.”

“Coming on the back of the 16-point rescue package for the real estate market, the RRR cut was not unexpected and could contribute to the additional credit support to the country’s developers by reducing the amount of reserves that banks need to hold. It is estimated to release CNY500 bn of long-term liquidity into the system while banks have pledged at least CNY925 bn since the announcement.”

“The PBoC is likely not done with its monetary policy easing yet, as we see possibility of another cut to the RRR and/or the interest rate in 1Q23. We now expect the 1Y LPR to fall to 3.55% by end-1Q23 from current 3.65% and the 5Y LPR to 4.20% from current 4.30%.”

“Given increasing headwinds facing the economy, we expect 4Q22 GDP at 3.9%y/y (instead of our earlier forecast of 4.5%). The main source of uncertainty is the current surge in COVID-19 infections and spreading anti-lockdown protests that are unprecedented in China. We are keeping our full-year GDP forecast for 2022 at 3.3% for now, after incorporating the stronger than expected 3Q22 data.”

“We are also maintaining our 2023 GDP forecast for China at 4.8% as we anticipate further gradual easing of its COVID-19 measures next year as well as flow-through of the stimulus measures to be positive for the economy.”

- USD/CAD attracts fresh buying near the 1.3400 mark and jumps to a nearly three-week high.

- A goodish recovery in the US bond yields and a softer risk tone help revive the USD demand.

- The mixed Canadian GDP report weighs on the Loonie and further provides a lift to the major.

The USD/CAD pair reverses an intraday slide to the 1.3400 neighbourhood and climbs to a nearly three-week high during the early North American session. The buying interest picks up pace following the release of the monthly Canadian GDP print and lifts spot prices to the 1.3545-1.3550 region in the last hour.

Statistics Canada reported that the domestic economy expanded a nominal 0.1% in September and by 0.7% during the third quarter, beating estimates for a reading of 0.4%. This, however, was largely offset by a lower-than-anticipated annualized growth rate of 2.9% during the July-September period. The mixed data, along with a modest pullback in crude oil prices, weighs on the commodity-linked Loonie and acts as a tailwind for the USD/CAD pair.

The US Dollar, on the other hand, trims a part of its intraday losses, which is seen as another factor lending support to the USD/CAD pair. The initial optimism led by hopes that the Chinese government will scale back its strict anti-COVID restrictions fades rather quickly amid worries about a deeper global economic downturn. Apart from this, a goodish intraday bounce in the US Treasury bond yields helps revive demand for the safe-haven buck.

The overnight hawkish remarks by influential FOMC members seem to act as a tailwind for the US bond yields and the USD. In fact, St. Louis Fed President James Bullard, New York Fed President John Williams and Fed Vice Chair Lael Brainard stated that more rate hikes were warranted and there was a long way to go to fight inflation. Furthermore, technical buying above the 1.3500 psychological mark provides an additional boost to the USD/CAD pair.

Next on tap is the release of the Conference Board's US Consumer Confidence Index. This, along with the US bond yields and the broader risk sentiment, will drive the USD demand. Apart from this, traders will take cues from oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

- Canadian economy grew at a much softer pace than expected in Q3.

- USD/CAD rose above 1.3500 with the initial reaction to the disappointing data.

The real Gross Domestic Product (GDP) in Canada expanded at an annualized rate of 2.9% in the third quarter, Statistics Canada reported on Tuesday. This reading followed the 3.2% (revised from 3.3%) growth recorded in the second quarter and missed the market expectation of 3.5% by a wide margin. On a quarterly basis, the real GDP grew by 0.7%.

"Growth in exports, non-residential structures, and business investment in inventories were moderated by declines in housing investment and household spending," Statistics Canada noted in its press release.

Market reaction

The USD/CAD pair shot higher with the initial reaction and it was last seen trading at its highest level since November 10 at 1.3525, gaining 0.2% on a daily basis.

- EUR/JPY adds to Monday’s retracement and revisits 143.00.

- Further decline could see the mid-142.00s revisited near term.

EUR/JPY extends the pessimism seen at the beginning of the week and puts the 143.00 area to the test on Tuesday.

In case the selling pressure gathers extra steam, then the cross could attempt a move to the November low at 142.54 (November 11) ahead of the temporary 100-day SMA, today at 141.62.

In the longer run, while above the key 200-day SMA at 138.89, the positive outlook is expected to remain unchanged.

EUR/JPY daily chart

GBP/USD regains positive traction on Tuesday and trades above the 1.2000 mark. Economists at Scotiabank believe that a move above 1.2060 will add to positive momentum.

Support aligns at 1.1940, then 1.1900

“Regaining the 1.20 area has helped steady the Pound and we think that additional gains through 1.2060 intraday will add to positive momentum.”

“Support is 1.1940, ahead of 1.1900, intraday.”

“Sterling should remain generally better supported on mild dips for now.”

See: GBP to strengthen against the USD in 2023 – HSBC

- Gold price catches fresh bids on Tuesday amid the emergence of fresh US Dollar selling.

- Bets for less aggressive rate hikes by the Federal Reserve continue to weigh on the USD.

- A positive risk tone seems to keep a lid on any further gains for the safe-haven XAU/USD.

Gold price regains positive traction on Tuesday and reverses the previous day's retracement slide from more than a one-week high. The XAU/USD maintains its bid tone heading into the North American session and trades near the top end of its daily range, around the $1,755 region.

Renewed US Dollar selling benefits Gold price

The US Dollar fails to capitalize on the overnight bounce from a technically significant 200-day Simple Moving Average (SMA) amid expectations for a less aggressive policy tightening by the Federal Reserve. The emergence of fresh selling around the Greenback turns out to be a key factor driving flows towards the US Dollar-denominated Gold price.

Expectations for a dovish Federal Reserve weigh on US Dollar

The minutes of the November Federal Open Market Committee (FOMC) meeting released last week cemented bets for a relatively smaller 50 bps rate hike in December. This is reinforced by sliding US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond languishes near a two-month low and continues to weigh on the US Dollar.

Upside potential for Gold price seems limited

That said, the overnight hawkish remarks by Federal Reserve officials should limit the downside for the US bond yields and the US Dollar. In fact, St. Louis Fed President James Bullard, New York Fed President John Williams and Fed Vice Chair Lael Brainard stated that more rate hikes were warranted and there was a long way to go to fight inflation.

Apart from this, a modest recovery in the global risk sentiment, as depicted by a stable performance in the equity markets, might also contribute to capping the safe-haven Gold price. Investors turned optimistic amid speculation that the Chinese government is considering scaling back its strict anti-COVID policies to prevent more protests.

The mixed fundamental backdrop warrants some caution for aggressive traders and before positioning for any further appreciating move for Gold price. Market participants now look to the release of the Conference Board's US Consumer Confidence Index. This, along with the US bond yields, will influence the USD and provide a fresh impetus to Gold price.

The focus, however, will remain on Fed Chair Jerome Powell's speech on Wednesday. Investors will be seeking more clarity on the central bank’s policy stance and future rate hikes. Furthermore, this week's important US macro data, including the closely-watched Non-Farm Payrolls (NFP) report, should determine the near-term trajectory for Gold price.

Gold price technical outlook

From a technical perspective, any subsequent move up is likely to confront resistance near the $1,770-$1,772 region. A sustained strength beyond will be seen as a fresh trigger for bulls, allowing Gold price to surpass the $1,778 intermediate hurdle and retest the $1,786 area, or its highest level since mid-August touched earlier this month. The momentum could further get extended and assist the XAU/USD to reclaim the $1,800 psychological mark.

On the flip side, the $1,740-$1,739 region now seems to have emerged as immediate strong support ahead of the $1,736-$1,735 region and the $1,725 zone, or a nearly two-week low touched last Wednesday. Failure to defend the said support levels might negate the positive outlook and prompt some technical selling, dragging Gold price further towards the $1,700 round-figure mark.

Key levels to watch

"Medium-term inflation expectations are very important for my assessment of where bank rate should go," Bank of England (BOE) policymaker Catherine Mann said on Tuesday, as reported by Reuters.

"Once inflation expectations have been managed, the bank rate can come off a future peak," Mann added and noted that the foreign exchange rate is an "important ingredient" for the UK inflation.

Market reaction

These comments don't seem to be having a significant impact on Pound Sterling's performance against its rivals. As of writing, GBP/USD was up 0.55% on the day at 1.2025.

- Annual CPI in Germany fell more than expected in November.

- EUR/USD continues to trade in positive territory slightly below 1.0400.

Inflation in Germany, as measured by the Consumer Price Index (CPI), declined to 10% on a yearly basis in November from 10.4% in October. This reading came in lower than the market expectation of 10%. On a monthly basis, the CPI declined 0.5%.