- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 30-11-2022

- GBP/USD rallies on dovish speech by Federal Reserve Chair Jerome Powell.

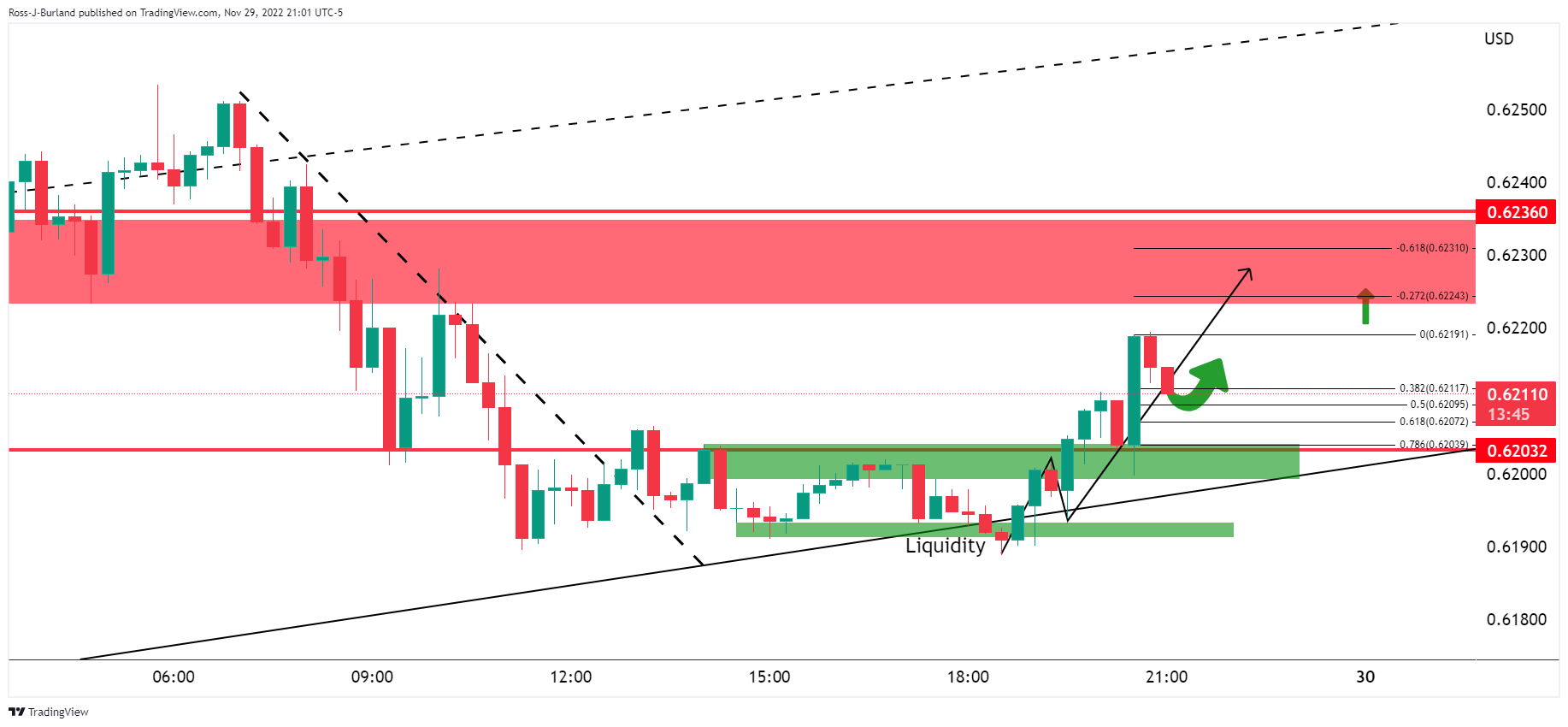

- The 1-hour GBP/USD chart shows a break of the structure (BoS).

- GBP/USD bulls could be targeting liquidity at 1.2150.

GBP/USD staged a significant recovery on Wednesday after an earlier drop on fear of a hawkish speech from Federal Reserve (Fed) chairman Jerome Powell. The British Pound broke 1.2080 into the rollover on Thursday following a rally from the depths of the day's business at 1.1900. A number of factors are impacting GBP/USD from all sides of the world, including China coronavirus, Bank of England (BoE) and Fed sentiment.

US Dollar sinks on Fed dovish rhetoric

Fed's Jerome Powell signalled that the central bank will be raising rates by just 50bps in December which weighed on the US Dollar. Fed's Jerome Powell said the policy will most likely need to remain restrictive for some time and that it makes sense to moderate the pace of interest rate increases. He said that the time to slow the pace of rate hikes could come as soon as the December meeting.

Consequently, a weaker US Dollar index, DXY, fell out of the sky to a low of 105.77. The yield on the US 10-year note was down to 3.604%, dropping below the last low that was made on November 28th. The US Dollar is on track for its biggest monthly loss since September 2010 as investors look toward the Fed reaching a peak rate early next year. Markets now see a 75% chance for a smaller 50 bps interest rate hike in December, after four consecutive 75 bps increases.

China coronavirus risk

China coronavirus risks continue to drive markets and signs that the nation would soon reopen its economy have lifted the commodity complex mid-week. There was some favourable news for risk currencies such as the British Pound of China starting to immunize senior citizens against COVID-19. Authorities also announced the lifting of lockdowns in around half of the districts throughout the southern metropolis of Guangzhou on Wednesday afternoon.

GBP positioning

Analysts at Rabobank explained earlier in the week that net short GBP speculators’ positions fell back for a fourth consecutive week as gilts yields stayed at pre-mini budget levels:

''While a new Prime Minister has followed a new Chancellor and emergency measures from the BoE, all of which have supported UK assets, the country’s fundamentals remain sour. A hefty 75 bps rate hike from the BoE this month failed to support the pound in the spot market, given the Bank’s gloomy UK economic forecasts,'' the analysts said. ''The sour tone of OBR forecasts has weighed on GBP in the spot market since the Autumn Statement.''

In the spot market, the British Pound has made its biggest one-month gain against the dollar since July 2020. However, fears of a lengthy UK recession are still weighing on sentiment, with the pound down 10% this year. Market players are pondering the BoE's next move, with the Monetary Policy Committee, the BoE's rate-setting body, expected to increase rates by 50 basis points with a lesser 25% chance of a 75 basis point hike.

GBP/USD technical analysis

GBP/USD is running into an area of prior resistance where liquidity is eyed between 1.2270/90/20. In the meantime, 1.1900 is key to the downside. As seen on the 1-hour chart, 1.1900 liquidity was swept:

GBP/USD H1 chart

The 1-hour GBP/USD chart shows a break of the structure (BoS) but the price imbalances left behind could offer the bulls targeting liquidity at 1.2150 a discount. Below a 50% mean reversion offers a price in GBP/USD at 1.1990 while 1.1970 comes near a 61.8% ratio.

- NZD/USD has reclaimed a three-month high of 0.6320 amid the improved risk appetite of investors.

- An establishment above the 200-EMA adds to the upside filters.

- The RSI (14) is oscillating in a bullish range of 60.00-80.00, which indicates more upside ahead.

The NZD/USD pair reclaimed its three-month high around 0.6320 in the early Tokyo session. The kiwi asset is enjoying significant liquidity as the Federal Reserve (Fed)’s confirmation of a slowdown in the interest rate hike pace has strengthened the risk appetite theme in the global market. The kiwi asset has resumed its upside journey after a mild correction to 0.6290 and has tested Wednesday’s high.

Meanwhile, the US Dollar Index (DXY) has displayed a steep fall after struggling around 106.00 and is expected to test Wednesday’s low at 105.80 in no time.

On a daily scale, the asset is comfortably established above the 200-period Exponential Moving Average (EMA) at around 0.6200, which indicates that the long-term trend has turned bullish. Also, a bull cross, represented by the 20-and 50-EMAs at 0.5871, indicates a continuation of the upside. Going forward, the ultimate resistance is placed from the August 12 high at 0.6470.

Apart from that, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates that the upside momentum is intact.

For further upside, a decisive move above Thursday’s high at 0.6317 will drive the kiwi asset towards August 1 high at 0.6353, followed by the round-level resistance at 0.6400.

On the contrary, the US Dollar could regain strength if the asset surrenders Monday’s low at 0.6155, which will drag the pair towards the round-level support at 0.6100. A slippage below 0.6100 will expose the kiwi asset for more downside toward July 14 low around 0.6060.

NZD/USD daily chart

-638054486483303761.png)

- US Dollar Index stays pressured after reversing from 21-DMA.

- Four-month-old ascending support line lures bears but further downside appears limited.

- 61.8% Fibonacci retracement level acts as immediate resistance.

US Dollar Index (DXY) bears keep the reins around 105.90 during early Thursday, taking a breather after posting the biggest monthly slump since September 2010.

The Greenback’s gauge versus the six major currencies reversed from the 21-Day Moving Average (DMA) the previous day to print the latest losses. The bearish move also gained clues from sluggish Moving Average Convergence and Divergence (MACD) and downbeat Relative Strength Index (RSI) line, placed at 14, not oversold.

With these conditions met, the DXY sellers are all set to approach an upward-sloping support line from early August, around 105.40.

However, the likely oversold RSI conditions around 105.40 support might stop the US Dollar bears around then, if not then the monthly low near 105.30 and the 105.00 round figure may challenge the quote’s further downside. Also acting as a downside filter is August month’s bottom surrounding 104.65.

Alternatively, the 61.8% Fibonacci retracement level, also known as the golden ratio, of the DXY’s May-September upside, near 106.45, restricts nearby upside move.

Following that, the 21-DMA level of 106.52 and the latest swing high near 107.20 could test the DXY bulls.

It’s worth noting, however, that the US Dollar Index remains on the bear’s radar unless crossing July’s high near 109.30. That said, the 50% Fibonacci retracement level surrounding 108.00 acts as an extra filter to the north.

US Dollar Index: Daily chart

Trend: Limited downside expected

- Gold price grinds higher after posting the biggest daily jump in three weeks.

- Federal Reserve Chairman Jerome Powell’s dovish commentary, United States data favored XAU/USD buyers.

- US Dollar dropped as Powell confirmed Fed’s slower interest rate hikes from December.

- Optimism surrounding China, likely weakness in US data tease Gold buyers towards refreshing monthly high.

Gold price (XAU/USD) begins December on a firmer footing around $1,768, after posting the biggest monthly gains in 29 months during November. That said, the yellow metal’s latest run-up could be linked to the dovish comments from Federal Reserve (Fed) Chairman Jerome Powell, as well as optimism surrounding China. However, buyers seem to take a breather ahead of the Fed’s preferred inflation gauge, namely the United States Core Personal Consumption Expenditure (PCE) Price Index for October.

Federal Reserve Chairman Jerome Powell drowned US Dollar, pumped Gold price

On Wednesday, Fed Chair Jerome Powell marked his first public appearance after November’s Federal Open Market Committee (FOMC) meeting while speaking at the Brookings Institute on the economic outlook, inflation and employment. The policymaker stated that it makes sense to moderate the pace of interest rate increases while also suggesting that the time to slow the pace of rate hikes could come as soon as the next meeting in December.

Ahead of him, Federal Reserve member of the Board of Governors Lisa D. Cook also spoke and praised the inflation data to signal that the Fed would likely take smaller steps as it moves forward.

Following Powell’s speech, the market’s wagers favoring a 50 basis points (bps) rate hike from the Federal Reserve in December increased from 69.9% ahead of the speech to above 75%.

With this, the US Dollar Index (DXY) snapped a three-day uptrend while portraying the biggest daily loss in a week, not to forget mentioning the biggest monthly fall in 12 years. It’s worth noting that the Wall Street benchmarks cheered the dovish remarks from Fed Chair while the United States 10-year Treasury bond yields reversed the early gains to end November on a negative footing around 3.61%.

Given the inverse relationship between the US Dollar and Gold, the metal cheered a slump in the Greenback by crossing the key technical hurdle and luring buyers.

Data from United States also favored XAU/USD bulls

In addition to the dovish comments from the Federal Reserve (Fed) policymakers, downbeat economics from the United States (US) also underpinned the Gold price rally the previous day.

Among them, US ADP Employment Change gained major attention as it marked the lowest readings since January 2021 with a 127K figure for November versus 200K forecast and 239K previous readings. On the same line was the US JOLTS Job Openings for October that eased to 10.334M versus 10.3M expected and 10.687M prior. On the other hand, the second estimate of the US Gross Domestic Product (GDP) Annualized for the third quarter (Q3) marked 2.9% growth versus 2.6% initial forecasts.

China-linked optimism adds strength to Gold price run-up

Considering China’s status as one of the biggest consumers of the Gold, the recent easing in the nation’s daily Covid infections favored the XAU/USD bulls. That said, the Dragon nation reported just around 38,000 daily Coronavirus cases on Tuesday, conveyed on Wednesday, marking the second consecutive day of receding virus numbers after refreshing the record high.

Not only the easy cases but the gradual reliefs in the virus-led activity controls in major cities like Zhengzhou, Guangzhou and Chongqing, also seemed to have favored the Gold price.

United States Core PCE Inflation eyed

Looking forward, US Core PCE Inflation, expected 5.0% YoY in October versus 5.1% prior, will be crucial for immediate Gold price moves as a surprise increase in the inflation numbers could probe the XAU/USD bulls. Also important will be the monthly prints of the US ISM Manufacturing PMI for November, expected 49.8 versus 50.2 prior.

Also read: US October PCE inflation & ISM Manufacturing PMI Preview: Seen through Fed’s eyes

Overall, the Gold price remains on the buyer’s radar ahead of the key US data.

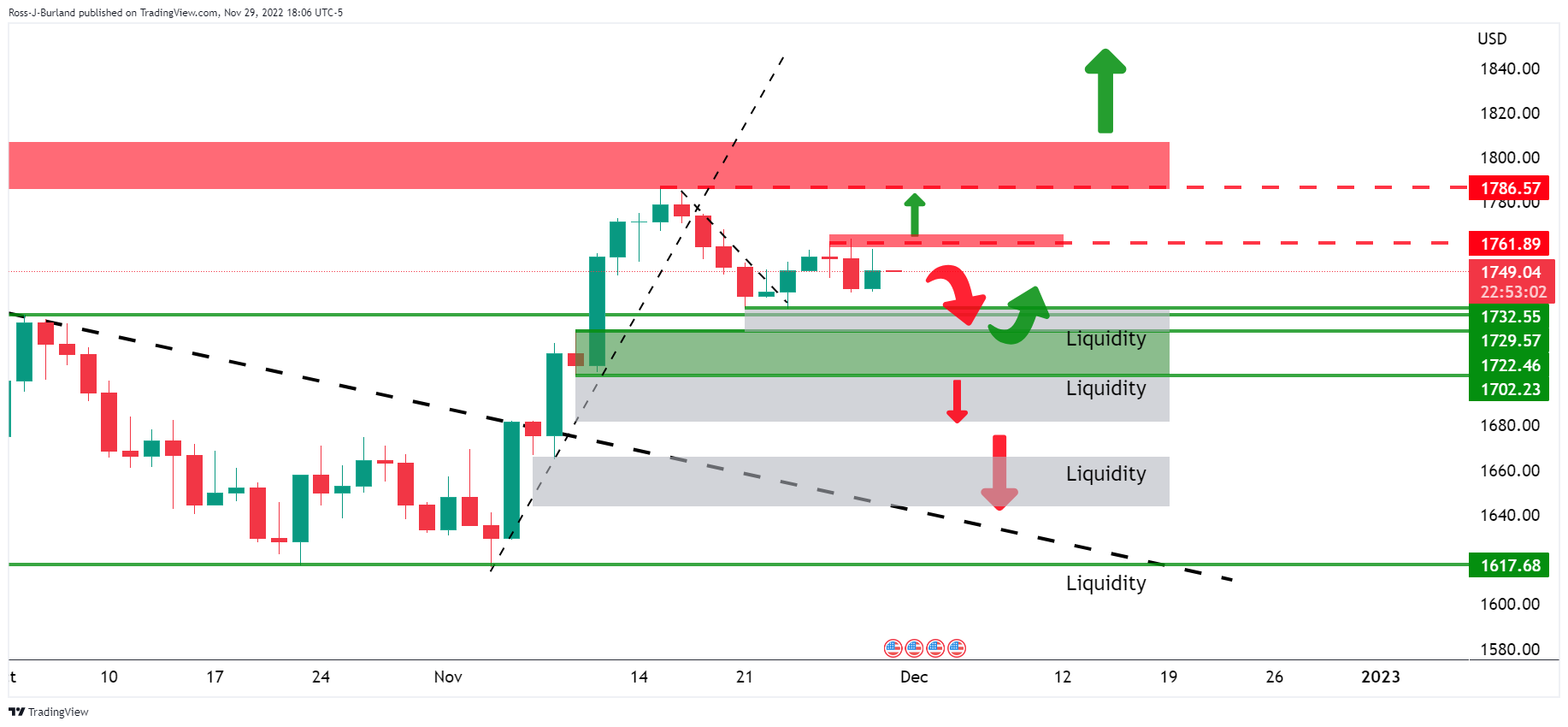

Gold price technical analysis

Gold price remains firmer after confirming further upside momentum by breaking a two-week-old descending trend line, as well as marking repeated bounces off the 100-bar Simple Moving Average (SMA), mostly known as the 100-SMA.

The bullion’s latest run-up also justifies the Moving Average Convergence and Divergence (MACD) indicator’s bullish signals, as well as firmer prints of the Relative Strength Index (RSI) line, placed at 14, which is not overbought.

With this, Gold price run-up towards the monthly high surrounding $1,787 appears imminent.

However, the $1,800 threshold and August month peak near $1,808 could challenge the XAU/USD bulls afterward.

On the flip side, the resistance-turned-support line, around $1,758 by the press time, restricts the immediate downside of the metal before the 100-SMA level surrounding $1,751.

It’s worth noting, however, that the Gold sellers might not risk entries unless witnessing a clear downside break of the one-month-old horizontal support, around $1,730.

Gold price: Four-hour chart

Trend: Further upside expected

- EUR/JPY is facing hurdles around 143.80 as the ECB is expected to shift to a lower rate hike structure.

- A decline in Eurozone HICP and an increment in German jobless numbers have weakened hawkish ECB bets.

- This week, the speech from Haruhiko Kuroda will be keenly watched.

The EUR/JPY pair is struggling to cross the immediate hurdle of 143.80 in the early Asian session. The cross is displaying a sideways auction profile in a 143.50-143.80 range after a perpendicular decline on Wednesday. A sheer fall in the cross was backed by a decline in the headline Eurozone Harmonized Index of Consumer Prices (HICP) and an increment in the German Unemployment Rate.

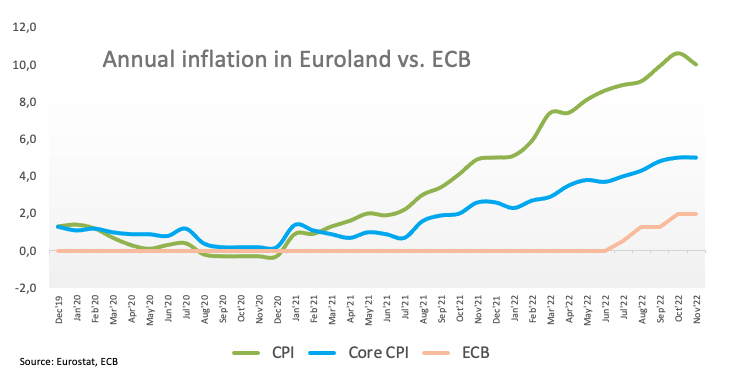

The headline Eurozone HICP landed at 10.0% lower than the expectations of 10.4% and the prior release of 10.6%. Thanks to a decline in energy prices that have resulted in a slowdown in inflationary pressures as food prices are still solid in the Eurozone economy. The core HICP numbers remained flat at 5.0% due to supply chain bottlenecks.

Meanwhile, the German Unemployment Rate escalated to 5.6% against expectations and the former release of 5.5%. Also, the Unemployment Change soared to 17K vs. the former release of 8K. Accelerating interest rates by the European Central Bank (ECB) has forced firms to use their current manpower optimally due to bleak economic projections.

A slowdown in employment generation and inflation has cemented the case of 50 basis points (bps) rate hike by the ECB in its December monetary policy meeting, as suggested by Commerzbank.

On the Tokyo front, investors are keeping an eye on a speech from Bank of Japan (BOJ) Haruhiko Kuroda. The BOJ Governor is expected to dictate cues about the likely monetary policy action and growth projections. Recently, a Reuters poll dictated that more than 90% of economists have supported the view of phasing out monetary easing in the latter half of CY2023. Any discussion related to the matter could strengthen Japanese yen bulls.

- Upbeat in risk sentiment weighed on the Japanese Yen and bolstered the Australian Dollar.

- US Federal Reserve Chair Jerome Powell gave the green light for lower-sized rate hikes.

- AUD/JPY Price Analysis: Upward biased, could print a fresh weekly high above 94.00.

The AUD/JPY advanced sharply on Wednesday amid an improved market sentiment spurred by the Federal Reserve (Fed) Chair Jerome Powell. He said that it makes sense to slow the speed of rate hikes while adding the Fed has made substantial progress towards a “sufficiently restrictive policy.” Therefore, the AUD/JPY bounced off the 200-day Exponential Moving Average (EMA) and rose almost 1%. At the time of writing, the AUD/JPY is trading at 93.64.

AUD/JPY Price Analysis: Technical outlook

On Thursday, the AUD/JPY daily chart portrays the cross as neutral-to-upward bias after bouncing at the 200-day Exponential Moving Average (EMA) at 92.79, reclaiming the 93.00 figure. As of writing, the AUD/JPY is pressuring the 50-day EMA at 93.67, which, if cleared, could drag the cross above the 94.00 mark toward the 100-day EMA at 94.29.

If that scenario is achieved, the next resistance would be November 16 weekly high at 94.65, followed by the November 8 swing high at 95.19.

Short-term, the AUD/JPY recovered some ground, particularly on Wednesday, after hitting a weekly low of 92.14, climbing more than 100 pips. Should be noted that the cross faces solid resistance at the 200-EMA at 93.68, but as the Relative Strength Index (RSI) is in bullish territory, the AUD/JPY might surpass the latter on its way toward the week’s high of 94.05.

AUD/JPY key resistance levels are at the weekly high of 94.05, followed by the R1 daily pivot at 94.19 and the R2 pivot point at 94.66. On the other hand, the AUD/JPY first support would be the 100-EMA at 93.45. A breach of the latter will expose the daily pivot at 93.37, followed by the 50-EMA at 93.14, ahead of the 93.00 figure.

AUD/JPY Key Technical Levels

- USD/CHF is displaying back-and-forth moves around 0.9450 after sheer volatility.

- A slowdown in growth rate and labor demand, and a decline in October inflation support Fed’s less-hawkish commentary.

- The US NFP is expected to display weak job numbers considering cues from US ADP Employment.

The USD/CHF pair turned sideways around 0.9450 in the early Asian session. Federal Reserve (Fed)-inspired massacre in the asset was followed by a casual recovery from around 0.9430 and the asset has turned sideways now to ease sky-rocketing volatility.

The risk appetite is extremely solid as the commentary from Fed chair Jerome Powell has confirmed that policymakers will consider a lower rate hike for December monetary policy meeting.

The less-hawkish commentary from the Fed chair sent the US Dollar Index (DXY) on a downside swing to near 105.80. The USD Index has also shown a mild recovery to near 106.00, however, the downside bias has been cemented. A stellar run in S&P500 portrays a cheerful market mood.

Meanwhile, the US Treasury yields have witnessed a bloodbath as investors poured liquidity into US Treasury bonds. The 10-year US Treasury yields have dropped to 3.60%.

The decision of slowing down the current pace of the interest rate hike by the Fed is backed by a deceleration in the employment generation process, a slowdown in growth rate, and a surprise decline in October’s inflation, which have put the Fed in a position where rate hike pace could be eased. The foremost agenda of the Fed is to bring price stability but it is not appropriate to ‘Crash the economy and clean it afterward, cited by Fed Chair.

For further guidance, investors are shifting their focus toward the United States Nonfarm Payrolls (NFP) data, which will release on Friday. The official employment report is expected to display a weaker number considering cues from US Automatic Data Processing (ADP) Employment data, which has shown fresh addition of 127K jobs in November.

On the Swiss franc front, investors are keeping an eye on Consumer Price Index (CPI) data. The monthly annual CPI figures are seen unchanged at 0.1% and 3.0% respectively. The Swiss National Bank (SNB) Chairman Thomas J. Jordan is still in favor of an expansionary policy to keep up the economic prospects.

- EUR/USD remains sidelined after posting the biggest daily gains in over a week.

- Bulls eye ascending resistance line from August on closing break of 200-DMA.

- 61.8% Fibonacci retracement level adds to the downside filters.

- MACD, RSI challenge bullish bias but bears have a long way to go before taking control.

EUR/USD bulls take a breather around 1.0400 during early Thursday, following the heavy run-up before a few hours, as traders await fresh clues to extend Fed Chair Jerome Powell-led gains. Also likely to have challenged the pair buyers are the signals from the Moving Average Convergence and Divergence (MACD) indicator and the Relative Strength Index (RSI) line, placed at 14.

Even so, the major currency pair’s sustained closing beyond the 200-DMA, around 1.0370 by the press time, keeps the buyers hopeful. On the same line could be the quote’s successful rebound from the 61.8% Fibonacci retracement level of June-September downside, close to 1.0300.

With this, the EUR/USD bulls keep their eyes on an upward-sloping resistance line from August 10, near 1.0500 at the latest, before targeting the late June swing high around 1.0615 and June’s peak surrounding 1.0775.

It should be noted that the impending bear cross on the MACD and the RSI’s nearness to the overbought territory suggests limited upside room for the quote.

However, the EUR/USD sellers may not risk entries until witnessing a clear break of the 61.8% Fibonacci retracement level, also known as the golden ratio, currently around 1.0300. That said, the 200-DMA level near 1.0370 restricts the immediate downside of the pair.

Should the quote drops below 1.0300, the previous weekly low near 1.0220 and September’s peak near 1.0200 could challenge the EUR/USD bears.

EUR/USD: Daily chart

Trend: Limited upside expected

- USD/CAD has expected to decline further to near 1.3400 as Fed sees a slowdown in the rate hike pace.

- S&P500 has displayed a juggernaut rally, portraying a stellar improvement in investors’ risk appetite.

- A significant jump in oil prices amid multiple tailwinds has strengthened the Canadian Dollar.

The USD/CAD pair plunged to near 1.3430 in the early Asian session after the Federal Reserve (Fed) chair Jerome Powell delivered a less-hawkish commentary on interest rate guidance. The loonie asset has shown a vertical decline from above 1.3550 and is expected to deliver more losses toward the round-level support of 1.3300 amid sheer weakness in the US Dollar Index (DXY).

The USD Index has printed a fresh three-day low at 105.80 as Fed Chair has confirmed a deceleration in the rate hike pace from December monetary policy meeting. Less-hawkish commentary from Fed Chair is backed by a surprise decline in October’s inflation report. Also, a slowdown in economic activities and moderation in labor growth indicate that inflation will dwindle further in the coming months.

S&P500 has displayed a juggernaut rally, portraying a stellar improvement in investors’ risk appetite. The returns on US Treasury bonds have witnessed a bloodbath. The 10-year US Treasury yields have dropped to near 3.60%.

Apart from that, the catalyst that has led to a significant fall in the US Dollar is the weak United Stated Automatic Data Processing (ADP) Employment data. According to the ADP Employment, the US economy has added 127K fresh jobs in the labor market, lower than the expectations of 200K and the prior release of 239K. Evidence of a slowdown in employment generation is going to weigh immensely on the inflation rate ahead.

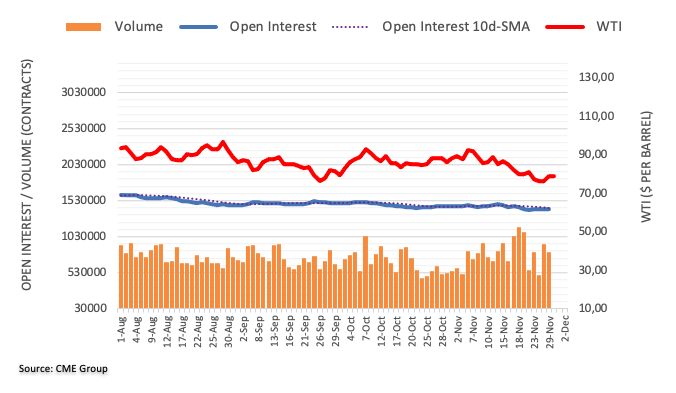

Meanwhile, the Canadian Dollar has got an adrenaline rush on solid gains in oil prices. Extreme drawdown in oil inventories reported by the US Energy Information Administration (EIA), Russia’s denial of providing oil at a novel price cap, and chances of sheer production cuts by OPEC+ have participated in strengthening oil prices.

- AUD/USD grinds at the highest levels since September 13.

- Aussie pair rallied the most in three weeks as Fed Chair Powell signaled easy rate hikes starting in December.

- Downbeat Australia Inflation, China PMIs failed to inspire bears on Covid-linked optimism.

- China Caixin Manufacturing PMI, US Core PCE Inflation and ISM Manufacturing PMI will provide fresh impulse.

AUD/USD bulls take a breather around 0.6785 after Fed Chairman Jerome Powell-led rally to the highest levels since mid-September. It’s worth noting that, the policymaker’s dovish signals allowed the Aussie pair to post the biggest daily run-up in three weeks.

It should be noted, however, that downbeat prints of Australia’s AiG Performance of Mfg Index and S&P Global Manufacturing PMI for November appeared to have probed the AUD/USD bulls at the multi-day high.

Fed Chair Powell spoke at the Brookings Institute on the economic outlook, inflation and employment late Wednesday while spreading the bearish remarks in his first public appearance after November’s Federal Open Market Committee (FOMC) meeting. The policymaker stated that it makes sense to moderate the pace of interest rate increases while also suggesting that the time to slow the pace of rate hikes could come as soon as the next meeting in December.

Ahead of him, Federal Reserve member of the Board of Governors Lisa D. Cook also spoke and praised the inflation data to signal that the Fed would likely take smaller steps as it moves forward.

It’s worth noting that the softening of the US employment numbers and optimism surrounding China’s Covid conditions also allowed the AUD/USD pair to remain firmer despite downbeat prints of Australia’s Monthly Consumer Price Index (CPI) for October. That said, US ADP Employment Change marked the lowest readings since January 2021 with 127K figure for November versus 200K forecast and 239K previous readings. On the other hand, the second estimate of the US Gross Domestic Product (GDP) Annualized for the third quarter (Q3) marked 2.9% growth versus 2.6% initial forecasts.

Amid these plays, Wall Street closed in the green and the US Treasury yields were down while the US Dollar Index (DXY) snapped a three-day uptrend.

Moving on, China’s private activity data may entertain AUD/USD traders, along with the risk catalysts. However, major attention will be given to the US Core PCE Inflation data for November and ISM Manufacturing PMI for the said month.

Also read: US October PCE inflation & ISM Manufacturing PMI Preview: Seen through Fed’s eyes

Technical analysis

A daily closing beyond the downward-sloping resistance line from the mid-September, now support around 0.6765, keeps AUD/USD buyers hopeful of approaching September’s top surrounding 0.6915, followed by the 200-DMA hurdle near 0.6925.

- Dovish speech of the Federal Reserve Chair Jerome Powell weighed on the US Dollar.

- Fed’s Powell opened the door for a 50bps rate hike in the December meeting.

- The New Zealand Dollar ignored a worse-than-expected Business Confidence report, as shown by the NZD/USD rising.

The New Zealand Dollar (NZD) soars sharply against the US Dollar (USD), towards the 200-day Exponential Moving Average (EMA) at 0.6290, following a speech of the US Federal Reserve (Fed) Chair Jerome Powell on Wednesday. At the time of writing, the NZD/USD is trading at 0.6302.

Sentiment shifted positively on dovish remarks by the Fed Chair Jerome Powell, who opened the door for slower rate hikes, since December. In his speech, Fed Chair Powell said that moderating interest-rate increases made sense and could happen as soon as the December meeting. The US central bank Chair added that rates would get higher than projected in September and remain restrictive for “some time.”

Following the Fed Chair Powell speech, money market futures odds for a 50 bps rate hike lie at 75%, while there is a 25% chance of 75. Meanwhile, swaps futures expect the Federal Funds rate(FFR) to peak under 5% by May 2023.

Also read: Breaking: Fed chair Powell speech sends US Dollar lower

On the New Zealand front, the economic docket featured Business Confidence for November, which dropped to -57.1 in November 2022 from -42.7 in October, as firms continued to grapple with intense inflationary pressures, declining margins, labor shortages, and tightening financial conditions. Activity measures were generally lower, led by sharp falls in ease of credit, profit expectations and own activity outlook.

NZD/USD Key Technical Levels

- USD/JPY bears are moving in following Fed Powell speech.

- A break of 135.80 opens risk to the lower end of the 133 area.

The US Dollar fell on Wednesday after Federal Reserve Chairman Jerome Powell said that the US central bank could scale back the pace of its interest rate hikes "as soon as December."

This has given the yen a boost and is seeing USD/JPY take on prior equal lows. A break here could make for a significant shift in the pair for the days ahead as the following illustrates:

USD/JPY daily chart

USD/JPY is trading on the back side of the daily trend lines which exposes 135.80 on the downside.

USD/JPY H4 charts

The bears are embarking on an equal low as seen more easily on the following zoomed-in chart:

There will be liquidity in here that could lead to a move back into the horizontal resistance in the sessions to follow. So long as the 139 area holds, the emphasis will remain on the downside. A break of 135.80 opens risk to the lower end of the 133 area.

What you need to take care of on Friday, December 1:

The market sentiment fluctuated between optimism and fear, with the US Dollar starting the day on the back foot, recovering mid-way, and finally plummeting to close it in the red against its major rivals.

The latest US Dollar slump resulted from US Federal Reserve Chair Jerome Powell’s words. Speaking at the Brookings Institute on the economic outlook, inflation and employment, Powell was mostly dovish. He said it makes sense to moderate the pace of interest rate increases, although he added that the monetary policy would need to remain “restrictive” for some time. Additionally, he said that the time to slow the pace of rate hikes could come as soon as the next meeting in December.

Powell added that economic growth has slowed below the long-run trend, which must be maintained. Finally, he said that he does not want to over-tighten and said that cutting rates is not something he intends to do anytime soon.

Federal Reserve member of the Board of Governors Lisa D. Cook spoke ahead of Powell but aligned with him. She said that inflation data shows some early signs of improvement and that the Fed would likely take smaller steps as it moves forward.

Chances of a 50 bps rate hike in December increased from 69.9% ahead of the speech to above 75%.

Earlier in the day, optimism was backed by China’s news and easing coronavirus-related restrictions in Zhengzhou and Guangzhou, despite the government's strives to control new cases. China has continued to report record daily contagions, but massive protests have forced the decision.

Meanwhile, European inflation fell for the first time in seventeen months, as the Euro Area annual Harmonized Consumer Price Index printed at 10% in October. Also, EU nations are considering lowering Russia’s oil price cap to $60 per barrel, according to people familiar with the matter.

Finally, the US economy grew at a 2.9% annualized rate in Q3, up from the 2.6% rate previously estimated.

EUR/USD nears the 1.0400 level, while GBP/USD trades around 1.2040. The Australian Dollar was the best performer, as AUD/USD stands at 0.6780. The USD/CAD pair is down to 1.3450, while USD/JPY changes hands at 138.10.

Spot gold trades at fresh weekly highs at around $1,765 a troy ounce, while crude oil prices were marginally higher, and WTI settled at $80.45 a barrel.

On Thursday, the US will publish core PCE inflation, the US Federal Reserve's favourite gauge, and the October ISM Manufacturing PMI.

Like this article? Help us with some feedback by answering this survey:

- Gold price is bid on the back of a dovish Fed Chair Powell.

- There could be consolidation ahead the bulls can not get above $1,770.

Gold price is rising because of a dovish speech by Federal Reserve's Jerome Powell on Wednesday that sunk the US Dollar. At the time of writing, Gold price is up around 0.6% and has climbed from a low of $1,744.95 to score a high of the day at $1,764.85.

Earlier in the day, Gold price pared gains as US bond yields climbed ahead a much-awaited speech from Federal Reserve Chair Jerome Powell. However, Powell said that policy will most likely need to remain restrictive for some time and that it makes sense to moderate the pace of interest rate increases. He said that the time to slow the pace of rate hikes could come as soon as the December meeting.

Consequently, a weaker dollar has kept Gold price on track for its best month since May 2021. The US dollar index, DXY, was last seen down 0.5% to 106.29, while the yield on the US 10-year note was down to 3.694%, not far from an over 7-week low of 3.62% on November 28th. The greenback is on track for its biggest monthly loss since September 2010 as investors look toward the Fed reaching a peak rate early next year. Markets now see a 75% chance for a smaller 50 bps interest rate hike in December, after four consecutive 75 bps increases.

US labour data cooling

Also, data suggested the labour market started to cool. ''The number of job openings in the US edged down to 10.3 million in October (10.7 million previously). The number of hires and total separations was little changed at 6.0 million and 5.7 million respectively. Job openings have eased from their peak of just under 12 million in March, but with 1.7 job openings per unemployed person in the US, the mismatch between labour demand and supply remains large,'' analysts at ANZ Bank explained.

Meanwhile, analysts at TD Securities argue that a bull trap is being set-up in precious metals markets. ''Systematic trend followers have significantly covered their gold shorts over the past few days, while the resilient price action has likely continued to attract new long interest from discretionary money managers looking for a recession hedge amid peak central bank hawkishness.''

''However,'' the analysts said, ''narrative is chasing prices, and we see several catalysts on the docket that could spark a renewed leg lower as CTAs run out of dry-powder on the bid. Chair Powell's speech is an obvious candidate for a catalyst, alongside inflation and jobs data.''

Gold technical analysis

The daily chart's harmonic pattern is bullish but there is a lot of resistance for the bulls to get through. The price could be destined for a further consolidation if the bulls can not get above $1,770 as per the 4-hour chart:

- The Pound Sterling jumped above 1.2000 as the Federal Reserve Chair, Jerome Powell, took the stance.

- Fed’s Powell: “Makes sense to moderate pace of interest rate hikes.”

- Fed’s Powell opened the door for a 50bps rate hike in the December meeting.

The British Pound (GBP) is trading negatively in the day, failing to capitalize on dovish remarks by the Federal Reserve Chair Jerome Powell, which opened the door for a 50 bps rate hike at the December meeting, albeit reiterating that work needs to be done. At the time of writing, the GBP/USD is trading volatile, around 1.1930-1.2050, as Powell begins to answer questions.

Powell’s speech remarks

In his speech, the Federal Reserve Chair said that it made “sense” to slow the speed of rate hikes, stating that it could happen at the December meeting. Powell added that the Fed has made substantial progress towards a “sufficiently restrictive policy,” though he said there’s “more ground to cover.”

Powell added that rates would get higher than projected in September and remain restrictive for “some time.” HE echoed some of his colleague’s comments adding that inflation is “far too high” and needs more evidence that inflation is actually “declining.”

Also read: Breaking: Fed chair Powell speech sends US Dollar lower

Following the Fed Chair Powell speech, money market futures odds for a 50 bps rate hike lie at 75%, while there is a 25% chance of 75. Meanwhile, swaps futures expect the Federal Funds rate(FFR) to peak under 5% by May 2023.

Powell’s Q&A Remarks

The initial surge in inflation was unrelated to wages, but wages will become increasingly important in the future.

Wage increases are now being offset by inflation for the majority of workers.

The Fed has been able to look through supply disruptions in the past, it is unclear whether this will continue.

Slowing down at this point is a good way to balance risks.

I still think there is a path to a soft or softish landing without a severe recession.

The initial surge in inflation was unrelated to wages, but wages will become increasingly important in the future.

GBP/USD 5-minute chart

The GBP/USD jumped from around 1.1925 towards 1.2011. Once he finished the speech, the GBP/USD retreated to 1.1970 before beginning its Q&A session, which rocked the boat, undermining the US Dollar and bolstering the Pound Sterling, as the GBP/USD hit the daily high of 1.2050.

- The Euro climbed as the Federal Reserve Chair, Jerome Powell, took the stance.

- Fed’s Powell: “Makes sense to moderate pace of interest rate hikes.”

- Fed’s Powell opened the door for a 50bps rate hike in the December meeting.

The EUR/USD jumped from weekly lows of 1.0290 as the Federal Reserve (Fed) Chair Jerome Powell acknowledged that moderation in the speed of interest rate increases might come as soon as the next meeting. That said, the Euro (EUR) is climbing, while the US Dollar Index (DXY) turned negative, dropping 0.42%. At the time of writing, the EUR/USD remains volatile, trading within 1.0300/1.0380, as Powell continues.

In some of his remarks, Fed Chair Jerome Powell said it “Makes sense to moderate pace of interest rate hikes,” adding that it could happen as soon as the December meeting. He said that the Federal Reserve has made substantial progress towards a “sufficiently restrictive policy,” though he added that there’s “more ground to cover.”

Powell added that rates are more likely to rise “somewhat higher” than what policymakers estimated at the September meeting. He emphasized that rates would need to be higher “for some time.” The Fed Chair reiterated that inflation remains “far too high,” and even though the October CPI report was a “welcome surprise,” he needs more evidence that inflation is actually “declining.”

Also read: Breaking: Fed chair Powell speech sends US Dollar lower

EUR/USD Market’s reaction

The EUR/USD initially dropped to 1.0307 and rallied sharply, towards 1.0376, still below the daily high of the day at around 1.0399. It should be noted that the 200-day Exponential Moving Average (EMA) sits around 1.0372, and so far, US Dollar (USD) buyers leaned on it, stalling the rally around the 1.0370 area.

EUR/USD 5-minute Chart

This is a developing story

Fed Chair Powell’s policy speech is a key event today:

Watch live: Fed Powell speech

In his first comments since the post-decision press conference on November 2, where he warned of a higher terminal rate, Fed chair Jerome Powell said today:

Key comments

Makes sense to moderate pace of interest rate hikes.

Time to moderate pace of rate hikes may come as soon as december meeting.

Have made substantial progress toward 'sufficiently restrictive' policy, have more ground to cover.

'It seems to me likely' rates must ultimately go 'somewhat higher' than policymakers thought in September.

Likely to need to hold policy at restrictive level 'for some time'.

History cautions strongly against prematurely loosening policy.

We have a long way to go in restoring price stability.

We will stay the course until the job is done.

Inflation remains far too high.

October inflation data was 'welcome surprise,' will take 'substantially more evidence' to give comfort inflation is actually declining.

We estimate pce price index rose 6% in 12 months through october; core pce rose 5%.

Path ahead for inflation 'highly uncertain'.

Growth in economic activity has slowed to well below longer-run trend, and this needs to be sustained.

Far too early to declare goods inflation vanquished, but if trend continues, goods prices should begin to exert downward pressure on overall inflation in coming months.

Expect housing services inflation to begin falling sometime next year, if lease trends continue.

Have so far seen only 'tentative' signs of moderation in labor demand, wage growth.

Moderation in labor demand growth will be required to restore labor market balance.

Price stability is fed's responsibility, bedrock of economy.

As a consequence of the dovish comments, futures tied to the Fed policy rate imply about a 75% chance of a 50bp hike in Dec vs a 25% chance of 75bp.

There will be a Q&A with further comments to follow:

Hard to pin down the natural rate of unemployment given disruption in labour market.

The initial surge of inflation not related to wages, but wages are going to be important going forward.

In the service sector, in particular, wages need to rise at a level consistent with 2% inflation over time.

Probably 1.5 to 2% above that now given adjustments for productivity.

Jolts data today show a continued imbalance between demand and supply of workers.

There is a role in moderating demand to get the labor force back into balance.

For most workers now increases in wages are being offset by inflation.

JOLTS data today was more or less in line with expectations, decline in openings a positive.

A possibility labor market can return to balance through decline in job openings, still to early to tell .

powell: hard to pin down the natural rate of unemployment given disruption in labor market.

In this situation fed continues to think number of vacancies versus number of unemployed is important.

Questions about elasticity of supply an important set of issues the fed is thinking about.

Has been that fed could "look through" supply disruptions; not sure if that will continue.

Fed still has a 2% inflation target it has to meet, even if supply conditions change.

Meanwhile, since the November 2 presser, markets have tuned into other Fed officials who have been framing the bank’s message. There have been conflicting tones from officials with, for instance, Fed vice chair Lael Brainard who has played up the move to smaller hikes, while others such as St Luis CEO, James Bullard, have played up the need for even higher rates.

The November 2 FOMC statement seemed to hint at a pivot, but Chair Powell pushed back against such notions of a pivot during his press conference.

''We believe he will take the same tone today; that is, the Fed may move to smaller hikes but the terminal rate is likely to be much higher than previously expected,'' analysts at Brown Brothers Harriman said.

Fed's Powell said today, ''it seems to me likely' rates must ultimately go 'somewhat higher' than policymakers thought in September.''

US Dollar update

Nevertheless, the dollar index, DXY, has fallen on the initial release of the speech from the 107 area to test below 106.70. It remains above the low made of 106.29 on the day but was below the 20-year high of 114.78 on Sept. 28. The greenback is on track for its biggest monthly loss since September 2010 as investors look toward the Fed reaching a peak rate early next year.

About Fed Jerome Powell

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

- The Swiss Franc trades with decent gains of 0.20% against the US Dollar.

- The USD/CHF is range-bound around 0.9300-0.9630 due to the lack of a catalyst.

- USD/CHF Price Analysis: Double bottom emerged around 0.9350, targeting a rally to 0.9800.

The USD/CHF retraces from weekly highs reached around 0.9540s, drops toward the 0.9500 figure, due to a mixed sentiment ahead of a scheduled speech by the US Federal Reserve (Fed) Chair Jerome Powell. At the time of writing, the USD/CHF is trading at 0.9516, below its opening price by 0.23%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the pair as downward biased after plummeting below the 200-day EMA. However, the USD/CHF has failed to crack below the August 22 swing low at 0.9474, exacerbating a consolidation within 0.9350-0.9600, just below the current location of the 200-day EMA at 0.9636.

Of note, the USD/CHF tested the 0.9350 price level twice, depicting a double bottom formation, which would target a rally toward 0.9800. However, to validate the pattern, the USD/CHF needs to break above 0.9650, exacerbating a rally towards 0.9700 and beyond.

Therefore, the USD/CHF first resistance would be 0.9600. Break above will expose the 200-day EMA at 0.9636, followed by the 38.2% Fibonacci retracement at 0.9659, ahead of the 0.9700 figure. Once cleared, the sellers' next line of defense would be the psychological 0.9800 figure.

USD/CHF Price Analysis: Technical outlook

- USD/CAD is pressured as the commodity complex picks up a bid on China.

- Fed Jerome Powell's speech will be important for the days ahead.

USD/CAD is under pressure by some 0.24% ahead of the Federal Reserve's chairman Jerome Powell's speech. Meanwhile, the Canadian dollar strengthened on Wednesday, paring back nearly all of its previous day's drop. Despite data suggesting that Canada's economy expanded faster than expected in the third quarter, the loonie on Tuesday fell to its worst level in over four weeks at 1.3645.

The USD/CAD exchange rate is 1.3553 at the time of writing and has fluctuated between a low of 1.3489 and a high of 1.3593. China risks continue to drive markets and signs that the nation would soon reopen its economy have lifted the commodity complex mid-week. The oil market helped CAD on Wednesday, with West Texas Intermediate prices increasing as China started immunizing senior citizens against COVID-19. Authorities announced the lifting of lockdowns in around half of the districts throughout the southern metropolis of Guangzhou on Wednesday afternoon.

Local officials were instructed to withdraw "temporary control orders" or to reclassify some regions as low risk in official announcements. They also declared the end of widespread PCR testing. OPEC+ is also expected to convene on Sunday with the possibility of reducing quotas once further at the same time as a report revealed a significant decline in US oil stocks.

Fed Powell speech eyed

Investors will be watching closely to see whether Fed chair Jerome Powell provides any new signs that the US central bank may be nearing the end of its tightening cycle as his speech is the important event for the day.

Given the uncertainty around upcoming jobs and inflation reports, Powell may contest the idea that a turn is imminent. However, market expectations may become muddied if different Fed officials' opinions on future monetary policy diverge.

When it meets on December 13–14, the Fed is anticipated to raise rates by an extra 50 basis points. The fed funds rate is predicted by traders to rise to 5.06% in June from its current level of 3.83% before reverting to 4.69% by December 2023.

- US Dollar remains on the back foot against the Australian Dollar.

- Mixed US economic data was ignored by investors focused on Fed’s Powell.

- Inflation in Australia eases lifting pressure on the Reserve Bank of Australia.

The Australian Dollar (AUD) advances steadily in the New York session amidst a mixed sentiment triggered by investors bracing for Jerome Powell’s speech for reasons that could give a leg-up to risk-perceived assets or rock the boat and bolster the US Dollar (USD). After hitting a daily low of 0.6670, the AUD/USD is trading at 0.6709, above its opening price by 0.24%.

Investors remained sidelined due to Powell’s speech

Wall Street’s sentiment remains fragile. Investors get ready for Powell after a slew of Federal Reserve officials paved the way for moderating interest-rate increases and emphasized that the Fed would not pause soon. Speculations for a Fed pivot sent US equities rallying, and the US Dollar weakened, as shown by the US Dollar Index (DXY) dropping from around 110.000 to 105.340.

In the FX space, the AUD/USD recovered after hitting a November low of 0.6272 and climbed toward 0.6800. Nevertheless, failure to decisively conquer the latter exacerbated a pullback to 0.6600 before consolidating around 0.6600-0.6700.

In the meantime, the US economic docket featured the ADP Employment Change report for November, showing that the impact of Fed tightening is finally taking its toll on the labor market. The reading came at 127K new jobs added to the economy, well below estimates. Later, the US Department of Commerce revealed that the US economy in the third quarter grew at a 2.9% pace, vs. 2.6% on its advance release, and smashed the second quarter’s 0.6% contraction.

Softer-than-expected Australia CPI eased pressure on the RBA

Aside from this, in the Asian session, the Australian CPI for October rose by 6.9% YoY, below the 7.6% forecasts. Additional data like Building Permits for October disappointed investors and plunged -6% MoM below estimates.

Therefore, the AUD/USD remains neutral-to-upward biased, but Jerome Powell’s speech could exert downward pressure if his remarks are hawkish. Otherwise, expect further AUD upside if he acknowledges the pace of rate hikes.

AUD/USD Key Technical Levels

Federal Reserve Governor Lisa Cook, who previously said the US central bank is focused on addressing inflation that is "much too high", said inflation remains too high.

However, she said it could soon be time for the US central bank to take its foot off the gas when it comes to its efforts to lower high levels of inflation.

Reuters reported her comments:

"Inflation remains much too high" and "as a result, the Federal Reserve must continue to focus on bringing inflation back down to our 2% target," Cook said in prepared remarks for a speech to the Detroit Economic Club.

"Given the tightening already in the pipeline, I am mindful that monetary policy works with long lags," she said.

As the Fed moves toward an "uncertain" stopping point for its rate rises, "it would be prudent to move in smaller steps," she said, adding that "how far we go, and how long we keep rates restrictive, will depend on observed progress in bringing down inflation."

In her remarks, Cook, one of the Fed's newest governors, said "we have begun to see some improvement in the inflation data," though she added that she "would be cautious about reading too much into one month of relatively favourable data" before deciding the high price pressures that have driven the Fed to act are abating.

Cook said the current pace of wage gains is above levels consistent with the Fed's 2% inflation target. She also said US productivity levels are weak but she hopes they will improve over time, and that the US manufacturing sector is healthy.

US Dollar update

The dollar index, DXY, has fallen to 106.29 on the day from a 20-year high of 114.78 on Sept. 28. The greenback is on track for its biggest monthly loss since September 2010 as investors look toward the Fed reaching a peak rate early next year.

Ahead of Fed's chairman, Jerome Powell's speech today, the index has reclaimed the 107 level. Some analysts expect Powell to push back against the notion that a pivot is coming soon given the uncertainty of future jobs and inflation releases.

- Silver price rallies above the 200-day EMA, despite a buoyant US Dollar.

- Federal Reserve Chair Jerome Powell is eyed by traders, remaining on the sidelines.

- Despite mixed US economic data, US Dollar got bid due to month-end flows.

Silver price climbs sharply as sentiment shifted slightly sour, and the US Dollar (USD) remains bid, sparked by month-end flows but also expectations of the posture of the Federal Reserve (Fed) Chair Jerome Powell after the latest economic data. At the time of writing, the XAG/USD is trading at $21.64 a troy ounce after clearing the 200-day Exponential Moving Average (EMA) at $21.31.

Market players on the sidelines waiting for Powell's speech

US stocks remain mixed as traders await Jerome Powell’s speech. Throughout the last couple of weeks, Fed policymakers laid the ground that the central bank would slow the velocity of tightening but reiterated that the Fed has ways to go before pausing rate increases. However, risk-perceived assets rallied, even though no official expressed that the Fed would pause or cut interest rates.

Since the last Federal Reserve meeting, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of peers, tumbled from 110.000 to 105.340, just above the 200-day Exponential Moving Average (EMA). But lately, the greenback is finding its foot and meanders around 106.986, up 0.14% ahead of Powell’s speech.

Elsewhere, the US economic docket featured the ADP Employment Change November report, which showed that the economy added 127K jobs, below 200K estimates, and trailed October’s 239K. Later, the US Department of Commerce reported that Q3’s Gross Domestic Product (GDP) on its second estimate rose by 2.9% vs. 2.6% preliminary reading and crushed Q2’s -0.6% contraction.

In the meantime, US Treasury bond yields are putting a lid on the XAG/USD rally, with the 10-year benchmark note rate at 3.787%, up four basis points. Another factor keeping Silver from trading back above $22.00 is US Real Yields, which sit at 1.62% as of Tuesday.

Silver Price Analysis: Technical outlook

From a daily chart perspective, the XAG/USD is upward biased once the white metal reclaimed the 200-day EMA. Additionally, a symmetrical triangle in an uptrend emerged, suggesting that buyers are in charge, after stepping in around the November lows of around $18.84. The Relative Strength Index (RSI) remains in bullish territory, aiming upwards, with room to spare before turning overbought. Hence, the XAG/USD first resistance would be the $22.00 figure, followed by the November 15 high at $22.24 and the June 6 swing high at $22.51.

The US Bureau of Economic Analysis showed that the US economy grew at an annual rate of 2.9% during the third quarter, surpassing expectations and the previous estimate of 2.6%. Analysts at Wells Fargo, point out that the still modest growth in the core areas of the economy and weakness in real gross domestic income, more clearly demonstrates the slowdown in Q3 economic growth.

Key Quotes:

“The headline continued to be flattered by a sizable gain in net exports due to an unsustainable gain in exports and decline in import activity.”

“There was also a modest upward revision to real personal consumption expenditures, which now look to have risen at a 1.7% annualized pace in Q3 amid upward revisions to goods consumption specifically. Real final sales to domestic purchasers were thus revised modestly higher to nearly a 1% gain in Q3, demonstrating a still-slow but better pace of growth for the core of the U.S. economy.”

“This release also included the first look at Gross Domestic Income (GDI), which in theory should be equivalent to GDP. The two have diverged recently, but the gap in the year-ago pace of the two narrowed to just 0.4% in Q2, from 1.1% in Q2. Still, the more modest 0.3% gain in the annualized rate of real GDI for Q3 and downward revisions to Q2 which flipped a 0.1% gain to a 0.8% decline provide further evidence the economy is slowing. The headline GDP growth rate continues to overstate strength in Q3, in our view.”

- Mexican peso among worst performers on Wednesday.

- USD/MXN reverses sharply to the 20-day SMA.

- Volatility to remain elevated amid market events and current price levels.

The USD/MXN is rising sharply on Wednesday, having the biggest daily gain in months after posting on Tuesday the lowest daily close since February 2020. The US Dollar is strengthening ahead of Federal Reserve Chairman Jerome Powell speech while the Mexican Peso is the worst among the most traded currencies in the world.

On Tuesday, the USD/MXN bottomed at 19.03 and then started to rise. After a correction during the Asia session, the pair resumed the upside even at a fastest pace. It peaked at 19.45 and remains near the top with the bullish tone intact.

The sharp reversal sent the US Dollar to the 20-day Simple Moving Average that stands at 19.43. A consolidation above would likely open the doors for a test of the next resistance area at 19.60. Although at 19.52 an interment resistance is seen.

The technical outlook has deteriorated significantly for the Mexican Peso. Technical indicators such as Momentum and RSI, at the moment, point north favoring further gains. A slide back under 19.25/30 could change the outlook exposing again the 19.00/05 support area.

USDMXN daily chart

Historically, USD levels have exerted a significant influence on Gold. Analysts at HSBC expect the yellow metal to remain defensive in early 2023, with upside more likely as the year unfolds.

Further tightening by the Fed could weigh on Gold at least into 1Q23

“In an environment where global growth is set to bottom out, rate volatility to peak, and risk sentiment to pick up, the USD is likely to weaken in 2023. A weaker USD should be positive for Gold.”

“Although some easing in inflation pressures in the US have called the pace of the rate increases by the Federal Reserve (Fed) into question, recent comments from Fed officials confirm further tightening. We believe that Fed tightening could remain an important negative for Gold at least into 1Q23.”

“We expect the outlook for underlying physical demand for Gold bars and coins to remain strong, spurred by ongoing inflation concerns and geopolitical and financial markets risks. Jewellery demand should also be steady. Following the sharp increase in central bank demand for Gold in 3Q22, the outlook for official sector demand for Gold may also be resilient in 2023.”

“With all factors considered, we expect Gold to remain defensive in early 2023, with upside more likely as the year unfolds.”

The US Dollar was the clear winner in the G10 universe in 2022. But economists at Commerzbank expect the US currency to weaken in 2023 as the Federal Reserve cuts interest rates.

Fed to lower its key rate again in the second half of 2023

“Our Fed watchers expect the US central bank to lower its key rate again in the second half of 2023 in view of easing inflation and in view of an (albeit mild) recession, with further rate cuts to follow early in 2024.”

“When the Fed cuts its key interest rate again next year, while hitherto less aggressive central banks like the ECB have been able to keep still, the Dollar is likely to weaken again.”

- Investors await the speech of Federal Reserve Chairman Jerome Powell.

- Mixed economic data in the United States calendar provided no support for the US Dollar.

- BoE Pill: Expects inflation to fall in 2nd half of 2023 and rates to peak below market estimates.

- GBP/USD Price Analysis: Could pull back towards 1.1800 before re-testing the 200-DMA.

The Pound Sterling (GBP) edges lower amidst a mixed sentiment as traders brace for the Federal Reserve (Fed) Chairman Jerome Powell’s speech, eyeing to get some signs of his current posture about interest rates. Also, a busy economic calendar in the United States (US) failed to support the US Dollar (USD). At the time of writing, the GBP/USD is trading at 1.1942 after hitting a daily high of 1.2029.

Federal Reserve Chair Jerome Powell eyed around 18:30 GMT

Sentiment remains fragile, as shown by US equities wavering. Latest Federal Reserve officials commented that the US central bank is ready to moderate the pace of rate hikes but also stated that rates would end higher than September projections. Even the St. Louis Fed President James Bullard commented that the Fed is “ways to go to a restrictive policy,” added that the Fed needs to increase rates until 2023 and foresees the Federal Funds rate (FFR) to peak at around 5% to 7%. Nonetheless, the markets are underpricing Fed policymakers. So any hawkish tilt remarks by Jerome Powell could rock the boat and bolster the US Dollar.

Dismal ADP Employment report kept the US Dollar defensive

Data-wise, the ADP Employment Change report for November disappointed investors as the economy added just 127K jobs below expectations and trailed the 239K employees hired by private companies in October. Nela Richardson, the Chief Economist at ADP, said the November report suggests that the Federal Reserve’s aggressive policy “is having an impact on job creation and pay gains.”

Economy in the United States in Q3 grew above estimates

Elsewhere, the US Gross Domestic Producto (GDP) for the third quarter, on its second estimate, increased by 2.9% above forecasts of 2.7%, smashing Q3’s advanced reading of 2.6%. Even though the report sent recession speculations in the United States to the trash can, it failed to bolster the US Dollar, with the GBP/USD remaining trading in the green, well below the daily high of 1.2024.

BoE’s Chief Economist Huw Pill foresees rates to peak lower than the market’s projections

The UK economic docket featured the Bank of England (BoE) Chief Economist Huw Pill. He said inflation is expected to fall quickly in the second half of 2023 while supply chain issues are being solved. Regarding the Bank’s Rate peak, he said that the BoE is expected to hike rates, lower than money market futures expectations of 5.25%. Pill echoed the BoE’s Governor Andrew Bailey’s remark on foreseeing a lower peak for the bank rates at their last monetary policy meeting. Therefore, further GBP weakness is expected.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD remains neutral-to-upward biased once the major could not crack the 200-day Exponential Moving Average (EMA) around 1.2157. Of note, after printing a daily high of 1.2029, shy of the week’s high of 1.2117, the Pound Sterling has fallen sharply, registering fresh weekly lows around 1.1941. The Relative Strength Index (RSI) aims downwards, albeit in bullish territory, suggesting buying pressure is waning. So in the near term, the GBP/USD might pull back before resuming upwards. Therefore, the GBP/USD first support would be the 1.1900 figure. A breach of the latter will expose the November 23 daily low at 1.1872, ahead of the November 21 swing low of 1.1762.

- USD/JPY rises to highest level in a week, holds above 139.50.

- US yields rise following US economic data that includes Q3 GDP and ADP employment.

- Fed chair Powell to speak later on Wednesday at the Brookings Institution.

The USD/JPY is rising on Wednesday before a speech from Federal Reserve (Fed) Chairman Jerome Powell. Following the release of various economic reports from the United States, US yields moved to the upside, supporting the pair that is hovering near daily highs at 139.70, the strongest level in a week.

Overall US data came in mixed, having a not very clear impact on the Dollar. Measured by the DXY, it is falling by 0.05%. The Japanese yen is among the worst performers of the day.

US economic data: mixed numbers

The report published by Automatic Data Processing (ADP) on Wednesday showed that private sector employment in the US rose by 127K in November, below the 200K of market consensus. It was the lowest reading since January 2021.

The US Bureau of Economic Analysis revealed that the US economy grew at an annual rate of 2.9% in the third quarter, above the 2.6% previous estimation. Price indicators were revised higher with the GDP deflator from 4.2% to 4.3%.

Other US economic reports showed the Chicago PMI tumbled from 45.2 to 37.2 in November against expectations of a modest increase. Pending Home Sales fell by 4.6%, a little less than expected.

Overall the numbers were mixed, supporting the idea the labor market continues to slowdown. On Thursday, the key report will be the core Personal Consumption Expenditure Price Index. Friday will be the turn of the official employment report that includes Non-farm payroll and the unemployment rate.

Fed’s Powell ahead

Fed Chair Jerome Powell will deliver a speech at 18:30 GMT at the Brooking Institution on “Fiscal and Monetary Policy on the outlook for the economy, inflation, and the changing labor market”. After his remarks, Powell will be interviewed by David Wessel, director of the Hutchins Center and will take questions.

Market participants will look in Powell’s comments for clues into whether the Fed will slow down its rate hikes. After the latest inflation readings, expectations of a 50 basis points rate hike at the December meeting rose. Also the economic outlook presented from Fed’s chair will be relevant for price action.

Higher yields weighed on JPY

The Japanese yen is among the worst performs on Wednesday hit by higher bond yields. The US 10-year yield is at 3.79%, the highest level since November 23. The German 10-year yield is up at 1.96%. At the same time the Greenback is gaining momentum from the moves in the bond market.

The JPY is not receiving help from the deterioration in market sentiment. The Dow Jones is falling by 0.55% and the S&P drops by 0.22%. The Nasdaq gains 0.31%.

USD/JPY price outlook

The USD/JPY is breaking a key resistance level seen around 139.50. If the US Dollar manages to consolidate above it would point to further gains, with a potential target at the resistance zone near 141.00.

A decline back under 139.50 would suggest a continuation of the current consolidation. On the downside, the critical support is located at 138.50. A daily close below would deteriorate the outlook for the USD, suggesting a test of the November low at 137.52.

USD/JPY daily chart

-638054186224761188.png)

- US JOLTS Job Openings declined modestly in October.

- US Dollar Index stays in negative territory near 106.50.

The number of job openings declined to 10.3 million on the last business day of October from 10.7 million in September, the US Bureau of Labor Statistics (BLS) reported in its Job Openings and Labor Turnover Summary (JOLTS) on Wednesday. This print came in largely in line with the market expectation.

"Over the month the number of hires and total separations changed little at 6.0 million and 5.7 million, respectively," the publication further read. "Within separations, quits (4.0 million) and layoffs and discharges (1.4 million) changed little."

Market reaction

The US Dollar Index edged slightly higher with the initial reaction to this report and was last seen losing 0.3% on the day at 106.52.

- The index drops to daily lows near 106.30 on Wednesday.

- Another revision saw GDP expand 2.9% YoY in Q3.

- Chair Powell will speak later in the NA session.

The greenback, when tracked by the USD index (DXY) remains on the defensive above the 106.00 hurdle in the wake of the opening bell in Wall Street on Wednesday.

USD Index now looks at Powell

The index surrenders part of the 3-day advance on the back of the improvement in the risk complex and ahead of the key speech by Chair Powell due later in the NA session.

In addition, the resumption of the downside pressure in the buck comes in tandem with another positive performance of US yields across the curve, which seem to have woken up and add to Tuesday’s gains.

In the US data space, MBA Mortgage Applications contracted 0.8% in the week to November 25 and the ADP Employment Change disappointed expectations after the US private sector created 127K jobs in November vs. 200K forecast. Further data saw the trade deficit widen to $99.0B in October and another revision of the Q3 GDP Growth Rate expect the economy to expand 2.9% YoY. Finally, the Chicago PMI eased to 37.2 in November, Pending Home Sales contracted 4.6% MoM in October and JOLTs Job Openings came at 10.334M in the same month. The Fed’s Beige Book will close the daily calendar later in the session.

Before Powell’s speech, FOMC Governor L.Cook will speak on “The Outlook for Monetary Policy and Observations on the Evolving Economy”.

What to look for around USD

The dollar loses part of the recent shine and returns to the 106.30 zone amidst prevailing cautiousness ahead of results from key fundamentals and the speech by Fed’s Powell.

While hawkish Fedspeak maintains the Fed’s pivot narrative in the freezer, upcoming results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the short term.

Key events in the US this week: Mortgage Applications, ADP Employment Change, GDP Growth Rate, Goods Trade Balance, Pending Home Sales, Fed Powell, Fed Beige Book (Wednesday) - PCE, Initial Jobless Claims, Personal Income/Spending, Final Manufacturing PMI, ISM Manufacturing, Construction Spending (Thursday) - Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.34% at 106.47 and the breakdown of 105.47 (200-day SMA) would open the door to 105.32 (weekly low November 28) and finally 104.63 (monthly low August 10). On the other hand, the immediate resistance emerges at 107.99 (weekly high November 21) followed by 109.11 (100-day SMA) and then 110.34 (55-day SMA).

The S&P 500 rally is showing tentative signs of stalling. Analysts at Credit Suisse remain of the view strength from October has been a bear market rally and look for a break below 3907/06 to establish a “double top.”

Overshoot to 4127/55 not ruled out

“Whilst we remain on alert for signs of a top, we would still not rule out an overshoot to the downtrend from the beginning of the year and 50% retracement of the 2022 fall at 4127/55, but we continue to look for a top in this 4054/4155 zone. A close above 4155 though may be the first real sign that we may have seen the worst of the sell-off, with resistance seen next at 4312/25.”

“Support stays seen at 3907 initially, below which can now set a small top to ease the immediate upside bias, with support seen next at the 63-day average at 3630. Below 3698 remains needed to suggest the recovery is over and broader downtrend is resuming.”

- EUR/USD trades in a firm note and approaches the 1.0400 zone.

- Extra gains need to clear the 9-month resistance line near 1.0420.

Wednesday’s occasional bullish attempt motivates EUR/USD to trade at shouting distance from the key 1.0400 neighbourhood.

The pair should clear the 9-month resistance line around 1.0420 on a sustainable fashion to catch fresh air and therefore challenge the November high at 1.0496 (November 28) just ahead of the round level at 1.0500.

Above the 200-day SMA (1.0372), the pair’s outlook should remain constructive.

EUR/USD daily chart

Today the focus is very much on Fed Chair Powell who will speak on the economy and labour market. Economists at MUFG Bank note that risks are tilted to the upside for the US Dollar.

Powell in focus

“We fully expect comments that are consistent with previous comments – more needs to be done, inflation risks remain to the upside and the terminal rate will be higher than implied by the dots in September.”

“Key for the US dollar and rates will be whether Powell’s comments are enough to alter notably the expectations for the terminal rate. That level is currently at about 5.00% and the risks in our view firmly lie to the potential for a shift higher that would provide a further catalyst for the reversal of the recent period of USD selling.”

- Gold price climbs to a two-week high on Wednesday amid renewed US Dollar selling.

- Upward revision of the US GDP print offsets dismal ADP report and fails to impress.

- Traders also seem reluctant ahead of Federal Reserve Chair Jerome Powell’s speech.

Gold price gains strong positive traction for the second successive day and climbs to a two-week high, during the early North American session on Wednesday. The momentum, however, stalls near the $1,765 area following the release of the US macro data, though the downside seems limited amid a weaker US Dollar, which tends to boost demand for the Dollar-denominated commodity.

Weaker US Dollar continues to lend support to Gold price

The US Dollar remains on track to post its worst monthly performance since September 2010 amid hopes that the Federal Reserve will soften its hawkish stance in the wake of looming recession risks. The current market pricing indicates a greater chance of a relatively smaller 50 bps rate hike at the next Federal Open Market Committee (FOMC) meeting on December 13-14. This is evident from a softer tone around the US Treasury bond yields, which, in turn, continues to act as a headwind for the Greenback.

Disappointing ADP report does little to impress US Dollar bulls

The intraday US Dollar selling remains unabated following the disappointing release of the ADP report, showing that the US private-sector employers added 127K jobs in November. The headline print was well below the previous month's reading of 239K and 200K anticipated. This, in turn, tempers expectations for any positive surprise from the official jobs report (NFP) on Friday. That said, an upward revision of the United States (US) Gross Domestic Product (GDP) helps offset the disappointment.

Upbeat US GDP report caps gains for Gold price ahead of Powell’s speech

The preliminary report (second estimate) released by the US Bureau of Economic Analysis showed that the economy expanded by 2.9% annualized pace during the third quarter against 2.6% reported previously. This helps limit any deeper losses for the US Dollar and caps Gold price. Traders also seem reluctant to place aggressive bets ahead of Chairamn of the Federal Reserve Jerome Powell's speech, which will be looked upon for clues about future rate hikes and provide a fresh directional impetus to the non-yielding yellow metal.

Technical Outlook

From a technical perspective, any further pullback now seems to find some support near the $1,748 zone (daily low). This is followed by the $1,740-$1,739 zone, which if broken decisively will negate any near-term positive outlook and make Gold price vulnerable. The downward trajectory might then extend to the $1,725 intermediate support, or a nearly two-week low touched last Wednesday, en route to the $1,700 round-figure mark.

On the flip side, momentum beyond the daily top, around the $1,765 area, has the potential to lift Gold price to the $1,770-$1,772 region. Some follow-through strength will be seen as a fresh trigger for bulls and prolong the upward trajectory to the $1,778 region. The next relevant hurdle is pegged near the $1,786 area, or the highest level since mid-August touched earlier this month, above which the XAU/USD could aim to reclaim the $1,800 psychological mark.

Key levels to watch

- The index comes under pressure and fades part of the recent advance.

- The underlying bullish view is underpinned by the 200-day SMA.

Sellers now put the recent upside momentum in DXY to the test and force it to return to the negative territory after three daily gains in a row on Wednesday.

In the meantime, the index manages to put some distance from the always relevant 200-day SMA, today at 105.47.

A drop below this region is expected to shift the outlook to negative and at thus allow for losses to accelerate to, initially, the August low at 104.63 (August 10).

DXY daily chart

- US Q3 GDP growth got revised higher to 2.9%% from 2.6%.

- US Dollar Index stays in red slightly below 106.50.

The United States economy grew at an annual rate of 2.9% in the third quarter, the US Bureau of Economic Analysis reported on Wednesday. This reading came in better than the initial estimate and the market expectation of 2.6%.

"The second estimate primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment," the BEA explained in its publication. "Imports, which are a subtraction in the calculation of GDP, decreased more than previously estimated."

Market reaction

The US Dollar Index recovered modestly with the initial reaction to this report and was last seen at 106.47, where it was still down 0.35% on the day.

Gold remains capped by the 200-Day Moving Average (DMA) at $1,797. Strategists at Credit Suisse expect a consolidation phase to emerge from here.

Break above 200DMA needed to open the door to a more meaningful recovery

“Gold holds a minor base but remains capped so far by the crucial 200DMA, currently seen at $1,797 and we expect a consolidation to emerge from here.”

“Below support at $1,729 is needed to ease the immediate upward bias in the range, but with a break back below the 55DMA at $1,688 needed to inject fresh downside momentum into the market again for a retest of the YTD low at $1,614.”

“Above the 200DMA at $1,797 is needed to open the door to a more meaningful recovery for a rise toward the $1,877 June high.”

- Private sector employment in the US rose less than expected in November.

- The US Dollar Index stays in negative territory below 106.50.

The data published by Automatic Data Processing (ADP) showed on Wednesday that private sector employment in the US rose by 127,000 in November. This reading came in weaker than the market expectation for an increase of 200,000. The publication further revealed that annual pay was up 7.6% on a yearly basis in November.

Assessing the findings of the report, "turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains,” said Nela Richardson, chief economist, ADP. "In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting and the post-pandemic recovery is stabilizing.”

Market reaction

The US Dollar Index stays on the back foot following this data and it was last seen losing 0.4% on the day at 106.42.

- USD/CAD remains heavily offered on Wednesday and is weighed by a combination of factors.

- Rising crude oil prices underpin the Loonie and exert some pressure amid fresh USD selling.

- Traders now look to the US macro data for some impetus ahead of Fed Chair Powell’s speech.