- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 30-03-2022

- USD/JPY is auctioning in a narrow range of 121.32-122.24 ahead of the bond-buying conclusion.

- The BOJ bought JGBs heavily to vanish signs of recession in case of yield inversion.

- The DXY has been dumped by investors on subdued US GDP and ADP Employment Change.

The USD/JPY pair is oscillating in a narrow range of 121.32-122.24 as a broad-based buying in the Japanese yen is likely to over after the conclusion of the unlimited bond-buying program by the Bank of Japan (BOJ). The four-day bond-buying program of the BOJ will conclude on Thursday.

To curtail the likely inversion of the yield curve, the BOJ pledges to offer bids for the Japanese Government Bonds (JGBs) to cap the yields at 25 basis points. To address the mega buying of JGBs, the BOJ has announced that it will buy 600B yen in 3-5 yr JGBs and 725B yen in 5-10 yr JGBs. The BOJ has heavily bought the JGBs to stick to its ultra-loose monetary policy and to skip the signs of recession.

Meanwhile, the US dollar index (DXY) has tumbled below 98.00 decisively and is likely to drag further amid subdued performance from the US Gross Domestic Product (GDP) numbers and US Automatic Data Processing (ADP) payrolls. The US Bureau of Economic Analysis reported GDP (Q4) growth on an annualized basis at 6.9%, slightly lower than the estimates and previous print of 7%.

While the ADP recorded Employment Change at 455k lower than the market consensus of 450k and earlier print of 486k.

Going forward, the US Nonfarm Payrolls (NFP) will remain the major driver that will keep the street busy. But before that, investors will focus on the US Initial Jobless Claims and speech from the Federal Reserve (Fed) President John C. Williams, which are due on Thursday. On the Japanese docket, monthly and yearly Industrial Production data will hold significant importance.

- The Japanese yen is recovering as a quarter, and month-end flows accelerate.

- AUD/JPY Price Forecast: The cross-currency remains upward biased but might correct lower before resuming the uptrend.

The AUD/JPY slid for the second consecutive day on Wednesday, as the Asian Pacific session is about to begin, courtesy of a dismal market mood as the Russia-Ukraine conflict escalates. Peace talks, according to Moscow, have failed to achieve a breakthrough as Russia intensifies its attacks on Ukraine. At 91.54 off the weekly highs, around 93.12, reflects the risk-off mood in the markets.

Wall Street’s finished Wednesday with a blood bath, with major indices in the red. Asian equity futures point to a lower open, except for China’s A50 and Hang-Seng, which benefit from a dovish People’s Bank of China (PBoC), which aims to pump more money into China’s financial markets to stimulate growth.

On Wednesday, the AUD/JPY began on a higher note, near 92.50s daily’s high, and then fell as the market mood shifted negatively, which boosted safe-haven peers appetite, particularly the Japanese yen and the Swiss franc, the leaders of the session. That said, the AUD/JPY settled down at current levels.

AUD/JPY Price Forecast: Technical outlook

The last two days’ AUD/JPY price action has achieved to record a series of lower highs and lower lows, so the pair is downward biased in the near term. It is worth noting that Wednesday’s close at 91.45 was lower than Monday’s 91.53 low, confirming the aforementioned.

That said, the AUD/JPY might correct before resuming upwards. So the AUD/JPY first support would be 91.50. A sustained break would expose 91.00. Once cleared, the next demand zone would be Pitchfork’s central-parallel line’s confluence with the 90.00 mark and then the 89.00 figure.

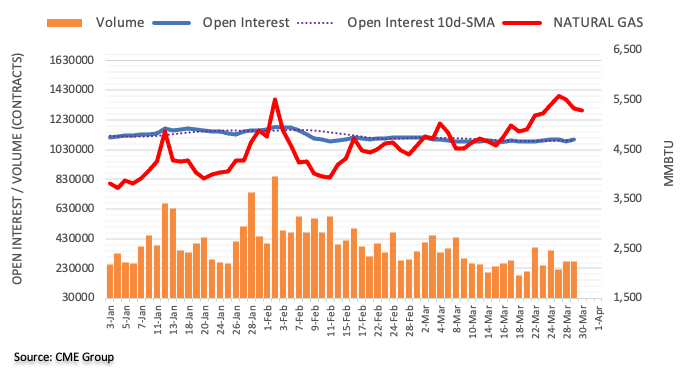

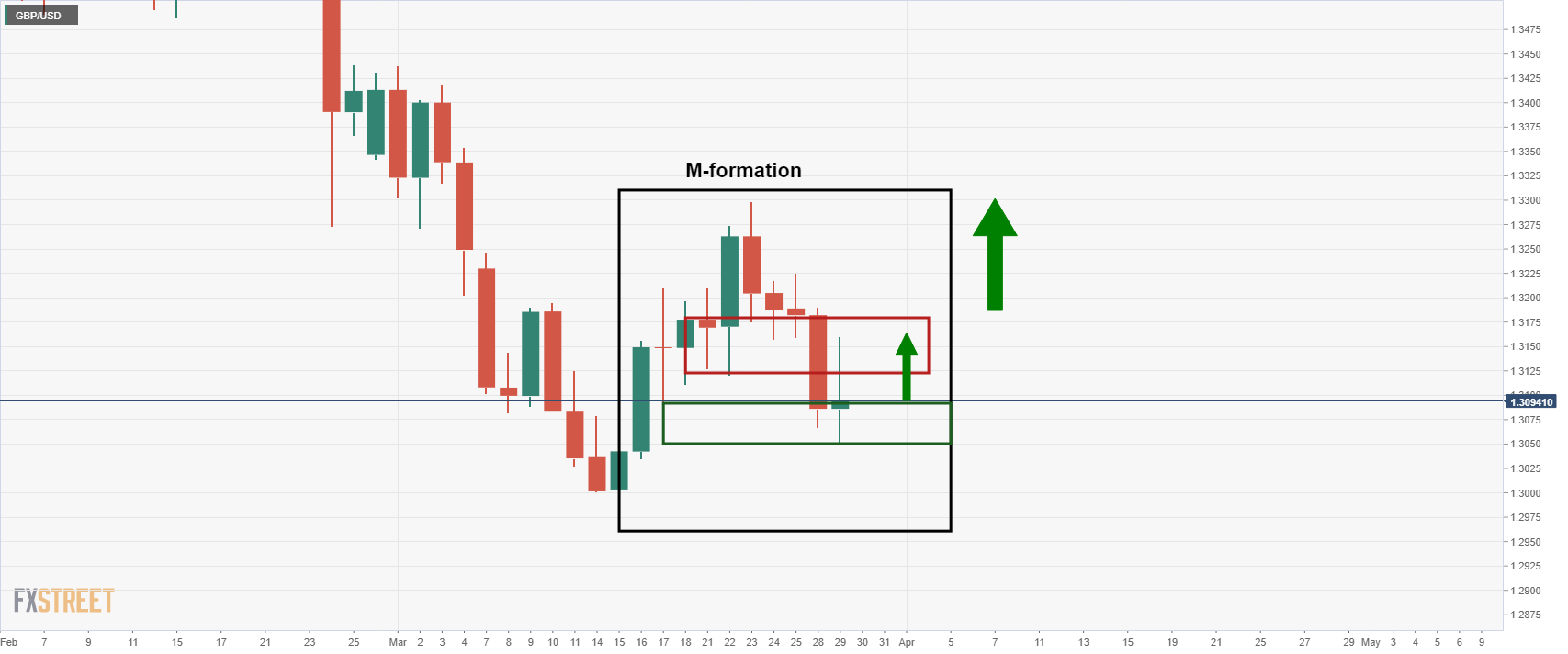

- WTI has attracted bids below $100.00 amid uncertainty over the OPEC meeting.

- The cumulative effect of OPEC uncertainty and reduction in oil inventories has underpinned WTI prices.

- Oil prices may shoot firmly if an embargo on Russian oil by Europe is put in place.

West Texas Intermediate (WTI), futures on NYMEX, has advanced towards $106.40 but is likely to remain lackluster as investors are keeping eye on the outcome of the OPEC meeting, which is due on Thursday. The agenda of the OPEC meeting is likely to revolve around the elevation of the oil supply to contain the prohibited oil from Moscow.

Russia had attracted plenty of sanctions from the Western leaders after its invasion of Ukraine. Right from the collapse of the International SWIFT banking system to the embargo on its oil, the Russian economy is losing financial stability. Overnight prohibition of Russian oil from the US and discussions on the embargo of Russian oil by the European Union (EU) has made their oil stockpiles toxic for them.

Although Russia has cut off its military activity from northern Ukraine and Kyiv in order to match the outcome of the first face-to-face negotiations between the officials of Moscow and Kyiv in Turkey, Western leaders are likely to stick with their sanctions amid destruction and death in Ukraine.

Apart from the uncertainty over the OPEC meeting, significant slippage in the US oil stockpiles reported by the Energy Information Administration (EIA) has underpinned the oil prices. The US EIA reported a slippage in oil stockpiles by -3.449M against the market consensus of -1.022M and prior print of -2.508M.

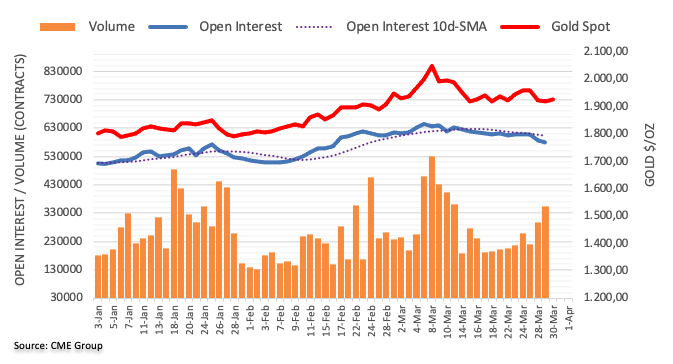

- The British pound on Wednesday gained some 0.32%.

- A dismal market mood failed to pressure the risk-sensitive currencies, which gained on US dollar weakness.

- GBP/USD Price Forecast: Unless bulls reclaim 1.3298, the GBP/USD might aim towards a renewed YTD low test around 1.2999.

The British pound recovered some ground vs. the greenback as the market mood turned sour, courtesy of reports of the Kremlin saying that although Ukraine’s effort to fulfill some of Russia’s demands, peace talks have not reached a breakthrough. At the time of writing, the GBP/USD is trading at 1.3137.

US equities reflected the aforementioned, trimming Tuesday’s gains on the Wednesday session. The US Dollar Index is down 0.58%, sitting at 97.838, portraying its softer tone on the Wednesday session. Furthermore, lower US Treasury yields are a tailwind for the Pound sterling, which reached a daily high of around 1.3182 but retreated towards the mid 1.3100-80 area.

GBP/USD Price Forecast: Technical outlook

The GBP/USD keeps trading within the boundaries of a descending channel in the daily chart. The daily moving averages (DMAs) keep residing above the exchange rate, confirming the downward bias, and as long as the GBP/USD remains below 1.3298, downside risks remain.

That said, the GBP/USD recent jump could be viewed as a rally in a downtrend.

On the way down, the GBP/USD first support would be 1.3100. A sustained break would open the door towards a renewed test of the YTD low at 1.2999 but firstly would face some hurdles on its way down. The next support would be the March 29 1.3050 daily low, followed by the bottom-trendline of the descending channel, which confluences with the YTD low at 1.2999.

Ukrainian Negotiator: Russia and Ukraine will resume peace talks online on April 1, according to Reuters.

During the latest talks, Ukraine said the countries' two leaders should meet, but Russia said more work needed to be done on a draft treaty.

This follows a series of disappointing headlines around the peace talks with the head of the Russian republic of Chechnya Kadyrov saying that the Kremlin negotiator Minsky was wrong because they will not make any concessions over Ukraine.

These talks are taking place in Istanbul, Turkey. The deputy defence minister had said that Russian forces would cut back their military operations around the capital, Kyiv. The negotiators they would do so in order to focus attention on the talks, build mutual trust and create the right conditions for a peace agreement. However, on Wednesday, Russian forces bombarded the outskirts of Kyiv. The US administration had warned on Tuesday they were sceptical of Russia’s vow to curtail its military assault on Ukraine.

Market implications

As a consequence, equities ticked down and oil bounced as doubts grew over Russia’s intentions in Ukraine. The Thomson Reuters CRB Index rallied 2.2% with West Texas Intermediate crude in the spot market breaking $108bbl in New York trade. This in turn is supporting the Aussie.

Market pricing remains very responsive to sudden shifts in sentiment and the onset of quarter and month-end is an additional hurdle for markets to contend with.

The end of the week's US jobs market data will be important in this regard to determine whether the US dollar can continue to run higher on safe haven flows and both positive economic data and central bank prospects in the face of higher interest rates and a wave of mounting inflation pressures.

- USD/CHF is balanced in a narrow range of 0.9220-0.9240 below 61.8% Fibo retracement.

- A death cross of 50 and 200-period EMAs signals more downside going forward.

- The RSI (14) has slipped into a bearish range of 20.00-40.00, which indicates more pain ahead.

The USD/CHF pair is oscillating in a narrow range of 0.9220-0.9240 in early Tokyo. The asset has witnessed a steep fall recently after dropping below the previous week’s low at 0.9260.

On an hourly scale, USD/CHF is staying below 61.8% Fibonacci retracement (placed monthly lows and highs at 0.9150 and 0.9460 respectively) placed at 0.9269. The asset is oscillating near the declining trendline placed from March 21 low at 0.9294 adjoining the previous week’s low at 0.9260.

A death cross from the 50 and 200-period Exponential Moving Averages (EMAs) at 0.9328 triggered a bear attack on the counter.

The Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00 from 40.00-60.00, which indicates more pain ahead.

For further downside, Swiss franc bulls need to drag the asset below the ongoing consolidation of 0.9220-0.9240. This will expose the pair to more downside at March 7 low and monthly lows at 0.9197 and 0.9150 respectively.

On the contrary, greenback bulls can obtain control if the asset advances above the 20 EMA at 0.9281. This will drive the asset towards the 200 EMA at 0.9313, followed by 38.2% Fibo retracement at 0.9341.

USD/CHF hourly chart

-637842751172601252.png)

- NZD/USD holds positive ground despite risk-off sentiment.

- The Ukraine crisis remains in the driving seat with an eye kept on central banks.

NZD/USD is trading in the bullish territory on Thursday following a strong performance on Wednesday. The currency rose from a low of 0.6927 to a high of 0.6998. The bulls were out in force as the euro rallied and risk assets jumped on the cautious optimistic headlines surrounding the Ukraine & Russian peace talks.

However, the markets were whipsawed by headlines to the contrary as well as by sentiment related to central bank outlooks. nevertheless, the NZD managed to stay on its flight path and ended the day higher. ''The Kiwi is higher again this morning, knocking on the door of 70 cents as it takes a lead from the higher EUR, which has, in turn, risen as high inflation there looks like it will force the ECB’s erstwhile dovish hand,'' analysts at ANZ Bank explained.

''The AUD is also higher, but to a lesser extent, and that’s seen a bounce in NZD/AUD (see below), but it also neatly demonstrates how the Kiwi has seemingly been able to latch on to any positivity of late. But of course when that happens, fickle markets can be quick to turn. Still, we think the re-awakening of the EUR and AUD will be key to how the NZD performs in the coming weeks, and the writing seems to be on the wall on that score given market expectations for hikes and recent inflation reads.''

Ukraine peace talks, lack of progress

Russian forces bombarded the outskirts of Kyiv on Wednesday and this came following the warnings from the US administration that they were sceptical of Russia’s vow to curtail its military assault on Ukraine.

Additionally, both the Ukraine Defence Ministry and the Polish Deputy Prime Minister crossed the wires and stated that Russia is preparing for a new attack in Ukraine. All indications are that we are facing a long war, Aljazeera Tweeted, quoting the Polish PM. A Ukraine Defence Ministry spokesperson expressed a view that the Russian military continues to aim to take control of Mariupol, a strategic city in the east, saying that a major withdrawal is not taking place, and Russia is ready to resume attacks. Talks will resume April 1.

- Breakout of an ascending triangle pattern may challenge the monthly highs.

- Euro bulls have surpassed the 200 EMA for the first time this month.

- The RSI (14) has shifted into a bullish range, which adds to the upside filters.

The EUR/USD pair has extended its gains on Wednesday after overstepping Tuesday’s high at 1.1137. The asset has witnessed a firmer upside this week after breaching the consolidation of the last week, which placed in a narrow range of 1.0966-1.1045.

On a four-hour scale, EUR/USD has given a breakout of the ascending triangle formation by surpassing the horizontal line, which is placed near March 2 high at 1.1143. However, the advancing trendline is plotted from monthly lows at 1.0806, adjoining the March 28 low at 1.0945.

Euro bulls are firmer above the 200-period Exponential Moving Average (EMA) at 1.0960, which adds to the upside filters. However, the bulls seek validation of a bull cross from the 20 and 200-period EMAs.

The Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00 from 40.00-60.00, which has triggered a bullish setup.

Should the asset test March 2 high at 1.1143, the major will start advancing towards monthly highs at 1.1233, followed by February 14 low at 1.1280.

On the contrary, greenback bulls can be worthy if the asset drops below March 21 high at 1.1070, which will drag the asset towards March 28 low at 1.0945, followed by round level support at 1.0900.

EUR/USD four-hour chart

-637842731077068921.png)

- The Loonie trims weekly losses, so far up 0.01% on dismal market mood.

- The longer the Russia-Ukraine war, the heaviest the burden of global inflation as commodities rally.

- USD/CAD Price Forecast: To continue downwards, except that USD bulls push the pair decisively above 1.2530.

The USD/CAD extends its fall for the second straight day; after Monday’s price action printed a weekly high near the 1.2600 mark, the Loonie strengthened on the back of high oil prices, amid a downbeat market mood, courtesy of recent developments in the Eastern Europe front. At the time of writing, the USD/CAD is trading at 1.2475.

Developments in Eastern Europe fail to show progress, boost oil prices

US equities finished in the red, reflecting a dismal sentiment. Russian officials said that even though Ukraine has made an effort to fulfill some of the Russian demands, peace talks have not reached a breakthrough, as reported by the Kremlin. Also, as reported by Aljazeera Tweets, the Polish Deputy Prime Minister noted that Russia is preparing a new attack in Ukraine and added that all indicate that we are facing a long war.

That said, commodity prices aimed higher, led by crude oil and precious metals. The US crude oil benchmark, WTI, is trading at $107.44 per barrel, up 2.26% compared to Tuesday, while gold closes to 1% gains, exchanging hands at $1935.16 troy ounce.

In the FX space, commodity-linked currencies like the Canadian dollar continues strengthening vs. the greenback. Overnight, the USD/CAD opened near 1.2500, the day’s highs, and retreated towards 1.2420s until settling down around the 1.2470-90 area.

An absent Canadian economic docket left USD/CAD traders leaning on US macroeconomics. The US docket unveiled the ADP Employment Report, which came better than expected, showing an increase of 455K jobs in the economy in March, more than the 450K foreseen. Furthermore, the US GDP for the Q4 of 2021 grew at its highest pace since 2020’s Q3. The final reading rose by 6.9%, lower than the 7.1% estimated.

Later, Richmond Fed President Tomas Barkin said that he’s open to raising rates by 50-bps at the May meeting, depending on how strong is the US economy.

USD/CAD Price Forecast: Technical outlook

The USD/CAD is facing solid support at the 1.2420, which once pierced, jumped off immediately, a signal that it’s going to be defended by USD bulls. In fact, Wednesday’s price action is forming a hammer, a candlestick that, at the end of an upward/downward move, signals a change of the trend, but it would need confirmation.

Upwards, the USD/CAD first resistance would be 1.2500. A clear break would send the pair towards a renewed test of 1.2600, but first, it would face resistance at 1.2552.

On the flip side, in the event of extending the downtrend, the USD/CAD first support would be January 19, 1.2438 daily low. A breach of the latter could open the door towards 1.2288, but first, it would face November 10, 2021, a daily low at 1.2387, followed by 1.2300, and then the aforementioned 1.2288.

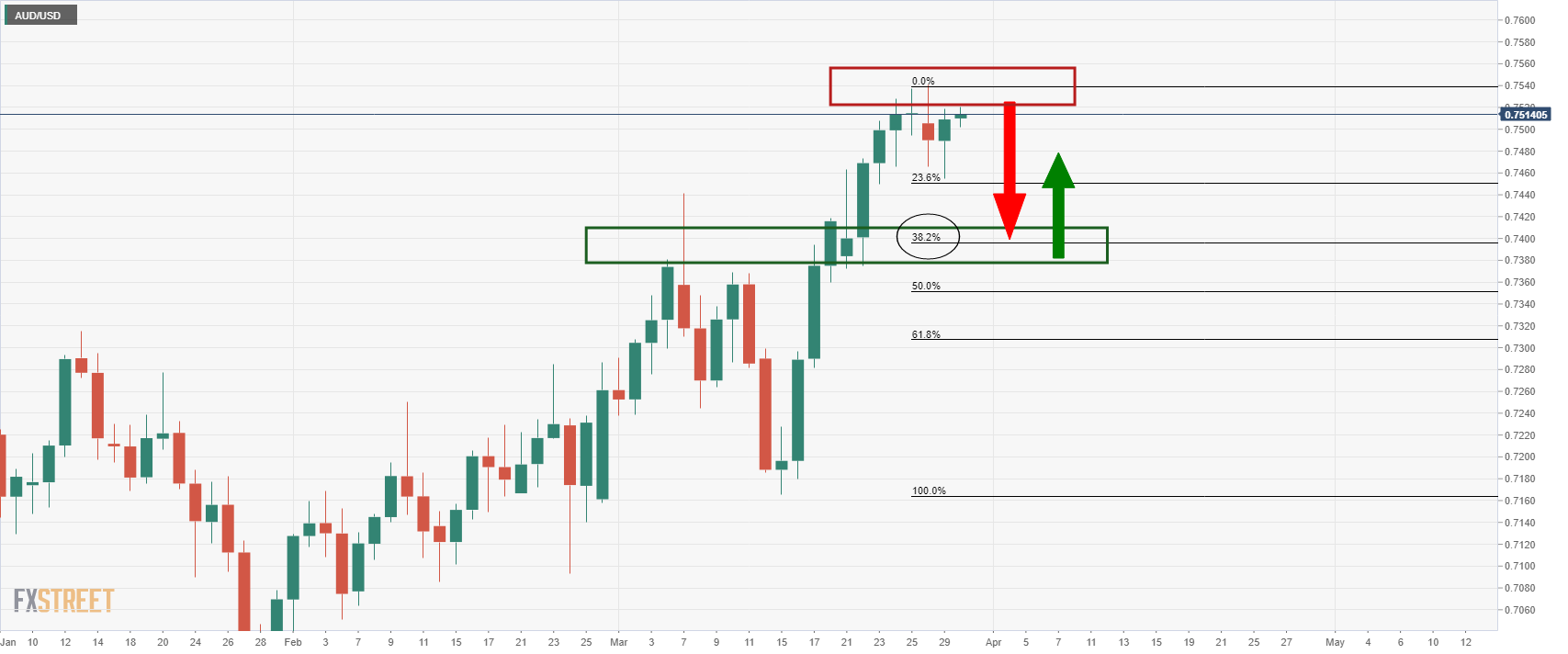

- AUD/USD bulls are running into a ceiling of resistance as commodities rise.

- The Ukraine crisis is intensifying, pressuring oil prices higher again.

AUD/USD has been stuck in a tight range on the day as the price attempts to move higher to test the resistance on the daily chart, but without conviction so far. At the time of writing, AID/USD is trading at 0.7508 and has chopped between 0.7502 and 0.7536 range so far.

The commodities markets have been given another boost by the prospects of the Ukraine crisis dragging on for longer. The prospects of a cease-fire have been dashed by the latest comments by key officials involved in the war.

The Kremlin on Wednesday has said there was no sign of a breakthrough yet. Ramzan Kadyrov, who is a powerful head of the Russia's republic of Chechnya, said on Wednesday that Moscow would make no concessions in its war in Ukraine and that Kremlin negotiator Vladimir Medinsky had been wrong to suggest otherwise.

Both the Ukraine Defence Ministry and the Polish Deputy Prime Minister crossed the wires and stated that Russia is preparing for a new attack in Ukraine. All indications are that we are facing a long war, Aljazeera Tweeted, quoting the Polish PM. A Ukraine Defence Ministry spokesperson expressed a view that the Russian military continues to aim to take control of Mariupol, a strategic city in the east, saying that a major withdrawal is not taking place, and Russia is ready to resume attacks.

Indeed, on Wednesday, Russian forces bombarded the outskirts of Kyiv and the US administration had warned on Tuesday they were sceptical of Russia’s vow to curtail its military assault on Ukraine, ending the day with a note of caution after hours of peace talks between the two sides appeared to make some headway.

As a consequence, equities ticked down and oil bounced as doubts grew over Russia’s intentions in Ukraine. The Thomson Reuters CRB Index rallied 2.2% with West Texas Intermediate crude in the spot market breaking $108bbl in New York trade. This in turn is supporting the Aussie.

Market pricing remains very responsive to sudden shifts in sentiment and the onset of quarter and month-end is an additional hurdle for markets to contend with. The end of the week's data will be important in this regard to determine whether the US dollar can continue to run higher on both positive economic data and central bank prospects in the face of higher interest rates and a wave of mounting inflation pressures.

On Friday, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction to the Ukraine crisis this Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

AUD/USD technical analysis

The price is testing the resistance in the daily chart but is yet to move in to mitigate that imbalance from the bullish rally on the daily chart. Therefore, the bears will be looking for a move to test at least 38.% Fibonacci retracement area that correlated with the prior resistance at the start of March near 0.74 the figure.

- The yen’s broad recovery continued for a second day on Wednesday as traders continued to pair short positions.

- GBP/JPY dipped as low as the 159.00 level at one point, but has since recovered back to the 160.00 area.

- BoJ relative dovishness, even versus an increasingly less hawkish BoE, plus falling geopolitical risk premia suggests support for the pair.

The yen’s broad recovery continued for a second day on Wednesday as traders continued to pair short positions against the currency in wake of recent jawboning from BoJ and Japanese government policymakers regarding JPY weakness. GBP/JPY thus dipped as low as the 159.00 level at one point but has since recovered back to the 160.00 area, where it continues to trade with on the daily losses of around 0.5%, meaning the pair has reversed nearly 3.0% lower versus earlier weekly highs in the mid-164.00s.

The recent pullback does not mean that the yen has suddenly become a long-term buy and GBP/JPY is set to fall back to earlier sub-151.00 monthly lows. Rather, the short-term bears riding a wave of profit-taking on recent GBP/JPY longs, which numerous technical indicators over the past few sessions had suggested had become heavily overbought at the start of the week, are likely targeting a retracement back to prior Q1 2022/Q4 2021 highs in the 158.00 area. Here, the longer-term and more patient GBP/JPY bulls may be inclined to add to long positions with a view to target an eventual move back into the mid-160s.

Recent BoJ insistence that it wants to stick to ultra-dovish policy, which it has backed up in recent days via market interventions to prevent Japanese 10-year yields moving above the top of the -0.25% to 0.25% target range, isn’t likely to change any time soon. That means that, even if the BoE is sounding much less hawkish as of late, rate differentials are likely to continue moving in sterling’s favour (against the yen anyway, though not versus most of the rest of the G10). That, combined with a recent unwind in geopolitical risk premia on a more promising tone to Russo-Ukraine peace talks, could keep the pair underpinned in the medium-term.

What you need to know on Thursday, March 31:

The main story in FX markets on Wednesday was a continued weakening of the US dollar, where the DXY dropped a further 0.6% to the 97.80s, where it now probes mid-March lows more than 1.5% below earlier weekly highs. Wednesday’s US data releases (ADP jobs and final Q4 GDP and Core PCE estimates) were robust, which alongside further hawkish Fed speak helped solidify expectations for a 50 bps rate hike from the bank in May.

But this wasn’t enough to shield the US dollar from a bearish combination of 1) unfavourable moves in rate differential amid downside in US yields, 2) month/quarter-end selling and 3) optimism regarding Russo-Ukraine peace talks. Regarding the latter, though skepticism about apparent progress in the talks this week remains elevated in wake of Russia’s continued offensive in Ukraine, FX markets seem to be pricing in a more favourable geopolitical outlook.

“The conflict may be moving to a more localized phase with some of the more extreme tail risk scenarios reducing in probability,” analysts at JPMorgan said on Wednesday in a note where they also recommended buying EUR/USD. For reference, EUR/USD hit its highest levels since the beginning of the month to the north of the 1.1150 mark on Wednesday, up 0.7% on the day and up 1.9% versus earlier sub-1.0950 weekly lows. The euro got some independent impetus from continued upside in short-end Eurozone yields as traders continued upping bets on ECB tightening in wake of the latest Spanish and German preliminary March HICP inflation figures, which surprised to the upside again.

In terms of the rest of the G10, while the euro was a strong performer, it was by no means the best, with the Swiss franc and Japanese yen taking that crown. USD/JPY dropped 0.8% to back under 122.00, a direct function of the drop in US yields on the day, leaving it now more than 2.5% below earlier weekly highs as traders pondered recent Japanese policymaker commentary regarding recent yen weakness. USD/CHF, meanwhile, saw an uncharacteristically large 0.9% drop from above 0.9300 to the low 0.9200s, leaving it only within a few pips of testing its 200-Day Moving Average.

In terms of the rest of the major G10 currencies, the kiwi was a beneficiary of strong domestic data (New Home Building Consents and Business Sentiment), with NZD/USD rallying slightly over 0.5% back to the upper 0.6900s. Its antipodean counterpart the Aussie failed alongside the loonie to benefit from higher energy prices, with AUD/USD trading in uninspired fashion in the 0.7500 area (still close to multi-month highs) and USD/CAD languishing just under 1.2500 and near-annual lows.

Finally, sterling was a middle-of-the-road performer, with GBP/USD rallying back into the mid-1.3100s but failing to hold above its 21-Day Moving Average for a sixth successive session, as EUR/GBP hit its highest level in more than three months near 0.8500.

Ahead, while FX market focus will remain transfixed on geopolitical developments and any associated impact on risk appetite/the commodity complex, economic data will also remain a key driver, with traders simultaneously also continuing to weigh up G10 monetary policy divergence. The OPEC+ meeting, US February Core PCE and Canadian January GDP figures are the main events to watch in the coming session, ahead of the release of the US labour market report on Friday, which is the most important event of the week. Eurozone HICP inflation figures are also out on Friday and should show a steep rise as the national figures out of Spain and Germany did on Wednesday.

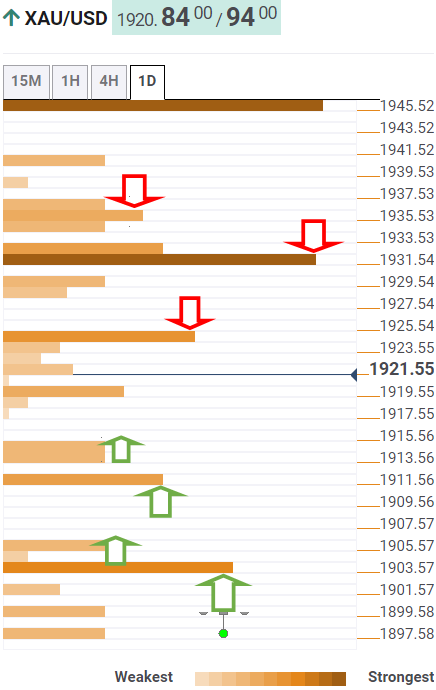

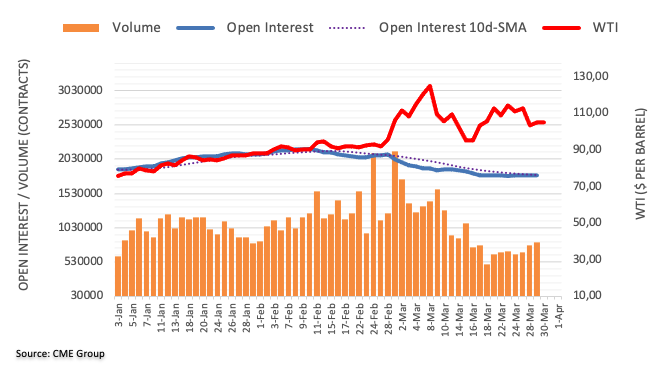

- Gold is on the bid in late New York and the DXY is pressured.

- The Ukraine crisis is intensifying as hopes of a cease-fire anytime soon are dashed.

- XAU/USD bulls are looking to the month-end close for prospects of a continuation next month.

At $1,933.54, the gold price is 0.72% higher on the day with XAU/USD travelling between a low of $1,916.01 and $1,938.62 the high so far. Gold prices rose and have been supported by a softer US dollar and renewed doubts about the possibility of a ceasefire between Russia and Ukraine.

The US dollar (DXY) fell 0.6% to nearly a two-week low despite peace talk hopes between Ukraine and Russia deteriorating again. Gold prices fell by as much as 1.8% after Russia pledged to cut down on military operations around Kyiv and in northern Ukraine in peace talks on Tuesday, but the precious metal pared most of the losses to settle just 0.2% lower for the day as sceptics remained in the room.

Ukraine crisis intensifies

Concerns were solidified when, although the Kremlin on Wednesday welcomed that Kyiv had set out its demands for an end to the conflict in Ukraine in written form, it said there was no sign of a breakthrough yet. Ramzan Kadyrov, who is a powerful head of the Russia's republic of Chechnya, said on Wednesday that Moscow would make no concessions in its war in Ukraine and that Kremlin negotiator Vladimir Medinsky had been wrong to suggest otherwise. Polish Deputy Prime Minister also crossed the wires and stated that Russia is preparing for a new attack in Ukraine and all indications are that we are facing a long war, Aljazeera Tweeted.

On Wednesday, Russian forces bombarded the outskirts of Kyiv and the US administration had warned on Tuesday they were sceptical of Russia’s vow to curtail its military assault on Ukraine, ending the day with a note of caution after hours of peace talks between the two sides appeared to make some headway.

However, traders will be watching closely to see if there can still be progress following yesterday's talks. After all, the Ukrainian presidential advisor Mykhailo Podolyak said that there had been ''successful enough for a possible meeting between Putin and Zelensky.'' Podolyak added, “we have documents prepared now which allow the presidents to meet on a bilateral basis,.''

Markets have also been keeping a close tab on the US 2-year/10-year Treasury yield curve, which briefly inverted on Tuesday. The bond markets monitoring for tightening by the Federal Reserve has resulted in an inverse of the curve, signalling to markets that a recession could be on the way.

''With haven flows remaining robust, the risk of buyers being forced to offload in a vacuum alongside potential CTA liquidations have diminished for now, with key downside CTA triggers sitting in the $1870/oz region,'' analysts at TD Securities argued.

''Nonetheless, gold traders will also have to contend with macro outflows associated with a hawkish Fed as rates markets are readying for the Fed to deliver a hawkish surprise to markets,'' the analysts added. ''With that said, while geopolitical tensions and yield curve recession signals re-ignite investor interest in gold, downside risks still remain amid a hawkish Fed backdrop and as negotiators continue to work towards a ceasefire.''

Gold technical analysis

- Chart of the Week: Gold is moulding a bullish close for the month

We are in the last week of the month and the start of a new quarter could print a bullish prospect on the monthly chart, as illustrated below:

The month could close with a bullish candle and long wick that represents a phase of accumulation on the lower time frames, meaning, there is potential for a move high in the weeks ahead and a fresh cycle high thereafter.

- The shared currency bulls failed to cling to the 136.00 mark.

- Geopolitical developments in Eastern Europe turned sentiment negative as Russia backpedaled by saying that peace talks have not progressed.

- EUR/JPY Price Forecast: The path of least resistance in the near-term is downward biased.

The EUR/JPY retreats in the North American session, on a risk-off mood trading session to news from Russia’s – Ukraine front, as negotiations have failed to progress, as the French Foreign Minister noted. At the time of writing, the EUR/JPY is trading at 135.95.

The market sentiment turned dismal in the mid-European session, as Russia reported that although Ukraine’s efforts, they noted that there’s has been no breakthrough on it as Russia redeploys troops towards Donbas. That said, alongside Polish Deputy Prime Minister saying that Russia is preparing a new attack in Ukraine confirms the continuation of hostilities.

Aside from this, the EUR/JPY overnight seesawed in a 180-pip range. In the Asian session, the cross-currency pair reached its daily high at 136.66, retracing in the European session as a raft of negative sentiment struck the market, which lifted safe-haven peers, sending the EUR/JPY towards 134.87. Late in the North American session, the shared currency gained traction toward current levels.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY price action in the last two days shows indecision surrounding the pair. Failure to push above/below Monday’s boundaries keeps the EUR/JPY trapped in the 134.00-137.00 range, though the highs have been lower than each previous trading day in the last two days.

With that said, the EUR/JPY might be heading lower, though it would find some hurdles on its way south. The EUR/JPY first support would be 135.30. A decisive break would expose 134.87, followed by 133.97.

Upwards, the EUR/JPY first resistance would be 136.00. Breach of the latter would expose 136.50, followed by 137.00, and the YTD high at 137.54.

Technical levels to watch

Russia is beginning to reposition about 20% of the troops it has arrayed around Kyiv, the US Pentagon stated on Wednesday, adding that while some are moving to Belarus, none are moving back to home their home-garrison. The US expects Russia to refit and resupply troops to then redeploy them elsewhere in Ukraine, the Pentagon added, saying that the Pentagon would concur with the conclusion that Russian President Vladimir Putin had not been "fully" informed by the Ministry of Defense "at every turn" over the past month.

Separately, the White House said that it has information that Putin has been misled by the military and that he has tensions with some of his aides. The White House said the information it has about Putin underscores the problems with Russia's campaign in Ukraine.

- US equities are modestly lower across the board on Wednesday, as investors take profit following the recent impressive run higher.

- Waning Russo-Ukraine optimism, robust US data that solidified Fed tightening expectations and yield curve inversions were all cited as worries.

- The S&P 500 currently trades just above 4600 and on course to end the month 5.3% higher.

US equities are modestly lower across the board on Wednesday, as investors take profit following the recent impressive run higher, with one eye on geopolitical developments and the outlook for Fed policy and the US economy. The S&P 500, which rallied nearly as high as 4640 on Tuesday, is back to trading near the 4600 level, having dropped about 0.5% as optimism about Russo-Ukraine peace negotiations wanes somewhat after continued Russian assaults across Ukraine.

Meanwhile, US data (March ADP jobs and final Q4 GDP and Core PCE inflation) was robust and deemed by investors as supportive of expectations for a 50 bps rate hike from the Fed in May. Expectations for faster Fed tightening has pushed key parts of the US yield curve towards inversion recently, a worry for investors as yield curve inversions have accurately forecasted recessions in the past. Both of these have also been cited by investors as reasons for profit-taking and the modest downturn on Wednesday.

That means the index is on course for its first negative session in five and only its third since 15 March. Indeed, since that date, the index has rallied a stunning roughly 9.5% and, as the month-end approaches, is on course to post a monthly gain of about 5.3%. The S&P 500 is thus on course to post a quarterly loss of about 3.3%, the worst quarterly performance since H1 2020. But that masks the fact that the index was able to recover over 11.5% from earlier quarterly lows printed back in February in the 4120 area.

Looking at the other major US indices; the tech-heavy Nasdaq 100 index was last down about 0.7%, though remains robustly supported to the north of the 15,100 mark after the index hit its highest level since mid-January on Tuesday in the 15,200s. On the week, the index still trades about 2.5% higher, as the month-end approaches, gains since the end of February stand at about 6.3%. That strong monthly gain means the Nasdaq 100 is on course to end the quarter with losses of about 7.0%, which isn’t bad considering the index was at one point down more than 20% on the quarter.

Finally, the Dow was last down about 0.2% and remains robustly supported above the 35,000 level, putting it on course to end the month with gains of about 3.9% and quarterly losses of about 5.0%. The CBOE S&P 500 volatility index (or VIX) was last consolidating in the 19.00 area and near its lowest level since mid-January, having fallen precipitously in recent weeks from 37.50ish highs printed earlier this month. Analysts have questioned the resilience of the broad stock market and apparent complacency of the VIX (which is back below its long-run average of 20) in the face of such elevated risks pertaining to geopolitics, Fed (and central bank) policy and inflation.

- The New Zealand dollar is up in the week so far by 0.3%.

- Despite Ukraine’s efforts, negotiations in Eastern Europe stall as Moscow reports no “breakthrough.”

- NZD/USD Price Forecast: The pair is neutral-upwards biased once broken the 200-DMA.

The New Zealand dollar climbs for the second straight trading session, despite a risk-off market mood in the financial markets, courtesy of Moscow, which said they had not seen anything else promising or a breakthrough in their peace talks with Ukraine. At the time of writing, the NZD/USD is trading at 0.6980.

Russia-Ukraine negotiations show no progress, as reported by Moscow

Market sentiment turned sour since the European session. Global equities are falling, a consequence of no progress in negotiations between Russia and Ukraine, which added to the current high inflationary scenario, threatens to derail the post-pandemic economic recovery. Of late, the Polish Deputy Prime Minister said that Russia is preparing for a new attack in Ukraine and all indications are that we are facing a long war, according to Aljazeera Tweets. In the same tone, the French Foreign Minister stated that negotiations between Russia and Ukraine have not progressed.

Aside from this, the NZD/USD remains buoyant, despite the dismal market sentiment, in part lifted by a softer greenback, as portrayed by the US Dollar Index, down 0.55%, currently at 97.870. Also, the 2 to 10-year yield curve, which inverted at a time on Tuesday, stays almost flat, but with the 10-year yields above 2s, each one sitting at 2.373% and 2.332%, respectively.

An absent New Zealand economic docket would keep NZD/USD traders focused on US macroeconomic data and more Fed speaking.

Earlier in the North American session, the US economic docket featured ADP Employment Report, which showed that private companies added 455K jobs to the economy in March, higher than the 450K estimated, a prelude for Friday’s Nonfarm Payrolls report. Also, the US economy in the Q4 of 2021 grew at its highest pace since 2020’s Q3. The GDP on its final reading rose by 6.9%, a tick lower than the 7.1% foreseen.

Later, Richmond Fed President Tomas Barkin said that he’s open to raising rates by 50-bps at the May meeting, depending on how strong is the US economy.

NZD/USD Price Forecast: Technical outlook

The NZD/USD reached a YTD high, but short of the 0.7000 mark, though retreated afterward. However, on Tuesday, the pair broke above the 200-day moving average (DMA) at 0.6908, a signal that the NZD/USD could aim higher. Also, the Relative Strength Index (RSI), a momentum indicator, points upward at 63.46, with room to spare before reaching overbought levels.

With that said, the NZD/USD’s first resistance would be the 0.7000 mark. Breach of the latter would expose the descending channel downslope top-trendline around the 0.7050-70 range, followed by 0.7100.

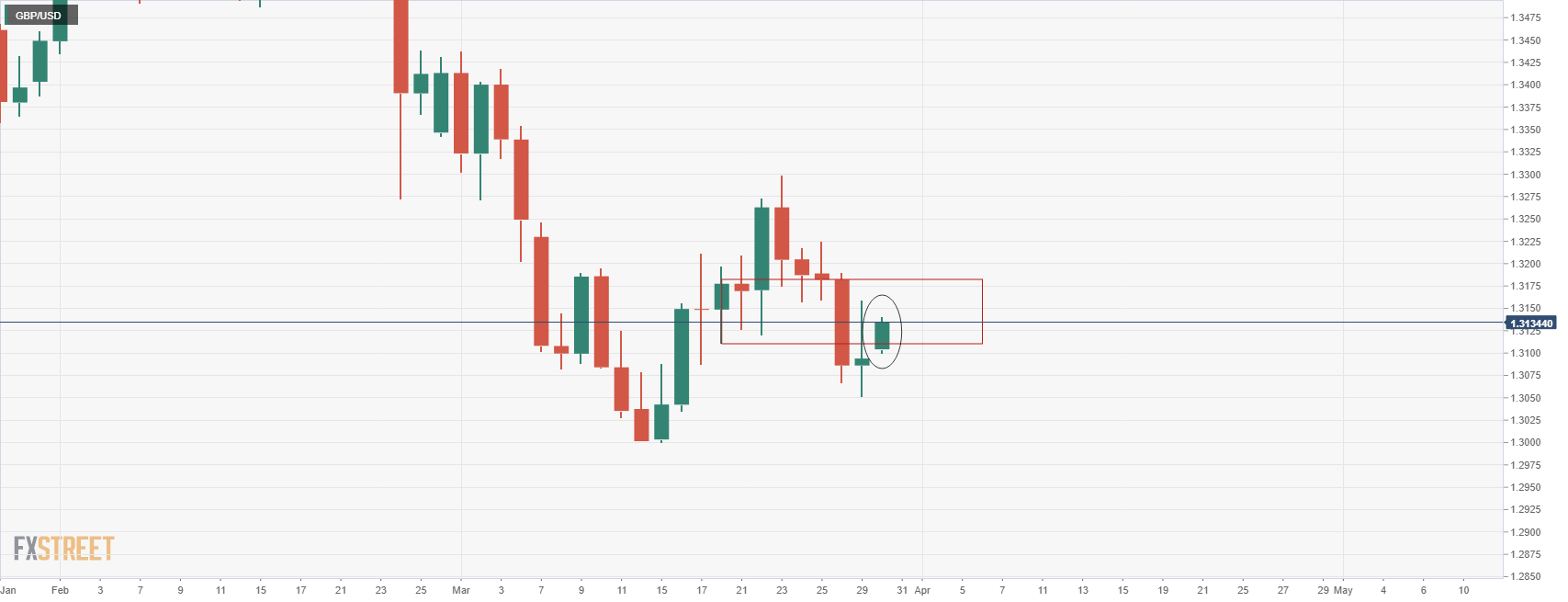

- GBP/USD bears are moving in on the hopes of a cease-fire dashed by relentless Russian attacks.

- Oil prices back on the bid, risk-off, US stocks lower and USD higher, weighing on GBP.

GBP/USD is trading around 1.313, 0.3% higher on the day in a technical move as the US dollar ebbed overnight on what, at first glance, seemed to be the makings of a breakthrough in Ukraine & Russian peace talks. However, the optimism over Ukraine-Russia peace talks waned on Wall Street and concerns over a recession are growing due to the prospect of a sharp rise in interest rates that is expected to hurt economic growth.

Ukraine crisis peace talks hopes dwindle

GBP is considered as being a risky currency and as such, it is coming under renewed pressure on Wednesday. The pair has started to slide from a high of 1.3182 that had been marked in the early New York trade. The Kremlin was reported to say that there was no sign of a breakthrough yet even though it welcomed Kyiv's move to set out its demands in written form. Ramzan Kadyrov, who is a powerful head of the Russia's republic of Chechnya, said on Wednesday that Moscow would make no concessions in its war in Ukraine and that Kremlin negotiator Vladimir Medinsky had been wrong to suggest otherwise. Polish Deputy Prime Minister also crossed the wires and stated that Russia is preparing for a new attack in Ukraine and all indications are that we are facing a long war, Aljazeera Tweeted.

As a consequence, US stocks fell on Wednesday. The S&P 500 is now down 0.6%. Markets had rallied in the previous session after Russia pledged to scale down military operations around Kyiv and in northern Ukraine. However. On Wednesday, Russian forces bombarded the outskirts of Kyiv. The US had warned on Tuesday they were skeptical of Russia’s vow to curtail its military assault on Ukraine’s capital, Kyiv, and the northern city of Chernihiv, ending the day with a note of caution after hours of peace talks between the two sides appeared to make some headway.

Still, there may be some hope yet. Following yesterday's talks, Ukrainian presidential advisor Mykhailo Podolyak said that there were ''successful enough for a possible meeting between Putin and Zelensky.'' he added, “we have documents prepared now which allow the presidents to meet on a bilateral basis," he said.

Eyes on oil prices

Looking at the positioning data, net short GBP positions had increased noticeably for a third week as concerns rise as to the cost of living crisis in the UK, so any signs of relief there are bound to support the pound in the spot market as inflation concerns abate.

There will therefore be a close eye kept on the price of oil and progress in peace talks that could trigger a sell-off in energy prices that might go a long way in supporting a recovery in the pound. Oil prices rebounded from day prior losses early on Wednesday on a report US inventories fell again and on skepticism over Russian promises during peace talks. West Texas Intermediate crude in the spot market is breaking $108bbl in New York trade.

BoE in focus

Meanwhile, the Bank of England's Governor Andrew Bailey acknowledged that the bank has softened its guidance on rate hikes this month to reflect the high level of economic uncertainty. This was backed up by BoE's Deputy Governor Ben Broadbent who has warned that the Ukraine crisis will have a big impact on the U.K. outlook:

- “As a big net importer of manufactures and commodities, it’s doubtful that the UK has ever experienced an external hit to real national income on this scale.”

- “From the narrow perspective of monetary policy it will result in the near term in the difficult combination of even higher inflation but weaker domestic demand and output growth.”

Looking ahead, analysts at Brown Brothers explained that, ''at the March 17 decision, the bank said that further tightening of policy “might be” appropriate in the coming months vs. the forward guidance in February, when such a move was seen as “likely.” Bailey said that while it’s been appropriate for the BoE to tighten policy under current circumstances, forward guidance should reflect the current heightened uncertainty,''

''WIRP suggests a hike at the next meeting May 5 is fully priced in, with only 25% odds of a 50 bp move then vs. 50% at the start of this week. Swaps market sees the policy rate at 2.25% over the next 12 months, up from 2.0% at the start of last week. Risks of another 25 bp of tightening over the following 12 months have now been priced out,'' the analysts added.

Key data events

Looking ahead for the week, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction to the Ukraine crisis this Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

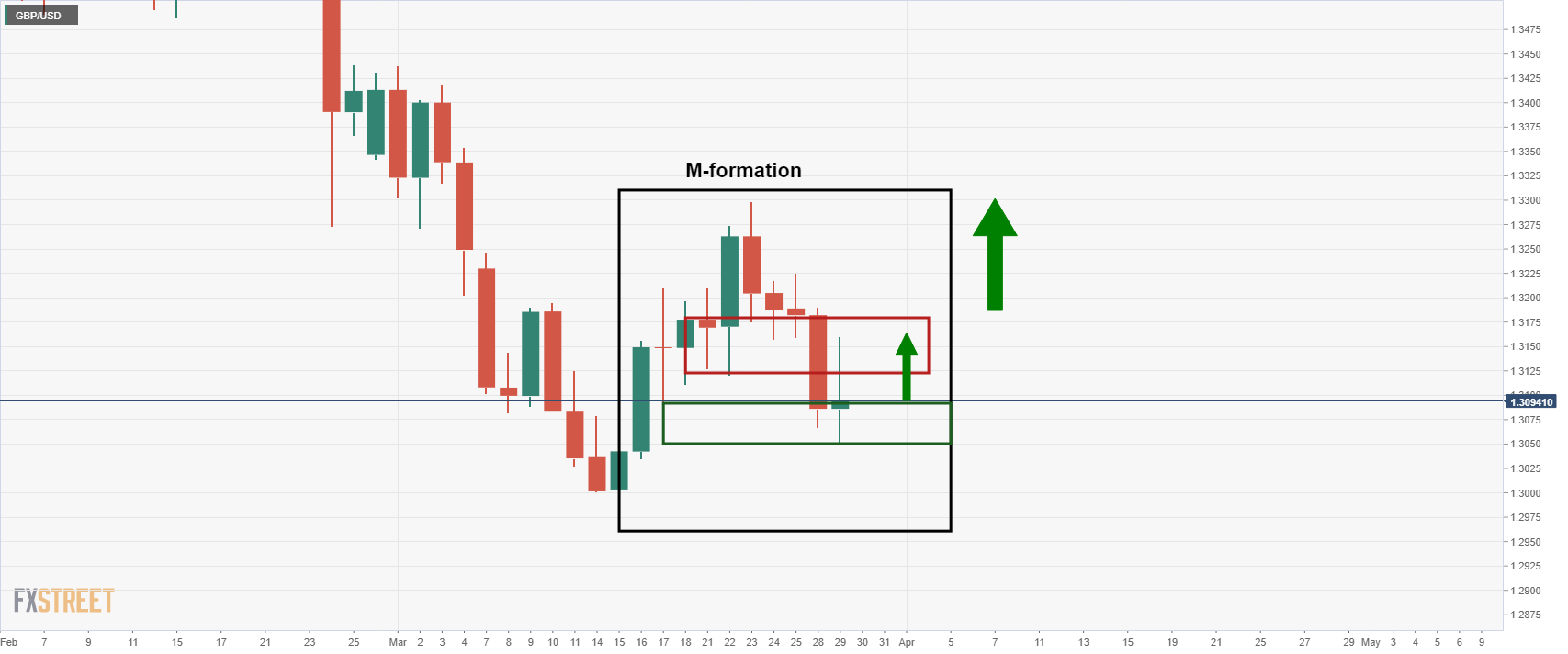

GBP/USD technical analysis

The following illustrates the pound's bullish trajectory on the daily chart in an M-formation:

GBP/USD daily chart

The chart above was from the prior day's close. The price attempts to recover towards the neckline of the formation:

Kansas City Fed President Esther George said in an interview with the WSJ on Wednesday that the current surge in inflation is different from what former Fed Chair Paul Volcker (served between 1975-1979) faced and has not yet become embedded in the economy. the path to policy normalisation is likely to be a long one, George continued, adding that the Fed's neutral rate is likely around 2.5%, though much is in flux.

The prospect of yield curve inversion should be considered in the Fed's balance sheet discussion, George continued, adding that the Fed's holdings should fall significantly, thus allowing long-term rates to climb. Yield curve inversions have implications for financial stability, she noted, and rolling off Fed assets could help steepen the curve. The policy rate will rise in a steady and deliberate manner, she added, before concluding that the US economy is performing well.

- The USD/JPY is trimming gains for the second consecutive day, down 300-pips since Tuesday.

- A dismal market mood, a softer greenback, and falling US bond yields boosted the prospects of the yen.

- USD/JPY Price Forecast: Faced solid support around 121.20s, which lifted the pair towards 122.00.

The Japanese yen extends its gains for the second straight day as the USD/JPY pair retreats from multi-year highs around 125.00, on a dismal market mood and Japanese month-end-flows. At the time of writing, the USD/JPY is trading at 121.89.

On Wednesday, the market sentiment turned sour on the Kremlin’s remarks that even though Ukraine has put demands down on paper, they don’t see anything really promising and stated that there’s much work ahead.

Aside from this, the greenback has remained soft for two consecutive trading sessions, with the US Dollar Index, down 0.58%, sitting at 97.836, a headwind for the USD/JPY. US Treasury yields remain on the back foot, with the 10-year US T-note at 2.352%, down four basis points.

Overnight, the USD/JPY began the Asian session above 123.20 but dove towards the 200-hour simple moving average (SMA) at 121.25, a price level that found buyers, which lifted the pair towards the 121.90ish region.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased, despite the 300-pip retracement from 125.00s. Nevertheless, the Relative Strength Index (RSI) just got out of overbought conditions at 68.94, a signal that could push the pair higher. However, it would need a daily close above 122.00 in the event of relaunching another test towards the YTD highs above 125.00.

If that scenario plays out, the USD/JPY first resistance would be 122.00. Breach of the latter would expose March 25 to 122.43 daily high, followed by the 123.00 mark, which once cleared would pave the way towards 125.10.

Technical levels to watch

Analysts at Wells Fargo expect the Australian dollar to soften in the quarters ahead, although they see the potential for some stabilization in early 2023. They forecast AUD/USD at 0.72 by the end of the third quarter.

Key Quotes:

“While the economy saw a strong rebound in Q4-2021 and is experiencing a tight labor market and resilient consumer sector, confidence indicators have shown some deterioration recently. Even in the context of strong jobs growth and rising underlying inflation trends, the Reserve Bank of Australia (RBA) maintains a patient stance, and we expect an initial 15 bps rate hike to occur in November of this year, bringing the Cash Rate to 0.25%. In our view, RBA rate hikes should still lag behind a hawkish Federal Reserve and fall short of the rate hikes currently priced by financial markets.”

“Our base case is for the Australian dollar to weaken moderately in the quarters ahead. However, we believe the risks are tilted to the upside, as it is possible that there will be a smaller decline in the currency than our base case forecast suggests.”

“Recent labor and consumer trends have been encouraging. If the economy proves to be more resilient than expected despite a softening in sentiment, this should provide some support for the Australian dollar. More persistent elevated underlying inflation could also prompt the Reserve Bank of Australia to raise rates earlier and faster than currently expected, which would provide further support the currency.”

Analysts at Wells Fargo forecast a period of extended weakness for the EUR, with risks tilted to the downside. They see EUR/USD trading at 1.0800 by the end of the third quarter.

Key Quotes:

“We forecast a period of extended euro weakness; however, the risks are potentially tilted toward a larger decline than we currently expect.”

“Growth slowed significantly in late 2021, and we expect a relatively gradual rebound in growth from early 2022. However, with higher energy prices likely to weigh on consumer purchasing power and given possible Ukraine uncertainties, Eurozone economic growth could be even more sluggish than we expect.”

“Eurozone inflation has surprised to the upside, although the rise in core inflation has been less marked to date. Were Ukraine uncertainties to intensify, it is possible the ECB could move more gradually to less accommodative policy than we currently forecast, which should weigh on the euro. Should these risks transpire, the euro could soften more than we currently forecast, with the EUR/USD exchange rate perhaps falling as low as $1.0000.”

- A continued pullback in the US dollar and yields from recent highs is giving precious metals a lift.

- XAG/USD is now more than 4.0% higher versus Tuesday’s sub-$24.00 lows, but has been unable to reclaim the $25.00 level.

- Waning geopolitical risk premia and caution ahead of key US data is holding back the silver bulls for now.

Even though the latest batch of US data (strong ADP and robust Q4 GDP and Core PCE numbers), alongside fresh hawkish commentary from Fed policymakers has been interpreted as solidifying expectations for a 50bps rate hike from the bank in May, the US dollar continues to come under intense selling pressure, supporting the precious metal complex. US yields also continue to ease back from recent highs, with the US-10 year on Wednesday falling back under the 2.40% mark, unwinding some of the recent upwards pressure on the “opportunity cost” of holding non-yielding assets like precious metals.

Spot silver (XAG/USD) prices are thus trading higher by about 0.75% on the day, though have not been able to mount a lasting push to the north of the $25.00 per troy ounce level. Still, at current levels in the $24.90s, XAG/USD is trading with gains of more than 4.0% versus Tuesday’s lows just under $24.00. Traders at the time piled in to buy silver as it tested its 200-Day Moving Average at $23.96. Successful defense of support in the key $24.00 area will have many bulls eyeing a retest of last week’s highs in the $25.80s.

But the recent shift in tone of Russo-Ukraine peace negotiations towards greater optimism that a peace deal can be struck means that geopolitical risk premia, a key factor underpinning silver prices in March, is somewhat lessened. Meanwhile, in the next two days, key US Core PCE and officials labour market data will be released, ahead of which its not unusual to see precious metal, FX and bond traders exercising greater levels of caution and more subdued trading conditions. Perhaps then it isn’t too much of a surprise that XAG/USD failed its efforts to push back above $25.00 on Wednesday.

Data released on Wednesday, showed real GDP grew during the fourth quarter an an annualized rate of 6.9%, below the 7% of previous estimates. According to analysts at Wells Fargo, the sequential rate of real GDP growth likely has downshifted in the first quarter of 2022, but it appears to have remained in positive territory.

Key Quotes:

“The first two estimates had shown that real GDP growth in the fourth quarter was driven largely by modest growth in consumer spending and by a sizable increase in inventories, which likely was intentional given the depleted nature of stocks in previous quarters. These drivers of growth in Q4 were generally reaffirmed by today's release. The sequential rate of real GDP growth likely has downshifted in the first quarter, but it appears to have remained in positive territory. The BEA is scheduled to publish the first estimate of Q1-2022 GDP growth on April 28.”

“Overall as demand softens we look for profit growth to slow this year. Our latest forecast has real GDP rising 3.0% for 2022 as a whole and corporate profits advancing roughly 8%.”

The USD/JPY could move toward 125.00 later in 2022, according to analysts at Rabobank. They warn the market has priced in a lot of interest rate hikes from the Federal Reserve, which may limit the appreciation of the pair.

Key Quotes:

“Having briefly hit the USD/JPY125 level earlier in the week, USD/JPY has been knocked by a bout of profit-taking. Yesterday’s decline in yields on shorter-dated US government paper supported the move lower in USD/JPY. Softer oil prices which can in part be linked with yesterday’s flurry of hopes regarding progress in peace talk between Ukraine and Russia have also contributed to the better tone on the JPY. The fact that this news happened to coincide with reports of a meeting between BoJ Governor Kuroda and PM Kishida was another persuading element in the drop in the value of USD/JPY. That said, the factors that has driven USD/JPY in recent weeks essentially remain in place. Consequently, the JPY remains vulnerable.”

“While interest rate differentials are supportive of USD/JPY, the market has priced in a lot of Fed rate rises. On a one year view the money market is currently positioned for rate rises totalling around 240 bps. This may mean scope for additional upside in short-dated US yields is limited. If US short-term US rates struggle to make further headway, this may limit or slow the pace of further appreciation of USD/JPY. “

“While actual FX intervention from Japan is unlikely, the authorities could be minded to make use of investors’ fear of a move to calm the market. News that BoJ Kuroda and PM Kishida were scheduled to meet this week certainly appeared to shake out short JPY positions. Subsequently Kuroda played down speculation that JPY weakness was a concern for the authorities.”

“We see scope for USD/JPY to move back towards 125 in the latter half of the year.”

- US dollar under pressure as US yields pullback.

- EUR/USD heads for the highest daily close in a month.

- Economic data shows accelerating inflation in Germany and job creation in the US.

The EUR/USD rose further during the American session and printed a fresh four week high at 1.1170. The pair is rising for the second day in a row, headed toward the highest close in a month.

A weaker US dollar is keeping the bullish tone of EUR/USD intact. Technical factors contribute to support the upside. The pair is holding well above 1.1100 and also breaking the 1.1135 resistance area.

The DXY is trading at weekly lows at 97.75, as US yields slide. The 10-year stands at 2.36%, away from the 2.43% it hit earlier on Wednesday. Equity prices in Europe ended lower amid skepticism about Russian withdrawing some troops from Kiev. In Wall Street stocks are off lows. Commodity prices are higher, weighing on the dollar.

Inflation up in EZ while US keeps creating Jobs

Inflation data from Germany came in above expectations, with the annual rate reaching 7.3%, the highest since 1981. The acceleration in prices creates a challenging environment for the European Central Bank (ECB). “The ECB will want to focus on inflation expectations and as long as these expectations remain fairly anchored, we only expect an end of the so-called unconventional measures over the next 12 months, i.e an end to net asset purchases and an end to negative deposit rates. It would need a clear end to the war, lifted sanctions combined with stepped up fiscal stimulus to engage the ECB in a more genuine tightening cycle”, wrote Carsten Brzeski, Global Head of Macro at ING.

In the US, the ADP employment report came in line with expectations showing an increase in private jobs of 455K. The third 4Q GDP reading showed a 6.9% expansion, below the 7% of previous estimates. The numbers did not affect the dollar. On Friday, the official employment report is due with Non-farm payrolls and the unemployment rate.

Technical levels

- The market sentiment turned sour as Moscow said there had been no “breakthrough” in talks.

- Global equities fall, commodities rise, and the greenback breaks under the 98.00 mark.

- XAU/USD Price Forecast: A hammer at the 50-DMA lifted the non-yielding metal above $1900.

Gold (XAU/USD) found some buying pressure around the $1900 mark, briefly broken on Wednesday amid an improvement in geopolitical developments in Eastern Europe, which dragged commodity prices down, with oil and silver recording losses, alongside the yellow-metal. At $1935.05, XAU/USD reflects the appetite for safe-haven assets, which in the FX space include the Japanese yen and the Swiss franc.

Moscow sees no “breakthrough” in peace talks with Ukraine

Meanwhile, reports from Moscow said that although Ukraine has begun to put demands down on paper and be more specific, they don’t see anything really promising that looks like a breakthrough and emphasized there’s a lot of work ahead. That said, the market sentiment shifted negatively, lifting the prices of commodities.

Global equities are dropping from weekly highs on the aforementioned, while the greenback is down. The US Dollar Index, a gauge of the buck’s measure vs. its peers, slides 0.64%, sits at 97.781, undermined by US Treasury yields down, with the 10-year benchmark note rate at 2.378%, down two basis points, though higher than the 2-year yield, which sits at 2.344%.

On Tuesday, the US 2 to 10-year yield curve briefly inverted when the 2-year exceeded the 10-year yield for the first time since 2019, reinforcing the view that the Federal Reserve tightening may cause a recession.

The US economic docket for Wednesday featured the US ADP Employment report for March, which showed that 455K jobs were added to the US economy, while the Department of Commerce reported that GDP for the Q4 in its Final reading came at 6.9%, a lower than the 7.1% estimated, but the highest since the Q3 of 2020.

Later, Richmond’s Federal Reserve President Thomas Barkin said that he would be open to a 50 bps hike in May “if necessary” and added that he would be looking at inflation and how strong the economy is. Barkin stated that it feels inflation will settle next year as the US central bank tightening moves take effect.

XAU/USD Price Forecast: Technical outlook

Gold’s Tuesday fall was stopped around the 50-day moving average (DMA) at $1894.43, in a downward move that looked like XAU/USD was going to get lower on positive news from Ukraine. However, once the market sentiment turned dismal, it printed a hammer, a bullish candlestick, that triggered Wednesday’s upward move, though downside risks remain unless XAU bulls reclaim the $1950 mark.

XAU/USD’s first resistance is March 1 daily high at $1950.30. Once cleared, it would open the door for a retest of the all-time high at $2075.28, but it would find the $2000 mark as the first resistance.

Russian President Vladimir Putin and German Chancellor Olaf Scholz held talks on Wednesday, reported Russian state media, and agreed to hold talks between experts on the potential for rouble payments for Russian gas payments. The call comes ahead of a 31 March deadline set by Putin for Gazprom and the Russian central bank to arrange for rouble payments for gas from "unfriendly countries", and may ease some fears of imminent disruption of gas flows into Europe.

Market Reaction

The Bloomberg Energy Index has been on the back foot in recent trade, perhaps as European gas shortage fears ease. The index has pulled back from around 101.50 to around 100.50 in a matter of minutes.

- WTI rebounded well on Wednesday and is back to the $108 area with oil markets skeptical on Russo-Ukraine peace progress.

- The Russia/West economic war continues also to ramp up, while oil inventories continue to drop and OPEC+ lifts output slowly.

The price action in crude oil markets over the past two days suggests that energy investors are not buying into optimism that has emerged this week regarding Russo-Ukraine peace talks. Russia has acknowledged that Ukraine has met its core request in pledging not to join NATO and on Tuesday announced plans to scale down military operations around Kyiv and northern Ukrainian city Chernihiv to foster better negotiating conditions.

That announcement, which came after Tuesday’s constructive talks between the two sides in Turkey, sent front-month WTI future momentarily below $100 per barrel on Tuesday. But as attacks by Russian forces across Ukraine have continued and President Zelenskyy and the Ukrainian Defense Ministry have warned of fresh troop build-ups, ceasefire hopes have diminished and WTI has made significant progress in rebounding towards $110.

At current levels in the $108.00 area, WTI trades higher by over $3 on the day and nearly $10 higher than Tuesday’s lows. Oil market participants are not just focused on the war in Ukraine, but also the unfolding economic war between Western powers and Russia. The latter camp are announced plans to impose even tougher sanctions on Russia on Wednesday, aimed at targeting the sectors of Russia’s economy critical to the sustaining of the offensive in Ukraine, including military supply chains.

Meanwhile, Russia signaled on Wednesday that it might also soon demand payment in rubles for the export of metals and grains as a 31 March deadline issued by the Russian President for Gazprom to arrange for gas payments in Russia’s domestic currency looms. Authorities across the EU are subsequently now bracing for disruption to gas flows from Russia and this is helping to broadly support the energy complex.

More broadly, amid uncertainties about energy flows out of Russia, expectations for the global oil market to remain very tight for the foreseeable future remain elevated. OPEC+ meet on Thursday and are not expected to do anything to ease this near-term tightness, with sources indicating the group is to stick to its current policy of gradual 400K barrel per day/month hikes to output quotas. OPEC+’s slow and steady approach comes at a time when OECD oil reserves are at historic lows the latest weekly US inventory figures emphasized this; headline crude oil stocks were down a larger than expected 3.45M barrels. WTI did not react to these latest numbers.

Philadelphia Fed President Tomas Barkin said on Wednesday that he would be open to a 50 bps rate hike in May if necessary and that he will be looking at inflation and how strong the economy is, according to an interview on Bloomberg TV. The war in Ukraine has added to inflationary pressures, he noted, caveating but has not impacted US demand. Indeed, there is still a tonne of excess demand for labour, he continued, noting that it feels like inflation will settle next year as the Fed's tightening actions take effect, excess consumer savings are spent and supply chain snags ease. Underlying demand in the economy remains strong, Barkin said.

At the same time as Barkin was giving his remarks, Fox reporter Charles Gasparino said that trading sources had told him that the robust core PCE reading (for Q4 2021) on Wednesday had pretty much locked in a 50 bps rate hike at the coming meeting. Gasparino said that some traders thought the Fed might move to lift rates on an intra-meeting basis, but other sources had told him that this was an unlikely move.

- AUD/USD edged higher for the second successive day on Wednesday amid sustained USD selling.

- The uptick lacked bullish conviction and remained capped near the YTD top set earlier this month.

- Bulls now await sustained breakthrough an ascending channel extending from sub-0.7000 levels.

The AUD/USD pair built on the previous day's goodish bounce from the vicinity of mid-0.7400s and edged higher for the second successive day on Wednesday. The pair held on to its modest intraday gains through the early North American session and was last seen trading around the 0.7520 region, just a few pips below the YTD high touched earlier this week.

Looking at the broader picture, the AUD/USD pair has been oscillating in a familiar trading band over the past one week or so. Given the recent strong recovery of over 500 pips from sub-0.7000 levels, this might still be categorized as a bullish consolidation phase. Moreover, the formation of an upward sloping trend channel adds credence to the constructive setup.

The upside, however, remains capped near the 0.7555 region, which marks the October 2021 swing high. The said area coincides with the top end of the aforementioned channel extending from the YTD low set in January and should act as a pivotal point. Sustained strength beyond will be seen as a fresh trigger for bullish traders and pave the way for additional near-term gains.

The AUD/USD pair might then accelerate the momentum and aim to reclaim the 0.7600 round-figure mark for the first time since June 2021. That said, technical indicators on the daily chart have moved on the verge of breaking into the overbought territory. This makes it prudent to wait for further near-term consolidation or modest pullback before placing aggressive bullish bets.

In the meantime, weakness back below the 0.7500 mark might continue to find decent support near the 0.7455-0.7450 region. A convincing below might prompt some long-unwinding trade and make the AUD/USD pair vulnerable to accelerate the corrective slide towards the 0.7400 mark. The downfall could get extended towards the very important 200-day SMA, around the 0.7300 round figure.

AUD/USD daily chart

-637842451212071892.png)

Technical levels to watch

Russian forces are preparing to resume offensive operations, a spokesperson of Ukraine's Defense Ministry said on Wednesday according to Reuters. Russian forces are still trying to take Mariupol and other towns and cities, the spokesperson added, noting that Russia's main efforts are focused on encircling Ukrainian troops in the East of the country.

The remarks come after the top Russian peace negotiator Vladimir Medinsky acknowledged that Ukraine has "essentially agreed" to Russia's core demands of not joining NATO and that, if Ukraine sticks to its promises, the threat of the emergence of a NATO stronghold in Ukraine is removed. Medinsky said that talks with Ukraine will continue, but the nation's position on Crimea and the Donbass are unchanged.

- EUR/USD extends the strong rebound to the 1.1160 zone.

- Next on the upside is seen the 55-day SMA near 1.1200.

EUR/USD has quickly left behind the 1.1100 hurdle and rose to new 4-week tops in the 1.1160/65 band on Wednesday.

That said, the recovery now targets the temporary resistance at the 55-day SMA, today at 1.1201 ahead of the 1.1250 region, where the 100-day SMA and the 8-month line coincide.

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1492.

EUR/USD daily chart

High oil and gas prices and improving risk sentiment have led to EUR/NOK trading below 9.50 for the first time since 2018. Economists at Nordea still see more downside in EUR/NOK until May/June. In their view, the cross could see 9.25, given that oil prices and risk sentiment do not worsen.

EUR/NOK could see 9.25 until Norges Bank starts selling NOK

“We still see more downside in EUR/NOK over the month or two so long as Norges Bank does not start selling ample amounts of NOK, which we don’t see happening before May/June. If we are right, the cross could see 9.25 before then.”

“Our view necessitates oil prices to hold their ground and risk sentiment not to worsen. The risk to this view is lower oil prices or Norges Bank starting to sell a lot of NOK from April 1 – which we don’t find very likely.”

“The window for NOK strengthening will close when Norges Bank eventually start selling a significant amount NOK. We see EUR/NOK turning higher (toward 10.00) when Norges Bank turns around.”

The S&P 500 Index has gapped higher to clear with ease the February highs at 4590/95. Analysts at Credit Suisse stay directly biased higher for the 78.6% retracement of the 2022 fall at 4663/68.

Support at 4593/76 holding on a closing basis to keep the immediate risk higher

“We stay directly biased higher for a test of the 78.6% retracement of the 2022 fall and price resistance at 4663/68 where we would then expect to see a cap at first. Should strength directly extend this would open the door to a move to 4707/12 next, then what we look to be tougher resistance, starting at 4744/49 and stretching up to the 4819 record high.”

“Support from the price gap at 4593/76 holding on a closing basis can keep the immediate risk higher. A closing break lower though would warn of a near-term exhaustive peak and a fall back to 4518/14.”

Gold has held strong as what appeared to be notable progress on ceasefire talks has since been walked back. Nonetheless, strategists at TD Securities highlight the downside risks that are still in place for the yellow metal.

Gold will have to contend with macro outflows associated with a hawkish Fed

“Headlines suggest Russia is even sending new forces, further emboldening the safe-haven flows into precious metals. At the same time, the 2y-10y curve flirting with inversion has further fueled talk of recession on the horizon.”

“While geopolitical tensions and yield curve recession signals re-ignite investor interest in gold, downside risks still remain amid a hawkish Fed backdrop and as negotiators continue to work towards a ceasefire.”

- USD/CHF drifted lower for the second successive day amid heavy USD selling bias.

- The US macro data failed to impress the USD bulls or lend any support to the pair.

- The Ukraine crisis benefitted the safe-haven CHF and also contributed to the slide.

The USD/CHF pair maintained its offered tone through the early North American session and was last seen hovering near the 0.9260 region, or over a three-week low.

The pair extended the overnight sharp retracement slide from the 0.9375-0.7380 area and witnessed heavy selling for the second successive day on Wednesday amid a broad-based US dollar weakness. Hopes for a diplomatic solution to end the war in Ukraine continued lending some support to the shared currency. This, along with a softer tone around the US Treasury bond yields, dragged the USD to over a one-week low and exerted some downward pressure on the USD/CHF pair.

The USD remained depressed and failed to gain any respite from the US ADP report, which showed that private-sector employers added 455K jobs in March as against the 450K anticipated. Adding to this, the previous month's reading was also revised higher to 486K from the 475K reported earlier. This, however, was overshadowed by the downward revision of the US Q4 GDP print, showing that the economic growth stood at 7.1% as compared to 7.2% estimated previously.

Meanwhile, the incoming geopolitical headlines raised scepticism about any progress in the Russia-Ukraine peace talks. In fact, a Kremlin spokesperson said that they have not noticed anything that looks like a breakthrough in negotiations. Moreover, an adviser to Ukraine’s President noted that Russia transferring forces from Kyiv to encircle troops in the east. This, in turn, tempered investors' appetite for riskier assets and benefitted the safe-haven Swiss franc.

On the other hand, sustained USD weakness suggests that the markets have fully priced in the prospects for a faster policy tightening cycle by the Fed. Hence, it would now be interesting to see if the USD/CHF pair is able to attract any buying at lower levels or prolongs its recent pullback from the YTD top, around the 0.9460 area touched earlier this month. Nevertheless, the market focus will remain on fresh developments surrounding the Russia-Ukraine saga.

Technical levels to watch

EUR/USD has staged a strong recovery. A break above 1.1151 would suggest the recovery can extend to its 55-day moving average (DMA) at 1.1202, but with a cap looked for here, in the view of analysts at Credit Suisse.

Support is seen at 1.0974/44

“We see scope for a break above 1.1151 for a test of the falling 55-DMA at 1.1202, but we look for this to then ideally cap for an eventual resumption of the broader downtrend.”

“A close above 1.1202 would be the first real sign we may have confirmation we have seen a more important low at our 1.0825 core objective and the now confirmed uptrend from 2017.”

“Support is seen at 1.1071 initially, below which can see a fall back to 1.1039/31, with fresh buyers expected here. Below 1.0974/44 is needed to mark an important turn lower again.”

The GBP is following the broad dollar-negative tone with a 0.4% gain on the day to the mid-1.31s. A close above this region could signal a possible reversal in the cable, economists at Scotiabank report.

Weak resistance stands at ~1.3180 ahead of the 1.32 mark

“GBP price action since its test of 1.33 last week points to continued losses toward a re-test of 1.30. Still, the currency held up decently on two occasions at support in the mid-figure zone yesterday and managed to break cleanly past 1.31 without much selling pressure.”

“A close above 1.3150 on the day would signal a possible reversal in the GBP that leaves the 1.30s behind more firmly; weak resistance stands at ~1.3180 ahead of the 1.32 mark.”

EUR/GBP has surged higher after establishing a low at 0.8295. A close above 0.8479 should confirm an important change of trend higher, economists at Credit Suisse report.

Support at 0.8384 to hold for a move to resistance at 0.8550/55

“A close above key resistance from the February high and 200-day average at 0.8471/79 should confirm to see the core trend higher with resistance seen at 0.8595/0.8618 initially, December 2021 high and 38.2% retracement of 2020/2022 fall. Whilst we would look for this to cap at first, above in due course should see the ‘measured base objective’ at 0.8715.

“Support is seen initially at the ‘neckline’ to the base at 0.8462/52, with 0.8384 now ideally holding to keep the immediate risk higher.”

The EUR/USD has started out the week strongly, rebounding from its close below 1.10 on Friday. Economists at Scotiabank highlight that the daily high of 1.1160 is key resistance.

ECB rate hike expectations are excessive

“With markets now expecting over 100bps in ECB hikes twelve months from now, we think EUR downside risks are building as the bank will have to temper expectations.”

“EUR’s decline under 1.11 yesterday stopped short at ~1.1070/75, which stands as intraday support after the figure.

“Daily high of 1.1160/65 is key resistance. The 50-day MA, which it hasn’t touched since late-Feb, follows as resistance at 1.1184 before the big figure.”

- GBP/USD has recovered back above the 1.3150 mark on Wednesday as geopolitical optimism weighs on the dollar.

- But the pair is struggling to emulate the likes of EUR/USD and break above its 21DMA, a potential bearish sign.

- The BoE’s recent dovish shift and subsequent unfavourable moves in yield spreads have dampened GBP’s appeal and continues to weigh.

Rather than being a result of any positive domestic UK fundamental developments (there are none to speak of), GBP/USD upside on Wednesday is largely a result of FX markets taking a more positive view of the geopolitical backdrop and selling USD. Indeed, the buck is down across the board and this has handed GBP/USD some respite, with the pair recently able to climb back to the north of the 1.3150 level for an on-the-day gain of around 0.5%. That’s a decent 0.8% recovery from earlier weekly lows in the 1.3050 region but still leaves the pair more than 1.0% below last week’s peaks near 1.3300.

Notably, cable continues to fail to emulate the recent gains seen in EUR/USD as it struggles to push above its 21-Day Moving Average, which currently resides near 1.3160. Failure to break higher towards 1.3200, a break above which would open the door to a retest of last week’s highs in the 1.3300 area, is likely to be taken as a bearish sign for GBP/USD moving forward. And these bearish technicals come against an equally bearish fundamental backdrop.

Analysts have noted that, since the BoE’s dovish shift where it softened its tone on the need for further rate hikes and emphasized its growing concern about the health of the UK economy amid the coming cost-of-living squeeze, UK yields have flatlined. US (and European) yields, by contrast, most certainly have not, as traders continue to up Fed and ECB tightening bets. Central bank policy divergence and pressure on yield spreads are likely to continue to weigh on sterling looking forward.

The pair was unreactive to US data in the form of the final estimate of Q4 GDP growth and March ADP national employment change, with the latter pointing to a strong official jobs report on Friday. Arguably, there is a lot of Fed hawkishness/US economic heat (high inflation, tight labour market) priced into the buck, suggesting further strong data/hawkish rhetoric this week won’t boost the US dollar much more.

Still, the lack of UK calendar events means the focus will remain on US fundamentals and the aforementioned divergence to UK fundamentals. That suggests a drop back towards weekly lows and a potential test of annual lows in the 1.3000 area may well be on the cards, assuming that further geopolitical optimism doesn’t come back into FX markets.

USD/JPY looks to have set an exhaustive peak at the 125.29/86 highs of 2015. Analysts at Credit Suisse look for a consolidation phase to emerge, with support seen at 121.02/120.72.

Consolidation phase to develop

“We have likely seen the peak in this phase of USD/JPY strength and with the JPY Trade Weighted Index also holding key support from the ‘neckline’ to its 2014/2016 base we look for further near-term weakness and then a consolidation phase.”