- Analiza

- Analiza tržišta

- Mišljenja eksperata

- Jay Powell's Public Hearings May Shed Some Light on Fed's 2020 Road Map

Jay Powell's Public Hearings May Shed Some Light on Fed's 2020 Road Map

.

Distracted by the US-China trade saga and then by the stock market correction, which the media hastily linked with a coronavirus agenda, scope on important market issues could be lost. The ultimate driver for investors' complacency over the last few months is the loose monetary policy of major central banks. The most important issue is what the US Federal Reserve (Fed) is going to do in the upcoming months and how the Fed officials' estimates could affect the Greenback and the world indexes.

After the Fed cut rates three times in 2019, a new US assets purchase program of $60 bln a month began. An unscheduled November meeting with Fed's Chair Jerome Powell and the US President Donald Trump, spurred mistrust concerning the Fed's independence. After the meeting, Mr. Powell was not very vocal with the press, but Trump tweeted that all possibilities were discussed, including negative interest rates. Some of the investors at least expected a slight verbal hint on the future monetary easing rounds before the year end, but in December the Fed's statement turned out to be "extremely" neutral and rather shapeless. The only absolute clear message was that most of the Fed officials did not expect any new rate changes over the course of the coming year.

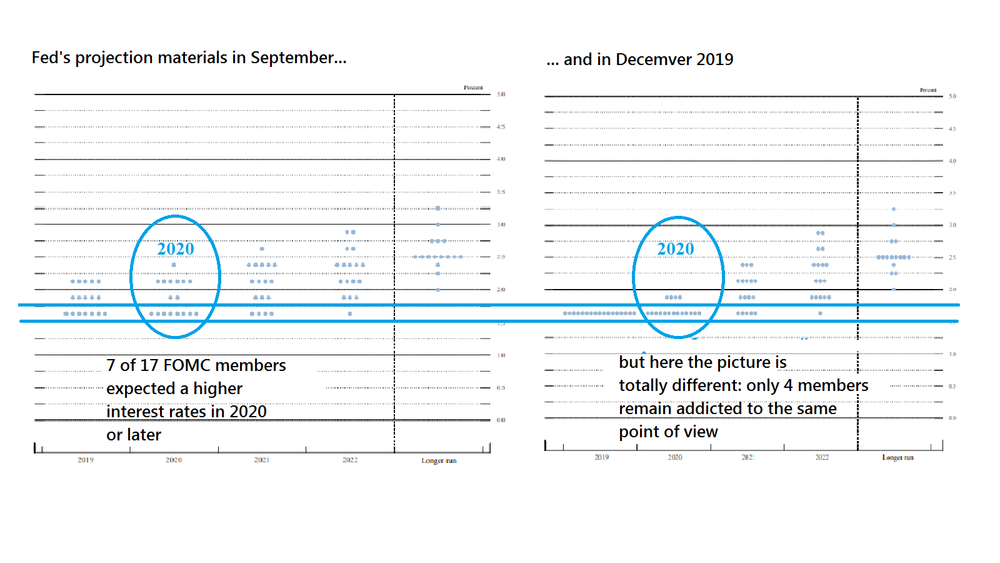

As the estimates for the economy were presented in a rather positive manner, further interest rate actions remained unclear. In September 2019, seven of the 17 Federal Open Market Committee (FOMC) members expected a higher interest rate over the next 15 months, but only four FOMC members were committed to the same point of view for 2020 during the last December FOMC meeting, which could be considered as a very lightweight, but essentially, a dovish message.

Pic.1 Fed's dot plot chart

Source: www.federalreserve.gov

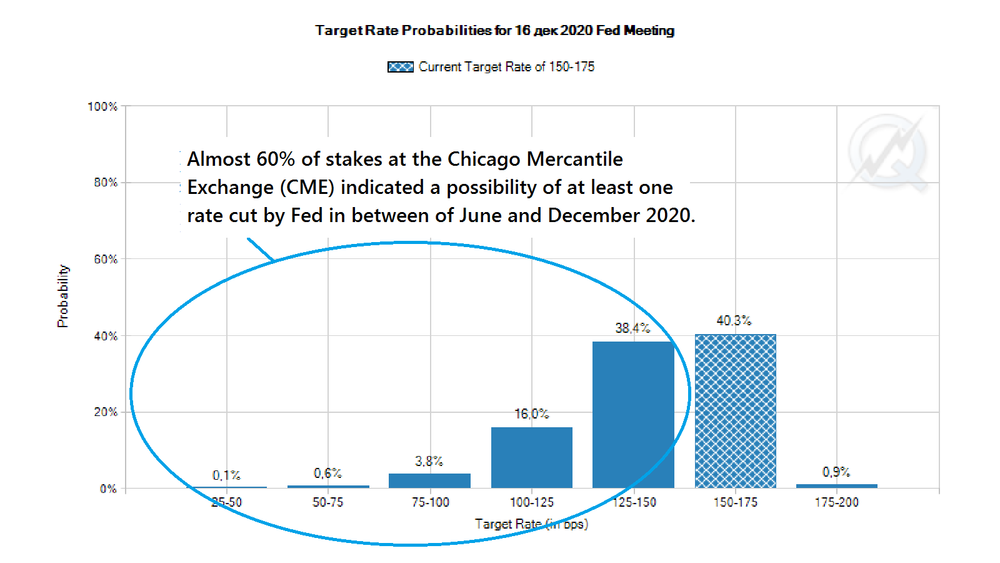

Almost 60% of stakes at the Chicago Mercantile Exchange (CME) indicated a possibility of at least one rate cut by Fed between June and December 2020.

Pic.2 Target Rate Probabilities for December 16 2020 Fed Meeting

Source: www.cmegroup.com

The markets believe the Fed could be more radical in the future than the Fed itself officially declares at the moment. This could look like a nice "cheaper money" bonus for a further possible stocks' rally in the longer run but, at the same time, also as a delayed "bench minor penalty" for the US Dollar - in ice-hockey terminology. On the hockey field, a delayed penalty can be cancelled only if the punished team lost a goal.

In our example, this would be the case if the Greenback somehow falls "itself" for some other reasons, whether this be because of a trade war or some other combination of events. However, this is not the case so far. This leaves the Fed open to a wide range of actions. The public hearings with the Fed's Chairman at the US Congress on Tuesday could be an opportunity to send a clearer message to the markets, just before the Senate banking committee's meeting this Wednesday.

The most interesting point to watch out for is how much Mr. Powell will keep up with the stand he took in the past when he preferred to use more or less colourless phrases like "the FED is watching current economic developments and will act as appropriate to sustain economic expansion" or "baseline outlook favourable but noteworthy risks remain" and so on.

The Fed said that "downside risks to the U.S. outlook seem to have receded in the latter part of the year, as the conflicts over trade policy diminished somewhat, economic growth abroad showed signs of stabilizing, and financial conditions eased" in the recent statement, noting that the US job market and consumer spending remain strong. "The likelihood of a recession occurring over the next year has fallen noticeably in recent months," the Fed said, basing its conclusion on models of recession probabilities that incorporate the behaviour of bond markets and other factors. Among the risks, the Fed had listed: the fallout from the spreading outbreak of coronavirus in China, "elevated" asset values, and near-record levels of low-grade corporate debt that the Fed fears will become a problem in case of an economic downturn.

White House influential economic adviser Larry Kudlow voiced to Bloomberg TV and Fox Business Network that "no signs U.S. economy is nearing end of the cycle, it is fundamentally sound". Nevertheless, he "wouldn't mind" some bolder moves from the Fed.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade.

Indiscriminate reliance on illustrative or informational materials may lead to losses.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.