- Analiza

- Analiza tržišta

- Mišljenja eksperata

- Technical Analysis on USDJPY

Technical Analysis on USDJPY

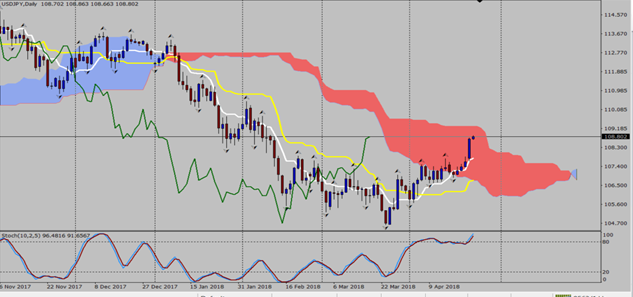

USDJPY Daily Timeframe

The pair USDJPY gives the impression that is trying to break the Kumo. This could be supported by the fact that the Tekan Sen and Kijun Sen seem to be in bullish formation, and the Chikou span above the price. The move could be captured by going down to the 1H timeframe and look for potential developing signals.

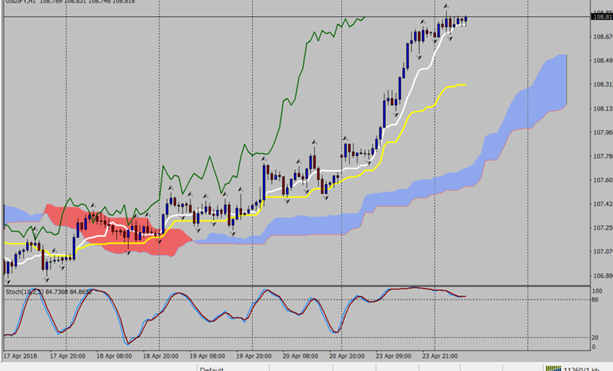

USDJPY 1H Timeframe

Based on the Ichimoku system, the price seems to be long and the cloud bullish on the 1H timeframe. In addition to this, the Tekan Sen and Kijun Sen are in bullish formation, and the Chikou span appears above the price. It might be considered important to notice that if the price retraced 50%-68% Fibonacci retracement level, then we could consider to start looking for developing long signals. Nevertheless, if the price moves below the Kumo, then we could consider looking for short signals in accordance with the Ichimoku rules.

Disclaimer: Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and education purposes. Personal Opinion of the Author does not represent and should not be construed as a statement or an investment advice made by TeleTrade. All Indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

Risk Warning: Investment services are provided by TeleTrade-DJ International Consulting Ltd, a Cyprus Investment Firm under reg. number HE272810 operating in accordance with MiFID, under license 158/11 by the Cyprus Securities and Exchange Commission. Trading in leveraged derivative financial instruments carries a high level of risk and may not be suitable for all investors. Past performance is not a reliable indicator of future results. Indiscriminate reliance on informational or historical materials may lead to losses.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.