- Analiza

- Analiza tržišta

- Mišljenja eksperata

- Technical analysis for USDJPY Probable Bearish Sentiment

Technical analysis for USDJPY Probable Bearish Sentiment

Technical analysis for USDJPY Probable Bearish Sentiment

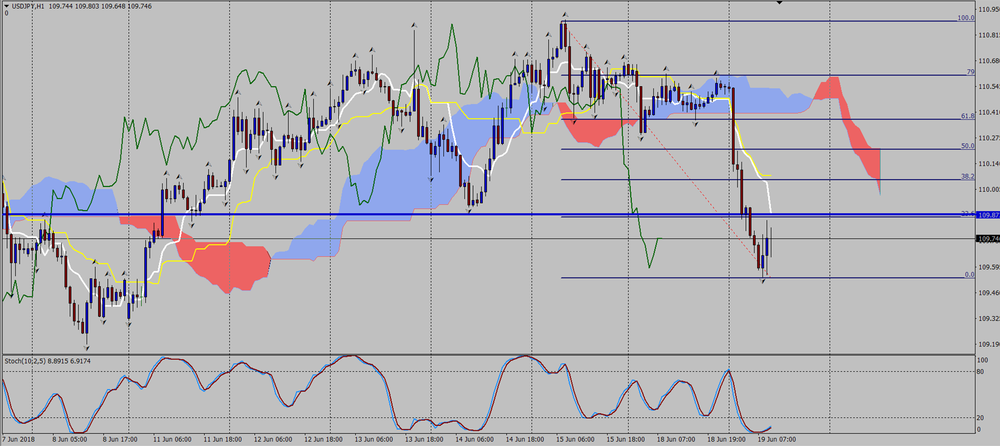

• On 18/6/18 the price reached the level 2 times 110.610 which was the Fibonacci level of 79% and reverse.

Based on the technical analysis we can see that the price is creating lower lows and lower highs, failing to recover.

On 18/6/18 the price reached the level 110.610 2 times which was the Fibonacci level of 70% and reverse.

If we examine the Ichimoku system, we can see that the price also respects the Kumo cloud by not be able to penetrate it which is at the same level 79% of Fibonacci.

It is notable here that we have a valid kumo break out signal as well on the bear side.

The price is below the cloud, the Tekan sen and kijun sen seem to be in a bear formation and the Chikou span is below the price.

Those clues giving us the confidence we need to confirm that the kumo breakout signal is valid

USDJPY 1H Chart

Disclaimer: Materials, analysis, and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the Author does not represent and should not be construed as a statement or an investment advice made by TeleTrade. All Indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

Risk Warning: Investment services are provided by TeleTrade-DJ International Consulting Ltd, a Cyprus Investment Firm under Reg. number HE272810 operating in accordance with MiFID, under license 158/11 by the Cyprus Securities and Exchange Commission. Trading in leveraged derivative financial instruments carries a high level of risk and may not be suitable for all investors. Past performance is not a reliable indicator of future results. Indiscriminate reliance on informational or historical materials may lead to losses

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.