- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 05-04-2012.

The euro fell to a three-week low against the dollar as Spanish and Italian bonds slumped and borrowing costs increased at a French auction, adding to concern the region’s debt crisis is spreading. The 17-nation currency dropped to a three-week low versus the yen as Spain’s 10-year bond yields increased to the biggest spread compared with German bunds since November amid investor concern that Spanish Prime Minister Mariano Rajoy may require international aid. Spain’s 10-year yields increased to 400 basis points, or 4.0 percentage points, more than similar-maturity bunds after demand declined at a Spanish debt sale yesterday. Italy’s 10- year yield increased 12 basis points to 5.48 percent. France auctioned 4.32 billion euros of 10-year debt today at an average yield of 2.98 percent, up from 2.91 percent at the previous offering on March 1. Borrowing costs for five-year and 15-year debt also increased.

The Swiss National Bank said it won’t allow the franc to go beyond 1.20 per euro after the currency rose past that level for the first time since the ceiling was put in place in September. The Swiss central bank set a limit of 1.20 francs per euro on Sept. 6 to protect exports after investors turned to the nation’s currency as a haven from Europe’s sovereign-debt crisis. The SNB won’t allow the franc to rise above the ceiling and is ready to buy foreign currencies in unlimited quantities, spokesman Walter Meier said by telephone today.

The pound strengthened for a second day versus the euro as the Bank of England left its bond-purchase target unchanged at 325 billion pounds ($515 billion) and its policy rate at 0.5 percent, as anticipated by surveys of economists.

EUR/USD $1.3100, $1.3150, $1.3200

USD/JPY Y81.70, Y82.00, Y82.30, Y82.70, Y83.00

GBP/USD $1.5850, $1.5900, $1.6015

AUD/USD $1.0250, $1.0225

EUR/GBP stg0.8300

USD/CHF Chf0.9225, Chf0.9300

AUD/JPY Y85.00

Data:

07:00 Switzerland Foreign Currency Reserves March 224.9 237.5

07:15 Switzerland Consumer Price Index (MoM) March +0.3% +0.4% +0.6%

07:15 Switzerland Consumer Price Index (YoY) March -0.9% -1.1% -1.1%

08:30 United Kingdom Industrial Production (MoM) February -0.4% +0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) February -3.8% -2.1% -2.3%

08:30 United Kingdom Manufacturing Production (MoM) February +0.1% +0.2% -1.0%

08:30 United Kingdom Manufacturing Production (YoY) February +0.3% +0.1% -1.4%

10:00 Germany Industrial Production s.a. (MoM) February +1.6% -0.1% -1.3%

10:00 Germany Industrial Production (YoY) February +1.8% +0.3% -1.0%

11:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50% 0.50%

The euro weakened for a fourth day versus the dollar as Spanish and Italian bonds slumped and borrowing costs increased at a French auction, adding to concern the region’s debt crisis is spreading.

Spain’s 10-year yield rose as much as 15 basis points to 5.84 percent, the highest since Dec. 13 after demand declined at a Spanish debt sale yesterday. Italy’s 10-year yield increased 12 basis points to 5.48 percent.

France auctioned 4.32 billion euros of 10-year debt today at an average yield of 2.98 percent, up from 2.91 percent at the previous offering on March 1. Borrowing costs for five-year and 15-year debt also increased.

The Swiss franc rose beyond the central bank’s limit of 1.20 per euro for the first time since the ceiling was put in place in September as investors sought the safest assets.

The pound strengthened for a second day versus the euro as the Bank of England left its bond-purchase target unchanged at 325 billion pounds and its policy rate at 0.5 percent.

EUR/USD: the pair fell in $1,3040 area.

GBP/USD: the pair decreased in $1,5830 area, fell below МА (200) for D1 ($1,5845).

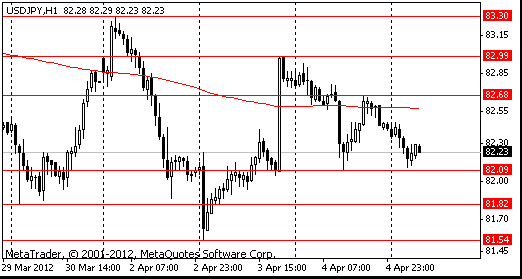

USD/JPY: the pair showed low below Y82,00, but returned above later.

The Canada Ivey Purchasing Managers Index is due at 1400GMT.

EUR/USD

Offers $1.3220, $1.3210, $1.3180/200, $1.3120/25, $1.3095/110

Bids $1.3050, $1.3035/30, $1.3020, $1.3005/00, $1.2980/70

GBP/USD

Offers $1.6000/15, $1.5980/85, $1.5950/60, $1.5910/20, $1.5880/85

Bids $1.5805/00, $1.5780/70, $1.5750/40

AUD/USD

Offers $1.0425/30, $1.0380/00, $1.0350, $1.0325/30, $1.0315/20

Bids $1.0250, $1.0230, $1.0210/00, $1.0150

EUR/JPY

Offers Y108.85/90, Y108.60/65, Y108.10/20, Y107.60/65

Bids Y106.70/60, Y106.50, Y106.00, Y105.65/60

Resistance 3: Y83.00 (Apr 3 high)

Resistance 2: Y82.55 (МА (200) for Н1)

Resistance 1: Y82.10 (earlier support, Apr 4 low)

Current price: Y81.85

Support 1: Y81.55 (Apr 3 low)

Support 2: Y81.10 (38,2 % FIBO Y76,00-Y84,20)

Support 3: Y80.60 (low of March)

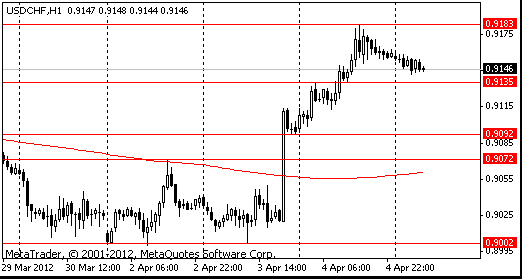

Resistance 3: Chf0.9340 (high of March)

Resistance 2: Chf0.9250 (Mar 16 high)

Resistance 1: Chf0.9210 (session high)

Current price: Chf0.9189

Support 1: Chf0.9140 (earlier resistance, session low, Mar 26 high)

Support 2: Chf0.9090 (earlier resistance, Mar 29 high )

Support 3: Chf0.9050 (area МА (200) for Н1 and resistance line from Mar 26)

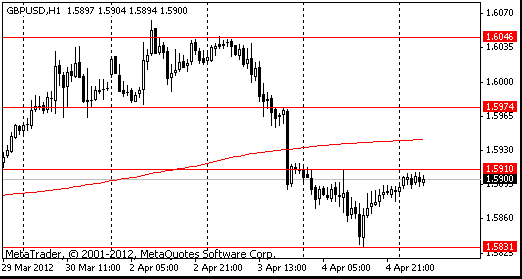

Resistance 3 : $1.5940 (МА (200) for Н1)

Resistance 2 : $1.5910 (area of session high and Apr 4 high)

Resistance 1 : $1.5840 (earlier support, area of Mar 28 and Apr 4 lows)

Current price: $1.5821

Support 1 : $1.5800 (Mar 26 low)

Support 2 : $1.5780/70 (support line from Jan 13, Mar 22 low)

Support 3 : $1.5700 (psychological level)

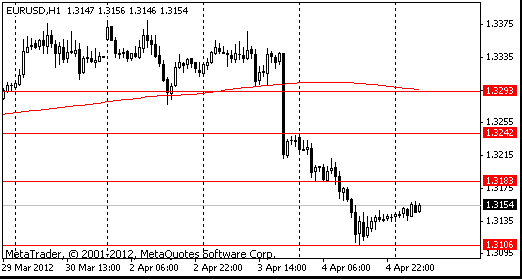

Resistance 3 : $1.3250 (Apr 4 high, Mar 29 low)

Resistance 2 : $1.3170 (session high)

Resistance 1 : $1.3100 (Apr 4 low)

Current price: $1.3069

Support 1 : $1.3050 (Mar 16 low)

Support 2 : $1.3000 (low of March)

Support 3 : $1.2975 (low of February)

EUR/USD $1.3100, $1.3150, $1.3200

USD/JPY Y81.70, Y82.00, Y82.30, Y82.70, Y83.00

GBP/USD $1.5850, $1.5900, $1.6015

AUD/USD $1.0250, $1.0225

EUR/GBP stg0.8300

USD/CHF Chf0.9225, Chf0.9300

AUD/JPY Y85.00

The euro fell toward a three-week low versus the yen before a report today that may show German industrial production declined, backing the case for the European Central Bank to avoid raising interest rates. Germany’s industrial production probably decreased 0.5 percent in February from the previous month, when it gained 1.6 percent, according to the median estimate of economists in a Bloomberg News survey before the Economy Ministry releases the figure.

The 17-nation currency was near a three-week low against the dollar before France auctions bonds due from 2017 to 2041 today amid concern Europe’s prolonged debt crisis will weigh on the economy. Investor demand for the debt of Spain, the euro area’s fourth-largest economy, slumped yesterday, with the country selling 2.59 billion euros ($3.4 billion) of bonds, less than its maximum target of 3.5 billion euros. Prime Minister Mariano Rajoy said Spain’s situation is one of “extreme difficulty” and signaled that his budget cuts are less painful than a bailout would be.

The Australian and New Zealand dollars strengthened against most of their 16 major counterparts before U.S. data tomorrow that may point to an improvement in the labor market. Employment in the U.S. probably rose by 205,000 in March, according to the median estimate of economists before tomorrow’s government report. That would be the fourth straight month with jobs growth above 200,000.

Demand for the South Pacific currencies was also bolstered as Asian stocks pared declines. The so-called Aussie was within 0.2 percent of a six-month low versus the New Zealand dollar as swaps traders increased bets the Reserve Bank of Australia will cut interest rates next month. Financial markets in both countries will be closed from tomorrow for holidays and will reopen on April 10.

EUR/USD: during the Asian session the pair traded in a range $1.3135-$1.3160.

GBP/USD: during the Asian session the pair traded in a range $1.5890-$1.5910.

USD/JPY: during the Asian session the pair fell to a yesterday's low.

Events for Thursday start at 0700GMT when the Swiss National Bank publishes the 2011 Annual Report. Swiss CPI is also due Thursday. Core-European data sees just the 1000GMT release of German industrial output data. It is a busy day for the UK, starting at 0830GMT with the data highlight of the week, February industrial production. The data is followed at 1000GMT by UK New car and CV registrations. The National Institute (NIESR) will release its estimate of Q1 GDP later in the session, at 1400GMT. The MPC will announce its April policy decision at 1100GMT. The expectation is that there will be no change either to Bank Rate or to the current 325 billion stock of QE in light of the data flow, which has offered some patchy backing to the idea of a moderate underlying recovery. The Canada Ivey Purchasing Managers Index is due at 1400GMT. US data starts at 1130GMT with Challenger Layoffs data, which is followed at 1230GMT by the weekly initial jobless claims, which are expected to remain relatively unchanged at 360,000 in the March 31 week after hitting a four-year low in the previous week. At 1310GMT, St. Louis Federal Reserve Bank President James Bullard speaks to the 13th Annual InvestMidwest Venture Capital Forum.

Yesterday the euro lost the most in almost a month against the dollar after demand declined at a Spanish bond auction, adding to concern the region is struggling to overcome its sovereign-debt crisis. Spain sold 2.59 billion euros of bonds today, less than its maximum target of 3.5 billion euros, the central bank said. Demand for notes maturing in 2015 was 2.41 times the amount allotted, down from 4.96 at the previous sale of the maturity in March. It also sold securities due in 2016 and 2020. The 17-nation currency weakened after the European Central Bank kept its benchmark rate at a record low and President Mario Draghi said the economic outlook remained subject to “downside risks.”

Sterling rallied as U.K. services growth accelerated last month and house prices increased. The pound rose against most of its major peers before the Bank of England meets. Sterling gained 0.6 percent to 82.68 pence per euro after a gauge of U.K. services activity based on a survey of purchasing managers increased to 55.3 from 53.8 in February. A separate report showed house prices climbed 2.2 percent in March from the previous month, Lloyds Banking Group Plc’s Halifax division said.

The yen and dollar strengthened versus all their most- traded counterparts amid demand for the relative safety of the nations’ debt.

EUR/USD: yesterday the pair fell to a figure to $1.3100.

GBP/USD: yesterday the pair fell, however restored the lost positions later.

USD/JPY: yesterday the pair fell having come nearer to Y82.00.

Events for Thursday start at 0700GMT when the Swiss National Bank publishes the 2011 Annual Report. Swiss CPI is also due Thursday. Core-European data sees just the 1000GMT release of German industrial output data. It is a busy day for the UK, starting at 0830GMT with the data highlight of the week, February industrial production. The data is followed at 1000GMT by UK New car and CV registrations. The National Institute (NIESR) will release its estimate of Q1 GDP later in the session, at 1400GMT. The MPC will announce its April policy decision at 1100GMT. The expectation is that there will be no change either to Bank Rate or to the current 325 billion stock of QE in light of the data flow, which has offered some patchy backing to the idea of a moderate underlying recovery. The Canada Ivey Purchasing Managers Index is due at 1400GMT. US data starts at 1130GMT with Challenger Layoffs data, which is followed at 1230GMT by the weekly initial jobless claims, which are expected to remain relatively unchanged at 360,000 in the March 31 week after hitting a four-year low in the previous week. At 1310GMT, St. Louis Federal Reserve Bank President James Bullard speaks to the 13th Annual InvestMidwest Venture Capital Forum.

Resistance 3: Y83.40 (Mar 27 high)

Resistance 2: Y83.00 (Apr 3 high)

Resistance 1: Y82.70 (high of the American session on Apr 4)

The current price: Y82.23

Support 1: Y82.10 (Apr 4 low)

Support 2: Y81.85 (Mar 29-30 low)

Support 3: Y81.55 (Apr 3 low)

Resistance 3: Chf0.9335 (Mar 15 high)

Resistance 2: Chf0.9255 (Mar 16 high)

Resistance 1: Chf0.9185 (Apr 4 high)

The current price: Chf0.9146

Support 1: Chf0.9135 (high of the Asian session on Apr 4)

Support 2: Chf0.9090 (Apr 4 low)

Support 3: Chf0.9070 (Apr 2 high)

Resistance 3 : $1.6045 (Apr 3 high)

Resistance 2 : $1.5975 (high of the American session on Apr 3)

Resistance 1 : $1.5910 (Apr 4 high)

The current price: $1.5900

Support 1 : $1.5830 (Apr 4 low)

Support 2 : $1.5800 (Mar 26 low)

Support 3 : $1.5770 (Mar 22 low)

Resistance 3 : $1.3300 (MA(233) H1)

Resistance 2 : $1.3240 (Apr 4 high)

Resistance 1 : $1.3185 (low of the Asian session on Apr 4)

The current price: $1.3154

Support 1 : $1.3105 (session low)

Support 2 : $1.3045 (Mar 16 low)

Support 3 : $1.3000 (psychological mark)

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3139 -0,72%

GBP/USD $1,5889 -0,14%

USD/CHF Chf0,9159 +0,70%

USD/JPY Y82,42 -0,47%

EUR/JPY Y108,30 -1,19%

GBP/JPY Y130,94 -0,61%

AUD/USD $1,0262 -0,64%

NZD/USD $0,8143 -0,63%

USD/CAD C$0,9962 +0,54%

07:00 Switzerland Foreign Currency Reserves March 224.9

07:15 Switzerland Consumer Price Index (MoM) March +0.3% +0.4%

07:15 Switzerland Consumer Price Index (YoY) March -0.9% -1.1%

08:30 United Kingdom Industrial Production (MoM) February -0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) February -3.8% -2.1%

08:30 United Kingdom Manufacturing Production (MoM) February +0.1% +0.2%

08:30 United Kingdom Manufacturing Production (YoY) February +0.3% +0.1%

10:00 Germany Industrial Production s.a. (MoM) February +1.6% -0.1%

10:00 Germany Industrial Production (YoY) February +1.8% +0.3%

11:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement 0

12:30 Canada Building Permits (MoM) February -12.3% +2.2%

12:30 Canada Employment March -2.8 +12.6

12:30 Canada Unemployment rate March 7.4% 7.5%

12:30 U.S. Initial Jobless Claims 31.03.2012 359 355

13:10 U.S. FOMC Member James Bullard Speaks 0

14:00 Canada Ivey Purchasing Managers Index March 66.5 64.8

14:00 United Kingdom NIESR GDP Estimate March +0.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.