- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-11-2021

- GBP/USD bull sin charge as the dollar softens following the Fed.

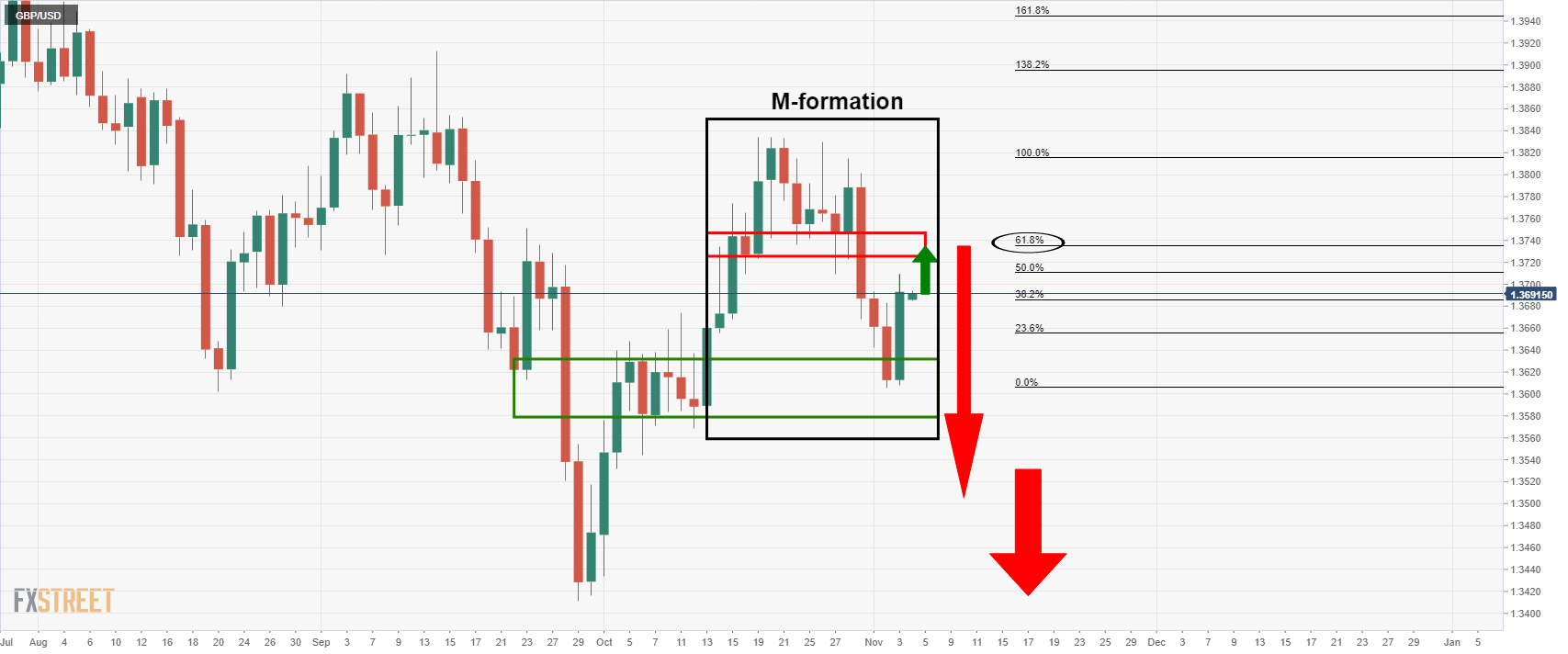

- Daily M-formation is compelling toward the 61.8% ratio.

GBP/USD has been bid over the last 24-hours on the back of the looming Bank of England as well as a slide in the US dollar that gave back some territory following the Federal Reserve on Wednesday. This has left cable mitigating the space between 1.3690 and 1.3660 from a technical standpoint.

The following illustrates the prospects of a test in the 1.37 area for the forthcoming session and also the possibility of mitigation of the lastest bullish rally from the 1.3660s.

GBP/USD H1 analysis

The price is already forming a support structure which gives rise to the likelihood of an onward journey into the 1.37 area. However, a correction to the 61.8% Fibo, based on current ranges, is not out of the question leading into the BoE event on Thursday.

GBP/USD daily chart

From a daily perspective, there is a meanwhile bullish bias to test into resistance prior to a downside continuation as follows:

The price has formed an M-formation on the charts and the neckline of the formation would be expected to pull in the price to test the 61.8% Fibo prior to the next downside impulse, depending on the outcome on the Bank of England.

- Gold begins the Asian session in the right foot, up 0.28%.

- The Federal Reserve will begin reducing bond purchases by the middle of November.

- The Fed would reduce its QE by $15 billion.

- The US T-bond 10-year yield advances to 1.60%.

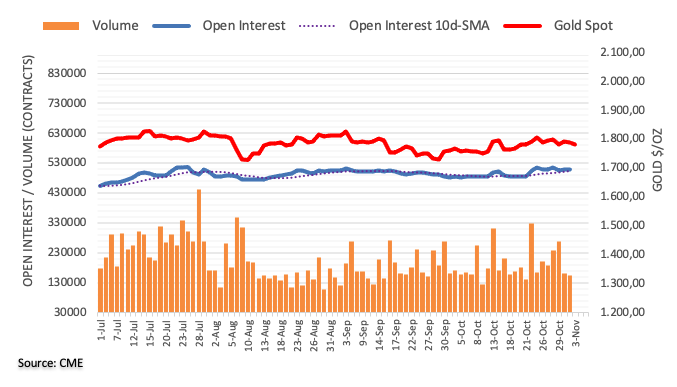

XAU/USD advances as the Asian session begin, up 0.28%, trading at $1,774 at the time of writing. On Wednesday, the Federal Reserve decided to keep rates unchanged at the 0 to 0.25% range. Also, the bond taper process is a reality. The central bank said that it will reduce the pace of bond purchases by $15 billion a month, until the end of the stimulus, by the first half of 2022.

Gold reacted to the downside, dipped to $1,759, but found some buying pressure to settle at the end around $1,770. On its way south, the yellow-metal pushed through the 100-day moving average, which keeps USD bulls in control, as long as the price remains below the abovementioned.

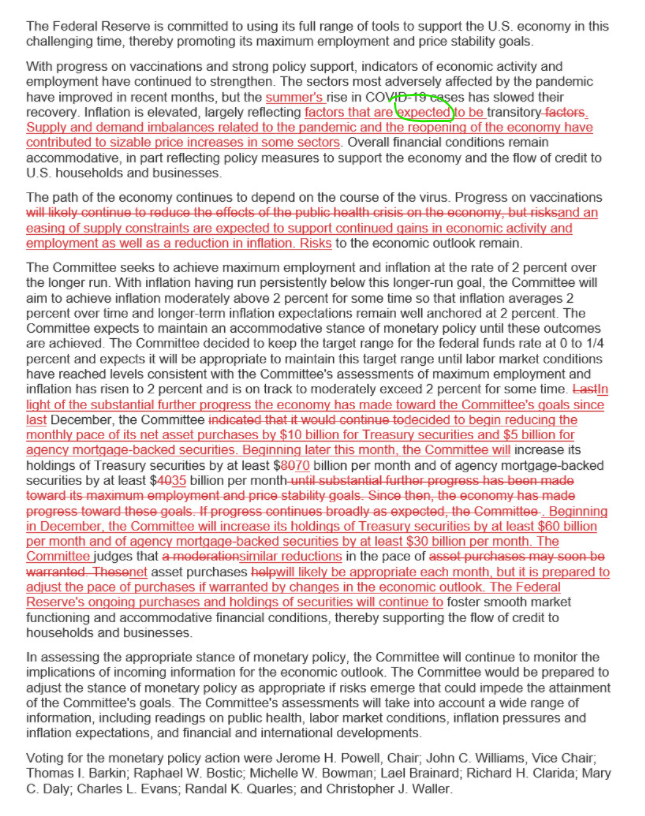

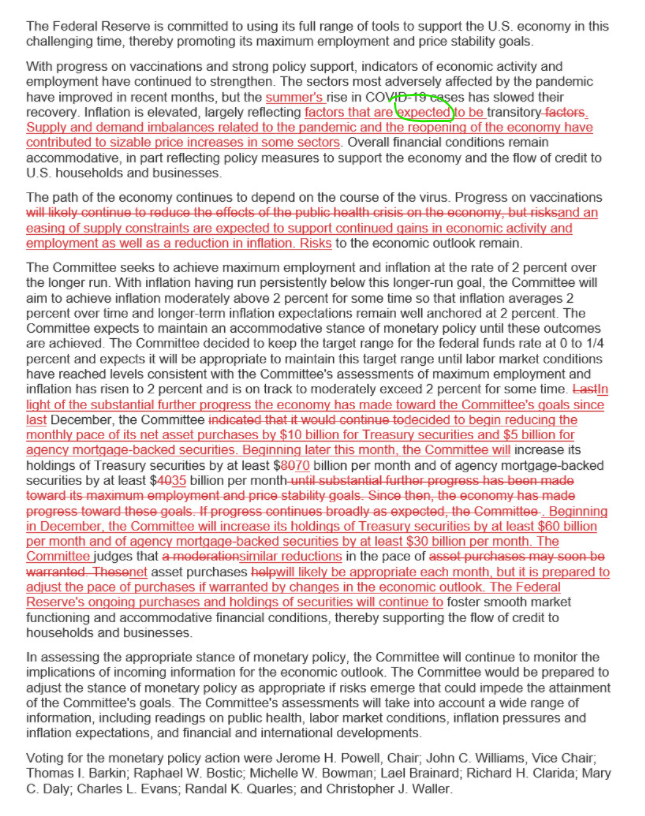

Sumary of the Federal Reserve monetary policy statement

Putting this aside, Wednesday’s focus was on the Fed. In its monetary policy statement, the US central bank noted that higher inflation pressures are transitory (sticking to its stance) and added that supply and demand imbalances contributed to elevated prices. Despite the jump in inflation, the Fed sees an improvement in economic activity and observes progress in the labor market.

Concerning the bond purchasing program, the Fed said that they “will begin taper later this month with reductions in treasuries purchases by $10 bln, MBS by $5 bln.” It is worth noticing that the central bank left the door open for adjustments at the QE’s pace. They added that “comparable decreases in buying pace are likely reasonable each month, but we are willing to adapt if necessary.”

As portrayed by US equity stocks printing new all-time highs, market participants’ reaction seems tilted to a dovish taper announcement. However, the central bank left the door open for an accelerating pace in case that higher inflation remains stickier than expected.

That said, at press time, the US 10-year bond yields advances two basis points, sitting at 1.60%, for the first time in the week. Also, the 2-year benchmark note rate, which gives clues about near-time interest rates, is flat at 0.48%.

Meanwhile, the US Dollar Index slides 0.25%, currently at 93.85, reinforcing the thesis that investors move towards riskier assets exchanging safe-haven currencies, like the greenback and the Japanese yen, as the abovementioned weakened on the release of the Fed’s monetary policy statement.

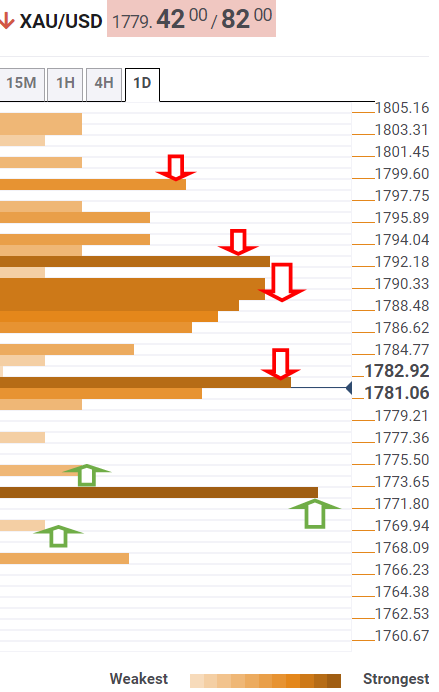

XAU/USD Price Forecast: Technical outlook

Daily chart

On Wednesday, XAU/USD price action seesawed in a $29 range, reaching a daily low at $1,759 before settling at current levels. The daily moving averages (DMA’s) remain above the spot price but with a flattish slope, depicting gold is in a sideways trend. Further, the yellow metal is approaching the abovementioned levels, signaling that the downward bias is fading. Nevertheless, a clear upside break above the 200-day moving average (DMA) at $1,800 might keep gold bulls in charge. In that outcome, the following resistance area would be the July 15 high at $1,834, followed by an empty road towards $1,900.

Conversely, if USD bulls like to remain in control, they need to hold prices below the 200-DMA. In that outcome, the first support area would be the November 3 low at $1,759. A breach of the latter would expose a rising upslope trendline that travels from the August 9 lows towards the September 29 low, around the $1,740-50 area.

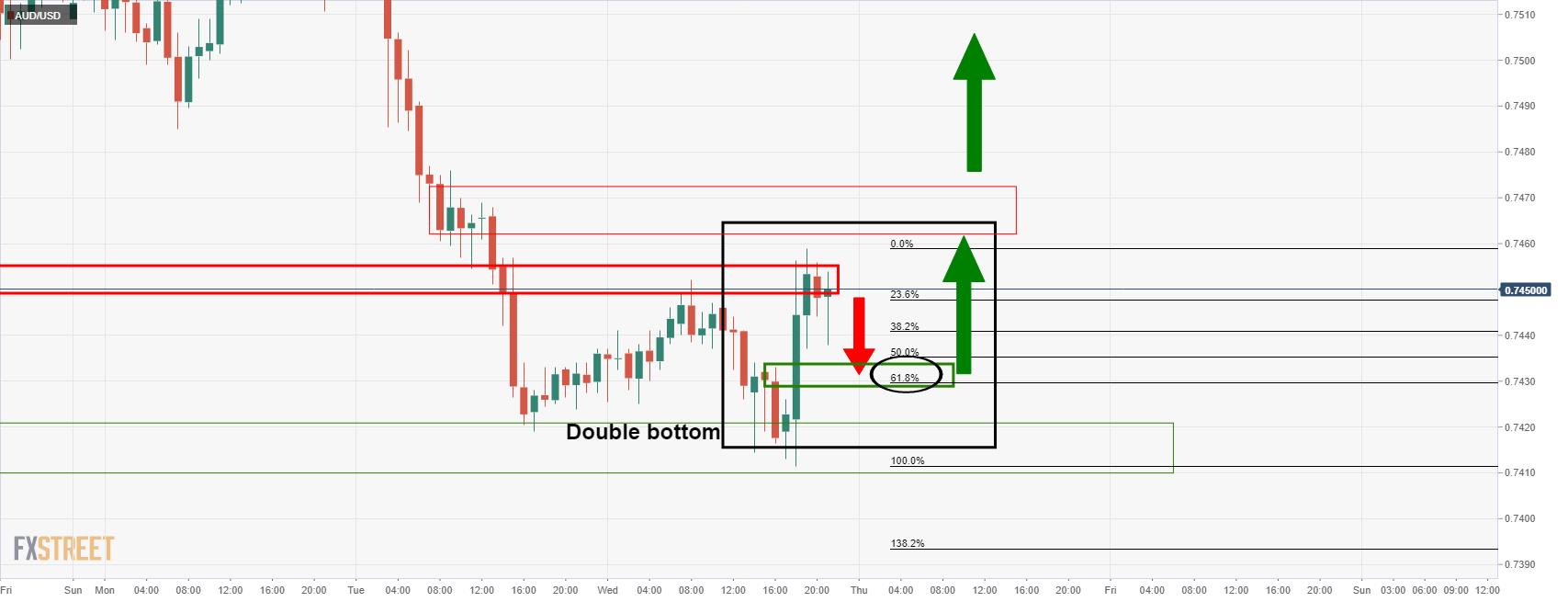

- AUD/USD hourly double bottom in place, medium term risks skewed to the upside.

- Nonfarm Payrolls will be the next major test for the pair.

- Meanwhile, the price could move in on the 61.8% Fibo of The Fed spike.

AUD/USD bears are moving in from a first resistance area for the session ahead, although the risks are skewed to the upside considering the hourly double bottom lows at a firm support area.

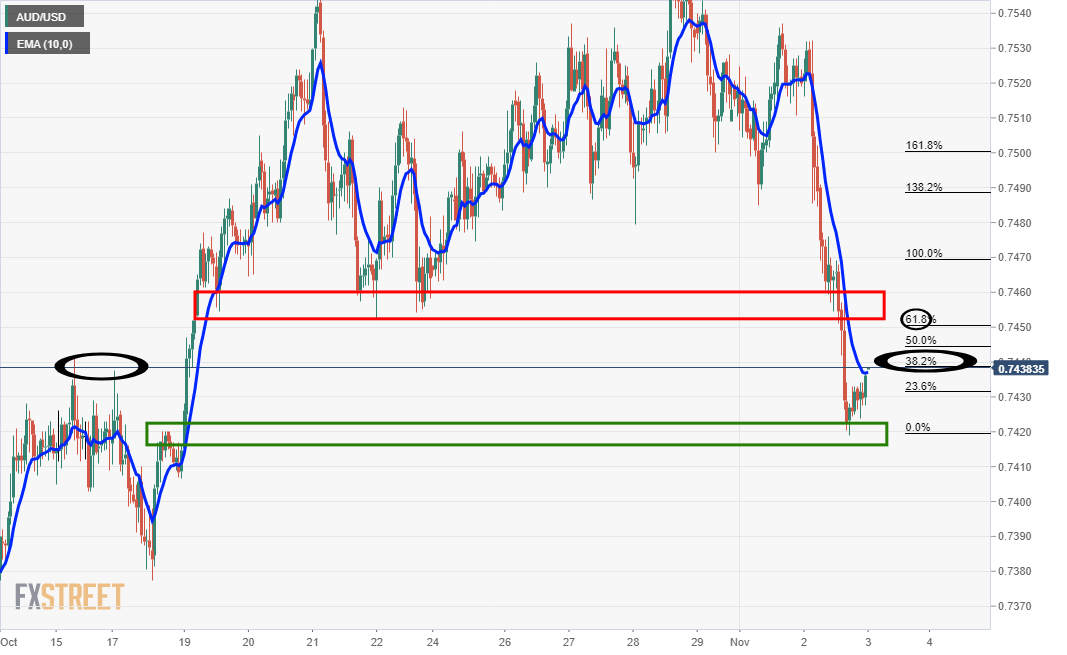

As per the prior analysis at the start of the week, AUD/USD Price Analysis: A countertrend trader's set up in the making? the price has indeed made the forecasted correction as follows:

AUD/USD prior analysis

It was stated that the price ran into what would be expected to be a strong area of support and given the imbalance, a correction was the most probable next scenario.

''Looking back at the price action, it would appear that there is a huge imbalance all the way back to the 0.7450s. This also coincides with a 61.8% Fibonacci as well as a smoothed 200 hourly moving average.''

AUD/USD's progress

Following the analysis, the price indeed started to recover from the marked support area. It made a 38.2% Fibonacci retracement initially that pave the way for with potentially more on the way:

AUD/USD meets 61.8% before and after Fed volatility

Meanwhile, the price did meet the 61.8% ratio and offered an opportunity to short into deeper pools of liquidity until the Federal Reserve meeting. The subsequent price action has left a W-formation on the hourly chart which would likely see the price retest the neckline and the confluence of the 61.8% ratio in the forthcoming sessions as follows:

Given the double bottom and the lack of event risks between now and the Nonfarm Payrolls on Friday, there could be some further consolidation prior to a retest of the 0.7480 resistance and a run on the 0.7520 liquidity.

- XAG/USD steady around $23.50 post-Fed taper announcement.

- The US central bank left the door open for a faster QE’s reduction pace.

- XAG/USD: From a technical perspective and confirmed by a bullish flag, tilted to the upside.

Silver (XAG/USD) edges higher post-Fed bond taper announcement, up 0.13%, trading at $23.54 during the New York session at the time of writing. On Wednesday, the Federal Reserve revealed that it would reduce its bond purchasing program in the middle of November. Furthermore, leave the door open that would adjust the pace of its QE reduction program as the central bank’s needed.

It seems investors perceived the US central bank bond tapering announcement as dovish, as portrayed by US equities printing new all-time highs around the New York close.

Fed’s Chairman Jerome Powell post-Fed press conference remarks

On Wednesday, after revealing the Fed’s QE reduction pace to kick start later in November, Fed’s Chairman Jerome Powell held its press conference. There he said that the central bank could be patient in regards to hiking rates. Further added that in case of needing to tackle heightened prices, he said, “we will not hesitate,” after announcing the scale back by $15 billion of its bond purchasing program.

Chairman Powell reiterated that tapering “does not imply any signal regarding the Fed’s interest rate policy.” Moreover, he noted that the pace would put them on track to finish the pandemic stimulus program in the middle of 2022 but left the door open for adjustments.

Jerome Powell insisted that “we don’t think it is a good time to raise interest rates because we want to see the labor market heal further.”

Concerning inflation, Fed’s Chairman said that it “is elevated,” but it is attributed to supply and demand imbalances related to the COVID-19 pandemic.

XAG/USD Price Forecast: Technical outlook

The white metal is approaching the tops of a bullish flag pattern in the 4-hour chart. Furthermore, the precious metal bounced off the 200-simple moving average (SMA) around $23.09, and rallied $0.50, as the Fed announced the bond taper. Nevertheless, to resume its upward trend, it would need to reclaim the 100-SMA at $23.73.

In the outcome of the above-mentioned, the following resistance area would be the confluence of the $24.00 psychological level and the 50-SMA. A breach of that level could send silver towards 2021 highs around $24.85.

On the flip side, failure at $23.73 would keep USD bulls in control, exposing the $23.00 figure as the first support level before re-testing the $22.00 figure.

- S&P 500 and Nasdaq 100 clinch fifth consecutive record closes, the latter at 4660.

- Stocks were supported on Wednesday amid a dovish slant to the latest Fed policy announcement.

For reasons that are not abundantly clear, US equity markets were jubilant in wake of the latest Fed policy announcement, enjoying broad gains in wake of the Fed’s rate decision and monetary policy statement, and then extending on those gains as Fed Chair Jerome Powell spoke in the post-meeting press conference. In the end, the S&P 500 and Nasdaq 100 both managed to notch record closes for a fifth consecutive session, the former closing at 4560 (+0.6% on the day) and the latter surging above 16K for the first time to close near 16.15K (+1.0% on the day). The Dow also managed to get in on the spoils, closing above 36.15K (+0.3% on the day).

In recent days, the main driver of the march higher across US equity markets has been a strong Q3 earnings season, where more than 60% of companies have beaten analyst expectations and aggregative Q3 S&P 500 earnings growth is set to exceed 40% YoY on the quarter (well above expectations just a few weeks ago). Corporate American continues to thrive, in other words, despite 1) the ongoing presence of the Covid-19 virus, 2) severe global supply chain issues and bottlenecks and 3) rising labour costs.

But it was all about the Fed on Wednesday. To recap, the main news was that the Fed has formally kicked off the process of unwinding its extraordinary stimulus measures, first implemented in 2020 to support the pandemic stricken economy, and will reduce the monthly pace of bond buying by $15B in November and then again in December. Thereafter, the pace of further monthly bond-buying reductions can be adjusted as the Fed deems appropriate, though the bank said a continuation of the current $15B/month pace seems appropriate. This is bang in line with market expectations, with Fed members signaling well in advance that they had been thinking about taking this course of action.

The other major focus of the meeting was the tone the Fed (and Chairman Powell in the press conference) would adopt on inflation and the potential for rate hikes. Here, the Fed may have disappointed the hawks; in the statement, the current spike in inflation was still described as largely being driven by transitory factors (some hoped the “transitory” word would be dropped). In the post-meeting press conference, Powell said emphasised that it was the Fed’s base case that inflation would “abate” in Q2/Q3 2022 and, thus, the bank is prepared to be patient when it comes to rate hikes, thus allowing more time for the labour market recovery to advance. This emphasis on patience and the Fed’s belief that inflation is still transitory was interpreted as dovish and likely goes some way in explaining why stocks have rallied so much.

Door opened for hawkish shift in 2022?

While markets have largely interpreted the tone of the updated FOMC statement on monetary policy and Fed Chair Powell’s remarks in the press conference as dovish, some analysts have noted that the Fed did also appear to open the door to a hawkish shift in policy in 2022. Firstly, the Fed statement said the pace of the QE taper would become flexible from January, meaning that if they wanted to, the Fed could quicken the taper process if inflation risks remain elevated.

Moreover, though Powell was keen to impress that the Fed wants to be patient when it comes to rate hikes, he also emphasised that the uncertainty with regards to the path of inflation in the US economy is now more pronounced. Powell also noted that the Fed is positioning for a number of potential scenarios must implicitly mean that the Fed is preparing for a possible hawkish shift if inflation comes in hotter than expected over the coming months. While markets might have thus far interpreted events as dovish, it seems that Fed policy going forward is set to be data-dependent. If it looks as though the YoY rate of US CPI is set to remain elevated in the 4.0-5.0% region into Q2 next year, prepare for a hawkish Fed shift in Q1.

- NZD/USD bulls reach up into neutral territory.

- Bears will be looking to a correction of the sharp hourly bullish impulse.

- Fed makes no great shakes and tapers as expected.

NZD/USD is on the front foot and higher by nearly 0.9% following a rally from 0.7103 to a high of 0.7173 the highs on the approach to the Asia open. The markets were fixated on The Federal Reserve on Wednesday that flew past without anything unexpected.

Consequently, the Kiwi is little changed from where it was at yesterday’s close but is higher on the day following a slide in the greenback after the Fed’s tapering announcement. ''Tapering doesn’t reduce liquidity but it does slow the pace of growth,'' analysts at ANZ bank explained.

''As such, Fed policy will be “less stimulatory” than contractionary. US bond markets did not react initially, but yields are now rising and that could put the bid back into the USD – this was a positive step and should sustain rather than crush the US economy.''

Fed main takeaways

- Meanwhile, the FOMC announced a tapering of its QE programme was followed up with the details as follows:

- A reduction in asset purchases will begin this month at a $15bn pace, split between $10bn treasuries and $5bn MBSs.

- There was no interest rate guidance, and the decision was a unanimous 11-0.

- The Fed state that the pace would alter as necessary.

- The statement reiterate that inflation pressures remain "elevated," but softened the language about it being transitory to "largely reflecting factors that are expected to be transitory" (versus "largely transitory" in September).

- The Fed repeated that the economy and the employment situation have "improved in recent months" but Covid has slowed the recovery.

- Maximum employment is yet to be achieved.

- "Policy will adapt appropriately" to those dynamics he said.

As for data, the US services ISM in October surprised with a rise to a record high of 66.7 (est. 62.0, prior 61.9). In addition to further gains in prices paid (to 82.9 from 77.5), new orders rose to 69.7 (from 63.5) - the highest reading since 1997, and business activity rose to 69.8 (from 62.3).

Ahead of this week's Nonfarm Payrolls, ADP private-sector employment in October at 571k beat expectations (est. 400k), although September was downgraded by 45k to 523k. this came as a welcoming prelude to the key event on Friday.

NZD/USD technical analysis

The focus is now on the downside following the rally into higher liquidity above and a correction into the 50% mean reversion location can be expected in surpassing the 38.2% Fibo target as first potential stop.

What you need to know on Thursday, November 4:

The American dollar ended Wednesday with modest losses against most of its major rivals, following the US Federal Reserve monetary policy announcement. The US central bank kept interest rates unchanged as expected, and announced the reduction of its asset purchases by $15 billion per month. The Fed will begin taper later this month with reductions in Treasuries purchases by $10 bln, and mortgage-backed securities by $5 bln.

Also, policymakers still think inflation will be “transitory” although Powell noted that supply chain issues will likely extend well into next year, which means inflation will also remain high. Utterly patient stance with inflation above 2%. Among other things, he also said that he would not want to surprise markets by changing the taper strategy, opposite to the statement that noted that they can adjust the strategy as needed.

His conservative stance put some pressure on the greenback while providing a boost to Wall Street, with the three major indexes reaching record highs. US Treasury yields advanced, with the yield on the 10-year Treasury note settling at 1.60%.

The EUR/USD pair is still incapable to advance beyond 1.1615, while GBP/USD trades near 1.3700. The AUD/USD pair recovered towards 0.7450, but the risk is skewed to the downside amid an also dovish RBA. The USD/CAD pair fell below 1.2400, despite weaker oil prices.

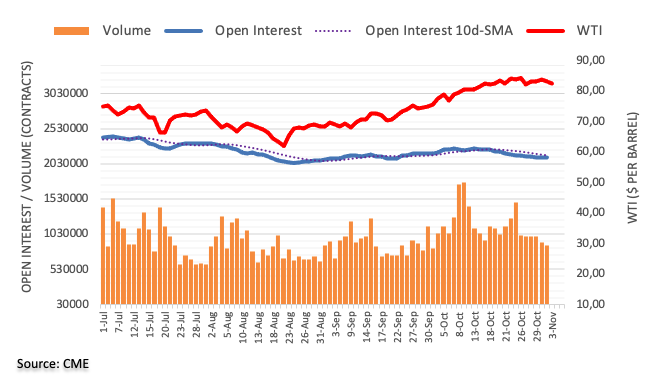

WTI settled around $80.00, down after US crude stocks rose by more than expected, while gasoline inventories hit a four-year low. Also, Iran nuclear talks are set to resume on November 29 in Vienna.

Gold plummeted ahead of the Fed’s decision, trimming part of their intraday losses ahead of the close. It finished the day at around $1,770.00 a troy ounce.

Ethereum in price discovery mode may not stop until ETH hits $7,000

Like this article? Help us with some feedback by answering this survey:

- Oil prices have dropped sharply in recent trade, with WTI now at $80.00 and down about $3.0 n the day.

- News that Iran/EU/US nuclear talks will restart at the end of the month has exacerbated the drop.

Oil prices have been dropping sharply in recent trade. Front-month futures contracts for the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, has now dropped back to $80.00 per barrel level for the first time since mid-October. As things stand, WTI is down about $3.0 or more than 3.5% on the day, the largest percentage drop in one day since early August.

News that Iran and the EU (and indirectly, the US) will return to the negotiating table regarding Iran and the US rejoining the 2015 nuclear pact, thus paving the way for the removal of sanctions that limit Iranian oil exports, is being cited as weighing on the price action. Talks will begin again on the 29th of November. Iran might be able to increase output by as much as 2M barrels per day if the sanctions are lifted, which would go some way to closing the current gap between the global supply of oil and the global demand for oil.

A stop run/technical selling may also have contributed to the pace of the recent drop; $81.00 was a key area of support that had held up on multiple occasions over the last two weeks and there may have been a number of stops in the $80.00-$81.00 region that got triggered. Also, when WTI broke below $82.00, it appears to have also dropped under a long-term upwards trendline, which may have also exacerbated the selling pressure.

Bearish Inventory Data

Prior to the acceleration of the sell-off in crude oil markets over the last few hours, prices had already been trading substantially lower on the day. Weekly Private API inventory data showed larger than expected build in both crude oil and distillate stocks in the US on Tuesday and official inventory data from the US EIA on Wednesday confirmed these builds. According to the EIA, crude oil inventories rose by 3.3M barrels. Market commentators said the bigger than expected build in crude oil stocks weighed on crude oil prices on Wednesday, though it should be noted that, according to the EIA, gasoline stocks fell to their lowest since 2017 and crude oil stocks at the Cushing Oklahoma storage hub were at their lowest in three years.

OPEC+

This is indicative of the fact that global oil market conditions remain tight, with global demand now thought to be back above 100M barrels per day, while supply continues to lag by a few million barrels per day as OPEC+ increases output at a slower pace than the recent recovery in demand. For this reason, some might see Wednesday’s drop in crude oil prices as a good dip-buying opportunity. But the proximity of Thursday’s OPEC+ meeting might keep traders hesitant.

The cartel is not expected to cave to international pressure to increase oil output at a faster pace and various member state oil ministers have signaled that they think it appropriate to stick to the current plan whereby output is lifted at a pace of 400K barrels per day/month. They might cite the recent outbreak of Covid-19 infections (which is touted to already be more widespread than at any other time since the initial outbreak in 2020), which threatens to send the country back into a nationwide lockdown, as a reason for their cautious approach.

In recent trade, it has been reported that Iran's talks with world powers aimed at reinstating a 2015 nuclear deal will resume on Nov. 29.

This comes across a number of news agencies in the last hour.

Iran's top nuclear negotiator, Ali Bagheri Kani, was reported to have spoken and announced the date as Western concerns over Tehran's nuclear advances grow.

This is from Reuters:

"In a phone call with @enriquemora, we agreed to start the negotiations aiming at removal of unlawful & inhumane sanctions on 29 November in Vienna," Bagheri Kani wrote in a tweet.

In April, Tehran and six powers started to discuss ways to salvage the nuclear pact, which has eroded since 2018 when then-President Donald Trump withdrew the United States from it and reimposed sanctions on Iran, prompting Tehran to breach various limits on uranium enrichment set by the pact. read more

But the talks have been on hold since the election of Iran's hardline President Ebrahim Raisi in June, who is expected to take a tough approach when the talks resume in Vienna.''

Market implications

Iran has been the wold card for oil for some time and this is sure to keep traders o the edge of their seats.

USD/CAD has pulled back sharply from earlier session highs above 1.2450 and is at present flirting with the 1.2400. Trade has been choppy over two or so hours given the Fed policy announcement and press conference with Fed Chair Jerome Powell, which is still ongoing. The US dollar is seeing broad weakness in response to the event and that is the main reason why USD/CAD has been able to pull back from highs.

Markets are seeing a broadly dovish reaction to the Fed announcement, seemingly because the Fed stuck to its classification of inflation as transitory (some feared this wording would be dropped) and after Fed Chair Powell said in the press conference that he thinks the Fed can be “patient” on interest rates to allow time for the labour market to continue its recovery. The Fed announced its QE taper plans, saying it would reduce the monthly pace of purchase by $15B in November and then again in December, in line with the pace that most market participants had been expecting Of course the bank also held the Federal Funds target range at 0.0-0.25%.

Dovish Fed vibes have not been enough to send USD/CAD convincingly back into negative territory on the day, however. At its current level close to 1.2400, USD/CAD is only down about 0.1% on the day. That’s because a sharp drop in oil prices is weighing heavily on oil-sensitive currencies like the Canadian dollar. Some analysts are citing the fact that a date has now been set for the resumption of nuclear talks between Iran and the EU (and also the US, indirectly) as weighing on oil. Talks will resume on the 29th of November, opening the door for a potential deal for Iran and the US to return to the 2015 nuclear pact which would allow for the lifting of US sanctions on Iranian oil exports, which could bring millions of barrels of oil per day in supply back to global markets.

Door opened for hawkish shift in 2022?

Back to the Fed; while markets have largely interpreted the tone of the updated FOMC statement on monetary policy and Fed Chair Powell’s remarks in the press conference as dovish, some analysts have noted that the Fed also appears to opening the door to a hawkish shift in policy in 2022. Firstly, the Fed statement said the pace of the QE taper would become flexible from January, meaning that if they wanted to, the Fed could quicken the taper process if inflation risks remain elevated.

Moreover, the greater emphasis that Powell placed on the uncertainty with regards to the path of inflation in the US economy and his more pronounced insistence that the Fed is positioning for a number of potential scenarios must implicitly mean that the Fed is preparing for a possible hawkish shift if inflation comes in hotter than expected over the coming months. While markets might have thus far interpreted events as dovish, it seems that Fed policy going forward is set to be data-dependent. If it looks as though the YoY rate of US CPI is set to remain elevated in the 4.0-5.0% region into Q2 next year, prepare for a hawkish Fed shift in Q1.

- USD/CHF seesaws around the 0.9100-0.9130 range as Fed’s Powell speaks.

- The USD/CHF is finding strong support at 0.9100, as the pair has jumped off that level three times.

- Fed’s Powell acknowledged that inflation is running well above the 2% goal.

The USD/CHF slides during the New York session, down 0.30%, trades around 0.9117 at the time of writing. On Wednesday, the Federal Reserve decided to keep interest rates at the 0-0.25% range, but most importantly, unveiled the bond taper process is a go, and it will start by the middle of November. Moreover, the monetary policy statement highlights that the Fed would be flexible with the pace of reductions in assets purchases, leaving the door open for a faster or slower QE’s reduction program.

Market reaction.

The USD/CHF pair dipped to 0.9100 but bounced off the lows, reaching up to 0.9140. However, at press time, Federal Reserve Chairman Jerome Powell is hosting his post-Fed press conference.

Summary of some of Chairman’s Powell conference remarks.

Federal Reserve Chairman Jerome Powell said that the slowdown in job gains is concentrated in specific sectors. Furthermore, he said that the participation rate remains subdued, and employers are having difficulties hiring people. Powell added, though, that “these problems on jobs should diminish.”

Regarding inflation, he said that supply and demand imbalances contributed to higher prices and acknowledged that inflation is running well above the 2% goal. The chairman blamed bottlenecks and supply chains as the main drivers of heightened inflationary pressures.

Moreover, he added that “our [central bank] tools can’t ease supply constraints.” Powell reiterated that if the Fed sees signs that inflation is more persistent beyond the central bank level, they will adjust.

Summary of the Federal Reserve monetary policy statement

Summarizing comments of the Federal Reserve’s statement, they said that “elevated inflation is largely transitory, and supply and demand imbalances related to pandemic have contributed to sizable prices increases in some sectors.”

Moreover, they added, “[the fed] will begin taper later this month with reductions in treasuries purchases by $10 bln, MBS by $5 bln.”

Nevertheless, the Fed left the door open for additional adjustments at the QE’s pace. They said “similar reductions in pace of purchases likely appropriate each month, but prepared to adjust if warranted.”

Concerning economic conditions, the central bank sees an improvement in economic activity while the labor market strengthens.

Regarding COVID-19, they said, “Summer’s rise in COVID-19 cases slowed the recovery of sectors adversely affected by the pandemic.” They reiterated that the

To finalize, they reiterated that the economy’s path would lie on the course of the COVID-19 pandemic.

- EUR/USD holds within familiar ranges following the Fed taper announcement.

- Fed statement inline with expectations, yet transitory language a touch more hawkish.

- All eyes on Powell's presser, the Fed Dec meeting, US data and how hawkish the ECB will be.

EUR/USD was trading around 1.1600 throughout the Federal Reserve event on Wednesday. The outcome was more or less in line with the market's expectations but the Fed has acknowledged in a tweak in its statement that inflation might not be as transitory as expected.

Nevertheless, the price made a fresh high during the chairman's presser, touching 1.1616 at the time of writing as Powell attempts to dial down inflation risks. The range, so far today, has been between 1.1562 and 1.1616.

Fed statement takeaways

A taper announcement was made, something that was well telegraphed in prior Fed communications. In the statement, it maintained the transitory language but changed the wording, from ''reflecting transitory factors'' to, ''factors that are expected to be transitory'':

- Tapering starting November, with monthly reductions of $15 bln.

- Prepared to adjust taper pace ‘as warranted’.

- Interest rate decision actual: 0.25% vs 0.25% previous; est 0.25%.

Fed's chair, Powell's presser

Powell is emphasising that the US is not at maximum employment and he has tried to water down the market's take on the tweak to the 'transitory' verbiage in the statement. The US dollar was sent on the backfoot following his reasoning but overall, the markets are steady and will very quickly move to a focus on US data with the Nonfarm Payrolls just around the corner.

EUR/USD H1 chart

From a technical standpoint, the downside is still vulnerable so long as the price stays within the confines of recent ranges as follows:

- The Fed as expected left rates unchanged on Wednesday.

- Tapering is finally to begin at the rate of $15 billion a month.

- Transitory inflation, well we will have to see about that.

The Federal Reserve as expected left interest rates unchanged on Wednesday in a widely telegraphed move. The Fed never likes to surprise markets too much and stuck to the well-flagged script. Signaling the beginning of the end of the massive bond-buying stimulus program that propped up the economy and notably equity markets since the pandemic began. However, the Fed is determined to get value for money from the transitory printing press as it sticks with its oft-stated view that inflation will be transitory. At least they did admit that it may be transitory for longer, if that makes sense! " Inflation is elevated, largely reflecting factors that are expected to be transitory," Powell said. "With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen". On a lighter note, Fed Chair Powell is asked to explain transitory and says it does not leave a permanent persistent mark on prices and inflation. Clearly this is where the test lies and so far the equity market feels the Fed is not behind the curve. The currency and bond markets are not so sure.

The Fed is to buy $60 billion in Treasuries during December and $30 billion in Mortgage Backed Securities (MBS). That's $10 billion fewer Treasuries and $5 billion less in MBS. Still, a significant amount thought so this taper is treading carefully.

The equity market reacted as only they can, positively. No news can dent this juggernaut just yet and certainly a meek and well-flagged taper is not going to do the trick. The dollar too has struggled for direction post the decision whipsawing around 1.16 but slightly weakening for now. US yields quickly spiked with the curve steeping but this has abated and 2-year yields remain little changed at 0.47%, 10 year at 1.57%, and 30 year at 1.98%.

Overall a solid and cautious approach from the Fed with the risk perhaps of straying too far behind the curve just about put to bed. Equity markets are within striking distance of more all-time highs and VIX, a measure of volatility in the equity market, is falling to the low end of the recent range at 15. MOVE, a measure of bond market volatility, has also dropped but this one is elevated compared to the recent past, indicating the bond market may be about to have a showdown with the Fed. For equity people, risk is on so more gains are likely.

-637715630918029562.png)

EuroUSD 15 minute.

Equities are clearly happy!

-637715631467835890.png)

S&P 500 15 minute

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"By many measures, we are in a very tight labor market."

"The issue is, how persistent is the labor market tightness, given it's due to COVID."

"It is clear we are set to go up to a higher employment level."

"You want to be in a position to act to cover the full range of possible outcomes; risks are skewed to higher inflation."

"We need to be ready to act if we have to."

"It is appropriate to be patient on jobs and inflation."

"Transition away from goods could bring inflation down."

"We want to see the process unfold to gauge true state of the economy."

"We think time will tell us more."

"Now is not the time to raise rates."

"If we need to raise rates, we'll be patient but not hesitate."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"We understand that people with lower incomes are affected more by inflation."

"We will use our tools to make sure high inflation doesn't become a permanent feature."

"Wages is a key measure of how tight the labor market is."

"We have to be humble about what we know about this economy."

"We want to see further development of the labor market in the absence of another COVID spike."

"People are still staying out of the labor market in part due to COVID."

"There is room for a whole lot of humility here on maximum employment."

"We have high inflation and we have to balance that with our employment goals."

"We are in a complicated situation."

"We hope to get more clarity over the first half of next year."

"When we reach maximum employment, it's very possible inflation test will already be met."

"We are not evaluating the liftoff test today."

"Liftoff test is clearly not met on employment goal."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

US equity markets saw upside in the immediate aftermath of the latest Fed rate decision, with the S&P 500 rallying to fresh record intra-day levels just shy of the 3640 mark. The Fed held the federal funds target range at 0.0-0.25% as expected, and, also as expected, announced that it would taper its QE programme, which is currently buying bonds at a pace of $120B per month, by $15B from mid-November and then again in mid-December. Thereafter, the Fed said that it would likely be appropriate for further reductions in the pace of bond-buying programme in 2022 to continue at a similar pace, though the Fed would be prepared to adjust as necessary.

The dovish surprise that appeared to support equities appears to have been the fact that the Fed did not adjust its language regarding how it views inflation as “hawkishly” as some might have expected. The bank maintained its description of inflation being largely driven by transitory factors, though did add another sentence going into a little more detail as to the drivers (reopening, supply chain problems) of high inflation. Some might have expected the bank to say something like “inflation is partly driven by transitory factors”.

Fed Chair Jerome Powell is currently conducting his usual post-monetary policy announcement press conference and equities seem to be liking what they are hearing, with the S&P 500 having now pushed to the north of the 4640 level and is eyeing a test of 4650. Taken in sum, Powell’s remarks on the labour market, inflation and interest rates seem to be more dovish than what the market may have been expecting; Powell doubled down on the classification of inflation as expected to be transitory, saying he expects it to abate in Q2 or Q3 next year. He also said that, as a result, the Fed is willing to be patient when it comes to rates. This isn’t the sort of language one would expect to hear from a man who is about to hike rates as soon as June 2022, as money markets are currently pricing.

Still, Powell has been hedging himself; he reiterated past comments that he does think the risk of more persistent inflation has risen and that the Fed is “positioning itself for a range of possible outcomes”, which could include being faced with a trade-off between inflation and employment (i.e. needing to hike before the jobs market has returned to full employment because inflation is too high). Still, Powell said he thinks the labour market can recover fully by mid-2022, which is conveniently also the period after which if inflation is still high, the Fed would start hiking rates (in other words, ignore high inflation until employment recovers, then start to address it!). These potentially more hawkish scenarios, under which rate hikes would likely begin in mid-2022 are not being presented as the Fed’s base case. Net-net, markets seem to be interpreting Powell tone/remarks as dovish, hence the upside seen in stocks and the broad weakness being seen in the US dollar.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"If we see a need to deviate from taper plan, will make that transparent."

"We wouldn't surprise markets if we have to change the pace of the taper."

"We would telegraph any changes transparently."

"Level of inflation we have right now is not at all consistent with price stability."

"We will use our tools as appropriate to get inflation under control."

"It is not a good time to raise interest rates because we want to give labor market time to heal further."

"Transitory means it will not leave behind persistently higher inflation."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"Inflation that we are seeing is not due to a tight labor market."

"Inflation we are seeing now is due to bottlenecks, and strong demand."

"We have to be aware of the risks of the trade-off between inflation and employment."

"We see higher inflation persisting and have to be in place to address that risk."

"We are positioning ourselves to address a range of plausible outcomes."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"It is time to taper, it is not time to raise rates."

"It is time to take a rethink because the economy has made substantial further progress but still ground to cover on employment gains."

"Our baseline expectation is supply chain issues will persist well into next year."

"We should see inflation moving down by Q2 or Q3."

"We can be patient on rates."

"If a response is called for, we will not hesitate."

"We are watching carefully on how the economy evolves, will adapt accordingly."

"We could achieve maximum employment by the middle of next year."

"Wages have been moving up very strongly."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"Our taper would cease by the middle of next year."

Even after balance sheet stops expanding, our holdings will support financial conditions."

"Decision to taper does not imply any direct signal on rates."

"We are focusing on what we can control."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"Supply and demand imbalances have contributed to sizable price increases."

Bottlenecks are affecting how supply can respond to demand."

"Inflation running well above 2% goal."

"Bottlenecks longer-lasting than expected."

"Drivers of higher inflation predominantly connected to COVID-related factors."

"We understand difficulties of high inflation for families."

"Our tools can't ease supply constraints."

"We think our economy will adjust to supply and demand imbalances and inflation will recede."

"Believe inflation will decline closer to 2% goal as economy adjusts."

"Global supply chains will return to normal, but timing uncertain."

If we see signs inflation is moving persistently beyond levels we want, we will adjust."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"Slowdown in job gains concentrated in certain sectors."

"Participation rate remains subdued."

"Unemployment rate understates shortfall in employment."

Prime-age participation remains well below pre-pandemic levels."

"Employers are having difficulties filling jobs."

"These problems on jobs should diminish."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged and to reduce asset purchases by $15 billion per month, FOMC Chairman Jerome Powell is delivering his comments on the policy outlook.

Key quotes

"We remain attentive to risks."

"Real GDP growth has slowed notably."

"COVID has held back recovery."

"Demand has been very strong."

"With COVID receding, economic growth should pick up this quarter."

"We expect strong economic growth this year."

"Pace of improvement in jobs has slowed."

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

- Federal Reserve leaves rates unchanged at 0-0.25%.

- The Federal Reserve will begin the bond tapering process in mid-November.

- The pace of the bond taper: $70 billion a month of treasuries, and $35 billion a month Mortgage-Backed Securities(MBS).

Gold (XAU/USD) extends its sharply fall, seesawing around $1,765 as the Federal Reserve announced the bond tapering, it will start by mid-November, and the pace of the QE program will reduce from $120 billion a month to $105 billion, a $15 billion reduction as the market expected. Furthermore, it leaves the doors open for a faster bond tapering process, as the Fed says that “comparable decreases in buying pace are likely reasonable each month, but we are willing to adapt if necessary.”

Market Reaction

XAU/USD is seesawing around the $1,760-$1,770 area, but its initial reaction spiked towards $1,770, retracing the move towards $1,766.

Summary of the Federal Reserve monetary policy statement

Summarizing comments of the Federal Reserve’s statement, they said that “elevated inflation is largely transitory, and supply and demand imbalances related to pandemic have contributed to sizable prices increases in some sectors.”

Furthermore, they added, “[the fed] will begin taper later this month with reductions in treasuries purchases by $10 bln, MBS by $5 bln.”

However, they leave the door open for adjustments at the QE’s pace. They said “similar reductions in pace of purchases likely appropriate each month, but prepared to adjust if warranted.”

Concerning economic conditions, they see an improvement in economic activity while the labor market continues to strengthen.

Regarding COVID-19, they said, “Summer’s rise in COVID-19 cases slowed the recovery of sectors adversely affected by the pandemic.” They reiterated that the

To finalize, they reiterated that the economy’s path would lie on the course of the COVID-19 pandemic.

- GBP/USD holds its ground following the Fed taper announcement.

- Fed statement inline with expectations, a slight tweak to the transitory language supports greenback.

- All eyes now turn to Powell's presser, the Fed Dec meeting and US data as well as the BoE.

GBP/USD was trading around 1.3670 on the release of the Federal Reserve's statement where it appears that the board members are less certain that inflation will be transitory. Nevertheless, the price made a fresh high during the knee-jerk reaction to the statement and wider spreads. The range, so far today, has been between 1.3607 and 1.3686.

Fed statement takeaways

The Federal Reserve will begin dialling back the quantitative easing that it has provided since the coronavirus pandemic erupted last year in response to high inflation that now looks likely to persist longer than it did just a few months ago. In the statement, it maintained the transitory language but changed the wording, from ''reflecting transitory factors'' to, ''factors that are expected to be transitory'':

- Tapering starting November, with monthly reductions of $15 bln.

- Prepared to adjust taper pace ‘as warranted’.

- Interest rate decision actual: 0.25% vs 0.25% previous; est 0.25%.

Next up, Fed's Powell presser, watch live

The Fed's chair Jerome Powell will now likely emphasize how tapering will lead to flexibility in responding if the economy evolves in a way that deviates significantly from expectations. He should be pressed on the change in the statement with regards to transitory language as well.

Given there is no set detail as for the path of tapering beyond December, he will likely be questioned as to what the expected lines are going to be from there onwards and how fast he expects the taper to be until the rate hike lift-off.

BoE and US data firmly in focus

The market will now be left data watching with respect to the US dollar. At the end of the week, Nonfarm Payrolls will be critical and given today's ADP report, the bias is tirled to the bullish side.

This week's Bank of England policy decision is close to a coin toss, according to analysis at TD Securities. However, regardless of the outcome, the analysts at TDS expect the BoE to hike rates by 15bps at one of the two remaining 2021 meetings. ''This meeting is marginally more suitable, given recent messaging and the accompanying MPR, projections, and press conference. The MPC's tone will likely imply a subsequent hike, but probably not until February.''

AUD/USD saw a temporary pop higher from earlier session lows in wake of the release of the latest FOMC rate decision and monetary policy statement, at one point coming within a whisker of the 0.7450 level. As expected, the bank held the federal funds target range at 0.0-0.25% and announced that it would taper its QE programme, which is currently buying bonds at a pace of $120B per month, by $15B from mid-November and then again in mid-December. Thereafter, the Fed said that it would likely be appropriate for further reductions in the pace of bond-buying programme in 2022 to continue at a similar pace, though the Fed would be prepared to adjust as necessary.

The dovish surprise that appeared to momentarily send AUD/USD higher appears to have been the fact that the Fed did not adjust its language regarding how it views inflation as “hawkishly” as some might have expected. The bank maintained its description of inflation being largely driven by transitory factors, though did add another sentence going into a little more detail as to the drivers (reopening, supply chain problems) of high inflation. Some might have expected the bank to say something like “inflation is partly driven by transitory factors”.

Nonetheless, the dovish initial reaction that saw AUD/USD pop higher has now more or less fully unwound, with AUD/USD back at pre-Fed announcement levels in the 0.7420s. Focus now shifts to Fed Chair Jerome Powell’s press conference which kicks off at 1830GMT. His remarks on inflation, the potential for further adjustments to the pace of the QE taper and the potential for rate hikes next year will be the key themes.

The Federal Open Market Committee (FOMC) announced on Wednesday that it left the benchmark interest rate, the target range for federal funds, unchanged at 0%-0.25% as widely expected.

More importantly, the Fed decided to reduce its asset purchases by $15 billion per month.

Follow our live coverage of the FOMC decision and the market reaction.

Market reaction

With the initial market reaction, the greenback weakened against its rivals and the US Dollar Index was last seen losing 0.2% on the day at 93.90.

Key takeaways from the policy statement as summarized by Reuters

"Elevated inflation largely transitory."

"Supply and demand imbalances related to pandemic have contributed to sizable prices increases in some sectors."

"Will begin taper later this month with reductions in treasuries purchases by $10 bln, MBS by $5 bln."

"Similar reductions in pace of purchases likely appropriate each month, but prepared to adjust if warranted."

"Economic activity, employment have continued to strengthen."

"Summer’s rise in COVID-19 cases slowed the recovery of sectors adversely affected by the pandemic."

"Path of economy continues to depend on course of virus."

- EUR/USD sits around 1.1580 resistance ahead of the Fed.

- Bears eye 1.1520 demand area and then a break below 1.1500 in coming sessions.

EUR/USD is sitting around 1.1580 ahead of the Federal Reserve interest rate decision at the top of the hour. The pair has changed hands between a low of 1.1562 and a high of 1.1598 so far on Wednesday following a slew of economic positives from the US in the early New York trade.

The greenback has edged higher on Wednesday, holding near recent peaks versus the euro as well as the yen. Traders are in anticipation today of an expected announcement on the unwinding of the Fed's pandemic-era stimulus. If there is going to be any surprises outside of a ''no-taper'', it will be most likely from the Fed's Chairman, Jerome Powell, in topics surrounding inflationary pressures and timings of lift-off. Before he speaks, the Fed's policy statement, which will likely kick-off the tapering of its $120 billion-a-month asset purchase program, is due at 2 p.m. Eastern time (1800 GMT), followed by the news conference with Powell.

What's priced in?

''At this point, the Fed has managed expectations perfectly in terms of preparing the markets for what is likely to be speed tapering,'' analysts at Brown Brothers Harriman. ''Most Fed officials seems to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed. The most likely path for tapering has already been flagged by the Fed, which would reduce asset purchases by $15 bln per month ($10 bln UST and $5 bln MBS) starting this month so that QE effectively ends mid-2022.''

Around tapering, flexibility will be something that markets will respond to as well as timings for rate hike lift-off. Any signal that Powell is open to responding with rate hikes to inflation, if the case for it being transitory keeps weakening, would reinforce the supportive US dollar backdrop.

''We don't expect any definitive new "liftoff" signal, and we expect "elevated" inflation will continue to be seen as "largely reflecting transitory factors," but the chair will likely emphasize how tapering will lead to flexibility in responding if the economy evolves in a way that deviates significantly from expectations,'' analysts at TD Securities explained.

ECB dials down hawkish sentiment

The Fed announcement follows meetings of the Reserve Bank of Australia on Tuesday and the ECB last Wednesday, both of which pushed back against market pricing of tighter policy. European Central Bank Christine Lagarde said an interest rate rise in 2022 was very unlikely because inflation was too low, sending government bond yields lower. But the euro barely budged.

She noted that “In our forward guidance on interest rates, we have clearly articulated the three conditions that need to be satisfied before rates will start to rise. Despite the current inflation surge, the outlook for inflation over the medium term remains subdued, and thus these three conditions are very unlikely to be satisfied next year.”

Of note, the swaps market is pricing in 7 bp of tightening over the next twelve months, down from 11 bp yesterday and over 20 bp right after Thursday’s decision. As such, Lagarde’s efforts seem to be working.

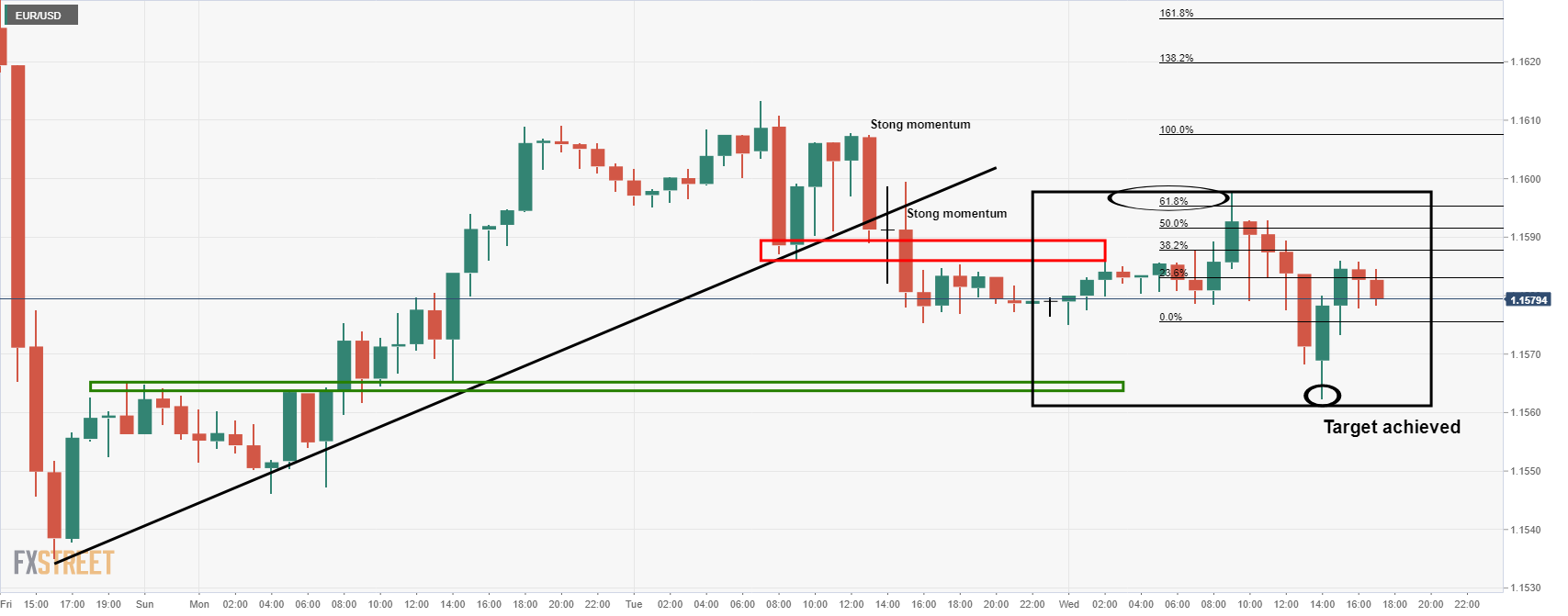

EUR/USD technical analysis

While the macro side of the trade is somewhat uncertain with respect to how markets will respond to the semi-unknown, the technical picture for EUR/USD is more heavily tilted to the downside as follows:

EUR/USD Price Analysis: Bears seeking a break below 1.15 the figure

As per the prior analysis above, the price action has followed suit:

EUR/USD prior analysis, H1 chart

EUR/USD live market update

The price picked up some extra liquidity in a touch of the 61.8% Fibo prior to reaching the target as illustrated above.

However, the bears may not be done yet and a break of 1.15 the figure is still very much to play for. Ahead of the Fed, where we could expect some price swings, either way, the hourly chart is still offering prospects of a downside continuation as follows:

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Related articles

Fed Interest Rate Decision Preview: Inflation, employment and interest rates.

Five dollar-moving things to watch out for on the historic tapering announcement.

EUR/USD Forecast: Dovish ECB and upcoming Fed hints at a bearish extension.

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

- USD/JPY has risen back above 114.00 from earlier lows aided by strong US data.

- The upcoming Fed meeting will ultimately determine the direction of FX markets on Wednesday.

While the upcoming Fed monetary policy announcement at 1800GMT and follow up press conference with Fed Chairman Jerome Powell from 1830GMT will ultimately dictate the lay of the land for FX markets when all is said and done on Wednesday, USD/JPY has tentatively managed to reclaim the 114.00 level in recent trade, as the currency pair tracks a modest move higher in US yields in response to a duo of strong US data releases earlier in the session. As things stand, the pair is not even 0.1% higher on the day, but it has reversed a more respectable 0.3% from earlier lows when it grazed 113.70. At 114.00, USD/JPY is pretty much bang in the middle of the roughly 113.50-114.50 range that has persisted for roughly the last three weeks.

Strong US data support USD/JPY ahead of the Fed

Notable upticks were seen on the chart at 1215GMT, when ADP released their national employment change estimate for October, which was notably stronger than the 400K median economist forecast at 571K thus adding some upside risk to Friday’s official payroll number (though analysts note the link between ADP and NFP in recent months has been hit and miss), and then again at 1400GMT, when the Institute of Supply Management released their October Services PMI survey, which rocketed to a record high of 66.7.

Anthony Nieves, Chair of the Institute for Supply Management, said in the report that “in October, strong growth continued for the services sector, which has expanded for all but two of the last 141 months”, though he cautioned that “ongoing challenges — including supply chain disruptions and shortages of labor and materials — are constraining capacity and impacting overall business conditions”. Overall, Wednesday’s economic data suggests the US economy is in good health at the start of Q4, with major contraint being the persistance of well documented, ongoing supply chain disruptions.

- US crude oil benchmark (WTI) drops almost 3%, barely holding to $81.00.

- US crude oil inventories increased more than estimates, pushing oil prices lower.

- WTI bulls will need to reclaim 82.65, to remain in charge.

Western Texas Intermediate (WTI), as the US crude oil benchmark is known, is plummeting during the day, down almost 3.50%, trading at $81.16 a barrel per day during the New York session at the time of writing.

The US Energy Information Agency (EIA) reported that US crude oil inventories increased by 3.291M barrels from the week ending on October 29. According to the report, US stockpiles are about 6% below the five-year average for this time of the year.

Furthermore, demands of the White House start to mount on the OPEC+, as US President Joe Biden says that higher prices are attributed to the cartel’s unwillingness to increase the crude oil output as required.

Meanwhile, the Organization of Petroleum Exporting Countries and its allies (OPEC+) will host its monthly meeting on November 4. Most analysts expect the cartel to stick with the 400,000 barrel a day production unless the White House pressure is enough to force an increase of it.

WTI Price Forecast: Technical outlook

4-hour chart

WTI’s price briefly tested the October 28 low at $80.58 but jumped off almost instantaneously. The price drop was sharp enough, leaving the 50 and the 100-simple moving averages (SMA’s) above, which were functioning as dynamic support levels. However, the $80.00-$81.00 seems strong enough to hold off sellers to push the price below.

Nevertheless, a breach of the October 28 low would put the $80.00 figure to the test. On the other hand, an upside break above the 100-SMA at $82.65 would leave oil bull’s in charge as they get ready to push towards higher readings.

- Euro pares Tuesday’s losses, as mild risk-on market sentiment weighs on the Japanese yen.

- Safe-haven currencies like the Japanese yen and the US dollar are down, while the outlier is the Swiss franc rising.

- EUR/JPY: Bullish flag in the daily chart could propel the cross-currency pair towards 134.00.

The EUR/JPY trims some of Tuesday’s losses and advances 0.12%, trading at 132.08 during the New York session at the time of writing. The market’s mood is mixed, but on the FX market, it is slightly tilted risk-on, as the Japanese yen and the US dollar fall, except for the Swiss franc, which advances against most G8 currencies.

During the Asian session, the pair was sharply down around 131.50. Once the European session kicked in, buying pressure sent the EUR/JPY rallying towards 132.17. However, the upside move was capped around those levels, as traders seem to prepare for the Federal Reserve monetary policy statement.

EUR/JPY Price Forecast: Technical outlook

Daily chart

The EUR/JPY daily chart shows that the pair has an upward bias. The daily moving averages (DMA’s) are well below the spot price, with the 200-day moving average below the shortest time frames but flattish. The cross-currency seems to be forming a bullish flag, indicating that the pair has upside, but a break above the top of the bullish flag, around 132.90, is required to confirm its validity.

In the case of that outcome, the final target of the upside move would be 134.00, but it would find some hurdles on the way north. The first resistance would be 133.00, followed by a downslope trendline that travels from June 1 high towards October 20 high, around the 133.40-60 area.

The Relative Strength Index (RSI) at 56, flattish, indicates the pair could print another leg-up before reaching overbought levels.

Data released on Wednesday, showed the ISM services index reached a record high level in October. Activity has never been more fast-paced, demand shows no signs of slowing, prices show no signs of falling, good help is hard to find and the wait time for supplies is everlong, explained analysts at Wells Fargo.

Key Quotes:

“October's services ISM rose to its highest level on records that date back to 1997. A number of components rose to multi-year, if not all-time highs.”

“The biggest increase of any component was the business activity measure, which shot up 7.5 points to a record high 69.8. Service providers have never been busier at any point in the past 24 years.”

“New orders surged to 69.7, a more than six-point jump from the 63.5 level in September. Finding sales and taking new orders used to be the tricky part. In today's white-hot demand environment taking orders is a piece of cake, the challenge comes when you try to deliver those services.”

“The highest reading of any sub-component is still the prices-paid measure.”

“The primary challenge to the labor market's recovery continues to be the supply of workers. While the factors deterring workers from looking for employment have not disappeared over the past month, many have eased with fewer people reporting not looking for work due to COVID fears and childcare in October. The recent expiration of enhanced unemployment benefits amid strong wage gains should also incentivize workers to return to the labor force. Squaring all of these developments, we still expect to see that employers added 390K workers in October when the payroll report is released Friday.”

- GBP/USD is the joint best performing G10 currency on Wednesday alongside NZD.

- However, FX markets are mostly in wait-and-see mode ahead of the Fed meeting.

GBP/USD is at present trading back to the north of the 1.3650 level, having bounced from Asia Pacific session lows close to 1.3600. With the pair higher by about 0.3% so far on the session, pound sterling is the best performing G10 currency this morning alongside the New Zealand dollar. Unlike for the New Zealand dollar, which is benefitting from a stellar Q3 jobs report released during the Asia Pacific session on Wednesday, the reason’s for GBP/USD outperformance on Wednesday ahead of the much anticipated Fed monetary policy announcement is not clear.

Looking at FX markets more broadly, conditions are mostly subdued, with most of the rest of the G10 majors flat, with traders/market participants reluctant to place big bets ahead of the Fed meeting at 1800GMT and the post-meeting press conference with Fed Chair Powell at 1830GMT. The US dollar broadly ignored a stronger than expected estimate of national employment change in October from US payroll processing company ADP (which came in at 571K versus forecasts for 400K), and was unfazed by a significantly stronger than expected ISM Services PMI survey, also for October. With regards to the latter, the headline index rose to its highest since the series began at 66.7, well above forecasts for 62.0, amid a sharp rise in the business activity and new orders subindices, a sign that US growth momentum has picked up sharply at the start of Q4.

GBP outperformance could be a reflection of economic optimism after IHS Markit released their final version of the October UK Services PMI survey this morning, which saw the headline index get a decent upwards revision to 59.1 from the prior estimate of 58.0, a substantial jump from September’s reading of 55.4. That suggests economic growth momentum has improved in the UK economy heading into October. According to Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, “the dominant service sector in the UK economy had a surprisingly good month in October with a strong uptick in overall output, job creation and new orders as business and consumers began to spend again unfettered by lockdown and pandemic restrictions”.

Elsewhere, Brexit remains in the headlines; UK PM Boris Johnson said on Wednesday that the UK wants “substantive” changes to the existing Northern Ireland Protocol. Political analysts expect the UK to soon trigger Article 16, which allows to the UK to take unilateral action on the agreement if it deems the application of the protocol is resulting in serious negative consequences. EU leaders are warning the UK against taking such a step, as it opens up the prospect of further fraught negotiations on trade and legal matters that may escalate, as the ongoing UK/France fishing row also threatens to. The tone of the news on this latter dispute has improved in recent days however after the French opted not to impose retaliatory measures on the UK overfishing access and French government ministers recently praised the UK government’s constructive approach to discussions on fishing.

Looking ahead, traders won’t have much time to rest following Wednesday’s Fed event, with attention turning to a live Bank of England meeting on Thursday, where economists are split over whether or not the bank will hike rates by 15bps.

- Metals drop sharply so far on Wednesday, ahead of the FOMC statement.

- US dollar gains momentum, rises modestly following better-than-expected US data.

- XAG/USD extends weekly losses, finds support at $23.00.

Silver and gold are falling sharply on Wednesday before the FOMC statement. XAG/USD is now off lows, hovering around $23.25, down 1.20% for the day. Earlier, it tumbled to $23.00, reaching the lowest level since October 18.

The sharp decline represents an extension of the slide that started from levels near $25.00 last week. It has accelerated over the last two days, when it dropped from $24.05.

The US dollar gained some momentum following US economic data but it still remains mixed for the day across the board as market participants await the outcome of the FOMC meeting. The Federal Reserve is expected to announce a taper to its purchase program. The tone and the words of Jerome Powell are likely to trigger volatility, including metals.

The ADP reports showed private payrolls increased by 571K in October, above the 400K expected, while the ISM service sector rose to a record high level of 66.7 in October. The data boosted US yields and added support to the dollar. Still, the FOMC meeting will be the key driver, at least until Friday’s NFP.

A daily close for XAG/USD under $22.70 would point to a renewed weakness while a recovery back above $24.00 should clear the way again for a test of $25.00.

Technical levels

- AUD/USD is probing two-week lows in the lower-0.7400s, but remains close to its 21DMA.

- FX markets are calm ahead of the Fed; if they are hawkish, AUD could be an underperformer.

AUD/USD printed fresh two-week lows under the 0.7420 level in recent trade but has since rebounded a little and continues to trade fairly close to its 21-day moving average at 0.7428. FX markets are likely to mostly remain calm in the coming hours given the proximity of arguably the most important Fed policy announcement yet this year at 1800GMT. Fundamental catalysts for the Aussie have been light on Wednesday; Australian Housing Approvals in September saw a sharp 4.3% MoM drop due to lockdowns, but any woes were outweighed by a better than expected Chinese Caixin Service PMI report for the month of October, that saw the headline index rising to 53.8 from the flash estimate of 53.1.

If the Fed is hawkish in terms of its tone on inflation (i.e. sees upside inflation risks growing, risk that inflation is more persistent than initially thought…), AUD would be one of the G10 currencies more at risk of succumbing to the US dollar’s advances, some FX strategists have reasoned. That’s because the RBA was out earlier this week emphasising that it will not be hiking rates in 2022, rather the first hike is likely not until 2023 or even 2024, meaning the bank is likely to fall well behind the Fed with regards to monetary policy normalisation. Note that three-month eurodollar futures for June 2022 currently trade at 99.58 (versus futures for this month trading at 99.83), implying that a 25bps rate hike is pretty much fully priced in by the end of Q2 2022. Based on the same logic, currencies whose central banks are ahead of the Fed in terms of monetary normalisation, like NZD, NOK, GBP and CAD are likely to hold up better in the scenario that the Fed does deliver a hawkish surprise.

In the above-outlined scenario, AUD/USD could see an exacerbation of recent losses and move below the 0.7400 level and towards 0.7350, where the 50DMA resides, would be on the cards. Technicians continue to cite AUD/USD’s recent failure to break above the 200DMA recently in the 0.7550 area as a bearish near-term indicator.

- Pound outperforms on Wednesday ahead of Bank of England announcement on Thursday.

- Yen under pressure amid higher US yields.

- GBP/JPY above the 20-SMA in 4-hour charts fails at 156.00.

The GBP/JPY gained momentum on Wednesday on the back of a stronger pound and a weak Japanese yen. The cross broke above 155.50 and jumped reaching at 155.90, a two-day high.

The rally lost momentum near 156.00 and the pound pulled back modestly. The intraday bias is still positive. GBP/HJPY is trading around two key levels: the 156.00 resistance and the 20-SMA in four-hour charts. If it manages to rise clear above 1256.00, the outlook would look brighter for the pound. The next resistance stands at 156.40.

If GBP/JPY is unable to regain 156.00 it will keep the cross in a bearish channel. A close below 155.00 should expose the weekly low at 154.62. Below the next support stands at 154.40.

GBP/JPY 4-hour chart

-637715493148294376.png)

- USD/CAD reached a daily high of around 1.2450, on upbeat US economic data.

- Falling crude oil prices weaken the commodity-linked Canadian dollar.

- Investors' expectations of US interest rates edge up, portrayed by the US 2-year yield, almost at 0.50%.

USD/CAD climbs during the New York session, up 0.06%, trading at 1.2424 at the time of writing. As portrayed by European and US equity indices fluctuating between gainers and losers, the market sentiment is subdued ahead of the Federal Reserve meeting.

Also, retreating crude oil prices, with Western Texas Intermediate (WTI) falling almost 3.5%, undermined the oil-linked currency, acting as a headwind for the CAD. Nevertheless, the price action is to remain within narrow ranges, as the greenback keeps contained, showed by the US Dollar Index, at 94.11, barely up 0.02%.

US T-bond yields rise ahead of the FOMC, the 2-year almost at 0.50%

Meanwhile, the US 10-year Treasury yield advances two basis points, sitting at 1.566%, while the US 2-year Treasury yield, which could give hints of market participants' point of view about short-term interest rates, is at 0.48%, three basis points up.

Investors expect the Federal Reserve to announce the reduction of its pandemic Quantitative Easing program. The total amount of monthly purchases of about $120 billion is expected to be cut by $15 billion, as the US central bank looks to normalize monetary policy conditions. Once the statement is released, the focus would turn to the Fed Chairman Jerome Powell post-meeting press conference.

In the meantime, the US economic docket featured the US ADP report, which unexpectedly surprised markets, showed the creation of 571K jobs added to the economy against 400K foreseen by analysts. Furthermore, the ISM Services PMI for October rose to 66.7, higher than the 62 estimated, showing the resilience of the services sector amid COVID-19 lockdowns.

FX Market Reaction

The USD/CAD rose to 1.2450 on the economic releases, but retreated at current levels, as investors await the FOMC meeting.

USD/CAD Price Forecast: Technical outlook

The USD/CAD daily chart depicts a break above an ascending channel around 1.2420. The price is pushing towards the 200-day moving average (DMA) that lies at 1.2481, a crucial level to watch at 18:00 GMT when the Federal Reserve unveils its monetary policy statement. In the case of an upbreak above the 200-DMA, traders would expect the price to travel towards the 100-DMA around 1.2530, but first, the 1.2500 figure needs to be broken.