- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-11-2021

- GBP/USD hovers around 1.3500 after the Bank of England decided to keep rates unchanged.

- US and UK central banks push back higher rates, thus propelling equity markets to all-time new highs.

- GBP/USD: As long as it remains below 1.3571, sellers are in control.

The GBP/USD is steady as the Asian Pacific session kicks in, up 0.04%, trading at 1.3503 during the day at the time of writing. The market sentiment is upbeat, as the Federal Reserve said it would begin the bond tapering process, reducing purchases by $15 billion in the middle of November while pushing back higher interest rates. Investors used that as a signal to keep pushing equities at all-time highs, while in the FX market risk-sensitive currencies, dropped against the buck.

Meanwhile, on Thursday, the Bank of England (BoE) Monetary Policy Committee (MPC) decided to keep rates at 0.10%, despite that some BoE policymakers, including Governor Andrew Bailey, expressed concerns about high inflation in weeks before the meeting.

According to the MPC statement, the BoE rationale to maintain rates unchanged is that “It will be necessary to raise bank rate over coming months if data, especially jobs, is in line with the forecast.” Furthermore, they added that the “MPC still sees value in waiting for official labour market data after end of furlough, before deciding on tightening policy.”

Regarding asset purchases, the bank stayed put at 895 billion of Sterling. Concerning high inflation levels, the Boe “forecasts inflation to peak of 4.80% in Q2 2022.” Moreover, the UK’s central bank forecasts show inflation in two years at 2.23%, based on market interest rates.

GBP/USD Price Forecast: Technical outlook

In the daily chart, the GBP/USD pair found resistance around 1.3500, but as long as it remains below the July 20 low at 1.3571, it would be vulnerable to British pound sellers. Additionally, the daily moving averages (DMA’s) are well above the spot price, with a bearish slope, so GBP/USD traders would expect some selling pressure mounting on the pair ahead of the US Nonfarm payrolls report.

If GBP/USD bulls reclaim 1.3571, an attack to the 1.3600 figure is on the cards. On the other hand, failure at the abovementioned would expose the 1.3500 psychological level, followed by the 2021 low at 1.3411.

- AUD/USD extended its second consecutive day losses after central banks kept rates unchanged.

- In the FX market, risk-averse mood weighed on the AUD boosts the greenback.

- AUD/USD: Failure to reclaim 0.7450 would clear the path for sellers on its way towards 0.7170.

The AUD/USD slides as the Asian Pacific session begins, barely down 0.01%, trading at 0.7400 at the time of writing. The market sentiment was upbeat throughout Thursday, portrayed by global equity indices finishing in the green, led by US major indices reaching all-time new highs, except for the Dow Jones Industrial, which lost 0.09%.

In the FX market, the risk-sensitive currencies were down, led by the British pound, which collapsed when the Bank of England (BoE) kept rates unchanged, despite some inflation worries expressed by some of its members, which ultimately backpedaled, as the vote to hold rates, was 7-2. Alongside Sterling, the AUD, the NZD, and the CAD, were also down, as safe-haven currencies were bid during the session.

Additionally, on Wednesday, the Federal Reserve unveiled that it is reducing the amount of its bond purchasing program by $15 billion, which was initially perceived as a dovish taper. Investors' reaction prompted a sell-off of the greenback, but as of Thursday, the market reversed its course, as the US dollar was one of the gainers of the session.

AUD/USD Price Forecast: Technical outlook

Weekly chart

The AUD/USD pair is forming a bearish-engulfing candle pattern with strong bearish implications but requires a weekly close at 0.7450 to confirm its validity. In that outcome, the next support level would be the confluence of the 100 and the 200-week moving average (WMA) around the 0.7170-0.7200 area. Furthermore, the Relative Strength Index (RSI) is at 48 aims lower, confirming the downward bias.

Daily chart

-637716622808107436.png)

In the daily chart, the AUD/USD pair bounced off the 100-day moving average (DMA) at 0.7377, retreating towards the 0.7400 figure. Nevertheless, it broke the strong support level now turned resistance at 0.7450m which could be viewed as a level where AUD/USD sellers would lean to open fresh offers as the pair has a downtrend bias, depicted by the 200-DMA above the spot price. Furthermore, the Relative Strength Index (RSI), a momentum indicator is at 47, aims lower below the 50-midline, adding another signal for AUD/USD sellers. However, caution is warranted, as the 50 and the 100-DMA are beneath the price action around the 0.7360-80 area, that in case of being breached, could open the door for further losses. The first support level would be the September 24 high at 0.7315. A clear break of the latter would expose the September 30 low at 0.7169.

- AUD/NZD is correcting the recent bearish daily impulse.

- Bulls will be on the lookout for resistance to target, namely in the 61.8% ratio.

AUD/NZD is stalling on the downside as the kiwi gives back some ground following the labour data surprise and dialled up risks of the Reserve Bank of New Zealand hiking interest rates at a faster pace as firstly anticipated. The following illustrates the prospects of an upside corrector price t the next downside leg.

AUD/NZD daily chart

The price has found demand in what has been a strong sell-off prior to the support on the daily chart. This leaves prospects of a significant correction to target the 61.8% Fibonacci retracement level near 1.10480 in the coming days.

Additionally, as extra conviction, the price has left a reversion pattern in the form of an M-formation as follows:

An M-formation has a high probability rate of the price reaching the neckline of the pattern and this has a confluence with the golden ratio. Therefore, this would be expected to act as resistance on a restest by the bulls and lead to a downside continuation.

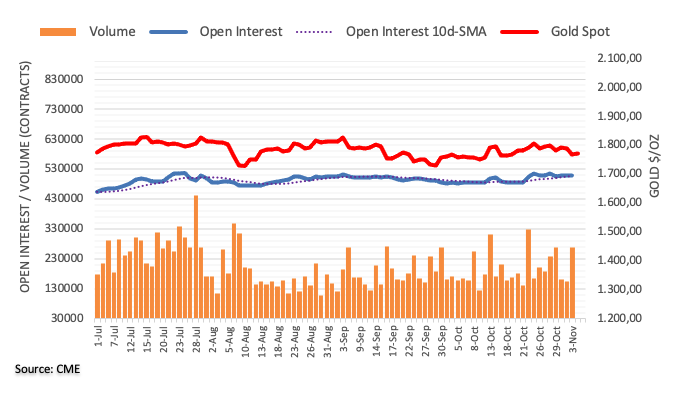

- Gold is on the defensive from a critical level of resistance on the daily chart.

- All eyes will now turn to the US jobs market as the US dollar seeks to regain its title on the forex leader board.

The price of gold was ending the day higher by 1.25% after travelling from a low of $1,769.64 to a high of $1,798.95 despite a front footed greenback as investors bought the post-Federal Reserve USD dip. The greenback recovered some 0.5% on Thursday as measured by the US dollar index, the DXY. The index rallied from a low of 93.825 to a high of 94.473.

The US dollar rebounded on Thursday from a dip after the US Federal Reserve repeated it saw high inflation as transitory and announced on Wednesday a $15 billion monthly cut to its $120 billion in monthly purchases of Treasuries and mortgage-backed securities. The knife was later buried when Chairman Jerome Powell said he was in no rush to hike borrowing costs leading to an additional sell-off in the greenback.

However, as fast as traders were to let go of the greenback, they were just as quick to buy back into the prospects of faster timings of a rate hike from the Fed following a series of strong data this week ahead of FrduaysNonfar Payrolls event.

Nonfarm Payrolls in focus

''We expect employment and wage gains to slow in the year ahead as the boosts from fiscal stimulus and reopening fade and the participation rate rises, but, more immediately, momentum appears to be up again as the drag from Delta fades.,'' analysts at TD Securities explained.

''We forecast up 550k in total for payrolls in October, with private payrolls up 600k. We forecast up 0.5% m/m for hourly earnings, with the 12-month change rising to 5.0% from 4.6%.''

The prospects of maximum employment in the comings months should keep the US dollar elevated and real yields less negative as a headwind for the gold price.

However, the analysts at TD Securities also acknowledged that ''the Fed reiterated that its tools cannot help ease the temporary supply constraints that have ultimately driven inflation higher.'' This, they say, is a dovish message ''relative to market expectations for Fed hikes, which still remains far too hawkish, but which may also be distorted by the recent positioning washout across Treasuries.''

''Nonetheless, the yield curve steepening does reflect that market pricing has started to acknowledge that the Fed may let inflation run hot for a bit longer. In this context, while the breadth of traders short positions is not extreme by any means, position sizing is bloated considering the number of participants short, which leaves the hawks vulnerable to a squeeze.''

''Going forward, the market will continue to gauge whether the Fed holds strong enough cards to bluff, which leaves a larger focus on economic data. In this respect, we expect some immediate strength resulting from the fading Delta wave, but that the fiscal drag will turn sufficiently contractionary to delay the prospect of rate hikes.''

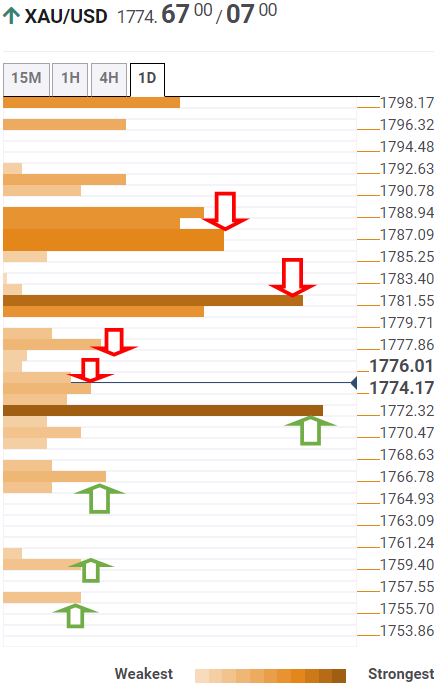

Gold technical analysis

The price is wedged back into a consolidation area on the daily chart and offers little clue as to where the market might be headed next.

However, should the resistance hold, then the path of least resistance is likely to the downside.

meanwhile, from a 4-hour perspective also, the market could well have picked up enough liquidity on the break of the counter trendline and filling buy stops for which could result in a downside move into the $1,750s for the forthcoming session.

- The S&P 500 and Nasdaq 100 posted their sixth successive record closes on Thursday.

- Equities, particularly duration-sensitive tech names, benefitted from a sharp drop in US yields.

- Focus now turns to US jobs data on Friday.

Another day, another record close for the S&P 500 and Nasdaq 100 indices. That’s marks six record closes now in the last six sessions for both indices. The S&p 500 posted a gain of 0.4% to close at 4680, while the Nasdaq 100 was higher by 1.25% to close at 16.35K. The Dow posted a small loss of 0.1%, but remain above the 36K level. The CBOE Volatility Index (VIX), often referred to as Wall Street’s fear guage, remained stable just above 15.00, leaving it not far from post-pandemic lows around 14.00 set back in June.

Chipmakers saw notable gains with the Philadelphia SE Semiconductor Index surging 3.5% on the day after strong earnings from heavyweight Qualcomm (+12.7% on the day), whose business is thriving despite severe global supply chain disruptions. More broadly, tech stocks were the beneficiaries of a sharp decline in US bond yields (2s -5bps to 0.43%, 5s -7bps to 1.115%, 10s -8bps to 1.53% and 30s -5bps to 1.97%) – the major catalyst of the drop was a dovish surprise from the BoE which triggered a historic decline in (particularly short-end) UK yields, a drop that spilled across to international markets.

Remember that the valuation of many tech stocks is much more dependent on expectations for future earnings growth rather than on current earnings, more so than for many other equity sectors, thus when interest rates rise, the opportunity cost of banking on future earnings growth rises, thus weighing on the valuation of these stocks. On the other side of the coin, these also so-called growth or “duration-sensitive” names benefit when yields fall.

With yields sharply lower, the S&P 500 financials index was under pressure, dropping 1.3%. Sticking with the sectors, a sharp drop in oil prices as traders took profit on pre-OPEC+ decision long positioning (some said they didn’t want to be caught out by a US policy response to OPEC+ not lifting output by as much as they wanted) weighed on the S&P 500 energy index, though just before the close it managed to recovery into positive territory on the day and close about 0.2% higher. A number of major US oil producers have announced plans to up investment to expand production in recent days.

Fed giveth, NFP taketh away?

Stocks have had a great week thus far, the S&P 500 up 1.6% and the Nasdaq 100 up over 3.0%, with both indices now up 9.5% and 13.5% respectively from the September lows. Key to the rally in recent weeks has been a much better than expected Q3 corporate earnings season, but another major driver of the rally this week was Wednesday’s Fed policy announcement; investors had fully priced in the $15B/month QE taper announcement and cheered the Fed’s continued characterisation of inflation as largely being driven by transitory factors, as well as Powell insistence that in the bank’s base case, inflation will be coming down in mid-2022 and he is willing to be patient when it comes to interest rate hikes.

But some analysts noted that the Fed did also acknowledge that uncertainty regarding the path of the economy (with regards to both inflation and employment), which they think opens the door to a potential hawkish shift by the Fed in early 2022 if inflation remains elevated and labour market progress is strong. The Fed clearly wants to maintain the optionality to shift in a hawkish or dovish direction next year, hence why it didn’t yet announce the pace of its QE taper beyond December. For now, Fed policy is on autopilot until the end of the year, but it will be watching the data intently.

Thus, Friday’s labour market data will be an important one and will set the tone of what is to be expected for the labour market for the rest of Q4. A very strong report could raise the risk of a hawkish Fed shift in 2022 and push yields higher, which could result in equities ending the week on a sour note. The major US indices are likely due a bit of a pullback at this point anyway, those seeking to take profit might not need much excuses.

- USD/JPY slumps during the day, despite broad US dollar strength across the board.

- Lower US T-bond yields weighed on the USD/JPY pair, benefiting the Japanese yen.

- USD/JPY: Bullish above 114.00, otherwise range-bound, with 113.50 as strong support.

The USD/JPY slides during the New York session, down 0.21%, trading at 113.76 at the time of writing. As portrayed by US stock indices rising between 0.01% and 1.30%, market sentiment is upbeat, except for the Dow Jones Industrial losing 0.35%. In the FX market, risk-averse sentiment prevails, as safe-haven peers appreciate, thus favoring the Japanese yen, versus the greenback.

In the meantime, the US Dollar Index, a basket of six currencies, rises almost half percent, up to 94.32. Contrarily, the US 10-year Treasury yield drops six basis points, sits at 1.519%, a tailwind for the USD/JPY, due to its high correlation.

USD/JPY Price Forecast: Technical analysis

4-hour chart

The USD/JPY is in consolidation within the 113.50-114.50 range. Furthermore, the 50 and the 100-simple moving averages (SMA’s) hover around 114.00, acting as a tailwind for price action in the last couple of days. It’s worth noticing that the 113.50 is a level respected by USD/JPY traders, in which the pair bounced off towards the top of the range. Nevertheless, the almost horizontal slope of the moving averages does not provide enough clues for the direction of the trend.

For USD bulls to resume the upward trend, they need to reclaim the 114.00 figure. In that ourcome, the following resistance on the way north would be the downslope trendline that travels from October 20 high towards November 1 high, around 114.30. A breach of the latter would expose the 2021 high at 114.70.

On the flip side, a break below 113.50 could open the way for further losses. The first demand zone would be 113.00, followed by the September 30 high at 112.00.

- USD/CAD is at session highs above 1.2450, the pair trading as a function of oil, which has sold off recently.

- Focus for the pair returns to economic fundamentals on Friday with the release of US and Canadian jobs numbers.

USD/CAD is currently trading at highs of the day slightly to the north of the 1.2450 per barrel mark, sharply up from Asia Pacific session lows around the 1.2400 level, the pair trading as a function of oil prices more than anything else. On which note, crude oil prices have reversed sharply from what were at the time very impressive on the day gains (WTI was up more than $3.0 above $83.00) to hit fresh near four-week lows (WTI currently trades around $79.00), with this latest bout of selling pressure exerting a drag on the loonie and giving USD/CAD tailwinds.

The pair now trades at its highest levels since 13 October, and the bulls will be hoping that oil can continue with its downwards trajectory enough so that USD/CAD hits the next notable area of resistance around 1.2480, where the 200-day moving average resides. With regards to Canadian economic news/fundamentals, there hasn’t been anything of note on Thursday aside from a slightly bigger than expected trade surplus of C$ 1.86B in September, data which hardly ever moves USD/CAD anyway.

There have been a number of important updates for crude oil markets today, which can be neatly summarized as; 1) as expected, OPEC+ agrees to hike output by 400K barrels per day in December, despite international calls for a larger output hike, 2) the US isnt happy about OPEC+’s decision and is assessing options (they could release crude oil from their strategic reserves or even ban crude oil exports) and 3) traders are citing post-OPEC+ profit-taking, technical selling and recent negative China Covid-19 outbreak news as the major drivers of the sell-off.

Crude oil newsflow is likely to take a back seat on Friday (although traders should be on notice for any announcement from the US) and economics will return to the forefront with the release of US and Canadian October labour market reports, both out at 1330GMT. With both the Fed and BoC currently on course to start lifting interest rates in 2022, the timing of lift-off is highly sensitive to the persistence of inflation at high levels, but also the progress back to pre-pandemic levels of health of the labour market. USD/CAD traders will have to weigh up both jobs reports simultaneously, which can sometimes make for a confused reaction in USD/CAD.

- Sterling crosses fell heavily on the back of the BoE surprise hold.

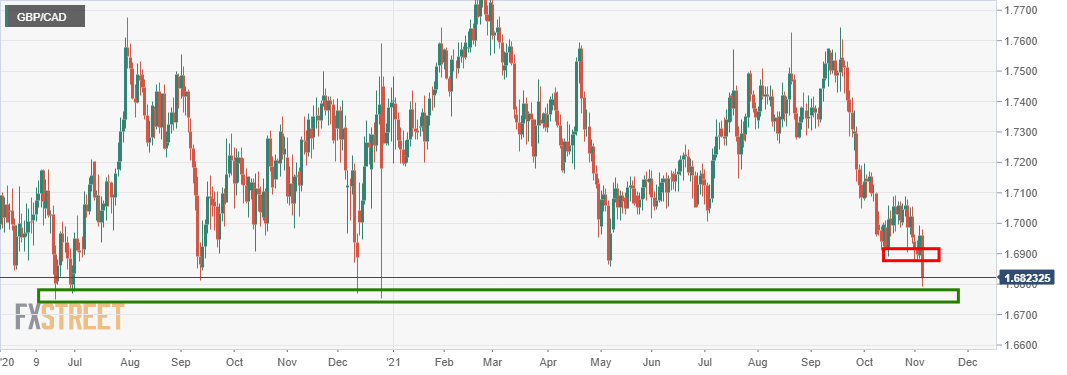

- GBP/CAD bears running out of juice into weekly demand territory.

GBP/CAD fell heavily in trade on Thursday following a surprise from the Bank of England that did not raise rates as expected. GBP/CAD fell from a high of 1.6962 to a low of 1.6792 and was ending on Wall Street down some 0.80%. The following, however, illustrate that the path of least resistance, for the time being, is likely to the upside.

GBP/CAD daily charts

The steep drop could be luring bears into a false sense of security at this juncture when zooming out and taking the weekly demand into consideration as follows:

There is a chance that the trend will continue a little while yet, however, 1.6800 marks a central point of demand and the more probable scenario at this juncture is a respite in the current move, especially from a lower time frame perspective, as follows:

GBP/CAD H1 chart

The price fell sharply on the back of the BoE and this leaves a huge imbalance for which would be expected to be filled in coming sessions. The 50% mean reversion target is compelling as it aligns with prior support that would be expected to act as resistance near 1.6880.

Should the area hold, then the downside will be opened again for a retest and bears will be keen to test below 1.68 the figure for a deeper probe of the weekly demand area with 1.6730 in scope.

What you need to know on Friday, November 5:

On Thursday, the American dollar is the overall winner, resuming its advance and reaching fresh weekly highs against high-yielding rivals. On the other hand, safe-haven assets edged higher against the greenback, although without breaking any critical level.

The Bank of England had a monetary policy meeting and decided to leave the benchmark interest rate unchanged at 0.1%, disappointing markets that were anticipating a rate hike and further boosting the dollar’s demand. The GBP/USD pair plummeted to 1.3470, to end the day around the 1.3500 figure.

The EUR/USD pair met sellers around 1.1615 for a third consecutive day, with bulls giving up, resulting in a test of 1.1527. AUD/USD briefly pierced the 0.7400 figure, settling around the level, while USD/CAD jumped to 1.2460, despite plummeting crude oil prices. WTI currently trades around $79.10 a barrel after the OPEC+ decided to maintain its current output steady at 400K barrels per day.

Gold returned to its comfort zone just below the 1,8000 mark, currently trading at around $1,793.00 a troy ounce.

Central bankers are putting a lot of effort into down-talking inflation concerns. BOE’s Governor Andrew Bailey noted that “the warning signs are there, the bells are ringing, as it were, so we have to watch this carefully, and that’s what we’re doing,” but he added that they yet see medium-term inflation “de-anchored.” On Wednesday, US Federal Reserve Chief Jerome Powell delivered a similar message, repeating that inflation is high but still expecting it to normalize without the central bank’s intervention.

European equities benefited from a dovish BOE, ending the day in the green. Wall Street was unable to follow the lead and finished the day mixed.

US Treasury yields retreated, with that on the 10-year note hitting an intraday high of 1.60% to settle near a daily low of 1.509%.

The week will end on a high note, as the US will publish the Nonfarm Payrolls report.

Dogecoin and Shiba Inu at war as Binance, Crypto.com add SHIB-DOGE trading pair

Like this article? Help us with some feedback by answering this survey:

- EUR/GBP continues to climb and is now above 0.8550, with bulls likely targetting a test of the 200DMA at 0.8587.

- After disastrous miscommunication by the BoE in the run-up to Thursday’s policy announcement, the BoE faces credibility questions.

EUR/GBP continues to steadily climb in wake of Thursday’s dovish BoE surprise that has sent GBP tumbling versus all of its major G10 counterparts, the euro included. The pair, having cleared a number of key levels of resistance at the psychological 0.8500 level, the prior weekly high at 0.8510 and the 50-day moving average at 0.8523, is now consolidating slightly to the north of the 0.8550 level. While the euro might not be the best G10 currency to express a bearish GBP view against, given that the ECB is still expected to lag well behind the BoE in terms of monetary policy tightening even if the BoE is now going to be more dovish than market participants had been expecting as recently as this morning, it still seems likely that the latest bounce in the pair will have legs. The next target for the bulls will be the 200DMA at 0.8587.

BoE faces credibility questions

Thursday was not a good day for the credibility of the Bank of England’s policymaking, something which the severe sterling sell-off and a sharp drop in UK gilt yields can attest to. Hawkish commentary from BoE Monetary Policy Committee (MPC) members in the run-up to the latest monetary policy meeting had convinced money markets and a good proportion of analysts/economists that a 15bps rate hike was on its way and that the bank would be signaling that further rapid tightening though to 2023 would also be likely. In the end, only two of the nine MPC members voted for a 15bps hike and only three voted for an early end to the bank’s current £895B bond-buying scheme (i.e. to cap it at £875B).

The BoE said that it wanted to wait to see more labour market data given the UK government’s furlough scheme just ended at the end of September (the unemployment rate is likely to rise modestly) and, rather than guaranteeing rate hikes as many thought the BoE would at minimum do if it opted not to hike rates, the bank merely said that rate increases would be appropriate in the coming months IF the economy progresses as expected. Meanwhile, in the post-meeting press conference, inflation was categorised as “transitory” and seen coming back close to the bank’s 2.0% target by the end of the forecast horizon.

Needless to say, markets were completely wrong-footed, and governor Bailey & co. now face intense scrutiny regarding the bank’s credibility in light of this failure to properly guide investor expectations. The governor retorted to a critical press that it was not the BoE’s job to guide market rates, which is not something you would see Fed Chair Jerome Powell saying; the Fed Chair, who just masterfully pulled of a QE taper without creating any notable market drama, understands the importance of guiding market expectations properly overtime to the transmission of monetary policy to the economy. In private, BoE members will know they messed up. But volatility surrounding BoE policy in UK markets is likely to be elevated in the months ahead as markets question whether they can trust anything BoE members are telling them.

- AUD/USD dipped below 0.7400 for the first time in ten days, printed a low of 0.7382.

- In the FX Market, the sentiment is risk-averse, as safe-haven currencies appreciate.

- US Jobless Claims improve for the fourth consecutive week.

The AUD/USD pair plunges during the day, down 0.62%, trading at 0.7402 at the time of writing. The market mood is upbeat, as portrayed by global equities trading higher, headed by US stocks indices reaching all-time highs, whereas, in the FX market, safe-haven peers appreciate against risk-sensitive currencies like the AUD, the NZD, and the GBP.

The Australian dollar has been seesawing in the last couple of days

On Wednesday, the AUD/USD pair dipped as low as 0.7420 on positive US macroeconomic figures for October. ADP employment jobs report, prelude of Nonfarm Payrolls, and US PMI Services number were better than expected, lifting the greenback against most G10 currencies. Later on the day, the Federal Reserve announced the telegraphed bond taper, which investors perceived as dovish, which witnessed a spike of 50 pips on the pair, settling around 0.7450.

On Thursday, during the Asian session, market participants changed their course as the Fed left the door open for a faster bond tapering process. The US central bank said that “comparable decreases in buying pace are likely reasonable each month, but we are willing to adapt if necessary.” AUD/USD traders reacted, sending the pair sliding towards 0.7382.

Meanwhile, the US Dollar Index, which tracks the buck’s performance against its peers, advances half percent, sits at 94.32, a tailwind for the AUD/USD pair. US T-bond yields drop in the bond market, with the 10-year falling five basis points, down to 1.524% at press time.

US Jobless Claims improve for the fourth consecutive week

On the macroeconomic docket, the Australian Retails Sales for the Q3 dropped by 4.4%, better than the 4.6% foreseen by analysts, blamed for lockdowns. Further, the Trade Balance for September showed a surplus of A$12.243 B lower than the A$15 B in August.

On the US front, the Bureau of Labor Statistics (BLS) reported the Initial Jobless Claims for the week ending on October 29, which rose to 269K, better than the 277K estimated by economists, adding to the improvement of the labor market, as it is the fourth consecutive week of drops.

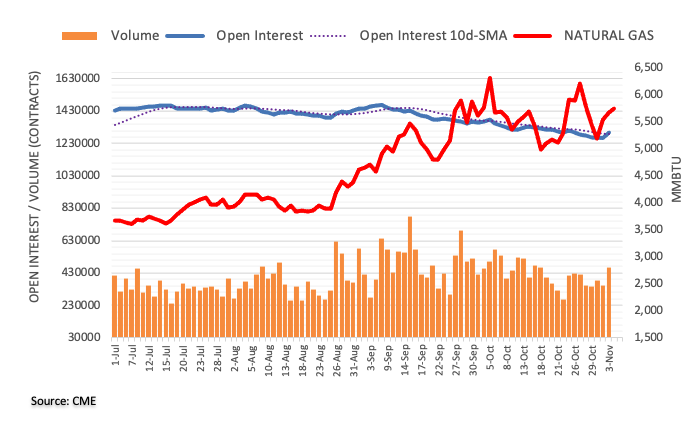

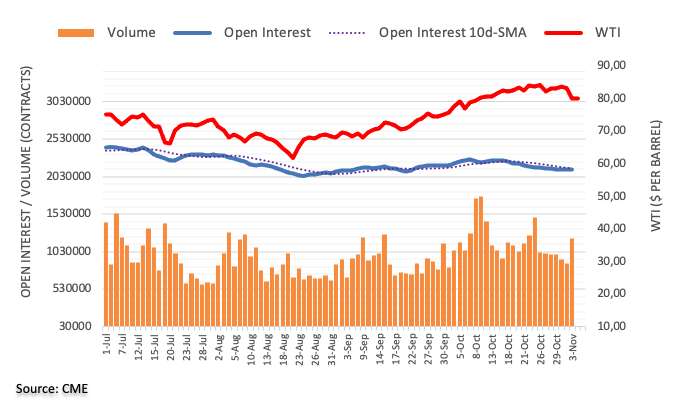

- WTI prices have seen a sharp reversal from earlier highs above $83.00 and now trade under $79.00.

- Profit-taking in wake of the OPEC+ meeting and technical selling are likely major factors driving the move.

Oil prices have seen rollercoaster price action thus far this Thursday. At one point, front-month WTI future prices were up more than $2.50 vs Wednesday’s closing levels, nearly reaching $83.50, but prices have since seen a near $5.0 (more than 5.0%) reversal and WTI is now trading underneath the $79.00 level. That means the American benchmark for sweet light crude oil is now trading at near one-month lows. Some analysts are perplexed that oil chose Thursday to sell off so aggressively, a day on which OPEC+ refused to cave to international pressure to increase output at a faster pace, instead opting to stick to the usual 400K barrel per day per month hike in output in December.

Some argued it was a classic case of buy the rumour, sell the fact; one analyst was quoted on Reuters arguing that, following a load up in speculative long positioning building up in the run-up to the OPEC+ meeting, traders were now inclined to take-profits in anticipation that further calls from the White House for the cartel to increase output might send prices lower. Rather than just putting verbal pressure on OPEC+ to increase output, the US government is also said to be considering options including releasing crude oil stored in the Strategic Petroleum Reserve (SPR) and imposing a ban on US oil exports, measures which could weigh on crude oil prices in the near-term. Another recent bearish development being cited by some analysts as weighing on crude oil markets this week is the resurgence of Covid-19 in China, where the country still operates a strict zero Covid-19 policy (meaning widespread lockdowns remain on the table), presenting a near-term risk to demand.

Technicians will argue that technical selling also played a key part in driving prices lower on Thursday; WTI prices had been supported by a bullish trendline going all the way back to August, a trendline that up until Wednesday was respected very well. After breaking below this trendline on Wednesday, Thursday saw the first major retest (when prices went above $83.50), which speculative, short-term sellers of crude oil may have leapt on. If oil is trading technically right now, the next key area of support to look at is the 6 July high at around $77.00 per barrel. Whilst some short-term sellers might want to book profit at this level, there is also a risk of the presence of stops below it, so a break below could see the sell-off accelerate and WTI head towards its 50DMA at just above $76.00.

-637716500229602594.png)

Reuters reported that The European Central Bank is keenly aware of citizens' concern about high inflation but is very unlikely to raise interest rates next year as price pressure are likely to abate, ECB board member Isabel Schnabel said on Thursday.

"This high inflation is causing growing concerns among people and we are taking these concerns very seriously," Reuters noted Schnabel saying at a financial conference.

"Despite the uncertainty, there remain good reasons to believe that inflation in the euro area will visibly decline over the course of next year and gradually fall back below our target of 2% in the medium term, meaning that the conditions ... for raising rates are very unlikely to be satisfied next year," she added.

More to come...

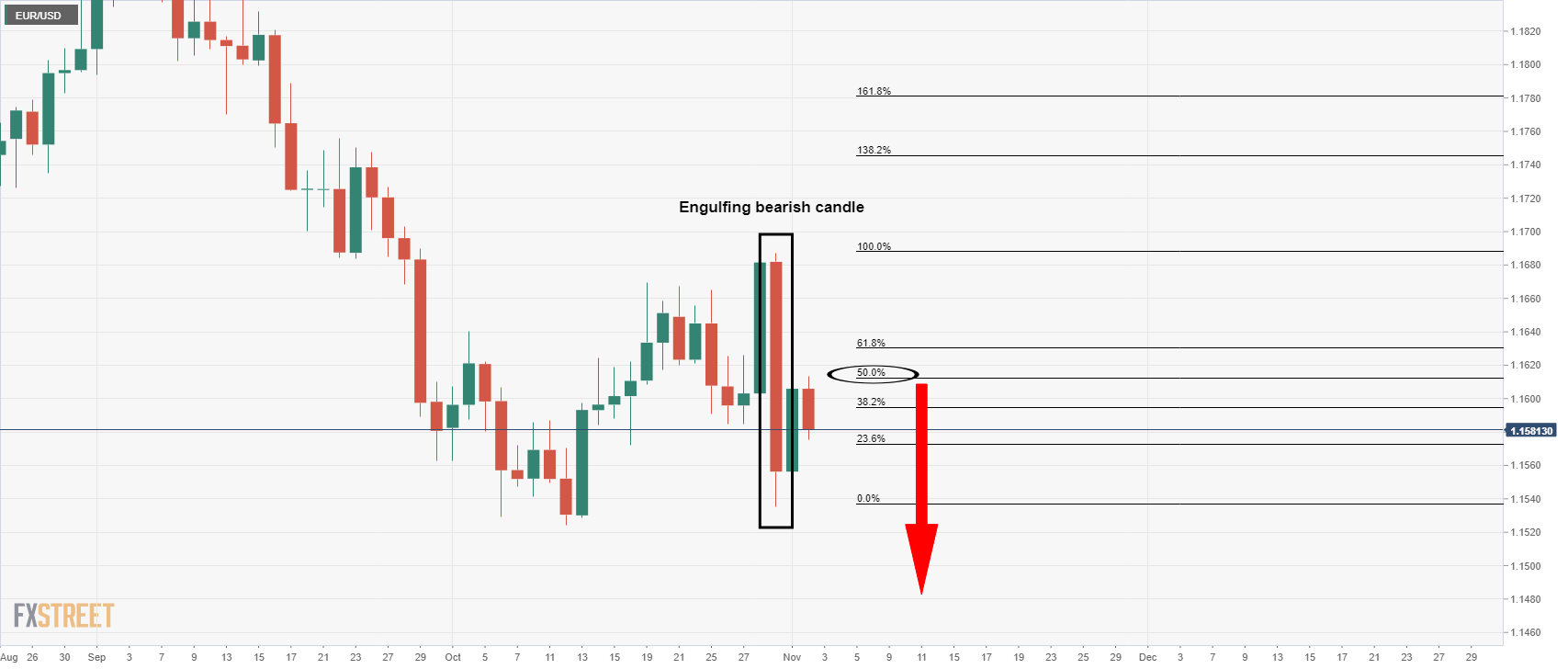

- EUR/USD bears take profit and wait patiently in the wings for a retest of 1.1580.

- Bulls accumulating from daily support and eye a 50% mean reversion of the hourly bearish impulse ahead of NFP.

As per the prior analysis, EUR/USD sits tight ahead of the Fed, but bears ready to clean-up, followed by EUR/USD bulls come up for their last breath? and EUR/USD Price Analysis: Bears giving way, for now the bears have finally sunk their teeth into the low baring fruits of the Federal Reserve.

The following illustrates the strength in the greenback and the subsequent downfall of the euro in and around the Fed meeting earlier this week and endorses more downside to follow.

EUR/USD weekly prospects to test 1.1500

Firstly, casting eyes over prior analysis, EUR/USD Price Analysis: Bears seeking a break below 1.15 the figure, the weekly chart was analysis as follows, forecasting a bear trend to test into the weekly fractal highs of the spring and summer below 1.15 the figure:

Since testing the 38.2% Fibo, the price is making headway in that respect:

Moving down to more recent price action, the bears have cleaned up from the discount that was on offer following the Federal Reserve as follows:

EUR/USD H1 chart, prior analysis

The W-formation was a compelling bearish reversion pattern that left the downside vulnerable and which has resulted in a break of support and given way to follow-through on Thursday as follows:

At this juncture, some consolidation would be the most probable outcome following such a sharp move to the downside. This is especially true ahead of the key risk event in the Nonfarm Payrolls and weaker hands that would prefer to take profits ahead of the weekend. Mitigation of the imbalance left behind could lead to a retest of the 1.1580s as follows:

From the daily support, the price is carving out a double bottom which would be expected to lead to a correction. A 50% mean reversion of the latest hourly bearish impulse comes in neat 1.1580 and the hourly wicks highs as a meanwhile target area.

- NZD/USD bulls are defending daily lows near 0.7100 ahead of critical events.

- NFP and the RBNZ are the next major catalysts for the pair.

On US dollar strength on Thursday, the New Zealand dollar has given back the bulk of its post-third-quarter jobs data that has reinforced bets the Reserve Bank of New Zealand will hike rates later this month.

However, the US dollar rebounded on Thursday, recovering after the Federal Reserve repeated it saw high inflation as transitory. A buy the US dip outcome has led to a break of 0.71 the figure in NZD/USD. The pair has fallen from a high of 0.7178 to a low of 0.7094 so far and into daily support.

RBNZ rate hike on the cards

Firstly, earlier in the week, the third-quarter NZ Employment Change arrived at 4.2% YoY, sharply higher than the consensus forecast of 2.7%, according to a Bloomberg survey. The increase in the participation rate and a drop in the jobless rate was a highly positive result leading to demand for the kiwi.

The data highlighted underlying strengths in the labour market. Consequently, RBNZ tightening expectations remain high, with WIRP suggesting a 5 bp hike is fully priced in for November 24, with nearly 30% odds of a 50 bp move.

The bird was further supported on Wednesday after the Fed announced a widely expected $15 billion monthly taper to its $120 billion in monthly purchases of Treasuries and mortgage-backed securities. Additionally, the Fed's Chairman Jerome Powell emphasise that there was no rush at the central bank to hike borrowing costs.

The US dollar lost ground but investors were keen to buy the dip right up until the beginning of the New York session, where the greenback came under pressure from Treasury yields. In more recent trade, the US 10-year Treasury yield touched a session low of 1.514%, the lowest since Oct. 14 which could give some support to NZD/USD ahead of what is expected to be a period of consolidation before Friday's Nonfarm Payrolls event.

All eyes turn to the NFP event

A strong report is expected, which might be the reasoning for the rebound in the greenback in the past 24-hours. ''We expect employment and wage gains to slow in the year ahead as the boosts from fiscal stimulus and reopening fade and the participation rate rises, but, more immediately, momentum appears to be up again as the drag from Delta fades,'' analysts at TD Securities said.

''We forecast up 550k in total for payrolls in October, with private payrolls up 600k. We forecast up 0.5% m/m for hourly earnings, with the 12-month change rising to 5.0% from 4.6%.''

NZD/USD technical analysis

As per the Asian session's analysis, the focus was on the downside following the rally into higher liquidity. A correction into the 50% mean reversion location was an expected move, but what followed was a very strong followthrough to test November lows.

Prior analysis:

Live update:

As illustrated, the price action since the prior analysis has followed accordingly, even testing the 50% mean reversion level as an area of resistance following the breakout to the downside. At this juncture, and holding in daily support, there could be a period of consolidation as markets get set for the end of the week's showdown in the US Nonfarm Payrolls event.

- EUR/JPY is downward pressured, on the back of central banks pushing back higher rates.

- The market sentiment is upbeat, except for the FX market, as the Japanese yen and the US dollar appreciate.

- EUR/JPY: The bottom-trendline of a bullish flag caused a jump of 30 pips in the pair.

The EUR/JPY plunges during the day, down 0.83%, trading at 131.28 in the New York session at the time of writing. The market sentiment is upbeat, spurred by central banks of developed countries, pushing back higher rates. On Wednesday, the Federal Reserve announced the so telegraphed bond taper, but it was perceived as dovish. Additionally, on Thursday, the Bank of England (BoE) backpedaled their intentions of hiking rates as the market expected, keeping them unchanged, catching some investors out off guard.

That said, global equities headed by US stocks in all-time highs rallied. Contrarily in the FX market, risk-sensitive currencies fall, benefitting the safe-haven peers, like the greenback and the Japanese yen

EUR/JPY Price Forecast: Technical outlook

4-hour charr

-637716443006753455.png)

The EUR/JPY pair briefly broke the bottom-trendline of a bullish flag but found buyers around the 131.00, bouncing off to current prices. The 50 and the 100-simple moving averages (SMA’s) are above the spot price, exerting downward pressure on the currency. However, the 200-SMA around 130.80 would be a tough hurdle for EUR/JPY sellers to overcome.

Nevertheless, to keep EUR/JPY bulls in charge, they need to reclaim the 50-SMA at 132.10. In that outcome, the following resistance area would be the 100-SMA at 132.25, followed by the top of a bullish fag around the 132.60 area. A breach of the latter would expose the October 20 high at 133.47.

On the flip side, failure at 132.10 would expose a downward break of the bullish flag around the 131.00 region. In that outcome, the first support would be the 200-SMA, followed by October 6 high at 129.49, which was resistance now turned support.

- Spot gold has recovered back to its 200DMA at $1790 following Wednesday’s dip as low as $1760.

- Wednesday’s Fed meeting got the recovery started, while a synchronised fall in global bond yields post-BoE has helped on Thursday.

Spot gold (XAU/USD) has undergone a strong recovery following sharp losses incurred on Wednesday that at the time saw prices drop as low as $1760, with prices having now recovered all the way back to the 200-day moving average (DMA) at $1790. Spot prices even had a go at break above the $1800 level again in earlier trade, though bullish momentum has since waned. Likely, precious metal markets will see more rangebound trade until the release of the official US October labour market report at 1230GMT on Friday, ahead of which traders are likely to refrain from placing any big bets.

What’s been driving recent moves

US data released on Wednesday in the run-up to the Fed meeting was the main catalysts for spot gold’s drop to $1760 at the time, with the October ADP national employment estimate and the headline ISM Service PMI index both beating expectations by a significant margin and thus boosting optimism about US economic health at the start of Q4 2021. A benign/even slightly dovish market reaction to Wednesday’s FOMC policy announcement, where the bank announced $15B/month QE tapers for November and December, reiterated its base case expectation was for inflation to still subside in mid-2022 and Powell said the bank was willing to be patient on rate hikes, helped lift XAU/USD from lows an into the mid-$1770s. The catalyst behind the most recent surge from the $1770s to current levels has been a sharp drop in global bond yields, led by bond markets in the UK following a much more dovish than anticipated BoE policy announcement (they didn’t hike rates and pushed back against market pricing for the number of hikes expected in 2022 and 2023).

Strong US jobs data could pull the rug

If Friday’s October labour market report is strong (i.e. payroll number of 500K+, further decline in the unemployment rate and further upside in rates of wage growth), this will likely boost optimism that full employment is not too far off (a key condition the Fed says it wants to see before hiking interest rates). That would likely see short and long-term US (and probably global) bond yields supported. A move back towards 0.50% for the 2-year and back to 1.60% for the 10-year would not be a good thing for gold and, in this scenario, XAU/USD could lose its grip on the 200DMA and slide back towards the 21 and 50DMAs in the $1780 region.

Gold stays sidelined and beneath the July and August highs and downtrend from August 2020 at $1,832/39. Strategists at Credit Suisse expect the yellow metal to head lower and fall below the $1,691/77 region.

Break above $1,834/39 to lessen the topping threat significantly

“We are mildly biased towards an eventual break lower, however, only a move below $1,691/77 would mark a major top for an important change of trend lower, with support then seen at $1,620/15 initially, before $1,565/60.”

“Only a break above $1,834/39 would be seen to complete an in-range base and lessen the topping threat significantly, instead clearing the way for a deeper recovery to $1,917.”

- The British pound collapsed 300 pips, down to 153.00 on a BoE’s decision to keep rates unchanged at 0.10%.

- The BoE decision lies on the back of a weaker labor market, as the furlough program ended in September.

- GBP/JPY: The 153.50 key support/resistance area, a daily close above, would keep bulls in control, otherwise the bears.

The GBP/JPY is plummeting, down 1.50%, trading at 153.56 during the New York session at the time of writing. The market sentiment is upbeat, as the Federal Reserve said it would start reducing bond asset purchases on $15 billion by the middle of November while pushing back higher interest rates. Investors used that as a signal to keep pushing equities at all-time highs, while in the FX market risk-sensitive currencies, drop against the greenback.

Back to the GBP/JPY, on Thursday, the Bank of England (BoE) Monetary Policy Committee (MPC) decided to keep rates unchanged at 0.10%, despite that some members, including BoE Governor Bailey, expressed concerns about high inflation in weeks before the meeting.

The reason to keep the rate unchanged is that “It will be necessary to raise bank rate over coming months if data, especially jobs, is in line with the forecast,” according to the MPC statement. Moreover, they added that the “MPC still sees value in waiting for official labour market data after end of furlough, before deciding on tightening policy.”

Concerning asset purchases, the bank stayed put at 895 billion of Sterling. Regarding high inflation levels, the BoE “forecasts inflation to peak of 4.80% in Q2 2022.” Further, the UK’s central bank forecasts show inflation in two years at 2.23%, based on market interest rates.

GBP/JPY Price Forecast: Technical outlook

Daily chart

The GBP/JPY Thursday’s price action depicts that investors were heavily-positioned towards a BoE rate hike, but the British pound collapsed as the BoE disappointed. The Average Daily Range (ADR) of the day is 300 pips, as the GBP/JPY dropped from 156.00 towards 153.00.

It is worth noticing that the pair briefly closed to the 50-day moving average (DMA) at 153.00 and bounced off, as the market found buyers around that level. However, if GBP/JPY bulls would like to keep in control, they would need a daily close above the July 29 high at 153.50. In that outcome, a renewed test towards 154.00 is on the cards.

On the flip side, failure at the abovementioned would open the door for another 153.00 challenge. A break of the latter would open the door for further losses, exposing the 100-DMA at 152.60, followed by the 200-DMA at 151.74.

- Spot silver has rebounded well from Wednesday’s sharp drop to $23.00, though hasn’t yet reclaimed $24.00.

- Precious metals are getting a boost from a sharp drop in global bond yields after Thursday’s dovish BoE policy announcement.

Spot silver (XAG/USD) prices have gained significant ground in recent trade and, having dipped as low as $23.00/oz on Wednesday, are now not far from trading in positive territory on the week in the $23.80s, though for now the precious metal is struggling to reconquer the $24.00 level. If XAG/USD can get above $24.00, this would mean that prices have broken out of a recent negative trend in place since 22 October. Any resultant technical buying could see XAG/USD continue higher towards the $24.50 level and perhaps even as high the $24.80s, where a double top from 3 September and 22 October resides.

Such a move higher would rely on continued downside in the global and US yield environment. For reference, much of Thursday’s rally in spot silver, which has seen prices rise from around $23.50, owes itself to a sharp drop in developed market bond yields in wake of a much more dovish than expected BoE policy announcement; UK 2-year yields have dropped a stunning more than 30bps to under 0.50% from above 0.7% prior to the policy announcement (biggest one-day drop since March 2020), while 10-year UK yields are down nearly 15bps to under 1.0%.

This has led yields in the US and elsewhere lower; US 2-year yields are down roughly 6bps and have been testing the 0.40% level in recent trade, while 10-year yields have pulled back from above 1.60% to the low 1.50s%. Real yields have also been heading lower in the US (a good indicator that it is dovish central bank vibes driving bond yields lower), with the 10-year TIPS yield back sharply to just above -1.05% from previously as high as -0.95%. The key point is that lower bond yields decrease the opportunity cost of holding non-yields precious metals such as silver, thus increasing investor demand and pushing their prices up.

Strong data to send yields up again?

But continued downside in global bond yields is far from guaranteed, with Friday’s US jobs report having the potential to throw a wrench into proceedings. The Fed yesterday pretty much put its policy on autopilot for the rest of 2021 with its $15B/month QE taper announcement for November and December, but essentially said uncertainty about the state of the economy (inflation and the jobs market) in 2022 is high and thus the bank is preparing for a range of possible outcomes. That should be interpreted as the Fed saying they are “data-dependent” and if the data justifies a hawkish shift, they will shift hawkish, while if it justifies a dovish shift, they will be more patient with monetary policy stimulus removal. That makes upcoming data releases, such as Friday’s jobs report, all the more important.

If the data on Friday is strong (i.e. payroll number of 500K+, further decline in the unemployment rate and further upside in rates of wage growth), this will boost optimism that full employment is not too far off (a key condition the Fed says it wants to see before hiking interest rates). That would likely see short and long-term US (and probably global) bond yields supported. A move back towards 0.50% for the 2-year and back to 1.60% for the 10-year would not be a good thing for silver, which, in this scenario, may slide back towards this week’s lows around $23.00/oz.

Solid domestic demand in the US has caused import growth to outpace exports for the better part of the past year, explained analysts at Wells Fargo. They point out that with consumption slowly rebalancing back toward services spending, imports should eventually slow and provide some relief at US largest ports.

Key Quotes:

“Exports plunged 3.0% in September, which more than offset the 0.6% gain in import growth and caused the U.S. trade deficit to widen to a record deficit of $80.9 billion. Weakness in exports was broad based with every major category of goods having moved lower during the month, with the exception of consumer goods where a $1.5 billion gain in pharmaceutical preparations prevented a decline in the overall category. Industrial supplies exports plunged 10.5%, in real terms, which was the largest monthly decline since 2008.”

“Consumption has started to slowly rebalance back toward services spending, which should weigh on imports and provide some relief at our nation's largest ports where a previously unimaginable number of container ships await port space to offload their goods. All of this said, we're likely some time away from a meaningful reprieve and things may get worse before they get better.”

“Further, the need to replenish record-low retail inventories will likely keep goods flowing into the country at an accelerated rate for some time. But the continued slowing in domestic spending and gradual gain in the pace of global growth should eventually lead trade to modestly boost growth as the trade deficit gradually narrows.”

The Bank of England (BoE) kept its monetary policy unchanged at the November meeting. Analysts at TD Securities point out the message was that the Monetary Policy Committee (MPC) is willing to be patient.

Key Quotes:

“The messaging today was cautious, and with a 7-2 vote to hold Bank Rate, it's clear that the committee isn't chomping at the bit to hike rates. We continue to expect a gradual pace of rate hikes from here, and as we recently explored, there are immense challenges facing the UK that the MPC will have to navigate carefully.”

“The BoE outcome was undoubtedly damaging for GBP, generating a positioning-induced squeeze lower. While GBP still holds one of the largest discounts of all currencies on our dashboard, things could get worse before value buyers emerge. We target a 1.3450 pivot in the weeks ahead and could see EURGBP eye a fresh retest of 0.86.”

“We expect the MPC to hike Bank Rate in February 2021, taking Bank Rate to 0.25%, though a December hike can't be ruled out. While the MPC expects inflation to peak around 5% y/y in April, we expect the pace of hikes in 2022 to be measured: uncertainty around COVID, the persistence of supply shocks and re-opening mis-match, and Brexit, remain elevated.”

“We look for a subsequent 25bps hikes in August and November, followed by two more hikes in 2023. This means the MPC will need to make a decision on reinvestments after its August 2022 meeting, and a decision on active selling of Gilts following its February 2023 meeting.”

Following the Bank of England decision to keep monetary policy unchanged on Thursday, analysts at Danske Bank see upside risks for the EUR/GBP pair in the short-term but they still expect it to move lower later, with a 0.83 target in twelve months.

Key Quotes:

“As expected, the EUR/GBP moved higher on announcement now trading at 0.856 vs. 0.847 before the announcement. We are still of the view that the move higher in EUR/GBP will be short-lived but near-term there are upside risks given the current market pricing of Bank of England.”

“We still expect rate hikes from the Bank of England, while we expect the ECB to stay patient despite recent increases in rate hike expectations.”

“We still believe the environment is more supportive for GBP than EUR, as GBP usually strengthens in an environment where USD does. That said, the potential for a stronger GBP is lower than for USD. We still target EUR/GBP in 0.83 12M.”

- The pound remains under pressure after the BoE decision.

- US dollar gains momentum as stocks turn lower and despite a decline in US yields.

- GBP/USD drops almost two hundred pips, heads for third lowers close since December.

The GBP/USD slide was triggered by the Bank of England and more recently reinforced by a rally of the US dollar across the board. Cable broke under 1.3500, reaching at 1.3482, the lowest level in a month. It is falling almost two hundred pips on Thursday, having the worst performance in weeks.

The decision of the Bank of England (BoE) to keep rates and QE unchanged weighed on the pound that lost ground against all its rivals. Governor Baily’s press conference did not alter cable’s sell off. Analysts at Danske Bank see the three rate hike in 2020 (15bp in February, 25bp in May and 25bp in November). “The reason is that we expect the economic recovery will continue (including increasing employment) amid still high inflation.”

More recently, the decline of GBP/USD gained momentum after breaking under 1.3500 and also amid a stronger US dollar. The DXY is up by 0.60%, at 94.45, the highest level since mid-October. At the same time, US yields are falling sharply with the 10-year at 1.52%, near Wednesday’s low.

The outcome of the FOMC meeting so far has not been negative for the dollar. On Friday, the critical Non-farm Payrolls report is due. The consensus point to a net gain in jobs of 425K and the unemployment rate to drop to 4.7%.

Technical levels

- NZD/USD is back to testing weekly lows in the 0.7100 region, having given back its post-Fed gains.

- The US dollar is seemingly getting a boost from strong US data ahead of Friday’s key jobs report.

NZD/USD has now more than erased Wednesday’s post-Fed rally that saw the currency pair reach as high as 0.7180. The pair is now back to testing its 200-day moving average (DMA) at pretty much bang on the 0.7100 level and is only a few pips above weekly lows and the 21DMA around 0.7090. FX market conditions may be set to enter a period of relative calm with the latest flurry of central banks now in the rearview mirror (the BoE and Norges Bank both issued policy decisions on Thursday following on from the Fed on Wednesday and RBA on Tuesday) ahead of the release of Friday’s key US labour market report.

That suggests that NZD/USD may struggle to push much lower than current levels; traders may instead wait to see whether the US labour market had as good a month as alternative labour market indicators for October suggest was the case; for reference, initial jobless claims fell throughout October, US payroll processing company ADP’s estimate of national employment change beat expectations in October by a healthy margin (coming in at 571K versus forecasts for 400K) and the ISM Manufacturing and Services PMI employment subindices both point to a continuation of job growth last month. If Friday’s headline payroll number is strong, this could be the impetus that the bears need to push NZD/USD lower, with the 50DMA at 0.7060 the next obvious target. Markets will also be focused on the US unemployment rate, the participation rate and the rate wage growth.

On the topic of jobs data, the New Zealand dollar has struggled to benefit in wake of a stellar Q3 New Zealand labour market report earlier in the week, which saw the unemployment rate plummet to 3.4%, its lowest since 2007 and well below the RBNZ’s estimate of the natural rate of full employment. December 2022 NZ Bank Bill futures, which moved to price in 100bps in additional rate hikes by next December during the month of October (helped by Q3 CPI nearly hitting 5.0%), are little moved this week, despite the strong data. At 97.29, the Bank Bill future implies a further 180bps in rate hikes (approximately) by the end of 2022.

- USD/CAD extends its recovery for the second day in a row, up 0.61%.

- Overall, US dollar strength across the board lifts the USD/CAD despite risk-on market sentiment.

- Rising crude-oil prices fail to lift the prospects of the CAD.

The USD/CAD climbs to fresh weekly highs, up 0.62%, trading at 1.2468 during the New York session at the time of writing. Investors’ mood is upbeat, portrayed by global equity indices in the green, except for the Dow Jones Industrial in the US, retracing some 0.12%. On Wednesday, the Fed announced the beginning of its pandemic-related QE reduction program at a pace of $15 billion, starting at the middle of November.

US Dollar bulls gained some ground against the loonie, despite higher crude oil prices, during the day, with Western Texas Intermediate (WTI) trading at $81.45, up more than 1%, failing to underpin the commodity-linked Canadian dollar. Furthermore, the US Dollar Index, which tracks the greenback’s performance against a basket of six peers, is firmly up more than a half percent, sitting at 94.38.

The US Dollar reaction to the Fed initially was as investors seemed to be convinced of a dovish taper. Nevertheless, Thursday’s price action has shown the opposite, as the US T-bond 2-year yield is retreating from almost 0.50% towards 0.40% threshold, as market participants backpedal against the possibility of a hike rate by the middle of 2022. Now the odds of the abovementioned dropped to 50%, as Chairman Powell pushed back against rising rates.

Dissecting the Fed’s message, the US central bank is expected to end the taper by June of 2022. But, it left the door open for adjustments of its program, hedging against a possibility of stickier than expected inflation that could prompt the Fed to react as quickly as they can. However, they reiterated their transitory posture on inflation, as Chair Powell admitted that the supply constraints are lasting longer than anticipated and could persist well into next year. He predicted that inflation would move down in Q2 or Q3.

On the macroeconomic front, the Canadian docket featured the International Merchandise Trade for September, which showed a surplus of $1.8B versus a $0.43B foreseen by analysts.

On the US front, the Bureau of Labor Statistics (BLS) reported the Initial Jobless Claims for the week ending on October 29, which rose to 269K, better than the 277K estimated by economists, adding to the improvement of the labor market, as it is the fourth consecutive week of drops.

USD/CAD Price Forecast: Technical outlook

In the daily chart, the USD/CAD is closing near the November 3 high at 1.2456, which saw on that day, a retracement towards 1.2400. The daily moving averages (DMA’s) are located above the spot price, meaning CAD bulls are in control. Nevertheless, the greenback has shown some strength, as the pair Is closing to the 200-DMA, which sits at 1.2479.

Furthermore, the November 3 high around 1.2456, coupled with the 200-DMA some 30 pips above, could be a substantial hurdle to overcome for USD bulls, but in case of breaching above of it, it would open the door for further gains, being 1.2500 the first supply area. Once that is breached, the following resistance level would be the confluence of the 50 and 100-DMA around the 1.2530-50 region.

On the flip side, failure of a daily close above 1.2456 would keep USD/CAD bears in charge, exposing the 1.2400 figure as the first support level.

- WTI has dropped sharply from earlier session highs above $83.00 to the mid-$81.00s.

- OPEC+ has agreed, as widely expected, to go ahead with a 400K oil output hike in December.

According to sources cited by Reuters, OPEC+ has, as widely anticipated, agreed to stick to their existing plan to increase output by 400K barrels per day/month in December. Despite this news, trade has been choppy over the last hour or so, with oil prices having fallen back sharply from earlier highs. Front-month WTI futures, which were above $83.00 less than two hours ago, have now dropped back to the mid-$81.00s, though that still leaves WTI higher by well over $1.0 on the day.

The recent emergence of selling pressure could be technical; on Wednesday, during oil’s sharp sell-off, WTI dropped below a long-term uptrend that had been supporting the price action all the way back to 20 August and had been respected on multiple occasions. When prices recovered back above the $83.00 level on Thursday and retested this prior uptrend, technical sellers might have used this as an opportunity to load up on short-positions again, perhaps to target a move back lower towards weekly lows around $80.00.

To recap, oil markets were under pressure on Wednesday due to a bearish combination of 1) bigger than expected build in US crude oil inventories, according to the latest weekly data from the US EIA and 2) news that Iran and the EU will restart nuclear deal negotiations at the end of the month, which could open the door to the removal of US sanctions on Iranian crude oil exports. Another factor cited to have been weighing on oil prices this week is the deteriorating Covid-19 situation in China; citizens are being advised not to go abroad for non-essential/urgent reasons and the current outbreak has now spread to 19 of China’s 33 provinces, more than during any other outbreak since the initial outbreak in Wuhan in early 2022.

Looking ahead, it will be key to watch 1) the outbreak in China (does it get worse and threaten oil demand, thus dragging prices lower?) and 2) the US response to OPEC+’s refusal not to hike output at a faster rate – they might start released crude oil from their strategic petroleum reserve to surpress US prices and the government is also threatening an oil export ban.

- EUR/USD dropped to weekly lows near 1.1540 on Thursday.

- The greenback keeps the bid tone intact despite lower yields.

- US Initial Claims surpassed estimates at 269K.

The intense move higher in the greenback keeps EUR/USD under pressure in the mid-1.1500s for the time being.

EUR/USD offered near YTD lows

EUR/USD came under moderate selling pressure on Thursday on the back of the persistent rebound in the greenback, which pushed the US Dollar Index (DXY) to fresh 3-week highs around 94.35 and shifted at the same time the focus to the 2021 highs in the mid-94.00s.

In fact, the pair quickly left behind the post-FOMC gains recorded on Wednesday and resumed the downtrend amidst the persistent negative mood in the risk complex and despite US yields trade on the defensive across the curve.

Same path follows yields of the German 10y Bund, which navigate the area of 4-week lows around -0.22%.

In the calendar, early results showed the final October Services PMIs in both Germany and the euro area receded from the previous readings, while Producer Prices in the bloc rose more than expected in September.

Across the pond, Challenger Job Cuts rose to 22.822 in October, Initial Claims increased by 269K in the week to October 30 and the trade deficit widened to $80.9B in September.

EUR/USD levels to watch

So far, spot is losing 0.51% at 1.1552 and faces the next up barrier at 1.1687 (55-day SMA) followed by 1.1692 (monthly high Oct.28) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1535 (weekly low Oct.29) would target 1.1524 (2021 low Oct.12) en route to 1.1495 (monthly low Mar.9 2020).

- US dollar gains momentum versus G10 currencies, but the yen is the best performer.

- USD/JPY continues to move in a two-week old range around 114.00.

The USD/JPY peaked on Thursday at 114.26 and then turned to the downside. Recently it reached a fresh daily low at 113.68, and it remains near the lows, with a clear short-term bearish bias.

The yen is the top performer amid lower US yields. The 10-year yield is at daily lows at 1.53%. US stocks are mixed in Wall Street, still holding onto most of Wednesday’s gains.

Despite the recent US economic report and the FOMC meeting, USD/JPY continues to move in a range between 113.40 and 114.40. The main trend still points north, but the dollar’s momentum eased.

After Fed, focus turns to NFP

The Federal Reserve on Wednesday announced a slowdown in its asset purchase program, as expected. Jerome Powell played down expectations about rate hikes in the short to medium term. Stocks rose, and US yields pulled back after the FOMC meeting.

Focus now turns to the US official employment to be released on Friday. The ADP report on Wednesday surpassed expectations, and on Thursday, the jobless claims report showed a new low since March 2020 for initial and continuing claims.

Regarding the NFP, analysts at TD Securities point out that a strong payrolls beat should broadly support the US dollar. “A strong payroll report is likely to reinforce the post-FOMC pricing suggesting the Fed will let inflation overshoot further. This could keep the market's pricing for hikes little changed but should lend additional support to curve steepeners and TIPS BEs.” If data sends US yields higher, USD/JPY could be among the biggest gainers.

Technical levels

- AUD/USD is currently at multi-week lows testing the 0.7400 level to the downside.

- The pair has been losing ground amid a broad USD pick-up, perhaps driven by good US jobs data.

AUD/USD has been heading lower over the last few hours and is currently probing the 0.7400 level, meaning it is at its lowest level since 18 October and has now seemingly lost its grip on its 21-day moving average (DMA), which currently resides in the 0.7430s. If the 0.7400 level goes, that could open the door to some more selling pressure, with bears perhaps targetting the 50DMA at 0.7360 and support around the 0.7380 level just above it.

Aussie rollercoaster

The pair has been on a bit of a rollercoaster over the last 24 hours, initially dropping to fresh multi-week lows under 0.7420 at the start of Wednesday’s US session amid strong US ADP and Service PMI data (both for October), before reversing higher amid broad dollar weakness following a more dovish than expected Fed policy announcement, with the exchange rate peaking in the 0.7470s.

The reversal back lower again and to fresh lows for the week since the start of the Thursday Asia Pacific session is mostly down to a pick up in USD strength; analysts seem to have arrived at the conclusion that, net-net, Wednesday’s Fed policy announcement wasn’t as dovish as first thought, as, while the bank did maintain its label of high inflation as transitory and say it wants to be patient on rate hikes, it also appeared to open the door for earlier rate hikes and a potential acceleration of the pace of QE tapering in early 2022. Thus, money market pricing for Fed rate hikes beginning in mid-2022 has been left relatively unchanged. This money market reaction contrasts with the RBA’s successful attempt at their rate decision earlier in the week to dampen market expectations for a rate hike in 2022.

The US dollar is getting further tailwinds on Thursday amid sharp losses in GBP after the BoE failed to live up to market hype for a rate hike and following another strong US weekly jobless claims report. Initial Jobless Claims (IJC) fell to a fresh post-pandemic low of 269K (that’s four weeks on the bounce of IJC coming in under 300K), leaving it now not far above the 200-250K range historically associated with a healthy US labour market. Stronger than expected Australian Retail Sales data for Q3 (sales dropped 4.4% QoQ due to lockdowns, less than the 4.6% expected decline) and Trade Balance numbers (the Aussie trade surplus came in at A$ 12.243B in September, a smaller than expected decline from A$ 15B in August) have failed to support the Aussie, which the third-worst performing G10 currency on the day (only GBP and NZD are faring worse).

Looking ahead, the main event for FX markets now is Friday’s US labour market report. If strong, AUD is vulnerable to further selling pressure.

- Wall Street's main indexes are trading mixed on Thursday.

- Falling US Treasury bond yields weigh on financial shares.

- Energy stocks regain traction as OPEC meeting gets underway.

Major equity indexes in the US opened mixed on Monday amid varying performances of major sectors. As of writing, the S&P 500 Index was trading at a new all-time high of 4,665, rising 0.12% on the day. The Dow Jones Industrial Average was down 0.15% at 36,110 and the Nasdaq Composite was up 0.2% at 15,843.

Among the 11 major S&P 500 sectors, the Financials Index is down nearly 1% after the opening bell pressured by the sharp decline witnessed in the benchmark 10-year US Treasury bond yield. On the other hand, the Energy Index is up 1.5% supported by rising crude oil prices ahead of OPEC's announcements.

Earlier in the day, the data from the US showed that Unit Labor Costs increased by 8.3% in the third quarter, surpassing the market expectation of 5.2% by a wide margin. Moreover, weekly Initial Jobless Claims declined to 269,000, the lowest print since the beginning of the pandemic.

S&P 500 chart (daily)

- EUR/GBP is sharply higher in wake of the latest BoE policy announcement, which was a dovish surprise.

- The pair hit its highest since early October above 0.8530 and its 50DMA.

EUR/GBP has risen sharply in the last hour or so in response to a more dovish than expected Bank of England policy announcement and is now trading at its highest levels since the 5th of October. The pair was trading close to its 21-day moving average at just above 0.8460 prior to the announcement but has since jumped all the way to the 0.8530s, which now puts it above its 50-day moving average at 0.8523.

BoE recap

To recap the BoE event quickly; the bank confounded investor expectations for a 15bps rate hike, instead of voting 7-2 to maintain interest rate at 0.1%, and voting 6-3 to maintain the size of its gilt remit at £895B, which means gilt purchases will continue until the end of the year. The bank said it wants to make sure the economy evolves as expected over the coming months, and is particularly keen to observe the labour market after the government’s furlough scheme ended at the end of September, before hiking, though it did say that rate hikes would likely be warranted in “the coming months”, which will keep expectations for a December rate hike alive.

The bank’s new economic forecasts also had a dovish bias, with 2022 GDP growth forecasts getting a sizeable downward revision to 5.0% from 6.0% and inflation, whilst seen peaking at 5.0% in April, seen falling back to the 2.0% target by the end of the three-year forecast horizon. This is in fitting with the BoE’s overarching view that the sharp rise in inflation will ultimately be transitory, though uncertainty about future energy prices makes forecasting more difficult. The dovish forecasts were are being interpreted as pushing back against the money market’s aggressive pre-announcement pricing to hikes over the next two years.

Policy divergence could weigh on GBP

The December 2022 short-sterling futures contract (a proxy for where the BoE bank rate is expected to be next December) rose sharply in response to the BoE meeting and is currently around 98.85, having been as low as 98.65 earlier on Thursday, which means markets are pricing about 20bps less in rate hikes by next December. By contrast, the three-month December 2022 Euribor future (a proxy for where the ECB deposit rate will be next December) has only risen from about 100.30 to 100.35 on Thursday.

That means the implied BoE/ECB December 2022 interest rate differential has dropped by about 15bps on Thursday – if this differential continues to close over the coming weeks as markets pare back on hawkish BoE rate hike bets, this could continue to lift EUR/GBP. A good target for the bulls might be the 200DMA at 0.8587.

- The BOE disappointed investors right after the Fed delivered as planned.

- US indexes are poised to open at record highs as European stocks soar.

- XAU/USD recovered to its comfort zone around $1,790 a troy ounce.

Gold added over $20.00 ahead of Wall Street’s opening and trades around $1,792.00 a troy ounce, trimming all of its post-Fed losses and returning towards its comfort zone. Market players are struggling to digest the latest headlines from central banks. On Wednesday, the US Federal Reserve announced it will start trimming its pandemic facilities, at a pace of $15 billion per month starting this month. The announcement was no shocker as Chief Jerome Powell anticipated it in the previous meeting.

The Bank of England just unveiled its monetary policy decision, keeping rates on hold despite the market’s speculation of a rate hike. Just 2 out of 9 MPCs voted for a hike, disappointing investors and sending the pound sharply down against most major rivals.

At the same time, global indexes are on the run, with Wall Street poised to hit all-time highs.

Gold price short-term technical outlook

XAU/USD trades around the 23.6% retracement of its latest daily advance after meeting buyers around the 61.8% retracement of the same rally on Wednesday. The overall technical picture is neutral, as the bright metal has hovered around the current level for most of the last two weeks, recovering sharply towards it on spikes on either side of it. The October high at 1,813.80 is a critical resistance level to break to gain bullish traction, while bears would take control only once below 1,756.60.

Following the Bank of England's (BoE) decision to leave the policy rate and the Asset Purchase Facility unchanged at 0.1% and £895 billion, respectively, BoE Governor Andrew Bailey is delivering his remarks on the policy outlook.

Key quotes

"We have not had any official labour market data that post-dates end of furlough scheme."

"Do not assume I am giving a strong clue by noting that there are 2 official labour market releases between now and December meeting."

"No member of the MPC, myself included, gave any commitment about this meeting."

"It was a very close call today."

"We are in a situation where calls are close and quite hard."

"We never said we would act at a particular meeting."

About Andrew Bailey (via bankofengland.co.uk)

"Andrew Bailey previously held the role of Deputy Governor, Prudential Regulation and CEO of the PRA from 1 April 2013. While retaining his role as Executive Director of the Bank, Andrew joined the Financial Services Authority in April 2011 as Deputy Head of the Prudential Business Unit and Director of UK Banks and Building Societies. In July 2012, Andrew became Managing Director of the Prudential Business Unit, with responsibility for the prudential supervision of banks, investment banks and insurance companies. Andrew was appointed as a voting member of the interim Financial Policy Committee at its June 2012 meeting."

- GBP/USD has dropped sharply and is down about 100 pips from pre-BoE announcement levels.

- The bank opted not to hike interest rates and seems to have pushed back against long-term rate hike pricing.

- But the bank signaled that a hike in December remains on the cards.

GBP/USD dropped sharply following a dovish surprise from the BoE. In an immediate reaction to the surprising monetary policy decision, the pair hit four-week lows under 1.3550, a near 90 pip drop from pre-BoE levels in the 1.3630s. Since the start of Governor Bailey’s press conference, GBP/USD has been extending on its losses and is now at more than one-month lows in the 1.3640s. Needless to say, GBP is the worst performing G10 currency on the day, with GBP/USD currently nursing losses of about 1.0%

The BoE’s decision not to hike rates on Thursday is likely to dampen investor expectations as to the aggressiveness of the coming BoE rate hiking cycle, which is in contrast to the market’s reaction to Wednesday’s FOMC meeting, which had a neutral effect on market expectations for rate hikes from the Fed. If anything, the risk is that the Fed might be drawn into lifting rates sooner than markets currently price, so if further divergence is seen in money market rate hike pricing between the UK and US (i.e. dovish bets upped in the UK, hawkish bets upped in the US), this could send GBP/USD back toward annual lows close to 1.3400. There isn't much by way of key support levels to prevent this.

BoE delivers dovish surprise

At 1200GMT, the Bank of England released their latest rate decision and monetary policy statement. The bank opted to hold interest rates at 0.1%, despite the fact that money markets were fully pricing in a 15bps rate hike. But the bank did say that it would probably have to start lifting interest rates “over the coming months” if the economy performed as expected, which should keep market expectations for a rate hike at the next monetary policy meeting in December alive. Only two BoE members voted to hike interest rates (MPC members Dave Ramsden and Michael Saunders), while three members voted to limit the bank’s UK government bond-buying remit to a total £875B. Given that six members voted to maintain the remit at £895B, QE purchases will continue until the end of the year.

The seven members who voted to hold rates at 0.1% expressed a desire to observe labour market developments in wake of the end of the government’s furlough scheme at the end of September – much of the official labour market data for October and beyond won’t be available until December, but a survey released by the UK Office for National Statistics showed that most workers who had still been on the government’s furlough programme at the end of September have now returned to their old jobs on the same number of hours. As a result, a large jump in the rate of unemployment seems unlikely, which should keep the BoE on course for a first rate hike in December, all going well.

The bank also released its new economic forecasts as part of its new Monetary Policy Report (MPR); GDP growth projections received a downgrade, with the UK economy now not seen reaching its pre-pandemic size until Q1 2022 as opposed to Q4 2021 (the forecast in the previous MPR). 2021 GDP growth is now seen at 7.0% and 2022 growth at 5.0% (down from 6.0% previously forecast). With regards to inflation, the bank now forecasts CPI reaching 5.0% by April 2022, mostly a reflection of higher energy costs (Ofcom raise the gas price cap in April), but then inflation is seen falling back towards the bank’s 2.0% target by the end of the three-year forecast time horizon. Some analysts have suggested that the bank’s inflation forecasts are more dovish than expected and may signal to rate markets that they are pricing in too many BoE hikes over the coming years. December 2022 Short-sterling futures (i.e. a proxy for where the BoE interest rate will be next December) jumped from 98.60 (implied 130bps of rate hikes) to around 98.80 (implied 110bps of rate hikes), a reflection of investors dialing back their expectations as to how aggressive the coming BoE hiking cycle will be.