- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-11-2021

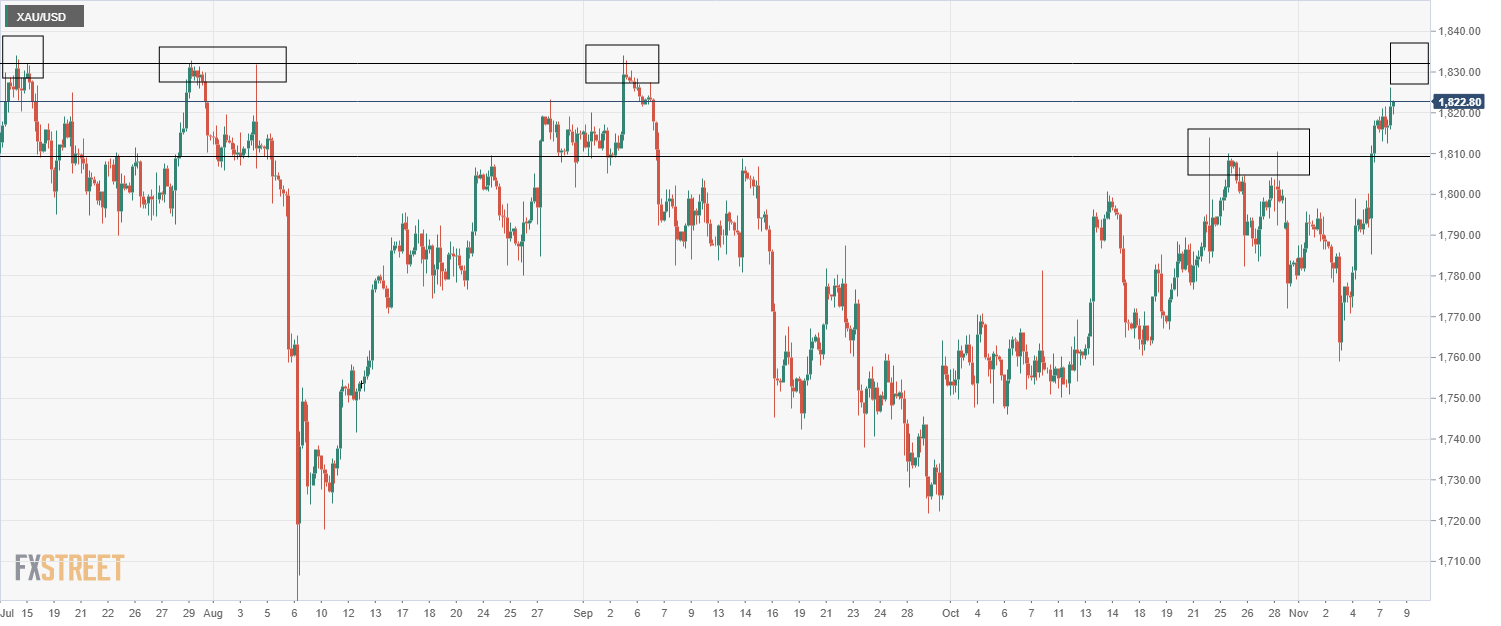

- Gold is on the verge of a breakout and $1,830 is key.

- A break of 1,830 opens the risk of a run on $1,850 stops and territory to $1,900.

- XAU/USD turns bullish on falling bond yields, technical breakout

Gold was an impressive performer in these past few sessions and XAU/USD has moved in towards the $1,830s, albeit still not quite there yet. $1,830, as illustrated below, is a key technical area on the longer-term charts, so it is paramount that bulls get over the line in the coming week.

Meanwhile, XAU/USD is trading at $1,824.67 and holds in bullish territory, ''itching for a breakout,'' as analysts at TD Securities say. ''Prices are set to challenge the multi-month downtrend from all-time highs. Counter-intuitively, this comes after a strong nonfarm payrolls report — but as noted, this datapoint does little to resolve the debate on inflation, nor does it inform the Fed's reaction function.'

In this regard, gold extended recent gains at the start of the week amid stronger investor demand. ''The weaker USD, combined with rising inflation expectations supported an appetite for the precious metal,'' analysts at ANZ bank argued.

On Monday, we heard from several Fed officials. Most prominently, James Bullard said the central bank may have to end the taper somewhat sooner to control inflation. However, this did little to support the greenback nor yields as the market has made up its mind that the Fed is in no hurry to hike rates nor speed up the tapering process. We will have to wait for more data, especially with regard to jobs, and the December Fed meeting in this regard will be important. However, according to the New York Fed, inflation expectations among US households rose to 5.7% in October which is higher than the market is priced for.

Focus is on US real yields

In this context, US real yields are plummeting, in support of gold prices. ''While the breadth of gold traders' short positions is not extreme by any means, position sizing is bloated considering the number of participants short, which leaves the hawks vulnerable to a squeeze,'' analysts at TD Securities said.

''Importantly, the market's microstructure still features little market depth, which suggests that a positioning squeeze could have an outsized impact on prices. Further, a breakout north of the multi-month downtrend could help the trend of ETF outflows reverse, powering gold prices even higher. Unfortunately for the bulls, we expect that a recent CTA buying program has run its course, suggesting algorithmic trend follower flow will not lend its support.''

Gold technical analysis

The above is an example of what could come from a break above the descending trendline resistance from a monthly perspective as the bulls gear up towards a run on the psychological $1,900 and then the $2,000 milestone.

Meanwhile, from a daily perspective, the price is testing the horizontal resistance for the fourth time where it now meets the descending trendline resistance near 1,830. If this breaks, bulls will be seeking a run above 1,850 buy stops and onwards.

- EUR/CAD extends its three-day rally, closes robust resistance at 1.4440.

- Dovish ECB stance has the potential of weighing on in the EUR.

- The Bank of Canada ended its QE program, could hike rates by April 2022.

The EUR/CAD pair begins the week in the right foot, flat as Tuesday’s Asian Pacific session begins, trading at 1.4420 at the time of writing. On Monday, US equities finished in the green, gaining between 0.09% and 0.29%, except for the Nasdaq Composite, which lost 0.14%.

ECB and BoC monetary policy divergence favors the Canadian dollar

On Monday, ECB’s Chief Economist Philip Lane crossed the wires. He said that elevated prices are temporary. Further added that the ECB believes that in 2022 bottlenecks and energy prices will ease or stabilize, according to El Pais.

Inflation rose by 4.1% on an annual basis in the Euro Area, up from 3.4%. Finance ministers are starting to worry that the jump could spur solid wage growth, triggering an inflationary spiral.

STIR in the Eurozone area retreated, as ECB policymakers led by ECB’s President Christine Lagarde reiterated that inflation is temporary and would moderate once supply constraints ease and shipping conditions improve. Also, ECB President Lagarde pushed back higher rates at the press conference after the monetary policy meeting, insisting that prices would ease.

Meanwhile, the Bank of Canada ended its QE program on October 27, which market participants viewed as a very hawkish taper announcement. Although a reduction in their bond purchasing program was expected, as the labor market recovered to pre-pandemic levels, the end of the program caught investors off guard.

Further, the BoC said it could begin hiking interest rates in April, three months sooner than previously thought. That to tackle inflation, which in September rose to 4.4%, the highest in two decades.

Money markets expect a hike as soon as March and five in total next year. Tightening cycles tend to slow economic activity.

That said, the EUR/CAD lies on the dynamics of the divergence between the ECB and the BoC. As long as the BoC keeps its hawkish stance and the ECB remains dovish, EUR/CAD traders could probably witness new year-to-date lows from the near term until the end of 2021.

EUR/CAD Price Forecast: Technical outlook

The daily chart shows that the EUR/CAD pair has remained trapped on the price action of October 27, within the 1.4292-1.4441 range, range-bound, tilted to an upward break at press time. However, the pair has mid-term downward bias as long as the daily moving averages (DMA’s) are still well above the spot price around the 1.4605 level. Furthermore, the Relative Strength Index (RSI), at 46, confirms the mid-term bias, so EUR/CAD sellers could be found around the 1.4400 area, as It was tested three times before.

To resume the downward bias, EUR/CAD sellers would need to reclaim the 1.4300 figure. In that outcome, the following demand zone would be February 16, 2020, low at 1.4263.

On the other hand, an upside break above the 1.4441 range would expose the 1.4500 figure as its first resistance level. A break above the abovementioned would expose the 50-day moving average (DMA) at 1.4625.

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, jump to the fresh high since October 27 by the end of Monday’s North American trading.

In doing so, the risk barometer extends the previous week’s rebound from the lowest levels since October 12 to flash 2.62%, per the official website data.

It’s worth noting that the jump in the US inflation expectations has been the key catalyst that pushes the Federal Reserve (Fed) policymakers towards rate lift-off. Recently, Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago said, “If inflation expectations increase a lot, it would make sense to think about a 2022 rate hike, per Reuters.

While the tapering tantrums underpin the US dollar strength, President Joe Biden’s stimulus and anxiety over the Fed reshuffle in 2022 seems to weigh on the greenback of late. The same highlights Tuesday’s speech from Fed Chairman Jerome Powell as the day’s crucial event to forecast market moves.

Read: AUD/USD stays firmer above 0.7400 amid softer USD, upbeat sentiment

- EUR/USD bulls pause after two-day uptrend, keeps short-term resistance breakout.

- Firmer RSI, Momentum line back buyers below two-month-old key trend line hurdle.

- Horizontal area from early October restricts short-term downside.

EUR/USD struggles to extend the two-day rebound, seesaws around 1.1590-85 during Tuesday’s Asian session. Even so, the major currency pair keeps the previous day’s upbeat break of a downward sloping trend line from October 28 amid price-positive signals from the RSI and Momentum indicators.

It should be noted, however, that the pair buyers remain worried below the descending resistance line from early September, near 1.1650.

Even if the EUR/USD bulls manage to cross the 1.1650 trend line hurdle, the last month’s high near 1.1695 and the 1.1700 threshold will challenge the further advances.

Meanwhile, the resistance-turned-support close to 1.1575 restricts short-term declines ahead of the multiple supports marked since the initial October month surrounding 1.1530-25.

Also acting as a downside filter is the yearly low near 1.1510 and the 1.1500 round-figure.

To sum up, EUR/USD is likely to remain in the recovery mode but the bulls remain cautious below 1.1700.

EUR/USD: Daily chart

Trend: Further recovery expected

- GBP/USD struggles to keep the strongest run-up in a week.

- DUP leader pushes for Article 16 activation amid sluggish Brexit talks.

- UK PM Johnson unveils more covid-led hospitalizations, highlights need for booster jabs.

- Brexit talks, speeches from BOE and Fed leaders will be in focus.

GBP/USD seesaws around 1.3560-70 following the heaviest daily jump in over a week. While the broad US dollar weakness allowed the Cable pair to recover the previous day, fears concerning Brexit and the UK’s coronavirus conditions seem to weigh on the quote of late.

Having heard of the ‘limited’ progress on the Brexit talks, the UK’s readiness to trigger Article 16 highlights fears concerning the key issue and drag down the GBP/USD prices of late. The Independent said, “Britain’s negotiator Lord David Frost emerged from a meeting with European Commission vice president Maros Sefcovic in Brussels on Friday saying advances towards new trading rules for Northern Ireland had been ‘limited’.” Following that, the BBC came out with the news saying, “Democratic Unionist Party (DUP) leader Sir Jeffrey Donaldson has reiterated his belief that ‘conditions have been met to trigger Article 16,’”

Elsewhere, UK PM Boris Johnson mentions the booster jabbing for the COVID-19 as the "single most important thing" people can do for "our country" and to protect the NHS (National Health Services), per Sky News. “We are starting to see too many elderly people going into hospital,” adds UK PM Johnson.

It’s worth noting that the passage of US President Joe Biden’s $1.0 trillion infrastructure spending plans by the House of Representatives and upbeat US jobs report for October offered a positive start to the week to the markets. The same joined chatters over the Fed reshuffle and weighed on the US Dollar Index (DXY) to help the GBP/USD buyers.

Amid these plays, Wall Street benchmarks closed with mild gains even as the US 10-year Treasury yields recovered.

Looking forward, comments from the Bank of England’s (BOE) Governor Andrew Bailey and Fed Chairman Jerome Powell can offer short-term direction to the GBP/USD prices as both the central bank leaders have been hawkish of late, with the BOE’s Bailey being a bit cautious after the last week’s hint of December hike in rates.

Technical analysis

GBP/USD rebound fades below a downward sloping resistance line from October 29, around 1.3620 by the press time. Also important is the convergence of 50-day and 20-day SMA near 1.3690-3700 area. Adding to the downside bias is the bearish MACD signals and weak RSI line.

- AUD/JPY struggles to keep rebound from 18-day low.

- Bearish MACD signals, failure to cross 20-day EMA keep sellers hopeful.

- 50-day EMA adds to the downside filters, late October’s swing low also challenges bulls.

AUD/JPY seesaws around 84.00 threshold after bouncing off the lowest levels since mid-October. In doing so, the cross-currency pair remains wobbles between the key support line and a short-term Exponential Moving Average (EMA) amid bearish MACD signals during the early Asian session on Tuesday.

Despite staying above an upward sloping support line from September 22, bearish MACD and the failure to cross 20-day EMA on a daily closing basis favor the pair sellers to attack the 83.95 trend line support level.

While a clear break of the 83.95 support directs the quote toward the 50-day EMA level of 83.15, any further weakness won’t hesitate to challenge the September’s peak surrounding the 82.00 round figure. During the fall, the 83.00 psychological level may offer an intermediate halt.

Alternatively, a daily close beyond 84.30, comprising the 20-day EMA, needs validation from the late October month’s swing low of 84.60 to recall the AUD/JPY buyers.

Following that, the 85.00 threshold and multiple hurdles around the 86.00-86.10 could challenge the pair’s further advances.

To sum up, AUD/JPY bears aren’t out of the woods despite Monday’s recovery moves.

AUD/JPY: Daily chart

Trend: Further weakness expected

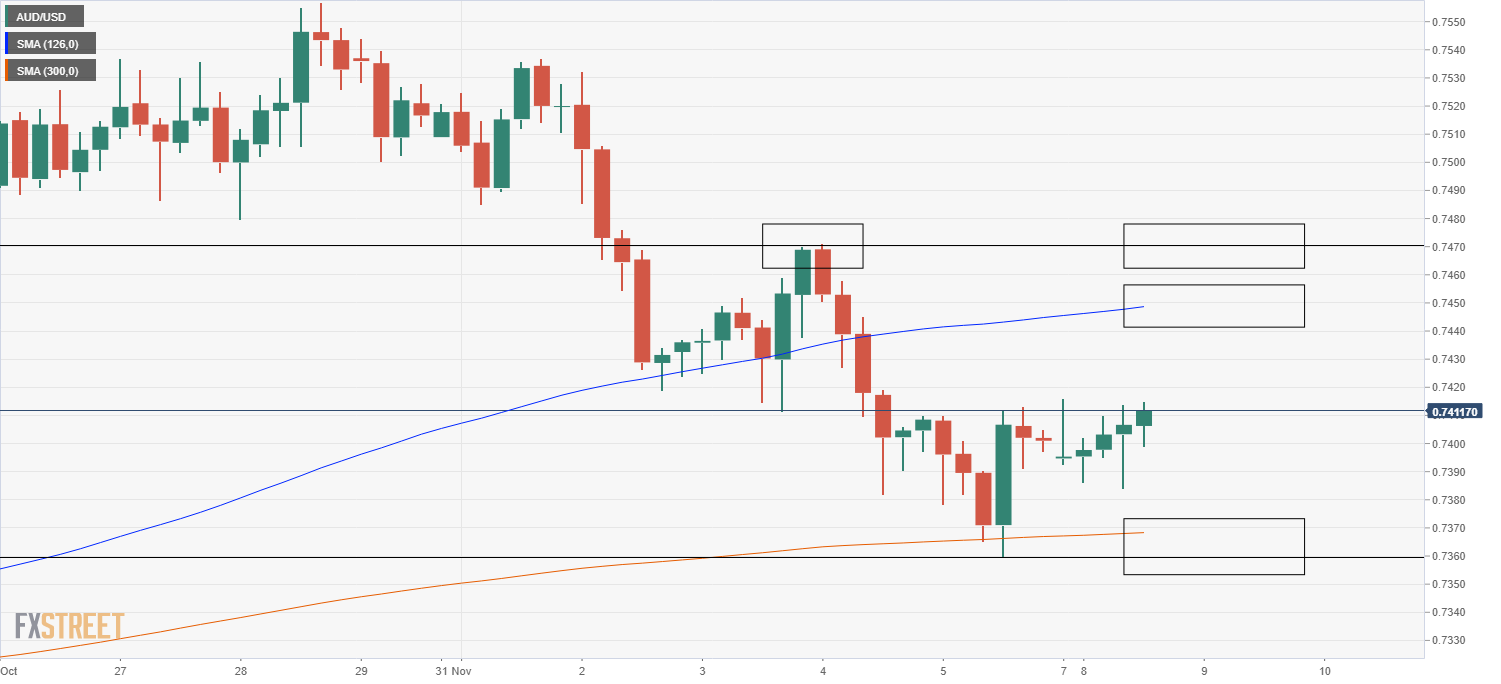

- AUD/USD grinds higher after printing the biggest daily gains in over a week.

- Equities, gold underpin recovery moves despite sluggish week-start.

- China trade numbers came in positive, Aussie NAB figures improved too.

- Fedspeak remains cautiously optimistic, Powell’s comments eyed.

AUD/USD holds onto Monday’s gains past 0.7400, edging higher around 0.7420 during the early Tuesday morning in Asia. The risk barometer pair recovered from the monthly low on Friday amid mixed concerns while a sluggish start to the week and the downbeat US dollar helped the Aussie pair print the biggest daily gains in seven days the previous day.

Although firmer US jobs report and President Joe Biden’s stimulus helped AUD/USDS bulls to remain hopeful, the Fed tapering tantrums didn’t allow bears to leave the desk. In doing so, the quote initially ignored upbeat trade numbers from Australia’s biggest customer, namely China, before tracking equities and gold to the north.

The passage of the US infrastructure spending bill followed firmer US jobs report for October to recall optimists of late. Joining them were chatters surrounding the likely change in the US Federal Reserve (Fed) board and its likely impact on the future monetary policies.

“A giddy President Joe Biden on Saturday hailed the congressional passage of a long-delayed $1 trillion infrastructure bill as a ‘once in a generation’ investment and predicted a broader social safety net plan will be approved despite tense negotiations,” said Reuters. Another US stimulus of around $1.75 trillion is looming but US President Biden seems hopeful to get it passed and hence favor the AUD/USD buyers.

On the other hand, US Nonfarm Payrolls (NFP) rose by 531,000 in October, better than the market expectation of 425,000. The figures were also beyond September's print got revised higher to 312,000 from 194,000. Further details of the publication revealed that the Unemployment Rate declined to 4.6% from 4.8% in September.

With around four or five Fed policymakers ready to leave the US central bank’s board, anxiety over the Fed’s next move amid push for tapering and rate hike weigh on the US dollar. Recently, Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago, said that the current surge in inflation is largely "temporary" and will fade as supply-side pressures get resolved, but he also sounded less convinced by that story than before.

Talking about the data, China reported a record trade surplus in October, with an all-time high surplus of $42 billion with the US. At home, the National Australia Bank’s (NAB) Business Conditions and Business Confidence indices grew past +5 and +10 figures to +11 and +21 respectively during October.

Amid these plays, US equities post a positive start to the week even as the US Treasury yields remain firmer. Further, the US Dollar Index (DXY) extended Friday’s loss.

Looking forward, firmer risk appetite enables AUD/USD to remain positive but a lack of major data/events ahead of Thursday’s Aussie jobs report may question the recovery moves. That said, the scheduled speech from Fed Chair Jerome Powell will be important for short-term direction.

Technical analysis

Friday’s Doji candlestick above 100-DMA backs AUD/USD run-up beyond a weekly resistance line, now support around 0.7410. However, the late October’s swing low near 0.7455 adds a filter to the upside momentum targeting 200-DMA, near 0.7550 at the latest.

- WTI bulls hold in there but struggle to surge. The US Biden administration is weight.

- The White House looks to curb high oil and gasoline prices.

The price of West Texas Intermediate WTI crude oil climbed on Monday on the demand vs supply play-off following OPEC+ declining to boost production last week. However, the US Biden Administration remains a thorn in the side for the bulls as it is still looking to take measures to lower prices help check gains. WTI climbed from a low of $81.07 on Monday and scored a high of $82.64 with demand up and supply waning due to weak production and dwindling global inventories.

Crude oil pared some of the day's gains as the White House looks to curb high oil and gasoline prices. President Biden said he wants to see more supply, with the administration looking at other tools such as tapping the strategic reserve, analysts at ANZ bank explained, noting that Energy Secretary, Jennifer Granholm, warned that could cut crude oil prices by 5%. This follows OPEC’s decision to stick with its scheduled 400kb/d increase in output despite consumers saying the current pace is too slow to sustain the post-COVID recovery.

Meanwhile, Saudi Arabia's decision to hike their official selling price underscores a tight market but also highlights that the group of producers is ignoring President Biden’s calls for more oil, analysts at TD Securities explained.

''OPEC's message to consumer nations was resoundingly clear—not only has the group of producers eased fears of a faster pace of output hikes, but it has clarified that member nations won't compensate for those who are underproducing relative to their quotas.''

''In reality,'' the analysts say, ''the OPEC+ group's decision likely acknowledges the fact that US production still remains curtailed, despite significantly higher prices, which allows the group to enjoy higher prices without fear of losing much market share. This suggests that the very cautious pace of output hikes should keep energy markets on a tightening trajectory in the near term.''

- XAU/EUR extends its rally to a third-straight day, up some 0.27% during the New York session.

- XAU/EUR raised almost 4% since last week’s lowest low, as central banks pushed back higher rates.

- XAU/EUR: A break above €1,592 would open the door to fresh yearly highs.

XAU/EUR advances for the third consecutive day, extending its rally since Thursday of last week, up 0.27%, trading at €1,574.63 during the New York session at the time of writing. The market sentiment has been upbeat throughout the day, as witnessed by major US equity indices rising between 0.08% and 0.29%.

In the last week, some central banks of global developed economies held their monetary policy meetings for November. In the case of the Reserve Bank of Australia (RBA), the central bank decided to keep its interest rates unchanged at 0.10% while continuing its bond purchasing program at A$4 Billion a week until February 2022. Furthermore, it dropped the Yield Curve Control on the Australian April 2024 Government bond. Also, it pushed back the expectations of higher rates but moved its target to 2023, instead of 2024, according to previous monetary policy meetings.

In the US, the Federal Reserve will begin the bond taper process by the middle of November. Additionally, it maintained its interest rates unchanged and reiterated that the bond taper would not mean that rates would need to get higher. Moreover, it pushed back higher interest rates, thus propelling a switch of the money market participants, as most expected two rate hikes to just one by the end of 2022.

The Bank of England (BoE) disappointed investors in the UK, as the market expected a rate hike, as some BoE’s members expressed concerns about higher inflation. They added that supply constraints, chains disruption, and elevated petrol prices are to be blamed regarding inflationary pressures.

That said, as portrayed by the central banks’ summary, investors flew towards safe-haven assets, in turn propelling XAU/EUR prices higher, jumping from €1,518 to €1,577, as the market expects policymakers to stay put on their monetary policy stances.

XAU/EUR Price Forecast: Technical outlook

In the daily chart, the XAU/EUR is trading well above the daily moving averages (DMA’s), meaning that the yellow metal has an upward bias. Furthermore, the following solid resistance area would be the 2021 high at €1,592. A breach of the latter would open the door for fresh yearly highs, with 1600 as the next supply zone in line.

On the other hand, failure at the abovementioned would expose the June 6 high at €1,567, followed by the October 28 high at €1,535.

- The S&P 500 clinched an eight successive record close and moved above 4700 for the first time.

- Tesla shares were down 4.9% after CEO Musk’s poll where he offered to sell 10% of his holdings.

The S&P 500 index managed to clinch an eighth consecutive record close on Monday, ending the session slightly to the north of the 4700 level for the first time after posting a modest gain of about 0.1% for the day. The Nasdaq 100 dropped 0.15%, though remains right at record levels in the 16,300s. The Dow outperformed, rallying 0.3% to move above 36.4K for the first time amid outperformance in industrial and material names; the S&P 500 industrials index was up 0.3%, while the material index was up over 1.0%. These sectors were boosted by the news last Friday that Congress had finally passed the $550B bipartisan infrastructure investment package. Also working in favour of the Dow is the fact that Tesla isnt included in the index, as is the case for the S&P 500, where it accounts for about a 2.5% weighting, and the Nasdaq 100, where it accounts for a more than 5.0% weighting.

Tesla (TSLA) shares dropped 4.9% after CEO Elon Musk held a Twitter poll over the weekend in which he asked his followers whether or not he should sell 10% of his TSLA holding and pledged to abide by the outcome of the poll. 57.9% of the 3.5M poll participants voted in favour of Musk selling shares. Musk owns 23% of Tesla shares and (at last Friday’s closing price) 10% of his stocks would be worth over $20B. Most analysts agreed it was normal for a public announcement of such a large stock sale would way on TSLA in the short run. Many suspected that the sale would do little to impact the value of TSLA shares in the long run, with strong institutional demand ready to lap up the available shares.

US equities remain well supported at/close to record levels for now as a strong Q3 earnings season draws to a close. According to Refinitiv data cited by Reuters, 81% of the 445 S&P 500 companies to report earnings thus far have beaten analyst expectations. Other positives being cited include a more certain outlook for Fed policy now that the Fed’s QE taper timeline has been announced for the rest of the year and a continued fading in the prevalence of the Covid-19 delta variant in the US, which has boosted the growth outlook for Q4.

- CAD has failed to benefit from a rise in crude price, with USD/CAD locked in the 1.2450 region.

- BoC Governor Macklem was keen to impress to the public over the weekend that the BoC would control inflation.

In fitting with mostly subdued trading conditions being seen across G10 foreign exchange markets, it’s been quite an uninspired day for USD/CAD, with the pair going sideways for most of the session within a few pips of the 1.2450 level. It's notable that USD/CAD was unable to test, let alone break to the north of, its 200-day moving around 1.2480 average at the end of last week. As is often the case in FX markets, rejection at a key moving average (like the 200DMA) can be interpreted as a bearish technical signal. There is support in the 1.2430 area, but should the bears push the pair below that, the next notable support is the 21DMA just under 1.2400.

USD/CAD was pushed higher from previously under 1.2400 by a sharp drop in crude oil prices towards the end of last week but has been unable to track a subsequent recovery in crude oil prices by pushing lower. WTI prices are up almost $1.0 on Monday and trading back to the north of the $82.00 level again, more than $3.50 above last week’s lows. It seems that market participants are taking a breather following the chaotic week just gone.

In terms of relevant news for the pair; BoC Governor Tiff Macklem spoke over the weekend and reiterated his expectation that the spike in inflation is set to be transitory. However, he was keen to impress to the public that the BoC would keep inflation under control. At the last BoC meeting, the bank statement opened the door for rate hikes as soon as Q2 2022.

Meanwhile, a few Fed speakers have hit the wires on Monday. Fed Vice Chair Richard Clarida reiterated a previously held stance that the conditions for rate hikes might be met by the end of 2022, perhaps a more dovish stance than market participants had been expecting given recent inflation developments. Meanwhile, St Louis Fed President James Bullard, who will be a voter in 2022, was hawkish, saying he sees one of the “hottest” labour markets in the post-war period and could see the unemployment rate dropping under 4.0% in Q1 2022. Comments from other Fed members, including Patrick Harker, Michelle Bowman and Charles Evans, largely stuck to the script established at the last meeting. Meanwhile, Fed Governor Randall Quarles will resign at the end of the year.

- NZD/USD bulls stay in charge as the RBNZ and Fed are played off in money markets.

- US dollar remains better offered despite recovery attempts post-Fed.

NZD/USD added around 0.7% on Monday and travelled from a low of 0.7103 to score a high of 0.7176 as it farse as one of the most reliable of the higher-yielding currencies with respect to the Reserve Bank of New Zealand. The US dollar was also a contributing factor given its 0.17% slide across a number of currencies on Monday, as measured by the DXY index.

The US dollar dipped on Monday after hitting 15-month highs on Friday following strong US Nonfarm Payrolls data. The report showed the US employment increased more than expected in October as the headwind from the surge in COVID-19 infections over the summer subsided. This was an encouraging signal that economic activity will be regaining momentum in the fourth quarter.

However, the data was not enough to steer investors' minds away from the fact that central banks are not as hawkish as the market was positioning for. This was evident across three central banks, the Reserve Bank of Australia, the Federal Reserve and the Bank of England. All three banks last week leaned on the side of patience with regards to timings of interest rate hikes and their transitory mantra with regard to inflation pressures.

Fed vs RBNZ in play

On Wednesday the Fed stuck to its view that current high inflation is expected to be transitory and said it would start trimming its massive bond-buying program this month. However, maximum employment was not yet achieved so the central bank will want to see more job growth before raising interest rates. This led to a fall in US yields and the greenback.

By contrast, short end NZ interest rate markets remain buoyant, with 66bps of hikes priced in over the next two meetings which are helping the NZD. ''If the RBNZ is of a mind to hike by 50bps, now’s the time, but that still seems incongruous with the uncertain global backdrop and cautious tone of other central banks,'' analysts at ANZ Bank said in a note on Tuesday. 'Still, until we know the outcome, markets will price in the risk.''

- The US Dollar is under selling pressure amid higher US T-bond yields.

- The single currency extends its two-day sharp rise, threatening to break above 1.1600.

- EUR/USD: A break above 1.1600 would expose 1.1650; otherwise, it could fall towards 1.1400.

The EUR/USD advances for the second day in a row, beginning the week in the right foot, up 0.18%, trading at 1.1587 during the day at the time of writing. Positive market sentiment as witnessed by rising US stock indices surrounds the financial markets. In the FX market, risk-sensitive currencies rise, with the NZD, the GBP, and the AUD, as the strongest ones, while the greenback falls, despite higher US T-bond yields.

In the last week, three central banks held their monetary policy reunions. They all pushed back higher interest rates, in line with what European Central Bank (ECB) President Christine Lagarde expressed two weeks ago. On Monday, Philip Lane, ECB’s Chief Economist, said that supply bottlenecks and higher energy prices are the main risks of inflation and economic recovery. Furthermore, added that “our [ECB] analysis is indicating that the euro area is still confronted with weak medium-term inflation dynamics remains compelling.” Further said that economic activity could outperform the central bank’s expectations only if consumer confidence increase and saves less tha expected.

In the meantime, the Federal Reserve announced the reduction by $15 billion to its Quantitative Easing program. Moreover, it left the door open for adjustments to the taper. If economic conditions improve faster than expected, the US central bank could increase the pace of reduction of its bond purchases program, meaning that it could finish sooner than the first half of 2022 as widely expected.

That said, the European economic docket will feature on Tuesday, the Zew Survey on Tuesday, and some ECB members' speeches. ECB's President Christine Lagarde and also Isabel Schnabel will cross the wires.

Across the Atlantic, the Producer Price Index will be unveiled. Also, Federal Reserve Chairman Jerome Powell will hit the wires.

EUR/USD Price Forecast: Technical outlook

In the daily chart, the shared currency bounced off the low around 1.1500, approaching the 1.1600 figure, which was respected in the last four previous tests, would be a strong resistance level to overcome. A daily close above the latter would expose the EUR/USD for further gains. The first supply zone would be a downward slope that confluences with the 50-day moving average around the 1.1650-80 area. A break above the abovementioned would open the door towards the October 28 high at 1.1691.

On the flip side, failure at 1.1600 would open the door for further downside, with the October 13 low at 1.1524, as the first demand zone. A break below the latter would expose the single currency towards new yearly lows, around the 1.1400 figure.

- AUD/JPY has seen a subdued start to the week, barely budging from the 84.00 level.

- Monday’s calm marks a significant shift from last week’s volatility.

It’s been a very mundane start to the week for AUD/JPY, with the pair largely sticking to within a few pips of the 84.00 level for most of the session. The currency pair did manage to squeak out a fresh multi-week lows under 83.80 at the Asia Pacific reopen of trade on Monday, but lacked the conviction to extend on the hefty losses incurred last week.

To recap last week’s price action; the pair tanked from highs around 86.00 to lows current levels around 84.00 (a near 2.5% drop) as a result of 1) a dovish showing from the RBA, where Governor Philip Lowe pushed back strongly against expectations for rate hikes in 2022 and 2) a broader paring back on hawkish central bank bets across developed markets (which benefits the yen, given there were no hawkish bets on the BoJ to pare back on in the first place). As of the time of writing, the pair is sat just to the north of the 84.00 level. The most notable upside resistance is at 84.50 (last Tuesday and Wednesday’s lows), while to the downside the next support is the 200-day moving average just to the south of the 83.00 level.

Chinese trade data for October was released over the weekend and came in mixed. Exports beat expectations, but imports missed. Given that China is a big export destination for Australian goods, this is likely to be interpreted as a net negative for AUD, although FX markets didn’t show much of a reaction. Analysts read the weaker than expected import data as further signs that Chinese growth momentum continues to weaken. Elsewhere, the Bank of Japan released the Summary of Opinions from the most recent policy meeting, which offered up few surprises and also did little to stir the FX pot.

AUD/JPY traders arriving for the upcoming Tuesday Asia Pacific session should keep an eye on Japan September trade, current account and bank lending figures scheduled for release at 2350GMT, the Australia October NAB Business Confidence survey at 0030GMT and the Japan October Eco Watchers Survey at 0500GMT.

What you need to know on Tuesday, November 9:

The greenback gave up some ground on a quiet Monday. The week started with China reporting a record Trade Balance surplus, although imports increased by less than anticipated, with notable declines in oil and soya beans buying.

Several US Federal Reserve policymakers give speeches within different events, although references to monetary policy were scarce. Vice-Chair Richard Clarida said that benchmarks for rate hikes could be met by the end of 2022 but added that the Fed is still "a ways away" from considering lift-off, adding that he expects a full return to pre-pandemic employment levels by the end of 2022.

More relevant is the fact that Fed’s Randal Quarles said he is stepping down from his post around the end of the year. Vice-Chair Richard Clarida leaves in January, while Powell’s term ends in February. A Fed’s reshuffle could bring some interesting changes next year.

The EUR/USD pair neared 1.1600, but held below the level, while GBP/USD recovered to the 1.3550 price zone. Commodity-linked currencies were marginally higher, with AUD/USD trading around 0.7420 and USD/CAD in the 1.2440 price zone. The USD/JPY pair is under selling pressure despite the better tone of Wall Street, down to the 113.20 region.

US government bond yields ticked higher with that on the 10-year Treasury note flirting with 1.50% by the end of the American session.

Gold was among the best performers, surging to a fresh one-month high of $1,826.43 a troy ounce, ending the day nearby. Crude oil prices edged lower at the beginning of the day, recovering most of the ground lost ahead of the close. WTI settled at $82.10 a barrel.

Bitcoin shoots past Tesla and Facebook to become world's sixth-largest asset

Like this article? Help us with some feedback by answering this survey:

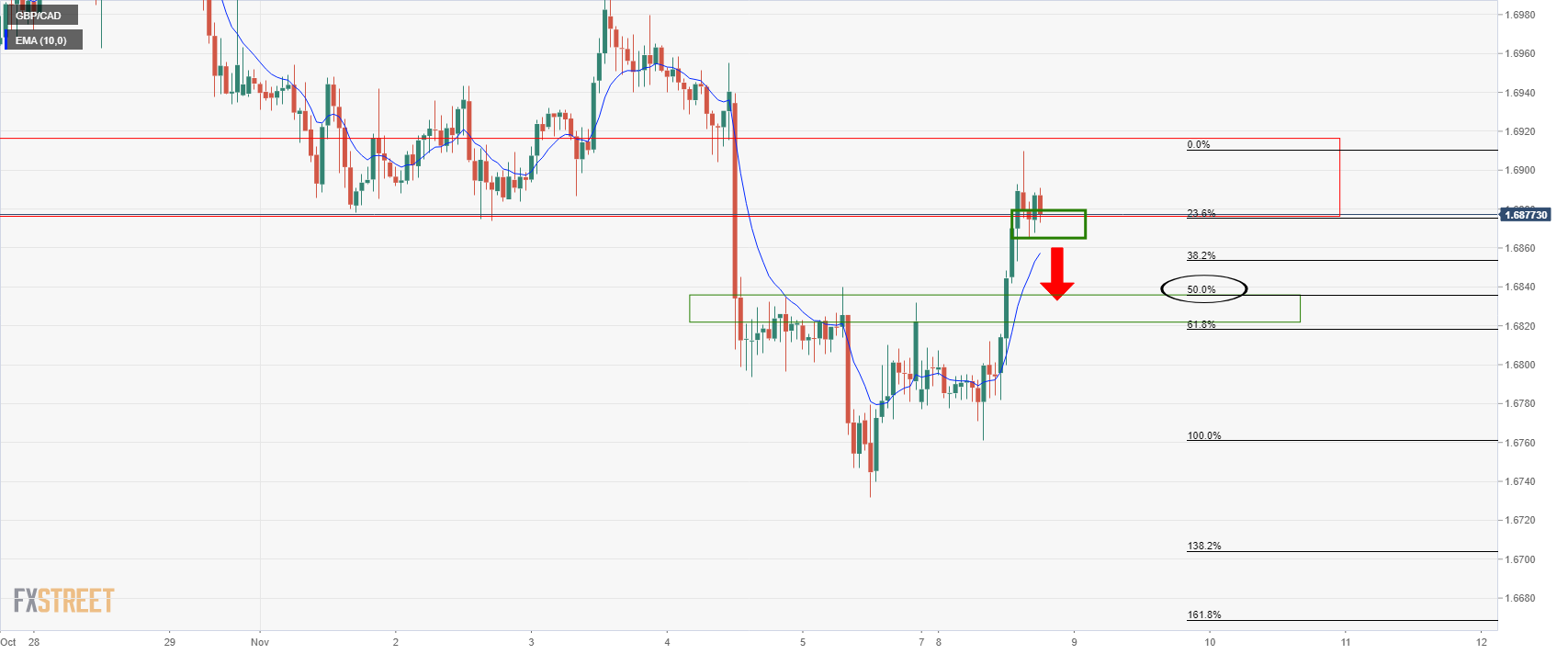

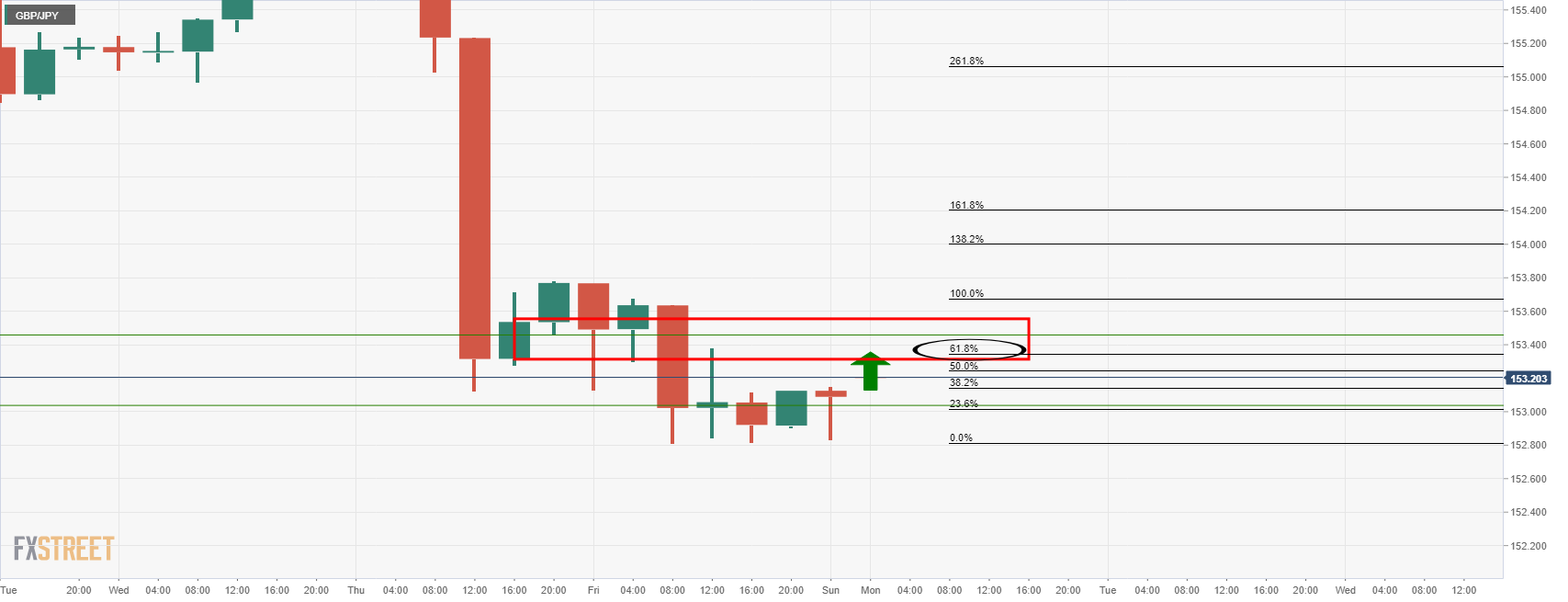

- GBP/CAD bears are looking for a fade on rallies.

- The weekly resistance s compelling and could give rise to a downside extension in the coming days.

GBP/CAD has been a strong performer at the start of the week as the pound parse back some of the Bank of England sell-off from last week. The cross has rallied around 0.5% on the day which has given rise to a bearish prospect on the charts for the week ahead, as illustrated as follows:

GBP/CAD weekly chart

The weekly chart shows that the price is testing what is expected to be a solid area of weekly resistance. A break above, however, opens risk of a restest to the upside for the weeks ahead and further wide consolidation.

GBP/CAD daily chart

The daily chart shows that the price has rallied into this critical area of resistance also which would be expected to hold up on initial tests. The 61.8% Fibonacci is a milestone in this regard. Consolidation would be expected at this juncture and should the overall downtrend play out, then we can expect a downside extension to develop over the course of the comings days.

GBP/CAD 4-hour chart

In the meantime, the 4-hour time frame sees the 50% mean reversion aligned nicely with the prior highs as a target for the bears. This comes near 1.6820.

GBP/CAD hourly chart

From an hourly perspective, there is some basing taking place near 1.6860, so bears will want to see this level of support cleared to open the way towards the 1.6820s in the forthcoming sessions.

Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago, is crossing the wires on Monday and he has repeated his view that the current surge in inflation is largely "temporary" and will fade as supply-side pressures get resolved, but he also sounded less convinced by that story than before.

"I had expected to see more progress by now," Evans said in remarks prepared for delivery to the Original Equipment Suppliers Association, adding that there are signs that inflationary pressures may be building more broadly, including increases in rents.

"These developments deserve careful monitoring and present a greater upside risk to my inflation outlook than I had thought last summer."

Key comments from Fed's Evans

Still have a ways to go until inclusive full employment.

Big question is how much of a mark current price pressures will leave on underlying inflation.

Economy still very much tied to virus, path forward is highly uncertain.

With case counts down, there's room for optimism.

By unemployment rate alone, full employment would be well within sight, but doesn't tell the whole story.

Stronger labor market conditions will draw some early retirees back to work.

Much of the current surge in inflation is temporary.

Highly uncertain how long it will take for supply and demand conditions to normalize and bring inflation lower.

Sees greater upside risk to inflation outlook than had seen last summer.

Uncertainties on outlook could lead fed to move up or delay rate increases.

Market implications

Evans comments are in line with the Fed's main message last week when the central bank continued to lean on the transitory mantra. This has weighed on the greenback in recent sessions.

- XAG/USD advances for the third day in a row, above the 100-DMA.

- Fed Vice-Chairman Clarida: The benchmark for higher rates could be met by the end of 2022.

- Fed Vice-Chairman Clarida: The Fed is still “a ways away” from lifting off rates.

- XAG/USD: Bull’s target is $24.60 before launching an attack towards $25.00.

Silver (XAG/USD) advances sharply for the third consecutive day, up some 1.05%, trading at $24.40 during the New York session at the time of writing. Further, it is printing a two-week high amid higher US T-bond yields, with the 10-year Treasury yield at 1.49%, up near four basis points in the session.

Silver rises, boosted by falling Real Yields

Usually, higher US Treasury yields have an inverse correlation with precious metals like gold or silver, but as of writing what it is influencing, the jump in XAG/USD is real yields. As noted by Joel Frank, FX Street analyst, in its article Gold Price Analysis: XAU/USD hits two-month highs above $1820 as real yields decline, he commented that “US real yields, which saw a sharp fall last week, continue to head lower on Monday, with the 10-year TIPS yields down roughly 2bps on the session and back below -1.10%.” Real yields it’s the interest rates minus inflation, though as TIPS yields drop lower, investors could expect higher prices on precious metals. Furthermore, US inflation expectations are edging higher, thus increasing the appetite of precious metals as an inflation hedge.

In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of six peers, is down 0.14%, sitting at 94.08, boosting the appetite of the non-yielding metal.

During the day, some Fedspeakers crossed the wires. One of the most relevant, Vice-Chairman Richard Clarida, said that the benchmark for higher rates could be met by the end of 2022 but reiterated that the Fed is still “a ways away” from lifting off rates, per Reuters. Further noted that “Core PCE inflation measured since Feb. 2020, before the pandemic, through Sept. 2021 already averaging 2.8%.”

XAG/USD Price Forecast: Technical outlook

In the daily chart, XAG/USD just broke the 100-day moving average (DMA) at $24.16, closing to the mid-line of Andrew Pitchfork’s indicator around the $24.60 area. A daily close above the latter could propel the white-metal towards higher prices, being the September 5 high at $24.85, its first resistance level. A sustained break above that level would expose the 200-DMA at $25.35.

On the other hand, failure at Pitchfork’s central line would expose the 100-DMA as the first support, followed by the $24.00 figure.

- EUR/GBP is back under 0.8550 after the pair rejected its 200DMA close to 0.8600.

- Central Bank divergence may continue to push the pair lower in the coming months.

EUR/GBP has traded with a largely negative bias this Monday, dropping from early session highs near 0.8590 to current levels below the 0.8550 mark. The pair has now on two occasions in the past two days failed to break above its 200-day moving average, which sits just below the 0.8600 level. Technicians might see this as a bearish sign, which may have exacerbated recent selling pressure. At present, EUR/GBP trades with on the day losses of around 0.2% and is still some way (about 1.0%) above its pre-BoE policy announcement levels from last week in the 0.8460s.

To quickly recap, the bank wrong-footed speculators as it opted not to go with a widely expected 15bps rate hike and sounded more dovish than expected on inflation and the prospect for rate hikes further out. But the ECB was also dovish last week, with ECB President Christine Lagarde pushing back strongly against EUR STIR market pricing for rate hikes as soon as the end of 2022. Since then, there has been further dovish commentary from the second most important ECB member, Chief Economist Philip Lane. He said over the weekend and reiterated on Monday his expectation that the current spike in inflation is set to be transitory and that over-reacting to a short-term spike would be a policy mistake.

Though the BoE’s disregard for investor expectations will have undoubtedly resulted in the build-up of some risk premia in GBP, the bank remains on course to begin the process of monetary policy normalisation well ahead of the ECB. BoE Governor Bailey was back on the wires only a few moments ago reiterating the bank’s worries about second-round inflation effects. Speculators may see the recent failures to break above the 200DMA as a sign that EUR/GBP’s near year-long downtrend has further room to run. Barring any further BoE surprises, a good medium-term central bank divergence play might be to ride EUR/GBP lower from here to annual lows around 0.8400.

Elsewhere, Brexit remains in the headlines and the UK looks set to trigger Article 16, which will inflame tensions with the EU and risks spilling into a trade war. As Brexit did back in the day, this presents upside risks to EUR/GBP. Otherwise, the only notable Eurozone and UK events this week is the German November ZEW survey and a speech from ECB President Christine Lagarde on Tuesday and the preliminary estimate of UK GDP on Thursday.

The Bank of England's governor, Andrew Bailey, has stated in recent trade that the Old Lady will have to act with rates if there is evidence of higher inflation expectations feeding into wages.

Key comments from BoE's Bailey

Says much of rise in inflation has to do with reopening after lockdowns.

Says what we are concerned about is once we have increase in inflation we want to stop it becoming generalised.

Says problem now is that what's pushing up inflation is not too much demand.

Says the risk is that we are going to get more bottlenecks, especially for labour.

Says we would and will have to act with rates if we see evidence of higher inflation expectations feeding into wages.

More to come...

- Crude oil has been choppy but trades with a positive bias around $82.00.

- A few positives have been attributed as supporting prices on Monday, though US intervention remains a risk.

Crude oil prices have been choppy in recent trade but continue to trade with a positive bias on the day. Front-month futures contracts for the American benchmark for sweet light crude oil, called West Texas Intermediary or WTI, currently trades close to $82.00/barrel, having swung between the $81.30-$82.60 at various points throughout the session. At present, WTI currently trades with on-the-day gains of about 60 cents or a little under 1.0%. To the upside, the next notable area of resistance is last Thursday’s high in the $83.30s, while, to the downside, the next notable area of support is last week’s low at around $78.30.

Market commentators have suggested a few factors as supportive for crude oil prices at the start of the week, including; 1) the passage of the $550B US infrastructure investment package at the end of last week (which improves the US growth and oil demand outlook), 2) news over the weekend that the Saudi Arabian’s had upped their Official Selling Price (OSP), which indicates strong demand, 3) better-than-expected Chinese export growth figures over the weekend, which suggest strong global demand ahead of the winter holiday’s and an easing of supply chain woes and 4) further signs that global jet fuel demand is set to rebound back to pre-pandemic levels as countries reduce travel restrictions (from 8 November, the US is allowing fully vaccinated travels to visit quarantine free from the EU, UK, China, India, Brazil and more and travel booking are reportedly rising).

One downside risk to prices this week is a potential announcement from the Biden administration of measures aimed at addressing high gasoline and heating costs. Reportedly, the US Energy Secretary is currently weighing up options and President Joe Biden could make an announcement as soon as the end of the week. Touted actions include tapping the strategic petroleum reserve, which is supposed to be only be used in emergency situations, and placing a ban on energy exports.

Federal Reserve Governor Michelle Bowman says that it is likely that we will see higher inflation from housing for a while.

More to come...

Patrick Timothy Harker, who is the President of the Federal Reserve Bank of Philadelphia, says he does not expect the Federal Funds Rate will rise before the Fed's bond tapering is complete.

"I don’t expect that the federal funds rate will rise before the tapering is complete, but we are monitoring inflation very closely and are prepared to take action, should circumstances warrant it," Harker said in remarks prepared for a virtual event organized by the Economic Club of New York.

Reuters reported that The also said he ''expects inflation to moderate over the next year as supply demand imbalances caused by the pandemic are resolved, echoing a message shared by Fed officials last week when they announced they will begin to reduce the pace of asset purchases by $15 billion a month.''

Key comments from Fed's Harker

Says he does not expect that the federal funds rate will rise before the fed's bond tapering is complete.

Says fed officials are monitoring inflation very closely and are prepared to take action, should circumstances. warrant it.

Says he expects inflation to moderate next year as supply chains come back online and bottlenecks ease

Says US economy should see another growth spurt to more than 4% next year if another major covid-19 wave can be avoided.

Says he expects economic growth to return to between 2% and 3% in 2023.

Says he expects more people to return to the workforce as forbearance programs run out.

More to come...

- The S&P 500 advances 0.07% is sitting at 4702, with energy and materials as the leading gainers.

- The Dow Jones Industrial adds 0.23%, currently at 36,412.

- The Nasdaq Composite is barely down 0.01% at 16,358.

The S&P 500 edges higher in the New York session, up some 0.08%, sits at 4,701 at the time of writing. The Dow Jones Industrial adds 0.23%, up to 36,412, while the Nasdaq Composite falls 0.01%, at 16,358. Positive US jobs data last Friday, coupled with a dovish taper by the Federal Reserve on Wednesday, prompted investors towards riskier assets, as US equity indices keep posting new all-time highs on the last week.

Furthermore, robust third-quarter earnings ease market participants’ worries about heightened inflation. In the last week, three central banks unveiled their monetary policy statements, in which It can be read that inflation is transitory despite high energy prices, blaming supply constraints and bottlenecks, coinciding that once those factors ease, inflation will moderate.

Sector-wise, Energy, Materials, and Financials are the gainers, rising 1.34%, 1.08%, and 0.84%, respectively. On the other hand, the main losers are Utilities and Consumer Staples, down 1.60% and 1.1%.

S&P 500 Price Forecast: Technical outlook

The daily chart shows the index keeps in a solid upward trend, showing no signs of exhaustion, despite that the Relative Strength Index (RSI) is at overbought levels at 77, aiming higher. Furthermore, the daily moving averages (DMA’s) are below the index value, sitting well below the 4,500 level. However, in case of a correction lower, the first demand zone would be the September 3 high at 4,550.

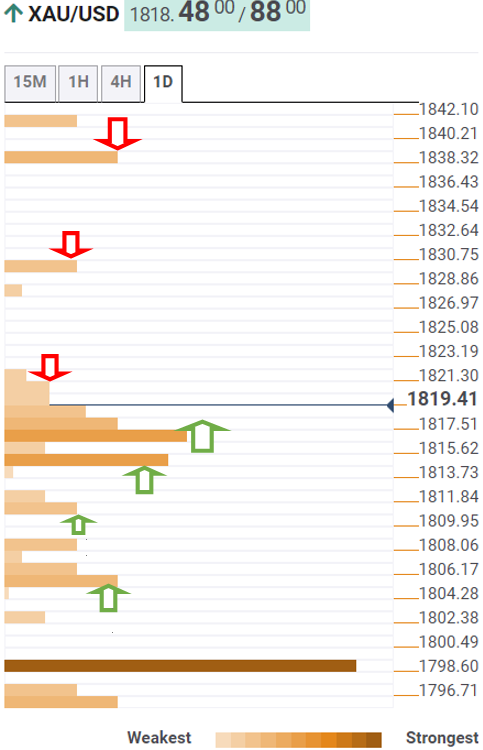

- Spot gold continues to nudge higher as real yields fall and is now above $1820.

- The precious metal is being supported by lower real yields and a weaker US dollar on Monday.

- Remarks from influential Fed member Clarida may have triggered a dovish market reaction.

Spot gold (XAU/USD) continues to trade with an upside bias on Monday after breaking above key resistance last Friday in the $1814/oz area. Spot prices surpassed $1820 earlier in the session, the highest level in over two months. Gold bulls will now be eyeing a move back to test resistance in the $1830s, an area that spot prices tried and failed to break above on between July and early September. To the downside, there is support in the form of the October highs around $1810.

Falling Real Yields

US real yields, which saw a sharp fall last week, continue to head lower on Monday, with the 10-year TIPS yields down roughly 2bps on the session and back below -1.10%. Gold has a negative correlation to real yields; as real yields decline, this reduces the opportunity cost for investors in holding non-yielding precious metals, thus boosting their appeal. The fact that US inflation expectations are moving higher may also be helping gold given its reputation as an inflation hedge. 10-year break-evens are up about 6bps to 2.58% on Monday and showing signs that a move back towards recent multi-decade highs close to 2.7% could be on the table.

Weaker Dollar

A weakening US dollar is also giving dollar-denomination spot gold a helping hand on Monday. The Dollar Index has weakened by about 0.3% on the session and has fallen back to test the 94.00 level. A weaker USD makes spot gold cheaper for global buyers, thus increasing its demand.

Influential Fed member and Vice Chairman of the FOMC Richard Clarida spoke earlier in the session and his comments were more dovish than many might have expected; he said the conditions for a rate hike could be met by the end of 2022 and the Fed is still some way from considering rate lift-off. USD STIR markets currently price a hike by September 2022, thus Clarida’s remarks may be interpreted by some as dovish pushback against the market’s pricing. This may have contributed to USD underperformance on Monday and may, thus, be helping gold.

On Tuesday, the Producer Price Index for October is due in the US and on Wednesday the Consumer Price Index. According to analysts at Wells Fargo, the numbers on Wednesday, are unlikely to offer much of a reprieve on the inflation front.

Key Quotes:

“Consumer Price Index report for the month of October is unlikely to offer much of a reprieve on the inflation front. Our forecast is for a 0.6% month-over-month increase on the headline index and a monthly increase of 0.4% on the core index. If realized, this would put headline CPI inflation at 5.9% year-over-year and core CPI inflation a bit lower at 4.4% year-over-year.”

“A key question for the inflation outlook is the extent to which some price growth in certain sectors coming back down to Earth, such as new and used vehicles, will offset a broadening out of inflation in other areas, such as housing.”

“Goods inflation has been running at rates not seen in decades, while services inflation has mostly been in line with its historical average. We expect goods inflation to hand the baton to services over the course of the next year, but all signs indicate that supply chain bottlenecks will keep fanning the flames on inflation in the near term.”

- Cable rises further from monthly lows amid a weaker dollar.

- DXY retreats from monthly highs toward 94.00.

- US inflation data due on Tuesday and Wednesday, to be watched closely.

The GBP/USD pair is recovering on Monday after falling last week to 1.3423, the lowest level in a month and slightly above the YTD low. During the American session, cable rose to 1.3578, reaching a fresh intraday high. It is hovering around 1.3550, up more than 70 pips for the day.

The recovery in GBP/USD is being driven by a weaker US dollar across the board. The greenback is retreating after last week rally, continuing the move that started on Friday after the NFP.

Higher US yields are not helping the greenback. The 10-year stands t 1.48%, (up more than 2%). The DXY is falling for the second day in a row, testing 94.00. US inflation data on Tuesday and Wednesday will be watched closely.

Market participants continue to digits the last week’s Bank of England meeting. The dovish tone from the central bank weighed on the pound. During Monday’s European session, the pound strengthened for the first time since the meeting and rose across the board.

Still, what the BoE did and the Brexit concerns could still impact on GBP. “The outlook for GBP will be guided by expectations regarding the pace of BoE policy tightening relative to the policy decisions taken by other major central banks such as the Fed and the ECB. On the margin, UK politics concerning the issues of Brexit and sleaze may also impact the performance of GBP”, explained analysts at Rabobank.

Supported again above 1.3400

The decline of GBP/US found support above 1.3400, like what happened back in September. If it breaks below, the pound would likely accelerate to the downside. On the upside, a firm recovery above 1.3600 should strengthen the bullish outlook.

Technical levels

- NZD/USD has been on the front foot in recent hours, rallying back to the upper 0.7100s.

- The kiwi is the best performing G10 currency on the day amid positive NZ reopening news.

NZD/USD has continued to advance as the US session gets underway, recently scaling new heights for the day in the 0.7170s, up from Monday Asia Pacific session levels of just above 0.7100. The most immediate upside resistance is last Wednesday’s high at 0.7180, which the pair hasn’t quite been able to pip just yet on Monday. The New Zealand dollar is the best performing G10 currency on the day so far, up around 0.8% on the session versus the US dollar.

Market commentators are citing positive New Zealand reopening news as supportive for the kiwi; the government announced that the country’s largest city Auckland would have its Covid-19 alert level downgraded on Wednesday, allowing shops to reopen. Further reopening is expected at the end of the month. The country’s full vaccination rate is expected to hit 90% within a few weeks, a key threshold the government has said must be met in order for lockdowns to be eased.

The New Zealand economy has performed much better than expected so far in 2021, with the latest jobs data showing the unemployment rate dropping to 3.4% in Q3, well below any economist/RBNZ estimate of NAIRU (the “natural” rate of unemployment, below which inflationary pressures will build). Prompt reopening after recent lockdowns will ensure this year’s economic progress isn't scuppered. Indeed, following the recent strong jobs report, some analysts are calling for a 50bps hike at the next RBNZ meeting. “We see an increased chance of a 50bps hike at the November RBNZ meeting, given the following meeting won’t take place until February 2022” comments Citi.

Technical buying could also be helping NZD/USD on Monday; last Friday, the pair was probing its 21 and 200-day moving averages around the 0.7100 level. The fact this significant area of support has held might be interpreted as a bullish signal by some technicians, many of whom may be targetting a return to the October highs in the 0.7220 area.

Looking ahead, kiwi traders will be keeping an eye on October Electronic Card Retail Sales data, scheduled for release at 2145GMT. Otherwise, the pair is likely remain focused on Fed speak, with remarks from NY Fed President John Williams, FOMC member Michelle Bowman and FOMC member Charles Evans coming up over the next few hours. Remarks from Fed Vice Chair Clarida earlier in the session were broadly viewed as dovish and may have contributed to USD weakness/upside in NZD/USD.

The pound has settled above its recent lows vs. both the USD and the EUR, but it remains in a clearly weakened positioned. EUR/GBP is still seen at 0.85 by year-end while UK politics concerning the issues of Brexit and sleaze may impact the performance of the pound, economists at Rabobank report.

Brexit and sleaze in the Tory party need to be monitored

“How much support the pound can garner from a potential BoE rate hike in the coming months will to some extent depend on whether a move is judged to be warranted. In the wake of mounting headwinds to growth in the UK, it appeared at the time that market participants were wary of a policy mistake from the Bank. This suggests that GBP may have struggled to rally even if the Bank had raised rates last week.”

“The fact that EUR/GBP has never come close to returning to the levels held prior to the 2016 referendum on EU membership suggests that Brexit-related uncertainty is largely already in the price. That said, headlines that the UK government may be close to triggering Article 16 of the Northern Ireland protocol has the potential to open a fresh set of worms for GBP.”

“The accusations regarding sleaze in the Tory party and the government’s U-turn last week over parliamentary standards have taken a toll on the PM personal poll rating. Given the government’s strong majority and absence of any near-term election, this may not translate directly into a softer pound near-term unless the situation worsens.”

“We retain our year-end EUR/GBP forecast of 0.85.”

- Japanese yen among top performer despite risk appetite and higher yields.

- US dollar weakens across the board during the American session.

- USD/JPY heads for lowest close in a month.

The USD/JPY is falling on Monday for the third day in a row and it reached at 113.07, the lowest level since October 12. It remains near under pressure amid a weaker greenback across the board.

After trading in a range for days, USD/JPY broke to the downside, clearing the way to more losses. The short-term outlook now favors the downside. The next support levels might be seen at 112.95 and 112.10. On the upside, now 113.40 is the immediate resistance. If it rises above 114.40 the US dollar would recover strength, probably resuming the bullish long-term trend.

The move lower in USD/JPY takes place despite a rebound in US yields. The 10-year stands at 1.48% and the 2-year rose to 0.43%. Not even risk appetite is giving support to the pair. The Dow Jones gains 0.36%, at new record levels, while the S&P500 rises by 0.14%.

After a quiet Monday in terms of US economic data, on Tuesday the PPI and on Wednesday the CPI could trigger market moves following last week FOMC meeting. Inflation numbers are likely to influence on expectations about Fed’s monetary policy.

Technical levels

- USD/CAD begins the week on the right foot, despite broad US dollar weakness.

- The US 10-year Treasury yield trims some of the last week's losses, up at 1.481%.

- Higher crude-oil prices failed to underpin the Loonie.

The USD/CAD begins the week on the right foot, advancing some 0.01% trading at 1.2450 during the New York session at writing. As portrayed by US equity indices rising, the market sentiment is upbeat. The greenback lost traction after a better than expected US jobs report, while US T-bond yields rose.

USD/CAD rises, despite weaker US dollar amid higher crude-oil prices

The USD Index, which measures the buck's value against a basket of six rivals, loses 0.10%, sits at 94.10. Contrarily, the US 10-year Treasury yield advances almost three basis points, currently at 1.481%, acting as a tailwind for the USD/CAD pair.

Furthermore, higher crude oil prices failed to underpin the Loonie, with Western Texas Intermediate (WTI) the US crude oil benchmark rallying some 0.63%, trading at $80.87, approaching the $81.00 figure.

In the last week, three central banks pushed back against higher interest rates. Focusing on the Federal Reserve, the US central bank unveiled its bond-taper asset, to begin by the middle of this month. The pace of its reduction would be $15 billion each month, but it opened the door for further acceleration depending on economic conditions. However, they start to put aside employment figures, becoming more vocal about inflation, blaming supply bottlenecks and chain disruptions.

After the FOMC meeting, market participants started to price in one interest rate hike by late 2022, which in the USD/CAD could be positive for USD bulls. However, the Bank Of Canada has already finished its QE program, and the market expects higher rates than in the US.

According to Royal Bank of Canada in a note to clients, "given inflation concerns and uncertainty about the degree of economic slack, we think the bank will lean toward an earlier rate hike in April. Our call for three rate increases in 2022 is still well short of the four to five hikes priced in by markets."

Later in the week, the US economic docket will feature fed speakers, inflation figures, and employment data that could offer fresh impetus for USD/CAD traders.

USD/CAD Price Forecast: Technical outlook

The USD/CAD pair is steady above the bearish-flag top-trendline in the daily chart, approaching the 200-day moving average (DMA) at 1.2475. Furthermore, the Relative Strength Index (RSI), a momentum indicator at 53, aims slightly up, confirming an upward bias. However, USD bulls will need a daily close above the 200-DMA to resume the uptrend firmly. In that outcome, the confluence of the 50 and the 100-DMA within the 1.2530-40 range would be the next supply zone. A breach of the latter would expose 1.2600.

On the flip side, failure at the 200-DMA and a break beneath the 1.2400 figure would open the door for further losses. The first demand zone would be the October 27 low at 1.2300. A downward break would expose the October 21 low at 1.2287.

EUR/USD seems to have gone into a consolidation phase. Still, economists at Scotiabank think a breach of 1.15 is only a matter of time with a test of 1.14 following relatively quickly.

EUR/USD at risk of falling below 1.15

“The EUR/USD traded narrowly in a <30pips range with decent support in the 1.1550 zone on dips while the 1.1575 area stands as resistance.”

“The EUR’s steep swings over the past two weeks have left it a clear risk of a test – and cross – of 1.15 amid continued downward pressure since late-May. A cross under the figure sees limited support until 1.1422 and the 1.14 area and then losses could quickly extend into the 1.11s.”

“The 1.16 zone is resistance followed by the mid-figure area that stands as downtrend resistance.”

The USD/CAD is little changed to start the week, with spot holding in the mid 1.24s. Last week, the pair were halted by the 200-day moving average (DMA) at 1.2479, which is a sign of CAD strength but a minor bounce in the next few weeks is on the cards.

CAD to remain generally well-supported

“The overall technical tone remains consolidative and it is impossible to exclude the risk of USD/CAD creeping a little higher still in the next few weeks. But rejection of the 200-DMA is an important sign of resilience in the CAD, we think.”

“USD support is 1.2415 and 1.2385.”

“Resistance is 1.2525/30.”

GBP/JPY is seeing subdued trade, with prices not deviating too far from the 50-day moving average (which currently resides just under 153.20). The pair seems to have found some support ahead of the September highs in the 152.50-1.5300 region. To the upside, the 2 November low at 154.70 and the 21DMA at 155.80 are the most notable areas of resistance.

The pair had dropped more than 2.0% from early Thursday highs above 156.00 to Friday lows under 153.00, with the sharp decline triggered as the Bank of England wrong-footed investors by opting not hike interest rates by 15bps and sounding much more dovish thank expected with regards to the potential for rate hikes over the coming years. But GBP/JPY is seeing a modest rebound on Monday and has now clambered back to the north of the 153.50 level, despite the ongoing presence of UK/EU tensions.

UK press reported over the weekend that the UK is set to trigger Article 16, a clause that allows the UK (or EU) to unilaterally suspend parts of the Northern Ireland protocal if its implementation is causing significant societal damage. A final decision will be taken by the end of the month, the reports suggested. EU leaders have warned in recent weeks that such a move by the UK could lead to the EU suspending the entirety of its existing trade deal with the UK. A suspension of the post-Brexit free-trade deal of represents a downside risk to a UK economy already struggling with supply chain turmoil, high energy costs and a sharp recent drop in fiscal stimulus after the expiry of the government’s employee furlough scheme.

This Week

Focus returns to the Bank of England on Monday, with Governor Andrew Bailey partaking in a Q&A session from 1700GMT. Looking ahead to the rest of the week, the main event for sterling traders will be the release of the preliminary estimate of Q3 GDP data at 0700GMT on Thursday. Yen traders, meanwhile, will keep an eye on a steady trickle of data releases, including September trade and current account metrics and the Eco Watchers Survey on Tuesday and October Producer Price Inflation on Thursday.

Gold has capitalized on falling US T-bond yields and looks to extend its rally north of the multi-month downtrend, strategists at TD Securities report.

Gold is itching for a breakout

“Gold prices are set to challenge the multi-month downtrend from all-time highs. Counter-intuitively, this comes after a strong Nonfarm Payrolls report.”

“The central bank has reiterated that its tools cannot help ease the temporary supply constraints that have ultimately driven inflation higher. In this context, markets for central bank hikes are repricing. In this context, US real yields are plummeting, in support of gold prices.”

“A breakout north of the multi-month downtrend could help the trend of ETF outflows reverse, powering gold prices even higher.”

“Unfortunately for the bulls, we expect that a recent CTA buying program has run its course, suggesting algorithmic trend follower flow will not lend its support.”

USD/MXN has come off the June, October and current November highs at 20.7490/9794. In the view of Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, the pair is set to head back down towards the 19.5980 June low.

Key resistance at 20.7490/9794 provoked failure

“USD/MXN recent steep ascent only briefly overcame the June and October highs at 20.7490/9035 and made its current November peak at 20.9794 before giving back most of its recent gains.”

“The October through at 20.1195 is back in focus, a drop below which would engage the 2020-2021 support line and September low at 19.9876/8476 and the April and May as well as the late June to mid-August lows at 19.8001/7061. Then there is the June low at 19.5980 which is also expected to eventually be reached provided that no rise and daily chart close above last week’s high at 20.9794 is made.”

“If last week’s high at 20.9794 were to unexpectedly be exceeded on a daily chart closing basis, the February high at 21.0483 would be back on the plate. Further up lies the March high at 21.6380.”

Federal Reserve Vice Chair Richard Clarida said on Monday that benchmarks for rate hikes could be met by the end of 2022 but added that the Fed is still "a ways away" from considering lift-off, as reported by Reuters.

Additional takeaways

"Policy path outlined in September dot plot would be consistent with Fed's framework if current inflation and jobs forecasts are met."

"Repeat of 2021 inflation next year would not be a policy success."

"Core PCE inflation measured since Feb. 2020, before the pandemic, through Sept. 2021 already averaging 2.8%."

"Expecting full return to pre-pandemic employment levels by end 2022, unemployment rate at 3.8% with participation rising."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen trading flat on the day near 94.20.

The Norwegian krone continued to weaken over the past week, mainly due to lower oil prices. Consolidation is likely the name of the game in the short-term, however, risks remain on the upside in both EUR/NOK and USD/NOK, economists at Nordea report.

NOK weakened during the past week

“Lower oil prices have led to a weaker NOK. Last week’s OPEC+ meeting resulted in an increase in production by 400K barrels/day, in line with the original plan from the cartel. What has likely contributed negatively to the oil price is a weaker demand outlook in China due to the resurgence of covid, and statements from President Biden that oil prices are unacceptably too high.”

“First resistance level for EUR/NOK is at 10.00 and then around 10.15. On the downside, 9.80 and then 9.75 are support levels.

“For USD/NOK, we have resistance around 8.60/8.70 on the upside, and support around 8.45 on the downside.”

“This week’s calendar is short. Inflation figures in the US and Norway will be released, but their effects on the NOK should be minor.”

St. Louis Federal Reserve President James Bullard told Fox Business Network on Monday that he sees the Fed hiking its policy rate twice in 2022, as reported by Reuters.

Additional takeaways

"If we had to, we could end the taper somewhat sooner than June."

"If inflation is more persistent, we may have to take action a little sooner."

"We have done a lot to move policy in a more hawkish direction."

"We have quite a bit of inflation."

"I expect supply chain disruptions to extend through 2022."

"I expect a lot of continuity in Fed policy no matter how Fed Chair appointment process works out."

Market reaction

Investors showed little to no reaction to these comments and the US Dollar Index was last seen losing 0.04% on a daily basis at 94.18.

In an interview with Fox Business Network on Monday, St. Louis Fed President James Bullard said that he expects the US economy to grow by more than 4% in 2022, as reported by Reuters.

Additional takeaways

"It's one of the hottest labour markets in the post-war era."

"I expect unemployment to fall below 4% sometime in the first quarter."

"Not really looking at much improvement in the labour force participation going forward."

Market reaction

These comments don't seem to be having a significant impact on the dollar's performance against its major rivals. As of writing, the US Dollar Index was posting small daily gains at 94.15.

AUD/USD continues to meander close to the 0.7400 level, a level around which is has gently pivoted since the US dollar weakened in response to last Friday’s US labour market report (despite that report being stronger than expected across most metrics). In recent trade, it has pushed to fresh daily highs just above 0.7410, but isn't showing much conviction as of yet. The key levels that technicians will be watching this week are the 50-day moving average (DMA) at 0.7445 and last Wednesday’s high at 0.7470 to the upside and the 21DMA and last week’s low in the 0.7360 region to the downside. Chinese trade data overnight was mixed; exports beat expectations, but imports missed and, thus, given that China is a big export destination for Australian goods, this is a net negative for AUD. Analysts read the weaker than expected import data as further signs that Chinese growth momentum continues to weaken.

This Week

Last week was a hectic one, with the RBA and Fed both deciding on monetary policy and the end result being a sharp fall for the pair as a dovish RBA Governor Philip Lowe pushed back more aggressively against market pricing for rate hikes in 2022 than his Fed counterpart Jerome Powell. In the absence of key central bank events and the US labour market report, this week should be a calmer affair, though there are plenty of Fed policymakers speaking publically this (including a number throughout Monday’s US session) and US inflation data is set for release on Tuesday (the Producer Price Inflation report) and Wednesday (the Consumer Price Inflation report).

Meanwhile, Thursday sees the release of both Australian and US jobs data; the former is the official labour market report for Australia for the month of October and is expected to show employment rising modestly as lockdowns were eased, while the latter is the US September JOLTs report, which should show that labour demand in the US remains incredibly strong. Ahead of Aussie jobs on Thursday, the release of the NAB October Business Confidence survey during Tuesday’s Asia Pacific session and then the release of the Westpac Consumer Confidence survey during Wednesday’s APac session may trigger some AUD volatility.

European Central Bank (ECB) chief economist Philip Lane said on Monday that supply bottlenecks and rising energy prices are the main risks to the pace of economic recovery and the inflation outlook, as reported by Reuters.

Additional takeaways

"Our analysis is indicating that the euro area is still confronted with weak medium-term inflation dynamics remains compelling."

"If supply shortages and higher energy prices last longer, these could slow down the recovery."

"If persistent bottlenecks feed through into higher than anticipated wage rises or the economy returns more quickly to full capacity, price pressures could become stronger."

"Economic activity could outperform our expectations if consumers become more confident and save less than currently expected."

Market reaction

These comments don't seem to be having a significant impact on the common currency's performance against its rivals. As of writing, the EUR/USD pair was up 0.12% on a daily basis at 1.1578.

EUR/USD failed to sustain its break to new lows on Friday and remains floored above 1.1495/93 – the March 2020 high and 50% retracement of the 2020/2021 bull trend. Nevertheless, a major top remains in place and analysts at Credit Suisse still look for a resumption of the core downtrend.

Resistance at 1.1683/95 to cap

“EUR/USD failed to sustain a break to new 2021 lows and remains floored above major support at 1.1495/93 – the March 2020 high and 50% retracement of the 2020/2021 bull trend, with short-term momentum increasingly poor. Nevertheless, our bias stays lower following the recent decisive rejection of key resistance from its falling 55-day average (and downtrend from June) at 1.1683/95.”

“A major top remains in place, reinforcing the case for a resumption of the core downtrend and a clear break below the 1.1524/13 October lows. Below here and 1.1495/93 would trigger a move to support then seen next at 1.1377/70, before the 61.8% retracement at 1.1300/1.1290, where we would expect to see another pause.”

“Resistance stays at 1.1614/18, with 1.1632/36 ideally capping. We shall maintain an immediate tactical bearish bias though whilst below 1.1689/95.”

Recent US dollar strength versus the South African rand has come to an end. USD/ZAR topped out at 15.4929 and is to slide back towards the September trough at 14.0630, Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, reports.

USD/ZAR depreciation is on the cards

“The 55-day moving average at 14.7906 and also the 200-day moving average and six-month support line at 14.5638/4530 are now back in the frame, as is the October trough at 14.3520 and also the September low at 14.0630.”

“Below the September low at 14.0630 the June trough can be spotted at 13.4066.”

“We will adhere to this bearish forecast while resistance at 15.4929 caps on a daily chart closing basis. Short-term sideways trading is likely to be seen, however.”

“Above the 15.6645/6945 zone lies the May 2016 high at 15.9854.”

- GBP/USD attracted some buying near mid-1.3400s amid renewed USD selling bias.

- The prevalent risk-on environment acted as a headwind for the safe-haven USD.

- Rebounding US bond yields might limit the USD slide and cap gains for the major.

- Dovish BoE, Brexit jitters might further hold bulls from placing aggressive bets.

The GBP/USD pair climbed further beyond the key 1.3500 psychological mark and refreshed daily tops heading into the North American session. The pair was last seen trading around the 1.3530-35 region, up nearly 0.30% for the day.

Following an intraday dip to mid-1.3400s, the GBP/USD pair gained some positive traction and built on Friday's recovery move from five-week lows touched in reaction to the upbeat US NFP report. The underlying bullish sentiment in the financial markets undermined the safe-haven US dollar, which, in turn, was seen as a key factor that provided a goodish lift to the major.