- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-11-2021

One-month risk reversal (RR) of GBP/USD, a gauge of calls to puts, snaps a two-day downtrend by the end of Tuesday’s North American session. In doing so, the RR prints 0.0000 level, following the -0.042 and -0.050 numbers.

Although the options market data suggests that the GBP/USD sellers have stepped back, concerns over Brexit, recently fueled by comments from an Irish Foreign Minister Simon Coveney, challenge the pair buyers.

Also questioning the pair buyers is the market’s anxiety over the Fed’s next action and inflation concerns ahead of the US Consumer Price Index. Hence, the resulting figure of 0.0000 seems to be justified.

Adding to the watcher’s list is Thursday’s UK GDP, as well as the British covid conditions, which pose a challenge to the GBP/USD bulls.

That said, the quote seesaws around 1.3560 after the previous day’s pullback from the weekly top.

Read: GBP/USD set to end the session flat in mid-1.3500s ahead key US, UK data looms

- AUD/USD remains on the back foot for second consecutive day, refreshes intraday low of late.

- Sustained trading below the key SMAs, join downbeat RSI and MACD signals to keep sellers hopeful.

- The previous support line from late September holds the key to bull’s entry.

AUD/USD takes offers to refresh intraday low around 0.7370, down 0.13% on a day, while extending Tuesday’s downbeat performance during Wednesday’s Asian session.

In doing so, the Aussie pair justifies the downside break of the 200-SMA and descending RSI line, not to forget mentioning that recently bearish MACD signals.

However, the double bottoms marked around 0.7360 restricts the quote’s immediate downside before directing it to the 61.8% Fibonacci retracement (Fibo.) of the September-October uptrend, near 0.7315.

Alternatively, a clear upside break of the 200-SMA hurdle around 0.7385 needs validation from the 0.7400 round figure to aim for a convergence of the 100-SMA and 23.6% Fibo. close to 0.7470.

In a case where the AUD/USD bulls cross the 0.7470 resistance, they can head towards the 0.7500 threshold and then to the monthly peak close to 0.7555. During the rise, the previous support line from late September, around 0.7520, will act as an extra filter to the north.

AUD/USD: Four-hour chart

Trend: Further downside expected

- USD/CAD remains pressured for the consecutive fourth day, nears intraday low of late.

- WTI jumps to fresh one-week high amid softer USD post API draw.

- BOC’s Mecklem refrained from monetary policy clues after previously citing inflation fears.

- US inflation, WTI EIA stockpiles and Canada Leading Indicators eyed for fresh impulse.

USD/CAD stays depressed around 1.2430, recently sidelined during the four-day downtrend on early Wednesday. In doing so, the Loonie pair cheers the upbeat performance of Canada’s key export item, i.e. WTI crude oil, while paying a little heed from the latest comments of Bank of Canada (BOC) Governor Tiff Mecklem.

WTI crude oil prices take bids around $83.50, the highest level in a week. The black gold recently cheered upbeat oil stocks change figures from the American Petroleum Institute (API). Also favoring the bulls were comments from the White House and softer US dollar.

Read: WTI refreshes weekly high past $83.00 on API oil inventory draw, EIA data in focus

That said, the US Dollar Index (DXY) dropped for three consecutive days in the last, indecisive around 93.95 of late. The greenback gauge tracked the US 10-year Treasury yields amid the market’s rush to risk safety and indecision over the Fed’s next moves.

Elsewhere, the BOC Governor Mecklem highlights the importance of direct communication channels, better listeners and improved understanding of policy during the closing remarks at an online conference on diversity and inclusion in economics and central banking. The policymakers earlier termed the inflation fears as ‘transitory’ but eyed a longer phase of higher price pressure, indirectly signaling tighter monetary policy going forward.

Amid these plays, S&P 500 Futures track Wall Street losses while the US Treasury yields and the DXY remain on the back foot by the press time.

Looking forward, Canada Leading Indicators for November will precede the weekly official oil inventory data from the US Energy Information Administration (EIA) to direct short-term USD/CAD moves. However, major attention will be on the monthly inflation figure from the US.

Read: US October CPI preview: Inflation data unlikely to discourage gold bulls

Technical analysis

While 200-DMA restricts immediate USD/CAD moves around 1.2475, two-week-old support challenges immediate downside near 1.2430. It should be noted, however, that bullish MACD signals and a steady RSI line keep buyers hopeful.

- EUR/USD at stone's throw from 1.1600, US inflation number may provide momentum.

- Multiple factors like ECB's dovish stance, new COVID-19 cases push the euro southwards.

- The single currency awaits Germany inflation figure, ECB's Elderson speech to provide fresh impetus.

The EUR/USD eases below 1.1600 level during the early Asian session on Wednesday. At the time of reporting, the single currency was trading at 1.1592, up by 0.01% for the day so far. The spot ranged from a low of 1.1569 to a high of 1.1609 overnight, ending slightly higher on the day. The euro may continue a similar trend today or decline further in the coming days on multiple factors. Major central banks could push against the market expectations for tighter monetary policies and fears of economic slowdown would be expected to hamper the euro's progress.

Earlier this month, the European Central Bank president, Christine Lagarde, renewed her dovish stance. Therefore, the markets are betting for an interest rate hike in the second half of the following year. However, the absence of any words on rate hikes have pushed the euro southwards, and this condition may subside.

In addition to this, on Monday, ECB chief economist Philip Lane said that tightening monetary policy to temper the current bout of inflation in the eurozone would be counterproductive. However, top ECB supervisor Andrea Enria said on Tuesday that low ECB interest rates were now hurting bank margins. Also, the rising number of new COVID-19 cases in the European region has pushed investors on edge, resulting in the decreasing EUR/USD.

For the day ahead, investors wait for Fedspeak and US stimulus to derive impetus. Also, ECB's Frank Elderson's speech, inflation figures for Germany and Bundesbank Weidmann can affect the pair near term moves. US Consumer data will be the main event.

''October’s CPI result is expected to be driven by a lift in core prices (Westpac f/c: 0.5%mth, market median 0.6%). A 0.6% rise in overall CPI would take the annual inflation rate to 5.9%, which would be the highest inflation rate since 1990,'' analysts at Westpac explained.

Meanwhile, the US dollar is trading at 93.96 and it may rebound to hit the 94 and above level on the back of a weaker US Treasury yield at 1.43%

EUR/USD technical support/resistance levels

The daily chart shows the initial resistance to the upside resistance remains at the 21-day Simple Moving Averages (SMA). The next barriers to the upside are at the 50, the 100 and the 200-day SMA, i.e., 1.1670, 1.1740 and 1.1887, respectively.

The support level of October 13, 1.1527 can be tested. If it breaks, the psychological levels 1.1500 and 1.1400 lie below.

The pair's Relative Strength Index (RSI) level recovers but stays below the 50-line barrier and holds ground in the short term. The Moving Average Convergence Divergence (MACD) has a bullish vibe while the euro has an unimpressive print.

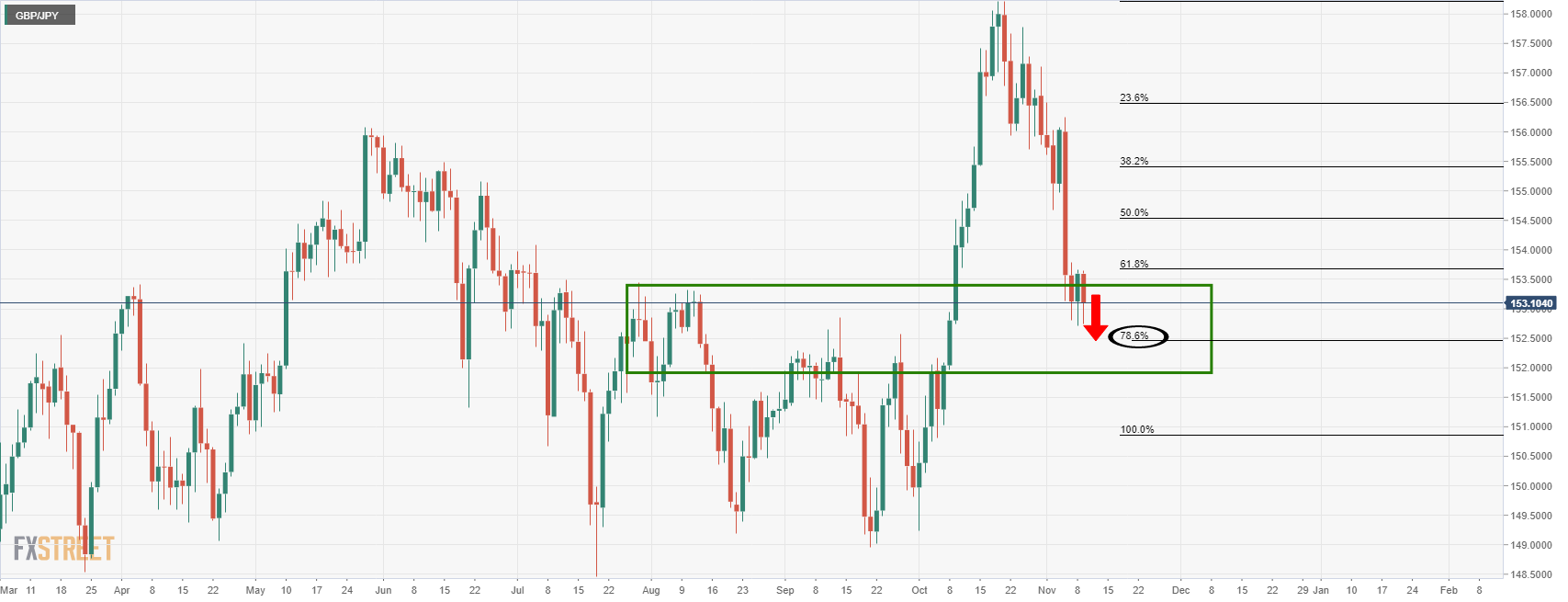

- GBP/JPY wavers inside short-term trading range, recently bounced off range support.

- 100-day, 50-day EMAs restrict immediate moves amid descending RSI line, not oversold.

- Key Fibonacci retracement levels also challenge the bears of late.

GBP/JPY consolidates the previous day’s losses around 153.07 during Wednesday’s Asian session.

In doing so, the cross-currency pair bounces off the 100-day EMA while staying inside the weekly trading range below 50-day EMA. Also acing as trade filters are the key Fibonacci retracement (Fibo.) levels of the late September-October upside.

Even so, descending RSI line, not oversold, keeps GBP/JPY sellers hopeful of breaking the immediate 100-day EMA support of 152.90 and battle with the 61.8% Fibo. level surrounding 152.50 for further downside.

In a case where the quote remains weak past 152.50, the mid-September lows near 150.80 and the 150.00 psychological magnet will lure the GBP/JPY bears before the yearly bottom of 148.45 marked in July.

On the contrary, recovery moves may initially poke the 50% Fibonacci retracement level of 153.60 before challenging the 50-day EMA, around 153.80 at the latest.

Even if the GBP/JPY buyers manage to cross the 153.80 hurdle, 38.2% Fibo. and a descending trend line resistance from October 21, respectively around 154.45 and 155.50, will question the quote’s further advances.

GBP/JPY: Daily chart

Trend: Further weakness expected

- EUR/CAD begins the Asian session up, 0.03% amid CAD weakness across the board.

- EUR/CAD Technical outlook: The pair is trapped within the 1.4292-1.4441 range, but it is closing to the top of the range.

- EUR/CAD: It has a downward bias in the mid-term, but support around the 1.4290’s could cap any downward move.

The EUR/CAD pair begins the Asian Pacific session on the right foot, advances 0.03%, trading at 1.4425 at the time of writing. On Tuesday, the market mood was in risk-off mode as portrayed by major US equity indices finishing in the red, losing between 0.31% and 0.71%. Also, in the FX market, risk-averse conditions boosted safe-haven currencies, like the Japanese yen and the Swiss franc.

On Tuesday, the Canadian dollar benefitted throughout the Asian and the European session, as witnessed by the EUR/CAD sliding towards 1.4391. But, once American traders got to their desks, the shared currency edged higher, propelled by gains in the EUR/USD pair. Contrarily, the Loonie depreciated against the greenback, which ultimately weighed on the EUR/CAD pair.

EUR/CAD Price Forecast: Technical outlook

-637720943288232555.png)

The daily chart depicts that the pair as of yesterday is trapped on the October 27 price action within the 1.4292-1.4441 range. The daily moving averages (DMA’s) above the spot price indicate the pair has a downward bias. Furthermore, the Relative Strength Index (RSI), at 46, confirms the mid-term bias, so EUR/CAD sellers could be found around the 1.4400 area, as It was tested three times before.

Nevertheless, the EUR/CAD pair has been trading near the top of the October 27 high in the last four days, so the near-term trend appears to be tilted to the upside. In the outcome of an upward break, above the latter, the first resistance level would be the May 12 low at 1.4581. A breach of that level could expose the 50-DMA at 1.4617.

On the flip side, to resume the downward bias, EUR/CAD sellers would need to reclaim the 1.4300 figure. In that outcome, the following demand zone would be February 16, 2020, low at 1.4263.

- WTI prints four-day uptrend, pokes monthly high after industry stockpile data.

- Weekly API Crude Oil Stocks Change drops 2.485 million barrels.

- Softer US dollar battles downbeat EIA oil demand forecasts, US SPR concerns.

- EIA inventories, US CPI will be in focus for near-term direction.

WTI bulls keep reins around $83.30, posting a fresh one-week high during Wednesday’s Asian session. The oil benchmark recently cheered industry data showing a draw in the weekly stockpiles as well as the White House comments rejecting announcement on Strategic Petroleum Reserve (SPR) for today. Also positive for the black gold is the softer US dollar. However, reflation fears question the up-moves ahead of the weekly official oil inventory data from the US Energy Information Administration (EIA).

That said, the private oil stocks change figures from the American Petroleum Institute (API) dropped below +3.594 Million Barrels (MB) to -2.485 MB for the week ended in November. Further, Bloomberg’s Javier Blas quotes the White House in his latest tweets while saying, “White House says it won't be announcing SPR oil release today.” His tweets also mention the White House as seeing oil prices as top issue, will act as needed. “White House says it continues to engage with OPEC+ on raising supply,” per Bloomberg’s Blas.

On Tuesday, the commodity prices cheered downbeat US dollar, tracking softer US Treasury yields on inflation fears. In doing so, the quote ignores Bloomberg’s Short Term Energy Outlook (STEO) forecasts predicting that the market would have an excess supply early in the following year and reported that prices would fall in December from current levels.

Elsewhere, concerns surrounding China’s debt markets and inflation fears ahead of the Consumer Price Index (CPI) data from Beijing as well as the US probe the oil buyers even as hopes of economic recovery and supply outage underpin the commodity prices.

Looking forward, the US inflation data for October will be important for the short-term USD moves and hence important for the oil traders to watch. Also, the weekly release of the EIA Crude Oil Stocks Change for the period ended on November 05, expected +1.91M versus +3.291M prior, will offer additional details to direct the WTI moves.

Read: US October CPI preview: Inflation data unlikely to discourage gold bulls

Technical analysis

A clear upside break of a 12-day-old resistance line, now support around $82.60, directs WTI bulls towards the multi-month high flashed in October around $85.00.

- Silver reverses pullback from short-term resistance, sidelined of late.

- Firmer RSI, sustained trading beyond 200-SMA keeps buyers hopeful.

- September’s top add to the upside filters, Fibonacci retracement levels eyed for immediate support.

Silver (XAG/USD) keeps the bounce off $24.00 during the initial Asian session on Wednesday, remains indecisive around $24.30 at the latest. In doing so, the bright metal reverses the pullback from a downward sloping trend line from early September while keeping the last week’s rebound from the 200-SMA.

Given the firmer RSI conditions backing the price strength, the commodity is likely to overcome the immediate trend line hurdle surrounding $24.50. However, September’s peak near $24.85 and the $25.00 threshold can challenge the XAG/USD bulls afterward.

Should the quote stay firmer past $25.00, June’s low around $25.50 and August month’s peak near $26.00 will be in focus.

Alternatively, pullback moves remain less important until staying beyond 61.8% Fibonacci retracement (Fibo.) of September month’s downside, around $23.55.

Following that, the 200-SMA level around $23.30, 50% Fibo. close to $23.15 and the $23.00 round figure should lure the silver bears.

Silver: Four-hour chart

Trend: Further upside expected

- AUD/USD struggles to overcome monthly low, consolidates weekly losses of late.

- Market sentiment worsens of reflation fears, doubts over Fed reshuffle.

- US Treasury yields drop six-week low, equities weakness as well.

- Aussie Westpac Consumer Sentiment, China CPI can entertain traders ahead of US inflation figures.

AUD/USD remains depressed around weekly low, fades bounce off 0.7360 near 0.7380 as Asia-Pacific traders begin Wednesday’s work.

Although the upbeat Aussie data and softer US dollar pleased the pair buyers during early Tuesday, concerns relating to inflation, Fed and China weigh on the quote afterward. However, today’s inflation numbers from Australia’s key customer China, followed by the US Consumer Price Index (CPI) figures, will be the key to watch for fresh impulse.

National Australia Bank’s (NAB) strong sentiment numbers for November failed to extend the week-start positive performance even as the US Dollar Index (DXY) stays weak. The reason could be linked to the market’s rush for risk-safety, which in turn underpinned the US Treasuries and gold prices while weighing down the equities.

The risk aversion takes clues from uncertainty over the US Federal Reserve’s (Fed) next step amid chatters over reshuffle and policy bears being interviewed by President Joe Biden. Also, the US Producer Price Index (PPI) matched the upbeat forecast for October and kept reflation fears on the table ahead of today’s key price pressure data. Additionally challenging the sentiment were fears over China’s debt concerns and Evergrande, not to forget chatters of further heating inflation and supply outage.

Alternatively, Fed Chair Jerome Powell tried to downplay the inflation fears and strong jobs report but failed to revive market optimism.

Moving on, the Westpac Consumer Confidence for November, prior -1.5%, will precede China’s CPI and PPI data for October to direct short-term AUD/USD moves. Following that, the US inflation numbers will be crucial to watch. Above all, Fedspeak and US stimulus are the key to follow.

Given the chatters over 26-year high factory-gate inflation from China, AUD/USD may remain pressured on firmer inflation data as Beijing struggles to handle multiple issues. The downside momentum may escalate should the US CPI remain firmer.

Read: US October CPI preview: Inflation data unlikely to discourage gold bulls

Technical analysis

Failures to cross the 200-day EMA resistance, around 0.7435 by the press time, redirects AUD/USD bears towards the 0.7360 support comprising 50% Fibonacci retracement (Fibo.) of September-October upside. A clear break of the key Fibo. becomes necessary for the bears to keep reins.

New Zealand (NZ) Trade Minister Damien O'Connor crossed wires via Reuters during early Wednesday morning in Asia, speaking over the matters relating to the Asia-Pacific Economic Cooperation (APEC) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Also joining the NZ Trade Minister O'Connor was New Zealand Foreign Minister Nanaia Mahuta who said, per Reuters, "No consensus yet on US offer to host apec 2023."

Key quotes

APEC Ministers reiterated strong stance against vaccine nationalism.

APEC members reject protectionism.

Welcome all applicants (On Taiwan's application to CPTPP).

FX reaction

NZD/USD pays a little heed to the news, staying pressured around 0.7130 by the press time.

Read: NZD/USD bears waiting to pounce, 0.7080 eyed

- AUD/JPY slides during the day. Almost 1% on risk-aversion through all the financial markets.

- AUD/JPY Technical Outlook: The double-top chart pattern target was reached, but downward pressure remains.

The AUD/JPY slides sharply during the day, down 0.9%, is trading at 83.30 at the time of writing. Risk-off market mood spurred a flight to safe-haven currencies, with the Japanese yen and the Swiss franc prospects rising, whereas the risk-sensitive currencies like the AUD and the NZD slump during the day.

Furthermore, major US equity indices slide between 0.44% and 0.80% during the New York session, as market participants await US consumer inflation figures on Wednesday.

AUD/JPY Price Forecast: Technical outlook

Daily chart: Double-top 83.10 target reached

The AUD/JPY daily chart depicts the pair reached the double-top pattern target at 83.10, that confluences with the 50% Fibonacci retracement around that area. The AUD/JPY bounced off that area towards the 83.20s area, where it currently resides, as the AUD/JPY traders wait for fresh impetus to resume the upward bias, as depicted by the daily moving averages (DMA’s) below the spot price.

4-hour chart

-637720894044718557.png)

Zooming into the 4-hour chart, it depicts that, albeit reaching the double top’s target, the pair has some selling pressure left, as witnessed by the simple moving averages (SMA’s) residing well above the spot price. Further, the Relative Strength Index (RSI) at 31 just exited oversold levels, meaning that AUD/JPY sellers could still aim for a correction beyond the 83.00 figure.

A break beneath the latter would expose the 82.00 psychological support that, once breached, would expose the October 6 high at 81.41.

On the flip side, a break above 83.71 could pave the way for further gains. The first resistance would be the 84.00 figure, followed by the so-called neckline of the double top, around 84.61, followed by the 100-SMA around the 85.00 area.

- NZD/USD is under pressure as traders in Asia take over the baton.

- Bears will be looking for a break of the hourly dynamic trendline support.

NZD/USD is starting out the Asian session at a precarious position on the charts. The pair ended on Wall Street down some 0.4% on the day after falling from a high of 0.7174 and meeting a low of 0.7109 in the mid-New York session. The pair has since corrected a significant portion of the slide, but bears are lurking at hourly resistance, as illustrated below.

At the time of writing, NZD/USD sit s at 0.7132 after another night of haphazard trading. ''The USD DXY index was actually little changed, but AUD and NZD are both lower, with newswires blaming everything from a souring in risk appetite to softer copper prices,'' analysts at ANZ Bank explained. ''It is difficult to be definitive, but having done well on most crosses, the NZD is under renewed pressure this morning, and holding above 0.72 has been a struggle of late.''

Key events in focus

Meanwhile, the key events for the week are minimal on the domestic front, but Aussie jobs data and US inflation numbers could move the needle on the bird. US Consumer Price Index data is what markets are in anticipation of the most. Economists polled by Reuters see monthly CPI accelerating to 0.4% from the previous month's 0.2% rise, with the closely watched year-on-year core measure gaining 0.3 percentage points to 4.3%, well above the Fed's average annual 2% inflation target.

As for Aussie jobs, what goes down in Australia is expected, usually, to impact the kiwi. However, there has been a divergence of themes between the two central banks playing out of late. The kiwi has been drawing support from the possibility that the Reserve Bank of New Zealand could raise rates by as much as 50 basis points later this month.

NZD/USD technical analysis

Should the bears take out the trendline support, then the horizontal 0.7120s will be pressured and a break thereof could give rise to a fall into the bear's target zone between 0.7105 and 0.7070 in the coming sessions.

- GBP/USD trades flat in the 1.3560 area, having failed an earlier attempt to push above 1.3600.

- Cable traders are in wait-and-see mode ahead of key US inflation data on Wednesday and UK GDP data on Tuesday.

It’s been a subdued session for GBP/USD, with the pair set to end the session flat in the 1.3560s, having swung between highs above 1.3600 to lows in the 1.3520s. The seemed to attract selling interest at the 1.3600 level, given that it also coincides nicely with last Tuesday’s low. But the selling momentum quickly waned, with FX market participants likely to keep their toes out of the water ahead of the two most important data releases of the week for cable; the US October Consumer Price Inflation report, set for release at 1330GMT on Wednesday, and the preliminary estimate of Q3 UK GDP growth, set for release at 0700GMT on Thursday.

Fed and BoE speakers have been on the wires today, but none added anything new to the policy debate and thus did not shift the dial for FX markets. There has been quite a lot of attention on a sharp drop in US yields, a move that has not been reciprocated in UK bond markets, though the move of US/UK rate differentials in GBP’s favour on Tuesday has not seemed to help GBP/USD. That could be because Brexit remained in the headlines on Tuesday. Essentially the EU is threatening countermeasures if the UK opts to trigger Article 16, which allows it to unilaterally suspend parts of the Northern Ireland Protocol. No-deal Brexit risk is back on the table.

Should Brexit risks materialise (i.e. the EU suspends large parts of the existing UK/EU trade deal in retaliation to the UK triggering article 16), GBP is likely to come under more severe pressure. In this case, a move lower towards annual lows in the low 1.3400s is on the cards. Indeed, technical momentum seems to point in this direction; Tuesday’s price action saw GBP/USD test and respect a downtrend that has been in play since the end of October, signaling continued downside in the pair is likely.

-637720879679650191.png)

- The S&P 500 looks set to snap an eight-session run of record closes.

- Traders cited profit-taking as Q3 earnings seasons draws to a close and inflation worries as weighing on stock prices.

- Tesla shares continue to drop with CEO Musk expected to sell 10% of his holdings.

The S&P 500 looks likely to snap a historic run higher on Tuesday. On Monday, the index posted a record closing high for an eighth consecutive session above 4700, but ahead of the Tuesday close the index is trading around 0.4% lower, having fallen back to the 4670s. Similarly, the Nasdaq 100 index is 0.7% lower and the Dow is 0.5% lower.

The Q3 earnings season, which has been one of the main drivers of the impressive rally across US equity markets from the September lows, is now drawing to a close. According to Refinitiv data cited by Reuters, 81% of the 445 S&P 500 to have reported earnings so far have beaten analyst expectations. As a result, traders said some profit-taking was inevitable, with one saying that “it's not a run for the exit, but I just don’t see a reason to add exposure now”.

Some analysts cited the October Producer Price Inflation (PPI) report, released prior to the US market open, as another reason for the cautious tone to trade. The YoY rate of PPI remained elevated at 8.6% in October, in line with expectations. That suggests the US October Consumer Price Inflation report, set for release at 1330GMT on Wednesday, is likely to also show persistently elevated price pressures. One risk to equity markets is that US price pressures remain elevated for longer than the Fed expects, or indeed worsen in the month ahead, which may force the Fed into raising interest rates earlier than currently expected. If the Fed is forced to raise interest rates before the labour market has fully recovered to pre-pandemic health, this could weigh on economic growth.

Tesla shares were down a further 10% on Tuesday, exerting a further drag on the S&P 500 and Nasdaq 100 indices, following Monday’s 4.8% decline. Over the weekend, Tesla CEO Elon Musk proposed selling 10% of his TSLA holdings in a Twitter poll, with the end result of the poll showing 57.9% in favour of the sale. Equity analysts said the underlying fundamentals that had underpinned the staggering rally in TSLA shares in recent years remain and that any downside as a result of the stock sale would be relatively short-lived amid strong investor demand to scoop up the available shares.

- WTI rallies during the New York session bounced off the lows at $80.900, gains $1.50.

- EIA cut the forecast for oil demand for 2022.

- WTI Technical outlook: Bullish flag in the 4-hour chart, targets $86.00

Western Texas Intermediate, also known as WTI, advances in the New York session, up almost 2%, trading at $82.93 per barrel at the time of writing. During the day, the black gold retreated under the $81.00 psychological figure, finding support at the 1-hour 50-simple moving average at $80.99, which capped the downward pressure on the US crude oil benchmark. Furthermore, recovered some early losses on positive news of the EIA cutting the forecast for oil demand for 2022.

According to Bloomberg, the Short Term Energy Outlook (STEO) predicted that the market would have an excess supply early in the following year and reported that prices would fall in December from current levels. Market participants were impatiently waiting for the report, as sources said the Biden administration was considering tapering the US Specific Petroleum Reserves (SPR).

Crude oil prices have risen as vaccination rates increased and COVID-19 cases dropped across the globe. That easied lockdowns, in turn, increased mobility of people, consequently spurring a higher oil demand. According to sources cited by Bloomberg, demand “is going to be reasonably tight” for the next 12 months, and a price spike to $100 a barrel is on the cards.

The White House has exerted pressure on OPEC and its allies to increase the crude oil output, but the cartel stayed put, sticking to its 400K crude oil barrel target per day.

At 21:30 GMT, the American Petroleum Institute (API) will reveal its Weekly Crude Oul Stock for the week ending on November 8. The previous reading was 3.594M. A report higher than the abovementioned could be bearish for WTI, otherwise could boost the WTI prospect for higher prices.

WTI Price Forecast: Bullish flag in the 4-hour chart, targets $86.00

The 4-hour chart depicts that WTI is breaking the top of a bullish flag, that according to technical analysis measures, could propel WTI’s towards $86.00 per barrel, but it needs to close above it. In that outcome, the first resistance would be the November 1 high at $83.97. A breach of the latter would expose the 2021 year-to-date high at $85.00 and then the bullish-flag target.

The start of the week came with renewed fears of a Brexit showdown as the Uk threatened to trigger emergency unilateral provisions in the Brexit divorce deal known as Article 16.

Article 16 is a clause in the Protocol on Ireland/Northern Ireland, a key part of the Withdrawal Agreement - the deal under which Britain left the European Union. The Article was sought to avoid a hard border between British-ruled Northern Ireland and EU member Ireland by introducing some checks on the movement of goods to Northern Ireland from mainland Britain.

The Article is essentially an emergency brake that will give permissions to either the UK or the EU to take action if the Protocol leads to persistent "serious economic, societal or environmental difficulties". The UK says this threshold has already been reached as a result of the trade frictions caused by the protocol, which requires all goods travelling from Great Britain into Northern Ireland to conform to EU rules.

''The UK government now says it has caused far greater disruption than anticipated at the time and needs to be fundamentally rewritten,'' the Financial Times recently reported. ''UK ministers also argue that the unionist community has lost confidence in the protocol and its continued application could destabilise the already fragile politics of the region.''

The FT explained that ''Brussels argues that without full legal controls on animal and plant products, Ireland’s place in the EU single market is undermined because its goods can no longer be trusted, so may require checks as they enter the EU. The UK would therefore be threatening Ireland’s economic rights as an EU member. This may be seen as intolerable by the 26 other EU member states. For its part, the UK says this concern is overstated.''

However, any UK decision to unravel the NI protocol would create another ‘no deal’ cliff-edge as the Irish foreign minister, Simon Coveney, has warned that the EU could shelve a Brexit trade deal if the UK triggers Article 16. Talks on possible reforms are seemingly deadlocked.

On Tuesday, the latest comments from the Irish Foreign Minister are a stark warning to the UK and should be noted by forex traders seeking investment in currencies vis sterling. He said in recent trade that if the UK sets aside parts of northern Ireland protocol, there will be a 'very robust response' from the EU. He says if the UK continues its current approach to talks, this is a negotiation that is going to run out of road.

GBP/USD daily chart

The daily chart shows that the price has been rejected at a 61.8% ratio already. Should the Brexit angst gain traction, then a break of the recent double bottom lows would be expected to put 1.3380 under pressure ahead of a deeper run towards the weekly 1.3180s (21 Dec lows).

What you need to know on Wednesday, November 10:

The greenback maintained its tepid tone during the Asian session but became more attractive during US trading hours. The catalyst for the dollar’s demand was another sign of inflationary pressures spurring risk-off. Wall Street edged lower after its overseas counterparts posted intraday gains, following the release of the US Producer Price Index, confirmed at 8.6% YoY in October.

The EUR/USD pair tried to advance past 1.1600 a couple of times but was rejected by persistently strong selling interest. European Central Bank policymakers commented on the future of the monetary policy. Klaas Knot said that conditions for a rate hike are very unlikely to be met in 2022, while top supervisor Andrea Enria said low ECB interest rates are now hurting bank margins more than they are boosting lending volumes. The European Central Bank maintains a wait-and-see stance, considering higher prices will be temporary.

The GBP/USD pair hovers around 1.3550 after a failed attempt to recover above 1.3600. Irish foreign minister Simon Coveney said that if the UK triggers Article 16 over Northern Ireland would prompt retaliatory action on Sunday, adding on Tuesday that it would trigger a “very robust response” from the EU.

Commodity-linked currencies fell alongside Wall Street. AUD/USD trades in the 0.7370 price zone, although the USD/CAD pair eased from its intraday high amid rallying oil prices.

The EIA cut its 2022 forecast of world oil demand by 130,000 barrels per day, raising this year forecast for oil demand by 60,000 barrels per day.

Gold trades at fresh one-month highs around $1,830 a troy ounce amid the dismal market’s mood. Government bond yields, however, edged lower with that on the 10-year US Treasury yield currently at 1.44%.

The US will publish the October Price Index on Wednesday, foreseen at 5.3% YoY.

Top 3 Bitcoin, Ethereum, XRP: Cryptos make all-time highs while investors realize profits

Like this article? Help us with some feedback by answering this survey:

- USD/CAD has reversed sharply back from earlier highs at its 200DMA and is back below 1.2450 again.

- A surge in crude oil prices has weighed on the pair in recent trade.

USD/CAD hit fresh four-week highs earlier in the session to the north of the 1.2480 level but has since pulled back below the 1.2450 level again amid ongoing strength in crude oil prices. Crude oil prices have been rallying in recent trade, which has been a tailwind for the energy-export-dependent loonie, with WTI prices now advancing in recent trade towards the $84.00 level from earlier session lows under $82.00.

Technical selling in USD/CAD is also playing an important role. The pair again tested its 200-day moving average at the 1.2480 area and the level was again rejected. But the selling pressure has eased with USD/CAD running into support in the form of an uptrend that has been in play since the end of October. Should prices break this uptrend to the downside and crude oil prices continue to advance, that would open the door to a move towards 1.2400, which also coincides with USD/CAD’s 50DMA.

So a move may have to wait for the latter half of the week, however, with FX market participants likely to remain reticent to place any big bets ahead of Wednesday’s all-important US Consumer Price Inflation report, which could cause choppiness for the US dollar. In terms of Canadian economic events, aside from a speech from BoC Governor Tiff Macklem on diversity at 2245GMT on Tuesday, there is nothing of note in the calendar for this week, which should ensure the pair trades as a function of USD and oil market dynamics.

Crude oil rallies

Crude oil prices have been rallying since the release of the latest US EIA monthly energy outlook report, which saw the agency increase its gas price forecasts when compared to the October report. The EIA now sees regular gas prices in the US averaging $3.0 per gallon in 2021 and $2.91 in 2022, up from $2.97 and $2.91 forecasts in the prior report.

The Biden administration, eager to do anything it can to lower energy prices, was said to be keen to scrutinise the report before making any final decisions on what measures it might take to reduce gas prices. A release of crude oil reserves from the Strategic Petroleum Reserve is on the table, but commodity analysts said they thought this would only temporarily weigh on prices, as it does nothing to fix the supply/demand imbalance that has lifted oil prices already by so much this year.

Minneapolis Federal Reserve Bank President Neel Kashkari is speaking at an Eau Claire Area Chamber of Commerce event and has said he believes the forces that are currently keeping people out of the labour market and pushing up prices will prove to be temporary.

He said the pressures will fade as COVID-19 turns from being pandemic to being endemic.

"We are getting mixed signals out of the economy," Kashkari said

"I'm optimistic, in the next three, six, nine months we will get a lot more information," and clarity about the outlook for both inflation and the labour market, he said.

Key comments

The next 3, 6, 9 months will be very important in getting more clarity on the economic outlook.

Right now there's a lot of uncertainty.

Whether it's a demand shock or a supply shock, either way, the story should be temporary.

Should reach equilibrium in the next few quarters.

The future outlook for inflation depends in part on what will happen with the labour supply.

Fed's Kashkari says he is ‘keeping an open mind’ on the monetary policy stance and has said that once the taper ends, the Fed would consider appropriate timing for rate hikes.

Market implications

Forex markets are waiting for the US Consumer Price Index and hence the US dollar is consolidating, rather than reacting to each comment from central bankers on Tuesday.

The US dollar has been moving in a tight range between 93.90 and 94.10 since data earlier the day showed that US Producer Prices had increased solidly in October.

Traders noted that while high inflation could persist for a while amid tight supply chains related to the pandemic, tomorrow's key event in CPI will be more key in this regard.

US dollar hourly chart

- USD/JPY bulls are testing the commitments of the bears from key hourly support.

- Bears need to break the double bottom lows for a run to the 112.08 daily target.

USD/JPY bears are in control from a daily basis while below 113.20 but are stalling in what could be hourly accumulation. The following illustrates the market structure and prospects of either a downside continuation towards daily targets 112.08/111.77 or a retest of 113.20 for the near term.

USD/JPY daily chart

As illustrated, the price is on the verge of a run towards the old higher of 112.08 and 111.77 below there.

USD/JPY H1 chart

USD/JPY is consolidating on the hourly time frame and is quite a mess. However, there is structure when breaking it down. The current trendline support will need to give out to the bears to expose the daily targets of 111.77/112.08.

However, given the double bottom lows, this is looking less likely as the price move into accumulation. With that being said, the old trendline support is now expected to act as a counter trendline resistance for which price closed below it on two occasions following a test of the 61.8% ratio. Until that trendline is broken, bears remain in the game and eye 112.08/111.77. If the price breaks 113 the figure and closes above on an hourly basis, then 113.20 will be vulnerable as the next area of interest.

- Spot palladium has pulled back sharply from earlier session highs above $2100 and now trades in the $2020s.

- Industrial metal prices are down and this could be pulling palladium lower, despite falling real yields boosting other precious metals.

Spot palladium has undergone a sharp drop in recent trade, pulling back aggressively from monthly highs just to the north of the $2100/oz level to the $2020s. Spot prices are currently about 2.5% lower on the day. The drop puts XPD/USD prices back below both its 50-day moving average (DMA) at $2064 and its 21DMA at $2044. For now, prices have found support at an uptrend that has been in play since the end of October, but should prices break below this uptrend (and the psychologically important $2000 level), that would open the door to a move towards October lows in the $1940s (more than 4% down from current levels).

The sudden pullback from highs comes despite a steady US dollar (the DXY is flat close to 94.00) and a sharp drop in US real yields (10-year TIPS yields are down over 9bps on the day and hoving just above record lows in just above -1.20%). Declining real yields reduces the opportunity cost of holding precious metals and thus is typically associated with stronger precious metal prices.

The reason for palladium’s underperformance on Tuesday may have something to do with the fact that, while the metal is classed as a precious metal, the majority of its demand (some 80%) is linked to auto-production. Automakers use palladium in exhaust systems to neutralise the harmful elements in emissions. Most industrial metal prices fell on Tuesday, with the Bloomberg Industrial Metal Subindex dropping 0.9%.

Palladium prices have pulled back by roughly 33% from record highs levels set back in May primarily as a result of the impact of the chip shortage on auto production. As the chip shortage eases, this should boost demand for the precious metal. A poll conducted by Reuters at the end of November showed XPD/USD is expected to average $2050/oz in Q4 and $2150/oz in 2022. Analysts are not bullish on palladium’s longer-term prospects given the expected phasing out of combustion engine production.

- The shared currency recovers from early daily losses close to 1.1600.

- US PPI index rose a tick more than expected, but investors are focused on Wednesday CPI readings.

- EUR/USD: A double-bottom coupled with a positive divergence in the daily chart could propel the pair towards higher prices.

The EUR/USD is steady during the day, failing to extend its two-day rally, is trading around 1.1590 in the last hour.

The shared currency bounced off daily lows around 1.1570 during the day as US bond yields fell sharply during the New York session, acting as a headwind for the greenback. Nevertheless, gains could be capped as the US Dollar Index is recovering, closing to the 94 figure, losing 0.08% at 93.98 at press time.

US PPI steady around 8.6% on an annual basis

On Tuesday, the US economic docket inveiled the Producer Price Index (PPI) for October, which in its headline expanded by 0.6%, higher than the 0.5% estimated by economists. On a year-over-year figure, the PPI increased 8.6%, in line with the forecast. Further, the Core PPI for the same period on a monthly basis rose by 0.4%, a tad higher than expected, whereas the annual basis number came in line with estimations at 6.8%.

The report released by the Bureau of Labor Statistics (BLS) noted that higher energy costs drove the gain on wholesale prices. Furthermore, it mentioned how recent months, transportation bottlenecks, material shortages, and increasing labor costs sent prices surging across the economy.

The EUR/USD pair reaction was muted, albeit being a US inflation report, investors' focus is on the consumer inflation readings.

On Wednesday, the US economic docket will feature the Consumer Price Index (CPI) for October, in which market participants are focused on, as the Federal Reserve dovish tone spurred a sell-off in the bond market, while US Treasury yields fall. Also, the Initial Jobless Claims for the week ending on November 6 will be revealed.

The Eurozone economic docket will unveil inflation figures for Germany, and Bundesbank Weidmann will cross the wires. Further, the ECB will host a Non-monetary policy meeting.

EUR/USD Price Forecast: Technical outlook

The daily chart depicts that a double-bottom pattern could be forming in the shared currency. The 1.1524 price level unsuccessfully tested six times acts as a floor for the EUR/USD pair, but on the upside, the 1.1616 is the barrier to overcome, on its way towards the "neckline" of the double-bottom at the October 28 high at 1.1691.

The Relative Strength Index (RSI) is at 47, slightly up, but remains below the 50-midline indicating that selling pressure remains. However, there is a subtle positive divergence, with the RSI showing higher lows, while the EUR/USD price action prints lower lows, meaning that the RSI acts as a leading indicator to the pair. Nevertheless, to resume the near-term upward bias, the RSI needs to break above the 50-central line to accelerate the uptrend.

- GBP/JPY bears are lurking below a key hourly counter trendline.

- From a longer-term perspective, a correction to the upside could be in the making.

GBP/JPY suffered a heavy blow last week, dropping to almost a 61.8% Fibonacci retracement of the prior bullish impulse. At this juncture, the price is meeting the neckline of the W-formation and is starting to consolidate. This makes for tricky grounds for bears seeking a lower low on the shorter time frames, for an upside correction could be imminent. The following illustrates this from a weekly perspective:

GBP/JPY weekly chart

GBP/JPY daily chart

From a daily perspective, as illustrated in the chart above, the price is attempting to move lower and for a deeper test of the weekly supporting territory, but so far to no avail. However, given that it has already broken the 61.8% Fibo of the prior daily rally's range, the 78.6% Fibo located at 152.40 is in range.

GBP/JPY H1 chart

From an hourly perspective, the resistance structure is compelling around the 10-EMA and the confluence of the 38.2% Fibonacci retracement of the latest bearish impulse near 153 the figure. However, the M-formation's neckline could come under pressure should counter-trendline give-out to the correction which has a confluence of the 61.8% Fibo near 153.25. If the counter-trendline holds and bears move in, then 152.50 could be an attractive target for the downside which is a -61.8% Fibo of the current range of the latest hourly correction.

San Francisco Federal Reserve Bank President Mary Daly was speaking at the National Association of Business Economists virtual meeting.

She said it is too early to know how far the US economy is from full employment, adding that there won’t be better clarity until the middle of next year.

“It’s going to take time to know,” Daly explained. With the great amount of uncertainty around the state of the labour market, the best thing to do for now is to stay “steady in the boat” and vigilant, she said.

Key comments

My modal outlook is that prices will moderate as we get through the pandemic.

I also have to worry about the non-modal outlook; watching carefully to see if inflation expectations rise.

Market implications

traders are waiting for the US Consumer Price Index and hence the US dollar is consolidating, rather than reacting to each comment from central bankers on Tuesday.

The dollar was oscillating between 93.90 and 94.10 in the morning trade of New York after data showed US producer prices increased solidly in October. While this was indicating that high inflation could persist for a while amid tight supply chains related to the pandemic, there were no great shakes ahead of tomorrow's key event in CPI.

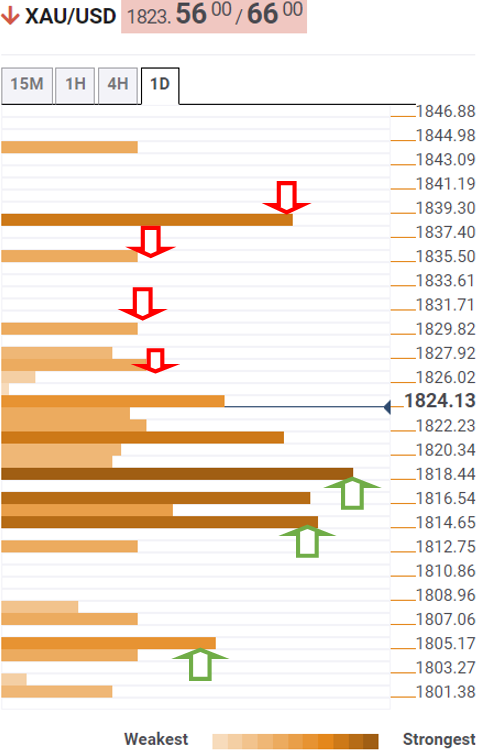

- Spot gold is trying to push above $1830 but hasn’t had success just yet.

- XAU/USD has been supported by a sharp decline in US real and nominal yields on Tuesday.

Spot gold (XAU/USD) continues to trade with an upside bias, though recent trade has been choppy, with prices briefly surpassing the $1830 level, but ultimately failing to hold above it. At the moment, XAU/USD is up by slightly more than 0.1% on the day and in the upper part of Tuesday’s $1820-$1830 range.

Falling nominal and real yields across developed markets have provided a tailwind for precious metals markets; US 10-year TIPS yields have dropped 9bps so far on the session to the -1.20% mark, leaving them only slightly above record lows at -1.216% printed during the summer. That has dragged nominal 10-year yields over 7bps lower to around 1.42%, its lowest since late September.

The reason for the sharp decline in US yields is not quite clear. Commentary this week from Fed policymakers Richard Clarida (the Vice Chairman of the Fed) and Charles Evans on when the bank might hike was dovish, with the former saying he sees the conditions for a rate hike being met at the end of 2022 and the latter in 2023. That compares to USD STIR market pricing which points to a strong probability of rate hikes starting in mid-2022. Perhaps the downside is as a result of market participants revising higher their perceived probability that more dovish-leaning Fed Governor Lael Brainard getting the nod to be the next Fed Chair following reports that she recently interviewed for the position.

XAU/USD’s gains are being capped by now by selling interest ahead of a key area of resistance in the $1830s. Prices on four occasions tried and failed to break to the north of this level during the summer months. A clean break back to the north of this level is likely going to require more than just a sharp drop in US real yields. The US dollar is also going to have to start slipping, with such a move unlikely in FX markets ahead of Wednesday’s US October Consumer Price Inflation report.

- The S&P 500 slumps for the first time in nine-session, down 0.31%, at 4,687.74.

- The Dow Jones slides 0.45%, currently at 36,266.80.

- The heavy-tech Nasdaq Composite shed 0.38%, at 15,921.68.

The S&P 500 edges lower during the New York session, down 0.31%, currently at 4,687.74 at the time of writing. The market mood is downbeat, as US equity indices drop between 0.31% and 0.60%, while in the FX market, investors flew to safe-haven currencies, boosting the Japanese Yen, the Swiss franc, and the greenback.

Tesla shares dropped 7% after Elon Musk held a poll over the weekend on Twitter asking his followers if it was a good decision to sell 10% of his Tesla shares, prompting a sell-off of the equity since Monday. Also, Paypal losses hurt the financial stocks after the company missed revenue expectations.

Sector-wise, real-estate, and utilities are the gainers, rising 0.26% and 0.14%, respectively. On the other hand, the main losers are consumer discretionary and financials down 0.89% and 0.79% each.

S&P 500 Price Forecast: Technical outlook

The daily chart depicts the S&P 500 has an upward bias, confirmed by the daily moving averages (DMA’s) well located below the index value, with an upward slope. Nevertheless, the Relative Strength Index (RSI) is at 71, well within overbought conditions, suggesting that a lower correction could happen. Furthermore, is testing the November 4 high at 4,683, which in case of a daily close beneath the latter, would expose the October 26 high at 4,598.53 that confluences with the 78.6% Fibonacci retracement as the first support level. In the outcome of a deeper correction, the October 27 low at 4,553.53.

- Crude oil markets are trading with a positive bias with WTI in the upper $82.00s.

- Ahead, the EIA’s monthly oil market report and private inventory data are in focus.

- The former could allegedly help the Biden administration decide on a policy response to high energy prices.

It’s been a subdued session thus far for crude oil markets, though by and large the complex has managed to shrug off modest selling pressure in equity markets to trade with a positive bias for most of the session. At present, front-month future contracts for the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, trade higher by about 75 cents on the session in the upper-$82.00s. Some commodity strategists said that the recent easing of US travel restrictions (fully vaccinated passengers are now free to enter the US without having to quarantine) ought to give jet fuel demand a boost and help global oil demand recover back to pre-pandemic levels above 100M barrels per day.

Since the start of the week, crude prices have stayed within about 75 cents either side of the 21-day moving average, which currently resides at $82.32. The much more subdued trading conditions this week stand in stark contrast to the volatility seen last week. WTI prices dropped from weekly highs just under $85.00 last Monday to under $78.50 by Thursday, before surging back to the mid-$81.00s by the Friday close.

Coming up

Key themes that could trigger a return of volatile trading conditions include the much-anticipated announcement from the Biden administration on what its response to high crude oil and gas prices will be. Some think the administration may choose to release reserves from the Strategic Petroleum Reserve, though an energy export ban has also been touted.

Some analysts have suggested that the Biden administration will want to see the latest US Energy Information Agency monthly oil market report (called the Short-term Energy Outlook or STEO) before making any final decisions. The report, due for release at 1700GMT on Tuesday, may thus garner more attention than usual. Various news reports have suggested that a final decision on the Biden administration’s response to high energy costs will be announced before the end of the week. Elsewhere, crude oil traders will be watching out for the release of weekly private API crude oil inventory data at 2130GMT ahead of official US inventory data out at 1530GMT on Wednesday.

- USD/MXN keeps falling, now testing levels below the key support at 20.30.

- Mexican peso remains strong, Banxico seen raising rates on Thursday.

The USD/MXN is falling for the third consecutive day on Tuesday and it dropped below 20.30. If the Mexican peso holds firm under the mentioned area, the negative tone will remain intact, with doors open to more losses, targeting 20.15.

The next critical support stands around 20.13/18 that contains the 100 and 200 moving average. A slide below would expose 20.00.

The Mexican peso is looking strong ahead of the Banxico meeting on Thursday. The central bank is seen raising the key rate from 4.75% to 5%, particularly after CPI data showed an increase above 6% in the annual rate.

On the upside, USD/MXN could face resistance at 20.45. If the dollar manages to rise and hold above, the short-term outlook should favor the upside. The next resistance levels are located at 20.65 and 20.80.

USD/MXN daily chart

-637720704810422161.png)

- US dollar strengthens during the American session as stocks slide, despite lower yields.

- EUR/USD finds resistance at the 20-day simple moving average.

The EUR/USD pair is moving sideways on Tuesday, unable to hold above 1.1600. Recently it printed a fresh three day high at 1.1608 but it quickly pulled back toward daily lows. It is hovering under 1.1580 wihtouy a clear direction.

The greenback gained momentum during the America session across the board, even as US yields remained near recent lows. The DXT is up 0.05%, ending a two-day negative streak.

US economic data showed the PPI rose mostly in line with expectations, having no significant impact on markets. On Wednesday, CPI data is due. Those numbers will be important for considerations about the next steps of the Federal Reserve. Also, market participants await President Biden’s decision regarding Fed’s Chair. The specialized media mentioned Brainard (a dovish) as a potential replacement for Powell.

EUR/USD upside capped by a strong area

The rally from YTD lows found resistance around 1.1600/10, area that contains the 20-day moving average. Slightly above at 1.1620 there is another relevant horizontal resistance. A daily close above 1.1620 would open the doors the more gains.

While under 1.1600, the upside seems limited. Support levels might be located at 1.1565 and 1.1545. If the price rmeais under 1.1550, the 1.1520 critical support are will liekyl be challenged.

Technical levels

- US 10-year Treasury yields hit fresh multi-week lows under 1.45% on Tuesday.

- Recent Fed news/commentary has had dovish implications and could be weighing on yields.

US 10-year Treasury yields hit fresh multi-week lows on Tuesday after sliding under the 200-day moving average (DMA) at 1.449% and last week’s low at 1.436%. Yields have risen a touch from session lows at 1.431%, which was their lowest since late September, and are now back in the 1.45% region. As things stand, 10-year yields are down by just under 5bps on the day, having started the session close to 1.50%.

The drop in US 10-year yields comes amid a broader bull-flattening move being seen across the US yield curve; 2-year yields are down around 3bps to around 0.42% and 30-year yields are down nearly 6bps to just above 1.85%. The drop in yields is driven by a further decline in US real yields, rather than a move in inflation expectations. For reference, 10-year TIPs yields are down over 5bps on the day to just under -1.15%, leaving them only a few bps above the record lows close to -1.20%, while 30-year TIPs yields are down by a similar margin to under -0.55%. Meanwhile, 10 and 30-year breakeven inflation expectations (the nominal minus the real yield) are flat in the respective 2.60% and 2.40% regions.

Dovish vibes drive yields down

US yields saw a sharp drop towards the end of last week in tandem with global peers in wake of the dovish tilt to the Fed and BoE rate decisions, as well as dovish commentary from key ECB policymakers and the RBA. In wake of last week’s central bank action, STIR markets have broadly been paring back on recent hawkish bets, which has weighed on short-end yields and longer-term real yields (given inflation expectations were pushed higher in anticipation of more dovish central banks). Tuesday’s price action suggests this recent trend of dovish repricing has room yet to run.

Recent Fed commentary/news has had dovish implications; Fed Vice Chair Richard Clardia said on Monday that he saw the conditions for a rate hike being met at the end of 2022 (versus STIR market pricing for hikes starting in September). Moreover, it looks like dovish-leaning Fed Governor Lael Brainard is in with a good shot of becoming the next Fed Chair. Market pricing for rate hikes as soon as September 2022 looks vulnerable to be pared back even further, though Wednesday’s US Consumer Price Inflation report could throw a spanner in the works if it shows inflationary pressures continuing to build.

- USD/CAD trims some Monday losses, advances 0.24% during the day.

- US Producer Price Index came in line with expectations, and the market reaction was muted.

- Market participants await Wednesday's CPI numbers, which expect inflation to rise by 5.8% YoY.

The USD/CAD edges higher during the New York session, up 0.12%, trading at 1.2465 at the time of writing. The market sentiment is a mixed bag, as major US equity indices futures fluctuate between gainers and losers. Further, the FX market is in risk-aversion, as traders fly towards the safe-haven currencies, like the Japanese yen and some to the greenback, as confusion meanders in market participants.

Falling US T-bond yields undermine the greenback

Furthermore, the yield curve in the US flattens as the 20s are two basis points above the 30s, while the 10-year losses five basis points sit at 1.444%. Meanwhile, the US Dollar Index, which tracks the greenback's performance against a basket of its peers, falls 0.15%, currently at 93.90.

However, the USD/CAD is seesawing around the 1.2430-60 area with no apparent bias, awaiting US inflation figures.

On Tuesday, the US economic docket featured the Producer Price Index (PPI) for October, which in its headline, rose 0.6%, a tick higher than the 0.5% expected by analysts. Nevertheless, on a year-over-year figure increased 8.6%, unchanged according to the forecast. Moreover, the Core PPI for the same period on a monthly basis rose by 0.4%, higher than expected, whereas the annual basis number came in line with estimations at 6.8%.

According to the report released by the Bureau of Labor Statistics (BLS), higher energy costs drove the gain. Furthermore, it mentioned how recent months, transportation bottlenecks, material shortages, and increasing labor costs sent prices surging across the economy.

The USD/CAD trader's reaction to the news was muted as investors waited for a speech of Bank of Canada Governor Macklem at 22:45 GMT, alongside Wednesday's US inflation figures.

On Wednesday, the US economic docket will unveil the Consumer Price Index (CPI) for October, and the Initial Jobless Claims for the week ending on November 6.

Expectations for CPI on a yearly basis are at 5.8%, while excluding food and energy, analysts expect an increase of 4.3%. Concerning US Initial Jobless Claims are expected to rise by 265K, a tad lower than the previous week at 269K.

- NZD/USD is ebbing lower and is now under 0.7150.

- The pair failed to derive support from evidence that NZ consumer spending is rebounding in Q4.

NZD/USD continues to trade with a negative bias and is currently down about 0.3% on the day and trading to the south of the 0.7150 level, having briefly challenged Monday’s highs in the 0.7170s during Tuesday Asia Pacific trade. Kiwi weakness comes despite data showing a solid rebound in consumer spending in New Zealand in October.

Whether the modest pullback from weekly highs seen on Tuesday will translate into a more meaningful turnaround following the recent recovery from the 200-day moving average at 0.7100 remains to be seen. FX markets are for now mostly happy to trade within recent ranges and in subdued fashion as market participants await fresh macro catalysts, of which Wednesday’s US Consumer Price Inflation (CPI) report of October could be one.

Ahead of Wednesday’s US CPI report, the October Producer Price Inflation (PPI) report was recently released. The headline and core YoY and MoM metrics were broadly in line with expectations thus there hasn’t been any notable market reaction, but all remained at historically elevated levels, which suggests that Wednesday's CPI report will show the same. US markets seem more focused on who US President Joe Biden will choose as next Fed Chair right now, however. US real and nominal yields have tumbled on Tuesday with some attributing the drop to reports that Fed Governor Lael Brainard (seen as more dovish than current Chair Jerome Powell) was interviewed for the position and is seen as a contender. Her nomination would weigh on the US dollar.

NZ consumer spending recovers as lockdowns eased

Economic data released overnight showed the impact of the Q3 New Zealand lockdowns waning at the start of Q4; October Electronic Card Retail Sales were up 10.1% MoM. That means retail sales have now recovered about half of the near 20% MoM drop seen in August when lockdowns first came into force across the country. With Auckland set to exit lockdown at the end of the month as vaccination rates hit key thresholds, retail sales are expected to continue to rebound for the remainder of Q4.

USD/JPY struggles below the 113.00 mark. Economists at TD Securities think the 112.00 level offers major support and should be a buying point for USD/JPY.

A dip into 112.00 is likely

“With Treasury markets settling, we think the path to 112.00 remains, but we see no appeal in chasing it.”

“On a cross-asset valuation basis, USD/JPY is fair.”

“We think USD/JPY is essentially at the mercy of technicals and Fed pricing. The latter looks to have mostly quieted down while the former should reinforce cloud support at 112.00.”

Cable’s steadily higher price action since yesterday’s test of 1.3450 saw it test the 1.36 mark earlier today before selling pressure emerged. However, economists at Scotiabank expect GBP/USD to tackle the 1.3600/10 resistance area.

Support is seen at 1.3550

“Technical signals point to a re-test of the level (1.3600/10) to be followed by intermediate resistance in the mid-figure area and then firmer around 1.37 (50-day MA at 1.3693).”

“A reversal of its losses above 1.36 may see the GBP/USD pair resettle into a 1.36-138 range but within a minor downtrend as it reached lower highs in its past three periods of strength.”

“Support is 1.3550 followed by the figure area.”

EUR/USD is unchanged after test of 1.16. In the opinion of economists at Scotiabank, the pair needs to surpass the 1.1600/15 region to alleavite downside pressure.

1.1575/85 zone provides support

“Downside action was limited to the 1.1575/85 area that will act as support followed by the 1.1550 zone.”

“Going forward, EUR/USD will have to firmly break past the figure (1.1600/15) and the mid-1.16s to negate the firm downtrend that has held it since mid-year (and remains geared towards a break under 1.15).”

With central banks having already said their piece, seasonal, valuation and positioning still looks favorable for the USD. On these measures, the CHF looks vulnerable to a reversal, in the view of economists at TD Securities.

CHF could be a major laggard in the coming weeks

“The CHF is the most overloved currency on our positioning dashboard. It also tracks modestly rich to the USD.”

“We note that the SNB has increased sight deposit activity since mid-October, which signals their discomfort of letting the CHF appreciate further.”

“With the major central banks from the Fed, to the ECB and to some extent the BoE largely having said their piece, the CHF could be a major laggard in the coming weeks as the circuit takes a backseat.”

- GBP/USD fails to hold above 1.3600, slips back to mid-1.3500s.

- Upcoming BoE and Fed speakers will be watched.

GBP/USD has pulled back from earlier session highs slightly to the north of the 1.3600 level and now trades slightly to the north of the 1.3550 mark, roughly flat on the day, though still up by about 0.5% on the week. The pair’s strong rejection of the 1.3600 level, which also coincides with resistance in the form of last Tuesday’s lows just above it, suggests that this week’s technical correction may have run its course. Recall that GBP/USD underwent a sharp drop last week after the BoE shocked markets by choosing not to go with a widely expected 15bps rate hike.

BoE, Fed Updates

BoE Governor Andrew Bailey spoke publically on policy on Monday, reiterating his stance laid out at the last meeting that rate hikes might be appropriate in the coming months if the economy, most notably the labour market, evolves as expected. He is scheduled to speak again on Tuesday at 1600GMT, though his comments might not address BoE policy given that the topic of the panel discussion is inequality. However, BoE Monetary Policy Committee member Ben Broadbent is slated to speak at 1530GMT and his comments might be more pertinent given he is talking about labour shortages before the UK parliament.

GBP/USD traders will also need to keep an eye on Fed speak/developments on Tuesday. News recently broke that Fed Governor Lael Brainard was recently interviewed for the position of Fed Chair and is considered a “contender” for the position. This follows Braindard and current Fed Chair Jerome Powell both being seen at the White House last week. Betting markets see the situation as a two horse race, with Powell still the favourite to be picked as the next Fed chair, though his percieved “lead” has dwindled in recent days. Brainard is considered more dovish than Powell and her nomination as Fed Chair would weigh on the US dollar.

Dovish comments from Fed Vice Chair Richard Clarida and FOMC member Charles Evans on Monday was cited as a reason why the US dollar weakened at the time (and GBP/USD was able to recover back above 1.3500). Neither saw the conditions for rate hikes being met by mid-2022 as USD STIR markets are pricing. FX markets will be watching remarks from FOMC members Daly and Kashkari speak at 1635GMT and 1830GMT respectively in wake of the just released October PPI report (annual rates of PPI remain highly elevated).

Jerome Powell, Chairman of the Federal Reserve System, said on Tuesday that they look at a wide range of indicators when assessing maximum employment, as reported by Reuters.

Additional takeaways

"Fed is attentive to labour market disparities rather than just headline numbers."

"An economy is healthier and stronger when as many people as possible are able to work."

"Those who have historically been left behind stand the best chance of prospering in a strong economy."

Market reaction

The market reaction to these comments was muted and the US Dollar Index was last seen posting small daily losses at 93.95.

- Headline US PPI came in at 8.6% YoY in October.

- The US Dollar Index hardly saw any reaction and continues to trade close to 94.00.

The YoY rate of Producer Price Inflation came in at 8.6% in October, unchanged from the month prior and slightly below expectations for 8.7%, according to a report by the US Bureau of Labour Statistics.

But the MoM rate of PPI rose to 0.6% in October, versus expectations for 0.5% and higher than September's 0.5% reading. Elsewhere, the YoY rate of Core PPI was stable at 6.8%, while the MoM pace of Core PPI in October came in at 0.4%, below expectations for 0.5%.

Market Reaction

The US Dollar Index (DXY) hardly saw any reaction to the data and has continued to trade close to 94.00.

- AUD/USD has slipped back to the 0.7400 level from earlier highs in the 0.7430 region.

- The pair failed to derive lasting impetus from a strong NAB business sentiment report.

- Focus is now on US inflation, Fed speak and more Australian survey data.

AUD/USD has waned from earlier session highs in the 0.7430s and is now again flirting with the 0.7400 level, down just under 0.3% on the day despite the release of an upbeat Australia business confidence survey during Tuesday Asia Pacific trading hours. If bearish momentum does build and AUD/USD breaks below the 0.7400 level and Monday’s lows around 0.7390, then technicians would likely target a move towards last week’s lows at 0.7360, which sits just below the 50-day moving average at 0.7369.

-637720605300549743.png)

Aussie data points to positive 2022 outlook

Australian bank NAB’s Business Confidence index rose to 21 in October from 13 in September, while the bank’s Business Conditions index rose to 11 in October from 5 the month prior. The improvement in business confidence was primarily driven by an easing of lockdown restrictions, local economists said, after the country’s most populous state New South Wales came out of lockdown on 11 October (the data for the survey was collected between 19-29 October). Sentiment also improved in Victoria, where the end of lockdown is in sight, and in Queensland, which should see its state borders reopened before the end of the year. According to local bank Westpac, “the reopening facilitated by high vaccination rates points to a positive outlook for 2022”.

Day Ahead

Looking ahead, AUD/USD traders will focus their attention back to stateside events for the remainder of the US session, with US inflation data and a few Fed speakers in focus. The US Bureau of Labour Statistics will release the October Producer Price Inflation report at 1330GMT ahead of comments from Fed Chair Jerome Powell on diversity at 1400GMT. Thereafter, FOMC members Daly and Kashkari speak at 1635GMT and 1830GMT respectively. Aussie traders returning for the Wednesday Asia Pacific session should keep an eye on the release of Westpac’s November Consumer Confidence survey at 2330GMT.

European Central Bank (ECB) policymaker Klaas Knot said on Tuesday that conditions for a rate hike are very unlikely to be met in 2022, as reported by Reuters.

Additional takeaways

"Inflation to fall below 2% towards the end of 2022 but must prepare for upside scenarios."

"APP is the appropriate tool for marginal policy adjustment beyond PEPP, should keep optionality to adjust APP both up and down."

"ECB should not make long-lasting unconditional commitments once PEPP ends; must maintain optionality."

"Inflationary pressures from higher energy prices, supply bottlenecks last longer than initially thought."

"Higher wage increases will become more likely if inflationary pressures were to persist longer."

Market reaction

The shared currency stays on the back foot following these comments and the EUR/USD pair was last seen losing 0.1% on the day at 1.1572.

- EUR/GBP continues to nudge lower, but recently bounced at its 50DMA around 0.8520.

- Amid a lack of key fundamental updates, focus turns to more BoE and ECB speak on Tuesday.

EUR/GBP continues to nudge lower in wake of Monday’s decline, though has in recent trade seen a modest bounce from the 50-day moving average at 0.8522. The pair currently trades in the 0.8530s, with modest on the day losses of about 0.1% and is now down about 0.6% from earlier weekly highs at the 200DMA around 0.8590. Trading conditions right now are subdued across G10 FX markets, meaning it may be a struggle for EUR/GBP to break below support, both in the form of the 50DMA and the 12 October/early November highs at around 0.8515 just below it.

In terms of fundamental updates, Brexit has been in the headlines, there has been some economic commentary and a few data releases, but nothing to significantly shift the dial for GBP. Starting with the former; reports suggested early on Tuesday that the EU was preparing a package of retaliatory measures against the UK if its triggers Article 16, measures which were allegedly going to be presented to the UK Brexit Minister Lord David Frost at the end of the week as a deterrent. But more recently, European Commission officials were on the wires denying that such a package of measures was being prepared. Simultaneously, talks between the UK and France on fishing rights continued, with the French Secretary of State for European Affairs Beaune reiterating this morning the need for a quick solution.

In terms of data; German and French trade numbers for September were out on Tuesday morning, the former posting a slightly smaller than expected, but still healthy trade surplus on the month of EUR 13.2B, the latter posting a slightly smaller than expected trade deficit of EUR 6.778B. The German ZEW survey for October was also released, with the forward-looking Economic Sentiment index posting a surprise rise to 31.7 from 22.3, but the Current Conditions index falling more than expected to 12.5 from 21.6.

Day Ahead

Looking ahead, attention turns to Tuesday’s BoE and ECB speakers; ECB hawk Klass Know it speaking at 1400GMT, BoE MPC member Ben Broadbent is speaking to the UK Parliament at 1530GMT on labour shortages and BoE Governor Andrew Bailey and ECB’s Isabel Schnabel are speaking on a panel on inequality at 1600GMT. Further “evidence that the (BoE) MPC is in no particular hurry to tighten policy from here could continue to keep the GBP on the defensive vs the USD and the EUR” says Credit Agricole, adding that they “remain long EUR/GBP”.

- EUR/USD struggled to preserve its modest intraday gains to levels just above the 1.1600 mark.

- A combination of factors helped revive the USD demand, which, in turn, exerted some pressure.

- Investors look forward to the US PPI report and Fed Chair Powell’s remarks for a fresh impetus.

The EUR/USD pair edged lower heading into the North American session and dropped to fresh daily lows, around the 1.1575 region in the last hour.

The pair struggled to find acceptance above the 1.1600 round-figure mark and witnessed a modest intraday pullback from three-day tops touched earlier this Tuesday. The EUR/USD pair has now drifted into the negative territory, snapping two days of the winning streak, and was pressured by the emergence of some buying around the US dollar.

Despite the Fed's dovish outlook, expectations that the US central bank would be forced to adopt a more aggressive policy response to contain stubbornly high inflation acted as a tailwind for the USD. The speculations were further fueled by the overnight hawkish comments by several FOMC officials, signalling that the Fed could raise rates by the end of 2022.

Apart from this, the cautious mood around the equity markets further underpinned the greenback's relative safe-haven status against its European counterpart. That said, a fresh leg down in the US Treasury bond yields held the USD bulls from placing aggressive bets and should help limit any deeper losses for the EUR/USD pair, at least for now.

Next on tap is a scheduled speech by the European Central Bank President Christine Lagarde and the release of the US Producer Price Index. This, along with Fed Chair Jerome Powell's remarks at an online conference, might provide some impetus to the EUR/USD pair. The key focus, however, will be on Wednesday's release of the latest US consumer inflation figures.

Technical levels to watch

- Silver attracted some dip-buying on Tuesday, though remained below two-week tops.

- The bias favours bulls and supports prospects for a move towards the $24.80-85 area.

Silver reversed modest intraday losses and was last seen hovering near daily tops, just below mid-$24.00s, or two-week tops touched in the previous day.

Given the overnight sustained move beyond the $24.20-15 confluence barrier, the emergence of some dip-buying on Tuesday favours bullish traders. The outlook is reinforced by the fact that technical indicators on the hourly/daily charts are holding comfortably in the bullish territory and are still far from being in the overbought zone.