- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-11-2021

- USD/JPY reached two-week tops around 114.00 retreating the upward move as the New York session began.

- The USD/JPY pair fell amid US dollar weakness across the board.

- Flat US bond yields undermined the US dollar prospects against the Japanese yen.

The USD/JPY retreated from weekly tops around 114.00, fell 0.17%, trading at 113.88 as the New York session finished. On Friday, the Japanese yen recovered some ground against the greenback, after losing in two days 1.24%, on the back of higher US consumer inflation figures, last seen in the 1990s. Furthermore, the US 10-year Treasury yield, which strongly correlates with the USD/JPY pair, ended flat in the session at 1.565%.

During the Asian session, the pair topped around 114.29, in tandem with US T-bond yields, but as European traders got to their desks, the USD/JPY dipped to 113.95. It seems that the move was triggered by USD bulls taking profits as investors head into the weekend.

In the meantime, the US Dollar Index, which tracks the greenback's performance against a basket of its peer, finished in the red, slid 0.05%, down to 95.096.

US consumer inflation reaches 6.2%, the highest in three decades

Doing a recap of the week, on Tuesday, the so-called wholesale prices with the Producer Price Index for October, excluding volatile items like energy and food, increased by 6.8%, in line with expectations. However, on Wednesday, the Consumer Price Index for the same period, which investors see as the most critical inflation gauge, rose by 6.2%, much higher than the 5.8% estimated by analysts, crushing the previous month's reading. It is worth noting that it is the highest level reached in 30-years, triggering an immediate reaction in the market.

Therefore, that would put the Federal Reserve under pressure. Their view of "transitory" inflation is not applicable, as it seems that elevated prices would last longer than policymakers expected. It is worth noting that the US central bank announced at its last monetary policy meeting that they would begin the bond tapering In mid-November.

Also, on Friday, the University of Michigan Consumer Sentiment Index for November edged lower to 66.8, lower than the 71.7 in October, marking the lowest reading since November 2011.

According to the report, "consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation," said Richard Curtin, Surveys of Consumers chief economist.

- USD/CAD slump for the first time in three days after posting losses of almost 1.70%.

- USD/CAD fell amid US dollar weakness across the board.

- USD/CAD: The 1-hour chart depicts a triple top chart pattern, with a target of 1.2530.

USD/CAD struggles to gain traction above 1.2600, is falling 0.31%, trading at 1.2549 during the New York session at the time of writing. The Canadian dollar has been under selling pressure, as witnessed by the price action in the last three days, down almost 1.70%. Nevertheless, on Friday, the Loonie has recovered some ground, mainly driven by USD profit-taking.

DXY falls as the weekend approaches but holds to the 95 figure

Meanwhile, the greenback is falling against most G8 currencies. The US Dollar Index measurement of the buck against six currencies slides 0.02%, sitting at 95.12. Contrarily, US T-bond yields rise, with the 10-year benchmark note rising two basis points, currently at 1.58%.

USD/CAD direction would lie in the hands of the Bank of Canada (BoC) and US dollar dynamics. However, on Wednesday, US inflation rose to a 30-year high above 6%, which spurred an upside move in US Treasuries and the US dollar.

On the macroeconomic front, the US economic docket featured the University of Michigan Consumer Sentiment Index for November edged lower to 66.8, lower than the 71.7 in October, marking the lowest reading since November 2011.

USD/CAD Price Forecast: Technical outlook

The 1-hour chart depicts a technical move that spurred the recovery of the Loonie. A triple-top chart pattern formed around the 1.2570-1.2600 range. The price broke below the neckline around 1.2567, which would act as resistance in case of an upward swing. Further, the USD/CAD price is under the 50-simple moving average (SMA), exerting additional selling pressure on the pair. The triple-top target is 1.2530, an area that confluences with the 50-day moving average (DMA).

A break below the triple’s top target would expose the 100-SMA around the 1.2500 figure.

- Spot silver has failed to push above its 200DMA at $25.40 despite weak US consumer data.

- The precious metal remains on course to post healthy weekly gains of about 4.5%, however, its best performance since May.

Spot silver (XAG/USD) prices have been trying to move above its 200-day moving average at $25.40 on Friday, but to no avail just yet. At present, the index trades around $25.25, which means it is flat on the day, though spot prices have managed a pretty impressive recovery from early European session losses that saw them drop all the way to the $24.80s.

Trading conditions have been thin on Friday. Thursday was a partial US holiday (Veteran’s Day) and, at the time, bond markets were closed, so many US players likely used the opportunity to take a long weekend. Hence, it is probably not too surprising to see spot prices fail to break above their 200DMA. Such a move may have to wait until next week if it is going to happen. Nonetheless, spot silver remains on course to post healthy gains on the week of over 4.5%, its best week since May.

In terms of the fundamentals, it's been a pretty slow session, with the highlight being the release of US consumer sentiment and job openings data at 1500GMT. The University of Michigan’s headline Consumer Sentiment index (the preliminary estimate for November) saw a surprise drop to 11-year lows with consumer citing heightened fears/uncertainty around inflation. Precious metal markets got a little boost at the time, in fitting with the broad theme of demand for inflation protection that has them supported all week.

To recap, Wednesday’s US Consumer Price Inflation report (for October) saw headline price pressures at their highest since 1990 on a YoY basis. The move higher in precious metals reflects fears that the Fed is “behind the curve” when it comes to curbing inflation and may lose control of the situation.

Back to the XAG/USD; with spot silver back to the north of the $25.00, a level which it had been unable to reconquer going all the way back to August, if it can clear the 200DMA, the next key level to keep an eye on it’s the early august high at almost bang on $26.00. But one risk that traders should be aware of is that the Fed may buckle under the mounting scrutiny/pressure from the press and financial markets to adopt a more hawkish stance in order to reign in inflation.

While markets are already to an extent betting on this (that’s why the DXY broke out to fresh annual highs this week and USD STIR markets have brought forward rate hike bets again), an actual endorsement of a more hawkish policy path would be another thing. If the Fed was to send real yields substantially higher in a hawkish policy shift, this would likely undo all of silver’s good work recently. Any hawkish signs next week may send silver back towards $24.00.

- The S&P 500 is up 0.5% but still on course for its first weekly loss in six.

- US equities largely ignored a disappointing US consumer confidence report, as focus thifts to next week’s US retail sales report.

The S&P 500 seems to have regained its mojo on Friday, currently trading 0.5% higher on the session having advanced from around 4650 to current levels around 4675. The index is still on course to week the day 0.4% lower, however, which will mark its first weekly decline in six.

Big Tech/Growth names are seeing the strongest performance. The S&P 500 growth index is up 0.9% amid 1.3% gains in Apple, 1.0% gains in Amazon, 1.2% gains in Microsoft, 1.8% gains in Alphabet and more than 3.0% gains in Meta Platforms (formerly called Facebook). That’s helping the tech-heavy Nasdaq 100 index (up 0.9%) outperform. But the Dow, often seen as more of a proxy for value stocks, isn’t performing poorly, and is up a respectable 0.4% and back to the north of the 36K level. The VIX has seen a fairly substantial drop of about 1.3 vols and is now back to the levels that it ended last week at under 17.00.

The sense of calm, even optimism, has come despite inflation concerns that have roiled FX and bond markets this week. Whilst it does seem likely the Fed is going to be forced to adopt a more hawkish policy stance in 2022 in order to must prioritise price stability over economic growth the labour market, stocks can rely on the backdrop of strong earnings. Indeed, the earnings season just gone saw S&P 500 companies report their third-highest profit margins on record, despite surging input costs, as companies found it easier to pass these costs onto consumers. In other words, there is no sign just yet that demand in the US economy is faltering from its highly elevated levels, despite increasing inflationary pressures.

But that story may soon change. The headline index from Friday’s University of Michigan Consumer Sentiment survey showed sentiment falling to its lowest in 11 years as consumer fret about inflation. Stocks ignored that data, but they won’t be able to ignore it if October Retail Sales data (out next Tuesday) misses expectations by a wide margin. On the other hand, a strong Retail Sales report for October would be a good sign for corporate bottom lines for Q4 and would likely support equities.

In individual stock news, the main story on Friday was an announcement by Johnson & Johnson that the company is planning on splitting into two businesses, one focused on consumer health care and the other on pharmaceuticals. Shares were up over 1.0% as a result. Meanwhile, news of further stocks sales by CEO Elon Musk weighed on Tesla’s share price, which fell another near 4.0%.

- EUR/USD consolidates around the 1.1440s region, extending its losses to three days in a row.

- EUR/USD printed a year-to-date low around 1.1430.

- UoM Consumer Sentiment Index fell to 66.3, its lowest reading since November 2011.

EUR/USD barely declines during the day, consolidating around 1.1446, down some 0.01% at the time of writing. The shared currency has failed to gain traction against the greenback, which has remained bid during the Asian and the European session, gaining follow-through as the New York session begins.

Furthermore, the single currency downfall has extended for three days, printing year-to-date new lows in each of those days. In fact, earlier in the New York session, it reached a new yearly low at 1.1432, a level not seen since July 2020. At press time, the euro is consolidating around the 1.1440s region as we get ahead into the weekend.

University of Michigan Consumer Sentiment Index drop overshadowed EU Industrial Production expansion

On the macroeconomic front, the Eurozone economic docket featured the Industrial Production for September, which increased by 5.2%, higher than the 4.1% foreseen, reported by Eurostat.

Across the pond, the University of Michigan Consumer Sentiment Index for November fell to 66.8, lower than the 71.7 number in October, marking the lowest reading since November 2011.

Richard Curtin, the chief economist of Surveys of Consumers, said that “consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation.”

According to Societe Generale analysts in a note to clients noted that “the euro will fall as a result” of difference between the US and Europan inflation threats. Further added that “the US faces a bigger and more demand-led inflation spike that cries out for tighter monetary policy, while in Europe it does not.” This cemented ECB dovishness postures, expressed by ECB top officials like President Christine Lagarde and ECB’s chief economist Philip Lane, who pushed back higher interest rates, saying that inflation is temporary and would moderate later in 2022.

EUR/USD Price Forecast: Technical outlook

-637723427048732515.png)

The single currency continues sliding in the week, and if the trend accelerates, it could slide as low as 1.1255, the July 10, 2020 low, but it would find some hurdles on the way south. The first support would be June 10, 2020, high at 1.1423, followed by 1.1300, and the target mentioned above at 1.1255.

- USD/CHF has fallen back to the 0.9200 level in recent trade following downbeat US consumer confidence numbers.

- But the US data this week will have the Fed worried about inflation and the appropriateness of their ultra-dovish stance.

- If any hawkish shift is forthcoming, that could propel USD/CHF back towards the September highs around 0.9350.

USD/CHF is set to end Friday’s session flat slightly to the north of the 0.9200 level. The pair had at one point been nearly as high as 0.9240, but a sharp, surprise deterioration in Consumer Confidence in November according to the University of Michigan’s preliminary survey pushed the pair from highs and back towards 0.9200. For reference, the headline consumer sentiment index dropped to an 11 year low at 66.8 versus forecasts for a small rise to 72.4 from 71.7 in October.

But the deterioration in consumer sentiment will not leave the Fed feeling vindicated in its stance that it should remain patient and only normalise monetary policy slowly, as the primary factor driving sentiment lower was concerns about inflation. If anything then, the report ought to put more pressure on the Fed to feel as though it should withdraw monetary stimulus at a faster rate. It is perplexing then that broad USD weakness was seen in response, especially given that JOLTs Job Opening data released at the same time also showed the number of job openings in the US economy exceeding the number of unemployed persons by a record 2.8M (and the quit rate hit a record high at 3.0%). The strong jobs data, which signifies that wage growth should remain elevated for the foreseeable future (which is very inflationary), comes after the YoY rate of US Consumer Price Inflation in October was revealed on Wednesday to have hit its highest level since 1990 at 6.2%.

Thus, pressure is building on the Fed to adopt a more hawkish policy stance. NY Fed President and Fed Board of Governors member John Williams had an opportunity to make such a signal on Friday but opted not to say anything of interest on policy. Core Fed members would likely rather wait until they could discuss the best course of action; whether they should shift in a hawkish direction as many market participants are calling for and, if so, to then decide upon new policy guidance and a strategy to save face as much as possible.

Back to USD/CHF; if the Fed is feeling the pressure to turn more hawkish in the coming days/weeks, then this is likely to keep the upwards pressure on USD/CHF. While some further profit-taking following the dollar’s advances this week might see the pair slip under 0.9200 next week, it is likely to remain a buy on dips. A gradual move back towards the late September highs in the 0.9350 area seems likely as long as front-end (and belly) US yields can maintain recent upwards momentum.

- GBP/USD reclaims the 1.3400, as it recovers from three-days previous losses.

- A weaker US dollar boosts the British pound, despite BoE dovishness in its last monetary policy meeting.

- GBP/USD: Failure to hold 1.3400 could send the pair tumbling to the 1.3200 zone.

The British pound bounces off year-to-date lows at 1.3352, edges up 0.40%, trading at 1.3418 during the New York session at the time of writing. In the last three days, cable lost almost 2%, driven mainly by US dollar strength, influenced by higher inflation figures in the US economy, reported by the Labor Department. Also, a dovish stance perceived by investors in the last Bank of England (BoE) monetary policy meeting fueled the slide of the GBP.

US Dollar weakness boost the British pound, which reclaims the 1.3400 figure

The US Dollar Index, which measures the greenback’s performance against its peers, slides 0.03%, sitting at 95.11, acting as a headwind on the USD against the GBP.

GBP/USD Price Forecast: Technical outlook

In the daily chart, the GBP/USD pair is trading within a descending channel, approaching the bottom-trendline around the 1.3350 area. Further, the daily moving averages (DMA’s) reside above the spot price, though supporting the downward bias.

In the case of a daily close above the Thursday high at 1.3433, it could spur an upside move in the pair, towards the psychological 1.3500 area, that also coincides with the 61.8% Fibonacci retracement level, a price level that GBP/USD sellers would defend to resume the downward bias.

On the flip side, failure at 1.3433 could open the door for a further downfall in the GBP/USD pair. The first support would be the Friday low at 1.3353, followed by the bottom of the descending channel around the 1.3300 area, a level last seen in December 2020. A breach of that level would expose December 12, 2020, low at 1.3188.

- EUR/GBP has been ebbing back towards weekly lows as Brexit tensions ease, though talks continue next week.

- Longer-term, ECB/BoE policy divergence could keep pressure on the pair, with the bears targetting 0.8400.

EUR/GBP has been ebbing lower in recent trade, boosted amid positive sounds coming from UK and EU officials on the Brexit front. According to UK Brexit Minister Lord David Frost and Vice President of the European Commission Maroš Šefčovič, talks regarding the implementation of the Northern Ireland protocol will continue next week and focus on medicine and customs. Sefcovic said that the EU was pleased by a welcome change in tone from the UK in the talks.

At present, the pair trades with on the day losses of about 0.3%, having reversed lower from earlier session highs above 0.8560 to current levels in the 0.8530s. If trading conditions weren’t so quiet, with the European session already over and the weekend fast approaching, the pair would perhaps be in with a shout of testing weekly lows at 0.8520. Perhaps it still might.

Either way, an improved tone on the Brexit front and a paring of some of last week’s post-dovish BoE surprise short-term bets means that EUR/GBP is on course for modest weekly losses of about 0.3%. That still leaves it about 1.5% above last month’s pre-BoE lows just above 0.8400, but if the pair’s long-term trend of gradually grinding lower and posting lower highs and lower lows continues, then this will be a good level for the bears to target.

One argument in favour of the long-term bearish thesis for EUR/GBP is that ECB/BoE policy divergence favours depreciation. Though the BoE failed to live up to market hype for a 15bps rate hike earlier in the month, GBP STIR markets are pricing about 12bps worth of tightening in December (implying about an 80% probability of a 15bps rate hike). Economists are more split; according to a Reuters poll taken between 8-12 of November, 26 of the 47 surveyed economists said they expected a 15bps rate hike, while 21 did not.

“Particularly important for the (BoE) MPC will be the two upcoming labour market releases”, said Marchel Alexandrovich at Jefferies, as quoted by Reuters. “If both are decent, the majority of the MPC could well be minded to increase Bank Rate by 15bps in December. However, if the December report is on the soft side, then it would clearly be more prudent for the decision on rates to be delayed until February.” All but one of the 47 surveyed economists said the bank would start hiking rates by the February meeting.

- XAU/EUR prints a new year-to-date high at €1,629.29.

- Inflationary pressures around the globe spurred demand for precious metals as a hedge against it.

- XAU/EUR: With RSI in overbought levels, gold might correct before resuming the upward trend.

Gold against the EUR (XAU/EUR) is trying to extend its weekly rally for seven consecutive days, trading at €1,627 during the New York session at the time of writing.

Early in the Asian session, the yellow-metal gave back some of its weekly gains, as bears pushed the precious metal towards the 50-simple moving average (SMA) in the 1-hour chart at €1,615, but they failed to gain follow-through, bouncing off towards new year-to-date highs at €1,629.29.

Demand on the precious metals segment has increased value in gold and silver. Since Wednesday, when the US inflation figure toped above 6% for the first time in three decades, investors flew towards gold as a hedge against elevated prices.

“Gold is taking a breather after breaking out, as the post CPI sell-off in bonds continued in the overnight session, with the market back to pricing the first hike in July and 60bp of hikes in 2022. But the breakout in gold has also attracted new buyers as global markets search for inflation-hedges,” per TD analysts note for customers.

Further added, that the breakout has driven “China Smart Money group of funds to add a significant amount of new length in SHFE gold. Considering that Shanghai’s gold net length remains near multi-year lows, a change in sentiment could attract a substantial amount of buying interest from this cohort."

XAU/EUR Price Forecast: Technical outlook

Daily chart

-637723319655679906.png)

XAU/EUR uptrend move seems to be fading, as witnessed by Friday’s price action. Furthermore, the Relative Strength Index (RSI) at 75 is slightly flattish in overbought conditions, indicating that the non-yielding metal might consolidate before resuming the trend, towards a test of November 9, 2020, high at €1,652. Further, it is approaching the top-trendline of Andrew Pitchfork’s indicator, around the €1,633 region that could stall the upward move.

In case of a correction lower, November 13, 2020, high at €1,604 would be the first support. A break of the latter would extend the downfall towards 2021 previous high at €1,589.

The USD/ZAR is headed toward a modest appreciation over the next quarters according to analysts at CIBC. They forecast USD/ZAR at 15.45 during the fourth quarter and at 15.75 by the first quarter of next year.

Key Quotes:

“After a brief flirtation below the 13.50 threshold into the end of H1, the ZAR has been the second worst performing global currency thus far in H2, as only the BRL has witnessed a greater degree of depreciation. That has developed as international investors have largely abandoned domestic bonds. The three-month moving average of foreign bond purchases has dipped to all-time lows, beyond 2020 extremes.”

“Rising domestic inflationary influences point towards real yields continuing to compress. Having peaked above 6% in Q1, they are set to dip below 4%, as CPI looks set to advance from September’s 5.0% amidst ongoing food and energy price gains.”

“Having moved beyond the mid-point of the 3-6% SARB target range in August, prices risk threatening the top of the price corridor into year-end. The recent ZAR depreciation will exacerbate the jump in the global oil price, as WTI has gained almost 30% in local currency terms across the period. While inflation expectations have yet to become materially de-anchored, signs of an uptick in wage deals, as the metalworkers union agreed to a 5-6% hike, point towards the need for central bank action to restrain inflationary pressures.”

“While a rate hike at the November meeting is likely to be a close call, the prospect of at least 75bps of tightening in the next 12 months risks materially compromising the growth trajectory, adding to near-term ZAR headwinds. Hence we expect a re-test of 2021 highs in the next six months.”

Data released on Friday showed an unexpected decline in the Consumer Sentiment Index measured by the University of Michigan in November to the lowest level in ten years. Sentiment has been shaken in recent months amid the more recent outbreak of COVID, dwindling stimulus and sharply higher consumer goods inflation, explained analysts at Wells Fargo. They argue inflation is also affecting confidence.

Key Quotes:

“Consumer sentiment tumbled 4.9 points to 66.8 in early November, its lowest reading since 2011. Sentiment has been shaken in recent months amid the more recent outbreak of COVID and dwindling stimulus, but the November fallout has inflation's name written all over it. Near-term inflation expectations inched up to 4.9%, and while longer-term (three-to-five years out) expectations stayed put at 2.9%, it appears that consumers see that the writing is on the wall as far as climbing prices in the next year or so.”

“This growing concern of elevated prices and the effect of inflation on household finances led consumers to report being downbeat about both their current economic conditions and their expectations for the future, which slid to 73.2 and 62.8 respectively.”

“With views of rising inflation and pessimistic outlooks on finances, it's of little surprise that buying conditions tumbled in early November. Buying conditions for major household items, vehicles and homes have all moved lower in recent months and now comfortably sit at their lowest levels in decades.”

“With inflation expected to remain hot and the labor market firmly on the path to recovery, we have brought forward our expectations for the FOMC to raise the federal funds rate 25bps in the third quarter of next year. The drivers of inflation leave the Fed in between a rock and a hard place in terms of setting monetary policy, but how it handles the next couple of months will be critical to preserving consumers' faith in the trajectory of the recovery.”

Analysts at CIBC forecast the USD/JPY pair could continue to rise during the next months at a slow pace. They see the pair at 114 during the fourth quarter and at 115 in the first quarter of next year.

Key Quotes:

“While the RBA recently moved away from yield curve control, it seems unlikely that the BoJ is set to follow suit anytime soon. Following a meeting between BoJ Governor Kuroda and PM Kishida, post the recent LDP election victory, the former acknowledged that not only does the bank remain committed to its 2% CPI target, it also will maintain YCC, even beyond Covid. The perpetuation of an ultra-easy BoJ policy stance is set to leave Japan alongside the eurozone and Switzerland as extending long term policy inertia, a scenario which should continue to leave the JPY on the defensive.”

“Post the re-election of the LDP, we can expect another round of fiscal stimulus. Press reports suggest a potential injection of around JPY35trn, which could even include cash handouts to youths and children. While we expect Q3 weakness to give way to a solid rebound in Q4 GDP as the economy re-opens, the extension of yield curve control will see a sizeable widening in USTJGB 10 year spreads, providing the rationale for ongoing outflows of capital looking for higher returns overseas.”

“One risk to our weaker yen scenario that bears watching is the sheer scale of existing JPY shorts. Speculative investors have continued to add to those positions over recent weeks, and leveraged shorts are threating extremes not seen since December 2018. The scale of the position skew risks a JPY corrective rally should risk sentiment prove to become materially compromised into year-end, but we would still maintain our medium term outlook for a weaker yen into 2022.”

- Spot gold is back to flat on the day around $1860, having found good demand when it dipped to $1850.

- Friday’s US consumer and JOLTs job openings data supported the precious metal.

- Attention now turns to a speech from Fed’s Williams at 1710GMT.

Spot gold (XAU/USD) prices have in recent trade recovered back to trading flat on the day, having at one point prior to the US open been trading with losses of nearly 1.0%. The precious metal appeared to find good demand at $1850 as gold bulls and those seeking inflation protection bought the dip.

Prices got a small boost at 1500GMT in wake of the release of the University of Michigan Consumer Sentiment survey for November and the JOLTs Job-Opening report. The former showed sentiment hitting decade lows as consumers despaired over persistent inflationary pressures, while the latter showed that in September, the number of job opening exceeded the number of unemployed persons by a record 2.8M and the quit rate hit a record high at 3.0% (both indicators of a very strong jobs market).

In particular, the strong JOLTs report adds to a growing mountain of evidence that inflation is going to remain persistent above the Fed’s 2.0% target for quite some time; high labour demand equals high wage growth which leads to higher inflation. Gold bugs will now be hoping that the precious metal can challenge its prior weekly highs just shy of the $1870 level. At present, XAU/USD is close to $1860.

Fed under pressure to respond to inflation

Spot prices are on course to post gains of around 2.5% this week, with the bulk of the move higher coming in wake of a much hotter than expected US Consumer Price Inflation report on Wednesday, which showed consumer prices surging at their fastest YoY rate since 1990. Pressure is mounting on the Fed to take its foot off the accelerator (i.e. remove monetary stimulus at a faster rate).

Thus, a speech from influential Fed Board of Governors member and NY Fed President John Williams at 1710GMT will be closely scrutinised. If he continues to emphasise that the Fed is willing to be patient with regard to rate hikes and that the bank continues to believe the spike in inflation to be transitory, this may exacerbate fears that the Fed is making a dovish mistake. This would likely help gold finish the week with a flurry.

- US consumer confidence drops unexpectedly to 10-year low.

- Greenback losses momentum during Friday’s American session as yields correct lower.

- EUR/USD unable to make a sustainable recovery above 1.1450.

The EUR/USD bounced from a fresh cycle low and climbed to 1.1461 but only to pull back quickly under 1.1450. The pair is about to end the week under pressure, unable to make a strong recovery.

The euro is about to post the lowest weekly close since July 2020 versus the US dollar. It remains under pressure and for another time, the rebound was seen as an opportunity for traders to sell EUR/USD.

Economic data in the US showed the US University of Michigan Consumer Sentiment index dropped unexpectedly to the lowest level in 10 years at 66.8 against expectations of an increase to 72.4. “US consumer confidence is being threatened by the rising cost of living. Thankfully the relationship between spending and sentiment has been weak for a number of years and the strong underlying economic position means spending will continue to grow. Meanwhile, people continue to quit their jobs in record numbers as pay rates rise,” explained analysts at ING.

The numbers triggered a decline in US yields and weighed on the greenback. The US Dollar Index turned negative for the day, retreating from one-year highs. The EUR/USD failed to benefit strongly from the weaker greenback, and it remains near weekly lows, showing that the bearish pressure persists.

Technical levels

Analysts at MUFG Bank continue to see the GBP/CHF headed to the downside in the short term. They see a potential benefit of the Swiss franc from inflation concerns and the pound facing increasing downside risks.

Key Quotes:

“We believe that risks for the GBP remain to the downside in the near-term. Firstly, we expect real yields in the UK to remain under downward pressure after the BoE stuck to plans to raise rates only gradually. At the same time inflation expectations could continue to drift higher as headline inflation continues to pick up towards 5% heading into year end. The release of the latest UK CPI for October in the week ahead could add to those inflation concerns.”

“We are wary of a heightened risk of a more disruptive Brexit outcome from the ongoing EU-UK tensions over the Northern Ireland protocol. Both sides remain far apart and there is increasing speculation that the UK government will trigger Article 16 which could be met by a powerful response from the EU that even puts No Deal Brexit risk back on the table. The UK government’s decision is expected by early December. Fresh EU-UK trade tensions could reinforce concerns over supply disruptions in the UK which are already contributing to the less favourable outlook for growth and inflation.”

“We chose a long CHF leg as we have already recommended long USD exposure against the EUR. The CHF should continue to benefit as well from building concerns over higher inflation. The CHF has proven to be better store of value over the long-term. It should also benefit from a pick-up in Brexit risks. Technically, EUR/CHF is approaching pandemic lows at 1.0505. CHF strength could accelerate if key support levels are broken and the SNB does not step up intervention to dampen the move.”

- US bond yields saw some downside in wake of weak US consumer sentiment numbers.

- But Friday’s US data supported the narrative that inflation won’t be transitory.

- Traders will look for any hawkish hints when Fed’s Williams speaks later.

US bond yields saw a modest drop in wake of the latest batch of US data, which included the release of the September JOLTs Job Openings report and the preliminary November University of Michigan Consumer Sentiment survey. The latter survey showed consumer sentiment at its weakest since 2011, which likely weighed on yields, though the data also supported the narrative that inflation won’t be transitory.

The yield of the US 10-year treasury fell from above 1.57% to session lows around 1.54%, though has subsequently recovered back to just under the 1.56% mark. That means the 10-year yield is flat on the day. More broadly, price action across the US treasury curve has been relatively tame on the final trading day of the week, with the 2-year yield flat just above 0.50%, the 5-year yield flat just above 1.21% and the 30-year yield about 1bps higher just under 1.93%.

Short-end yields had been a little higher earlier in the session, with the 2-year at one point above 0.54%. Some profit-taking on bond short-positions from earlier in the week, when bond markets sold off hard in wake of a much hotter than expected US Consumer Price Inflation report, is likely driving the drop minor pullback in short-end yields.

Consumer Sentiment battered by inflation concerns

The headline University of Michigan Consumer Sentiment index fell to 66.8 in November, well below forecasts for a slight rise to 72.4 from 71.7. As noted, that marked its weakest reading since 2011. According to Richard Curtin, Surveys of Consumers chief economist, sentiment was hit by “an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation”. Curtin added that “one-in-four consumers cited inflationary reductions in their living standards in November”. With consumers not hopeful about the prospect for near-term improvement in the inflation outlook, the expectations index saw a sharp drop to 62.8 (expected 70.0, previous 67.9), while the assessment of current conditions index fell to 73.2 (expected 80, previous 77.7), multi-year lows for both as well. 1-year inflation expectations rose slightly to 4.9% from 4.8% in October, while the 5-year expectation was steady at 2.9%.

At the same time as the Consumer Sentiment survey, the latest US JOLTs Job Openings report was also released for September. A smaller than expected drop in job openings was witness on the month, with openings coming in at 10.438M versus forecasts for a drop to 10.3M. The number of openings in August was revised higher to 10.629M. That meant that there was a record 2.8M more job openings than unemployed persons in the US economy in September. The quit rate also reached a record high at 3.0%, up from 2.9% the month prior. A higher quit rate indicates that employees are more confident in their ability to find a new, likely better paid job, a good indicator that the labour market is healthy.

Pressure mounts on Fed to react to inflation

With inflation now weighing more on consumer sentiment than the emergence of the Covid-19 pandemic did back at the start of 2020, pressure is mounting on the Fed to do something about it. Meanwhile, the fact that the labour market is red hot, as indicated by the recent official jobs report for October and Friday’s JOLTs report for September, the idea that the current spike in inflation above the Fed’s 2.0% target is merely transitory seems increasingly unbelievable.

Coming up, Fed Board of Governor member and NY Fed President John Williams will have chance to react to the recent run of highly inflationary data releases. Any hint towards a hawkish shift in Fed policy would likely put upwards pressure on bond yields, particularly the short-end.

- Limited gains in equity markets and lower US yields boost Japanese yen across the board.

- US dollar retreats on American hours, DXY turns negative.

- USD/JPY erases gains, back into the previous range around 114.00.

The USD/JPY retreated further during Friday’s American session and dropped to 113.75, hitting a two day low. Earlier on the day, the pair climbed to 114.29, hitting the highest level in almost two weeks.

The combination of lower US yields, caution across equity markets and mixed economic data from the US strengthened the Japanese yen on Friday. The US dollar lost momentum near the end of the week. The DXY is falling after a strong two-day rally. It hit a fresh multi-month high and the 95.26 and then pulled back toward 95.10.

Economic data released on Friday showed the Consumer Confidence index, measured by University of Michigan, dropped from 71.7 to 66.8, against expectations of an increase to 72.4. US yields bottomed after the report with the 10-year falling to 1.54%.

The outlook for USD/JPY continues to point to a consolidation after the sharp rebound from 112.70 back above 113.40. It is back to the previous range around 114.00. A daily close above 114.40 should point to more gains, while under 113.30, a test of the monthly lows seems likely.

Technical levels

UK Brexit Minister Lord David Frost said that the UK and EU will hold intensified talks next week on the implementation of the Northern Ireland protocol and the talks will focus on customs and medicine, according to Reuters. He noted that significant gaps remain between the UK and EU.

- AUD/USD edges up after three-day of consecutive losses.

- Bad Australian jobs report it weighed on the AUD, which dropped almost 2% in three days.

- A jump in US inflation not seen in 30-years boosted the US dollar, with the DXY above 95.00.

AUD/USD recovers some of its weekly losses, advances for the first time in four days, edges up 0.32%, trading at 0.7312 during the New York session at the time of writing. The Australian dollar took three days of consecutive losses, losing almost 2%, but in the European session found some demand, bouncing from daily lows around 0.7270s pushing higher, despite broad US dollar strength.

The US Dollar Index, which tracks the greenback’s performance against a basket of six peers, advances 0.06%, sitting at 95.20, underpinned by higher US T-bond yields, with the 10-year benchmark note moving higher one basis point, currently at 1.561%.

The AUD/USD seems to be moving in US dollar profit-taking. The Australian 10-year bond yield drops one basis point at 1.795%, contrary to the abovementioned US 10-year Treasury.

Australia Unemployment Rate jumped to 5.2% on a dismal jobs report

Recapping the week, the Australian economic docket witnessed the Jobs report, severely missing the market’s expectations. The Employment Change for October dropped 46.3K when the market expected 50K new jobs added to the economy. Consequently, the Unemployment Rate for the same month jumped to 5.2%, from 4.6% in the September reading. After those figures, the Reserve Bank of Australia (RBA) cemented its dovishness stance, as witnessed by Governor Philip Lowe, who remarked that the central bank would be patient concerning rising rates in the near term.

US inflation above 6%, for the first time in three decades

On the US front, the so-called Wholesale inflation, the Producer Price Index (PPI) excluding food and energy rose by 6.8%, in line with expectations, was ignored by the market. The highlight of the week was US inflation from the consumer perspective. The headline reading increased by 6.2%, higher than the 5.8% foreseen by analysts, reaching the highest reading since 1990.

That would put the Federal Reserve under pressure, as their view of “transitory” inflation seems to last longer than expected. It is worth noting that the US central bank announced at its last monetary policy meeting that they would begin the bond tapering in mid-November.

Further, on Friday, the University of Michigan Consumer Sentiment Index for November edged lower to 66.8, lower than the 71.7 in October, marking the lowest reading since November 2011.

According to the report, "consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation," said Richard Curtin, Surveys of Consumers chief economist.

- Mexican peso recovers on Friday, still among worst weekly performers.

- USD/MXN moving in the new range, upside bias.

The USD/MXN is retreating on Friday, pulling back after reaching earlier at 20.72 the highest level in a week. It is trading under 20.50, with a strong bearish intraday momentum. The daily chart nevertheless stills shows a bullish bias.

If the slide continues, USD/MXN will likely face some support around 20.45. A break lower would set the attention to the 20.30 area that should limit the decline and favor a rebound. The next critical support stands around 20.13/18 that contains the 100 and 200 moving average.

On the upside, the 20.65/70 zone capped the rally so far. A daily close above 20.65 should expose the next key area of 20.85/90, the last defense to an attack of 21.00.

The daily chart shows a modest bullish bias that will likely remain in place while above 20.20. A weekly close below 20.10 (20-WMA) should strengthen the Mexican peso.

USD/MXN daily chart

Vice President of the European Commission Maroš Šefčovič, giving public comments regarding Brexit negotiations, said we are ready to look at any issue that is within the Northern Ireland protocol. Šefčovič added that problems should be tackled one at a time, perhaps starting with medicines and customs next week. When about the EU's position that the ECJ must maintain jurisdiction in Northern Ireland, he said nothing had changed.

Consumer confidence in the US deteriorated in early November with the University of Michigan's Consumer Sentiment Index declining to 66.8 from 71.7 in October. This marked the lowest reading since November 2011.

Commenting on the data, "consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation," said Richard Curtin, Surveys of Consumers chief economist. "One-in-four consumers cited inflationary reductions in their living standards in November."

Further details of the publication revealed that the Current Conditions Index fell to 73.2 from 77.7 and the Consumer Expectations Index declined to 62.8 from 70.5.

Market reaction

With the initial market reaction, the US Dollar Index edged slightly lower and was last seen losing 0.03% on the day at 95.14.

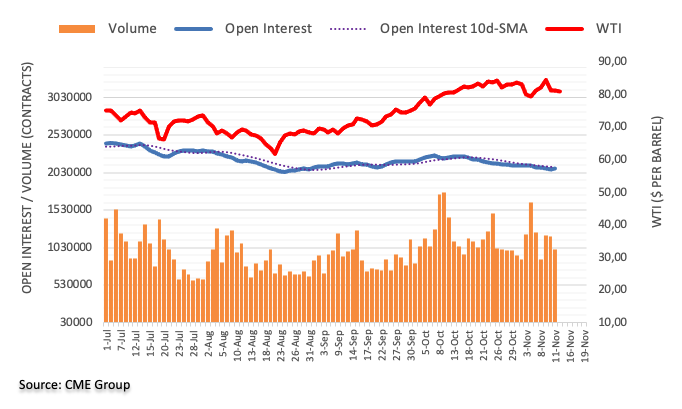

- WTI is trading with losses of around $1.0 on Friday, though has found decent support at $80.00.

- That marks a near $5.0 reversal from earlier weekly highs close to $85.00.

Crude oil prices are set to end the week at lows following significant choppiness over the past few sessions. Front-month futures contracts for the American benchmark for sweet light crude oil, West Texas Intermediary of WTI, are down about $1.0 (over 1.0%) on the day, though have for now remained supported to the north of the $80.00 level. That marks a near $5.0 reversal from earlier weekly highs close to $85.00. On the week, WTI is set to close lower by about 0.75%. Much of the downside took place on Wednesday after the hotter than expected US Consumer Price Inflation report triggered speculation that 1) the Fed would start hiking interest rates early, thus weighing on US growth in 2022 and beyond and 2) that the Biden administration might release crude oil reserves in order to (attempt to) lower energy prices and thus ease inflationary pressures being felt across the US economy.

Some market commentators cited a downgrade by OPEC+ to their 2021 oil demand growth forecast on Thursday as another bearish factor for the oil complex. Crude oil-specific newsflow since Thursday has been relatively light and so crude oil market focus has centered around demand-side dynamics. Here there are conflicting themes; there has been a lot of chatter about how an easing of international travel restrictions sets the stage for a strong rebound in jet fuel demand, which was pretty much the final component holding total global crude oil demand back from hitting pre-pandemic levels. But there has also been a building of Covid-19 concerns in Europe; lockdowns have now been announced in Austria (just for the unvaccinated) and the Netherlands and Germany, where infections rates are at record highs, looks to be next. In the US, infection rates have plateaued since the start of October and are likely to follow Europe as the winter months approach.

Danske Bank “expect many countries will re-introduce (or tighten) some of the soft measures such as face mask requirements and COVID-19 green pass” in the coming months and while the bank does “expect a weaker relationship between new cases and hospitalisations/deaths, especially in countries with high vaccine uptakes”, they warn that “if the waves get bigger than last year (due to a combination of fewer restrictions and a more transmissible variant), hospitalisations may still increase to the same levels as last year”. Even in the absence of harsh lockdown restrictions, higher Covid-19 public fear is a downside risk to developed market growth in Q4 2021/Q1 2022.

- EUR/USD keeps the offered stance unchanged near 1.1430.

- US yields trade in a mixed note following Thursday’s holiday.

- US flash Consumer Sentiment next on tap in the docket.

EUR/USD extends the weekly bearishness for yet another session and clinches fresh 2021 lows near 1.1430 at the end of the week.

EUR/USD offered on dollar’s rally

EUR/USD navigates levels last traded back in the summer 2020 amidst the relentless march north in the greenback, which pushed the US Dollar Index (DXY) to new cycle peaks in the 95.25/30 band on Friday.

The pair, in the meantime, remains at the mercy of dollar dynamics and it has definitely accelerated the downtrend following the release of US inflation figures during October (Wednesday) and the breakdown of the key 200-week SMA (1.1561). The first event triggering a sharp move higher in the buck along with US yields and speculations of an anticipated lift-off by the Fed.

Back to the calendar, Industrial Production in the broader Euroland came above expectorations after contracting 0.2% inter-month in September, while expanding 5.2% vs. the same month in 2020.

Across the Atlantic, September JOLTs Job Openings and the preliminary Consumer Sentiment for the month of November are due.

EUR/USD levels to watch

So far, spot is down 0.09% at 1.1439 and faces the next up barrier at 1.1583 (20-day SMA) followed by 1.1609 (weekly high November 9) and finally 1.1616 (monthly high Nov.4). On the other hand, a break below 1.1432 (2021 low Nov.12) would target 1.1422 (monthly high Jun.10 2020) en route to 1.1300 (round level).

- Wall Street's main indexes trade in the positive territory on Friday.

- Technology shares push higher after the opening bell.

- Investors await the University of Michigan's Consumer Sentiment Index data.

Major equity indexes in the US started the last day of the week in the positive territory on the back of improving market sentiment. The CBOE Volatility Index, Wall Street's fear gauge, was last seen falling more than 4% on the day at 16.94.

As of writing, the S&P 500 Index was up 0.2% at 4,656, the Dow Jones Industrial Average was rising 0.27% at 36,015 and the Nasdaq Composite was gaining 0.5% at 15,704.

Among the 11 major sectors, the Communication Services and the Technology indexes are up 0.3% after the opening bell. On the other hand, the defensive Utilities Index is losing 0.4%.

Later in the session, the University of Michigan will release the preliminary Consumer Sentiment Index data for November.

S&P 500 chart (daily)

GBP/USD has seen a decent intraday rally from the mid-1.33s. Economists at Scotiabank believe the cable can extend its rebound above the 1.3410 mark.

GBP/USD to enjoy a short-term bounce

“Cable is showing tentative signs of a shorter-term bounce. A small ‘cup/handle’ pattern seems to be developing and we think gains should extend above 1.3410 intraday.”

“A daily close above 1.3415 may provide the GBP with broader relief.”

EUR/USD is steady in the low 1.14s. However, the bear trend is set to persist, economists at Scotiabank report.

Resistance seen at 1.1525/30

“We continue to target 1.14 as the near-term bear objective.”

“The 1.10/1.11 zone remains a very viable objective in the next few months.”

“Resistance is 1.1525/30.”

- USD/TRY rises to 9.9800 on Friday, new all-time high.

- Turkey Retail Sales rose 1.2% MoM in October.

- Industrial Production surprised to the downside.

The Turkish lira remains well on the defensive and lifts USD/TRY closer to the psychological 10.0000 mark on Friday.

USD/TRY now looks to CBRT

USD/TRY navigates the fourth consecutive session with gains at the end of the week and corrects lower after climbing as high as the 9.9800 level, or a new all-time peak.

The firmer stance in the greenback in past sessions, particularly in response to the multi-decade spike in inflation recorded during last month, sponsored the investors’ exodus from the EM FX space along with the rest of the risk-linked assets and put the lira under extra pressure.

Earlier on Friday, Turkey’s finmin L.Elvan ruled out speculations that the government was deliberately aiming at a weaker lira in order to support the country’s export sector, while he added that the economy could expand more than 9% this year and that the current account deficit is seen below 2% by year end.

In the domestic data space, Retail Sales expanded at a monthly 1.2% in October and 15.9% from a year earlier, while Industrial Production expanded 8.9% in the year to September. Additional data saw the End Year CPI Forecast rising to 19.31% (from 17.63%).

USD/TRY key levels

So far, the pair is gaining 0.62% at 9.9452 and a drop below 9.5911 (20-day SMA) would expose 9.4722 (monthly low Nov.2) and finally 9.4128 (weekly low Oct.26). On the other hand, the next up barrier lines up at 9.9794 (all-time high Nov.12) followed by 10.0000 (psychological level).

The commitment from the Fed to support the economy, while letting inflation print higher, prompts strategists at Société Générale to revise up their gold forecast. They expect XAU/USD to average $1,950 in the first quarter of 2022.

XAU/USD to fall towards $1,700 in 4Q22

“We are still slightly supportive in the near-term as we expect monetary and fiscal policy to remain highly accommodative. Indeed, the Fed seems to be reluctant to increase interest rates any time soon, this combined with high inflation create the perfect mix of negative real rates for gold.”

“The renewed commitment from the Fed to support the economy while letting inflation printing higher lead us to revised up our forecast. We now expect price to average $1,950 in 1Q22. Then it should gradually decline down to $1,700 in 4Q22 as the situation normalises.”

See – Gold Price Forecast: XAU/USD to form an uptrend by March 2022 – TDS

- USD/CAD recent rally seems to have stalled at 1.2600.

- FX market focus now turns to US data and Fed speak, as well as the BoC Loan Officer survey.

USD/CAD’s bull run of the past two sessions looks to have come to an end on Friday as the pair runs into solid resistance at 1.2600. The pair rocketed higher in recent session amid 1) broad US dollar strength as traders brought forward Fed rate hike bets following a hot October US Consumer Price Inflation report and 2) as crude oil prices (WTI) reversed sharply back from earlier weekly highs around $85.00 to current levels just above $80.00.

On its way higher this week, the pair cleared a number of key levels of resistance, including the 200-day moving average at 1.2480, a balance area around 1.2500 and the 50DMA at 1.2535. The next area of notable resistance, besides the 1.2600 level that is currently capping the price action, is at 1.2650 but beyond that, it's clear air all the way up to above 1.2750.

Day Ahead

FX markets now look to upcoming US data and Fed speak for further impetus. The September JOLTs Job-Opening report is out at 1500GMT, which should show that labour demand remains very strong. Also released at 1500GMT will be preliminary November University of Michigan Consumer Sentiment survey, which will give a timely insight as to the state of US consumer health heading into the winter holiday shopping season. As ever, the consumer inflation expectation data in the report will be closely scrutinised. Risks for USD are tilted to the upside with markets twitchy about anything that might add to the inflation narrative (like a tighter than expected labour market or higher than expected consumer inflation expectations).

FOMC Board of Governors member and NY Fed President John Williams is then scheduled to speak at 1710GMT. San Fransisco Fed President and FOMC member Mary Daly has been the only FOMC member to address this week’s shock consumer price inflation report so far. While she expressed concern about high inflation, she reiterated the stance laid out by Fed Chair Jerome Powell at the latest policy meeting that inflation pressures will likely subside next year and the Fed should be patient on rate hikes to allow time for the labour market to recover. Williams’ comments will carry more weight.

Outside of US economic events, traders will also be watching the release of the Bank of Canada’s quarterly Senior Loan Officer survey at 1530GMT, which will update on the business-lending practices of major Canadian financial institutions. The report usually does not have an impact on FX markets.

- Silver managed to recover a part of its intraday losses, though remained on the defensive.

- The technical set-up favours bulls and supports prospects for a further appreciating move.

- A sustained break below mid-$24.00s is needed to negate the near-term positive outlook.

Silver witnessed some selling on the last day of the week, though lacked any follow-through. The white metal has now pared its intraday losses and was last seen trading around the 50% Fibonacci level of the $28.75-$21.42 downfall, just above the key $25.00 psychological mark.

Given this week's sustained breakout through 100-day SMA/38.2% Fibo. confluence barrier, a subsequent strength beyond the mid-$24.00s favours bullish traders. This, along with the emergence of some dip-buying on Friday, supports prospects for an extension of the appreciating move.

Apart from this, the emergence of some dip-buying on Friday and bullish oscillators on the daily chart further adds credence to the constructive outlook. Hence, a follow-through move towards the $25.55-60 intermediate hurdle, en-route the $26.00 mark, remains a distinct possibility.

The latter coincides with the 61.8% Fibo. level should act as a strong resistance amid absent relevant fundamental catalyst. That said, a convincing breakthrough will be seen as a fresh trigger for bullish traders and pave the way for additional near-term gains for the XAG/USD.

On the flip side, any meaningful corrective pullback might continue to attract some dip-buying and remain limited near the $24.50 resistance breakpoint. Failure to defend the mentioned support could turn the XAG/USD vulnerable to accelerate the slide towards the $24.00 mark.

Some follow-through selling below the $23.70 area will shift the bias in favour of bearish traders and set the stage for deeper losses, towards the $23.00 mark. The next relevant support is pegged near mid-$22.00s, below which the XAG/USD could slide to YTD lows, around the $21.40 area.

Silver daily chart

Technical levels to watch

- NZD/USD is currently flat, having rebounded from an earlier test of the 0.7000 level.

- The pair is set to end the week sharply lower, however, after hot US inflation triggered broad USD strength.

FX market conditions are broadly subdued so far this Friday and NZD/USD is no exception, with the pair currently trading flat on the day around the 0.7020 mark, having recovered from a test of the 0.7000 level during the Asia session. Given the partial closure of US markets on Thursday for Veteran’s Day, liquidity conditions are thinner than usual for a Friday, likely indicative of the fact that many US market participants took a long weekend’s holiday.

Things have been pretty quiet in terms of fundamental developments this week in New Zealand. The main focus in markets there is on the gradually rising full vaccination rate in the country that should soon hit the 90% threshold set by the government as a condition for full removal of lockdown restrictions. For Auckland, where restrictions are toughest, that lockdown easing is scheduled to come at the end of the month and should see shops allowed to reopen. Focus will then be on whether the government and health authorities can stomach a surge in Covid-19 infections amongst the vaccinated (as seen in other parts of the world with a high vaccination rate such as Europe and the US in recent months).

NZD/USD looks set to end the week with fairly sharp losses of about 1.2%, most of which were accrued in the immediate aftermath of Wednesday’s much hotter than expected US Consumer Price Inflation report for October, which triggered a spike in US bond yields and prompted an aggressive hawkish repricing in USD STIR markets. That mark’s the pair’s worst week since mid-August when snap lockdowns were announced, thus delaying a previously widely expected first rate hike from the RBNZ. The RBNZ’s relative hawkishness vs the Fed may shield the pair from further USD advances and next week could see a tentative recovery back toward’s the pair’s 50DMA just above 0.7060.

EUR/USD continues to drip lower. Economists at TD Securities expect the world’s most popular currency pair to dive towards 1.13 on a break below 1.1420.

EUR/USD is on a course correction lower

“We note that the momentum indicators continue to suggest a drip lower for EUR/USD.”

“1.1420 marks the next support marker but this does not look formidable. Below this, there isn't much in the way of support until 1.13.”

- GBP/USD is back to 1.3400 from Asia session lows just above 1.3350.

- The pair is outperforming its G10 counterparts amid hopes that the UK diffuses Brexit tensions.

GBP/USD has seen a modest rebound from Friday’s Asia Pacific session lows just above 1.3350 and is currently trading close to the 1.3400 level. Pound sterling is the best performing G10 currency on what has otherwise so far been a relatively quiet Friday. Nonetheless, GBP/USD appears to be struggling to extend its gains beyond 1.3400 and even if it does manage that, it faces resistance in the form of the prior annual lows in the 1.3410-20 area.

On the week, cable still stands to lose about 0.75%, with the main bearish driver being a broad strengthening of the US dollar (the DXY surged to fresh annual highs above 95.00) in wake of hotter than expected US inflation reports. The only notable UK data was the preliminary estimate of UK GDP growth in Q3, which showed a sharp slowdown in the QoQ pace of growth from above 5.0% in Q2 to 1.3% in Q3, broadly in line with expectations. The next important UK data will be the labour market report on Tuesday. The BoE is paying more attention than usual to labour market developments and wants to see that the unemployment rate didn’t spike sharply in wake of the end of the government’s furlough scheme at the end of September before opting to hike interest rates.

Sterling outperformance as Brexit concerns ease

As to why GBP is the strongest G10 performer on Friday, market commentators are citing a report by The Times that the UK wants to de-escalate Brexit-related tensions with the EU and does not want to trigger Article 16 – this would allow the UK to unilaterally suspend parts of the Northern Ireland protocol that governs the movement of goods in and out of Northern Ireland. According to sources cited in the article, UK Brexit Minister Lord David Frost is keen to emphasise to the Vice President of the European Commission that while the UK is still not fully on board with the bloc’s most recent proposals to reduce checks on goods crossing between Britain and Northern Ireland, they could form the basis of an agreement.

Tensions have been bubbling in recent weeks between the UK and EU over the former’s threats to trigger Article 16 and amid growing speculation that the EU could suspend parts of (or all of) the post-Brexit trade deal in retaliation. France and the UK have also been bickering over access to UK fishing waters for French boats. UK PM Boris Johnson is in Paris on Friday and in talks with French President Macron, where the above-noted issues will undoubtedly by the main topic of discussion. ING thinks “we think the risks for the pound (which is currently showing no political risk premium) are not as high as in 2018/19 when the risk of no-deal Brexit triggered extended periods of GBP weakness”.

- USD/JPY witnessed a modest pullback from near two-week tops touched earlier this Friday.

- A combination of factors should help limit the corrective slide and attract some dip-buying.

The USD/JPY pair edged lower through the early North American session and dropped to fresh daily lows, below the 114.00 mark in the last hour.

The pair struggled to capitalize on its intraday uptick, instead witnessed a modest pullback from the 114.30 area, or near two-week tops touched earlier this Friday. The downtick could be attributed to some profit-taking amid a subdued US dollar demand and following this week's rally of over 150 pips, triggered by hotter-than-expected US CPI.

Meanwhile, the downside remains cushioned on the back of a positive tone around the equity markets, which tends to undermine the safe-haven Japanese yen, and elevated US Treasury bond yields. The hotter-than-expected US CPI print released on Wednesday reaffirmed hawkish Fed expectations and continued acting as a tailwind for the US bond yields.

Investors now seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflationary pressures. In fact, the Fed funds futures indicate that the first rate hike could come as soon as July 2022. This should assist the greenback to attract some dip-buying and lend some support to the USD/JPY pair.

That said, the pair's inability to gain follow-through traction warrants caution for bullish traders. Next on tap will be the release of the Prelim Michigan Consumer Sentiment Index from the US. This, along with the US bond yields, will influence the USD. Traders will further take cues from the market risk sentiment for some impetus around the USD/JPY pair.

Technical levels to watch

- EUR/JPY meets support around the 200-day SMA near 130.40.

- The dollar’s upside loses momentum after hitting 2021 highs.

- The US flash Consumer Sentiment for November comes next.

EUR/JPY remains under pressure and navigates the fourth consecutive session with losses on Friday, this time around the 130.40 region, where the key 200-day SMA is also located.

EUR/JPY looks to USD, data

EUR/JPY remains on track to close the fourth consecutive week with losses, extending the rejection from October’s high near 133.50.

The solid momentum in the greenback has been weighing on the performance of the risk-associated assets in past weeks, all amidst the corrective downside in US yields along the curve, while the latest US inflation figures only added to the dollar’s attractiveness.

Earlier in the calendar, Industrial Production in the broader Euroland surprised to the upside after contracting 0.2% MoM in September and 5.2% over the last twelve months.

In the NA session, the preliminary November Consumer Sentiment gauge comes up next.

EUR/JPY relevant levels

So far, the cross is losing 0.06% at 130.51 and a surpass of 131.51 (38.2% Fibo of the October upside) would expose 131.85 (20-day SMA) and then 132.56 (monthly high Nov.4). On the downside, the next support comes at 130.41 (monthly low Nov.12) followed by 130.23 (100-day SMA) and finally 129.43 (78.6% Fibo of the October upside).

- Gold edged lower on Friday and snapped six days of the winning streak to multi-month tops.

- Hawkish Fed expectations seemed to be the only factor that prompted some profit-taking.

- Inflation fears should help limit the corrective pullback and attract dip-buying at lower levels.

- Gold Price Forecast: XAU/USD awaits acceptance above $1,870, focus on US consumer data

Gold witnessed some selling on Friday and for now, seems to have snapped six consecutive days of the winning streak. In the absence of fresh catalyst, bulls preferred to take some profits off the table following the recent strong run-up to the highest level since June 14 and hawkish Fed expectations.

This week's hotter-than-expected US CPI print fueled speculations that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. In fact, the Fed funds futures indicate that the first-rate hike could come as soon as July 2022. The prospects for an early policy tightening by the Fed was reinforced by elevated US Treasury bond yields, which, in turn, drove flows away from the non-yielding yellow metal.

This, along with the prevalent bullish sentiment surrounding the US dollar, acted as a headwind for dollar-denominated commodities, including gold. Apart from this, stability in the financial markets also did little to lend any support to the safe-haven precious metal, or stall the intraday decline to the $1,845 region during the mid-European session. That said, worries about a faster-than-expected rise in inflationary pressures helped limit the downside for the XAU/USD, which is a proven long-term hedge against rising prices.

Hence, any subsequent pullback might continue to attract some dip-buying near the $1,834-32 strong horizontal resistance breakpoint. Nevertheless, gold remains on track to post its biggest weekly gains in six months and seems poised to appreciate further. A sustained move beyond the $1,865 region, or multi-month tops touched on Wednesday, will reaffirm the bullish bias and set the stage for an extension of the upward trajectory.

Technical outlook

Looking at the technical picture, gold this week confirmed a bullish breakout through the $1,834-32 supply zone and ascending trend-channel resistance. This further adds credence to the near-term constructive outlook, though slightly overbought RSI on short-term charts kept a lid on any further gains. Bulls might also wait for a sustained move beyond the $1,865 region before placing fresh bets around gold. The commodity might then accelerate the momentum towards testing an intermediate hurdle near the $1,886-87 region and aim to reclaim the $1,900 mark.

On the flip side, the ascending channel resistance breakpoint, coinciding with the $1,834-32 supply zone, should now act as a strong base for spot prices. Some follow-through selling might trigger long-unwinding trade and drag gold towards the next relevant support near the $1,815 horizontal zone en-route the $1,800 mark.

Gold daily chart

- EUR/USD drops further and reaches new YTD low at 1.1436.

- Further selling could see the 1.1422 level revisited near term.

EUR/USD remains under heavy pressure on Friday, although the vicinity of 1.1430 appears to be holding well the downside for the time being.

The continuation of the downtrend appears favoured in the short-term horizon. Against this, and if the pair clears the YTD low at 1.1436, the focus of attention is expected to quickly gyrate to the June 2020 high at 1.1422 (June 10).

In the meantime, extra losses remain look likely as long as the pair trades below the immediate resistance line (off September’s high) today near 1.1630.

EUR/USD daily chart

26 out of 47 economists surveyed by Reuters see the Bank of England (BoE) hiking its policy rate to 0.25% on December 16. The October poll showed that the majority of economists was expecting the BoE to raise its rate in the first quarter of 2022.

Economists forecast the UK inflation to average 4.1% in the last quarter of 2021, 4.2% in the first quarter of 2022 and 4.2% in the second quarter. Finally, the UK economy is expected to expand by 5.0% in 2022 and 2.1% in 2023.

Market reaction

The British pound showed no immediate reaction to this headline and the GBP/USD pair was last seen rising 0.15% on a daily basis at 1.3390.

- DXY records a new 2021 high at 95.26 on Friday.

- Next on the upside is seen the 97.80 level (June 30 2020 high).

DXY extends the rally for yet another session and clinches fresh YTD tops in the 95.25/30 band at the end of the week.

Both the macro and the technical outlooks favour extra gains in the dollar for the time being. That said, while above former tops in the mid-94.00s (October 12) the index is expected to edge higher to, initially, the round levels at 96.00 and 97.00, while a more significant level is located at the June 30 2020 at 97.80.

Looking at the broader picture, the constructive stance on the index is seen intact above the 200-day SMA at 92.13.

DXY daily chart

Copper prices more than doubled from 1Q20 to May 2021, but this impressive rally then stopped and prices have trended downward over the past six months. Strategists at Société Générale are slightly bearish in 2022 on abundant supply, however, things are set to get very bullish in later years.

Copper prices to drop throughout 2022

“We are still bearish on copper in the short-to-medium term and see prices averaging a low $7,500/t in 2Q22.”

“We think this subdued price reaction shows that the investor frenzy related to copper’s usage in the green transition is fading. The copper market is reconnecting with its fundamentals and we expect it to be bearish in the short-term.”

“In the longer-term, both supply and demand outlook for copper are extremely bullish. We could see prices averaging $12,500/t by 2025. This is far beyond our one year-out forecast, but we expect the market to be forward-looking and prices to start rebounding to $8,500 by the end of next year.”

- EUR/JPY extends the leg lower to the 130.40 area.

- The 200-day SMA holds the downside so far.

EUR/JPY adds to the ongoing decline and keeps navigating the area of 4-week lows in the 130.40 region on Friday.

EUR/JPY gyrates around the 55-day SMA in the mid-130.00s at the end of the week, while a drop below this area should expose another visit to the critical 200-day SMA around 130.40. This area of support remains propped up by the proximity of a Fibo retracement (of the October’s rally) near 130.30.

Below the 200-day SMA, the outlook for the cross is predicted to shift to bearish.

EUR/JPY daily chart

EUR/SEK has staged an initial bounce after forming a low near 9.86 last month. However, economists at Société Générale expect the pair to move back lower towards the 9.80 level.

Upside limited

“Signals of an extended up-move are still not visible.”

“200-DMA near 10.14/10.21 is short-term resistance.”

“Holding below the 200-DMA near 10.14/10.21, the pair is likely to drift lower towards 9.80, the 50% retracement from 2012.”

See – EUR/SEK: Riksbank tightening expectations to support krona momentum – CIBC

For 2022 at least, OPEC+ can manage supply and, as such, strategists at Société Générale forecast Brent prices to average $77.5/bbl in 2022.

The market balance to remain in surplus throughout 2022

“We revise up our oil price forecasts for 2022 by $10/bbl, as the oil market environment becomes more bullish.”

“We now forecast Brent prices at $80/bbl in 1Q22 and to average $77.5/bbl over 2022.”

“OPEC still maintains a healthy supply cushion, Iranian barrels have yet to be released into the market and US shale could respond at these price levels despite companies maintaining strong discipline. Beyond 2022, however, things could get very bullish, as demand recovers but longer-term supply is vulnerable, with lower global upstream spending fuelling speculation about adequate oil supply.”

- USD/CHF gained strong follow-through traction for the third successive day on Friday.

- Hawkish Fed expectations continued underpinning the USD and remained supportive.

- The cautious market mood could benefit the safe-haven CHF and cap any further gains.

The USD/CHF pair continued scaling higher through the mid-European session and shot to over three-week tops, around the 0.9230 region in the last hour.

The pair built on this week's hotter-than-expected US CPI-inspired strong positive move from the 0.9100 mark and gained some follow-through traction for the third successive day on Friday. The momentum was sponsored by the prevalent bullish sentiment surrounding the US dollar, which remained well supported by prospects for an early policy tightening by the Fed.

The US consumer prices in October rose at the fastest pace since 1990 and fueled speculations that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation. In fact, the Fed funds futures indicate that the first-rate hike could come as soon as July 2022. This, in turn, was seen as a key factor that acted as a tailwind for the USD.

The greenback was further underpinned by elevated US Treasury bond yields, though the cautious market mood could benefit the safe-haven Swiss franc and cap gains for the USD/CHF pair. Nevertheless, the ongoing positive move suggests that the recent sharp corrective slide from September monthly swing lows has run its course and supports prospects for additional near-term gains.

Investors now look forward to the US economic docket, highlighting the release of the Prelim Michigan Consumer Sentiment Index later during the early North Amerian session. This, along with the US bond yields, will influence the USD price dynamics. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities around the USD/CHF pair.

Technical levels to watch

EUR/USD has visited 2021 lows around 1.1430. The policy divergence between the Federal Reserve and the European Central Bank (ECB) continues to drive the pair's action. Economists at MUFG Bank expect not to get any let-up on policy stimulus from the ECB, subsequently, EUR/USD should see another leg lower.

The market remains excessively priced for rate hikes in the eurozone

“The market remains excessively priced for rate hikes in the eurozone. While other markets may also be overpriced now (but have corrected somewhat) it is only the ECB that remains so adamant in its dovish guidance, guidance which is likely to be repeated strongly at the next meeting.”

“Over the coming months, the scope for further declines in EUR/USD could come from changes in tightening over a longer period. Currently, there is only a 10bp spread between 2yr and 3yr US OIS (135bps vs 145bps) but if the US labour market starts to recover strongly in the coming months, the markets view of rate hikes further out could change more relative to the eurozone – that could be the catalyst for another move lower in EUR/USD.”

Gold has broken out from a small base by breaking above July/August/September peaks of $1,835. The yellow metal could extend its upmove on a break above the $1,875 mark, strategists at Société Générale report.

$1,835 and $1,810 are short-term support levels

“Gold is marching towards a multi month descending trend line near $1,875. A break above $1,875 would denote an extended rebound towards projections of $1,930 and graphical levels of $1,965/$1,980.”

“Daily MACD has entered positive territory which denotes upside momentum is regaining.”

“Upper band of the base near $1,835 and $1,810 are short-term support levels.”

The US dollar continues to gather strength. Economists at MUFG Bank expect the greenback to march forward in the coming months.

UST bond volatility picking up helping lift USD

“The near-term outlook for the USD remains positive and the sharp moves higher in UST bond yields on higher inflation looks likely to remain in place for now. The 10-year UST-Bund yield spread is testing the 180-level again and seems more likely to break higher this time – the first time that would have happened since early March. Higher UST bond volatility has tended to lift the USD this year.”