- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-11-2021

- Silver remains sidelined around three-month high, pauses two-day uptrend.

- Bullish Momentum, break of short-term horizontal hurdle keep buyers hopeful.

- 100-DMA, rising trend line from September 29 adds to the downside filters.

Silver (XAG/USD) seesaws in a choppy range above $25.00, recently easing to $25.20 amid Friday’s Asian session.

The bright metal jumped to its highest levels since August the previous day while extending the run-up beyond a two-month-old horizontal hurdle surrounding $24.85-80.

However, a failure to cross the 200-DMA level of $25.35 joins cautious sentiment ahead of the US Treasury market open, after a one-day US bank holiday, to challenge the bulls even as upbeat Momentum line hints at the further upside.

Hence, a clear upside break of the $25.35 becomes necessary for the XAG/USD buyers to keep reins. Following that, August month’s high of $26.00 and a descending resistance line from February, near $26.50, will be in focus.

On the contrary, a daily closing below the $24.85-80 resistance-turned-support area will recall the short-term sellers of silver. Even so, the 100-DMA and a two-month-old upward sloping trend line, close to $24.15 and $23.40 in that order, will be tough nuts to crack for the metal bears.

Silver: Daily chart

Trend: Bullish

- USD/JPY stays around 114.00, continues its weekly top situation.

- Investors look for fresh impetus amid light calendar events, Evergrande news is in focus.

- USD/JPY looks for direction from upcoming economic aid.

USD/JPY is appending yesterday rally led by US inflation to trade around 114.00 during early Asian hours on Friday. The cross on Thursday spiked on the back of US Treasury yields now turning cautious after annual consumer inflation in the US accelerated to a three-decade high of 6.2% in October. The outcome is raising expectations of earlier interest rate hikes by the Federal Reserve. The monetary policy views boosted the US Treasury yields to the highest rise in seven weeks, which propelled the US Dollar Index (DXY).

Previously, the wholesale inflation in Japan hit a four-decade high in October due to rising commodity prices and supply bottlenecks, as per government data. However, Bank of Japan (BoJ) policymakers iterated, acknowledging inflationary pressures arising from higher energy prices. They believe that it was moderate and that monetary easing should be maintained, according to BOJ October policy meeting minutes.

Meanwhile, besides Japan’s stimulus package news worth more than 30 trillion yen ($265 billion), China’s embattled Evergrande is in the headlines of late. It has once again met a deadline to pay overdue interest on three US dollar bonds before their grace periods ended. The Evergrande shares surged in Hong Kong on Thursday. Amidst undecided Fed Policymakers, coupled with the mild risk-on mood in a comparatively quiet market, USD/JPY seems to have buoyed. USD/JPY may continue to find impetus from a US rate hike hints and developing news from the China property sector.

USD/JPY technical levels

After capturing three-week-old resistance around 114.00, the USD/JPY daily chart now indicates that 114.70 (one-month high) can be re-tested. The following psychological barrier to the upside is at 115.00.

The price can reverse, wherein that the support level of 111.11, 100-day Simple Moving Average (SMA) will be first, followed by 110.82 (one-month low).

- AUD/NZD edges up for the third day in a row amid a dismal than expected Australian jobs report.

- RBNZ rate hike in October could be the prelude to more hikes coming in the short term.

- RBA cemented its dovish stance on a worse than expected Australian employment report.

The AUD/NZD has been moderately edging up in the last three sessions. As the Asian Pacific session begins, the pair is barely up 0.05%, trading at 1.0385 during the day at the time of writing.

On Thursday, the AUD/NZD during the Asian session dipped as low as 1.0355 as the market dissected a dismal Australian report. However, throughout the day, the Australian dollar licked its wounds, bouncing off the lows, reaching a daily high at 1.0400, but in the end, it retreated to its current price.

Australian Employment Change dropped 46.3K, and the unemployment rate jumped above 5%

Further, the Australian economic docket featured the Employment Change for October, which fell 46.3K, sharply lower than the 50K rise expected by analysts, spurring a jump in the Unemployment Rate, from 4.7% to 5.2%. That cemented the Reserver Bank of Australia (RBA) dovishness, as expressed by Governor Lowe at the press conference after unveiling the bank's monetary policy statement.

Central bank monetary policy divergence would be the main driver for the AUD/NZD

On its last monetary policy meeting, the Reserve Bank of New Zealand hiked its Overnight Cash Rate by 25 basis points, up to 0.50%, taking the lead amongst major developed countries. Also, the bank said that it would remove stimulus measures as the New Zealand economy continue its recovery.

According to sources cited by Reuters, said that the "RBNZ won't stop here. October marks the beginning of a new chapter for the cash rate: Onwards and upwards."

Most analysts expect a similar rate hike in November, February, and May.

Moving to the Reserve Bank of Australia (RBA), the RBA unwound its pandemic-stimulus packaging on its last monetary policy when it dropped the Yield Curve Control. Furthermore, it opened the door for an earlier hike rate, removing the 2024 calendar target on its monetary policy statement.

Yet, the RBA Governor Philip Lowe reiterated to market participants that the bank would be patient with its monetary policy and rejected that a hike could come as early as May 2022. Furthermore, keep its bond purchasing program at a pace of A$4 billion a week and emphasizes that inflation is expected to be around the 2.5% RBA target band by the end of 2023.

That said, and driven by recent economic data, the NZD could rise in the near term against the AUD, but the RBNZ will have its last monetary policy of the year by November 24, where the market expects a 50 basis point increase, according to futures market expectations.

Reuters came out with the survey details of 14 economists’ views on the next week’s monetary policy decision of the Central Bank of the Republic of Turkey (CBRT) on late Thursday. The headline findings suggest the 100 basis points (bps) of a rate cut to 15%, following a 200 bps of a rate cut witnessed in the last meeting to the 16% mark.

It’s worth noting that the CBRT is up for conveying monetary policy decisions on November 18.

Additional findings

At least four regular participants in Reuters polls did not make a forecast, citing unusual difficulties guessing the central bank's moves.

In a shift in guidance, the central bank said last month the current account deficit was the country's main problem, and narrowing the shortfall was key to price stability and supporting the lira.

It has said there is limited room for further cuts this year, after unexpectedly reducing its policy rate by 200 basis points last month.

The median estimate of 12 economists for the policy rate at year-end was 15%, with forecasts ranging between 13% and 16%.

Also read: USD/TRY pushes higher and approaches 10.0000

- GBP/USD remains on the back foot, recently sidelined around yearly low.

- Bearish impulse fades but bulls have limited upside room.

- September’s low challenges immediate recovery moves, further downside to aim for early November 2020 tops.

GBP/USD bears seem tiring around the lowest level since December 2020 as the cable pair seesaws near 1.3360-65 amid Friday’s Asian session, after refreshing the multi-day bottom the previous day.

The latest pause in the south-run could be linked to the oversold RSI conditions and the quote’s failures to break the 61.8% Fibonacci Expansion (FE) level of the quote’s moves between late October and November 09.

However, September’s low around 1.3410 stays ready to challenge the anticipated corrective pullback. Also acting as an upside barrier is the early month bottom close to 1.3425.

In a case where the GBP/USD prices remain firmer past 1.3425, a descending resistance line from October 28 and 50-SMA, respectively near 1.3520 and 1.3540, will be in focus.

Alternatively, further weakness needs to provide a decisive closing below 1.3350 immediate FE support ahead of visiting the early November 2020 peak near 1.3310.

Following that, the 100% FE level around the 1.3200 threshold will lure the GBP/USD bears.

GBP/USD: Four-hour chart

Trend: Corrective pullback expected

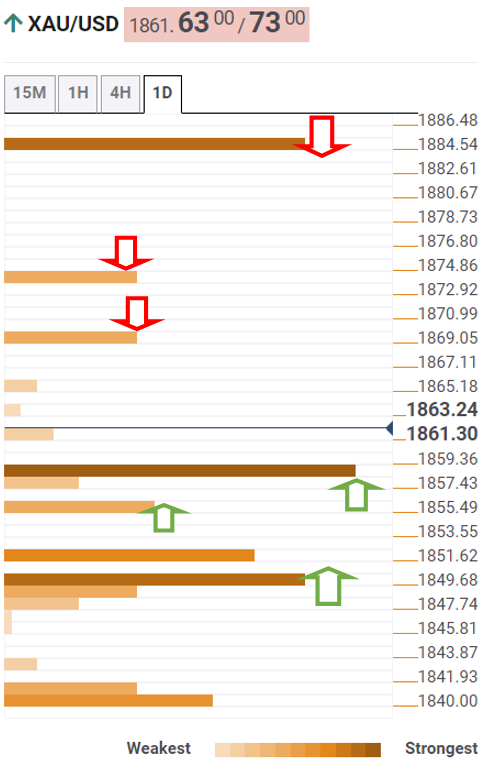

- Gold is testing critical resistance territories and a correction could be in store.

- Fundamentally, gold is enjoying the bullish landscape which could attract more buyers.

Gold extended gains following the prior day's US Consumer Price Index which is a weight on real yields for which gold is regarded as the perfect hedge. XAU/USD rose from a low of $1,842 to $1,866 on Thursday, adding around 0.7% points by the close of Wall Street.

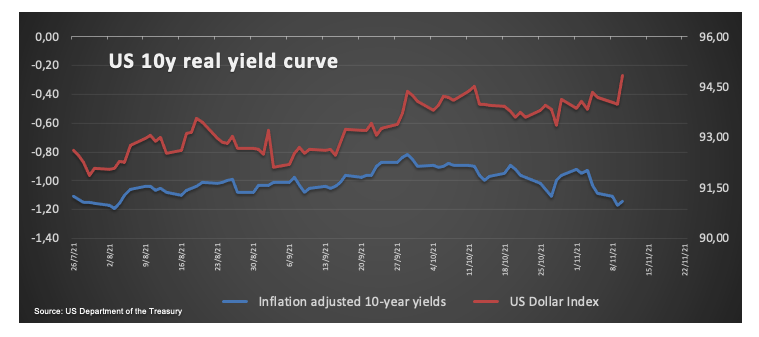

Gold climbed despite the advance in the US dollar that rose to a 16-month high a day after the strongest US inflation reading in more than three decades. Amid a holiday-thinned session, US Treasury markets were closed overnight. However, the 10-year Treasury yields implied by futures rose from 1.55% to 1.60%.

Bond yields have remained elevated due to the residual effects of the strong inflation data. The Consumer Price Index is now at new cycle highs and both the yearly and monthly prints show a second straight month of accelerating gains. Consequently, the markets are expecting US interest rate hikes next year which are underpinning the US dollar.

In related markets, equities rebounded on expectations higher consumer prices will help corporate growth. Commodity prices were mostly higher, the Bloomberg Commodity Index up 1.3%, its strongest day since 25 October. '' The spectre of higher and entrenched inflation saw investor demand surge for the precious metal,'' analysts at ANZ Bank said.

''Spot prices broke out of a downward trend that has been in place for the past 15 months. The move suggests the market doesn’t expect the Fed to tackle inflation soon,'' the analysts added. ''For the moment, the buying hasn’t manifested itself in the exchange-traded funds market, with inflows remaining muted.''

Gold's key level is at $1,860/oz

Gold is making its marl around the $1,860 level, an area on the carts where analysts at TD Securities have earmarked as being key. ''Gold prices need only close north of $1860/oz to catalyze further CTA long acquisitions, which should cement a more supportive trend.''

''Hawks are still getting squeezed,'' the analysts said, ''but the breakout in gold has also attracted new buyers.''

'''Importantly,'' the analysts added further, ''the breakout has driven the China Smart Money group of funds to add a significant amount of new length in SHFE gold.''

''After all, our ChartVision framework, which stress-tests 75 technical indicators to identify the critical threshold for a change in trend, suggests that with gold prices north of $1845/oz, an uptrend in gold should form by March 2022.''

Gold technical analysis

While the fundamental backdrop is bullish, the technical outlook points towards an imminent correction. The price is reaching into daily resistance where rejection would be expected to lead to a significant retracement. The 38.2% Fibonacci ratio aligns with the summer and mid-Sep highs as a potential target for the bears in the comings days near $1,830.

- USD/CAD remains sidelined after jumping to five-week tops.

- Bank holidays in US, Canada couldn’t restrict the bulls amid Fed rate hike chatters, softer oil prices.

- US Michigan Consumer Sentiment, risk catalysts eyed for fresh impulse.

USD/CAD seesaws around early October levels near 1.2580-90 during Friday’s Asian session. The Loonie pair refreshed the multiday peak the previous day despite banking holidays in Canada and the US restricted market moves.

The reason could be linked to the US dollar’s sustained run-up on the back of the Fed rate hike chatters and sluggish prices of Canada’s main export item, WTI crude oil. However, traders turn cautious ahead of the Treasury market’s opening after a one-day off and will be waiting for US data, as well as old catalysts for fresh impulse.

US Dollar Index (DXY) refreshed the 16-month high to 95.1961 before closing around 95.1228 by the end of Thursday’s North American session.

Over a three-decade high US inflation number propelled the Fed rate hike concerns and favored the US dollar of late.

On the same line could be the greenback’s safe-haven allure that gains importance amid growing concerns over China’s economic growth, mainly due to credit crisis for real-estate companies and power-cut problems. The same joins the Sino-American tussles over the phase 1 deal, Vietnam and Hong Kong to weigh on oil prices and offer additional fuel to the USD/CAD prices.

It is worth noting that talks of the US releasing Strategic Petroleum Reserve’s (SPR) to battle the energy crisis also recently challenged WTI bulls and favored the USD/CAD upside.

Amid these plays, Wall Street closed mixed with the off in the US Treasury markets. However, the US Michigan Consumer Sentiment for November will be eyed for fresh impulse as the traders return for a holiday.

Technical analysis

A clear break of the 100 and 50-DMA convergence, near 1.2540-45, enables USD/CAD bulls to aim for multiple levels marked since late July around the 1.2600 threshold.

- EUR/USD remains heavy near the lowest levels in 16 months.

- Bearish MACD, sustained trading below October’s trough allow sellers extra time.

- Five-month-old support line joins June 2020 peak to highlight 1.1420-10 as the key area.

- Monthly horizontal line guards immediate upside ahead of 20-DMA.

EUR/USD bears take a breather around the July 2020 levels following a two-day downtrend, taking rounds to 1.1450 during Friday’s early Asian session.

The major currency pair’s slump could be linked to the clear downside break of a horizontal area comprising multiple levels marked since early October. Also favoring sellers are the bearish MACD signals.

However, a convergence of a five-month-long descending trend line and high marked in June 2020 offer a tough nut a crack for the EUR/USD sellers around 1.1420-10 zone. The nearly oversold RSI conditions also highlight the importance of the said support region.

It’s worth noting that the 1.1400 threshold adds to the downside filter and allows counter-trend traders an extra opportunity for taking the risk.

On the other hand, corrective pullback remains less lucrative until the quote stay below one-month-old horizontal resistance, previous support around 1.1530.

Following that, the 20-DMA and a descending resistance line from September, respectively around 1.1585 and 1.1635, will be in focus.

Adding to the upside filters is the downward sloping trend line from May, close to 1.1670 at the latest.

EUR/USD: Daily chart

Trend: Further declines limited

- GBP/JPY declines for three days in a row, accumulating losses of almost 1%.

- GBP/JPY is trading sideways but slightly tilted to the downside, as sellers eye the 200-DMA.

GBP/JPY extends its losing streak to three consecutive days, down some 0.01%, trading at 152.44 during the day at the time of writing. On Tuesday, the pair failed to break strong resistance around 153.60, collapsing on Wednesday, in a hotter-than-expected US inflation reading, dipping down to the 100-day moving average (DMA) at 152.57.

On Thursday, during the Asian session, the GBP/JPY cross-currency pair failed to recover the 153.00 level amid mild risk-on market sentiment. Furthermore, weaker than expected UK macroeconomic data, which investors slightly ignored, dented the British pound prospects, favoring Japanese yen bulls.

That said, the GBP/JPY pair would remain trapped within the 152.60-153.00 range as investors wait for a fresh impetus to take action.

GBP/JPY Price Forecast: Technical outlook

Daily chart

As of writing, the pair is trading beneath the Wednesday low (152.57), printing a fresh monthly low. Furthermore, the GBP/JPY pair left behind the shorter time-frames DMA’s, and GBP/JPY sellers turn their attention towards the 200-DMA lying at 151.97. If sellers reclaim the latter, the first demand zone would be the 151.00 psychological level. A breach of that level would expose an upslope support trendline that travels from July 20 low towards the September 21 low near the 150.00 area.

Contrarily, GBP/JPY buyers, if they would like to regain control, will need a daily close above the 50-DMA at 153.17. In that outcome, key supply zones would be exposed. The first supply zone would be the November 5 high at 153.77, followed by the psychological resistance level at 154.00.

- AUD/USD seesaws around early October levels following three-day downtrend.

- Aussie employment allows RBA to defend current rates contrary to inflation-backed rate hike push for Fed.

- Sino-American rivalry, Evergrande act as additional bearish factors.

- No major data/events in Asia highlight risk catalysts, US consumer sentiment figures will be important to watch.

AUD/USD holds onto bearish bias around the recently flashed three-week lows near 0.7285 during early Friday morning in Asia.

The Aussie pair dropped during the last three days as surprise negative Australian employment figures favored the pair’s latest downside amid the US bank holiday. Also pleasing the pair sellers were chatters concerning a likely monetary policy divide between the Reserve Bank of Australia (RBA) and the US Federal Reserve (Fed), as well as the US-China phase 1 deal and Evergrande.

Although AUD/USD bulls have reasons to argue with the October month contraction in Australia Employment change and a six-month high Unemployment Rate, they gain a little momentum as the Aussie jobs report shows a vast gap between market forecasts and actual data. The same enables the RBA to reiterate its rejection of the rate hike, also citing the inflation figures that are still to remain stable between the 2.0% and 3.0% target. On the contrary, the 31-year high US inflation puts the rate hike are on the Fed’s platter. Hence, the US Dollar Index (DXY) has this key reason to aim for a fresh high since July 2020 and extend the last two-day uptrend.

Other than the central bank actions, downbeat forecasts concerning the economic growth of Australia’s largest customer China, mainly due to credit crisis for real-estate companies and power cut problems, also weigh on the AUD/USD pair. Additionally, the US-China difference remains wide open despite the policymaker’s readiness to talk, virtually, over the phase 1 deal in the next week. The reason could be traced from US Trade Representative (USTR) Katherine Tai’s comments that cited weakness in China’s phase 1 performance.

It should be noted that an off in the US Treasury market and mixed performance of the Wall Street benchmarks couldn’t even stop the AUD/USD downside and hence signaling further weakness when the markets turn active.

Even so, a light calendar in the Asian session may allow the pair sellers to take a breather around the multi-day low unless the aforementioned risk catalysts flash any fresh negatives. On the data front, US Michigan Consumer Sentiment for November will be looked for additional signals of reflation and Fed rate hike.

Technical analysis

AUD/USD bears keep reins as a clear downside break of the 100-DMA and 50-DMA, close to 0.7366-72, precedes the latest weakness below multiple tops marked during late September around 0.7315. That being said, 61.8% Fibonacci retracement (Fibo.) of August-October upside, around 0.7275 and a three-month-old ascending support line near 0.7240 gains the market’s attention.

- EUR/JPY edged lower for a fifth time in the last six session on Thursday, dropping below a key 50% fib.

- The pair is now probing its 200DMA just to the south of the 130.50 mark.

Thursday was another down day for EUR/JPY, a fifth in the last six sessions, during which time the pair has dropped from above 132.50 to current levels around 130.50 (a 1.5% decline). On the face of it, Thursday’s 0.1% drop hardly feels significant, but from a technical perspective, things are more interesting, as the pair dropped below a key 50% Fibonacci retracement level between the summer lows just above 128.00 and the October high around 133.50.

EUR/JPY also seems to have cracked below its 50-day moving average (DMA) at 130.60, but faces significant opposition if it wants to continue to depreciate in the form of the 200DMA at 130.46, which also coincides with the late September high. Should the pair break below these next key levels of support, the door will be open for a run lower towards the next key fib level (the 61.8% retracement) at just above 130.00.

In terms of the fundamentals, there hasn’t been much to update on. Real and nominal yields in the Eurozone have seen a significant slide in recent weeks, and the subsequent shift in EZ/Japan rate differential in JPY’s favour explains a large part of the recent move lower. Risk appetite has also been somewhat ropey this week as a result of US inflation fears, benefitting the safe-haven yen. Some more localised Eurozone-related risks are also increasingly showing up on investors’ radars; amid a sharp spike in Covid-19 infections across the bloc, countries are mulling or even already enacting Covid-19-related restrictions. This will weigh on the Eurozone economy in Q4 2021/Q1 2022 and is likely to weigh on EUR/JPY.

- NZD/USD printed a fresh low on Thursday as the US dollar continues to press higher.

- Fresh cycle highs for the greenback has sunk the bird ahead of the RBNZ next week.

NZD/USD ended the day down 0.55% at around 0.7020. The pair touched a low of 0.7012 and fell from a high of 0.7071. The US dollar remained on top as markets continued to buy into the inflation theme following Wednesday's surprise inflation data.

The US dollar printed its highest level since July 2020 at 95.196. The DXY ended the session higher by some 0.32% following the strongest inflation reading in more than three decades. On Wednesday, the Consumer Price Index posted its biggest monthly gain in four months, This took to lift the annual increase in inflation to 6.2%, the strongest year-on-year rise since November 1990.

CPI is now at new cycle highs and both the yearly and monthly prints show a second straight month of accelerating gains. Consequently, traders are anticipating US interest rate hikes next year which is underpinning the US dollar.

All eyes turn to the RBNZ

The kiwi was dragged lower on the surprisingly soft Aussie jobs data from Thursday. However, analysts at ANZ bank said that there are good reasons to look through that data. Some observers will note that the data did not catch the opening up of lockdowns, so this may not reflect the true picture of the health of the jobs market,

Meanwhile, looking ahead, the domestic data calendar is pretty light ahead of the RBNZ MPS. ''Yesterday we noted that the NZD had potential to benefit from the actual delivery of hikes, but as we near the decision, markets don’t seem to be shy of fading NZD strength even knowing that hikes (and thus carry) are coming.,'' the analysts at ANZ Bank said,

''The Kiwi did well after the 2020 lockdown, and has been mixed through 2021 (and has struggled >0.72 of late), but headwinds could be coming in 2022 as the rest of the world normalises policy. Let’s see.''

- AUD/JPY retreated from around 84.00 on weaker Australian employment data.

- AUD/JPY slide on the back of a mixed-market sentiment.

- AUD/JPY Technical outlook: A break below the 200-DMA would open the door for a move towards 82.00.

The AUD/JPY pair falls for the second day in the week, down 0.32%, trading at 83.18 during the New York session at the time of writing. The market sentiment is a mixed bag, as witnessed by US stocks fluctuating between gainers and losers. In the FX market, risk-aversion favored safe-haven currencies, like the Japanese Yen and the US dollar.

During the Asian session, AUD bulls pushed the pair to the upside, but the trend stalled around 83.67, retreating towards the 83.10s region. The move was triggered by a weaker than expected Australian employment report that prompted a spike in the Unemployment rate to 4.7%. Furthermore, it cemented the recent dovishness of the Reserve Bank of Australia (RBA), which is pushing for lower rates until 2024.

Therefore, the market sentiment would be the main driver for the pair. A risk-on mood would be positive for the AUD; otherwise, it would benefit the JPY.

AUD/JPY Price Forecast: Technical outlook

-637722595641694339.png)

The AUD/JPY pair is trading sideways around the double-top chart pattern target at 83.22. On Wednesday, the cross-currency printed a daily high at 84.09 but retreated around the 83.50 area. Despite the daily moving averages (DMA’s) remaining below the spot price, meaning the pair has an upward bias, the AUD/JPY could be headed lower in the near term.

Furthermore, confirmation of the Relative Strenght Index (RSI) below the 50-midline edging lower added another bearish signal in the near term.

For AUD/JPY bears, to reclaim control, they will need a daily close below the 200-DMA at 82.87. A breach of the latter would expose the shorter time-frame moving averages, with the 50-DMA at 82.57, followed by the 100-DMA at 81.90.

On the other hand, for AUD/JPY bulls to resume the uptrend, they will need a daily close above the November 9 high at 84.10. In that outcome, the following resistance level would be the October 22 low at 84.61, followed by the psychological 85.00 level.

On the flip side, a break above 83.71 could pave the way for further gains. The first resistance would be the 84.00 figure, followed by the so-called neckline of the double top, around 84.61, followed by the 100-SMA around the 85.00 area.

- The S&P 500 is trading around 4650 and nursing modest gains ahead of the close following a subdued session.

- Growth/tech stocks are outperforming amid bond market closures and strength in chipmakers.

- On Friday, equity investors will be watching JOLTs and Consumer Confidence data, as well as a speech from Fed’s Williams.

Trading conditions on Thursday have been contained, with many US market participants away for Veteran’s Day. Bond markets have been closed. The S&P 500 index started the session above 4660 but has gradually ebbed lower to around the 4650 mark, where it trades with one the day gains of about 0.1%. The broad stabilisation comes following the S&P 500’s worst day in over a month on Wednesday when investors took profit in wake of the highest US YoY Consumer Price Inflation reading since 1990.

The Nasdaq 100 is up 0.3%, though has also pulled back from prior session highs above 16,100 to current levels just above the 16K level. The Dow is the underperformer, down 0.4%, dragged lower by a near-7.0% fall in index heavyweight Disney’s share price following a disappointing earnings release. Equity analysts cited disappointing growth in streaming subscriber numbers and in theme park revenues. Also contributing to the Dow’s underperformance was the fact that investors seemed to favour growth stocks (of which the Nasdaq 100 is a proxy) over value stocks (of which the Dow is a proxy).

One reason for growth stock outperformance may well have to do with the fact that US bond markets were shut on Thursday in observance of Veteran’s Day. US bond yields spiked on Wednesday, weighing heavily on duration-sensitive growth names – higher bond yields increase the opportunity cost of holding stocks whose value depends to relatively more upon expectations for future earnings growth rather than on current earnings. Tech stocks (which disproportionately make up the growth stock contingent) also got a boost from a strong performance by semi-conductor names. The Philadelphia SE Semiconductor index was up 1.7% on Thursday, mostly erasing Wednesday’s post-US inflation data losses, led by a near-3.0% rally in Nvidia’s share price after Susquehanna raised the co.’s price target to $360 from $250 (it currently trades just above $300).

US stock market focus now shifts to the release of the September job openings (JOLTs) reports at 1500GMT, which should show that labour demand remains very strong. Also in focus at 1500GMT will be the release of the preliminary November University of Michigan Consumer Sentiment report, which will give a timely insight as to the state of US consumer health heading into the winter holiday shopping season. As ever, the consumer inflation expectation data in the report will be closely scrutinised.

US equity investors will also closely scrutinise a speech from influential FOMC Board of Governors member and NY Fed President John Williams. San Fransisco Fed President and FOMC member Mary Daly has been the only FOMC member to address this week’s shock consumer price inflation report so far. While she expressed concern about high inflation, she reiterated the stance laid out by Fed Chair Jerome Powell at the latest policy meeting that inflation pressures will likely subside next year and the Fed should be patient on rate hikes to allow time for the labour market to recover. Williams’ comments will carry more weight.

What you need to know on Friday, November 12:

The dollar kept advancing in the absence of another catalyst that could diverge investors’ attention from skyrocketing inflation. Poor UK data fueled the ruling dismal mood, as the UK reported quarterly growth of 1.3% in the three months to September, much worse than the previous 5.5% and the expected 1.5%. Industrial Production, Business Investment and the country’s trade balance also missed expectations, hinting at a more conservative BOE and pushing GBP/USD to a fresh 2021 low of 1.3359.

The EUR/USD pair also fell to its lowest for this year, hitting 1.1445 and ending the day a handful of pips above it. In the case of the shared currency, the weight come from central banks imbalances, as while the Fed has already kick-started tightening and may have to accelerate its pace, the ECB maintains a conservative stance.

AUD/USD stands below 0.7300 following the release of dismal Australian data and the poor performance of equities. The USD/CAD pair flirts with the 1.2600 level, trading at a fresh one-month high.

Gold retained its strength, advancing for a sixth consecutive day. Spot trades above $1,860 a troy ounce and has room to extend its rally towards the 1,900 mark. Crude oil prices seesawed between gains and losses, with WTI ending the day little changed at $81.50 a barrel.

The USD is extremely overbought and may correct lower ahead of the weekend, although it would likely retain its strength.

The US celebrated a holiday with bonds markets closed. Wall Street was opened, with the DJIA falling deeply in the rest while other major indexes posted uneven gains.

Shiba Inu must hold key support to avoid total capitulation

Like this article? Help us with some feedback by answering this survey:

- USD/MXN has jumped from prior session lows under 20.50 to around 20.60 in wake of the Banxico policy decision.

- The bank raised interest rates by 25bps to 5.0%, though some expected a 50bps hike and one voter dovishly dissented.

USD/MXN has erased a substantial portion of its earlier losses in recent trade in wake of the Banxico’s decision to hike interest rates by 25bps as expected. The pair has bounced from close to session lows around 20.50 to current levels around 20.60 and currently trades with on the day losses of about 0.2%. USD/MXN saw a substantial rally on Wednesday as a result of broad USD strength in wake of a much hotter than expected US inflation report and currently trades with on-the-week gains of about 1.4%. Mexican Consumer Price Inflation data was also released earlier this week, also rising at a 6.2% YoY rate in October, though this was unable to result in sustained MXN strength, given that the Banxico is already well into a hiking cycle to maintain price stability.

Banxico hikes rates as expected

The Bank of Mexico raised its interest rate by 25bps as expected for a fourth consecutive policy meeting on Thursday, taking benchmark rates to 5.0%. The board voted four to one in favour of the rate hike, citing concerns about above actual inflation and inflation expectations that are above the bank’s 3.0% target. While the bank reiterated that it sees the shocks that have increased inflation recently to be largely transitory, it said that the balance of risks for the trajectory of inflation remained biased to the upside. Moreover, the bank said the horizon over which these shocks may affect inflation are unknown, thus posing a greater risk to the process of price formation and to inflation expectations. The bank adjusted higher its 2021 inflation forecast to 6.8% YoY in Q4, though left the end 2022 forecast unchanged at 3.3% YoY.

The initial reaction of MXN in response to the meeting was to weaken. Some analysts had predicted the bank would hike rates by 50bps, thus the move could reflect an unwind of some hawkish bets. Meanwhile, the fact that one voter dissented against the decision to hike interest rates diminishes the prospect for further rate hikes. The one dissenter was likely motivated by the fact that the Mexican economy likely contracted in Q3 2021, a fact acknowledged by Banxico, though the bank also stated that the economy was expected to resume its recovery in Q4 2021.

Speaking to Reuters on Monday, Latin America analysis director for Moody's Analytics Alfredo Coutino said that the bank should raise the benchmark interest rate to between 5.50% and 6.00% by the end of this year if it hopes to comply with its mandate to pursue stable prices. Thus, dovish descent at the latest rate decision may raise some fears that Banxico may fail to raise interest rates sufficient to tame inflation, a potential dovish mistake.

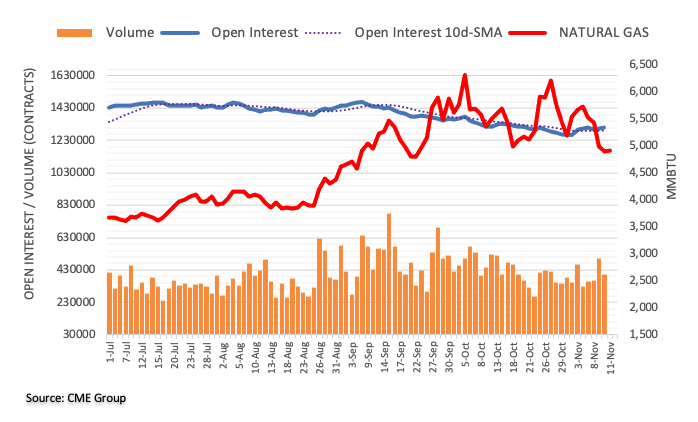

- West Texas Intermediate crude oil recovers in late trade for the lows of the day.

- Oil prices are under pressure as markets discount the most likely course of action.

West Texas Intermediate crude oil has risen on the day and trades around 0.4% higher into the close on Wall Street. The black gold rallied from a low of $80.23 to a high of $82.29 on the day. The black gold has recovered from the day's lows which were printed after OPEC lowered its 2021 demand forecast on weaker than expected demand from China and India.

OPEC has cut its demand forecast by 0.16-million barrels per day from its October estimate its monthly report showed. OPEC now sees global demand this year reaching 96.4-million bpd, rising to 100.6-million bpd in 2022. Meanwhile, its forecast for supply outside the cartel was unchanged at 63.6-million bpd this year and 66.7-million bpd in 2022.

US inflation worries investors

In other themes, US inflation has concerned investors. US Consumer Price Index came in the strongest increase in some 30 years and energy prices will be a top priority for the White House. On Wednesday reported inflation rose to the highest since 1990, with higher energy costs the largest contributor to the 6.2% annualized rise in prices. Higher inflation is increasing pressure on the Biden Administration to release oil from the country's strategic reserves to bring down the price of oil and gasoline.

''Energy prices are under pressure as markets discount the most likely course of action, which would involve a release of SPR crude,'' analysts at TD Securities explained. ''This follows the EIA's Short Term Energy Outlook, which rather pointed to an oversupplied market in 2022. Yet, a continued recovery in demand is expected as global economies exit the pandemic, which can fuel strong short-term performance as OPEC pursues a rather cautious approach, ignoring calls to hike output at a faster pace.''

- USD/CHF is consolidating around its 50DMA at 0.9220 having rallied 100 pips in the last two days.

- If the pair can break higher, this opens the door to a move towards resistance in the 0.9250 region.

USD/CHF is currently consolidating either side of its 50-day moving average just under the 0.9220 mark, having rallied from Asia Pacific session lows around the 0.9180 mark. The move higher comes amid a continuation of broad USD strength as market participants continue to assess the implications of the latest US Consumer Price Inflation report, which showed the YoY rate of headline US CPI hitting its highest since November 1990 at 6.2% in October.

Thursday’s upside means the pair has now risen by nearly 100 pips from its just above 0.9120 levels prior to the data, a rally of about 1.0%. If USD/CHF can break to the north of its 50DMA at 0.9220, there is a balance area of some mid-October lows and highs around 0.9250 that could offer some resistance. Above that, a more notable area of resistance is just above 0.9300 level, where resides a triple top from early October.

Commentary from Swiss National Bank (SNB) policymakers has not had any noticeable impact on USD/CHF in the last few days. SNB Governing Board member Andrea Maechler has spoken publically on a few occasions over the past few days. She reiterated the bank’s well-known positions that the value of CHF is high and its strength is keeping inflation low in Switzerland and that the bank is thus willing to intervene in currency markets and though there is no set level at which the bank intervenes.

- GBP/USD scores fresh cycle lows but bulls bite back.

- Cable has been under pressure due to Brexit and decelerating growth while US CPI underpins the US dollar.

GBP/USD is printing fresh cycle lows in late North American trade, shaking out some stale longs and making way for further advances to the downside for the sessions ahead. At the time of writing, GBP/USD is trading down some 0.26% after falling from a high of 1.3433 to a low of 1.3359 on the day. However, the bulls have stepped in and cable has snapped back from the lows.

Cable was printing the lowest level of 2021. A combination of domestic data and political turmoil, coupled with the divergence between the Federal reserve theme to that of the Bank of England weighs towards the end of the week.

Bets of a BoE rate hike are dwindling

On the domestic front, the British economy is losing steam. Data released by the Office for National Statistics showed Britain's economy grew by 0.6% in September. However, estimates for previous months were revised lower, leaving the economy still smaller than it was in February 2020.

As for the central bank, during the November policy meeting, the Bank of England surprised markets by leaving its main interest rate unchanged at 0.1%. Leading into the event, however, numerous members of the MPC had been advocating for rate hikes, teeing up the market for disappointment. Nevertheless, markets are now pricing in a high probability of a December rate rise. However, the caveat was economic progress and a resole to the Brexit risks, either of which is going in the right direction.

- Brexit angst is heating-up: GBP traders be warned

Investors are nervous about the negative ramifications that a post-Brexit dispute between Britain and the European Union over trade with Northern Ireland could have for the UK economy. However, in the latest update, Ireland's foreign minister said on Thursday that comments from Britain's Brexit minister suggest there is still some time to find a solution to trading difficulties before Britain seeks to trigger article 16.

US dollar soars to fresh cycle highs

Meanwhile, the greenback has printed the highest level since July 2020 at 95.1410. It is currently up by some by 0.29% in late North American trade and tracks higher following the strongest inflation reading in more than three decades.

On Wednesday, the Consumer Price Index posted its biggest monthly gain in four months to lift the annual increase in inflation to 6.2%, the strongest year-on-year rise since November 1990. CPI is now at new cycle highs and both the yearly and monthly prints show a second straight month of accelerating gains. Consequently, traders are anticipating US interest rate hikes next year which is underpinning the US dollar.

- XAU/USD broke above a 4-month downslope resistance trendline, aiming towards $1,900.

- XAU/USD rallied on higher US consumer inflation above 6%, the highest in 30 years.

- XAU/USD: Trading sideways, within the $1,840-65 range.

Gold (XAU/USD) is steady during the New York session, up some 0.50%, trading at $1,861 at the time of writing. During the Asian session, it seems that gold bulls bought the dip, as witnessed by the 1-hour chart, as XAU/USD consolidated around the $1,840-50 area, before resuming the upward move, which stalled around the $1,860s tops-

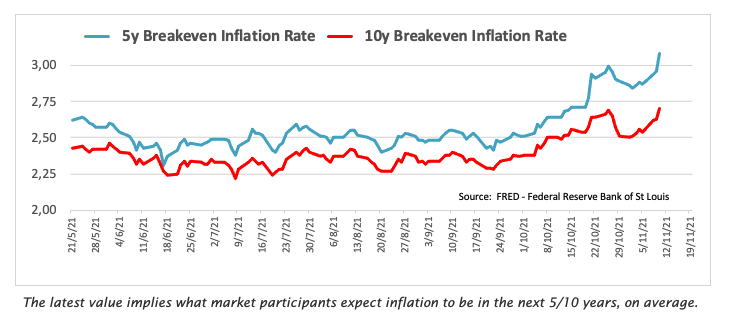

The market sentiment is mixed after hotter-than-expected US inflation figures unveiled on Wednesday. In fact, the headline US CPI number on a yearly basis spiked above 6% for the first time in three decades. This spurred appetite for precious metals, which have been an inflation hedge over time, with gold and silver rallying in the last couple of days.

Overall, US dollar strength has not been an excuse for the yellow metal to rise. Furthermore, the US 10-year Treasury yield rose above 1.50%, which could usually exert pressure on gold prices; however, real yields are the main driver for gold. As of November 10, real yields sit at -1.85%; therefore, as long as real yields keep falling, gold would maintain an upward bias.

The US economic docket will be light on Thursday in observance of the Veterans Day holiday. On Friday, the University of Michigan Consumer Sentiment Index for November could offer gold traders a fresh impetus to take action. Also, New York Fed’s President John Williams will speak at a virtual event hosted by the New York Federal Reserve.

XAU/USD Price Forecast: Technical outlook

-637722529294005092.png)

Gold keeps trading above a 4-month downslope resistance trendline, broken on Wednesday, steady around tops $1,860s. The daily moving averages (DMA’s) were left behind the spot price, meandering around the $1,780-95 area, with the 50-DMA aiming higher, while the longer time-frames one directionless.

Further, the Relative Strength Index (RSI) is at 70, inside overbought conditions, confirming that the upward move might ease before resuming to the upside. However, for XAU/USD bulls to accelerate an attack towards $1,900, they will need a daily close above the June 3 low at $1,864.98. In that outcome, the following resistance area would be the psychological $1,900.

On the flip side, the September 3 high at $1,834 would be the first support area, that once breached, would open the door for a further downfall towards $1,800.

Amid a lack of any meaningful fresh fundamental catalysts on Thursday aside from a slightly softer than expected UK GDP report, EUR/GBP has continued to nudge higher whilst also continuing to respect weekly ranges. The pair looks set to post a third consecutive daily gain of about 0.1%, during which time it has edged higher from weekly lows posted back on Tuesday at around 0.8520 to current levels just under 0.8570. That still leaves the pair some way below recent highs from earlier in the week/the end of last week around the 0.8590 mark. The 200-day moving average at 0.8580 seems to be offering some resistance, just as the 50DMA (just above 0.8520) earlier in the week provided the foundations for a rebound.

Brexit Update

UK PM Boris Johnson is set to travel to Paris on Friday to meet with French President Emmanuel Macron, where fishing access for French boats in UK waters will likely be at the top of the agenda. The UK’s broader disagreement with the EU over the implementation of the Northern Ireland protocol will also be an important topic for discussion. Political analysts still think there is a strong likelihood that the UK will trigger Article 16 to unilaterally override parts of the protocol, potentially triggering a broader trade/legal conflict with the EU. But there were reports that the EU was prepared to improve its offer on checks on goods going in and out of Northern Ireland, an offer that might be presented to the UK PM on Friday.

For now, FX markets are shrugging off Brexit risk. ING’s fair value model for EUR/GBP shows the pair to only be trading with about 1.0% “Brexit” risk premium, versus over 5.0% at some points during 2019. “With UK CPI heading to the 5% area into April, keeping BoE tightening prospects on the front-burner, we are happy with an end-year EUR/GBP target near 0.8500, and lower levels as 2022 progresses,” says the bank.

- EUR/USD bears are taking on the bull's commitments at 1.1450.

- US dollar moves in on a fresh weekly high as central bank divergence underpins the mighty dollar.

EUR/USD is trading on the backfoot in a sleepy mid-day North American session with the bond market closed for Veterans Day. The euro is still suffering from the surge in the US dollar following the prior day's US inflation data beat. At the time of writing, EUR/USD is down some 0.20% at the time of writing after falling from a high of 1.1487 to a low of 1.1453.

The US dollar continues to track higher levels, currently printing the highest since July 2020 at 95.1410 and higher by 0.29%. The following through comes on the back of the strongest inflation reading in more than three decades.

Traders are anticipating US interest rate hikes next year The Consumer Price Index posted its biggest monthly gain in four months to lift the annual increase in inflation to 6.2%, the strongest year-on-year rise since November 1990. CPI is now at new cycle highs and both the yearly and monthly prints show a second straight month of accelerating gains.

Time for Fed lift-off?

''The transitory theme remains under fire,'' analysts at Brown Brothers Harriman argued. ''With low base effects from November and December 2020 in place, the YoY rates are very likely to move even higher from these already lofty levels. The Federal Reserve’s preferred measure of inflation (core PCE deflator) won’t be reported until November 24 but it seems very likely to accelerate from the 3.6% YoY pace in September.''

''We still think Q2 seems too soon for lift-off but the market now sees a nearly two-thirds chance. Q3 liftoff is fully priced in, as is another hike in Q4,'' the analysts added.

ECB/ Fed divergence weighs on EUR/USD

Meanwhile, the European Central Bank's dovish theme will most likely hamstring the euro. However, ECB’s Roberts Holzmann said QE could end next fall and tipped an exit strategy for the centralbank. ''We do not think the majority at the ECB shares this hawkish take but we will know more on December 16, when the ECB is set to announce its plans for QE (PEPP and APP) going forward,'' the analysts at BBH argued.

- AUD/USD has gone sideways around 0.7300 in recent trade amid subdued conditions.

- Weak labour market data does not seem to be weighing on the Aussie too badly.

AUD/USD trading conditions have been calm since the start of the European session, with the pair swinging either side of the 0.7300 level over the last few hours. The pair is currently trading with on the day losses of about 0.5%, having slipped from above 0.7320 during Asia Pacific trading hours in a continuation of the downside it has been experiencing since Wednesday. To recap, the pair was sent tumbling from the upper-0.7300s in wake of a much hotter than expected US Consumer Price Inflation report that has pumped expectations for the Fed to start hiking interest rates sooner in 2022, and probably also to accelerate the pace of its QE taper at the start of next year.

Some market commentators cited the downbeat October labour market report released by the Australian Bureau of Statistics during Asia Pacific hours as a negative that weighed on the Aussie. The economy unexpectedly shed nearly 50K jobs on the month versus forecasts for a 50K employment gain and the unemployment rate spiked more than expected to 5.2% from 4.6% in September (versus an expected rise to 4.8%). But the weakness being experienced by AUD/USD is more a function of USD strength rather than localised Aussie weakness, with NZD and CAD experiencing even worse on the day losses versus the buck.

If the AUD/USD can break more convincingly below the 0.7300 level in the coming session, there is very little by way of notable support levels ahead of 0.7200. The most notable downside levels include the 29 September low at 0.7170 and then the August low at just above 0.7100.

Labour market to improve in November

According to MUFG, “the worsening of labour market conditions in October despite the easing of restrictions reflects in part the timing of the survey reference period that ended on 9 October”, prior to significant re-opening in New South Wales after 11 October and the start of re-opening in Victoria from 21 October. “As a result”, continues the bank “the November employment report should show a significant improvement in labour market conditions”. Credit Agricole add to this that “payrolls data suggest strong jobs growth in the second half of October; after lockdowns were eased”. Expectations for a November rebound in the labour market could thus be one reason why AUD is not underperforming its fellow risk/commodity-sensitive G10 peers on Thursday.

However, analysts broadly agreed that the weak labour market data, for now, endorses the RBA’s dovish message of no rates hikes into 2023. Furthermore, Credit Agricole expects that next week’s Australian wage data will likely also reinforce the RBA’s view. In terms of the outlook for the Aussie, MUFG are bearish; they think that 1) AUD STIR market pricing for 75bps of hikes in 2022 is excessive and the Fed will tigthten faster than the RBA, 2) the Aussie is likely to be exposed to the ongoing growth slowdown in China (which property sector woes are likely to worsen), 3) the Aussie is vulnerable to weakness in iron ore prices, which continue to fall back to pre-Covid-19 levels. “We expect AUD/USD to re-test key support at the 0.7200-level in the near-term”, concludes MUFG.

- XAG/USD extends its two-day rally, amid thin liquidity conditions, despite US dollar strength.

- Silver is rising as long as US Real Yields keep falling, sitting at -1.85 as of November 10.

- XAG/USD Technical outlook: If it breaks above the 200-DMA, a move towards $27.00 is on the books.

Silver (XAG/USD) climbs to three-week tops, advances 2%, trading at $25.20 during the New York session at the time of writing. The market mood is mild-risk on, as witnessed by US stocks fluctuating between gainers and losers amid thin liquidity conditions, with the US bond market closed in observance of the Veterans Day holiday.

Despite broad US dollar strength across the board, with the US dollar index rising above 95.00 for the first time since July 2020, the white metal keeps rising. Higher US inflation readings, topping above 6% for the first time in three decades, spurred flows towards precious metals, which have been an inflation hedge over time, so that’s why silver has advanced 4.90% in the last two days.

Furthermore, US T-bond nominal yield has risen as inflation rises, but real yields keep falling, sitting at -1.85 as of November 10. Therefore, as long as real yields fall, silver is tilted to the upside in the near term but has some strong resistance levels to overcome.

XAG/USD Price Forecast: Technical outlook

Daily chart

-637722485677127236.png)

XAG/USD is hovering around the midline of Andrew Pitchfork’s indicator. However, it is approaching a robust resistance area that would be difficult to surpass at the confluence of the 200-day moving average (DMA) at $25.32 and a downslope resistance trendline that passes near the 200-DMA.

If silver bulls break above the abovementioned, a move towards $27.00 is on the cards, but it would find some hurdles on the way north. The first resistance would be $26.00. A breach of that level would expose the July 6 high at $26.75, followed by the psychological $27.00.

On the flip side, failure at the abovementioned would open the door for a lower correction towards the 100-DMA at $24.12.

- NZD/USD extends its losses for the third consecutive day.

- No economic data from NZ and the US keep the pair trending in the dynamics of US dollar demand.

- Philadelphia Fed’s Harker argued that the Fed can raise rates while still tapering if necessary.

The NZD/USD slides for the third day in a row, down 0.36%, trading at 0.7034 during the New York session at the time of writing. Early in the Asian Pacific session, the New Zealand dollar capped its downfall for a couple of hours around the 0.7054-0.7071 range. However, it failed to gain traction amid a light NZ economic calendar before dropping towards 0.7000, driven by US dollar demand.

On Wednesday, US inflation rose to levels last seen in the 1990s. The Consumer Price Index (CPI) for October rose sharply to 6.2%, higher than the 5.3% foreseen. The so-called Core CPI that excludes volatile items like energy and food edged up to 4.6%, higher than the 4% estimated, per the US Labor Department.

“The transitory inflation argument is coming under increasing scrutiny, and the risk of a policy error on inflation has the potential to unsettle risk appetite,” per ANZ analysts In a report for customers. Further, the bank added that it seems inevitable that there would be upward revisions in inflation forecasts and in the dot plot when the Fed releases its Summary of Economic Projections (SEP) in the next meeting.

It is worth noting that Philadelphia Fed’s Harker argued that the Fed can raise rates while still tapering if necessary, adopting a tool that the Bank of England (BoE) would use as it begins to tighten economic conditions in the UK.

US Dollar Index breaks above 95.00 for the first time since July 2020

Meanwhile, the greenback successfully gains traction after the US CPI report, extending its lead against most G8 currencies. The US Dollar Index, which tracks the buck’s performance versus a basket of six rivals, advances 0.15%, breaking above 95 for the first time since July 2020, sitting at 95.03.

Therefore, for the remainder of the week, the NZD/USD price action will lie in the hands of US dollar dynamics and market sentiment. On Friday, the New Zealand economic docket will feature Business NZ PMI for October, with the previous reading at 51.4.

On the US front, the University of Michigan Consumer Sentiment Index for November will be revealed. Also, New York Fed’s President John Williams will speak at a virtual conference hosted by the New York Fed.

NZD/USD Price Forecast: Technical outlook

In the daily chart, the NZD/USD accelerated its downward move, but it was capped by the 0.7000 psychological support and the 100-day moving average (DMA) lying at 0.7023. Nevertheless, in the near-term still tilted to the downside, as the 50 and the 200-DMA stand above the spot price. Also, the Relative Strength Index (RSI) recently broke the 50-midline, sitting at 43, aiming lower, adding another bearish signal to the New Zealand dollar outlook.

However, to accelerate the downtrend, NZD/USD sellers will need a daily close below 0.7000. In that outcome, the next support would be 0.6950, followed by an upslope trendline that travels from August lows towards September lows, lying around the 0.6920-30 area.

- XAU/EUR has continued its run higher and is now above $1620 amid continued inflation fears.

- Bullish technicians will now target a move towards Q4 2020 highs at $1650.

Since breaking above key resistance at $1590 (the prior 2021 high) and then the psychologically important $1600 level on Wednesday in wake of a much hotter than expected US inflation report, XAU/EUR has continued to advance. Euro-denominated spot gold prices now trade to the north of $1620, with further gains of about 0.7% on the day (after rallying nearly 2.00% on Wednesday). Now that XAU/EUR has cleared prior year-to-date highs and the $1600 level, bullish technicians will set their sights on the next key area of resistance, which comes in the form of the Q4 (November) 2020 highs at just above $1650.

Since bouncing from its 50-day moving average on 3 November all the way down at $1520, euro-denominated spot gold prices have surged nearly 7.0%. That coincides with a sharp downturn in Eurozone (and global) real yields; German 10-year inflation-linked bond yields are down more than 20bps from above -1.80% (on 3 November) to current levels below -2.0% and hit fresh record lows earlier in the week at -2.09%. Lower real yields on bonds reduce the opportunity cost of holding non-yielding precious metals.

Inflation anxiety

Record low long-term real yields in the Eurozone (and not far from record lows in the US) also reflect a market view that central banks are going to keep their monetary policy settings highly accommodative over the coming years, despite the sharp uptick in global inflationary pressures in recent months. There are going fears that this might constitute a policy mistake; i.e. that central banks might make a dovish policy mistake and not normalise monetary policy setting quickly enough to tame inflationary pressures.

Such fears were ignited by Wednesday’s US inflation report and prompted a number of high-profile market commentators and investment advisors to call for the Fed to abandon its insistence that inflationary pressures are transitory and to accelerate the timeline of monetary policy normalisation (i.e. the QE taper and then rate hikes). In light of heightened inflation fears, it is not surprising to see investors flock to assets that provide inflation protection, such as precious metals and inflation-linked bonds.

- Technical indicators in GBP/JPY still favors the downside.

- While under 153.00, the pound looks vulnerable to more losses.

The GBP/JPY failed to recover 153.75 and dropped back under key short-term moving averages, and currently, it stands under 153.00, at one-month lows, looking vulnerable.

The pound needs to quickly recover 153.00 in order to alleviate the bearish pressure. The negative tone will continue to prevail, while below 153.75. If the pound manages to rise above the mentioned level, it could have established an interim bottom. Above the next resistance is seen around 155.00.

While below 153.00 (horizontal level, and also the 21-SMA in four hour chart) more losses seems likely. The potential target is the 152.25 zone. If the decline continues, under 152.00 there is a strong support area at 151.60 that should limit the downside. A rebound from 151.50/60 seems likely, favoring a pause in GBP/JPY slide, before another leg lower.

GBP/JPY 4-hour chart

-637722433025534514.png)

On Thrusday, the Bank of Mexico (Banxico) will announce its decision on monetary policy. Market consensus points to a 25bp rate hike while some analysts see a 50bp hike. Analysts at Wells Fargo side with financial markets and expect a 50 bps rate hike; however, should consensus be proved accurate, the Mexican peso could come under pressure in the immediate aftermath of the meeting.

Key Quotes:

“Should consensus economists prove accurate and Banxico lift rates only 25 bps, we would expect the Mexican peso to selloff sharply and USD/MXN to push toward the MXN20.75 level. On the other hand, should the central bank lift rates 50 bps and maintain a similar level of concern over inflation as we expect, the peso reaction could be more muted. Should our base case scenario unfold, we would expect the Mexican peso to settle back to pre-policy rate announcement levels as we believe financial markets are priced for this scenario.”

“In a nod to our fellow international economists, we do feel financial markets are priced for too aggressive tightening between now and the end of this year. Right now, markets are priced for 100 bps of tightening before the end of 2021. In our view, following a 50 bps hike on Thursday, policymakers are likely to slow the pace of tightening and lift the Overnight Rate only 25 bps in December. Our less hawkish view relative to market pricing is key a rationale behind our medium-term view for Mexican peso weakness.”

“As financial markets adjust to a more gradual pace of tightening after the November meeting, we would expect downward pressure on the peso to build and for the currency to weaken into the end of 2021.”

- US dollar holds onto recent gains after US CPI data.

- Holiday in the US, bond market closed.

- USD/JPY recovers critical technical level above 113.40.

The USD/JPY is moving sideways on Thursday in neutral territory near 114.00. Earlier it climbed to 114.17, reaching the highest level in a week, and then pulled back. The pair is holding onto Wednesday’s gains when it climbed from under 113.00 to 114.00.

The rally of the US dollar across the board and higher US yield boosted USD/JPY. The US bond market is closed on Thursday due to a holiday in the US. If the decline in Treasuries continues, the pair could extend gains. The moves were triggered by higher-than-expected inflation readings in the US.

Short-term outlook

The USD/JPY is back into the prior range between 113.40 and 114.40. The recovery above 113.40 eased the bearish pressure. On the upside, the pair faces a strong barrier around 114.20/40. A consolidation above should clear the way to more gains and to a test of the YTD highs near 114.70.

A slide back under 113.30 should weaken again the USD/JPY, favoring a bearish correction. The next support stands at 113.00 followed by the weekly low at 112.70.

Technical levels

- USD/CAD is trading sharply higher on Thursday and eyeing a test of the 1.2600 level after surging above 1.2480 resistance.

- The pair is seeing some belated outperformance in wake of Wednesday’s hot US CPI report.

USD/CAD is seeing some overdue outperformance on Thursday. In wake of a much stronger than expected US Consumer Price Inflation (CPI) report on Wednesday, the US dollar surged against the majority of its G10 counterparts, but the loonie was largely spared at the time. That’s because, as USD/CAD attempted to push higher, it ran into a wall of resistance around the 1.2480 level in the form of recent highs and its 200-day moving average. In the end, USD/CAD ended the session just 0.4% higher (versus much larger moves in the likes of GBP/USD, EUR/USD and USD/JPY).

As trading volumes picked up during Asia Pacific hours, the pair was finally able to break to the north of the key area of resistance and has subsequently shot above the 1.2500 level, the 50DMA at 1.2535, and is currently closing in on the 1.2600 mark. Oil prices dropped sharply on Wednesday amid fears that higher US inflation would prompt the Biden administration to release crude oil reserves to combat high energy costs. Though prices are a little higher on Thursday, they still remain some way off from recovering back to pre-CPI data levels, thus crude oil weakness is one reason the loonie is dropping sharply on Thursday.

Another reason for loonie underperformance is that, in wake of the US CPI data, the Canadian rate advantage over the US has been slightly eroded (as traders up their bets on a more hawkish Fed in 2022). US 5-year government bond yields saw a 14bps surge to 1.22%, while the Canadian 5-year rose 10bps to and was unable to move back above 1.50%. Government bond and short-term interest rate (STIR) markets still price a much more hawkish BoC when compared to the Fed.

But there is a growing throng of economists/analysts who are starting to believe that this view is wrong. According to CIBC, “markets have overpriced Bank of Canada (BoC) action in 2022, and underestimated the Federal reserve post-2022”. “A recalibration”, continues the bank, “will leave the CAD out of favor with investors”, before concluding “we see USD/CAD drifting above the 1.30-mark next year, as it becomes clear that Canada's central bank will not be outgunning the Fed”.

The Norwegian krone has proved the top performing major versus the USD and EUR over the last year. Key to the outperformance has been monetary tightening byt the Norges Bank, which is set to continue supporting NOK, economists at CIBC Capital Markets report.

Oil prices to reverse some of its gains in 2022

“We look for another 25bps tightening to come at the 16 December meeting, in line with the updated Monetary Policy Report.”

“While the macro rebound and uptick in the oil sector are seen to justify policy action, the obvious differential between the Norges Bank and most other major central banks is that the tightening cycle is framed by an inflation profile which is set to remain below target over the forecast horizon.”

“Our global base case has crude oil prices reversing some of its gains in 2022, which could have the central bank pushing back a bit on the degree of tightening ahead.”

“Although we continue to expect NOK gains versus the EUR, they are set to be less aggressive in the next 12 months compared to the last.”

- AUD/USD extends its sharp decline for three days, from 0.7430 to 0.7300.

- Australian Employment Change dropped 46.3K, and the unemployment rate jumped above 5%.

- AUD/USD Technical outlook: A break under 0.7300 exposes the September 30 low at 0.7169.

The Australian dollar slides for the third consecutive day, down 0.25%, trading at 0.7309 in the New York session at the time of writing. The AUD/USD traded within the 0.7314-40 range during the APAC session, but Australian economic data spurred the downfall.

Australian Employment Change dropped 46.3K, and the unemployment rate jumped above 5%

On Thursday, the Australian economic docket featured the Consumer Inflation Expectations for November, which rose 1% higher than in October, up to 4.6%, from 3.6% in October. The market ignored that data, but employment figures collapsed, triggering a sell-off on the pair. The Australian Bureau of Statistics revealed that Employment Change for October fell 46.3K, sharply lower than the 50K rise expected by analysts, spurring a jump in the Unemployment Rate, from 4.7% to 5.2%.

It is worth noting that the jobs survey was taken from September 26 to October 9, when lockdown restrictions in New South Wales were just being eased, while Victoria state was still lockdown.

Meanwhile, the US economic docket reported US inflation figures, which jumped above 6% for the first time in 30-years. It seems that AUD/USD traders priced in the move, as witnessed by price action stabilizing around the 0.7300-40 range. On Thursday, the US economic docket is light due to the observation of the US Veterans Day Holiday.

AUD/USD Price Forecast: Technical outlook

-637722394496178044.png)

The daily chart shows that the pair tests the 0.7300, extending the downward move to three days. On its way down, it broke the 50 and the 100-day moving averages (DMA’s), which in tandem with the 200-DMA, indicates the AUD/USD pair has a downward bias.

On the way down, the first support level to break is 0.7300. A breach of the latter would expose the September 30 low at 0.7169, but an upslope trendline that travels from August 20 low towards the September 30 low, lie around the 0.7230-50 range, and act as support before reaching the September 30 low.

- USD/TRY extends the rally to the vicinity of 10.0000.

- The loses around 25% vs. the greenback so far in 2021.

- The CBRT meets on November 18 and could reduce rates further.

The Turkish lira depreciates to fresh all-time lows vs. the greenback and pushes USD/TRY to the boundaries of the psychological 10.0000 mark on Thursday.

USD/TRY: The 10.00 yardstick is around the corner

USD/TRY advances for the third consecutive session so far on Thursday against the backdrop of the relentless move higher in the US dollar.

In fact, spot picked up further pace as of late following the higher-than-expected US inflation figures during October (published on Wednesday). The 30-year spike in the US CPI rapidly ignited speculations over a sooner rates lift-off by the Fed, exactly the opposite situation to what is happening in Turkey.

Indeed, the Turkish CPI rose to nearly 20% in October vs. the same month of 2020… and the Turkish central bank (CBRT) surprised markets with a shocking 200 bps reduction of the One-Week Repo Rate.

That said, while the next CBRT meeting on November 18 remains a close call (ish), another interest rate cut by the central bank should not surprise anybody and could open the door to USD/TRY to challenge… the moon?.

USD/TRY key levels

So far, the pair is gaining 0.71% at 9.9125 and a drop below 9.5581 (20-day SMA) would expose 9.4722 (monthly low Nov.2) and finally 9.4128 (weekly low Oct.26). On the other hand, the next up barrier lines up at 9.9723 (all-time high Oct.25) followed by 10.0000 (psychological level).

The strong US inflation print has catalyzed a meaningful breakout in gold prices. Strategists at TD Securities believe that the yellow metal is set to extend its advance on a close above the $1,860 level.

The breakout in gold has attracted new buyers

“The breakout has driven the China Smart Money group of funds to add a significant amount of new length in SHFE gold. Considering that Shanghai gold net length remains near multi-year lows, a change in sentiment, potentially driven by the technical breakout, could attract a significant amount of buying interest from this cohort.”

“With US real yields plummeting, the tides could sway the persistent waves of ETF sellers to add length.”

“Gold prices need only close north of $1,860/oz to catalyze further CTA long acquisitions, which should cement a more supportive trend.”

“After all, our ChartVision framework, which stress-tests 75 technical indicators to identify the critical threshold for a change in trend, suggests that with gold prices north of $1,845/oz, an uptrend in gold should form by March 2022.”

- Wall Street's main indexes trade in the positive territory on Thursday.

- Technology shares rebound after suffering heavy losses on Wednesday.

- CBOE Volatility Index is down nearly 6% after the opening bell.

After falling sharply amid heightened inflation fears on Wednesday, major equity indexes in the US managed to open in the positive territory on Thursday. Reflecting the improving market mood, the CBOE Volatility Index, Wall Street's fear gauge, is down nearly 7% on the day.

Bond markets in the US will remain closed due to the Veterans Day holiday and the action in stock markets could remain subdued for the remainder of the day.

As of writing, the S&P 500 Index was up 0.2% at 4,655, the Dow Jones Industrial Average was little changed at 36,015 and the Nasdaq Composite was rising 0.6% at 15,728.

Among the 11 major S&P 500 sectors, the risk-sensitive Technology Index is up 0.5% following Wednesday's slump. On the other hand, the defensive Real Estate Index is losing 0.3%.

S&P 500 chart (daily)

There is growing talk of the EU suspending its trade deal with the UK, should the British government make unilateral wholesale changes to the Northern Ireland protocol. However, fresh Brexit uncertainty may actually not have as big a market impact as perhaps presumed. Economists at ING expect EUR/GBP near 0.8500 at year-end.

The return of Brexit may not be dramatic for sterling

“On paper then, an increased layer of uncertainty and the reintroduction of a negative economic tail risk is bad news for UK markets. But there are a few reasons why the return of Brexit may not be dramatic for sterling.”

“Could another round of Brexit headlines demand the kind of 5% 'no deal' risk premium seen in 2019? We suspect the impact on GBP is more muted this time around.”

“With UK CPI heading to the 5% area into April, keeping BoE tightening prospects on the front-burner, we are happy with an end-year EUR/GBP target near 0.8500, and lower levels as 2022 progresses.”

- WTI is consolidating either side of the $81.00 level, having slipped sharply on Wednesday in wake of hot US CPI.

- The inflation data has triggered worries that the Biden administration might release crude oil reserves to lower prices.

Oil prices are consolidating on Thursday ahead of the US open, with front-month futures contracts of the American benchmark for sweet light crude oil, called West Texas Intermediary or WTI, swinging either side of the $81.00 per barrel mark. Subdued trading conditions are not too surprising given thin liquidity conditions in US markets, which are partially closed on Thursday in observance of the Veteran’s Day holiday (bond markets are closed, but equity and futures markets are open).

Thursday’s consolidation comes after a sharp drop on Wednesday. WTI fell more than $3.00 on the session, pulling back from intra-day peaks at $85.00 per barrel to end the session at $81.28. With crude oil now having failed to break above the $85.00 on multiple occasions over the past few weeks, this level may now form the ceiling of a new range. The bottom of that range might well be last Wednesday’s lows in the $78.00s. As traders await further clarity on US energy policy (how will the Biden admin address high prices) and the state of the demand recovery (lockdown chatter in the EU is a worry and may hit demand over winter), rangebound conditions may prevail.

Biden to release crude reserve amid high inflation?

The sell-off on Wednesday was triggered by a much hotter than expected US Consumer Price Inflation report for October, which showed headline inflation surpass 6.0% on a YoY basis and almost hit 1.0% on a MoM basis.

Rising energy prices made up a significant component of the sharp jump in US consumer prices. Speculation is now swirling that the report has increased the likelihood that the Biden Administration opts to release reserves from the Strategic Petroleum Reserve (SPR) as a way of pushing down energy prices. In response to Wednesday’s inflation report, President Joe Biden said that dealing with inflation was a top priority for his administration and that he had asked the White House National Economic Council to pursue means to reduce energy costs.

Note that high inflation is the main reason why Biden’s approval rating has been dropping in recent months. This is already impacting Democrat election performance ahead of the November 2022 mid-term elections (an underdog Republican candidate for Virginia Governor secured an easy win earlier in the month). That gives Biden a strong incentive to do all he can to lessen inflationary pressures in the US, especially the rise in energy costs.

EUR/RUB is likely to revisit the 80.38/79.03 October low and 200-week moving average provided that 86.60 caps before rising in Q1 2022, Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, reports.

EUR/RUB to slide to the 80.38/79.03 zone

“EUR/RUB’s descent eyes the 80.38/79.03 October low and 200-week moving average while the June-to-August lows and mid-September high at 85.75/86.60 cap.”

“Should the 80.38/79.03 support zone give way, we would have to allow for the 55 month moving average, June 2020 low and 2013-2021 uptrend line at 77.69/75.26 to be hit. The latter we expect to hold throughout the remainder of this year and during 2022, though. From there another uptrend should begin in Q1 2022.”

“For a bullish reversal to occur before 2022 not only the recent minor highs at 83.66/70 would need to be exceeded but also the above mentioned 85.75/86.60 resistance area. Stronger resistance can be found between the 200-day moving average at 87.42 and the July 2021 high at 89.05. This area may well be reached during 2022 when the 2020 uptrend is expected to resume.”

- EUR/JPY loses further momentum and drops to 4-week lows.

- The cross meets support around the key 200-day SMA.

- The rebound in the greenback pushed DXY above 95.00.

The intense upside momentum in the greenback puts the risk complex under further pressure and forces EUR/JPY to extend the losses to the 130.40 region.

EUR/JPY focuses on the 200-day SMA near 130.40

EUR/JPY drops and navigates the area of multi-week lows in the 130.50/40 band on Thursday, all against the backdrop of the persistent move higher in the dollar.

Indeed, and with the US bonds markets closed, the Japanese yen maintains a steady performance so far in the session, while the unabated offered stance in the single currency – and the rest of the risk galaxy – drags the cross lower.

So far, the critical 200-day SMA appears to be holding the downside for the time being, while a breach of this area on a sustainable fashion might prompt investors to shift the outlook to negative in the short-term horizon.

Nothing of note data wise on both sides of the ocean, although the European Commission (EC) updated its Macroeconomic Projections and now sees the euro area expanding 5% this year and 4.3% in 2022; when it comes to inflation, prices are seen rising 2.4% this year and 2.2% in the next one.

EUR/JPY relevant levels

So far, the cross is losing 0.14% at 130.54 and a surpass of 131.51 (38.2% Fibo of the October upside) would expose 131.95 (20-day SMA) and then 132.56 (monthly high Nov.4). On the downside, the next support comes at 130.43 (200-day SMA) followed by 130.25 (100-day SMA) and finally 129.43 (78.6% Fibo of the October upside).

- AMD stock fell heavily in both Tuesday and Wedneday sessions.

- AMD rocketed over 10% on Monday after re-named Facebook said it would use their processors in its data centers.

- Recent upgrades have moved its consensus price target up to $140.51.

Advanced Micro Devices (AMD) saw its stock tank 6.1% on Wednesday to $139.87. It was a bad showing and erased much of Monday's 10% run-up that came from the chip makers' new business relationshiop with Meta Platforms (FB). AMD stock is up 1.8% to $142.38 in Thursday's premarket at the time of writing.