- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-11-2021

- EU GDP data release and ECB Lagarde’s speech, due later in the day, will affect the pair.

- EUR/USD continues to slide as US yields remain strong ahead of US Retail Sales.

EUR/USD continues to trade around yearly low levels of 1.1370 during the early Asian session on Tuesday. Multiple factors and data announcements due for later in the day as well as in the week will determine the pair's outcome. At the time of reporting, the pair is trading at 1.1371, up by 0.1%. The currency pair has not been as low as this since July last year.

The market participants’ sentiments are going to be primarily affected by Federal Reserve speakers, the Eurozone’s upcoming Gross Domestic Product data release and European Central Bank (ECB) President Christine Lagarde’s speech, due for later in the day.

Notably, Lagarde’s previous statement on the rate hike had pushed the pair lower. She hinted that the conditions for a rate hike are unlikely to be met in 2022, providing support to the dovish sentiments in markets.

Along with this, investors are also eyeing the US Retail Sales data. Improved figures could benefit the US dollar on expectations for higher growth, while failure to meet the expectations would trigger a dollar-positive risk-off mood.

In addition, as US President Joe Biden formally signed his $1.0 trillion, bi-partisan infrastructure bill that adds another challenge to the pair’s seller. The US 10-year Treasury yields jumped to a fresh three-week high of 1.61%, supporting the US Dollar Index rally at 95.51 to renew the yearly top.

Meanwhile, as the greenback continued, its strength weakens investor appetite. EUR/USD may pause at its current spot for a while but is just resting up before moving to either side.

EUR/USD technical levels

Early Tuesday morning in Asia, at 00:30 GMT, the Reserve Bank of Australia (RBA) will release minutes of the latest monetary policy meeting held during November.

The RBA’s November month monetary policy meeting surprised markets with no changes to the official cash rate (OCR), leaving it at a record low of 0.10%. The board decided to discontinue the target of 10 basis points (bps) for the April 2024 Australian government bond while also extending the bond purchase at the rate of $4 billion a week until at least mid-February 2022.

Although the RBA’s move was initially considered dovish, followed by a downbeat Aussie jobs report, recent unlocks in Australia and upbeat data from the biggest customer China keep the policy hawks hopeful, which in turn highlight today’s Minutes as the key.

Following the RBA Minutes, RBA Governor Philip Lowe is up for a speech around 02:30 AM GMT and will offer details of the Aussie central bank’s next move.

Westpac is on the same line and said,

At 11:30 AEST, 08:30 Singapore time, the RBA’s minutes for the November policy decision will provide more color around the Board’s central view and the risks. But for a more timely update on the bank’s thinking, there will be more interest in the speech by RBA Governor Lowe at 1:30 pm Sydney time, with the hot topic ‘Recent Trends in Inflation’, followed by Q&A.

How could the minutes affect AUD/USD?

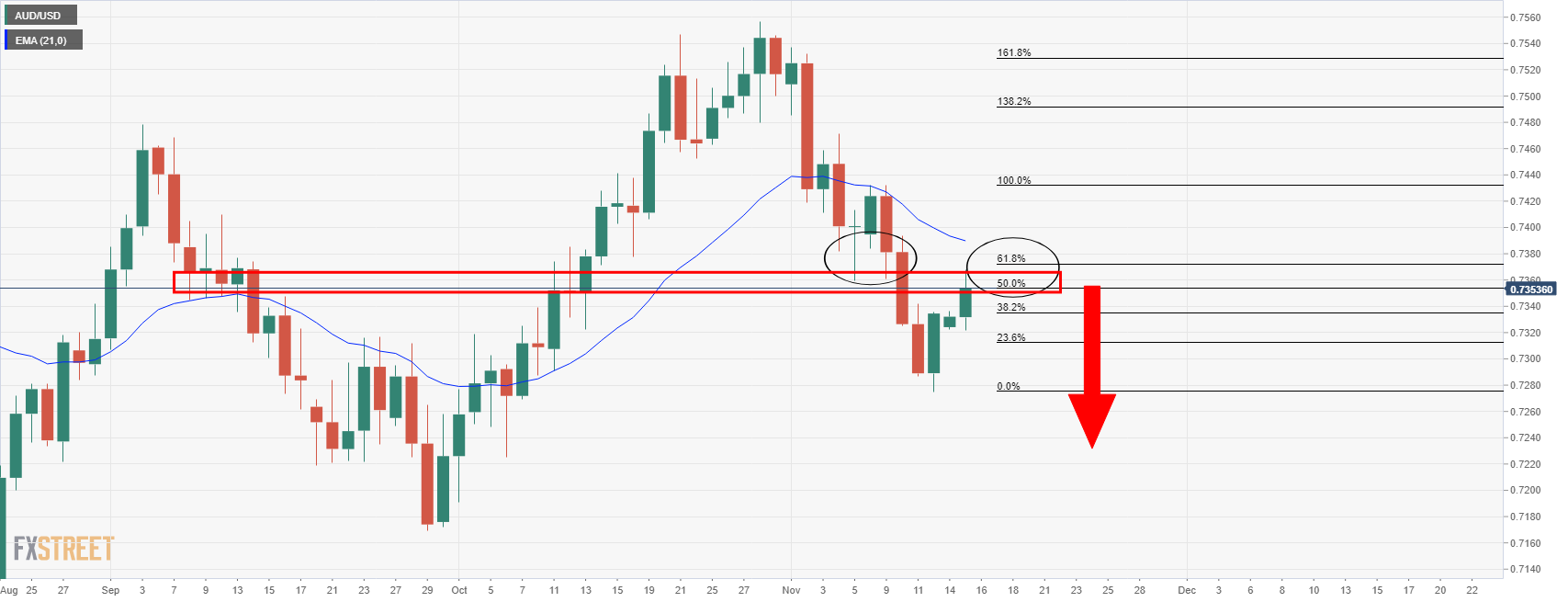

AUD/USD fades the two-day rebound from the monthly low ahead of the RBA minutes, pressured around 0.7350 by the press time. In doing so, the Aussie pair struggles amid mixed clues over the Fed rate hike and US stimulus update. Also challenging the AUD/USD moves are the anxiety over the US Retail Sales data after 31-year high inflation figures.

Considering the increasing odds of the Aussie rate hike and firmer yields, RBA policymakers’ readiness to alter the benchmark rate could help the AUD/USD bulls to tighten their grips. However, any strong rejection of the hawkish policy moves, considering the latest economics, could help the pair to drop towards the monthly low surrounding 0.7275.

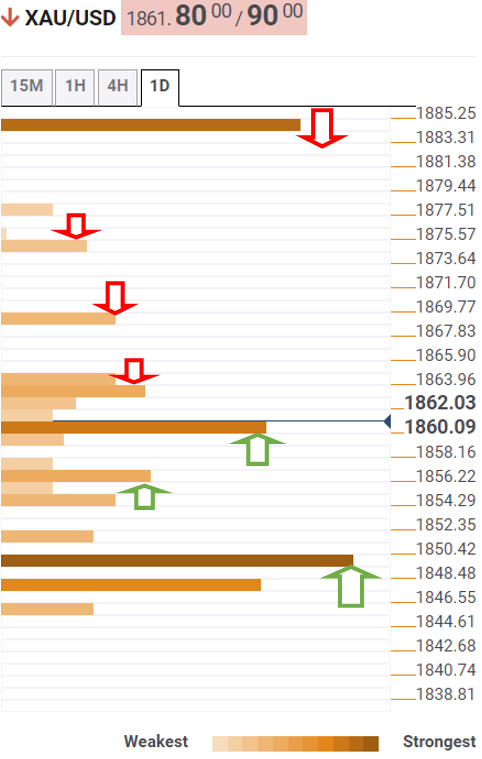

Technically, a convergence of 100-DMA and 50-DMA, around 0.7360-65 restricts the AUD/USD pair’s bounce off the 61.8% Fibonacci retracement (Fibo.) level of the August-October uptrend, near 0.7275. Hence, a decisive break of the stated levels becomes necessary for a clear direction. Bearish MACD and steady RSI line suggest the sellers are having an upper hand.

Key Notes

AUD/USD bulls pause around 0.7350 with eyes on RBA Minutes, Governor Lowe

AUD/USD Forecast: Further recoveries depend on the RBA Minutes

About the RBA minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

- NZD/JPY begins the Asian session on the wrong foot, down 0.01%.

- Worse than expected, Japanese GDP figures, amid risk-on market mood, boosted the NZD.

- NZD/JPY: A bullish-flag chart pattern could open the door for a renewed test of the 2021 year high at 82.50.

After trading for two consecutive days in the green, the NZD/JPY begins the Asian Pacific session, on the wrong foot, down some 0.01%, trading at 80.37 at the time of writing.

On Monday, the cross-currency pair edged higher, extending the New Zealand dollar rally against the Japanese yen, which suffered on dismal than expected Japanese GDP figures. Furthermore, the risk-on mood in the financial markets dented the prospects of safe-haven assets, like the Japanese yen.

NZD/JPY Price Forecast: Technical outlook

The daily chart depicts the NZD/JPY pair is trading within a descending channel that formed a bullish flag. Further, the daily moving averages (DMA’s) remain below the spot price, adding another upward bias signal. Moreover, the Relative Strength Index (RSI) is at 51, is slightly flat, but above the 50-midline. Also, the pair is approaching the top-trendline of the bullish flag, which in case of being broken, it could open the way for further gains.

In the abovementioned outcome, the first resistance level would be the November 8 high at 81.33. A breach of the latter would expose key essential levels like the November 1 high at 82.20, followed by the year-to-date high at 82.50.

On the flip side, failure to break above the bullish flag top-trendline, the NZD/JPY pair would keep trading within the 80.00-81.00 range.

- GBP/USD fades bounce off yearly low, retreats from one-week high.

- UK PM Johnson shows readiness to trigger Article 16 but says agreement with EU is still possible.

- Worsening covid conditions renew talks over British lockdown.

- Brexit talks, virus developments and UK/US data to entertain traders.

GBP/USD remains pressured towards the 1.3400 threshold, around 1.3415 during early Asian session Tuesday, as pessimism surrounding Brexit and the UK’s coronavirus conditions join the pre-jobs data anxiety. In doing so, the cable pair ignores hawkish comments from Bank of England (BOE) Governor Andrew Bailey.

Having earlier said that their aim remains to reach a consensual solution on to the Northern Ireland protocol, as reported by Reuters, UK Prime Minister Boris Johnson mentioned that the deal with the European Union (EU) is still possible. Intensive Brexit talks are on and the latest chatters surrounded the British readiness to trigger Article 16, the key clause to unilaterally avoid Brexit compliance over the Northern Ireland (NI) borders.

Elsewhere, BOE Governor Bailey also crossed wires, via Reuters, while saying that all future BoE policy meetings are now “in play” for a rate rise. The policymaker refrained to vote for an immediate end to the bank’s QE program during the latest monetary policy meeting and surprised markets. However, the jump in the inflation expectations and rate hike calls, per the CME’s BOEWatch indicator, highlights the hawkish case for the GBP/USD traders.

However, the recently peaking COVID-19 numbers in the UK and Europe raise concerns over the “Old Lady’s” early stop to the easy money and hence challenge the rate hike views. The same highlights today’s UK jobs report for fresh impulse. That being said, the headlines Claimant Count Change for October may have to improve from the previous -51.1K forecast to keep the GBP/USD buyers hopeful. Supporting the optimists is the upbeat market consensus over the ILO Unemployment Rate for three months to September, expected 4.4% versus 4.5% prior. Though, the Average Earnings are likely to be easy and may test the bulls.

On the other hand, the Fed rate hike concerns renew amid a jump in the US inflation expectations. However, the hawks may wait for the US Retail Sales for October, expected to reprint the 0.7% MoM growth.

Read: US Retail Sales October Preview: Inflation Is the key, not Retail Sales

It’s worth mentioning that the market sentiment dwindles and helps the US Dollar Index (DXY) to refresh multi-day top but sluggish equities test the momentum traders on a key day.

Technical analysis

Monthly descending trend line near 1.3465 guards the immediate upside of the GBP/USD prices before a one-month-old horizontal hurdle around 1.3565-70. Alternatively, the 1.3400 and a downward sloping support line from April, around 1.3340, become the key to watch.

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, jumped to the fresh high since March 2005 while hitting the 2.76% level by the end of Monday’s North American session.

In doing so, the inflation gauge posts a one-week uptrend, also fueling the Fed rate hike expectations, ahead of the key US Retail Sales figures for October, expected to keep 0.7% MoM growth.

Also portraying the market’s rate hike fears is the jump in the US 10-year Treasury yields to a three-week high, around 1.618% at the latest.

Although the Fed rate hike chatters weigh on the sentiment and favor the US dollar bulls, US stimulus chatters and the Sino-American talks favor the market’s mood of late.

Read: AUD/USD bulls pause around 0.7350 with eyes on RBA Minutes, Governor Lowe

A stronger print of the US Retail Sales data could trim the market’s bullish bias towards the Fed’s next move and may help the greenback to consolidate the recent gains.

Read: US Retail Sales October Preview: Inflation Is the key, not Retail Sales

- AUD/JPY retreats from upper limit of weekly trading range.

- Upbeat Momentum, sustained trading above 50% Fibonacci retracement favor bulls.

- 61.8% Fibonacci retracement adds to the downside filters.

AUD/JPY grinds higher around the weekly top, sidelined near 83.85 amid the initial Asian session on Tuesday. In doing so, the cross-currency pair remains inside a short-term trading range below the 100-EMA.

However, the upward sloping Momentum line joins the quote’s ability to stay positive past 50% Fibonacci retracement (Fibo.) level of October month up-moves, near 83.05, to keep the pair buyers hopeful.

That said, a clear upside break of the stated EMA, around 84.05 by the press time, becomes necessary for the pair’s run-up towards the October 22 swing low of 84.60. Though, any further advances will be challenged by a three-week-old horizontal area near the 86.00 threshold.

In a case where the AUD/JPY bulls remain dominant past 86.00, the last month’s high near 86.25 will be in focus.

Alternatively, the lower end of the stated range, also surrounding the 50% Fibo., restricts the short-term downside of the AUD/JPY pair near the 83.00 round figure.

Should the pair sellers break 83.00 round-figure, 61.8% Fibonacci retracement of 82.30 and late September’s peak near 81.30 may entertain traders ahead of directing them to the previous month’s low of 79.90.

AUD/JPY: Four-hour chart

Trend: Further upside expected

- GBP/JPY begins on the right foot the Asian session, up 0.03%.

- The Japanese GDP contracts more than the -0.2% expected.

- GBP/JPY focus turns to UK’s employment figures, to be unveiled on Tuesday.

The British pound extends its two-day gains, up some 0.03% as the Asian session begins, trading at 153.08 at the time of writing. Overall, market sentiment is downbeat. Major US Stock indices finished in the red, losing between 0.01% and 0.64%. Furthermore, the third quarter’s weaker than expected Japanese GDP dragged the Japanese yen lower amid risk-on market mood.

Japan Gross Domestic Product (GDP) for the third quarter, shrank

On Monday, the Japanese economic docket featured the GDP for the Q3, which shrank 0.8%, more than the -0.2% expected by analysts, according to preliminary data released by the Cabinet Office. That curtailed the government’s anticipation of a rebound to a pre-pandemic level by year-end.

Japanese data blamed the resurgence of new COVID-19 cases, which spurred lockdowns across 21 prefectures, out of 47, asking people to stay at home, and restaurants and bars closed early to refrain from serving alcohol. Also, the car industry was affected by the chip shortage, forcing automakers to cut output around the summer.

In the meantime, UK’s prime minister Boris Johnson crossed the wires. He said that he is ready to trigger Article 16, despite continuing negotiations with the EU. Also, he added that an agreement is still possible while he hopes to negotiate a settlement with Northern Ireland.

On Tuesday, a light Japanese economic docket would leave the GBP/JPY pair dynamics in the hands of the British pound. Concerning the UK economic docket, employment figures could offer fresh impetus for traders, as the October report would be the first one without the furlough scheme provided for workers in the UK.

GBP/JPY Price Forecast: Technical outlook

-637726121012313623.png)

The daily chart depicts the GBP/JPY pair rebounded from the 100-day moving average (DMA), keeping its upward bias intact, with the 50-DMA at 153.31 and the 100-DMA at 152.63. Further, the 200-DMA lies well below the spot price. Furthermore, the GBP/JPY reclaimed the bottom of a descending channel broken two days before, leaving the 154.50-60 area as resistance.

However, to resume the upward bias, British pound buyers will need a daily close above the 50-DMA. In that outcome, the first supply area would be the psychological 154.00. A breach of the latter would expose the top-trendline of the descending channel around the 154.50-60 region.

On the flip side, failure at the 50-DMA would expose the confluence of the bottom-trendline of the descending channel and the 200-DMA around the 152.00-50 range.

“US President Joe Biden signed into law a $1 trillion infrastructure bill at a White House ceremony on Monday that drew Democrats and Republicans who pushed the legislation through a deeply divided US Congress,” said Reuters during early Tuesday morning in Asia.

Key quotes

The bill had become a partisan lightning rod, with Republicans complaining that Democrats who control the House of Representatives delayed its passage to ensure party support for Biden's $1.75 trillion social policy and climate change legislation, which Republicans reject.

The New York Times offered details of the bill as follows:

- $73 billion for the electricity grid.

- $66 billion for rail.

- $65 billion for broadband.

- $47 billion for climate resiliency.

- $21 billion for environmental projects.

- $15 billion for removing lead service lines.

- $7.5 billion for electric vehicles.

- $2 billion for underserved rural areas.

Market reaction

Given the already known news, traders paid little heed to the official announcement. However, the same builds recent optimism in the market ahead of the key US Retail Sales data.

Read: US Retail Sales Preview: Win-win for the dollar? Three scenarios, only one dollar-negative

- AUD/USD retreats after two-day run-up from monthly low.

- China data, hopes from Sino-American talks underpin bullish bias despite firmer DXY.

- Yields remain strong ahead of US Retail Sales, ignore Fedspeak to tame rate hike calls.

- RBA Minutes, Governor Lowe’s speech eyed for rate hike clues, US data will be important too.

AUD/USD fades a two-day rebound from a monthly low, pressured around 0.7345 at the start of Tuesday’s Asian session. The Aussie pair overcame firmer US Dollar Index (DXY) and Treasury yields to mark a positive week-start before easing from 0.7371 ahead of the Reserve Bank of Australia’s (RBA) latest monetary policy meeting minutes and a speech from Governor Philip Lowe.

A surprisingly strong China Retail Sales and Industrial Production data for October joined the People’s Bank of China’s (PBOC) liquidity injection to offer a positive start to the AUD/USD prices. China Retail Sales rose past 3.5% market forecast and 4.4% prior to 4.9% YoY whereas Industrial Production (IP) jumped to 3.5% versus 3.0% expected and 3.1% prior release. Further, the People’s Bank of China (PBOC) injected CNY1 trillion via one-year medium-term lending (MLF).

Also positive for the AUD/USD prices was optimism surrounding the US-China talks and US stimulus. US President Joe Biden and his Chinese counterpart Xi Jinping are up for a virtual meeting after multiple months of silence among the world’s top two economies.

It’s worth noting that US President Joe Biden formally signed his $1.0 trillion bi-partisan infrastructure bill and recently challenged the pair sellers. On the same line were the latest Fedspeak that tried to tame the rate hike talks and reflation fears. Recently, Richmond Federal Reserve Bank President Thomas Barkin said, “If ‘need is there’ fed will act to curb inflation, but good to have a few more months ‘to see where reality is.’”

Amid these plays, the US 10-year Treasury yields jumped to a fresh three-week high, underpinning the US Dollar Index rally to renew the yearly top. However, the Wall Street benchmarks traded mixed.

Looking forward, AUD/USD traders will pay close attention to the latest RBA Minute, followed by comments from RBA Governor Lowe, for clear direction after the downbeat Aussie jobs report preceded the recent unlocks. Should the policymakers sound optimistic, the RBA rate hike chatters will renew, which in turn can add to the pair’s latest rebound. Also important will be the US Retail Sales for October, expected to keep 0.7% MoM growth.

Read: US Retail Sales October Preview: Inflation Is the key, not Retail Sales

Technical analysis

A convergence of 100-DMA and 50-DMA, around 0.7360-65 restricts the AUD/USD pair’s bounce off the 61.8% Fibonacci retracement (Fibo.) level of the August-October uptrend, near 0.7275. Hence, a decisive break of the stated levels becomes necessary for a clear direction. Bearish MACD and steady RSI line suggest the sellers are having an upper hand.

Early Tuesday morning in Asia, Reuters quotes Richmond Federal Reserve Bank President Thomas Barkin’s comments, first appeared in Yahoo Finance, to confirm the policymaker’s “wait and see” approach.

Key quotes

Infrastructure bill not a "near term stimulant.”

Anticipate supply chains problems will last "well into next year".

Will watch wages, labor market for signs inflation is becoming more persistent.

Household and market indicators suggest inflation expectations over the medium to long term still in line.

If "need is there" fed will act to curb inflation, but good to have a few more months "to see where reality is."

Market reaction

Given the initial Asian session and the market’s wait for the US Retail Sales for October, traders paid little heed to the news.

Read: Forex Today: Sentiment driving financial markets

Early Tuesday morning n Asia, UK PM Boris Johnson crossed wires while speaking on Brexit and other political matters. While the UK leader shows readiness to trigger Article 16, he also remains hopeful of an agreement with the European Union (EU) as the Brexit talks continue.

Key quotes

The Russian pipeline to Europe poses a threat to stability.

An agreement with the EU is still possible.

Triggering Article 16 will be perfectly legitimate.

I hope to reach a negotiated settlement with northern Ireland.

FX implications

GBP/USD remains pressured around 1.3413, consolidating gains marked during Friday and Monday, irrespective of the positive news.

Read: GBP/USD bulls fail first attempt to break 1.3450 critical round number

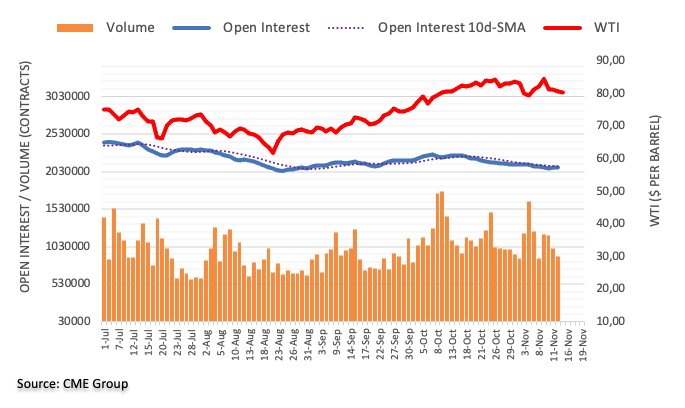

- WTI recovered from an earlier dip under $80.00 and now trades flat and closer to $81.00.

- Some commodity strategists argued speculation over the US tapping the SPR was overdone.

Front-month futures for the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, shrugged off earlier selling pressure that threatened to send prices below $80.00 and back towards monthly lows at $78.28 to trade flat near $81.00. Nonetheless, a cloud of worries is building for crude oil markets.

Analysts are concerned about a potential hit to crude oil demand in Europe this coming winter as Covid-19 infection rates rise and countries tighten health-related restrictions. Meanwhile, there was more verbal pressure from the White House at OPEC+ over their sluggish output hikes and jawboning from Democrat lawmakers in favour of releasing US crude oil reserves. Other touted concerns include the strengthening US dollar and global inflationary pressures that might pull forward central bank tightening, stifling economic growth (and the outlook for crude oil demand).

Traders also pointed to comments from the UAE’s Oil Minister about how global oil supply is likely to return to a surplus in Q1 2022 as US shale comes back online. London-based energy research house Rystad Energy said on Monday that US shale would likely return to its pre-pandemic output levels of 8.68M barrels per day in December.

A few commodity strategists argued that speculation about a move by the US to tap the Strategic Petroleum Reserve (SPR) had gone too far, which explained how crude oil prices were able to recover later in the session. But WTI is showing little sign of being at the beginning of posting a recovery all the way back to last week’s highs close to $85.00.

Speaking to Reuters, Louise Dixon, senior markets analyst at Rystad Energy, said “the market now seems to be less concerned about the current supply tightness, expecting it to be short-lived”. “Traders are instead refocusing on the return of two bearish factors – the possibility of more oil supply sources and more COVID-19 cases” she added.

- USD/JPY bulls are on the verge of a fresh cycle high.

- There are multiple bullish candle formations on the daily chart.

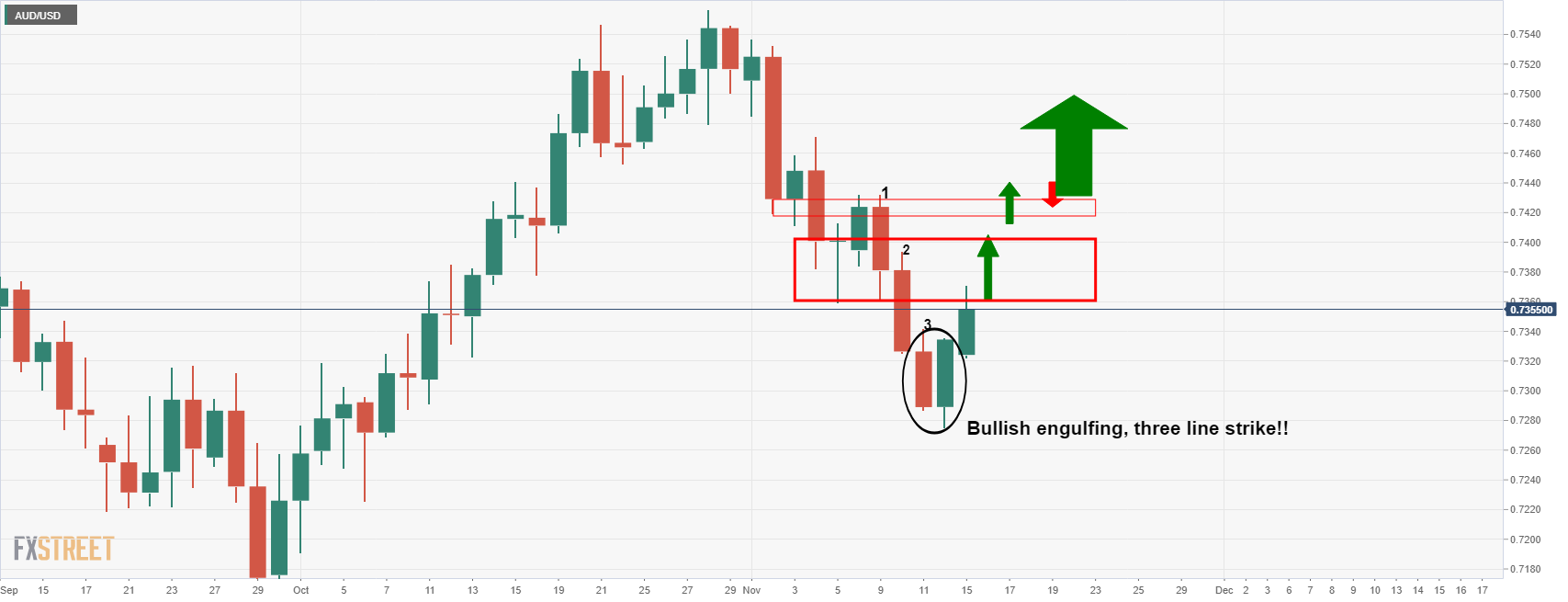

USD/JPY rallied again on Monday, showing the bullish intentions for the price following a very strong move last Wednesday which left a three-line bullish strike on the daily charts. The price is on the verge of printing a fresh cycle high after the greenback surged to a 16-month high against a basket of major peers. The dollar index DXY hit 95.50 on Monday, its highest since July 2020.

At the time of writing, USD/JPY is trading 0.24% higher into the close of the North American session. The pair rallied from a low of 113.75 and reached as high as 114.13, some 50 pips below the 20 Oct and 2021 cycle highs. Global growth and inflation concerns are underpinning the greenback, risks that are in their infancy.

All aboard the US dollar train

Gains in the heavily euro-weighted dollar index followed the European Central Bank President Christine Lagarde continuing to push back on market bets for tighter policy. Meanwhile, for the week ahead, investors will look to US Retail Sales data on Tuesday for clues as to where the dollar may be headed next. The data are to come in at 1.1% for last month, according to a Reuters poll.

Another influencer for the DXY will be the UK's economic diary this week where employment, inflation and retail sales numbers are expected to provide clues about whether the Bank of England will raise rates in December. However, as a fresh wave of covid swells of Europe, bets of a rate hike at the BoE are starting to dwindle following last month's hawkish hold. This could also feed into US dollar strength and thus tip the yen over the edge.

USD/JPY technical analysis

On the daily time frame, we have multiple confluences of bullish signals. 1. Three line strike which is a reversal pattern. This is a bullish engulfing candle that was printed on Nov. 10. 2. Reverse head and shoulders which is a bullish formation as well. 3. And lastly, Monday's bullish engulfing candle, (albeit with 10 mins left to go until the daily close).

- USD/PLN hit fresh 19-month highs on Monday above 4.0800 and is now up more than 3.0% since last Wednesday.

- A weaker euro, as well as inflation concerns and not as hawkish as hoped for NBP commentary, hurt the Zloty.

USD/PLN continued its recent bull run on Monday to hit fresh 19-month highs at 4.0800, where it trades higher by about 0.75% on the day. Broad euro weakness amid concerns about the state of the pandemic in mainland Europe and amid dovish ECB speak has exerted a heavy drag on the Central European currencies on Monday, though the Polish Zloty is the underperformer.

USD/PLN’s recent bull run was ignited last Wednesday in wake of hotter than expected US inflation numbers, which launched the pair above the psychological 4.00 level. Since then, it has barely looked back and is now up around 3.0% in the last four sessions.

Zloty woes

Unlike for the US dollar, hot Polish inflation has failed to give the Zloty any respite. The final version of Poland’s October Consumer Price Inflation (CPI) report was released on Monday and the YoY rate of CPI was left unchanged from the flash estimate at 6.8% as expected, up from 5.9% in September. That is nearly double the upper limit of the Polish Central Bank’s 3.5% inflation target (the bank targets 2.5% plus or minus 1.0%).

The October inflation figures thus put heavy pressure on the Polish Central Bank to quicken the pace of their hiking cycle. That's because the inflation spike has sent short-term Polish real yields into deeply negative territory - at roughly 2.4%, the Polish Government’s 1-year bond yield has a negative yield of 4.4% to the current YoY rate of inflation. This not only constitutes a drastic, unnecessary easing of financial conditions but also puts pressure on the Zloty.

The Polish Central Bank (called the Narodowy Bank Polski or NBP), hiked rates by 75bps to 1.25% earlier in the month, but the failure of the Zloty strengthen suggests markets think this is far from enough. NBP Governor Adam Glapinski, speaking in the Polish press, said that further rate hikes are more likely than not. But he said that this was “a conditional probability” and “it may change”, or in other words, there is a chance the bank might still hold rates at its next meeting. The Zloty seems to have reacted poorly to this dovishness.

Looking ahead, USD/PLN will continue to track movements in EUR/USD as focus shifts to state-side events, including US Retail Sales, Fed speak and the potential announcement of who is going to be the Fed’s next chair.

- The US Dollar Index begins the week on the right foot, up 0.25%.

- The US 10-year Treasury yield rises almost four basis points, sits at 1.621%.

- DXY Technical outlook: A break above 96.00 exposes June 30, 2020, high at 97.80, followed by a test of 100.00.

The US Dollar Index, also known as DXY, which tracks the greenback’s performance against a basket of its peers, advances 0.34%, sitting at 95.42 during the New York session at the time of writing. Since last Wednesday, the DXY had gained over 1.55% when it traded as low as 94.00, until Monday’s session when it reached a year-to-date high around 95.45.

Earlier in the Asian session, the DXY hovered around the psychological 95.00 price level, undermined by falling US bond yields. Further, on Friday of the last week, the University of Michigan Consumer Sentiment Index dropped to a 10-year low as consumers expressed concerns about elevated prices. This would exert pressure on the Federal Reserve, which in fact, in this week will begin the reduction of its QE pandemic program by $15 billion, which would end by June 2022.

As of writing, US bond yields are rising. The 10-year Treasury yield rises three and a half basis points, sitting at 1.621%, acting as a tailwind for the buck.

US Dollar Index (DXY) Price Forecast: Technical outlook

-637726049313881572.png)

The daily chart depicts the DXY approaching Pitchfork’s indicator’s central line around the 95.50-60 region. The daily moving averages (DMA’s) remain well below the current price action, with an upslope, supporting the upward bias. Also, the Relative Strength Index (RSI) at 68 is above the 50-midline, aims higher, suggesting that DXY has another leg-up before reaching overbought conditions

A break above the mid-line of Pitchfork’s channel would expose 96.00 as its first resistance area. A clear breach of the latter would expose June 30, 2020, high at 97.80, followed by May 25, 2020, high at 99.97.

- EUR/JPY has slid under 130.00 and is set for a seventh negative session in the last eight.

- The euro saw broad underperformance on Monday amid dovish ECB vibes, concerns about the state of the EU’s Covid-19 outbreak.

Amid a bout of broad euro weakness, EUR/JPY has seen significant selling pressure on the first trading day of the week, falling from around the 130.40 area and close to its 200DMA to current levels under 130.00. The pair is set to end Monday’s session 0.3% lower, which would mark a fifth consecutive session in the red and seventh negative session in the last eight. Over this time period (the last eight sessions), the pair has dropped around 2.0% from above 132.50 to current levels under 130.00.

EUR/JPY has now convincingly lost grip of its 200DMAat 130.50 and also broke below a key Fibonacci retracement at just above 130.00 (the 61.8% retracement back from the October high at 13350 to the summer lows at 1.2800). Technically speaking then, recent losses have opened the door to an extension of downside towards those summer lows.

Euro underperformance

Market commentators cited dovish ECB speak and concerns about the worsening pandemic situation in the Eurozone as key drivers of Monday’s underperformance in the euro. In terms of the former, ECB officials, including President Christine Lagarde and Vice President de Guindoes, doubled down on the insistence that favourable financing conditions must be maintained in the Eurozone to support the economic recovery. ECB officials also continue to see inflationary pressures as transitory. Meanwhile, the Netherlands started a three-week lockdown at the weekend, Austria is imposing a lockdown on the unvaccinated and infection rates in Germany are at a record high.

Whilst these themes, which have been talking points for a while now, haven't necessarily been driving broad euro underperformance in recent sessions, they likely have been driving the euros underperformance versus the safe-haven yen. Some of the recent underperformance may also reflect some catch-up to a narrowing of Eurozone/Japan rate differentials. Between 1 – 5 November, German 10-year yields dropped nearly 20bps versus a mere 5bps drop in Japan 10-year yields, all while EUR/JPY barely moved.

Either way, as the economic outlook in the Eurozone darkens this winter due to the pandemic and the ECB continues to push back against any hint of early monetary tightening, the euro may well continue to underperform the yen. Monday’s Asia Pacific session saw the release of Japanese Q3 GDP data and whilst this did disappoint on expectations, this likely boosts the outlook for the Japanese economy in Q4 2021/Q1 2022 as it improves the momentum behind Japan PM Kishida’s stimulus plans.

- USD/CAD bulls are seeking a bullish continuation for the days ahead.

- The daily Fibonacci retracements levels are under pressure.

The price of USD/CAD has so far corrected to test the 38.26% Fibonacci and on towards the 50% mean reversion mark near 1.2495. 1.2486 is where the Nov 9 highs are which could be tested as well, in line with the 61.8% Fibo, aka the golden ratio.

USD/CAD daily chart

Anywhere between these levels support can be expected to lead to a bullish continuation.

USD/CAD H1 chart

From an hourly perspective, the day has not been favourable to the bullish outlook. The price continued to sink and is now well below the bearish 21 and 50 EMA crossover.

1.2503 is about to come under pressure as being the lastest resistance prior to the rally. This could act as support. On a break, then the 1.2480s will be in focus and be expected to hold initial tests. So long as the 200-EMA remains intact, then the bias will stay with the daily bullish outlook.

What you need to know on Tuesday, November 16:

The EUR was the worst performer, falling against the greenback to a fresh 2021 low of 1.1381. The dollar also appreciated against safe-haven CHF and JPY, but shed ground against the pound and commodity-linked currencies. Overall, the action was limited across the FX board as speculative interest awaits fresh clues.

The market sentiment was positive at the beginning of the day following upbeat Chinese data but faded after Wall Street’s opening. US Treasury yields jumped without a clear catalyst. However, it may be related to the US reporting last Friday that over 4.4 million people in the US quit their jobs in September, overshadowing the upbeat Nonfarm Payrolls report released earlier this month.

Brexit returned to the headlines. UK PM Johnson's spokesman said they aim to reach a consensual solution to the Northern Ireland protocol, adding that they want to reach a consensual solution and continue “intensive talks” with the EU. Meanwhile, UK PM Johnson hit the wires, warning that, to avoid new restrictions, everyone must get vaccinated. The definition of a fully-vaccinated person will change to account for booster shots, he added. The number of coronavirus contagions is reaching worrisome levels in Europe, which suffers its sixth wave.

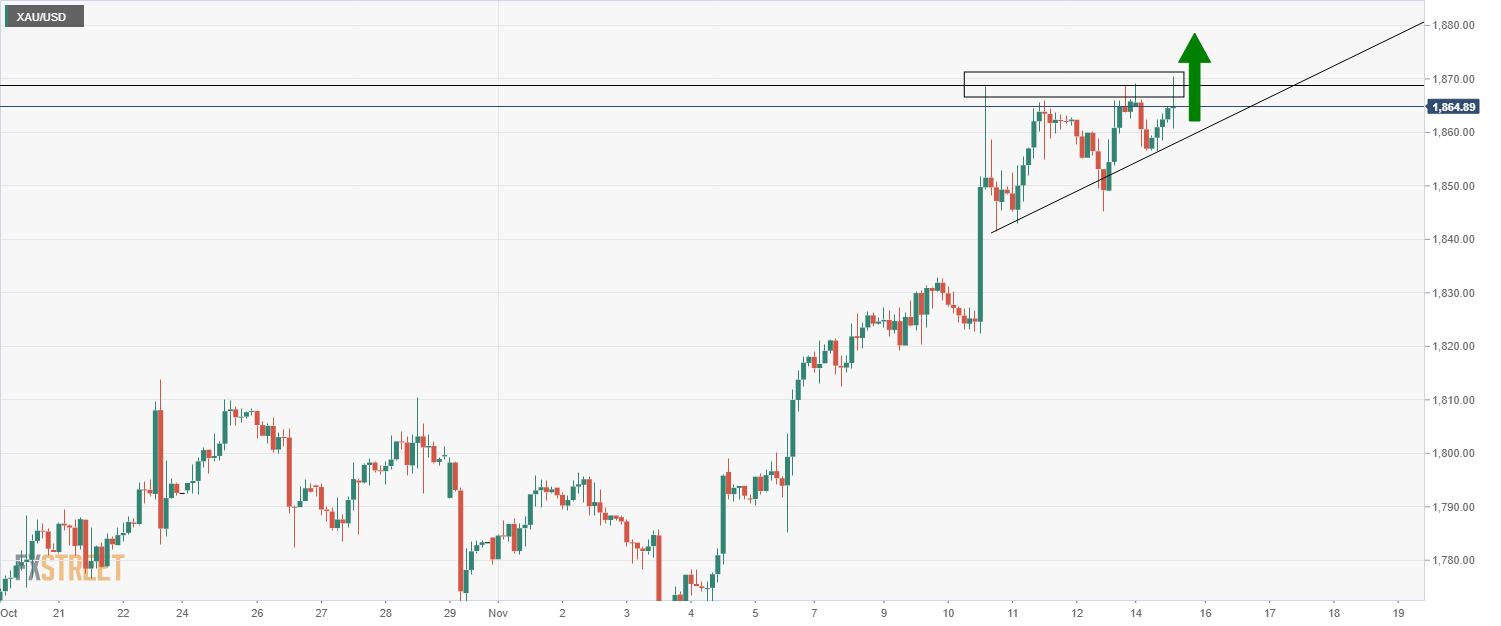

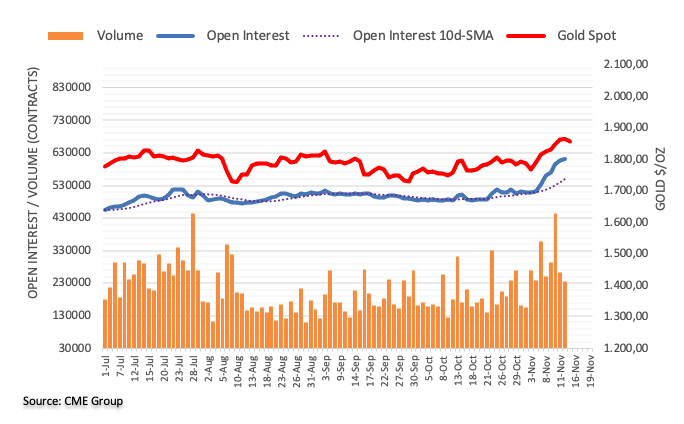

Gold extended its advance to reach a fresh multi-month high of $1,870.48 a troy ounce. While crude oil prices posted modest intraday losses and finished the day at around $79.80 a troy ounce.

On Tuesday, the RBA will release the Minutes of its latest meeting, while the US will unveil October Retail Sales. Also, the UK will publish its October employment data.

Bitcoin buy-side volume rises as bulls continue uptrend towards $70,000

Like this article? Help us with some feedback by answering this survey:

- NZD/USD retreats from the 200-DMA as the US dollar trims early losses.

- The US Dollar Index advances to new year-to-date highs around 95.44.

- NZD/USD Technical outlook: A break above the 200-DMA would expose the 2021 high at 0.7465.

The NZD/USD retreats from three-day highs around 0.7100 though keeps in the green territory, advances some 0.07%, trading at 0.7051 during the New York session at the time of writing. In the last couple of hours, a rise in US Treasury yields underpinned the greenback with the US Dollar Index

DXY trades at new year-to-date highs around the 95.40s

The US Dollar Index, which measures the buck’s value against a basket of its peers, advances 0.31%, sitting at 95.42, hovering around year-to-date highs at 95.44

During the Asian and European session, the NZD rallied, topping around 0.7080 as the US dollar went under pressure, after a weaker than expected University of Michigan Consumer Sentiment data, which fell to 10-year lows amid higher inflation. Further, on the abovementioned sessions, falling US Treasury yields underpinned the buck’s which fell to three-day lows against the kiwi.

However, as American traders got to their desks, amid a light US economic docket, demand for the greenback increased, thus dragging the NZD/USD pair lower, down to last Friday’s high at 0.7048. In the meantime, the US 10-year benchmark note rose three basis points up to 1.613%.

This week, the Federal Reserve begins its bond taper, while the Reserve Bank of New Zealand (RBNZ) will host its last monetary policy of the year on November 24. Central bank monetary policy divergence between the Fed and the RBNZ would play a crucial role in the NZD/USD pair outlook, in which the NZD has the upper hand.

The market has priced in a 100% chance of a 25 bps hike by the RBNZ in its November meeting, but there is a slight 40% chance of a 50 bps. For 2022, investors are fully priced in for a 25 bps hike in February, with a 70% chance of a 50 bps hike.

NZD/USD Price Forecast: Technical outlook

In the daily chart, the NZD/USD retreated from 0.7080s towards Friday’s high around 0.7048, within the 50 and 100-day moving averages (DMA’s). The daily moving averages (DMA’s) remain directionless but provide support/resistance levels in the pair. However, as the 200-DMA remains above the spot price, the pair is tilted to the downside, but it remains almost horizontally, at risk of being broken.

A break above the 200-DMA, which sits around 0.7100, could open the door for further gains. The first resistance would be 0.7200. A breach of the latter would expose crucial supply zones, like the May 26 high at 0.7317, followed by the year-to-date high at 0.7465.

- Spot silver is subdued on Monday, remaining supported above $25.00 but capped by the 200DMA.

- Precious metal markets await key upcoming US data, Fed speak and Biden’s Fed Chair nomination decision.

Spot silver (XAG/USD) prices have spent Monday’s session consolidating within recent ranges, finding support at the $25.00 level, but failing to push towards the 200-day moving average just under $25.40. Consolidative conditions are not too surprising on Monday. The DXY is pushing on to further year-to-date highs and towards 94.50, but this is mainly due to weakness in the euro rather than broad USD strength, thus sparing precious metals. Meanwhile, the bond market picture is mixed, with long-term US yields up due to higher inflation expectations, while short-end nominal yields are flat and 5-year real yields substantially lower.

A much stronger than anticipated NY Fed Manufacturing index for November (coming at 30.9 versus forecasts for a rise to 21.6 from 19.8) is a good omen for US November data. Indeed, the release has been the only notable fundamental catalyst thus far on Monday (it triggered the rise in long-term US yields). For now, precious metals markets would rather bide their time and await the outcome of Tuesday’s October Retail Sales report. Traders also want more information on two key fronts with regards to the Fed; 1) how will Fed policymakers (who speak in droves this week) respond to the recent inflation surprise and 2) who will be nominated as the next Fed Chair? Reportedly US President Biden’s decision on the latter could come as soon as this week.

Chatter amongst analysts, market commentators and Fed watchers is that the bank should pivot towards accelerating the pace of asset purchases in Q1 2022 and signal intent to start hiking by the end of Q2 2022 at a minimum. Political pressures are growing on the Fed to do something about inflation, as President Joe Biden (and his VP Kamala Harris) see their approval ratings tank. If Fed members don’t sound sufficiently hawkish, precious metals could get another boost on rising inflation/fiat debasement fears. That could send spot silver above its 200DMA, which could open the door to extended upside towards $26.00 (the early August high).

- The S&P 500 has swung between gains and losses on the first day of the week within a 4675-4695 range.

- The Nasdaq 100 is an underperformer amid a rise in long-term US yields.

The S&P 500 has seen choppy trade thus far this Monday, swinging within a 20-point 4675-4695 range amid an indecisive start to the week. At present, the index is roughly at the midpoint of this range just under 4685, meaning it trades flat on the day. The Nasdaq started the session in the green, rising as high as 16.25K at one point, but has since dropped back into negative territory, and currently trades around 16.15K, down about 0.3% on the day. So far, the 16.1K level which coincides with last Thursday’s highs has offered decent support.

Weighing on the Nasdaq 100 index has been a rise in long-term US bond yields. That’s because so-called growth stocks, whose valuation is disproportionately dependent upon expectations for future earnings growth rather than on actual reported numbers, make up a heavy weighing in the Nasdaq 100. As long-term interest rates rise, this increases the opportunity cost of betting on earnings growth. Further downside in Tesla’s share price amid a Twitter storm from CEO Elon Musk that saw him lash out against left-wing US politician Bernie Sanders (who called for higher taxes on billionaires) probably hasn’t helped. Musk sarcastically asked Sanders if he should sell more shares (after publically criticising/insulting him). Tesla shares are down another near-5.0% on Monday and back under $1000, having pulled back more than 15% last week as Musk unloaded shares.

The Dow is currently trading roughly flat on the session like the S&P 500. A 5.0% surge in Boeing’s share price amid reports that the Saudi Arabians are in talks with the company over a wide-body jet order has failed to give the index a meaningful lift. In terms of the S&P 500 GICSs sectors, banks are outperforming the index and are up 0.2% as long-term yields rise. Materials are underperforming the index, down 0.5%, as traders cite concerns about metal demand amid further evidence during Monday’s Asia session that growth in the Chinese real estate sector continues to slow.

Aside from the knock-on impact that higher long-term yields had on growth stocks after they rallied in wake of the strong NY Fed survey, the data has been ignored. But it does bode well for upcoming US PMI surveys and hard activity data for November further down the line. Equities will be much more attuned to Tuesday’s US October Retail Sales report. Investors will also keep a keen eye on the “unofficial end” to earnings season as brick-and-mortar retailers, Walmart, Target, Home Depot and Macy’s report this week. Walmart is up first on Tuesday. Investors will be hoping they round off what has thus far been an excellent earnings season.

- AUD/USD bears need to watch out for the trap.

- Bullish reversal pattern spotted on the daily chart.

- Bears await the break of weekly trendline support to target 0.7220.

AUD/USD is in the process of an upside correction according to the daily chart and has broken the 38.2% Fibonacci retracement level for the opening day. This was located at 0.7336 and a pip higher than the highs of Friday.

The price has since climbed through the 50% mean reversion and has come close to a test of the golden 61.8% Fibo at 0.7323. This is an area of heavier resistance given the confluence of bearish moving averages. At this juncture, the bears could start looking for an optimal entry in anticipation of a downside continuation.

AUD/USD daily chart

AUD/USD weekly chart

However...

... the weekly time frame is not so bearish while there are prospects of the dynamic support holding and resulting in a higher high for the weeks ahead. In examining the daily chart a little closer as well, the 12 Nov bar was bullish engulfing:

This is actually a three-line strike candlestick formation which is a reversal pattern. Therefore, we could see the weekly outlook playout should the price clear the overhead resistance and breakout above 0.7420:

On the other hand, should the weekly dynamic trendline support break and price drop below 0.7320, then the three-line strike will be invalidated as a trade set-up and the bears will be back in control.

Bears can still get prepared for a downside continuation by monitoring for a bearish environment from the 4-hour car as follows:

The bears will be looking for the 21 and 10 EMAs to turn south and crossover o signal a bearish environment. A break of the 0.7320s will likely result in a downside continuation for a fresh daily low towards 0.7250 and then 0.7220.

- EUR/USD has slumped under the 1.1400 level for the first time since July 2020 and is now over 0.5% lower.

- The pair has also broken to the south of a long-term downtrend, signaling a near-term acceleration of the bear-run.

EUR/USD has slumped under the 1.1400 level for the first time since July 2020. The pair trades lower by about 0.5% on Monday and has broken below a few key areas of support on its way down, including at around 1.1420 and then the psychologically important 1.1400 level just below it. The bears will now look to push the pair lower towards the next area of support at 1.1350. If that breaks, it’s a clean run lower to the late June/early July 2020 lows under 1.1200. Notably, EUR/USD broke to the downside of a long-term downtrend that had been supporting the price action going all the way back to August, signaling a near-term acceleration of the pair’s bear run.

Market commentators are citing a few fundamental reasons for EUR/USD’s drop. Firstly, US bond yields have reversed early losses and now the yield curve is predominantly higher, as well as steeper. US 30-year yields are up around 6bps on the day and flirting with the 2.0% level again, while German 30-year yields are up a more modest 3bps. Meanwhile, the US 2s10s spread has widened by about 3bps, while the German 2s10s spread has narrowed by just under 1bps. A steepening of the yield curve suggests improved optimism about future economic growth and inflationary outcomes that hasn’t also exacerbated fears about near-term monetary policy tightening.

The steepening of the US curve is a result of a better than expected US regional Fed manufacturing survey released earlier in the session. To recap, the NY Fed Manufacturing survey for November rose to 30.9 from 19.8 in October, well above the expected rise to 21.6. This is a good sign that the solid start the US economy enjoyed to Q4 continued into the second month of the quarter and this will be boosting USD directly, not just indirectly via yields.

Note that as the data points to the US picking up economic momentum, the Eurozone economy is expected to slow in the coming months amid surging Covid-19 infection rates that threaten hurting consumer confidence and the reimposition of restrictions (the Netherlands has already implemented a full lockdown). This is also touted as bearish for EUR/USD.

Finally, dovish remarks from ECB members may also have highlighted fundamentals divergences between the euro and dollar; the general message was to emphasise that the bank still view the current spike in inflation as transitory and that cost-push inflation (higher energy/fuel bills) is hurting the economy, thus the ECB should keep financing conditions accommodative.

Looking ahead to the rest of the week, more ECB speak is also likely to be (mostly) dovish and there is no tier one Eurozone data. Focus will be on stateside events. Fed speakers come out in force and will need to comment on inflation after last week’s surprise and markets await US President Joe Biden’s Fed Chair appointment decision. There is also a decent dose of data for traders to sink their teeth into, starting with the October US Retail Sales report out on Tuesday.

- EUR/CHF bears are running head in with weekly support.

- 1.050 could be a tough nut to crack from a technical perspective.

- SNB is potentially comfortable with a stronger CHF instead of hiking rates.

EUR/CHF is turning heads in the currency markets at the start of the week as the bears take control and target an imminent break of the 1.05 key psychological level. At the time of writing, EUR/CHF is trading down 0.21% after sliding from 1.0546 to a low of 1.0515.

This is a May 2020 low for the euro against the safe-haven Swiss franc. A double whammy of inflation fears and renewed concerns over the COVID-19 pandemic that is sweeping across mainland and eastern Europe in a fresh wave is pressuring the risk-sensitive markets.

Swiss National Bank governing board member Andrea Maechler said modest Swiss inflation, at an annual rate of around 1.2%, was capping the franc's rise. But she reiterated the SNB's commitment to currency market interventions designed to limit if needed, the effect that the Swiss franc's strength has on Switzerland's export-orientated economy.

CHF is a natural hedge against inflation

Deutsche Bank's Robin Winkler argued that the franc is a good stagflation hedge, ''and the SNB are likely to be more tolerant of currency appreciation than in the past, considering it insurance against importing inflation from the Eurozone.''

''The rates market has been trying to price the first hike from the SNB next year, in sympathy with the ECB, but in our view the SNB will use the exchange rate, rather than the policy rate, to tighten policy.''

EUR/CHF technical analysis

While there are prospects of a break of 1.0500, there are prospects for a significant correction to the upside in the near future, from a technical standpoint.

-637725952722087715.png)

The weekly chart shows that the price has fallen for eight consecutive weeks without a correction. This is the longest weekly losing streak since the turn of 2010. While that in itself is not a reason to try and catch a falling knife, it does give rise to the prospect of a correction in the near future.

Profit-taking could emerge around a test of the 1.0500 level and result in consolidation and a phase of accumulation that could well target the July 202 lows that have a confluence with the 23.6% Fibo at 1.0605 and then the Nov 2020 lows that have a confluence with the 38.2% Fibo near 1.0660. On the downside, 1.0470 could be a stronger level of support according to the monthly chart should the bears conquer bullish commitments at 1.0500.

-637725959523182393.png)

- Crude oil falls almost 1%, as Democrats pressure US President to act on high gasoline prices.

- OPEC+ sticks to its 400,000 barrels per day crude oil output, despite the pressures from the US.

- WTI Technical outlook: A death-cross in the 4-hour chart opens the door for further losses for crude oil prices.

During the New York session, the Western Texas Intermediate (WTI) US crude oil benchmark slides as Democrats increased pressure on the White House to tap the Strategic Petroleum Reserve (SPR) to cap elevated gasoline prices. At the time of writing, WTI extends its four-day slump, falling 1.07%, trading at $78.89.

According to sources cited by Bloomberg, Energy Secretary Jennifer Gharnholm told CNN that the US President is evaluating the available tools, including a release from the SPR. Market participants said that a release from the US SPR would help in the near term, but it would not solve the problem.

Earlier in the American session, the black gold dipped as low as $78.33 but bounced off, recovering some $0.50 throughout the day.

Meanwhile, OPEC and its allies will be adding 400,000 barrels a day of crude oil each month in the middle east. The cartel is cautious about demand stability in the coming months. Some countries in central and eastern Europe have reimposed restrictions as COVID-19 cases have increased.

WTI Price Forecast: Technical outlook

-637725944240942654.png)

In the 4-hour chart, WTI is trading within a descending channel, below the simple moving averages (SMA’s), with the 50-SMA just crossing below the 200-SMA, depicting a death-cross. This means that crude oil has a downward bias in the short-term confirmed by the Relative Strength Index (RSI) at 40, aims lower.

The first support level would be November 4 pivot low at $77.61. A breach of the latter would expose the October 7 swing low at $74.74.

- GBP/USD bulls are trying to take charge at 1.3450 despite the risks of a fresh covid wave.

- Brexit headlines will be important for the week ahead also.

- BoE sentiment is for a rate hike in Dec, but will covid disrupt this?

At the time of writing, GBP/USD is attempting to correct a daily bearish impulse and is trading 0.18% higher on the day so far. GBP/USD has travelled from a low of 1.3402 to a high of 1.3449, scoring the high in recent trade as bulls take on daily resistance with 1.3480 eyed.

The pound has been edging higher at the start of the week although post-Brexit trade arrangements for Northern Ireland remain a risk. Relations between the UK and EU have been frayed due to the brinksmanship over the Britians threats to trigger an emergency clause known as Article 16 of the Northern Ireland Protocol. The pound is especially vulnerable as the prospects of a trade war are an outcome that would be expected to leave the Uk worse off by comparison.

European Commission's Maros Sefcovic said the EU will consider all of the tools at its disposal if the UK Government triggers Article 16. ''If the British Government suspends the Northern Ireland Protocol, it will have “serious consequences” for the region and Brussels’ relationship with the UK.

However, on the more positive side, he said, ''Last Friday, I held my fourth weekly meeting with David Frost on the EU package of solutions.''

“I acknowledged and welcomed the change in tone of this discussion compared to previous ones. After weeks of intensified discussions, we need the UK to reciprocate the big move the EU has made. The EU has taken big steps to find solutions and to provide solutions to concrete problems faced by Northern Irish people and businesses on the ground as a consequence of the Brexit chosen by the UK.”

Mr Sefcovic said he would not speculate on whether the UK will trigger Article 16. Britain and the European Union will intensify efforts this week to find a solution.

GBP traders get mixed messages in futures and options

Meanwhile, looking at the options and futures markets, there are mixed messages.

On the one hand, the weekly CFTC positioning data is telling that speculators have increased their longs on the pound versus the dollar. But on the other hand, the one-month risk reversals that are a gauge of the market's expectations of the pound's direction, have hit their lowest since December 2020 on Thursday last week. The gauge is in negative territory which indicates the market expects the pound to fall, probably likely to the following...

GBP to face Covid risks on the horizon

In starkly riskier headlines, Europe's latest covid storm is expected to affect the Uk, the PM Boris Jonson has stated:

- PM Boris Johnson says it is unclear how the "storm clouds" of the new wave of Covid in Europe "will wash up on our shores".

- He urges people to get vaccinated "as soon as...eligible", and says it would be a "tragedy" if double-jabbed people fell ill without their booster.

- Asked if he can rule out Christmas lockdown, PM says current data does not point to the need for a Covid "Plan B".

- England's chief medical officer, Chris Whitty, renews the call for pregnant women to get vaccinated

- The UK's top vaccine advisers, the JCVI, say all over-40s should be offered a third dose of a Covid vaccine.

- The medicines regulator, the MHRA, says it is safe for people aged 16-17 to have second Pfizer/BioNTech vaccine dose.

(Source: BBC)

This leaves the pound vulnerable to risk-off and heavy selling, especially in light of the recent rhetoric from the Bank of England and surprise interest rate hold.

BoE Dec rate hike sentiment in jeopardy

The risks are mounting for the Bank of England to hold again at their next policy meeting in December. The BoE left rates on hold, much to the surprise of the markets following a number of hawkish tilts of the hat leading into the meeting from various MPC members. The BoE signalled that a rate hike will be appropriate in the coming months if data is broadly in line with expectations.

Governor Andrew Bailey linked rate hikes to labour market outcomes. However, should there be risks of a fresh wave of covid in the UK as a result of mainland European contagion, then rate hikes could well be off the menu for the foreseeable future. As it stands, however, markets are pricing in approximately 90bp over a period of between 2022-late 2025.

GBP/USD technical analysis

There are prospects of a deeper correction on the daily chart as per the bullish momentum and market structure on the hourly chart.

As illustrated, the price is headed into daily resistance and correcting the latest bearish daily impulse, testing the 38.2% Fibonacci retracement level. There is room to go to the 50% mean reversion level though that meets the firmer resistance near the 4 & 8 Nov closing and opening levels respectively near 1.3480.

GBP/USD H1 chart

The reverse head and shoulders formation is a bullish pattern. Given that the price is being supported by the hourly dynamic trendline, there are prospects of a bullish continuation towards the 1.3480s.

- XAU/EUR reaches a new year-to-date high at €1,634.04.

- Demand for gold increases as global inflation rises, and investors turn to the yellow metal as a hedge.

- XAU/EUR: RSi in overbought conditions suggests a correction towards €1,604 is on the cards.

Gold spot against the euro (XAU/EUR) is steady around the year-to-date high at €1,634.04, after edging up some 0.15% to trade at €1,632 during the day at the time of writing. As the week began, the precious metal extended its rally to eight days in a row.

During the Asian session, the precious metal edged lower towards the €1,620 lows, however, it found support around the 50-simple moving average (SMA), spiked towards the new 2021 yearly high at €1,634.04 and retreated above the 50-hour simple moving average at press time.

In the meantime, the German 10-year Bund yield has gained one basis point, though remains negative at -0.245%, caping the upside move in XAU/EUR.

According to TD analysts in a note to customers, “gold prices have managed to break out nonetheless as global markets scour for inflation-hedges.” The note further added, that “the breakout in gold has driven the China Smart Money group of funds to add a significant amount of new length in SHFE gold, which highlights a potential avenue for a significant amount of buying interest, considering that Shanghai gold net length remains near multi-year lows.”

XAU/EUR Price Forecast: Technical outlook

Daily chart

-637725908203050999.png)

The non-yielding metal has an upward bias as depicted by daily moving averages (DMA’s) below the spot price. At time of writing it is testing the top trendline of the Andrew Pitchfork’s indicator, however, the Relative Strength Index (RSI) at 76 is in overbought conditions for the last four days, which suggests the possibility of a correction towards the November 13, 2020, high at €1,604.

If that outcome were to come to pass, and once the RSI exited overbought conditions, a test towards the November 9, 2020 high at €1,652 would be on the books, but it would find some hurdles on the way north. Initial resistance would come at €1,634.04. A breach of the latter would expose the top trendline of the Pitchfork’s indicator around €1,640-50.

The Bank of England's governor, Andrew Bailey, says that the recent EU announcement on clearing was a sign we can work constructively together after Brexit

He also added that climate issues are coming right into the monetary policy horizon.

More to come...

Improving growth prospects in Japan do not necessarily correspond to improving Japanese currency prospects, argue analysts at Wells Fargo. They point out that with inflation still absent, the Bank of Japan is set to maintain an accommodative monetary policy for the foreseeable future. They forecast a USD/JPY exchange rate of 120.00 by early 2023.

Key Quotes:

“For the time being, a brief period of yen stability is possible, given some recent declines in global bond yields and existing FX positions. IMM currency futures, for example, show speculative yen short positions near their largest levels since 2019, potentially limiting yen softness for now. However, we do expect global bond yields to show a renewed rise in the months and quarters ahead as inflation pressures persist.”

“U.S. price pressures in particular remain quite robust, with the U.S. October CPI rising 6.2% year-over-year. As U.S. inflation remains quite elevated by historical standards and the Federal Reserve winds down its quantitative easing program by mid-2022 and starts its rate hike cycle before then end of next year, we see U.S. 10-year Treasury yields rising to 2.20% by early 2023.”

“With Japanese yields unlikely to follow U.S. yields perceptibly higher, we expect that will translate into a weaker yen versus the U.S. dollar, and target and USD/JPY exchange rate of JPY120.00 by early 2023.”

- Mexican peso holds a negative bias versus US dollar.

- USD/MXN moving in a new higher range biased to the upside.

- The area around 20.65/70 keeps the upside limited.

The USD/MXN is rising on Monday after a pullback on Friday. The cross is approaching last week high at 20.72. More important, it is testing the 20.65/70 resistance area. A break higher should clear the way to more gain.

The bias points to the upside in USD/MXN. Currently, is it moving in a range between 20.45 and 20.70. A slide below 20.45 should clear the way for an extension toward 20.30. Below the net support stands around 20.13/18 that contains the 100 and 200 moving average.

On the upside, the 20.65/70 area capped the rally so far. A daily close above 20.70 should expose the next key area of 20.85/90, the last defence to 21.00.

USD/MXN daily chart

-637725896872037899.png)

In a reiteration of the ECB's now well-known stance/inflation view, ECB's de Guindos said that the current phase of higher inflation, which in part reflects an increase in energy prices and supply constraints, could last longer than expected only some months ago. Supply-side shortages may dampen activity while pushing up prices, adding to the uncertainty in the outlook for growth and inflation, he said.

De Guindos said that rising energy costs are weighing on growth by limiting the purchasing power of households. To prevent the materialisation of the medium-term risks that we have identified, he added, it is essential to maintain the momentum of the recovery and avoid scenarios that could put our price stability objective in jeopardy. To do this, the bank must continue to ensure favourable financing conditions.

Market Reaction

De Guindos' comments on inflation are nothing new, but his remarks on the need for the maintenance of favourable financing conditions to ensure the economic recovery continues might be interpreted as dovish. EUR/USD has been gradually ebbing lower in recent trade and recently broke out to fresh year-to-date lows around 1.1420. Dovish ECB vibes may be playing a part, though stronger than expected US manufacturing survey data released earlier in the session is likely to also be weighing on the pair.

EUR/NOK has again started to move higher the last month. Economists at Danske Bank continue to expect EUR/NOK to march forward over the coming year and reach the 10.40 level.

More upside in store for EUR/NOK

“We see the NOK potential exhausted on the back of a shift in the global investment environment, weaker growth, tighter global liquidity conditions, less fiscal NOK buying, positioning, year-end headwinds and NOK rates pricing. We thus maintain a negative view on NOK.”

“EUR/NOK has risen over the last month and in that light we lift the short-end of our forecast profile but leave the long-end unchanged forecasting 10.40 in 12 months.”

“The biggest risk to our forecasts lies in global commodity prices. Should oil and gas prices continue higher while global risk appetite remains positive then we would expect EUR/NOK to trade below our forecasts. On the other hand, marked risk-off could trigger a larger-than-projected setback.”

- US 10-year yield rebounds sharply from 1.54%, back to 1.60%.

- Yields across the curve hit fresh daily highs on American hours.

- DXY is back in positive territory for the day, above 95.00.

US yields turned to the upside during the American session and climbed to weekly highs. The 10-year yield rose from under 1.55% to 1.609%, reaching the highest level in two weeks. Treasury yields across the curve reached fresh highs with the 2-year rising to 0.542%, the 5-year at 1.257% and the 30-year at 1.989%.

At the same time, the US 10-year TIPS yield (protected by inflation) remains is flat on Monday, near the record low at -1.162%.

Last week US inflation numbers weighed on Treasuries, triggering a rally in yields that still goes on. If the 10-year manages to consolidate above 1.60%, higher figures are expected.

The moves in the bond market continue to support the greenback. The DXY is back into positive territory after falling toward 95.00 and it stands at 95.16, looking at the recent cycle high of 95.26.

Economic data released on Monday surpassed expectation with the Empire Manufacturing index at 30.9 in November up from 21.6, and significantly above the 21.9 of market consensus. On Tuesday, the retail sales report is due.

Bank of England Governor Andrew Bailey, speaking before the UK Parliament Treasury Select Committee TSC, said that all future BoE policy meetings are now “in play” for a rate rise. He added that, given the very high uncertainty in economy, it would be hazardous to give specific forward guidance about when exactly these hikes might come.

Regarding his decision at the most recent BoE meeting not to vote for an immediate end to the bank’s QE programme, Bailey said he did not want to raise questions over whether BoE would complete future QE programmes.

Fellow MPC member Michael Saunders, also speaking before the TSC, noted that the risk of delaying too long on raising rates is that they might then have to go up a faster and further.

Finally, BoE MPC member Huw Pill said that while medium to long-term inflation expectations remain anchored, if those expectations were to shift, it would be key that “we meet that challenge”.

Market Reaction

GBP/USD has seen very little reaction to the testimony of BoE members before parliament just yet and the pair, for now, remains capped to the south of the 1.3450 mark.

- USD/CAD falls on broad US dollar weakness amid falling US Treasury yields.

- According to BBH, Fed Fund futures sees a 66% chance of Q2 liftoff, while a Q3 hike is fully priced in.

- BoC Tiff Macklem: Economic slack is still not absorbed, but “we are getting closer.”

After reaching four-week highs, the USD/CAD slumps for the second day in a row, down 0.18%, trading at 1.2524 during the day at the time of writing. The fall is mainly driven by US dollar weakness, caused by a weaker than expected University of Michigan consumer sentiment that plummeted to a 10-year low in November amid concerns about the pace of elevated prices. Also, a leg down in US bond yields weighed on demand for the US dollar, which is on defensive mode as the week begins.

Meanwhile, crude oil prices fell as investors wait for the next move of the White House regarding high gasoline prices. Speculations are mounting that US President Joe Biden will release supplies from the Strategic Petroleum Reserve (SPR), which could weigh on the oil-commodity-linked Canadian dollar, that could lift the prospects of the USD/CAD pair.

Fed bond taper week begins

According to Brown Brothers Harriman (BBH), on a note to customers said “the New York Fed last week released an updated purchase schedule that will result in total purchases of $70 bln in USTS and $35 bln of MBS this month, $15 bln less than peak QE. How bonds trade this week will be significant in understanding the potential impact of tapering.” Further added that at that pace, the QE will end by June of 2022.

Moreover, BBH added that “Fed Funds futures still see nearly two-thirds odds of Q2 liftoff, which seems too soon, while Q3 liftoff is fully priced in. Strong data and rising inflation are likely to keep upward pressure on US rates.”

As of writing, Tiff Macklem, BoC Governor, said that economic slack in the Canadian economy is still not absorbed but that “we are getting closer,” thus added that QE is no longer needed. Further added that if the BoC turns to be wrong about long-lasting inflation, they “will adjust.”

That said, the USD/CAD pair might consolidate, as according to investors, the Bank of Canada (BoC) is expected to raise rates sooner than the Federal Reserve, but a change of the pace of the Fed’s QE reduction could reduce the bond spread between the US and Canada, favoring the greenback in the medium-term.

EUR/GBP has been more volatile lately and has moved closer to 0.86 after the Bank of England (BoE) kept monetary policy unchanged. Nevertheless, strategists at Danske Bank remain bullish on the pound as the USD-positive environment is usually also benefitting GBP and keep their EUR/GBP forecast intact at 0.83 in 12 months.

BoE’s rate hikes are looming

“Against market pricing but in line with our call, the BoE kept monetary policy unchanged at its November meeting. The BoE signalled, however, that rate hikes are looming. We still expect the BoE will hike 15bp in February, 25bp in May and 25bp in November (65bp in total).”

“We remain bullish on GBP as the USD-positive environment is usually also benefitting GBP. We thus continue to target EUR/GBP at 0.83 in 12M.”

“A risk to our forecast is a hit to global risk sentiment and/or if Bank of England keeps monetary policy accommodative for longer than currently expected. Stagflation may become more pronounced in the UK compared to the euro area. EU-UK tensions remain a risk.”

EUR/SEK has again moved higher since the beginning of November. However, with global growth outlook deteriorating and too aggressive medium-term pricing on the Riksbank, analysts at Danske bank remain bearish on the Swedish krona forecasting EUR/SEK at 10.50 in 12 months.

Brief visit in single-digits for EUR/SEK

“A perfect storm of equities-related flows, positioning and monetary policy re-pricing recently pushed EUR/SEK below 10.00. However, we expect the visit into single-digit territory to be short-lived and maintain our strategically bearish view on SEK with global growth outlook deteriorating and too aggressive medium-term pricing on the Riksbank.”

“We continue to forecast EUR/SEK to 10.50 in 12 months.”

“A risk to our forecast is if markets continue to push for an early Riksbank hike, leaving the SEK to possibly gain even further. If instead the market re-price in line with our view, SEK depreciation might come faster than expected.”

- USD/TRY advances to new record highs above 10.0000.

- The CBRT meets on Thursday and could reduce rates further.

- Markets’ consensus points to a 100bps rate cut.

The Turkish lira depreciates (much) further and pushes USD/TRY to new all-time highs past the psychological 10.0000 mark on Monday.

USD/TRY: Door open to extra upside near term

USD/TRY adds to Friday’s advance and extends the rally well north of the critical 10.0000 mark, clinching at the same time the fifth consecutive session with gains.

Further losses in the lira are likely in the short-term horizon, as bets on the likeliness that the Turkish central bank (CBRT) could reduce the policy rate by 100 bps at its meeting on Thursday, taking the One-Week Repo Rate to 15%, remain well on the rise.

In the domestic calendar, House Sales rose by 14.9%, or 137.401K units, in the year to October. In the US, the NY Empire State Index improved to 30.9 for the month of November.

USD/TRY key levels

So far, the pair is gaining 0.88% at 10.0545 and a drop below 9.6285 (20-day SMA) would expose 9.4722 (monthly low Nov.2) and finally 9.4128 (weekly low Oct.26). On the other hand, the next up barrier lines up at 10.0566 (all-time high Nov.12) followed by 11.0000 (psychological level).

EUR/USD has reach new lows, falling below 1.15. Economists at Danske Bank continue to see a stronger dollar in the months to come and, therefore, expect the world’s most popular currency pair to dive to the 1.10 level over the next 12 months.

Broader market themes are increasingly turning pro-dollar

“Fed has begun discussions on the timing of rate hikes and tapering of asset purchases: Tapering is starting here in November. This will continue to shift the market’s attention towards USD on a theme of monetary divergence vis-à-vis EU. Such upside risk is amplified by the dollar rebounding from relatively weak levels.”

“As a reflection of broader market themes increasingly turning pro-dollar with global liquidity conditions tightening, PMIs moving lower and central banks facing rising inflation concerns we keep our profile for EUR/USD to 1.10 in 12 months in favour of USD strength.”

“The risks to see EUR/USD above 1.20 include global inflation pressures fading.”

USD/CAD is drifting steadily lower after testing the 1.26 level late last week. The pair’s failure to push on through the 1.26 zone leaves it at risk of sliding below the 1.25 mark, economists at Scotiabank report.

Bullish outlook for the Canadian dollar

“The loonie looked somewhat misaligned with underlying fundamentals last week (even with crude oil drifting lower) from our point of view and investors appear to concur as levels near 1.26 draw out bargain hunters. We remain bullish on the CAD outlook.”

“The turn lower from the 1.26 zone is not particularly powerful on the charts at this point and we think a push under 1.2500 (40-day MA) will give the CAD rebound a little more momentum for a recovery to the mid/upper 1.24s.”

Speaking before the UK Parliament's Treasury Select Committee, Bank of England Governor Andrew Bailey said that he is very uneasy about the inflation situation, according to Reuters. He added that the November decision was a very close call and that we now face much more two-sided risks.

Bailey added that while the labour market looks very tight, the real puzzle is what happens at the end of the government's furlough scheme (which ended at the end of September). Bailey noted that early anecdotes suggest that the end of the furlough scheme has not raised unemployment.

EUR/USD is steady in mid-1.14s with limited domestic drivers as the European Central Bank’s Lagarde and Lane play down the risks to inflation over the forecast horizon. Economists at Scotiabank warn that a break below 1.14 would open up the 1.11/10 area.

Firm bearish pressure remains well in place

“Lagarde pointed to the transitory path of price pressures and repeated her expectation that rates are very unlikely to increase in 2022. Lane called the recent surge in prices ‘really part of the pandemic’ and noted that he expects inflation to be ‘significantly below 2%’ in 2023.”

“With Fed hike bets mounting and the ECB unlikely to move before late-2023, we expect downside pressure on the EUR to persist over the foreseeable future toward the low 1.10s.”

“The 1.14 level stands as psychological support with limited markers to defend the EUR until the 1.10/11 area – though oversold conditions will likely act to stall its losses.”

“EUR/USD faces resistance at 1.15 followed by 1.1515/25 and firmer in the 1.16 area.”

European Commission Vice President Maros Šefčovič said that his most recent meeting with UK Brexit Minister Lord David Frost was much better than last week, according to Reuters. Šefčovič added that an agreement on medicines was very close and that the two sides had agreed to move on to concrete discussions on legal texts.

- AUD/USD has recovered back to its 50DMA in the 0.7360s, aided by stronger Chinese macro data.

- Some analysts warn that weak Chinese real estate investment data suggests further economic weakness lies ahead, a negative for AUD.

AUD/USD has managed to recover all the way back to its 50-day moving average in the 0.7360s on Monday, having been as low as the 0.7270s last week. FX markets didn’t show much of a reaction to the latest NY Fed manufacturing survey released, which pointed to an improvement in business conditions in the US at the start of this month. According to market commentators, Monday’s 30 pip gains from the 0.7330s is as a result of better than expected activity data released out of China, Australia’s most important trade partner, during Monday’s Asia Pacific session. For reference, Chinese Industrial Production rose at a YoY pace of 3.5% in October, above economist forecasts for 3.0%, while Retail Sales rose at a pace of 4.9% YoY, above economist forecasts for 3.7%.

Some analysts raised concerns that the beat on Retail Sales, rather than suggesting the beginnings of a sustained pickup in consumer spending, was a result of higher prices as higher food sales as consumer pre-empt any possible winter lockdowns. Other analysts pointed to the Chinese Real Estate Investment data, which showed investment coming in at 6.1%, a tad under expectations for 6.2%. Societe Generale said that “for our economists, it doesn't change the view that a property-led slowdown (in Chinese growth) will continue over the coming months and more broad-based easing is still warranted”. This is hardly going to be a long-term positive for the Aussie.

Some market participants might thus look at current AUD/USD levels as an attractive short-entry point. According to Westpac, there are “multiple opportunities for the RBA to remind the market this week that they (are dovish)” and “the A$ should be well capped by 0.7350/70… We expect to see further weakness below 0.7300.” Should AUD/USD fail to break above its 50DMA, that might be taken as a bearish sign by some technicians, which could also help to propel the pair lower towards 0.7300 again. Conversely, if recent bullish momentum continues and the 50DMA is broken, the next area of resistance is around 0.7400 and in the 0.7430s.