- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-11-2021

- AUD/CHF has formed a topping pattern on the hourly chart.

- The daily chart is in confluence with the reversion pattern.

AUD/CHF bears have stepped in following a rally that started on Friday, Nov.12. However, the Australian dollar has faced some fundamental headwinds in the last 24-hours or so which leaves it vulnerable to the downside.

Moreover, the Swiss franc is regarded as a perfect hedge against stagflation and the recent growth concerns in the eurozone could also give it an edge. This makes for a compelling case for a technical breakout in AUD/CHF to the downside and a meaningful correction that opens risk to towards the mid point of the 0.67 area.

AUD/CHF daily chart

-637727021466331029.png)

The W-formation is a reversion pattern that would be expected to draw in the price towards at least a 38.2% Fibonacci retracement of the bullish impulse of the W. A break there opens prospects of a test all the way back to the neckline of the W-formation near 0.6750.

AUD/CHF H1 chart

-637727026197395066.png)

The hourly chart shows the price on the verge of a breakout below a head and shoulders formation, a topping pattern that would be expected to lead to a significant downside breakout. This would tie in nicely with the daily chart's reversion pattern's analysis for the sessions ahead.

- GBP/USD retreats from weekly top, bears attack intraday low of late.

- Ireland’s Coveney admits EU ready to compromise over NI protocol, Friday’s Frost- Šefčovič meeting will be the key.

- BOE rate hike hopes renew on strong UK jobs report, bulls await firmer CPI.

Having poked one-week high the previous day, GBP/USD bears return during Wednesday’s Asian session. That said, the cable pair remains pressured at around 1.3420 by the press time.

The latest UK employment data underpinned bullish bias towards the Bank of England’s (BOE) next moves.

That said, the UK's Office for National Statistics revealed that the ILO Unemployment Rate declined to 4.3% in September from 4.5% in August. This reading came in slightly better than the market expectation of 4.4%. Further details of the report showed that the Claimant Count Rate edged lower to 5.1% in October from 5.2% and the Average Earnings Including Bonus rose by 5.8% in September, surpassing analysts' estimate of 5.6%. Following the data, the target rate probabilities for the December 16 meeting of the BOE show 67.5% chances of a 20 pip rate hike.

Elsewhere, the UK Express said, “Ireland's foreign minister, Simon Coveney claimed the EU is ready to offer proposals on medicines to ally concerns in Northern Ireland.” The news was linked to UK’s Brexit Minister David Frost’s threat to trigger Article 16. However, The taoiseach (Irish prime minister) Mícheál Martin told the Dáil (Irish parliament) that he felt UK negotiators had indicated they want a resolution, per the BBC. “The Taoiseach said he believed political parties in NI want to remain part of the European Single Market,” adds the BBC. Hence, the complex headlines over Brexit keep fears of a hard Brexit on the table and challenge the GBP/USD buyers ahead of Friday’s meeting between UK’s Frost and European Commission Vice-President Maroš Šefčovič.

Alternatively, Fed rate hike expectations jumped following an eight-month high print of the US Retail Sales for October, 1.7% MoM versus 1.4% expected. Adding to the bullish bias were figures concerning the US Industrial Production and housing market data. It’s worth noting that Fed policymakers like St. Louis Fed President James Bullard joined ex-US Treasury Secretary and former New York Fed President, Lawrence Summers and Bill Dudley respectively, to back the need for the Fed’s action. However, San Francisco Federal Reserve Bank President Mary Daly recently said, “Rate hikes would not fix high inflation now, would curb demand and slow recovery.”

Against this backdrop, the US Treasury yields rose 2.3 basis points (bps) to refresh a three-week high whereas the US Dollar Index (DXY) jumped to the new 16-month top. Further, equities were also positive whereas the S&P 500 Futures remain firm by the press time.

Moving on, the UK’s Consumer Price Index (CPI) and Producer Price Index (PPI) data for October will be important to watch for immediate GBP/USD forecast. Given the upbeat expectations from the scheduled inflation data, the cable may witness another push towards the north but the Brexit headlines and the Fed rate hike calls may hinder the run-up.

Read: UK CPI Preview: Buy the rumor, sell the fact? Three scenarios for GBP/USD

Technical analysis

Failures to provide a daily close past the monthly resistance line, around 1.3445 by the press time, direct GBP/USD prices towards the yearly bottom surrounding 1.3350.

San Francisco Federal Reserve Bank President Mary Daly on Tuesday said now that the Fed has begun to taper its asset purchases, the next step is to tweak the communications the Fed gives about the future path of rate hikes.

Shre has said this in light of the market's reaction, most probably, to her colleagues today and in light of racing US Treasury yields and the greenback surging to fresh cycle highs.

"It's this forward guidance piece that I'm currently looking at myself, to say, do we need to think about the forward guidance we have so that we get that better aligned with the way that we are seeing the economy evolve," Daly told reporters after an event at the Commonwealth Club in San Francisco. "That’s the next step in my judgment."

Fed's Daly, key comments

I have a strong bias to stick to current taper pace.

If we hadn't had delta, I'd be thinking about raising rates; but that's not where we are.

If inflation is still high once pandemic subsides, that's a different conversation.

After taper, the next step is forward guidance, to get that better aligned with the economic outlook.

Market implications

On Tuesday, US data showed US consumers looked past rising prices and drove Retail Sales higher than expected last month. This helped to fuel a big bid in the US dollar index, DXY:

DXY H1 chart

US Retail Sales rose 1.7% in October, topping consensus expectations of a 1.4% rise. Additionally, US Industrial Production lifted 1.6% in October which was considerably higher than expected.

The greenback has been better bid ever since US inflation data last week surprised to the upside and showed consumer prices surged to their highest rate since 1990.

US yields rallied on Tuesday as investors now expected that the Federal Reserve will taper their QE programme at a faster pace. More hawkishly, some observers even expect that the Fed could potentially hike interest rates sooner than first anticipated in the markets. Fed's James Bullard was an advocate of that overnight. He said that the US central bank should speed up its reduction of monetary stimulus in response to a surge in US inflation.

US Dollar Index retreats from a new year-to-date high around 95.97, steady around 95.80s

- Silver stays pressured after breaking two-week-old support line.

- Failures to cross 200-DMA replicate pullback in Momentum to keep sellers hopeful.

- Horizontal area from June adds to the upside filters.

Silver (XAG/USD) extends the week-start U-turn from 200-DMA to $24.80 during the initial Asian session on Wednesday.

In doing so, the bright metal justifies the previous day’s downside break of an ascending trend line from November 03 amid a retreat in the Momentum line.

That said, the 61.8% Fibonacci retracement (Fibo.) of July-September fall, around $24.70, becomes immediate support for the metal before declining towards the $24.15-10 area comprising the 100-DMA and 50% Fibo.

In a case where the silver bears dominate past $24.10, the $24.00 threshold and highs marked during mid-October around $23.60 will be in focus.

Alternatively, the support-turned-resistance line around $25.00 and the 200-DMA level of $25.33 guards the quote’s recovery moves.

Also acting as the key resistance is the region including multiple levels marked since June around $25.50.

Silver: Daily chart

Trend: Further weakness expected

- The US Dollar Index extends to two-consecutive days its rally in the week.

- The US 10-year Treasury yield edges up to 1.64%, underpins the buck.

- DXY Technical outlook: A break above 96.00 exposes June 30, 2020, high at 97.80

- US Dollar Index retreats from a new year-to-date high around 95.40, bull's eye 96.00.

The US Dollar Index, also known as DXY, which measures the greenback’s performance against a basket of six rivals, advances 0.57%, sitting at 95.88 as the Asian session begins at the time of writing. The US dollar was boosted by upbeat comments of St. Louis Fed President Bullard, who will be an FOMC voter in 2022. Also, positive macroeconomic data from the biggest economy lifted the prospects of the buck, despite the risks of higher inflation.

On Tuesday, in the New York session, the US Census Bureau revealed that October’s Retail Sales in the US rose by 1.7%, higher than the 1.4% foreseen by economists. Further, it reported that sales excluding Autos increased by 1.7%, precisely at the same rhythm as the headline, more than the 1% estimated.

The jump in retail sales showed the resilience of consumers, despite having elevated prices to pay. It is worth noticing that the figure is not adjusted for any price changes that reflect the increased cost of goods and services. Receipts at gasoline pumps spiked almost 4%, the highest reading since March of 2021, reflecting how people are paying some of the highest prices in seven months.

Moreover, US Industrial Production for October rose by 1.6%, better than the 0.7% expected by economists.

US Dollar Index (DXY) Price Forecast: Technical outlook

-637727005462948888.png)

The daily chart depicts the DXY has broken above the Pitchfork’s indicator’s central line around the 95.50-60 region, which now would act as support. The daily moving averages (DMA’s) remain well below the current price action, with an upslope, supporting the upward bias. Also, the Relative Strength Index (RSI) at 71 in overbought conditions, though slightly flattish, indicates that the DXY might consolidate before resuming the upward move.

A break above 96.00 would expose its first resistance area on June 30, 2020, high at 97.80. A breach of the latter could send the US Dollar Index rallying towards May 25, 2020, high at 99.97.

- EUR/USD bears take charge, loses upside momentum.

- The euro hit 16-month low post dovish comments by the ECB chief.

The EUR/USD pair renewed its vow and continues to slide at the Early Asian session on Wednesday, trading around yearly low levels of 1.1300 level. The pair expects that the European Central Bank (ECB) would stick to its dovish policy settings in the near term against the backdrop of a slowing economy.

The cross-currency pair is at its lowest since July last year. European Central Bank's ECB president Christine Lagarde said that tightening monetary policy to curb inflation could choke off the eurozone's recovery. She further iterated factors pushing prices higher would fade next year, increasing contrast from hawkish hints from other central banks.

Furthermore, Scotiabank expects "Widening Bunds-UST differentials remain a firm downward force on the euro. The spread between US and German debt in the 10-year space has risen to its largest since April as markets adjust for the Fed's tapering and eventual hikes."

The US T-bond yields remain strong ahead of Fed daily speak. Meanwhile, the greenback continued its strength forward, reaching fresh 2021 highs, further hitting the common currency. Both retail trade data and industrial activity in the US beat expectations signalling strength in the American economy, further pressuring the Federal Reserve to hike rates earlier. The US dollar now has weakened investor appetite, leaving EUR/USD vulnerable to a much-needed catalyst to show direction. To further add pressure, US President Joe Biden formally signed a $1.0 trillion, bi-partisan infrastructure bill underpinning the dollar value.

Looking ahead, investors will be eyeing for (ECB) Financial Stability Review, Consumer Price Index data release from Eurostat. ECB member Isabel Schnabel speech could provide some insight.

EUR/USD technical levels

- WTI fails to cheer industry stockpiles data after a mixed daily performance.

- Fears of increase in supply join expectations of tighter monetary policies to favor bears.

- OPEC’s Barkindo expects oil market surplus beginning in December, IEA eyes easy prices.

- US EIA inventory data, Fedspeak will provide fresh impulse.

WTI begins Wednesday’s trading session on a back foot around $79.60, teasing the biggest daily loss in a week. In doing so, the oil benchmark ignores private oil stocks change figures from the American Petroleum Institute (API) while tracking firmer USD and demand-supply matrix.

As per the latest API Weekly Crude Oil Stocks data for the period ended on November 12, the inventories rose 0.655M versus an expected addition of 1.55M and previous depletion of 2.485M.

It’s worth mentioning that the fresh fears of the coronavirus, mainly in Europe and the UK, challenge the oil bulls of late. On the same line is an absence of any chatters favoring supply disruptions and downbeat comments from the International Energy Agency (IEA) and OPEC Secretary-General Mohammed Barkindo.

The IEA left its forecast for oil demand growth largely unchanged at 5.5 million barrels per day (bpd) for 2021 and 3.4 million bpd in 2022, as reported by Reuters. However, the institute did mention that "Reprieve from oil price rally could be on the horizon due to rising supplies."

On the same line was the analysis from OPEC’s Barkindo who said, "The projections show throughout the quarters of next year that there could be oversupply in the market. This is also further evidence of why we should be very cautious, measured in the decisions we take every month."

Additionally, fears of tighter money supply and an absence of cordial relations between the US and China, despite the latest virtual meeting, join firmer US Retail Sales for October to underpin the US Dollar Index (DXY) strength around a fresh 16-month high.

Moving on, weekly official oil inventory data from the US Energy Information Administration (EIA), expected +1.550M versus +1.001M previous readouts, will be important for fresh direction. Also on the radars will be the Fedspeak and demand-supply talks.

Technical analysis

Failures to cross the 10-DMA, around $80.30 at the latest, joins a sustained trading below three-week-old resistance line near $82.35, to direct WTI bears towards 50-DMA level of $77.95.

GBP/JPY advances as good UK’s economic employment data boosted the British pound.

The market sentiment is upbeat, lifting risk-sensitive currencies, dampening the risk appetite of safe-haven peers.

GBP/JPY: An upside break of the bullish-flag chart pattern would expose 156.00.

The British pound advances against the Japanese yen, up 0.02%, trading at 154.19 during the day at the time of writing. Positive market sentiment through the New York session seems to carry on towards the Asia-Pac Wednesday one, as major Asian equity indices futures advance, between 0.03% and 0.82%.

In the European session, positive economic data from the UK lifted the pound. The ILO Unemployment Rate for the last 3-month reading ending in September rose to 4.3%, lower than the 4.4% expected, as the furlough scheme program ended in September. Also, the Claimant Count Change for October dropped by 14.9K less than the 51.1K contraction in September.

The GBP/JPY pair jumped from 153.20s towards 153.86 at the release before settling around the 153.40-60 range. As the American session began, the cross-currency broke to fresh two-week highs, around 154.15.

GBP/JPY Price Forecast: Technical outlook

-637726977403073527.png)

The GBP/JPY pair broke above the 50-day moving average (DMA) in the daily chart, accelerating towards the top-trendline of a bullish flag chart pattern formation. Further, all the DMA reside below the spot price, boosting the upward bias of the pair. Momentum indicator like the Relative Strength Index (RSI) at 50.11, though barely above the 50-central line, adds another bullish signal.

If GBP/JPY buyers want to accelerate the uptrend, they will need a break above the top-trendline of the bullish-flag chart pattern. In that outcome, the first resistance would be the 155.00 psychological round level. A breach of the latter would expose the November 4 high at 156.25, followed by the October 29 high at 157.10.

- USD/CAD grinds higher after bouncing off three-week-old support line.

- Bullish MACD, sustained trading beyond horizontal support stretched from August favor buyers.

- Key Fibonacci retracement levels add to the upside filters, bears have a bumpy road beyond 1.2400.

USD/CAD holds onto the bounce off 1.2490-2500 support confluence around the weekly top of 1.2568 during early Wednesday morning in Asia.

The loonie pair’s rebound from an ascending trend line from October 27, as well as a horizontal area from early August, gains support from the bullish MACD signals to keep the buyers hopeful.

That said, a clear upside break of the 200-DMA level near 1.2570 is on the cards to challenge 50% and 61.8% Fibonacci retracement (Fibo.) levels of August-October downside, respectively near 1.2620 and 1.2700.

However, the 1.2765-70 and September’s peak near the 1.2900 threshold will challenge the pair buyers afterward.

Alternatively, a downside break of the 1.2500-2490 support area won’t offer a green pass to the USD/CAD bears as 23.6% Fibo. level of 1.2443 and multiple tops marked during the latest October can keep challenging the downside before the 1.2400 round figure.

In a case where the quote remains weak past 1.2400, the yearly low of 1.2288 will be in focus.

USD/CAD: Daily chart

Trend: Further upside expected

San Francisco Fed President Mary C. Daly pushes back concerns that the infrastructure spending will propel inflation, per Reuters, during her speech late Tuesday.

Read: Fed's Daly calls for central bank patience in the face of high inflation

Key quotes

Running a sustained expansion gives people time to come back to the jobs market.

The decision on interest rates is not about a punch bowl, it's about millions of jobs.

Expect that infrastructure spending will increase growth potential going forward.

US stock market is euphoric.

Uncertainty is high over the next 6 to 9 months, not only for the US economy but also globally.

It's unclear how or if technology will boost productivity growth; investing in human capital is the surer way to get to higher productivity.

FX implications

Although the push for the US stimulus may help improve the market sentiment and can put an immediate floor under the falling Antipodeans, the market’s refrain from rejecting the Fed rate hike concerns can keep the US dollar on the upper hand.

Read: AUD/USD bears brace for fresh monthly low near 0.7300 amid firmer USD

- AUD/USD stays pressured following the biggest daily loss in a week.

- RBA Minutes, Governor Lowe pushed back rate hike expectations.

- Xi-Biden meeting falls short of positive surprises, US data adds to the Fed rate hike chatters.

- Australia Q3 Wage Price Index, Fedspeak to decorate calendar.

AUD/USD remains depressed around 0.7300, having dropped the most in a week the previous day, as Asian markets kick-start for Wednesday.

The Aussie pair took multiple scars from domestic and overseas catalysts to welcome the bears on Tuesday. Notable among them were updates from the Reserve Bank of Australia (RBA), headlines concerning US President Joe Biden and his Chinese counterpart Xi Jinping’s virtual meeting and the US data that propelled hopes of Fed action, backed by comments from some present and former US Federal Reserve (Fed) policymakers.

Minutes of the latest RBA meeting reconfirmed the Aussie central bank’s outlook that the rate hike is off the table before 2024. RBA Governor Philip Lowe backed the same ideal while saying, “The latest data do not warrant a rate hike next year,” while adding that it is still plausible that the first increase will be not before 2024. These updates cooled down rate hike expectations that soared especially after the jump in the Australia Q3 inflation figures.

Elsewhere, Xi-Biden talks couldn’t amuse optimists as both sides had their differences and US President Biden recently signaled that they have a lot to follow up despite having a “good meeting” with China’s Xi.

Furthermore, the Fed rate hike expectations jumped following an eight-month high print of the US Retail Sales for October, 1.7% MoM versus 1.4% expected. Adding to the bullish bias were figures concerning the US Industrial Production and housing market data. It’s worth noting that Fed policymakers like St. Louis Fed President James Bullard joined ex- US Treasury Secretary and former New York Fed President, Lawrence Summers and Bill Dudley respectively, to back the need for the Fed’s action. However, San Francisco Federal Reserve Bank President Mary Daly recently said, “Rate hikes would not fix high inflation now, would curb demand and slow recovery.”

Amid these plays, the US Treasury yields rose 2.3 basis points (bps) to refresh a three-week high whereas the US Dollar Index (DXY) jumped to the new 16-month top. Further, equities were also positive but gold prices dropped after rising to a fresh peak since June.

Looking forward, AUD/USD traders will wait for the third quarter (Q3) Wage Price Index, expected 0.5% versus 0.4% prior, for a corrective pullback even as the RBA has ruled out rate hike concerns. Following that, Fedspeak and risk catalysts will be the key. Overall, a firmer US dollar and push for the Fed action can keep the pair bears hopeful.

Technical analysis

AUD/USD pair’s failures to cross a convergence of the 50-SMA on the four-hour chart and a two-week-old resistance line, around 0.7360 by the press time, directs the quote towards refreshing the monthly low of 0.7278.

US President Joe Biden said on Tuesday that he had a good meeting with Chinese President Xi Jinping, according to Reuters. Biden said that he and Xi have a lot to follow up on and that their aides would be working together on a range of issues. Biden added that he made clear to President Xi that the US supports the Taiwan Act.

For reference, the US and China conducted talks during Tuesday's Asia Pacific trading hours (the talks started at 0046GMT on Tuesday and lasted about three hours). Analysts at the time said the meeting went well, offered signs of improvements in bilateral relations and even the chance of partial tariff removals.

According to analysts at ANZ, Tuesday's "virtual summit was only meant to ease tension... (and was) not intended to achieve normalisation of the bilateral relationship". "The summit paves the way for subsequent trade negotiations, during which the US may soften its trade measures against China" the bank added.

Market Reaction

Markets have not reacted to the latest comments from Joe Biden.

San Francisco Federal Reserve Bank President Mary Daly called for the Federal Reserve to be patient when it comes to interest rate hikes despite high inflation, according to a speech to the Commonwealth Club of California cited by Reuters. Daly said that patience is the boldest and best action and that it would be better to wait for more clarity on the economy and inflation than it would be to raise interest rates pre-emptively. Raising rates now would not fix high inflation, Daly argued, but would instead curb demand and slow the US recovery.

Daly said that there is good reason to think that inflation won't last beyond the pandemic and that over the next several quarters, the bank will watch to see if inflation eases and discouraged workers return to the labour force. Once the Fed has a clearer signal as to the state of the economy, Daly reasoned, the bank would be ready to act. Moreover, the Fed is well-positioned to act to reign in inflation if it does look to be more persistent.

Market Reaction

Daly's comments are more dovish than those from St Louis Fed President James Bullard earlier, who called for the Fed to accelerate its QE taper pace to $30B/month to make way for potential hikes in Q1 2022. Nonetheless, they have not been able to slow the USD's rise as the DXY continues to charge towards the 96.00 level.

- The NZD/USD retreats below 0.7000 despite investors’ expectations of an RBNZ rate hike on its next meeting.

- The US Dollar Index trades at year-to-date new highs around 95.92.

- US Retail Sales rose more than expected, topping seven-month highs.

The New Zealand dollar retreats below the 0.7000 figure last touched in the last week, down 0.62%, trading at 0.6997 during the New York session at the time of writing. Positive US macroeconomic data from the US boost the greenback, US T-bond yields barely advance, and major US equity indices edge higher, gaining between 0.43% and 0.78%, in the day.

The US Dollar Index, which tracks the greenback’s performance against a basket of its peers, advances 0.42%, sitting at 95.91, new year-to-date highs, weighing on the NZD/USD pair. The US dollar was boosted by positive comments of St. Louis Fed President Bullard, who will be an FOMC voter in 2022. Further, NZD bulls seem to be unable to hold their ground despite the hawkish monetary policy stance by the Reserve Bank of New Zealand (RBNZ), the first central bank of the G8 to hike rates and is widely expected to do it once more before 2021 end.

US Retail Sales post the biggest gain since March 2021

During the New York session, the US Census Bureau revealed that October’s Retail Sales in the US expanded by 1.7%, better than the 1.4% foreseen by economists. Excluding Autos, retail sales rose by 1.7%, at the same pace as the headline, more than the 1% estimated.

Further, the retail sales jump showed the resilience of consumers, despite having elevated prices. In fact, the figure is not adjusted for any price changes that reflect the above-mentioned. Receipts at gasoline stations jumped 3.9%, the highest since March of 2021, reflecting how people are paying some of the highest prices in seven years.

Some minutes later, US Industrial Production for October followed Retail Sales footsteps, rose by 1.6%, better than the 0.7% expected by economists.

NZD/USD Price Forecast: Technical outlook

In the daily chart, the NZD/USD pair retreated below the 50 and the 100-day moving averages (DMA’s) which are located above the spot price. Also, the 200-DMA lies on top of them, confirming the downward bias in the near term. Further, a downslope resistance trendline, broken to the upside on October 18, reclaimed its resistance status, lying near the 100-DMA.

To accelerate the downtrend, NZD/USD bears will need a daily close below 0.7000. In that outcome, the first demand zone would be the October 13 low at 0.6911.

On the flip side, If NZD/USD bulls want to regain control, they will need a daily close above the 50-DMA at 0.7060. In that outcome, the following resistance level would be the 200-DMA at 0.7095.

US President Joe Biden said he will make his final decision on who will be the next Fed Chair in about four days, according to Reuters.

According to PredictIt, a US-based betting website where punters can gamble on political outcomes, a 62 cents bet on Fed Chair Jerome Powell wins $1.0, while a 40 cents bet on Board of Governor member Lael Brainard wins $1.0. That marks the highest implied odds Brainard has ever had of being nominated as the next Fed Chair and the lowest odds for Powell since late September. In September, Powell's odds took a hit as the Fed was mired by a string of trading scandals involving regional Fed Presidents.

Market Reaction

There has not been any notable market reaction to this news, though the US Dollar Index (DXY) continues to push towards the 96.00 level.

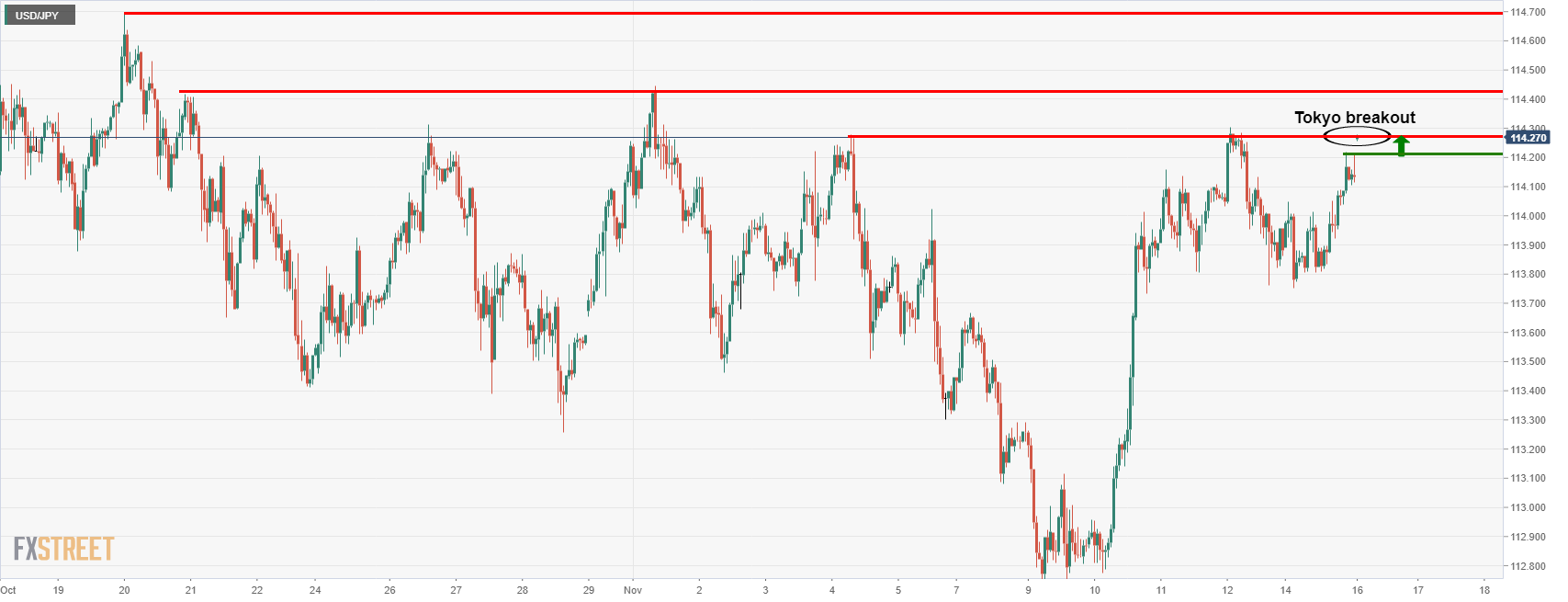

USD/JPY has just printed a fresh cycle high of 114.70 as the US dollar takes up more ground on the bid to 95.925 vs a basket of rival currencies as measured by the DXY index.

USD/JPY H1 chart

As illustrated, the move started in Tokyo and just kept on going throughout London and New York right into the final hours of Wall Street.

The US dollar has been better bid ever since US inflation data last week surprised to the upside and showed consumer prices surged to their highest rate since 1990. Investors now expected that the Federal Reserve will taper their QE programme at a faster pace. More hawkishly, some observers even expect that the Fed could potentially hike interest rates sooner than first anticipated in the markets.

DXY H1 chart

On Tuesday, US data showed US consumers looked past rising prices and drove Retail Sales higher than expected last month. US Retail Sales rose 1.7% in October, topping consensus expectations of a 1.4% rise. Additionally, US Industrial Production lifted 1.6% in October which was considerably higher than expected. Also, the Federal Reserve Bank of St. Louis President James Bullard said that the US central bank should speed up its reduction of monetary stimulus in response to a surge in US inflation.

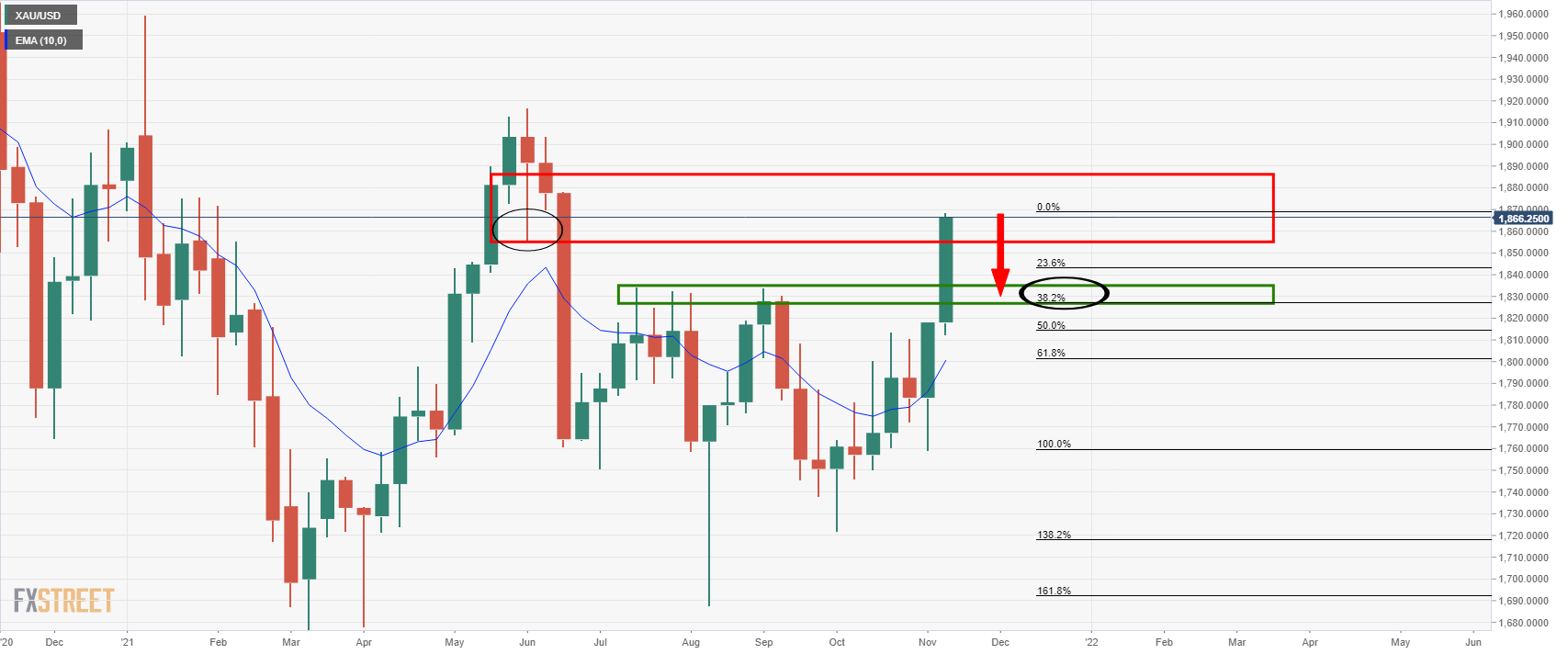

- Gold is on the verge of a 38.2% Fibonacci correction to test prior daily highs.

- The US dollar is on fire as US data impress and Fed rate hike expectations resurface.

The price of gold sank by over 0.6% on Tuesday and printed a low of $1,849.77 following a big move in the US dollar. XAU/USD fell from a high of $1,877.14 after the greenback rallied to the highest levels since June 2020, reaching as high as 95.899.

The US dollar rallied to a fresh 16-month high as US yields took off on the back of impressive data and hawkish Federal Reserve speakers. US data showed US consumers looked past rising prices and drove Retail Sales higher than expected last month. US Retail Sales rose 1.7% in October, topping consensus expectations of a 1.4% rise.

The US dollar has been better bid ever since US inflation data last week surprised to the upside and showed consumer prices surged to their highest rate since 1990. Investors now expected that the Federal Reserve will taper their QE programme at a faster pace. More hawkishly, some observers even expect that the Fed could potentially hike interest rates sooner than first anticipated in the markets.

Fed speakers spur on the USD bulls

Also spurring up-the US dollar bulls was the well-known hawk, St. Louis Federal Reserve bank president James Bullard. "If inflation happens to go away we are in great shape for that. If inflation doesn't go away as quickly as many are currently anticipating it is going to be up to the (Federal Open Market Committee) to keep inflation under control," Bullard said on Bloomberg Television.

"The inflation rate is quite high," Bullard said. "It behoves the committee to tack in a more hawkish direction in the next couple of meetings so that we are managing the risk of inflation appropriately."

He also said that the Fed could also play up the idea that it does not have to wait to end the taper in order to raise rates.

This follows previous comments from Bill Dudley – former New York Fed President – who said “they’re going to have to get the taper done quicker”. The Fed has already said it could change the pace of tapering if warranted and thus far the inflation data supports the need to slow stimulus.

US stocks cheer positive data

Meanwhile, US stocks were boosted by the strong Retail Sales data, also alongside strong manufacturing and home-build data. However, US equity markets took little notice of comments from Federal Reserve members that monetary stimulus should be curbed more quickly to combat inflation. The S&P 500 lifted 0.6% into the close on Wall Street.

Overall, it was a setback for the price of gold despite the prospects of higher inflation and lower real US yields. Analysts at TD Securities' have forecasted slowing growth and inflation next year and that to them suggests that market pricing remains far too hawkish. However, they note that gold prices have managed to break out nonetheless as global markets scour for inflation hedges. This leaves a bullish bias on the fundamental side, but there could be a meanwhile correction left to play out still as follows:

Gold technical analysis

As per the prior analysis, Gold Price Forecast: Bulls could be throwing in the towel here, the price is correcting from a weekly resistance that was illustrated as follows:

The following is an update with the price action and market structure drawn on the daily chart in confluence with the above prior analysis:

The bears could be on the verge of a test of prior resistance structure in the $1,830s.

- USD/CHF has risen for a fifth straight day and is now testing resistance at the 93.00 level.

- Strong US inflation and economic data and the associated divergence in central bank tightening expectations has been the main driver.

USD/CHF has seen substantial upside throughout Tuesday’s session and is now up around 0.6% on the day at 0.9300. The main catalyst for Tuesday’s upside was a further positive US data surprises, which triggered a broad strengthening of the US dollar (the DXY is now at year-to-date highs in the 95.80s). The US October Retail Sales report was much better than expected and there was a stronger than expected rebound in October Industrial Production from September’s Hurricane Ida disruption-related slump.

There is significant resistance at the 0.9300 level in the form of a triple top from early/mid-October. Should that resistance be broken, then it seems likely that the next stop for USD/CHF would be the annual high at 0.9360.

Bullish run continues

USD/CHF is now set to have risen for five straight sessions, during which time it will have rallied over 2.0% from the low 0.9100s to current levels at 93.00. The initial catalyst for the rally was last week’s much hotter than expected US Consumer Price Inflation report, which sent the pair shooting above a negative trendline that had been capping the price action for more than six weeks. Technical momentum has thus played a role, as has the broader theme of central bank divergence.

That is to say, in wake of recent inflation and economic data surprises, markets have been moving to price in a more hawkish Fed. This divergence can be examined by looking at Short-Term Interest Rate (STIR) future markets. December 2022 Swiss France LIBOR futures are broadly unchanged versus last Wednesday’s pre-US CPI data levels at 100.52, implying an SNB rate of roughly -0.5% at the end of 2022, or 25bps of tightening from the bank’s current -0.75% rate. Contrast that with the more than 15 point move lower in the December 2022 Eurodollar future to around 99.05 from previously above 99.20. In other words, USD money markets have pretty much moved to price in three rate hikes from the Fed in 2022, versus two prior to the CPI release.

Watch the EUR/CHF 1.05 floor

USD/CHF traders should key an eye on a key level in the EUR/CHF cross. The Swiss National Bank has been keen to not let EUR/CHF slip below 1.05, indeed, this was the level it defended in the early stages of the pandemic. The pair tested the level on Monday, but has since rebounded somewhat. Some analysts are of the view that this time, the SNB might be willing to let the pair fall below 1.05.

According to Capital Economics, the “persistent weakness of Swiss inflation, and the resulting trend appreciation in the nominal exchange rate, presents the SNB with a moving target when assessing when it will intervene during bouts of upward pressure on the franc... Having defended the CHF 1.05 per euro mark in earnest last year, we suspect that the SNB’s “line in the sand” may now be closer to CHF 1.025, and that it could live with the franc rising to parity with the euro over the coming years.”

A rise in Covid-19 infection rates and Eurozone countries rushing to re-impose restrictions is one reason for FX markets to favour the Swiss Franc over the euro. With regards to the pandemic situation in Europe, things are likely to get far worse before they get any better. Any sustained move below 1.05 in EUR/CHF would make it difficult for USD/CHF to continue its recent rally. In the long-run, though, this is likely to scupper the broader trend of USD/CHF appreciation driven by economic/central bank divergence.

What you need to know on Wednesday, November 17:

The greenback strengthened against most major rivals, reaching fresh 2021 highs against the shared currency. The dollar was partially underpinned by a sour market mood, later by upbeat US data.

The macroeconomic calendar was a bit busier on Tuesday. The UK published employment figures, which showed that those claiming unemployment benefits decreased by 14.9K MoM, while the ILO Unemployment rate for the three months to September contracted by more than anticipated to 4.3%. Average Earnings in the same period were up 4.9% excluding bonus, and 5.8% including bonus.

The EU published the second estimate of its Q3 Gross Domestic Product, which was confirmed at 2.2% QoQ. Employment change in the same quarter was up 0.9%, beating expectations. Finally, the US released September Retail Sales and Industrial Production figures, which came in better than anticipated, further supporting the greenback.

Meanwhile, EU gas prices were up over 12%, as Germany suspended Nord Stream 2 certification. Geopolitical tensions escalated in Europe, and higher gas prices would certainly will affect inflation.

The EUR/USD pair trades around 1.1320, while GBP/USD is stable at around 1.3430. Commodity-linked currencies lost ground vs the greenback although they held within familiar levels.

Gold reached a fresh multi-month high of $1,877.15 but pulled back to close in the red for a second consecutive day in the 1,850 price zone. Crude oil prices shed some ground, with WTI down to $79.70 a barrel.

US Treasury yields reached fresh weekly highs, with that on the 10-year note reaching 1.63%, further supporting the dollar’s demand.

Global indexes struggled to post gains, ending the day mixed. Wall Street opened with substantial gains but gave up to the risk-off mood.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos face market-wide profit-taking

Like this article? Help us with some feedback by answering this survey:

- GBP/USD has fallen back from earlier highs after running into resistance in the form of a key downtrend.

- Wednesday’s UK CPI report, if much hotter than expected, could provide GBP/USD with the tailwinds it needs to break higher.

Amid a broad pick up in the fortunes of the US dollar following Tuesday’s strong retail sales and industrial production figures, GBP/USD has fallen back from earlier session highs in the 1.3470s and is back to trading in the 1.3430s. At the start of the European trading session, the pair had rallied as much as 0.5%, boosted by a strong labour market report that amny analysts saw as giving the BoE the green light to hike rates in December. While the pair has slipped back from highs, it still holds onto gains of about 0.2% on the session and is, at present, the best-performing currency in the G10.

While broad USD strength is likely the main reason why GBP/USD pulled back from earlier highs, technical selling likely also played a role. GBP/USD appeared to test and reject a descending trendline that has been capping the price action since the end of October. Whether or not the pair is able to break above this trend line and recover some lost ground may depend on how Wednesday’s October Consumer Price Inflation (CPI) report goes.

The latest jobs report showed employer payrolls growing by 160K in October, thus easing concerns about the post-end of furlough health of the UK labour market that prevented the BoE from hiking rates in November. Wednesday’s CPI report, if it comes in much hotter than expected as was the case in the US last week, could exacerbate inflation concerns at the bank, thus boosting market expectations for a more aggressive policy response.

GBP Short-Term Interest Rate (STIR) future market pricing has been gradually becoming more hawkish in recent days. In the aftermath of the BoE’s dovish November surprise, December 2022 sterling LIBOR futures rallied from under 98.70 to above 98.90. In other words, markets suddenly went from expecting more than 120bps of tightening by the end of 2022 to under 100bps. But the December 2022 sterling LIBOR futures has quietly fallen back to pre-BoE meeting levels in recent days, with Tuesday’s jobs report sending it under 98.70.

A hotter than expected UK inflation reading tomorrow could send it back to year-to-date lows at just above 98.50. This would be bullish for GBP/USD, and could be the catalyst it needs to break above its recent downtrend. If that were to be the case, bullish technicians may target the 9 November high at 1.3600 as the next key area of resistance. Conversely, should the data disappoint, thus taking hawkish pressure off of the BoE and should the euro continue its dovish ECB/Covid-19 infection surge-related decline, GBP/USD is likely to turn lower. Technical selling may then push it down to annual lows at 1.3350.

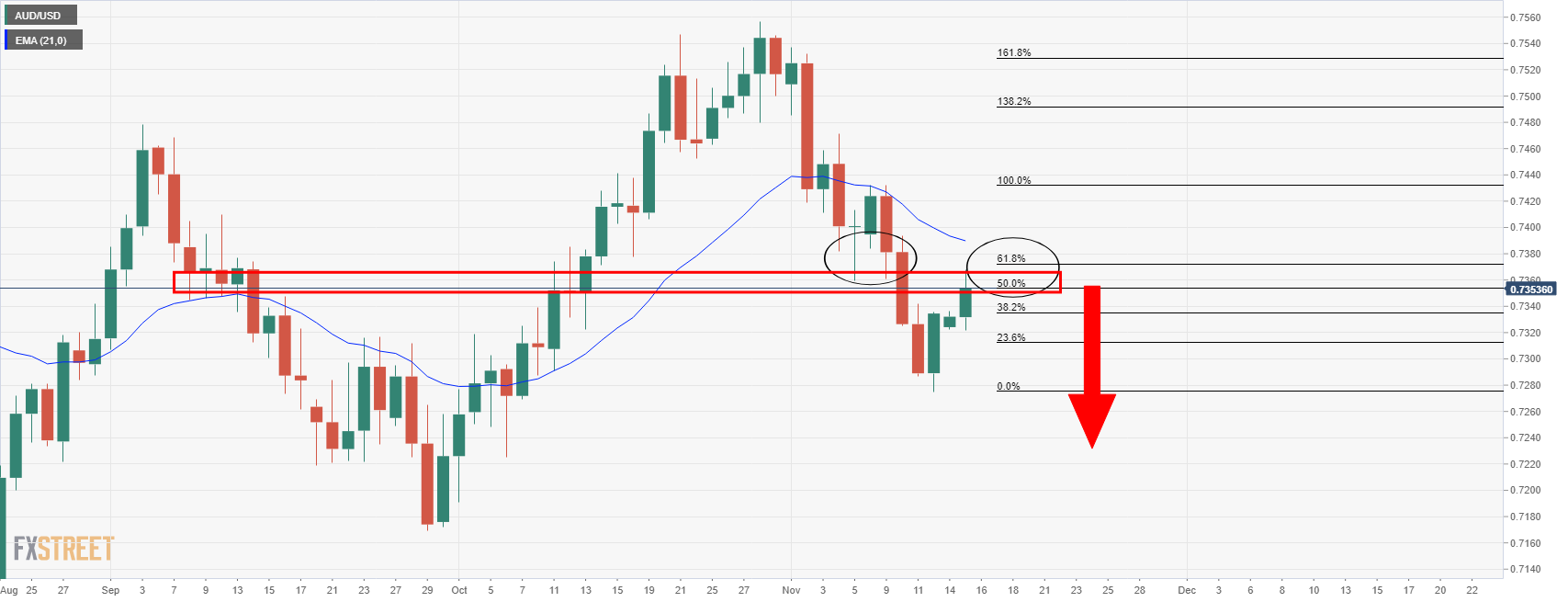

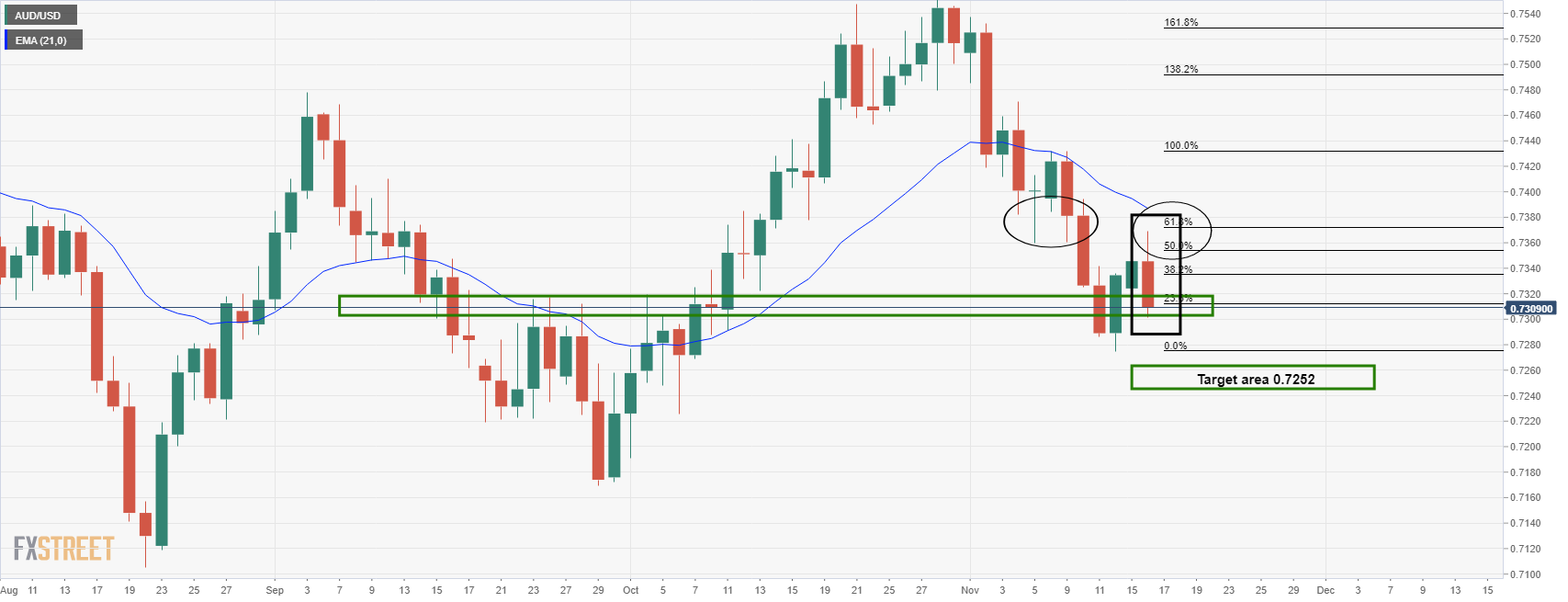

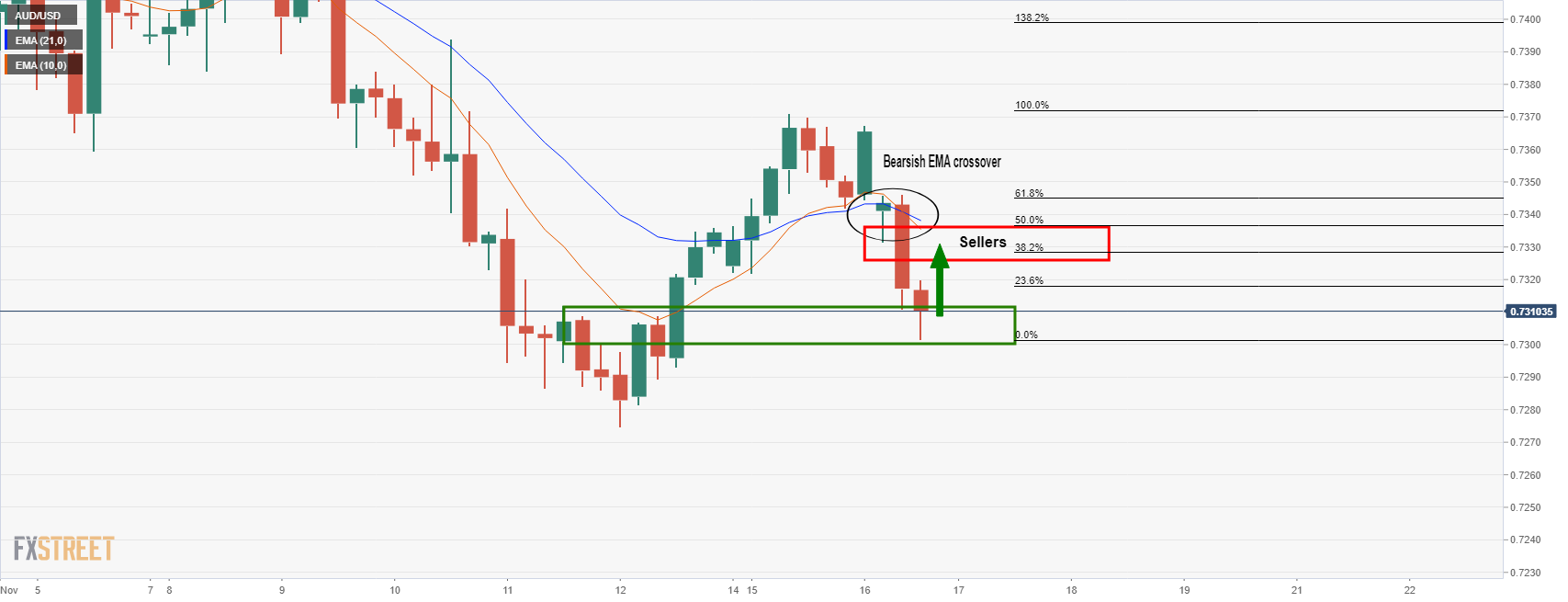

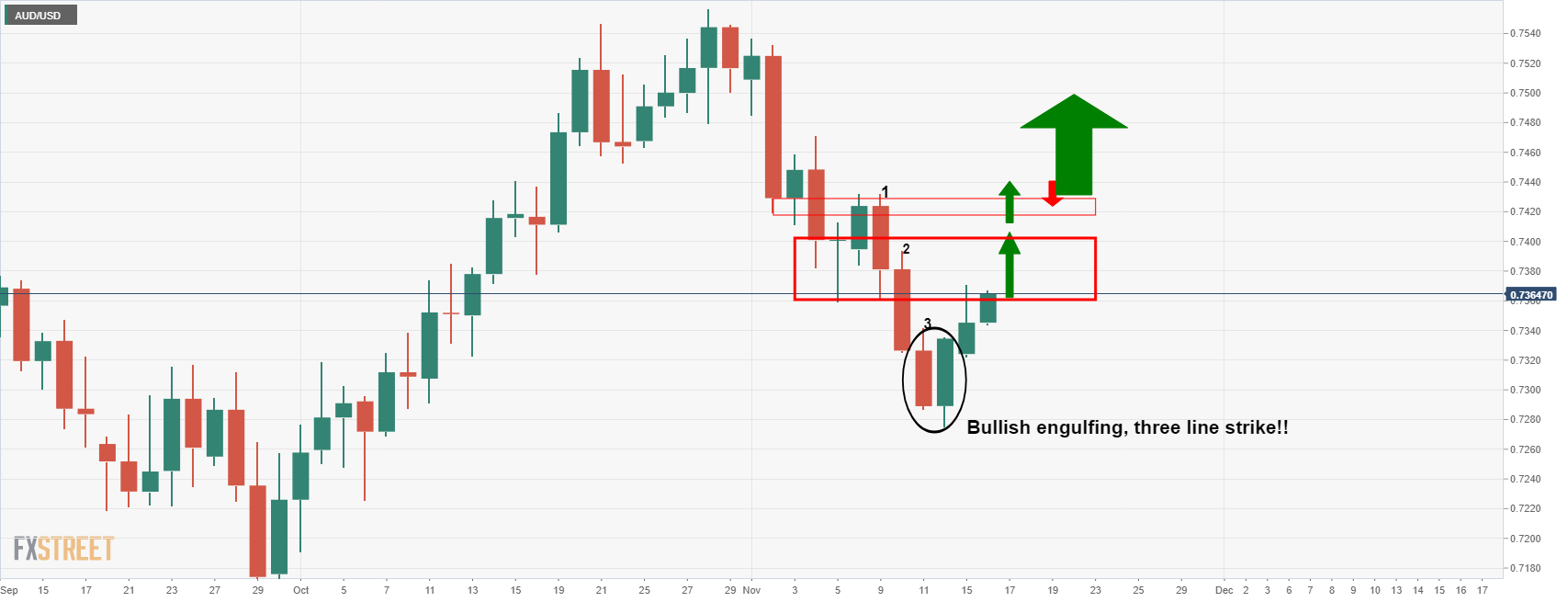

- AUD/USD bears move in on critical 4-hour support in a flash.

- This could be the makings of a fresh daily low, although the 4-hour support is a risk.

As per the prior analysis, AUD/USD Price Analysis: Bears to target 0.7220, bulls look for test of 0.7420, the bears have finally taken charge and with vigour. However, it could be too late to take advantage, at least from a swing trading perspective on the daily chart.

Nevertheless, the following is a breakdown of price action and where there still could be the possibility of an optimal entry on the 4-hour time frame.

AUD/USD prior analysis

The above analysis was from the prior session and we have seen some superb bearish development as follows:

The price, as illustrated, has indeed fallen into the projected support area. However, it has done so in a sharp move which gives rise to the risk of a support structure forming which could be problematic from an entry perspective.

AUD/USD H4 chart

As per the prior analysis, it was stated that bears could be getting ''prepared for a downside continuation by monitoring for a bearish environment from the 4-hour chart as follows,'' ...

It was explained that the bears would be looking for the 21 and 10-EMAs to turn south and crossover to signal a bearish environment. ''A break of the 0.7320s will likely result in a downside continuation for a fresh daily low towards 0.7250 and then 0.7220.''

The price has followed suit as follows:

At this juncture, the bears could be seeking a discount near the EMA crossover and between the 38.2% and 50% ratios near 0.7330 that would be expected to act as resistance on a retest of the structure. This will enable bears that are late to the party to get on board what could turn out to be a continuation of the weekly bear trend.

With that being said, the M-formation is a reversion pattern that would be expected to pull the price in to test the neckline of the formation which has a confluence of the 61.8% Fibo near 0.7350. Considering that the price has already met support, there is the risk that the price basis there and potentially moves higher beyond the M-formation's structure towards 0.7380. Ideally, bears will have already engaged with this current impulse to the downside and have moved their stop loss to breakeven by now to protect against such a scenario.

- XAG/USD upward move, stalled around the 200-DMA, retreats $0.30, to $24.89.

- XAG/USD extends its slump to two days driven by broad US dollar strength across the board.

- Higher US bond yields weighed on the non-yielding metal.

Silver (XAG/USD) struggled at the 200-DMA around $25.10, slides below $25.00 for the first time in three days, down some 1.20%, trading at $24.80 during the New York session at the time of writing. The market mood is upbeat in the financial markets, spurred by good US macroeconomic data that produced a rally in US stocks. Further, the 10-year Treasury yield is barely flat in the US bond market, up one basis point sitting at 1.628%.

In the New York session, the US Retail Sales for October increased by 1.7%, more than the 1.4% foreseen by analysts, smashing the 0.8% September’s number. Excluding Autos, retail sales for the same period expanded at the same pace that the headline, 1.7%, higher than the 1% estimated.

It is the most significant jump in retail sales since March 2021 figures. Though it is worth noting that the figures are not adjusted for inflation, reflecting price adjustments passed to the consumer.

Moving back to XAG/USD, in the Asian Pacific session, the white metal remained subdued in a narrow trading range within the $25.00-25 area. However, once US economic data crossed the wires, the white-metal seesawed between the high and the low of the day at that time, finally settling below Monday’s low around $24.80.

Furthermore, broad US dollar strength across the board has weighed on the non-yielding metal, with the US Dollar Index advancing some 0.30% in the day, sitting at 95.80, acting as a headwind for silver.

XAG/USD Price Forecast: Technical outlook

-637726856392532897.png)

Silver is approaching the mid-line of Andrew Pitchfork’s indicator in the daily chart, around the October 22 high at $24.83. Further, that support area, which was previous resistance, was unsuccessfully tested three consecutive days, meaning that XAG/USD buyers could view the opportunity to open fresh bets against the US Dollar.

However, in the outcome of breaking below the abovementioned support, the following support would be $24.50, followed by the 100-day moving average at $24.14.

- EUR/JPY bulls looking for a retracement to 130.20 in the sessions ahead.

- US dollar is exceptionally strong as fundamentals play out in favour of the bulls.

EUR/JPY has started to resurface after a whitewash across the forex board as a tsunami of USD bids took down the single currency earlier in the day. At the time of writing, EUR/JPY is trading with its head back above water at 129.81 and is up 0.08%. It has come up from a low of 129.62 after sliding from 130.11 the high.

The euro fell to a new 16-month low versus the dollar on Tuesday, extending recent losses made on Monday after dovish comments from European Central Bank President Christine Lagarde. The euro was pressured further amid growth concerns and a surge in COVID-19 cases. It also suffered a surge in the greenback that rallied to the highest levels since June 2020, reaching as high as 95.899. This sank EUR/USD to as low as 1.1319 in the last hour of trade, (by 17.50 GMT).

US Retail Sales were the final straw

The US dollar rallied to a fresh 16-month high as US yields took off on the back of impressive data and hawkish Federal Reserve speakers. US data showed US consumers looked past rising prices and drove Retail Sales higher than expected last month. US Retail Sales rose 1.7% in October, topping consensus expectations of a 1.4% rise.

However, there is some speculation that the data was stronger due to the holiday season approaching and fears of higher prices. Americans may have also started their holiday shopping early to avoid empty shelves amid shortages of some goods as the ongoing pandemic squeezes supply chains. Nevertheless, the data was in the harmony with the inflationary pressures.

The dollar has been bid event since US inflation data last week showed consumer prices surged to their highest rate since 1990. This has led to sentiment in the markets that the Federal Reserve will have to curtail QE at a faster pace and potentially even hike interest rates sooner than first anticipated in the markets.

Additionally, covid in the US is seen to be less of a risk than in Europe again. COVID-19 is also surging there again which is causing some countries to contemplate lockdowns already. This, coupled with European Central Bank President Christine Lagarde saying that tightening monetary policy now to rein in inflation could choke off the euro zone's recovery, have both weighed on the outlook for the single currency.

EUR/JPY technical analysis

Meanwhile, the bulls are attempting to catch a falling knife:

The price is in a strong downtrend, although there are prospects of a significant and healthy correction towards the 38.2% Fibonacci retracement level near 130.20.

- The S&P 500 advances up 0.51%, at 4,706.87.

- The Dow Jones climbs 0.50%, currently at 36,270.40.

- The heavy-tech Nasdaq Composite edges higher 0.65%, at 15,957.49.

The S&P 500 edges higher during the New York session, up some 0.51%, currently at 4,706.87 at the time of writing. As portrayed by major US equity indices, the market sentiment is upbeat, rising between 0.50% and 0.65%. Positive US macroeconomic data spurred a rally in US stocks, as the Retail Sales jumped to a seven-month new high, doubling September reading.

In the New York session, the US Retail Sales for October were unveiled, showing an increase of 1.7%, more than the 1.4% estimated by analysts, smashing the 0.8% September’s number. Moreover, excluding Autos, sales for the same period expanded at the same pace that the headline, 1.7%, higher than the 1% expected.

Consumers propelled sales to their most significant jump in seven months. However, it is worth noticing that the figures are not adjusted for price changes due to higher prices. In some gasoline stations, the receipt heightened almost 4%, its highest level since March, portraying the spike in energy prices in the last couple of months.

Sector-wise, consumer discretionary, technology, and health advance 1.29%, 0.90%, and 0.73%, respectively. On the other hand, the main losers are utilities, real estate, and consumer staples, down 0.48%, 0.47%, and 0.42% each.

S&P 500 Price Forecast: Technical outlook

-637726801829589811.png)

The daily chart depicts the S&P 500 has an upward bias, confirmed by the daily moving averages (DMA’s) well located below the index value, with an upward slope. Nevertheless, the Relative Strength Index (RSI) is at 70, well within overbought conditions, suggesting that a lower correction could happen.

At press time, is testing the all-time high at 4,716, which in case of a daily close above the latter, would expose the 4,800 as its following resistance area.

On the flip side, in the case of a correction, the first support would be the October 26 high at 4,598.53 that confluences with the 78.6% Fibonacci retracement as the first support level. In the outcome of a deeper correction, the October 27 low at 4,553.53.

In a videocast speech to a business group cited by Reuters, Bank of Canada Governor Lawrence Schembri said on Tuesday that the relationship between labour market conditions and inflation has weakened and become more difficult to measure, thus making it harder to know when economic slack has been absorbed.

Additional takeaways

“There is uncertainty about the level of maximum sustainable employment and the relationship between labour market conditions and inflation.”

“Understanding how high the level of employment can get without sparking inflation is crucial.”

“Evidence suggests that with firmly anchored inflation expectations, the relationship between inflation and the output gap has weakened.”

“Structural forces affecting the Canadian labour market are likely causing the level of maximum sustainable employment to change, making it harder to identify.”

“Traditional tools to measure employment aren't as useful as they once were” and the “bank is looking at new ways to measure spare capacity in the labour market.”

The “bank has developed new tools to measure impact of Covid-19 pandemic on workers and employers.”

“Despite the recent spike in inflation, medium-term inflation expectations have remained relatively well-anchored.”

“Considerable excess capacity remains in labour market” and “rates of unemployment and underemployment remain elevated.”

“We expect pandemic shock will have some scarring effects” and “could see skills of long-term unemployed workers erode and their attachment to labor market weaken.”

Market Reaction

The loonie has not seen any notable reaction to the latest BoC rhetoric. The comments mostly refer to a higher degree of uncertainty that BoC policymakers face, including with regards to NAIRU, or the non-accelerating inflation rate of unemployment. This is defined as the specific level of unemployment that is evident in an economy that does not cause inflation to increase.

The comments do not discuss the outlook for BoC policy and thus are unlikely to impact market expectations.

- USD/TRY continues to surge higher after it broke above 10.00 for the first time last week.

- The pair nearly hit 10.40 early in the US session but has since moderated back below 10.30.

- The CBRT is expected to cut interest rates by another 100bps on Wednesday despite surging inflation.

The Turkish Lira has been under intense selling pressure since the start of Tuesday European session. USD/TRY, which pushed above 10.00 for the first time since, picked up pace from 0600GMT upon the arrival of European market participants, and has since surged north of 10.20. At one point, about an hour after the US market open, the lira appeared to undergo a small flash crash, with USD/TRY surging from 10.28 to just under 10.40 in a matter of minutes. It has since reversed back below 10.30, where it trades higher by about 2.2% on the day and is the worst-performing major currency in the world.

There haven’t been any fresh fundamental catalysts to drive the upside in the lira on Tuesday. Rather, traders have cited concerns about another rate cut from the Turkish central bank (CBRT), who set policy on Wednesday, as the main reason for the lira’s ongoing woes.

Despite the fact that the YoY rate of CPI in Turkey surged to just shy of 20% in October, the is expected to lower interest rates by another 100bps to 15.0% on Wednesday. That would take Turkey’s real interest rate on bank deposits (when compared to current headline CPI) to around -5.0%, one of the lowest in the world - no wonder no one wants to hold liras.

The ongoing decline of the lira points to an ongoing lack of trust in the CBRT’s ability to get inflation back to its 5.0% target. That’s because the bank’s policymaking is tainted by the hand of Turkish President Recep Erdogan, who unconventionally believes that interest rates should be lowered to bring down inflation and has consistently fired governors who failed to cut rates. Only a few weeks ago, Erdogan fired three rate-setters who reportedly disapproved of the CBRT’s most recent 200bps rate cut back in September.

Erdogan, who served as the country’s PM from 2003-2014 and has since served as the country’s President, is not expected to lose the 2023 election. Therefore, the prospect that the CBRT manages to rebuild credibility and reverse the lira’s ongoing decline is very unlikely in the coming years. Fears continue to grow that Erdogan’s unconventional approach to economic policy, sometimes quipped as “Erdoganomics”, will ignite a financial crisis in the country. The lira has lost 40% of its value versus the dollar so far this year, with more than 20% of that decline coming in the past three months.

Leader of the House Majority Steny Hoyer said on Tuesday that a vote on the Biden administration's $1.75T "Build Back Better" social spending bill would take place on Friday at the latest. Whilst it would likely pass in the House, the fate of the bill in the Senate is far less certain.

The Democrats only hold a majority of one in the Senate and thus need all Democrat Senators to support the bill if they want it to pass via simple majority using the budget reconciliation process. Moderate Senate Democrat Joe Manchin is reportedly skeptical about the timing of the bill after he publically expressed grave concern about the build-up of inflationary pressures in the US economy after last week's higher than expected inflation figures. Reports last week suggested he may favour withholding his support for the bill until 2022, when he hopes the inflation situation will have improved.

Market Reaction

FX markets have not seen any reaction to the comments.

- XAU/EUR’s nine-day rally has gained almost 9% in the last couple of weeks.

- XAU/EUR: Fed and ECB monetary policy divergence could benefit gold against euro traders, as ECB interest rates are below zero.

- XAU/EUR: RSI’s in overbought conditions could spur a correction towards €1,604 before resuming an upward move.

Gold (XAU/EUR) extends its rally to nine days in a row gaining against the EUR, up 0.11% during the day, trading at €1,642 at the time of writing. The nine-day rally accumulated gains of almost 9% and showed no signs of pausing, as long as the European Central Bank (ECB) sticks to its dovish posture.

In the Asian session, gold dipped as low as €1,637, but bounced off the lows, reaching a new year-to-date high at 1651, then retreated some to stabilize around €1,641. Furthermore, the German 10-year bund yield is flat at -0.245%.

Fed and ECB monetary policy divergence offers gold traders another hedge option in the XAU/EUR

From the central bank divergence point of view, between the Fed and the ECB, gold against the euro offers some attractive inflation hedge options.

In the US, the Federal Reserve just began its bond taper to its pandemic-stimulus package, contrary to the ECB, which stills in the QE, pushing back the possibility of a hike rate in the near term. Further, recent Fed policymakers have turned to a more slight neutral-hawkish posture, something that market participants have noticed, as money markets futures have priced in a July 2022 rate hike by the Federal Reserve. The consequence of that is that higher US bond yields usually benefit the greenback, thus weakening gold.

Contrarily, the ECB dovish posture weighed on the EUR/USD pair, which has fallen almost 2.50%, in the last couple of weeks, printing new year-to-date lows. XAU/EUR has followed the EUR/USD footsteps, as gold against the euro has reached new year-to-date highs during the previous five trading days.

That said, and with the ECB interest rates below zero, XAU/EUR could be an interest option to trade.

XAU/EUR Price Forecast: Technical outlook

-637726759048713823.png)

On Monday, XAU/EUR broke above Andrew Pitchfork’s top-trendline indicator, which prompted an upside move to €1,651, which was rejected. At press time, gold is testing Monday’s close around €1,640, which seems to be forming a gravestone doji, meaning that the fight between bulls and bears is at equilibrium. Further, the Relative Strength Index (RSI) is at 78, well inside the overbought territory, suggesting exhaustion in the upward move, which could trigger a correction before resuming the uptrend.

In that outcome, the first demand area would be November 13, 2020, high at €1,604.

- US 10-year Treasury yields have pared earlier gains to trade a tad lower, but still above 1.60%.

- Strong US data and hawkish Fed commentary helped to boost yields earlier in the session.

US 10-year Treasury yields continue to consolidate slightly to the north of the 1.60% level, where they trade modestly lower by about 1bps on the session. Last week’s high at 1.60% is offering support for now. The 30-year yield is down by a similar very modest margin to just below 2.0%. Short-end yields are flat with the 2-year just below 0.52%.

Yields have pulled back from earlier session highs when the 2-year hit 0.54% and the 10-year hit three-week highs just under 1.64%. A much stronger than expected US Retail Sales report for October, as well as hawkish commentary from St Louis Fed President and 2022 FOMC voter James Bullard, had pushed yields higher earlier in the session. For reference, headline retail sales rose 1.7% MoM versus forecasts for a 1.2% rise and Bullard suggested the Fed accelerate the pace of QE taper to $30B per month to pave the way for a Q1 2022 rate hike.

Though the earlier upside has now mostly been given back, it would seem that risks are pointed towards higher US yields right now. Last week’s much hotter than expected US inflation data has put pressure on the Fed to turn more hawkish, while other US data has also been surprising to the upside. The NY Fed Manufacturing survey for November that was released on Monday was much stronger than expected and pointed at a further acceleration in US growth this month. The data sent yields higher at the time. Analysts do note that one key downside risk for bond yields if it ends up triggering a broad demand for safe-haven assets, could be a resurgence in Covid-19 infections in the US this coming winter.

Looking ahead, bond traders will be keeping an eye on further Fedspeak, with FOMC members Raphael Bostic and Thomas Barkin slated to speak at 1700GMT, followed by FOMC member Mary Daly at 2030GMT. For the rest of the week, bond markets will remain focused on Fed speak, US data and a $23B 20-year bonds auction on Wednesday. Note that last week’s $25B 30-year bond auction was poor.

The 1.6% increase in industrial production for October is partly a make-up for the 1.3% storm-related decline in September, explained analysts at Wells Fargo. They consider the enduring challenge for production is the supply chain crisis, something far more disruptive to output than a Hurricane.

Key Quotes:

“Industrial production gained 1.6% in October more than making up for the 1.3% dip in September. The gain handily exceeded expectations and the Federal Reserve attributes half of the gain in October to recovery from the effects of Hurricane Ida. This makes intuitive sense as you look into the underlying details.

The largest overall increase within manufacturing industries was motor vehicle and parts production which shot up 11.0% in October. That would ordinarily be a remarkably outsized gain. However, coming on the heels of back-to-back monthly declines that sum to just over 10% in August and September, the big surge in October begins to feel more like a matter of just getting back on track.”

“In this context it is an immense frustration to firms that find themselves unable to put their plants and equipment to profitable use despite core capital orders having risen more in this cycle than any other in the past 20 years. Capacity utilization rose, but at just 76.4% it remains below it long run 30-year average of 78.4%.”

“The rebound from Hurricane Ida was also behind the pickup in mining production. After the Hurricane limited oil & gas production in the Gulf of Mexico for the first half of September, mining output jumped 4.1% in October and oil & gas drilling specifically rose 9.3%, the highest monthly gain since January. Every category of energy production moved higher during the month. For utilities, relatively warmer-than-usual weather in October was behind the 1.2% gain.”

Analysts at Danske Bank expect renewed upward pressure on long-term yields, with 10Y US Treasury yields set to hit 2% within the next 6-12 months. They continue to expect 10Y German Bund yields to edge up to 0.25% in 2022.

Key Quotes:

“We expect 2Y US yields to rise in the coming 12 months as rate hikes approach. That would tend to flatten the curve. However, we can also see from the right-hand chart above that 10Y yields normally increase at the same time. In other words, we usually see the entire yield curve shift upwards when the curve flattens due to policy tightening.”

“We have a 2% target for 10Y Treasury yields and a 0.25% target for 10Y Bund yields. Hence, we expect higher 10Y US yields to push long European yields up.”

“We also expect real interest rates to rise in coming quarters. 10Y real interest rates have declined further this autumn. While inflation expectations (break-evens) in fixed-income markets have risen, nominal 10Y yields have remained broadly flat, sending real interest rates lower. We expect real interest rates to start increasing again in 2022, putting upward pressure on long nominal yields.”

Data released on Tuesday, showed retail sales in the US rose more than expected in October. According to analysts at Wells Fargo, the 1.7% increase in October retail sales sets up holiday sales for another record gain, but the real insight in is how wallet share is shifting as consumers reprioritize spending amid the highest inflation in 30 years.

Key Quotes:

“Retail sales increased 1.7% in October on the heels of upward revisions to the prior month's figures. E-commerce posted the largest monthly gain of 4.0% on the month. Prices played a role in lifting the monthly sales figures once again, with core goods consumer prices up another 1% in October. Encouragingly, even excluding some of the categories most associated with recent price hikes like autos and gas, the monthly gain of 1.4% was double the consensus expectation for a more modest 0.7% increase.”

“Even with declines in holiday sales in November and December, today's report still presents some upside to our call for holiday sales to rise 11% compared to last year. If sales are flat in November and December, holiday sales would rise 14.8% this year. When adjusting for inflation, we estimate real sales would rise a still-strong 10%, which would be the highest in at least seven years.”

- Higher equity prices and US yields weigh on the Japanese yen.

- US economic data released on Tuesday surpass expectations.

- USD/JPY breaks key resistance and strengthens positive outlook.

The USD/JPY broke above 114.30 and jumped to test the multi-year high below 114.70. It peaked at 114.63, the strongest in four weeks and then pulled back modestly. The combination of higher US yields, rising equity prices and a rally of the dollar across the board keeps boosting the pair.

US economic data released on Tuesday came in above expectations (retail sales and industrial production) and boosted US yields. The 10-year Treasury reached 1.63%, before pulling back.

The economic figures show an improvement in economic activity that fuels expectations about an adjustment in Federal Reserve’s monetary policy sooner than expected. The numbers also help the greenback that is rising sharply. The DXY stands at fresh 16-month highs above 95.10, up 0.20% for the day.

USD/JPY short-term outlook

The pair trades near the multi-year high area around 114.70. While above 114.40 the bullish tone will remain intact and another test of the recent top seems likely. A break above should clear the way to more gains.

A slide back under 114.30 would put USD/JPY back into the range between 114.30 and 113.40, with an intermediate level at 113.75.

Technical levels

- The Forint has seen choppiness in response to the latest Hungarian central bank rate decision.

- USD/HUF briefly hit 18-month highs above 322.00, but has since fallen back towards 320.00.

The Hungarian Forint has seen choppy conditions in recent trade, with USD/HUF at one point surpassing prior weekly highs at 322.00 to print fresh 18-month highs, before reverting back towards 320.00. At 1300GMT, the Hungarian central bank (the Magyar Nemzeti Bank of MNB) announced that it had decided to hike its base rate by 30bps to 2.1% as expected, marking a re-acceleration of the pace of monetary tightening. The overnight deposit rate was also lifted by 30bps to 1.15% as expected.

At the September meeting, the bank opted to slow the pace of rate hikes down from 30bps per meeting to 15bps and followed up with another 15bps hike in October. The forint didn’t like the decision to slow the pace of rate hikes and at current levels, USD/HUF is up nearly 4.0% from its September lows close to 308.00.

Despite the MNB’s decision to re-accelerate the pace of rate hikes, USD/HUF’s initial reaction was a kneejerk move higher to above 322.00 from previously around 320.50, suggesting some traders had been betting on a bigger rate hike. Some might have been betting/hoping that the Hungarian central bank would follow in the footsteps of its Polish and Czech counterparts in implementing a much larger than expected rate hike. The Polish central bank hiked interest rates by 75bps in November and the Czech National Bank by 1.25%.

USD/HUF was able to reverse lower, however, in wake of the MNB’s post-policy meeting press conference, which began at 1400GMT. The bank pledged to continue the tightening cycle as expected and noted that it might lift its one-week deposit rate above the base rate (the interest rate on its one-week deposit facility was 1.8% last Thursday). The Hungarian central bank also said tightening would continue until the inflation outlook had stabilised, before noting that the risks that inflation remains elevated for longer have grown. Furthermore, the bank announced that it would stop providing HUF liquidity via its FX swap facility.

After October Consumer Price Inflation surprised to the upside at 6.5%, the Hungarian central bank said it sees inflation surpassing 7.0% in November. Analysts argued that the MNB is nimble and if upwards inflation surprised persist, the bank could accelerate the pace of rate hikes again. Whether this would be enough to turn the tide for USD/HUF, which is now up about 7.5% on the year, remains to be seen.

- AUD/USD dipped 30 pips as US Retail Sales for October grew the most in seven months.

- US Industrial Production crushed expectations, boosting the greenback.

- RBA’s Governor Philip Lowe said that data would not support a rate hike in 2022.

During the New York session, the Australian dollar falls, as better than expected US Retail Sales, seems to convince USD bulls to support the greenback against the AUD, prompting a 23 pip downside move on the announcement. At the time of writing, the AUD/USD is down some 0.42%, trading at 0.7315.

US Retail Sales for October smashed September's reading

In the New York session, the US Census Bureau revealed October’s Retail Sales which increased by 1.7%, more than the 1.4% foreseen by analysts, crushing the 0.8% September’s number. Further, excluding Autos, sales for the same period expand at the same pace that the headline, 1.7%, higher than the 1% estimated.

The jump in retail sales is the largest in seven months and followed a revised September figure. It is worth noticing that figures are not adjusted for price changes to reflect elevated prices. Receipts at gasoline stations jumped 3.9%, the highest since March, reflecting how people are paying some of the highest prices in seven years.

Some minutes later, US Industrial Production for October followed Retail Sales footsteps, rose by 1.6%, better than the 0.7% expected by economists.

RBA’s Governor Philip Lowe said that recent data would not support a rate hike in 2022

Meanwhile, in the Asian Pacific session, the Reserve Bank of Australia (RBA) revealed its monetary policy minutes. The central bank reinforced its previous posture that the cash rate will stay at its current level until 2024 unless wage growth and inflation targets are met. Further, RBA Governor Philip Lowe said that the last data does not guarantee a rate hike in 2022.

Later on the day, Fedspeakers will cross the wires. Atlanta’s Fed Raphael Bostic and Richmond’s Fed Thomas Barkin will speak at 17:00 GMT. At 20:30 GMT, San Francisco Fed’s Mary Daly would be the last policymaker to hit the wires.

Therefore, AUD/USD traders might expect further downward pressure on the pair. Central bank policy divergence, between the Fed and the RBA, would be the main driver of the price of the pair, but also market sentiment needs to be considered, as a tailwind for the AUD/USD.

- DXY advances further and surpasses 95.80, fresh tops.

- Higher US yields lend extra sustain to the buck on Tuesday.

- US Retail Sales, Industrial Production surprised to the upside.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main rival currencies, advances to fresh tops in levels last seen in late July 2020 in the 95.80/85 band on Tuesday.

US Dollar Index supported by yields, data

The index extends the optimism witnessed at the beginning of the week and motivates the dollar to record fresh tops in the 95.80 region on Tuesday.

Further rebound in US yields across the curve lend oxygen to the buck, while auspicious results from the US calendar were also supportive of the strong buying interest in the dollar.

On the latter, Retail Sales expanded at a monthly 1.7% in October, while Industrial Production expanded 1.6% MoM and Capacity Utilization ticked higher to 76.4% during the same period.

Later in the session, Business Inventories, the NAHB Index and TIC Flows are due along with FOMC’s speakers Daly, Harker, Bostic and Barkin.

US Dollar Index relevant levels

Now, the index is gaining 0.17% at 95.69 and a break above 95.82 (2021 high Nov.16) would open the door to 96 (round level) and then 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 93.87 (weekly low November 9) seconded by 93.69 (55-day SMA) and finally 93.27 (monthly low October 28).

- After a spike higher, gold spikes to the downside and then rebounds to $1865.

- Volatile session for metals as the US dollar strengthens.

- US economic data surpass expectations, stocks and yields rise.

Gold prices dropped almost $20 from the peak during the last sixty minutes as volatility soars. XAU/USD hit a fresh five month high at $1877 and then turned to the downside following US economic data. Recently it bottomed at $1858, before rising to $1865. Silver is also affected by volatility. XAG/USD reversed sharply after reaching $25.41 and fell under $25.00.

USD gains on data, metals sideways

US data surpassed expectations with both reports: retail sales and industrial production. The numbers boosted the greenback and also US yields. The 10-year yields climbed to 1.63% a fresh high, and then pulled back. The DXY printed fresh monthly highs above 95.70 and is gaining 0.20%.

Gold was trading higher for the day, at five-month highs and then dropped sharply. The upside bias weakened during the last hour and price is testing levels below a key short-term uptrend line. A consolidation below $1855 should point to a correction. The next relevant support stands at $1840.

On the upside, if XAU/USD manages to rise back and hold above $1870, it would keep the doors open to more gains, targeting the next resistance zone around $1890.

Technical levels

EUR/USD records fresh 2021 lows and test 1.1330, weighed by spreads and relative fundamentals. Economists at Scotiabank expect the pair to continue its move downward to the 1.1300 level.

Near-term drivers for the euro remain negative

“Widening Bunds-UST differentials remain a firm downward force on the euro. The spread between US and German debt in the 10-yearr space has risen to its largest since April as markets adjust for the Fed’s tapering and eventual hikes.”

“Near-term drivers for the euro remain negative as the continent battles a surge in COVID-19 cases, elevated energy prices, and supply shortages limiting industrial output.”

With a relatively bare domestic calendar and no change in tone expected from scheduled European Central Bank speakers to change the outlook on the EUR/USD, we expect further losses ahead, toward 1.13, in the coming days.”

The British pound is outperforming as strong jobs data refocuses attention on hikes rates from the Bank of England (BoE). Economists at Scotiabank expect the GBP/USD pair to stage a recovery towards the 1.36 level.

BoE set to hike rates in December

“Payroll data for October showed a 160K increase in employment – following the September end of the furlough programme – and vacancies rose to a new record high. It is the jobs picture that prevented the BoE from hiking rates at its November meeting so today’s solid print increases the possibility that the Bank hikes in December – although markets may go into the meeting with more caution.”

“Wednesday’s CPI release will act to pressure the bank into action next month and we think the GBP has a solid path to recovery toward the 1.36 level, at least, in the coming weeks.”

- EUR/USD loses further momentum and tests 1.1330.

- Flash EMU Q3 GDP came at 2.2% QoQ, 3.7% YoY.

- US headline Retail Sales surprised to the upside in October.

EUR/USD remains mired well into the negative territory and records fresh 2021 lows in the boundaries of 1.1330 on Tuesday.

EUR/USD risks further downside

The earlier bullish attempt in EUR/USD ran out of steam past the 1.1380 level, and it was all the way down since then. Indeed, the bid bias in the buck remains well and sound and now pushes the US Dollar Index (DXY) to fresh cycle tops near 95.80 on the back of the continuation of the rebound in US yields.

Sustaining further the momentum surrounding the dollar, US headline Retail Sales surprised to the upside in October after expanded at a monthly 1.7%, while Core sales also rose above estimates 1.7%. Further data for October saw the Industrial Production expanding 1.6% and Capacity Utilization rising 76.4%.

Next on the docket will be the speech by ECB's Lagarde and US Business Inventories, the NAHB Index and TIC Flows.

EUR/USD levels to watch

So far, spot is down 0.31% at 1.1332 and faces the next up barrier at 1.1498 (10-day SMA) followed by 1.1556 (20-day SMA) and finally 1.1609 (weekly high Nov.9). On the other hand, a break below 1.1329 (2021 low Nov.16) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).