- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-11-2021

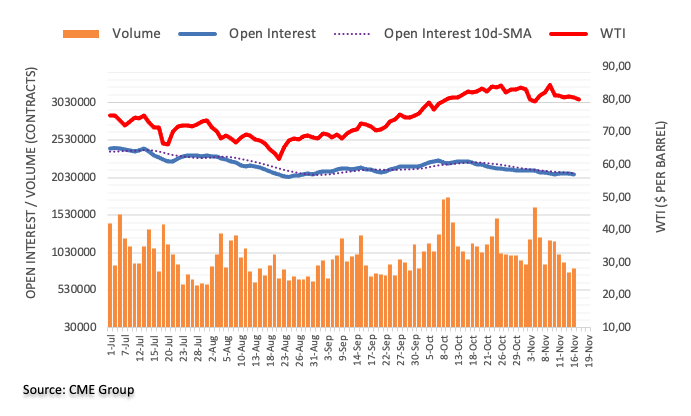

- WTI grinds lower at multi-day bottom, keeps downside break of 50-DMA.

- Bearish MACD signals back downside momentum towards July’s top.

- Three-week-old resistance line adds to the upside filters.

WTI crude oil dribbles around $77.50, following the heaviest daily fall in a week to test early October lows. Even so, the black gold extends the previous day’s downside break of the 50-DMA amid bearish MACD signals.

That said, the commodity prices remain directed towards July’s peak of $76.40 before challenging the 100-DMA surrounding $73.80.

Should the oil sellers keep reins past $73.80, the pair’s downside towards 50.0% and 61.8% Fibonacci retracement of August-October upside, respectively near $73.35 and $70.60, can’t be ruled out.

Alternatively, corrective pullback needs to provide a daily closing beyond the 50-DMA level of $78.10 to recall the WTI buyers.

Following that, the weekly resistance line and a descending trend line from late October, close to $79.20 and $83.00 in that, will be in focus.

If at all the oil prices cross the $83.00 hurdle, the previous month’s high near $85.00 should return to the chart.

WTI: Daily chart

Trend: Further weakness expected

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, drop for the second consecutive day by the end of Wednesday’s North American session, per the data source Reuters.

In doing so, the inflation gauge widens the gap from the highest levels since 2005 tested earlier in the week, around 2.70% at the latest.

The receding inflation expectations could be linked to the recent retreat in the US Treasury yields and the US Dollar Index (DXY). The White House optimism regarding the US supply chain seems to underpin the receding inflation fears.

However, the Fed policymakers remain divided on the reflation woes and the rate hike concerns, which in turn challenge market sentiment. That said, Chicago Fed’s Chief Executive Officer Charles L. Evans recently mentioned, per Reuters, “It will take until the middle of next year to complete the Fed's wind-down of its bond-buying program, even as the central bank remains 'mindful' of inflation.”

Moving on a lack of major data/events may keep the markets gyrated but receding inflation woes may exert additional downside pressure on the US bond yields and the greenback, which in turn could help the gold buyers to remain hopeful of visiting the $1,900 mark.

Read: Gold Price Forecast: XAU/USD grinds higher towards $1,900 on softer yields

- Silver struggles to extend bounce off weekly low inside immediate bearish chart pattern.

- Sustained trading below previous support, sluggish Momentum keep sellers hopeful.

- Bulls need $25.40 breakout for fresh entries to target August month’s top.

Silver (XAG/USD) remains sidelined around $25.00, inside a one-week-old symmetrical triangle bearish formation during Thursday’s Asian session.

That said, the bright metal’s failure to jump back beyond the support-turned-resistance line from October 03, around $25.20, joins Momentum line’s retreat to tease silver sellers.

However, a clear downside break of the stated triangle’s support, around $24.85 at the latest, as well as a break of the 200-HMA level of $24.75, becomes necessary for the bear’s entry.

Following that, November 08 swing high near $24.50 and a two-week-long horizontal area near $24.00 will gain the market’s attention.

Meanwhile, the stated previous support line, around $25.20, guards the quote’s immediate upside ahead of the triangle’s resistance line near $25.40.

Should the silver buyers keep reins past $25.40, a run-up towards the August month’s high of $26.00 can’t be ruled out.

Silver: Hourly chart

Trend: Pullback expected

- EUR/USD bears take no heed, consolidate toward the 1.300 level.

- The pair may find impetus from several speeches lined up for the day.

- The euro area fresh COVID-19 spread worry investors.

The EUR/USD pair grinds lower towards 1.1300 level in the early Asian session on Thursday, on the back of receding US dollar and Treasury yields.

The shared currency pair has developed a mood of late and remained at its lowest since July last year. Now, expectations remain that the European Central Bank (ECB) would stick to its dovish policy settings in the near term. Against the backdrop of a slowing economy and as Covid-19 cases resurge throughout the continent.

On Thursday morning, Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago, sounds cautiously optimistic while saying, “It will take until the middle of next year to complete the Fed’s wind-down of its bond-buying program, even as the central bank remains ‘mindful’ of inflation.”

The Fed policymaker’s mixed comments weighed on the market sentiment and dragged the US equities down, keeping the Treasury yields pressured.

Previously, ECB president Christine Lagarde said that tightening monetary policy to curb inflation could choke off the Eurozone’s recovery. She further iterated factors pushing prices higher would fade next year, increasing contrast from hawkish hints from other central banks.

The Eurozone inflation for October rose by 4.1% YoY, in line with expectations. The MoM figure is at 0.8%, also in line with estimations and failed to trigger any reaction in the EUR/USD. Additionally, both Austria and the Netherlands announced lockdown measures. Germany is also due to meet next week to discuss tightening standards as infections start to peak.

Meanwhile, the greenback continued ardour reaching fresh 2021 highs and went out of steam on Wednesday, with the DXY falling back to the 95.80s.

Looking ahead, investors will be eyeing several Fed speeches and comments from ECB’s Fabio Panetta, Philip Richard Lane in addition to ECB President Lagarde.

EUR/USD technical levels

- EUR/JPY is flat as the Asian Pacific session begins, near Wednesday’s low around the 129.20s.

- EUR/JPY: Broke below a descending channel, accelerating the downtrend towards 129.00.

- EUR/JPY: A break below 129.00 could pave the way for a deeper correction, firstly 128.00, followed by 126.00.

The EUR/JPY is subdued as the Asian session begins, flat trading at 129.21 during the day at the time of writing.

On Wednesday, during the overnight session, the shared currency failed to break above the 50-hour simple moving average (HSMA). It also broke below the bottom-trendline of a descending channel, accelerating the downtrend, dropping 100 pips throughout the day, reaching a low around the 129.00 flat.

EUR/JPY Price Analysis: Technical outlook

The daily chart depicts that the EUR/JPY pair broke below the descending channel, which seemed to be a bullish flag. However, once the spot price broke the bottom-trendline, it negated the validity of the pattern. Additionally, it broke a four-week upward trendline, cementing the downward bias in the pair.

Further, the 50-day moving average (DMA) just crossed under the 200-DMA, forming a death-cross usually viewed as a bearish signal.

If EUR/JPY sellers want to accelerate the downtrend, they will need to break below the October 6 low at 128.33. A breach of the latter would expose key support levels, like 128.00, followed by the February 4 low at 126.10.

On the flip side, if EUR buyers would like to reclaim control, they would need a daily close above the 100-DMA at 130.19. In that outcome, the following supply zone would be the convergence of the 50 and the 200-DMA around the 130.50-60 area.

- AUD/USD fails to cheer USD pullback, stays pressured around six-week low.

- RBA’s rejection of rate hike precedes subdued Q3 Australian wage growth data to back the bears.

- Fed tapering concerns remain elevated but US Treasury yields retreat amid a lack of major data/events.

- RBA’s Ellis will be eyed to confirm the bearish bias ahead of US second-tier data.

AUD/USD grinds lower around the six-week bottom, taking rounds to 0.7265 during Thursday’s initial Asian session. In doing so, the Aussie pair drops for the third consecutive day amid sour sentiment and receding odds of the Reserve Bank of Australia’s (RBA) rate hike.

Although the US Dollar Index (DXY) track Treasury yields in stepping back from the multi-day high, the AUD/USD prices remain pressured and dropped to the lowest levels since early October as the Aussie wage price data backed RBA’s rejection of rate lift the previous day.

That said, Australia Wage Price Index matches the 2.2% YoY forecast and crossed 0.5% QoQ market consensus for the Q3. Earlier in the week, the RBA Minutes and Governor Philip Lowe both pushed back rate hike concerns.

It’s worth noting that an absence of any major positive news from the virtual meeting between US President Joe Biden and his Chinese counterpart Xi Jinping adds to the bearish bias for the AUD/USD. Additionally, the hawkish Fedspeak keeps the US central bank (Fed) on top of its counterparts while watching for a rate hike, which in turn exert downside pressure on the Aussie prices. Recently, Charles L. Evans, the Chief Executive Officer of the Federal Reserve Bank of Chicago said, “It will take until the middle of next year to complete the Fed's wind-down of its bond-buying program, even as the central bank remains 'mindful' of inflation.”

Alternatively, the US efforts to increase oil supply and the White House comments suggesting receding supply chain issues join mixed housing data from the US to offer breathing space to the AUD/USD sellers.

Amid these plays, US 10-year Treasury yields retreat from the highest levels since October 26 to post the heaviest daily fall in a week while ending Wednesday’s US trading session around 1.59%, down 4.3 basis points (bps). DXY tracks bond yields and marks a first negative daily closing in three after refreshing the 16-month top during early Wednesday. It’s worth noting that the Wall Street benchmarks remained negative for the second consecutive day.

Looking forward, RBA Assistant Governor (Economic) Luci Ellis is up for a speech at an online event hosted by the Committee for Economic Development of Australia around 02:00 GMT. His comments will be watched to confirm the latest bearish impulse for the AUD/USD. Following that, the US Jobless Claims and Fedspeak will be eyed for clearer direction.

Technical analysis

A 12-day-old resistance line precedes convergence of the 100-DMA and the 50-DMA, respectively around 0.7310 and 0.7360-65, to restrict the short-term upside of the AUD/USD prices. Also keeping the pair sellers hopeful is the latest downside break of the 61.8% Fibonacci retracement (Fibo.) of August-October uptrend, around 0.7275. it should be noted, however, that an ascending support line from August near 0.7250, challenges further downside amid oversold RSI conditions.

- USD/CAD grinds higher following the run-up to refresh seven-week top.

- Short-term ascending trend line, 61.8% Fibonacci retracement tests immediate upside overbought RSI conditions.

- 50-SMA restricts immediate downside, late September peak lures bulls past 1.2660.

USD/CAD picks up bids in a 20-pip trading range above 1.2600 after rising to the highest levels since early October the previous day. That said, the quote rises to 1.2613 amid the initial Asian session on Thursday.

Sustained trading beyond 50-SMA and a six-week-old horizontal area keeps USD/CAD buyers hopeful. However, a convergence of an ascending trend line from October 27 and 61.8% Fibonacci retracement (Fibo.) of September-October fall, challenge the bulls around 1.2660 amid the overbought RSI conditions.

Hence, the pair buyers should wait for a clear upside break of 1.2660 for fresh entry. Following that, the 1.2700 threshold and late September high near 1.2775 will be in focus.

Even if the USD/CAD upside remains intact past 1.2775, September’s top around the 1.2900 threshold should attract the buyers.

Alternatively, pullback moves may aim for the 50% Fibo. level of 1.2592 before targeting the 50-SMA, around 1.2515 at the latest.

However, USD/CAD should watch for entry if the quote breaks a horizontal region comprising multiple levels since October 08, around 1.2480-95.

USD/CAD: Four-hour chart

Trend: Pullback expected

Early Thursday morning in Asia, the White House crossed wires, via Reuters, to convey the US supply chain position.

Key quotes

Ocean carrier alliances immune from antitrust laws, but FMC can challenge such pacts if they result in unreasonable costs or lessen competition.

Federal Maritime Commission (FMC) should use all tools at its disposal to ensure free and fair competition in shipping sector.

US Justice Department ready to aid FMC in promoting competition in maritime sector.

Congress should take action to improve transparency in shipping, boost protections for exporters, importers and consumers.

October data shows US goods supply chain working better, velocity of goods leaving L.A. Long beach ports increasing.

White House official sees need to look at holding carriers accountable to retailers, ensuring retailers can get goods on ships at fair prices.

Fx implications

Although the comments could be considered encouraging as supply chain issues are the key to the latest inflation woes, the market reaction was muted on the release. The reason could be linked to the early Asian session and a light calendar.

Read: Gold Price Forecast: XAU/USD grinds higher towards $1,900 on softer yields

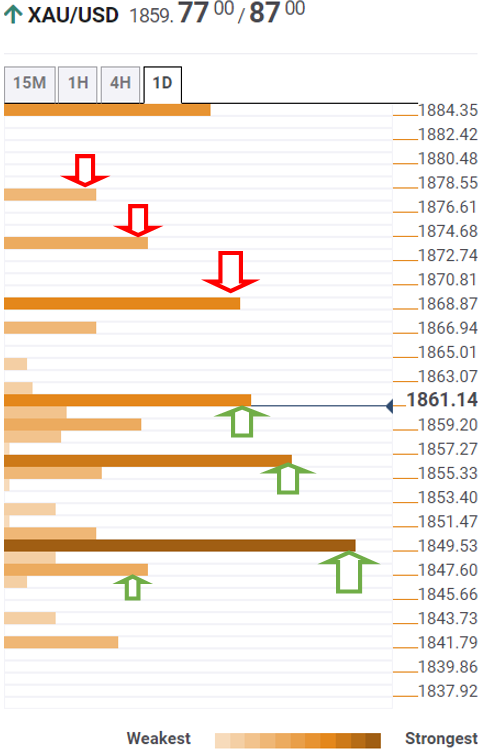

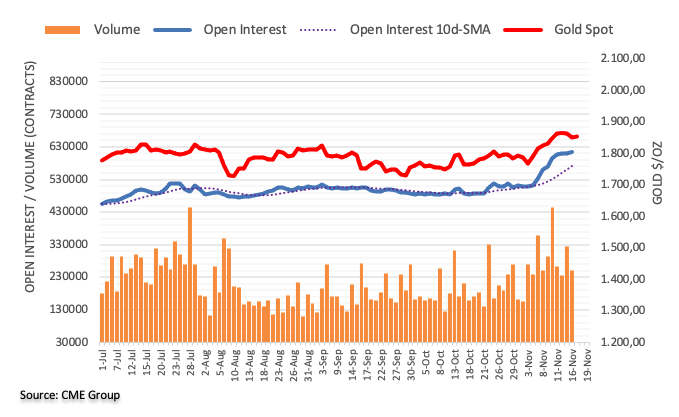

- Gold bulls keep reins inside weekly trading range at five-month high.

- DXY tracked yields to step back from multi-day low, allows bulls to tighten the grips.

- Mixed US data, Fedspeak favor price run-up amid inflation fears, US Jobless Claims, Fed policymakers’ speeches eyed.

- Gold Price Forecast: XAU/USD bulls eager to end consolidation phase, critical drop in yields eyed

Gold (XAU/USD) ends Wednesday’s North American trading session with the highest daily gains in a week, edges around $1,867 as Asian traders braces for Thursday’s bell.

The yellow metal cheers the heavy pullback of the US Treasury yields that weighed on the US Dollar Index (DXY) amid a lack of major catalysts and ongoing inflation chatters. Also favoring the gold buyers is the mixed US housing numbers and policymakers’ indecision over the next moves of the Federal Reserve (Fed).

That said, US 10-year Treasury yields retreat from the highest levels since October 26 to posting heaviest daily fall in a week while ending Wednesday’s US trading session around 1.59%, down 4.3 basis points (bps). DXY tracks bond yields and marks a first negative daily closing in three after refreshing the 16-month top during early Wednesday.

A light calendar and mixed US housing numbers allowed the traders to consolidate recent moves but the ongoing inflation fears and talks of the monetary policy tightening underpin gold’s safe-haven demand as the greenback steps back. US Housing Starts mark a surprise fall in October and the previous readings were also revised down while the Building Permits rose past expectations and prior during the stated period.

Fedspeak keeps trying to push back the inflation fears and tame the rate hike talks. However, the policy hawks aren’t defeated and hence challenge gold buyers. Recently, Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago said, “It will take until the middle of next year to complete the Fed's wind-down of its bond-buying program, even as the central bank remains 'mindful' of inflation.”

It’s worth noting that US President Joe Biden signaled that they have a lot to follow up on despite having a “good meeting” with China’s Xi after the first round of virtual meeting. Alternatively, US Treasury Secretary Janet Yellen announced the extension of the debt ceiling to December 15, versus the previous expiry of December 03, to underpin the risk-on mood earlier the previous day.

Amid these plays, US stocks closed lower and oil had to bear the burden of the US push to the key global energy players to release their strategic reserves.

Moving on, US Weekly Jobless Claims and Fedspeak could entertain gold traders amid a light calendar going forward. However, inflation and rate hike remain the key catalysts to watch.

Technical analysis

Gold remains on a front foot inside a weekly ascending trend channel. Also validating the bullish bias are the MACD signals, upward sloping but not overbought RSI line and sustained trading beyond 200-HMA.

However, sustained trading below a fortnight-long ascending trend line, around $1,887, restricts short-term advances of the metal. Adding to the upside filter is the upper line of the stated channel near $1,880 and the $1,900 threshold.

Meanwhile, a downside break of the channel’s support line, at $1,850, will defy the bullish formation but the gold sellers will need validation from the 200-HMA level of $1,843 to retake controls.

Following that, gold prices become vulnerable to revisit $1,830 and $1,813-12 support levels before directing the bears to the $1,800 psychological magnet.

Gold: Hourly chart

Trend: Further upside expected

Charles L. Evans, the chief executive officer of the Federal Reserve Bank of Chicago crossed wires, via Reuters, amid early Thursday morning in Asia. The policymaker sounds cautiously optimistic while saying, “It will take until the middle of next year to complete the Fed's wind-down of its bond-buying program, even as the central bank remains 'mindful' of inflation.”

Additional comments

We're going to be looking to see how much additional accommodation is boosting inflation.

If indeed that is the case, we'll be thinking about when the right time to start raising rates will be.

Then at some point we'll let the balance sheet's maturing assets roll off so that we get the size of the balance sheet back down south of where we are.

Gasoline prices are hitting household budgets, will be an economic headwind.

On the other hand, the stock market is high, financial conditions are good.

Optimistic will have a vibrant labor market in 2022.

Looking for inflationary pressures to recede, will be monitoring this well in the middle of 2022.

Would not be surprised if the unemployment rate is 4.5% by the end of 2021.

Had expected a more resilient supply chain than what we have seen.

FX implications

The Fed policymaker’s mixed comments weigh on the market sentiment and dragged the US equities down, also keeping the Treasury yields pressured, following the release.

Read: US 10-year Treasury yield pulls back below 1.60% after earlier hitting three week highs at 1.65%

“The Biden administration has asked some of the world's largest oil-consuming nations to consider releasing some of their crude reserves in a coordinated effort to lower prices and stimulate the economic recovery,” Reuters quotes anonymous sources to convey the news on late Wednesday night.

Key quotes

The Organization of the Petroleum Exporting Countries and allied producers including Russia have resisted calls from President Joe Biden to speed up the rate of their supply increases.

In recent weeks, Biden and top aides have raised the issue with close allies including Japan, as well as with China, the sources said.

White House spokesperson says no decision made on oil reserve release.

US tap of SPR (Strategic Petroleum Reserve) could either be in form of sale and/or loan from the reserve.

US release of oil from reserve needs to be more than 20 mln-30 mln barrels to get message to OPEC.

US asked India, South Korea to consider oil reserve release.

US did not ask European countries to release oil from reserves.

US officials asked large oil-consuming countries to release oil after pleas to OPEC to supply more failed.

FX implications

WTI crude oil prices take offers to refresh the lowest levels in seven weeks, around $77.85 at the latest, following the news.

Read: WTI drops to fresh daily lows under $79.50 despite bullish inventory report

- Despite that UK’s high inflation report increased the odds of a BoE’s rate hike, the British pound fell against the Japanese yen.

- UK’s Consumer Price Index (YoY) for October rose by 4.2%, higher than the 3.9% estimated.

- GBP/JPY: Failure at 154.00 could pave the way for a further correction towards 153 or below.

The British pound gave back some of its weekly gains, despite a higher than expected jump in UK’s inflation. The GBP/JPY declines 0.10%, trading at 153.96 during the day at press time.

On Wednesday in the European session, the Office for National Statistics (ONS) in the UK revealed that CPI for October rose by 4.2%, higher than the 3.9% estimated on a yearly basis, spurring expectations that the December Bank of England’s (BoE) monetary policy meeting, could witness the first rate hike by a major economy central bank, other than the Reserve Bank of New Zealand.

The GBP/JPY in the overnight session slid from 154.70 two-week tops, below the 154.00 as market sentiment dampened throughout the day. That hurt risk-sensitive currencies like the GBP, the AUD, and the NZD, favoring safe-haven peers like the Japanese yen.

Moving back to UK’s macroeconomic data, the Core Consumer Price Index (Core CPI), which excludes volatile items like food and energy for October, also beat estimations, increasing by 3.4%, higher than the 3% foreseen by economists. Wednesday’s macroeconomic data coupled with strong UK employment figures on Tuesday raised the odds of a rate hike by the BoE. That outcome would boost the prospects of higher prices for the British pound, as spreads between the UK and Japan would widen.

GBP/JPY Price Forecast: Technical outlook

The daily chart shows the long up-wick on Wednesday’s candlestick price action, which reached a daily top around 154.73, but later retreated beneath the 154.00 figure. Also, GBP bulls failed to break above the top-trendline of a bullish flag, exposing the 50-day moving average (DMA) at 153.42 as the first support level. If the pair extends its correction, the following demand zone would be 153.00, followed by the 100-DMA at 152.64.

Contrary, if GBP/USD bulls reclaim the 154.00 figure, that would expose the November 17 high at 154.73 nearby the top-trendline of the bullish-flag pattern, followed by 155.00, and then the June 24 high at 155.14.

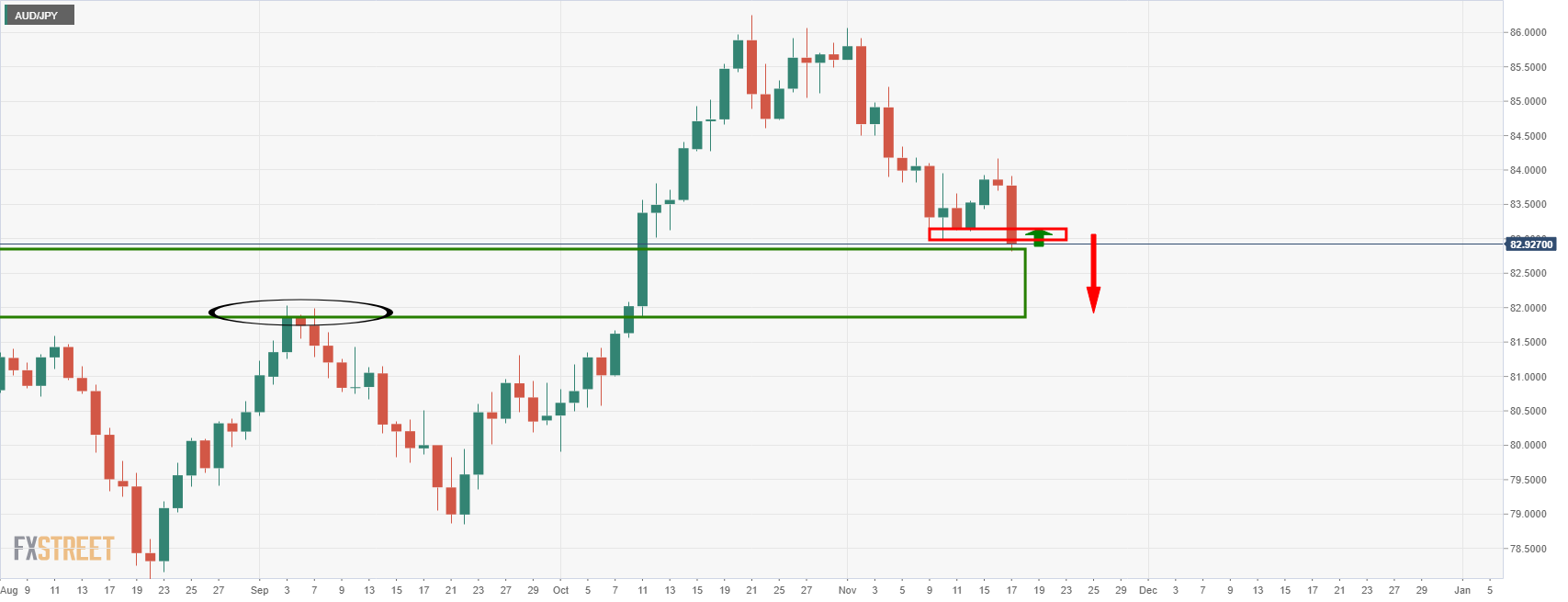

- AUD/JPY has been battered this week but there could still be plenty to go.

- The cross is a risk-off and high beta pair, so inflation risks matter.

AUD/JPY, the forex market's risk barometer, is meeting a critical level of daily support that if broken will potentially lead to the next waterfall sell-off. Inflation concerns are weighing on the pair and the Aussie is out of favour due to the central bank divergences. The following illustrates the latest price action and what could be in store next.

AUD/JPY daily chart

As illustrated, there is potentially a lot of room to go to the downside at this juncture. However, a correction could be in order first:

A correction to the old support near 83.16 is probable.

AUD/JPY H1 chart

A correction to the old support, as illustrated on the hourly chart above, has a confluence with the 38.2% Fibonacci level. This would be expected to hold and in doing so, attract bears which would result in further supply and a downside continuation in the price for the sessions ahead.

- US 10-year yields pulled back under 1.60% after hitting three-week highs at 1.65% earlier in the session.

- Investors may have to wait until Thanksgiving for a decision on the Fed chair to be announced.

US 10-year treasury yields pulled back from the three-week highs at 1.65% that it printed earlier in the session on Wednesday, eventually falling back below 1.60% for an on-the-day drop of about 3.5bps. Yields were down across the curve, though the decline was most pronounced in the belly. 2s fell 2bps to 0.50%, 5s fell 3.5bps to 1.23%, 7s fell 4bps to under 1.48% and 30s fell 2.5bps to back under 2.0%.

There was no one specific catalyst for the decline. Bond prices have been hit hard in recent sessions by positive US data surprises and seemingly took the opportunity on Wednesday amid the lack of tier one US data to recover some recently lost ground. As bond prices rise, yields fall. US housing data on Wednesday was mixed and did shift thinking on the current state of the US economy or the Fed policy debate. According to the White House, investors may have to wait until Thanksgiving (25 November) before a decision on the Fed chair nomination is announced.

Yields saw short-lived pop higher midway through the session in wake of a $23B 20-year bond auction at 1800GMT. The bonds sold at a high yield of 2.065%, 1.4bps above the When Issued (i.e. the 20-year yield prior to the start of the auction). That compares to a six-auction average tail of 0.5bps, which some traders took as a sign of weaker demand for the 20-year bond. 20-year yields continue to trade higher than 30-year yields. According to Reuters, the 20-year bond is suffering from relatively less demand than for other maturities since its reintroduction back in May 2020.

5-year break-even inflation expectations, calculated by subtracting the 5-year real yield from the 5-year nominal yield, fell on Wednesday. Having been as high as 3.31% on Tuesday, they currently trade at 3.24%. That’s because 5-year TIPS yields were unable to match the rally seen in nominal 5-year yields, instead trading within a -1.90-95% range and set to end the session flat.

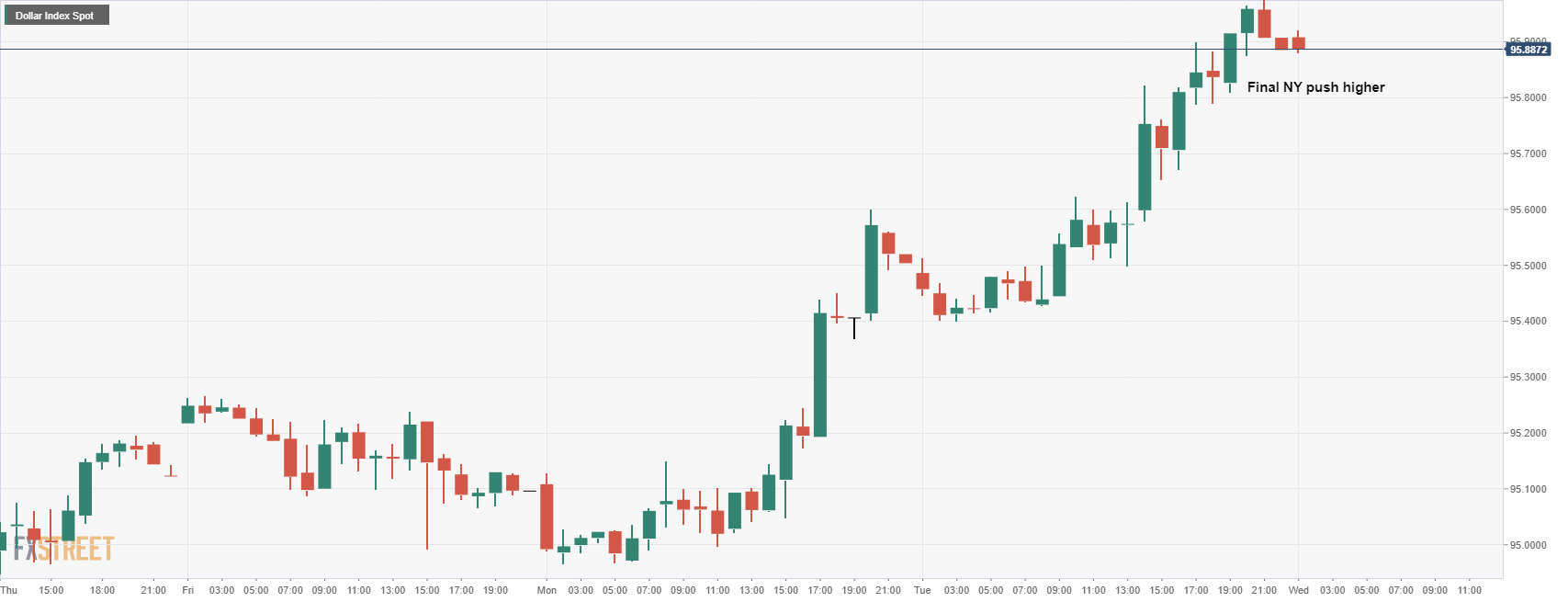

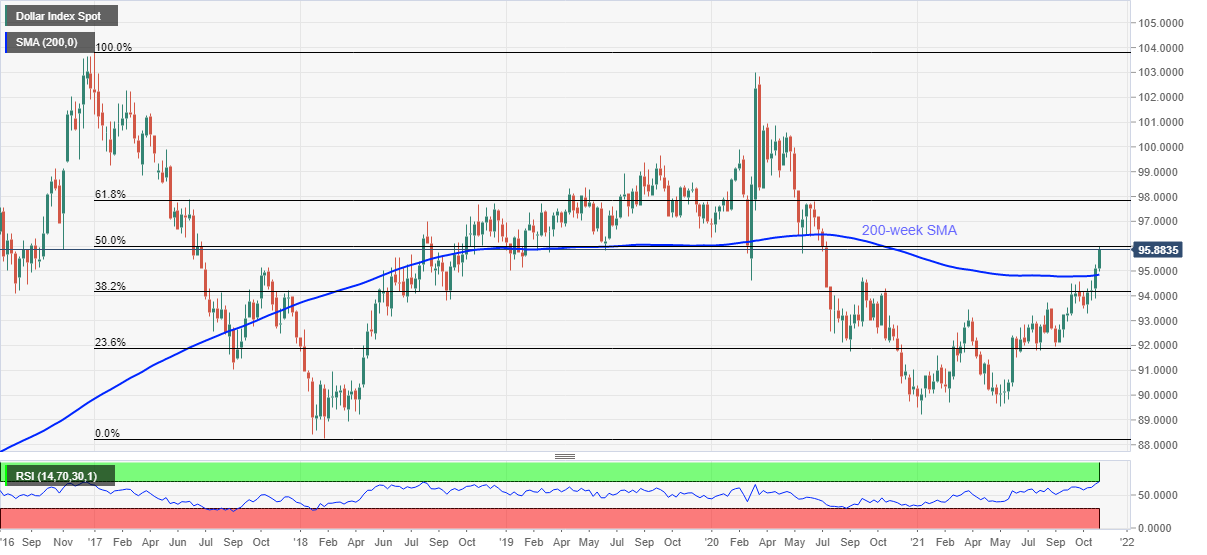

What you need to know on Thursday, November 18:

The US dollar’s recent charge higher ran out of steam on Wednesday, with the DXY falling back to the 95.80s by the end of the US session having printed fresh 16-month highs at 96.26 in early Asia trade. The White House said a final decision on the Fed chain nominee would be made before Thanksgiving (25 November, or next Thursday).

Mixed US housing data failed to spur the greenback higher as positive retail sales, regional Fed manufacturing survey and Consumer Price inflation data did in recent sessions. US yields pulled back a little, with the dropping 2bps back to 1.60%, eroding the dollar’s rate advantage somewhat.

JPY was the best performing G10 currency, gaining 0.6% versus the buck as US/Japan rate differentials tightened. USD/JPY fell sharply lower from earlier session highs close to 1.1500, the pair’s highest level since Q1 2017, to test 1.1400.

Pound sterling was the second-best performer, gaining 0.4% versus USD, sending GBPUSD through above a key downtrend that has been capping the price action since the end of October. GBP/USD’s gains have been halted for now at the 1.3500 level, but technicians will eye a move towards the next key resistance at 1.3600.

UK inflation data was hotter than expected, with the Consumer Price Index rising at its quickest YoY pace in more than 10 years at 4.2% in October, supporting hawkish BoE bets and the pound. Brexit newsflow has also been positive, with the UK and EU reportedly on the cusp of agreement on the movement of medicine in and out of Northern Ireland.

Consumer Price Inflation data was also released out of Canada and also showed that price pressures growing there too, though this did not come CAD’s aid, which got battered on Wednesday amid a sharp drop in crude oil prices. USD/CAD hit fresh seven-week highs above 1.2600, up 0.4% on the day.

But the loonie wasn’t the worst performing G10 currency on the day. That title went to AUD, with AUD/USD losing 0.6% and hitting fresh six-week lows under 0.7260 as the pair continues to head lower within a bearish trend channel. Subdued Q3 Australian wage growth data supported the RBA’s dovish stance and undermined the case for rate hikes next year, weighing on the Aussie.

EUR/USD was subdued having recovered from its earlier session plunge to 16-month lows at 1.1260 and was set to end the day flat slightly above the 1.1300 level. US equities were mixed, with the S&P 500 dropping back modestly from 4700, but remains very close to the record highs it printed above 4720 earlier in the month.

In EM FX, the standout mover was the lira, which continued to plunge. USD/TRY rose to fresh record levels above 10.60, a gain of 2.6% on the day, as investors continue to dump the lira amid concerns that the CBRT is sleep walking into hyper inflation. The bank is expected to cut interest rates by another 100bps on Thursday to 15%, despite inflation nearing 20% in October.

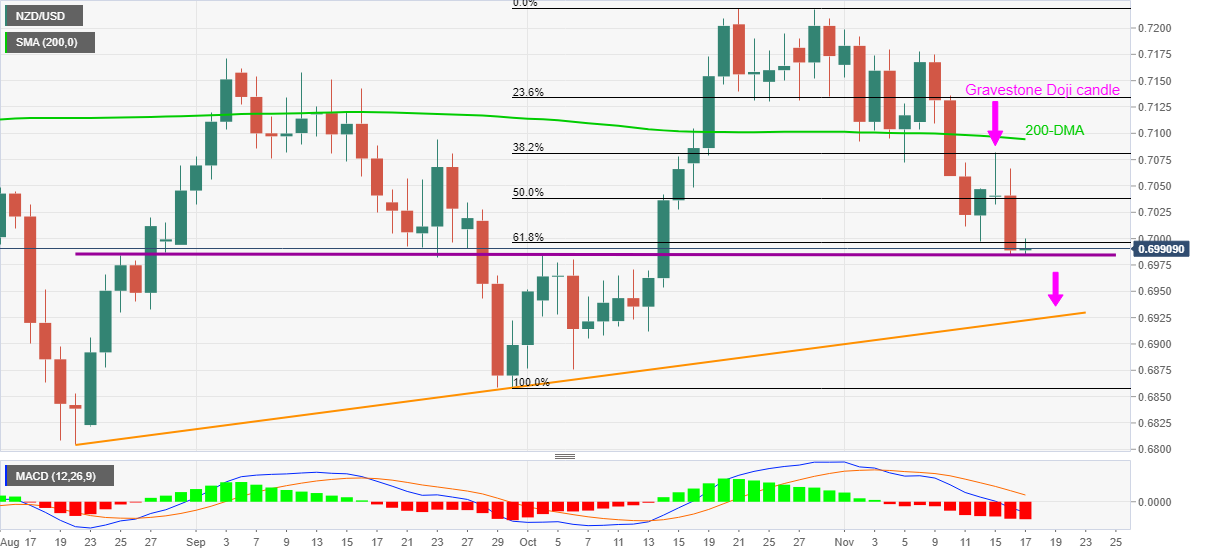

- The kiwi was little changed by the end of the North American session.

- NZD/USD will now become a significant focus in forex markets.

- The RBNZ Survey of Expectations for Q4 is released today.

NZD/USD is under pressure in the close of Wall Street as the US dollar attempts to correct some of the losses on the session. The kiwi, however, is little changed in the absence of domestic drivers so far this week. At the time of writing, the pair trades flat at 0.6993 and has stuck to a tight 0.6979 / 0.7020 range.

The day was slightly risk-off which weighed on the higher beta currencies. Equities were down on the day due to concerns over inflation following the UK's stronger Consumer Price Index coupled with the US's earlier in the week.

The mighty US dollar drifted to the downside and ducked below a 16-month high that was printed on Tuesday. Nevertheless, it can be expected to remain elevated and money markets are now pricing in a high probability of a Fed rate increase in June, followed by another in November. CME data suggest a 50% probability of a 25 bps rate hike by July 2022.

The dollar index, DXY, which measures the currency against a basket of six rivals, was down around 0.08% into the close on Wall Street. It was trading at 95.843 at the time of writing and within the day's range of between 95.734 and 96.241. Yesterday's high was 96.266, the best level marked since mid-July 2020. The dollar's rise has also pushed broader FX market volatility higher, with one gauge rising to an 8-month high of nearly 7%.

Time to focus on NZD

''This is all part and parcel of the volatility that we have seen as global markets grapple with turning points and rising inflation, and locally ahead of next week’s RBNZ MPS,'' analysts at ANZ Bank said.

''As the inflation theme takes hold elsewhere (eg UK CPI was stronger overnight), that is seeing a relative re-pricing of the NZD, potentially fanning headwinds. In the wake of a slew of bumper NZ data releases, upside surprises may now be harder to come by.''

This brings us to today's key even. The RBNZ releases the Q4 Survey of Expectations. The headline figure here is the 2-year-ahead inflation expectations measure – which is watched closely for signs that expectations are drifting away from the 2% target.

''The RBNZ’s survey usually lines up well with our own Business Outlook – and if that continued in Q4, then we should see a sizeable uptick in expectations,'' the analysts at ANZ Bank explained.

''But with inflation running at 4.9% (and we think it’ll flirt with 6% in Q1), an increase wouldn’t be too much of a surprise. The real test will be if the 5- and 10-year-ahead measures remain at 2%, since that’s an indication of whether people believe the RBNZ will be successful at getting surging inflation under control. The Survey is the final key data the RBNZ gets before next week’s MPS.''

- EUR/USD sellers, take a breather before resuming another leg-down in the pair.

- EUR/USD recovered amid greenback weakness across the board, blamed on lower US bond yields.

- ECB’s members reinforced the dovish monetary policy stance by the central bank.

The euro trims some weekly losses in the day, gains 0.04%, trading at 1.1318 during the New York session at press time. The shared currency recovers some ground after dipping to a new year-to-date low around 1.1263, mainly driven by US dollar strength as the US T-bond benchmark note rose close to 1.65%, but as of writing, clings to 1.60% falling almost five basis points.

Meanwhile, the US dollar seems to be affected by falling yields. The US Dollar Index (DXY), which measures the greenback’s performance against a basket of six rivals, slides 0.12%, down to 95.79, retreating from 16-months highs, near the 96.00 figure.

The weakening of the US dollar comes despite that the Federal Reserve is tightening its monetary policy. Further, money market futures have fully priced in a rate hike by July of 2022 and increased the odds of another adjustment to the US interest rate by the end of 2022. Therefore, Wednesday’s move could be viewed as a correction before resuming the undergoing downtrend.

Data-wise, in the Eurozone, inflation for October rose by 4.1% on a yearly basis, in line with expectations. The month-over-month reading, which significantly moves the pair, came at 0.8%, also in line with estimations, though it failed to trigger any reaction in the EUR/USD.

Across the pond, the US dollar economic docket features housing data. Building Permits for October rose to 1.65M, higher than the 1.638M expected by analysts. Contrarily, Housing Starts for the same period slowed their pace to 1.52M, lower than the 1.576M foreseen.

ECB policymakers expressions about Eurozone CPI above 4%

Once Eurozone CPI data was known, some policymakers crossed the wires. Olli Rehn, an ECB Governing Council Member, said that the price pressures would ease in the next year. In the same tone, Bruno Le Maire, French Finance Minister, reinforced the “temporary” thesis, saying that it is transitory, but added, “we need to remain vigilant on this.”

Contrarily, adopting a more neutral stance, ECB Governing Council Member and head of the National Bank of Belgium Pierre Wunsch said that “all of us need to be patient, but we shouldn’t exclude that the inflationary forces are quite strong and at some point will require a reaction.”

- AUD/USD extends losses despite a drift lower in the Us dollar.

- RBA uber dovishness finally kicks in and sends AUD off a cliff.

AUD/USD has fallen to fresh cycle lows to meet daily structure in the 0.7260s, sliding from a high of 0.7305. The perfect storm came this week when a stronger US dollar coupled with a dovish Reserve Bank of Australia and hawkish bets on the Federal Reserve fermented

On Wednesday, UK and US equities were softer as well. AUD, as a higher beta currency, suffered as a consequence due to the inflation concerns that are swelling in financial markets. In the same respect, UK inflation came in stronger than expected while supply constraints weighed on housing starts in the US.

Meanwhile, the US dollar has drifted lower from a new 16-month high that was printed on Tuesday as markets position for rate increases from the Federal Reserve. Money markets are now pricing in a high probability of a Fed rate increase in June, followed by another in November. CME data suggest a 50% probability of a 25 bps rate hike by July 2022.

The dollar index, DXY, which measures the currency against a basket of six rivals, is down around 0.13% at the time of writing, trading at 95.788 within the day's range of between 95.734 and 96.241. Yesterday's high was 96.266, the best level marked since mid-July 2020. The dollar's rise has also pushed broader FX market volatility higher, with one gauge rising to an 8-month high of nearly 7%.

RBA uber dovishness

As for the RBA, markets had been betting against the central banks dovish rhetoric. However, the RBA Board minutes and Governor Lowe’s speech were uber dovish and sent the Aussie off a cliff. Key takeaways of these events, courtesy of analysts at ANZ Bank, are as follows:

The RBA’s estimate of the neutral rate as being 2.5% or higher;

The RBA’s willingness to “look through” inflation of 3% or more if it is not accompanied by stronger wages growth;

The implications of a flat Phillips curve when the RBA does start to lift the cash rate; and

Lowe’s weaker wording around a rate hike in 2024 as “still plausible.”

- USD/CAD hit seven-week highs above 1.2610 in recent trade, though his since slipped back a few pips.

- The loonie is suffering from a drop in oil prices, with rising Canadian inflation failing to come to its aid.

USD/CAD hit fresh seven-week highs at 1.2610 on Wednesday, marginally eclipsing last week’s high 1.2604 high. The pair has since dropped back from session extremes a little. Crude oil markets have been under pressure in recent hours, with WTI and Brent both now down by more than $2.0 on the day each and this has been weighing on the oil price-sensitive loonie. Technicians appeared to see an earlier dip back towards the 50-day moving average in the 1.2530s as a buying opportunity. If the pair can break cleanly above 1.2600, then technicians may target resistance at 1.2650, the 6 October high.

CAD’s losses of about 0.25% on the day versus the US dollar make it the second-worst performing G10 currency on the day. Only the Aussie, down about 0.5% on the day versus the buck, is fairing worse. The loonie is underperforming despite the latest Canadian Consumer Price Inflation report confirming that price pressures increased in October earlier in the session. For reference, the headline rate of CPI rose to its highest level since 2003 at 4.7%, up from 4.4% in September. That was in line with median economist expectations, but the negative CAD reaction today suggests that market participants might have been expecting a positive surprise, as was seen in UK inflation data this morning and in the US last week.

In fairness, the Bank of Canada’s core measures of inflation did surprise to the upside. The core measure was up 3.8% YoY, above expectations for a 3.5% rise, while the core measure rose 0.6% MoM, above expectations for a 0.4% jump. Moreover, analysts expect inflation to rise further in the months ahead amid recent disruptions to the port in Vancouver, which has been impacted by deadly flooding and landslides. Analysts at Scotiabank said they see headline inflation surpassing 5.0% by the end of the year. Regarding what all of this means for the BoC, according to Canada-based TD Securities, “this doesn’t change anything” as it was broadly in line with the bank's forecasts.

- GBP/USD bulls stampede on BoE rate expectations.

- US dollar drifts lower following yesterday's spike to fresh cycle highs.

At 1.3490, GBP/USD is trading near to the highs of the day that came in just shy of 1.3495. The pair has moved from a low of 1.3396 and climbed to a one-week high after data showed UK inflation surged to a 10-year high last month.

The pound is firmer across the board due to the expectations of an interest rate hike as early as next month following a week, so far, of better than expected data. On Tuesday, for instance, UK data showed Britain's job market withstood the end of the government's furlough scheme.

Subsequently, the Bank of England is expected to join the Reserve Bank of New Zealand as one of the first major central banks to raise rates since the coronavirus pandemic hit the global economy. The markets are now pricing a 60% chance that the BoE will raise rates at a Dec. 16 meeting.

US dollar drifts below 16-month highs

Meanwhile, the US dollar has drifted lower from a new 16-month high that was printed on Tuesday as markets position for rate increases from the Federal Reserve that is now seen hiking rates by as early as mid-2022. The dollar index, DXY, which measures the currency against a basket of six rivals, is down around 0.13% at the time of writing, trading at 95.788 within the day's range of between 95.734 and 96.241. Yesterday's high was 96.266, the best level marked since mid-July 2020.

- USD/BRL has chopped either side of 5.50 on Wednesday and is currently broadly flat.

- The pair has seen a choppy reaction to new government economic forecasts which raised concerns about stagflation.

USD/BRL is currently trading flat on the day close to 5.50, with the pair having rallied from earlier session lows of just under 5.47. The Brazilian real took encouragement earlier in the session amid reassuring commentary from the Economy Ministry that the government’s spending plans continue to respect the constitutional spending cap, something which it sees as key. The Brazilian real has been weighed in 2021 by concerns about Brazil’s fiscal sustainability amid fears that President Jair Bolsanaro might be tempted to overstimulate the economy ahead of the October 2022 Presidential election.

However, the Economy Ministry also unveiled new fiscal and economic forecasts on Wednesday which seemed to weigh on sentiment amid stagflation fears. GDP growth forecasts for 2021 and 2022 were downgraded to 5.1% and 2.1% respectively (from 5.3% and 2.5%). Meanwhile, inflation forecasts (as measured by the IPCA consumer price index) were lifted higher to 9.7% from 7.9% for 2021 and to 4.7% from 3.75% for 2022.

The Economy Ministry cited higher interest rates as the main reason for the GDP downgrade. For reference, the Brazilian Central Bank (BCB) has been hiking rates aggressively in recent months as it seeks to get a handle on inflation that is not north of 10%, more than 6.0% above the bank’s 3.75% inflation target for 2021. In October, the bank hiked interest rates by 150bps to 7.75% and signaled further hikes would be forthcoming.

From a technical standpoint, things are looking bullish for USD/BRL. The pair this week broke to the north of a downtrend that had been capping the price action for much of November. This opens up the possibility of a run back towards to 21-day moving average at 5.55 and then the November high at 5.70 beyond it.

- The S&P 500 is losing 0.33%, at 4,684.81, as Target plunges.

- The Dow Jones Industrial follows the S&P lead, down 0.50%, at 35,965.49.

- The heavy-tech Nasdaq Composite rises 0.19%, up to 16,338.50, led by Apple and Tesla.

The S&P 500 retreats from Tuesday’s highs, down some 0.33%, currently at 4,684.81 during the New York session at the time of writing. The market mood is in risk-off mode, portrayed by falling US major equity indices. The Dow Jones Industrial Average (DJIA) also falls 0.50%, at 35,965.49, while the Nasdaq Composite rises 0.19%, up to 16,338.50.

On Wednesday, the US economic docket featured housing data, which came mixed. Building Permits for October rose to 1.65M, higher than the 1.638M expected by analysts. Contrarily, Housing Starts for the same period slowed their pace to 1.52M, lower than the 1.576M foreseen.

Once the data was released, it seemed that traders took some risk off the table as construction slowed down, implying that high material prices and labor shortages are to be blamed. Meanwhile, the tech-heavy Nasdaq rise is led by a rally in Apple and Tesla.

Sector-wise, consumer discretionary, and health advance 0.63%, and 0.26%, respectively. On the other hand, the main losers are energy, financials, and industrials, losing 1.42%, 1.26%, and 0.88% each.

In the bond market, the US 10-year benchmark note falls one basis point, sits at 1.616%, undermining the US Dollar Index, which falls 0.12% in the day, at 95.80.

S&P 500 Price Forecast: Technical outlook

-637727676837672481.png)

The daily chart depicts the S&P 500 has an upward bias, confirmed by the daily moving averages (DMA’s) well located below the index value, with an upward slope. Nevertheless, the Relative Strength Index (RSI) is at 70, well within overbought conditions, suggesting that a lower correction could happen.

In the case of a correction, the first support would be the October 26 high at 4,598.53 that confluences with the 78.6% Fibonacci retracement as the first support level. In the outcome of a further correction, the October 27 low at 4,553.53 would be the next demand zone.

According to the Telegraph, the UK and EU are reportedly closing in on an agreement to protect medical supplies being sent to Northern Ireland, which would mark their first deal in talks over the Northern Ireland protocol, breaking recent deadlock. The Telegraph also reported that the EU had backed down from threats to retaliate against the UK over Article 16.

UK Brexit Minister Lord David Frost and his EU counterpart Maros Sefcovic are scheduled to meet for talks on Friday. Sefcovic had in the past said getting a deal on medicines was "low hanging fruit" that could create momentum for broader talks.

Market Reaction

GBP/USD has recently pushed to session highs in the 1.3490s and the positive news on the Brexit front, which will embolden hopes for a deal before the year's end, may push the cross above 1.3500. GBP has been broadly underpinned on Wednesday by hotter than expected UK inflation data.

- USD/RUB has pulled back sharply from Tuesday’s multi-week highs above 73.50 and is back below 72.50.

- While geopolitics has weighed on the rouble recently, broader Russian fundamentals remain bullish for RUB, argue strategists.

USD/RUB has fallen sharply this Wednesday, reversing the entirety of a 0.8% rally on Tuesday that saw it at one point hit 73.50, its highest levels since mid-September. At present, the pair is trading just to the south of 72.50, though for now is being prevented from pressing any lower by resistance just above 72.00 in the form of the early November highs.

Following a prolonged decline during the summer months/early autumn that saw USD/RUB fall from highs above 75.00 to lows October lows just above 69.00, USD/RUB has been on the front foot in recent weeks. Part of that has to do with a broad strengthening of the US dollar amid a run of strong US inflation and economic data releases that has encouraged USD STIR markets to up their hawkish bets.

But part of the recent rally also has to do with a renewed build-up of risk premia in the RUB as geopolitical tensions mount. The US last week warned the EU that it was worried that Russia might be gearing up for a military intervention into Ukraine. That sent USD/RUB from around 71.50 to above 73.00. There are also concerns about the migrant crisis on the Belarusian/EU border (which Russia is seen as enabling given the country is Belarus’s key ally) and any fallout following a recent Russian anti-satellite missile test which was widely condemned.

Following news earlier in the week that German regulatory agencies had suspended the approval process for the Nord Stream 2 pipeline, European gas prices have spiked. According to German government sources, the suspension could delay the opening of the pipeline until March, after the winter peak of European gas demand. Surging gas prices are likely lending a hand to the energy export-dependent Russian rouble.

Energy prices aside, it seems that most analysts remain bullish on the rouble’s long-term prospects. Matthew Ryan, senior market analyst at Ebury, told Reuters on Wednesday that he was bullish on the rouble because of Russia's solid macro fundamentals and a rising differential between the Central Bank of Russia (CBR) and most other central banks. The CBR, which has hiked rates from record lows of 4.25% to 7.5% already this year to reign in inflation, may hike rates further, and said on Wednesday that a wide range of options would be available to its at its next meeting.

Data released on Wednesday showed inflation in Canada reached the highest level in 18 years. Analysts at the National Bank of Canada still believed the Bank of Canada will hike interest rate probably in April of next year.

Key Quotes:

“The Canadian CPI print for October was in line with the relatively high consensus expectations. As a result, annual inflation reached 4.7%, its highest level in 18 years. Gasoline prices jumped to a record high, registering another sharp increase of 5% during the month. Shelter prices were also propelled by the surge in energy prices. Consistent with the rise in food commodity prices earlier this year, food prices continued to post strong advances in October.”

“The average of the central bank's three preferred measures of annual inflation remained unchanged at 2.7%, above the mid-point of the central bank’s target range of 1 to 3 percent. These annual figures understate the recent trend for core inflation.”

“The central bank already expected high headline inflation for Q4, so this morning's print does not change our view that they will not raise the policy rate sooner as believed by the market. The Bank of Canada telegraphed a first hike in Q2 or Q3 in its last communication, and we continue to believe that April is the most likely scenario.”

- XAU/EUR bulls attack the €1,650 area for the second day in a row.

- XAU/EUR found strong support around the €1,630 area.

- German 10-year real yields keep falling below -2.0%, boosting gold prospects versus the euro.

Gold (XAU/EUR) against the EUR advances during the New York session, up 0.78%, trading at €1,648 at the time of writing. On Tuesday, the eight-day rally was capped as XAU/EUR printed its first close in the red, at €1,636, a tad above the top-trendline of Andrew Pitchfork’s indicator.

In the overnight session, XAU/EUR dropped to the 50-hour simple moving average (HSMA) at €1,634 but found bids around that area that pushed the pair towards a renewed test of the €1,650 year-to-date high, settling at current levels abovementioned.

German 10-year real yields keep falling below -2.0%, boosting gold prospects versus the euro

At press time, the German 10-year Bund yield is flat at the session at -.02405, while the German 10-year real yields are falling, down to -2.066, acting as a headwind for the XAU/EUR.

Earlier in the New York session, ECB’s Governing Council member Isabel Schnabel said that the rise in inflation expectations is a welcome development, per Reuters. She added that the ECB would continue buying bonds at a low level, signaling that a rate hike is not imminent. Hence, it reinforced the dovish posture by the European Central Bank (ECB).

Therefore, XAU/EUR outlook looks positive for the non-yielding metal as the German 10-year real yields keep pushing lower. In fact, that would also hurt the euro’s prospects against the US Dollar as bond spreads widen, extending its fall towards the 1.1300 figure and potentially lower.

XAU/EUR Price Forecast: Technical outlook

Daily chart

-637727629082511700.png)

Despite that XAU/EUR had a down day on Tuesday, the uptrend keeps intact, as long as the daily moving averages (DMA’s) reside below the spot price and if gold keeps trading above the €1,567 price level. Further, Tuesday’s price action formed a spinning-top, closing below Monday’s close, but it failed to break below Andrew Pitchfork’s top-trendline indicator, finding support around the €1,630 region.

The Relative Strength Index (RSI) keeps at overbought levels at 78, though it is flattish, suggesting that gold might consolidate before trying to break above €1,650 for the first time in the year.

In that outcome, the top of Andrew Pitchfork’s channel would be the first support area, around €1,630. Also, a break below the abovementioned could open the door for a further correction, towards November 13, 2020, high at €1,604.

- WTI has turned lower in recent trade, breaking out to fresh daily lows despite a bullish inventory report.

- The report has perhaps been interpreted as increasing the likelihood that the Biden administration taps the SPR.

Front-month futures of the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, have traded on the back foot in recent trade. WTI has broken out to fresh daily lows under the $79.50 level and is now eyeing a test of earlier weekly lows in the $79.30 region. Should that level break, a run towards monthly lows at $78.30 may be in store.

A more bullish than expected official EIA US crude oil inventory report, released recently at 1530GMT, failed to substantially alter the mood in crude oil markets. For reference; headline crude oil stocks posted a surprise draw or 2.1M barrels in the week ending on 12 November versus expectations for a build of just under 1.4M barrels. API inventory data released on Tuesday had pointed to a weekly build of 655K barrels. EIA data showed that gasoline inventories fell by 700K barrels (versus forecasts a 575K barrel draw). Distillate stocks posted an 824K barrel draw (versus forecasts for a 1.229K barrel draw).

Typically, a bullish EIA inventory report would trigger upside in crude oil prices, as it suggests stronger than expected demand for oil and its products. But analysts have argued that larger than expected inventory draws right now might encourage the Biden administration to release crude oil reserves from the US Strategic Petroleum Reserve. The administration has been threatening to do so since the start of the month when OPEC+ refused to lift output by more than 400K barrels per day in December, given their worries about high US gas and energy prices. According to the Chinese press, the US administration has asked China to release crude oil reserves as part of its talks with the US on economic cooperation. US lawmakers are divided over whether or not the SPR should be tapped, with Democrat House Majority Leader Steny Hoyer coming out in disagreement with Senate Majority Leader Chuck Schumer’s call for the SPR to be tapper over the weekend.

- Mexican peso holds a negative bias against the US dollar.

- USD/MXN moving in a new higher, testing upper limit.

- Key support is seen at 20.30/35, horizontal line and trendline.

The USD/MXN is falling marginally on Wednesday after rising during two consecutive days and after posting on Tuesday, the second-highest close of the current month. The stronger US dollar across the board continues to be the key driver in the cross.

Key moving averages pointing north, technical indicators mixed and far from extreme readings, are tilted to the upside in USD/MXN. Also supporting the bullish outlook is price holding above the 20, 55 and 100 simple moving averages and above a short-term uptrend line that today stands at 20.30.

The positive outlook would be negated with a slide under 20.30 that would target initially the 20.20 area and below the October low at 20.10.

On the upside, the critical resistance is seen at around 20.85/90. A consolidation above would clear the way for a test of 21.00; above the next strong resistance is located at 21.15.

USD/MXN daily chart

-637727588198710703.png)

Economists at ING believe the Riksbank will not meet market expectations of tightening in 2022. Still, RB is expected to take a hawkish stance later next year, which should drive the EUR/SEK pair to 9.65, in their opinion.

Waiting for the Riksbank’s delayed hawkish turn

“The market is currently pricing in around 50bp of monetary tightening by the Riksbank in 2022. We think such hawkish expectations are unwarranted given a relatively subdued medium-term inflation outlook in Sweden. We expect no hikes before 2023, and we think the RB will push back against the market’s hawkish bets in November and possibly until early-2022. Still, tightening plans elsewhere and a robust domestic story should force a hawkish shift in communication by 2H22.”

“Our trade team expects global demand to stay strong, while supply strains may keep hindering the trade rebound in 1H22 before easing in 2H22. We expect a YoY increase in global trade by 2.9% in 2022. More than half of Swedish exports are intra-EU and while we do not see eurozone growth exceeding expectations, we still forecast a decent 3.9% YoY for 2022, which should keep supporting the Swedish export industry.”

“We expect SEK gains to prove more moderate. We target 9.65 in EUR/SEK for the end of 2022.”

The Norwegian krone has already benefitted in the past few months from being a large energy exporter, but the positive implications for the Norwegian economy are likely there to stay. Therefore, analysts at ING expect the EUR/NOK to edge lower towards 9.50.

Still a bright outlook for the krone

“We must remember that, unlike other exporters, Norway’s low hydro reserves makes it prone to a sharp rise in domestic energy costs. There is a non-negligible risk that the country may face a situation where higher costs of living may coincide with wider room for wage increases as investments rise and the job market tightens; the result could be a considerable heat-up of the economy and inflation.”

“We think the growth and inflation outlooks will continue to support the Norges Bank’s tightening plans, which currently imply three hikes in 2022 after the already announced hike in December. We think the risks are skewed towards the central bank overdelivering (four hikes in 2022). Still, even with three hikes next year, a policy rate at 1.0% means that NOK will be at the forefront of benefitting from any revamp of carry trade interest in G10.”

“Our bullish views on NOK rely on the assumption that global tightening cycles will not generate a persistently risk-averse environment in markets next year. Despite this year’s extended downtrend, EUR/NOK is still around 7% overvalued according to our medium-term BEER model, and we see room for a move to 9.50 by 4Q22.”

- USD/JPY slides from year-to-date tops near 115.00, as USD bulls take a breather.

- Money market futures have fully priced in a Fed 25 basis point rate hike by July 2022.

- The US 10-year Treasury yield and the US dollar are flat in the session, thus strengthening the Japanese yen.

The USD/JPY struggles at the 115.00 figure, is down 0.24%, trading at 114.55 during the New York session at the time of writing. Sentiment-wise, the market is a mixed bag, as European stocks fluctuate between gainers and losers. Also, US equity indices seem poised to open down, as futures trade in the red at press time, as investors worried about early rate hikes by the Federal Reserve on robust economic data.

In the overnight session, the USD/JPY attempted an attack towards the 115.00. However, it did not have the strength to overcome strong resistance, thus retreating towards Wednesday’s daily central pivot point at 114.57, where it found some buying pressure, jumping towards the 114.70 area.

The US Dollar Index, steady around 95.90, USD bulls prepare an attack towards 96.00

In the meantime, money markets futures have fully priced in a 25 basis point rate hike by the US central bank by July 2022, one month after the Federal Reserve stops buying assets. After a 30-year spike in the US CPI, investors seem convinced that the Federal Reserve will need to act fast, to curb elevating prices, reflecting it, in the bond market. Further, the US 10-year yield advances one basis point, sitting at 1.64%, acting as a headwind for the USD/JPY.

The US Dollar Index, which measures the buck’s performance against a basket of its peers, is flat in the day, at 95.90, underpinned by the US 10-year benchmark note.

Putting this aside, on the macroeconomic front, the Japanese economic docket, exports growth decelerate to an 8-month low, as demand for Autos slowed down, as global supply constraints hit Japanese manufacturers. According to sources cited by Reuters, “while carmakers are planning ‘revenge production’ in November and December, clouds still loom - semiconductor shortages will last until year-end at least, and no one knows if carmakers’ plans to avert the impact of chip shortages by adjusting their supply chains would succeed.”

In the US economic docket, housing data came mixed, although it seems to be ignored by investors. Building Permits for October rose to 1.65M, higher than the 1.638M expected by analysts. Contrarily, Housing Starts for the same period slowed their pace to 1.52M, lower than the 1.576M foreseen.

Therefore, the USD/JPY leans in the dynamics of the US bond yields, which act as a tailwind for the pair. If the 10-year benchmark note, remains unchanged, that could be positive for Japanese yen bulls, pushing the pair down. However, USD bulls seem to be pausing before launching an attack towards the 115.00 figure.

- EUR/GBP has printed fresh 21-month lows in recent trade under 0.8390.

- The pair has been weighed on Wednesday by strong UK inflation data.

- But the euro is also suffering from its own problems.

Over the last few hours, EUR/GBP has reversed lower, with the pair crossing back below the 0.8400 level in recent trade and printing new 21-month lows under the 0.8390 level. The pair has been trading heavily on Wednesday due to a hotter than expected UK Consumer Price Inflation (CPI) report for October. Headline UK CPI rose to 4.2%, above expectations for a rise to 3.9%. Analysts broadly agreed that the inflation data supported the case for a BoE rate hike in December. According to Lloyds, though CPI “is still generally expected to start to ease back from H2 2022 onwards... an extended period of above-target inflation and indications that the labour market remained strong after the furlough scheme ended means that a Bank of England interest rate rise next month remains in play”.

After a second consecutive day of positive UK data surprises (recall that jobs data released on Tuesday was broadly seen as better than expected), traders are clearly viewing EUR/GBP as a sell on rallies. That likely explains why EUR/GBP early European session to attempt to rally back towards the mid-0.8400s was faded. Now that the pair has cleared the previous year-to-date low from back in October at just above 0.8400 to the downside, technicians will be asking what is next. The next target for the bears is likely to be the late 2019/early 2020 lows just below 0.8300.

Euro weakness

Traders and analysts are noting the vulnerability of the euro on multiple fronts. Firstly, ECB rhetoric remains resolutely dovish, meaning the ECB monetary policy normalisation timeline remains well behind that of the Fed and BoE’s. Secondly, Covid-19 infections and hospitalisations are rising sharply in the Eurozone, prompting some countries to reimpose restrictions on day-to-day life, risking an economic slowdown in Q4 2021 and Q1 2022. Finally, European gas prices (the bloc is dependent on imports) are surging following the news of a delay to the approval process of the Nord stream two pipeline, which is now not expected by analysts to start pumping gas until the end of winter, after demand has peaked.

Chile’s peso has suffered. Despite likely aggressive hikes from the local central bank, economists at ING expect USD/CLP to press 875/900 as copper turns lower.

Peso needs some assistance

“Front and centre now is the first round of the presidential election to be held on 21 November. Most recent opinion polls point to the left-wing threat of Gabriel Boric fading and conservative candidate Jose Kast likely to win in a run-off on 19 December. That could provide a little more stability to the peso, as could any sign that Congress is blocking any further release of private pensions.”

“The CBC has been aggressive in its tightening and is talking about bringing the policy rate to neutral more quickly than expected. Where is neutral? The policy rate was 3.00% pre-pandemic, but we suspect that neutral now could be closer to the 5% area seen a decade ago.”

“Our commodities team warns that copper could average closer to the $8,650/MT area through 2022 – clearly a negative for the peso.”

“At this stage, we are concerned for the peso’s prospects next year and a stronger dollar/higher US rate environment could see USD/CLP pressing 850/900.”

As economists at ING note, the combination of loose fiscal policy and tight monetary policy has typically not been a positive one for the Brazilian real. They see USD/BRL heading towards 6.00 as the left makes a challenge for control into October.

Policy mix undermines BRL

“It looks as though Brazil’s post-pandemic policy mix could be heading in the wrong direction. This can be categorised as a pre-election government looking to find loopholes in the constitutional spending cap and deteriorating fiscal risk premia forcing the central bank into even more aggressive rate hikes.”

“Brazil holds presidential elections on 2 October 2022 with a run-off on 30 October, if necessary. Candidates have yet to declare, yet it seems that President Bolsonaro could be facing a challenge from former President Lula. Latest opinion polls favour Lula in a run-off. The previous Lula administration was synonymous with unfunded government spending and Brazil’s loss of investment grade status. Brazil’s fiscal credibility looks as though it will come under pressure through 2022.”

“Given a strong dollar environment and elections in 2022, we favour USD/BRL trading towards the 6.00 area through the year.”

- EUR/JPY recorded new lows near 129.40 earlier on Wednesday.

- The strong mood in the dollar keeps weighing on the single currency.

- US 10y yields trade without a clear direction around 1.64%.

Further selling pressure in the European currency dragged EUR/JPY to fresh lows in the 129.40 region on Wednesday.

EUR/JPY looks to yields, risk trends

EUR/JPY resumes the downside and rapidly leaves behind Tuesday’s uptick. The continuation of the downtrend reached the 129.40 region before bouncing earlier in the session. In this area also coincides a Fibo level (of the October rally) and is considered the last defense before an assault to the October lows around 128.30.

The lack of direction in yields of the key US 10y note motivated the greenback to give away part of the earlier advance, while mixed results from the US housing sector also collaborated with the knee-jerk in the buck.

Earlier in the euro docket, the final October CPI in the euro area rose 4.1% YoY and 2.0% when it comes to the Core CPI. In Japan, the trade deficit shrank to ¥67.4B in October (from ¥624.1B) and Machinery Tools Orders expanded 12.5% in the year to September.

EUR/JPY relevant levels

So far, the cross is losing 0.26% at 129.64 and a surpass of 130.18 (100-day SMA) would expose 130.49 (200-day SMA) and then 131.41 (high Nov.10). On the downside, the next support comes at 129.41 (78.6% Fibo of the October upside) followed by 128.33 (monthly low Oct.6) and finally 127.93 (monthly low Sep.22).

ECB Governing Council Member Isabel Schnabel said that the rise in inflation expectations is a welcome development on Wednesday, according to Reuters. The ECB is carefully monitoring German wage developments, she added, noting that union demands are relatively high but actual outcomes are likely to be much lower.

Schnabel added that continuing to buy bonds, even at a low level, could signal to markets that a rate hike is not imminent. Perhaps this is a lesson learned by observing the Fed's struggles to convince markets that the ending of its QE taper does not mean the start of rate hikes.

For reference, Eurozone 5-year 5-year forward inflation swaps (i.e. inflation expectations for the five years starting in five years time) rose back above 2.0% on Wednesday for the first time since late October, boosted by rising European gas prices.

Market Reaction

EUR/USD continues to struggle and is trading just above 1.1300, not far above annual lows in the 1.1260s.

Economists at ING believe the bright outlook of the Canadian economy is set to fuel the Canadian dollar. They expect the USD/CAD pair to hover around 1.20 next year.

Loonie is the safest commodity currency

“We expect oil to average $76/bll (Brent) in 2022, with a gradual return to surplus driving prices moderately lower. Such a gradual downtrend should not be enough to undermine the recovery in the Canadian oil and gas industry. Being a very open economy, Canada is also set to benefit from the further recovery in global trade. As 70% of Canada’s exports head to the US, long-CAD should continue to be a proxy trade for the strong US growth story.”

“In Canada, the jobs market is at pre-pandemic levels, record-level investments keep supporting the growth outlook and a very successful vaccination campaign is allowing a loosening of the so-far very strict border policy. The domestic economic story is set to remain a positive for CAD, and partly shield it from any risk-off waves or USD appreciation.”

“We currently forecast four 25-bp rate hikes in 2022, so expect only limited scope for a re-pricing of tightening expectations.”

“Having the lowest volatility among G10 commodity currencies, CAD may emerge as a popular carry bet against low-yielders next year. We think CAD has the lowest downside risk in the commodity FX space and expect USD/CAD to stay closer to 1.20 rather than to 1.25 in 2022.”

Bank of England Monetary Policy Committee member Catherine Mann said on Wednesday that, going into 2022, it is less clear if companies will have less pricing power, so we think core goods inflation will moderate.

Market Reaction

GBP/USD continues to push to fresh highs in the 1.3470s and EUR/GBP has recently fallen back under 0.8400. GBP has been performing well on Wednesday following strong UK Consumer Price Inflation (CPI) data which showed the YoY rate of CPI rising to 4.2% in October from 3.1% in September, a 10-year high.

The EUR/USD’s break of 1.1310 saw sharp selling past the figure before a reversal from the 1.1270. This level currently stands as a support, but economists at Scotiabank think the pair is set to slide below it.

Resistance is seen around 1.1325

“The 1.1270 level will stand as support through the session – while oversold conditions possibly limit downside. EUR/USD may see some buying interest on dips below the figure, but strong downward momentum should see the pair close under the level soon and there are no notable support markers except for the big figure areas.”

“Resistance is ~1.1325 followed by 1.1350/60.”

Economists at ING think the cable can hold onto its 2021 gains unlike a market generally more pessimistic on the pound. What’s more, the Bank of England (BoE) is set to hike rates in December, underpinning GBP.

Reports of sterling’s demise look exaggerated

“A common refrain now from GBP bears is that the Bank of England is about to make a policy error. The argument goes that the BoE is set to tighten policy at exactly the wrong moment. We see a reasonably healthy UK growth profile next year, initially running at 1% QoQ. That should allow the BoE to hike 15bp this December and a further 50bp in 2022.”

“GBP bears point to London’s thorny relationship with Brussels and the risk that the EU-UK Trade and Cooperation Agreement falls apart. We take on this is a reminder that this agreement is barely better than a No Deal Brexit. Additionally there is plenty of scope for last-minute position adjustment from both sides and we doubt 2022 becomes characterised as a year of looming Brexit deadlines.”

“We think GBP can withstand the strong dollar onslaught better than some. We doubt cable has to trade substantially under 1.30 and expect the early BoE tightening to provide GBP with a cushion.”

Gold has taken out the 2020-2021 downtrend at $1,832/34. However, Tuesday’s key day reversal points to some near-term consolidation ahead of further gains, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, reports.

Previous resistance now acts as support at $1,832/34

“The close above $1,835 is key longer term, it has targeted $1,917/22, the May 2021 peak and 61.8% retracement and the 2011 high. This will act as the breakup point to the $1,965 November 2020 peak and the 78.6% retracement at $1,989. This is the last defence for the August 2020 peak at $2,072.”

“Please note that Tuesday’s price action was a key day reversal and we may see some near-term slippage/consolidation.”

“Dips lower should find initial support at $1,834 and is likely to be contained by the 200-day ma at $1,791.”

See – Gold Price Forecast: XAU/USD to struggle to rally on a peak in inflation expectations – Credit Suisse

Economists at ING expect the euro to underperform against the dollar in 2022. They forecast the EUR/USD pair at 1.10 by the end of 2022.

Most roads lead to a stronger dollar

“It now looks as though the Fed may hike rates next summer. Good growth momentum going into 2022 (we forecast GDP at 5%) backed by strong corporate and consumer balance sheets should mean that pricing power holds and inflation stays above 3% all year. A stronger dollar can play a role in tightening monetary conditions.”

“Pricing of the ECB policy path fell foul and at one point nearly 30bp of tightening was priced in for 2022. We view that pricing as extreme and unlikely, although it may take eurozone inflation dipping into next spring before the market backs away from that kind of pricing. The eurozone is still expected to run a 0.5% of GDP negative output gap in 2022 and the ECB has made it pretty clear it does not want to repeat the mistakes that Trichet made by tightening policy in July 2008.”

The main risk to the above scenario is probably stagflation, where early hikes to address a transitory price shock trigger a recession. The current Fed seems light years away from the Volcker Fed of the early 80s, thus we would see this scenario as unlikely. Even if it were to materialise, stagflation would be negative for risk assets and probably provide support for the anti-cyclical dollar.”

“Perhaps the only scenario for a much stronger EUR/USD in 2022 would be a strong global recovery, a eurozone renaissance and a Fed turning dovish. With supply chain disruptions expected to weigh on growth in manufacturing-heavy Europe next year, such a scenario seems unlikely.”

“ Recent terms of trade changes have depressed EUR/USD fair value to around 1.10. That is our year-end 2022 forecast which is well below the consensus of 1.18.”

In a speech on Wednesday, ECB Governing Council Member Isabel Schnabel said that global and Eurozone economic activity had started to moderate, and that uncertainty had increased around the pace and extent of the slowdown in inflation. Nonetheless, Schnabel said that the fear of stagflation appeared to be unfounded, and reflation, not stagflation, remained the defining theme of our times.

More persistent supply bottlenecks imply that part of the increase in production and demand that was expected in 2021 and 2022 may now materialise later on. However, Schnabel conceded that there were concerns that the slowdown may be more abrupt and more enduring.

Thus, Schnabel continued, monetary policymakers need to focus on the entire range of possible outcomes to ensure that they will be able to deliver on their mandate. On the one hand, she reasoned, this means avoiding the mistake of a premature tightening of monetary policy in response to a temporary and possibly short-lived inflation spike. On the other, she continued, it means keeping a watchful eye on the upside risks to inflation that financial markets currently anticipate and retain optionality to be able to act if needed.

ECB’s Schnabel added that, in all likelihood, the output gap in the Eurozone will turn positive in 2022 and will be significantly positive in 2023 and beyond.

Market Reaction

EUR/USD has not seen any notable reaction to Schabel's comments, with the pair going sideways around 1.1300 in recent trade. Her comments about the output gap turning positive in 2022 and then significantly positive in 2023 and beyond may lend support to market expectations for ECB rate hikes from 2023.

- USD/CAD gained positive traction for the second successive day on Wednesday.

- Weaker oil prices undermined the loonie and acted as a tailwind for the major.

- The underlying USD bullish tone remained supportive of the intraday move up.

- Canadian CPI/mixed US housing market data did little to provide any impetus.

The USD/CAD pair caught some bids during the early North American session and shot to the 1.2600 neighbourhood or fresh weekly highs in the last hour.

The pair gained some positive traction on Wednesday and built on the previous day's goodish rebound from levels below the key 1.2500 psychological mark. A softer tone around crude oil prices undermined the commodity-linked loonie and turned out to be a key factor that acted as a tailwind for the USD/CAD pair. The uptick, however, lacked strong bullish conviction amid some US dollar profit-taking from a 16-month peak touched earlier today.

On the economic data front, the headline Canadian CPI rose 0.7% in October from 0.2% previous, while the yearly rate accelerated to 4.7% from 4.4% in September. Meanwhile, the Bank of Canada's core CPI edged higher to 3.8% YoY rate as against estimates for a dip to 3.5% from 3.7% previous. From the US, the disappointment from Housing Starts was largely offset by an unexpected rise in Building Permits and did little to provide any meaningful impetus.

That said, the prevalent cautious mood around the equity markets, along with hawkish Fed expectations and elevated US Treasury bond yields continued lending some support to the greenback. This, in turn, was seen as a key factor that provided a fresh lift to the USD/CAD pair, with bulls now looking to reclaim and build on momentum beyond the 1.2600 mark.

Technical levels to watch

- EUR/USD recorded new lows near 1.1260 on Wednesday.

- A deeper move could see 1.1185 retested in the short term.

Sellers remain well in control of EUR/USD and dragged it to the area of fresh 16-month near 1.1260 earlier on Wednesday.

The continuation of the downtrend appears favoured in the short-term horizon. That said, a breach of YTD low at 1.1263 (November 17) should aim to a drop further south to July’s 2020 low at 1.1185 ahead of 1.1168 (low June 19 2020).

In the meantime, extra losses remain on the cards as long as the pair trades below the immediate resistance line (off September’s high) today near 1.1610. In the longer run, the negative outlook persists while below the 200-day SMA, today at 1.1865.

EUR/USD daily chart

- Headline CPI came in at 4.7% YoY, in line with forecasts.

- But the BoC's Core measures of inflation were hotter than expected.