- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-11-2021

- GBP/CAD seesaws around the lowest levels since March 2020, sidelined of late.

- Sustained break of a multi-month-old support line directs bears to 61.8% Fibonacci retracement level.

- 200-week SMA adds to the upside filters amid the sluggish Momentum line.

GBP/CAD defends the 1.6700 threshold during an inactive Thursday morning in Asia, seesaws around 1.6750 following the slump to the 20-month low.

Although oscillators do suggest a corrective pullback on the shorter timeframe, the weekly chart has further downside room for the GBP/CAD prices.

That being said, the 61.8% Fibonacci retracement (Fibo.) of August 2019 to March 2020 upside, around 1.6645 can offer immediate support to the quote ahead of the last yearly trough near 1.6535.

Following that, the late July 2019’s high near 1.6450 will be in the focus of the GBP/CAD sellers.

Meanwhile, a corrective pullback may aim for the 1.6800 round figure ahead of targeting the May 2021 low near 1.6855 and 50% Fibo. level close to 1.6920.

It should be noted, however, that the GBP/CAD bulls remain unconvinced till the quote remains below the 200-week SMA level of 1.7160.

Also challenging the upside momentum is the support-turned-resistance line from March 2020, near 1.7000 by the press time.

GBP/CAD: Weekly chart

Trend: Further weakness expected

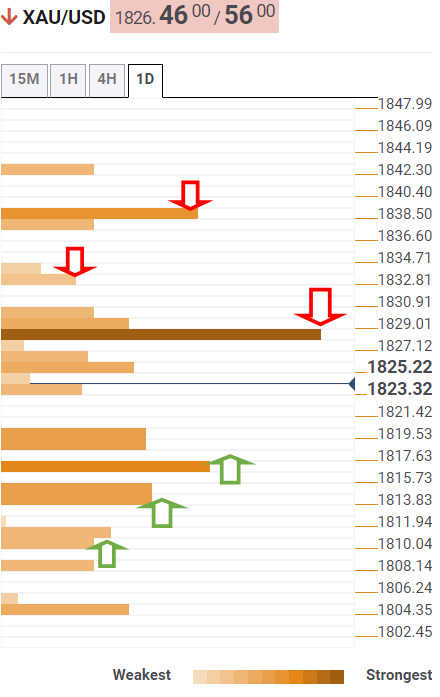

- XAU/USD broke above a 4-month downslope resistance trendline, aiming towards $1,900.

- XAU/USD rallied on higher US consumer inflation above 6%, the highest in 30 years.

- Gold, US bond yields, and the US Dollar rallied after the US inflation report.

Gold (XAU/USD) edges lower as the Asian session begins, down some 0.18%, trading at $1,849.30 during the day at the time of writing. On Wednesday, the yellow-metal spiked as high US inflation figures crossed the wires, reaching a daily high at $1,868.61, easing the upward move later, ending the New York session at $1,852.67.

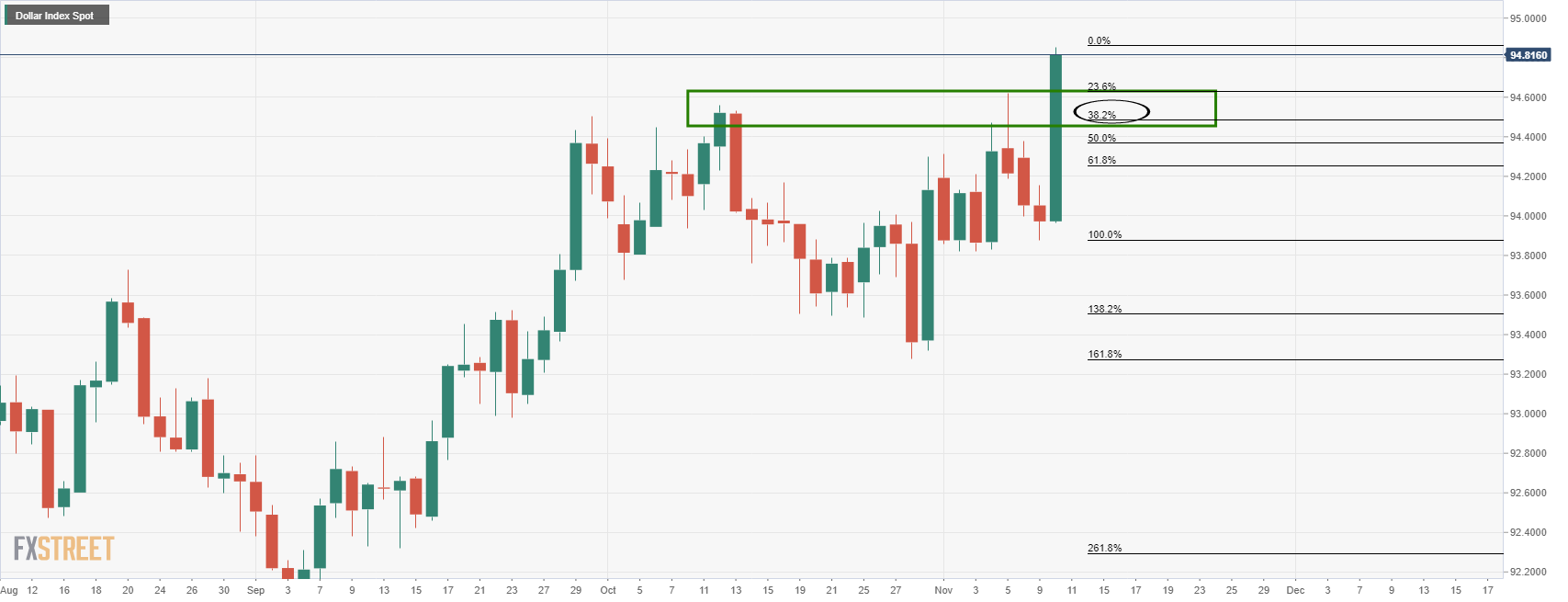

It is worth notice, that US T-bond yields and the US Dollar followed the XAU/USD spot footsteps, finishing in the green. The 10-year benchmark note rose twelve basis points, sitting at 1.57%, recovering this week's losses. Meanwhile, the US Dollar Index, a measurement of the greenback's value against a basket of six peers, advanced 0.98%, closed at 94.87.

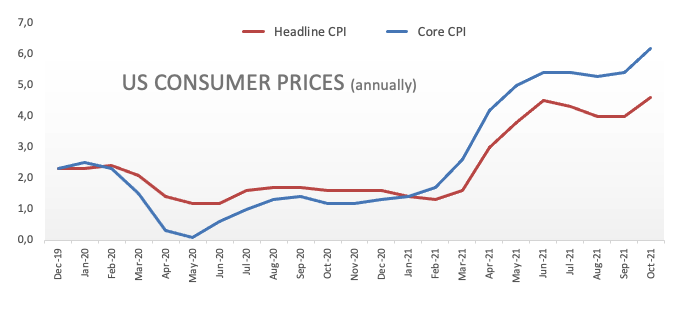

US consumer inflation tops 6.2%, the highest level since 1990

During the New York session, the US Bureau of Labor Statistics (BLS) featured the Consumer Price Index (CPI) for October, which surged 6.2% on a yearly basis, up from 5.4% in September, leaving behind the 5.3% estimations by economists. Further, the Core CPI reading, which excludes volatile items like energy and food, expanded by 4.6% in the same period, higher than the 4.8% foreseen by the market.

That said, the US Dollar rallied, US T-bond yields spiked, and gold shot through the roof, as expectations that the US central bank would need to accelerate the bond taper process amid long-lasting inflation. Also, the US 2-year yield sits at 0.519%, implying that market participants are pricing in a Fed rate hike by June of 2022.

The US economic docket will be light on Thursday. However, on Friday, the University of Michigan Consumer Sentiment Index for November could offer gold traders a fresh catalyst to take action at. Further, the US JOLTS Job Openings will be unveiled. Later, New York Fed's President John Williams will speak.

XAU/USD Price Forecast: Technical outlook

Daily chart

The non-yielding metal broke above a 4-month downslope resistance trendline, reaching a new daily high at $1,868.61, but retreated the move, sitting on the top of the abovementioned. The daily moving averages (DMA's) are long left behind the spot price, sitting around the $1,780-95 area, with the 50-DMA aiming higher, while the longer time-frames one, directionless.

Further, the Relative Strength Index (RSI) is at 67, beneath overbought levels, confirming the upward bias. However, for XAU/USD bulls to accelerate an attack towards $1,900, they will need a daily close above the June 3 low at $1,864.98. In that outcome, the following resistance area would be the psychological $1,900.

Having witnessed a 30-year high Consumer Price Index (CPI) print, 6.2% YoY, the US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, jumped to the fresh high since May 2006.

That said, the risk barometer jumped to 2.70% by the end of Wednesday’s North American trading. In doing so, the risk barometer extends the previous week’s rebound from the lowest levels since October 12, per the official website data.

The same propelled the US Fed rate hike concerns and underpinned the US 10-year Treasury yields to post the biggest daily jump in seven weeks, around 1.57% by the press time. Not only the firmer yields but equities also portray the market’s risk-off mood.

Even so, comments from Patrick Timothy Harker and Mary C Daly, respective Presidents of the Federal Reserve Bank of Philadelphia and San Fransisco, tried to defend the Fed doves. While Harker highlighted the possibilities of a rate hike even while tapering is on, Fed’s Daly said, per Reuters, that it would be premature to change the calculation on raising rates.

It should be noted, however, that the sour sentiment may weigh on the risk barometers like the AUD/USD and gold prices even if the US witnesses a baking holiday.

Read: AUD/USD flirts with monthly low under 0.7350, Aussie employment report eyed

- GBP/USD sellers take a breather, indecisive after refreshing the yearly low.

- Sustained trading below September’s low of 1.3411, break of 1.3400 become necessary to keep bears on the table.

- Corrective pullback remains doubtful until crossing July’s trough.

GBP/USD defends the 1.3400 threshold amid Thursday’s initial Asian session, following the slump to refresh the yearly low.

The lackluster moves could be linked to the cable pair’s inability to extend the downside break of September month’s low near 1.3410, as well as the nearly oversold RSI conditions.

That said, the corrective pullback may aim for 50% Fibonacci retracement (Fibo.) of the pair’s run-up from September 2020 to June 2021, around 1.3460.

However, the rebound remains doubtful until staying below July’s bottom near 1.3575, a break of which will direct the quote towards the 50-DMA level of 1.3677.

Meanwhile, a clear downside break of the 1.3400 mark will direct the GBP/USD prices towards December 2020 low near 1.3130, with the 61.8% Fibo. likely offering an intermediate halt around 1.3270.

GBP/USD: Daily chart

Trend: Corrective pullback expected

- EUR/USD holds in negative territory following US CPI induced side below 1.1500.

- US CPI was the biggest year-on-year rise since November 1990.

The dollar jumped on the CPI data, with the euro hitting a 16-month low against the greenback. The dollar index, DXY, which measures the US dollar versus a basket of six currencies, rose 0.914% to 94.886. Consequently, the euro fell 0.97% vs the greenback at $1.1476. At the time of writing, EUR/USD is trading at 1.1478 and steady in a slow start to the new trading day.

US CPI way above Fed's target

US CPI rose 0.9% on a monthly basis after rising 0.4% in September as the largest gain in four months boosted the annual increase to 6.2%. It was the biggest year-on-year rise since November 1990 and followed a 5.4% leap in September. Economists polled by Reuters had forecast the overall CPI to rise 0.6%.

''The rise in cyclical components of inflation, like rents, will extend further in coming months, so core inflation can be expected to rise further,'' analysts at ANZ Bank argued. ''The October CPI data implies that if US inflation miraculously falls back to 0.2% MoM from November and maintains that rate of increase for 12 months, CPI inflation will still average 3.2% YoY in Q3 next year – way above the Fed’s target.''

For the day ahead, Australia’s October labour force survey is due but US bond markets will be closed for Veterans Day. Equities, however, will be open.

-

Breaking: EUR/USD breaks 1.1500 like a knife through butter

- AUD/USD holds lower ground following the biggest daily loss in over a week.

- 30-year high CPI, US President Biden’s push to battle inflation pressure propel Fed rate hike concerns.

- USTR comments ahead of Sino-American virtual summit, Evergrande woes exert additional downside pressure.

- Australia jobs data may probe pair bears amid recent unlocks but RBA rate hike needs more push.

AUD/USD keeps the US inflation-led bearish bias even as the bears take a breather around monthly bottom close to 0.7320 amid early Thursday morning in Asia. In doing so, the Aussie pair justifies the market’s risk-off mood amid rate hike concerns and updates over the US-China trade relations, as well as Evergrande.

Having witnessed a multi-year high US inflation, President Joe Biden showed readiness to battle the price pressure, which in turn exerts additional downside pressure on the Fed to increase the benchmark rate.

Chatters over the US Federal Reserve’s (Fed) rate hike swirled after the headline Consumer Price Index (CPI) jumped to the highest levels in three decades, 6.2% YoY, pushing the AUD/USD prices lower. “The October CPI data implies that if US inflation miraculously falls back to 0.2% m/m from November and maintains that rate of increase for 12 months, CPI inflation will still average 3.2% y/y in Q3 next year – way above the Fed’s target,” the ANZ report recently said.

However, comments from Patrick Timothy Harker and Mary C Daly, respective Presidents of the Federal Reserve Bank of Philadelphia and San Fransisco, tried to defend the Fed doves. While Harker highlighted the possibilities of a rate hike even while tapering is on, Fed’s Daly said, per Reuters, that it would be premature to change the calculation on raising rates.

Further, the growing rift between the US and China ahead of next week’s virtual summit of US President Biden and his Chinese counterpart Xi Jinping also weighs on the AUD/USD prices. Recent comments from US Trade Representative (USTR) Katherine Tai weren’t signaling any optimism ahead of the key meeting.

Additionally, China’s struggling real-estate major Evergrande is said to have officially defaulted as the DMSA - Deutsche Marktscreening Agentur (German Market Screening Agency), is up for preparing for the firm’s bankruptcy filing, per the Daily Express.

Hence, multiple challenges to the market sentiment join the Fed rate hike concerns to weigh on the risk-barometer AUD/USD prices.

Amid these plays, Wall Street closed lower and the US 10-year Treasury yields jumped the most in seven weeks.

Moving on, the updates over China and Evergrande may entertain the AUD/USD traders ahead of the Aussie jobs report for October. Although the data is likely to allow bears to take a breather, the Reserve Bank of Australia (RBA) has already set high bars for the rate hike and hence the trend reversal of the Aussie pair isn’t on the table even if the figures arrive as too positive.

Read: Australian Employment Preview: A positive surprise or too much optimism?

Technical analysis

AUD/USD marked a daily closing below the 50-DMA, as well as the 100-DMA, around 0.7375-70 to keep sellers hopeful of visiting the 61.8% Fibonacci retracement (Fibo.) of September-October upside, around 0.7320. Alternatively, a monthly resistance line and the 38.2% Fibo. level, respectively around 0.7390 and 0.7410, gains the market’s attention during the recovery moves.

- AUD/JPY stays pressured around monthly low despite avoiding daily losses the previous day.

- Bearish MACD signals, immediate descending trend line favor sellers.

- Late October lows add to the upside filters.

AUD/JPY remains on the back foot around a one-month low, close to 83.45 amid the initial Asian session on the key Thursday comprising the Aussie jobs report for October.

Read: Australian Employment Preview: A positive surprise or too much optimism?

Although the cross-currency pair’s early Wednesday gains saved it from a negative daily closing, bearish MACD signals and a sustained following up of the descending resistance line from November 02 keep the sellers hopeful.

However, the 200-DMA level near 82.85 becomes a tough nut to crack for the bears before taking entries.

Following that, 50% Fibonacci retracement (Fibo.) of August-October upside joins October’s peak around the 82.00 threshold to challenge the AUD/JPY downturn.

Alternatively, a clear upside break of the immediate resistance line, close to 83.65 by the press time, isn’t a green pass to the pair bulls as lows marked during the late October, surrounding 84.60, adds to the upside filters.

Even if the quote manages to remain firm past 84.60, the 85.00 round figure and multiple tops near 86.00 will be challenging the AUD/JPY bulls before driving them to the last month’s peak of 86.25.

AUD/JPY: Daily chart

Trend: Further weakness expected

Having earlier showed readiness to combat the inflation, US President Joe Biden reiterate that the consumer prices remain too high during early Thursday morning in Asia.

More to come

“Exploring all weaknesses in china's phase 1 performance, including lack of commercial aircraft purchases,” US Trade Representative (USTR) Katherine Tai said, per Reuters, during early Thursday morning in Asia.

Additional comments

Optimistic engagement with China on the Phase 1 trade deal will lead to better outcomes but cannot predict results.

Biden administration is 'getting traction' with Chinese counterparts in trade discussions.

Discussions with China aim to hold Beijing accountable to Trump-era 'phase 1' trade agreement.

The US is exploring all weaknesses in China's phase 1 performance, including lack of commercial aircraft purchases.

Biden, Xi familiarity with each other will help manage complex relationship during difficult period.

Not in her interest for talks on the China phase 1 deal to take a 'very, very long time'.

USTR focused on 'big picture' and US competitiveness (when asked whether easing tariffs on Chinese goods could help tame inflation).

FX implications

With Politico news saying the virtual summit between US President Joe Biden and his Chinese counterpart Xi Jinping tentatively set for Monday, such comments from USTR Tai escalate market’s tension considering not so good US-China trade relations. It should be noted, however, be noted that there was little reaction to the catalyst amid the Asian market’s wait for Australian employment data after witnessing a volatile Wednesday, due to the US inflation figures.

Read: Forex Today: Dollar wins as inflation fears return

- EUR/JPY has reversed an attempt earlier in the session to hit 131.50 and is back below 131.00.

- The pair is finding solid support, however, though if risk appetite continues to deteriorate, it could drop towards 130.00.

It’s been a choppy session today for EUR/JPY though, ultimately, the pair is set to end the day flat after moves elsewhere in FX markets stole the limelight (the dollar surged to fresh annual highs). At the start of US trading hours, EUR/JPY swung as high as the 131.40s to hit a key Fibonacci retracement level (the 38.2% retracement back from the October highs to the summer lows), before paring all of these gains to fall back to the 130.75 region. That means the pair is back to probing near-one-month lows. However, EUR/JPY is receiving support from a number of key levels including the 50% retracement from the October high back to the summer lows, the 50-day moving average (DMA) at 130.60, the 29 September high at 130.47 and the 200DMA just below it at 130.45.

With inflation concerns in the US triggering downside in US equities, not least given concerns that the Fed will be forced to remove monetary stimulus sooner to address elevated price pressures, risk appetite looks at risk of seeing further deterioration in the sessions ahead. That should favour the safe-haven Japanese yen over the euro.

If a further downturn in stocks and broader risk appetite does favour the safe-haven yen and push EUR/JPY below the next notable area of support, this would open the door to a run at the psychologically important 130.00 level. This level coincides with the 61.8% Fibonacci retracement between EUR/JPY’s summer lows at around 1.2800 and the October highs at 133.50. A break below here could signal an eventual move all the way back to these summer lows.

- NZD/USD is weaker on the back of a firmer US dollar and higher US inflation data.

- Markets now will turn their focus to the RBNZ for guidance.

NZD/USD is ending the North American session down by some 0.9% after falling from a high of 0.7132 to a low of 0.7062 on the day. A stronger than expected US Consumer Price Index data overnight saw the USD rally against all G10 currencies.

The US Consumer Price Index rose 0.9% last month after gaining 0.4% in September and in the 12 months through October, the consumer price index accelerated 6.2%. the US Labor Department said on Wednesday, while analysts expected on average the rise to be limited to 5.8%.

The markets have responded in kind following the Federal Reserve last week restating that the current inflation surge will be transitory. However, today's data comes in stark contrast to such a belief. meanwhile, the NZD was the second-best performer although remains pressured due to the US data casting doubt on the idea that the Fed can remain patient. ''The NZD’s resilience is pretty understandable given that markets have already come to grips with high NZ CPI and hefty rate hikes are already priced in,'' analysts at ANZ Bank argued.

RBNZ in focus

''The NZD has the potential to respond very positively to the next couple of Reserve Bank of New Zealand OCR hikes (especially if one of them is 50bps), but as we head into 2022, with mortgage rates already well higher and the Fed then likely eyeing hikes, that timing mismatch could be a real challenge for the NZD. So maybe this isn’t as good as it gets, but it may not be too far off it.''

- After the US CPI report, the AUD/USD seesawed around the 0.7320-0.7392 range during the day.

- US CPI increased the most since 1990, topping 6.2%.

- AUD/USD Technical outlook: DMA’s above the spot price and the RSI indicate a downward bias in the near term.

The Australian dollar slides during the New York session, down 0.64%, trading at 0.7334 at the time of writing. Earlier in the Asian Pacific session, the pair edged slightly lower, around the 0.7350 area, in choppy trading conditions, sideways. When US inflation figures crossed the wires, the AUD/USD fluctuated around the 0.7339-92 range.

US CPI increased the most since 1990, topping 6.2%

The Labour Department reported on Wednesday that the US Consumer Price Index (CPI) for October increased by 6.2%, on annual base numbers, higher than the 5.3% foreseen by analysts. Additionally, unveiled that the Core CPI that excludes energy and food volatile items increased by 4.6% for the same period, more than the 4.3% estimated by economists.

According to the report, prices in energy, shelter, food, and vehicles triggered the spike in the CPI. Also, inflation is broadening beyond areas associated with a reopening.

AUD/USD Price Forecast: Technical outlook

Daily chart

At press time, after the flurry of US CPI, the AUD/USD settled around the 0.7330 area. The daily moving averages (DMA’s) reside above the spot price, confirming in the near-term a downward bias, acting as resistance levels.

Also, the Relative Strength Index (RSI) at 39, below the 50-central line and with enough room before reaching oversold levels, adds another signal to the bearish bias.

To accelerate the downtrend, AUD/USD sellers will need a break below the September 24 high at 0.7316. In that outcome, the pair could travel south towards the October 6 low at 0.7225.

- The S&P 500 has continued to push lower in recent trade and currently trades in the 4630s.

- That puts it one course for a near 1.0% drop, it's worst day since the start of October.

- US equities have come under pressure amid heightened inflation fears in wake of a hotter than expected US CPI report.

US equity markets have continued to head lower in recent trade, having been on the back foot since the market open at 1430GMT. Inflation fears are being touted as the major reason for the selling in wake of a much hotter than expected US October Consumer Price Inflation report. For reference, headline CPI came in at 6.2% YoY/0.9% MoM, both metrics well above expectations, while core CPI came in at 4.6% YoY/0.6% MoM, also well above expectations. The YoY rate of headline CPI was its highest since 1990, while the YoY rate of core CPI was at its highest since the early 90s.

The S&P 500 recently dropped below the 4640 level and is currently trading with on the day losses of just shy of 1.0%, putting the index on course for its worst day since 4 October, more than one month ago. Amid the sharpest jump in long-term US government borrowing costs in months, which has seen the 2-year yields rise nearly 10bps, 5-year yields spike nearly 15bps and 10-year yields rally nearly 11bps, the duration-sensitive Nasdaq 100 index is an underperformer. The Dow Jones Industrial Average is nursing losses of about 0.7%, having recently slipped back under the 36K level.

The CBOE S&P 500 Volatility Index also jumped on Wednesday to its highest level in nearly one month, just missing out on hitting the 20.00 mark. On the day, the index is up just under 1.5 vols at the time of writing, the largest one-day jump since the end of September, a day when the S&P 500 dropped 2.0% to close more than 6.0% below the index’s current level.

Inflation fears

Analysts broadly framed the latest CPI report as indicative that inflation pressures in the US are set to both longer-lasting and broader than previously expected. As a result, the Fed’s base case assumption upon which their policy guidance is pinned, that inflationary pressures will fade in mid-2022, is coming under pressure. 5-year breakeven inflation expectations surged to fresh record levels (they can only be calculated back to 2004) above 3.15%, well above the Fed’s 2.0% inflation target, making it harder for Fed members to argue that inflation expectations remain well-anchored. ING said they cannot rule out headline CPI surpassing 7.0% YoY in the months ahead. They expect this to ultimately force the Fed’s hand and expect the QE taper to be accelerated in Q1, followed by a minimum of two rate hikes in 2022.

What you need to know on Thursday, November 11:

Risk-aversion took over financial markets and the dollar made the most out of it. The catalyst was US inflation, as the US annual Consumer Price Index soared to its highest in three decades, hitting 6.3% YoY in October. Stocks took a turn for the worse as yields soared, reflecting mounting concerns of further tightening in the US.

Also, Federal Reserve Bank of San Francisco President Mary Daly said noted that even though it’s temporary, high inflation hurts. She added that it would be premature to change the pace of monetary policy tightening.

The dismal mood was exacerbated by news indicating that the Chinese giant Evergrande stands on the verge of default. Some bondholders have not received coupon payments by the end of the 30-day grace period on coupon payments of more than $148 million on its April 2022, 2023 and 2024 bonds at the close of Asia business, and market talks hint at DMSA preparing bankruptcy proceedings against the Evergrande Group. With that in mind, it's possible that Asian shares follow their overseas counterparts on their way down.

The EUR/USD pair settled below 1.1500, its lowest since July 2020. GBP/USD nears 1.3400 as investors await news on the Brexit front.

The AUD/USD pair is down to the 0.7330 region, with losses partially offset by soaring gold prices, as the bright metal trades around $1,840 a troy ounce after reaching a multi-month high of 1,868.54. USD/CAD flirts with 1.2500 as crude oil prices gave up to the ruling dismal mood, with WTI ending the day at $81.10 a barrel.

Bitcoin smashes through $69,000 as US inflation hits its highest point in 30 years

Like this article? Help us with some feedback by answering this survey:

- The US dollar is on fire following the US CPI surprise beat.

- USD/JPY has rallied 1% in the day and bulls seek space on the 114 round number.

The US Consumer Price Index rose 0.9% last month after gaining 0.4% in September and has sent the greenback higher across the board. USD/JPY has rallied around 1% on the day as a consequence, penetrating critical resistance on the charts. At the time of writing, USD/JPY is trading around the highs of the day near 114 the figure after rallying from a low of 112.77 to a high of 114.01 so far.

In the 12 months through October, the consumer price index accelerated 6.2% the US Labor Department said on Wednesday, while analysts expected on average the rise to be limited to 5.8%. The Consumer Price Index rose 0.9% last month after gaining 0.4% in September and in the 12 months through October.

DXY rallied into 94.80s, stocks on a knife-edge

The Federal Reserve last week restated its belief that the current inflation surge is transitory, but this data comes in stark contrast to that assumption and has sent the US dollar on a tear. The US dollar index, DXY, which measures the greenback against six major currencies, was up 0.86% at 94.80 and has accelerated its gain after reaching a high of 94.440 immediately after the data was released.

Many investors had feared that underestimating price increases could prove to be a costly policy mistake and markets are responding in kind. US stocks have plummeted with the S&P 500 no won course for a significant correction towards the Oct 4,600s, supporting the risk-sensitive JPY. Additionally, the Evergrande default news is denting risk-sensitive assets.

Evergrande and US inflation fears sink US stocks

-637721701646922144.png)

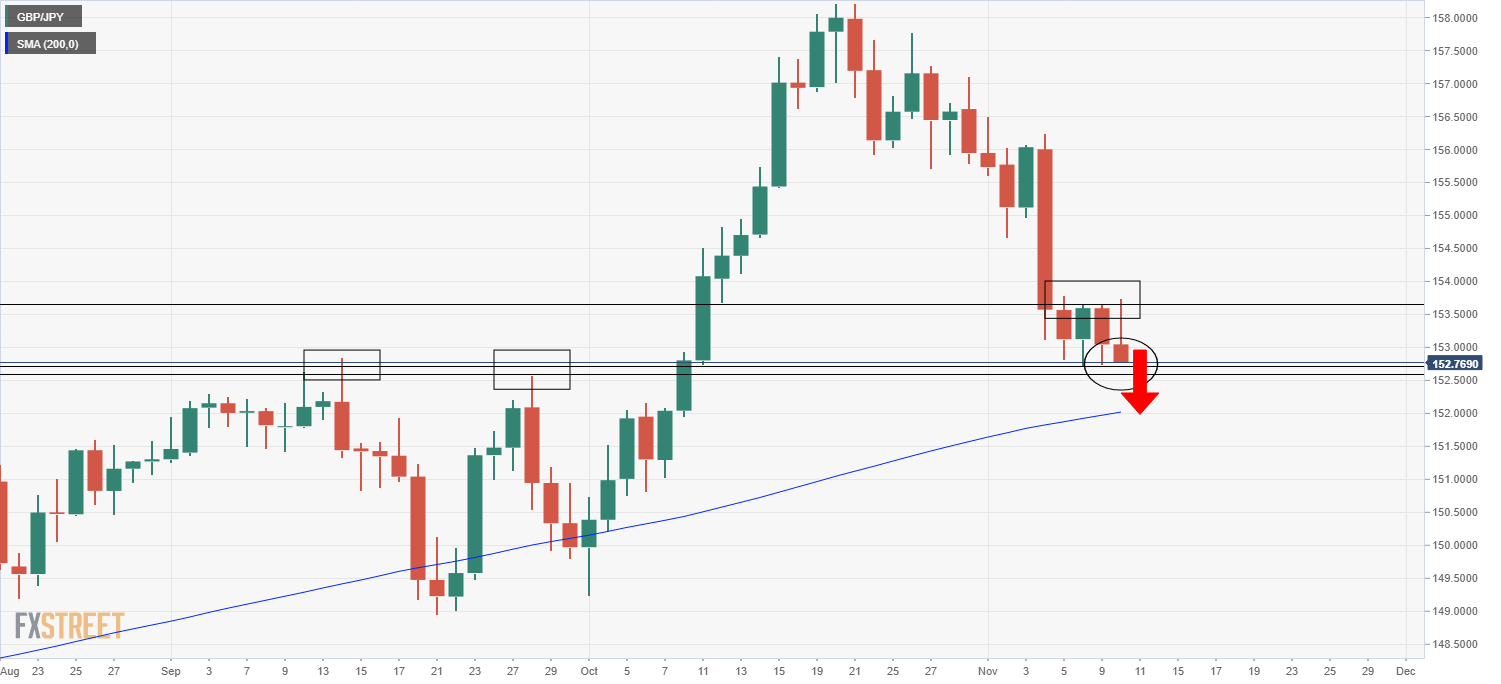

- GBP/JPY is probing multi-week lows under 153.00 ahead of UK GDP data out on Thursday.

- If the pair does break to the downside, technicians may target a move towards the 200DMA at 152.00.

It’s been a choppy and ultimately indecisive day for GBP/JPY, with the pair ultimately respecting recent ranges FX markets focussed more on macro themes (such as US inflation) rather than UK/Japan domestic issues. The pair managed to hit its highest level since last Thursday in the 153.70s at the start of the US trading session, but has since reversed these gains to trade ever so slightly in the red on the day back to the south of the 153.00 handle.

Indeed, given that it is back below 153.00, the pair is hovering just above the multi-week lows set at the start of this week at around 152.70. For now, support in the form of the 14 and 28 September highs in the 152.50-80 region is holding up. The preliminary estimate of Q3 UK GDP is released at 0700GMT on Thursday and could provide the momentum to either break below support (in the case of poor GDP numbers) or move back to test weekly highs (in the case of good numbers).

Brexit newsflow is also going to be worth monitoring over the coming days and weeks with the UK on the cusp of escalating tensions with the EU and even putting the post-Brexit trade deal at risk if it opts to trigger Article 16 of the Northern Ireland Protocol (which allows either side to unilaterally suspend parts of the agreement if it is causing significant societal damage).

In the case of a downside break, the next key area of support is the 200-day moving average which sits almost band on the 152.00 level. In the case of an upside breakout, the next key area of resistance is the 2 November low at just above 154.50.

Update: Evergrande officially defaults despite reports of meeting some of its debt repayment liabilities.

Following a hotter-than-expected US Consumer Price Index for October and news that Evergrande has missed a 30-day grace period to pay its debts have sunk US stocks on Wall Street. The S&P 500 index is down 0.7% at the time of writing, but the move might have just got started according to the technical analysis below.

Firstly, CPI has jumped 0.9% after climbing 0.4% in September, the Labor Department said. This was the largest gain in four months boosted the index's annual increase to 6.2%. It was also the biggest year-on-year rise since November 1990 and followed a 5.4% leap in September.

Therefore, markets are noting that inflation and the persistence of elevated inflation are much more than what policymakers had expected and are posting accordingly. This is hurting US stocks and sending the US dollar on a tear on Wednesday.

To top it off, risk-off is accelerating on the news that the cash-strapped China Evergrande Group has missed coupon payments by the end of a 30-day grace period, pushing the developer again to the edge of default.

Update: In more recent trade, the headlines are now stating that the company has met at least one of its deadlines for repayments, but there are reports that bankruptcy proceedings are still underway.

Market implications

This is spelling contagion risks for investors because the failure to pay will inevitably result in a formal default by the company, thus triggering cross-default provisions for other Evergrande dollar bonds, exacerbating a debt crisis looming over the world's second-largest economy. Evergrande, the world's most indebted developer has been grappling with more than $300 billion in liabilities, $19 billion of which are international market bonds.

Consequently, US stocks are reeling in the fear of contagion risks:

-637721677188280145.png)

The S&P 500 chart shows that the daily price action has hit a 38.2% Fibonacci retracement of the latest bullish rally. A break below there opens risk all the way back to the Oct highs and beyond.

- The British pound collapses, down 160 pips during the day on high US inflation.

- US CPI increased the most in 30 years, topping 6.2%.

- Brexit: UK and EU look far from reaching a post-Brexit deal on Northern Ireland.

The British pound reverses this week’s gains and some more, plummeting 160 pips during the day, down almost 1%, trading at 1.3426 at the time of writing. Since the beginning of the week, the GBP/USD pair trimmed last Friday’s losses, bouncing from 1.3400 to this week’s high (November 9) at 1.3606, amid the lack of a catalyst, mainly driven by US dollar weakness. Also, lower US bond yields dragged the greenback lower, ahead of the critical US CPI release.

US CPI increased the most in 30 years, topping 6.2%

On Wednesday, the Labour Department reported that the US Consumer Price Index for October rose by 6.2%, on a yearly basis, higher than the 5.3% expected by analysts. Further, the Core CPI that excludes energy and food volatile items increased by 4.6% for the same period, more than the 4.3% foreseen by market participants.

According to the report, prices in energy, shelter, food, and vehicles triggered the spike in the CPI. Also, inflation is broadening beyond areas associated with a reopening.

That said, USD bulls gained traction, spurring a 160 pip drop in the GBP/USD pair, overcoming intraday support levels like the November 9 low at 1.3523, followed by the November 8 low at 1.3490, and then the S3 pivot level at 1.3433.

Additionally, in the last hour or so, Brexit woes hit the wires, as the UK and the EU look far from reaching a post-Brexit agreement over Northern Ireland.

“EU governments agreed on the need for “robust” action against Britain if London follows through on its threat to invoke emergency unilateral provisions,” per Reuters.

According to sources cited by Reuters, “Downside risk may emerge for the pound in the coming days as it looks increasingly likely that the UK will unilaterally suspend parts of the Northern Ireland Protocol.”

That said, GBP/USD traders should note that if the UK triggers Article 16, the British pound could potentially sell-off because the Euro Zone would not stand still instead would retaliate against the UK.

EUR/USD has just broken the 1.1500 level and has made the lowest low since July 2020 as follows:

EUR/USD daily chart

The price has room to go until the 1.1450s at this rate as per the order block highlighted in the summer of the 2020s above.

EUR/USD H1 chart

On the hourly chart, we can see that the price has retested the prior lows and sank from there on the impulse. Any correction would be expected to be resisted at around 1.1520 and be a fade on rallies.

The moves today come on the back of the US Consumer Prices surging to their highest rate since 1990 and against market predictions. This has been fueling speculation mid-week that the Federal Reserve may raise interest rates sooner than expected.

The Consumer Price Index jumped 0.9% last month after gaining 0.4% in September and in the 12 months through October, CPI accelerated 6.2%. Analysts had expected on average the rise to be limited to 5.8%.

While the Fed last week restated its belief that the current inflation surge would be short-lived, many investors worry that underestimating price increases could prove to be a costly policy mistake.

More to come...

Rivian Automotive listed on the Nasdaq today in one of the hottest IPO's of the year. Rivian is listed under the ticker symbol RIVN. RIVN opened at $106.75 from the IPO price of $78.

Rivian is an electric vehicle manufacturer backed by Amazon and Ford. Demand was exceptionally high for this one. The initial price range for the IPO was $57 to $62 but this was increased sharply to $72 to $74 on Monday after a strong investor roadshow. Finally, the IPO price was set late Tuesday at $78 meaning Rivian (RIVN) raised nearly $12 billion dollars in what is one of the top 10 biggest US IPO's ever.

Rivian opened for trading on the Nasdaq at $106.75 giving it a market cap of over $100 billion. This makes it bigger than Ford (F), BMW, General Motors (GM), Honda, and others. Volkswagen which owns VW, Audi, Porsche, Skoda, SEAT, Lamborghini has a market cap of $122 billion.

- US 10-year yields shot nearly 10bps higher to the mid-1.50s% following hot US inflation data.

- The data puts pressure on the Fed to abandon its ultra-dovish monetary policy stance.

The latest US Consumer Price Inflation report (for the month of October) has triggered a significant move higher in the US 10-year yield. On the day, 10-year yields are up just shy of 10bps, having rallied from around 1.44% to close to the 1.55% mark. That marks the biggest one-day rise since 23 September, when the Fed caught the market off guard with a more hawkish than expected dot-plot.

The move higher in 10-year yields comes amid a broader move higher of yields across the US curve. 2s are up 9bps to above 0.50% again, 5s are up more than 12bps to close to 1.20%, 7s are up nearly 11bps to above 1.40% and 30s are up over 6bps to just shy of the 1.90% mark. The larger move higher of yields in the short-end/belly of the curve means that the US yield curve has also flattened. The 5s/30s spread hit its lowest since Q2 2020 on Wednesday at just above 40bps.

Higher bond yields mean bond prices have fallen. Higher inflation eats away at the value of a bond by reducing the future value of the bond’s cash flow (coupon and principal payments). It was not surprising to see investors dump US bonds in wake of a much hotter than anticipated US inflation report on Wednesday. To recap the details quickly, headline CPI came in at 6.2% YoY/0.9% MoM, both metrics well above expectations, while core CPI came in at 4.6% YoY/0.6% MoM, also well above expectations. The YoY rate of headline CPI hit a fresh highs since 1990.

If market participants still believed the Fed’s argument that the current spike in inflation is set to be transitory and that inflation will on its own come back towards their 2.0% target by the end of 2022 and in 2023, then bonds likely would not have been sold so heavily. But there is increasing evidence that the transitory argument is incorrect, as the latest report revealed inflationary pressures becoming more broad-based. Housing rose 0.7% MoM, food 0.8% MoM and medical care 0.5% MoM. House costs have been getting particular focus as of late given the tendency of the housing cost component in the CPI calculation to follow house price trends over time.

The Federal Housing Finance Agency's House Price Index was up 18.5% YoY in September and some economists are forecasting that the inflation rate of the housing cost component in CPI (which makes up 25% of the headline index and 40% of the core) will reach 4.0% next year, double the Fed’s target. Add to all of the above the growing evidence over the last few months that the US labour market is very tight owing to the labour shortage and that, as a result, wage growth is picking up, and the transitory argument is on shaky legs.

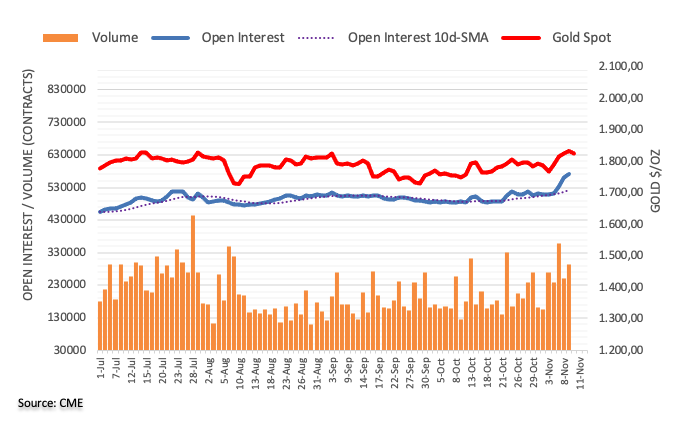

Notably, the demand for medium-term inflation protection was strong. Despite 5-year yields surging more than 12bps, the 5-year TIPS yield (i.e. on the 5-year inflation-protected bond) dropped 5bps. That meant that 5-year inflation expectations rocketed more than 17bps higher on the day. In that context, its not surprising to see gold (widely seen as an inflation hedge) rocket to multi-month highs.

The CPI data and the sharp move higher in medium-term inflation expectations (5-year breakevens suggest inflation will average 3.14% over the next five years) will put heavy pressure on the Fed to abandon their ultra-dovish stance that at the moment leaves than on course continue buying bonds into mid-2022 and then likely not hiking rates until sometime after.

- NZD/USD falls sharply, as US inflation numbers hit the highest level since 1990.

- A downbeat market sentiment boosts the safe-haven currencies, like the US dollar, weighed on the risk-sensitive NZD.

- NZD/USD: A daily close below the 200-DMA opens the path towards 0.7000 and beyond.

The NZD/USD extends its daily losses to two consecutive days, slides 0.70%, trading at 0.7081 during the New York session at the time of writing. The market sentiment is downbeat, portrayed by falling US stock indices printing losses between 0.11% and 0.18%, as US inflation figures rose above 6%, the highest reading since 1990.

Since the Asian session, the New Zealand dollar lost traction against the greenback on the expectations that higher US inflation numbers could spur a faster reaction of the Federal Reserve. Money markets increased the odds of a 25 basis points Fed rate hike by June of 2022.

US inflation reading post the most significant jump In 30 years

In the US economic docket, the Consumer Price Index for October increased by 6.2%, on an annual basis, higher than the 5.4% number in September, above the 5.3% expectations by analysts. The Core CPI, which excludes food and energy items, rose by 4.6% for the same period, also above the 4.3% foreseen by the market. Prices in energy, shelter, food, and vehicles spurred the spike in the CPI. Also, inflation is broadening beyond areas associated with a reopening.

Meanwhile, the US bond yields rise, with the 10-year benchmark note advancing seven and a half basis points, up to 1.524%, while the US Dollar following the 10-year footsteps, rising 0.62%, currently at 94.59.

NZD/USD Price forecast: Technical outlook

The NZD/USD moved to the downside since the Asian Pacific session began, retreating from the daily top at 0.7130 towards 0.7100, breaking below the 200-day moving average (DMA), usually viewed as a bearish signal. However, a daily close below the 200-DMA could open the door for further losses. The first demand area would be the 50-DMA at 0.7063, followed by the 100-DMA at 0.7023.

On the other hand, if NZD/USD buyers reclaim the 0.7100 figure, it would open the door towards a renewed test of the 0.7130 resistance level, followed by the November 4 high at 0.7178.

- EUR/GBP trades flat and rangebound just under 0.8550, as broader macro themes steal the FX market’s focus.

- UK GDP data out on Thursday could reinfuse some volatility.

It’s been a tame session thus far for EUR/GBP, with today’s FX market focus largely on broader macro themes (like higher-than-expected US inflation) which have had little impact on the relative strength of the euro and pound sterling versus each other. Thus, trading conditions have been rangebound, with the pair going sideways within 0.8530-0.8560ish parameters. At present, the exchange rate is changing hands just to the south of the 0.8550 level and is flat on the day.

Things might pick up a little on Thursday with the release of the preliminary estimate of UK Q3 GDP at 0700GMT. Traders await the data to see if EUR/GBP’s recent pullback since rejecting its 200-day moving average in the 0.8580 region has any further legs. The 0.8560 level also seems to have formed a bit of a ceiling over the past two sessions and EUR/GBP might find current levels attractive to ride the pair back down to the weekly lows at the 21DMA around 0.8520.

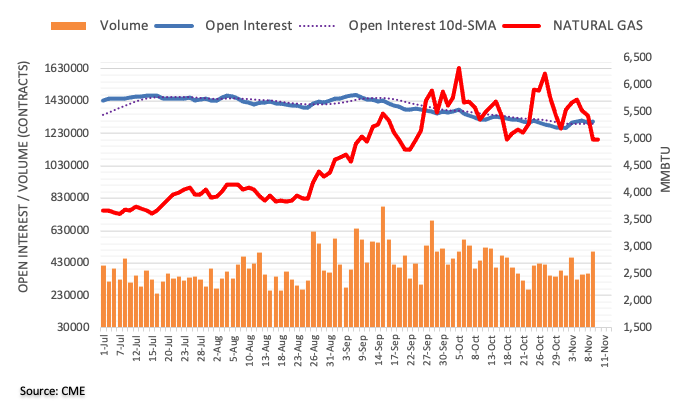

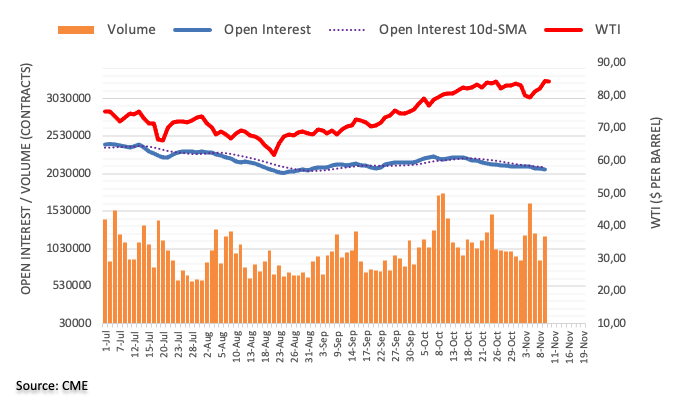

- WTI prices have slipped in wake of a less bullish than hoped for US crude oil inventory report.

- WTI have slipped back to their 21DMA at $82.50.

Crude oil prices have turned lower in wake of the latest official weekly US crude oil inventory report. Front-month future prices of the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, has fallen more than $1.0 since the report from above $83.50 to around $82.50, meaning losses on the day currently stand just above 1.0%. For now, WTI seems to be finding some support at its 21-day moving average at $82.50.

The latest crude oil inventory report from the US Department of Energy showed that headline crude oil stocks had risen by just over 1M barrels last week. Some market participants likely expected a draw after Tuesday’s private weekly API inventory data showed US crude oil stocks drawing over 2M barrels. Gasoline and Distillate stocks both saw larger than expected draws of 1.555M and 2.613M barrels respectively.

One factor that might also be weighing on oil prices is a pick-up in the US dollar following a much hotter than expected US Consumer Price Inflation report for October. US yields, particularly in the short-end, are up sharply as market participants upgrade near-term inflation and central bank interest rate forecasts and this is supporting the dollar versus (most of) its G10 peers. A stronger US dollar makes US crude oil (WTI) more expensive to the holders of foreign currencies.

But analysts/key crude oil market participants for the most part remain bullish on crude oil’s near-term prospects. According to Reuters, trading giant, Vitol Group's CEO Russell Hardy said on Tuesday that oil demand had returned to pre-pandemic levels and demand in the Q1 2022 could exceed 2019 levels. Hardy also said that any release of crude oil reserves by the Biden administration to address high energy costs would likely only have a short-term impact on the oil market.

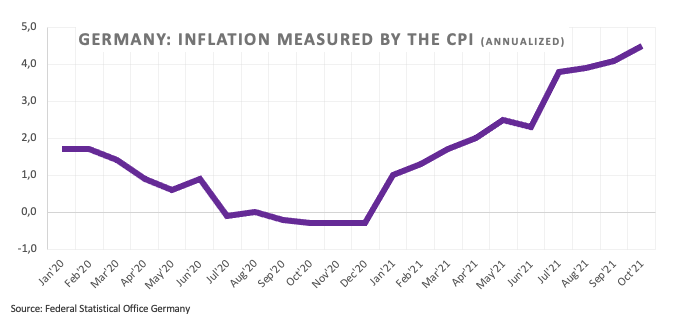

Data released on Wednesday showed the annual inflation rate in the US in October reached the highest level since 1990. The breadth of price hikes continues to widen well beyond the industries most affected by the pandemic, according to analysts at Wells Fargo. They expect inflation to push even higher over the next few months, before starting to subside around the second quarter of next year.

Key Quotes:

“The onslaught of inflation continued in October, with the Consumer Price Index rising a hotter-than-expected 0.9%.Over the past year, inflation has risen 6.2%, which surpasses the 2008 peak and is the strongest one-year increase in prices since 1990. The breadth of price increases cannot be ignored and suggests any softening in the overall pace of inflation remains a ways off.”

“Goods inflation has been the primary contributor to the historically high inflation experienced this year. Goods inflation showed no signs of easing in October, with prices for goods excluding food and energy rising 1.0% in the month.”

“We expect to see the run of strong monthly prints to continue over the near term. More businesses than ever plan to raise prices, according to records dating back to 1973.”

“A return to levels consistent with the Fed's goal is unlikely be a story for 2022. Along with fairly resilient consumer demand and a tight labor market that looks set to keep the heat turned up on wages, inflation seems here to stay for quite a while.”

According to Reuters citing comments made by San Fransisco Fed President Mary Daly on Bloomberg Television, Daly pushed back against the notion that the Fed should act immediately to address inflation pressures, saying that it would be premature for the Fed to change its calculation on raising interest rates. Her comments come in wake of the latest US Consumer Price Inflation report for October, which showed the headline YoY rate surpassing 6.0% for the first time since 1990.

Further Comments

"Inflation is high, we have a challenge right now."

"This is a transitory period."

"High inflation is not expected to persist at these rates once Covid is behind us."

"Even though it's temporary, high inflation hurts."

"Higher inflation readings have my attention."

"The number of missing jobs also has my attention."

"We need an economy that's self-sustaining once we get through Covid."

"Historically we have been too bearish, and wrong, about labor force participation."

"Americans want to work, but they are constrained by covid-related issues."

"If we raise rates now, that could be quite premature."

"It could leave the economy short on both price stability and employment."

"Uncertainty requires us to wait and watch with vigilance."

"I expect inflation to moderate."

"Continuity of Fed policy does not depend on who is in Fed chair."

"It would be premature to start asking if we should quicken the taper."

"As (the) delta variant wears off, (I) expect economy to regain momentum."

"I'm optimistic but would not surprise me if growth ahead is more moderate than what we saw earlier in year."

"Fed would not be constrained by what other central banks are doing."

"Infrastructure spending might boost inflation in short term but lower it, and boost productivity, in long term."

- XAG/USD rallies as US inflation shoots through the roof, its most significant jump in 30 years.

- XAG/USD spiked $0.80 as news headlines crossed the wires.

- US 5-year real yields measurement falls from -1.85% to -1.941%, weighing on the US dollar.

Silver (XAG/USD) price spiked higher as the Bureau of Labor Statistics (BLS) revealed that the Consumer Price Index for October, a US measurement of prices paid by consumers, expanded by 6.2% – higher than the September 5.4% jump in inflation, and the largest since 1990. That said, the non-yielding metal has advanced almost 3%, trading at $25.01 at the time of writing.

XAG/USD reacted with a price jump of $0.80, from $24.20 to $25.00, once the news crossed the wires. The bounce in prices left behind September and October highs at $24.87 and $24.82, respectively, which could now act as support areas going forward.

US Consumer Price Index rose by 6.2%, the most significant reading since 1990

In the US economic docket, the Bureau of Labor Statistics (BLS) revealed that the Consumer Price Index (CPI) surged 6.2% on a year-over-year basis, up from 5.4% in September, leaving behind estimations of 5.3% by economists. Further, the Core CPI reading, which excludes volatile items like energy and food, expanded by 4.6% in the same period, higher than the 4.8% foreseen by the market.

Meanwhile, the 10-year US T-bond benchmark note rose almost seven basis points, recovering some of its weekly losses, sitting at 1.517%, underpinning demand for the greenback. The US Dollar Index, a measure of the buck’s value against its peers, advanced 0.67%, to currently trade at 94.59.

But why do silver prices keep getting higher? The answer is that real yields, the difference of interest rates minus inflation, are dropping. The US 5-year TIPS, real yields measurement, has fallen from -1.85% to -1.941%, the second-lowest reading since July 2021, per Reuters.

XAG/USD Price Forecast: Technical outlook

Daily chart

The white metal has a near-term upward bias, as witnessed by the shorter time-frame daily moving averages (DMA’s) below the spot price, but the 200-DMA sits at $25.38, which would be strong resistance for silver bulls to overcome. Despite the abovementioned, the Relative Strength Index (RSI) at 67 still has enough room left before reaching overbought conditions, indicating that XAG/USD could print another leg-up.

As mentioned in the previous paragraph, the 200-DMA at $25.38 would be the first resistance level in the outcome of another push higher. A breach above that level could open the door for the bulls to attack the $26.00 area, which would then expose the $27.00 figure to being broken.

On Thursday, the Bank of Mexico will have its monetary policy meeting. According to the Research Department at BBVA, Banxico will hike rates by 25bps to 5%. They consider it would be important for the central bank not to signal the possibility of a faster pace of tightening.

Key Quotes:

“A strong core inflation print and a further rise in 12-months ahead core inflation expectations will keep Banxico in a tightening mode.”

“We expect Banxico to revise upwards its headline inflation forecasts for 4Q21 and 1Q22 and we would not be surprised if one of the hawk members of the Board votes for a larger 50bp hike.”

“We think the majority of the Board will not vote for a larger hike. We think that a faster pace of tightening is not warranted and would risk and unwanted excessive policy tightening in 2022.”

“If Banxico hikes the policy rate by 25bp two more times by year end, it will take the rate close to the neutral estimated level with the Federal Reserve about to start the liftoff in late 2022. We think that it is a better strategy to avoid increasing rates faster.”

The Israeli shekel (ILS) has fought back against an aggressive Bank of Israel (BOI) foreign exchange intervention program and is currently stronger than pre-intervention levels, explained analyts at Wells Fargo. However, they see the shekel is due for a correction as renewed dollar strength and a new intervention program are likely, and should push the currency weaker over the coming months.

Key Quotes:

“Most of our currency-related models and frameworks identify the Israeli shekel as one of the least vulnerable and low volatility emerging market currencies. Our currency tools identify Israel as having strong underlying economic fundamentals and stable local politics, making the shekel somewhat insulated from any unforeseen shocks to global financial markets.”

“In our view, the shekel has overshot to upside and the currency is likely to experience a correction in the near future. We base this view on two factors: 1) broad U.S. dollar strength and 2) BOI policymakers initiating another FX intervention program.”

“We also believe the central bank will become increasingly worried about the overall strength of the shekel and will look to get more active in foreign exchange markets after the current intervention program officially ends.”

“Using prior levels as a guidepost, a USD/ILS exchange rate at ILS3.11 could be where BOI policymakers once again look to resist against the shekel getting much stronger.”

“The combination of renewed dollar strength and another BOI intervention should push the USD/ILS exchange rate weaker over the coming months. To that point, we expect the shekel to weaken back toward ILS3.20 by the beginning of Q2-2022.”

“Over time, we expect the shekel to once again gradually strengthen as markets focus on Israel's persistent current account surplus, stable politics and strong institutional framework.”

- USD/JPY has rallied sharply from Asia session lows under 113.00 and is testing its 21DMA at 113.80.

- A spike in US yields post-inflation data is widening US/Japan rate differentials and pushing the pair higher.

USD/JPY continues to recover from its earlier weekly lows under the 113.00 level and is now, in wake of a much hotter than expected US Consumer Price Inflation report, testing its 21-day moving average at 113.80. That means the pair is now trading about 0.8% higher on the day, its best one-day performance in a month.

The move is primarily being driven by a sharp rally in (nominal) US bond yields as traders up their bets that the Fed is more aggressive with rate hikes to combat inflation and as investors flee assets whose value is eroded by inflation (such as nominal bonds). 2-year yields are up 9bps to 0.50% and 5-year yields are up more than 10bps on the day to above 1.17%. That compares to a rally of just over 1bps in the 30-year yield. US yield curve flattening traders are betting on a combination of higher inflation/a more hawkish Fed response in the medium term (i.e. over the next up to five years), but are not significantly upgrading their long-term growth or inflation expectations.

Either way, higher yields and expectations for a more forceful Fed response to inflation has given US/Japan rate differentials a sizeable boost. USD/JPY is highly sensitive for rate differentials and is thus rallying as a result. As pressure builds on the Fed to drop its current stance that the spike in inflation is transitory, and thus doesn’t warrant a policy response, builds, traders should lookout for any signs that the bank might shift policy in a hawkish direction. Any hints of this would send short-end US yields even higher, put further upwards pressure on US/Japan rate differentials, and likely push USD/JPY back to annual highs.

If USD/JPY is able to break to the north of its 21DMA, this will open the door to a run at the 114.00 level and the recent highs just above it in the 114.20-114.40 region. Bullish technicians may be targetting an eventual move back to annual highs just above 114.60.

- US dollar mixed despite US data, DXY holds at daily highs

- Canadian dollar among top performers of the day.

The USD/CAD is falling modestly on Wednesday, with the Loonie among the few currencies to rise against the greenback. The pair bottomed at 1.2386 after the beginning of the American session, and during the last hour, it rebounded back above 1.2400.

The rebound of the pair took place as the US dollar recovered strength across the board. It is trading near 1.2420, still negative for the day but off lows. The greenback is resuming the upside supported by higher US yields.

Economic data from the US surprised with the CPI inflation rate reached the highest level since 1990. A different report showed initial jobless claims dropped to fresh pandemic lows.

Short-term outlook

The bias in USD/CAD still points to the downside. A recovery above 1.2450 would remove the bias, favoring a test of the weekly high at 1.2485. A consolidation below 1.2400 should strengthen the negative tone. The next support stands at 1.2365.

On the contrary, the daily chart shows USD/CAD rebounding from the 20-day moving average and holding a bullish perspective. The 200-day simple moving average at 1.2475 continues to curb the upside.

Technical levels

Developing story...

- US Inflation figures rose at the fastest annual pace since 1990.

- XAU/EUR: Broke the €1,600, once the headline crossed the wires, as investors flew to gold as an inflation hedge, as real-yields extend its losses.

- XAU/EUR: Two resistance levels lie on the way towards €1,700.

Gold spot against the Euro, rallies 1.42%, trading around €1,605 during the New York session at the time of writing. Factors like US inflation figures rising towards the highest readings since 1990 and a dovish European Central Bank (ECB) spurred a €20 jump on Wednesday’s price action. Furthermore, the market sentiment is in a risk-off mood, which gained follow-through once US Inflation figures were known.

US Consumer Price Index increased by 6.2%, the largest reading since 1990

In the US economic docket, the awaited inflation figures were unveiled. The Bureau of Labor Statistics (BLS) revealed that the Consumer Price Index (CPI) surged 6.2% on a year-over-year basis, up from 5.4% in September, leaving behind the 5.3% estimations by economists. Further, the Core CPI reading, which excludes volatile items like energy and food, expanded by 4.6% in the same period, higher than the 4.8% foreseen by the market.

The US real yields plummeted once the figure crossed the wire, with the US 5-year TIPS, real yields measurement dropping from -1.85% to -1.941%, the second-lowest reading since July 2021, per Reuters.

XAU/EUR Price Forecast: Technical outlook

Daily chart

-637721528120124142.png)

The yellow-metal rose sharply through the €1,600 roof when the headline crossed the wires, leaving the January 5 high at €1,591 previous resistance level behind, which will act as support. Additionally, the Relative Strength Index is at 72, aims higher, while the daily moving averages (DMA’s) remain well below the spot price, supporting the upward bias.

The first resistance level would be November 9, 2020, high at €1,652. A breach of the former would expose the August 8, 2020, high at €1,689, and then the psychological €1,700 figure.

AUD/USD has trended lower since the start of the month having failed to break above the 200-day moving average (DMA) now at 0.7549. Today, the aussie is testing the 100-DMA at 0.7386 and economists at Rabobank expect the pair to fall to the 0.73 level.

Declining iron ore prices weighs on the aussie

“A close below the 100-DMA at 0.7386would strengthen the case for a move towards 0.73.”

“AUD/USD has extended the losses made in the wake of the November 2 RBA policy meeting with further falls in the prices of iron ore and weak technical indicators undermining confidence in the AUD.”

“We retain our three-month AUD/USD target of 0.73.”

Economists at Deutsche Bank believe that the US dollar is set to enjoy a more favourable environment by the end of 2021. Therefore, they have lowered EUR/USD year-end forecast to 1.16.

European basic balance very weak

“We modestly upgraded our dollar forecasts for year-end: persistently stagflationary dynamics – lower growth but higher inflation expectations and a hawkish Fed bias – leave little room for a dollar downtrend.”

“In Europe, there has been a huge decline in real yields on the back of persistent ECB dovishness. The European inflow story has also proven a disappointment. Hence, we have a lower year-end EUR/USD forecast of 1.16 with downside risks.”

GBP/USD drops on renewed Brexit-related concerns. Economists at Scotiabank expect the cable to test the low-1.34s after initial support around the 1.3485 mark.

Tensions with the EU over Northern Ireland cloud the near-term outlook for the GBP

“With the UK planning to abandon parts of the accord that regulate the free movement of goods between Northern Ireland and Great Britain, the EU is considering retaliatory measures that could eventually include ripping up the free-trade agreement signed in late-2020. For now, we think that is a minimal risk but the probability of this scenario and continued tensions with the EU over the next few months will act as a weight on the GBP.”

“Sterling is testing the 1.35 support area as it extends its losses from yesterday’s test of 1.36. The figure area should halt the steep slide in the GBP, but technical factors are aligned for a re-test of the low 1.34s – after intermediate support at ~1.3485 and the mid-figure zone.”

“Firm resistance is 1.3600/10 followed by the mid-figure area, but the GBP will have to push through 1.37 (50-day MA at 1.3688) to meaningfully negate downward momentum.”

- Major equity indexes in the US push lower on Wednesday.

- Defensive sectors edge higher after US inflation data.

- Technology shares suffer heavy losses after the opening bell.

Wall Street's main indexes opened in the negative territory on Wednesday with the October inflation data weighing on risk sentiment. As of writing, the S&P 500 Index was down 0.46% on the day at 4,663, the Dow Jones Industrial Average was losing 0.1% at 36,295 and the Nasdaq Composite was falling 1.05% at 15,711.

Reflecting the souring market mood, the CBOE Volatility Index, Wall Street's fear gauge, is up more than 3%.

The US Bureau of Labor Statistics reported on Wednesday that the Consumer Price Index (CPI) jumped to its strongest level since 1990 at 6.2% in October from 5.4% in September.

Among the 11 major S&P 500 sectors, the risk-sensitive Technology Index is down 1%. On the other hand, the defensive Real Estate and Utilities indexes push higher after the opening bell.

S&P 500 chart (daily)

- DXY edges higher to 3-day highs near 94.45 on Wednesday.

- US CPI surprised to the upside in October at 6.2% YoY.

- Weekly Claims came just below expectations at 267K.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rival currencies, keeps the bid tone unchanged above the 94.00 mark on Wednesday.

US Dollar Index up on yields, CPI

The resurgence of the buying interest in the greenback pushed the index further north of the 94.00 hurdle with some conviction midweek, helped at the same time by the rebound in US yields along the curve and higher-than-expected inflation figures.

In fact, the headline CPI rose 6.2% in the year to October, while the Core CPI gained 4.6% vs. the same month of 2020. Further results in the docket showed Initial Claims rising by 267K in the week to November 6.

From the US cash markets, yields of the 2y note extend the correction to the 0.50% area, while yields of the 10y benchmark note gradually approach the key 1.50% yardstick.

US Dollar Index relevant levels

Now, the index is gaining 0.16% at 94.14 and a break above 94.62 (2021 high Nov.5) would open the door to 94.74 (monthly high Sep.24 2020) and then 95.00 (round level). On the flip side, the next down barrier emerges at 93.87 (weekly low November 9) seconded by 93.48 (55-day SMA) and finally 93.27 (monthly low October 28).

- AUD/USD has reversed kneejerk losses in wake of US inflation data and is now in the green above 0.7380.

- US medium-term inflation expectations have shot higher, calling the Fed’s dovish stance into question.

AUD/USD saw a kneejerk move lower in wake of the latest US Consumer Price Inflation (CPI) report, which showed price pressures were much higher than expected in the US in October. The pair initially dropped from the 0.7360s to as lows as 0.7340. However, in the subsequent minutes, the pair has seen a more than 40-pip recovery to fresh session highs in the 0.7380s, where it currently trades higher on the day by about 0.15%.

That could is likely because in response to the latest US inflation numbers, which seem to have triggered fears that the Fed is going to let inflation get out of control, the demand for inflation protection in US markets has surged. The US 5-year TIPS yield (a bond which offers inflation protection) has tanked 10bps on the day to its lowest levels since early August under -1.9%. Thus, the decline in US real yields is seemingly helping AUD/USD as it pushes real rate differentials in favour of AUD.

US inflation expectations becoming de-anchored

Nominal (as in, not inflation-protected) US 5-year bond yields have surged 8bps to above 1.15%. That implies a roughly 18bps rise in US 5-year break-even inflation expectations on the day to, as calculated by subtracting the 5-year TIPS (real) yield from the 5-year nominal yield. Indeed, according to Reuters market data, 5-year US breakevens are currently at 3.14%, their highest since the 5-year TIPS began trading (and the breakeven could start to be calculated) in 2004.

Surging medium-term US inflation expectations to levels well beyond the Fed’s 2.0% inflation seriously undermine the Fed’s current stance that inflationary pressures are “transitory” and set to fade in Q2/3 2022 and that, therefore, the bank patiently hold interest rates at close to zero as it waits for a full labour market recovery. In response to the data, USD STIR markets have been aggressively upping bets for Fed rate hikes in 2022; December 2022 eurodollar futures have dropped 12bps on the day from 99.25 (less than 60bps of implied policy tightening by the end of 2022) to 99.12 (more than 70bps of implied tightening by the end of 2022).

The fact that the US dollar is not strengthening on these hawkish Fed bets may reflect expectations that the Fed will respond to inflation too late and thus not be able to bring inflation back to the bank’s 2.0% target in the medium term. That erodes the real value of USDs versus other currencies where inflation isn’t as high and also keep’s US real yields suppressed.

EUR/USD slides on warning over German government finances. Accordingly, economists at Sotiabank expect the eurozone economy to lag behind its peers, weakening the common currency.

Germany's government finances are in a critical state

“The German audit office found that the government’s finances are in a ‘critical state.’ The auditor’s report means that the incoming SPD-led government may face resistance to turning on the spending taps over 2022 – thus delaying the country’s, and the Eurozone’s, economic recovery.”

“We think the Eurozone’s economic underperformance will be a key driver of EUR losses against the USD over the coming year to decline into the low 1.10s (our end-2022 forecast is 1.12).”

“We do not foresee an ECB hike until late-2023 at the earliest if everything goes as planned – including continuing fiscal stimulus.”

Australia will report its October employment data on Thursday, November 11 at 00:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks. The country is expected to have added 50K new jobs after losing 138K positions in September. The Unemployment Rate is expected to have ticked higher, from 4.6% to 4.7%, although the Participation Rate is seen improving from 64.5% to 64.8%.

ANZ

“We expect employment to rise 50K ahead of the reopening but the unemployment rate to increase to 4.8%.”

Westpac

“Our -50K forecast is balancing the start of a recovery in NSW vs ongoing lockdown drags in Vic. Risks are to the upside. We expect to see 0.2ppt drop in participation to 64.3% which will result in a 40K drop in the labour force, enough to limit the rise in unemployment to just 0.1ppt (rounded) to 4.7%.”

BBH

“A gain of 50K is expected vs. -138K in September, as the economy begins to reopen. The unemployment rate is expected to rise two ticks to 4.8%, suggesting little risk of accelerating wage pressures right now. No wonder the RBA’s Statement of Monetary Policy underscored the likelihood that lift-off won’t be seen until 2024. Next policy meeting is December 7 and no change in policy is expected then.”

SocGen

“We expect a significant rebound in employment numbers for the month of October (+80K), as the economy reopened in the two major cities of Sydney and Melbourne. However, the unemployment rate is likely to rise a bit (4.8%) despite the recovery in employment, as the participation rate will probably show a sizeable increase (65%). In other words, the number of job seekers will rise faster than the number of jobs. Strong job market recovery from the Delta outbreak-driven damage is likely to continue into 2022.”

Citibank

“Employment (Citi: +48.1K, previous: -138K); Unemployment Rate (Citi: 4.7%, previous: 4.6%); Participation Rate (Citi: 64.8%, previous: 64.5%). Volatility in the labour force survey is expected to persist in October, as NSW began reopening at the start of the month, VIC following towards month’s end. We expect employment to rise in October. The pickup in the participation rate is expected to offset the increase in job gains. While uncertainty persists around the headline labour force statistics, We are more certain of the fact the number of hours worked has troughed, and may likely improve further in October with both locked down states reopening.”

See – Australian Employment Preview: A positive surprise or too much optimism?

The S&P 500 has entered a short-term breather after rising sharply again last week. But as the the 4750 level is now within reach, analysts at Credit Suisse believe that an overshoot to 4875 is increasingly likely.

Support remains seen at 4663/51 initially

“S&P 500 remains only slightly below our 4741/50 core Q4 objective, as well as confirmed trend resistance from April 2021. We expect this pause to persist over the next couple of sessions given the importance of this resistance, however post this phase, we believe that the top of our typical extreme zone, which is now seen at 4875, is increasingly likely to be achieved before year-end, due to the strong momentum observed within US equities.”

“Both short-term RSI and MACD momentum are at very strong levels, whilst medium term momentum is accelerating, which reinforces the case for a further ‘melt-up’ into year-end.”

“Support remains seen at 4663/51 initially, before 4627/20 and then 4589/82, which ideally holds to keep the immediate upside bias. A break can see a deeper corrective pullback, however this is certainly not our base case.”

- AUD/USD dropped to near one-month lows in reaction to stronger US CPI print.

- The downtick was bought into amid some repositioning ahead of Aussie jobs data.

- The risk-off impulse, hawkish Fed expectations should cap the upside for the pair.

The AUD/USD pair quickly reversed the US CPI-led fall to near one-month lows and was last seen trading with only modest intraday losses, around the 0.7365-70 region.

The pair added to the previous day's heavy losses and witnessed follow-through selling for the second successive day amid resurgent US dollar demand on Wednesday. The downward trajectory extended through the early North American session following the release of hotter-than-expected US consumer inflation figures.

In fact, the headline CPI rose 0.9% MoM in October – marking the largest advance in four months – and the yearly rate accelerated to 6.2% or the most since 1990. Adding to this, the annual Core CPI (excluding volatile food and energy prices) increased 4.6% as against the expectation for a steady reading of 4%.

The data added to concerns about persistent inflationary pressures and reinforced speculations about an early policy tightening by the Fed. This, in turn, acted as a tailwind for the US Treasury bond yields. Apart from this, a softer risk tone benefitted the safe-haven USD and weighed on the perceived riskier aussie.

The AUD/USD pair to an intraday low level of 0.7340, though the slide was quickly bought into as the markets have been pricing in the possibility of a Fed rate hike move in 2022. Investors also prefer to wait for a fresh catalyst from Thursday's release of the Australian jobs report before placing fresh directional bets.

Nevertheless, a sustained break/acceptance below 100-day SMA favours bearish traders and supports prospects for an extension of the recent downward trajectory. Hence, the attempted recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the 0.7400 round-figure mark.

Technical levels to watch

More and more stories are emerging on the “French Trump”, Éric Zemmour. How will markets react if Eric Zemmour starts gaining even further momentum in polls? Economists at Nordea believe that markets will position for “doomsday” in French assets into the election, which will be reversed quickly after the actual election.

The French election matters for positioning

“French bonds sold-off markedly versus peers into the election in 2017 when Marine Le Pen carried momentum into the election. This goes to show that ‘fearmongering’ in the media actually works to scare of positioning, why we would envisage a similar or even larger positioning effect should the media truly start to believe that there is a risk of Eric Zemmour winning the presidential outing.”

“The EUR will likely suffer versus peers from such a positioning flow (due to Japanese and US investors closing down French positions), while French-German spreads will widen and moreover we could see a further tendency towards intra-European haven seeking with EUR/CHF, EUR/DKK and EUR/SEK under downside pressure should Zemmour’s current polling trends intensify. Ultimately, these positioning trends will likely reverse immediately after the second election round, even if Zemmours wins, but we will not get there without substantial fearmongering ahead of it.”

“We are yet to see any France negative flows, why the story is most likely still non-consensus.”

- Spot gold has surged to fresh multi-month highs in the $1840s after much higher-than-expected US inflation figures.

- The YoY rate of headline inflation rose to 6.2%.

Spot gold (XAU/USD) prices have spiked higher in response to the latest US Consumer Price Inflation (CPI) report. Prior to the data release, XAU/USD was just under $1828, but it now trades close to the $1850 mark, a level likely being targetted by short-term bullish speculators and with on-the-day gains of about 0.9%. Spot prices are up around 1.2% from earlier session lows around $1823.

Crucially, the recent surge higher in spot gold prices has taken the precious metal above a key area of resistance and to its highest levels since June. Over the summer months, spot prices had been unable to break beyond the $1835 level, but it seems this level has now been busted. Any retracement back towards the mid-$1830s may be used as a buying opportunity for gold bulls.

Hot US Inflation

The YoY rate of headline CPI rose to 6.2% in October (expected was 5.8%) from 5.4% in September, amid a much faster than expected MoM increase of 0.9% (expected was 0.6%). Core measures of inflation also came in higher than expectations, with the YoY rate rising to 4.6% from 4.0% in September, and the MoM rate accelerating to 0.6% from 0.2% in September.

The data has put significant upwards pressure on US yields, particularly at the front end, with the 2-year yield current up nearly 8bps on the day above 0.48% and the 5-year yield up about 7bps to above 1.14%. The rise in yields is being driven by a sharp surge in inflation expectations. This explains the sharp rise in gold – demand for inflation hedges, which could also explain why Bitcoin is now up 1.5% on the day.

- EUR/USD recedes further and retests 1.1530 on Wednesday.

- US October CPI rose 6.2% YoY, Core CPI gained 4.6% YoY.

- US Initial Claims rose by 267K from a week earlier.

Further upside in the greenback forced EUR/USD to drop and clinch new weekly lows near 1.1530 midweek.

EUR/USD offered on US data

EUR/USD extends the daily pullback in response to the solid performance by the greenback, in turn underpinned by the rebound in US yields and higher-than-expected inflation.

On the latter, US inflation tracked by the CPI rose at an annualized 6.2% in October and 0.9% inter-month. Core consumer prices also rose above expectations at 4.6% from a year earlier and 0.6% vs. the previous month. Additional US data saw weekly Claims rising by 267K, just a tad below estimates.

The persistent move lower in spot exclusively follows the rebound in the buck amidst the recovery in US yields along the curve.

EUR/USD levels to watch

So far, spot is down 0.44% at 1.1541 and next up faces the barrier at 1.1616 (monthly high Nov.4) followed by 1.1675 (55-day SMA) and finally 1.1692 (monthly high Oct.28). On the other hand, a break below 1.1513 (2021 low Nov.5) would target 1.1495 (monthly high Mar.9 2020) en route to 1.1422 (monthly high Jun.10 2020).

- Resurgent USD demand prompted fresh selling around GBP/USD on Wednesday.

- Hotter-than-expected US CPI, the risk-off impulse further underpinned the USD.

- Brexit woes, dovish BoE weighed on the GBP and support prospects for further losses.

The GBP/USD pair added to its intraday losses and weakened further below the key 1.3500 psychological mark in reaction to hotter-than-expected US consumer inflation figures.

Following a brief consolidation earlier this Wednesday, the GBP/USD pair met with fresh supply and extended the previous day's retracement slide from levels beyond the 1.3600 round-figure mark. The downfall was exclusively sponsored by a strong pickup in demand for the US dollar, which drew support from rebounding US bond yields and a softer risk tone.

Intraday, USD buying picked up pace following the release of the latest US inflation figures, which showed that the headline CPI rose 0.9% MoM in October as against an uptick to 0.5% anticipated. Adding to this, the yearly rate jumped to 6.2%, while the core CPI which excludes food and energy prices also surpassed market expectations by a big margin.

The data further fueled speculations that the Fed would be forced to adopt a more aggressive policy response to contain the continuous rise in inflationary pressures. This, in turn, acted as a tailwind for US Treasury bond yields, which continued underpinning the greenback and dragged the GBP/USD pair lower.

Meanwhile, worries that the UK government will trigger Article 16 of the Northern Ireland Protocol, along with the Bank of England's dovish decision last week acted as a headwind for the British pound. This was seen as another factor that contributed to the GBP/USD pair's decline below the 1.3500 mark, setting the stage for additional losses.

Technical levels to watch