- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-11-2021

- GBP/JPY printed a daily low at 152.81, but late in the New York session bounced off, reclaiming 153.00.

- GBP/JPY: In the near term, the trend is tilted to the downside but found strong support around 153.00.

The British pound recovered some ground on Friday, as the New York session finished, trading at 153.12, down 0.29% at the time of writing. The New York session ended with an upbeat market mood, as portrayed by US stock indices, rising between 0.08% and 0.56%.

On Friday, the GBP/JPY pair reached a daily low at 152.81, but the Sterling pound recovered some losses as the American session progressed, trimming some losses, and the GBP/JPY bulls reclaimed the 153.00 level.

GBP/JPY Price Forecast: Technical outlook

Daily chart

-637717475793217102.png)

The GBP/JPY Friday’s price action witnessed the pair breaking the 50-day moving average (DMA) to the downside, as the 50-DMA sits at 153.14, leaving GBP bulls at risk. The positive out of the drop in the day is that the 100-DMA was not at risk, but if the GBP/JPY selling pressure continues to mount, it could be broken, exposing the 152.00 psychological support level.

For GBP/JPY bulls to reclaim the near-term control, they will need to reclaim the 50-DMA so that they can challenge the psychological 154.00. In the case of that outcome, the following supply zone would be 156.00.

- AUD/JPY: The break below 84.60 confirmed the double-top chart pattern, with 83.00 as the target.

- AUD/JPY: The near-term trend is downward, but caution is warranted as the longer-term trend is up.

The AUD/JPY slides to fresh weekly lows during the New York session, down 0.33%, trading at 83.90 at the time of writing. The market mood is upbeat, portrayed by global equities rising during the day. In the FX market, risk-off mood benefits safe-haven currencies like the Japanese yen and the Swiss franc.

Meanwhile, the US Dollar has been offered since the American session got underway, on the back of plunging US T-.boind yields, as investors take notice that the Federal Reserve would not raise rates at the pace expressed by market participants in the money markets.

AUD/JPY Price Forecast: Technical outlook

Daily chart

In the daily chart, the AUD/JPY broke below the neckline of a double-top at 84.60. Additionally, the 84.00 gave way to AUD/JPY sellers, which seem to be in control for the last couple of sessions. Despite that, in the near term, the cross-currency pair has a downward bias; the longer-term trend is up. The daily moving averages (DMA’s) remain below the spot price but would be at risk of being breached as they lie below the double-top target at 83.00, within the 81.80-82.80 range.

- The S&P 500 closed at record highs for a seventh session in a row, climbing above 4700 intra-day.

- The index, and stocks more broadly, were boosted on Friday by positive US jobs and Pfizer pill news.

It was a strong end to a strong week for the S&P 500 and other major US equity indices. The S&P 500 clinched a seventh consecutive record close at 4697 after briefly surpassing the 4700 level intraday. The index ended the week up over 2.0% on the week, its best such run since June and is on course for five straight weeks in the green, the best run of weekly gains since August 2020. Out of the last 18 sessions, the S&P 500 has only seen 2 negative days. The Nasdaq 100 rose 0.1% and the Dow gained 0.6%.

Strong US labour market data, which appeared at the time to infuse markets with confidence in the strength of the US economic recovery, and positive news regarding a new, effective Covid-19 treatment were the two major news stories driving equities higher on Friday. With regards to the latter story, Pfizer announced that it was halting a trial of a new pill early due to overwhelmingly positive early data (90% reduction in deaths and hospitalisations in at risk adults, according to early findings) and would apply directly for emergency use authorisation.

Some analysts said the pill, which comes on the heels of a recently developed alternative pill from Merch with a 50% mortality rate reduction, would be a game-changer and enable the global economy to “live with the pandemic”. Pfizer shares were up 11% on the news, whilst pandemic-hit sectors like airlines and cruises operators also got a sizeable boost, amid optimism that better available Covid-19 treatments would boost consumer confidence and accelerate a return to their pre-pandemic holiday/travel habits. “Stay-at-home” stocks like Zoom and Netflix fell.

The positive jobs and Pfizer pill news comes on the back of a well-telegraphed QE taper announcement from the Fed earlier in the week, whose patient tone at the time with regards to rate hikes/policy tightening helped boost equities at the time. Earnings have also broadly been positive this week.

Some important US political themes are worth watching; the House of Representatives looks set to vote on and pass the $550B infrastructure spending package and a vote on Biden’s social-care package will likely follow soon after. By the end of next week, Biden’s economic agenda may have passed Congress and be signed into law, which could see the President’s faltering approval rating get a boost. President Biden is also soon likely to decide on whether he is going to renominate Fed Chair Jerome Powell, or whether he will pick a Democrat favoured candidates like Lael Brainard or Raphael Bostic. Powell is expected to secure the renomination, but if Brainard gets the nod, it could roil markets, as she is seen as more dovish.

- AUD/USD is on course to end the week sharply lower around the 0.7400 level, down about 1.6%.

- A dovish RBA on Tuesday was the major catalyst behind this week’s sharp drop.

AUD/USD is on course to end the week sharply lower around the 0.7400 level, about a 1.6% or 120 pip drop from last Friday’s closing levels around 0.7520. That marks the worst week for the pair since August.

Recapping this week's price action

AUD/USD was weighed heavily on Tuesday, falling from above 0.7500 to the low 0.7400s after the RBA delivered strong pushback against STIR market pricing for rate hikes as soon as 2022; RBA Governor Philip Lowe called the pricing an “over-reaction” to recent global inflation data and explained that it was far from clear whether or not such inflationary pressures would show up in Australia. The bank conceded that it might need to hike rates in 2023, a hawkish shift from their previous position of saying no rate hikes into 2024, but that would still leave the RBA substantially behind other major G10 central banks in terms of monetary policy normalisation, including the RBNZ, Norges Bank, BoC, Fed and BoE.

After consolidating on Wednesday, the Aussie dollar took a turn for the worse again on Thursday after the BoE roiled global rate and FX markets with a surprise decision not to hike interest rates by 15bps, triggering further global dovish repricing that seemed to hurt AUD in particular. That pushed AUD/USD down from the mid-0.7400s to under the psychological 0.7400 level. In wake of a very strong US labour market report on Friday, it seemed things were set to get even worse for Aussie, with AUD/USD at one point dropping as low as the 0.7460 level.

But a sharp drop in global developed market long-term yields led by the US has taken the wind out the US dollar’s sails and the Dollar Index, which did briefly hit a year-to-date high above 94.60 in the immediate aftermath of the jobs report, has now reversed into negative territory on the day in the 94.20s, giving tailwinds to its major G10 counterparts, including AUD. Thus, AUDUSD has been able to recover back to the 0.7400 level. FX markets now turn their attention to next week’s US October Consumer Price Inflation report on Wednesday, followed by the October Australia jobs report during Thursday’s Asia Pacific session. With regards to the former, the headline YoY rate of CPI is seen rising to a fresh multi-decade highs at 5.8%, reflecting the sharp recent rise in energy costs, as well as other rising cost pressures. It is likely to serve as a reminder that the Fed’s “transitory” argument is on shaky ground.

- USD/JPY slides for the second day in a row, below 113.50.

- The market sentiment is upbeat, on better than expected US Nonfarm Payrolls.

- Lower US T-bond yields acted as a headwind for the greenback.

- USD/JPY: A daily close beneath 113.50 exposes the 113.00 figures as the next support level.

USD/JPY extend its slump for two-straight days, down 0.32%, trading at 113.38 during the New York session at the time of writing. The market sentiment is upbeat, portrayed by US equity markets rising to all-time highs during the day amid a better than estimated US Nonfarm Payrolls report. Also, lower US Treasury yields, with the 10-year, which strongly correlates with the USD/JPY pair, are plunging eight basis points, down to 1.44%.

US Nonfarm Payrolls rose by 534K, better than the expected

The Bureau of Labour Statistics (BLS) in the US reported that the US economy added in October 534K new jobs to the economy, better than the 425K foreseen by analysts. Furthermore, the Unemployment Rate dipped from 4.7% to 4.6%.

Moreover, last month’s numbers reported that payrolls are stil short, 4.2 million below pre-COVID-19 levels. Further, the Unemployment rates for Hispanic Americans fell, whereas the African American and the Asian rates were unchanged.

The USD/JPY pair initially reacted to the upside, reaching a daily high around 114.00, but retreated the move once market participants dissected the report. It seems that the report was ignored after three central banks throughout the week pushed backward the idea of higher rates, as expressed by the RBA, the Fed, and the Bank of England in its monetary policy statements.

That, in turn, spurred the sell-off in the global bond market, led by US Treasuries, dropping severely, benefitting the prospects of safe-haven assets, like the Japanese yen and the precious metals.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is in consolidation within the 113.50-114.50 range. Furthermore, the 50 and the 100-simple moving averages (SMA’s) hover around 114.00, acting as a tailwind for price action in the last couple of days. At press time, the 113.50 level respected by USD/JPY traders has been broken, opening the door for further losses towards the 113.00 figure.

For USD bulls to resume the upward trend, they need to reclaim the 114.00 figure. In that outcome, the following resistance on the way north would be the downslope trendline that travels from October 20 high towards November 1 high, around 114.30. A breach of the latter would expose the 2021 high at 114.70.

On the flip side, a break below 113.00 could open the way for further losses. The first demand zone would be the September 30 high at 112.00.

- USD/CAD is flat at 1.2450 as US and Canadian jobs report fail to trigger lasting volatility.

- The pair will remain focused on oil price movements next week with a bare Canadian economic calendar.

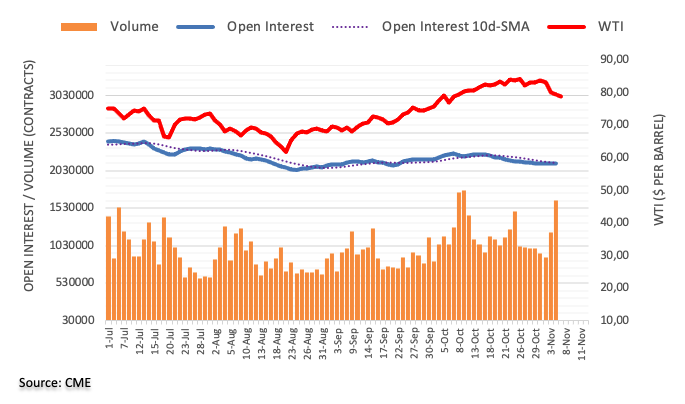

The Canadian dollar has broadly failed to benefit from the release of a strong Canadian labour market report on Friday, much like the US dollar and USD/CAD is sitting in neutral territory on the day around the 1.2450 mark. The pair has been subject to significant chop in recent days, in tandem with the volatile conditions seen in crude oil markets. As things stand, and though crude oil prices are well off weekly lows, WTI is set to end the week down around $2.0 or slightly more than 2.0%.

Bearish impulses from profit-taking, technical selling, big US inventory builds, concerns about demand in China (where a new Covid-19 outbreak is kicking off), and concerns that the US might release oil from its strategic reserve has outweighed the (widely expected) OPEC+ decision not to increase output in December by more than the 400K barrels per day/month rate stipulated in the cartel's current agreement. Looking ahead, with the Canadian economic calendar bare next week, choppiness in crude oil markets will remain a key driver of the pair.

Strong Canadian Labour Market

The Canadian labour market is on a tear. The economy added 31.2K jobs in the month of October, and while this was a little below the market consensus forecast for 50K, its was entirely driven by gains in full-time employment. Moreover, the private sector gained 70K jobs, taking its five-month count to 618K. That’s amounts to the fastest pace that the Canadian economy has added private-sector jobs on record if the initial post-lockdown reopening period of 2020 is discounted. Hours worked was also up 1.0% MoM, taking the YoY change in hours worked to 7.3%. The unemployment rate dropped more than expected to 6.7% from 6.9% in September.

The strong jobs report bodes well for the Canadian economy, suggesting a strong start to Q4. National Bank of Canada (a local bank, NOT the central bank) believe “there is room for more labour market build up in the months ahead” and cite indicators of strong demand for labour, including CFIB data which shows as many as 49% of SMEs are reporting a lack of skilled labour as limiting production, while 40% are reporting a lack of unskilled labour, with both of these metrics at their highest since 2009. Friday’s jobs report does not harm the prospect of BoC rate hikes as soon as Q2 2022.

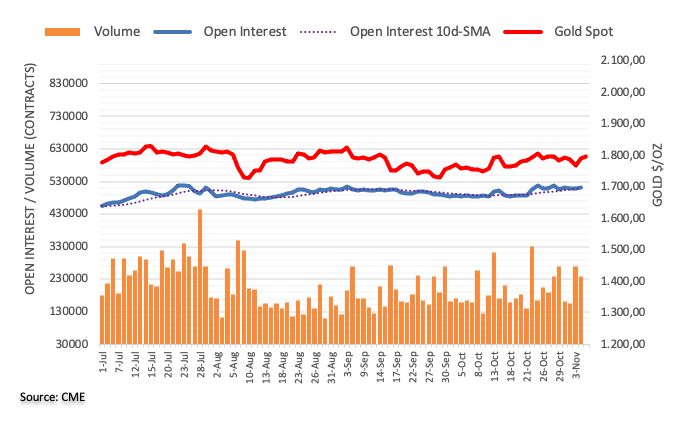

- Spot gold hit its highest level in nearly two months above $1815 in recent trade, boosted as US yields drop.

- The precious metal has pulled off an impressive recovery from Thursday lows around $1760.

Spot gold (XAU/USD) hit two-month highs on Friday, printing highs in the $1815.00s, slightly above the October high at $1813.85. With spot prices now up over $20 on the day, that marks an impressive more than $50 turn-around from previous weekly lows around the $1790 mark set on Wednesday. If prices can manage a clean break above the October highs, that could open the door to an extension of gains towards the next key area of support, a quadruple top in the low $1830s that gold was unable to get above despite multiple tests in July, August and September.

Yields fall sharply

A sharp decline in long-term US government borrowing costs, which reduces the opportunity cost of holding precious metals, thus incentivizing market participants to invest, has been the major fact driving the gains on Friday, as was also the case on Thursday when the precious metal recovered sharply from weekly lows. For reference, US 10-year yields have fallen sharply from around 1.55% to 1.45%, despite the strong US labour market report released ahead of the US market open and a similar move lower has also been witnessed in US real yields, with the 10-year TIPS dropping sharply from around -1.03% to current levels around -1.10%. Gold’s cause is also helped by the fact that the US dollar has pulled back after hitting fresh year-to-date highs earlier in the session. The Dollar Index is now flat on the day at 94.30 having at one point been above 94.60.

What's driving the drop in yields?

Some analysts are perplexed by the market’s reaction to the October US jobs report, which saw headline payrolls beat expectations by 100K, a positive revision to the September payroll number of more than 100K, a larger than expected fall in the unemployment rate and a further rise in the YoY rate of wage growth. Typically, a better-than-expected US labour market report would be expected to boost optimism about the health of the US economy and boost the likelihood that the Fed is going to be more hawkish, thus pushing up interest rates and bond yields (and the dollar).

One reason why this may not have been the case is the fact that markets may still be focused on this week’s plethora of central bank updates rather than on US economic data; the RBA, Fed and BoE all issued monetary policy decisions and while the Fed was interpreted quite neutrally by markets, the RBA and BoE were interpreted as unequivocally dovish, contributing to a broad-based decline in global bond yields, which seems to have carried over into Friday. Some also cited technical buying of the US 10-year bond as it broke a key area of resistance to the upside (when prices rise yields fall and in terms of yields, this area of support was around 1.51%).

Another reason why bonds might have dropped sharply could be because markets have also been quite heavily focussed on who US President Joe Biden is going to pick as his next Fed Chair. Odds this morning favoured Jerome Powell’s reappointment, given that he was spotted visiting the White House on Thursday. But since then, both Powell and fellow Board of Governors member Lael Brainard (who is VERY popular in the Democrat party) have been spotted at the White House, which has increased speculation that Brainard might get the nod. Recently, Brainard has been seen as one of the more dovish Fed members (who is seen as preferring to prioritize getting the US back to full-employment rather than prioritising bringing down inflation), so her nomination might be harmful to the prospect of rate hikes in 2022.

- The US Dollar Index printed a new 2021 high at 94.62, on better than expected US NFP.

- The US 10-year Treasury yields drop almost seven basis points, undermining the greenback.

- DXY: A break above 94.62 would open expose the 95.00 figure.

The USD Dollar Index, also known as DXY, measures the greenback’s performance against a basket of six peers, slides during the New York session, down 0.07%, sitting at 94.26 at the time of writing.

Better than expected US Nonfarm Payrolls report showed that the US economy added 531K new jobs, more than the 425K foreseen, initially prompting the US Dollar Index towards new yearly highs, around 94.62. However, US Treasury yields are dropping, with the 10-year benchmark note slumping almost seven basis points, down to 1.458%, for the first time since October 4.

US Dollar Index Price Forecast: Technical outlook

The daily chart depicts the US dollar’s upward bias, as the daily moving averages (DMA’s) remain well below the price, with an upward slope. It is worth noting that despite the greenback being weaker on the day, it is holding above the November 1 high at 94.31, which in case of closing above it, would keep USD bulls at the range of another test of the 2021 year highs.

Furthermore, Andrew Pitchfork’s indicator tool shows that the US dollar has been comfortably trending up in the lower range of the channel at no risk of a downward break.

If the US dollar bulls want to accelerate the uptrend, they will need a break above 94.60. In that outcome, the following resistance area would be 95.00. On the flip side, a break below 94.00 would push the DXY towards the 50-day moving average at 93.48.

- GBP/USD recovers from earlier losses advance 0.05% during the day.

- Global bond yields, drop led by US Treasuries.

- GBP/USD trader’s focus is on US inflation figures to be revealed on November 9.

GBP/USD stages a comeback during the New York session, after dipping as low as 1.3411, is trading at 1.3503, up some 0.05% at the time of writing. Positive US Nonfarm Payrolls report initially struck the British pound, which collapsed 70 pips towards the daily low. However, as investors dissect US jobs news, global bond yields plunge, led by US Treasury yields, with the 10-year benchmark note down almost seven basis points, sitting at 1.462%, undermining the US dollar prospects.

On Wednesday, the US Bureau of Labor Statistics reported that the Nonfarm Payrolls for October increased by 531K higher than the 425K foreseen by analysts. Additionally, the Unemployment Rate shows the labor market’s resilience, as it dropped from 4.7% to 4.6%.

The GBP/USD, which was licking its wounds after the Bank of England held its interest rate unchanged (not a move expected at least by 50% of the analysts), continued its slide during the last two days. Nevertheless, it seems investors are reassessing current conditions, as money markets are witnessing a global bond sell-off, which acted as a headwind on the greenback, as portrayed by the US Dollar Index falling 0.09%, sitting at 94.24.

UK and US important macroeconomic events for the next week

The UK economic docket will feature on November 6, Retail Sales. Then on November 11, the Gross Domestic Product for the third quarter, followed by the Manufacturing and Industrial Production readings for September.

Across the pond, on November 8, the Producer Price Index for October, followed by November 9 Inflation figures for the same period. Then by November 12, the University of Michigan Consumer Sentiment Index for November.

GBP/USD Price Forecast: Technical outlook

In the daily chart, the GBP/USD pair bounced off 1.3411, and at press time is trading above Thursday’s close at 1.3497. Furthermore, if it achieves a daily close of at least around 1.3500, it would form a hammer after a strong downtrend, meaning that solid buying pressure around the lows of the day propelled the British pound higher. However, the Relative Strength Index (RSI) is at 37, flattish, which would refrain GBP/USD traders of opening fresh bids, on the possibility of higher prices.

Analysts at MUFG Bank raise their USD forecasts for the fourth quarter of 2021 and the first one of 2022. They continue to see some upside potential in the near term.

Key Quotes:

“The US dollar is strengthening in the aftermath of the updated guidance from the FOMC and Fed Chair Powell on Wednesday evening. There were certainly no big surprises and the announcement of the taper plan was exactly as had been indicated in the minutes from the last FOMC meeting. There is flexibility in the pre-set pace reduction of USD 15bn (USD 10bn UST; USD 5bn MBS) and based on incoming data could be accelerated or slowed down. The termination point is therefore as expected also and despite our view that Chair Powell erred on the dovish side in his communications the short-end of the rates curve actually increased modestly, thus providing some support for the dollar.”

“September rate hike is more than priced. The limited response to the dovish tilt to Fed communication is down to the fact that ultimately it will be incoming data that will dictate policy changes. The speed of tapering could alter and the markets for now consider a faster taper more probable than a slower taper. That bias makes sense with the ADP data this week pointing to upside risks for the jobs report and other data this week has also been strong. The leveraged market is already positioned long USD and the Fed’s communication won’t discourage that.”

“We raised our USD forecasts for Q4 and Q1 2022 and we continue to see near-term upside potential for the US dollar.”

- The S&P 500 hit 4700 for the first time on Friday and looks set to gain for a seventh session.

- US equities are boosted in wake of strong US jobs data, positive Covid-19 treatment news and lower yields.

The S&P 500 bull run continues, with the index hitting the 4700 for the first time ever amid broad-based gains across equity sectors. A positive close on Friday would mark seven consecutive sessions in the green and would mean the index has only fallen in two out of the last 18 sessions. The S&P 500 is now up more than 2.0% on the week, its best such run since June and is on course for five straight weeks in the green, the best run since August 2020. Whilst earnings has underpinned much of the recent rally, attention has switched elsewhere in the latter part of this week, with broadly dovish central bank vibes from the likes of the Fed, ECB, RBA and BoE all seemingly helping.

US economic data has also been very strong this week. US labour market data for October was released on Friday and showed the economy adding 531K jobs, more than the 425K expected, with the previous month’s payroll number also getting a hefty more than 100K upwards revision. The rest of the labour market report was also strong, with the Unemployment Rate falling to 4.6% and Average Hourly Earnings rising to 4.9%. Rather than triggering any worries about an earlier move to hike interest rates from the Fed, Friday’s strong US jobs report (and the rest of the strong US data out this week) appears to have instead injected a dose of optimism in the pace and health of the US economic recovery. A drop in long-term US government borrowing costs at the end of the week is also helping to underpin the price action.

Stocks have also been getting a boost from the news that Pfizer stopped a trial of an experimental anti-viral pill after early results showed the drug cut the chances of hospitalisation and death in at risk adults by 89%. The company said it would submit the findings to the US FDA to get emergency use authorisation as soon as possible. Some analysts are framing the latest news from Pfizer as a “game-changer” and “the end of the pandemic”, which may be a bit of an overstretch, but with vaccines already significantly reducing the death toll of the virus and now the added confidence that death rates can be reduced by a further 90%, it is likely that confidence in public health will be drastically better in 2022 versus 2021 and 2020.

Unsurprisingly, pandemic-hit equity sectors such as travel stocks are surging. The S&P 1500 Airlines Index is up 6.5% on the day, and major cruise stocks (like Carnival and Royal Caribbean Cruises) are up by just shy of 10%. On the flip side, stocks that have benefitted from lockdowns and the transition to home working like Zoom and Netflix suffered. There has also been a lot of attention on Pelaton Interactive’s share price, which is down over 30% on Friday, though this is due to poor earnings more than anything else.

October’s NFP report showed a net gain in jobs of 531K above the 425K of market consensus. Analysts at Wells Fargo point out that those numbers in employment hinted that many of the recent headwinds to hiring, such as the Delta variant, parts shortages and the availability of labor itself, are beginning to ease. They expect hiring to remain robust over the coming months, as workers' constraints ease and financial needs rise.

Key Quotes:

“With tapering announced, the next mile-marker Fed watchers need to look out for is the labor market reaching "maximum employment". Wage growth is one way in which the jobs market is already tight, with measures of hiring difficulties hovering near record highs. The record rate at which workers are voluntarily quitting jobs to pursue other opportunities is another.”

“Other indicators that inform the Fed's view of maximum employment are still off the mark, but are moving the right direction. After dropping to 4.6% in October from 5.9% as recently as June, the unemployment rate is rapidly closing in on the FOMC's long-run estimate of 4.0%. The labor force increased by 104K workers, even if it was not enough to move the needle on the headline participation rate.”

“We expect job growth to still be held back by labor availability in the coming months, but look for workers to continue to trickle back into the hiring pool. More discernable improvement should come next spring. Constraints such as health concerns and unpredictable childcare should ease on the other side of the winter season, and the financial imperative to return to work should be greater with growing distance between fiscal support and the inflation gnawing away at individuals' spending power. These factors should help hiring continue at a robust pace and keep the level of employment on track to recover around the end next year.”

On Friday, the Canadian employment report was released and showed numbers above expectations. According to analysts at the National Bank of Canada, the labor market remains strong and they believe there is room for more labor market build up in the months ahead.

Key Quotes:

“After exceptional gains this summer that completed the recovery of all jobs lost during the pandemic, a decent October’s print illustrates the strength of the Canadian labour market. The details of the report are also impressive. All the gains were full-time, and the private sector was the driving force, gaining 70K jobs.”

“We believe there is room for more labour market build up in the months ahead. CFIB data continues to show strong labor shortages in October, with as many as 49 percent of SMEs reporting that the lack of skilled labour was a factor limiting production, compared with 40 percent for unskilled workers. Both indicators were at their highest levels on record (since 2009). This suggests a decent pace of hiring, especially in an environment where extraordinary income support programs are being phased out and immigration returning to normal. Still, this assumes that the health situation remains under control and that the current supply chain challenges do not lead to production stoppages and layoffs.”

- EUR/USD has bounced from fresh annual lows under 1.1520 to trade flat on the day and week above 1.1550.

- The US dollar has been weakening in recent trade as US bonds lead to a further decline in global yields.

EUR/USD has seen a surprising reversal after printing fresh annual lows under 1.1520 earlier in the session in wake of the stronger than expected US labour market report for October. The pair is now trading back to the north of the 1.1550 level and back to trading flat on both the day and week. The most recent move is dollar-driven, with the buck losing ground versus all of its major G10 counterparts. The US dollar has slid down the G10 rankings in recent trade and now sits around the middle of the performance table, having prior to the US data been one of the better performing G10 currencies.

US bonds lead global yield drop

Profit-taking with the currency pair at year-to-date extremes may be one reason for the bounce. More likely is that FX markets are taking their cue from some odd moves being seen in global bond markets. Global bond yields continue to slide, though are on Friday being driven in the US; US 2-year yields are down about 3bps to back under 0.40%, while 10-year yields currently trade lower by about 7bps and have fallen to their lowest since late September around 1.45%. Meanwhile, European yields are also falling, though to a slightly lesser degree, with German 2-year yields down about 2bps to -0.74% and German 10-year yields down about 6bps to around -0.28%. US/European yield differentials have thus seen a very modest closing, supporting EUR/USD.

It is somewhat perplexing that the reaction in global markets to a stronger than expected US labour market report would be for yields to fall. Typically, the opposite reaction would be expected as markets price in stronger economic growth, raise their expectations for inflation and, thus, raise their expectations for higher interest rates to counter said inflation. Technical buying, particularly for the US 10-year, might be playing a role. The 1.51% level was a key level for the US 10-year yields, below which there may well have been some stop losses, which could explain the acceleration in the drop once this level was broken.

It seems likely that as bond investors have time to mull over the implications for economic growth, inflation and Fed policy of the latest jobs report, they may realise that bonds at these prices are not particularly attractive (i.e. yields are too low). US Consumer Price Inflation data is also set for release next week and, if the headline number remains elevated above 5.0%, this may serve as a reminder that the narrative being pushed by many central banks across the globe that inflation is “transitory” is coming under increasing pressure.

- XAG/USD climbs for the second day in a row amid positive US economic data.

- The US Dollar is falling, underpinned by falling US Treasury yields, boosts precious metals.

- XAG/USD: A daily close above the 100-DMA opens the door for $25.00; otherwise, it could fall to $23.00.

Silver (XAG/USD) advances for the second-consecutive day, up 1.08% trading at $24.02 during the New York session at the time of writing. The US jobs positive data improve market sentiment, equity markets climb, while US T-bond yields slide, benefitting precious metals.

On Friday, the US Bureau of Labor Statistics (BLS) revealed its Nonfarm Payrolls report for October, which reported the creation of 531K new jobs added to the economy, higher than the 425K foreseen by economists. Further, the Unemployment Rate dropped to 4.6% from 4.7%, while labor force participation was unchanged.

The market reacted positively to the report, sending US stocks rallying while US T-bond yields slump, with the 10-year benchmark note slipping six basis points sitting at 1.465% for the first time under the 1.50% threshold since October 4.

Concerning the greenback, the US Dollar Index that measures the US dollar against six rivals edges lower some 0.06%, at 94.28, underpinned by falling US Treasury yields.

XAG/USD Price Forecast: Technical outlook

-637717248875461546.png)

In the daily chart, the XAG/USD broke above the top-trendline of a bullish flag, approaching the 100-day moving average (DMA) at $24.18. Also, the Relative Strength Index (RSI), a momentum indicator, is edging higher, at 57, with enough room left, before reaching overbought conditions. A daily close above the 100-DMA could propel silver price towards the 2021 high at $24.85, followed by the possibility of a test of $25.00.

On the other hand, failure to break above the 100-DMA and to hold above $24.00 could open the door for further losses. The first support would be the 50-DMA at $23.35, followed by $23.00.

- Metals on the rise as US yields tumble despite upbeat NFP.

- XAU/USD hits two week highs above $1810.

- Gold is about to end the week on a positive tone, almost $50 above the weekly low.

Metals are rising considerably boosted by lower US yields on Friday. Gold broke above $1800 and is testing a key short-term resistance area around $1810. A firm break higher could trigger more gains.

Economic data form the US came in above expectation with payrolls rising by 531K in October above the 425K of market consensus. The greenback rose initially but then, during the American session pulled back and reversed its course, amid a sharp decline in US bonds and as equity prices rise. The US 10-year yield fell from 1.54% to the lowest in a month at 1.45%.

Testing critical area

Gold peaked at $1812, the highest in two weeks. It is trading around $1810 and a firm break above would put the price at the highest in almost two months, targeting the next resistance at $1820.

A failure to break above $1810 would leave gold vulnerable to a bearish correction. Support levels are located at $1795, $1785 and then $1770.

Technical levels

- Gold has benefited from the collapse of US 10-year yields and soared above $1,810..

- Three barriers await the precious metal on its way up.

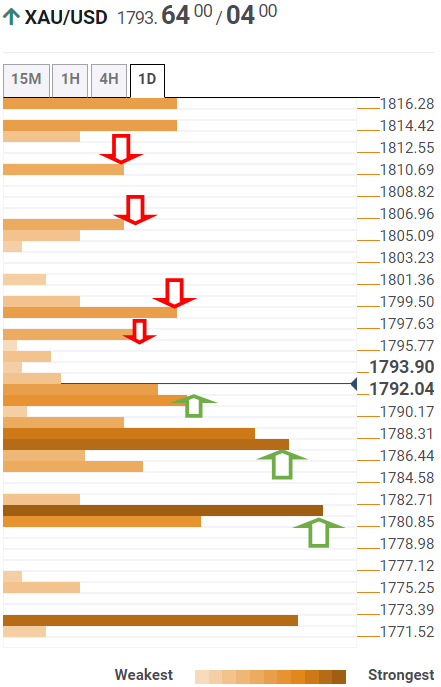

- Gold Price Forecast: Back to its comfort zone ahead of 1,800

Is the Federal Reserve going to raise interest rates? That is pushing yields on short-term bonds higher, but weighing heavily on 10-year Treasury returns – which is good for gold. XAU/USD has finally recaptured $1,800 in what looks like a meaningful move that may usher in a weekly close above that battle line.

How is gold positioned on the technical chart?

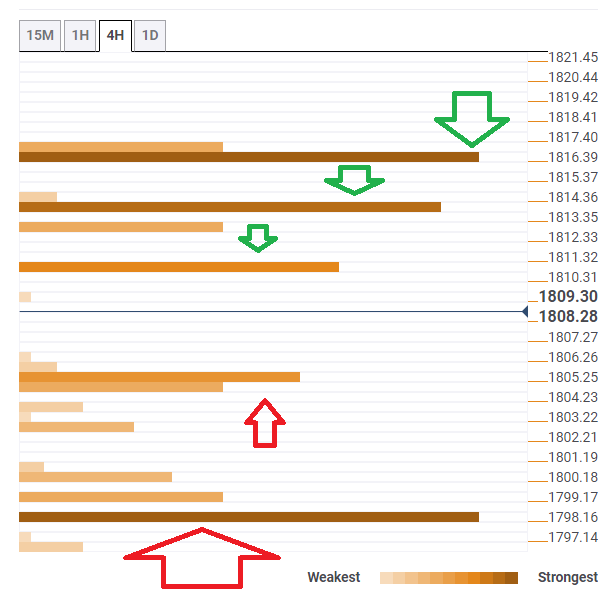

Gold Price: Key levels to watch

The Technical Confluences Detector is showing that some resistance awaits at $1,811, which is the previous week's high.

It is followed by $1,814, which is where the previous monthly high converges with the Bollinger Band one-day Upper.

Further up, a strong cap awaits at $1,817, which is where the Pivot Point one-day Resistance 2 and the PP one-month R1 meet up.

Some support is at $1,805, which is the confluence of the BB 15min-Upper and the PP one-week R1.

Further down, a critical cushion is at $1,799, which is a juncture including the Fibonacci 23.6% one month and the previous daily high.

XAU/USD Confluence levels

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- NZD/USD has recovered back to the north of 0.7100 despite strong US data.

- Significant widening of NZ/US rate differentials in recent weeks is likely playing a supportive role.

NZD/USD has been gaining ground in recent trade, despite the release of a very healthy US labour market report for the month of October earlier in the session, which the US dollar has so far failed to capitalise on. The pair has moved back to the north of the 0.7100 level in recent trade, meaning its has moved back to the north of its 200 and 21-day moving averages again, both of which sit just below the psychologically important level.

Looking at the lay of the land in FX markets on the final session of the week; NZD is one of the best performing G10 currencies on the day, behind only JPY and SEK and currently trades higher versus the dollar by about 0.1%. NZD might be holding well versus the dollar despite strong US jobs data because New Zealand too reported jobs data this week, and it showed the New Zealand economy in much better health than the US. By comparison, in Q3 of this year, the New Zealand unemployment rate was 3.4% versus 4.6% in the US in October. That is well below most estimates of full employment and fully justifies the RBNZ’s stance that gradual withdrawal of monetary stimulus via rate hikes is appropriate moving forward. That contrasts to the US, where the Fed said earlier in the week it is not yet ready to hike interest rates given the labour remains some ways off full employment.

Looking at STIR future markets for next December, which act as a proxy for where markets believe Fed and RBNZ interest rates will be 13 months time, it can be seen that, since the start of October, New Zealand markets have moved to price in almost 100bps in additional rate hikes. That compares to US markets, which have, since the start of October, moved to price in an additional 25bps of rate hikes. That corresponds to New Zealand 10-year bond yields moving 50bps higher to above 2.50% over the same time period, versus US 10-year yields, which are flat vs early October levels at around 1.45%.

It’s a big week for US markets next week with October Consumer Price Inflation metrics set for release, while the New Zealand economic calendar is benign. Nonetheless, it wouldn’t be crazy to assume that rate and STIR market differentials could continue to support the kiwi going forward.

Gold staged a decisive rebound toward $1,800 on Thursday as the yellow metal turns bullish on falling bond yields. FXStreet’s Eren Sengezer notes that a daily close above $1,820 would open up the $1,835 mark.

Investors will keep a close eye on yields

“Currently, the 10-year yield is below 1.5% and unless it manages to rebound above that level, XAU/USD could continue to push higher. On the other hand, gold could lose interest in case the 10-year yield reclaims 1.6% and steadies above that level.”

“On the upside, XAU/USD could target $1,810 (static level) ahead of $1,820 (Fibonacci 38.2% retracement of the April-June uptrend). A daily close above the latter could open the door for additional gains toward $1,835 (static level).”

“First support now aligns at $1,790 (200-day SMA) before $1,785 (100-day SMA) and $1,770 (Fibonacci 61.8% retracement).”

See 0 Gold Price Forecast: XAU/USD to regain upside momentum above the $1,834 mark – Commerzbank

- October US employment report surpasses expectations.

- US dollar weakens as Treasury yields decline despite employment data.

- USD/JPY remains sideways, now testing the lower bottom.

The USD/JPY peaked at 114.02 following the US employment report and then turned to the downside. Recently it bottomed at 113.48, the lowest level in three days. It is hovering around 113.50, near the lowest bottom of the current range.

The US official employment report came in above expectations, with payroll rising by 531K above the 425K of markets consensus. The dollar initially rose but then weakened amid lower US yields. The economic numbers were not enough strong to change the perspectives of the November FOMC meeting. The views presented by Jerome Powell on Wednesday are still intact after today’s NFP.

The reversal in the bond market, with the US 10-year yield falling from 1.54% to 1.47%, the lowest in a month, pushed USD/JPY to the downside. The pair received support from market sentiment. The Dow Jones is up by .085% and the Nasdaq gains 0.60%.

Despite recent price action, USD/JPY continues to move sideways in a range between 113.40 and 114.20, now from more than two weeks. It is trading closer to the lower bottom. A break under 113.40 could trigger a bearish corecction. Still the dominant trends is bullish.

Technical levels

- The AUD/USD pair printed a daily low at 0.7359.

- US Nonfarm Payrolls rose by 534K, better than estimated.

- The Reserve Bank of Australia pushes back the first-rate hike until 2024.

AUD/USD extends its two-day slide on the week, dipped to a new weekly low around 0.7359, but bounced off on a better than expected US Nonfarm Payrolls report, though still losing 0.14% trading at 0.7391 during the New York session at the time of writing.

US Nonfarm Payrolls rose by 534K, better than the 425K expected

On Friday, the Bureau of Labor Statistics (BLS) unveiled the Nonfarm Payrolls report for October, which showed the creation of 531K new jobs added to the US economy, better than the 425K estimated by analysts. Additionally, the Unemployment Rate dropped to 4.6% from 4.7%, while labor force participation was unchanged.

Last month's figures leave payrolls short 4.2 million beneath the pre-pandemic level. Another positive of the report is that Unemployment rates for White and Hispanic Americans fell, while the African American and the Asian rates were unchanged.

The Reserve Bank of Australia pushes back the first rate hike until 2024

An additional factor to the weakness of the Australian dollar is that the Reserve Bank of Australia (RBA, which pushed back higher interest rates until 2024, according to the RBA Statement of Monetary Policy (SoMP).

Dissecting the SoMP, it also says that the economy will expand by 3% in 2021, despite the severe contraction of the third quarter, due to COVID-19 lockdowns. The RBA sees an acceleration in economic growth by 5.5% in 2022. Regarding inflationary pressures, the RBA expects wages to grow 3% and inflation to 2.5%, the mid-point of the RBA objective by the end of 2023.

AUD/USD Price Forecast: Technical outlook

In the daily chart, the AUD/USD just bounced off the 50-day moving average (DMA) at 0.7362, and now it is on its way to a renewed test of the 0.7400 figure. On its way, it pased through the 100-DMA, which turned support at 0.7377. Despite all that, the AUD/USD has a downward bias, confirmed by the 200-DMA sitting at 0.7549 above the spot price, while the Relative Strength Index (RSI) at 46, aims lower.

For AUD/USD to accelerate the downtrend, they need a daily close below the 50-DMA. In that outcome, the following support would be the September 24 high at 0.7315. A breach of the latter would expose the September 30 low at 0.7169.

On the flip side, AUD/USD buyers will need a daily close above 0.7400 if they still hope for higher prices. The following resistance area would be the October 22 low at 0.7453, followed by 0.7500.

- Oil is back above $80.00 but trade has been calmer on Friday.

- Traders await the US response after OPEC+ ignored calls for a larger output hike.

After significant volatility in recent days, US oil prices are enjoying calmer trade on the final day of the week, having shrugged off the strong US labour market report released earlier in the session as traders await the US government’s response to OPEC+, who ignored their calls to increase output by more than 400K barrels per day in December. The American benchmark for sweet light crude oil, called West Texas Intermediary or WTI, which had been trading between relatively tight $79.00-$80.00 range for most of the session, recently broke to the north of the $80.00 per barrel level again.

To recap the recent volatility; prices slumped from around $83.00 to $80.00 on Wednesday as a result of bearish inventory data and concerns about a Covid-19 outbreak in China and, in doing so, broke below a long-term uptrend. Early in Thursday’s session, prices staged a remarkable comeback, rallying all the way back to the mid-$83.00s, before sharply reversing despite news of the (as expected) OPEC+ agreement and slumping all the way as low as $78.50. Traders cited profit-taking now that OPEC+ was out of the way, concerns that the US might release crude oil reserves in response to OPEC+ and technical selling, with prices having retested the old long-term uptrend, thus offering an opportunity for sellers to add to their positions.

Why the US wants lower oil prices

US President Biden’s approval rating has been in decline since May, falling from the 53-55% area to its current level at 43%. Over the same time period, his disapproval rating has risen to slightly above 50% from previously close to 40%. Understandably, this is worrying the Democrats ahead of the November 2022 mid-term elections, where all of the 435 seats in the House of Representatives will be up for grabs and 34 of the 100 Senate seats. There are already warning signs that Biden’s recent slump in approval ratings is weighing on the Democrat’s election chances; earlier in the week Virginia and New Jersey held Governor elections. Biden had won both states at last year’s presidential election by double-digit margins, but a previously unknown Republican candidate managed to secure an easy win in Virginia, while the Democrat candidate only won in New Jersey by a razor-thin margin.

The sharp spike in inflation in recent months that has outpaced wage growth and is thus lowering living standards for many middle- and working-class Americans is a key reason why Biden’s approval rating has dropped so much in recent months. Rising food and energy prices are of particular concern to the public; average US gas prices were at $3.42 per gallon on Thursday, up from $3.20 one month ago and around $2.12 one year ago. The Biden administration is keen to avoid the negative optics of gas prices reaching $4.0 per gallon. Hence the intense public pressure on OPEC+ to increase output at a faster rate in recent weeks (this comes with the added bonus of being able to shift the blame to OPEC+ for high prices). Now that OPEC+ has disregarded the US’ pleas and gone ahead with its pre-planned output hike of just 400K barrels per day in December, the Biden Administration will want to be seen to be doing something about it. That explains why US officials have been talking about why the US might tap its strategic petroleum reserve (SPR), even though the SPR is only supposed to be used in an economic emergency (which oil prices around $80.00 per barrel hardly qualifies as). Other measures touted to bring down US prices (though raise prices elsewhere) would be to ban US producers from exporting oil.

In view of. Strategists at the Quarterly Global Outlook from UOB Group’s Global Economics & Markets Research, USD/CNY could edge higher to the 6.5600 zone in Q1 2022.

Key Quotes

“Going forward, the CNY will face growing growth headwinds. Previous calls by the market for monetary tightening in the first half of the year have dissipated. Monetary policy is likely to be biased slightly looser to cushion slowing growth momentum.”

“As the growth and monetary policy divergence between US and China continues to close, we hold our view of a modestly higher USD/CNY in the coming quarters. Our updated point forecasts are 6.52 in 4Q21, 6.56 in 1Q22, 6.60 in 2Q22 and 6.64 in 3Q22.”

GBP/USD is consolidating its losses around 1.3450. Economists at Scotiabank expect the cable to drop substantially towards the 1.30 level once below the 1.34 mark.

GBP/USD heads towards the 1.34 level

“Cable is on track to test the 1.34 mark to a new low since last December amid sharp selling since its failed to push above 1.38 last week.”

“Beyond 1.34, there are no obvious support markers for the GBP until the 1.30 zone aside from its 100 and 200-week MAs at 1.3282 and 1.3167, respectively.”

“Resistance is intermediate around 1.3450 followed by firm at 1.3500/10 and the mid-1.35s zone.”

The euro is following broad losses against the dollar. Downside risk persists for the world's most popular currency pair and economists at Scotiabank see EUR/USD nosediving to the 1.10 over the next year.

Support is 1.15 followed by the 1.14

“The ECB’s dovishness will soon see the EUR/USD tackling the 1.15 level and a test of 1.14 should also come with relative ease while we anticipate losses to extend to the low 1.10s over 2022.”

“Near-term risks around climbing contagions in Europe also act as a drag on the common currency.”

“The EUR will have to trade past the mid-1.16s area to counteract downtrend resistance from its mid-year highs, but we expect selling pressure to emerge well before then upon a cross of 1.16.”

- USD/TRY adds to the weekly upside near 9.7000.

- The pair entered its third consecutive month with gains.

- US Nonfarm Payrolls surprised to the upside in October.

The downtrend in the lira remains well and sound for yet another session and pushes USD/TRY to daily highs near 9.7500 just to shed some ground soon afterwards.

USD/TRY keeps targeting 10.000

USD/TRY advances for the fourth consecutive session at the end of the week and trades a tad lower than Thursday’s weekly peaks past the 9.7600 mark.

The solid rebound in the dollar has been weighing heavily on the risk-linked assets and sponsoring the exodus from the EM FX space as of late, and particularly after the FOMC finally announced the start of the tapering process at its meeting on Wednesday.

On the lira side, rumours of the death/illness of President Erdogan have been quickly reversed by officials in Turkey, although the impact on the FX was marginal, if any at all. The currency, in the meantime, remains mired into the negative territory amidst the usual fragile backdrop and following another uptick in consumer prices during October published earlier in the week (+19.89% YoY).

USD/TRY key levels

So far, the pair is gaining 0.23% at 9.7088 and a drop below 9.4722 (monthly low Nov.2) would aim for 9.4128 (weekly low Oct.26) and finally 9.1965 (weekly low pre-CBRT meeting Oct.21). On the other hand, the next up barrier lines up at 9.7657 (monthly high Nov.4) seconded by 9.8395 (all-time high Oct.25) and then 10.0000 (psychological level).

US labour market recovery picked up steam in October. We only saw a modest lift to the USD post payrolls, but economists at TD Securities view this as consistent with their bias that the data, valuation and positioning are supportive of further firmness in the weeks ahead.

NFP picked up again

“The data were strong, with payrolls up 531K (604K for the private sector), revisions adding another 235K, unemployment dropping 0.2pt to 4.6%, and hourly earnings up 0.4% MoM and 4.9% YoY. The one disappointing part was the participation rate, which was flat.”

“It's not that we look for an impulsive shift higher in the USD, but rather, more consistent with the idea that the USD is better positioned in the weeks ahead from a data, valuation and positioning point of view.”

“We think the bias will be for a broad grind higher in the USD, in line with the seasonal trend observed in the month of November.”

“We think EUR/USD is at risk of slipping below 1.15.”

- EUR/GBP has failed to break to the north of its 200DMA in recent trade and is currently flat on the day.

- The pair continues to trade with significant gains on the week after Thursday’s dovish BoE.

EUR/GBP tested its 200-day moving average at the 0.8585 mark in earlier trade but has for now failed to break above this key level, or indeed to surpass the psychologically important 0.8600 level. The pair is now back to trading broadly flat on the session just above 0.8560, though this still leaves it about 100 pips higher versus Thursday’s pre-dovish Bank of England policy announcement levels and still well above the next notable level of downside support in the form of the 50DMA at just above 0.8520. If EUR/GBP was to close the week at these levels, it would finish the week with gains of about 1.5%, the best week for the pair since a 2.0% gain posted back at the start of April.

However, from a technical standpoint, the recent rally does not yet seem to signal a shift in the long-term trajectory of EUR/GBP. Since the early April rally, the pair has been quite consistent in that it prints ever lower, followed by ever lower highs. For the long-term bearish technicians, current levels might be seen as another example of an ever lower high, meaning a good selling opportunity.

EUR/GBP fundamentals favour further downside?

From a fundamental standpoint, the argument for a lower EUR/GBP is also there; while the Bank of England is in the midst of a communication nightmare after Thursday’s decision to buck market expectations and hold interest rates, it still seems very likely that the bank will be hiking interest rates in the coming months, as they have indicated would be appropriate if the economy evolves as expected. Contrast that to the ECB; policymakers (led by ECB President Christine Lagarde) successfully managed to tame expectations that the bank would hike rates in 2022 this week. Despite events this week, the ECB is still set to lag the BoE in terms of monetary policy normalisation by a significant degree. That means over the coming months, rate differentials are likely to remain in GBP’s favour.

Meanwhile, downside risks to the Eurozone economy are becoming more apparent. The latest manufacturing production data out of Germany showed that the Eurozone manufacturing remained on a weak footing at the end of Q3 as a result of supply chain disruptions. Manufacturing makes up a much less important proportion of the UK economy. Meanwhile, unlike in the UK, Covid-19 infection, hospitalisation and death rates are rising sharply in the Eurozone right now, which is likely to darken the bloc’s economic outlook for the rest of the quarter and for Q1 2022. This may also weigh on the euro versus sterling.

The Canadian economy added 31K jobs in October, slightly below the market consensus for a 42K print. USD/CAD's reaction was to respect 1.2480/00 resistance and economists at TD Securities think the modest lift to the CaD is temporary as a lot of good news is in the price.

Canadian employment shifts into a lower gear in October

“The Canadian labour market shifted into a lower gear in October with just 31K jobs added during the month, below the market consensus for 42K, and a fraction of the 157K print for September. However, details were more favourable; job growth was driven by full-time employees (+36k) with an offsetting decline in part-time employment. The LFS also revealed a slight decline in the participation rate, which saw unemployment fall by 0.2pp to 6.7% (market: 6.8%).”

“Hours worked rose by 1.0% in October which bodes well for industry-level GDP, while wage growth firmed to 2.1% YoY.”

“Unless we see a material surge higher in oil prices, we think dips in USD/CAD will be fairly shallow and short-lived.”

“With some G3 central banks offering more explicit pushback on market pricing for hikes, we think this will reverberate in regions where hawkish pricing looks a bit too aggressive. Taken in conjunction with the CAD being one of the most overbought currencies on our positioning measures, we are comfortable with holding onto our USD/CAD long.

- Wall Street's main indexes opened higher on Friday.

- Upbeat October jobs report seems to be providing a boost to risk sentiment.

- Healthcare is the only major S&P sector trading in the negative territory.

Major equity indexes extended the weekly rally on Friday and reached new all-time highs with the upbeat October jobs figures allowing risk flows to continue to dominate the financial markets.

As of writing, the S&P 500 was trading at 4,710, rising 0.67% on a daily basis. The Dow Jones Industrial Average was up 0.7% at 36,355 and the Nasdaq Composite was gaining 0.8% at 15,940.

The US Bureau of Labor Statistics reported on Friday that Nonfarm Payrolls rose by 531,000 in October, surpassing the market expectation of 425,000. Additionally, the Unemployment Rate edged lower to 4.6% from 4.8% in September.

Among the 11 major S&P 500 sectors, the Industrial Index is up 1.3% as the biggest gainer after the opening bell. On the other hand, the Healthcare Index is the only major sector trading in the negative territory, losing 1%.

S&P 500 chart (daily)

Kansas City Fed President Esther George said on Friday that inflation is running well ahead of the long-term average and added that the labor market appears to have further room to recover, as reported by Reuters.

Additional takeaways

"Reason to expect inflation will eventually moderate, but the risk of prolonged high inflation has increased."

"Choices for policymakers complicated by uncertainty on the outlook for how long inflation, labor market frictions will last."

"Supply disruptions have contributed to the rise in prices."

"Now may be a time when fed's goals appear to be in conflict."

"Tightness in labor market could prove temporary."

"Number of indicators point to a tight labor market."

Market reaction

These comments were largely ignored by market participants and the US Dollar Index was last seen rising 0.12% on the day at 94.44.

"I expect supply-chain bottlenecks to fade next year," Bank of England (BOE) policymaker Silvana Tenreyro said on Friday, as reported by Reuters.

Additional takeaways

"Labour market uncertainty is the main short-term uncertainty I focus on."

"Monetary policy should not try to offset short-lived shocks, but central banks are in trade-off territory."

"Labour market data is particularly hard to read in many economies."

"Significant uncertainty about how fast furloughed workers will find jobs."

Market reaction

The GBP/USD pair showed no immediate reaction to these remarks and was last seen losing 0.27% on the day at 1.3462.

- USD/CAD holds in the 1.2450s following a positive outcome for both the US Nonfarm Payrolls and Canadian jobs data.

- Technically, the pair is attempting a test of critical resistance and is bound by the 1.2420s and 1.2480s.

USD/CAD is on the back foot again following the US Nonfarm Payrolls beat as the US dollar extends the day's highs, according to the DXY index which measures the greenback vs a basket of rival currencies. At the time of writing and shortly after the release of the US jobs data, USD/CAD has been forced to test the prior day's close after sliding from the day's high of 1.2479 to a current low of 1.2444 leaving the pair flat on the day so far.

US September Nonfarm Payrolls arrived as +531K vs. the expected +425K. Meanwhile, the Canadian jobs market data has also been released. The nation's October Employment Change arrived at 31.2K versus a 42K estimate which likely leaves pressures to the upside for the pair at the end of the week. However, the Unemployment Rate fell by 0.2 percentage points to 6.7%, albeit, the Participation Rate arrived at 65.3% versus 65.5% last month.

BoC hawkishness supports the loonie

Nevertheless, in a hawkish shift, and supportive of the loonie, the Bank of Canada has decided to end its QE asset purchases immediately and has brought forward its guidance on the first-rate hike to mid-2022. In contrast, the Federal Reserve has been less forthcoming and with the Canadian economy growing strongly, creating jobs and experiencing more sustained inflation, there is the real prospect of 100bp of rate hikes next year, which bods well for the Canadian dollar, leading the way in the commodity-fx sphere.

USD/CAD technical analysis

USD/CAD, however, has been in a phase of accumulation since mid-October, yet is now facing a wall of daily resistance, so it could be subject to a meanwhile correction back into a familiar liquidity area:

A rejection at this juncture opens risk towards the 1.2420s and the hourly 50-EMA as illustrated above, prior to the next upside attempt to break the 1.2480s and beyond 1.25 the figure.

Spot gold (XAU/USD) prices have seen a mixed reaction to the latest US labour market report, which was stronger than expected across most metrics. At present, spot prices are trading flat vs pre-data levels around the $1790 mark, having chopped between the $1784-$1797 levels in a two-way knee-jerk reaction to the data.

It does seem logical that in response to the data, the US dollar would start to see some broad-based strength (which could push the DXY beyond prior year-to-date highs in the 94.50 region) and that US real yields might also start to pick up if traders deem the latest report as increasing the likelihood of a hawkish Fed policy shift in early 2022. This could weigh on gold prices, in which case it might be worth keeping an eye on the 21 and 50-day moving averages in the $1780s just below Friday’s lows as the next area of support. A more extended hawkish move could see gold drop back towards Wednesday’s lows around $1760. But for now, spot gold traders seem content to keep the precious metal trading in the $1790 region.

US Jobs Report Review

The latest US labour market numbers released by the US Bureau of Labour Statistics for the month of October were strong on practically all fronts; firstly, the October non-farm payroll (NFP) number, which shows the number of jobs added to the US economy on the month, came in at 531K, above median economist forecasts for 425-450K. The September NFP number also saw a healthy upwards revision of more than 100K, rising to 312K from 194K. So in sum, that amounts to a beat on expectations for the headline NFP number of slightly around 200K. The headline beat was driven by the private sector adding a massive 600K jobs in October, way above expectations for 400K private sector jobs being added, which more than made up for a surprise drop in government employment on the month. Meanwhile, the unemployment rate fell more than expected to 4.6% from 4.8% in September, with the U6 underemployment rate dropping to 8.3% from 8.6% as well. The participation rate was flat at 61.6%, and average hourly earnings rose to 4.9% from 4.6% as market participants had been expected.

The latest strong US jobs numbers are in fitting with other strong data points that have already been released for the month of October, such as Markit and ISM’s PMI surveys, both of which remain at elevated levels and payroll company ADP’s estimate of employment change in October, which was released on Wednesday. Clearly then, the US economy has enjoyed a strong start to Q4 2021, which is not too surprising given the prevalence of the Covid-19 delta variant has diminished in recent weeks, after having held back economic activity and discouraged workers from returning to the labour force back in Q3. Most economists expect Q4 to be stronger than Q3 for this reason, though severe supply chain disruptions and high input costs are expected to continue to restrain economic activity. However, labour demand is expected to remain high, with the number of job vacancies currently well above the number of unemployed persons in the US.

In terms of what the above means for the Fed; the bank said that it could feasibly see full-employment being reached by mid-2022, which is in line with STIR market pricing for the bank to start lifting interest rates by about then. Friday’s labour market report is very much in fitting with this timeline of full-employment being reached by then, or perhaps even sooner. Q4 jobs data if strong, and if coupled with continued elevation of inflation readings well above the Fed’s 2.0% target, could set the stage for a hawkish FOMC shift in early 2022. As this risk rises, it is not surprising to see USD supported.

Bank of England (BoE) Deputy Governor Dave Ramsden explained on Friday that he voted to raise rates because he saw the labour market getting tighter, as reported by Reuters.

"I wanted to ensure that once we are past the transitory phase we don't see inflation expectations getting dislodged," Ramsden added. "I felt I had enough information on the labour market."

Market reaction

These comments don't seem to be having a significant impact on the British pound's performance against its major rivals. As of writing, the GBP/USD pair was down 0.35% on the day at 1.3450.

- EUR/USD fell to fresh year-to-date lows in wake of the latest strong US jobs report.

- Traders will be eyeing a test of key long-term support at the 1.1500 level.

In an immediate reaction to the latest US labour market report, which was stronger than markets had been expecting on most metrics, EUR/USD fell to fresh year-to-date lows under the 1.1520 mark. Having printed a daily low at 1.15156, this puts the new annual low about 10 pips below the previous low set back on 12 October. But EUR/USD has been choppy in recent trade and has not been able to convincingly push below the prior annual low just yet. If dollar bullish momentum does start to build as traders have more time to digest the implications of the latest jobs report, EUR/USD might well fall towards key support at the round 1.1500 number and in the form of the 9 March 2020 high just below it.

US Jobs Report Review

The latest US labour market numbers released by the US Bureau of Labour Statistics for the month of October were strong on practically all fronts; firstly, the October non-farm payroll (NFP) number, which shows the number of jobs added to the US economy on the month, came in at 531K, above median economist forecasts for 425-450K. The September NFP number also saw a healthy upwards revision of more than 100K, rising to 312K from 194K. So in sum, that amounts to a beat on expectations for the headline NFP number of slightly around 200K. The headline beat was driven by the private sector adding a massive 600K jobs in October, way above expectations for 400K private sector jobs being added, which more than made up for a surprise drop in government employment on the month. Meanwhile, the unemployment rate fell more than expected to 4.6% from 4.8% in September, with the U6 underemployment rate dropping to 8.3% from 8.6% as well. The participation rate was flat at 61.6%, and average hourly earnings rose to 4.9% from 4.6% as market participants had been expected.

The latest strong US jobs numbers are in fitting with other strong data points that have already been released for the month of October, such as Markit and ISM’s PMI surveys, both of which remain at elevated levels and payroll company ADP’s estimate of employment change in October, which was released on Wednesday. Clearly then, the US economy has enjoyed a strong start to Q4 2021, which is not too surprising given the prevalence of the Covid-19 delta variant has diminished in recent weeks, after having held back economic activity and discouraged workers from returning to the labour force back in Q3. Most economists expect Q4 to be stronger than Q3 for this reason, though severe supply chain disruptions and high input costs are expected to continue to restrain economic activity. However, labour demand is expected to remain high, with the number of job vacancies currently well above the number of unemployed persons in the US.

In terms of what the above means for the Fed; the bank said that it could feasibly see full-employment being reached by mid-2022, which is in line with STIR market pricing for the bank to start lifting interest rates by about then. Friday’s labour market report is very much in fitting with this timeline of full-employment being reached by then, or perhaps even sooner. Q4 jobs data if strong, and if coupled with continued elevation of inflation readings well above the Fed’s 2.0% target, could set the stage for a hawkish FOMC shift in early 2022. As this risk rises, it is not surprising to see USD supported.

- Unemployment Rate in Canada continued to decline in October.

- USD/CAD erases earlier gains, trades around mid-1.2400s.

The Unemployment Rate in Canada edged lower to 6.7% in October from 6.9% in September, the data published by Statistics Canada showed on Friday.

Net Change in Employment arrived at +31.2K in the same period, beating the market expectation of 19.3K.

Further details of the report revealed that the Participation Rate edged lower to 65.3% from 65.5% in the same period and the Average Hourly Wages rose by 2.1% on a yearly basis.

Market reaction

The USD/CAD pair edged lower from the multi-week high it set at 1.2479 and was last seen trading flat on the day at 1.2454.

- Nonfarm Payrolls beat expectations and supports the US dollar, weighing on an already damaged pound.

- GBP/USD remains better offered on the outcome as markets weigh the central bank divergences.

US September Nonfarm Payrolls arrived as +531K vs. the expected +425K and weighs on cable. GBP/USD has been on the back foot ever since the Bank of England disappointed markets with a surprise hold and today's Nonfarm Payrolls have potentially hammered the nail in the proverbial coffin. On the release of the numbers, GBP/USD is slightly offered, down some 0.40% on the day so far, travelling from a high of 1.3509 to a low of 1.3424.

Prior to today's jobs data, Initial Claims came in at 269k vs. 275k and a revised 283k (was 281k) the previous week, while continuing claims came in at 2.105 mln vs. 2.150 mln and a revised 2.239 mln (was 2.243 mln) the previous week.

The US dollar was heading for a second straight week of gains versus major peers on Friday ahead of this key US jobs report after a string of central banks this week pushed back against a faster tightening of monetary policy.

Consequently, the greenback is better-bid, currently higher by 0.20% according to the dollar index, DXY, which measures the greenback against a basket of six rivals. Prior to the data, the index had already strengthened nearly 1% over the past fortnight and consolidated its gains on Friday. It stands at 94.50 at the time of writing, having moved up from a low of 94.279 to a high of 94.620 so far.

Meanwhile, the Bank of England's decision on Thursday had already forced traders to abandon it, consequently sending the currency to its biggest one-day fall in more than 18 months by as much as 1.6% on the central bank's decision.

GBP/USD technical analysis

Prior to the data, GBP/USD had already corrected a significant portion of the latest bearish impulse to a 38.2% Fibonacci retracement level as follows:

Following the data, the price is yet to react significantly, but the 38.2% Fibo would now be expected to remain a tough nut to crack.

Overall, however, GBP/USD is meeting a longer-term demand area and it will take some doing to break before a healthy correction will prevail, leaving the 1.3580s exposed.

- The index advances further and records fresh YTD peaks.

- US Non-farm Payrolls rose by 531K jobs in October.

- The unemployment rate ticked lower to 4.6%.

The buying interest around the greenback accelerated in the wake of the publication of the October Nonfarm Payrolls, lifting the US Dollar Index (DXY) to new highs near 94.60 on Friday.

US Dollar Index in fresh tops near 94.60

The index keeps the constructive stance on Friday after the US economy created 531K jobs during October, surpassing expectations for a gain of 450K jobs. In addition, the September reading was revised to 312K jobs (from 194K).

Further data showed the jobless rate eased to 4.6% and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.4% MoM and expanded 4.9% over the last twelve months. Another key gauge, the Participation Rate, stayed put at 61.6%.

US Dollar Index relevant levels

Now, the index is gaining 0.29% at 94.60 and a break above 94.74 (monthly high Sep.24 2020) would expose 95.00 (round level). On the flip side, the next down barrier emerges at 93.42 (55-day SMA) followed by 93.27 (monthly low October 28) and finally 92.98 (weekly low Sep.23).

Nonfarm Payrolls (NFP) in the US rose by 531,000 in October, the data published by the US Bureau of Labor Statistics showed on Friday. This reading came in better than the market expectation of 425,000. Additionally, September's print got revised higher to 312,000 from 194,000.

Further details of the publication revealed that the Unemployment Rate declined to 4.6% from 4.8% in September, compared to analysts' estimate of 4.7%. Additionally, the Labor Force Participation Rate remained unchanged at 61.6% and the wage inflation, as measured by the Average Hourly Earnings, rose 4.9% on a yearly basis vs 4.6% in September.

Follow our live coverage of the US jobs report and the market reaction.

Market reaction

With the initial reaction, the greenback continues to outperform its rivals and the US Dollar Index was last seen rising 0.3% on the day at 94.60.

- EUR/USD stays depressed and near the YTD low.

- Further south should emerge the 1.1500 region.

EUR/USD trades at shouting distance from the 2021 lows near 1.1520 at the end of the week.

The bearish note surrounding the pair almost calls for another visit to the 2021 low at 1.1524 (October 12) in the very near term. A breakdown of this level should expose a test of the 1.1500 zone, where the March 2020 high sits (1.1495) ahead of the June 2020 high at 1.1422.

In the meantime, further losses are likely while below the 5-month resistance line, today near 1.1680.

EUR/USD daily chart

USD/INR is expected to advance to the 76.00 region at some point in Q1 2022, commented Strategists at the Quarterly Global Outlook from UOB Group’s Global Economics & Markets Research.

Key Quotes

“While virus risks have receded, bond purchases by the RBI and India’s dual deficits are structural tailwinds that will continue to weigh on the INR, on top of the broad-based USD strength due to the Fed’s normalization.”

“Overall, we keep to our upward trajectory of USD/INR but will moderate the point forecasts 100 pips lower in view of the recent stabilization of the INR. The revised forecasts are now at 75.5 in 4Q21, 76.0 in 1Q22, 76.5 in 2Q22 and 77.0 in 3Q22.”

- DXY adds to recent gains and approaches the YTD peak.

- A break above 94.56 opens the door to test 94.74.

The buying pressure around the dollar extends for the second straight session and motivates DXY to flirt with the 2021 high in the mid-94.00s (October 12).

If the yearly tops are cleared, then the focus of attention is expected to gyrate to the September 2020 top at 94.74 ahead of the round level at 95.00 in the short-term horizon.

Extra gains remain well in the pipeline as long as the index navigates above the short-term resistance line (off the September low) near 93.50.

DXY daily chart

Strategists at the Quarterly Global Outlook from UOB Group’s Global Economics & Markets Research suggested USD/THB could climb to the 33.80 area by end of 2021.

Key Quotes

“The THB is the worst performing Asia FX year-to-date, dropping about 11% against the USD. By now, a large part of the negatives surrounding the THB is probably priced in.”

“As such, we are guarded to extrapolate further excessive weakness in the THB from current levels. Our updated USD/ THB forecasts are at 33.8 in 4Q21, 34.1 in 1Q22, 34.4 in 2Q22 and 34.7 in 3Q22.”

- EUR/JPY remains on the defensive around 131.50.

- Immediate contention appears at recent lows around 131.00.

EUR/JPY recorded new 3-week lows near 131.00 on Thursday. In spite of the subsequent bounce off that area, the cross remains well entrenched into the negative territory on Friday.

The loss of the 131.50 area on a sustainable basis - where recent lows and a Fibo retracement (of the October’s rally) coincide – should open the door to a deeper pullback to the 131.00 region, where is located another Fibo level at 130.97. Further south from here comes the September tops around 130.75 followed by the mid-130.00s (high September 29)

In the broader scenario, while above the 200-day SMA at 130.34, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

The Indonesian rupiah could depreciate to the 14,700 area vs. the US dollar in the first quarter of 2022, according to strategists at the Quarterly Global Outlook from UOB Group’s Global Economics & Markets Research.

Key Quotes

“Despite IDR’s resilience in 3Q, there are still reasons to be cautious about the IDR going forth. These include a slow vaccination drive casting uncertainty over the economic recovery and a narrowing yield advantage of Indonesia Government Bonds over USTs. A persistent and widening twin deficit also anchors a gradual uptrend in USD/IDR over the medium term.”

“As such, we reiterate our view of a higher USD/IDR but have moderated the trajectory in view of current market developments. The updated point forecasts at 14,600 in 4Q21, 14,700 in1Q22, 14,800 in both 2Q and 3Q22.”

- Retail Sales in the euro area edged lower in September.

- EUR/USD continues to push lower after the data.

According to the monthly data published by Eurostat, Retail Sales in the euro area fell by 0.3% on a monthly basis in September after rising by 1% in August. This reading missed the market expectation for an increase of 0.2%.

Further details of the publication revealed that Retail Sales declined by 0.2% in the EU.