- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-02-2013

The euro fell the most in two weeks against the dollar as Italian and Spanish bonds slumped amid political turmoil in the euro-area’s third- and fourth-largest economies, damping demand for the shared currency. The 17-nation euro dropped versus the majority of its 16 major peers as Spanish Prime Minister Mariano Rajoy faced calls to resign after newspaper reports alleged he accepted illegal cash payments. A poll showed former Italy Premier Silvio Berlusconi closed the gap on front-runner Pier Luigi Bersani even as he appeals a four-year prison sentence for tax fraud.

Spain’s 10-year bond yield climbed as much as 23 basis points, or 0.23 percentage point, to 5.43 percent, the highest since Dec. 18. Rajoy, who said the allegations published in Spain’s biggest newspaper El Pais are unfounded, travels to Berlin today to meet German Chancellor Angela Merkel.

Italian 10-year yields jumped as much as 15 basis points to 4.47 percent. The additional yield investors demand to hold the securities instead of German bunds increased for a fourth day after Prime Minister Mario Monti said the spread may widen if Berlusconi, who also is standing trial on charges he paid a minor for sex, is elected this month.

Barclays Plc raised its forecasts for the euro against the dollar to take into account gains that pushed the shared currency to the strongest level since November 2011 last week. The euro will drop to $1.32 in six months and $1.28 in a year, higher than from previous estimates of $1.26 and $1.22, strategists Raghav Subbarao and Guillermo Felices in London wrote today in a note to clients.

The yen weakened beyond 93 per dollar for the first time since May 2010. European Central Bank policy makers meet this week. The ECB, which has held its main refinancing rate at 0.75 percent since July, will make no change at its next policy decision on Feb. 7. Central-bank President Mario Draghi may make more dovish remarks at the meeting without the central bank altering policy, according to analysts.

The yen fluctuated against the dollar after a record 12 straight weeks of declines as Prime Minister Shinzo Abe’s administration presses the central bank to ease monetary policy further to beat deflation. Finance Minister Taro Aso said yesterday the government is imitating his Depression-era predecessor, Korekiyo Takahashi, who told the Bank of Japan to underwrite government debt to fund deficit spending.

The pound retreated from its weakest level in 15 months against the euro, as the political turmoil, the growth yield of Spanish and Italian government bonds increased the relative attractiveness of the UK currency. Exchange rate increased, despite the fact that one of the report published today showed that activity in the UK construction sector continued to decline in January, which is fixed for the third month. Economists say that this dynamic is primarily associated with a reduction in the number of new orders. According to the data, the index of business activity in the construction sector was 48.7 in January, unchanged from the previous month. Note that this value is a minimum of six months. The data also showed that the number of new orders in the sector continued to decline in January, registering with the 8th monthly fall. However, the rate of decline was the slowest since October 2012.

European stocks tumbled the most in more than three months as Spanish and Italian banks retreated with the nations’ government bonds amid signs of returning political uncertainty in the region’s weakest economies.

Newspaper El Pais last week published allegations of illegal cash payments, featuring extracts from handwritten ledgers by the former People’s Party Treasurer Luis Barcenas showing payments to officials including Rajoy. The premier, who is facing opposition calls to resign, visits Berlin today before a European Union summit begins on Thursday.

The yield on 10-year Italian debt increased 14 basis points to 4.47 percent. Berlusconi yesterday promised to abolish a property tax valued at about 4 billion euros ($5.4 billion) if elected in the Feb. 24-25 ballot, in an effort to roll back austerity implemented by Prime Minister Mario Monti.

National benchmark indexes declined in all of the 18 western European markets, except Greece and Denmark. Italy’s FTSE MIB Index sank 4.5 percent, the most in six months. Spain’s IBEX 35 slid 3.8 percent for a sixth day of declines, the longest losing streak in 10 months. France’s CAC 40 plunged 3 percent for the biggest drop since April. The U.K.’s FTSE 100 dropped 1.6 percent and Germany’s DAX lost 2.5 percent.

Santander plunged 5.7 percent to 5.69 euros in Madrid while Banco Bilbao Vizcaya Argentaria SA fell 4.7 percent to 6.97 euros. Yields on Spanish 10-year securities climbed 23 basis points to 5.44 percent today as Rajoy denied corruption and strategists from Commerzbank AG recommended reducing holdings of the nation’s debt.

In Italy, UniCredit tumbled 8.3 percent to 4.25 euros as UBS AG downgraded the shares to neutral from buy. Intesa Sanpaolo SpA, the nation’s second-biggest bank, retreated 5.4 percent to 1.38 euros.

Royal Imtech NV plunged 48 percent to 10.20 euros, the largest drop since at least 1989. The Dutch provider of infrastructure for stadiums said it may have to book writedowns of at least 100 million euros because of alleged irregularities at its Polish business.

Swatch Group AG added 5 percent to 543.50 francs, its highest price since at least 1993, after the biggest maker of Swiss watches reported a 26 percent increase in 2012 net income to 1.6 billion francs. That beat the average analyst estimate of 1.49 billion francs in a survey as the company produced more watches and took advantage of expanded production capacity at its factories.

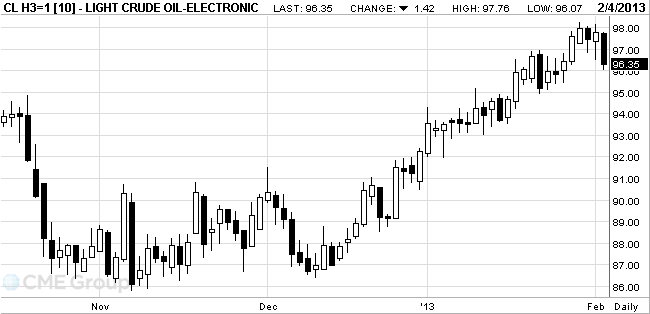

Oil fell as

equities dropped on political turmoil in Europe and as the prospect of renewed

talks between Western countries and

Futures slipped as much as 1.7 percent and the euro weakened after Spanish Premier Mariano Rajoy faced opposition calls to resign amid contested reports about illegal payments.

Talks to

defuse tension over

Crude oil

for March delivery dropped to $96.07 a barrel on the New York Mercantile

Exchange. Futures are up 5.2 percent this year.

Brent oil

for March settlement fell 61 cents, or 0.5 percent, to $116.15 a barrel on the

London-based ICE Futures Europe exchange. The contract settled at $116.76 on Feb.

1, the highest level since Sept. 13. The volume of all contracts traded was 16

percent above the 100-day average.

Gold prices at auction on Monday fluctuate within the range Friday, as improved U.S. economic performance reduces the appeal of gold as a safe investment.

Employment in the U.S. economy, excluding the agricultural sector in January increased by 157,000, while analysts had expected growth to 160,000.

Industrial production growth accelerated in January: the combined purchasing managers index (PMI), which is calculated by Markit, rose to 55.8 points from 54.0 points in December.

However, gold prices have experienced downward pressure due to the release of more positive-than-expected data on the manufacturing sector in January, which signaled the continuation of recovery.

Prospects for the gold price remains negative as the downtrend remains, said Matt Zeman, head of trading arm Kingsview Financial. Gold futures fell by 7.1% from October 4 reached a peak in 1798.60 dollars per troy ounce.

Demand in the physical market due to sluggish Asian low prices. Activity in the Chinese market will slow this week before the week-long celebration of the New Year according to the lunar calendar.

Stocks of the world's largest exchange-traded fund backed by gold ETF SPDR Gold Trust in January fell by 22.728 tons, which was the largest outflow since July 2012.

February futures price of gold on COMEX today fell to 1661.60 dollars an ounce, and then rose to 1672.70 dollars per ounce.

US Stock Futures fell on brokerage downgrades of Wal-Mart (WMT), Chevron Corp. (CVX) and Merck (MRK), combined with a resurgence of eurozone worries linked to political uncertainty in Spain and Italy.

Global Stocks:

Nikkei 11,260.35 +69.01 +0.62%Hang Seng 23,685.01 -36.83 -0.16%

Shanghai Composite 2,428.15 +9.13 +0.38%

FTSE 6,273.59 -73.65 -1.16%

CAC 3,714.39 -59.14 -1.57%

DAX 7,724.89 -108.50 -1.39%

Crude oil $96.25 -1.55%

Gold $1663.70 -0.41%

Upgrades:

Stifel Nicolaus upgrades Yahoo (YHOO) to Buy from Hold and sets target price at $25.

Downgrades:

Merck (MRK) downgraded to Mkt Perform from Outperform at Leerink Swann

Merck (MRK) downgraded to Underweight from Equal-Weight at Morgan Stanley

JPMorgan downgrades Wal-Mart (WMT) to Neutral from Overweight and lowers its price target on shares to $75

Chevron (CVX) downgraded from Buy to Neutral at UBS

Other:

Wunderlich raises their Walt Disney (DIS) target to $58 from $50

Oppenheimer raises their Cisco (CSCO) target to $24 from $22

EUR/USD $1.3500, $1.3600, $1.3625, $1.3700, $1.3750

USD/JPY Y91.00, Y91.50, Y91.80, Y92.00, Y92.25, Y92.50

GBP/USD $1.5800

AUD/USD $1.0400, $1.0450, $1.0500Data

00:30 Australia Building Permits, m/m December +2.9% +1.1% -4.4%

00:30 Australia Building Permits, y/y December +13.2% +14.9% +9.3%

00:30 Australia ANZ Job Advertisements (MoM) January -3.8% -0.9%

09:30 Eurozone Sentix Investor Confidence February -7.0 -2.2 -3.9

09:30 United Kingdom PMI Construction January 48.7 49.7 48.7

10:00 Eurozone Producer Price Index, MoM December -0.2% -0.2% -0.2%

10:00 Eurozone Producer Price Index (YoY) December +2.1% +2.1% +2.1%

The euro exchange rate fell sharply against the dollar after the yield of Italian and Spanish bonds rose, which was associated with political instability in the third and fourth largest economies of the eurozone, while causing a decrease in demand for the European currency. Also influenced by the dynamics of trading forecasts, published today Barclays Plc. It is learned that the EUR / USD could fall to $ 1.32 in six months and up to $ 1.28 for the year, which was higher than the previous estimate of $ 1.26 and $ 1.22.

The single currency in relation to all but one of the 16 major currencies, amid speculation that the Prime Minister of Spain, Mariano Rajoy may resign after Spanish media reported that he accepted illegal payments. The poll also showed former Prime Minister Silvio Berlusconi has narrowed the gap between the favorite Pier Luigi Bersani, even though the litigation related to tax evasion.

Also today, the statistics agency Eurostat reported that the annual increase in producer prices in the euro area remained unchanged in December at 2.1%. Note that according to the average forecast of economists value of this index was to rise to the level of 2.2%.

The yen weakened to a level of 93 yen to the dollar, which was the first time since May 2010, as many market participants are waiting for a meeting of politicians of the European Central Bank, which will be held later this week.

The pound retreated from its weakest level in 15 months against the euro, as the political turmoil, the growth yield of Spanish and Italian government bonds increased the relative attractiveness of the UK currency. Exchange rate increased, even though the fact that one of the report published today showed that activity in the UK construction sector continued to decline in January, which is fixed for the third month. Economists say that this dynamic is primarily associated with a reduction in the number of new orders. According to the data, the index of business activity in the construction sector was 48.7 in January, unchanged from the previous month. Note that this value is a minimum of six months. The data also showed that the number of new orders in the sector continued to decline in January, registering with the 8th monthly fall. However, the rate of decline was the slowest since October 2012.

EUR/USD: during the European session the pair fell to a new low of $ 1.3550

GBP/USD: during the European session the pair rose to $ 1.5740

USD/JPY: during the European session the pair rose to a new high of Y93.20, but it is now trading at Y92.69

At 15:00 GMT we will know about the change in the volume of industrial orders in the U.S. in December. At 21:45 GMT New Zealand report on the change in the level of pay in the private sector, excluding overtime for the 4th quarter. At 00:30 GMT will index of activity in the service sector of the AiG Australia in January.

EUR/USD

Orders $1.3750, $1.3720/25, $1.3690/700

Bids $1.3545/40, $1.3530/20, $!.3500, $1.3480

GBP/USD

Orders $1.5895/900, $1.5870/80, $1.5840/50, $1.5800/10, $1.5770/80, $1.5740/50

Bids $1.5680, $1.5650/40, $1.5610/00, $1.5580/70, $1.5550

AUD/USD

Orders $1.0520/30, $1.0500, $1.0480, $1.0465/70, $1.0450

Bids $1.0405/00, $1.0380/70, $1.0360, $1.0350, $1.0330/20, $1.0300

EUR/JPY

Orders Y127.50, Y127.00, Y126.85/90, Y126.40/45

Bids Y125.85/80, Y125.50, Y125.30/20, Y125.00, Y124.80/75, Y124.50

EUR/GBP

Orders stg0.8750, stg0.8720/25, stg0.8700

Bids stg0.8605/00, stg0.8580, stg0.8565/55, stg0.8545/40, stg0.8525/20

USD/JPY

Orders Y94.25, Y93.50, Y93.30/40, Y93.25

Bids Y92.40, Y92.10/00, Y91.90

Indices for European stock markets show a decrease. Positive statistics on the industry in China and reporting Swatch Group AG, the results of which exceeded analysts' estimates, did not significantly affect the market.

Do not add to the positive news released today by the indicator of investor confidence Sentix euro zone, which was -3.9 in February at the forecast of -2.2 and an index of business activity in the construction sector in the UK, the value of which 48.7 in January on a monthly basis, the forecast 49.7.

To date:

FTSE 100 6,326.53 -20.71 -0.33%

DAX 7,823.94 -9.45 -0.12%

CAC 3,765.09 -8.44 -0.22%

Swatch Group AG shares rose 2.2% after a positive corporate reporting.

Market quotes BG Group rose by 0,1%, Total SA - 0.6%.

Royal Imtech NV capitalization declined by 41% due to the fact that a company which is known for its cutting-edge developments in the field of new technologies postponed publication of reports over the past year and expects a loss of 100 million euros in connection with alleged irregularities in business projects in Poland.

EUR/USD $1.3500, $1.3600, $1.3625, $1.3700, $1.3750

USD/JPY Y91.00, Y91.50, Y91.80, Y92.00, Y92.25, Y92.50

GBP/USD $1.5800

AUD/USD $1.0400, $1.0450, $1.0500Asia’s benchmark stock index rose to the highest level in 18 months as U.S. payrolls expanded and China services industries grew at the fastest pace since August, adding to optimism in the global economic recovery.

Nikkei 225 11,260.35 +69.01 +0.62%

S&P/ASX 200 4,907.52 -13.58 -0.28%

Shanghai Composite 2,428.15 +9.13 +0.38%

Rio Tinto Group, the world’s second-largest mining company, advanced 1.2 percent in Sydney, leading gains among companies with earnings closely tied to economic growth.

Sony Corp., trying to reverse a two-year decline in PlayStation sales, surged 7.5 percent in Tokyo amid speculation the firm is prepping a new version of the home console.

Panasonic Corp., Japan’s second-largest TV maker, soared 17 percent after reporting an unexpected third-quarter profit.

The dollar fell to its weakest level against the euro in November 2011 on the background data, which showed that the number of people employed in non-agricultural sectors rose in December to 157 thousand, compared with forecasts for the level of 156 thousand

But, at the same time it was announced that the previous month was revised upwards by 41 thousand Meanwhile, the rate for November was revised from 161 thousand to 247 thousand impressive.

The yen fell to the lowest level in two and a half years against the dollar, amid speculation that Prime Minister Abe will choose a new head of the Bank of Japan, which will promote the growth of monetary stimulus.

The New Zealand dollar reached its highest level since August 2008 against the yen after the Governor of the Reserve Bank of New Zealand Graeme Wheeler said that the country should reduce its budget deficit or to resort to an increase in interest rates.

The Canadian dollar weakened against its U.S. counterpart, as market participants are waiting for data on the unemployment rate, which is projected to grown. Note that this report will be presented in the following Friday. However, despite the decline for most of the day, the currency was able to regain some lost ground, which helped the U.S. report on employment.Asian stocks fell, with the regional benchmark index retreating a second day from the highest since August 2011, after mixed reports on Chinese manufacturing. Japanese shares advanced on earnings and a weaker yen.

Nikkei 225 11,191.34 +52.68 +0.47%

Hang Seng 23,721.84 -7.69 -0.03%

S&P/ASX 200 4,921.1 +42.31 +0.87%

Shanghai Composite 2,419.02 +33.60 +1.41%

China Overseas Land & Investment Ltd., the biggest mainland developer listed in Hong Kong, slumped 2.3 percent after home prices in China posted their biggest gain in two years, sparking concern that the government will introduce additional property curbs.

NEC Corp. surged 8.5 percent after the maker of telecommunications equipment returned to profit in the third quarter from a loss a year earlier.

Toyota Motor Corp., which last year regained its position as the top-selling carmaker, rose 3 percent in Tokyo after the yen weakened.

European stocks posted their biggest weekly decline this year as a report showed the U.S. economy unexpectedly shrank in the fourth quarter and Spain’s markets regulator lifted a ban on shorting equities.

The benchmark Stoxx 600 fell 0.5 percent to 288.2 this week, its biggest drop since the end of 2012.

Spanish banks slumped, with Banco de Sabadell SA plunging 14 percent and Bankia tumbling 25 percent, as the country’s stock-market regulator, known as CNMV, said on Jan. 31 that it wouldn’t extend a ban on shorting stocks.

Santander lost 7.7 percent after the country’s largest lender set aside money for further loan losses in its home market. The bank reported fourth-quarter profit of 401 million euros ($549 million), missing the average analyst estimate of 801.6 million euros.

National benchmark indexes retreated in 12 of western Europe’s 18 markets this week.

FTSE 100 6,347.24 +70.36 +1.12% CAC 40 3,773.53 +40.93 +1.10% DAX 7,833.39 +57.34 +0.74%

Saipem (SPM) plunged 36 percent. Europe’s largest oil-services company by sales lowered its forecast for earnings before interest and taxes in 2012 to about 1.5 billion euros. Ebit will fall to about 750 million euros in 2013, the company said. It predicted that earnings from onshore projects would slump by about 80 percent this year.

Imagination Technologies rallied 18 percent. Morgan Stanley upgraded the British maker of chip technology for phones and tablet computers to overweight, the equivalent of buy, from equal weight.

Swedbank AB (SWEDA) jumped 12 percent as the second-best capitalized major lender in the European Union proposed a dividend of 9.90 kronor a share, compared with 5.30 kronor a year earlier. The lender posted net income of 4.34 billion kronor ($690 million) in the fourth quarter, beating the 3.54 billion-krona average analyst estimate.

Major U.S. stock indexes rose significantly today, completing trades near maximum. For the week DOW index rose 0,8%, Nasdaq rose 0,91%, S & P500 gained 0.56%.

Major U.S. stock indexes the second month of 2013 begins to increase. The closing of the major indexes rise more than 1%, this index showed a maximum DOW above $ 14,000 for the first time since October 2007.

Growth is the reason for today's published data on the U.S. labor market, the index of business activity in industry and consumer sentiment, as well as construction costs.

On the labor market data we have mentioned now and again. Again, they got it for what the market needed: not too optimistic that the continued prevalence of chances to continue stimulating the U.S. economy by the Federal Reserve, and not too weak, confirming the current trend of moderate recovery.

Other reports showed improvement in consumer sentiment from Reuters / Michigan, the manufacturing index of the Institute for Supply Management, as well as a stronger than expected increase in construction cost.

Against the publication of important macroeconomic data published quarterly reports a significant impact on the dynamics of today's trades do not have.

Among the components of the index DOW only shares Merck & Co. Inc. (MRK, -3.33%), Hewlett-Packard Company (HPQ, -0,30%) suffer losses. At the moment, the leader shares in Bank of America Corporation (BAC, +3.27%).

All sectors of the S & P is in the green zone. The leader is the sector conglomerates (1.2%).

At the close:

Dow +149.21 14,009.79 +1.08%

Nasdaq +36.97 3,179.10 +1.18%

S & P +15.06 1,513.17 +1.01%00:30 Australia Building Permits, m/m December +2.9% +1.1% -4.4%

00:30 Australia Building Permits, y/y December +13.2% +14.9% +9.3%

00:30 Australia ANZ Job Advertisements (MoM) January -3.8% -0.9%

The yen rose against most major peers as technical indicators signaled the pace of recent declines has been too quick. The Japanese currency’s 14-day relative strength index against the dollar was at 24 on Feb. 1, below the 30 level that some traders see as a signal an asset has fallen too far, too fast and may be due to reverse course. Against the euro, it was 22.

Gains in the yen were limited before reports predicted to show U.S. factory orders increased and European investor confidence improved, damping demand for the refuge assets. Orders to U.S. factories rose in December by the most in three months, economists projected before a Commerce Department report today. Booking rose 2.3 percent after being little changed in November, economists surveyed by Bloomberg News predict. That would follow data from last week showing payrolls in the U.S. expanded by 157,000 in January following a revised 196,000 advance in the prior month and a revised 247,000 surge in November.

Japan’s currency advanced against the greenback after completing on Feb. 1 a record 12 straight weeks of declines, triggered by speculation the Bank of Japan will boost monetary stimulus.

The euro maintained four days of gains versus the dollar before a report predicted to show investor confidence improved in the region.

Australia’s dollar rallied against its peers after a private report showed inflation advanced to the middle of the Reserve Bank of Australia’s goal, adding to the case for policy makers to hold interest rates unchanged tomorrow.

EUR/USD: during the Asian session the pair fell to $ 1.3620.

GBP/USD: during the Asian session, the pair traded in the range of $ 1.5685-10.

USD/JPY: during the Asian session, the pair traded in the range of Y92.45-85.

This week sees a light schedule of releases in the US, but Europe looks forward to meeting and decisions by both the ECB and the Bank of England. Monday sees the week get off to a fairly slow start. The first release of the day sees Spain's January unemployment report cross the wires, with the latest look at Spain's jobless numbers. At 1000GMT, the EMU Dec PPI data will be released. Back on the continent, at 1700GMT, Bundesbank board member Joachim Nagel is slated to speak on the Eurozone debt crisis, in Hamburg. At 1845GMT, the Economic and Monetary Affairs Committee of the European Parliament are due to hold a key vote on OTC derivative trading legislation.

00:30 Australia Building Permits, m/m December +2.9% +1.1%

00:30 Australia Building Permits, y/y December +13.2% +14.9%

00:30 Australia ANZ Job Advertisements (MoM) January -3.8%

09:30 Eurozone Sentix Investor Confidence February -7.0 -2.2

09:30 United Kingdom PMI Construction January 48.7 49.7

10:00 Eurozone Producer Price Index, MoM December -0.2% -0.2%

10:00 Eurozone Producer Price Index (YoY) December +2.1% +2.1%

15:00 U.S. Factory Orders December 0.0% +2.3%

21:45 New Zealand Private Sector Labor Costs (ex. overtime), q/q IV quarter +0.5% +0.5%

22:30 Australia AIG Services Index January 43.2© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.