- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-02-2013

The euro fell the most since July against the dollar after European Central Bank President Mario Draghi said the recent strength of the currency creates a concern that inflation will slow.

The 17-nation euro declined versus all but two of 16 major counterparts as Draghi said after a policy meeting in Frankfurt that the risk to the region’s growth remains on the “downside.”

There are downside risks to inflation “stemming from weaker economic activity and, more recently, the appreciation of the euro exchange rate,” according to a statement of opening remarks from Draghi placed on the ECB’s website. The central bank kept its benchmark rate at a record-low 0.75 percent today.

Draghi said the euro’s exchange rate is in line with its long-term average, though officials will monitor it in case a “sustained” appreciation alters the ECB’s assessment of risks to price stability. Germany’s two-year note yield fell four basis points, or 0.04 percentage point, to 0.17 percent.

The pound rose for a second day versus the euro and the dollar after Carney, the Bank of Canada governor who succeeds Bank of England Governor Mervyn King in July, told lawmakers in London that current monetary policy may be enough to help the economy.

The central bank left its benchmark interest rate at a record-low 0.5 percent and its asset-purchase target unchanged at 375 billion pounds ($589 billion) at a policy meeting today.

New Zealand’s dollar dropped for a second day against the U.S. currency after the statistics bureau said payrolls fell 1 percent in the final three months of 2012. The workforce participation rate declined to the lowest in eight years.

European stocks were little changed as France and Spain sold debt, while European Central Bank President Mario Draghi said that economic recovery should begin later this year amid a continued accommodative policy.

The ECB left its benchmark rate at a record low of 0.75 percent following a meeting of policy makers in Frankfurt today. Draghi said the combined economy of the 17 nations that use the euro will begin to recover later this year because the absence of inflation risks will allow the ECB to leave interest rates at their record low.

In the U.K., Bank of England officials refrained from adding further stimulus to aid the economy and held its interest rate unchanged at 0.5 percent. The BOE panel led by the current governor, Mervyn King, left its target for bond purchases at 375 billion pounds ($588 billion). All 43 economists in a Bloomberg survey had forecast no change.

France sold 7.98 billion euros ($11 billion) of government debt and Spain raised more than its maximum target at a bond auction. Yields climbed, compared with the most recent sales.

National benchmark indexes declined in 12 of the 18 western-European markets today. Germany’s DAX advanced 0.1 percent, while the U.K.’s FTSE 100 fell 1.1 percent. France’s CAC 40 lost 1.2 percent, erasing its gain for the year.

Vodafone gained 0.9 percent to 171.9 pence after the world’s second-biggest mobile-phone operator repeated its forecast that adjusted operating profit for the year through March will be in the upper half of a range of 11.1 billion pounds to 11.9 billion pounds. Analysts had estimated 11.6 billion pounds.

Sanofi declined 4 percent to 66.60 euros after projecting that earnings per share may drop as much as 5 percent this year as generic competition to its Plavix blood thinner limits revenue in the U.S. Analysts had predicted that earnings would slip 0.2 percent.

Alcatel-Lucent SA climbed 4.9 percent to 1.23 euros after its chief executive officer announced he will leave. The stock earlier rallied as much as 11 percent, as Chief Executive Officer Ben Verwaayen stepped down after his 4 1/2-year-long attempt to turn around the phone-equipment maker failed. The company reported a fourth-quarter net loss of 1.37 billion euros and as it booked a one-off impairment charge of 1.4 billion euros. Verwaayen will remain in place until the board finds a replacement.

Daimler AG gained 2.8 percent to 44.21 euros after the world’s third-biggest maker of luxury vehicles forecast that group revenue and deliveries of Mercedes-Benz cars will increase in 2013.

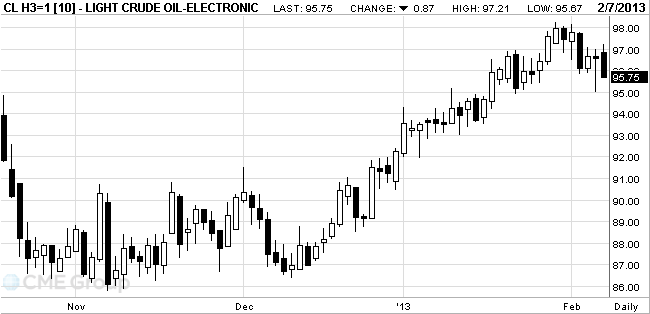

Oil fell in

West Texas

Intermediate oil dropped as much as 1 percent as the euro slumped for a second

day against the dollar. The European Union accounted for 16 percent of global

oil use in 2011, according to BP Plc’s Statistical Review of World Energy. WTI’s

discount to Brent oil in

ECB policy

makers are concerned that an advance in the euro, which gained 2.5 percent this

year through yesterday, could damp inflation. They “want to see if the

appreciation is sustained,” Draghi said.

WTI oil for

March delivery slid to $95.67 a barrel on the New York Mercantile Exchange. Volume

was 72 percent above the 100-day average.

Brent for

March settlement climbed 32 cents, or 0.3 percent, to $117.05 a barrel on the

ICE Futures Europe exchange. Volume was 41 percent above the 100-day average.

EUR/USD $1.3350, $1.3400, $1.3500, $1.3615, $1.3650, $1.3750

USD/JPY Y92.50, Y93.00, Y93.50, Y94.00, Y94.10

GBP/USD $1.5630, $1.5700, $1.5715

USD/CHF Chf0.9000

AUD/JPY Y95.25Data

00:30 Australia Unemployment rate January 5.4% 5.5% 5.4%

00:30 Australia Changing the number of employed January -3.8 +6.1 +10.4

00:30 Australia NAB Quarterly Business Confidence IV quarter -4 -5

05:00 Japan Leading Economic Index December 92.1 93.8 93.4

05:00 Japan Coincident Index December 90.2 92.6 92.7

06:45 Switzerland SECO Consumer Climate IV quarter -17 -11 -6

08:00 Switzerland Foreign Currency Reserves January 427.2 428.5 427.0

09:30 United Kingdom Industrial Production (MoM) December +0.2% +0.7% +1.1%

09:30 United Kingdom Industrial Production (YoY) December -2.4% -2.2% -1.7%

09:30 United Kingdom Manufacturing Production (MoM) December -0.3% +0.7% +1.6%

09:30 United Kingdom Manufacturing Production (YoY) December -2.0% -2.6% -1.5%

09:30 United Kingdom Trade in goods December -9.2 -9.0 -8.9

10:00 Eurozone Economic Growth Forecasts from European Commissiom -

11:00 Germany Industrial Production s.a. (MoM) December -0.2% +0.2% +0.3%

11:00 Germany Industrial Production (YoY) December -3.1% -0.5% -1.1%

12:00 United Kingdom BoE Interest Rate Decision - 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility - 375 375 375

12:00 United Kingdom MPC Rate Statement -

12:45 Eurozone ECB Interest Rate Decision - 0.75% 0.75% 0.75%

The euro rose against the dollar on speculation that the European Central Bank President Mario Draghi will signal an optimism about growth, not of concern in the power of the European currency.

The single currency rose against all 16 major currencies, as many market participants are waiting for ECB press conference. Meanwhile, in a positive way on their mood also affects the latest data showed that the level of confidence among German investors as well as economic sentiment in the region has grown significantly. Note also that a little earlier the ECB announced its decision on interest rates, leaving her with unchanged at 0.75%, which is largely unaffected by momentum trading.

The pound fell sharply against the dollar, which was associated with the performance of Mark Carney before a special committee in the parliament. Recall that in the near future Carney led the Bank of England. According to the policy, the central bank should turn unconventional policies and maintain the integrity of the sterling. Carney emphasized the importance of changes in monetary policy, adding that the central bank should be flexible with regard to inflation targeting. The new head of the Bank of England also believes that the Bank should improve forecasting.

The New Zealand dollar fell against the greenback after the Bureau of Statistics said the number of employees decreased by 1% in the last three months of 2012, while the percentage of participation was the lowest in the last eight years.

EUR / USD: during the European session, the pair rose to a maximum of $ 1.3575

GBP / USD: during the European session, the pair rose to $ 1.5770, but later fell to $ 1.5708

USD / JPY: during the European session the pair rose to Y93.91, then decreased, and is now trading at Y93.60

On the dynamics of trade can significantly affect the monthly press conference of the ECB, which will be held at 13:30 GMT. Also at this time, Canada will announce the change of volume of building permits issued in December, and will present the house price index in the primary market in December. Also, at 13:30 GMT U.S. report on changes in the level of labor productivity in the non-manufacturing sector, and changes in the cost of labor for the 4th quarter. A little later - at 15:00 GMT UK will release data on the change of the NIESR GDP for January. Finish the day at 20:30 GMT New Zealand publishing house price index from REINZ, as well as data on the change in the volume of home sales from REINZ for January.

EUR/USD

Offers $1.3650, $1.3610-25, $1.3580-600

Bids $1.3500, $1.3495/90, $1.3485/80, $1.3460/40, $1.3420, $1.3400

GBP/USD

Offers $1.5840/50, $1.5820, $1.5800/10, $1.5770/80

Bids $1.5685/80, $1.5630, $1.5610/00

AUD/USD

Offers $1.0420/25, $1.0400, $1.0375/80, $1.0350, $1.0335/40

Bids $1.0285, $1.0250, $1.0200

EUR/GBP

Offers stg0.8720, stg0.8700

Bids stg0.8585/80, stg0.8555, stg0.8545/40, stg0.8525/20, stg0.8500

EUR/JPY

Offers Y128.50, Y128.00, Y127.70/75, Y127.50

Bids Y126.50, Y126.20, Y126.05/00, Y125.80/70, Y125.50

USD/JPY

Offers Y94.75, Y94.50, Y94.30, Y94.25, Y93.95/00

Bids Y93.35/30, Y93.00, Y92.40/35

Stock market indices in Europe show an increase on the background of the forthcoming meeting of the European Central Bank and a decision on the level of interest rates. Despite the statistics on inflation, market participants are increasingly expected that the rate will remain at the current level of 0.75%. However, the market is waiting to hear plans for stimulating the economy, programs or rejecting them.

The impact on the market has a leading publication of the quarterly reports of companies Sanofi SA, Vodafone Group Plc.

To date:

FTSE 100 6,300.75 +5.41 +0.09%

CAC 40 3,654.2 +11.30 +0.31%

DAX 7,609.07 +27.89 +0.37%

Sanofi SA shares fell 4%, as the company expects a profit this year will decline.

The market value of Vodafone Group Plc rose 2.1% after the company confirmed its outlook for financials current fiscal year, which ended in March.

Alcatel-Lucent capitalization increased by 9.7% to the highest price since April, after the chief executive officer resigned.

EUR/USD $1.3350, $1.3400, $1.3500, $1.3615, $1.3650, $1.3750

USD/JPY Y92.50, Y93.00, Y93.50, Y94.00, Y94.10

GBP/USD $1.5630, $1.5700, $1.5715

USD/CHF Chf0.9000

AUD/JPY Y95.25

Most Asian shares dropped on earnings concern after Nikon Corp. and News Corp. cut forecasts and Japan’s Nikkei 225 Stock Average fell from a four-year high.

Nikkei 225 11,357.07 -106.68 -0.93%

Hang Seng 23,177 -79.93 -0.34%

S&P/ASX 200 4,935.7 +14.75 +0.30%

Shanghai Composite 2,418.53 -15.95 -0.66%

Nikon plunged the most since 1985 as the Japanese camera maker reduced its profit forecast on slowing demand in Europe.

Rupert Murdoch’s News Corp. lost 3.2 percent in Sydney after cutting its earnings outlook on declining ratings for shows such as “American Idol” and “X Factor.”

Kubota Corp. lost 3.8 percent, among the biggest drops on the Nikkei 225, as net income at the Japanese tractor maker missed analysts’ estimates.

National Australia Bank gained 1.9 percent as the lender reported a rise in first-quarter profit.- Tesoro sold E4.61bln vs target E3.5bln-E4.5bln

- Sold 2.75% Mar 2015 Bono at avg yield 2.823% vs 2.48% prev

- Sold 4.50% Jan 2018 Bono at avg yield 4.123%

- Sold 6.00% Jan 2029 Obligaciones at avg yield 5.787%.

- E1.948bln of 2.75% Mar 2015 Bono, cover 2.21 vs 2.07 previous

- E2.07bln of 4.50% Jan 2018 Bono, cover 2.24

- E593mln of 6.00% Jan 2029 Obligaciones; cover 2.02.

The euro exchange rate fell sharply against the dollar, reaching with one-week low, as many market participants are waiting for the meeting of the European Central Bank, which will be held.

The single currency fell against most of its 16 major currencies, against the fact that the Prime Minister of Spain, faced opposition calls to resign, and the expectations of investors report losses for 2008 and 2009 of Banca Monte dei Paschi di Siena SpA.

The yen weakened to a 32-month low against the dollar on speculation that the new head of the Central Bank of Japan will increase monetary easing supporter.

Pound fluctuates within a narrow range against the dollar, which is associated with the published data which showed that house prices in Britain registered in January its first annual increase since October 2010, increasing by 1.3%. However, despite a marked improvement, the value of this indicator was below analysts' expectations of 1.6%. Note also that on a monthly basis the cost of housing fell by 0.2%, in line with the fall, which was celebrated last month, and coincided with the estimates of experts. At the same time, Halifax noticed signs of improvement, which occurred in the housing market at the end of 2012 is likely to remain in the new year.

The Australian dollar fell against all but one of the 16 major currencies, as released, retail sales were worse than analysts' expectations. It provokes new calls to reduce the interest rate RBA. Rate in December fell by 0.2% against November. This was heard reports the Australian Bureau of Statistics, while economists had expected retail sales to increase by 0.5%. A small increase of 0.1% in the fourth quarter was also significantly lower than the expected 0.5% growth.Asian stocks rose, with Japan’s Nikkei 225 Stock Average closing at the highest in four years, as Toyota Motor Corp. raised its profit forecast and the yen weakened, boosting the earnings outlook for exporters.

Nikkei 225 11,463.75 +416.83 +3.77%

Hang Seng 23,256.93 +108.40 +0.47%

S&P/ASX 200 4,920.95 +38.23 +0.78%

Shanghai Composite 2,434.48 +1.35 +0.06%

Toyota, the world’s largest carmaker, jumped 6.1 percent after increasing its profit forecast to a five-year high.

Mizuho Financial Group Inc. paced gains among lenders as the yen traded near the weakest level in almost three years on speculation Japan will hasten the selection of a new central bank chief who will take further steps to end deflation.

Galaxy Entertainment Group Ltd. led Macau casinos lower as the U.K.’s Times newspaper said China will crack down on junket operators.

European stocks fell, almost cutting off with early growth, at a time when that public survey in Italy showed that the anti-rigid economic campaign Berlusconi has led to its popularity.

The cost of UniCredit SpA and Intesa Sanpaolo SpA fell, causing a fall while Italian shares. Shares of Vinci SA, the largest builder in Europe fell by 3.3% after a report for 2012, which showed a decrease in yield. ArcelorMittal price rose by 1.1 percent. Volvo AB shares jumped 4.2%, despite the fact that profits fell in the fourth quarter. At the same time, the company said that according to their projections for the North American and European markets will improve this year.

Stoxx 600 fell 0.4% to 284.52 at the close, although he had previously showed growth of 0.4%.

National indexes fell in 14 of the 18 western European markets.

FTSE 100 6,295.34 +12.58 +0.20%, CAC 40 3,642.9 -51.80 -1.40%, DAX 7,581.18 -83.48 -1.09%

Cost Vinci fell to 35.41 euros after the company said that net income from sales was reduced to 5% from 5.2% a year earlier.

ArcelorMittal shares rose to 12.56 euros euros, after it became known that earnings before interest, taxes, depreciation and amortization decreased in the fourth quarter to $ 1.32 billion, up from $ 1.71 billion a year earlier, and expectations at $ 1.25 billion.

Hargreaves Lansdown price jumped by 11% to 817 pence while still achieving record prices. It is learned that in the first-half profit before tax was 93.7 million pounds ($ 147 million), exceeding analysts' forecast at 91 million pounds.

U.S. stock indexes spent almost all trading in the red zone, but the end of trading rose to fletovoe line amid mixed data on corporate profits and concern the situation in Europe.

Indexes started the session in the red, following the European stock markets, many of which have decreased substantially. In Europe, market participants expect tomorrow's ECB meeting. Negative impact on the European stock markets also reflected the application of European officials to the effect that the single currency is overvalued and this has a negative impact on the regional economy. Investors expect that on this occasion to say, ECB President Mario Draghi at tomorrow's press conference.

In the middle of the trading indexes rebounded somewhat due to corporate reports and messages. The first is to note the quarterly report Walt Disney (DIS, +0.42%). The company's profit for the 1 st quarter of the fiscal year was $ 0.79 per share, versus analysts' average forecast of $ 0.77. Revenue for the period stood at $ 11.34 billion (+5.2%) compared to the average forecast of $ 11.22 billion

It is worth noting the growth stocks computer manufacturer Hewlett-Packard Co (HPQ, +0.48%). The media, referring to the sources in the company, reports that Hewlett-Packard is considering separating its business into independent units, which should have a positive impact on the financial performance of its operations.

Also showed a significant increase in the shares of conglomerate 3M (MMM, +1.20%), which have become leaders in the index DOW. The company reported a quarterly dividend increase of 8%.

Shares in clothing premium Ralph Lauren soared by 5.9% - Management reported a quarterly profit that beat analysts' expectations.

At the same time, not all corporate news was met with optimism, because reporting CH Robinson Worldwide (-9,7%), it puts pressure on the transport industry.

As part of the index rose mainly DOW components (19 of 30). As already mentioned, the leader shares were 3M (MMM +1.20%). All shares have lost more International Business Machines (IBM, -0.87%) and Intel Corporation (INTC, -0.90%).

All sectors of the index S & P, with the exception of the basic materials sector (-0.1%), rose. Sector has grown more than other conglomerates (0.4%).

At the close:

S & P 500 1,512.12 +0.83 +0.05%

NASDAQ 3,168.48 -3.10 -0.10%

Dow 13,986.52 +7.22 +0.05%

00:30 Australia Unemployment rate January 5.4% 5.5% 5.4%

00:30 Australia Changing the number of employed January -3.8 +6.1 +10.4

00:30 Australia NAB Quarterly Business Confidence IV quarter -4 -5

05:00 Japan Leading Economic Index December 92.1 93.8 93.4

05:00 Japan Coincident Index December 90.2 92.6 92.7

The euro fell to within 0.4 percent of a one-week low versus the dollar before European Central Bank policy makers meet today amid political turmoil that threatens to renew the region’s sovereign-debt crisis. The ECB, which has held its main refinancing rate at 0.75 percent since July, will make no change today, according to all 60 economists surveyed by Bloomberg News. ECB President Mario Draghi may make more dovish remarks, according to analysts.

The 17-nation currency weakened from its highest since April 2010 against the yen before Spain prepares to auction bonds today amid calls for Prime Minister Mariano Rajoy to resign. Prime Minister Rajoy faced calls to step down amid contested reports of corruption in his party. He has imposed the harshest austerity measures in Spain’s democratic history to curb the budget deficit and lower borrowing costs.

The yen rose as declining Asian stocks spurred haven demand.

The New Zealand fell after reports pointed to weak employment trends in country. Payrolls slumped 1 percent, or 23,000 jobs, in the final three months of 2012, the statistics bureau said today. The workforce participation rate reached the lowest in eight years.

Australia’s currency weakened for a second day against the yen after the statistics bureau said employers cut 9,800 full- time positions in January even as the jobless rate remained unchanged at 5.4 percent.

EUR/USD: during the Asian session the pair fell to $1.3500.

GBP/USD: during the Asian session the pair fell to $1.5645.

USD/JPY: during the Asian session the pair fell to the previous day's low of Y93.25.Change % Change Last

Gold 1,678 +5 +0.27%

Oil 96.82 +0.18 +0.19%Change % Change Last

Nikkei 225 11,463.75 +416.83 +3.77%

Hang Seng 23,256.93 +108.40 +0.47%

S&P/ASX 200 4,920.95 +38.23 +0.78%

Shanghai Composite 2,434.48 +1.35 +0.06%

FTSE 100 6,295.34 +12.58 +0.20%CAC 40 3,642.9 -51.80 -1.40%

DAX 7,581.18 -83.48 -1.09%

S&P 500 1,512.12 +0.83 +0.05%

NASDAQ 3,168.48 -3.10 -0.10%

Dow 13,986.52 +7.22 +0.05%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3521 -0,45%

GBP/USD $1,5660 +0,02%

USD/CHF Chf0,9100 +0,20%

USD/JPY Y93,60 -0,03%

EUR/JPY Y126,59 -0,44%

GBP/JPY Y146,58 0,00%

AUD/USD $1,0318 -0,68%

NZD/USD $0,8398 -0,57%

USD/CAD C$0,9955 +0,01%00:30 Australia Unemployment rate January 5.4% 5.5% 5.4%

00:30 Australia Changing the number of employed January -3.8 +6.1 +10.4

00:30 Australia NAB Quarterly Business Confidence IV quarter -4 -5

05:00 Japan Leading Economic Index December 92.1 93.8

05:00 Japan Coincident Index December 90.2 92.6

06:45 Switzerland SECO Consumer Climate IV quarter -17 -11

08:00 Switzerland Foreign Currency Reserves January 427.2 428.5

09:30 United Kingdom Industrial Production (MoM) December +0.3% +0.7%

09:30 United Kingdom Industrial Production (YoY) December -2.4% -2.2%

09:30 United Kingdom Manufacturing Production (MoM) December -0.3% +0.7%

09:30 United Kingdom Manufacturing Production (YoY) December -2.1% -2.6%

09:30 United Kingdom Trade in goods December -9.2 -9.0

10:00 Eurozone Economic Growth Forecasts from European Commissiom -

11:00 Germany Industrial Production s.a. (MoM) December +0.2% +0.2%

11:00 Germany Industrial Production (YoY) December -2.9% -0.5%

12:00 United Kingdom BoE Interest Rate Decision - 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility - 375 375

12:00 United Kingdom MPC Rate Statement -

12:45 Eurozone ECB Interest Rate Decision - 0.75% 0.75%

13:30 Eurozone ECB Press Conference -

13:30 Canada Building Permits (MoM) December -17.9 +4.3%

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims - 368 361

13:30 U.S. Nonfarm Productivity, q/q (preliminary) IV quarter +2.9% -0.8%

13:30 U.S. Employment Cost Index IV quarter -1.9% +2.8%

14:30 U.S. FOMC Member Jeremy Stein Speaks -

15:00 United Kingdom NIESR GDP Estimate January -0.3%

18:00 U.S. FOMC Member James Bullard Speaks -

20:00 U.S. Consumer Credit December 16.0 13.2

23:50 Japan Current Account Total, bln December 225.9 235.8

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.