- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-02-2013

European stocks climbed the most in almost four weeks as companies from Munich Re to BP Plc beat earnings estimates and a measure of euro-area services output shrank less than forecast.

An index based on a survey of purchasing managers in the services industry of the 17 countries that use the euro rose to 48.6 in January from 47.8 in December, Markit Economics said in a report today. The London-based research company had initially estimated a reading of 48.3 for the measure. A reading below 50 means that activity contracted.

About 55 percent of the 151 western European companies that have reported earnings since Jan. 8 beat analysts’ projections for profit, according to data. Of the 177 that have posted sales, 54 percent exceeded forecasts.

National benchmark indexes rose in 15 of the 18 western European markets. The U.K.’s FTSE 100 gained 0.6 percent and France’s CAC 40 jumped 1 percent. Germany’s DAX advanced 0.4 percent.

Munich Re rose 3.9 percent to 138.95 euros after saying it will increase its dividend for 2012 to 7 euros a share from 6.25 euros. The company also reported preliminary net income of 480 million euros, beating the 448.3 million-euro average estimate of 10 analysts. It made a profit of 627 million euros a year earlier.

BP Plc added 1.4 percent to 468.7 pence. Europe’s second- largest oil producer reported earnings adjusted for one-off items and changes in inventory of $4 billion, more than the $3.7 billion average estimate of 16 analysts.

KPN slumped 16 percent to 3.45 euros after the biggest phone company in the Netherlands posted a fourth-quarter net loss of 162 million euros. The average estimate of eight analysts had predicted a profit of 362 million euros. KPN spent 1.35 billion euros at an auction of wireless spectrum during the quarter.

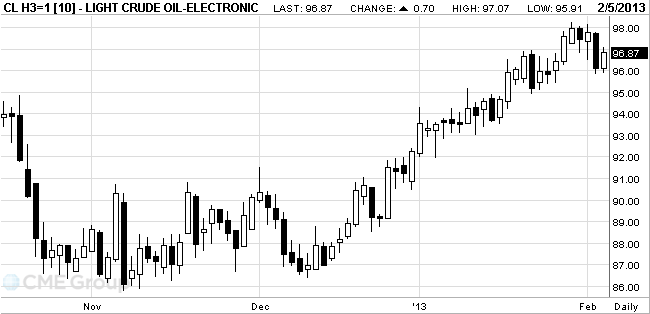

Oil

rebounded after the biggest loss in two months as

Oil

advanced as much as 0.9 percent as the Institute for Supply Management’s index

of

Services in

the

In

West Texas

Intermediate crude for March delivery to $97.06 a barrel on the New York Mercantile

Exchange. Prices dropped the most since Dec. 6 yesterday. Prices have gained

5.3 percent this year.

Brent oil for March settlement climbed $1.16, or 1 percent, to $116.76 on the London-based ICE Futures Europe exchange.

Gold prices are reduced by the unfavorable U.S. macroeconomic statistics. According to published data, the index of economic conditions in the ISM non-manufacturing sector in January, according to the average forecast dropped from 55.7 to 55.2, in the meantime, the business activity index in the ISM non-manufacturing sector by the end of last month, down from 60.8 to 56, 4, although expected to be much less significant decline.

Earlier, the price of gold rose after strong Chinese and European data.

In China, it was noted the acceleration of growth of services in January, and the index PMI for services eurozone has been revised upwards. The PMI service sector in Germany in January showed the strongest increase since August 2009, and the reduction of Spain's service sector slowed to its lowest rate since June 2011.

Also supported the growth of gold output more positive than expected PMI index for the services sector the UK, which has suddenly become a point to increased activity.

February futures price of gold on COMEX today rose to 1683.40 dollars an ounce, and then dropped to 1666.50 dollars per ounce.

U.S. stock futures rose as investors awaited a report on service-industries and earnings on companies from Walt Disney Co.

Global Stocks:

Nikkei 11,046.92 -213.43 -1.90%Hang Seng 23,148.53 -536.48 -2.27%

Shanghai Composite 2,433.13 +4.98 +0.20%

FTSE 6,283.3 +36.46 +0.58%

CAC 3,699.89 +39.98 +1.09%

DAX 7,662.66 +24.43 +0.32%

Crude oil $96.79 +0.64%

Gold $1683.10 +0.40%

Other:

UnitedHealth (UNH) added to Conviction Buy List at Goldman (55.75)

EUR/USD $1.3500, $1.3510, $1.3550, $1.3600, $1.3650

USD/JPY Y91.50, Y92.00, Y92.50, Y93.00

GBP/USD $1.5700

EUR/CHF Chf1.2300

AUD/USD $1.0340, $1.0410, $1.0450, $1.0455, $1.0500

AUD/NZD NZ$1.2450

AUD/JPY Y96.50Data

00:01 United Kingdom BRC Retail Sales Monitor y/y January +0.3% -0.5% +1.9%

00:30 Australia Trade Balance December -2.64 -0.81 -0.43

00:30 Australia House Price Index (QoQ) IV quarter +0.3% +0.3% +1.6%

00:30 Australia House Price Index (YoY) IV quarter +0.3% +0.9% +2.1%

01:45 China HSBC Services PMI January 51.7 54.0

03:30 Australia Announcement of the RBA decision on the discount rate - 3.00% 3.00% 3.00%

03:30 Australia RBA Rate Statement -

07:00 Switzerland Trade Balance December 2.90 2.74 1.00

08:50 France Services PMI (finally) January 43.6 43.6 43.6

08:55 Germany Services PMI (finally) January 55.3 55.3 55.7

09:00 Eurozone Services PMI (finally) January 48.3 48.3 48.6

09:30 United Kingdom Purchasing Manager Index Services January 48.9 49.8 51.5

10:00 Eurozone Retail Sales (MoM) December -0.1% -0.5% -0.8%

10:00 Eurozone Retail Sales (YoY) December -1.9% -1.4% -3.4%

The euro rose against the yen, reaching maximum values at the same time for the last 2.5 years, which was associated with the release of data that showed that the final purchasing managers index for the euro area services sector rose in January more than originally reported that immediately also led to increased demand for the currency. According to the final data, the composite index, which measures activity in the manufacturing sector and the service sector rose in January to a level of 48.6, which is a nine-month high, compared with a preliminary estimate at around 48.2. Recall that in December, the index stood at 47.2. Additionally, the final purchasing managers' index for the services sector rose to 48.6, up from 47.8 in December. In addition, the reading was higher than the preliminary assessment 48.3.

Meanwhile, the currency remains under pressure, as many market participants are waiting for the meeting of the European Central Bank, which announced bude decision on interest rates.

The Australian dollar fell against the dollar after the central bank said that, given the outlook for inflation, there is scope for further reductions in interest rates. However, at this meeting the RBA left rates unchanged at 3%.

The yen fell against all 16 major currencies, after the governor of the Bank of Japan Governor Masaaki Shirakawa said that he will retire earlier (March 19) than planned (April 8).

The pound strengthened against the dollar after a report showed activity in the services sector in Britain unexpectedly expanded in January, indicating at the same time that the economy can avoid a recession triple. According to data seasonally adjusted purchasing managers' index for the services sector rose in January to a level of 51.5. Note that the predicted value of this indicator should have been 49.8. Note that the number of new orders received by firms in the services sector, a marked increase during the month, helped by rising demand and improving market conditions, in spite of the bad weather conditions. Meanwhile, in line with the increase of orders, the company raised the number of personnel to the maximum value in the last six months. However, despite this positive report, the pound fell sharply, reaching a minimum value at the same session.

EUR / USD: during the European session, the pair rose to a maximum of $ 1.3568

At 15:00 GMT the U.S. publication of the composite index of ISM non-manufacturing areas in January. At 17:00 GMT in Switzerland with an address by a member of the Board of the National Bank of Switzerland Fritz Zurbrugg. At 21:30 GMT the U.S. are data on changes in the volume of crude oil according to the API.

EUR/USD

Offers $1.3635/40, $1.3600, $1.3580

Bids $1.3515/00, $1.3460/40, $1.3420, $1.3400

AUD/USD

Offers $1.0495/00, $1.0480, $1.0465/70, $1.0455/60, $1.0435/40

Bids $1.0370/60, $1.0350, $1.0330/20, $1.0300

GBP/USD

Offers $1.5895/900, $1.5870/80, $1.5840/50, $1.5830/35

Bids $1.5755/50, $1.5710/00, $1.5680, $1.5650/40, $1.5610/00

EUR/GBP

Offers stg0.8700, stg0.8670/80, stg0.8650/55, stg0.8630/35, stg0.8600/05

Bids stg0.8555, stg0.8545/40, stg0.8525/20, stg0.8500

EUR/JPY

Offers Y127.50, Y127.00, Y126.85/90, Y126.40/45

Bids Y125.05/00, Y124.85/80, Y124.45/40, Y124.05/00, Y123.80

USD/JPY

Offers Y94.25, Y93.50, Y93.30/40, Y93.25

Bids Y92.40/35, Y92.05/00, Y91.90/80, Y91.60/50

Positively impacted the market corporate reporting companies during the quarter. Thus, the net profit of Munich Re in the fourth quarter of 2012 amounted to 480 million euros, exceeding the average market forecast at 448.3 million euros. The company also announced its intention to increase the dividend for 2012. Revenue ARM Holdings in October-December 2012 increased by 19% - to 164.2 million pounds ($ 259 million), exceeding the median forecast of experts at 152.4 million pounds.

Data released today by the euro zone retail sales were not encouraging. These were worse than expected. Retail sales in December in annual terms amounted to -3.4%, forecast -1.4% for December MoM -0.8%, forecast 0.5%.

To date:

FTSE 100 6,264.30 +17.46 +0.28%

DAX 7,627.69 -10.54 -0.14%

CAC 3,678.85 +20.11 +0.54%

Shares of Alfa Laval AB rose 4.7%. The company's profit also surpassed analysts' expectations. Capitalization of ARM Holdings rose 5.4%.

Market quotes Royal KPN NV fell by 21%. The company plans to further placement of shares for € 4 billion to stabilize its financial position.

Net profit of BP Plc. in 2012, has fallen by almost half - to 11.582 billion dollars compared with 25.7 billion dollars, received in 2011.

EUR/USD $1.3500, $1.3510, $1.3550, $1.3600, $1.3650

USD/JPY Y91.50, Y92.00, Y92.50, Y93.00

GBP/USD $1.5700

EUR/CHF Chf1.2300

AUD/USD $1.0340, $1.0410, $1.0450, $1.0455, $1.0500

AUD/NZD NZ$1.2450

AUD/JPY Y96.50

Asian stocks fell, dragging the regional benchmark equities index down from an 18-month high, amid renewed concern about Europe’s debt crisis.

Nikkei 225 11,046.92 -213.43 -1.90%

Hang Seng 23,148.53 -536.48 -2.27%

S&P/ASX 200 4,882.72 -24.80 -0.51%

Shanghai Composite 2,433.13 +4.98 +0.20%

Konica Minolta Holdings Inc., a Japanese maker of imaging equipment that gets 28 percent of its sales in Europe, dropped 3.1 percent.

Macquarie Group Ltd. lost 4.1 percent amid concern full-year earnings may trail the Australian lender’s forecast.

China Petroleum & Chemical Corp. fell 6.6 percent in Hong Kong after Asia’s biggest refiner said it plans to sell shares worth HK$24 billion ($3.1 billion) at a discount.

The euro fell the most in two weeks against the dollar as Italian and Spanish bonds slumped amid political turmoil in the euro-area’s third- and fourth-largest economies, damping demand for the shared currency. The 17-nation euro dropped versus the majority of its 16 major peers as Spanish Prime Minister Mariano Rajoy faced calls to resign after newspaper reports alleged he accepted illegal cash payments. A poll showed former Italy Premier Silvio Berlusconi closed the gap on front-runner Pier Luigi Bersani even as he appeals a four-year prison sentence for tax fraud.

Spain’s 10-year bond yield climbed as much as 23 basis points, or 0.23 percentage point, to 5.43 percent, the highest since Dec. 18. Rajoy, who said the allegations published in Spain’s biggest newspaper El Pais are unfounded, travels to Berlin to meet German Chancellor Angela Merkel.

Italian 10-year yields jumped as much as 15 basis points to 4.47 percent. The additional yield investors demand to hold the securities instead of German bunds increased for a fourth day after Prime Minister Mario Monti said the spread may widen if Berlusconi, who also is standing trial on charges he paid a minor for sex, is elected this month.

Barclays Plc raised its forecasts for the euro against the dollar to take into account gains that pushed the shared currency to the strongest level since November 2011 last week. The euro will drop to $1.32 in six months and $1.28 in a year, higher than from previous estimates of $1.26 and $1.22, strategists Raghav Subbarao and Guillermo Felices in London wrote in a note to clients.

The yen weakened beyond 93 per dollar for the first time since May 2010. European Central Bank policy makers meet this week. The ECB, which has held its main refinancing rate at 0.75 percent since July, will make no change at its next policy decision on Feb. 7. Central-bank President Mario Draghi may make more dovish remarks at the meeting without the central bank altering policy, according to analysts.

The yen fluctuated against the dollar after a record 12 straight weeks of declines as Prime Minister Shinzo Abe’s administration presses the central bank to ease monetary policy further to beat deflation. Finance Minister Taro Aso said yesterday the government is imitating his Depression-era predecessor, Korekiyo Takahashi, who told the Bank of Japan to underwrite government debt to fund deficit spending.

The pound retreated from its weakest level in 15 months against the euro, as the political turmoil, the growth yield of Spanish and Italian government bonds increased the relative attractiveness of the UK currency. Exchange rate increased, despite the fact that one of the report published today showed that activity in the UK construction sector continued to decline in January, which is fixed for the third month. Economists say that this dynamic is primarily associated with a reduction in the number of new orders. According to the data, the index of business activity in the construction sector was 48.7 in January, unchanged from the previous month. Note that this value is a minimum of six months. The data also showed that the number of new orders in the sector continued to decline in January, registering with the 8th monthly fall. However, the rate of decline was the slowest since October 2012.

Asia’s benchmark stock index rose to the highest level in 18 months as U.S. payrolls expanded and China services industries grew at the fastest pace since August, adding to optimism in the global economic recovery.

Nikkei 225 11,260.35 +69.01 +0.62%

S&P/ASX 200 4,907.52 -13.58 -0.28%

Shanghai Composite 2,428.15 +9.13 +0.38%

Rio Tinto Group, the world’s second-largest mining company, advanced 1.2 percent in Sydney, leading gains among companies with earnings closely tied to economic growth.

Sony Corp., trying to reverse a two-year decline in PlayStation sales, surged 7.5 percent in Tokyo amid speculation the firm is prepping a new version of the home console.

Panasonic Corp., Japan’s second-largest TV maker, soared 17 percent after reporting an unexpected third-quarter profit.

European stocks tumbled the most in more than three months as Spanish and Italian banks retreated with the nations’ government bonds amid signs of returning political uncertainty in the region’s weakest economies.

Newspaper El Pais last week published allegations of illegal cash payments, featuring extracts from handwritten ledgers by the former People’s Party Treasurer Luis Barcenas showing payments to officials including Rajoy. The premier, who is facing opposition calls to resign, visits Berlin today before a European Union summit begins on Thursday.

The yield on 10-year Italian debt increased 14 basis points to 4.47 percent. Berlusconi yesterday promised to abolish a property tax valued at about 4 billion euros ($5.4 billion) if elected in the Feb. 24-25 ballot, in an effort to roll back austerity implemented by Prime Minister Mario Monti.

National benchmark indexes declined in all of the 18 western European markets, except Greece and Denmark. Italy’s FTSE MIB Index sank 4.5 percent, the most in six months. Spain’s IBEX 35 slid 3.8 percent for a sixth day of declines, the longest losing streak in 10 months. France’s CAC 40 plunged 3 percent for the biggest drop since April. The U.K.’s FTSE 100 dropped 1.6 percent and Germany’s DAX lost 2.5 percent.

Santander plunged 5.7 percent to 5.69 euros in Madrid while Banco Bilbao Vizcaya Argentaria SA fell 4.7 percent to 6.97 euros. Yields on Spanish 10-year securities climbed 23 basis points to 5.44 percent today as Rajoy denied corruption and strategists from Commerzbank AG recommended reducing holdings of the nation’s debt.

In Italy, UniCredit tumbled 8.3 percent to 4.25 euros as UBS AG downgraded the shares to neutral from buy. Intesa Sanpaolo SpA, the nation’s second-biggest bank, retreated 5.4 percent to 1.38 euros.

Royal Imtech NV plunged 48 percent to 10.20 euros, the largest drop since at least 1989. The Dutch provider of infrastructure for stadiums said it may have to book writedowns of at least 100 million euros because of alleged irregularities at its Polish business.

Swatch Group AG added 5 percent to 543.50 francs, its highest price since at least 1993, after the biggest maker of Swiss watches reported a 26 percent increase in 2012 net income to 1.6 billion francs. That beat the average analyst estimate of 1.49 billion francs in a survey as the company produced more watches and took advantage of expanded production capacity at its factories.

U.S. stock indexes spent all trading in negative territory amid weak data on factory orders, reduce rating on the stock number of "blue chip" and government bond yield growth in Italy and Spain.

Today the yield of government bonds in Italy and Spain rose, although not critical, accompanied by increased risk of political instability in these countries, which could aggravate their exit from the current crisis.

Media reported that the Prime Minister of Spain, Mariano Rajoy may resign. The reason for this is the information that Rajoy might be involved in a corruption scandal.

The market also reacted negatively to the information that the former Italian prime minister, Silvio Berlusconi, the gap between the race favorite Pier Luigi Bersani, despite the lawsuits related to tax evasion.

After the start of the negative pressure on the index was published data on factory orders in the U.S., which were lower than forecast (1.8% vs. 2.3%), with the value from the previous reporting period has been revised downwards (from 0 , 0% to -0.3%).

As for the news of the corporate plan, it is worth noting downgrade shares of companies such as Merck (MRK, -2.34%), Wal-Mart (WMT, -1.22%) and Chevron (CVX, -1.12%).

All components of the index DOW dropped, except for shares Boeing Co. (BA, +0.45%). More than the others fell in the share price The Travelers Companies (TRV, -2.37%).

All sectors of the S & P finished trading in the red. More than other basic materials sector declined (-1.7%).

At the close:

S & P 500 1,495.71 -17.46 -1.15%

NASDAQ 3,131.17 -47.93 -1.51%

Dow 13,880.08 -129.71 -0.93%

00:01 United Kingdom BRC Retail Sales Monitor y/y January +0.3% -0.5% +1.9%

00:30 Australia Trade Balance December -2.64 -0.81 -0.43

00:30 Australia House Price Index (QoQ) IV quarter +0.3% +0.3% +1.6%

00:30 Australia House Price Index (YoY) IV quarter +0.3% +0.9% +2.1%

01:45 China HSBC Services PMI January 51.7 54.0

03:30 Australia Announcement of the RBA decision on the discount rate - 3.00% 3.00% 3.00%

03:30 Australia RBA Rate Statement -

The euro fell against the yen, following yesterday’s drop which was the biggest since June, amid corruption allegations against Spanish Premier Mariano Rajoy and uncertainty ahead of Italian elections this month. Spain’s Rajoy, facing opposition calls to resign amid contested reports about illegal payments, traveled to Berlin yesterday as euro-area leaders schedule a series of meetings this week ahead of a Feb. 7-8 European Union summit. Spanish bonds slumped yesterday, sending the 10-year yield up to 5.44 percent, the highest since Dec. 11.

A poll showed former Italy Premier Silvio Berlusconi closed the gap on front-runner Pier Luigi Bersani even as he appeals a four-year prison sentence for tax fraud. Voting takes place on Feb. 24-25.

The 17-nation currency halted this year’s climb against the dollar before European Central Bank policy makers meet on Feb. 7.

The yen rose against most major peers as investors bought haven assets after Asian equities slid.

Australia’s dollar slid against all of its 16 major peers after the Reserve Bank of Australia kept its benchmark interest rate unchanged at the half-century low of 3 percent. The inflation outlook gives scope for further easing, the RBA said in a statement after the decision.

EUR/USD: during the Asian session the pair fell below $1.3500.

GBP/USD: during the Asian session, the pair traded in the range of $1.5740-70.

USD/JPY: during the Asian session, the pair traded in the range of Y91.95-55.

EMU services PMI data due this morning, Spain up at 0813GMT through to EMU at 0858GMT. EMU retail sales due at 1000GMT. US non mfg ISM the interest into the afternoon (1500GMT).

Change % Change Last

Gold 1,675 +5 +0.27%

Oil 96.18 -1.59 -1.63%

Change % Change Last

Nikkei 225 11,260.35 +69.01 +0.62%

S&P/ASX 200 4,907.52 -13.58 -0.28%

Shanghai Composite 2,428.15 +9.13 +0.38%

FTSE 100 6,246.84 -100.40 -1.58%CAC 40 3,659.91 -113.62 -3.01%

DAX 7,638.23 -195.16 -2.49%

S&P 500 1,495.71 -17.46 -1.15%

NASDAQ 3,131.17 -47.93 -1.51%

Dow 13,880.08 -129.71 -0.93%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3512 -1,06%

GBP/USD $1,5763 +0,38%

USD/CHF Chf0,9082 +0,12%

USD/JPY Y92,37 -0,53%

EUR/JPY Y124,81 -1,60%

GBP/JPY Y145,55 -0,16%

AUD/USD $1,0437 +0,35%

NZD/USD $0,8431 -0,21%

USD/CAD C$0,9986 +0,14%

00:01 United Kingdom BRC Retail Sales Monitor y/y January +0.3% -0.5%

00:30 Australia Trade Balance December -2.64 -0.81

00:30 Australia House Price Index (QoQ) IV quarter +0.3% +0.3%

00:30 Australia House Price Index (YoY) IV quarter +0.3% +0.9%

01:45 China HSBC Services PMI January 51.7

03:30 Australia Announcement of the RBA decision on the discount rate - 3.00% 3.00%

03:30 Australia RBA Rate Statement -

07:00 Switzerland Trade Balance December 2.95 2.74

08:00 United Kingdom Halifax house price index January +1.3% -0.2%

08:00 United Kingdom Halifax house price index 3m Y/Y January -0.3% +1.6%

08:50 France Services PMI (finally) January 43.6 43.6

08:55 Germany Services PMI (finally) January 55.3 55.3

09:00 Eurozone Services PMI (finally) January 48.3 48.3

09:30 United Kingdom Purchasing Manager Index Services January 48.9 49.8

10:00 Eurozone Retail Sales (MoM) December +0.1% -0.5%

10:00 Eurozone Retail Sales (YoY) December -2.6% -1.4%

15:00 U.S. ISM Non-Manufacturing January 56.1 55.2

17:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks -

21:30 U.S. API Crude Oil Inventories - +4.2© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.