- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-05-2017

(raw materials / closing price /% change)

Oil 48.23 -0.88%

Gold 1,236.80 +0.03%

(index / closing price / change items /% change)

Nikkei +49.97 19919.82 +0.25%

TOPIX +4.23 1584.23 +0.27%

Hang Seng -35.65 25335.94 -0.14%

CSI 300 +29.46 3428.65 +0.87%

Euro Stoxx 50 +0.01 3641.89 +0.00%

FTSE 100 +67.66 7522.03 +0.91%

DAX -2.51 12804.53 -0.02%

CAC 40 -11.30 5406.10 -0.21%

DJIA -2.19 20979.75 -0.01%

S&P 500 -1.65 2400.67 -0.07%

NASDAQ +20.20 6169.87 +0.33%

S&P/TSX -86.14 15543.33 -0.55%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1080 +0,93%

GBP/USD $1,2914 +0,14%

USD/CHF Chf0,9857 -1,04%

USD/JPY Y113,09 -0,44%

EUR/JPY Y125,31 +0,49%

GBP/JPY Y146,05 -0,29%

AUD/USD $0,7424 +0,15%

NZD/USD $0,6884 +0,03%

USD/CAD C$1,3606 -0,18%

00:30 Australia Westpac Consumer Confidence May 99.0

01:30 Australia Wage Price Index, q/q Quarter I 0.5% 0.5%

01:30 Australia Wage Price Index, y/y Quarter I 1.9% 1.9%

04:30 Japan Industrial Production (MoM) (Finally) March 3.2% -2.1%

04:30 Japan Industrial Production (YoY) (Finally) March 4.7% 3.3%

08:30 United Kingdom Average Earnings, 3m/y March 2.3% 2.4%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y March 2.2% 2.2%

08:30 United Kingdom ILO Unemployment Rate March 4.7% 4.7%

08:30 United Kingdom Claimant count April 25.5 7.5

09:00 Eurozone Construction Output, y/y March 7.1%

09:00 Eurozone Harmonized CPI April 0.8% 0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) April 0.7% 1.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April 1.5% 1.9%

12:30 Canada Manufacturing Shipments (MoM) March -0.2% 0.4%

14:30 U.S. Crude Oil Inventories May -5.247

23:50 Japan GDP, q/q (Preliminary) Quarter I 0.3% 0.4%

23:50 Japan GDP, y/y (Preliminary) Quarter I 1.2% 1.7%

The main US stock indexes finished trading near zero. The negative impact on the mood of investors was provided by data on the US housing market, as well as reports that Trump could give the Russian Foreign Minister secret information concerning the threat posed by the terrorist organization Islamic State.

As it became known, bookings of new houses in the USA unexpectedly fell in April against the background of a constant decrease in the construction of multi-apartment houses and a modest rebound in one-family projects, which indicates a slowdown in the housing market recovery. The Ministry of Housing reported that bookings of new homes fell 2.6% to 1.17 million (seasonally adjusted). This was the lowest level since November 2016, after a downward revision to the level of 1.20 million in March. Economists predicted that last month's bookmarks rose to 1.26 million units from the previously announced level of 1.22 million units in March.

Meanwhile, the optimism of the market has added data on industrial production. The Federal Reserve said that industrial production in April rose at the fastest monthly pace in more than three years, thanks to the broad achievements in the manufacturing sector. According to the data, the volume of industrial production grew by 1% in April, exceeding the consensus forecast of growth economists by 0.3%. This was the fastest growth rate since February 2014.

The components of the DOW index showed mixed dynamics (15 in positive territory, 15 in negative territory). Most fell shares of UnitedHealth Group Incorporated (UNH, -2.06%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.53%).

Most sectors of the S & P index finished trading in the red. The conglomerate sector fell most of all (-1.2%). The leader of growth was the technological sector (+ 0.5%).

At closing:

DJIA -0.01% 20.979.54 -2.40

Nasdaq + 0.33% 6,169.87 +20.20

S & P -0.07% 2,400.64 -1.68

EURUSD: 1.0850 (313m) 1.0880 ( 300m) 1.0900-10 (627m) 1.0920 (552m) 1.0950 (322m)

USDJPY: 112.50 (USD 255m) 112.75 (270m) 113.00 (271m) 113.30 (301m) 114.00 (477m) 114.15-25 (789m)

AUDUSD: 0.7300 (AUD 198m) 0.7400 (176m)

USDCAD: 1.3570 (USD 222m) 1.3650 (270m)

EURJPY: 123.80 (EUR 173m)

U.S. stock-index futures rose moderately as investors paused for a breather a day after the S&P 500 and the Nasdaq closed at record highs. Investors assessed statistics on the U.S. housing market and industrial production.

Stocks:

Nikkei 19,919.82 +49.97 +0.25%

Hang Seng 25,335.94 -35.65 -0.14%

Shanghai 3,113.50 +23.27 +0.75%

S&P/ASX 5,850.52 +12.12 +0.21%

FTSE 7,511.95 +57.58 +0.77%

CAC 5,407.06 -10.34 -0.19%

DAX 12,817.24 +10.20 +0.08%

Crude $49.26 (+0.84%)

Crude $1,235.30 (+0.44%)

Industrial production advanced 1.0 percent in April for its third consecutive monthly increase and its largest gain since February 2014. Manufacturing output rose 1.0 percent as a result of widespread increases among its major industries.

The indexes for mining and utilities posted gains of 1.2 percent and 0.7 percent, respectively. At 105.1 percent of its 2012 average, total industrial production in April was 2.2 percent above its year-earlier level.

Capacity utilization for the industrial sector increased 0.6 percentage point in April to 76.7 percent, a rate that is 3.2 percentage points below its long-run (1972-2016) average.

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,229,000. This is 2.5 percent below the revised March rate of 1,260,000, but is 5.7 percent above the April 2016 rate of 1,163,000. Single-family authorizations in April were at a rate of 789,000; this is 4.5 percent below the revised March figure of 826,000. Authorizations of units in buildings with five units or more were at a rate of 403,000 in April.

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,172,000. This is 2.6 percent below the revised March estimate of 1,203,000, but is 0.7 percent above the April 2016 rate of 1,164,000. Single-family housing starts in April were at a rate of 835,000; this is 0.4 percent above the revised March figure of 832,000. The April rate for units in buildings with five units or more was 328,000.

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 960.57 | 2.60(0.27%) | 10614 |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.87 | 1.05(1.70%) | 3768 |

| Apple Inc. | AAPL | 156.18 | 0.48(0.31%) | 79932 |

| AT&T Inc | T | 38.6 | 0.01(0.03%) | 1769 |

| Barrick Gold Corporation, NYSE | ABX | 17.04 | 0.14(0.83%) | 37648 |

| Caterpillar Inc | CAT | 102.7 | 0.28(0.27%) | 1116 |

| Chevron Corp | CVX | 107.5 | 0.65(0.61%) | 1635 |

| Cisco Systems Inc | CSCO | 34.37 | 0.14(0.41%) | 7045 |

| Citigroup Inc., NYSE | C | 61.5 | 0.08(0.13%) | 3953 |

| Exxon Mobil Corp | XOM | 83 | 0.20(0.24%) | 3273 |

| Facebook, Inc. | FB | 150.4 | 0.21(0.14%) | 60536 |

| Ford Motor Co. | F | 11.02 | 0.08(0.73%) | 138116 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.88 | 0.13(1.11%) | 29422 |

| General Motors Company, NYSE | GM | 33.85 | 0.03(0.09%) | 6408 |

| Goldman Sachs | GS | 225.1 | -0.02(-0.01%) | 1620 |

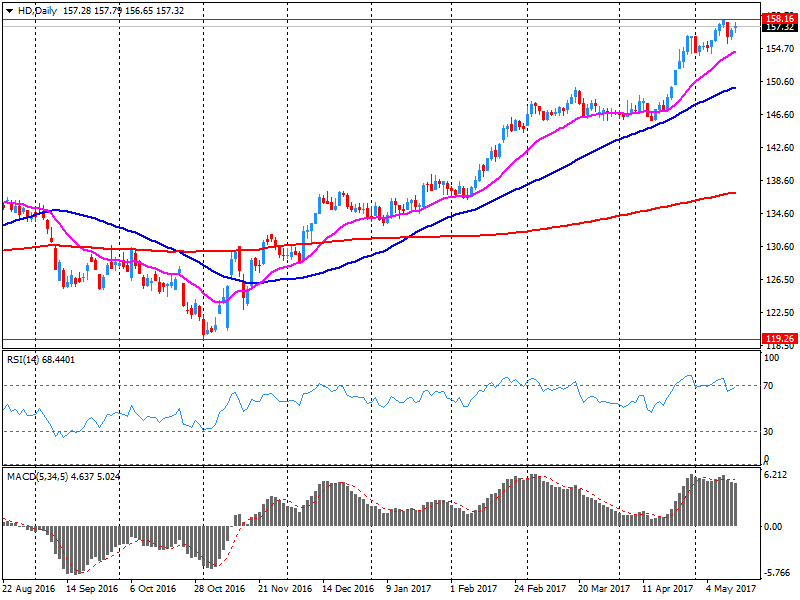

| Home Depot Inc | HD | 159.36 | 2.03(1.29%) | 123780 |

| Intel Corp | INTC | 35.74 | 0.11(0.31%) | 1934 |

| JPMorgan Chase and Co | JPM | 87.3 | -0.04(-0.05%) | 2191 |

| Microsoft Corp | MSFT | 68.2 | 0.16(0.24%) | 16175 |

| Nike | NKE | 53.5 | -0.27(-0.50%) | 28935 |

| Pfizer Inc | PFE | 32.55 | -0.57(-1.72%) | 64195 |

| Procter & Gamble Co | PG | 86.68 | 0.35(0.41%) | 6597 |

| Starbucks Corporation, NASDAQ | SBUX | 60.7 | 0.25(0.41%) | 3289 |

| Tesla Motors, Inc., NASDAQ | TSLA | 318 | 2.12(0.67%) | 47290 |

| The Coca-Cola Co | KO | 43.94 | 0.21(0.48%) | 128 |

| Twitter, Inc., NYSE | TWTR | 19.39 | 0.16(0.83%) | 87227 |

| UnitedHealth Group Inc | UNH | 171.02 | -0.51(-0.30%) | 11888 |

| Verizon Communications Inc | VZ | 45.5 | 0.12(0.26%) | 5081 |

| Visa | V | 93.3 | 0.07(0.08%) | 1359 |

| Walt Disney Co | DIS | 109 | -0.13(-0.12%) | 2672 |

| Yahoo! Inc., NASDAQ | YHOO | 50.09 | 0.23(0.46%) | 302297 |

| Yandex N.V., NASDAQ | YNDX | 28.25 | -0.65(-2.25%) | 25632 |

Upgrades:

Downgrades:

Pfizer (PFE) downgraded to Sell from Neutral at Citigroup

Other:

NIKE (NKE) initiated with a Buy at Berenberg; target $70

Home Depot (HD) reported Q1 FY 2017 earnings of $1.67 per share (versus $1.44 in Q1 FY 2016), beating analysts' consensus estimate of $1.61.

The company's quarterly revenues amounted to $23.887 bln (+4.9% y/y), generally in-line with analysts' consensus estimate of $23.738 bln.

HD rose to $159.90 (+1.63%) in pre-market trading.

EUR/USD

Offers: 1.1035 1.1050 1.1080 1.1100 1.1130 1.1150

Bids: 1.1000 1.10980 1.0960 1.0920 1.0900 1.0880 1.0850

GBP/USD

Offers: 1.2935 1.2950 1.2965 1.2980-85 1.3000 1.3020 1.3050

Bids: 1.2900 1.2875-80 1.2850 1.2830 1.2800 1.2785 1.2750

EUR/JPY

Offers: 125.30 125.50 125.80 126.00 126.50

Bids: 125.00 124.80-85 124.60 124.30 124.00 123.80 123.50

EUR/GBP

Offers: 0.8535 0.8550 0.8585 0.8600 0.8655-60

Bids: 0.8500-10 0.8480-85 0.8450 0.8425 0.8400

USD/JPY

Offers: 13.60 113.80-85 114.00 114.20 114.35 114.50

Bids: 113.20 113.00 112.80 112.45-50 112.00

AUD/USD

Offers: 0.7435 0.7450-55 0.7480 0.7500

Bids: 0.7400 0.7385 0.7370 0.7350 0.7330-35 0.7300

The first estimate for euro area (EA19) exports of goods to the rest of the world in March 2017 was €202.3 billion, an increase of 13% compared with March 2016 (€178.9 bn), says Eurostat. Imports from the rest of the world stood at €171.4 bn, a rise of 14% compared with March 2016 (€150.7 bn).

As a result, the euro area recorded a €30.9 bn surplus in trade in goods with the rest of the world in March 2017, compared with +€28.2 bn in March 2016. Intra-euro area trade rose to €168.1 bn in March 2017, up by 12% compared with March 2016.

Seasonally adjusted GDP rose by 0.5% in both the euro area (EA19) and the EU28 during the first quarter of 2017, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the fourth quarter of 2016, GDP grew by 0.5% and 0.6% respectively. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.7% in the euro area and by 2.0% in the EU28 in the first quarter of 2017, after +1.8% and +1.9% respectively in the previous quarter.

During the first quarter of 2017, GDP in the United States increased by 0.2% compared with the previous quarter (after +0.5% in the fourth quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.9% (after +2.0% in the previous quarter).

The ZEW Indicator of Economic Sentiment for Germany continued to increase in May 2017. Compared to the previous month, it climbed by 1.1 points to a current reading of 20.6 points. The long-term average of 23.9 points has not quite been reached yet. The assessment of the current economic situation in Germany also improved once again in May. The indicator climbed by 3.8 points to 83.9 points. Taken together, the assessment of the current situation and the economic sentiment show a positive outlook for the German economic growth in the coming six months.

"The latest figures on the gross domestic product confirm that the German economy is in good shape. ZEW indicators have been pointing to this trend for some time. The prospects for the eurozone as a whole are gradually improving, further strengthening the economic environment for German exports," comments ZEW President Professor Achim Wambach.

Factory gate prices have grown for 15 consecutive months to April 2017 despite raw material costs being relatively flat since January 2017.

The monthly rate of inflation for goods leaving the factory gate (output prices) was unchanged at 0.4% in April 2017, while input prices rose 0.1% following 2 months of no growth.

The annual rate for factory gate price inflation was positive but unchanged at 3.6%, while the annual growth rate for input prices fell back to 16.6% from a peak of 19.9% in January 2017.

Prices for imported materials and fuels rose 14.9% on the year and were lower than overall input costs for the third month in a row following a strengthening in the value of sterling over recent months.

UK house prices grew by 4.1% in the year to March 2017, 1.5 percentage points lower than in the year to February 2017.

In terms of housing demand, the Royal Institute of Chartered Surveyors' (RICS) residential market survey for March 2017 reported that housing market activity remained "relatively subdued". New buyer enquiries and agreed sales remain broadly unchanged since the start of the year. This is consistent with UK Property Transaction statistics which showed that in March 2017 the total number of seasonally adjusted property transactions completed in the UK with value of £40,000 or above has remained at a similar level for the last 3 months.

The Consumer Prices Index including owner occupiers' housing costs (CPIH, not a National Statistic) 12-month inflation rate was 2.6% in April 2017, up from 2.3% in March.

The rate has been steadily increasing following a period of relatively low inflation in 2015 and is at its highest since June 2013.

Air fares were the main contributors to the increase in the rate in April 2017, although this balanced out a downward effect of similar magnitude in March 2017 and is due to Easter falling later than last year.

Rising prices for clothing, vehicle excise duty and electricity also contributed to the increase in the rate.

These upward contributions were partially offset by a fall in motor fuel prices between March 2017 and April 2017, compared with a rise between the same 2 months a year ago.

The Consumer Prices Index (CPI) 12-month rate was 2.7% in April 2017, up from 2.3% in March.

EURUSD: 1.0850 (313m) 1.0880 ( 300m) 1.0900-10 (627m) 1.0920 (552m) 1.0950 (322m)

USDJPY: 112.50 (USD 255m) 112.75 (270m) 113.00 (271m) 113.30 (301m) 114.00 (477m) 114.15-25 (789m)

AUDUSD: 0.7300 (AUD 198m) 0.7400 (176m)

USDCAD: 1.3570 (USD 222m) 1.3650 (270m)

EURJPY: 123.80 (EUR 173m)

Информационно-аналитический отдел TeleTrade

In April 2017, the Consumer Prices Index (CPI) was at a standstill (+0.1% over a month after +0.6% in March). Seasonally adjusted, it was stable, as in the previous month. Year on year, consumer prices accelerated barely, to +1.2% after +1.1% in the previous month.

Over a month, this marked slowdown came from that, seasonal, of manufactured product prices. Energy and food prices fell again, but less than in the previous month. Contrariwise, services prices accelerated a little, due to a sharp rebound in transport services prices.

In April 2017, manufactured product prices slackened sharply (+0.1% after +2.5%). Year on year, the fall in prices eased again (−0.7% after −1,0% in March and −1.6% in February). Seasonally in April, clothing and footwear prices slowed down (+0.9% after +14.5%; −0.1% year on year). The prices of "other manufactured products" were stable after an increase of 0.6% in the previous month

-

March qtr inflation increased confidence in forecasts that core inflation would pick up to around 2 pct by early 2018

-

Developments in labour and housing markets warrant "careful monitoring"

-

Members had in-depth discussion about changes in the composition of employment in recent decades

-

Recent data suggests economy expanded at a "moderate pace" in march quarter

-

Gdp still expected to pick up to be a little above 3 pct by h1 2018 as drag from mining investment wane, resources exports pick up

-

Utilities prices likely to increase in next few qtrs, could see second-round effects on cpi through upward pressure on business costs

-

Housing credit growth continue to outpace income rise, suggesting higher risks associated with household balance sheets

-

Not too concerned about normalisation of fed policy as it reflects strength of U.S. economy

-

It is well understood, well recognised in global community that free trade is key to global growth

-

If any country introduces protectionist measures, that would hurt that country as well as global growth

EUR/USD

Resistance levels (open interest**, contracts)

$1.1081 (7544)

$1.1039 (4162)

$1.1016 (3827)

Price at time of writing this review: $1.0995

Support levels (open interest**, contracts):

$1.0952 (274)

$1.0914 (1945)

$1.0856 (4364)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 84432 contracts, with the maximum number of contracts with strike price $1,1100 (7882);

- Overall open interest on the PUT options with the expiration date June, 9 is 90332 contracts, with the maximum number of contracts with strike price $1,0700 (6149);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from May, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.3202 (2364)

$1.3103 (2665)

$1.3005 (3733)

Price at time of writing this review: $1.2917

Support levels (open interest**, contracts):

$1.2795 (2185)

$1.2697 (2087)

$1.2598 (1553)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 33494 contracts, with the maximum number of contracts with strike price $1,3000 (3733);

- Overall open interest on the PUT options with the expiration date June, 9 is 35745 contracts, with the maximum number of contracts with strike price $1,1500 (3061);

- The ratio of PUT/CALL was 1.0 versus 1.05 from the previous trading day according to data from May, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European equity-index gauges finished with modest gains Monday, scoring a fillip from commodity shares as oil and metals prices rose. The Stoxx Europe 600 index SXXP, +0.09% ended up 0.1% at 395.97, marking a second straight advance and keeping the index around its highest since August 2015. But the index moved between small gains and losses throughout the session. The oil-and-gas, basic-materials and financial sectors fared the best, but health-care, consumer-related and telecom shares struggled.

The S&P 500 and the Nasdaq Composite closed at fresh records on Monday as a jump in oil prices to a two-week high lifted Wall Street sentiment. The proposed extension still needs to be confirmed when the 13 members of the Organization of the Petroleum Exporting Countries gather for a closely watched meeting in Vienna on May 25.

Stock markets across Asia-Pacific lacked direction early Tuesday, with gains for regional energy and mining firms thanks to a jump in commodity prices, while Chinese markets again succumbed to selling pressure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.