- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-05-2017

(raw materials / closing price /% change)

Oil 49.34 -0.02%

Gold 1,246.80 -0.48%

(index / closing price / change items /% change)

Nikkei -261.02 19553.86 -1.32%

TOPIX -20.81 1555.01 -1.32%

Hang Seng -157.11 25136.52 -0.62%

CSI 300 -11.86 3398.11 -0.35%

Euro Stoxx 50 -22.61 3562.22 -0.63%

FTSE 100 -67.05 7436.42 -0.89%

DAX -41.55 12590.06 -0.33%

CAC 40 -28.16 5289.73 -0.53%

DJIA +56.09 20663.02 +0.27%

S&P 500 +8.69 2365.72 +0.37%

NASDAQ +43.89 6055.13 +0.73%

S&P/TSX +3.52 15277.20 +0.02%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1100 -0,58%

GBP/USD $1,2938 -0,29%

USD/CHF Chf0,98 +0,18%

USD/JPY Y111,56 +0,76%

EUR/JPY Y123,84 +0,19%

GBP/JPY Y144,33 +0,47%

AUD/USD $0,7416 -0,26%

NZD/USD $0,6898 -0,67%

USD/CAD C$1,3604 +0,15%

06:00 Germany Producer Price Index (YoY) April 3.1% 3.2%

06:00 Germany Producer Price Index (MoM) April 0.0% 0.2%

08:00 Eurozone Current account, unadjusted, bln March 27.9

09:00 Eurozone ECB's Peter Praet Speaks

10:00 United Kingdom CBI industrial order books balance May 4 4

11:00 Eurozone ECB's Benoit Coeure Speaks

12:00 Eurozone ECB's Vitor Constancio Speaks

12:30 Canada Retail Sales YoY March 4.7%

12:30 Canada Retail Sales, m/m March -0.6% 0.4%

12:30 Canada Consumer Price Index m / m April 0.2% 0.4%

12:30 Canada Consumer price index, y/y April 1.6% 1.7%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y April 1.3% 1.4%

12:30 Canada Retail Sales ex Autos, m/m March -0.1% 0.2%

13:15 U.S. FOMC Member James Bullard Speaks

14:00 Eurozone Consumer Confidence (Preliminary) May -3.6 -3

17:00 U.S. Baker Hughes Oil Rig Count May 712

Major US stock indices grew moderately on Thursday, closing the wave of recessions on major world stock markets caused by uncertainty on the agenda of US President Donald Trump.

The reports that Trump tried to intervene in the investigation of the alleged Russian interference in the presidential elections in the US last year and that his aides had numerous undisclosed contacts with Russian officials held tensions on the market the day after the S & P 500 published the biggest fall From september.

In addition, as shown by the report submitted by the Federal Reserve Bank of Philadelphia, the index of business activity in the manufacturing sector increased in May, reaching a level of 38.8 points compared to 22 points in April. Economists had expected the decline to 19.5 points.

However, new applications for unemployment benefits in the US unexpectedly fell last week, and the number of Americans who continue to receive unemployment benefits has reached a 28.5-year low, indicating a rapid reduction in the weakness of the labor market. Primary requests for unemployment benefits fell by 4,000 to 232,000, seasonally adjusted for the week to May 13. This returned the appeals closely to the levels that were last seen in 1973.

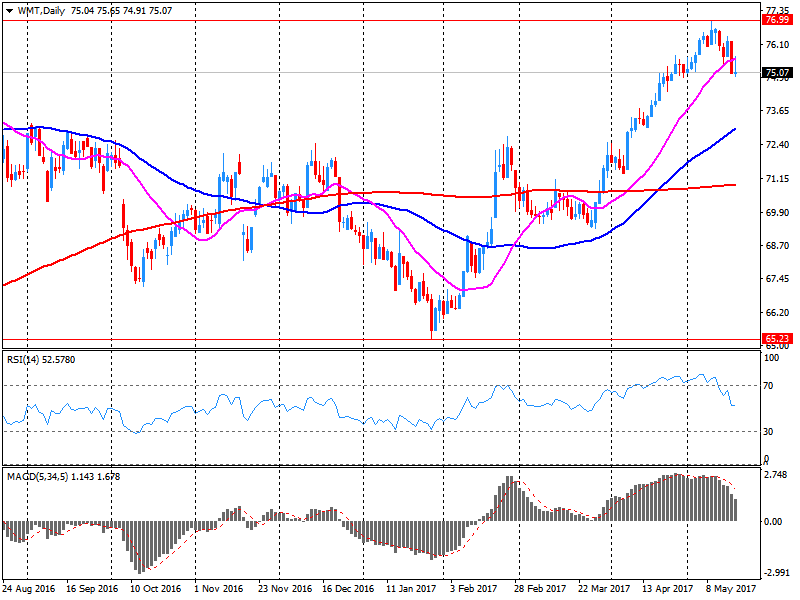

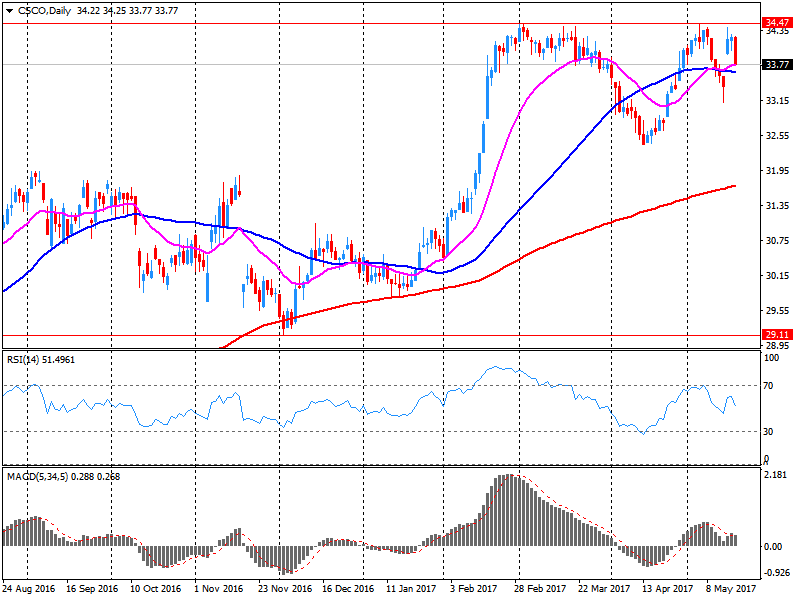

Most components of the DOW index finished trading in positive territory (21 out of 30). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 3.20%). More shares fell shares of Cisco Systems, Inc. (CSCO, -8.19%).

Most sectors of the S & P index recorded an increase. The growth leader was the conglomerate sector (+ 1.3%). The main materials sector fell most of all (-0.5%).

At closing:

DJIA + 0.27% 20.661.78 +54.85

Nasdaq + 0.73% 6,055.13 +43.89

S & P + 0.37% 2,365.73 +8.70

-

Will focus on housing reform in second half of 2017

EURUSD: 1.1000 (EUR 4.5bln) 1.1050 (578m) 1.1076 (455m) 1.1150 (362m) 1.1180 (227m)

USDJPY: 110.00 (USD 408m) 110.20 (240m) 111.55 (350m) 112.00 (253m)

GBPUSD: 1.2860-65 (GBP 541m) 1.2900 (740m) 1.3000 (424m)

EURGBP: 0.8600 (EUR 330m)

AUDUSD: 0.7350 (AUD 248m) 0.7390-0.7400 (842m) 0.7500 (333m)

NZDUSD: 0.6960 (NZD 224m)

EURJPY: 125.00 (EUR 477m)

U.S. stock-index futures fell amid continuing uncertainties about President Donald Trump's political future and its impact on his pro-growth agenda.

Stocks:

Nikkei 19,553.86 -261.02 -1.32%

Hang Seng 25,136.52 -157.11 -0.62%

Shanghai 3,090.40 -14.04 -0.45%

S&P/ASX 5,738.31 -47.72 -0.82%

FTSE 7,413.39 -90.08 -1.20%

CAC 5,260.63 -57.26 -1.08%

DAX 12,532.10 -99.51 -0.79%

Crude $48.37 (-1.43%)

Gold $1,260.00 (+0.10%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 194.50 | -0.34(-0.17%) | 350 |

| ALCOA INC. | AA | 31.23 | -0.40(-1.26%) | 230 |

| Amazon.com Inc., NASDAQ | AMZN | 943.40 | -1.36(-0.14%) | 42661 |

| Apple Inc. | AAPL | 151.19 | 0.94(0.63%) | 273744 |

| AT&T Inc | T | 37.53 | 0.07(0.19%) | 12360 |

| Barrick Gold Corporation, NYSE | ABX | 17.02 | -0.09(-0.53%) | 59727 |

| Boeing Co | BA | 177.58 | -1.20(-0.67%) | 477 |

| Caterpillar Inc | CAT | 99.56 | -0.58(-0.58%) | 4331 |

| Chevron Corp | CVX | 104.30 | -0.40(-0.38%) | 2046 |

| Cisco Systems Inc | CSCO | 31.31 | -2.51(-7.42%) | 976709 |

| Citigroup Inc., NYSE | C | 59.27 | -0.71(-1.18%) | 158794 |

| Deere & Company, NYSE | DE | 113.00 | -0.23(-0.20%) | 1035 |

| Exxon Mobil Corp | XOM | 81.84 | -0.15(-0.18%) | 3079 |

| Facebook, Inc. | FB | 144.60 | -0.25(-0.17%) | 146373 |

| Ford Motor Co. | F | 10.74 | -0.02(-0.19%) | 23726 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.23 | -0.20(-1.75%) | 45943 |

| General Electric Co | GE | 27.35 | -0.06(-0.22%) | 61233 |

| General Motors Company, NYSE | GM | 32.23 | -0.19(-0.59%) | 4812 |

| Goldman Sachs | GS | 212.48 | -1.24(-0.58%) | 25554 |

| Google Inc. | GOOG | 918.00 | -1.62(-0.18%) | 7652 |

| Home Depot Inc | HD | 155.60 | -0.49(-0.31%) | 4155 |

| Intel Corp | INTC | 35.06 | 0.02(0.06%) | 95520 |

| International Business Machines Co... | IBM | 151.00 | 0.07(0.05%) | 37288 |

| JPMorgan Chase and Co | JPM | 83.69 | -0.58(-0.69%) | 66255 |

| McDonald's Corp | MCD | 146.00 | -0.41(-0.28%) | 1047 |

| Merck & Co Inc | MRK | 62.44 | -0.56(-0.89%) | 175 |

| Microsoft Corp | MSFT | 67.47 | -0.01(-0.01%) | 35645 |

| Pfizer Inc | PFE | 32.07 | -0.16(-0.50%) | 1599 |

| Procter & Gamble Co | PG | 86.16 | -0.10(-0.12%) | 3526 |

| Starbucks Corporation, NASDAQ | SBUX | 59.66 | -0.07(-0.12%) | 992 |

| Tesla Motors, Inc., NASDAQ | TSLA | 305.38 | -0.73(-0.24%) | 56292 |

| The Coca-Cola Co | KO | 43.84 | -0.09(-0.20%) | 8712 |

| Twitter, Inc., NYSE | TWTR | 18.20 | -0.08(-0.44%) | 127951 |

| United Technologies Corp | UTX | 119.00 | -0.58(-0.49%) | 628 |

| UnitedHealth Group Inc | UNH | 168.30 | -0.56(-0.33%) | 104 |

| Verizon Communications Inc | VZ | 44.50 | 0.02(0.05%) | 7462 |

| Visa | V | 91.42 | -0.34(-0.37%) | 3908 |

| Wal-Mart Stores Inc | WMT | 76.40 | 1.28(1.70%) | 251050 |

| Walt Disney Co | DIS | 105.33 | -0.98(-0.92%) | 1511 |

| Yahoo! Inc., NASDAQ | YHOO | 48.60 | -1.05(-2.11%) | 87485 |

| Yandex N.V., NASDAQ | YNDX | 27.30 | -0.28(-1.02%) | 34083 |

Foreign investment in Canadian securities amounted to $15.1 billion in March, largely in Canadian corporate instruments. At the same time, Canadian investors added $15.4 billion of foreign securities to their holdings, led by acquisitions of US equities.

For the first quarter as a whole, foreign investment in Canadian securities exceeded Canadian investment in foreign securities by $28.8 billion, led by issuances of new Canadian shares to non-resident investors in February.

The index for current manufacturing activity in the region increased from a reading of 22.0 in April to 38.8 this month. The index has been positive for 10 consecutive months. This month, the index recovered some of the declines of the previous two months, but it still remains slightly below its high reading of 43.3 in February.

Fifty-one percent of the firms indicated increases in activity in May, while 13 percent reported decreases. The current new orders and shipments indexes remained at high readings. The shipments index increased 16 points, while the new orders index declined 2 points. Both the delivery times and unfilled orders indexes were positive for the seventh consecutive month, suggesting longer delivery times and increases in unfilled orders.

In the week ending May 13, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 4,000 from the previous week's unrevised level of 236,000. The 4-week moving average was 240,750, a decrease of 2,750 from the previous week's unrevised average of 243,500.

Johnson & Johnson (JNJ) target raised to $128 from $124 at Stifel

Walmart (WMT) reported Q1 FY 2018 earnings of $1.00 per share (versus $0.98 in Q1 FY 2017), beating analysts' consensus of $0.96.

The company's quarterly revenues amounted to $116.526 bln (+1.3% y/y), generally in-line with analysts' consensus estimate of $117.013 bln.

The company also issued guidance for Q2, projecting EPS of $1.00-1.08 versus analysts' consensus estimate of $1.07.

WMT rose to $75.99 (+1.16%) in pre-market trading.

Cisco Systems (CSCO) reported Q3 FY 2017 earnings of $0.60 per share (versus $0.57 in Q3 FY 2016), beating analysts' consensus of $0.58.

The company's quarterly revenues amounted to $11.940 bln (-0.5% y/y), generally in-line with analysts' consensus estimate of $11.900 bln.

The company also issued guidance for Q4, projecting EPS of $0.60-0.62 (versus analysts' consensus estimate of $0.62) and revenues of $11.88-12.13 bln, down 4-6% y/y (versus analysts' consensus estimate of $12.53 bln).

CSCO fell to $31.22 (-7.69%) in pre-market trading.

EUR/USD

Offers: 1.1150 1.1165 1.1180 1.1200 1.1260 1.1300

Bids: 1.1120 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers: 1.2965 1.2985 1.3000 1.3020 1.3050 1.3080 1.3100

Bids: 1.2930-35 1.2900 1.2875-80 1.2850 1.2830 1.2800

EUR/JPY

Offers: 124.00 124.30 124.50 124.80 125.00

Bids: 123.50 123.30 123.00 122.80 122.50 122.00

EUR/GBP

Offers: 0.8610 0.8620-25 0.8655-60 0.8680 0.8700

Bids: 0.8580 0.8565 0.8550 0.8535 0.8500-10

USD/JPY

Offers: 111.50 111.65 111.80 112.00 112.30 112.60 112.80 113.00

Bids: 111.00 110.80 110.50 110.30 110.00 109.80 109.50 109.00

AUD/USD

Offers: 0.7465 0.7480 0.7500 0.7530 0.7550

Bids: 0.7430 07410 0.7390-7400 0.7380 0.7370 0.7350

-

Will remain signatories to the european convention of human rights for the next parliament

-

Will determine a fair settlement of the UK's rights and obligations as a departing EU member state

-

Will not bring EU's charter of fundamental rights into UK law

-

Pledges to maintain common travel area and as frictionless border as possible between Northern Ireland and Republic of Ireland

-

Trump campaign had at least 18 undisclosed contacts with russian officials and others close to Kremlin between april and november 2016

-

Records of the 18 contacts between Trump campaign and Putin-linked figures among material being reviewed by investigators

-

Kremlin-linked individuals in contact with Trump campaign included Ukrainian oligarch and Russian ambassador to United States

-

Trump adviser Michael Flynn and Russian ambassador discussed setting up back channel between Trump and Putin

In April 2017, the quantity bought in the retail industry increased by 2.3% compared with March 2017 and by 4.0% compared with April 2016.

The underlying pattern, as measured by the 3 month on 3 month estimate, showed a slight increase in April 2017 following a short period of contraction, increasing by 0.3%.

Anecdotal evidence from retailers suggests that good weather contributed to growth.

Average prices slowed slightly in April 2017, falling from 3.3% in March to 3.1% in April.

EURUSD: 1.1000 (EUR 4.5bln) 1.1050 (578m) 1.1076 (455m) 1.1150 (362m) 1.1180 (227m)

USDJPY: 110.00 (USD 408m) 110.20 (240m) 111.55 (350m) 112.00 (253m)

GBPUSD: 1.2860-65 (GBP 541m) 1.2900 (740m) 1.3000 (424m)

EURGBP: 0.8600 (EUR 330m)

AUDUSD: 0.7350 (AUD 248m) 0.7390-0.7400 (842m) 0.7500 (333m)

NZDUSD: 0.6960 (NZD 224m)

EURJPY: 125.00 (EUR 477m)

Japan's gross domestic product gained 0.5 percent on quarter in the first three months of 2017, the Cabinet Office cited by rttnews.

That was in line with expectations and up from 0.3 percent in the previous three months.

On an annualized basis, GDP jumped 2.2 percent - exceeding forecasts for 1.7 percent and up from the upwardly revised 1.4 percent gain in the three months prior (originally 1.2 percent).

Nominal GDP was flat on quarter, missing forecasts for a gain of 0.1 percent and down from 0.4 percent in the previous three months.

-

Inflation rise not yet durable, self-sustaining

-

Credibility of forward guidance depends on its adjustment to facts

-

Ecb cash facility working well, has flexibility

-

Ecb ready to adjust if it needs to

-

There will be no shortage in german bonds

-

Rate hike possible, in abstract, if negative deposit rate hurts lending

-

Elections should not weigh much in decisions

-

Vestager says rescue talks over Popolare di Vicenza, Veneto Banca are not very advanced and are not easy but all parties have constructive approach

Trend estimates (monthly change)

-

Employment increased 19,900 to 12,071,300.

-

Unemployment increased 1,700 to 744,400.

-

Unemployment rate remained steady at 5.8%.

-

Participation rate increased by less than 0.1 pts to 64.8%.

-

Monthly hours worked in all jobs decreased 2.0 million hours (0.12%) to 1,663.6 million hours.

Seasonally adjusted estimates (monthly change)

-

Employment increased 37,400 to 12,099,300. Full-time employment decreased 11,600 to 8,227,400 and part-time employment increased 49,000 to 3,871,900.

-

Unemployment decreased 19,100 to 732,300. The number of unemployed persons looking for full-time work decreased 12,300 to 514,200 and the number of unemployed persons only looking for part-time work decreased 6,800 to 218,000.

-

Unemployment rate decreased by 0.2 pts to 5.7%.

-

Participation rate remained steady at 64.8%.

-

Monthly hours worked in all jobs decreased 4.3 million hours (0.26%) to 1,659.5 million hours.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1231 (5858)

$1.1198 (7064)

$1.1181 (4096)

Price at time of writing this review: $1.1138

Support levels (open interest**, contracts):

$1.1086 (339)

$1.1035 (1497)

$1.0967 (1886)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 80785 contracts, with the maximum number of contracts with strike price $1,1000 (7064);

- Overall open interest on the PUT options with the expiration date June, 9 is 93153 contracts, with the maximum number of contracts with strike price $1,0700 (6225);

- The ratio of PUT/CALL was 1.15 versus 1.11 from the previous trading day according to data from May, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.3202 (2339)

$1.3105 (2997)

$1.3008 (3901)

Price at time of writing this review: $1.2948

Support levels (open interest**, contracts):

$1.2893 (1371)

$1.2796 (2164)

$1.2698 (2033)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 33901 contracts, with the maximum number of contracts with strike price $1,3000 (3901);

- Overall open interest on the PUT options with the expiration date June, 9 is 35762 contracts, with the maximum number of contracts with strike price $1,1500 (3061);

- The ratio of PUT/CALL was 1.05 versus 1.06 from the previous trading day according to data from May, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European stocks moved sharply lower on Wednesday, with investors rattled by the latest political turmoil in the U.S. that is feared to put President Donald Trump's pro-growth agenda at risk.

The Nasdaq on Wednesday saw its worst one-day decline since the day after U.K.'s vote to exit from the European Union rattled markets, as turmoil in Washington cast doubt on President Donald Trump's pro-growth agenda that had helped to drive stocks to records.

Asian equity markets were broadly lower, extending a selloff in the U.S. overnight, as doubts increased that the Trump administration would be able to deliver on its policy goals due to mounting political problems.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.