- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-02-2013

The euro rose against the dollar on positive results of the February survey ZEW. Economic sentiment in Germany (from 31.5 to 48.2) and the euro area (from 31.2 to 42.4) improved in February, exceeding forecasts of 35.0 and 35.5 respectively. Assessment of the current situation fell from 7.1 to 5.2 vs. 9.0 (in Germany). We also learned that in December, production in the construction sector eurozone fell by 1.7% m / m vs. 0.4% a month earlier. In the annual comparison index fell by 4.8% compared to -4.7% in November. Current account deficit narrowed in December, Greece from € -0.850 billion to € -0.534 billion

The Australian dollar rose Tuesday against most major currencies after the Reserve Bank of Australia does not rule out the possibility of further lowering the interest rate in case of a fall in economic growth in the region. RBA said that he was satisfied that the series has lasted more than lower rates help stimulate the economy. According to published protocols Tuesday meeting of the central bank, which was held on February 5, the rate of inflation the central bank of Australia provides room for further lowering rates. As a result of this meeting, it was left unchanged at 3.0%.

The Canadian dollar has increased the loss and fell to a new 7-month low after weak economic data in Canada. Wholesale Canada in December fell by 0.9%. The rate of decline is more than two times higher than economists' expectations. Foreign investors reduced their holding are in Canadian shares for 6.68 billion Canadian dollars (6.59 billion U.S. dollars) in December, which was the most significant decline since November 2007. The reason for this was the activities of companies in mergers and acquisitions, said the agency Statistics Canada. Foreign investors in the year invested a total of 83.19 billion Canadian dollars in securities of Canada, with most of this capital was invested in debt securities.

The yen rose against the dollar on comments by Japanese authorities as well as the lack of a common position in the government as to the approach to monetary policy has an impact on the behavior of the Japanese yen. Finance Minister Aso spoke against purchases of foreign bonds, as opposed to Prime Minister Abe. The focus of investors is Abe met with U.S. President Barack Obama. If Obama will support policy measures taken by Abe, the weakening of the yen will continue, experts say.

The British pound fell to the lowest level since July 1.5415 dollar. On the British currency negatively affects fears that tighter fiscal policy will continue to put pressure on the economy, concerns possible downgrade the credit rating of the United Kingdom and the assumption that the next head of the Bank of England will announce the implementation Carney milder policy than that which supports the current Managing King. UK authorities may welcome drop pounds if it will strengthen the competitiveness of British exports. Last week, King said that the weakening of the pound is necessary to reduce the deficit of foreign trade in the UK.

European stocks rose to the highest level in three weeks as German economic sentiment improved more than forecast and Danone SA rallied after reporting earnings.

German investor confidence increased to the highest level in almost three years in February. The index of investor and analyst expectations climbed to 48.2 from 31.5 in January, the ZEW Center for European Economic Research said. That exceeded the median estimate of economists in a survey calling for an increase to 35.

National benchmark indexes advanced in all 18 western European markets, except Iceland. Germany’s DAX jumped 1.6 percent and France’s CAC 40 surged 1.9 percent. The U.K.’s FTSE 100 climbed 1 percent to a five-year high.

Danone jumped 5.9 percent to 53.15 euros as the company said it plans to cut 900 jobs in Europe after 2012 profitability declined on weak consumption in southern Europe. Fourth-quarter net income from continuing operations rose to 1.82 billion euros, in line with the 1.81 billion-euro average analyst estimate in a survey.

Bayer rose 2.50 euros to 71.79 euros after saying it began a Phase-3 trial of the Eylea injection, along with Regeneron Pharmaceuticals Inc. The trial aims to evaluate the efficacy and safety of the drug in treating Diabetic Macular Edema in Russia, China and other Asian countries, the companies said.

Vodafone dropped 2 percent to 163.5 pence after Bernstein lowered its recommendation on the shares to underperform, the equivalent of sell, from market perform. The European assets of the world’s second-largest wireless carrier will shrink by 23 percent in the next three years as the company faces “structural decline,” analysts led by Robin Bienenstock wrote in a report.

Nobel Biocare Holding AG fell 3.2 percent to 9.61 Swiss francs after Chief Executive Officer Richard Laube said markets will remain difficult in the short term. The world’s second- biggest maker of dental implants reported fourth-quarter net income of 11.2 million euros, exceeding the average analyst estimate of 9.55 million euros.

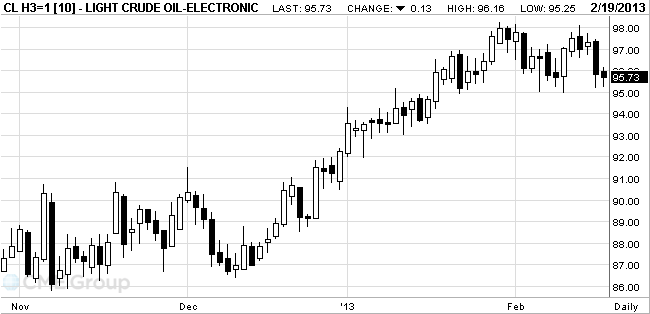

West Texas

Intermediate oil in

WTI traded

in a 91-cent-a-barrel range. Enterprise Product Partners LP said Seaway isn’t

able to move a planned capacity of 400,000 barrels a day. Surging

Oil in

WTI futures

for March delivery, which expire tomorrow, traded in a range of $95.25 - $96.16 a barrel on the New York Mercantile

Exchange.

Brent oil

for April settlement dropped 45 cents, or 0.4 percent, to $116.93 a barrel on

the London-based ICE Futures Europe exchange.

The price of gold down the fourth consecutive session, despite buying in the physical market of Asia after the holidays in China.

Last week, prices fell by 3 percent, and Chinese traders began to actively buy depreciating gold back after the holidays, making the volume of transactions on the Shanghai Gold Exchange on Monday reached a record.

Rising prices also hindered the strengthening of the dollar, has risen to more than one month maximum to a basket of currencies. Demand in the physical market of Asia rose after the New Year holidays in China.

Investors are waiting for publication of the minutes of the last meeting of the Federal Reserve System, in order to understand its relation to financial incentives, which became one of the most important growth factors in gold prices in recent years.

April futures price of gold on COMEX today dropped to 1603.70 dollars per ounce.

Shares of Office Depot Inc. and OfficeMax Inc. advanced as a person familiar with the matter said the companies have discussed a merger and may announce a deal as early as this week.

Global Stocks:

Hang Seng 23,143.91 -238.03 -1.02%

Shanghai Composite 2,382.91 -38.64 -1.60%

FTSE 6,352.6 +34.41 +0.54%

CAC 3,717.25 +50.21 +1.37%

DAX 7,713.58 +84.85 +1.11%

Crude oil $95.93 +0.07%

Gold $1610.90 +0.09%

Downgrade:

Wal-Mart (WMT) downgraded to Sell from Neutral at Oracle Investment Research

Other:

3M (MMM) added to US 1 List at BofA/Merrill

EUR/USD $1.3400, $1.3500

USD/JPY Y92.00, Y92.70, Y93.00, Y93.50, Y94.00, Y94.30

EUR/GBP stg0.8500

EUR/CHF Chf1.2320, Chf1.2400

AUD/USD $1.0270, $1.0200

Data

00:30 Australia RBA Meeting's Minutes February

10:00 Germany ZEW Survey - Economic Sentiment February 31.5 35.3 48.2

10:00 Eurozone ZEW Economic Sentiment February 31.2 35.5 42.4

10:00 Eurozone Construction Output, m/m December -0.4% -1.7%

10:00 Eurozone Construction Output, y/y December -4.7% -4.8%

The yen rose against the dollar and euro, which was the first time in three days, as the Finance Minister Taro Aso said the government did not intend to buy foreign bonds. The yen retreated from the lowest level since May 2010 against the U.S. currency, as his comments were opposed to the statement of Prime Minister Shinzo Abe, who said that the purchase of foreign bonds is one of many options, which should help to monetary policy.

The Australian dollar rose after the central bank signaled that further interest rate cut is possible, but there is no such intention.

Recall that the Reserve Bank of Australia cut interest rates by 1.75 percentage points from November 2011, and the decline he describes now as "significant." The minutes of the meeting of February 5, the Reserve Bank of Australia said that he saw the first signs of reducing the impact of the economy. While there is the possibility of further rate cuts due to inflation contained, the RBA stated the need to see clear signs of further slowdown in the economy. RBA also said that the rate in February remained unchanged, as "monetary policy has been accommodative due to a significant easing policy the last 15 months, and the challenge continues to work on the economy.

The pound rose sharply against the euro, but it is now lost all his positions in the light of the fact that many market participants are waiting for the release of the unemployment rate, which will be presented tomorrow. Note that according to the forecasts of economists, the unemployment rate fell in January, while stimulating increased optimism that the economy is recovering. UK currency declined against the dollar, because tomorrow will also be minutes of the meeting of the Bank of England. Note also that the falling currency is also related to the fact that the representative of the Bank of England's Martin Weale approved lowering rates, saying that it can enhance exports.

EUR / USD: during the European session, the pair rose to high of $ 1.3375, and set the minimum at $ 1.3327

GBP / USD: during the European session, the pair rose to high of $ 1.5502, but is now trading near the lows at $ 1.5463

USD / JPY: during the European session is reduced, and is now trading at Y93.53

At 13:30 GMT, Canada will present data on the volume of transactions with foreign securities, as well as changes in the volume of wholesale trade in December. At 21:45 GMT New Zealand will publish a Producer Price Index and the Producer Price Index for Q4. At 23:00 GMT Australia will release the index of leading economic indicators from the Conference Board and the index of leading economic indicators from the Melbourne Institute in December. At 23:50 GMT, Japan will report on the total balance of trade in goods, the adjusted balance of trade in goods, changes in the volume of exports of goods and changes in the volume of imports of goods in January.

EUR/USD

Offers $1.3450/60, $1.3415/25, $1.3400, $1.3380

Bids $1.3320, $1.3300, $1.3290, $1.3280/70, $1.3250

AUD/USD

Offers $1.0450, 1.0415/20, $1.0400, $1.0380/85, $1.0350

Bids $1.0305/00, $1.0275/70, $1.0250, $1.0240/35, $1.0205/00

GBP/USD

Offers $1.5650, $1.5600/10, $1.5580/85, $1.5550, $1.5520, $1.5505/10

Bids $1.5420, $1.5400, $1.5390

EUR/JPY

Offers Y126.30, Y126.00, Y125.70, Y125.50

Bids Y124.55/50, Y124.40/35, Y124.05/00, Y123.55/50, Y123.25/20, Y123.10/00

USD/JPY

Offers Y94.40, Y94.20/30, Y93.90/00, Y93.65/70

Bids Y93.30, Y93.00, Y92.80/75, Y92.65/60, Y92.50

EUR/GBP

Offers stg0.8685/90, stg0.8650

Bids stg0.8600, stg0.8580/70, stg0.8545/40, stg0.8520/15

Growth responded major stock indexes in Europe on positive data on the index business sentiment from the institute ZEW. Both Germany and the Eurozone as a whole is significantly higher than analysts' forecasts (Germany 48.2 in February, the forecast 35.3, 42.4 euro zone, the forecast 35.5 points).

However, data from the Bureau of Eurostat, showed a decline in construction in December, accelerating the pace compared to the previous month.

According to the data, annualized construction output decreased by 4.8% after falling 4.7% in November and 3.3% in October.

FTSE 100 6,342.28 +24.09 +0.38%

DAX 7,691.23 +62.50 +0.82%

CAC 3,702.66 +36.09 +0.97%

Paper Danone SA added 4.7% to the cost. World's largest dairy proischvoditel announced plans to cut about 900 jobs in Europe in the next two years to cope with the "sharp deterioration in the general consumer demand" in the region and to support a gradual increase in sales in 2013.

Stock quotes Nobel Biocare Holding AG, a global manufacturer of dental equipment, fell in price by 3.3%.

Nobel Biocare's net profit in the fourth quarter of last year fell to 11.2 million euros from 13.3 million euros a year earlier, but exceeded the average forecast of experts at 9.5 million euros. In the company's announcement marked the expectations preservation difficult operating conditions in the short term.

EUR/USD $1.3400, $1.3500

USD/JPY Y92.00, Y92.70, Y93.00, Y93.50, Y94.00, Y94.30

EUR/GBP stg0.8500

EUR/CHF Chf1.2320, Chf1.2400

AUD/USD $1.0270, $1.0200Sold E4.001bln vs target E3.0-E4.0bln

Sold 3-month Letra at avg yield 0.421% (0.441%); Tail 2.4bp (1.9bp)

Sold 9-month Letra at avg yield 1.144%; Tail 2.1

E886mln 3-month Letra; bid-to-cover 5.76 vs 4.18 prev

E3.115bln 9-month Letra; bid-to-cover 2.31

Asian stocks rose, with the regional benchmark index trading near its highest close in 18 months, as Bridgestone Corp. surged by the most in four years on better- than-expected profit.

Nikkei 225 11,372.34 -35.53 -0.31%

Hang Seng 23,143.91 -238.03 -1.02%

S&P/ASX 200 5,081.9 +18.48 +0.36%

Bridgestone, the world’s biggest tiremaker, soared 10 percent in Tokyo, to the highest close since 2006.

Gree Inc., a Japanese social-network website operator, rose 2.7 percent on a share-buyback plan.

Nissan Motor Co., a Japanese carmaker that gets 79 percent of its revenue abroad, fell 1.1 percent as the yen strengthened after Finance Minister Taro Aso ruled out foreign bond buying.

Sands China Ltd. paced declines among casino operators in Hong Kong on a report Macau gaming revenue missed estimates.

The yen fell against the dollar, while approaching to the maximum value from February 12, after a group of G20 countries to refrain from criticism of Japanese monetary policy, which triggered a sharp and substantial depreciation of the currency. Note that the yen has fallen by 13% against the dollar in the past three months, as Japan's Prime Minister Shinzo Abe announced an increase in costs and increased pressure on the Bank of Japan to raise monetary easing. The data show that the decline of the yen is the largest of the 16 major currencies.

Economists say that now the focus will be on the appointment of the new head of the Bank of Japan, which will replace the current head of Masaaki Shirakawa, who will retire on March 19.

The pound fell against 13 of its 16 major counterparts as futures traders increased bets that the currency will continue to decline. According to the data, the number of positions of hedge funds and other large speculators reduced pound was at 12 February 16 776, compared with the positions to buy at 1174. Also exerted pressure on the currency by the representative of the Bank of England Wil Martin, who noted that exports can benefit from the depreciation of the currency.

Asian stocks rose, with the regional benchmark index near an 18-month high, as Japanese shares rallied after the Group of 20 nations refrained from censuring the nation’s policies that have weakened the yen.

Nikkei 225 11,407.87 +234.04 +2.09%

Hang Seng 23,381.94 -62.62 -0.27%

S&P/ASX 200 5,063.42 +29.50 +0.59%

Shanghai Composite 2,421.56 -10.84 -0.45%

Toyota Motor Corp., the world’s biggest carmaker, rose 1.3 percent as the yen fell, boosting the earnings prospects for Japanese exporters.

Li & Fung Ltd., a supplier of toys and clothes to Wal-Mart Stores Inc., lost 1.4 percent in Hong Kong as internal e-mails showed the U.S. retailer had the worst sales start to a month in seven years as payroll-tax increases hit shoppers.

BlueScope Steel Ltd. surged 15 percent after Australia’s largest steelmaker reported a smaller net loss.

European stocks retreated for a third day as companies including Carlsberg A/S missed earnings estimates and European Central Bank President Mario Draghi said he sees risks to the euro area’s recovery.

Draghi said that while he expects economic weakness at the beginning of the year to be followed by a “very gradual” recovery later in 2013, risks remain to the economic outlook for the euro region. “They relate to the possibility of weaker than expected domestic demand and exports, slow implementation of structural reforms in the euro area, as well as geopolitical issues and imbalances in major industrialised countries,” he told lawmakers in the European Parliament in Brussels. “These factors have the potential to dampen the ongoing improvement in confidence and thereby delay the recovery.”

Global finance chiefs signaled Japan has scope to keep stimulating its economy as long as policy makers cease publicly advocating a sliding yen. The message was delivered at weekend talks of finance ministers and central bankers from the Group of 20 in Moscow.

National benchmark index fell in 14 of the 18 western- European markets. France’s CAC 40 added 0.2 percent, while the U.K.’s FTSE 100 slipped 0.2 percent. Germany’s DAX gained 0.5 percent.

Carlsberg tumbled 5.8 percent to 567.50 kroner. Fourth- quarter earnings advanced to 2.15 billion kroner ($384 million) from 1.83 billion kroner in the same period a year earlier, Carlsberg said. That compares with the 2.28 billion-kroner median estimate of analysts. The Danish owner of Russia’s biggest brewer forecast annual earnings before interest, tax and some one-time items will be about 10 billion kroner. It reported profit on the same basis of 9.8 billion kroner for 2012.

Natixis jumped 22 percent to 3.48 euros after the investment-banking unit of France’s second-largest lender by branches said it will make a payment to shareholders after selling back stakes in its parent’s banking networks. Natixis plans to sell holdings valued at 12.1 billion euros to French regional lenders Banques Populaires and Caisses d’Epargne, which jointly form its parent, Groupe BPCE.

U.S. stock markets were closed on Monday in observance of President's Day

00:30 Australia RBA Meeting's Minutes February

The New Zealand dollar fell against its 16 major peers after reports that China has destroyed some milk powder imported from the South Pacific nation. The so-called kiwi dropped versus the U.S. dollar and yen after Beijing News reported China’s quarantine administration destroyed milk powder for three different brands, citing the government agency. Some milk powder imported from the Netherlands and Spain was also found to be unqualified, the report said. China replaced Australia as New Zealand’s biggest export market in December for the first time in data going back to 1981, based on the smallest nation’s statistics office. New Zealand’s shipments to China surged last year, led by milk powder, butter and cheese.

Australia’s dollar rose against 14 of 16 major currencies after the RBA said prices of many metals, coal and crude oil have benefited from the better global outlook, according to minutes of the Feb. 5 meeting released today. Prices of iron ore, Australia’s largest export, have increased but have “run well ahead of Chinese steel prices” and may not be sustained at high levels, central bank board members said. Policy makers reiterated that tame prices provide scope to ease further if needed. The bank has lowered its benchmark rate by 1.75 percentage points to 3 percent since November 2011 and this month cut forecasts for inflation and growth.

EUR/USD: during the Asian session, the pair traded in the range of $1.3335-65.

GBP/USD: during the Asian session, the pair traded in the range of $1.5460-80.

USD/JPY: during the Asian session, the pair traded in the range of Y93.55-95.

EU Almunia, Barnier, Rehn and Steinbrueck are due to speak in Brussels from 0715GMT. Spain sell 3-mos, 9-mos bills at 0930GMT, with EZ construction data, along with Germany ZEW, due at 1000GMT to provide the morning interest.

Change % Change Last

Oil $95.34 -1.27 -1.30%

Gold 1,608.00 -1.50 -0.09%

Change % Change Last

Nikkei 225 11,407.87 +234.04 +2.09%

Hang Seng 23,381.94 -62.62 -0.27%

S&P/ASX 200 5,063.42 +29.50 +0.59%

Shanghai Composite 2,421.56 -10.84 -0.45%

FTSE 100 6,318.19 -10.07 -0.16%CAC 40 3,667.04 +6.67 +0.18%

DAX 7,628.73 +35.22 +0.46%

Dow Closed

Nasdaq Closed

S&P Closed

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3350 -0,08%

GBP/USD $1,5463 -0,34%

USD/CHF Chf0,9232 +0,21%

USD/JPY Y93,94 +0,45%

EUR/JPY Y125,42 +0,37%

GBP/JPY Y145,26 +0,11%

AUD/USD $1,0305 +0,06%

NZD/USD $0,8450 +0,05%

USD/CAD C$1,0105 +0,46%

00:30 Australia RBA Meeting's Minutes February

10:00 Germany ZEW Survey - Economic Sentiment February 31.5 35.3

10:00 Eurozone ZEW Economic Sentiment February 31.2 35.5

10:00 Eurozone Construction Output, m/m December -0.4%

10:00 Eurozone Construction Output, y/y December -4.7%

13:30 Canada Foreign investment in Canadian securities December 5.62 7.21

13:30 Canada Wholesale Sales, m/m December +0.7% -0.4%

15:00 U.S. Mortgage Delinquencies Quarter IV 7.4%

15:00 U.S. NAHB Housing Market Index February 47 48

21:45 New Zealand PPI Input (QoQ) Quarter IV -1.0%

21:45 New Zealand PPI Output (QoQ) Quarter IV -0.9%

23:00 Australia Conference Board Australia Leading Index December -0.2%

23:50 Japan Adjusted Merchandise Trade Balance, bln January -800.7 -586.7© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.