- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-02-2013

The euro declined below $1.32 for the first time in six weeks as an industry report showed services and manufacturing in the region shrank at a faster pace in February than economists forecast. The euro declined versus the majority of its 16 most-traded peers as a composite index of factory and services output in the 17-nation currency bloc fell to 47.3 from 48.6 in January, London-based Markit Economics said. Economists forecast a reading of 49, according to the median of 22 estimates in a survey. A reading below 50 indicates contraction.

The 17-nation currency fell for a third day versus the yen on speculation the European Central Bank may have to keep borrowing costs lower for longer to help spur a recovery.

The Dollar Index fell from a five-month high as manufacturing in the Philadelphia region unexpectedly contracted. Fed’s Philadelphia’s general economic index dropped to minus 12.5, the lowest reading since June, from minus 5.8 in January. Readings lower than zero signal contraction in the area covering eastern Pennsylvania, southern New Jersey and Delaware.

The yen advanced all of its major peers as former Bank of Japan Deputy Governor Kazumasa Iwata and Asian Development Bank President Haruhiko Kuroda were seen as the leading candidates to head the central bank, the Mainichi newspaper reported today, without citing anyone. Iwata would be the most yen-bearish candidate because he advocates foreign-bond purchases, according to a note from Citigroup Inc. this week.

European stocks declined the most in more than two weeks as a measure of services and manufacturing output contracted, while concern mounted that the Federal Reserve will scale back its asset-purchase program.

Euro-area services and manufacturing shrank in February more than economists had forecast. A composite index of both industries in the 17-nation currency bloc fell to 47.3 from 48.6 in January, London-based Markit Economics said today. Economists had predicted a reading of 49, according to the median of 22 estimates in a survey. A reading below 50 means that activity contracted.

Several participants at the FOMC’s meeting “emphasized that the committee should be prepared to vary the pace of asset purchases, either in response to changes in the economic outlook or as its evaluation of the efficacy and costs of such purchases evolves,” according to minutes released after the close of European markets yesterday.

National benchmark indexes fell in every western-European market except Iceland. France’s CAC 40 declined 2.3 percent, while the U.K.’s FTSE 100 slid 1.6 percent. Germany’s DAX dropped 1.9 percent.

Safran decreased 3.1 percent to 34 euros. Europe’s second- biggest maker of aircraft engines has begun exploratory discussions with Avio, Chief Executive Officer Jean-Paul Herteman said on a conference call.

Axa SA retreated 3.1 percent to 13.27 euros as net income unexpectedly fell to 4.15 billion euros ($5.5 billion) in 2012 from 4.19 billion euros in 2011. That missed the 4.47 billion- euro average analyst estimate in a survey.

Swiss Re Ltd. gained 2.5 percent to 75.65 francs, its highest price since June 2008. Investors will receive a special dividend of 4 francs a share, plus an ordinary dividend of 3.50 francs, the insurer said. That exceeded the average forecast of eight analysts for a total payout of 6.21 francs a share. Fourth-quarter net income of $795 million beat the average analyst estimate of $240.3 million.

Schneider Electric SA climbed 2.3 percent to 56.67 euros after the world’s biggest maker of low- and medium-voltage equipment said revenue will rebound in 2013. The company added that net income rose 3 percent to 1.84 billion euros in 2012. The average analyst estimate had called for profit of 1.83 billion euros.

BAE Systems Plc jumped 4.1 percent to 345.9 pence, its biggest rally in more than five months. Europe’s largest arms company said it will buy back as much as 1 billion pounds ($1.5 billion) of shares over three years after reporting full-year earnings that fell less than analysts had predicted.

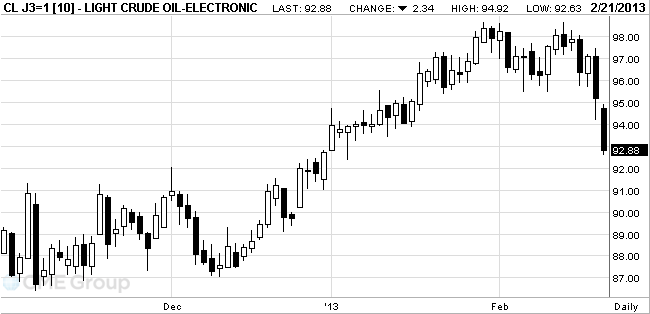

West Texas

Intermediate oil in

Futures

dropped as much as 2.7 percent after the Energy Information Administration said

that stockpiles climbed 4.14 million barrels last week to 376.4 million. A 2

million barrel gain was projected, according to a Bloomberg survey. Production

jumped to the most in more than 20 years. Markets also fell after the Federal

Reserve signaled it may consider slowing the pace of asset purchases, according

to minutes of the Jan. 29-30 meeting, released yesterday.

Several Fed

policy makers said the central bank should be ready to vary the pace of its $85

billion in monthly bond purchases, according to the minutes released late

yesterday. The debt buying, known as quantitative easing, aim to keep long-term

rates low and support economic growth.

WTI oil for

April delivery dropped to $92.63 a

barrel, the lowest level since Jan. 7 on the New York Mercantile Exchange.

Gold prices retreated on Thursday on the eve of the achieved minimum of seven months on fears that the U.S. Federal Reserve cut the program of "quantitative easing."

Report published on Wednesday January Fed meeting showed that many officials expressed concern about the risks associated with the continuation of the acquisition of bonds. In recent years, gold prices rose mainly due to "quantitative easing" of the American central bank.

Loose monetary policy boosted gold prices to record highs against the fact that investors were looking for a hedge against inflation, which may follow an increase in liquidity in the financial system. Gold prices fell last month after the minutes of the previous meeting of the Federal Open Market Fed. According to them, some committee members were in favor of the completion of the current program of the Fed's bond purchases by the end of 2013.

Some investors use gold as a hedge against economic uncertainty, and investor demand for the metal is weakened amid rising U.S. stock indexes to multi-year highs. U.S. housing market has recovered, China seems to have escaped the sharp economic downturn and the continuing debt crisis in Europe years there is still a period of calm.

According to experts, the sale of gold is premature, because central banks are likely to retain a policy change in 2013. A strong dollar also put pressure on prices: the dollar index to a basket of currencies on Thursday rose to a three-month high.

Stocks of the world's largest gold-exchange-traded fund (ETF) SPDR Gold Trust on Wednesday fell by 1.6 percent to 1.299,164 tons - the minimum value of more than five months.

April futures price of gold on COMEX today rose to 1584.40 dollars per ounce.

U.S. stock futures fell as more Americans filed for unemployment benefits last week and investors awaited a home sales report.

Global Stocks:

Hang Seng 22,906.67 -400.74 -1.72 %

Shanghai Composite 2,325.95 -71.23 -2.97 %

FTSE 6,294.26 -101.11 -1.58 %

CAC 3,639.15 -70.73 -1.91 %

DAX 7,592.11 -136.79 -1.77 %

Crude oil $93.26 -2.06%

Gold $1568.10 -0.63%

EUR/USD $1.3310, $1.3335, $1.3340, $1.3345, $1.3350, $1.3365, $1.3475

USD/JPY Y94.00

EUR/JPY Y124.50

USD/CHF Chf0.9150

AUD/USD $1.0310, $1.0415

AUD/JPY Y96.50Data

07:00 Switzerland Trade Balance January 1.00 1.74 2.13

08:00 France Manufacturing PMI (Preliminary) February 42.9 43.9 43.6

08:00 France Services PMI (Preliminary) February 43.6 44.5 42.7

08:30 Germany Manufacturing PMI (Preliminary) February 49.8 50.4 50.1

08:30 Germany Services PMI (Preliminary) February 55.7 55.5 54.1

09:00 Eurozone Manufacturing PMI (Preliminary) February 47.9 48.4 47.8

09:00 Eurozone Services PMI (Preliminary) February 48.6 49.2 47.3

09:30 United Kingdom PSNB, bln January 13.2 -11.3 -9.8

11:00 United Kingdom CBI industrial order books balance February -20 -16 -14

The euro fell against the dollar, dropping below the level at the same $ 1.32 for the first time in six weeks after a report showed that the decline in the private sector continued in the euro zone this month, interrupted in this series increases, which lasted for the previous three months . According to the report, the composite index, which assesses activity in the manufacturing sector and the service sector fell in February to the level of 47.3, up from 48.6 in January. Note that according to the average forecast value of this indicator was increased to the level of 49. At the same time, the data showed that the index of business activity in the services sector fell to a level 47.3, compared to 48.6 in January, as well as Experts rate at around 49.2. Meanwhile, the index of business activity in the manufacturing sector fell to 47.8 from 47.9 in January.

The single currency also fell against the yen on speculation the European Central Bank will keep borrowing costs lower over time to help stimulate the recovery.

The dollar index rose to five-month high before the release of the U.S. leading indicators and regional indicators of production, which can add evidence that the economy is gaining momentum.

The yen rose against all 16 major currencies, after the media reported that the former deputy head of the Bank of Japan Iwata and Asian Development Bank President Haruhiko Kuroda, considered as prime candidates for the post of head of the central bank. Note also that Iwata stands for foreign purchases of bonds.

The pound fell to its lowest level since July 2010 against the dollar after the minutes of the FOMC meeting made clear, a number of Fed officials favored asset repurchase rate adjustments as new data with the possibility of a more rapid cessation of incentive programs than assumed the current legal Installation of U.S. securities. However, despite these concerns, the pound was able to recover all their lost during today's trading position, setting all new session high.

EUR / USD: during the European session, the pair decreased by setting the minimum at $ 1.3165

GBP / USD: during the European session, the pair rose to a maximum of $ 1.5270

USD / JPY: during the European session the pair fell to Y92.77, and is now trading at Y93.16

At 13:30 GMT the United States will be released consumer price index, consumer price index excluding prices for food and energy, the Consumer Price Index (not seasonally adjusted), the main consumer price index for January. At 14:00 GMT the U.S. will provide an index of business activity in the manufacturing sector in February. At 15:00 GMT the United States will report on the volume of sales in the secondary market in January, and will be published by the manufacturing index, the Philadelphia Fed in February. At 22:30 GMT head of the Reserve Bank of Australia makes a speech.

EUR/USD

Orders $1.3250/55, $1.3230, $1.3215/20

Bids $1.3150/40, $1.3120/15, $1.3100

GBP/USD

Orders $1.5300, $1.5280/85, $1.5265/70, $1.5250

Bids $1.5200, $1.5185/80, $1.5170, $1.5120, $1.5100, $1.5085/80

AUD/USD

Orders $1.0350, $1.0320/30, $1.0300, $1.0280

Bids $1.0215, $1.0210/00, $1.0180/75, $1.0150, $1.0120, $1.0110/00

EUR/JPY

Orders Y124.50, Y124.35/40, Y124.00, Y123.75/80

Bids Y122.55/50, Y122.00, Y121.50, Y121.00

USD/JPY

Orders Y94.40, Y94.20/30, Y93.95/00, Y93.50/55

Bids Y93.00, Y92.90, Y92.80/75, Y92.65/60, Y92.50

EUR/GBP

Orders stg0.8850, stg0.8780, stg0.8700/10

Bids stg0.8655/45, stg0.8630/25, stg0.8610/00

European stock indices show a decline due to the fact that market participants are worried that the Fed will turn off a program to purchase assets, which appear to have a negative incentive measures of the U.S. economy, despite the publication of the Fed minutes, which adds to the positive investor sentiment.

The focus of the market is a publication of statistical data on the index of producer prices, the U.S. labor market, as well as the Philadelphia Fed manufacturing index.

To date:

FTSE 100 6,300.86 -94.51 -1.48%

DAX 7,614.13 -114.77 -1.48%

CAC 3,653.78 -53.38 -1.58%

Axa SA shares fell by 3.1% due to the fact that the profits of the company up to 2012 is not exceeded analysts' estimates.

Market quotes Straumann Holdings AG fell 3.3%, the profit for the fourth quarter was worse than analysts' forecasts.

The market value of Swiss Re increased by 2% on the basis of information that the company will pay shareholders a special dividend of $ 2.8 billion

EUR/USD $1.3310, $1.3335, $1.3340, $1.3345, $1.3350, $1.3365, $1.3475

USD/JPY Y94.00

EUR/JPY Y124.50

USD/CHF Chf0.9150

AUD/USD $1.0310, $1.0415

AUD/JPY Y96.50

Asian stocks plunged, with a gauge of Chinese companies in Hong Kong erasing the year’s gains, amid concern the Federal Reserve may scale back U.S. economic stimulus and as China ordered increased property curbs.

Nikkei 225 11,309.13 -159.15 -1.39%

Hang Seng 22,906.67 -400.74 -1.72%

S&P/ASX 200 4,980.09 -118.62 -2.33%

Shanghai Composite 2,325.95 -71.23 -2.97%

Guangzhou R&F Properties Co. lost 2.4 percent in Hong Kong, pacing declines among Chinese developers.

BHP Billiton Ltd., the world’s biggest mining company, dropped 3.8 percent, the most since May, on concern that global demand will decrease if policymakers reduce stimulus.

Origin Energy Ltd. slumped 8.5 percent to A$11.33 in Sydney after Australia’s biggest electricity retailer cut its profit forecast and reported a cost increase at its A$25 billion ($26 billion) gas project.The pound fell to a 15-month low against the euro after the Bank of England minutes showed that some officials voted to expand the program to buy assets at a meeting this month. Sterling fell to its lowest level since June against the dollar after reports showed that the policy is also considered cutting interest rates. Note that Mervyn King, Paul Fisher and David Miles in a vote called for increased bond purchase program by 25 billion pounds ($ 38.3 billion) to 400 billion pounds, while the remaining six members of the Monetary Policy Committee were against the increase. Also exerted pressure on the currency presented data that showed that, according to estimates of the International Labour Organization, the number of unemployed for three months (December) increased by 10,000, reaching with 2.5 million people, amid the unemployment rate rose to mark of 7.8%, compared to 7.7% three months earlier (before November). At the same time, the Office for National Statistics reported that the number of unemployed in the same period decreased by 14 thousand. The ONS also said that the number of employed people increased by 154,000 (in the three months to December), while still achieving the level of 29.730 million, which is the highest figure since the introduction of registration in 1971. In addition, the Office for National Statistics said the number of applications for unemployment benefits fell in January by 12,500 to 1.54 million,

The New Zealand dollar fell against 16 major peers after the governor of the Reserve Bank of New Zealand Wheeler said the bank is ready to intervene in the foreign exchange market if necessary. Meanwhile, he added that the official interest rate will also be used if necessary. In addition, it was announced that the central bank is also considering the possibility of macro tools that can support monetary policy. At the same time, Graham Wheeler acknowledged that the New Zealand dollar was "significantly overvalued" in terms of the economic base, a negative effect on some of the production sectors.

Asian stocks rose for a third day, with the regional benchmark index extending an 18-month high, amid signs the global economy is recovering.

Nikkei 225 11,468.28 +95.94 +0.84%

Hang Seng 23,307.41 +163.50 +0.71%

S&P/ASX 200 5,098.71 +16.82 +0.33%

Shanghai Composite 2,397.18 +14.26 +0.60%

South Korea’s Kospi Index led benchmark gauges higher after Bank of Korea Governor Kim Choong Soo said the world economic outlook is improving.

Tokyo Electric Power Co. led Japanese utilities higher.

BHP Billiton Ltd., the world’s largest mining company, fell 0.9 percent in Sydney after reporting a 58 percent drop in first-half profit.

Woodside Petroleum Ltd., Australia’s second-biggest oil and gas producer, added 3.1 percent after full-year profit almost doubled.

European stocks retreated from a three-week high as commodity producers declined and companies from Deutsche Lufthansa AG to RSA Insurance Group Plc cut their payouts to shareholders.

Negative data was caused by volume of construction in the EU, as well as data on car sales, which were published yesterday. Sales of passenger cars in the European Union in January 2013 fell to a record low. European automakers association ACEA said on Tuesday, February 18, that the first month of sales decreased by 8.7 percent compared to the same period last year to 885,159 new cars. January is the lowest figure since 1990, when the ACEA began keeping such records.

Positive news came from Greece, where the current account deficit of the balance of payments for 2012. declined by 73% year on year and reached the lowest level since the country's accession to the eurozone. Influence it reduce imports and reduced rates on sovereign debt.

Germany's DAX was down on the record CPI and HICP Germany, which rose by 1.7% y / y (vs. 1.9% previously), in line with the forecast. PPI rose 1.5% to 1.7% falling to 1.2%, and on a monthly basis rose by 0.8% (+0.3% expected).

France's CAC 40 fell, despite the restoration of the French business climate index. French business climate index unexpectedly rose from 87 (revised from 86) to 90 in February, and the HICP fell 0.6% m / m and up 1.4% y / y (vs. 1.5%), not short of projections.

Britain's FTSE 100 rose protocol IFA. Bank of England voted to King expansion QE, but was in a minority (6-3).

National benchmark indexes gained in 10 of the 18 western- European markets. Germany’s DAX declined 0.3 percent, while France’s CAC 40 slid 0.7 percent. The U.K.’s FTSE 100 climbed 0.3 percent.

BHP Billiton slipped 2.4 percent to 2,183.5 pence after the world’s biggest mining company reported a 58 percent decline in first-half profit and appointed Andrew Mackenzie as its new chief executive officer. Mackenzie, who takes over on May 10, was head of its copper unit.

Lufthansa dropped 6.2 percent to 15 euros after Europe’s biggest airline by sales canceled its dividend for 2012. The company made a payout of 25 euro cents a share for 2011.

Lafarge jumped 5.5 percent to 49.27 euros. The world’s biggest cement maker said fourth-quarter earnings before interest, taxes, depreciation and amortization rose to 856 million euros ($1.1 billion), beating the average analyst estimate of 821.6 million euros.

Credit Agricole SA rose 3.9 percent to 7.61 euros after saying it plans to reduce costs by 650 million euros by 2016. France’s third-largest bank said in a web presentation it expects to cut costs by 650 million euros by 2016 through information-technology resources, real estate and procurement.

U.S. stocks fell, slipping from five-year highs, as minutes from the Federal Reserve’s last meeting showed a debate over further stimulus action.

Minutes of the Federal Open Market Committee’s Jan. 29-30 meeting released today showed policy makers were divided about the strategy behind Chairman Ben S. Bernanke’s program of buying bonds until there is “substantial” improvement in a U.S. labor market burdened with 7.9 percent unemployment.

Some said an earlier end to purchases might be needed, and others warned against a premature withdrawal of stimulus. Several policy makers said the central bank should be ready to vary the pace of their $85 billion in monthly bond purchases.

After the discovery of a negative impact on the dynamics of trading reflected data on the index of consumer confidence in the eurozone. The index value, though improved in February (from -23.9 to -23.6), but it turned out worse than expected (-23.1). After yesterday's data from the ZEW, many hoped that today's data will record a significant improvement in consumer sentiment.

Most of the components of the index DOW finished trading in the red (24 of 30). Lost more than 3% shares Bank of America Corporation (BAC, -3.20%) and Alcoa, Inc. (AA, -3.31%). Leader was led Merck & Co. Inc. (MRK, +1.04%).

All sectors of the S & P showed a negative trend. More than other basic materials sector declined (-2.2%).

Quotes biotechnology company Chelsea Therapeutics International soared 152% on news that U.S. regulators are allowed to reapply for permission to sell the drug Northera in the market.

Shares of American developer Toll Brothers fell by 9.1% after the publication of quarterly results - profit was below analysts' forecasts.

At the close:

S & P 500 1,511.95 -18.99 -1.24%

NASDAQ 3,164.41 -49.18 -1.53%

Dow 13,927.54 -108.13 -0.77%21:00 New Zealand ANZ Job Advertisements (MoM) January +0.4% -1.5%

The Dollar Index rose to a three- month high before the release of U.S. leading indicators and a regional manufacturing gauge that may add to evidence a recovery in the world’s largest economy is gathering pace. The Conference Board’s index of U.S. leading indicators probably rose 0.2 percent in January, according to the median estimate of economists surveyed by Bloomberg News. It would be a second month of gains in the gauge, which consists of data including work hours of manufacturers and initial jobless claims. A Fed report on manufacturing in the Philadelphia area is projected to show a rebound, according to another poll.

Minutes of the Federal Reserve’s last meeting showed several policy makers advocated varying the pace of bond purchases. Some officials on the Federal Open Market Committee “emphasized that the committee should be prepared to vary the pace of asset purchases,” according to the minutes of the FOMC’s Jan. 29-30 meeting released yesterday in Washington. The U.S. central bank buys about $85 billion of government and mortgage securities a month to support growth, in the third round of so-called quantitative easing that tends to debase the dollar.

The euro slid for a second day before data that economists say will show manufacturing and services industries shrank in the currency bloc. In Europe, manufacturing and services industries probably contracted in February, albeit by less than the previous month, according to a Bloomberg survey of economists. The manufacturing purchasing managers index is projected to be 48.5 compared with 47.9 in January, and the services PMI may come in at 49.0 from 48.6 a month earlier. A reading below 50 indicates contraction.

Australia’s dollar dropped as Asian stocks declined, sapping demand for higher-yielding assets, and the British pound fell to a 2 1/2-year low.

EUR / USD: during the Asian session the pair fell below $1.3250.

GBP / USD: during the Asian session the pair fell below $1.5150.

USD / JPY: during the Asian session the pair was trading around the level of Y93.60.

UK gets underway at 0930GMT, with the release of the January Public Sector Finances. Also at 0930GMT, the January SMMT Auto Production Figures are scheduled for release. Further UK data is expected at 1100GMT, with the release of the January CBI Industrial Trends Survey. EZ flash PMI's begin with France at 0758GMT through to the EZ at 0858GMT. Tuesday's strong ZEW reading for Germany has market expecting stronger numbers. The afternoon sees a raft of US data, CPI and jobless claims at 1330GMT, US PMI at 1358GMT, Phila Fed and housing data at 1500GMT.

Change % Change Last

Oil $94.85 +0.39 +0.41%

Gold $1,563.80 -14.20 -0.90%Change % Change Last

Nikkei 225 11,468.28 +95.94 +0.84%

Hang Seng 23,307.41 +163.50 +0.71%

S&P/ASX 200 5,098.71 +16.82 +0.33%

Shanghai Composite 2,397.18 +14.26 +0.60%

FTSE 100 6,395.37 +16.30 +0.26%CAC 40 3,709.88 -25.94 -0.69%

DAX 7,728.9 -23.55 -0.30%

S&P 500 1,511.95 -18.99 -1.24%

NASDAQ 3,164.41 -49.18 -1.53%

Dow 13,927.54 -108.13 -0.77%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3283 -0,78%

GBP/USD $1,5232 -1,26%

USD/CHF Chf0,9269 +0,49%

USD/JPY Y93,55 -0,01%

EUR/JPY Y124,24 -0,82%

GBP/JPY Y142,50 -1,26%

AUD/USD $1,0255 -0,98%

NZD/USD $0,8356 -1,33%

USD/CAD C$1,0165 +0,52%

07:00 Switzerland Trade Balance January 1.00 1.74

08:00 France Manufacturing PMI (Preliminary) February 42.9 43.9

08:00 France Services PMI (Preliminary) February 43.6 44.5

08:30 Germany Manufacturing PMI (Preliminary) February 49.8 50.4

08:30 Germany Services PMI (Preliminary) February 55.7 55.5

09:00 Eurozone Manufacturing PMI (Preliminary) February 47.9 48.4

09:00 Eurozone Services PMI (Preliminary) February 48.6 49.2

09:30 United Kingdom PSNB, bln January 13.2 -11.3

11:00 United Kingdom CBI industrial order books balance February -20 -16

13:30 U.S. Initial Jobless Claims February 341 361

13:30 U.S. CPI, m/m January 0.0% +0.1%

13:30 U.S. CPI, Y/Y January +1.7% +1.7%

13:30 U.S. CPI excluding food and energy, m/m January +0.1% +0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January +1.9% +1.8%

14:00 U.S. Manufacturing PMI (Preliminary) February 55.8 55.6

15:00 U.S. Leading Indicators January +0.5% +0.2%

15:00 U.S. Existing Home Sales January 4.94 4.91

15:00 U.S. Philadelphia Fed Manufacturing Survey February -5.8 0.7

15:30 U.S. Crude Oil Inventories February +0.6

15:30 Canada Bank of Canada Review Quarter I

17:30 U.S. FOMC Member James Bullard Speaks February

22:30 Australia RBA's Governor Glenn Stevens Speech February© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.