- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-04-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Leading Index | March | -0.4% | |

| 06:00 | United Kingdom | Retail Price Index, m/m | March | 0.5% | -0.2% |

| 06:00 | United Kingdom | Producer Price Index - Output (YoY) | March | 0.4% | 0% |

| 06:00 | United Kingdom | Producer Price Index - Input (MoM) | March | 0.9% | -3.5% |

| 06:00 | United Kingdom | Producer Price Index - Input (YoY) | March | 2.1% | -3.6% |

| 06:00 | United Kingdom | Producer Price Index - Output (MoM) | March | -0.3% | -0.4% |

| 06:00 | United Kingdom | Retail prices, Y/Y | March | 2.5% | 2.3% |

| 06:00 | United Kingdom | HICP ex EFAT, Y/Y | March | 1.7% | |

| 06:00 | United Kingdom | HICP, m/m | March | 0.4% | 0% |

| 06:00 | United Kingdom | HICP, Y/Y | March | 1.7% | 1.5% |

| 12:30 | Canada | New Housing Price Index, MoM | March | 0.4% | |

| 12:30 | Canada | New Housing Price Index, YoY | March | 0.6% | |

| 12:30 | Canada | Consumer Price Index m / m | March | 0.4% | -0.4% |

| 12:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | March | 1.8% | |

| 12:30 | Canada | Consumer price index, y/y | March | 2.2% | 1.3% |

| 13:00 | U.S. | Housing Price Index, m/m | February | 0.3% | |

| 14:00 | Eurozone | Consumer Confidence | April | -11.6 | -19.3 |

| 14:30 | U.S. | Crude Oil Inventories | April | 19.248 |

FXStreet reports that Robert Kavcic from the Bank of Montreal notes that as of the April 10th week, purchase applications were down 35% from year-ago and pre-shock levels, which gives a taste of what's to come for sales activity.

“US existing home sales fell 8.5% in March to 5.27 mln annualized units, worse than expected and an early look at the fallout from COVID-19 shutdowns.”

“Prices were still pushing higher in the month on a seasonally-adjusted basis, and the median was up a solid 8.0% from year-ago levels.”

“New home sales results (Thursday) will give us another look, but that too will cover March. Note that homebuilder confidence plunged in April by the most on record, to the lowest level since 2012, so some tough numbers are still to come.”

FXStreet reports that in the opinion of strategists at TD Securities, the CPI data will hold no bearing on CAD, which is preoccupied with developments in oil and risk markets.

“TD looks for inflation to decelerate sharply in March with headline CPI slipping to 1.1% y/y (down 1.1pp from February), with risks tilted towards an even weaker print.”

“We expect a similar deceleration in April before CPI bottoms out near 0% y/y in May. Even in a scenario where restrictions are rolled back in May we expect inflation to remain below 1% through Q3.”

“We do not think that CPI will do much to alter the status-quo in CAD trading even if the data surprises on either side of expectations.”

“We are focused on topside USD/CAD; 1.4350 is next major resistance, while 1.4150 should be interim support.”

- Immediate response to virus was decisive and comprehensive

- We must avoid bankruptcy of solvent firms, illiquid firms and governments

- Pan-European response is needed

- ECB policy is directed at maintaining favourable financing conditions for households, firms and governments, to mitigate any amplification

- Coronavirus may speed up deglobalisation

The National Association of Realtors (NAR) announced on Tuesday that the U.S. existing home sales fell 8.5 percent m-o-m to a seasonally adjusted rate of 5.27 million in March from a revised 5.76 million in February (originally 5.77 million), impacted by COVID-19. That was the lowest rate since April 2019.

Economists had forecast home resales decreasing to a 5.30 million-unit pace last month.

In y-o-y terms, however, existing-home sales rose 0.8 percent in March.

According to the report, single-family home sales stood at 4.74 million in March, down from 5.16 million in February, and up 1.3 percent from a year ago. The median existing single-family home price was $282,500 in March, up 8.0 percent from March 2019. Meanwhile, existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 530,000 units in March, down 11.7 percent from February and down 3.6 percent from a year ago. The median existing condo price was $263,400 in March, an advance of 7.9 percent from a year ago.

"Unfortunately, we knew home sales would wane in March due to the coronavirus outbreak," said Lawrence Yun, NAR's chief economist. "More temporary interruptions to home sales should be expected in the next couple of months, though home prices will still likely rise."

Statistics Canada reported on Tuesday that the Canadian retail sales rose 0.3 percent m-o-m at CAD52.25 billion in February, following a revised 0.6 percent m-o-m advance in January (originally a 0.4 percent m-o-m advance). That marked the first time retail sales grew for four months in a row since October 2018.

Economists had forecast a 0.2 percent m-o-m increase for February.

According to the report, the February gain was primarily attributable to higher sales at motor vehicle and parts dealers (+1.1 percent m-o-m), general merchandise stores (+1.4 percent m-o-m) and gasoline stations (+0.6 percent m-o-m). These increases, however, were partially offset by lower sales at food and beverage stores (-1.0 percent m-o-m).

Excluding motor vehicle and parts dealers, retail sales were unchanged m-o-m in February compared to a revised 0.1 percent m-o-m increase in January (originally a 0.1 percent m-o-m drop) and economists' forecast for a 0.3 percent m-o-m advance. Excluding motor vehicle and parts dealers and gasoline stations, retail sales edged down 0.1 percent m-o-m in February.

In y-o-y terms, Canadian retail sales climbed 3.0 percent in February, following a revised 3.7 percent surge in January (originally a 3.4 percent jump).

NFXStreet reports that economists at Rabobank apprise that it may be way too early for politicians and central bankers to start patting themselves on the back, but in Australia there may at least be room for the first sighs of relief.

“RBA Governor Lowe forecast that domestic output is likely to fall by around 10% over H1, with most of the decline taking place in the June quarter. In tune with this, he is expecting the unemployment rate to be around 10% in Q2.”

“The RBA is looking for the recovery to gain a foothold in Q3 and sees the potential of a 6-7% y/y growth rate next year. There is scope for the jobless rate to remain above the 6% level through the next couple of years.”

“Australia’s large coal exports have linked the value of the AUD with the oil price. Given this backdrop, it is difficult to be optimistic about the outlook for the AUD.”

“We see risk on another dip below AUD/USD 0.60 on a 1 to 3-month view.”

U.S. stock-index futures fell on Tuesday a gloomy Q1 earnings reports and a continuing rout in U.S. crude prices heightened concerns of a deep global recession in the coming months.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 19,280.78 | -388.34 | -1.97% |

| Hang Seng | 23,793.55 | -536.47 | -2.20% |

| Shanghai | 2,827.01 | -25.54 | -0.90% |

| S&P/ASX | 5,221.30 | -131.70 | -2.46% |

| FTSE | 5,679.38 | -133.45 | -2.30% |

| CAC | 4,391.76 | -136.54 | -3.02% |

| DAX | 10,329.23 | -346.67 | -3.25% |

| Crude oil | $14.27 | | -30.15% |

| Gold | $1,671.00 | | -2.35% |

- Says African countries highly dependent on oil revenues are particularly exposed to drop in prices

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 142.5 | -1.17(-0.81%) | 12543 |

| ALCOA INC. | AA | 7.2 | -0.25(-3.36%) | 42009 |

| ALTRIA GROUP INC. | MO | 38.3 | -0.77(-1.97%) | 14513 |

| Amazon.com Inc., NASDAQ | AMZN | 2,411.00 | 17.39(0.73%) | 72315 |

| American Express Co | AXP | 81.14 | -2.87(-3.42%) | 18035 |

| AMERICAN INTERNATIONAL GROUP | AIG | 23.1 | -0.65(-2.74%) | 4097 |

| Apple Inc. | AAPL | 276.18 | -0.75(-0.27%) | 622015 |

| AT&T Inc | T | 30.63 | -0.35(-1.13%) | 56075 |

| Boeing Co | BA | 138.67 | -4.94(-3.44%) | 452546 |

| Caterpillar Inc | CAT | 111.5 | -3.10(-2.71%) | 23073 |

| Chevron Corp | CVX | 80.3 | -3.27(-3.91%) | 278951 |

| Cisco Systems Inc | CSCO | 41.88 | -0.66(-1.55%) | 52688 |

| Citigroup Inc., NYSE | C | 42.55 | -1.46(-3.32%) | 116954 |

| E. I. du Pont de Nemours and Co | DD | 38.82 | -0.90(-2.27%) | 4179 |

| Exxon Mobil Corp | XOM | 39.8 | -1.38(-3.35%) | 533803 |

| Facebook, Inc. | FB | 175.68 | -2.56(-1.44%) | 99610 |

| Ford Motor Co. | F | 4.89 | -0.09(-1.81%) | 657272 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7.5 | -0.52(-6.48%) | 166955 |

| General Electric Co | GE | 6.45 | -0.06(-0.92%) | 471242 |

| General Motors Company, NYSE | GM | 21.69 | -0.69(-3.08%) | 14118 |

| Goldman Sachs | GS | 175 | -5.40(-2.99%) | 21806 |

| Google Inc. | GOOG | 1,258.78 | -7.83(-0.62%) | 5113 |

| Hewlett-Packard Co. | HPQ | 15 | -0.36(-2.34%) | 922 |

| Home Depot Inc | HD | 201.01 | -5.04(-2.45%) | 17035 |

| HONEYWELL INTERNATIONAL INC. | HON | 133.3 | -2.40(-1.77%) | 2604 |

| Intel Corp | INTC | 57.95 | -1.23(-2.08%) | 63234 |

| International Business Machines Co... | IBM | 114.6 | -5.81(-4.83%) | 110570 |

| International Paper Company | IP | 30.66 | -0.12(-0.39%) | 595 |

| Johnson & Johnson | JNJ | 149.74 | -1.93(-1.27%) | 32388 |

| JPMorgan Chase and Co | JPM | 89.44 | -2.27(-2.48%) | 157296 |

| McDonald's Corp | MCD | 177 | -4.65(-2.56%) | 15781 |

| Merck & Co Inc | MRK | 81.22 | -1.88(-2.26%) | 11263 |

| Microsoft Corp | MSFT | 173 | -2.06(-1.18%) | 285638 |

| Nike | NKE | 85.7 | -2.20(-2.50%) | 133587 |

| Pfizer Inc | PFE | 35.6 | -0.48(-1.33%) | 31579 |

| Procter & Gamble Co | PG | 119.06 | -1.54(-1.28%) | 28825 |

| Starbucks Corporation, NASDAQ | SBUX | 74.3 | -1.02(-1.35%) | 32164 |

| Tesla Motors, Inc., NASDAQ | TSLA | 724.55 | -21.81(-2.92%) | 196267 |

| The Coca-Cola Co | KO | 46.38 | -0.15(-0.32%) | 182009 |

| Travelers Companies Inc | TRV | 97.51 | -4.27(-4.20%) | 14712 |

| Twitter, Inc., NYSE | TWTR | 26.69 | -0.32(-1.19%) | 89325 |

| UnitedHealth Group Inc | UNH | 273.5 | -8.64(-3.06%) | 14914 |

| Verizon Communications Inc | VZ | 57.4 | -0.73(-1.26%) | 42875 |

| Visa | V | 161.2 | -3.02(-1.84%) | 35386 |

| Wal-Mart Stores Inc | WMT | 128.7 | -1.15(-0.89%) | 55692 |

| Walt Disney Co | DIS | 100.35 | -1.91(-1.87%) | 135671 |

| Yandex N.V., NASDAQ | YNDX | 33.93 | -1.48(-4.17%) | 39375 |

FXStreet reports that economist Lee Sue Ann at UOB Group, reviewed the recent CPI figures in New Zealand and assessed the prospects for the rest of the year.

“Consumer prices in New Zealand were up 0.8% q/q in the first quarter of 2020, higher than the 0.5% q/q print in the three months prior, and way above expectations for a print of 0.4% q/q. Annual inflation was at 2.5% y/y compared to 1.9% y/y in the fourth quarter of 2019, beating estimates for an annual rise of 2.1% y/y. This was also the highest reading since the September 2011 quarter, where it was 4.6%.”

“As it is, the latest inflation data does not fully capture COVID-19-related price movements as most of the data was collected prior to the lockdown that kicked off on 25 March.”

“Household incomes will be lower, and confidence dented. Businesses will be cautious for some time. Demand for goods and services, both domestically and abroad, will remain stagnant for a considerable period. As such, we could see the annual rate of inflation tumbling quickly to the bottom of the RBNZ’s targeted 1% to 3% range.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | United Kingdom | Average earnings ex bonuses, 3 m/y | February | 3.1% | 3% | 2.9% |

| 06:00 | United Kingdom | Average Earnings, 3m/y | February | 3.1% | 3% | 2.8% |

| 06:00 | Switzerland | Trade Balance | March | 2.1 | 3.2 | |

| 06:00 | United Kingdom | ILO Unemployment Rate | February | 3.9% | 3.9% | 4.0% |

| 06:00 | United Kingdom | Claimant count | March | 17.3 | 175 | 12.2 |

| 09:00 | Eurozone | ZEW Economic Sentiment | April | -49.5 | 25.2 | |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | April | -49.5 | -41 | 28.2 |

| 12:30 | Canada | Retail Sales YoY | February | 3.7% | 3% | |

| 12:30 | Canada | Retail Sales, m/m | February | 0.6% | 0.2% | 0.3% |

| 12:30 | Canada | Retail Sales ex Autos, m/m | February | 0.1% | 0.3% | 0% |

USD and JPY rose against other major currencies in the European session on Tuesday as demand for safe-haven currencies increased amid a continuing drop in the U.S. oil prices. JPY firmed against USD.

After dropping to -$37.63 per barrel on Monday, the May WTI contract, expiring today, recovered to -$3.91 per barrel on thin trading volumes. Meanwhile, the June WTI contract extended losses by 22.4% to trade at $15.86 per barrel due to a lack of storage capacity as oil supply exceeds demand.

On this backdrop, commodity currencies, including CAD, NOK and AUD, saw sell-offs.

GBP was also under pressure, despite good employment data, as investors had to liquidate some of the positions they had to cover the losses. The Office for National Statistics (ONS) reported the UK's employment rate rose 0.2 percentage points in the three months to February to a record high of 76.6 percent. At the same time, the UK's jobless rate edged up 0.1 percentage points from the previous three-month period to 4 percent, which was slightly above economists' forecast of 3.9 percent. The report also showed that the claimant count increased marginally in March - to 3.5 percent from 3.4 percent in February.

EUR fell against USD and JPY but rose against the rest of major rivals, helped by the ZEW's survey, which showed that German economic confidence improved strongly in April. Market participants also continued to price in the increased borrowing that would be necessary to support the region's economic recovery. The ECB's policymaker Fabio Panetta called on European officials to approve a joint fiscal response to the COVID-19 crisis, adding that action taken to date had been insufficient.

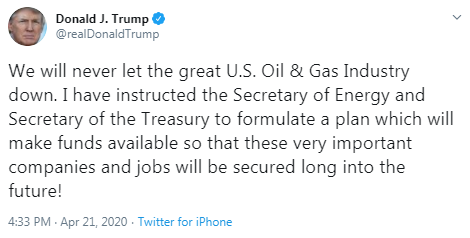

Oil: Heightened volatility – Charles Schwab

FXStreet reports that in the opinion of David Kastner from Charles Schwab, the price of oil will continue to experience heightened volatility until supply and demand can be balanced.

“While oil companies are dealing with significant short-term inventory issue, energy company stocks are heavily influenced by the future price of oil, that is, one to two years out. Those prices are still positive, which helps explain why energy company stock prices did not fall by as much as one might have expected today.”

“With oil prices well below profitable levels, the impact of COVID-19 on energy companies is expected to be enormous, particularly for smaller exploration & production and oil services companies.”

“In a recent Kansas City Federal Reserve Bank survey, nearly 40% of oil companies said they would be insolvent within a year if oil prices were to stay at or below $30 per barrel.”

Australian Q1 CPI Preview: The pace is clearly moderating – Westpac

FXStreet reports that analysts at Westpac Institutional Bank note that the deflationary shock of COVID-19 won’t hit till Q2 but price pressures were already easing in Q1. Australia will release CPI data on Wednesday, April 29 at 01:30 GMT.

“Westpac is forecasting a 0.1% rise in the March quarter CPI but due to base effects the annual pace lifts to 1.9%yr from 1.8%yr. However, the pace is clearly moderating with the six month annualised pace easing back to 1.6%yr from 1.9%yr.”

“The trimmed mean is forecast to rise 0.3%qtr/1.6%yr and the weighted median is forecast to rise 0.3%qtr/1.4%yr. The six month annualised pace of the trimmed mean is set to ease to 1.4%yr from 1.7%yr.”

WHO spokeswoman says coronavirus "likely" to have come from animals, not lab - Reuters reports

“All available evidence suggests the virus has an animal origin and is not a manipulated or constructed virus in a lab or somewhere else,” WHO spokeswoman Fadela Chaib told a news briefing in Geneva.

“It is probable, likely that the virus is of animal origin,” she said, adding that there had “certainly” been an intermediate animal host before it had been transmitted to humans.

FXStreet reports that Morgan Stanley’s 2020 year-end price targets for the S&P 500 are exactly what they were in December because they were already assuming this year would likely include a recession, albeit a much milder one.

“The monetary policy response has been effective in stabilizing credit spreads and equity risk premiums, which reached the same level for the S&P 500 observed at the lows of the Great Financial Crisis. Therefore, it's unlikely we will approach the same levels again anytime soon.”

“The policy response is like nothing we've ever seen either. And that means a V-shaped recovery next year is likely, which is what stocks are already starting to discount.”

“In S&P500 terms, a 200-week moving average of 2650 should provide very strong support on what could be a choppy few weeks as companies give us the bad news on earnings and there is more political posturing as states try to decide when to reopen.”

Travelers (TRV) reported Q1 FY 2020 earnings of $2.62 per share (versus $2.83 per share in Q1 FY 2019), missing analysts' consensus estimate of $2.83 per share.

The company's quarterly revenues amounted to $7.229 bln (+5.5% y/y), slightly missing analysts' consensus estimate of $7.301 bln.

The company's Board of Directors declared regular quarterly cash dividend of $0.85 per share, an increase of 4%.

TRV fell to $99.50 (-2.24%) in pre-market trading.

- This isn't reason for overly negative assessments of current reality

FXStreet reports that in the opinion of strategists at ANZ Bank, if the oil industry wasn’t taking the level of demand destruction seriously, it certainly will now after crude oil futures went negative.

“The OPEC+ supply agreement should stem the flow of oil into storage tanks in the medium term. In the US, the number of drilling rigs is falling, which should see US shale output start to fall in coming months.”

“WTI futures rebounded in early Asian trading; but we suspect the WTI June future will come under pressure unless there is more immediacy around supply closures. This may come as forced closures or even bankruptcies in the US shale industry.”

“We would expect OPEC+ members to talk about bringing forward their planned production cuts from the recent supply agreement. The 9.7mb/d reduction is scheduled for 1 May. Even so, we see it having minimal impact on crude oil prices in coming weeks.”

Coca-Cola (KO) reported Q1 FY 2020 earnings of $0.51 per share (versus $0.48 per share in Q1 FY 2019), beating analysts' consensus estimate of $0.45 per share.

The company's quarterly revenues amounted to $8.600 bln (+7.2% y/y), beating analysts' consensus estimate of $8.323 bln.

The company said that its FY 2020 financial and operating results cannot be reasonably estimated at this time due to the uncertainty around the coronavirus pandemic.

KO rose to $47.00 (+1.01%) in pre-market trading.

FXStreet reports that Ho Woei Chen, Economist, CFA at UOB Group, assessed the recent decision by the PBoC to lower its reference 1-year Loan Prime Rate.

“… the People’s Bank of China (PBoC) lowered its benchmark 1Y Loan Prime Rate (LPR) by 20 bps to 3.85% and the 5Y & above LPR by 10 bps to 4.65% in line with consensus expectation. … Overall, it is the policy intention of the PBoC to lower the real interest rate in the economy by bringing down the funding costs.”

“Despite the larger move in April, the pace of monetary easing in China has remained very gradual compared to more aggressive cuts in the other economies. This measured and targeted approach is likely to be maintained even as China increases its counter-cyclical adjustments to support domestic growth recovery.”

“The politburo meeting chaired by Chinese President Xi Jinping last Friday has promised stronger economic policies to support the economy after it registered the first GDP contraction since 1976.”

“With the severe COVID-19 outbreak in the other major economies delaying the potential economic rebound in China, we have downgraded our 2020 growth forecast for China to 1.8% from previous 4.1%. In line with this weaker growth trajectory, we now foresee a slightly larger LPR adjustment this year. We expect the 1Y LPR to be lowered to 3.65% by end-2Q20 (10 bps cut each in May and June) and then to 3.55% by end-3Q20 and end-4Q20.”

IBM (IBM) reported Q1 FY 2020 earnings of $1.84 per share (versus $2.25 per share in Q1 FY 2019), beating analysts' consensus estimate of $1.80 per share.

The company's quarterly revenues amounted to $17.571 bln (-3.3% y/y), generally in line with analysts' consensus estimate of $17.620 bln.

IBM withdrew its FY 2020 guidance in light of the current COVID-19 crisis. The company said it would reassess this position based on the clarity of the macroeconomic recovery at the end of Q2 FY 2020.

IBM fell to $115.50 (-4.08%) in pre-market trading.

FXStreet reports that analysts at Westpac Institutional Bank note that the Reserve Bank Governor has provided the Bank’s first forecasts during this crisis.

“The economy will contract by around 10% in the first half of 2020 with most of the contraction centered around the June quarter. Westpac forecast contraction of -0.7% in the March quarter followed by -8.5% in the June quarter.”

“The Governor forecast that the Australian economy would contract by 6% in 2020 compared to our forecast of minus 5%. We forecast a growth “bounce back” of around 5% in the second half of 2020, centered mainly on the December quarter.”

“We do differ on the pace of growth in 2021 with the RBA expecting a spectacular 6-7% in 2021 whereas we expect around a 4% recovery with the economy still being smaller by around 1% by the end of 2021 compared to the beginning of 2020.”

“We forecast that the unemployment rate was likely to fall to 7% by year’s end but remain above 6% in 2021. The Governor concurs noting ‘the unemployment rate will remain above 6% for the next couple of years’. We agree but expect that if the RBA achieves it’s 6-7% growth forecast in 2021 then unemployment is likely to fall somewhat below 6%.”

FXStreet reports that one of the more remarkable moments in financial history was seen yesterday and that is a deeply negative oil price, that is paying someone to take delivery, economists at Deutsche Bank apprise.

"The May contract for WTI, which started the day at $17.85, traded at -$39.55 at one point and in negative territory for a total of about six hours before popping back to $1.43 this morning. This move is all about supply and demand. American energy users and refiners do not have the storage capacity given all that is going on."

"According to our colleague Michael Hsueh, the fact that June is currently still trading $21 per barrel should not be seen as a guarantee that this sort of price action could not happen again upon June's expiry if demand hasn't increased over the next 2 months."

"Even prior to the move lower on WTI, lower quality runs of crude were near to or in negative territory, with Wyoming Asphalt Sour, a landlocked stream with higher associated costs than WTI, traded at negative 19 cents a barrel last month."

FXStreet reports that Standard Chartered monthly proprietary SME survey reveals a gradual recovery in April, but with concerns about the near-term outlook.

"The headline SMEI rose to 50.9 in April from 49.6 in March. The latest 'current performance' reading rose 3.8ppt to 50.0, but 'expectations' eased 1.9ppt to 52.1, suggesting that despite an improvement in real activity, uncertainty about the recovery has increased on growing headwinds from a likely global recession in Q2."

"Production activity has accelerated in April as more SMEs resume work. Capacity utilisation is up to 62% from 52% in March, but the demand recovery is subdued, with current orders at c.58% of normal levels."

"We expect more targeted measures to be rolled out, including another 80bps of RRR cuts in Q2-Q3, a 25bps cut to the benchmark deposit rate in Q2, and another 10bps cut in the medium-term lending facility (MLF) rate in Q3."

According to the report from Leibniz Centre for European Economic Research (ZEW), the Indicator of Economic Sentiment for Germany has risen by 77.7 points in April 2020, now being valued at 28.2 points. The assessment of the current economic situation, however, has worsened dramatically, with the corresponding indicator dropping to a new reading of minus 91.5 points, 48.4 points lower than in March. This constellation of values currently witnessed for expectations and the assessment of the current situation roughly corresponds to that seen in April/May 2009 during the financial crisis.

"The financial market experts are beginning to see a light at the end of the very long tunnel. The results of the special questions on the coronavirus crisis included in the survey show that the experts do not expect to see positive economic growth until the third quarter of 2020. Economic output is not expected to return to pre-corona levels before 2022," comments ZEW President Professor Achim Wambach on the experts' predictions.

Financial market experts' sentiment concerning the economic development of the eurozone has also considerably improved, bringing the indicator to a current level of 25.2 points for April, 74.7 points higher than in the previous month. By contrast, the indicator for the current economic situation in the eurozone declined by 45.4 points, falling to a current reading of minus 93.9 points.

Although inflation expectations for the euro area have risen by 23.0 points, they are still well in negative territory, currently standing at minus 23.9 points. A further decline in the inflation rate is therefore expected for the next six months.

FXStreet reports that economists at TD Securities buy gold at $1710/oz, targeting $1900/oz in anticipation of continued growth in investment demand amid massive and prolonged unconventional central bank stimulus.

"The Fed's latest QE program is now the largest on record. While this creates an opportune environment for gold, we suspect that the market continues to underprice its impact on gold."

"The Fed and other central banks are likely to keep their uber-easy policies in place for far longer than anticipated, following a decade of below-target inflation and a newfound interest in asymmetric inflation targeting."

"Consensus analyst forecasts remain below spot prices, strengthening the argument that the market is underestimating the potential impact on gold. We expect investment demand to rise as liquidity returns."

Reuters reports that EU's industry chief Thierry Breton said that an economic support package being readied to help the European Union recover from the coronavirus crisis may need be to worth around 1.6 trillion euros (1.37 trillion pounds).

The European Commissioner for Internal Market and Services told French TV station BFM TV he was working on plans around that type of figure with Economics Commissioner Paolo Gentiloni.

That would represent some 10% of EU GDP, Breton said.

Member states disagree over the technical aspects of how to finance such a plan, and national leaders are expected to defer a final decision on it when they meet by videolink on Thursday, diplomats and officials told Reuters on Tuesday.

There are also differences over how big such a fund needs to be.

Spain has called for a fund worth 1.5 trillion euros - roughly on a par with Breton's views but around three times the figure estimated by the head of the euro zone's bailout fund.

FXStreet reports that David Plank, Head of Australian Economics at ANZ Bank, recaps the speech of the Reserve Bank of Australia (RBA) Governor.

"The Governor's speech highlighted the near-term challenges for the economy, with output 'likely to fall by around 10 per cent over the first half of 2020'."

"Even with recovery, the RBA thinks 'it is likely that the unemployment rate will remain above 6 per cent over the next couple of years'."

"We think the recovery will likely take longer than what seems to be the Bank's central view, with unemployment remaining higher for longer. It will be the speed at which unemployment falls that determines how long the cash rate remains at 0.25%."

FXStreet reports that FX Strategists at UOB Group noted USD/CNH remains side-lined for the time being, likely between 7.0450 and 7.1250.

24-hour view: "USD traded between 7.0739 and 7.0926 yesterday, narrower than our expected range of 7.0680/7.0930. The underlying tone has firmed somewhat and this could lead to USD edging higher to 7.1050 (next resistance is at 7.1150). Support is at 7.0840 followed by 7.0750."

Next 1-3 weeks: "USD traded in a relatively quiet manner last Friday and for now, we continue to hold the same view from last Thursday (16 Apr, spot at 7.0770) wherein USD 'has likely moved into a consolidation phase' and 'is likely to trade between 7.0450 and 7.1250 for a period."

Bloomberg reports that Bank of Japan said that tight funding conditions may spread to more sectors and to larger firms if the economic downturn triggered by the coronavirus drags on.

So far, the credit crunch is limited to small service businesses with limited access to funding, the BOJ said in its Financial System Report Tuesday. Problems could spread to larger firms and the manufacturing sector, it said.

"Smooth implementation of public support such as credit guarantees and interest subsidies is considered to be of vital importance," the report said.

For now, the BOJ said issuance conditions in corporate bond and commercial paper markets have stayed mostly favorable since March, but the bank's warning suggests it may take new steps to help businesses access credit if needed.

CNBC reports that S&P Global warned that job losses across Asia Pacific could double due to the coronavirus pandemic - and some of these jobs may not come back for a while.

"Unemployment rates across Asia-Pacific could rise by well over 3 percentage points, twice as large as the average recession," said S&P's Asia Pacific Chief Economist Shaun Roache in a report.

The services industries are among the first to feel the impact of those lockdowns, but that very sector is also what's driving job creation in countries like Japan and South Korea, the ratings giant said.

"Jobs are at the core of the current economic crisis," said Roache. "Measures designed to limit viral spread are striking at the heart of the engine of job creation across Asia-Pacific - the service sector."

"Service sector activities often require human-to-human contact while mitigation policies aim at social distancing. The clash of these two is obvious," he wrote.

Based on projected reduced growth of about 7.5 percentage points, S&P laid out the impact on job losses among major countries in the region.

These are the estimated increase in unemployment rates at their peak, about four quarters after the growth decline:

Australia: More than 3 percentage points.

Japan: More than 2 percentage points.

South Korea: More than 4 percentage points.

New Zealand: Close to 3 percentage points.

Thailand: Less than 1 percentage point.

"Given the way the services sector is being hit by social-distancing measures, it's plausible that, for every percentage point fall in growth in Asia-Pacific, the rise in unemployment could be larger now than in previous cycles," the report said.

FXStreet reports that in opinion of FX Strategists at UOB Group, NZD/USD is expected to remain locked within the 0.5900/0.6100 in the next weeks.

24-hour view: "The strong advance in NZD to a high of 0.6090 and the subsequent sharp sell-off came as a surprise. The rapid drop appears to be running ahead of itself but there is room for NZD to extend its decline to 0.5980. For today, the next support at 0.5960 is unlikely to come into the picture. On the upside, 0.6070 is expected to be strong enough to hold any intraday rebound (minor resistance is at 0.6065)."

Next 1-3 weeks: "Our view for further NZD weakness was proven wrong as it surged above our 'strong resistance' level of 0.6050 (high of 0.6090) before dropping back quickly. The price action suggests that NZD is likely trading in a consolidation phase. For the next week or so, NZD is expected to trade between the two major level of 0.5900 and 0.6100."

According to the report from Office for National Statistics, the UK employment rate in the three months to January 2020 was estimated at a joint record high of 76.5%, 0.4 percentage points higher than a year earlier and 0.3 percentage points up on the previous quarter.

The UK unemployment rate in the three months to January 2020 was estimated at 3.9%, largely unchanged compared with a year earlier and 0.2 percentage points higher than the previous quarter.

Estimated annual growth in average weekly earnings for employees in Great Britain in the three months to January 2020 was 3.1% for both total pay (including bonuses) and regular pay (excluding bonuses).

In real terms (after adjusting for inflation), annual growth in both total pay and regular pay is estimated to be 1.5% in the three months to January 2020, down from a recent peak of 2.0% in the three months to June 2019.

In real terms (after adjusting for inflation), annual growth in total pay is estimated to be 1.4% and annual growth in regular pay is estimated to be 1.8% in the three months to January 2020.

There were an estimated 817,000 vacancies in the UK for December 2019 to February 2020; this is 19,000 more than the previous quarter but 30,000 fewer than a year earlier.

-

China's total number of confirmed cases stood at 82,758 and its cumulative death toll at 4,632 as of April 20.

-

Hong Kong will extend social restrictions targeted at containing the coronavirus outbreak for another 14 days from April 23, Reuters reported, citing the city's leader Carrie Lam at a weekly press conference.

-

Germany reported 1,785 new coronavirus cases and 194 additional deaths, according to the latest data by Robert Koch Institute.

-

Global cases: More than 2.4 million

-

Global deaths: More than 169,986

-

Most cases reported: United States (784,326), Spain (200,210), Italy (181,228), France (156,480), and Germany (147,065).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1031 (1400)

$1.0995 (770)

$1.0965 (657)

Price at time of writing this review: $1.0837

Support levels (open interest**, contracts):

$1.0785 (1857)

$1.0753 (1766)

$1.0716 (1373)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 8 is 68457 contracts (according to data from April, 20) with the maximum number of contracts with strike price $1,1200 (3498);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2649 (954)

$1.2563 (545)

$1.2512 (292)

Price at time of writing this review: $1.2404

Support levels (open interest**, contracts):

$1.2305 (681)

$1.2236 (603)

$1.2156 (762)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 16428 contracts, with the maximum number of contracts with strike price $1,2700 (1713);

- Overall open interest on the PUT options with the expiration date May, 8 is 16854 contracts, with the maximum number of contracts with strike price $1,2850 (1073);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from April, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 25.42 | -7.63 |

| WTI | 14.22 | -22.93 |

| Silver | 15.28 | 0.99 |

| Gold | 1693.91 | 0.75 |

| Palladium | 2161.7 | 0.65 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -228.14 | 19669.12 | -1.15 |

| Hang Seng | -49.98 | 24330.02 | -0.21 |

| KOSPI | -16.17 | 1898.36 | -0.84 |

| ASX 200 | -134.5 | 5353 | -2.45 |

| FTSE 100 | 25.87 | 5812.83 | 0.45 |

| DAX | 50.12 | 10675.9 | 0.47 |

| CAC 40 | 29.29 | 4528.3 | 0.65 |

| Dow Jones | -592.05 | 23650.44 | -2.44 |

| S&P 500 | -51.4 | 2823.16 | -1.79 |

| NASDAQ Composite | -89.41 | 8560.73 | -1.03 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 05:00 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 06:00 | Switzerland | Trade Balance | March | 2 | |

| 06:00 | United Kingdom | Average earnings ex bonuses, 3 m/y | February | 3.1% | 3% |

| 06:00 | United Kingdom | Average Earnings, 3m/y | February | 3.1% | 3% |

| 06:00 | United Kingdom | ILO Unemployment Rate | February | 3.9% | 3.9% |

| 06:00 | United Kingdom | Claimant count | March | 17.3 | 300 |

| 09:00 | Eurozone | ZEW Economic Sentiment | April | -49.5 | |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | April | -49.5 | -41.7 |

| 12:30 | Canada | Retail Sales YoY | February | 3.4% | |

| 12:30 | Canada | Retail Sales, m/m | February | 0.4% | 0% |

| 12:30 | Canada | Retail Sales ex Autos, m/m | February | -0.1% | -0.1% |

| 14:00 | U.S. | Existing Home Sales | March | 5.77 | 5.3 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.63308 | -0.47 |

| EURJPY | 116.947 | 0.02 |

| EURUSD | 1.08674 | -0.05 |

| GBPJPY | 133.861 | -0.45 |

| GBPUSD | 1.24366 | -0.54 |

| NZDUSD | 0.60302 | -0.02 |

| USDCAD | 1.41299 | 0.86 |

| USDCHF | 0.96711 | 0.03 |

| USDJPY | 107.611 | 0.07 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.