- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-09-2012

The euro rose against the dollar after the media reported that the euro-area policy will present a program of financial rescue Spain in the beginning of next week.

The single currency rose for the first time in four days against the yen after the Financial Times said that officials of Spain and the European Union are working on plans for bond purchases by the European Central Bank to support the economy of countries in need.The plan will be announced on September 27 and will focus on structural reforms in the economy of Spain, at the request of the EU, not in new taxes and spending cuts.

Also today, the Spanish Prime Minister Mariano Rajoy will meet with his Italian counterpart Mario Monti in Rome.

The pound rose to its highest level in over a year against the dollar, despite the fact that the United Kingdom reported the largest budget deficit in August.

The Canadian dollar was down against the U.S. dollar after the controversial data on consumer prices in Canada in August. Basic annual inflation in Canada was 1.6%, below the Bank of Canada's target of 2% in the medium term. Overall inflation was 1.2%. Economists had expected core inflation of 1.5%, and the total - 1.3%.

European stocks rose to a one-week high after a report said that policy makers will next week unveil an economic reform program for Spain that will allow the country to seek a bailout.

Spanish Economy Minister Luis de Guindos is in talks with European Commission authorities to facilitate a new bailout program that will be presented Sept. 27, the Financial Times reported, citing unidentified officials involved in the discussions. The plan will focus on structural measures sought by the EU and not on new taxes or spending cuts, the FT said.

The yield on Spain’s 10-year bonds fell two basis points this week to 5.76 percent. It rose above the 6 percent mark in intraday trading earlier in the week.

National benchmark indexes advanced in 13 of the 18 western-European markets. Germany’s DAX gained 0.8 percent, France’s CAC 40 added 0.6 percent and the U.K.’s FTSE 100 was little changed.

Novo Nordisk climbed 1.3 percent to 917 kroner after UBS raised the rating on the shares to buy from neutral.

Devgen NV soared 69 percent to 15.89 euros, the biggest rally since it sold shares to the public in June 2005, after Syngenta AG offered to buy the company for 16 euros per share. That’s a 70 percent-premium to yesterday’s closing price of 9.43 euros.

Mediobanca SpA, Italy’s biggest publicly traded investment bank, gained 3.3 percent to 4.21 euros after UBS AG raised its share-price target to 4.1 euros from 3.5 euros and kept a neutral rating.

Stimulating the Fed "help" accelerate the growth

Stimulating the Fed should reduce the downside risks to the economy

Actions were necessary because of the slowing economy, weak labor market

While the Fed's actions "justified," they "open to discussions"

Rise in house prices - a positive sign of progress

Purchases of mortgage-backed securities the Fed could help housing sector

The rise of the housing sector can contribute to world economic growth

The Fed should reduce the cost of mortgage

The improvement in the housing market will boost confidence

Economic activity slows

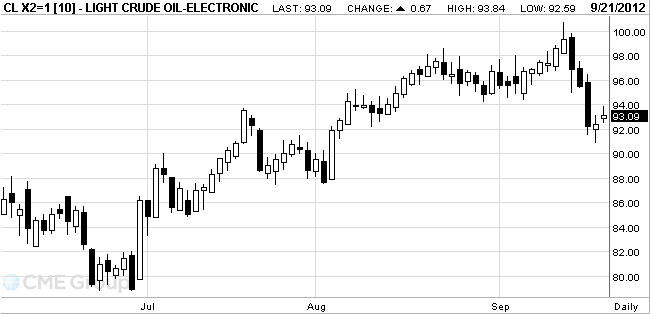

World oil prices continue to rise during the trading session on Friday amid cheaper U.S. dollar, as well as investors' hopes that the world's central bank stimulus measures will support the development of the world economy and, consequently, the demand for oil.

The depreciation of the dollar makes crude more attractive for holders of other currencies. In addition, bidders are still hoping for a positive effect of the measures the world's central banks to support the development of national economies.

In addition, oil prices are rising because of the deterioration of the political situation in Libya and fears for the stability of the production in the North Sea.

Libya, a member of OPEC, and the third largest oil producer among African countries, rapidly increase production after the overthrow of Muammar Gaddafi last year, but an attack on the U.S. Embassy last week raised doubts about the ability of the new government to keep the situation under control.

In Europe was postponed scheduled for October shipment of two more batches of North Sea Forties grade due to the reduction of its production. Delay export this class in September and October - the most significant since May, when they were delayed 11 of 19 games, according to Reuters, based on sources in the trade circles. North Sea Forties - the most important of the four varieties, forming basket Brent.

On the eve of OPEC reported that members of the organization, which accounts for about 40% of world oil supplies, planning to cut for a while rough exports by 0.7% - to 23.66 million barrels per day at the beginning of the maintenance operations of oil capacity. Exports of crude oil from the Middle East for four weeks fell by 1.1% - to 17.27 million barrels a day.

However, the head of the IEA Maria van der Hoeven, the market will have no shortage of raw material through the supply from Saudi Arabia, Canada and the USA. "We will closely monitor the market and see that it has a lot of raw material," - said van der Hoeven at an energy conference in Madrid

At the same time, the decline in oil for the current week was approximately 6%. Negative dynamics was caused by rumors of a possible opening of the strategic reserves of the United States, the statistical data of the Ministry of Energy of the country saw an increase of stocks of raw materials wholesale stores U.S., and the news from Saudi Arabia, which offer to increase supplies of raw materials.

Experts do not expect a significant increase in oil prices in the medium term, given a sufficient supply of the market and the problems of the world economy. Published on Thursday data from the euro zone, China and the USA have shown a weak industrial activity in these regions.

Crude oil for November delivery increased to $93.84 a barrel on the New York Mercantile Exchange.

Brent oil for November settlement climbed 99 cents, or 0.9 percent, to $111.02 a barrel on the London-based ICE Futures Europe exchange.

On the last day of the week gold rose after four stable sessions on the weakening dollar and the strengthening of the euro. Euro on Friday strengthened the U.S. dollar and other world currencies following the increase in the prices of government bonds in Spain.

Support the European currency and securities in Spain had the newspaper Financial Times that the European authorities are involved in the development of new economic program the Spanish government, which should be released next week.

According to sources, the newspapers, the parties focused on measures that may be required from Spain's foreign creditors, if Madrid officially turn to them for help. This should provide the opportunity to harmonize these measures in advance.

The government's plan is to focus on structural measures on which long insisted Brussels, not in new spending cuts and tax increases.

Yield on 10-year benchmark government bonds in Spain fell in the course of trading on Friday, up 5.7%.

October futures price of gold on the COMEX is now 1773.3 dollars per ounce.

U.S. and Japan need medium-term plan

The global economy should emerge from the influence of the eurozone crisis

We must address the root causes prizisa not stop halfway

Adjustment of the eurozone economy was significant, except in Greece

No one should be talking about the benefits of the new Greek debt write-offs

Greece must implement a second program

Unlimited ECB bond purchases have their limits

Italy should continue successful reforms

No one wants to exit of Greece from the eurozone

Europe remains strong for a long period

The liquidity of the ECB can not always keep the economy

EUR/USD $1.2900, $1.2910, $1.2940, $1.2990, $1.3085, $1.3100

USD/JPY Y78.20, Y78.40

GBP/USD $1.6250, $1.6120

EUR/GBP stg0.7945

AUD/USD $1.0410, $1.0450, $1.0460

AUD/JPY Y82.50

U.S. stock futures rose on a report said European officials will unveil a bailout plan for Spain.

Global Stocks:

Nikkei 9,110 +23.02 +0.25%

Hang Seng 20,734.94 +144.02 +0.70%

Shanghai Composite 2,026.69 +1.85 +0.09%

FTSE 5,852.21 -2.43 -0.04%

CAC 3,528.23 +18.31 +0.52%

DAX 7,471.03 +81.54 +1.10%

Crude oil $93.40 +1,06%

Gold $1788.30 +1.02%

International Business Machines (IBM) was initiated with a Hold at Jefferies.

Data

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.0%

03:00 New Zealand Credit Card Spending August +0.1% +1.9%

08:30 United Kingdom PSNB, bln August -1.8 13.0 12.3

The euro rose against the dollar after the media reported that the euro-area policy will present a program of financial rescue Spain in the beginning of next week.

The single currency rose for the first time in four days against the yen after the Financial Times said that officials of Spain and the European Union are working on plans for bond purchases by the European Central Bank to support the economy of countries in need. The plan will be announced on September 27 and will focus on structural reforms in the economy of Spain, at the request of the EU, not in new taxes and spending cuts.

The Australian dollar rose sharply against most high-yielding currencies after the Federal Reserve Bank of Minneapolis President Narayana Kocherlakota said the central bank will keep interest rates at near zero for as long as the unemployment rate has fallen below 5.5 percent. Recall that the rate is kept above 8% since January 2009.

The pound rose to its highest level in over a year against the dollar, despite the fact that the United Kingdom reported the largest fiscal deficit in August.

Also today, the Spanish Prime Minister Mariano Rajoy will meet with his Italian counterpart Mario Monti in Rome.

EUR/USD: during the European session, the pair has grown rapidly, setting all-time high at $ 1.3047 and then fell to the opening level of the day

GBP/USD: pair soared to $ 1.6308, but then declined and is now at a value of $ 1.6260

USD/JPY: the pair is trading in a narrow range with a slight decline

At 12:30 GMT, Canada will release data on the consumer price index, consumer price index, the main consumer price index from the Bank of Canada in August, and the change in the volume of wholesale trade for July.

EUR/USD

Offers $1.3165/75, $1.3110/20, $1.3100, $1.3075/85, $1.3045/50

Bids $1.3000/990, $1.2920, $1.2900, $1.2855/50

GBP/USD

Offers $1.6390/400, $1.6350, $1.6340

Bids $1.6150/40, $1.6120, $1.6085/80, $1.6060/50

AUD/USD

Offers $1.0570/80, $1.0540/50, $1.0520, $1.0490/5.00

Bids $1.0350/40, $1.0168

EUR/GBP

Offers stg0.8070/80, stg0.8045/50, stg0.8020

Bids stg0.7970, stg0.7945/40

USD/JPY

Offers Y79.30, Y78.37

Bids Y78.00, Y77.80/75, Y77.60

EUR/JPY

Offers Y103.80/4.00, Y101.67

Bids Y100.80/60, Y100.50

European stock indexes began trading growth. Positively influenced by the news that on Monday plans to start action program to help Spain.

Greek authorities have agreed with international lenders to raise the retirement age to 67 years, reports Reuters. Currently, the retirement age in Greece 65. Raising the retirement age would allow the country to save each year to 1.1 billion euros.

Markets in Asia and the U.S. also closed in the green zone.

To date:

FTSE 100 5,848.77 -5.87 -0.10%

CAC 40 3,521.83 +11.91 +0.34%

DAX 7,416.37 +26.88 +0.36%

Shares of one of the largest Italian banks Mediobanca SpA increase 1.3% after UBS AG and Equita SIM SpA raised forecasts for equities. Quotes Randgold Resources Ltd increase amid forecasts of Bank of America and Deutsche Bank AG to increase the prices of precious metals in the coming year.

EUR/USD $1.2900, $1.2910, $1.2940, $1.2990, $1.3085, $1.3100

USD/JPY Y78.20, Y78.40

GBP/USD $1.6250, $1.6120

EUR/GBP stg0.7945

AUD/USD $1.0410, $1.0450, $1.0460

AUD/JPY Y82.50

Asian stocks rose, paring the regional benchmark index’s first weekly decline in three weeks, as Apple Inc.’s iPhone 5 debut boosted information technology shares and energy companies advanced on higher crude prices.

Nikkei 225 9,110 +23.02 +0.25%

S&P/ASX 200 4,408.3 +11.07 +0.25%

Shanghai Composite 2,026.69 +1.85 +0.09%

Samsung Electronics Co., a smartphone maker that gets 9 percent of its sales from Apple, gained 1.2 percent in Seoul as the new iPhone went on sale.

Inpex Corp., Japan’s No.1 energy explorer, advanced 2 percent as crude oil rebounded from a 7.2 percent drop in the past four days.

GrainCorp Ltd. rose 1.2 percent as JPMorgan Chase & Co. advised buying shares of eastern Australia’s largest grain handler.

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.0%

03:00 New Zealand Credit Card Spending August +0.1% +1.9%

The yen headed for a weekly gain against most major peers as signs of a global economic slowdown spurred demand for the refuge of Japan’s currency. Reports yesterday showed a composite index for manufacturing and services industries in the euro area dropped to a three-year low and a factory output gauge in China signaled contraction for an 11th month.

The euro was poised for the biggest five-day decline since July against the greenback before data next week forecast to show German business sentiment remained near the lowest in more than two years. The Ifo institute in Munich will probably say its business climate index, based on a survey of 7,000 executives, was at 102.8 this month from 102.3 in August, according to the median estimate of economists surveyed by Bloomberg News before the data on Sept. 24. Last month’s reading was the lowest since March 2010.

Losses in the euro were limited before Spanish Prime Minister Mariano Rajoy meets his Italian counterpart Mario Monti today in Rome. The Financial Times reported that Spanish and European Union officials were working on plans to trigger European Central Bank bond purchases.

The plan will be announced on Sept. 27 and will focus on structural reforms to the Spanish economy requested by the EU, rather than new taxes and spending cuts, the newspaper said yesterday, citing officials involved in the talks.

The International Monetary Fund will cut economic forecasts for the global economy “by a few decimal points,” a fund official said yesterday.

EUR/USD: during the Asian session, the pair rose to $1.3300.

GBP/USD: during the Asian session, the pair rose above $1.6250.

USD/JPY: during the Asian session, the pair traded in the range of Y78.20-40.

At 1300GMT, German Finance Minister Wolfgang Schaeuble talks to the foreign press, in Berlin. The data calendar gets underway just ahead of 0600GMT, when UK retailer John Lewis release their latest weekly sales numbers. Despite a fairly sluggish UK retail sector. Lewis has been an outperformer. UK public sector finance data is expected at 0830GMT. No major US releases are expected at 1230GMT, but Canadian inflation data is slated for release, with consumer prices for August and also wholesale sales numbers for July expected. US data kicks off at 1400GMT, with he release of the August BLS unemployment and mass lay-off data. At 1640GMT, Atlanta Federal Reserve Bank Pres Dennis Lockhart speaks to the Atlanta Institute of Internal Auditors on the subject of "U.S. Economic Outlook and Monetary Policy." He will answer questions from the audience. Late data, out at 2015GMT, sees U.S. C&I loans numbers hit the screens.

Yesterday the euro dropped the most in two months against the dollar as services and manufacturing in the region shrank to a three-year low, adding to evidence the central bank will need to do more to spur growth.

The yen and the dollar strengthened against most of their major counterparts as demand for the perceived safety of those nations’ assets increased after separate reports showed China’s manufacturing and Japanese exports declined for a third month.

A preliminary reading was 47.8 for a China purchasing managers’ index released today by HSBC Holdings Plc (HSBA) and Markit Economics, compared with a final level of 47.6 last month. Japan’s overseas shipments slid 5.8 percent on weakness in demand from Europe and China.

The euro weakened against most of its 16 major peers even after Spain’s borrowing costs fell at a 4.8 billion-euro auction of three- and 10-year debt, the biggest since January. The sale came amid expectations the nation will ask the European Central Bank to buy its debt.

A composite index based on a survey of purchasing managers in euro-area services and manufacturing industries dropped to 45.9 for September, the lowest since June 2009, London-based Markit Economics said in an initial estimate. A reading below 50 indicates contraction.

Australia’s currency fell as the Chinese data clouded the prospects for the South Pacific nation’s resource exports.

Asian stocks fell, with the regional benchmark retreating from its highest close since May, after Japan’s exports fell a third month and on signs China’s manufacturing may contract an 11th month, adding to concern the global economic slowdown is deepening.

Nikkei 225 9,086.98 -145.23 -1.57%

S&P/ASX 200 4,397.2 -21.16 -0.48%

Shanghai Composite 2,026.45 -41.38 -2.00%

Kyocera Corp., a maker of electronic parts that gets more than half of its sales outside Japan, slid 2.9 percent.

Nippon Telegraph & Telephone Corp. surged 7.1 percent after Japan’s leading fixed-line phone company said it plans to buy back as much as 3.4 percent of its shares.

Billabong International Ltd. slumped 6.9 percent as a second bidder withdrew from the sale of Australia’s largest surfwear company.

European stocks declined for the third time in four days after a report signaled that Chinese manufacturing will contract for an 11th month, adding to concern the global economic slowdown is deepening.

China’s manufacturing industry will contract in September, according to the preliminary reading of a purchasing managers’ index released today by HSBC Holdings Plc and Markit Economics. The result of 47.8 compared with a final 47.6 last month. A reading above 50 indicates expansion.

A composite index for services and manufacturing activity in the euro area fell in September more than economists had projected. The PMI slipped to 45.9, its lowest since June 2009, from 46.3 last month.

National benchmark indexes declined in 12 of the 18 western-European markets. Germany’s DAX slid less than 0.1 percent, while the U.K.’s FTSE 100 and France’s CAC 40 each dropped 0.6 percent.

BHP Billiton Ltd. and Anglo American Plc declined 2.3 percent to 1,954.5 pence and 4.4 percent to 1,944 pence, respectively, contributing the most to a retreat by a gauge of mining companies following the Chinese manufacturing report.

Vedanta Resources Plc, India’s largest copper producer, fell 2.4 percent to 1,054 pence. Evraz Plc, the mining company and steelmaker partly owned by billionaire Roman Abramovich, slumped 6 percent to 260.8 pence.

Daimler retreated 2 percent to 39.23 euros as the world’s third-largest luxury vehicle maker said earnings from its car division will drop in the second half of 2012. Bayerische Motoren Werke AG, the biggest manufacturer of luxury cars, lost 2.9 percent to 59.44 euros.

Major U.S. stock indexes are under pressure on concerns about further deterioration in the global economy.

The cause of these concerns were data on business activity in the industry in China and the U.S. labor market.

According to preliminary data, the manufacturing PMI from HSBC China to the end of September once again went below 50, indicating a decline in activity in the sector. Index value below 50 points is from August of last year.

Not pleased with the market participants data on the number of applications for unemployment benefits, which came above forecasts (figure out at 382 thousand vs. 373 thousand).

Negatives also added data on the index of consumer confidence in the euro area, which in September fell to -26 vs. -24 and values from -26.4 in August.

In the composition of the index DOW components show a mixed trend. Leaders are stocks Kraft Foods (KFT, +1.86%). More than the others fell in the share price Alcoa (AA, -2.32%).

Most of the major economic sectors are in the red. In the black sectors are utilities (+0.3%) and health (0.3%). Sector fell more than the rest of conglomerates (-0.7%) and financial (-0.7%).

Bank of America (BAC) fell by 1.1% under the pressure of the news that the bank is going to cut 16,000 people by the end of the year.

American food group ConAgra Foods jumped by 6.2% - the company reported a better-than-expected quarterly profit due to recent purchases and successful marketing.Change % Change Last

Gold 1,771 -1 -0.04%

Oil 92.14 +0.16 +0.17%Change % Change Last

Nikkei 225 9,086.98 -145.23 -1.57%

S&P/ASX 200 4,397.2 -21.16 -0.48%

Shanghai Composite 2,026.45 -41.38 -2.00%

FTSE 100 5,854.64 -33.84 -0.57%

CAC 40 3,509.92 -21.90 -0.62%

DAX 7,389.49 -1.27 -0.02%

Dow 13,597 +19 +0.14%

Nasdaq 3,176 -7 -0.21%

S&P 500 1,460 -1 -0.07%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2964 -0,62%

GBP/USD $1,6214 -0,04%

USD/CHF Chf0,9328 +0,54%

USD/JPY Y78,23 -0,17%

EUR/JPY Y101,43 -0,79%

GBP/JPY Y126,84 -0,20%

AUD/USD $1,0429 -0,43%

NZD/USD $0,8287 +0,34%

USD/CAD C$0,9765 +0,20%

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.0%

03:00 New Zealand Credit Card Spending August +0.1%

08:30 United Kingdom PSNB, bln August -1.8 13.0

12:30 Canada Consumer Price Index m / m August -0.1% +0.4%

12:30 Canada Consumer price index, y/y August +1.3% +1.3%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.3%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7% +1.6%

12:30 Canada Wholesale Sales, m/m July -0.1% -0.1%

13:00 Belgium Business Climate September -11.8 -11.1

16:40 U.S. FOMC Member Dennis Lockhart Speaks -© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.