- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-01-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 04:30 | Japan | All Industry Activity Index, m/m | November | 1.9% | -0.4% |

| 09:30 | United Kingdom | MPC Member Dr Ben Broadbent Speaks | |||

| 11:00 | United Kingdom | CBI industrial order books balance | January | 8 | 5 |

| 13:30 | Canada | Retail Sales, m/m | November | 0.3% | -0.6% |

| 13:30 | Canada | Retail Sales YoY | November | 0.6% | |

| 13:30 | Canada | Retail Sales ex Autos, m/m | November | 0% | -0.4% |

| 14:00 | U.S. | Housing Price Index, m/m | November | 0.3% | 0.2% |

| 15:00 | Eurozone | Consumer Confidence | January | -6.2 | -6.5 |

| 15:00 | U.S. | Richmond Fed Manufacturing Index | January | -8 | -6 |

Major US stock indexes dropped significantly on Tuesday due to losses in the industrial and technology sectors, as fears of a slowdown in global economic growth reappeared after the International Monetary Fund lowered its forecasts.

The updated IMF forecasts, presented on Monday, predict that the global economy will grow by 3.5% in 2019 and by 3.6% in 2020, which is 0.2 percentage points and 0.1 pp, respectively, below the estimates released last October. The reason for the decline in forecasts was the weakness of the European economy.

In addition, as it became known, home sales in the US fell to the lowest level in December for the last three years, and the growth in real estate prices slowed sharply, which indicates a further loss of momentum in the housing market. The National Association of Realtors said that sales of homes on the secondary market decreased by 6.4%, to a seasonally adjusted annual rate of 4.99 million units. This was the lowest level since November 2015. The pace of sales in November was slightly revised - to 5.33 million units from the previously reported 5.32 million units. Economists had forecast that home sales in the secondary housing market would fall by 1.0% in December, to 5.25 million units.

Oil prices fell by about 2% on Tuesday amid signs of a slowdown in China's growth, fueling concerns about global growth and fuel demand.

Almost all DOW components recorded a decline (28 out of 30). Caterpillar Inc. shares turned out to be an outsider. (CAT, -3.51%). The growth leader was McDonald's Corporation (MCD, + 0.72%).

All sectors of the S & P finished trading in the red. The largest decline was shown by the industrial goods sector (-2.4%)

At the time of closing:

Dow 24,404.48 -301.87 -1.22%

S & P 500 2,632.90 -37.81 -1.42%

Nasdaq 100 7,020.36 -136.87 -1.91%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 04:30 | Japan | All Industry Activity Index, m/m | November | 1.9% | -0.4% |

| 09:30 | United Kingdom | MPC Member Dr Ben Broadbent Speaks | |||

| 11:00 | United Kingdom | CBI industrial order books balance | January | 8 | 5 |

| 13:30 | Canada | Retail Sales, m/m | November | 0.3% | -0.6% |

| 13:30 | Canada | Retail Sales YoY | November | 0.6% | |

| 13:30 | Canada | Retail Sales ex Autos, m/m | November | 0% | -0.4% |

| 14:00 | U.S. | Housing Price Index, m/m | November | 0.3% | 0.2% |

| 15:00 | Eurozone | Consumer Confidence | January | -6.2 | -6.5 |

| 15:00 | U.S. | Richmond Fed Manufacturing Index | January | -8 | -6 |

None of the four major U.S. regions saw a gain in sales activity last month.

Total existing-home sales,, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.4 percent from November to a seasonally adjusted rate of 4.99 million in December. Sales are now down 10.3 percent from a year ago (5.56 million in December 2017).

Lawrence Yun, NAR’s chief economist, says current housing numbers are partly a result of higher interest rates during much of 2018. “The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring.”

U.S. stock-index futures rose on Tuesday amid investor fears of a global economic slowdown, which intensified after the International Monetary Fund (IMF) reported about a cut in its world economic growth forecasts for 2019 and 2020.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,622.91 | -96.42 | -0.47% |

Hang Seng | 27,005.45 | -191.09 | -0.70% |

Shanghai | 2,579.70 | -30.81 | -1.18% |

S&P/ASX | 5,858.80 | -31.60 | -0.54% |

FTSE | 6,937.70 | -32.89 | -0.47% |

CAC | 4,848.18 | -19.60 | -0.40% |

DAX | 11,087.00 | -49.20 | -0.44% |

Crude | $52.93 | -2.05% | |

Gold | $1,283.50 | +0.07% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 194.27 | -1.59(-0.81%) | 1145 |

ALCOA INC. | AA | 28.9 | -0.37(-1.26%) | 8945 |

ALTRIA GROUP INC. | MO | 47.22 | -1.09(-2.26%) | 38821 |

Amazon.com Inc., NASDAQ | AMZN | 1,683.34 | -12.86(-0.76%) | 40604 |

American Express Co | AXP | 98.48 | -2.00(-1.99%) | 582 |

AMERICAN INTERNATIONAL GROUP | AIG | 43.8 | -0.36(-0.82%) | 400 |

Apple Inc. | AAPL | 155.87 | -0.95(-0.61%) | 135207 |

AT&T Inc | T | 30.85 | -0.11(-0.36%) | 20886 |

Boeing Co | BA | 361.2 | -3.53(-0.97%) | 14313 |

Caterpillar Inc | CAT | 135 | -1.60(-1.17%) | 5619 |

Chevron Corp | CVX | 114.35 | -0.02(-0.02%) | 915 |

Cisco Systems Inc | CSCO | 44.66 | -0.37(-0.82%) | 9865 |

Citigroup Inc., NYSE | C | 62.52 | -0.60(-0.95%) | 55557 |

Deere & Company, NYSE | DE | 163.4 | -1.21(-0.74%) | 488 |

Exxon Mobil Corp | XOM | 72.4 | -0.59(-0.81%) | 3513 |

Facebook, Inc. | FB | 149.29 | -0.75(-0.50%) | 63414 |

FedEx Corporation, NYSE | FDX | 176 | -0.91(-0.51%) | 1509 |

Ford Motor Co. | F | 8.51 | -0.07(-0.82%) | 27223 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.25 | -0.31(-2.47%) | 53435 |

General Electric Co | GE | 8.95 | -0.11(-1.21%) | 287774 |

General Motors Company, NYSE | GM | 38.17 | -0.44(-1.14%) | 5287 |

Goldman Sachs | GS | 200.67 | -1.87(-0.92%) | 4179 |

Google Inc. | GOOG | 1,090.42 | -7.84(-0.71%) | 1488 |

Hewlett-Packard Co. | HPQ | 21.76 | 0.01(0.05%) | 250 |

Intel Corp | INTC | 48.89 | -0.31(-0.62%) | 30562 |

International Business Machines Co... | IBM | 123.3 | -0.52(-0.42%) | 6553 |

International Paper Company | IP | 45.64 | -0.04(-0.09%) | 201 |

Johnson & Johnson | JNJ | 128.8 | -1.89(-1.45%) | 80913 |

JPMorgan Chase and Co | JPM | 103.36 | -1.23(-1.18%) | 5674 |

McDonald's Corp | MCD | 182.2 | -0.37(-0.20%) | 1746 |

Merck & Co Inc | MRK | 75.79 | -0.08(-0.11%) | 264 |

Microsoft Corp | MSFT | 106.63 | -1.08(-1.00%) | 39216 |

Nike | NKE | 80.91 | 0.46(0.57%) | 12362 |

Pfizer Inc | PFE | 42.3 | -0.23(-0.54%) | 4253 |

Starbucks Corporation, NASDAQ | SBUX | 64.5 | -0.20(-0.31%) | 16987 |

Tesla Motors, Inc., NASDAQ | TSLA | 304.41 | 2.15(0.71%) | 183933 |

The Coca-Cola Co | KO | 47.48 | -0.13(-0.27%) | 2207 |

Travelers Companies Inc | TRV | 124.9 | 0.89(0.72%) | 2165 |

Twitter, Inc., NYSE | TWTR | 32.95 | -0.32(-0.96%) | 29679 |

United Technologies Corp | UTX | 113.05 | -0.85(-0.75%) | 1495 |

UnitedHealth Group Inc | UNH | 264.5 | -1.00(-0.38%) | 4405 |

Verizon Communications Inc | VZ | 57.05 | -0.04(-0.07%) | 3561 |

Visa | V | 137.2 | -1.30(-0.94%) | 5513 |

Wal-Mart Stores Inc | WMT | 97.49 | -0.24(-0.25%) | 753 |

Walt Disney Co | DIS | 110.76 | -0.28(-0.25%) | 825 |

Altria (MO) downgraded to Underweight from Equal-Weight at Morgan Stanley

NIKE (NKE) upgraded to Outperform from Market Perform at Cowen

The decline in November mainly reflected lower sales of petroleum and coal products. Excluding this industry, manufacturing sales rose 0.2%.

Sales were down in 13 of 21 industries, representing 45.3% of total manufacturing sales. Sales of non-durable goods fell 3.4% to $27.2 billion, while sales of durable goods rose 0.5% to $30.1 billion.

In volume terms, manufacturing sales decreased 0.9%.

Sales were down in five of seven subsectors, representing about 82% of total wholesale sales.

The machinery, equipment and supplies, and the building material and supplies subsectors contributed the most to the decline in November, while the motor vehicle and parts subsector posted the largest gain.

In volume terms, wholesale sales decreased 1.2%.

e machinery, equipment and supplies subsector dropped 2.3% to $13.2 billion in November, the second decline in three months. Sales decreased in three of four industries, led by the other machinery, equipment and supplies industry, down 5.8% and more than offsetting the 5.6% gain in October. Meanwhile, sales in the farm, lawn and garden machinery and equipment industry fell for the fourth time in five months, down 4.7% in November.

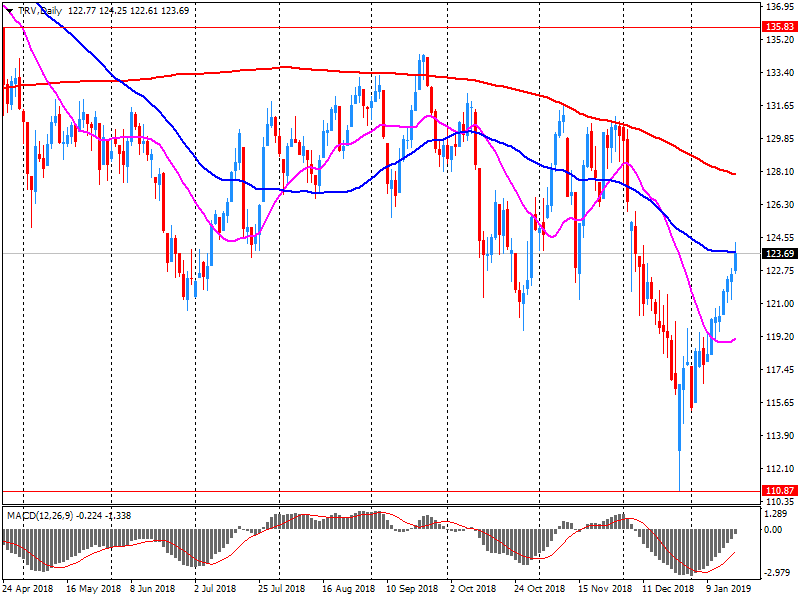

Travelers (TRV) reported Q4 FY 2018 earnings of $2.13 per share (versus $2.28 in Q4 FY 2017), missing analysts’ consensus estimate of $2.23.

The company’s quarterly revenues amounted to $6.945 bln (+4.8% y/y), generally in line with analysts’ consensus estimate of $6.922 bln.

TRV closed Friday's trading session at $124.01 (+0.87%).

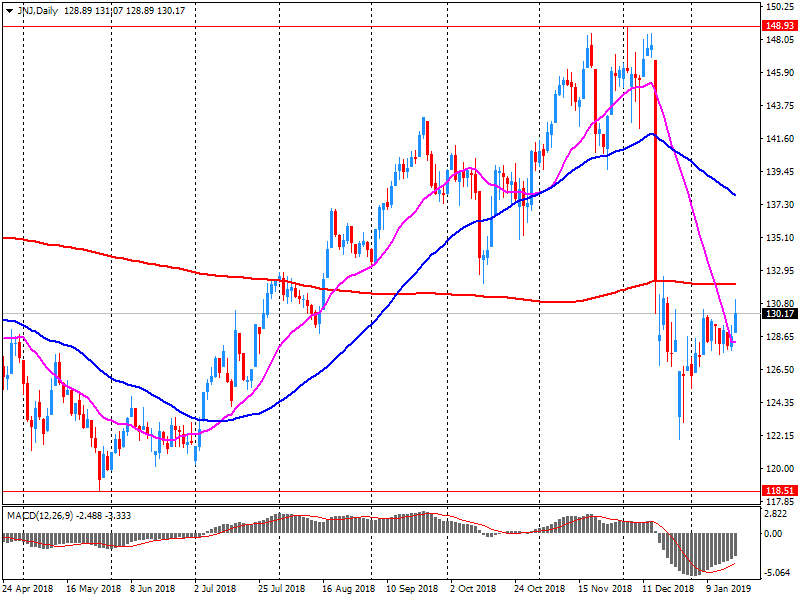

Johnson & Johnson (JNJ) reported Q4 FY 2018 earnings of $1.97 per share (versus $1.74 in Q4 FY 2017), beating analysts’ consensus estimate of $1.95.

The company’s quarterly revenues amounted to $20.394 bln (+1.0% y/y), generally in line with analysts’ consensus estimate of $20.267 bln.

The company also issued guidance for FY 2019, projecting EPS of $8.50-8.65 (versus analysts’ consensus estimate of $8.60) and revenues of $80.4-81.2 bln (versus analysts’ consensus estimate of $82.74 bln).

JNJ rose to $131.70 (+0.77%) in pre-market trading.

The ZEW Indicator of Economic Sentiment for Germany recorded an increase of 2.5 points in January 2019, and now stands at minus 15.0 points. Despite this increase, the indicator is still well below the long-term average of 22.4 points. The assessment of the current economic situation in Germany once again decreased considerably in January, with the corresponding indicator falling by 17.7 points to a level of 27.6 points. This has been the lowest reading since January 2015.

According to the January 2019 bank lending survey, credit standards remained broadly unchanged for loans to enterprises and housing loans. Given the extended period over which credit standards have been easing, bank lending conditions continue to support loan growth. Loan demand continued to increase across all loan categories.

Borrowing (public sector net borrowing excluding public sector banks) in December 2018 was £3.0 billion, £0.3 billion more than in December 2017; with the exception of the £2.7 billion borrowed in December 2017, this was the lowest December borrowing for 18 years (since 2000).

Borrowing in the current financial year-to-date (YTD) was £35.9 billion, £13.1 billion less than in the same period in 2017; the lowest year-to-date for 16 years (since 2002).

Borrowing in the financial year ending (FYE) March 2018 was £41.9 billion, £3.0 billion less than in FYE March 2017; the lowest financial year for 11 years (since FYE 2007).

Debt (public sector net debt excluding public sector banks) at the end of December 2018 was £1,808.9 billion (or 84.0% of gross domestic product (GDP)); an increase of £48.6 billion (or a decrease of 0.5 percentage points of GDP) on December 2017.

Estimates from the Labour Force Survey show that, between June to August 2018 and September to November 2018, the number of people in work increased, the number of unemployed people was little changed and the number of people aged from 16 to 64 years not working and not seeking nor available to work (economically inactive) decreased.

There were an estimated 32.53 million people in work, 141,000 more than for June to August 2018 and 328,000 more than for a year earlier.

The employment rate (the proportion of people aged from 16 to 64 years who were in work) was estimated at 75.8%, higher than for a year earlier (75.3%) and the highest since comparable estimates began in 1971.

There were an estimated 1.37 million unemployed people (people not in work but seeking and available to work), little changed compared with June to August 2018 but 68,000 fewer than for a year earlier.

The unemployment rate (the number of unemployed people as a proportion of all employed and unemployed people) was estimated at 4.0%, it has not been lower since December 1974 to February 1975.

January 22

Before the Open:

Johnson & Johnson (JNJ). Consensus EPS $1.95, Consensus Revenues $20267.28 mln.

Travelers (TRV). Consensus EPS $2.23, Consensus Revenues $6922.41 mln.

After the Close:

IBM (IBM). Consensus EPS $4.82, Consensus Revenues $21792.78 mln.

January 23

Before the Open:

Procter & Gamble (PG). Consensus EPS $1.21, Consensus Revenues $17159.21 mln.

United Tech (UTX). Consensus EPS $1.53, Consensus Revenues $16856.20 mln.

After the Close:

Ford Motor (F). Consensus EPS $0.30, Consensus Revenues $36833.70 mln.

January 24

Before the Open:

Freeport-McMoRan (FCX). Consensus EPS $0.19, Consensus Revenues $3875.25 mln.

After the Close:

Intel (INTC). Consensus EPS $1.23, Consensus Revenues $19015.03 mln.

Starbucks (SBUX). Consensus EPS $0.65, Consensus Revenues $6485.46 mln.

This is a continuation of the negative sentiment that is observed in Asia as the slowdown in the Chinese economy to 28-year lows has caused new concerns about global growth.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1509 (2439)

$1.1484 (474)

$1.1451 (547)

Price at time of writing this review: $1.1358

Support levels (open interest**, contracts):

$1.1341 (3933)

$1.1310 (5090)

$1.1274 (2582)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 70955 contracts (according to data from January, 18) with the maximum number of contracts with strike price $1,1600 (5486);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3000 (1244)

$1.2968 (549)

$1.2938 (261)

Price at time of writing this review: $1.2873

Support levels (open interest**, contracts):

$1.2812 (554)

$1.2767 (383)

$1.2739 (442)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 23246 contracts, with the maximum number of contracts with strike price $1,3000 (1965);

- Overall open interest on the PUT options with the expiration date February, 8 is 26084 contracts, with the maximum number of contracts with strike price $1,2600 (1930);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from January, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 62.6 | 0.53 |

| WTI | 54.18 | 0.82 |

| Silver | 15.25 | -0.46 |

| Gold | 1280.094 | -0.17 |

| Palladium | 1357.46 | -1.41 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 53.26 | 20719.33 | 0.26 |

| Hang Seng | 105.73 | 27196.54 | 0.39 |

| KOSPI | 0.33 | 2124.61 | 0.02 |

| ASX 200 | 10.8 | 5890.4 | 0.18 |

| FTSE 100 | 2.26 | 6970.59 | 0.03 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71569 | -0.08 |

| EURJPY | 124.614 | -0.07 |

| EURUSD | 1.13647 | -0.01 |

| GBPJPY | 141.35 | 0.08 |

| GBPUSD | 1.28907 | 0.14 |

| NZDUSD | 0.67285 | -0.19 |

| USDCAD | 1.32942 | 0.26 |

| USDCHF | 0.99703 | 0.25 |

| USDJPY | 109.648 | -0.06 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.