- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-01-2019

The 10-year Treasury yield rose 1.8 basis points to 2.730%. The two-year note yield was up by 1.9 basis points to 2.581%, while the 30-year bond yield picked up 1.4 basis points to 3.048%. Bond prices move in the opposite direction of yields.

U.S. stock-index rose on Friday, as investors grew more optimistic about an end to the government shutdown and digested another batch of corporate earnings.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,773.56 | +198.93 | +0.97% |

Hang Seng | 27,569.19 | +448.21 | +1.65% |

Shanghai | 2,601.72 | +10.03 | +0.39% |

S&P/ASX | 5,905.60 | +39.90 | +0.68% |

FTSE | 6,834.57 | +15.62 | +0.23% |

CAC | 4,923.89 | +51.93 | +1.07% |

DAX | 11,306.83 | +176.65 | +1.59% |

Crude | $53.21 | +0.15% | |

Gold | $1,296.60 | +0.83% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 193.59 | 1.07(0.56%) | 211 |

ALCOA INC. | AA | 28.2 | 0.24(0.86%) | 1802 |

ALTRIA GROUP INC. | MO | 43.5 | 0.17(0.39%) | 9500 |

Amazon.com Inc., NASDAQ | AMZN | 1,666.40 | 11.47(0.69%) | 62831 |

American Express Co | AXP | 100 | 0.28(0.28%) | 410 |

Apple Inc. | AAPL | 154.63 | 1.93(1.26%) | 222261 |

AT&T Inc | T | 30.67 | 0.07(0.23%) | 32537 |

Boeing Co | BA | 362.04 | 3.77(1.05%) | 7534 |

Caterpillar Inc | CAT | 134.4 | 1.67(1.26%) | 10500 |

Chevron Corp | CVX | 113.98 | 0.47(0.41%) | 733 |

Cisco Systems Inc | CSCO | 46 | 0.39(0.86%) | 29037 |

Citigroup Inc., NYSE | C | 63.18 | 0.47(0.75%) | 20850 |

Exxon Mobil Corp | XOM | 71.58 | 0.18(0.25%) | 3171 |

Facebook, Inc. | FB | 147.3 | 1.47(1.01%) | 82692 |

FedEx Corporation, NYSE | FDX | 175.24 | 1.14(0.65%) | 1098 |

Ford Motor Co. | F | 8.68 | 0.08(0.93%) | 55232 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.84 | 0.14(1.31%) | 77391 |

General Electric Co | GE | 8.89 | 0.11(1.25%) | 299987 |

General Motors Company, NYSE | GM | 38.26 | 0.10(0.26%) | 452 |

Goldman Sachs | GS | 199.25 | 1.45(0.73%) | 2733 |

Google Inc. | GOOG | 1,084.25 | 10.35(0.96%) | 2208 |

Home Depot Inc | HD | 178 | 0.71(0.40%) | 152 |

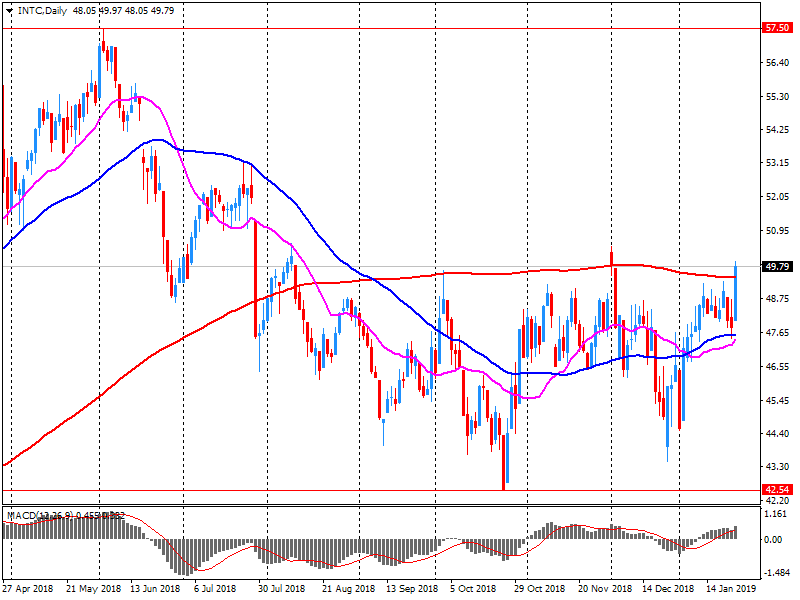

Intel Corp | INTC | 46.41 | -3.35(-6.73%) | 1061075 |

International Business Machines Co... | IBM | 132.9 | 0.37(0.28%) | 9375 |

Johnson & Johnson | JNJ | 127.29 | 0.26(0.20%) | 1492 |

JPMorgan Chase and Co | JPM | 103.34 | 0.60(0.58%) | 12234 |

McDonald's Corp | MCD | 188.08 | 0.71(0.38%) | 433 |

Merck & Co Inc | MRK | 73.6 | 0.43(0.59%) | 3523 |

Microsoft Corp | MSFT | 107.07 | 0.87(0.82%) | 100102 |

Nike | NKE | 80.91 | 0.47(0.58%) | 1152 |

Procter & Gamble Co | PG | 94.17 | -0.13(-0.14%) | 11075 |

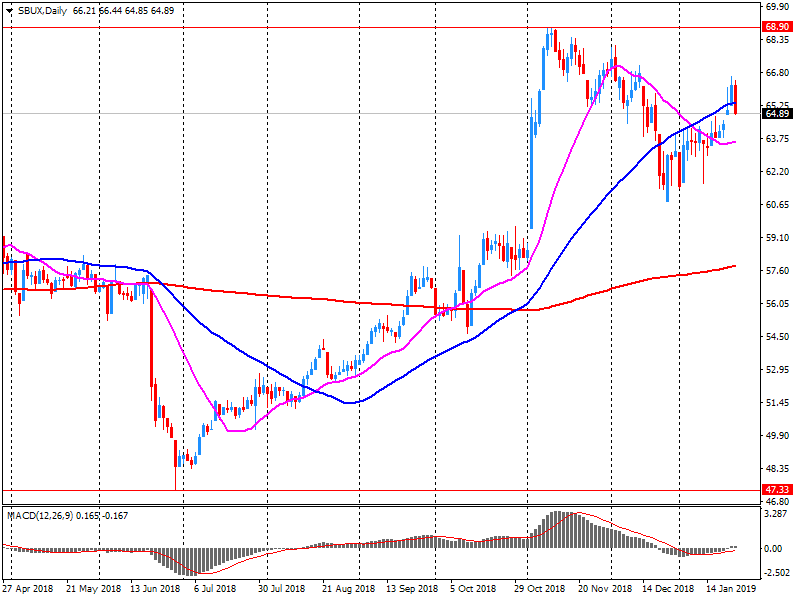

Starbucks Corporation, NASDAQ | SBUX | 67.14 | 2.40(3.71%) | 189892 |

Tesla Motors, Inc., NASDAQ | TSLA | 293.68 | 2.17(0.74%) | 57370 |

Travelers Companies Inc | TRV | 124.4 | 0.02(0.02%) | 100 |

Twitter, Inc., NYSE | TWTR | 31.84 | 0.23(0.73%) | 79532 |

United Technologies Corp | UTX | 116.5 | 0.94(0.81%) | 891 |

Verizon Communications Inc | VZ | 57.2 | 0.13(0.23%) | 2269 |

Visa | V | 138.71 | 1.01(0.73%) | 5688 |

Wal-Mart Stores Inc | WMT | 98.32 | -0.04(-0.04%) | 1351 |

Walt Disney Co | DIS | 111.1 | 0.55(0.50%) | 4525 |

Yandex N.V., NASDAQ | YNDX | 31.87 | -0.15(-0.47%) | 2514 |

Intel (INTC) downgraded to Mkt Perform from Buy at Charter Equity

Intel (INTC) downgraded to Neutral from Positive at Susquehanna

Intel (INTC) downgraded to Hold from Buy at Needham

Starbucks (SBUX) reported Q1 FY 2019 earnings of $0.75 per share (versus $0.58 in Q1 FY 2018), beating analysts’ consensus estimate of $0.65.

The company’s quarterly revenues amounted to $6.633 bln (+9.2% y/y), beating analysts’ consensus estimate of $6.487 bln.

The company also issued upside guidance for FY 2019, projecting EPS of $2.68-2.73 versus analysts’ consensus estimate of $2.65 and its previous guidance of $2.61-2.66.

SBUX rose to $66.85 (+3.26%) in pre-market trading.

Intel (INTC) reported Q4 FY 2018 earnings of $1.28 per share (versus $1.08 in Q4 FY 2017), beating analysts’ consensus estimate of $1.22.

The company’s quarterly revenues amounted to $18.657 bln (+9.4% y/y), missing analysts’ consensus estimate of $19.015 bln.

The company also issued downside guidance for Q1 FY 2019, projecting EPS of $0.87 (versus analysts’ consensus estimate of $1.01) and revenues of ~$16.0 bln (versus analysts’ consensus estimate of $17.38 bln).

For the FY 2019, the company projected EPS of $4.60 (versus analysts’ consensus estimate of $4.54) and revenues of $71.5 bln (versus analysts’ consensus estimate of $73.22 bln).

INTC fell to $46.40 (-6.75%) in pre-market trading.

Brexit Could Disturb Financial Markets, Exchange Rates

The survey of 103 firms, of which 42 were retailers, showed that sales volumes for the retail sector stabilised (in line with expectations), following a decline in the previous month. Sales for the time of year remained well below average – to the greatest extent since November 2011 – while orders placed with suppliers rose only slightly.

The outlook for the coming month is better, with retailers expecting sales volumes and orders to rise in the year to February.

Online sales rose at a similar pace to that seen in December 2018, slightly above the long-run average. Online sales growth is expected to slow however in the year to February, to below the long-run average.

Disquiet is growing among German businesses. The ifo Business Climate Index fell from 101.0 points in December to 99.1 points in January, dropping to its lowest level since February 2016. Companies assessed their current business situation slightly less favourably. Their business expectations also deteriorated sharply and turned pessimistic for the first time since December 2012. The German economy is experiencing a downturn.

In manufacturing the business climate index fell markedly once again this month. This was primarily due to far more pessimistic business expectations. Manufacturers also assessed their current business situation slightly less favourably. The business climate deteriorated in all of the key business sectors apart from the chemicals industry. Capacity utilisation fell by 0.7 percent to 86.3 percent, but remains above its long-term average of 83.7 percent.

Gross mortgage lending across the residential market in December 2018 was £21.1bn, some 4.7 per cent higher than the same month the previous year. Gross mortgage lending across the residential market during 2018 was £267.5bn, some 3.8 per cent higher than in 2017.

The number of mortgages approved by the main high street banks in December 2018 was 2.4 per cent lower than the same month the previous year; approvals for home purchase were 5.3 per cent higher, remortgage approvals were 5.8 per cent lower and approvals for other secured borrowing were 18.9 per cent lower.

The £11.0bn of credit card spending in December 2018 was 8.8 per cent higher than the same month the previous year. The outstanding level of credit card borrowing grew by 4.7 per cent in the twelve months to December. Personal borrowing through loans and overdrafts grew by 3.4 per cent in the year to December.

Personal deposits in total grew by 0.6 per cent in the year to December 2018. Deposits held in instant access accounts were 2.4 per cent higher than last December.

Respondents to the ECB Survey of Professional Forecasters (SPF) for the first quarter of 2019 reported point forecasts for annual HICP inflation averaging 1.5%, 1.6% and 1.7% for 2019, 2020 and 2021, respectively. These results represent downward revisions of 0.2 percentage point (p.p.) for 2019 and 0.1 p.p. for 2020 compared with the previous (Q4 2018) survey round. Average longer-term inflation expectations (which, like all other longer-term expectations in this SPF, refer to 2023) were revised down to 1.8%, from 1.9% in the previous survey.

SPF respondents’ expectations for growth in euro area real GDP averaged 1.5%, 1.5% and 1.4% for 2019, 2020 and 2021, respectively. This represents downward revisions of 0.3 p.p. for 2019 and 0.1 p.p. for 2019. Average longer-term expectations for real GDP growth were revised down to 1.5%, from 1.6% in the previous survey.

Average unemployment rate expectations were broadly unchanged. At 7.8%, 7.6% and 7.5% for 2019, 2020 and 2021, respectively, the latest expectations continued to point to further falls in the unemployment rate over the next three years. Expectations for the unemployment rate in the longer term remained at 7.5%.

Says He'll Cast Net As Wide As Possible For BoE Chief

EUR/USD

Resistance levels (open interest**, contracts)

$1.1473 (3293)

$1.1438 (560)

$1.1410 (382)

Price at time of writing this review: $1.1324

Support levels (open interest**, contracts):

$1.1288 (4659)

$1.1259 (2625)

$1.1224 (3819)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 72349 contracts (according to data from January, 24) with the maximum number of contracts with strike price $1,1350 (4659);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3204 (1428)

$1.3181 (1004)

$1.3161 (1957)

Price at time of writing this review: $1.3120

Support levels (open interest**, contracts):

$1.3005 (396)

$1.2956 (370)

$1.2926 (593)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 23101 contracts, with the maximum number of contracts with strike price $1,3000 (1957);

- Overall open interest on the PUT options with the expiration date February, 8 is 26304 contracts, with the maximum number of contracts with strike price $1,2600 (1930);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from January, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In November 2018 compared with November 2017, visitor arrivals were up 25,600 to 385,800. The biggest changes were in arrivals from:

Australia (up 7,900)

United States (up 3,200)

Taiwan (up 1,800)

China (down 1,900).

The number of New Zealand residents returning from an overseas trip in November 2018 was up 7,400 from November 2017 to 221,800. The biggest changes were in arrivals from:

Australia (up 2,600)

Indonesia (up 1,200)

United Kingdom (up 1,200).

Except for those in the 15–24-year age group, the number of visitor arrivals from all other age groups increased in November 2018 compared with November 2017.

Overall consumer prices in the Tokyo region were up 0.4 percent on year in January, according to rttnews.

That was unchanged from the December reading, although it exceeded expectations for an increase of 0.2 percent.

Core consumer prices, which exclude food prices, climbed an annual 1.1 percent. That beat expectations for 0.9 percent, which would have been unchanged from the previous month.

On a monthly basis, overall Tokyo inflation was up 0.5 percent, while core CPI advanced 0.2 percent.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.12 | 0.54 |

| WTI | 53.16 | 1.43 |

| Silver | 15.29 | -0.33 |

| Gold | 1280.717 | -0.13 |

| Palladium | 1321.3 | -1.92 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -19.09 | 20574.63 | -0.09 |

| Hang Seng | 112.78 | 27120.98 | 0.42 |

| KOSPI | 17.25 | 2145.03 | 0.81 |

| ASX 200 | 22 | 5865.7 | 0.38 |

| FTSE 100 | -23.93 | 6818.95 | -0.35 |

| DAX | 58.64 | 11130.18 | 0.53 |

| Dow Jones | -22.38 | 24553.24 | -0.09 |

| S&P 500 | 3.63 | 2642.33 | 0.14 |

| NASDAQ Composite | 47.69 | 7073.46 | 0.68 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70909 | -0.68 |

| EURJPY | 123.959 | -0.62 |

| EURUSD | 1.13066 | -0.64 |

| GBPJPY | 143.204 | -0.02 |

| GBPUSD | 1.30622 | -0.04 |

| NZDUSD | 0.67605 | -0.38 |

| USDCAD | 1.3354 | 0.08 |

| USDCHF | 0.99613 | 0.14 |

| USDJPY | 109.628 | 0.02 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.