- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-08-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Germany | GDP (YoY) | Quarter II | -2.3% | -11.7% |

| 06:00 | Germany | GDP (QoQ) | Quarter II | -2.0% | -10.1% |

| 08:00 | Germany | IFO - Current Assessment | August | 84.5 | |

| 08:00 | Germany | IFO - Expectations | August | 97 | |

| 08:00 | Germany | IFO - Business Climate | August | 90.5 | |

| 10:00 | United Kingdom | CBI retail sales volume balance | August | 4 | 8 |

| 13:00 | Belgium | Business Climate | August | -13.9 | |

| 13:00 | U.S. | Housing Price Index, m/m | June | -0.3% | |

| 13:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | June | 3.7% | 3.6% |

| 14:00 | U.S. | Richmond Fed Manufacturing Index | August | 10 | |

| 14:00 | U.S. | New Home Sales | July | 0.776 | 0.786 |

| 14:00 | U.S. | Consumer confidence | August | 92.6 | 93 |

| 17:30 | Canada | BOC Deputy Governor Lawrence Schembri Speaks | |||

| 19:25 | U.S. | FOMC Member Daly Speaks | |||

| 22:45 | New Zealand | Trade Balance, mln | July | 426 |

A better market mood has helped EUR/USD to recover the 1.1800-mark, now trading near 1.1819. Nonetheless, the pair lacks momentum enough to confirm a bullish extension, FXStreet’s Chief Analyst Valeria Bednarik reports.

“The market is optimistic about a promising coronavirus treatment, the use of convalescent plasma, which was approved by the FDA. The treatment was already being used in some other countries.”

“The 4-hour chart shows that EUR/USD is struggling to surpass a bearish 20 SMA, while technical indicators have advanced within negative levels, now losing momentum ahead of their midlines.”

“The pair could ease in the American session, but the bearish case will become clearer on a break below the 1.1770 support. Bulls, on the other hand, will take their chances on a break above 1.1870.”

FXStreet notes that the EUR/GBP cross edged higher through the early North American session and was last seen trading near two-day tops, around the 0.9030 region.

"The cross built on the previous session's goodish rebound from over one-month lows and gained some follow-through traction for the second consecutive session. The lack of progress in Brexit talks was seen as a key factor behind the British pound's relative outperformance against its European counterpart and driving the EUR/GBP cross higher on the first day of the week.

It is worth recalling that the EU's chief negotiator Michel Barnier said on Friday that the seventh round of Brexit talks failed to yield any breakthrough. Barnier's UK counterpart, David Frost also mentioned about the deadlock and paved the way for weeks of uncertainty. This, in turn, took its toll on the sterling and remained supportive of the EUR/GBP pair's ongoing positive move.

On the other hand, the shared currency remained well supported by the fact that that the European governments have taken decisive action to support economic growth. The intraday positive move took along some short-term trading stops placed near the key 0.9000 psychological mark. Hence, the uptick could further be attributed to some technical buying above the mentioned barrier.

It will now be interesting to see if bulls are able to capitalize on the move or opt to take some profits off the table. Market participants now look forward to this week's key event risk, the Jackson Hole Symposium, where a scheduled speech by influential central banker will infuse some volatility and provide a fresh directional impetus to the EUR/GBP cross."

Education Minister Niki Kerameus said schools are expected to reopen on September 7 but an extension may be deemed necessary.

Mask wearing will be mandatory in all indoor spaces of schools across the country, Kerameus said, adding that authorities will offer fabric masks for free to students and teachers. The number of pupils in each class will be limited to 17.

- Convalescent plasma has been around for decades and should not be uncontroversial

- Facebook's (FB) CEO Zuckerberg does not have any influence on administration's TikTok policy

U.S. stock-index futures rose on Monday, on the back of increased hopes for a coronavirus treatment breakthrough and continuing gains in shares of big tech companies.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,985.51 | +65.21 | +0.28% |

Hang Seng | 25,551.58 | +437.74 | +1.74% |

Shanghai | 3,385.64 | +4.96 | +0.15% |

S&P/ASX | 6,129.60 | +18.40 | +0.30% |

FTSE | 6,108.88 | +106.99 | +1.78% |

CAC | 5,002.75 | +106.42 | +2.17% |

DAX | 13,077.79 | +312.99 | +2.45% |

Crude oil | $42.71 | +0.87% | |

Gold | $1,957.90 | +0.56% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 162.49 | 0.78(0.48%) | 3288 |

ALCOA INC. | AA | 14.79 | 0.19(1.30%) | 10970 |

ALTRIA GROUP INC. | MO | 43.7 | 0.24(0.55%) | 11171 |

Amazon.com Inc., NASDAQ | AMZN | 3,311.00 | 26.28(0.80%) | 64115 |

American Express Co | AXP | 96.96 | 0.81(0.84%) | 3325 |

AMERICAN INTERNATIONAL GROUP | AIG | 28.49 | 0.22(0.78%) | 6119 |

Apple Inc. | AAPL | 512.95 | 15.47(3.11%) | 2129575 |

AT&T Inc | T | 29.83 | 0.14(0.47%) | 132247 |

Boeing Co | BA | 169.75 | 2.25(1.34%) | 190704 |

Caterpillar Inc | CAT | 139.95 | 1.52(1.10%) | 5381 |

Chevron Corp | CVX | 86.15 | 1.07(1.25%) | 15232 |

Cisco Systems Inc | CSCO | 42.23 | -0.02(-0.05%) | 108746 |

Citigroup Inc., NYSE | C | 49.75 | 0.45(0.91%) | 64102 |

Deere & Company, NYSE | DE | 202.79 | 3.29(1.65%) | 13376 |

E. I. du Pont de Nemours and Co | DD | 55.78 | 0.64(1.16%) | 3099 |

Exxon Mobil Corp | XOM | 41.46 | 0.45(1.10%) | 92553 |

Facebook, Inc. | FB | 270.77 | 3.76(1.41%) | 213518 |

FedEx Corporation, NYSE | FDX | 212.7 | 2.21(1.05%) | 4136 |

Ford Motor Co. | F | 6.74 | 0.08(1.20%) | 215217 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.56 | 0.20(1.39%) | 35373 |

General Electric Co | GE | 6.38 | 0.07(1.11%) | 729993 |

General Motors Company, NYSE | GM | 29.36 | 0.80(2.80%) | 181373 |

Goldman Sachs | GS | 204.07 | 1.64(0.81%) | 7531 |

Google Inc. | GOOG | 1,595.00 | 14.58(0.92%) | 10006 |

Hewlett-Packard Co. | HPQ | 18.48 | 0.25(1.37%) | 14253 |

Home Depot Inc | HD | 285.47 | 2.24(0.79%) | 17406 |

Intel Corp | INTC | 49.37 | 0.09(0.18%) | 282539 |

International Business Machines Co... | IBM | 124 | 0.84(0.68%) | 10344 |

International Paper Company | IP | 35.75 | 0.57(1.62%) | 2713 |

Johnson & Johnson | JNJ | 152.78 | 1.03(0.68%) | 12181 |

JPMorgan Chase and Co | JPM | 98.34 | 1.02(1.05%) | 52294 |

McDonald's Corp | MCD | 212.6 | 1.03(0.49%) | 2155 |

Merck & Co Inc | MRK | 85.45 | 0.47(0.55%) | 10870 |

Microsoft Corp | MSFT | 214.83 | 1.81(0.85%) | 235589 |

Nike | NKE | 110.04 | 0.29(0.26%) | 19026 |

Pfizer Inc | PFE | 39.08 | 0.20(0.51%) | 123945 |

Procter & Gamble Co | PG | 137.75 | 0.31(0.23%) | 2173 |

Starbucks Corporation, NASDAQ | SBUX | 77.88 | 0.81(1.05%) | 20401 |

Tesla Motors, Inc., NASDAQ | TSLA | 2,123.82 | 73.84(3.60%) | 555585 |

The Coca-Cola Co | KO | 47.4 | 0.12(0.25%) | 12825 |

Travelers Companies Inc | TRV | 112.25 | 0.42(0.38%) | 877 |

Twitter, Inc., NYSE | TWTR | 39.6 | 0.34(0.87%) | 92709 |

UnitedHealth Group Inc | UNH | 315.5 | 1.36(0.43%) | 579 |

Verizon Communications Inc | VZ | 59.18 | 0.19(0.33%) | 8332 |

Visa | V | 205.55 | 1.42(0.70%) | 22800 |

Wal-Mart Stores Inc | WMT | 132.42 | 0.79(0.60%) | 36128 |

Walt Disney Co | DIS | 128.8 | 1.36(1.07%) | 18957 |

Yandex N.V., NASDAQ | YNDX | 64.66 | 1.09(1.71%) | 310969 |

Apple (AAPL) target raised to $520 from $431 at Morgan Stanley

Deere (DE) upgraded to Buy from Neutral at BofA Securities; target $234

The Chicago

Federal Reserve announced on Monday the Chicago Fed national activity index

(CFNAI), a weighted average of 85 different economic indicators, came in at 1.18

in July, down from an upwardly revised 5.33 in June (originally 4.11), pointing

to a slower growth in economic activity than in June but still

well-above-average of 0.01.

Economists had

forecast the index to come in at 2.73 in July.

At the same

time, the index’s three-month moving average moved up to +3.59 in July from -2.78

in June.

According to

the report, three of the four broad categories of indicators used to construct

the index made positive contributions in July, but all four categories dropped

from June.

Production-related

indicators made a positive contribution of 1.09 to the CFNAI in July, down from

+2.21 in June. Employment-related indicators contributed +0.38 to the CFNAI in July,

down from +1.94 in June. Meanwhile, the contribution of the sales, orders, and

inventories category to the CFNAI decreased to -0.31 in July from +0.77 in June.

The contribution of the personal consumption and housing category to the CFNAI

improved decreased to +0.02 in July from +0.42 in June.

USD fell against its major rivals in the European session on Monday as hopes for a coronavirus treatment breakthrough bolstered risk appetite, while market participants waited for the Fed’s annual Jackson Hole Symposium. The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, dropped 0.39% to 92.88.

The U.S. Food and Drug Administration (FDA) issued an "emergency use authorization" for convalescent plasma as a treatment of Covid-19 in hospitalized patients. According to the FDA, early evidence indicated that the antibody-rich plasma "may be effective" in treating Covid-19. “This is a powerful therapy,” the U.S. President Donald Trump stated on Sunday at a White House news conference. “Today’s action will dramatically expand access to this treatment.” The Financial Times reported that the Trump administration is considering "fast-tracking" the Covid-19 vaccine candidate being developed by AstraZeneca and Oxford University.

Investors also looked ahead to the U.S. Federal Reserve's annual Jackson Hole meeting later in the week, where its Chair Jerome Powell will discuss the U.S. monetary policy.

FXStreet notes that the S&P 500 remains well supported above the 13-day average and uptrend from June at 3360 and 3371 respectively. Above 3400 can see the uptrend extend to the 3432/36 resistance from which economists at Credit Suisse would then look for a corrective phase.

“S&P 500 remains well supported above its 13-day average and uptrend from late June, seen at 3360 and 3371 respectively and the market has (just) managed to close at a new record high. Although the momentum picture remains poor, with a bearish RSI momentum divergence still in place, the immediate risk still leans slightly higher, even if the risk for a correction lower is seen growing steadily.”

“Above 3400 can negate the recent small bearish ‘reversal day’ for strength to trend resistance at 3416 initially, then more importantly at our ‘ideal’ objective at 3432/36. It is from here we continue to look for a correction lower to finally emerge.”

“Support moves to 3379 initially, then 3371, with a close below 3360/54 still needed to suggest a correction lower is finally underway with support then seen next at 3326, then gap support from early August at 3317/07.”

Strategists at ING note that the EUR/USD rally is showing increasing signs of fragility, the latest triggered by some disappointing eurozone PMIs on Friday, with the services gauge pouring cold water on the recent data excitement.

"Tomorrow’s Ifo indicator in Germany may be pivotal for the euro to avert another leg lower, with positive signals from manufacturing possibly offsetting the slump in services."

"While there is a chance of the correction gaining momentum and pushing the pair briefly below 1.1700 this week, the factors that drove the recent EUR/USD strength still look in place and we maintain our one-month target at 1.20."

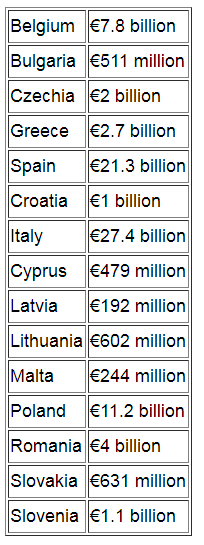

European Commission has presented proposals to the Council for decisions to grant financial support of EUR81.4 billion to 15 Member States under the SURE instrument.

Once the Council approves these proposals, the financial support will be provided in the form of loans granted on favourable terms from the EU to Member States. These loans will assist Member States in addressing sudden increases in public expenditure to preserve employment.

Following consultations with the Member States that have requested support and after assessing their requests, the Commission proposes to the Council to approve the granting of financial support to:

SURE can provide financial support of up to EUR100 billion in total to all Member States. The proposals put forward by the Commission to the Council for decisions to grant financial support amount to EUR81.4 billion and cover 15 Member States. Portugal and Hungary have already submitted formal requests which are being assessed.

NZD/USD to confirm a top on a close below 0.6503/6489 - Credit Suisse

FXStreet reports that the Credit Suisse analyst team notes that NZD/USD continues to struggle to sustainably break below key support at 0.6503/6489 despite the USD strength seen on Friday, however, a break below here would still complete a top.

“NZD/USD posted a neutral session on Friday, leaving our cautious outlook for the cross unchanged as the market still holds a large bearish ‘outside day’ and a bear ‘wedge’ and the potential for a ‘head and shoulders’ top. Furthermore, the close below the 55-day average and the cross below zero in daily MACD also provide further bearish technical signals.”

“We look for further weakness below 0.6503 /89, which would open up a move to the 23.6% retracement of the 2020 rally at 0.6422 initially, then our ‘wedge measured objective’ at 0.6400/6377. It’s worth highlighting the potential ‘measured objective’ to the larger potential top is at 0.6290.”

“Short-term resistance moves to 0.6571, above which would trigger a recovery back to the short term downtrend from the 2020 high at 0.6627/51. Only above here would remove the downside bias.”

As of Sunday, 1.07 million barrels per day (bpd) of offshore crude oil production cut in the U.S. Gulf of Mexico because of the twin threat from Hurricane Marco and Tropical Storm Laura. In addition, 44.6%, or 1,205 million cubic feet per day (mmcfd), of natural gas output was shut. Workers have been evacuated from 114 production platforms out of the 643 manned platforms in the Gulf of Mexico.

Strategists at ING note that US politics remains center stage ahead of the Republican National Convention. Investors are also keeping a close eye on the course and strength of two hurricanes set to hit the Gulf of Mexico.

"The new week has started with range-bound moves in the G10 despite Asian equities having set an optimistic tone in early trading. US politics remains center stage. Along with any developments in the US relief package talks, two threads will be closely monitored from an election perspective: (a) the $25 billion of funding to the US Postal service voted by the House, which should however be voted down by the Senate; (b) President Trump’s reported interest to fast-track the approval of Covid-19 vaccines, and the FDA having granted an emergency authorisation for blood plasma treatment."

"Developments in the first thread may impact the perceived chances of a contested result in November, while the latter is seen as a way for Trump to regain some consensus."

"Meanwhile, investors will keep a close eye on the course and the strength of two hurricanes set to hit the US Gulf of Mexico. Sixty percent of oil production in the region has already been shut, but oil has yet to benefit from the expected supply shock as rising Covid-19 contagion worldwide (and especially in Europe), are playing as a strong counter-factor for now.'

"Finally, concerns around geopolitical turmoil are being fuelled by more demonstrations in Belarus, as markets weigh the risk of direct intervention by Russia. Amid such an abundance of potentially market-moving events, data will play second-fiddle today, with the calendar looking quiet in the G10 space."

"Moving ahead in the week, risk-sentiment will depend on the ability of policymakers to keep the recovery hopes alive, and will culminate with the Jackson Hole Symposium starting on Thursday."

FXStreet reports that Charles Schwab recently conducted a second survey this year of Active Traders (>36 trades per year) to gauge how the current geopolitical climate, economic data and market conditions may be impacting trading. Ryan Frederick analyzes the results of the survey fielded between 11 August and 17 August. The S&P 500 has already rebounded 51% since the bear-market bottom on 23 March.

“31% said they are bullish on the equity markets (up from 26% in April), while only 29% are bearish (down significantly from 36% in April). Additionally, 40% (on par with 38% in April) reported feeling neutral.”

“61% expect overall market volatility in Q4 to exceed the volatility we’ve experienced (and are experiencing) in Q2 and Q3. About a quarter of you expect it to be the same, and the rest of you expect lower volatility. Even at its current level in the low 20’s, the VIX remains several points above normal levels, and is expected to increase as the election approaches.”

“Nearly half of traders (45%) believe it will take one-to-three years for the economic recovery to reach pre-COVID levels once the virus is contained, and more than 20% of you think it will take longer than three years.”

“About 74% felt there is a disconnect between the stock market and the economy. And among those who are concerned about it, 83% said they are very or somewhat concerned.”

Bloomberg reports that investors should seek portfolio hedges for Chinese equity positions as trade tensions with the U.S. mount, according to strategists at Societe Generale SA.

Stocks are yet to respond to a deterioration in U.S.-China relations since the coronavirus outbreak, particularly to developments over the summer, strategists including head of Asia equity strategy Frank Benzimra wrote in a note dated Aug. 24.

“Onshore equity markets have barely reacted,” they said. “The sanguine reaction of the market contrasts with the initial period of the trade war when tariff hikes weakened the market.”

The CSI 300 Index is up 16% for the year as China’s economy recovers from the pandemic, but White House actions against the country’s tech giants and a bill passed by the Senate in May which could restrict U.S. listings of Chinese companies have buffeted stocks recently.

FXStreet reports that EUR/USD has seen a fresh and sharp fall for the completion of a bearish “outside day” and with the momentum picture already poor this sees the threat of a top quickly return, with key support seen starting at 1.1725 and stretching down to 1.1697, per Credit Suisse.

“The brief hold above the 13-day exponential average did not last long on Friday and the subsequent sharp fall has seen this removed for the completion of a bearish ‘outside day’, and this is seen significantly raising the prospect we are looking at a near-term topping process, especially given the poor existing momentum picture.”

“Resistance at 1.1819 capping can keep the immediate risk lower with the ‘neckline’ to the top seen at 1.1725 today, with key price support then seen at 1.1710 and then more importantly at the 1.1697 August low. Only below this latter level though would see a top confirmed to mark a more important turn lower with support then seen next at 1.1661/52 – the 23.6% retracement of the entire rally from March and 38.2% retracement of the rally from late June – which we would expect to hold at first. A break in due course though can see the uptrend from May next at 1.1618, with the ‘measured top objective’ though would be seen set lower at 1.1476.”

“Above 1.1819 can see a recovery back to 1.1847, but with a break above 1.1883 needed to neutralise Friday’s bearish session, with resistance then seen next at 1.1949/53.”

Reuters reports that French authorities will in coming days reciprocate Britain’s decision to impose a 14-day quarantine on all arrivals from France, the junior minister for European affairs said on Monday.

Britain said on Friday travellers from the United Kingdom to France are required to self-certify that they are not suffering coronavirus symptoms or have been in contact with a confirmed case within 14 days preceding travel.

Since Aug. 15 British authorities have also required travellers returning from France to self-isolate upon their return due to high COVID-19 infection rates in France.

“We will have a measure called reciprocity so that our British friends do not close the border in one single way,” French Junior European Affairs Minister Clement Beaune told French TV France 2.

“For travellers returning from the United Kingdom, there will probably be restrictive measures decided in the next few days by the Prime Minister and by the Defence Council.”

Britain’s imposition of quarantine conditions have hit Briton’s favourite holiday destinations in mid-summer and have been called unnecessary by authorities in some of those countries.

FXStreet reports that analysts at JP Morgan are bearish on USD/JPY and have put in a stop loss at 107.69 in their short trade on the currency pair.

Subdued outflow of funds from Japan, USD-bearish environment due to fiscal impasse in Washington and deteriorating US-Japan real yield differential are factors that are likely to drive the currency pair lower, analysts said.

The anti-risk Japanese yen is also undervalued, analysts noted and added that the dollar remains 6% rich to its long-term average despite its recent depreciation.

MarketWatch reports that democratic presidential nominee Joe Biden said he would shut down the economy to stop the spread of the coronavirus, if that was the course of action scientists recommended to him.

In his first joint interview with his running mate Sen. Kamala Harris, Biden said that the Trump White House’s “fundamental flaw” during the pandemic was not to get it completely under control.

“In order to keep the country running and moving and the economy growing, and people employed, you have to fix the virus, you have to deal with the virus,” Biden said.

Asked if this meant shutting the economy down, Biden replied: “I would shut it down; I would listen to the scientists.”

Biden is not the first to suggest a possible second shutdown.

Minneapolis Fed President Neel Kashkari earlier in August called for a six-week shutdown to stop the spread of the coronavirus.

Fed officials have said the future health of the economy depends on the course the virus takes.

Trump administration officials have said since June that they were against a second broad shutdown of the economy.

In the ABC interview, Biden also said he was open to serving two four-year terms as president.

Asked if he was leaving open the possibility of serving eight years, Biden said: “Absolutely.”

FXStreet reports that GBP/USD’s RSI has diverged. Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, expects the cable to slump toward the 1.2814 June high whiñe below 1.3284. On the other hand, above 1.3284 GBP/USD will target the 1.35 level.

“GBP/USD last week reversed just ahead of the 1.3284 December high. The new high of 1.3268 was accompanied by a divergence of the daily RSI and this was coupled with a 13 count. We would thus allow for a corrective dip back.”

“While the cable remains below 1.3284 we would allow for a slide to the 1.2814 June high and possibly the 1.2718 support line.”

“Above 1.3284 introduces scope to the 1.3500/15 December 2019 high and the January 2009 low.”

Bloomberg reports that the U.S. economy will emerge from the recession in the second half of this year or at some point in 2021, and a majority of economists said Congress needs to extend supplemental aid, according to a National Association for Business Economics survey.

Two-thirds of panelists said the economy is still in the recession that started in February, while nearly 80% indicated that there is at least a one-in-four chance of a double-dip recession. The NABE survey summarizes the responses of 235 members and was conducted between late July and early August.

A majority of panelists said they believe Congress should extend supplemental unemployment insurance and the Paycheck Protection Program for small businesses, with 22% indicating that the next fiscal package should be $1.5 trillion to $2 trillion.

After Congress failed to agree on a new stimulus package, letting the extra $600 a week in unemployment assistance expire, President Donald Trump announced in early August that he would redirect disaster-relief funds to provide federal aid to the unemployed by executive action.

While 40% of respondents rate the fiscal response by Congress as “insufficient,” 37% said it’s “adequate.” At the same time, more than 75% of panelists said the Federal Reserve monetary policy is currently “about right,” the strongest approval in more than 13 years.

During today's Asian trading, the US dollar changed slightly against the main world currencies against the background of ambiguous signals for the market.

The rise in stock markets supports risk appetite, while continuing uncertainty about the COVID-19 situation in various regions of the world limits it.

The ICE index, which tracks the dynamics of the US dollar against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell by 0.11%.

"While the calendar of events for this week is quite light, the key will be the online event of the Federal reserve bank of Kansas city, which was traditionally held in Jackson hole," Maybank experts note.

"The online Symposium will allow the Fed to present its views on the ongoing review of monetary policy before the next meeting of the Federal open market Committee (FOMC)," the Maybank review said.

The annual event, organized by the Federal reserve of Kansas city, brings together the heads of world Central banks, finance ministers, academics and financial market participants. This year it will be held online on August 27-28. The theme of this year's event is "Moving into the next decade: consequences of monetary policy".

Reuters reports that New Zealand Prime Minister Jacinda Ardern on Monday extended a coronavirus lockdown in the country’s largest city until the end of the week and introduced mandatory mask wearing on public transport across the nation.

Ardern said the four-day extension in the city of Auckland was critical to enable the country to step down its scale of emergency restrictions - and remain at less restrictive levels.

“We want both confidence, and certainty for everyone,” Ardern said during a televised media conference.

The Auckland lockdown, imposed on Aug. 11 after officials detected the country’s first locally acquired cases of COVID-19 in more than three months, had been scheduled to end on Wednesday.

It will now end on Sunday night. The city’s step down from Level 3 to Level 2 restrictions will be made gradually from Monday, Ardern said.

Around 150 people have been diagnosed as part of the cluster that originated in Auckland, which is home to 1.7 million people, but daily new case numbers have slowed to single digit increases over the past three days.

“This is a contained cluster. But it is our biggest one. And that means the tail will be long, and the cases will keep coming for a while to come,” Ardern told reporters in Wellington.

To maintain control as Auckland eases down to Level 2 restrictions, which will allow schools and shops to reopen, public gatherings will still be restricted to a maximum of 10 people, Ardern said.

The rest of the country will remain at Level 2 restrictions, but with the broader limit of up to 100 people at public gatherings. Both situations will be reviewed before Sept. 6, she said.

New Zealand, which has a population of 5 million, has so far recorded just over 1,300 COVID-19 cases, including 22 deaths.

Meanwhile, neighbouring Australia reported its lowest one-day rise in new coronavirus infections in almost two months on Monday, fuelling optimism that a deadly second wave is subsiding.

eFXdata reports that Bank of America Global Research discusses EUR/USD outlook and now targets the pair at 1.16 by end of Q3 and at 1.14 by year-end.

"Following the strong EURUSD rally during the summer, which was mostly a USD sell-off, we see downside EURUSD risks for the remaining of the year, mostly driven by a USD correction higher. EUR has remained broadly stable with respect to non-USD currencies. The market remains long EUR, with some indicators suggesting historically stretched positioning, particularly for real money," BofA notes.

"We are concerned the consensus is: too optimistic on the global economy; too optimistic on a vaccine; too pessimistic on the Covid-19 situation in the US compared with that in Europe; and complacent on the US elections.

In the long term: we disagree with the view that the EU Recovery Fund sets a precedent; we are concerned that the consensus is focused too much on the increasing US debt and is complacent about similar or even worse trends in the rest of the world, and in the Eurozone periphery in particular; the consensus expects the Fed to keep policies loose for a long time, but may be missing a possibility that the ECB may need to keep policies loose for even longer," BofA adds.

CNBC reports that the weakening U.S. dollar is set to slide even further, but its importance as the world’s reserve currency is unlikely to be diminished, according to analysts.

The greenback had benefited as investors flew to safety amid the pandemic, which drove it to a three-and-a-half year high in March.

But now strategists say the country’s economic recovery is in question, given its weak coronavirus response. The dollar had also reacted to the country’s surging deficit and the prospect of U.S. interest rates remaining lower for longer.

The dollar index fell to a 27-month low last week at 92.477, a steep decline from its 102 level in March. Since then, it has been fluctuating, swinging between the 92 and 93 levels in the past week.

“U.S. economic outperformance relative to the euro area and Japan (no longer) seems guaranteed, at least over the next few years, given the faltering virus response. Furthermore, the European Union’s new EUR 750 billion recovery fund is giving investors more confidence in the euro as an alternative,” JPMorgan Asset Management’s Patrik Schowitz said in a recent note.

The global multi-asset strategist added: “The shrinking of its interest rate advantage makes the USD less appealing and pushes investors to consider deposits in other currencies. These cyclical factors won’t turn around in a hurry and the US dollar likely has room to fall further.”

BlackRock Investment Institute also said that dollar weakness will persist in the near term, as the factors that led to the currency’s recent decline will continue to play a part.

“The prospect of the dollar retaining its perceived safe-haven status is another concern. We are weighing these as a contentious U.S. presidential election looms,” BlackRock strategists wrote.

Analysts argue, however, that recent fears that the dollar may lose its status as the world’s reserve currency are overblown.

Research firm Capital Economics’ senior economist Jonas Goltermann says talk of the dollar’s downfall is “greatly exaggerated.”

He said dollar bears have pointed to the greenback’s declining share of global foreign exchange reserves over the past few years. According to International Monetary Fund data, the dollar share of total global reserves fell from 64.7% in the first quarter of 2017 to around 62% in the first quarter of 2020. In the last quarter of 2019, it saw a low of 60.9%.

Goltermann said, however, the dollar index’s decline since March can be attributed to reasons other than the currency’s reserve status, including low interest rates and Europe’s steps to stimulate the continent’s economy. The latter has spurred a “remarkable” shift toward the euro.

Since June, the dollar has lost around 6.6% against the euro.

RTTNews reports that retail sales values in New Zealand plummeted 15 percent on quarter in the second quarter of 2020 during the COVID-19 lockdown, Statistics New Zealand said on Monday - marking the largest drop on record going back 25 years.

Individually, declines in value were led by food and beverage services, down 40 percent (NZ$1.2 billion); fuel retailing, down 35 percent (NZ$770 million); motor vehicle and parts retailing, down 22 percent (NZ$729 million); and accommodation, down 44 percent (NZ$418 million).

"This unprecedented fall in the June quarter was not unexpected, with COVID-19 restrictions significantly limiting retail activity," retail statistics manager Kathy Hicks said. "Non-essential businesses closed temporarily for about half of the quarter during alert levels 4 and 3."

Most industries saw unprecedented sales falls in the June quarter. Sales for food and beverage services fell 40 percent or NZ$1.2 billion in the quarter, the largest drop of any industry.

"For a team of 5 million, that is equal to each person spending about $18 a week less on eating out over the June quarter," Hicks said.

Fuel retailing had the second largest fall, down 35 percent or NZ$770 million. These falls were followed by: motor vehicles and parts retailing, down 22 percent (NZ$729 million); accommodation services, down 44 percent (NZ$418 million); and hardware, building, and garden supplies down 16 percent (NZ$350 million).

These falls were partly offset by a substantial increase in supermarket and grocery stores, up 12 percent (NZ$615 million) from the June 2019 quarter. This follows a record rise of 13 percent (NZ$665 million) in the March 2020 quarter.

Sales values for the non-store and commission-based industry rose 20 percent (NZ$94 million) in the June 2020 quarter. Online businesses were in demand during the lockdown period, providing a wide range of products and the advantage of home delivery. Electrical and electronic goods retailing was up 5.4 percent (NZ$49 million).

The total volume of retail sales dropped 14 percent on quarter.

Sales volumes for food and beverage services were down 42 percent. The second largest fall was for motor vehicles and parts retailing (down 22 percent). These falls were followed by fuel retailing (down 25 percent), hardware, building and garden supplies (down 18 percent), and accommodation, (down 45 percent).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1897 (2311)

$1.1868 (2297)

$1.1844 (1181)

Price at time of writing this review: $1.1793

Support levels (open interest**, contracts):

$1.1746 (1261)

$1.1726 (787)

$1.1699 (937)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 4 is 91475 contracts (according to data from August, 21) with the maximum number of contracts with strike price $1,0500 (5007);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3242 (1107)

$1.3181 (824)

$1.3139 (1134)

Price at time of writing this review: $1.3090

Support levels (open interest**, contracts):

$1.3014 (551)

$1.2988 (508)

$1.2956 (1570)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 22605 contracts, with the maximum number of contracts with strike price $1,3800 (3394);

- Overall open interest on the PUT options with the expiration date September, 4 is 18803 contracts, with the maximum number of contracts with strike price $1,3000 (1570);

- The ratio of PUT/CALL was 0.83 versus 0.82 from the previous trading day according to data from August, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 44.26 | -1.21 |

| Silver | 26.66 | -1.99 |

| Gold | 1938.792 | -0.37 |

| Palladium | 2168.77 | -0.24 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 39.68 | 22920.3 | 0.17 |

| Hang Seng | 322.45 | 25113.84 | 1.3 |

| KOSPI | 30.37 | 2304.59 | 1.34 |

| ASX 200 | -8.8 | 6111.2 | -0.14 |

| FTSE 100 | -11.45 | 6001.89 | -0.19 |

| DAX | -65.2 | 12764.8 | -0.51 |

| CAC 40 | -14.91 | 4896.33 | -0.3 |

| Dow Jones | 190.6 | 27930.33 | 0.69 |

| S&P 500 | 11.65 | 3397.16 | 0.34 |

| NASDAQ Composite | 46.85 | 11311.8 | 0.42 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 12:30 | U.S. | Chicago Federal National Activity Index | July | 4.11 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71586 | -0.43 |

| EURJPY | 124.815 | -0.52 |

| EURUSD | 1.17958 | -0.54 |

| GBPJPY | 138.486 | -0.93 |

| GBPUSD | 1.30876 | -0.95 |

| NZDUSD | 0.65416 | 0.16 |

| USDCAD | 1.31886 | 0.07 |

| USDCHF | 0.91169 | 0.47 |

| USDJPY | 105.807 | 0.02 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.