- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-02-2014

ICE Brent Crude Oil $108.70 -0.09 -0.08%

NYMEX Crude Oil $100.35 +0.54 +0.54%

Nikkei 225 14,534.74 -265.32 -1.79%

Hang Seng 22,165.53 -120.26 -0.54%

S&P/ASX 5,308.1 -1.95 -0.04%

Shanghai Composite 2,098.4 -11.55 -0.55%

S&P 1,829.83 +10.57 +0.58%

NASDAQ 4,240.67 +39.38 +0.94%

Dow 16,027.59 +63.65 +0.40%

FTSE 6,659.42 -15.61 -0.23%

CAC 4,312.8 +7.30 +0.17%

DAX 9,596.77 +56.77 +0.60%EUR/USD $1,3679 +0,64%

GBP/USD $1,6656 +0,37%

USD/CHF Chf0,8932 -0,83%

USD/JPY Y102,16 -0,36%

EUR/JPY Y139,75 +0,29%

GBP/JPY Y170,16 +0,02%

AUD/USD $0,8977 -0,53%

NZD/USD $0,8340 +0,25%

USD/CAD C$1,0975 -0,24%

01:30 China CPI y/y January +2.5% +2.4%

06:30 France GDP, q/q (Preliminary) Quarter IV -0.1% +0.2%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.2% +0.6%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.3% +0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.1% +1.3%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.1% -0.1%

10:00 Eurozone Trade Balance s.a. December 16.0 14.5

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV -0.4% +0.4%

13:30 Canada Manufacturing Shipments (MoM) December +1.0% +0.3%

13:30 U.S. Import Price Index January 0.0% -0.1%

14:15 U.S. Industrial Production (MoM) January +0.3% +0.2%

14:15 U.S. Capacity Utilization January 79.2% 79.4%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 81.2 80.6 %

The euro exchange rate has risen considerably in relation to the U.S. dollar , which was mainly due to the publication of the ECB's Monthly Report and inflation data for Germany. Note that in his February report ECB hinted that inflation in the euro area should remain low for an extended period of time before it starts to gradually recover to the target of 2%. " Comparison with the monetary analysis confirms the reduced prices in the euro area in the medium term ," said the ECB.

According to a study of professional forecasters , forecast HICP in 2014 was revised to 1.1 % from 1.5% previously . Forecast for 2015 was lowered to 1.4 % from 1.6 % in Q4 . , The forecast for 2016 was 1.7 %.

With respect to data for Germany , inflation, agreed by EU standards , remained unchanged in January, according to preliminary estimates . These are the latest data from the Federal Statistical Office. Harmonized index of consumer prices (HICP) increased by 1.2 percent per annum in January , the result was unchanged compared with the growth rate in December . Outcome corresponded to preliminary estimates . HICP fell by 0.7 percent compared to December , when it recorded a growth of 0.5 percent . Monthly changes are also consistent with preliminary estimates .

Also had little impact on the U.S. data , which showed that retail sales fell 0.4 percent last month , led by a drop in car sales . Sales fell by a revised 0.1 percent in December . Economists had forecast that retail sales will be unchanged in January after rising 0.2 percent in December , which was reported earlier.

Meanwhile, another report showed that the number of initial claims for unemployment benefits , a measure of layoffs, increased by 8000 and amounted to a seasonally adjusted 339,000 in the week ended February 8. The result was slightly higher than the 331,000 projected by economists. Meaning last week 331,000 remained without revision.

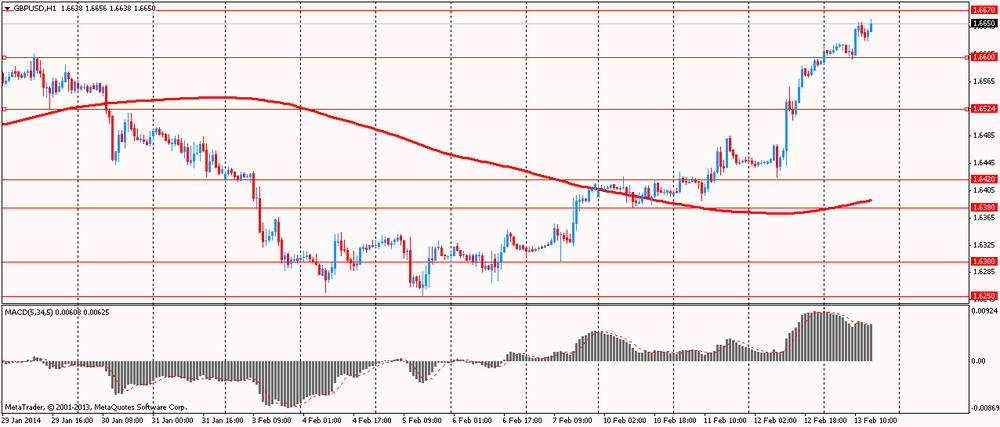

Pound rose moderately against the dollar , helped by a positive report on Britain. Monthly survey , which was presented today by the Royal Institution of Chartered Surveyors showed that house prices continued to rise last month, which was due to inventory homes near four-year low . According to the balance housing prices fell in January to 53 percent from 56 percent for December . Recall that the house price balance is calculated by subtracting the number of respondents who reported a fall in prices , and those who said that house prices rose .

The survey also showed that the average number of homes for sale through a real estate agency in January fell to the level of 59 units ( the lowest level since mid-2009 ) , compared with 60.4 units in December. It was also reported that respondents continue to expect prices to rise over the next year , which is also confirmed by other indicators of the housing market . Add that average prices were below the pre-crisis peak in 2007 , but they are moving fast towards this level.

Staying vigilant about the housing market , economists and politicians , however, argue that the "bubble" in the housing market is not a threat at the moment.

The Canadian dollar rose against the U.S. dollar , which was associated with the release of data on Canada. As it became known , Canadian prices for new homes rose slightly in December , while the increase at an annual rate showed the slowest 12-month increase in nearly four years .

Prices for new homes across the country increased by 0.1 % on a monthly measurement in December. Note that prices for new homes in the previous month showed zero change . 12 -month basis , prices rose by 1.3% , which corresponded to the market consensus forecast and represented the weakest 12-month gain since February 2010 . Rising prices in monthly terms led the Greater Toronto, where the cost of a new home rose 0.2%, the largest increase since July. In 2013, the average annual increase in the price of new homes was 1.8 % , compared with 2.4 % in the previous year , and became the smallest increase since 1999.

European stocks retreated, halting their longest winning streak of the year, as companies from Rolls-Royce Holdings Plc to BNP Paribas (BNP) SA reported results.

The Stoxx Europe 600 Index dropped 0.2 percent to 331.48 at 4:30 p.m. in London after earlier losing as much as 1 percent. The gauge jumped 4.5 percent in the six days through yesterday, with comments by Federal Reserve Chair Janet Yellen fueling optimism the economy can weather further stimulus cuts.

A U.S. Commerce Department report in Washington showed that retail sales unexpectedly declined 0.4 percent in January after falling a revised 0.1 percent the previous month. Separate data showed that initial unemployment claims rose to 339,000 in the week ended Feb. 8 from 331,000 in the prior period. Economists had expected a drop to 330,000.

European shares pared earlier losses after a report showed U.S. consumer confidence improved for the first time in five weeks. The Bloomberg Consumer Comfort Index rose to minus 30.7 in the week ended Feb. 9 from minus 33.1 the prior period. A measure of the state of the economy jumped to the highest level since September.

National benchmark indexes dropped in 13 of the 18 western-European markets.

FTSE 100 6,660.66 -14.37 -0.22% CAC 40 4,314.03 +8.53 +0.20% DAX 9,590.94 +50.94 +0.53%

Rolls-Royce (RR/) tumbled 14 percent to 1,044 pence. The maker of commercial-jet engines said 2014 revenue won’t increase because of lower demand for defense equipment. The company reported that pretax profit excluding hedging and some one-time items rose to 1.76 billion pounds ($2.9 billion) in 2013, while sales advanced 27 percent to 15.5 billion pounds.

BNP Paribas retreated 2.7 percent to 59.24 euros. Net income fell to 127 million euros ($173 million) from 519 million euros a year earlier after the lender set aside $1.1 billion. The Paris-based bank said in October that it was reviewing payments that might be subject to U.S. sanctions. Today’s result was the lowest quarterly profit since the fourth quarter of 2008, when it posted a loss, and it missed the 1.02 billion-euro average analyst estimate.

Nestle slipped 1.6 percent to 66.05 Swiss francs. The world’s largest food company projected that revenue will rise about 5 percent this year excluding acquisitions, disposals and currency shifts. The Kit Kat maker also reported the smallest annual sales advance in four years amid sluggish spending in developed markets.

Lloyds Banking Group Plc (LLOY) declined 2.4 percent to 81.5 pence. Britain’s biggest mortgage lender reported its net loss narrowed to 838 million pounds for 2013, more than the 519 million-pound loss that analysts had estimated.

ABB Ltd. (ABBN) decreased 2.5 percent to 22.42 francs. The maker of power transformers lowered its medium-term sales target, citing weak global economic growth. The company predicted that sales excluding acquisitions will grow at an annual rate of 4 percent to 5 percent in the four years to 2015. That compared with a previous target of 5.5 percent to 8.5 percent. Net income declined 13 percent to $525 million in the fourth quarter, the company said.

Commerzbank AG rose 1.6 percent to 13.61 euros. Germany’s second-largest bank said net income amounted to 64 million euros in the fourth quarter, beating the average analyst projection that called for a 23.3 million-euro profit. Today’s profit compared with a loss of 726 million in the year earlier.

Oil prices declined moderately , being near $ 108 per barrel, in anticipation of an expected drop in demand during the season refinery maintenance .

The fall in prices was also due to the Report on the United States, which showed that the number of initial claims for unemployment benefits , a measure of layoffs, increased by 8000 and amounted to a seasonally adjusted 339,000 in the week ended February 8. The result was slightly higher than the 331,000 projected by economists. Meaning last week 331,000 remained without revision. The four-week moving average of applications , which smooths the volatile weekly data , rose to 336,750 . Secondary applications for jobless benefits in the week January 26 - February 1, decreased by 18,000 to 2.953 million

Little support had a message that the International Energy Agency after OPEC raised its forecast for global oil demand. Under the new global consumption in 2014 will be about 92.6 million barrels a knock, which is 1.4 % higher than last year . Forecast annual consumption was increased by 120,000 barrels. IEA noted a significant reduction of oil reserves in storage caused by the increased demand in the developed countries , primarily the United States. At the same time, developing countries demand for oil fell . Another reason that strengthened inventory reduction , the decline in the volume of shipments from Libya by the rebels last year. Despite the fact that the level of production in this country has already recovered , you will need some time to normalize the situation . Tensions in Iraq has also helped to reduce the amount of oil in storage . In December of stocks in developed countries fell by 56.8 million barrels and reached 2.6 billion barrels. The Agency believes that countries belonging to the OPEC will increase production to replenish .

Oil prices may get some support from further supply disruptions from Libya, where protesters shut down gas and oil deposits from Wafa and blocked another major field line from El Shararah . Spokesman for the National Oil Corporation of Libya said that production fell to 460,000 barrels per day.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 100.24 a barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose 23 cents to $ 108.44 a barrel on the London exchange ICE Futures Europe.

Gold prices rose today , reaching a three-month high at the same time , and closer to $ 1,300 per ounce , as disappointing economic data from the United States put pressure on the dollar and the stock markets.

As it became known , retail sales fell 0.4 percent last month , led by a drop in car sales . Sales fell by a revised 0.1 percent in December . Economists had forecast that retail sales will be unchanged in January after rising 0.2 percent in December, which was reported earlier. Retail sales excluding auto sales remained unchanged from the previous month. Excluding autos , gasoline, building materials and food services , so-called core sales fell 0.3 percent after rising by a revised 0.3 percent down in December.

Meanwhile, another report showed that the number of initial claims for unemployment benefits , a measure of layoffs, increased by 8000 and amounted to a seasonally adjusted 339,000 in the week ended February 8. The result was slightly higher than the 331,000 projected by economists. Meaning last week 331,000 remained without revision.

The four-week moving average of applications , which smooths the volatile weekly data , rose to 336,750 .

Secondary applications for jobless benefits in the week January 26 - February 1, decreased by 18,000 to 2.953 million

With regard to the technical picture, experts say it looks more optimistic , and many participants are waiting for a dip to buy. However, they warn that the medium-term outlook for gold is still negative , given the U.S. economic recovery and the dynamics of the dollar. Recall that , as a rule , gold has an inverse correlation with the dollar - a weaker U.S. currency makes metals cheaper and increases demand . Meanwhile, investor risk aversion tends to increase interest in gold , which is often seen as a safe haven .

Traders note that strong resistance is now located at $ 1,300 per ounce, which is just the 200-day moving average .

Higher gold prices over the past few sessions reduced physical buying in China, which is the world's largest consumer of gold , after earlier in the week 's trading volume reached high values in May . We add that the premium for gold fell to $ 5 on Thursday to $ 7 in the previous session .

The cost of the April gold futures on the COMEX today rose to $ 1297.00 per ounce for ounce.

European stocks snapped a six-day rally as reported results disappointed investors and U.S. retail sales unexpectedly fell.

Global markets:

Nikkei 14,534.74 -265.32 -1.79%

Hang Seng 22,165.53 -120.26 -0.54%

Shanghai Composite 2,098.4 -11.55 -0.55%

FTSE 6,621.94 -53.09 -0.80%

CAC 4,287.35 -18.15 -0.42%

DAX 9,514.31 -25.69 -0.27%

Crude oil $100.07 (-0.30%)

Gold $1294.50 (-0.04%).

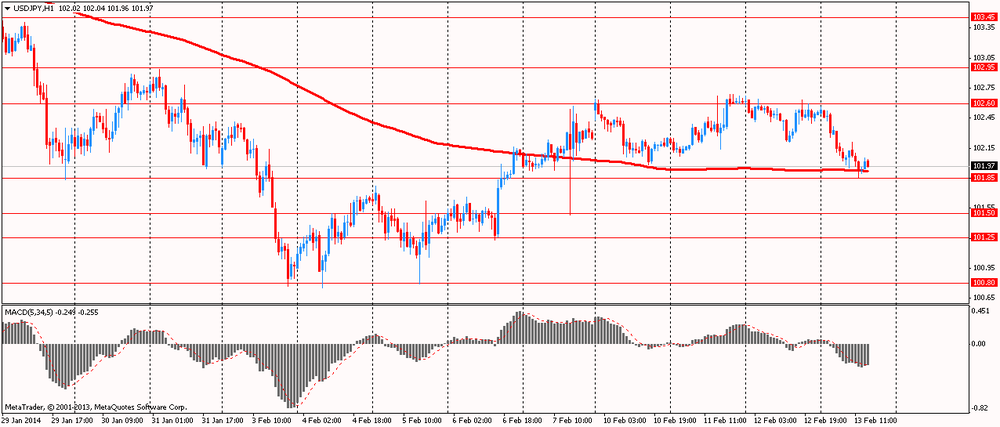

USD/JPY Y101.50, Y102.00, Y103.00

EUR/USD $1.3475, $1.3525, $1.3600

GBP/USD $1.6350-60, $1.6500

EUR/GBP stg0.8400

AUD/USD $0.9000, $0.9050

AUD/JPY Y92.00

USD/CAD C$1.1000, C$1.1100

07:00 Germany CPI, m/m (Finally) January -0.6% -0.6% -0.7%

07:00 Germany CPI, y/y (Finally) January +1.3% +1.3% +1.2%

08:15 Switzerland Producer & Import Prices, m/m January 0.0% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, y/y January -0.4% -0.3% -0.3%

09:00 Eurozone ECB Monthly Report February

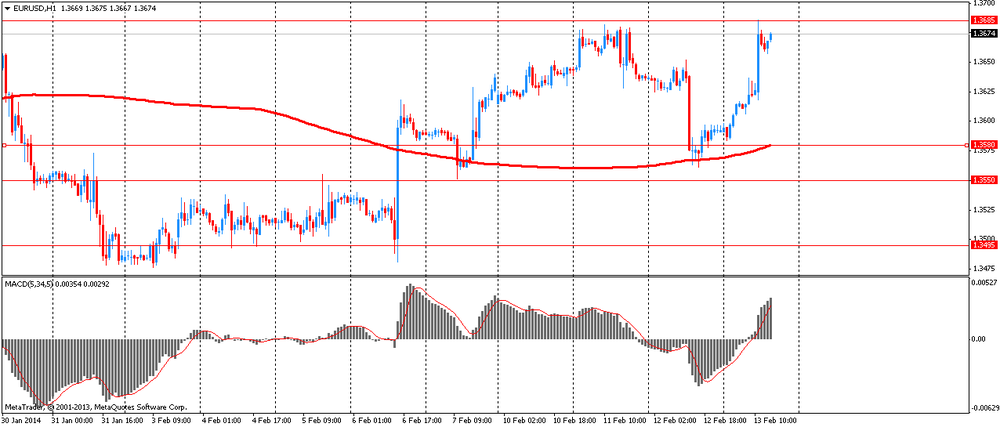

The euro rose against the U.S. dollar on a background of the ECB Monthly Report and data on inflation in Germany .

ECB in its February report indicated that inflation in the euro area should remain low for an extended period of time before it starts to gradually recover to the target of 2%. " Comparison with the monetary analysis confirms the reduced prices in the euro area in the medium term ," said the ECB.

According to a study of professional forecasters , forecast HICP in 2014 was revised to 1.1 % from 1.5% previously . Forecast for 2015 was lowered to 1.4 % from 1.6 % in Q4 . , The forecast for 2016 was 1.7 %.

With respect to data for Germany , inflation, agreed by EU standards , remained unchanged in January, according to preliminary estimates . These are the latest data from the Federal Statistical Office. Harmonized index of consumer prices (HICP) increased by 1.2 percent per annum in January , the result was unchanged compared with the growth rate in December . Outcome corresponded to preliminary estimates . HICP fell by 0.7 percent compared to December , when it recorded a growth of 0.5 percent . Monthly changes are also consistent with preliminary estimates .

Statistical Office also reported that consumer price inflation fell to 1.3 percent in January from 1.4 percent in December , according to initial estimates . Moderation in inflation mainly reflects a downward trend in prices for mineral oil products. In contrast, the cost of electricity and solid fuel increases. In monthly terms, the consumer price index fell by 0.6 percent in early 2014. This followed an increase of 0.4 percent in December .

The British pound strengthened against the U.S. dollar. Published data on the UK housing market , according to which in January house price balance of RICS ( Royal Institution of Surveyors ) fell to 53 %, compared with 56 % earlier in December. Recall that the index is calculated as the proportion of subtraction of respondents who reported a decline in prices, the share of those who reported an increase in prices.

Nevertheless , it is worth noting that the demand for homes remains strong. " It's no secret that we have seen a rise in prices in many parts of the country due mainly lack of objects represented in the market. Given the fact that more people are now attuned to buying a home than at any time in recent years , the number of objects is simply not enough to meet demand. The result is a rise in prices in many areas , and it seems to continue for the foreseeable future "- says Peter Bolton King of the RICS.

The survey also showed that the evaluators continue to expect prices to rise over the coming year .

EUR / USD: during the European session, the pair fell to $ 1.3686

GBP / USD: during the European session, the pair rose to $ 1.6656

USD / JPY: during the European session, the pair dropped to Y101.86

At 13:30 GMT , Canada will release the housing price index on the primary market in December. In the U.S. at 13:30 GMT will change in the volume of retail trade , the change in retail sales excluding auto sales , the change in volume of retail trade turnover , excluding sales of cars and fuel for January to 15:00 GMT - change in stocks in commercial warehouses for December .

EUR/USD

Offers $1.3770/80, $1.3735/50, $1.3720, $1.3690/700

Bids $1.3625/20

GBP/USD

Offers $1.6745/50, $1.6690/700

Bids $1.6600, $1.6570/65, $1.6555/50

AUD/USD

Offers $0.9050, $0.9000, $0.8980/85

Bids $0.8910/00, $0.8880, $0.8850, $0.8825/20

EUR/GBP

Offers stg0.8300/05

Bids stg0.8165/60, stg0.8150, stg0.8120

EUR/JPY

Offers Y140.95/00, Y140.50, Y140.20, Y140.00, Y139.80

Bids Y139.00, Y138.50, Y138.25/20

USD/JPY

Offers Y102.90/00, Y102.65/70, Y102.35/40

Bids Y101.55/50, Y101.00

European stocks retreated, with the Stoxx Europe 600 Index halting its longest winning streak of the year, as companies from Rolls-Royce Holdings Plc to BNP Paribas (BNP) SA reported results. Asian shares and U.S. index futures fell.

The Stoxx 600 dropped 0.6 percent to 330.11 at 10:09 a.m. in London. The gauge jumped 4.5 percent in the six days through yesterday, with comments by Federal Reserve Chair Janet Yellen fueling optimism the economy can weather further stimulus cuts. Standard & Poor’s 500 Index futures fell 0.4 percent, and the MSCI Asia Pacific Index declined 0.9 percent.

A U.S. Commerce Department report at 8:30 a.m. New York time may show that retail sales were unchanged in January, after rising 0.2 percent the previous month, according to the median economist forecast in a Bloomberg survey. Separate data will probably show that initial-unemployment claims dropped to 330,000 in the week ended Feb. 8 from 331,000 the prior period.

Rolls-Royce tumbled 13 percent to 1,051 pence. The maker of commercial-jet engines said 2014 revenue won’t increase because lower demand for defense equipment cuts into civil-aviation sales. The company reported that pretax profit excluding hedging and some one-time items rose to 1.76 billion pounds ($2.9 billion) in 2013, while sales advanced 27 percent to 15.5 billion pounds.

BNP Paribas retreated 4 percent to 58.39 euros. Net income fell to 127 million euros ($173 million) from 519 million euros a year earlier after the lender set aside $1.1 billion tied to a review of payments to parties subject to U.S. economic sanctions. That was the lowest quarterly result since 2008, and it missed the 1.02 billion-euro average analyst estimate.

Nestle, the world’s largest food company, slipped 1.6 percent to 66 Swiss francs. The company projected that revenue will rise about 5 percent this year excluding acquisitions, disposals and currency shifts. Nestle also reported the smallest annual sales advance in four years amid sluggish spending in developed markets.

FTSE 100 6,630.18 -44.85 -0.67%

CAC 40 4,291.45 -14.05 -0.33%

DAX 9,520.66 -19.34 -0.20%

USD/JPY Y101.50, Y102.00, Y103.00

EUR/USD $1.3475, $1.3525, $1.3600

GBP/USD $1.6350-60, $1.6500

EUR/GBP stg0.8400

AUD/USD $0.9000, $0.9050

AUD/JPY Y92.00

USD/CAD C$1.1000, C$1.1100

Asian stocks dropped after the regional benchmark index climbed for a sixth day yesterday to cap its longest run of advances this year.

Nikkei 225 14,534.74 -265.32 -1.79%

S&P/ASX 200 5,308.1 -1.95 -0.04%

Shanghai Composite 2,098.4 -11.55 -0.55%

Asahi Group Holdings Ltd. slid 4.5 percent in Tokyo after Japan’s second-largest beermaker’s net-income forecast missed estimates.

Tokyo Tatemono Co. plunged 8.3 percent after the developer predicted full-year operating profit below analyst expectations.

Qantas Airways Ltd. jumped 6.3 percent after the Sydney Morning Herald reported that Australian Treasurer Joe Hockey said the nation’s biggest carrier met pre-conditions for government support.

00:00 Australia Consumer Inflation Expectation February +2.3% +2.3%

00:01 United Kingdom RICS House Price Balance January 56% 59% 53%

00:30 Australia Unemployment rate January 5.8% 5.9% 6.0%

00:30 Australia Changing the number of employed January -23.0 Revised From -22.6 15.3 -3.7

01:25 Australia RBA Assist Gov Debelle Speaks

The dollar headed for its biggest drop in more than a week versus the yen before a report today forecast to show U.S. retail sales stalled. U.S. retail sales stagnated in January, according to the median estimate of economists surveyed by Bloomberg News before the U.S. Commerce Department reports the data today. That follows a 0.2 percent gain the month before, when winter clothing sales increased while auto demand dropped owing to the harsh weather.

The yen strengthened versus its most-traded counterparts as declines in Asian equities boosted demand for the perceived safety of Japan’s currency.

Australia’s dollar fell as much as 1.1 percent versus the greenback after the government said unemployment jumped to a 10-year high. In Australia, employment unexpectedly shrank by 3,700 last month. Economists polled by Bloomberg forecast a 15,000 gain. The jobless rate rose to 6 percent, the highest since July 2003, according to a Bloomberg economist poll.

Federal Reserve Chair Janet Yellen’s testimony to the Senate Banking Committee, scheduled for today, will be postponed because of a storm forecast to dump heavy snow on the U.S. East Coast. The latest storm has left thousands without electricity across the U.S. South, snarled ground and air traffic from Atlanta to New York, and spurred weather alerts from Louisiana to Maine. Washington may get 8 inches (20 centimeters) of snow, according to the National Weather Service.

EUR / USD: during the Asian session, the pair rose to $ 1.3615

GBP / USD: during the Asian session, the pair rose to $ 1.6625

USD / JPY: on Asian session the pair fell to Y102.05

A somewhat slower calendar in Europe Thursday, although there is some important data on the schedule in the US. The European calendar starts at 0700GMT, when the German January final HICP numbers are set to be published. At 0830GMT, Dutch December retail sales numbers and the January HICP numbers will be released. Also due at 0830GMT is the latest interest rate from Sweden's Riksbank. The ECB will release the February monthly report at 0900GMT, although it is expected to mirror ECB President Mario Draghi's opening statement at the recent press conference. ECB borad member Benoit Coeure speaks in Brussels at 1000GMT. On Thursday, Italy conducts its regular mid-month medium-long auctions - 1 day ahead of Moody's review of Italy's sovereign rating.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.