- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 14-12-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | RBA Meeting's Minutes | |||

| 02:00 (GMT) | China | Retail Sales y/y | November | 4.3% | |

| 02:00 (GMT) | China | Industrial Production y/y | November | 6.9% | |

| 02:00 (GMT) | China | Fixed Asset Investment | November | 1.8% | 2.6% |

| 06:45 (GMT) | Switzerland | SECO Economic Forecasts | |||

| 07:00 (GMT) | United Kingdom | Average earnings ex bonuses, 3 m/y | October | 1.9% | 2.6% |

| 07:00 (GMT) | United Kingdom | Average Earnings, 3m/y | October | 1.3% | 2.3% |

| 07:00 (GMT) | United Kingdom | ILO Unemployment Rate | October | 4.8% | 5.1% |

| 07:00 (GMT) | United Kingdom | Claimant count | November | -29.8 | |

| 07:30 (GMT) | Switzerland | Producer & Import Prices, y/y | November | -2.9% | |

| 07:45 (GMT) | France | CPI, y/y | November | 0% | 0.2% |

| 07:45 (GMT) | France | CPI, m/m | November | 0% | 0.2% |

| 09:00 (GMT) | France | IEA Oil Market Report | |||

| 13:15 (GMT) | Canada | Housing Starts | November | 214.9 | 214.8 |

| 13:30 (GMT) | Canada | Manufacturing Shipments (MoM) | October | 1.5% | 0.6% |

| 13:30 (GMT) | U.S. | NY Fed Empire State manufacturing index | December | 6.3 | 6.8 |

| 13:30 (GMT) | U.S. | Import Price Index | November | -0.1% | 0.3% |

| 14:15 (GMT) | U.S. | Capacity Utilization | November | 72.8% | 72.9% |

| 14:15 (GMT) | U.S. | Industrial Production YoY | November | -5.3% | |

| 14:15 (GMT) | U.S. | Industrial Production (MoM) | November | 1.1% | 0.3% |

| 19:30 (GMT) | Canada | BOC Gov Tiff Macklem Speaks | |||

| 21:00 (GMT) | U.S. | Net Long-term TIC Flows | October | 108.9 | |

| 21:00 (GMT) | U.S. | Total Net TIC Flows | October | -79.9 | |

| 21:45 (GMT) | New Zealand | Current Account | Quarter III | 1.828 | |

| 23:50 (GMT) | Japan | Trade Balance Total, bln | November | 872.9 | 529.8 |

- May allow lenders to payout 15% of 2019-2020 cumulative profits

- We are seeing sharp rise in coronavirus cases in London, South Wales and East England

- We have identified a new variant of the coronavirus over the last few days

- We have identified over 1000 cases of new variant; this new variant growing faster than existing variant

- Similar variance identified in other countries in recent months

- However, says nothing to suggest new variant more likely to cause serious disease

- Nothing to suggest new variant more likely to cause serious disease

- Nothing to suggest new variant won't respond to the vaccine

- London to go into top tier coronavirus restrictions

Three risks for the bright outlook of risk assets in 2021 - Rabobank

FXStreet reports that according to economists at Rabobank, risk assets can arguably outperform in 2021 unless three key, linked risks are triggered:

“First is central banks tightening monetary policy. This seems extremely unlikely. In the last rates cycle, only the US and Canada among developed markets raised their policy rate by more than 100bp, after many years, and the Fed’s attempt to unwind its bloated balance sheet did not last long before being more than reversed. Central bank escape-velocity will be harder to achieve this time round. Nonetheless, fears of reflation happening earlier than expected may be seen in H1 2021 due to a combination of base effects, commodity prices and post-Covid joie de vivre on headline inflation. Tactically, this must be noted even if strategically it is a blip in the opposite trend.”

“The second is governments implementing tighter fiscal policy. While there is little official rhetoric about a return to austerity, there are also a range of actions, overt to covert, and large to small, which suggest that this is what may still happen anyway. After all, the alternative is fundamentally too challenging for the conservative central bank/Treasury economics teams to embrace. History also suggests we will probably get this wrong.”

“The third is USD. Any new global dollar liquidity squeeze, driven by either a US recession, the need for even looser fiscal and monetary policy in other economies, or geopolitical tensions/instability, for example, would push USD higher and risk firmly off again.”

OPEC forecasts 2021 global oil demand up 5.9 mbpd versus 6.25 mbpd in prior monthly forecast

Forecasts 2020 global oil demand down 9.77 mbpd versus 9.75 mbpd in prior monthly forecast

Lower 2021 oil demand view reflects uncertainty around COVID-19 impact on OECD-transport fuel use in H1 2021 and forecast of mild winter

Recent vaccine news is upside risk

Says OPEC's oil output rose 710,000 bpd in November to 25.11 million bpd, driven by Libya recovery

Bert Colijn, a Senior Economist at ING, notes that Eurozone's industrial production surprised on the upside increasing by 2.1%, leaving production just -3.5% below pre-pandemic levels, but suggests that the winter uncertainty could well mean we see another drop in industrial output.

"Data show that eurozone industry remains immune to the impact of the second Covid-19 wave as industrial production for October increased by 2.1% month-on-month."

"The increase in output was widespread, with all production categories increasing in comparison to September except for a stable reading for non-durable consumer goods."

"For November, survey data indicates continued recovery of production as manufacturing PMI fell but stood well above 50 at 53.8. That corresponds to slowing but still strong growth as businesses indicate that new orders continue to come in despite the second wave. As new restrictive measures that dominated the economy in November left industry largely unscathed, it is indeed likely that another rise is in the making. Slower nonetheless as second-round effects of the restrictions will also plague industry."

"We don't expect similar declines as seen during the first lockdown, but the fate of the manufacturing recovery has become a lot more uncertain for the winter months."

S&P 500 Index: Close above key support at 3646/42 keeps the near-term risks higher - Credit Suisse

FXStreet notes that the S&P 500 Index reversed higher late on Friday to post a small potentially bullish ‘hammer’ candlestick reversal pattern, which looks set to be reinforced by further bullish price action today, per Credit Suisse.

“The S&P 500 reversed higher late in the day on Friday, posting a small, potentially bullish ‘hammer’ candlestick pattern. This late reversal saw the market recover to close above key price/gap support and a short-term uptrend at 3646/42. Whilst above here on a closing basis, our immediate bias stays (cautiously) higher with resistance seen at 3681 initially, above which is need to clear the way for strength back to 3712, above which would negate the recently completed ’reversal day’ and open up 3720/25.”

“Nevertheless, a small bearish ‘reversal day’ on elevated volume is still in place, with daily MACD also crossing lower. With the market also still seen in a ‘euphoric’ state (91% S&P 500 stocks are above their 200-day average and the market above the upper end of what we see as its ‘typical’ extreme) the rally is still seen at a more critical and vulnerable state and supports need to continue to be watched very carefully. However, only a close below 3646/42 would suggest a more concerted correction lower is underway with support then seen next at 3625/22.”

Stimulative policies to drive XAU/USD above $2,000 - TDS

FXStreet notes that after hitting a record $2,075.47/oz back in August, XAU/USD tumbled to just below $1,765/oz in late November and is now trading near $1,840/oz. TD Securities expects gold to perform well in the coming year as the yellow metal should do well once the economic growth path is established which will see lower volatility, higher inflation expectations and negative real rates.

“With the Fed’s intentions to ease policy by increasing the average maturity weighting of its Treasury purchases following the December FOMC meeting, gold enthusiasts may not need to wait much longer for a convincing move higher. The combination of a commitment to the zero bound and a flat yield curve should be a bullish catalyst, as it caps short and long-term rates at the same time as fiscal stimulus and vaccines drive economic normalization. This suggests that the market should see a boost in inflationary expectations, leading to a renewed downtrend in real rates and a positive outlook for gold. Such an environment is also likely to drive the USD along a declining trajectory, which is also a mana for the yellow metal.”

“Based on the nomination of Janet Yellen for the Treasury Secretary of the United States role, it is likely that the Biden Administration policies should be quite tilted to robust fiscal stimulus. Various income and social support programs may also increase inflationary expectations, and with the Fed now comfortable allowing its policy rates to move above the stated two percent target, gold should benefit once economic normalization takes root. It is likely that investor demand should be firm, with fabrication demand also being helped by the normalization.”

“With mining supply only growing modestly relative to physical demand and money supply growth and the rate environment keeping gold inventories in vaults, the yellow metal is still expected to move toward $2,100/oz over the next twelve months or so. But as recent history suggests, it will be a very bumpy road.”

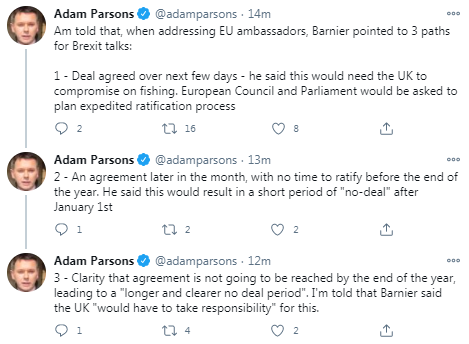

- Time is in very short supply in trade talks with EU

- No trade deal is a possible outcome, gaps still remain

WTI: Market rebalancing key to see $50 in 2021 - TDS

FXStreet notes that energy markets are projected to post a respectable performance, but the strength of the increase is likely to be less than one would expect given the magnitude of the demand recovery in 2021. This is owing to OPEC+ large excess capacity, which will be released into the market to match the recovering demand, strategists at TD Securities apprise.

“On the demand front, the rollout of a COVID-19 vaccine in the early months of the year offers upside promise for both crude and product demand. But while the balance of risks still points in an upward direction, crude is not immune to potential hiccups, as COVID-19 lockdowns can remain a concern in the early months of the year, OPEC rifts emerge and Iran becomes a political talking point once again. All of this suggests that WTI crude could very well return to a 5-handle later in the year, with Brent marginally higher, but a significant move above this level is unlikely as prices are capped by COVID-related weakness in the early part of 2021 and by further increases in OPEC+ production as the rest of the year unfolds.”

“We continue to see firm support from the supply side into 2021, but the strength is certainly easing as uncertainties mount. As such, for crude markets to continue their strength through 2021, a passing of the baton from the supply side to the demand side needs to take place. OPEC+ and US shale declines carried a large portion of the initial recovery and should continue to help, but moving beyond COVID demand dynamics is the key to further upside.”

“As the economy continues to normalize amid a readily available vaccine, and the renewed stimulus impulse kicks off, the ‘Great Rebalancing’ should remain intact. Continued deficits and eroded inventory overhang should ultimately see crude prices return to the $50/bbl region in 2021.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 10:00 | Eurozone | Industrial Production (YoY) | October | -6.3% | -4.4% | -3.8% |

| 10:00 | Eurozone | Industrial production, (MoM) | October | 0.1% | 2% | 2.1% |

| 11:00 | Germany | Bundesbank Monthly Report |

GBP rose against its major rivals in the European session on Monday amid renewed hopes for potential breakthroughs in trade negotiations between the UK and the EU.

The British Prime Minister (PM) Boris Johnson and the European Commission's (EC) president President Ursula von der Leyen agreed to extend talks on the post-Brexit trade relations despite a Sunday deadline. This renewed bets that the UK and the EU's negotiators can make a deal before Britain leaves the bloc on December 31.

Von der Leyen said on Monday that the two sides are on the very last mile in negotiations and reiterated that the EU wants a level playing field. Meanwhile, the EC's spokesman Daniel Ferrie said that that the EU is "fully dedicated to trying to reach a deal with the UK".

In addition, the EU's chief Brexit negotiator Michel Barnier sounded more upbeat about the prospects of a deal with the UK. “It is our responsibility to give the talks every chance of success,” Barnier tweeted, adding that "the next few days are important". He also noted that “fair competition, and a sustainable solution for our fishermen and women, are key to reaching a deal.”

FXStreet reports that economists at Westpac expect that the Reserve Bank of Australia (RBA) will decide to extend the program for a further six months with another $100 billion in committed purchases. What’s more, the AUD/USD pair will be rising to 0.80 over the course of 2021 and there is a risk that the RBA will assess the aussie at 0.80 as being overvalued.

“The RBA will be making its decision on the extension of the program in the context that other central banks are continuing to expand their balance sheets. We expect that by June next year, despite a much more positive growth and risk environment, central banks will still assess that they have major challenges in reaching their inflation targets and will be continuing to expand their balance sheets given they have no flexibility on short-term interest rates.”

“For 2021 our expectation is that the RBA will maintain its yield curve control approach to target the three-year bond rate at the cash rate supplemented by two rounds of QE, each at $100 billion, with a slight increase in the proportion of semi-government bonds in the ‘mix’. Looking further out recall that our forecast is for the unemployment rate to fall to 5.2% by end-2022.”

“We also expect bond yields to be rising (AU 10 year bond rates up to 1.25% by end 2021 to 1.7% by end 2022). That will also be in the context of AUD/USD rising to 0.82 in 2022 (with upside risks). Under those circumstances, we expect the RBA will be unable to credibly support forward guidance that the cash rate will remain on hold for three years – out to mid-2025.”

FXStreet notes that USD/CAD reverted back mildly higher on Friday, shifting into a near-term consolidation around the 1.2783/29 October and May 2018 lows. Looking ahead, the Credit Suisse analyst team is closely watching the key support at 1.2707/00, removal of which would see further downside unfold.

“USD/CAD has not managed to follow through from last week’s break of the 1.2783 October 2018 low, as the market remains in a consolidation phase around this level. Hence, further sideways trading is likely to unfold at first.”

“Post this consolidation, we remain biased lower over the medium-term, as a large ‘head and shoulders’ top still in place. Support is seen initially at 1.2720, then back at 1.2707/00, removal of which should see a move back to the 78.6% retracement of the 2017/2020 surge at 1.2620, where we would expect to see fresh buyers at first. Big picture, we expect a move below here in due course with support then seen next at 1.2528.”

- Inflation will remain subdued

- ECB will not accept inflation settling at levels inconsistent with its aim

- Financing conditions will need to remain very supportive even as growth accelerates from next year onwards

- We are fine about the architecture of trade deal but details are crucial

- EU is fully dedicated to trying to reach trade deal with UK

FXStreet reports that economists at TD Securities expect silver to outperform gold and reach the $30 level next year.

"Silver tends to do well when there is a favorable environment for gold. As such, it should respond positively to the same favourable macroeconomic, monetary conditions and fiscal drivers as does the yellow metal. Since silver has a historical volatility roughly double that of gold, based on historic norms it should outperform gold, when the yellow metal once again follows an upward price trajectory."

“In 2021, silver is likely to capitalize on the post-COVID industrial recovery as over 60% of silver demand comes from industrial sources.”

“Given supply is constrained and considering our improved demand projections, there will be pressure on the existing supply which should see silver move to $30/oz next year.”

According to the report from Bank of France, in November, in the context of the lockdown, activity levels hardly changed compared to October. The chemical industry improved, while the automobile sector declined. Cash positions picked up slightly and returned to their long term average. Order books continued to rise, although they remained below normal levels. Business leaders expect activity to remain stable in December.

In market services, as expected last month at the start of the lockdown, activity dropped significantly, but to a lesser extent than in March-April. Accommodation and catering services, car repairs, leisure and personal services, as well as advertising and market research, were particularly affected. Cash position deteriorated slightly, below pre-crisis levels. Business leaders expect little change in activity in December, although the situation may vary across sectors.

In construction, activity levels were stable. Order books rose slightly, but remained below their long-term average. Business leaders expect activity to remain virtually unchanged in December.

According to the report from Eurostat, in October 2020, the seasonally adjusted industrial production rose by 2.1% in the euro area and by 1.9% in the EU, compared with September 2020. Economists had expected a 2.0% increase in the euro area. In September 2020, industrial production grew by 0.1% in the euro area and by 0.3% in the EU.

In October 2020 compared with October 2019, industrial production decreased by 3.8% in the euro area and by 3.1% in the EU.

In the euro area in October 2020, compared with September 2020, production of capital goods rose by 2.6%, intermediate goods by 2.1%, energy by 1.8% and durable consumer goods by 1.5%, while production of nondurable consumer goods remained unchanged. In the EU, production of capital goods rose by 2.6%, intermediate goods by 2.1%, durable consumer goods by 1.3% and energy by 1.2%, while production of non-durable consumer goods fell by 0.4%.

In the euro area in October 2020, compared with October 2019, production of capital goods fell by 8.2%, nondurable consumer goods by 2.1% and intermediate goods by 1.3%, while production of durable consumer goods rose by 0.3% and energy by 0.1%. In the EU, production of capital goods fell by 7.1%, non-durable consumer goods by 2.4%, energy by 1.5% and intermediate goods by 0.5%, while production of durable consumer goods rose by 2.3%.

FXStreet reports that according to analysts at Nordea, the ECB has paved the way for 1.25 levels in the EUR/USD pair.

“The ECB refrained from rattling the EUR bull cage as the deposit rate cut remains a tail scenario for the policymakers”. The trade-weighted EUR has roughly traded sideways since August”

“The ECB inflation staff projections treat FX very mechanically. A development in line with the 75th percentile in a ‘risk cone’ around the implied EUR/USD forward equals a 0.2%, 0.5% and 0.6% downwards revision of 2021,2022 and 2023 in forecasts. It also means that EUR/USD can move to 1.25 or thereabout during the spring without any repercussions should inflation surprise by 0.2%-points compared to the current staff projection.”

FXStreet reports that although a no-deal is clearly the biggest near-term downside risk to the UK economy, economists at Capital Economics doubt the economic consequences will be as big as most fear.

“A ‘no-deal’ would most probably involve all those agreements in the Withdrawal Agreement (the financial settlement, citizens’ rights, Northern Ireland), the substantial progress made on financial services equivalence and the rollover of the bulk of the UK’s third-party EU trade deals. A no-deal at this stage would be a less disruptive ‘cooperative’ no deal than a more disruptive ‘uncooperative’ no-deal. As a result, the economic consequences would probably be smaller than most people fear.”

“The Bank of England would probably respond by loosening monetary policy further (perhaps by increasing the pace of its gilt purchase, increasing its purchases of corporate bonds and/or widening its lending schemes to banks and businesses) and the Chancellor may also loosen fiscal policy (perhaps by cutting VAT and/or providing financial support to those businesses whose exports to the EU would be subject to tariffs).”

“We suspect that in a ‘cooperative’ no-deal GDP growth would be around 1% lower in 2021 as a whole than it would be if there were a deal. Put into context, the COVID-19 crisis has meant that GDP this year will be about 11.5% lower than last year and at one point earlier this year it was 25% lower.”

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade fell by 1.7% in November 2020 in comparison with the corresponding month of the preceding year. In October 2020 and in September 2020 the annual rates of change had been -1.9% and -1.8%, respectively.

From October 2020 to November 2020 the index rose slightly by 0.1%.

The biggest influence on the decline in wholesale selling prices compared to November 2019 was the price development in wholesale petroleum products (-18.1 %).

There were also sharp price decreases compared to the previous year in the wholesale trade of live animals (-22.9 %). Prices fell slightly in the wholesale trade of data processing equipment, peripheral equipment and Software (-3.7%) and in iron, steel, semi - finished products (-1.6%).

On the other hand, prices were particularly higher than in November 2019 in the wholesale trade of waste materials and residual materials (+7.5%), cereals, raw tobacco, seeds and animal feed (+7.2 %) and fruit, vegetables and potatoes (+2.0 %).

FXStreet reports that Morgan Stanley analysts foresee 2021 as another big year for liquidity injection.

"On our projections, G10 central banks will inject another US$2.8 trillion of liquidity next year – just in their government bond purchases. That's more than twice the amount of liquidity central banks injected in any year prior to the one drawing to a close," Morgan Stanley analysts said.

"The US dollar has further to fall against a host of G10 and emerging market currencies next year, and the safest investment of all – US Treasuries – will struggle to make ends meet. Scarce assets such as gold could also benefit from the massive liquidity injections," the investment bank said.

Reuters reports that Michel Barnier, the European Union's Brexit negotiator, said that sealing a new trade pact with Britain was still possible and that negotiations are continuing to attempt to solve rifts over access to UK fishing waters and rules of economic fair play for companies.

"A good, balanced agreement. That means two conditions which aren't met yet. Free and fair competition... and an agreement which guarantees reciprocal access to markets and waters. And it's on these points that we haven't found the right balance with the British. So we keep working," Barnier said.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 04:30 | Japan | Industrial Production (YoY) | October | -9.8% | -3.2% | -3% |

| 04:30 | Japan | Tertiary Industry Index | October | 2.3% | 1% | |

| 04:30 | Japan | Industrial Production (MoM) | October | 3.9% | 3.8% | 4% |

During today's Asian trading, the US dollar declined against major currencies amid growing risk appetite due to news about the COVID-19 coronavirus vaccine and hopes for new measures to support the us economy.

The Food and drug administration (FDA) has approved the emergency use of Pfizer and BioNTech's COVID-19 coronavirus vaccine in the United States. A mass vaccination campaign against COVID-19 is expected to start in the United States on Monday.

Meanwhile, a group of congressmen from the Democratic and Republican parties plans to divide the package of new measures to support the US economy into two separate proposals, CNN reports. The first part of the $748 billion package includes, in particular, support for small businesses and the unemployed, while the second part, worth $160 billion, includes assistance to local authorities and protection of companies from claims related to the pandemic. The first part of the package is expected to receive broad support from members of the US Congress.

This week, investors are waiting for the results of the meeting of the US Fed.

The pound rose against the dollar. British Prime Minister Boris Johnson on Sunday said that London is committed to continuing negotiations with the EU on relations after Brexit, but is not sure that they will produce a result.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.37%.

Reuters reports that the Bank of France said that the French economy will rebound next year as coronavirus restrictions are lifted although not as fast as previously expected.

After contracting about 9% this year, the euro zone's second biggest economy will post growth around 5% in 2021 and 2022 before easing to slightly more than 2% in 2023, the Bank of France forecast.

Prior to the second wave, the bank had forecast in September a contraction of 8.7% this year and growth of 7.4% in 2021 and 3% in 2022.

The French economy would not return to pre-crisis levels of output until mid-2022, it said, whereas that had previously been expected early next year.

Despite the anticipated rebound, the unemployment rate is expected to keep rising to 11% in the first half of 2021 before falling to 9% by the end of 2023.

eFXdata reports that Citi maintains a medium-term bullish bias on EUR/USD through 2021.

"CitiFX acknowledges the December ECB Meeting was slightly hawkish relative to our expectations. The ECB reinforced the persistence of stimulus, including by increasing the PEPP envelope by EUR500bn until at least March 2022 and recalibrating a range of other measures, notably LTRO terms and reinvestments," Citi notes.

"We continue to hold our long-standing medium-term EURUSD bullish bias with a target of 1.30, based on cyclical recovery, the search for value, diversification, changes in hedging and funding patterns and an expectation that the ECB would not yet try to aggressively stall EUR appreciation," Citi adds.

RTTNews reports that the Bank of Japan's quarterly Tankan Survey on business sentiment showed that large manufacturing in Japan posted some improvement in the fourth quarter of 2020 - diffusion index climbs to -10. That beat forecasts for a reading of -15 as expectations were very soft because of the global Covid-19 pandemic. But it was up from a score of -27 three months ago.

The outlook came in at -8, again beating expectations for -11 and up from -17 in the previous quarter.

The large non-manufacturers index came in at -5, beating forecasts for -6 and up from -12. The outlook came in at -6, also topping forecasts for -7 and up from -11 in the three months prior.

Large all industry capex is now seen lower by 1.2 percent, missing expectations for a fall of 0.1 percent and down from 1.4 percent in the previous three months.

The index for business conditions came in at -10 for large enterprises, -17 for medium and -27 for small.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2241 (1014)

$1.2218 (1399)

$1.2199 (832)

Price at time of writing this review: $1.2139

Support levels (open interest**, contracts):

$1.2051 (1425)

$1.2025 (3892)

$1.1993 (699)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 8 is 61911 contracts (according to data from December, 11) with the maximum number of contracts with strike price $1,1800 (4204);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3438 (303)

$1.3403 (646)

$1.3375 (1530)

Price at time of writing this review: $1.3321

Support levels (open interest**, contracts):

$1.3172 (643)

$1.3143 (520)

$1.3106 (653)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 58466 contracts, with the maximum number of contracts with strike price $1,4000 (33013);

- Overall open interest on the PUT options with the expiration date January, 8 is 27324 contracts, with the maximum number of contracts with strike price $1,2800 (4020);

- The ratio of PUT/CALL was 0.47 versus 0.47 from the previous trading day according to data from December, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 (GMT) | Japan | Industrial Production (YoY) | October | -9% | -3.2% |

| 04:30 (GMT) | Japan | Industrial Production (MoM) | October | 3.9% | 3.8% |

| 04:30 (GMT) | Japan | Tertiary Industry Index | October | 1.8% | |

| 10:00 (GMT) | Eurozone | Industrial Production (YoY) | October | -6.8% | -4.4% |

| 10:00 (GMT) | Eurozone | Industrial production, (MoM) | October | -0.4% | 2% |

| 11:00 (GMT) | Germany | Bundesbank Monthly Report |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.75307 | -0.01 |

| EURJPY | 126.032 | -0.36 |

| EURUSD | 1.21127 | -0.2 |

| GBPJPY | 137.525 | -0.73 |

| GBPUSD | 1.32176 | -0.54 |

| NZDUSD | 0.70807 | -0.16 |

| USDCAD | 1.27671 | 0.21 |

| USDCHF | 0.88929 | 0.39 |

| USDJPY | 104.044 | -0.17 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.