- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 21-07-2022

- EUR/GBP is juggling in a minute range of 0.8520-0.8527 as investors await UK Retail Sales.

- The ECB paddled up its interest rates surprisingly by 50 bps.

- A slippage in UK Retail Sales is likely to weaken the pound bulls.

The EUR/GBP pair is displaying back and forth moves in a narrow range of 0.8520-0.8527 in the early Tokyo session. The cross has turned sideways as investors are awaiting the release of the UK Retail Sales. In the New York session, the asset surrendered its entire gains recorded on an interest rate hike by the European Central Bank (ECB).

ECB President Christine Lagarde unexpectedly announced a rate hike by half a percent vs. expectations of 25 bps. Credit goes to the soaring price pressures which forced the ECB policymaker to feature a jumbo rate hike. Earlier, ECB Large in his testimony guided that the ECB is interested in elevating interest rates by 25 bps in July and later on by 50 bps in September.

Also, the ECB announced a new quantitative tool to support the southern European economies. The new fragmented tool ‘Transmission Protection Instrument’ will provide liquidity to the above-mentioned countries against public securities and also private securities, if required, having a maturity period of 1-10 years.

As per the market consensus, the UK Retail Sales may slip to -5.3% vs. -4.7% recorded earlier. This indicates the vulnerability in the overall demand in the UK. The Retail Sales data is already contaminated with higher price pressures and more damage to the Retail Sales indicates that the overall demand is extremely lower.

- AUD/NZD has faced barricades around while attempting to surpass 1.1095 on weak Aussie PMI.

- The upbeat Australian employment data will support the RBA for hiking rates unhesitatingly.

- Kiwi bulls remained under pressure despite the rate hike announcement by the RBNZ.

The AUD/NZD pair has slipped below 1.1090 as the S&P Global reported downbeat Aussie PMI data. The Composite PMI has landed at 50.6, lower than the prior release of 52.6. Also, the Manufacturing and Services PMI remained lower at 55.7 and 50.4 respectively than their expectations and their former figures.

The cross has remained in the grip of bulls for the past week after the release of the upbeat aussie employment data. The Unemployment rate slipped significantly to 3.5% from the prior release of 3.9% and the expectations of 3.8%. The print of 3.5% jobless rate has been the lowest in the past 48 years. Also, the economy managed to generate 88.4k employment opportunities in June, much higher than the estimates of 25k and the former figure of 60.6K. There is no denying the fact that the tight labor market will delight the Reserve Bank of Australia (RBA) while drafting the next rate hike.

On the kiwi front, the kiwi bulls have failed to capitalize on the interest rate hike announcement by the Reserve Bank of New Zealand (RBNZ). RBNZ Adrian Orr features a consecutive rate hike by 50 basis points (bps), pushing the Official Cash Rate (OCR) to 2.5% in order to combat the runaway inflation rate.

Next week, the release of the Australian Consumer Price Index (CPI) by the Bureau of Statistics will be of significant importance. Earlier, the overall CPI for the first quarter of CY2022 landed at 5.1%. This time, investors should brace for further elevation as oil prices remained upbeat.

- EUR/JPY is set to finish the week with decent gains of 0.58%.

- The EUR/JPY seesawed on a 200 pip range due to ECB’s decision on Thursday.

- EUR/JPY Price Analysis: The hourly chart is neutral-downward biased and might print a leg up towards 141.00 before resuming downwards.

The EUR/JPY edges up as the Asian session begins, though it is trading near Thursday’s lows, printed on a volatile trading session, where the European Central Bank (ECB) hiked rates by 50 bps. After the ECB's decision, the EUR/JPY hit a fresh two-week high at 142.32 but nosedived to the daily low at 140.13 once investors dissected the monetary policy statement, alongside the ECB’s President Mrs. Lagarde’s presser. At the time of writing, the EUR/JPY is trading at 140.41.

Also read: EUR/JPY Price Analysis: Struggles around 142.00, tanks below 140.50

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart depicts the pair as neutral biased, even though the daily EMAs reside below the spot price. EUR/JPY traders should note that buyers have been unable to challenge the YTD high around 144.27, signaling sellers that it was the time to step in. The latter ones piled around the GBP/JPY weekly high around 142.32 and sent the pair towards the 20-day EMA at 140.17, but they will need a daily close below to increase their chances of testing the 50-day EMA at 139.61.

EUR/JPY 1-hour chart

The EUR/JPY hourly chart is neutral-to-downward biased. Although the hourly EMAs are above the exchange rate, except for the 200-hour, the Relative Strenght Index (RSI) shifted above the RSI’s 7-period SMA, used them in conjunction as buying/selling signals, suggesting that a leg-up is on the cards. Therefore, the GBP/JPY might aim to the confluence of the 20 and 50-hour EMAs, where the daily pivot resides around the 140.95-141.05 area, before resuming downwards.

That said, the GBP/JPY’s first support will be the July 21 daily low at 140.13. A breach of the latter will expose the confluence of the 200-hour EMA and the S1 daily pivot around the 139.53-63 range, followed by a challenge to the S2 daily pivot at 138.80.

EUR/JPY Key Technical Levels

- AUD/JPY takes offers to refresh intraday low after Australia’s PMIs for July.

- Australia’s preliminary S&P global PMIs for July dropped below market forecasts and prior.

- BOJ couldn’t help yen, Aussie benefited from mildly positive market sentiment.

- Japan’s National Consumer Price Index for June, risk catalysts will be important for fresh impulse.

AUD/JPY slides towards 95.00, down 0.10% intraday near 95.15 during Friday’s initial Asian session. The cross-currency pair posted a corrective pullback around 95.60 the previous day but the bears returned to the table on downbeat Australia data, not to forget the fears of recession.

Australia’s S&P Global Manufacturing PMI eased to 55.7 in July versus 56.2 prior and 56.4 expected. Further, the S&P Global Services PMI dropped to 50.4 during the stated month compared to 55.0 market consensus and 52.6 prior. Further, the S&P Global Composite PMI also declined to 50.6 versus 52.6 previous readouts.

Bank of Japan (BOJ) announced no change in its monetary policy the previous day while keeping the benchmark rate unchanged at -0.10% while keeping the target rate for the Japanese Government Bonds (JGBs) at 0.0%. However, fears of firmer inflation and challenges to growth, as signaled in the BOJ’s quarterly Outlook Report appeared to have weighed on the Japanese yen.

It’s worth noting that the risk-on mood appeared to have favored the AUD/JPY, due to its risk barometer status. The upbeat sentiment could be linked to the resumption of gas flows from Russia’s Nord Stream 1 pipeline, as well as the European Central Bank’s (ECB) new tool called the Transmission Protection Instrument (TPI) to tame disorderly market dynamics in the bloc.

Amid these plays, Wall Street benchmarks closed firmer and the US Treasury 10-year Treasury yields marked the biggest daily slump in five weeks. That said, S&P 500 Futures drops 0.40% by the press time.

Moving on, Japan’s National Consumer Price Index (CPI) for June, prior 2.5% YoY, could offer immediate directions. However, major attention will be given to the risk catalysts for fresh impulse.

Technical analysis

AUD/JPY remains mildly positive while trading between a weekly support line around 95.25 and a three-month-old horizontal resistance near 95.75.

- WTI pares the biggest daily loss in over a week ahead of the key activity data for July.

- Restoration of Nord Stream 1 gas pipeline drowned oil prices despite risk-on mood, softer USD.

- Libya’s resumption of oil production, ECB rate hikes and fears of recession in China also favor sellers.

- Key PMIs for the US, Eurozone and the UK will be crucial to watch.

WTI crude oil prices remain sidelined at around $96.00, after posting the biggest daily slump in eight days, as energy traders await fresh clues. The black gold dropped heavily the previous day, despite the risk-on mood, amid fears of more output and less demand.

The resumption of gas flows from Russia’s Nord Stream 1 pipeline was the key catalyst weighing on the oil prices. “Flows through Russia's Nord Stream 1 natural gas pipeline, which runs under the Baltic Sea to Germany, partially resumed after being shut for maintenance on July 11. The pipeline had already run on reduced volumes following a dispute sparked by Russia's invasion of Ukraine,” said Reuters.

On the same line as the European Central Bank’s (ECB) higher-than-expected 0.50% rate hike, as well as the announcement of the Transmission Protection Instrument (TPI) tool. Analysts at the Australia and New Zealand Banking Group (ANZ) describe it as a bond purchase program aimed at countering unwarranted disorderly market dynamics that pose a risk to effectively delivering on its price stability mandate.

Elsewhere, the resumption of oil production by Libya's National Oil Corp (NOC) and fears of China’s economic slowdown, as signaled by the Asian Development Bank (ADB) the previous day, also weigh on the black gold prices.

It’s worth noting, however, that the softer US dollar and risk-on mood may help the energy benchmark to lick its wounds.

Moving on, the preliminary activity details for July will be important for the oil traders amid fears of an economic slowdown. Also important will be how the major oil producers react to the US-led push to increase the output to tame the prices. Recently, Russian President Vladimir Putin called Saudi Arabia’s Crown Prince Mohammed bin Salman to discuss the output as they both led OPEC+ producers in June.

Technical analysis

Despite the U-turn from $100.69, WTI bears need validation from the 200-DMA level of $93.65 to retake control.

- The GBP/JPY is set to finish the week with gains, up by 0.37%.

- GBP/JPY Price Analysis: A break below the 200-hour EMA to send the pair sinking towards 163.60s.

GBP/JPY barely rises as the Asian Pacific session begins, after Thursday’s session witnessed the cross-currency pair sliding from daily highs near 166.00 to 164.53 daily lows, in a volatile trading session, where the European Central Bank (ECB) grabbed the spotlight, hiking 50 bps for the first time in a decade. At the time of writing, the GBP/JPY is trading at 164.90, up 0.10%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart depicts the pair as upward biased. Nevertheless, the risks are skewed to the downside, as sellers piled around the high 165.90-166.00 area and sent the pair plummeting towards the July 11 daily high at 164.46, which, once broken according to market structure, would shift the trend to neutral.

GBP/JPY 1-hour chart

The GBP/JPY hourly chart depicts the pair as downward biased. GBP/JPY buyers, unable to break Wednesday’s high around 166.25, left the pair vulnerable, so sellers stepped in and dragged the cross-currency pair towards the daily low around 164.53. Worth noting that the Relative Strength Index (RSI) is aiming higher but remains in bearish territory. However, the price action suggests that the GBP/JPY might print a leg up to the confluence of the 20 and 50-hour EMAs, around 165.26-33, before resuming the downtrend.

Therefore, the GBP/JPY first support would be the 200-hour EMA at 164.43. Break below will expose the S1 daily pivot at 164.20, followed by the 164.00 figure. A decisive break will send the GBP/JPY sliding towards the July 15 daily low at 163.64.

GBP/JPY Key Technical Levels

- EURUSD is advancing towards 1.0300 as DXY tumbles amid a positive market mood.

- The ECB elevated its interest rates by 50 bps and announced a new tool ‘TPI’ to support southern Europe.

- Investors are shifting their focus to the Fed as it will announce monetary policy next week.

EURUSD price is displaying a sheer upside move after picking bids below 1.0200 in the late New York session. The pair displayed wild moves on Thursday after the European Central Bank (ECB) came forward with 50 basis points (bps) interest rate hike. The asset printed a fresh three-week high of 1.0277 and is expected to reclaim again. Broadly, the major has turned sideways and is auctioning in a wide range of 1.0153-1.0277 from the past three trading sessions.

The US dollar index (DXY) has surrendered the cushion of 107.00 completely after failing to sustain above 107.30 on Thursday. On a broader note, the asset is consolidating in a wide range of 106.40-107.33 and is eyeing a fresh downside impulsive wave with a downside break. It is worth noting that the asset has displayed volatility contraction after a sheer downside move from a high of 109.30, recorded last week. Now, the ongoing process of inventory distribution will unfold the downside potential.

Also Read: Oversized ECB hike fails to turn the tide on EURUSD

ECB President Christine Lagarde announced a rate hike by 50 bps

EURUSD turns volatile as ECB hikes interest rates surprisingly by 50 bps

EURUSD price displayed topsy-turvy moves on Thursday as the ECB elevated its interest rates by 50 bps. ECB President Christine Lagarde unexpectedly announced a rate hike by half a percent vs. expectations of 25 bps. Credit goes to the soaring price pressures which forced the ECB policymaker to feature a jumbo rate hike. Earlier, ECB Large in his testimony guided that the ECB is interested in elevating interest rates by 25 bps in July and later on by 50 bps in September.

-637940398461598499.png)

-637940398463808994.png)

Introduction of TPI to support Southern Europe

ECB President Christine Lagarde came with plenty of surprises on Thursday. Other than the interest rate hike by 50 bps, the introduction of the Transmission protection Instrument (TPI) to support southern European economies was not expected. The announcement of higher interest rates may be fruitful for core European Union (EU) members such as Germany and France due to their stable financial position. However, southern European economies such as Italy, Greece, and Spain that are facing financial instability may face more headwinds due to higher borrowing costs.

Therefore, the ECB has introduced a new fragmented tool under which the ECB will purchase public securities of these countries and also private securities, if required, to support them against unwarranted deterioration in financing conditions. The public securities would have a maturity between 1 to 10 years.

ECB is unable to determine a neutral rate for now

EURUSD price vapored its optimism early on Thursday after ECB Lagarde didn’t lay down a crisp framework for neutral rates that would keep inflation near its standards. Price pressures have soared in eurozone as a figure of 8.6% for an overall inflation rate is sufficient to annoy households. It looks like the ECB has still not crunched out how far price pressures can go, which has paused them to derive neutral rates for lending operations.

Focus shifts to Fed

EURUSD price is likely to find further direction from the monetary policy announcement by the Federal Reserve (Fed), which is due next week. As a slippage in long-run inflation expectations ruined the odds of a rate hike by 100 bps, an interest rate decision by 75 bps is still on the cards. No doubt, the decision will accelerate the Fed-ECB policy divergence further in absolute terms. But relative mathematics in Fed-ECB policy divergence will calm down as ECB has just started hiking its interest rates.

DXY sees a bumpy ride on firmer Wall Street

The DXY surrendered its optimism on Thursday after the second quarter show by the US companies delighted with the better-than-expected earnings from Tesla. Wall Street remained firmer led by upbeat results from Tesla and a stellar performance by tech companies. This improved the risk appetite of the market participants and the safe haven lost its appeal. The DXY is looking bearish now and is expected to extend its losses after slipping below Wednesday’s low at 106.39.

EURUSD technical analysis

EURUSD price is forming a Bullish Flag on a four-hour scale that signals a continuation of bullish momentum after a rangebound phase. Usually, a consolidation phase denotes intensive buying interest from the market participants, which prefer to enter an auction after the establishment of the trend.

The shared currency bulls have successfully defended the 20-period Exponential Moving Averages (EMA) a few times around 1.01720, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is attempting to shift into the bullish range of 60.00-80.00. An occurrence of the same will infuse fresh blood into the shared currency bulls.

A breach of Thursday’s high at 1.0278 will drive the asset towards the round-level resistance at 1.0300, followed by July 1 low at 1.0366.

Alternatively, the greenback bulls could gain control if the asset drops below Monday’s low at 1.0081. An occurrence of the same will drag the asset towards the psychological support at 1.0000. A breach of the psychological support will expose the greenback bulls to recapture its two-year low at 0.9952.

EURUSD four-hour chart

-637940397943628907.png)

Elliott Wave Trading Strategies: DAX 40, FTSE 100, STOXX 50, DXY, EUR/USD

- USD/CAD remains pressured towards three-week-old ascending support line.

- RSI retreat, failures to cross 200-SMA and monthly horizontal resistance all favor sellers.

- 61.8% Fibonacci retracement of June-July upside adds to the downside filters.

USD/CAD holds lower grounds around 1.2870 during the initial hour of Friday’s Asian session, after reversing from 1.2936 the previous day. In doing so, the Loonie pair portrays the initially to stay beyond the 200-SMA while also marking the U-turn from a horizontal resistance establishes since the month’s start.

Given the downbeat RSI and sluggish MACD adding strength to the bearish bias, the USD/CAD prices are likely to challenge an upward sloping support line from June 28, at 1.2850 by the press time.

Following that, the 61.8% Fibonacci retracement (Fibo.) of the June-July advances, near 1.2785, will be important to watch for the pair sellers.

Meanwhile, the 200-SMA and the aforementioned horizontal resistance, respectively near 1.2915 and 1.2940, guard short-term recovery moves of the USD/CAD pair.

Following that, an area comprising multiple levels marked since June 17, between 1.3080 and 1.3090, could challenge the pair buyers before directing them to the monthly peak of 1.3223.

Overall, USD/CAD is likely to witness further downside but needs validation from 1.2850.

USD/CAD: four-hour chart

Trend: Further weakness expected

- Bulls run up to a key level on the charts and a correction could be in order.

- AUD/USD W-formation on the 4-hour time frame is a compelling feature.

AUD/USD is flat in the first hour of Asian trade on Friday as it moves in on extremes of a broadening formation on the charts, but fundamentally, the stock markets o Wall Street and a softer US dollar have been a driver as well as a hawkish central bank. AUD/USD rallied to 0.6937 from a session low of 0.6858.

On Wednesday Reserve Bank of Australia, (RBA) Governor Philip Lowe emphasised higher rates with the Australian government bond futures have also started to price in higher rates. Yields on most government bonds up about 10 basis points since the start of the week.

Global stock markets are also supportive of the Aussie and are on track for a fifth straight session of gains. The euro was up in and the greenback down in choppy trading after the European Central Bank raised interest rates for the first time in more than a decade as it tries to combat inflation. The ECB rose by 50 bps and it also introduced a bond protection plan, called the Transmission Protection Instrument (TPI), that is designed to cap borrowing costs across the region.

Another thorn in the side of the US dollar, Wall Street's main indexes climbed on Thursday boosted by a late-afternoon rally and gains in heavyweight growth stocks, including Tesla. The tech-heavy Nasdaq added 1.4% to lead the gains while the S&P 500 closed at its highest level since June 9. The Dow Jones Industrial Average climbed 0.5%.

Meanwhile, despite a risk on tone in financial markets, the concerns over Europe's gas supply, fresh wobbles in China's property market and the detection of foot-and-mouth viral fragments in imported meat products in Australia could be a weight going forward.

Additionally, traders will wait anxiously for the US Federal Reserve meeting next week where policymakers are expected to raise interest rates by 75 basis points to curb runaway inflation. There will also be a focus on crucial second-quarter US Gross Domestic product data, which is likely to be negative again. Two-quarters of negative GDP growth would mean the United States is in a recession, which has been a supportive factor for the greenback for its safe haven qualities. If stocks stumble on a bad outcome, the Aussie will potentially follow suit.

AUD/USD technical analysis

The price is meeting a broadening formation extreme and the W-formation on the 4-hour time frame is a compelling feature as well which could see the price revert to test the neckline and 15-min price bar lows if bears stay committed. 0.6890 is eyed in that regard.

- The Japanese yen appreciated sharply against the greenback, more than 0.60%.

- Worse than expected, US data begins to anticipate a recession.

- The Bank of Japan (BoJ) kept rates unchanged and pledged to its ultra-loose monetary policy stance.

The USD/JPY plunges as Wall Street Thursday’s session ends, with equities registering decent gains as sentiment improved since the mid-North American session, despite high inflation and growing concerns of a global recession. However, instead of boosting the greenback, the Japanese yen strengthened and trimmed weekly losses amidst an upbeat market mood.

The USD/JPY is trading at 137.39, down 0.56%. The major began trading around the 138.00 area but rallied towards the bottom trendline of a daily chart ascending wedge near 138.87, tumbling afterward as the greenback and US Treasury yields plunged. That said, the USD/JPY hit the daily low at 137.37.

US data missed estimations, a headwind for the USD/JPY

In the New York session, US sensitive economic data show the slowdown in the US labor market. Firstly, Initial Jobless Claims rose 251K, most than the 240K estimate, the highest in 8 months. Also, the Philadelphia Fed Manufacturing Index for June tumbled to -12.3, its lowest level since 1979, while the Conference Board dropped -0.8% MoM, more than the -0.5% estimated.

Elsewhere, the US Dollar Index fell 0.41% to 106.598, undermined by dropping US Treasury yields. The US 10-year Treasury yield sank 15 bps, from 3.028% to 2.877%, a headwind for the USD/JPY.

On Thursday Asian session, the Bank of Japan decided to leave rates unchanged and maintained its Yield Curve Control (YCC) in the 10-year JGB bond at around 0%. Further, the central bank raised forecasts for inflation while noting that growing risks are skewed to the downside.

What to watch

The Japanese economic docket will feature inflation figures alongside Jibun Bank Manufacturing and Services PMIs. On the US front, the S&P Global Services, Manufacturing, and Composite PMIs would shed some clues about the current status of the US economy.

Also read: USD/JPY Price Analysis: Stumbles below 138.00 on RSI negative divergence

USD/JPY Key Technical Levels

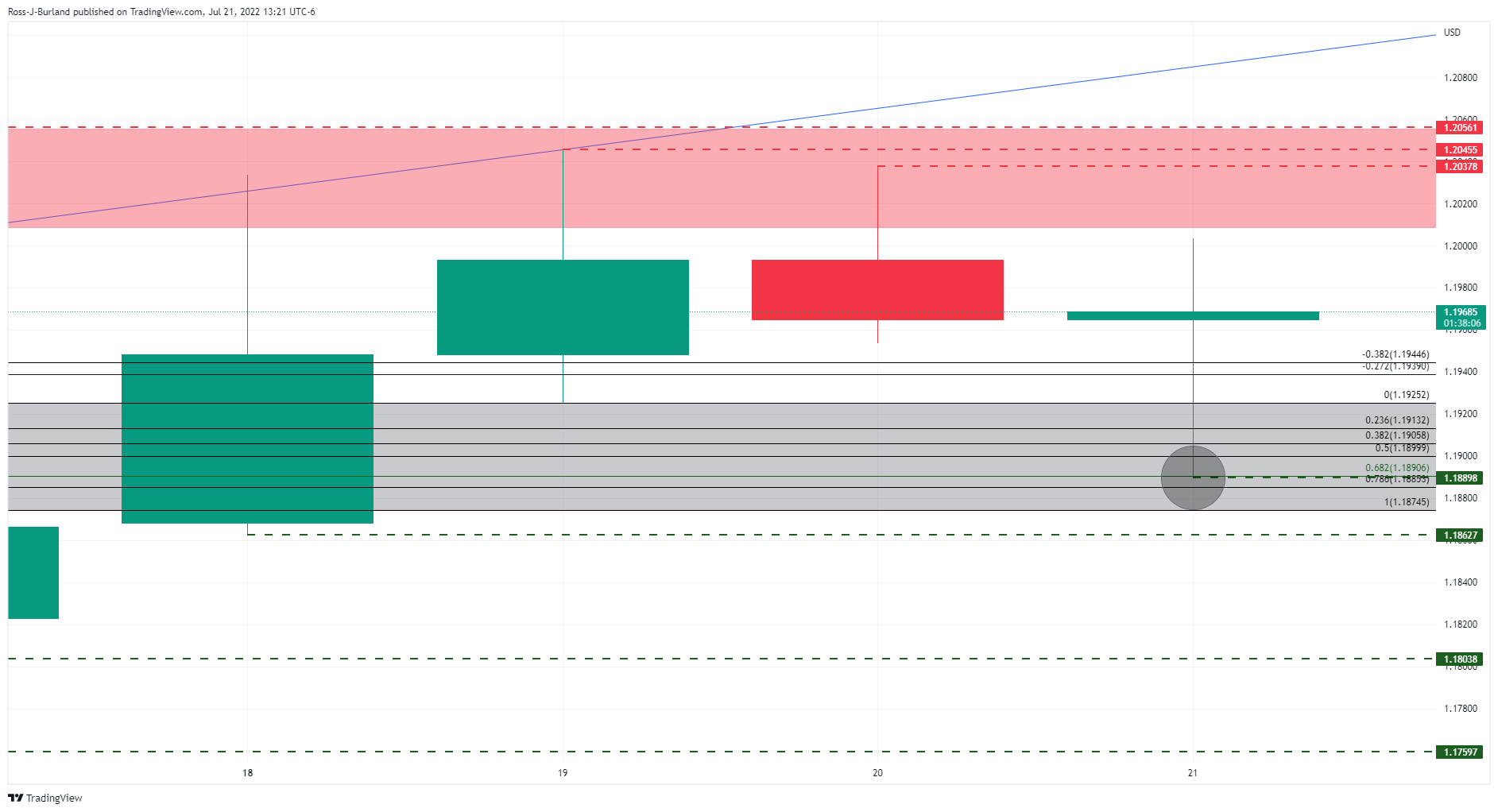

- GBP/USD bulls are taking back control in late New York trade.

- The days ahead is bullish as per the current price action.

- Bears will need to commit to a break of 1.1890 to open downside risk.

GBP/USD's broadening formations and current price action open the way towards the 1.2050s and beyond for the sessions ahead. A break of the round 1.2000 will be key in this regard.

GBP/USD daily chart, the bearish scenario

The daily chart's W-formation has played out with the price mitigating 61.8% of the inefficiency so far, grey area:

If the price were to continue lower, then the broadening formation would be expected to see cable extend into the low 1.17s in the days ahead. 1.1804 will be key in this regard ahead of 1.1760 as illustrated by the daily lows above.

GBP/USD daily chart, bullish scenario

Should the bulls commit at this juncture, on a break of the cluster of daily highs and resistance, then there will be prospects of a move towards the broadening formation's upper boundaries near 1.2220.

GBP/USD H1 chart, bullish scenario

The broadening formation and bullish price action on the hourly time frame open risk of a break of the recent highs to open the way for a move to the upper boundary of the broadening formation towards the 1.2050s and beyond for the sessions ahead. A break of the round 1.2000 will be key in this regard.

What you need to take care of on Friday, July 22:

The market's attention was on the EU on Thursday, amid a series of events taking place in the Union.

The most relevant was the European Central Bank monetary policy decision. The ECB hiked rates by 50 bps, the first hike in over a decade, and moved away from negative rates. The main issues that forced the ECB into taking more aggressive action were inflation and the ongoing crisis with Russia.

However, Gazprom resumed gas flows to the EU through the Nord Stream 1 pipeline. The German Energy Regulator noted that the pre-maintenance level of 40% capacity could be exceeded on this first day, providing additional relief to EUR buyers.

Finally, Italian Prime Minister Mario Draghi effectively resigned, and elections will be held by the second half of September. Italian President Sergio Mattarella has dissolved the Italian parliament, opening the door for a snap election on September 25.

The American dollar advanced after the ECB's decision, but easing US Treasury yields limited its gains. The EUR/USD pair finished the day just below the 1.0200 threshold. GBP/USD settled at around 1.1975.

US stocks managed to post modest gains, which put further pressure on the dollar.

Crude oil prices remained under pressure, with WTI settling at $96.30 a barrel. Gold advanced and finished the day at $1,717 a troy ounce.

Commodity-linked currencies posted modest gains against the dollar, with AUD/USD trading at 0.6910 and USD/CAD at 1.2880. Safe-haven JPY and CHF posted substantial gains vs their American rival.

The focus on Friday will be on growth-related figures, as S&P Global will publish the preliminary estimates of the July PMIs.

Bitcoin Price Update: Tesla's impact on Bitcoin market value

Like this article? Help us with some feedback by answering this survey:

- NZD/USD slides almost 0.12% on Thursday; the major is still up by 1% in the week.

- A risk-on impulse fails to propel the NZD/USD higher as traders’ focus shifts to the Fed in the next week.

- The US labor market has begun to slow down, aligning with the housing market, as data reported in the week missed expectations.

The NZD/USD snaps four days of gains on Thursday, barely losing almost 0.06%, despite an upbeat mood around the financial markets. US equities are rising after the ECB hiked rates 50 bps for the first time in 11 years, while better-than-expected US corporate earnings keep investors’ nerves controlled amidst high inflation and a global economic slowdown.

The NZD/USD is trading at 0.6221. After opening near 0.6220s, the major climbed to 0.6241, the daily high, but price action shifted gears, and the NZD/USD tumbled towards the daily low at 0.6184. However, the major recovered some ground, and buyers reclaimed the 0.6200 figure as the New York session winded down.

In the meantime, the greenback is retracing from daily highs, as illustrated by the US Dollar Index (DXY). The DXY is down 0.13%, at 106.896, a tailwind for the NZD/USD, which so far failed to capitalize on the buck weakness. Also weakening across the board are US Treasury yields led by the 10-year benchmark note coupon, down ten bps, at 2.923%.

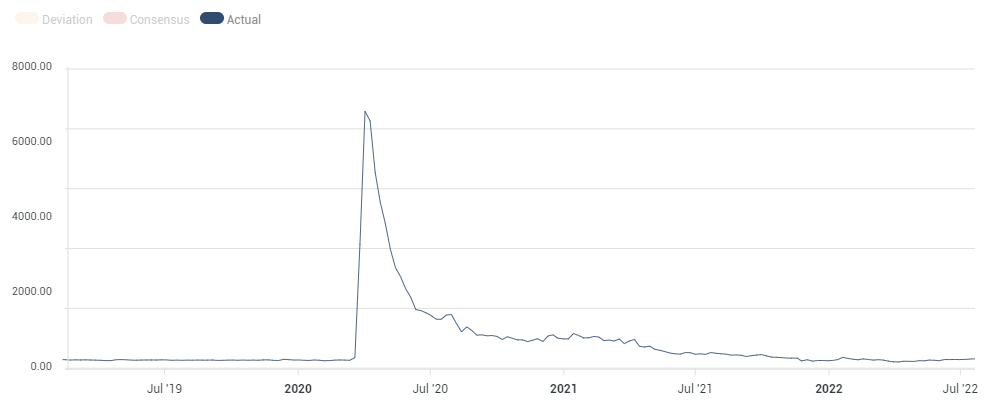

US employment data, although lagging, shows signs of slowing down

Before Wall Street opened, the US Bureau of Labor Statistics reported that claims for unemployment in the week ending on July 16 rose more than estimations and hit an 8-month high. The labor market begins to show flashes of an aggressive Federal Reserve, but would not deter Jerome Powell and Co. from reaching its target to tame inflation to the 2% target.

At the same time, the Philadelphia Fed Manufacturing Index in June declined for the second consecutive month to -12.3 from -3.3. The report said that “on balance, the firms continued to report increases in employment, but the employment index declined 9 points to 19.4, the lowest reading since May 2021.”

Meanwhile, during the Asian session, the NZ Trade Balance fell from -$9.56B to -$10.51B YoY from (revised) prior. Monthly figures reported a deficit of $701 million vs. a $195M surplus in the previous month.

What to watch

An absent NZ economic docket would leave NZD/USD traders adrift to US data and the market mood. On Friday, the US docket will feature S&P Global PMIs, ahead of the next week’s Federal Reserve monetary policy meeting.

NZD/USD Key Technical Levels

- Gold price falls back into the hands of the bulls following the ECB events.

- XAUUSD is now at a critical juncture in the bearish cycle where a significant correction could play out.

- The Federal Reserve meeting will be an important event for rate and gold traders.

Gold price is higher by 1% in midday New York trade and has recovered from the fresh lows of $1,680.93 after sliding from $1,718.39 to Thursday's highs. The yellow metal was pressured even as the US dollar weakened early on Thursday, with the ICE dollar index last seen down below the 107 figure but in the middle of the day's range of 106.415 and 107.323. The day has been turbulent due to the European Central Bank that raised interest rates for the first time in more than a decade as it seeks to tame inflation.

ECB lifts the lid on rates, gold price rallies

The ECB took the well-telegraphed plunge and raised rates. Seeking to tame inflation, the ECB had for weeks flagged a 25 basis point hike, until earlier this week, when sources told Reuters the central bank was weighing a bigger move. This came to fruition on Thursday when the central bank hiked by 50bps and also announced a bond protection plan, called the Transmission Protection Instrument (TPI), that is designed to cap the borrowing costs across the region in an effort to help heavily indebted countries like Italy, whose coalition government fell after the resignation of Prime Minister Mario Draghi. The outcome for XAUUSD was bullish despite the two-way trip in the euro and US dollar. Gold rallied from the day's lows and the bulls committed to the upside, buying the dip throughout the hours ensuing the ECB event.

Read more: Eurozone rate hike: A big step for the ECB, but a small help for the euro

US bond yields fall in wake of ECB hasty normalization

Bullish for the gold price, US bond yields fell with the benchmark 10-year note below 3% after the first interest rate hike in 11 years by the ECB as concerns about runaway inflation trumped worries about growth. The two-year US Treasury yield was down to a low of 3.121% while the yield on 10-year Treasury notes fell to 2.917% which is back into the middle of the range for July as investors get set for the Federal Reserve interest rate decision on July 27 in which it is largely expected to hike rates by 75 basis points.

10-year yield broadening formation, bearish bias

Fed expectations

Fed chairman, Jerome Powell

For the Fed, which meets next Tuesday and Wednesday, many are of the opinion that the central bank will hike by 75 bps, especially now that the ECB rose rates by 50bps. The fed would also be expected to continue hiking rates by at least 50 bps hikes at each meeting in the remainder of the year. This would raise the target range for the federal funds rate to 3.75-4.00% by 2023 which is more than indicated by the FOMC’s dot plot (3.4%) and futures markets (3.55%).

''We think that the Fed is still underestimating the persistence in inflation, and has yet to acknowledge that a wage-price spiral has already started in the US,'' analysts at Rabobank argued. ''US CPI inflation rose to 9.1% in June and its core measure stands at 5.9%. At the same time, nominal wages have risen by 6.7% year-on-year in July according to the Atlanta Fed’s wage growth tracker. This does suggest that the wage-price spiral that the Fed still hopes to avert, is already here.''

Gold price outlook, all things considered

For the gold price, while today's surprise 50bp hike from the ECB has helped prices pare their losses as the USD weakens, analysts at TD Securities argue that the liquidation vacuum in gold will persist. ''Risks for a significant capitulation event are rising,'' the analysts said, and this, they say, is because ''prop traders have overtaken money managers as the dominant speculative force in gold markets.''

''Today, the behemoth position held by the average prop-trader is near twice its typical size, suggesting a substantial amount of pain is reverberating across gold markets as prices revert lower amid the most hawkish Fed regime in decades. Given this massive speculative length was established in 2020, and does not appear to be associated with a Fed or inflation narrative, this complacent position appears particularly vulnerable. Weakening prices may fuel additional selling into a liquidation vacuum, with every participant from Shanghai traders to ETF holders selling their length.''

Gold price technical analysis

Gold price analysis, from a longer-term perspective, reveals the prospects of a correction from the weekly broadening formation's lower boundary as illustrated below:

XAUUSD has fallen a handful of dollars shy of the $1,677 pivot lows and bulls are moving in which could leave this week's candle as a bull hammer. A move into the grey areas as dawn on the chart above, which are spaces of price imbalance, will open the risk of a significant continuation higher triggering a series of buy stops along the way.

A 50% mean reversion guards the golden 61.8% ratio on a break of the psychological $1,800. On the other hand, a break of the said picot lows of $1,677 could play out first of all which could likely;y cause a flurry of volatility considering the number of orders that are sitting below.

- USD/CHF is still upward biased, but in the short-term might aim towards 0.9600.

- A market sentiment shift, dented demand for the greenback, and a headwind for the USD/CHF.

- USD/CHF Price Analysis: Downwards-to-neutral, and if sellers reclaim 0.9670, the major will tumble towards 0.9600.

The USD/CHF slides for the second day in four retreats below 0.9700, amidst an improved market mood weighing on the greenback after the ECB delivered its first rate hike in 11 years, which initially sent the USD/CHF towards its daily low at 0.9667. Nevertheless, buyers stepped in and saw it as an opportunity for a better entry price. At the time of writing, the USD/CHF is trading at 0.9694.

Of late, sentiment shifted upbeat, as shown by US equities rising. Nonetheless, it remains fragile, with high global inflation, worldwide economic slowdown, and a US recession looming. Efforts of global central banks to tighten monetary conditions would likely end with a worldwide recession.

USD/CHF Price Analysis: Technical outlook

On Thursday, the USD/CHF began trading around 0.9700 but climbed as the mood shifted sour, hitting a daily high at 0.9739. However, earlier gains were retraced on the ECB’s decision, which sent the major to the daily low at around 0.9667 before marching firmly, shy of the 0.97000 mark. Nevertheless, the USD/CHF daily chart is upward biased, and unless sellers reclaim 0.9495, buyers remain in charge.

USD/CHF 1-hour chart

The USD/CHF hourly chart portrays the major as downwards-to-neutral biased, with the SMAs above the exchange rate. Also, the Relative Strength Index (RSI), albeit flat, is in negative territory and below the RSI’s 7-day SMA, further cementing the bias. All that said, alongside USD/CHF price action below the mid-line of an ascending channel, suggest the downtrend would continue in the short term.

Therefore, the USD/CHF first support would be the S1 daily pivot at 0.9675. A breach of the latter will immediately expose the bottom trendline of the aforementioned ascending channel, meaning that the USD/CHF next target would be 0.9600. However, firstly the USD/CHF sellers would need to clear the S2 pivot point at 0.9641 before reaching the 0.9600 figure

USD/CHF Key Technical Levels

- USD/JPY drops during the day but remains range-bound until sellers break below 137.70.

- The BoJ decided to hold rates unchanged, and the YCC control in the 10-year at 0.25%.

- USD/JPY Price Analysis: Negative divergence in the daily chart opens the door for further losses.

The USD/JPY falls below the 138.00 threshold following the Bank of Japan’s decision to hold rates unchanged while pledging to its dovish monetary policy stance and keeping the Yield Curve Control (YCC) in the 10-year JGB bond yield at 0.25%. At the time of writing, the USD/JPY is trading at 137.98, down by a minimal 0.18%.

USD/JPY Price Analysis: Technical outlook

USD/JPY Daily chart

The USD/JPY uptrend is still intact, but it appears to be losing steam. Albeit reaching higher highs, the Relative Strength Index (RSI) is still diverging from price action. Indeed, two days ago, the RSI slid below the RSI’s 7-day SMA, meaning that sellers began to overcome buyers. Additionally, the break of the rising wedge to the downside opened the door for a fall to 133.50, but the pair is consolidating around 137.70s-138.80s.

Therefore, the USD/JPY’s first support will be the July 19 low at 137.38. Break below will expose the 20-day EMA at 136.75, followed by the MTD low at 134.74.

USD/JPY 1-hour chart

In the near term, the USD/JPY 1-hour chart illustrates the pair sliding below all the hourly EMAs but bracing for the 200-hour EMA, just below it, around 137.88. USD/JPY traders should notice that the exchange rate is also below the July 20 low lying at 137.95, further opening the door for a test of the weekly lows at 137.38.

However, on its way south, USDJPY’s sellers would have some hurdles to overcome. The USD/JPY first support will be the S2 daily pivot at 137.69. A breach of the latter will send the major towards the week’s low at 137.38, followed by the figure at 137.00.

USD/JPY Key Technical Levels

The European Central Bank (ECB) raised the key interest rates on Thursday for the first time in 11 years. Analysts at Danske Bank expect the central bank to hike another 100bp this year, before halting its cycle. They still prefer the idea of selling ECB-induced euro rallies.

Key Quotes:

“EUR/USD initially rallied close to 1.03 upon announcement before (paradoxically) ending the session below pre-ECB levels. In our view, this highlights one of our long-held views: currencies should primarily be treated as a play on the relative attractiveness of asset markets and only secondly as a play on relative rates. Higher shortened EUR rates on balance improve the carry attractiveness of investing in the single currency.”

“The larger-than-expected ECB rate hike and the signal of more frontloaded tightening also skew European asset return distributions to the left. This makes EUR-denominated assets less attractive. The lack of convincing details on the TPI programme highlights how the ECB cannot have its cake and eat it, in the sense that the price of tightening policy across the Eurozone requires a relatively tighter stance for the economies with the lowest r*s; Italy being the case in point. In turn, this challenges the investment outlook for the EUR that still suffers heavily on a relative terms of trade and cost-adjusted-productivity basis vis-à-vis the USD.”

“In our view, EUR/USD remains fundamentally overvalued. Hence, at this stage, we still like to sell ECB-induced EUR rallies and still pencil in EUR/USD firmly settling below parity over the coming quarters.”

- Silver erased losses and rose back above $18.70.

- The rebound could gain momentum if it breaks $19.00.

- The primary trend remains bearish; break under $18.00, to open doors to $17.50.

Silver bottomed on Thursday at $18.23, slightly above the YTD low of $18.13. It then rebounded sharply back above $18.50, boosted by a rally in gold prices following a sharp decline in US yields.

XAGUSD rose above the $18.75 area, a relevant short-term support. It peaked at $18.81 hitting a fresh daily high. If the rebound holds, the odds of a more sustainable recovery will rise. The next critical resistance stands around $19.00.

If silver firmly breaks the $19.00 zone, it could point to a double bottom near $18.20 and recover a strong support. The following relevant barrier is seen at the $19.50 area that contains the 20-day Simple Moving Average (intermediate resistance at $19.15).

The daily chart also offers some positive signs for the metal, with MACD making the first bullish cross in two months. Stochastic Oscillators are coming out from oversold levels.

A decline back under $18.50 should add pressure to the $18.20 low, softening the mentioned bullish signs. The break under $18.20 would expose $18.00. The break below could trigger volatility and a potential acceleration toward $17.45.

Silver daily chart

-637940173898558753.png)

The European Central Bank's internal metrics do not currently show an unwarranted fragmentation in any eurozone country, Reuters reported on Thursday, citing sources familiar with discussions.

Sources further told Reuters that the ECB does not expect the Transmission Protection Instrument (TPI) to be triggered imminently and that policymakers did not discuss any particular country on Thursday. "All eurozone countries currently eligible for ECB's TPI based on conditions outlined on Thursday."

Market reaction

The shared currency lost interest on this headline and the EUR/USD pair was last seen trading flat on the day at 1.0183.

Analysts at TD Securities said that they expect the European Central Bank to hike its policy rate by 50 basis points (bps) in September and by 25 bps thereafter until the repo rate reaches its terminal level of 1.5%.

EUR rally looking like a strategic fade

"Rates: The ECB delivers a 50bps rate hike hedged with its new TPI tool and PEPP reinvestments. Price action in front-end was still relatively muted as markets were already positioned for bigger moves after this week's leaks. The ECB's tool was credible, but the key issue is will any member state "activates" it. We consider that the path for peripherals could be rocky. We continue to favour flatter 5s30s curve and wider EGB spreads."

"FX: The ECB delivered a 'surprise' 50bp hike and an anti-fragmentation tool. Despite this, today's ECB decision looks more like a faux-flex than a resolute commitment to fight inflation. There is little the ECB can do to avert an impending energy crisis or an implosion in the current account. EUR's recent rally is increasingly looking like a strategic fade as a sub-parity paradigm looks increasingly difficult to avert."

Italian President Sergio Mattarella has dissolved the Italian parliament, opening the door for a snap election on September 25, Reuters reported on Thursday, citing Italian state broadcaster RAI.

Market reaction

This development doesn't seem to be having a noticeable impact on the shared currency's performance against its major rivals. As of writing, the EUR/USD pair was trading at 1.0200, where it was up 0.23% on a daily basis. Meanwhile, Italy's FTSE MIB Index lost 0.7% on the day after Prime Minister Mario Draghi resigned earlier in the day.

- AUD/USD sets to finish the week with gains, up 1.54%.

- Wobbling sentiment keeps the AUD/USD seesawing in a 50-70 pip range.

- AUD/USD to remain below 0.7000 according to National Australia Bank.

The AUD/USD rally shows signs of losing steam but remains up in the day after recording its first losing day out of the last five on Wednesday, though at the time of writing, it registers minimal gains of 0.14%. The AUD/USD is trading at 0.6897 amidst a trading session characterized by fragile sentiment.

AUD/USD Thursday’s price action witnessed the pair opening around 0.6880s, below the 0.6900 figure. However, it climbed to the daily high at 0.6916 before retreating to the 0.6850s area, hitting a daily low at 0.6858; once the dust settled, it is trading at current levels.

AUD/USD seesawing as sentiment swings amidst a volatile session

Sentiment remains fragile, shifting throughout the day. The ECB’s first hike in 11 years, the global economic slowdown looming, led by China and US recession fears lingering in traders’ minds, keep riskier assets on the backfoot. Reflection of that is the AUD/USD seesawing in a 50-70 pip range, with no apparent bias. However, during recessionary times, the greenback is king.

In the meantime, in tone with recent news of US companies halting hiring, namely Apple, Google, and Ford; the US Department of Labour unveiled that Initial Jobless Claims for the week ending on July 16 increased by 251K, more than the 240K estimated, hitting a fresh 8-month high. Claims rose when the Fed it’s raising rates to tame stubbornly high inflation. Nevertheless, it’s a consequence that US workers would have to deal with until the US central bank begins to see inflation slowing down.

Meanwhile, the Philadelphia Fed Manufacturing Index in June declined for the second consecutive month to -24.8 from -12.4. The report said that “on balance, the firms continued to report increases in employment, but the employment index declined 9 points to 19.4, the lowest reading since May 2021.”

On the Australian side, the Reserve Bank of Australia (RBA) Governor Philip Lowe emphasized that higher rates would be needed to anchor inflation expectations, he said on Wednesday.

AUD/USD to remain below 0.7000 according to National Australia Bank

“We think the USD has not yet peaked given a hawkish Fed and rising concerns over an imminent global recession,” said analysts at National Australia Bank in a note.

“Our stronger for still longer dollar view implies a more extended period below 0.70 for Aussie/dollar with the currency seen broadly contained in a $0.65-0.70 range over coming quarters.”

AUD/USD Key Technical Levels

The European Central Bank raised key interest rates on Thursday by 50 bps. The move was larger than expected. Analysts at Wells Fargo believe inflation remains elevated enough, and inflation risks worrisome enough, to continue with a more forceful pace of rate hikes for the time being.

Key Quotes:

“As the lead into the July meeting made clear, even forward guidance on interest rates does not guarantee a particular policy rate outcome. Moreover, we believe inflation remains elevated and inflation risks worrisome enough—Lagarde cited inflation risks were to the upside and have intensified in the short-term—to continue with a more forceful pace of rate hikes for the time being.”

“Our view remains that today's hike will be followed up by another 50 bps Deposit Rate increase at the September meeting. In addition, while inflation remains elevated and until Eurozone economic growth slows in a much more meaningful manner, we also see a steady series of rate increases as more likely than not. In that context, we also forecast a 25 bps rate increase at the October and December meetings, which would bring the Deposit Rate to 1.00% by the end of 2022.”

“We anticipate that will be the peak during the current cycle—as inflation begins to recede by 2023 and growth slows sharply, we see the ECB keeping interest rates steady through most, if not all, of next year. In essence, after today's announcement, we anticipate a shorter, sharper rate hike cycle from the European Central Bank than previously.”

- Volatile session across financial markets after ECB meeting.

- US Dollar without a clear direction, US yields tumble.

- USD/CAD holds onto weekly losses as recovery fades above 1.2900.

The USD/CAD reversed and dropped back below 1.2900 in a volatile session for financial markets following the European Central Bank meeting and US data.

The pair peaked at 1.2935 and then pulled back. It is hovering around 1.2880, flat for the day and approaching the weekly low, near the strong support zone of 1.2850.

The rejection from above 1.2900/05 (horizontal levels, and 20 and 200 Simple Moving Average in four-hour chart) reinforced the bearish short-term bias. If USD/CAD consolidates above it would point to further gains.

USD/CAD 4-hour chart

Data, ECB and uncertainty

Equity markets are posting modest losses, but the dollar is not benefiting from this as US yields are falling sharply. The US 10-year stands at 2.92%, the lowest since Monday, and the 30-year at 3.06%. Crude oil prices are falling more than 3%.

US economic data weighed on the US dollar on Thursday. Initial Jobless Claims rose more than expected to the highest level in eight months while Continuing Claims also rose above expectations to the highest in eleven weeks. The Philly Fed tumbled unexpectedly. On Friday, Canada will report May retail sales and the US the flash July S&P Global PMI.

Technical levels

- The GBP/USD is almost flat during the day, barely up 0.02%.

- A dismal mood weighs on the British pound due to ECB’s hiking rates and US President Joe Biden testing positive for Covid-19.

- GBP/USD Price Analysis: Tilted to the downside, as sellers eye 1.1800.

GBP/USD stays in positive territory, though downward pressured, once the European Central Bank (ECB) added to the list of global bank authorities shifting to tightening monetary policy, delivering a surprisingly 50 bps rate hike to all of its three rates, aimed to normalize policy amidst a high inflation scenario.

The GBP/USD is trading at 1.1962 after hitting a daily high at 1.2003, but its correlation with the EUR/USD dragged the pair down towards the daily low below 1.1900. However, once the dust settled, the British pound stood still at current levels.

GBP/USD capped by sentiment and safety flows

A risk-off impulse has kept investors’ flows toward safe-haven assets. Sentiment deteriorated due to factors like the ECB’s monetary policy decision and US President Joe Biden testing positive for Covid, which sent US equities down between 0.22% and 0.87%. The greenback is clinging to the 107.000 area as shown by the US Dollar Index, almost flat, while US Treasury yields are down, reflecting safety flows.

Before Wall Street opened, the US Department of Labour reported that Initial Jobless Claims for the week ending on July 16 rose 251K, higher than the 240K estimated, hitting a fresh 8-month high. At the same time, the Philadelphia Fed Manufacturing Index in June declined for the second consecutive month to -24.8 from -12.4. The report said that “on balance, the firms continued to report increases in employment, but the employment index declined 9 points to 19.4, its lowest reading since May 2021.”

US Jobless Claims rise above expectations

The lack of UK economic data keeps GBP/USD traders assessing words from the Bank of England Governor Andrew Bailey. On Wednesday he stated that a 50 bps rate hike in August is possible, triggering a jump in the GBP/USD. Nevertheless, the gloomy UK economic outlook will keep the pound under selling pressure, despite the efforts that the BoE makes to tame inflation, opening the door for a stagflationary scenario.

Analysts at Rabobank expect the GBP/USD to fall towards 1.1800

“Given our expectation that USD strength is likely to persist for around 6 months or so in view of risks to global growth, we foresee the potential for further sharp drops in the value of the pound. We have revised lower our target for cable from 1.18 and see the potential for a dip to levels as low as 1.12 on a 1-to-3-month view. The assumes a more sustained break below EUR/USD 1.00.”

GBP/USD Price Analysis: Technical outlook

The GBP/USD is still downward biased, despite bouncing off the weekly lows around 1.1860s. GBP/USD buyer’s failure to break above the 20-day EMA at 1.2015 sent the pair tumbling below the 1.2000 figure, extending towards the 1.1920s area. Even the Relative Strength Index (RSI), which at the beginning of the week aimed higher, shifted gears and is about to break below 40 as selling pressure mounts on the pair.

Therefore, the GBP/USD first support would be the 1.1900 mark. Break below will expose the July 18 daily low at 1.1862, followed by the figure at 1.1800 and the YTD low at 1.1760.

The European Central Bank (ECB) recently published additional details regarding its new anti-fragmentation tool titled "the Transmission Protection Instrument (TPI)."

Key takeaways

"TPI purchases would be focused on public sector securities."

"Purchases under the TPI would be conducted such that they cause no persistent impact on the overall Eurosystem balance sheet and hence on the monetary policy stance."

"TPI buys with a remaining maturity of between one and ten years."

"Purchases of private sector securities could be considered."

"Purchases would be terminated either upon a durable improvement in transmission, or based on an assessment that persistent tensions are due to country fundamentals."

"TPI conditions: Sound and sustainable macroeconomic policies."

Market reaction

The EUR/USD pair is struggling to gain traction and was last seen trading flat on the day near 1.0180.

- EUR/JPY sees wild swings as Lagarde fails to impress.

- ECB hikes key rates by 50 bps and announces a new anti-fragmentation tool.

- BOJ sticks to its ultra-loose monetary policy guidance.

EUR/JPY is looking to stabilize around 141.00 after the sharp 150-pips volatile trading witnessed in the last hour, thanks to the ECB policy announcements.

The cross broke its intraday trading range to the upside and jumped sharply to hit the highest level in two weeks at 142.32 after the ECB hiked the key interest rates by 50 bps while announcing its Transmission Protection Instrument (TPI), a new bond purchase scheme aimed at helping more indebted eurozone countries and preventing financial fragmentation within the currency bloc.

The optimism on a more hawkish than expected ECB quickly vapored out after the central bank revealed the forward guidance, noting the meeting-by-meeting approach, as the next rate hike path remains data-dependent.

Also, the lack of specifics on the new anti-fragmentation tool and doubts about its ability to protect the member countries weighed heavily on the euro. This took the wind out of the EUR/JPY impressive rally.

On the JPY side of the story, EUR/JPY continues to find support from the BOJ’s dovish rhetoric, as it stuck to its ultra-loose monetary policy stance. The BOJ stood pat on its monetary policy settings while leaving the policy guidance unchanged. BOJ Governor Haruhiko Kuroda, however, did acknowledge the negative effects of the rapid weakening of the yen in his post-policy meeting press conference.

With the ECB and BOJ policy decisions out of the way, investors now look forward to the sentiment on Wall Street for fresh trading impetus. US earnings season is underway and could have a significant impact on risk sentiment.

EUR/JPY technical levels

- Gold price witnessed an intraday short-covering move from over a 15-month low.

- The post-ECB rise in the euro weighed on the USD and offered support to the metal.

- A weaker tone around the equity markets benefitted the safe-haven commodity.

Gold price staged a goodish intraday bounce from the $1,680 region, or its lowest level since March 2021 touched earlier this Thursday and shot to a fresh daily high in the last hour. The XAUUSD was last seen trading around the $1,710 region, up nearly 0.50% for the day, though any meaningful upside still seems elusive.

Gold price benefitted from modest USD weakness

The US dollar came under renewed selling pressure as investors continue scaling back their bets for a massive 100 bps rate hike move by the Federal Reserve in July. Apart from this, the hawkish European Central Bank (ECB) inspired an intraday spike in the shared currency and dragged the USD Index to a fresh two-week low. This, in turn, was seen as a key factor that prompted an intraday short-covering around the dollar-denominated gold.

Also read: Gold Price Forecast: Will the ECB rescue XAUUSD bulls?

Aggressive major central bank moves to cap gains

That said, the prospects for further interest rate hikes by major central banks to curb inflation might continue to act as a headwind for the non-yielding gold. The ECB followed the global tightening trend and raised its official rates for the first time since 2011 on Thursday. The central bank delivered a jumbo 50 bps rate increase against the broader consensus for a 25 bps and also indicated that rates would rise further in future meetings.

Adding to this, the overnight hawkish comments by the Bank of England Governor Andrew Bailey bolstered bets for a 50 bps rate hike in August, which would be the biggest since 1995. The Federal Reserve is also expected to raise rates by another 75 bps at its upcoming policy meeting on July 26-27. Moreover, the Reserve Bank of Australia had signalled earlier this week the need for higher interest rates to tame rising inflation.

ECB hikes rates by 50 bps

Risk-off impulse offered some support

A softer risk tone, however, offered some support to the safe-haven gold. The recent bounce in the equity markets ran out of steam rather quickly amid the worsening global economic outlook and growing recession fears. Investors remain concerned that rapidly rising interest rates, the Russia-Ukraine and the imposition of strict COVID-19 controls in China would pose challenges to global growth. This, in turn, tempered investors' appetite for riskier assets.

Gold price technical outlook

Gold price might struggle to move back above the $1,710-$1,712 immediate hurdle, which is followed by the $1,725-$1,726 supply zone. Some follow-through buying could trigger a fresh bout of a short-covering move and lift the XAUUSD back towards the $1,744-$1,745 resistance zone. The latter should act as a key pivotal point, which if cleared decisively would suggest that the metal has formed a near-term bottom.

On the flip side, the $1,700-$1,695 zone now seems to protect the immediate downside ahead of the YTD low, around the $1,680 region. Sustained weakness below, leading to a subsequent break through the 2021 yearly low, around the $1,677-$1,676 area, would be seen as a fresh trigger for bearish traders. The gold price could then prolong the downward trajectory and test the next relevant support near the $1,670 horizontal zone.

-637940086205061604.png)

Gold price: Will the ECB drive gold prices higher or lower?

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 50 basis points.

Key quotes

"Governing Council would rather not use TPI, would not hesitate if it has to."

"Differences in local finances can legitimately arise."

"Governing Council will make a decision on whether TPI activation is proportionate."

"There is no recession under the baseline scenario."

"Euro has a bearing on inflation going forward."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 50 basis points.

Key quotes

"Compliance of EU fiscal framework a condition of TPI."

"Absence of severe macro imbalances is condition for TPI."

"Third TPI condition: fiscal sustainability."

"Debt sustainabilty analysis to take into account ECB, ESM, IMFanalyses."

"Fourth TPI condition: Sound and sustainable macro policies in line with recovery and resilience funds."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 50 basis points.

Key quotes

"Activating TPI will be at the discretion of the Governing Council."

"Initial signs of inflation expectations above target warrant monitoring."

"Risks to inflation tilted to upside."

"If TPI is activated, it will avoid an interference with the appropriate monetary policy stance."

"We will address issue of excess liquidity."

"ECB is capable of going big on TPI."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 50 basis points.

Key quotes

"Decision was unanimous on TPI."

"Bigger rate hike justified by the materialization of inflation risk, among others."

"TPI, reinvestments also supported bigger hike."

"All members of governing council rallied to consensus of 50 bps hike."

"All members can be eligible for TPI."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 50 basis points.

Key quotes

"Energy costs should stabilise, bottlenecks ease."

"Wage growth has continued to increase gradually, including forward-looking indicator."

"Wage growth is still contained."

"Strengthening economy, catch-up effects should support faster wage growth."

"Inflation risk has intensified."

"Volume of lending remains strong but it's expected to decline."

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions following the bank's decision to hike key rates by 50 basis points.

Key quotes

"Outlook clouded for second half of 2022 and beyond."

"Economic activity is slowing."

"The war is an ongoing drag."

"Firms face higher costs, supply chain disruptions."

"Supply bottlenecks may be easing."

"Global energy prices may stay high in near term."

"Price pressure is spreading across more and more sectors."

"We expect inflation to be undesirably high for some time."

"Higher inflation pressures also stem from weaker euro."

- EUR/GBP gained strong positive traction and shot to over a two-week high on Thursday.

- The ECB raised interest rates by 50 bps and provided a goodish lift to the shared currency.

- Investors now await ECB President Lagarde’s press conference for some meaningful impetus.

The shared currency strengthened across the board after the European Central Bank announced its policy decision, lifting the EUR/GBP cross to over a two-week high. The cross was last seen trading around the 0.8575-0.8580 region, up nearly 1% for the day.

As was expected, the ECB's governing council took a larger first step on its policy rate normalisation path than signalled and opted to hike key interest rates by 50 bps vs. 25 bps expected. Policymakers judged that the frontloading to exit the negative interest rates regime was appropriate because of higher-than-expected inflation.

The ECB also unveiled a new tool called 'Transmission Protection Instrument' to prevent rising borrowing costs from sparking a debt crisis amid the ongoing political turmoil in Italy. The central bank said additional details of the anti-fragmentation toll would come in as a separate announcement during the post-meeting press conference.

Hence, traders would now closely scrutinize ECB President Christine Lagarde's comments, which will play a key role in influencing the common currency and provide a fresh impetus to the EUR/GBP cross. In the meantime, the resumption of Russian gas supply via the Nord Stream 1 pipeline and a jumbo ECB rate hike should continue to underpin the euro.

Technical levels to watch

- Philadelphia Fed Manufacturing Index fell sharply in July.

- US Dollar Index stays deep in negative territory near 106.50.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity declined to -12.3 in July from -3.3 in June. This print missed the market expectation of 0 by a wide margin.

Additional takeaways

"The index for new orders declined for the second consecutive month, from -12.4 to -24.8."

"The current shipments index rose from 10.8 to 14.8. The indexes for current inventories and unfilled orders were negative, at -9.3 and -10.4, respectively."

"On balance, the firms continued to report increases in employment, but the employment index declined 9 points to 19.4, its lowest reading since May 2021."

Market reaction

The greenback struggles to find demand after this report and the US Dollar Index was last seen losing 0.5% on the day at 106.50.

- Initial Jobless Claims rose by 7,000 in the week ending July 16.

- US Dollar Index stays on the back foot following earlier recovery.

There were 251,000 initial jobless claims in the week ending July 16, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 244,000 and came in worse than the market expectation of 240,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 240,500, an increase of 4,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending July 9 was 1,384,000, an increase of 51,000 from the previous week's revised level," the DOL's publication further read.

Market reaction

The US Dollar Index stays on the back foot in the early American session and was last seen losing 0.44% on the day at 106.58.

Christine Lagarde, President of the European Central Bank (ECB), is scheduled to deliver her remarks on the monetary policy outlook at a press conference at 12:45 GMT.

Follow our live coverage of ECB's policy announcements and the market reaction.

About ECB's press conference

Following the ECB´s economic policy decision, the ECB President gives a press conference regarding monetary policy. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- EURUSD refreshed its daily high after the ECB raised interest rates by 50 bps vs 25 bps expected.

- The risk of a sovereign debt crisis in Italy could hold back traders from placing fresh bullish bets.

- Investors now look forward to ECB President Lagarde’s comments for some meaningful impetus.

EURUSD price gained some positive traction in the last hour and shot to a fresh daily high, beyond mid-1.0200s after the European Central Bank (ECB) announced its monetary policy decision.

As was widely expected and pre-committed, the ECB followed the global tightening trend and raised its official rates for the first time since 2011. The landmark decision to hike rates by 50 bps, as against the broader consensus for a 25 bps increase, underpinned the shared currency and provided a modest lift to the EURUSD pair.

That said, a rate hike raises the risk of a sovereign debt crisis in Italy, especially after Mario Draghi chose today to end his term as Prime Minister. This, in turn, could offset the optimism led by the resumption of Russian gas supply via the Nord Stream 1 pipeline and hold back traders from placing aggressive bullish bets around the EURUSD pair.

Investors might also prefer to wait for details of the ECB's new anti-fragmentation tool aimed to shield highly indebted countries from surging borrowing costs. Hence, the focus remains on the post-meeting press conference, where comments by ECB President Christine Lagarde might infuse some volatility around the euro crosses.

Technical levels to watch

The European Central Bank (ECB) announced on Thursday that it raised its key rates by 50 basis points (bps) following the July policy meeting. Markets were expecting the bank to hike its rates by 25 bps.

With this decision, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 0.50%, 0.75% and 0.00% respectively, with effect from 27 July 2022.

The bank also announced that the Governing Council approved the new anti-fragmentation tool titled "Transmission Protection Instrument (TPI)."

Follow our live coverage of the market reaction to the ECB's policy announcements.

Key takeaways from policy statement via Reuters

"In line with ECB's strong commitment to its price stability mandate, ecb took further key steps to make sure inflation returns to its 2% target over medium term."

"ECB judged that it is appropriate to take a larger first step on its policy rate normalisation path than signalled at its previous meeting."

"This decision is based on ECB's updated assessment of inflation risks and reinforced support provided by TPI for effective transmission of monetary policy."

"At ECB's upcoming meetings, further normalisation of interest rates will be appropriate."

"Frontloading today of exit from negative interest rates allows ECB to make a transition to a meeting-by-meeting approach to interest rate decisions."

"Future policy rate path will continue to be data-dependent and will help to deliver on its 2% inflation target over medium term."

"ECB assessed that establishment of TPI is necessary to support effective transmission of monetary policy."

"TPI will be an addition to ECB's toolkit and can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area."

"Scale of TPI purchases depends on severity of risks facing policy transmission."

"Purchases are not restricted ex-ante."

"By safeguarding transmission mechanism, TPI will allow ecECB to more effectively deliver on its price stability mandate."

"In any event, flexibility in reinvestments of redemptions coming due in Pandemic Emergency Purchase Programme (PEPP) portfolio remains first line of defence to counter risks to transmission mechanism related to pandemic."

"Details of TPI are described in a separate press release to be published at 15:45 CET."

Market reaction

With the initial market reaction, the EUR/USD pair gained traction and was last seen rising 0.7% on the day at 1.0247.

The Central Bank of the Republic of Türkiye (CBRT) left its benchmark interest rate, the one-week repo rate, unchanged at 14.00% as expected on Thursday.

Key takeaways from policy statement via Reuters

"Despite losing momentum, credit growth, and allocation of funds for real economic activity purposes are closely monitored."

"Will continue to implement the strengthened macroprudential policy set decisively and take additional measures when needed."

"Will continue to use all available instruments decisively within the framework of liraization strategy until strong indicators point to a permanent fall in inflation."

"Effects of high global inflation on inflation expectations and international financial markets are closely monitored."

"Stability in the general price level will foster macroeconomic stability and financial stability."

"Tourism-led improvement in current account balance continues with a solid pace."

"High course of energy prices and the likelihood of a recession in main trade partners keep the risks on current account balance alive."

Market reaction

USD/TRY retreated from 2022-highs after the CBRT's policy announcements and was last seen trading at 17.6675, where it was up 0.35% on a daily basis.

ECB monetary policy decision – Overview

The European Central Bank (ECB) is scheduled to announce its monetary policy decision this Thursday at 12:15 GMT, which will be followed by the post-meeting press conference at 12:45 GMT. The ECB is all but certain to hike its benchmark interest rates for the first time since 2011. Markets, meanwhile, are split on whether the ECB policymakers would stick to the previously telegraphed 25 bps increase or raise rates by 50 bps to curb runaway inflation.

According to Dhwani Mehta, Senior Analyst at FXStreet: “The ECB will deliver a 50 bps lift-off this month, in the wake of rampant inflation, resumption of the Russian gas supply and the fact that the ECB is way behind the curve. It’s also worth noting that front-loading rates now may allow the central bank some room to pause or go slower on rate hikes when a recession hits.”

How could it affect EURUSD?

Given that the ECB has pre-committed to start the rate-hike cycle in July, a 25 bps increase is fully priced in the markets and might do little to provide a meaningful impetus to the shared currency. A bigger move, meanwhile, could trigger a sharp rise in the bond yields for highly indebted countries. The risk, however, could be mitigated if the ECB announces details of its new anti-fragmentation tool. Nevertheless, the event is likely to infuse some volatility around the euro cross and produce some meaningful trading opportunities around the EURUSD pair.

Eren Sengezer, European Session Lead Analyst at FXStreet, outlined important technical levels for the EURUSD pair: “On the downside, 1.0170 (Fibonacci 38.2% retracement of the latest downtrend) aligns as first support ahead of 1.0100 (psychological level, Fibonacci 23.6% retracement, 50-period SMA on the four-hour chart). In case the latter fails, the pair, once again, could test parity. Resistances are located at 1.0200 (psychological level), 1.0220 (Fibonacci 50% retracement, 100-period SMA) and 1.0270 (Fibonacci 61.8% retracement).”

Key Notes

• ECB Preview: Is the time ripe for a 50 bps rate hike?

• ECB Preview: Three critical factors to watch, and why EUR/USD is set to plunge

• EUR/USD Forecast: 25 bps ECB hike might not be enough to save the euro

About the ECB interest rate decision

ECB Interest Rate Decision is announced by the European Central Bank. Usually, if the ECB is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the EUR. Likewise, if the ECB has a dovish view on the European economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

Commenting on the potential impact of the latest UK political developments on the British pound, Rabobank analysts argued the new British prime minister will be unlikely to substantially alter the gloomy tone that has been weighing on the GBP.

BoE’s mandate may have to be re-examined

"While tax hikes would boost demand, they could also create further inflation and counter the current policy tightening efforts of the BoE. This could mean further rate rises from the BoE then would otherwise be the case, which would sap the growth potential that Truss hopes to create. "