- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 26-08-2013

The dollar rose modestly against the euro, returning with all previously lost ground, even though the publication of weak U.S. data.

It is learned that orders for manufactured durable goods fell sharply in July as demand for aircraft and reduced business costs were weak.

Total orders for durable goods - big-ticket items lasting three years or more - to a seasonally adjusted fell 7.3% to $ 226.6 billion in July compared with the previous month, the Commerce Department said Monday. Economists had forecast a 3% fall. Businesses and consumers usually make such purchases when they are confident in the economy and reduced orders showing possible signs of weakness at the time, as the economy struggles to grow. The decrease came largely from the category of civilian aircraft, which fell by 52.3% for the month. The company Boeing (BA), for example, reported only 90 aircraft orders in July, compared with 287 in June. Orders aircraft represent a small group of producers and their production takes several years, but their high prices can have a significant impact on the total orders. Without the volatile transportation category of durable goods were also relatively weak for the month and fell 0.6%. But the annual figures, which smoothes the data showed that the total orders for durable goods rose by 3.3%, while orders excluding transportation rose 2.5%. A key indicator of business spending - orders for non-defense capital goods excluding aircraft - fell 3.3% after rising in the previous five months.

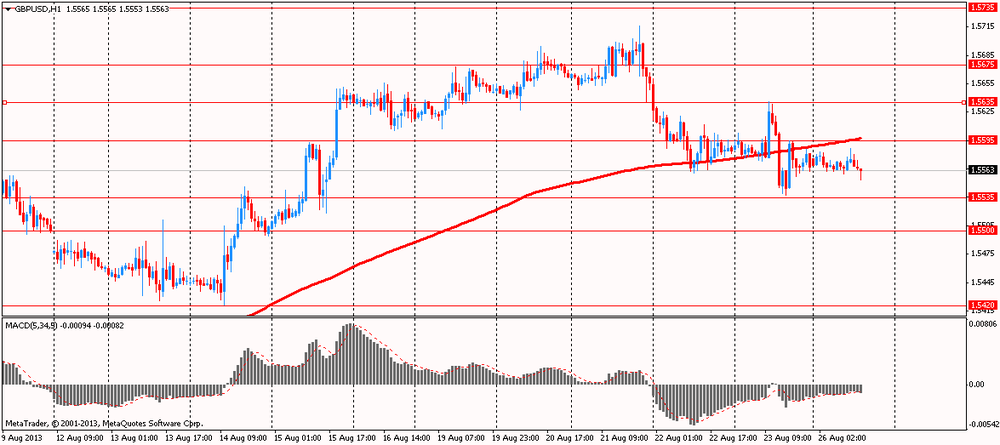

Value of the pound was little changed against the dollar, with the absence of publication of economic data for the UK, as well as the official day off. However, it is worth noting that a partial influence on the bidding had data for the U.S., as well as the comments of the Bank of England Deputy Governor Charlie Bean. He said that officials hints about keeping rates unchanged in the near future, recognizing the surprise of the market, when offered the so-called "policy of further intentions"

"What we're trying to do is to explain as clearly what are the factors that determine the policy in the future," - said in an interview with Charlie Bean, while attending the annual meeting of the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming.

"The question of what the market is justified and what is not, depends on your point of view and answer the question when inflationary pressures will begin to manifest itself." The new head of the Bank of England, Mark Carney, said earlier this month that the bank will not consider raising rates before unemployment reaches 7%. The UK economy grew by 0.7% in the second quarter, and Mr. Bean said that if the economy is experiencing a "significant slowdown" that politicians can introduce further quantitative easing.

EUR/USD $1.3315, $1.3335, $1.3350, $1.3360, $1.3420

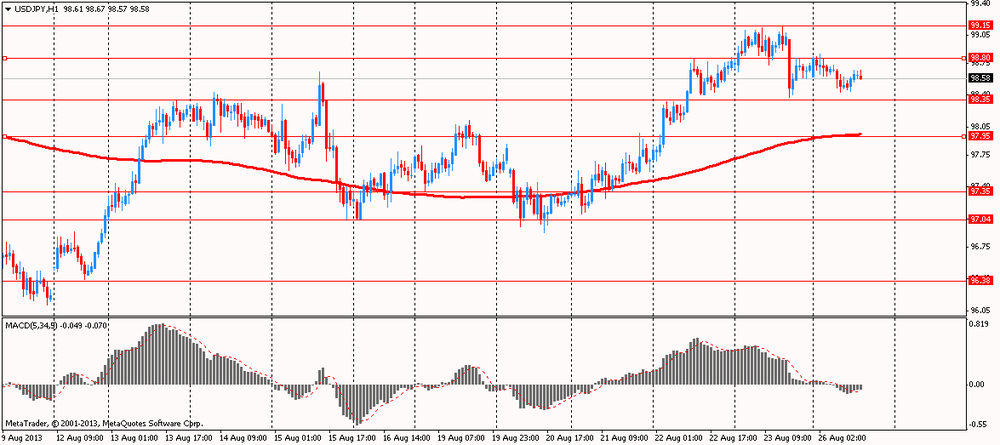

USD/JPY Y97.00, Y98.00, Y98.50, Y100.00

EUR/GBP stg0.8555

USD/CHF Chf0.9350

AUD/USD $0.8925, $0.9000, $0.9150

USD/CAD C$1.0400, C$1.0450, C$1.0460, C$1.0465, C$1.0570

08:00 Eurozone ECB's Jens Weidmann Speaks

Dollar index recovers losses incurred last Friday, trading near session highs around 81.40/45.

For the dollar this week promises to be interesting, and today we know the results of the report on orders for durable goods in the United States. Markets expect a reduction of orders by 3.0% in July, while the index excluding the transport sector is projected at 0.6%. Investor sentiment continues to control the talk about the prospects for reducing the Fed asset purchases, which are amplified as we approach the September meeting of the FOMC. "Our economists still expect the Fed to announce the beginning of tightening at the next meeting, but as yet no figures and dates will not be made public. However, the decision itself will signal the movement of the Central Bank to normalize. We believe that QE could be completed in the middle of next year ", - noted Mr. Barry and J. Yu, strategists at UBS.

Euro traded near-month high against the yen in anticipation of tomorrow's data IFO business climate index in Germany. It is expected that the figure will continue to further recovery of the fourth month in a row. According to the median forecast of economists, the level of business confidence in Europe's largest economy is likely to grow this month to 107 from 106.2 in July. In this case, the German unemployment rate for August is likely to be 6.8%. This is the lowest level since May 2012.

Today in Japan, Chief Cabinet Secretary Suga said that before the start of an extraordinary session of parliament, which will be held this fall, Prime Minister Shinzo Abe will take the decision to raise the sales tax in the country.

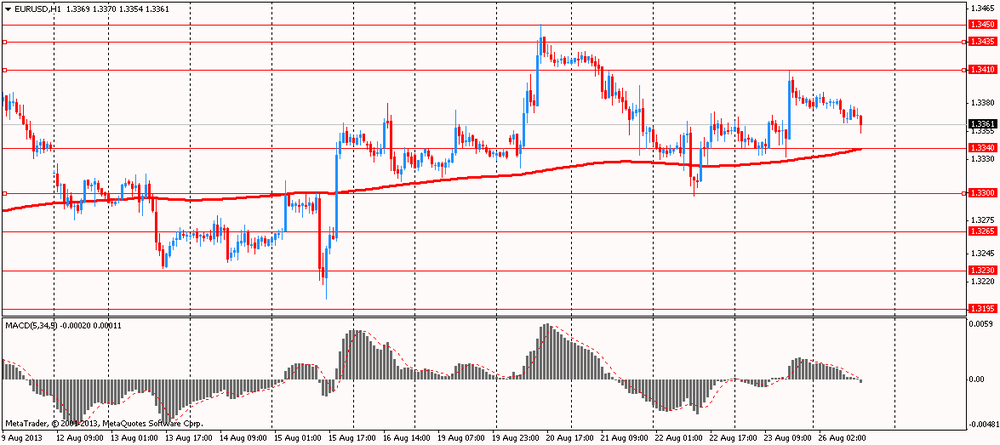

EUR / USD: during the European session, the pair fell to $ 1.3354

GBP / USD: during the European session, the pair fell to $ 1.5553

USD / JPY: during the European session, the pair consolidated in the Y98.43-Y98.67

At 12:30 GMT will be published data on the Consumer Price Index in Canada in July. At 13:00 GMT Belgium publish an index of business sentiment for August. At 14:00 GMT is expected to publish an indicator of consumer confidence for August for the euro area. Also this time, the U.S. will present data on the volume of sales in the primary market in July.

At 12:30 GMT the United States will change in orders for durable goods, including excluding transportation equipment in July.

In Britain, the summer bank holiday

EUR/USD

Offers $1.3500, $1.3475/85, $1.3450/60, $1.3410-20, $1.3400

Bids $1.3365/55, $1.3335/30, $1.3300, $1.3285/80

GBP/USD

Offers $1.5750/55, $1.5720/25, $1.5680/85, $1.5615/20, $1.5590/600

Bids $1.5555/50, $1.5525/15, $1.5505/00, $1.5495/90

AUD/USD

Offers $0.9150, $0.9120, $0.9090/00, $0.9075/80

Bids $0.8980/70, $0.8950, $0.8935/30, $0.8920, $0.8900, $0.8880/75

EUR/JPY

Offers Y133.50, Y133.20, Y133.00, Y132.40/50

Bids Y131.10/00, Y130.80, Y130.50, Y130.20/15

USD/JPY

Offers Y99.50, Y99.20

Bids Y98.10, Y98.00/7.90, Y97.85/80, Y97.50

EUR/GBP

Offers stg0.8675, stg0.8665, stg0.8640/45, stg0.8620/30, stg0.8600/10

Bids stg0.8560, stg0.8545/35, stg0.8520-10, stg0.8485/75

EUR/USD $1.3315, $1.3335, $1.3350, $1.3360, $1.3420

USD/JPY Y97.00, Y98.00, Y98.50, Y100.00

EUR/GBP stg0.8555

USD/CHF Chf0.9350

AUD/USD $0.8925, $0.9000, $0.9150

USD/CAD C$1.0400, C$1.0450, C$1.0460, C$1.0465, C$1.0570

---

The U.S. Dollar Index was little changed before a report forecast to show durable goods orders fell for the first time in four months. Orders placed with U.S. factories for goods meant to last at least three years probably fell 4 percent in July from the previous month, when they gained 3.9 percent, according to the median estimate of economists polled by Bloomberg News before the Commerce Department data today.Fed officials last week rebuffed calls to take the threat of fallout in emerging markets into account when tapering quantitative easing.

The euro was near the highest in a month against the yen before data tomorrow forecast to show continued improvement in Germany’s business climate. In Germany, Europe’s biggest economy, business confidence probably rose for a fourth month in August. The Ifo institute’s business climate index, based on a survey of 7,000 executives, rose to 107 from 106.2 in July, economists predicted ahead of tomorrow’s report. The German unemployment rate likely held at 6.8 percent in August, according to a separate poll before the Aug. 29 data. The jobless rate hasn’t been lower than that since May 2012

In Japan, Chief Cabinet Secretary Yoshihide Suga said today that Prime Minister Shinzo Abe will make a decision on whether to raise the country’s sales tax before the start of the extraordinary Diet session set for the autumn.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3375-90

GBP / USD: during the Asian session the pair traded in the range of $ 1.5560-80

USD / JPY: during the Asian session the pair fell below Y99.50

The approaching long weekend (UK closed today Aug26) prompted a paring back of long sterling positions ahead of this week's BOE Governor Carney speech (Wednesday, and expected to be dovish) as well as expected end month demand for euro-sterling.

06:00 United Kingdom Bank holiday

08:00 Eurozone ECB's Jens Weidmann Speaks

12:30 U.S. Durable Goods Orders July +4.2% -3.0%

12:30 U.S. Durable Goods Orders ex Transportation July 0.0% +0.6%

12:30 U.S. Durable goods orders ex defense July +3.0%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.