- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 01-02-2012

The euro rose against the dollar for the first time in three days as a purchasing managers’ index of manufacturing output in the region beat analysts’ estimates, adding to signs Europe’s economy is stabilizing. The euro reversed an earlier decline after Markit Economics said its manufacturing gauge based on a survey of purchasing managers in the euro region rose to 48.8 in January from 46.9 in December. In Germany, the output gauge reached the highest in six months. The euro appreciated 1 percent against the dollar last month as Italian and Spanish bonds outperformed their German counterparts amid speculation policy makers are bringing the region’s debt crisis under control. European economic confidence increased in January and German unemployment dropped more than economists estimated from the previous month. In discussions late last week in Athens, bondholders negotiating a debt swap with Greece lowered their demands for an average coupon on the new 30-year securities they would receive to as little as 3.6 percent from 4.25 percent after European officials demanded they take steeper losses, people familiar with the matter said at the time.

The greenback fell versus 14 of its 16 most-traded peers after manufacturing in China and the U.S. also rose, damping demand for safer assets. The official Chinese purchasing managers’ index increased to 50.5 from 50.3 in December, though the data may have been distorted by a weeklong holiday. U.S. manufacturing expanded at the fastest pace since June. The Institute for Supply Management’s manufacturing index rose to 54.1 in January from 53.1 in December, the group said today. Companies in the U.S. added 170,000 workers in January, reflecting job gains in services and at small businesses, according to a private report based on payrolls.

The yen appreciated for a fifth day against its U.S. counterpart, adding to speculation Japan’s central bank may sell the currency to stem its appreciation.

Switzerland’s franc climbed to a four-month high against the euro, approaching the Swiss National Bank’s ceiling.

European stocks advanced to a six- month high, with the Stoxx Europe 600 Index extending its best start to a year since 1998, as gauges of manufacturing increased from America to the euro area to China.

The Institute for Supply Management’s U.S. manufacturing index rose to 54.1 in January from 53.1 in December, the Tempe, Arizona-based group’s data showed today. Chinese manufacturing rose last month as the world’s second-biggest economy withstood weaker exports driven by the euro-area debt crisis and a government-induced property slowdown.

Greek bondholders may get a sweetener tied to a revival in economic growth that would ease the impact of accepting a lower interest rate on new bonds, people with knowledge of the talks said.

National benchmark indexes rose in 17 of the 18 western European markets. France’s CAC 40 added 2.1 percent. The U.K.’s FTSE 100 climbed 1.9 percent and Germany’s DAX jumped 2.4 percent.

Banks and carmakers led gains.

Banco Santander SA, Spain’s biggest lender, advanced 3.6 percent to 6.16 euros. Credit Agricole SA, France’s third-largest bank, rallied 7.4 percent to 5.06 euros.

BP Plc, Europe’s second-biggest oil company, gained 2.6 percent to 483 pence.

ICAP jumped 7.7 percent to 362 pence. The world’s largest broker of inter-bank transactions said pretax profit for the year ending March 31 will be at the “upper end” of the current range of analyst estimates of 336 million pounds ($528 million) to 358 million pounds. ICAP had said in November it expected full-year profit to be within analysts’ projections at that time of 358 million pounds to 390 million pounds.

Renault SA jumped 4.9 percent to 34.18 euros. Renault- Nissan 2011 global sales rose 10 percent to a record, driven by emerging markets and the U.S., the company said.

U.S. stocks advanced, erasing a four- day decline for the Standard & Poor’s 500 Index, amid signs that manufacturing across the world is strengthening.

Equities rallied after data showing manufacturing in the U.S. grew in January at the fastest pace in seven months. Chinese manufacturing indexes rose and a U.K. manufacturing gauge jumped to an eight-month high. In Germany, Europe’s largest economy, output grew for the first time since September. Manufacturing contracted less than initially estimated in the euro region. A spokesman said Greece expects to complete talks on a private sector debt swap and a second international financing deal for the country in the next days.

Dow 12,773.64 +140.73 +1.11%, Nasdaq 2,853.29 +39.45 +1.40%, S&P 500 1,329.44 +17.03 +1.30%

Morgan Stanley added 6.9 percent as Facebook Inc. is said to pick the firm to take the lead on its planned initial public offering.

Whirlpool Corp. surged 17 percent as the largest appliance maker projected earnings that beat forecasts.

Bank of America Corp. (ВАС) increased 4 percent, the most in the Dow, to $7.42. Citigroup Inc. advanced 4 percent to $31.95.

Amazon.com Inc. tumbled 8.6 percent, the most in the S&P 500, to $177.66. Sales missed estimates, signaling that its investments in media services, Kindle devices and shipping promotions have been slow to pay off.

Oil prices pared gains after an Energy Department report showed that U.S. inventories climbed and gasoline demand tumbled to the lowest level in a decade.

Futures dropped as much as 0.4 percent as supplies climbed 4.18 million barrels to 338.9 million last week, the report showed. A 2.6 million-barrel gain was forecast, according to analysts surveyed by Bloomberg News. Gasoline stockpiles rose 3.02 million barrels to 230.1 million. Demand for the fuel dropped to 7.97 million barrels a day.

Crude oil for March delivery fell to $98.12 a barrel on the New York Mercantile Exchange. The contract traded at $99.49 before release of the inventory report at 10:30 a.m. in Washington.

Brent crude oil for March settlement climbed $1.23, or 1.1 percent, to $112.21 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rise a second day due to the strengthening of the euro, but for all of January precious metal showed the maximum increase for that month since 1980. In January, prices rose by 11 percent due to weak dollar, demand of investors and consumers and through purchases by central banks.

The euro is rising after the announcement of increased industrial activity in Germany, carrying the gold. Analysts expect rally in the gold market this year, but warned of the possibility of lower prices in the near future.

The price of gold in euros are close to a maximum of six months, and in January rose 10percent.

Stocks ETF backed by gold funds in January rose to 650,000 ounces.

Cost of the February gold futures on the COMEX today rose to 1751.5 dollars per ounce.

Resistance 3:1352 (high of July'2011)

Resistance 2:1348 (Jul 22'2011 high)

Resistance 1:1329 (Jan 26 high)

The current price: 1322,50

Resistance 1:1300 (intraday low)

Resistance 2:1303 (Jan 31 low, session low)

Resistance 3:1296/94 (Jan 30 low, 61,8 % FIBO 1272-1329)

EUR/USD $1.2875, $1.3000, $1.3050, $1.3100, $1.3150, $1.3200

USD/JPY Y76.50, Y76.70, Y77.10, Y77.50

EUR/JPY Y99.50

GBP/USD $1.5650, $1.5700, $1.5750

USD/CHF Chf0.9350

AUD/USD $1.0700, $1.0600, $1.0475-70

U.S. stock futures advanced before data showing American manufacturing expansion and as Greece made progress on its debt swap negotiations.

Global stocks:

Nikkei 8,810 +7.28 +0.08%

Hang Seng 20,333 -57.12 -0.28%

Shanghai Composite 2,268 -24.53 -1.07%

FTSE 5,753 +71.33 +1.26%

CAC 3,343 +44.45 +1.35%

DAX 6,587 +127.72 +1.98%

Crude oil: $99.03 (+0,6%).

Gold: $1748.20 (+0,5%).

Data:

07:00 United Kingdom Nationwide house price index January -0.2% -0.1% -0.2%

07:00 United Kingdom Nationwide house price index, y/y January +1.0% +1.2% +0.6%

08:15 Switzerland Retail Sales Y/Y December +1.8% +1.6% +0.6%

08:30 Switzerland Manufacturing PMI January 50.7 52.0 47.3

08:50 France Manufacturing PMI (finally) January 48.9 48.5 48.5

08:55 Germany Manufacturing PMI (finally) January 48.4 50.9 51.0

09:00 Eurozone Manufacturing PMI (finally) January 46.9 48.7 48.8

09:30 United Kingdom Purchasing Manager Index Manufacturing January 49.6 50.2 52.1

10:00 Eurozone Harmonized CPI, Y/Y (preliminary) January +2.7% +2.7% +2.7%

The euro rose as a purchasing managers’ index of manufacturing output in the region beat analysts’ estimates, adding to signs Europe’s economy is stabilizing.

The greenback as equities advanced, damping demand for safer assets.

The euro reversed an earlier decline after Markit Economics said its manufacturing gauge based on a survey of purchasing managers in the euro region rose to 48.8 in January from 46.9 in December.

EUR/USD: the pair grown, showed high in $1,3200 area.

GBP/USD: the pair shown high in $1,5860 area, but receded later.

USD/JPY: the pair decreased, showed low in Y76.00 area.

Will continue put the block of statistics from the USA - industrial index ISM (15:00 GMT), data on EIA Crude Oil Stock from the ministry of power (15:30 GMT). Will finish put New Zealand data on employment and unemployment (21:45 GMT).

EUR/JPY

Offers Y101.85/90, Y101.45/50, Y100.95/00, Y100.85/90

Bids Y99.80/75, Y99.55/50, Y98.95/90

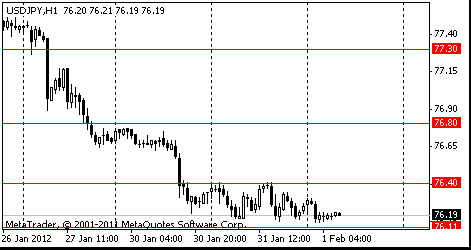

Resistance 3: Y77.20 (hourly high on Jan 27)

Resistance 2: Y76.80 (Jan 30 high)

опротивление 1: Y76.40 (Jan 31 high)

Current price: Y76.05

Support 1:Y76.00 (session low, psychological level)

Support 2:Y75.60 (historical low)

Support 3:Y75.00 (psychological level)

Resistance 3: Chf0.9290 (38,2 % FIBO Chf0.9570-Chf0.9120)

Resistance 2: Chf0.9250 (session high)

Resistance 1: Chf0.9190 (low of asian session)

Current price: Chf0.9169

Support 1: Chf0.9150 (session low, resistance line from Jan 17 brocken earlier)

Support 2: Chf0.9120 (Jan 27-31 lows)

Support 3: Chf0.9060 (low of December)

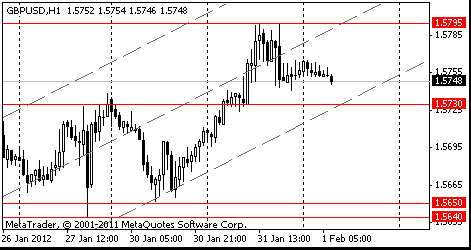

Resistance 3 : $1.5960 (МА (200) for D1)

Resistance 2 : $1.5890 (Nov 18 high)

Resistance 1 : $1.5790 (Jan 31 high)

Current price: $1.5779

Support 1 : $1.5740 (intraday low)

Support 2 : $1.5700 (session low)

Support 3 : $1.5655/40 (Jan 27-30 lows, МА (200) for Н1)

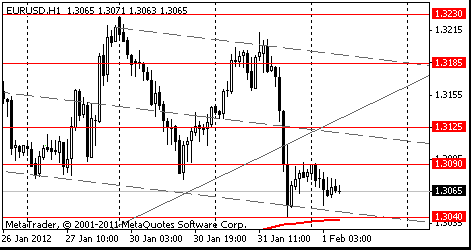

Resistance 3 : $1.3230/45 (Jan 30 high, 38,2 % FIBO $1,4250-$ 1,2620)

Resistance 2 : $1.3200 (resistance line from Jan 27)

Resistance 1 : $1.3150 (session high)

Current price: $1.3132

Support 1 : $1.3090 (high of asian session)

Support 2 : $1.3020 (session low)

Support 3 : $1.3000 (psychological level, 38,2 % FIBO $1,2620-$ 1,3230)

EUR/USD $1.2875, $1.3000, $1.3050, $1.3100, $1.3150, $1.3200

USD/JPY Y76.50, Y76.70, Y77.10, Y77.50

EUR/JPY Y99.50

GBP/USD $1.5650, $1.5700, $1.5750

USD/CHF Chf0.9350

AUD/USD $1.0700, $1.0600, $1.0475-70

Asian stocks fell, erasing gains, amid speculation that an unexpected expansion in China’s manufacturing reduces the need for easier monetary policy and as weaker economic reports in the U.S. dimmed the earnings outlook for exporters.

Nikkei 225 8,810 +7.28 +0.08%

Hang Seng 20,335 -55.44 -0.27%

S&P/ASX 200 4,226 -37.02 -0.87%

Shanghai Composite 2,268 -24.53 -1.07%

Industrial & Commercial Bank of China Ltd., the world’s biggest lender, slid 0.9 percent in Hong Kong.

Li & Fung Ltd., the supplier of toys and clothes to retailers including Wal-Mart Stores Inc., fell 1.5 percent.

Sumitomo Heavy Industries Ltd. sank 9.6 percent in Tokyo after the machinery maker cut its full-year profit forecast by 28 percent. Shipping stocks gained on speculation rising cargo rates will help shore up earnings.

00:00 Australia HIA New Home Sales, m/m December +6.8% -4.9%

00:30 Australia House Price Index (QoQ) IV quarter -1.2% -0.7% -1.0%

00:30 Australia House Price Index (YoY) IV quarter -2.2% -3.3% -4.8%

01:00 China Manufacturing PMI January 50.3 49.8 50.5

01:30 Japan Labor Cash Earnings, YoY December -1.0% -0.3% -0.2%

02:30 Сhina HSBC Manufacturing PMI (finally) January 48.7 48.8

05:30 Australia Commodity Prices, Y/Y January +10.9% +6.0%

The euro maintained a two-day decline as Greece struggles to conclude debt-swap talks with creditors by the end of this week.

The 17-nation currency touched a one-week low versus the yen before Portugal sells bills today amid concern the nation will follow Greece in needing more aid to avoid default. Portugal will sell 105-day and 168-day bills today. Standard & Poor’s increased the number of Portuguese banks on “creditwatch negative” after it cut the sovereign rating of the country. Yields (GSPT2YR) on Portugal’s two-year notes soared to a record 21.82 percent yesterday.

The Australian dollar maintained a gain from yesterday after a report showed manufacturing unexpectedly expanded last month in China, the South Pacific nation’s biggest trading partner.

Demand for the so-called Aussie was supported after a purchasing managers’ index for Chinese manufacturing rose to 50.5 from 50.3 in December, above the level of 50 that marks the division between contraction and expansion.

Australian house prices plunged by the most on record in 2011, figures from the statistics bureau showed today. Sales of newly built homes dropped in December after a revised 4.4 percent gain the previous month, according to a separate report from the Canberra-based Housing Industry Association.

New Zealand’s dollar, nicknamed the kiwi, slid as Asian stocks fell. Demand for both currencies was limited on speculation U.S. jobs data will point to a slowing recovery in the world’s largest economy, reducing demand for higher-yielding assets.

EUR/USD: during the Asian session the pair fell.

GBP/USD: during the Asian session the pair decreased.

USD/JPY: during the Asian session the pair was under pressure.

On Wednesday at 05:30 GMT Australia will publish the RBA Commodity Price SDR for January. Day will be continued by data on the SVME Manufacturing Purchasing Managers Index (PMI) for January at 08:30 GMT Switzerland. The Manufacturing Purchasing Managers Index (PMI) in Germany will leave at 08:55, in the Eurozone - at 09:00 GMT and in Britain - at 09:30 GMT. At 10:00 GMT the Eurozone will publish an estimation of a consumer price index for January. Will continue put the block of statistics from the USA - The Employment Change released by the Automatic Data Processing for January (13:15 GMT), industrial index ISM (15:00 GMT), data on EIA Crude Oil Stock from the ministry of power (15:30 GMT). Will finish put New Zealand data on employment and unemployment (21:45 GMT).

Yesterday the euro fell to its weakest level in almost a week versus the dollar as investors speculated European policy makers won’t be able to reach an agreement regarding Greece’s debt obligations. The euro weakened against the majority of its most- traded peers as Standard & Poor’s increased the number of Portuguese banks on “creditwatch negative.” Greece pledged a last-ditch effort to prevent the collapse of a second rescue package from creditors, aiming to complete talks this week on a financial lifeline that’s been in the works for six months.

The dollar and yen pared earlier losses as stocks fell after consumer confidence and business activity in the U.S. was weaker than forecast in January. The dollar gained against half its major counterparts after Institute for Supply Management-Chicago Inc. said today its business barometer decreased to 60.2 from 62.2 in December. Consumer confidence unexpectedly dropped in January as gas prices picked up and more Americans said jobs are hard to get.

EUR/USD: yesterday the pair fell to a floor of a figure and closed day below $1.3100.

GBP/USD: yesterday the pair rose, updated monthly high.

USD/JPY: yesterday the pair holds in range Y76.15-Y76.40.

On Wednesday at 05:30 GMT Australia will publish the RBA Commodity Price SDR for January. Day will be continued by data on the SVME Manufacturing Purchasing Managers Index (PMI) for January at 08:30 GMT Switzerland. The Manufacturing Purchasing Managers Index (PMI) in Germany will leave at 08:55, in the Eurozone - at 09:00 GMT and in Britain - at 09:30 GMT. At 10:00 GMT the Eurozone will publish an estimation of a consumer price index for January. Will continue put the block of statistics from the USA - The Employment Change released by the Automatic Data Processing for January (13:15 GMT), industrial index ISM (15:00 GMT), data on EIA Crude Oil Stock from the ministry of power (15:30 GMT). Will finish put New Zealand data on employment and unemployment (21:45 GMT).

Asian stocks rose, with a regional benchmark index headed for its second-biggest monthly rally since September 2010, as Greek Prime Minister Lucas Papademos said major progress was made in debt-swap talks and Japan’s industrial production grew faster than economists estimated. Greece aims to complete debt-swap talks with bondholders by the end of this week, Papademos told reporters after the European Union summit in Brussels.

Nikkei 225 8,803 +9.46 +0.11%

Hang Seng 20,390 +230.08 +1.14%

S&P/ASX 200 4,263 -10.06 -0.24%

Shanghai Composite 2,293 +7.57 +0.33%

Fanuc Corp., Japan’s top maker of factory robots, added 1 percent.

Sumitomo Mitsui Financial Group Inc., Japan’s second- largest lender by market value, rose 1.5 after saying it will meet its full-year profit forecast.

Daewoo Shipbuilding & Marine Engineering Co., the world’s third-biggest shipyard, jumped 6.5 percent after winning a $560 million contract to supply tankers to Kuwait Oil Tanker Co.

European stocks rose, posting their best monthly start to a year since 1998, as most countries in the region agreed to tighter budget controls, outweighing worse- than-estimated economic data.

European Union leaders, meeting in Brussels yesterday, agreed on a fiscal-discipline treaty that allows for sanctions on high-deficit states and requires members to enact laws to limit budget shortfalls. Britain and the the Czech Republic refused to sign the pact.

The policy makers also decided to bring the region’s permanent bailout fund, the European Stability Mechanism, into operation on July 1, a year before schedule.

Greece aims to complete debt-swap talks with bondholders this week. Prime Minister Lucas Papademos told reporters after summit that he is “strongly committed” to reaching a deal.

German unemployment dropped more than economists forecast to a two-decade low in January. The number of people out of work fell a seasonally adjusted 34,000 to 2.85 million, the Federal Labor Agency said. That’s the biggest drop since March.

National benchmark indexes rose in 15 of the 18 western European markets today. The U.K.’s FTSE 100 climbed 0.2 percent, Germany’s DAX advanced 0.2 percent, and France’s CAC 40 gained 1 percent.

Oil gained after the December industrial output rose more than forecast in Japan, the third-biggest crude consumer. BP, Europe’s second-largest oil producer, gained 2.7 percent to 470.85 pence. Shell and Total SA gained 0.5 percent to 2,240.5 pence and 1.5 percent to 40.41 euros, respectively.

ThyssenKrupp, Germany’s largest steelmaker, rose 2.7 percent to 21.67 euros in Frankfurt after agreeing to sell its Inoxum stainless steel unit to Outokumpu Oyj. The deal valued the German company’s unit at about 2.7 billion euros. ThyssenKrupp will retain a 29.9 percent stake in the business, receive 1 billion euros in cash, and transfer liabilities of 422 million euros for Inoxum to Outokumpu. Outokumpu fell 15 percent to 6.27 euros in Helsinki.

ARM Holdings jumped 2 percent to 609.5 pence. The maker of processors for Apple Inc.’s iPads and iPhones said fourth- quarter revenue climbed 21 percent as the company increased the number of licenses sold for smartphones and tablet computers.

U.S. stocks fell for a fourth day, the longest streak for the Dow Jones Industrial Average since August, as reports showed consumer confidence trailed economists’ projections and business activity cooled. Stocks erased early gains as reports showed that consumer confidence unexpectedly dropped in January and a gauge of business activity fell, underscoring forecasts that the U.S. economy will cool after expanding at the fastest pace since the second quarter 2010. Earlier gains were triggered after most countries in Europe agreed to tighter budget controls and Greece made progress on debt talks.

Dow 12,632.91 -20.81 -0.16%, Nasdaq 2,813.84 +1.90 +0.07%, S&P 500 1,312.40 -0.61 -0.05%

Stocks pared earlier losses as financial shares rallied. Morgan Stanley and Goldman Sachs Group Inc. added at least 1.5 percent.

Exxon Mobil Corp. (XOM) dropped 2.1 percent, the biggest decline in the Dow, to $83.74. Revenue rose 16 percent to $121.6 billion during the quarter, less than the $124.4 billion average of five analysts’ estimates.

ADM sank 3.6 percent to $28.63. The company, led by Chairman and Chief Executive Officer Patricia Woertz, has missed analysts’ estimates for three straight quarters. Operating profit at the agricultural-services unit, the company’s largest segment by revenue in fiscal 2011, fell 63 percent to $158 million after U.S. grain exports declined because of a smaller domestic crop and “adequate” global supplies, ADM said.

RadioShack Corp. tumbled 30 percent to $7.18 after the consumer-electronics retailer suspended share repurchases and reported preliminary fourth-quarter earnings that trailed analysts’ estimates.

Resistance 3: Y77.30 (Jan 20 high)

Resistance 2: Y76.80 (Jan 30 high)

Resistance 1: Y76.40 (Jan 31 high)

The current price: Y76.19

Support 1: Y76.10 (Sep 21 low)

Support 2: Y75.60 (Oct 31 low)

Support 3: Y75.00 (psychological level)

Resistance 3: Chf0.9290 (high of the Asian session on Jan 24)

Resistance 2: Chf0.9255 (MA (233) H1)

Resistance 1: Chf0.9225 (Jan 31 high)

The current price: Chf0.9218

Support 1: Chf0.9195 (session low)

Support 2: Chf0.9165 (low of the American session on Jan 30)

Support 3: Chf0.9120 (Jan 31 low)

Resistance 3 : $1.5930 (Nov 15 high)

Resistance 2 : $1.5885 (Nov 18 high)

Resistance 1 : $1.5795 (Jan 31 high)

The current price: $1.5748

Support 1 : $1.5730 (support line from Jan 18)

Support 2 : $1.5640/50 (area of Jan 27-30 low)

Support 3 : $1.5600 (MA (233) H1)

Resistance 3 : $1.3185 (Jan 26 high)

Resistance 2 : $1.3125 (middle line from Jan 27)

Resistance 1 : $1.3090 (session high)

The current price: $1.3065

Support 1 : $1.3040 (Jan 31 low, MA (233) H1)

Support 2 : $1.3000 (38.2 FIBO $1.3230-$1.2625)

Support 3 : $1.2950 (Jan 24 low)

Change % Change Last

Oil $98.48 0.00 0.00%

Gold $1,738.30 +0.50 +0.03%

Change % Change Last

Nikkei 225 8,803 +9.46 +0.11%

Hang Seng 20,390 +230.08 +1.14%

S&P/ASX 200 4,263 -10.06 -0.24%

Shanghai Composite 2,293 +7.57 +0.33%

FTSE 100 5,682 +10.52 +0.19%CAC 40 3,299 +32.91 +1.01%

DAX 6,459 +14.46 +0.22%

Dow 12,632.91 -20.81 -0.16%

Nasdaq 2,813.84 +1.90 +0.07%

S&P 500 1,312.40 -0.61 -0.05%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3083 -0,46%

GBP/USD $1,5757 +0,31%

USD/CHF Chf0,9200 +0,34%

USD/JPY Y76,25 -0,12%

EUR/JPY Y99,77 -0,56%

GBP/JPY Y120,16 +0,22%

AUD/USD $1,0620 +0,22%

NZD/USD $0,8265 +0,90%

USD/CAD C$1,0024 +0,11%

00:00 Australia HIA New Home Sales, m/m December +6.8%

00:30 Australia House Price Index (QoQ) IV quarter -1.2% -0.7%

00:30 Australia House Price Index (YoY) IV quarter -2.2% -3.3%

01:00 China Manufacturing PMI January 50.3 49.8

01:30 Japan Labor Cash Earnings, YoY December -1.0% -0.3%

02:30 China HSBC Manufacturing PMI (finally) January 48.7

05:30 Australia Commodity Prices, Y/Y January +10.9%

07:00 United Kingdom Nationwide house price index January -0.2% -0.1%

07:00 United Kingdom Nationwide house price index, y/y January +1.0% +1.2%

08:15 Switzerland Retail Sales Y/Y December +1.8% +1.6%

08:30 Switzerland Manufacturing PMI January 50.7 52.0

08:50 France Manufacturing PMI (finally) January 48.9 48.5

08:55 Germany Manufacturing PMI (finally) January 48.4 50.9

09:00 Eurozone Manufacturing PMI (finally) January 46.9 48.7

09:30 United Kingdom Purchasing Manager Index Manufacturing January 49.6 50.2

10:00 Eurozone Harmonized CPI, Y/Y (preliminary) January +2.7% +2.7%

13:15 U.S. ADP Employment Report January 325 193

13:30 U.S. FOMC Member Charles Plosser Speaks 0

15:00 U.S. ISM Manufacturing January 53.9 54.6

15:00 U.S. Construction Spending, m/m December +1.2% +0.9%

15:30 U.S. EIA Crude Oil Stocks change 27/01/2012 +3.6

21:45 New Zealand Employment Change, q/q IV quarter +0.2%

21:45 New Zealand Unemployment Rate IV quarter 6.6%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.