- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 03-02-2012

The dollar gained, recovering from an almost postwar low against the yen, after U.S. employers added more jobs than forecast, damping speculation the Federal Reserve will add another round of asset purchases to spur growth. Nonfarm payrolls rose by 243,000, after a revised 203,000 gain in December, the Labor Department reported today in Washington. The unemployment rate fell to 8.3 percent. Data this year have signaled the U.S. economy is recovering at a quickening pace. Manufacturing grew in January at the fastest pace in seven months, the Institute for Supply Management reported Feb. 1. Consumer confidence rose last month to the highest level in almost a year, according to a Thomson Reuters/University of Michigan index published Jan. 27.

The Japanese currency dropped, after trading within one yen of its post-World War II high versus the dollar, reducing speculation the nation will intervene in the currency market to stem its appreciation. Japan’s Finance Minister Jun Azumi has said he will take decisive steps against one-sided moves in the yen if needed. The currency’s level doesn’t reflect economic fundamentals, and falling U.S. interest rates are increasing speculative yen buying, he told reporters in Tokyo.

The euro erased losses after the European Central Bank was said to be considering using its bond holdings to bolster Greece’s next rescue program and support efforts to contain the sovereign-debt crisis, according to three euro-region officials. The 17-nation shared currency headed for a weekly decline against 15 of its 16 most-traded peers as finance ministers from the euro region’s top-rated countries, meeting in Berlin, didn’t discuss a higher public sector contribution to a second aid program for Greece, reflecting reluctance to place bigger burdens on their taxpayers.

European stocks rose for a fourth day, extending a six-month high, after a report showed that the U.S. economy added more jobs last month than economists had predicted and the unemployment rate unexpectedly retreated.

European stocks extended their advance after a report showed the U.S. economy added 243,000 jobs in January. Employers hired an extra 203,000 people in December. The release also showed that the jobless rate retreated to 8.3 percent, its lowest level since February 2009.

A report showed that services industries in the U.K. unexpectedly increased last month. The measure of activity rose to 56 in January from 54 in December, according to a statement from Markit Economics and the Chartered Institute of Purchasing and Supply. That beat the average economist estimate for a reading of 53.3.

National benchmark indexes climbed in every western- European market today except Greece. The U.K.’s FTSE 100 Index added 1.8 percent. France’s CAC 40 Index gained 1.5 percent and Germany’s DAX Index advanced 1.7 percent.

Temenos surged 16 percent to 19.90 Swiss francs, its biggest rally since November 2008, after Misys said it has held talks with the Swiss software maker about an all-share merger. In a separate statement, Temenos said it is “evaluating its strategic options.” Misys gained 1.2 percent to 329.5 pence in London trading.

Admiral jumped 7.9 percent to 1,038 pence, its biggest jump since January 2009. The U.K. car insurer that owns the confused.com website rose the most since January 2009 after saying it has extended its reinsurance partnerships, without increasing its costs.

Daimler AG, the carmaker that makes 24 percent of its sales in the U.S., climbed 3.1 percent to 45.46 euros following the U.S. jobs report.

Volvo AB rose 4.4 percent to 94.70 kronor after the world’s second-largest truckmaker reported fourth-quarter earnings before interest and taxes that increased 26 percent to 6.96 billion kronor ($1.04 billion) from 5.52 billion kronor a year earlier. The Gothenburg, Sweden-based manufacturer posted sales that jumped 18 percent.

U.S. stocks advanced, extending the best start to a year for the Standard & Poor’s 500 Index since 1989, after a report showed that employment growth topped estimates and the jobless rate unexpectedly fell to 8.3 percent. Stocks and bond yields jumped as the report fueled optimism the economy is weathering the European debt crisis. The 243,000 increase in payrolls was the most since April and exceeded all forecasts. The unemployment rate dropped to the lowest since February 2009.

Financial and industrial shares led the gains among 10 groups in the S&P 500. Bank of America (ВАС) added 4.8 percent to $7.81. Caterpillar (САТ) increased 2.4 percent to $112.97. Alcoa (АА) climbed 2.4 percent to $10.67. FedEx jumped 1.4 percent to $94.04.

Genworth Financial soared 14 percent, the most in the S&P 500, to $9.18. Chief Executive Officer Michael Fraizer has scaled back the retirement-products business to conserve capital as Genworth seeks to maintain sales of U.S. mortgage coverage. The company has no plans to add more capital to the U.S. mortgage insurance operation, Fraizer said today.

Tyson Foods rose 5.3 percent to $19.61. The meat processor reported first-quarter earnings of 42 cents a share. On average, the analysts surveyed by Bloomberg estimated profit of 34 cents.

Brocade Communications Systems Inc. rose 1.2 percent to $5.90. Blackstone Group LP is studying a leveraged buyout of the company, said a person with knowledge of the situation. While Blackstone is in talks with Brocade, which has been seeking a buyer since 2009, reaching a deal may be difficult, said the person.

Estee Lauder Cos. lost 4.3 percent to $56.32. The maker of Mac cosmetics and Clinique skin care forecast third-quarter earnings of no more than 32 cents a share, before restructuring charges, missing the average analyst estimate of 41 cents.

Oil in New York trading in a narrow range against the background of the positive macroeconomic data from the U.S. and the continuing uncertainty about the debt of Greece.

The volume of production orders in the U.S. in December registered the 2nd consecutive month of growth. It was another sign that the manufacturing sector continues to recover. In December, orders rose by 1.1% compared to November's rise of 2.2%, as reported today, the Ministry of Commerce in Washington. It was funded to some analysts' forecasts, expected to grow by 1.5%. In January, factories increased employment record over the past 12 months, rate, and duration of the working week was the highest in the last 14 years, as reported today, the Ministry of Labour. U.S. companies need to replenish stocks and maintain equipment that is likely to support the level of activity in the manufacturing sector.

Nevertheless, the debt crisis in Europe could limit export growth, which creates certain risks for American manufacturing companies. The pressure on the futures continue to speculation about the role of the European Central Bank and eurozone governments in resolving the debt problem in Greece.

March futures price of U.S. light crude oil WTI (Light Sweet Crude Oil) traded in a range of 96.01 - 97.47 dollars per barrel.

Gold fell after upbeat data on the U.S. labor market, causing a strong appreciation of the dollar. As demonstrated by statistics released by the end of January in non-agricultural sectors of the U.S. economy has been created 243K jobs, well above the average forecast at 125K. The data for December were revised up to 203K with a 200K. At the same time the unemployment rate declined to the level of 8.3% from 8.5% in December.

In addition, the orders in the manufacturing sector grew in December at 1.1%, expected to grow by 1.5%, previous change was revised from 1.8% to 2.2%. Orders for durable goods, according to revised data, in December rose by 3.0% m / m, the previous change of 3.0% m / m The index of economic conditions in the ISM non-manufacturing sector in January was 56.8 points, 53.0 points was expected, the previous value of 53.0 points.

The cost of the February gold futures on the COMEX today fell to 1734.5 dollars per ounce.

Resistance 3:1352 (July'2011 high)

Resistance 2:1348 (Jul 22'2011 high)

Resistance 1:1339 (session high)

Current price: 1336,75

Resistance 1:1329 (earlier resistance, Jan 26 high)

Resistance 2:1317 (Feb 2 low)

Resistance 3:1303 (Jan 31 and Feb 1 lows)

prices paid 63.5;

new orders 59.4 vs 54.6;

employment 57.4 vs 49.8.

EUR/USD $1.3050, $1.3060, $1.3100, $1.3200, $1.3300

USD/JPY Y76.00, Y76.50

AUD/USD $1.0600, $1.0700, $1.0800, $1.0825

EUR/CHF Chf1.2075, Chf1.2000

USD/CAD C$0.9900, C$1.0000

EUR/GBP stg0.8400

US futures rose a report showed that the U.S. economy added more jobs last month than economists had predicted.

Global stocks:

Nikkei 8,831.93 -44.89 -0.51%

Hang Seng 20,756.98 +17.53 +0.08%

Shanghai Composite 2,330.4 +17.85 +0.77%

FTSE 5,860.47 +64.40 +1.11%

CAC 3,393.31 +16.65 +0.49%

DAX 6,741.52 +85.89 +1.29%

Crude oil: $96.95 (+0,6%).

Gold: $1754.70 (-0,3%).

Data:

08:50 France Services PMI (finally) January 50.3 51.7 52.3

08:55 Germany Services PMI (finally) January 52.4 54.5 53.7

09:00 Eurozone Services PMI (finally) January 48.8 50.5 50.4

09:30 United Kingdom Purchasing Manager Index Services January 54.0 53.6 56.0

10:00 Eurozone Retail Sales (MoM) December -0.8% +0.4% -0.4%

10:00 Eurozone Retail Sales (YoY) December -2.5% -1.3% -1.6%

The dollar fell before a report economists said will show U.S. employers increased payrolls in January, damping demand for the safest assets.

The advance trimmed the euro’s weekly decline, after Greece and its creditors struggled to reach an agreement on a deal to reduce the nation’s debt.

U.S. employers boosted payrolls by 125,000 in January after an increase of 200,000 in December, according to the median estimate of economists. Unemployment probably held at 8.4 percent in January from the previous month, a separate survey shows.

Finance ministers from the four euro-area countries with AAA grades from all three major ratings companies -- Germany, Finland, Luxembourg and the Netherlands -- will meet in Berlin today, a German Finance Ministry spokesman, said yesterday. The ministers won’t brief reporters after the meeting, according to the spokesman, speaking on condition of anonymity.

EUR/USD: the pair grown, but hasn’t managed to overcome resistance in $1,3180 area.

GBP/USD: the pair grown, but hasn’t managed to overcome resistance in $1,5860 area.

USD/JPY: movement of the pair was limited Y76,13-Y76,28.

The main event is at 1330GMT, when the US Department of Labor Statistics releases its annual benchmark revision of its Current Employment Statistics along with the January report on employment. US data continues at 1500GMT when the ISM on-manufacturing index is expected to rise to a reading of 53.2 in January. Late US data includes the 2115GMT release of C&I loans data.

EUR/USD

Bids $1.3260/80, $1.3250, $1.3200/20

Offers $1.3110/00, $1.3085/80, $1.3055/50, $1.3020

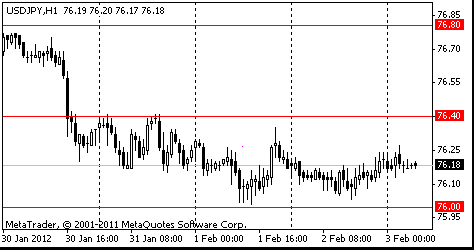

Resistance 3: Y77.20 (hourly high on Jan 27)

Resistance 2: Y76.80 (Jan 30 high)

Resistance 1: Y76.40 (Jan 31 high)

Current price: Y76.25

Support 1:Y76.00 (Feb 1 low)

Support 2:Y75.60 (historical low)

Support 3:Y75.00 (psychological level)

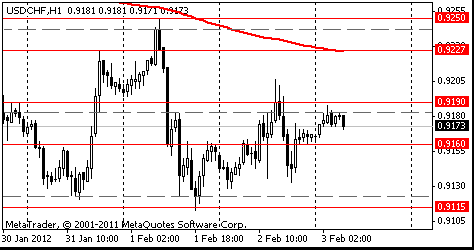

Resistance 3: Chf0.9290 (38,2 % FIBO Chf0.9570-Chf0.9120)

Resistance 2: Chf0.9250 (Feb 1 high)

Resistance 1: Chf0.9200 (МА (200) for Н1)

Current price: Chf0.9155

Support 1: Chf0.9120 (area of Jan 27-31 and Feb 1 lows)

Support 2: Chf0.9060 (low of December)

Support 3: Chf0.9000 (psychological level)

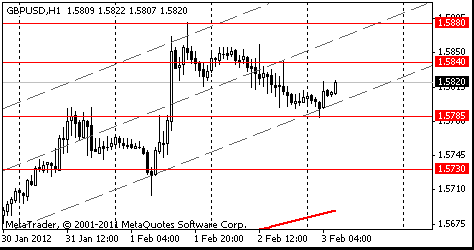

Resistance 3 : $1.5960 (МА (200) for D1)

Resistance 2 : $1.5890 (area of Nov 18 and Feb 1 highs)

Resistance 1 : $1.5860 (session high, Feb 2 high)

Current price: $1.5830

Support 1 : $1.5820 (support line from Jan 13)

Support 2 : $1.5780 (session low)

Support 3 : $1.5700 (Feb 1 low, МА (200) for Н1)

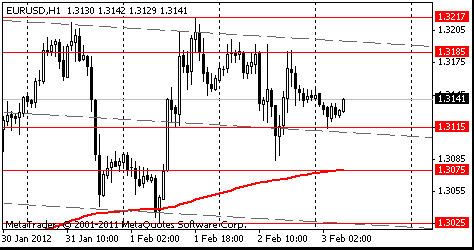

Resistance 3 : $1.3350 (МА (100) for D1)

Resistance 2 : $1.3230/45 (Jan 30 high, 38,2 % FIBO $1,4250-$ 1,2620)

Resistance 1 : $1.3180 (session high, resistance line from Jan 27)

Current price: $1.3180

Support 1 : $1.3110 (session low, МА (200) for Н1)

Support 2 : $1.3080 (Feb 2 low)

Support 3 : $1.3020/00 (Feb 1 lows, psychological level, 38,2 % FIBO $1,2620-$ 1,3230)

00:15 U.S. FOMC Member Richard Fisher Speaks 0

01:00 China Non-Manufacturing PMI January 56.0 52.9

The euro headed for a weekly decline against all of its 16 major peers as Greece and its creditors struggle to reach an agreement on a debt swap. The euro held losses from yesterday against the yen as finance ministers from Germany, Finland, Luxembourg and the Netherlands were said to hold talks in Berlin today. Finance ministers from the four euro-area countries with AAA grades from all three major ratings companies -- Germany, Finland, Luxembourg and the Netherlands -- will meet in Berlin today, a German Finance Ministry spokesman. The ministers will discuss current issues without briefing reporters after the meeting, according to the spokesman, speaking on the condition of anonymity.

Japan’s currency traded within one yen of a postwar high versus the dollar, raising speculation the country will intervene to weaken it. Japan’s Finance Minister Jun Azumi said today he will take decisive steps against one-sided moves in the yen if needed. The currency’s level doesn’t reflect economic fundamentals, and falling U.S. interest rates are increasing speculative yen buying, he told reporters in Tokyo. Japan sold the yen on Oct. 31 on concern its advance to a record would hurt exporters.

The so-called Aussie slid after reaching a five-month high yesterday as a gauge showed non-manufacturing industries in China, Australia’s largest trading partner, expanded at a slower pace last month.

New Zealand’s currency, nicknamed the kiwi, fell versus all of its major peers as Asian stocks dropped. Australia’s dollar failed to extend a three-day advance against its U.S. counterpart after a report from China Federation of Logistics and Purchasing and the National Bureau of Statistics showed the country’s non-manufacturing purchasing managers’ index fell to 52.9 in January from 56 the previous month. A reading above 50 indicates an expansion. The Australian and New Zealand currencies were poised to complete a seventh-straight week of gains amid speculation reports today will show an increase in U.S. employment, supporting demand for higher-yielding assets.

EUR/USD: during the Asian session the pair fell.

GBP/USD: during the Asian session the pair advanced.

USD/JPY: during the Asian session the pair holds in range Y76.13-Y76.26.

European data sees the release of the final services PMI data from the major European states, including France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT. The final PMI figures are expected to remain unrevised from the preliminary figures. EMU retail trade then follows, at 1000GMT. The UK Markit/CIPS Services PMI is also due, at 0928GMT. The main event is at 1330GMT, when the US Department of Labor Statistics releases its annual benchmark revision of its Current Employment Statistics along with the January report on employment. US data continues at 1500GMT when the ISM on-manufacturing index is expected to rise to a reading of 53.2 in January. Late US data includes the 2115GMT release of C&I loans data.

EUR/USD $1.3050, $1.3060, $1.3100, $1.3200, $1.3300

USD/JPY Y76.00, Y76.50

AUD/USD $1.0600, $1.0700, $1.0800, $1.0825

EUR/CHF Chf1.2075, Chf1.2000

USD/CAD C$0.9900, C$1.0000

EUR/GBP stg0.8400

Asian stocks fell, with a regional index dropping from a three-month high, as companies from Singapore Airlines Ltd. (SIA) and Hynix Semiconductor Inc. (000660) reported weaker earnings amid Europe’s debt crisis and an uncertain U.S. economic outlook.

Nikkei 225 8,831.93 -44.89 -0.51%

Hang Seng 20,756.98 +17.53 +0.08%

S&P/ASX 200 4,251.17 -16.67 -0.39%

Shanghai Composite 2,330.4 +17.85 +0.77%

Nippon Sheet Glass Co., a Japanese glassmaker, slumped 12 percent in Tokyo after forecasting a 3 billion yen ($39 million) loss for the year ending March 31 on slumping demand in Europe, its top market. Singapore Airlines, the world’s No. 2 carrier by market value, fell 3.6 percent as third-quarter profit tumbled 53 percent. Hynix Semiconductor, the world’s second-largest maker of computer-memory chips, slid 3.7 percent after posting a wider-than-expected loss.

00:15 U.S. FOMC Member Richard Fisher Speaks 0

01:00 China Non-Manufacturing PMI January 56.0 52.9

The euro headed for a weekly decline against all of its 16 major peers as Greece and its creditors struggle to reach an agreement on a debt swap. The euro held losses from yesterday against the yen as finance ministers from Germany, Finland, Luxembourg and the Netherlands were said to hold talks in Berlin today. Finance ministers from the four euro-area countries with AAA grades from all three major ratings companies -- Germany, Finland, Luxembourg and the Netherlands -- will meet in Berlin today, a German Finance Ministry spokesman. The ministers will discuss current issues without briefing reporters after the meeting, according to the spokesman, speaking on the condition of anonymity.

Japan’s currency traded within one yen of a postwar high versus the dollar, raising speculation the country will intervene to weaken it. Japan’s Finance Minister Jun Azumi said today he will take decisive steps against one-sided moves in the yen if needed. The currency’s level doesn’t reflect economic fundamentals, and falling U.S. interest rates are increasing speculative yen buying, he told reporters in Tokyo. Japan sold the yen on Oct. 31 on concern its advance to a record would hurt exporters.

The so-called Aussie slid after reaching a five-month high yesterday as a gauge showed non-manufacturing industries in China, Australia’s largest trading partner, expanded at a slower pace last month.

New Zealand’s currency, nicknamed the kiwi, fell versus all of its major peers as Asian stocks dropped. Australia’s dollar failed to extend a three-day advance against its U.S. counterpart after a report from China Federation of Logistics and Purchasing and the National Bureau of Statistics showed the country’s non-manufacturing purchasing managers’ index fell to 52.9 in January from 56 the previous month. A reading above 50 indicates an expansion. The Australian and New Zealand currencies were poised to complete a seventh-straight week of gains amid speculation reports today will show an increase in U.S. employment, supporting demand for higher-yielding assets.

EUR/USD: during the Asian session the pair fell.

GBP/USD: during the Asian session the pair advanced.

USD/JPY: during the Asian session the pair holds in range Y76.13-Y76.26.

European data sees the release of the final services PMI data from the major European states, including France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT. The final PMI figures are expected to remain unrevised from the preliminary figures. EMU retail trade then follows, at 1000GMT. The UK Markit/CIPS Services PMI is also due, at 0928GMT. The main event is at 1330GMT, when the US Department of Labor Statistics releases its annual benchmark revision of its Current Employment Statistics along with the January report on employment. US data continues at 1500GMT when the ISM on-manufacturing index is expected to rise to a reading of 53.2 in January. Late US data includes the 2115GMT release of C&I loans data.

Yesterday the euro fell against the majority of its most-traded counterparts as Greece struggles to reach an agreement with its bondholders on cutting the nation’s debt burden. Luxembourg Prime Minister Jean-Claude Juncker said steps to tackle the debt crisis adopted at a summit on Jan. 30 were “largely insufficient.” China’s Premier Wen Jiabao said his nation supports European efforts to stabilize the 17-nation currency. China is still researching the best way to participate in the European Financial Stability Facility, Wen said at a briefing with German Chancellor Angela Merkel in Beijing.

The dollar rose before a report that may show employers boosted payrolls in January and the jobless rate held at an almost three-year low. Applications for unemployment insurance payments in the U.S. dropped by 12,000 to 367,000 in the week ended Jan. 28, Labor Department figures showed today in Washington. Fed Chairman Ben S. Bernanke said the economy has shown signs of improvement while remaining vulnerable to shocks, and he called on lawmakers to reduce the long-term U.S. budget deficit.

The yen rose to almost a postwar high against the dollar, prompting speculation Japan will intervene. Japanese Finance Minister Jun Azumi said he “can’t overlook” speculative moves in the foreign-exchange market and is ready take “decisive” actions if necessary.

The franc weakened against all except two of its 16 major counterparts amid talk of possible intervention by the Swiss National Bank. The SNB in September said it would cap the franc at 1.20 against the euro after it reached a euro-era record 1.00749 the previous month.

EUR/USD: yesterday the pair decreased.

GBP/USD: yesterday the pair fell.

USD/JPY: yesterday the pair holds in range Y76.00-Y76.25.

European data sees the release of the final services PMI data from the major European states, including France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT. The final PMI figures are expected to remain unrevised from the preliminary figures. EMU retail trade then follows, at 1000GMT. The UK Markit/CIPS Services PMI is also due, at 0928GMT. The main event is at 1330GMT, when the US Department of Labor Statistics releases its annual benchmark revision of its Current Employment Statistics along with the January report on employment. US data continues at 1500GMT when the ISM on-manufacturing index is expected to rise to a reading of 53.2 in January. Late US data includes the 2115GMT release of C&I loans data.

Asian stocks advanced for a third day, with the regional benchmark index heading for its highest close in three months, as manufacturing gained in the U.S. and Europe, boosting confidence the global economy is recovering. Stocks also rose as discussions between Greece and its creditors continued to progress. The Greek government is “one step from closing” a debt-swap deal with private bondholders, Finance Minister Evangelos Venizelos told reporters in Athens yesterday.

Nikkei 225 8,876.82 +67.03 +0.76%

Hang Seng 20,739.45 +406.08 +2.00%

S&P/ASX 200 4,267.85 +42.18 +1.00%

Shanghai Composite 2,312.56 +44.48 +1.96%

LG Electronics Inc. (066570), the world’s No. 3 maker of mobile phones, jumped 7.4 percent in Seoul. Glencore International Plc, rose 5.3 percent in Hong Kong on a report the world’s biggest publicly traded commodities trader is nearing an agreement to combine with Xstrata Plc. Lynas Corp. surged 19 percent in Sydney after the rare earths supplier won approval to start production in Malaysia.

European stocks climbed for a third day as a report showed that U.S. jobless claims dropped more than economists had estimated and Glencore International Plc held talks to buy Xstrata Plc, boosting mining companies.

In the U.S., a Labor Department report showed that applications for unemployment benefits fell last week more than economists had predicted, indicating the labor market is improving in the world’s largest economy.

National benchmark indexes climbed in 14 of the 18 western- European (SXXP) markets today. The U.K.’s FTSE 100 Index added 0.1 percent. France’s CAC 40 Index gained 0.3 percent and Germany’s DAX Index advanced 0.6 percent.

Xstrata surged 9.9 percent to 1,230.5 pence after confirming that Glencore has held talks to buy the shares in the company that it doesn’t already own. Glencore’s shares soared 6.9 percent to 461.7 pence.

Novo Nordisk A/S rose 4.3 percent to 709.50 kroner after the world’s largest insulin maker posted net income that climbed to 4.69 billion kroner ($830 million) from 3.95 billion kroner a year earlier.

Benetton Group SpA surged 17 percent to 4.74 euros after the Benetton family, the company’s largest shareholder, said it will offer 276.6 million euros ($364 million) for the shares it doesn’t already own in the company. Edizione Holding SpA, which owns 67 percent of Benetton, will offer 4.60 euros a share, it said in a statement last night on the Italian bourse.

Unilever dropped 4.4 percent to 1,994 pence as the maker of Hellmann’s mayonnaise and Lynx deodorants said it expects difficult economic conditions and elevated commodity costs to persist this year.

Most U.S. stocks advanced, sending the Standard & Poor’s 500 Index higher for a second straight day, as investors awaited tomorrow’s employment report to gauge the strength of the recovery in the world’s largest economy.

A report tomorrow may show employers boosted payrolls in January by 140,000 workers and the jobless rate held at an almost three-year low of 8.5 percent. Data today showed that claims for U.S. jobless benefits fell last week and productivity cooled in the fourth quarter, signaling hiring may accelerate as companies reach the limits of how much efficiency they can wring from

Gap surged 11 percent, the biggest gain in the S&P 500, to $21.52. The San Francisco-based company said it expects fourth- quarter earnings to be as much as 42 cents per share. That beats the 35-cent estimate of 29 analysts surveyed by Bloomberg.

Green Mountain Coffee Roasters Inc. surged 24 percent, the most since March, to $66.42. The maker of Keurig brand single- cup pods and brewers reported profit that beat analysts’ estimates as sales rose.

Abercrombie & Fitch Co. tumbled 14 percent, the biggest decline in the S&P 500, to $40.40. The teen apparel chain reported preliminary fourth-quarter earnings that trailed analysts’ estimates as holiday promotions narrowed profit margins.

Resistance 3: Y77.30 (Jan 20 high)

Resistance 2: Y76.80 (Jan 30 high)

Resistance 1: Y76.40 (Jan 31 high)

The current price: Y76.18

Support 1: Y76.00 (Feb 1 low)

Support 2: Y75.60 (Oct 31 low)

Support 3: Y75.00 (psychological level)

Resistance 3: Chf0.9250 (Feb 1 high)

Resistance 2: Chf0.9225 (Jan 31 high)

Resistance 1: Chf0.9190 (session high)

The current price: Chf0.9173

Support 1: Chf0.9160 (session low)

Support 2: Chf0.9115 (Feb 1 low)

Support 3: Chf0.9065 (Nov 30 low)

Resistance 3 : $1.5930 (61.8% FE $1.5700-$1.5880 from $1.5815)

Resistance 2 : $1.5880 (Feb 1 high)

Resistance 1 : $1.5840 (high of the American session on Feb 2)

The current price: $1.5820

Support 1 : $1.5785 (session low)

Support 2 : $1.5730 (23.6% FIBO $1.5880-$1.5230)

Support 3 : $1.5640/50 (area of Jan 27-30 low)

Resistance 3 : $1.3260 (123.6% FIBO $1.3025-$1.3215)

Resistance 2 : $1.3215 (Feb 1 high)

Resistance 1 : $1.3185 (high of the American session on Feb 2)

The current price: $1.3141

Support 1 : $1.3115 (session low, middle line from Jan 30)

Support 2 : $1.3075 (Jan 30 low, MA(233) H1)

Support 3 : $1.3025 (Feb 1 low)

Change % Change Last

Oil $96.58 +0.22 +0.23%

Gold $1,763.60 +4.30 +0.24%

Change % Change Last

Nikkei 225 8,876.82 67,03 +0,76%

Hang Seng 20,739.45 406,08 2,00%

S&P/ASX 200 4,267.85 42,18 +1,00%

Shanghai Composite 2,312.56 44,48 +1,96%

FTSE 100 5,796.07 +5.35 +0.09%

CAC 40 3,376.66 +9.20 +0.27%

DAX 6,655.63 +38.99 +0.59%

Dow 12,705.41 -11.05 -0.09%

Nasdaq 2,859.68 +11.41 +0.40%

S&P 500 1,325.54 +1.45 +0.11%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3143 -0,13%

GBP/USD $1,5804 -0,17%

USD/CHF Chf0,9167 +0,13%

USD/JPY Y76,21 +0,05%

EUR/JPY Y100,16 -0,08%

GBP/JPY Y120,44 -0,17%

AUD/USD $1,0710 +0,07%

NZD/USD $0,8330 +0,08%

USD/CAD C$0,9991 +0,07%

00:15 U.S. FOMC Member Richard Fisher Speaks 0

01:00 China Non-Manufacturing PMI January 56.0

08:00 United Kingdom Halifax house price index January -0.9% +0.1%

08:00 United Kingdom Halifax house price index 3m Y/Y January -1.3%

08:50 France Services PMI (finally) January 50.3 51.7

08:55 Germany Services PMI (finally) January 52.4 54.5

09:00 Eurozone Services PMI (finally) January 48.8 50.5

09:30 United Kingdom Purchasing Manager Index Services January 54.0 53.6

10:00 Eurozone Retail Sales (MoM) December -0.8% +0.4%

10:00 Eurozone Retail Sales (YoY) December -2.5% -1.3%

12:00 Canada Employment January 17.5 23.5

12:00 Canada Unemployment rate January 7.5% 7.5%

13:30 U.S. Nonfarm Payrolls January 200 125

13:30 U.S. Unemployment Rate January 8.5% 8.4%

13:30 U.S. Average hourly earnings January +0.2% +0.2%

13:30 U.S. Average workweek January 34.4 34.4

15:00 U.S. ISM Non-Manufacturing January 52.6 52.8

15:00 U.S. Factory Orders December +1.8% +1.2%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.