- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 02-12-2021

- EUR/USD holds lower ground after two consecutive days of downtrend.

- Sustained trading below 100-SMA, bearish MACD favor sellers.

- Weekly support becomes the key for bear’s entry targeting 61.8% FE.

- 1.1385, five-week-old descending trend line add to the upside filters.

EUR/USD bears remain hopeful around 1.1300, grinding lower during early Friday morning in Asia.

The major currency pair dropped for the last two days following its failures to cross the 100-SMA. Also favoring the sellers is the MACD line that flashed bear cross.

However, a clear downside break of the one-week-long ascending support line, around 1.1255 at the latest, becomes necessary for the pair sellers to aim for the yearly low of 1.1186.

Following that, 61.8% Fibonacci Expansion (FE) of November 09-30 moves, near 1.1120, will gain the market’s attention.

Alternatively, a 100-SMA level of 1.1320 will guard the immediate recovery moves ahead of a horizontal area comprising multiple tops marked since mid-November, near 1.1375-85. Adding to the resistance is a downward sloping trend line from late October, close to 1.1430 by the press time.

Should the quote manage to rally past 1.1430, the 1.1465 level may act as an intermediate halt during the rally targeting the early November’s low near 1.1515.

EUR/USD: Four-hour chart

Trend: Further weakness expected

- On Thursday, XAU/EUR pare Wednesday gains, down some 1.49%.

- WHO’s official said that some of the early indications regarding the Omicron variant are that most cases are mild.

- XAU/EUR: The upward bias is still in play, though a daily close above €1,590 is needed to extend gold gains.

Gold (XAU/EUR) vs. the euro advances as the Asian session begins, up some 0.05%, trading at €1,565 at the time of writing. Investors’ worries about the Omicron coronavirus strain seem to ease, as a World Health Organization (WHO) official said that some of the early indications are that most cases are mild. Either way, financial markets would likely remain volatile unless investors get more clarity on the new COVID-19 variant.

In the overnight session, XAU/EUR seesawed around the €1,560-€1,580 range, remaining at those levels until the New York open. Since then, the gold vs. the euro slid towards €1,555, though staged a recovery of 15, to settle down at current levels.

On Thursday, the macroeconomic docket of the Eurozone featured the so-called “prices at the gate,” with the Producer Price Index for October on a monthly and yearly basis. Both readings were higher than expected, with the monthly figure rising 5.4%, more than the 3.5% foreseen. The annual figure rose by 21.9%, higher than the 19% estimated.

In the meantime, the German 10-year Bund yield is falling four basis points, sitting at -0.375%, boosting the yellow metal prospects against the single currency.

XAU/EUR Price Forecast: Technical outlook

The XAU/EUR daily chart shows that the single currency trimmed some losses against the non-yielding metal, but the bias remains tilted to the upside. Why? Because the daily moving averages (DMA’s) with an upslope reside well below the spot price, signaling that XAU bulls are in charge. In fact, Thursday’s low coincides with the 50-DMA level at €1,557, which would be the first support, if the EUR appreciates

In the outcome of extending Wednesday’s gains, the first resistance would be the November 30 high at €1,590. Breach of the latter could pave the way for further gains. The following resistance would be the €1,600 psychological level, followed by the November 18 cycle low previous support-turned-resistance at €1,633.

On the flip side, the first support would be the 50-DMA at €1,557. The break of the previous-mentioned would expose essential support areas, like the 100-DMA at €1,539, followed by the confluence of 200-DMA and the November 3 low, between the €1,516-20 range.

-637740837583742282.png)

On Thursday, US Deputy Secretary of State Wendy Sherman and the Secretary-General of the European External Action Service, Stefano Sannino, held talks in Washington. They released a joint statement raising strong concerns over China’s "problematic and unilateral actions" in the South and East China Seas and the Taiwan Strait, per Reuters.

Key quotes

The two sides discussed rights abuses in China, including repression of religious minorities in Xinjiang and Tibet and the erosion of autonomy in Hong Kong.

They expressed strong concern over China’s problematic and unilateral actions in the South and East China Seas and the Taiwan Strait that undermine peace and security in the region and have a direct impact on the security and prosperity of both the United States and European Union.

Sherman and Sannino are due to continue their China-related discussions with high-level consultations on the Indo-Pacific on Friday.

FX reaction

The news should have weighed down the AUD/USD prices, considering Australia’s trade proximity to China, but the pre-NFP trading lull keeps the quote mostly unchanged around 0.7100 of late.

Read: AUD/USD bears look to 0.7000 on firmer yields ahead of US NFP

- AUD/USD remains depressed after seven-day south-run around yearly low.

- Fed hawks fuelled yields, equities consolidate losses amid mixed concerns over Omicron.

- Aussie, China PMIs can offer intermediate moves during pre-NFP trading lull.

AUD/USD traders flirt with the 0.7100 threshold after seven consecutive days of a south-run. That said, the risk barometer struggled for a clear direction the previous day despite posting mild losses on firmer Treasury yields. Though, equity bulls stopped the quote’s weakness as Aussie traders brace for the key Friday comprising the US Nonfarm Payrolls (NFP) data.

The benchmark US 10-year Treasury yields bounced off a 10-week low to regain 1.45% level, up five basis points (bps), on Thursday as Fedspeak pushed for sooner tapering in the last-ditched efforts before the silent-period starting from this Saturday. Among the key promoters of faster rolling back of easy money, also conveying reflation fears, were Federal Reserve (Fed) Bank of San Francisco President Mary Daly and Richmond President Thomas Barkin.

It’s worth noting that softer-than-expected prints of the US Initial and Continuing Jobless Claims for the week, as well as downbeat Challenger Job Cuts for November, also underpinned the hopes of faster Fed tapering and favored the yields.

The firmer bond coupons in turn propelled the US Dollar Index (DXY) to print a second consecutive day of gains but couldn’t stop equities from consolidating the previous two days’ losses.

At home, Australia Trade Balance and housing numbers came in stronger but the Imports and PMI details were mixed for October and November respectively. That said, the Pacific major is alert enough to tame the virus outbreak, with various state boundaries and checks announced of late.

Also important for the AUD/USD traders to know is the fact that multiple Chinese developers were bracing for the bond issue, suggesting relief for the cash-crunch market. Adding to the positives was the news that China will prolong the period of tax exemption for foreign bond investors. Furthermore, chatters that the UK announced SOTOVIMAB, an injectable drug, to be effective against Omicron joins the US policymakers’ rush to avoid government shutdown to ease the market fears and favor the risk-barometer pair.

That said, AUD/USD traders may react to China’s Caixin Services PMI but major attention will be given to the virus updates. Above all, the US jobs report for November will be a make-or-break case to follow.

Read: Nonfarm Payrolls Preview: Jobs’ headline could be a make it or break it in tapering’s decision

Technical analysis

Having offered a clear downside break of yearly support, AUD/USD is well-set for 0.7000-0.6990 support zone comprising lows marked during September and November 2020. The 0.7050 levels may offer an intermediate halt during the fall.

Should the bulls return, the previous support line near 0.7145 and the monthly descending trend line surrounding 0.7175 will challenge the corrective pullback.

After multiple days of jostling, the US policymakers managed to avoid the government shutdown as the House of Representatives passed a bill to extend the government funding through February.

The short-term government funding bill approaches the Senate as market chatters spread that it will be law before Saturday’s deadline.

FX reaction

Given the already higher odds of no US government shutdown, coupled with the market’s attention to the US jobs report, the news gets mostly ignored. That said, equities posted notable gains on Thursday but the yields were also stronger ahead of the key day.

Read: US Nonfarm Payrolls November Preview: Can we agree the labor market is healing?

Early Friday morning in Asia, global rating giant Fitch crossed wires while conveying the news to downgrade Turkish long-term Issuer Default Ratings (IDRs) to negative from stable. The rating giant kept the status of BB- for Turkey’s IDR unchanged.

Key quotes (from Fitch)

The central bank's premature monetary policy easing cycle and the prospect of further rate cuts or additional economic stimulus ahead of the 2023 presidential election have led to a deterioration in domestic confidence, reflected in a sharp depreciation of the Turkish lira, including unprecedented intra-day volatility, and rising inflation.

After the 2018 and 2020 crises, Turkey enters this new period of stress from a vulnerable position, with a high degree of uncertainty regarding the economic authorities' policy reaction function, high external financing requirements, deteriorating inflation dynamics and weakened external buffers.

The central bank has repeatedly changed its policy guidance in recent months from a commitment to maintaining positive real rates to focusing on core inflation dynamics, and more recently on narrowing the current account deficit.

We forecast inflation to reach 25% by end-2021 and remain one of the highest among rated sovereigns, averaging 20% in 2022-2023.

There is a high degree of uncertainty regarding the timing and type of policy response due to the public statements of government authorities, including the president, in favor of low rates and a weaker lira, and the increased visibility of political interference in the central bank decisions and management.

Moreover, the focus of the government on supporting faster commercial credit growth, a key rationale behind the easing cycle in Fitch's view, and the prospect of significant real wage increases for 2022 could reverse the improvement in the current account (forecast to halve to 2.5% of GDP in 2021) and increase external financing pressures.

USD/TRY en-route $14.00

Having reacted to Turkish Prime Minister Erdogan Recep Tayyip Erdoğan’s action, by replacing Finance Minister with his Deputy Nureddin Nebati, USD/TRY remains firmer around $13.69 by the press time. That said, the Turkish Lira (TRY) pair is well-set to refresh the record top of $13.95.

Read: Turkish Finance Minister Nebati says high interest rates won't be a priority

- The shared currency trims some of Wednesday’s losses, up some %.

- The market sentiment is upbeat, boosting the prospects of riskier assets to the detriment of the JPY and the CHF.

- EUR/JPY: Trading range-bound, though slightly tilted to the downside.

As the New York session ends, the EUR/JPY advance some 0.24%, trading at 127.88 at the time of writing. The market sentiment is upbeat at press time, following a risk-off European session, with all of its indices in the red. In the US, equity indices finished the session with gains, rising between 0.52% and 1.66%.

Market participants reassess the impact of the new COVID-19 Omicron variant. Although it has been reported to be more transmissible, it appears to cause mild symptoms. Apart from that, the US central bank looking to finish the bond taper in the Q1 of 2022 dented the prospects of safe-haven assets like the Japanese yen, with US equities rallying and US bond yields following their footsteps.

EUR/JPY Price Forecast: Technical outlook

In the 1-hour chart, the EUR/JPY pair is trading sideways. In the overnight session, EUR/JPY bulls pushed the pair towards the confluence of the 50 and the 100-hour simple moving averages, around 128.20, failing to break above it. That left the pair, at the mercy fof JPY bulls, which sent the pair tumbling towards 127.70.

It is worth noting that the pair has a downward bias in the near term, as the 1-hour moving averages (MA’s) reside above the spot price. If the EUR/JPY keeps falling further, the first support would be the December 1 high 127.56. A breach of the latter would expose the 127.00 figure, followed by February 9 swing low at 126.43.

On The flip side, the first resistance would be 128.00. A break above that level would expose the November 30 high at 128.60, followed by the 200-hour SMA at 128.62.

-637740790412102771.png)

- GBP/JPY bull sin charge and eye 151 the figure.

- The daily chart is moving in on a critical level of resistance.

GBP/JPY bulls are taking charge at the end of the week's sessions as risk appetite improves. Markets are moving into consolidation and profits are being taken ahead of Friday's Nonfarm Payrolls. This is giving the yen bulls something to be fearful of and helping GBP/JPY to move higher.

GBP/JPY hourly chart

GBP/JPY is riding dynamic hourly support and is on the verge of an upside extension following a 78.6% Fibonacci retracement. The bulls will eye the 150.80 key psychological level for the coming sessions.

GBP/JPY daily chart

From a daily perspective, the bulls eye the 61.8% Fibonacci retracement level near 151 the figure. This meets an old support area that would be expected to act as resistance.

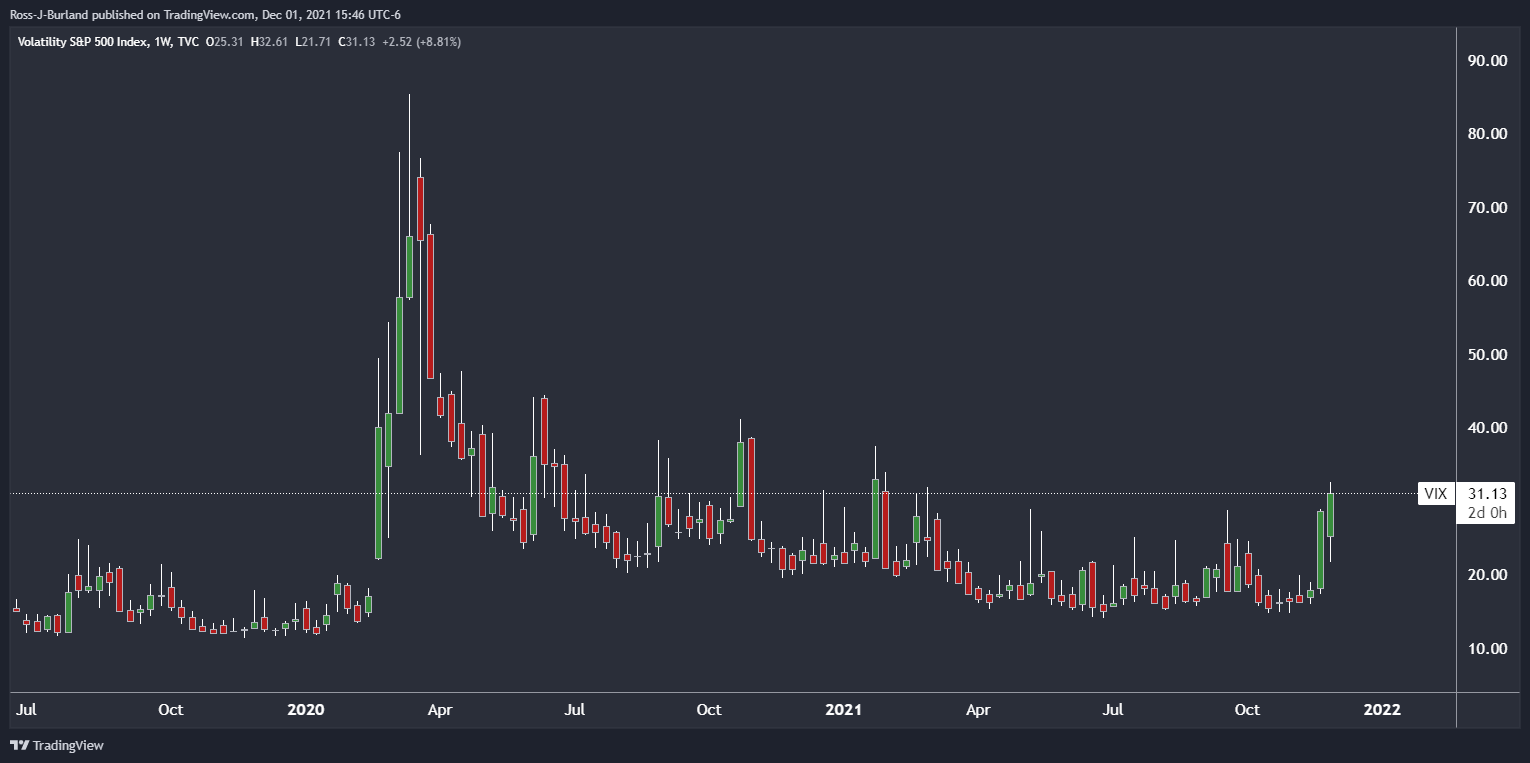

- US equities gained on Thursday, despite a lack of fresh fundamentals, as market conditions remain choppy and unpredictable.

- The S&P 500 recovered from the low 4500s to close to the 4600 level ahead of the close.

US equity market conditions remained for the most part choppy and unpredictable on Thursday. The S&P 500, which sold off sharply into the Wednesday close and ended the session under the 21-day moving average in the 4510s, bounced in early Thursday trade and now trades nearly 1.7% higher on the day at 4590. The index has now pared its on-the-week losses to just 0.3%, though still trades some 3.5% below last week’s record peaks close to 4750.

The Nasdaq 100 saw comparatively modest gains of under 1.0%, with the index bouncing from lows under 15.8K to back above 16.0K. Short-end and real yields continued to rally, reducing the duration-sensitive tech sector’s tailwinds. The index continues to trade about 4.0% below record levels printed back on 22 November. The Dow was up more than 2.0%. The CBOE S&P 500 Volatility Index (VIX) was down nearly 4.0 points to close to 27.0, more than 5.0 points down from Wednesday’s 11-month highs above 32.0.

Driving the day

There wasn’t any one specific reason for the upside on Thursday. Omicron and uncertainty about the influence that its global spread will have on the global economic/monetary bank policy outlook remains the dominant market theme. On that front, there hasn’t been much fresh information on the virus, aside from more data from South Africa that points to its high transmissibility and ability to partially evade vaccine/natural immunity (both known qualities of the variant).

The equity bulls remain hopeful that the severity of symptoms caused by infection is a lot milder than other variants, but it remains far too soon to say for sure at this point. Even if the illness is as severe, most suspect vaccines/part infection will still offer enough protection to avoid March 2020-style lockdowns.

Some pointed to the recent string of strong US macro data releases as behind the rally on Thursday. Initial weekly jobless claims and November challenger layoffs on Thursday were both better than expected after Wednesday’s strong November ISM Manufacturing PMI survey and ADP employment change estimate. The data suggests Friday’s November labour market report, the most important data release of the week, should show strong gains in employment.

But strong US data endorses the Fed’s increasingly hawkish view of the economy, something which some investors have said has added another layer of uncertainty to the market right when it didn’t need it (due to Omicron). Recall that earlier in the week in his testimony before Congress, Fed Chair Jerome Powell was bullish on growth and the labour market, expressed concern about high inflation, and, thus, hinted towards a faster QE taper. Fed speakers on Thursday endorsed this viewpoint. A strong NFP number on Friday should solidify market expectations for a faster pace of taper from January.

- After falling for eight consecutive days, the British pound snapbacks edges up 0.50%.

- A risk-on market mood benefits the risk-sensitive GBP.

- GBP/JPY: Found strong demand around the 149.00 area, as the pair gains 130+ pips in the day.

The British pound advances during the New York session as risk-sensitive currencies rise, while the safe-haven ones like the Japanese yen and the Swiss franc fall sharply. The GBP/JPY is rising, trading at 150.51 at the time of writing.

The market sentiment is upbeat in the New York session, with US equity indices rising between 0.77% and 2.62%. It seems that the Omicron variant, although being more transmissible, it causes mild symptoms that would not threaten people’s life. That alongside the US central bank looking to finish the bond taper in the Q1 of 2022, dented the prospects of safe-haven assets, with US equities rallying and US bond yields following their footsteps.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY has been on a free fall since November 24, when it broke the 50-day moving average (DMA). However, the December 1 low at 149.60 seems to be the bottom of the eight-day dip, at press time advancing 0.50%. Furthermore, an upslope trendline that travels from July swing lows to September cycle lows was briefly broken, but GBP bulls entered around the 149.40s area, pushing the pair higher.

In the outcome of a daily close above 150.45, that would form a bullish engulfing candle pattern with bullish implications. The first resistance on the way up would be the 151.00 psychological level. The latter’s breach would expose the November 29 high at 151.90, followed by the 200-DMA at 152.43.

On the flip side, the GBP/JPY first support level would be the 150.00 figure. A break under that level would expose the upslope trendline lying around 149.59, followed by the October 1 swing low at 149.22.

-637740735698347046.png)

- USD/CHF remained supported above its 200DMA at 0.9180 for a third straight session.

- The pair continues to trade with tight ranges ahead of the key US jobs data and amid ongoing Omicron uncertainty.

USD/CHF found good support at its 200-day moving average for a third consecutive day on Thursday. The pair has been hovering just to the north of its 200DMA at close to 0.9180 since Tuesday, during which time it has undulated within a fairly tight 0.9180-0.9220 range. The 21 and 50DMA both currently sit at the 0.9230 level and have been, for the most part, capping the gains.

The pair has been going sideways despite Fed Chair Jerome Powell’s hawkish assessment of the state of the US economy in Congressional testimony earlier in the week. Powell said it would be appropriate to discuss speeding the pace of the bank’s QE taper. There has also been a string of strong US data releases for the month of November; the ISM Manufacturing survey, ADP estimate of national employment change, and Challenger layoffs all endorse Powell’s bullish stance on the economy.

Two factors are keeping market participants tentative and cautious on placing big bets on the pair. Firstly, the most important US data release of the week is on Friday in the form of the official November US labour market report. Fed members will want to see continued strong gains in employment if they are to agree on an acceleration of the QE taper at the 15 December meeting.

Secondly, the outlook for the US economy remains clouded by the emergence of Omicron, with infections now being detected in the US. In the worst-case scenario, which is being considered as a reasonable possibility, the new variant might couple high transmissibility and immune escape with severe symptoms and a high mortality rate. This may see the US (and other countries) go into lockdown and may push back Fed (and other central bank tightening plans). This would benefit the Swiss franc which is 1) a safe haven and 2) not exposed to dovish central bank repricing (there are no hawkish SNB expectations to pull back on in the first place!).

Until uncertainty about the virus has cleared up, USD/CHF may have a difficult time recovering to its pre-Omicron levels in the mid-0.9300s, even in the face of further strong data and hawkish Fed vibes. That’s not to say Friday won’t see volatile trading conditions. But in the short-run, the pair's determination to remain supported above the 0.9200 may be a signal that the recent bearish run will soon reverse.

- NZD/USD was the second-best performer vs. USD on Thursday.

- US Nonfarm Payrolls will now be the key.

Despite a more hawkish sentiment around the Federal Reserve following the set-up in Fed speaker's rhetoric, in including the Fed chair, Jerome Powell's, traders bought the dip on Wall Street. This led to a recovery in risk-FX and pushed the New Zealand dollar higher in a correction to 0.6831 from 0.6799 the low.

It would appear that the US dollar is regarded as overbought. The DXY index, which measures the greenback vs a basket of currencies, was unable to capitalise on the risks surrounding the new coronavirus variant, Omicron nor hawkish Fed speakers.

The greenback, throughout the pandemic, has been regarded as a safe haven and benefitted at times of panic and uncertainty. However, this time around, it has fallen behind the yen, CHF and even the euro. This has enabled the commodity complex to find support and has given some stability to the forex space.

The Kiwi was the second-best performer against the USD overnight, and the bump in the USD was barely discernible, analysts at ANZ Bank explained.

''Stepping back, the Kiwi continues to hover around 0.68, with the bears citing key support at around 0.6750, and the bulls focussed on typical December seasonality. If buyers are in the wings, they are certainly not revealing themselves. Still, let’s see what tonight’s US jobs numbers look like, as that will set USD direction,'' the analysts argued.

US Nonfarm Payrolls coming up

Looking ahead, US Nonfarm Payrolls will be key. 'Payrolls probably surged again,'' analysts at TD Securities explained. ''A strong trend continues to be signalled by surveys and claims, but our forecast also reflects the latest Homebase data—with a decline in the Homebase series more than accounted for by seasonality. Along with our +650k forecast for payrolls, we forecast a 0.2pt decline in the unemployment rate and a 0.4%MoM (5.0% YoY) rise in hourly earnings.''

What you need to know on Friday, December 3:

The dollar gathered some momentum in the last trading session of the day on Thursday, helped by upbeat local data and higher US government bond yields, as concerns were put temporarily aside. Wall Street posted substantial gains, although major indexes are still in the red on a weekly basis.

As for government bond yields, that on the 10-year Treasury note peaked at 1.466%, holding nearby at the session ends. US indexes posted substantial gains, with the Dow Jones Industrial Average up nearly 700 points and the S&P500 adding roughly 2% at the time being.

Different US Federal Reserve officials backed chief Jerome Powell’s recent words. Federal Reserve Bank of San Francisco President Mary Daly said the Fed might need to taper asset purchases faster than anticipated, while Richmond President Thomas Barkin said inflation has gone up faster than he expected due to the virus, vaccines and fiscal support.

European Central Bank policymaker Fabio Panetta said that inflation and the new pandemic wave is endangering the Union’s recovery at an early stage, although earlier this week, he noted that there’s no need to tighten monetary policy to control inflation, driven by temporary factors.

The EUR/USD pair briefly pierced the 1.1300 level, hovering around it heading into the Asian opening. The British Pound remained weak, with GBP/USD stuck around 1.1330. Commodity-linked currencies edged lower, with the AUD/USD pair trading below 0.7100 and the USD/CAD above 1.2800.

Gold fell to a fresh one-month low of 1,761.87, having bounced modestly ahead of the close. Crude oil prices fell to fresh multi-month lows but bounced back, with WTI currently trading at $66.10 a barrel.

The US will publish the Nonfarm Payrolls report on Friday. The country is expected to have added 550K new jobs in November, while the unemployment rate is seen contracting to 4.5% from 4.6%. The country added 531K positions in October, which brought the total number of jobs to 148.3 million, leaving a shortfall of 4.2 million compared to pre-pandemic levels.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: ETH outperforming its peers, BTC struggles and XRP bearish

Like this article? Help us with some feedback by answering this survey:

- USD/CAD squeezed out a fresh two-and-a-half month high on Thursday but is now flat just above 1.2800.

- The pair continues to ebb higher within the confines of a bullish trend channel.

It’s been a largely subdued day for USD/CAD, with the pair for the most part following the path of least resistance and gradually ebbing higher. USD/CAD has been moving higher in recent weeks within a bullish trend channel. The pair at one point managed to squeeze out a fresh another two-and-a-half month high at 1.28376 (less than one pip above Tuesday’s high at 1.28369). The pair has since dropped back to trade around 1.2810, where it is flat on the session.

Strong US data

Amid a lack of any fresh Canadian fundamental newsflow on the day, USD/CAD traders were mainly focused on US dollar and crude oil market flows. Beginning with the former; the US dollar was broadly neutral against its G10 peers on Thursday, despite further strong US macro data. Initial weekly jobless claims and November challenger layoffs on Thursday were both better than expected after Wednesday’s strong November ISM Manufacturing PMI survey and ADP employment change estimate.

One reason why the dollar may have ignored the strong data is because it broadly fits with the narrative of US economic/labour market strength being painted by the Fed. For another, it's official US jobs report day on Friday (the November report), so it's perhaps not surprising to see FX markets enter wait-and-see mode. A few Fed members spoke, though none added anything beyond Powell’s hawkish message from earlier in the week.

Choppy oil

Moving on to oil markets; conditions were choppy with WTI now broadly flat on the day after OPEC+ announced its decision to press ahead with a 400K barrel per day output hike in January. The surprise decision (analysts had expected a halt amid Omicron-related uncertainty) initially triggered downside, but oil prices swiftly recovered. Omicron and oil flows will remain a key driver on Friday, but maybe overshadowed somewhat by the dual release of both US and Canadian November jobs data at 1330GMT.

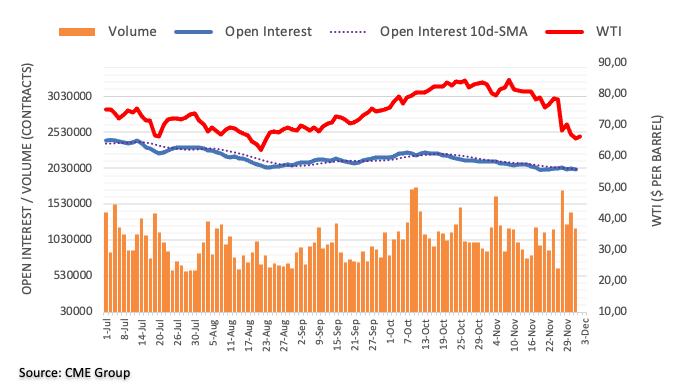

- It’s been a choppy day for oil, with traders in two minds about the OPEC+ decision to hike January output.

- WTI has swung between lows in the $62.00s and highs above $67.00, and currently trades a tad higher near $66.00.

Oil prices have had a choppy day on Thursday. Front-month futures of the American benchmark for sweet light crude oil, called West Texas Intermediary or WTI, swung between lows at $62.50 and highs just above $67.00, a near $5.0 range. At present, WTI is trading close to the $66.0 mark and is slightly in the green on the day.

OPEC+ press ahead with output hikes

The day’s price action reflects the market’s ongoing struggle to ascertain what's next for the crude oil demand outlook. The big news of the day was OPEC+’s decision to surprise markets by not choosing to halt output hikes in January but to press ahead with another incremental 400K barrel per day output hike on the month. The decision cause initial selling pressure, which is when WTI hit the $62.00s, but the dip was quickly bought into.

Some analysts interpreted the OPEC+ decision as a positive for oil markets as it signaled that the group’s confidence in the market had not been rocked by recent Omicron-related developments. OPEC “thought it might do more damage than good, to pause on production increases and that it might send a signal to the market that the demand destruction priced in was real,” said a senior analyst at Price Futures Group. “I think the OPEC decision is sending a signal of confidence that they believe the price action recently has been overdone” the analyst added.

WTI still well below pre-Omicron levels

But WTI continues to trade some $12 below its levels this time last week. Of course, the emergence of the new Omicron Covid-19 variant has been the main driver of the downside. A number of countries have restricted flights, delivering an immediate blow to the near-term outlook for crude oil prices via a dampening of jet fuel demand. This partly explains the recent drop, but another big reason for lower crude oil prices is simply the high level of uncertainty about the new variant. The key questions are 1) how transmissible is it? 2) how well does it evade vaccine/natural immunity? and 3) how severe are the symptoms when infected?

Early evidence strongly supports the notion that the new variant is significantly more transmissible than prior variants, which obviously is not good news. Meanwhile, a study on the Omicron variant released by South Africa’s NICD on Thursday showed that re-infection was three times as likely as compared to other variants. This adds further evidence to the hypothesis that Omicron is better able to avoid natural immunity (acquired by infection with a past Covid-19 variant) than past variants have been. It seems very likely this would also apply to vaccine-acquired immunity.

More reassuringly, early front-line experience of doctors in South Africa suggests the symptoms are much milder than other variants. But it is very early days still these early hypotheses could quickly shift. Thus, markets are set to remain highly headline-driven. The best-case scenario for crude oil would be if Omicron proves to be very mild and actually something health officials want to let spread around the world in order to reach herd immunity and eradicate the nastier Covid-19 strains (like delta).

- AUD/USD is dangerously close to breaking to the downside again.

- The daily chart points to a test of the recent lows down at 0.7062 and 0.7030 thereafter.

As per the prior analysis, AUD/USD Price Analysis: High forex vol points to continuation to weekly support, the price is moving in on the weekly lows:

In the daily chart above, the weekly lows are illustrated with 0.6990 eyed as a potential target on a break of 0.7030. With that below said, the weekly chart's M-formation is a bullish reversion pattern that should be noted as well.

AUD/USD H1 chart

Meanwhile, the pull back on the hourly chart has not made it to a 38.25 Fibonacci retracement level and instead stalled at 0.7120, staying blow the 21-EMA:

Bears will want to see a break of the 0.7080 support before fully engaging, or otherwise face the risk of a trapped market between support and resistance.

- In the last couple of hours, the euro slump continues, seesawing around the 1.1300 figure.

- Fed’s Bostic and Daly aims for a faster bond taper, Barkin would rather keep the $15B pace.

- EUR/USD break under 1.1300 could pave the way for a re-test of YTD low at 1.1186.

The shared currency drops sharply during the New York session, down 0.08%, trading around the 1.1300s at the time of writing. In the last couple of hours, the market sentiment has been mixed. European stock indices finished the session in red, contrarily of rising US indices across the pond. The NZD and the GBP are the leading gainers in the FX market, while the rest of the G8 peers print modest losses.

The EUR/USD tries to break under the 1.1300 figure for the second time, as the USD seems to benefit from higher US bond yields, rising from the short-term until the long-maturity ones. The US 10-year Treasury yield, one of the barometers for rates, edges up two and a half basis points, sitting at 1.46%, amid a group of Fed speakers crossing the wires. In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, advances 0.11%, reclaiming the 96 handle, sitting at 96.13.

Fed’s Bostic and Daly aims for a faster bond taper, Barkin would rather keep the current pace

Atlanta Fed President Raphael Bostic said, “The longer we have higher inflation, the greater the risk.” Further added that he will push for ending QE taper sooner than later and aim to finalize it by the first quarter of 2022. Additionally, Bostic commented that if inflation stays elevated at around 4% in the next year, that would be a good case of pulling forward interest rate hikes.

In the same tone, San Francisco Fed President Mary Daly said that the “Fed may need to start crafting a plan to think about raising interest rates.”

Meanwhile, Richmond Fed President Thomas Barkin said that he is supporting the pace of the bond tapering, Further added that long-term inflation expectations are always a concern.

EUR/USD Price Forecast: Technical outlook

The daily chart of the EUR/USD depicts the pair has a downward bias. The simple moving averages (SMA’s) with a downslope reside above the spot price, confirming the bearish bias. Also, in the last three days, the EUR/USD has found strong resistance lying around 1.1340s, causing a retracement on the pair, down to 1.1300.

In the outcome of breaking under 1.1300, the first support would be the November 30 low at 1.1235. The breach of the latter would expose the year-to-date low at 1.1186.

On the other hand, the EUR/USD first resistance would be the November 30 swing high at 1.1382, immediately followed by 1.1400. A break above that level could pave the way for further gains. The following resistance would be 1.1459, followed by the 50-SMA at 1.1507.

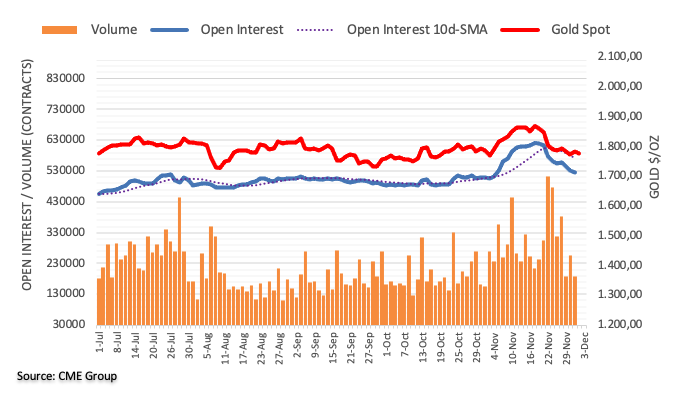

- Gold is on the offer below critical daily support structures.

- Bears are looking for a break into the $1,750s for the rest of the week.

The price of gold has been on the backfoot while the greenback consolidates and risk appetite improves. The US stock market has surged back to life with the S&P 500 running up over 1.6% on the day so far.

Gold, on the other hand, has fallen around 1% and is printing a fresh low at the time of writing at $1,763.51. The price has fallen from $1,783.45 on the day. Investors continue to acknowledge the hawkish tilt at the Federal Reserve which makes this week's Nonfarm Payrolls a key event ahead of the December Fed meeting.

The idea that the Fed is closer to a rate hike is dampening the demand for the non-yielding inflation hedge that is the yellow metal. Strong jobs on Friday could be the nail in the coffin for gold and support the greenback higher in anticipation of a faster rate of tapering from the Fed.

''Payrolls probably surged again,'' analysts at TD Securities explained. ''A strong trend continues to be signalled by surveys and claims, but our forecast also reflects the latest Homebase data—with a decline in the Homebase series more than accounted for by seasonality. Along with our +650k forecast for payrolls, we forecast a 0.2pt decline in the unemployment rate and a 0.4%MoM (5.0% YoY) rise in hourly earnings.''

Meanwhile, the United States recorded its first case of the Omicron variant on Wednesday, weighing on market sentiment. The person was fully vaccinated and is experiencing "mild symptoms, which are improving at this point," Fauci said. Dr. Grant Colfax, San Francisco's director of public health, said the person had not had a booster shot. Meanwhile, the United States and Germany also added to the nations around the globe planning stricter COVID-19 restrictions on Thursday.

Gold technical analysis

''The yellow metal has struggled to shore up enough support to catalyze a buying program amid Chair Powell's more hawkish communications,'' analysts at TD Securities argued.

''However, while the hawkish announcement has thus far kept gold prices from breaking north of a key threshold for CTA short covering, it ultimately does not represent a significant shift relative to market pricing. In turn, CTA trend followers may still have a surprise in store for the hawks should prices break north of $1790/oz.''

Following a restest of the counter trendline, the price is deteriorating below daily support that would now be expected to act as resistance. The focus is on the $1,750s for the remainder of the week.

- The British pound recovered some ground against the EUR.

- The 4-hour chart shows the formation of an ascending triangle that would target the 0.8580-0.8580 area once broken.

The British pound has regained some strength against the shared currency, advancing after losing for five consecutive days. The EUR/GBP pair falls moderately during the New York session, down 0.36%, trading at 0.8497 at the time of writing.

In the overnight session, the EUR/GBP pair tested the December 1 high at 0.8530. However, the upward move was faded, retreating towards the S1 daily pivot at 0.8498, which coincidentally confluences with the 100-hour simple moving average. In the last couple of hours, the pair seesawed between tie 0.8490-0.8524, steady around that range.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP has an upward bias, as portrayed by the 4-hour chart. In this timeframe, the simple moving averages (SMA’s) reside below the spot price, although in disorder. From top to bottom lies the 200-SMA at 0.8468, the 100-SMA at 0.8462, and the 50-SMA at 0.8452.

Also, it is essential to notice the formation of an ascending triangle that has bullish implications, that in the outcome of breaking higher, would target 0.8570-0.8580. Nevertheless, the last candlestick, pushed lower, breaking the bottom upslope support trendline, would negate the chart pattern on the outcome of being broken.

If the EUR/GBP continues falling, it will negate the triangle formation, leaving as the first support the SMA’s confluence in the 0.8452-0.8470 range. The breach of the latter would expose the 0.8400 figure, followed by the year-to-date low at 0.8380

In the outcome of regaining the triangle-bottom-upslope trendline, the first resistance would be 0.8525. Once that level is broken, the next supply zone would be 0.8541, followed by the 0.8570-0.8580 range.

Federal Reserve Bank of San Francisco President Mary Daly said on Thursday that the Fed might need to taper asset purchases faster than anticipated.

Additional Comments:

"Fed may need to start crafting a plan to think about raising interest rates."

"Long-run inflation expectations have been remarkably stable, giving her confidence that people still believe the Fed is credible."

"The Fed's goals are in tension today and officials always need to plan for all scenarios."

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said on Thursday that inflation has gone up faster than he expected due to the virus, vaccines and fiscal support.

Additional Comments:

"He is as comfortable with the Fed's new average inflation targeting framework as he was 18 months ago."

"Forward guidance may not be as easy to understand as when the central bank was approaching inflation from below 2% target."

"Long term inflation expectations are always a concern."

"Important to have long-run inflation expectations stable at the fed's target."

"He is supportive of normalizing monetary policy as the fed is doing."

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said on Thursday that the Fed is open to the possibility that maximum employment might be fewer jobs than before.

Additional Comments:

"Understanding what maximum employment is in the current environment will take some time."

"My interest rate path is to go slow and steady, get to neutral rate in late 2024, early 2025."

"I am hopeful that as fed moves policy, some tensions in the economy will dissipate."

"If that doesn't happen, the Fed will have to take more strident steps."

"Fed will try to try to stay focused as much as possible on both sides of the dual mandate."

"It would be appropriate to try and get fed balance sheet smaller."

"I haven't given detailed thought yet on exactly how to shrink balance sheet, but discussing that over next several months."

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said on Thursday that he would push for getting the QE taper over with sooner rather than later.

Additional Comments:

"We do need to be tapering bond purchases, have served purpose."

"Tapering will provide more optionality in 2022 on interest rate liftoff."

"If inflation stays elevated in 2022, at around 4%, there will be good case for pulling forward interest rate hikes and doing more than one next year."

"Good for fed to taper before raising interest rates."

"I think tapering of the bond-buying program by end of the first quarter of 2022 is in our interest."

"Fed can let data inform policy once taper is out the way."

"We want to see continued momentum in job gains in the monthly report tomorrow."

"I don't see tension right now between maximum employment and price stability."

"Taper will not put brakes on the economy, just removing some stimulus."

"The labor market is in a tremendous amount of flux

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said on Thursday that analysis from the Fed board suggests that successive waves of Covid-19 have been associated with a milder slowdown each time. If that happens again, he added, he thinks the US economy will grow despite new variants.

Additional Comments:

"In early stages on omicron assessment on the economy."

"How much omicron affects people participating in the economy is key."

"I don't think demand and supply imbalances will get worse."

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, said on Thursday that we're at elevated inflation levels and we need to make sure we're on top of that.

Additional Comments:

"The longer we have higher inflation, the greater the risk."

"Uncertainty on inflation has the ability to prolong inflation environment for longer."

"We've seen a pretty robust recovery in employment and GDP growth."

- Spot silver prices are subdued on Thursday beneath $22.50 ahead of Friday’s key US jobs data.

- A strong report may solidify silver’s recent bearish trend.

Spot silver (XAG/USD) prices remained subdued to the south of the $22.50 mark, having slipped beneath this level on Wednesday. On the day, spot prices are flat but losses on the week stand at nearly 4.0%. Moreover, since the silver topped out at its 200-day moving average of just under $25.50 back in early/mid-November, prices have declined more than 12%. The main driver of recent weakness in silver markets has been a strengthening US dollar (the DXY has risen from around 94.00 to current levels around 96.00) and rising US real yields 5-year TIPS are roughly 40bps higher versus mid-November levels under -1.90%. Both reflect a hawkish shift in Fed expectations.

Looking ahead, silver is likely to continue to trade in subdued fashion on Thursday in the absence of any important new data coming out about the Omicron variant, given that the November US jobs report is due out on Friday. Silver prices have been under pressure this week in wake of Fed Chair Jerome Powell’s surprisingly hawkish tone on inflation, the economy and the potential for a faster QE taper. The major US macro data releases so far this week have been strong, endorsing the Fed’s bullish view and Friday’s jobs report is expected to be no different. For reference, the report is expected to show 550K jobs added to the US economy in November.

A strong US labour market report for November may add further fuel to XAG/USD’s recent bearish trend. Bears will be targetting a test of the September lows in the $21.50 area soon. This is a key area of support going all the way back to September 2020. A break below there opens the door to a run towards the 50% retracement back to the post-pandemic high just above $30.00 to the post-pandemic low just under $12.00 at $20.90, as well as the psychologically important $20.00 level.

On Friday, the NFP report and in Canada job figures will be released. Analysts at TD Securities expect the Canadian unemployment rate at 6.6% in November (in line with market consensus) and a positive net change in employment of 37K.

Key Quotes:

“We look for relatively modest labour market gains in November with another 30k jobs added, pulling the UE rate 0.1pp lower to 6.6%. Job growth should be driven by full-time employment, but we will not see the impact of BC floods due to an early reference week. We also look for a sharp uptick in wages, reflecting a combination of base-effects and recent momentum.”

“Barring a very significant surprise, the focus should be on US payrolls where we expect a strong report. We think the CAD's losing streak may be coming to an end. 1.28/29 in USDCAD looks toppish to us but we think better prospects may be had against the funders. We are particularly focused on CADJPY.”

- XAU/USD drops further even as US yields remain in recent range.

- US dollar and equities mixed, oil rebounds, and metals hold soft tone.

Gold prices continue under pressure on Thursday. XAU/USD dropped further to 1762$, reaching the lowest level in four weeks; it remains near the lows, looking at the 1760$ support area.

The declines are taking place even as US yields remain relatively steady and amid mixed US dollar. Also in Wall Street, equity prices are mixed. Price action suggests the negative tone in gold has strengthened and a slide below $1760 would expose the next support at $1745/50. A consolidation above $1780 should alleviate the bearish pressure, clearing the way for a test of $1790.

Economic data released on Thursday in the US showed a lower than expected increase in initial jobless claims. On Friday, the Non-farm payroll is due. Those numbers could have a significant impact on monetary policy expectations, affecting yields, the dollar and gold.

The weekly chart also shows gold under pressure, headed toward the third decline in a row, and price back under the 20-week simple moving average. If it ends Friday around current levels would be the lowest weekly close since early October.

Technical levels

- Sterling advances, amid a mixed-market sentiment, favored by rising US equities.

- Omicron COVID-19 nervousness seems to ease as investors’ risk appetite moderately improves.

- GBP/USD Technical outlook: In the 4-hour chart, the 50-SMA has capped three times any GBP upside moves, at press time lies around 1.3330s

The British pound edges higher, snapping three days losses so far, up some 0.32%, trading at 1.3307 during the New York session at press time. Market conditions remain mixed, which is portrayed by European stock indices falling, contrary to the US, with the Dow Jones, the S&P 500, and the Nasdaq rising. Also, it seems that investors’ worries linked to the Omicron new coronavirus strain just discovered 1in the last week, ease as a World Health Organization (WHO) official said that some of the early indications are that most cases are mild.

Either way, markets would likely remain volatile unless market participants get more clarity on the new COVID-19 variant.

Apart from this, in the overnight session, the GBP/USD pair printed a daily low at 1.3263, amid USD strength on dampening market sentiment through the Asian session. However, the British pound is staging a rebound, trading above the 100 and the 50-hour simple moving averages (SMA’s) that could favor GBP bulls in the near term, unless USD bulls could push the pair below the 1.3300 handle. The upward move was courtesy of USD selling pressure as US equity indices rise, influencing risk-sensitive currencies like the GBP.

On Wednesday, two Fed policymakers favor a fast bond taper. In an appearance at the Congress, Fed’s Chair Powell reiterated that a faster wind-down of the QE’s program is necessary so that the Fed could tame inflationary pressures. Later on, Cleveland Fed President Loretta Mester expressed that a more rapid taper would be like “buying insurance” in the necessity of hiking rates as need it

In the Brexit saga, according to BBH analysts, noted that “reports suggest a compromise on fishing rights is within reach, with the EU hailing the granting of a new batch of fishing licenses by the UK as progress towards a concrete long-term deal later this month.”

In the macroeconomic docket, there’s nothing from Canada to report. On the US front, Initial Jobless Claims for the week ending on November 26 rose to 222K, better than the 240K forecasted, while the Continuing Jobless Claims for the week ending on November 18 rose to 1.956M, lower than 2M for the first time, since March 2020.

GBP/USD Price Forecast: Technical outlook

The GBP/USD in the 4-hour chart has a downward bias, as the GBP/USD has tested dynamic resistance at the 50-simple moving average (SMA) three times, failing to overcome it. Also, the 100 and the 200-SMA on top of the shorter time-frame one adds more fuel to the bearish bias.

In the outcome of GBP/USD further falling, the first support would be December 1 low at 1.3261, followed by a confluence area around November 30 low and the figure at 1.3190-1.3200.

- Mexican peso ends two-day rally versus US dollar amid risk aversion on Wednesday.

- USD/MXN likely to face consolidation before next directional move.

- Primary trend remains bullish, but under 21.30 more losses could take place.

The USD/MXN is falling again on Thursday but it remains far from Wednesday’s low. It bottomed at 21.11 and then rebounded sharply, erasing most of the day’s losses. In the very short-term it remains with a negative bias, still facing volatility, although trading quietly on Thursday.

Price is moving around 21.30, a key technical level. A consolidation below would keep the door open to more losses, with the next support levels at 21.15 and then the strong barrier at 20.90. A break of the support at 20.90, could be followed by more losses toward the uptrend line at 20.50.

On the upside, a firm recovery above 21.45 would alleviate the negative pressure. No signs of a resumption of the primary uptrend are seen at the moment. The USD/MXN seems to be forming a consolidation range likely between 21.15 and 21.65. Above 21.70, the 22.00 zone would be exposed.

Technical levels

-637740557709448214.png)

- USD/JPY found resistance at its 50DMA and has slipped back under 113.00.

- Further strong US data has failed to support the pair.

- FX markets are in wait-and-see mode ahead of Friday’s NFP.

USD/JPY found resistance at its 50-day moving average in earlier trade in a telling sign that, despite surging short-end and real US yields on strong US macro data and a more hawkish Fed, the safe-haven favouring the yen remains strong. USD/JPY has been fairly subdued on Thursday and trades within recent intra-day ranges. The pair hit highs earlier in the session in the 113.30s, but has since reversed back to the south of the 113.00 level.

Strong US data

Better than expected initial jobless claims numbers for the week ending on 27 November failed to give USD/JPY any notable lift, as did the strongest monthly Challenger job layoff reading since 1993. The strong US data comes on the heels of a better-than-expected November US ISM manufacturing PMI survey and a slightly above expected ADP national employment number, both released on Wednesday. The string of strong US macro data reports ought to boost expectations for Friday’s official jobless claims report. Markets currently expect the report to show that 550K jobs were added to the economy last month and that the unemployment rate continued to decline to 4.5%.

In fairness, ahead of the key official US jobs report, it does make sense that the FX markets would enter wait-and-see mode to a degree. But the US dollar’s inability to recover its post-Omicron variant emergence losses versus the likes of the yen and euro this week despite Fed Chair Jerome Powell’s hawkishness earlier in the week triggering a recovery in Fed tightening expectations is perplexing. Recall that much of the USD depreciation versus the yen and euro seen last Friday was attributed to a pullback in Fed tightening expectations, so the question is, as these have recovered why has the dollar not kept pace?

Why USD/JPY remains subdued

Some have suggested that it is because the dollar was overbought this time last week and thus was due a technical correction anyway. Others point at long-end US yields. Unlike short-end and real yields, long-term nominal yields have not recovered after Powell’s hawkishness. The 10-year continues to trade in the low 1.40s%, barely above multi-month lows and more than 20bps down from pre-Omicron levels. USD/JPY tends to be most sensitive to US/Japan 10-year rate differentials. The bid in long-term bonds that has pushed yields down liekly reflects worries that the long-term outlook for US growth and inflation has become more muted with the Fed set to start tightening despite the threat of Omicron.

- The Loonie falls for the third consecutive day amid mixed-risk sentiment and unmoved oil prices.

- In the overnight session, the USD/CAD remained subdued around the 1.2775-1.2829 range.

- Fed policymakers favoring a faster taper: Bullard, Bostic, Mester, and Powell.

The US/CAD extends its gains for the third day in a row, amidst a mixed bag market sentiment, modestly rising 0.02%, trading at 1.2817 at the time of writing. European indices are falling, following the Asian equity futures path, whereas, In the US, major stock indices are rising as traders keep assessing the impact of the COVID-19 Omicron variant in the global economy.

The USD/CAD remained range-bound in the overnight session, trading between the 1.2775-1.2829 range, fluctuating between the daily central pivot point and the December 1 swing high. That, in part, as risk-off market sentiment, dented investors’ appetite for riskier assets; also, crude oil prices remained subdued ahead of the OPEC+ meeting. As Wall Street opened, USD/CAD bulls pushed the pair to a new daily high at 1.2835, but the move was faded, retreating towards the 1.2810s area.

Fed officials add to the hawkish list

On Wednesday, Fed policymakers reinforced the need for a faster taper. Fed’s Chair Jerome Powell said that inflation is linked to the pandemic, and elevated prices have been stubbornly persistent. Further noted that “we need to move on from the word transitory” and reinforced the strength of the US economy.

In the same posture, Cleveland Fed President Loretta Mester said, “making the taper faster is definitely buying insurance and optionality so that if inflation doesn’t move back down significantly next year, we’re in a position to be able to hike if we have to.” She noted that recent data “have come in supportive of that case, so I’m very open to considering a faster pace of tapering.”

That said and for those who like to keep the score, Bullard, Bostic, Mester, and Powell favor a faster QE’s reduction, which would aim to end in the first quarter of 2022.

Meanwhile, Western Texas Intermediate (WTI) US crude oil benchmark falls almost 1%, trading at $64.99, underpinning the USD/CAD direction, amid some US Dollar weakness.

In the macroeconomic docket, there’s nothing from Canada to report. On the US front, Initial Jobless Claims for the week ending on November 26 rose to 222K, better than the 240K forecasted, while the Continuing Jobless Claims for the week ending on November 18 rose to 1.956M, lower than 2M for the first time, since March 2020.

During the day, Fedspeaking would be the driver of the day, with Bostic, Quarles, Daly, and Barkin crossing the wires.

In 2022, economists at ING expect the dollar to stay strong. EUR/USD and USD/JPY could trade at 1.10 and 120.00, respectively.

Sharper Fed tightening cycle to propel the greenback

“Assuming that Omicron risks play out closer to the benign end of the spectrum, we look for the sharper Fed tightening cycle to return as a theme in early 2022. This should be good news for the dollar.”

“In a world where the European and Japanese central banks are late to tighten – or have the biggest cause to pause – dollar gains should largely come at the expense of the low-yielding currencies. Here EUR/USD can trade to 1.10 through the year and USD/JPY potentially as high as 120.”

- EUR/USD has nudged higher to the 1.1340s but remains stuck within recent intra-day ranges.

- Further strong US macro data has been ignored, with focus instead on Friday’s US jobs report.

EUR/USD continues to trade within recent intra-day ranges in the 1.1300-1.1350 region as FX markets take a breather from the heightened volatility of recent sessions. FX market conditions are likely to remain fairly subdued now ahead of Friday’s US jobs report. The pair has nudged modestly higher and is currently trading in the 1.1340s, up about 0.2% on the day. These gains come despite further strong US macro data in the form of a better-than-expected initial weekly jobless claims number and job layoffs in November dropping to near 30-year lows.

The pair has also largely ignored the latest headlines about Germany imposing restrictions on the unvaccinated and restrictions being tightened in Belgium. Ahead, four Fed speakers will be coming out of the woodworks on Thursday and if they adopt more a hawkish line in tandem with Fed Chair Jerome Powell earlier in the week.

Hawkish Fed being priced back in

On the back of strong US macro data and hawkish commentary from Powell, who sounded concerned about inflation risks and hinted at a faster QE taper, USD money markets have been unwinding last Friday’s dovish repricing. Recall, news of the Omicron variant last Friday saw markets aggressively pare back expectations for Fed policy tightening in 2022 amid fears it would derail the US economic recovery. The implied yield on the December 2022 three-month eurodollar future fell from close to 1.10% on Thursday to as low as 0.80% on Tuesday prior to Powell’s comments but has since recovered to around 1.0%.

But dollar struggling to keep up

Yet the dollar recovery has been far less impressive. EUR/USD was trading close to 1.1200 prior to the omicron news and is only about 30-40 pips below Tuesday’s 1.1385 highs. Uncertainty regarding the new variant remains elevated and it seems that this, combined with profit-taking on the overbought dollar (particularly versus the euro) is keeping EUR/USD supported. In terms of the technicals; EUR/USD is currently testing a key downtrend that acted as support until mid-November but is now acting as resistance. This, coupled with the earlier weekly highs and 21-day moving average in the 1.1380s, is likely to continue capping the price action for now.

Just when we thought we were through the worst, along comes the Omicron variant. Nobody knows if the new variant will be more transmissible or deal a significant blow to the current vaccines. These are the best and worst outcomes for the global economy, in the view of economists at ING.

Optimistic Omicron

“Omicron proves to be a ‘storm in a teacup’. The Federal Reserve accelerates its taper in December and gears up for three rate hikes in 2022. Sporadic Delta lockdowns slow eurozone growth over Christmas and early into the new year, but the situation improves through the spring. The European Central Bank begins to taper amid growing wariness about inflation. The Bank of England kicks off its rate hike cycle this month.”

Omicron ‘difficult’ but not a ‘disaster’

“This is loosely our base case. Omicron doesn’t help Europe at a time of spiking cases and offers more justification for more aggressive action in the run-up to Christmas. But high vaccine rates and the arrival of boosters mean the continent (including the UK) comes off more lightly than other parts of the world. The effect might be slightly more noticeable in the US, even if the bar for lockdowns is much higher. Meanwhile, in Asia, Omicron stalls the move away from zero-Covid, especially in China. The recovery of supply chains is further delayed.”

“Central banks are likely to ‘wait and see’ in December, not least because it may be weeks before we know what we’re dealing with. But inflation remains front and centre, so we should still expect some tightening of monetary policy next year.”

Omicron deals significant blow to the recovery

“We expect a dip in first-quarter GDP in the major developed economies, albeit not as deep as in early-2021. But the subsequent recovery could be gradual. Overall growth momentum proves more lacklustre through 2022, compared to the rapid rebounds we saw in Q2/3 2021.”

- EUR/JPY challenges once again the mid-127.00s on Thursday.

- Markets remain side-lined on omicron jitters, upcoming US NFP.

- US yields trade in a mixed fashion; yen struggles vs. the dollar.

EUR/JPY manages to reverse the initial drop to the 127.50 region and so far posts decent gains just below 128.00 the figure on Thursday.

EUR/JPY looks to risk trends for direction

EUR/JPY bounces off the so far solid contention area around 127.50 on Thursday, always against the backdrop of the absence of clear direction in the global markets, a mild selling bias in the greenback and increasing cautiousness surrounding the progress of the omicron variant.

Indeed, the dollar appears offered amidst the mixed performance in US yields and despite another auspicious print from the weekly Claims in the US economy, all morphing into fresh legs for the European currency and the resumption of the upsid momentum in the cross.

In the euro docket, the unemployment rate in Euroland came down to 7.3% in October. In Japan, the Consumer Confidence stayed put at 39.2 in November and Foreign Bond Investment shrank by ¥1343.2B in the week to November 27.

EUR/JPY relevant levels

So far, the cross is gaining 0.26% at 127.95 and a surpass of 128.78 (weekly high Dec.1) would expose 129.59 (weekly high Nov.23) and then 130.53 (200-day SMA). On the downside, the next support comes at 127.48 (monthly low Nov.29) followed by 126.00 (round level) and finally 125.08 (2021 low Jan.18).

US Treasury Secretary Janet Yellen, speaking at a Reuters Next event, said on Thursday that a strong US economy, which could likely prompt interest rate increases, is generally good for the world and emerging markets.

Key takeaways:

“It's up to the Federal Reserve to decide when to raise interest rates.”

“Don't want to have wage-price spiral develop in which inflation becomes chronic.”

“It's Fed's job to ensure we don't have wage-price spiral seen in the 1970s.”

“Learned while serving as fed chair to avoid surprises for markets on any rate increases.”

“Working with semiconductor manufacturers, but takes a long time to ramp up production.”

“Tariffs do contribute to higher prices.”

“Some Trump-era tariffs create problems without having any 'real strategic justification'.”

“Lowering tariffs through 'exclusion process' could be helpful, but not a 'game-changer.”

“Omicron variant could cause 'significant problems' for the economy, still evaluating that.”

Market Reaction

Market have not reacted to Yellen's commentary.

GBP/USD is on track for its first gain in four sessions as it climbs back above 1.33. The pair could extend its advance on a break above the 1.3334 downtrend, economists at Scotiabank report.

Support is seen at the 1.33 region

“A firm breach above the Oct/Nov downtrend that acted as resistance on Tuesday and Wednesday, and today at 1.3334 could see the pound aim for a test of 1.34 that stands as resistance after 1.3360/70.”

“Support is the 1.33 zone followed by ~1.3275 and ~1.3260 ahead of the next big figure.”

USD/CAD rallied over 3% during November. Economists at Rabobank expect the pair to trade back in the 1.28-1.30.

USD/CAD and volatility, expect both to remain elevated

“The USD smile theory seems to be in play, so we are bullish USD regardless of whether the US continues to outperform and the Fed tightens policy, or if the global environment sours and global growth slows. The new omicron variant posing a tail risk that could trigger that second scenario.”

“Despite being diverse environments, the outcome is likely to be the same; that is, USD outperformance. However, positioning is stretched and with volatility high we can certainly expect to see sizeable pullbacks.”

“Still, the trend for USD is likely to remain positive and as such we favor USD/CAD returning to the 1.28-1.30 range that dominated the back end of 2020.”

- EUR/USD leaves behind Wednesday’s daily retracement.

- Further upside is seen initially challenging 1.1382.

EUR/USD regains the smile and the buying interest and advances to the 1.1350 zone on Thursday.

In case the recovery picks up further impulse, then the pair is forecast to test the weekly top at 1.1382 (November 30) ahead of another weekly high at 1.1464 (November 15).

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1545. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1819.

EUR/USD daily chart

Oil prices have come under severe selling pressure in recent trade after Reuters reported that, according to an OPEC+ source, the cartel agreed to go ahead with its planned 400K barrel per day output hike in January.

Analysts had expected that, given greater uncertainty about the medium-term crude oil demand outlook due to the global spread of the Omicron Covid-19 variant, OPEC+ would pause output hikes.

Market Reaction

In the last few minutes, WTI has sunk from above $65.00 to around $63.50, though is off earlier lows around $62.50.

The S&P 500 has completed a large bearish “outside day” to reinforce the existing bearish “reversal week” from 4750. A weekly close below the key 63-day average support at 4524 would warn of a more serious correction lower, analysts at Credit Suisse report.

A close above 4524 this Friday can help stabilize the market

“Critical remains as to how we close the week, especially with Payrolls on Friday as a weekly close below 4524 would warn of a more serious correction lower especially in light of widening US credit spreads and with both the VIX and Oil also currently through key technical levels.”

“Immediate support is seen at the 50% retracement of the October/November rally at 4512/10, below which can see support next at 4486 ahead of gap support from mid-October at 4448/38. The critical long-term 200-day average is currently seen lower at 4299.”

“A close above 4524 this Friday can help stabilize the market with resistance then seen next at 4560. More important resistance is seen at the recent price gap, 13-day exponential average and ‘outside day’ high at 4631/55.”

- DXY resumes the downside and revisits the sub-96.00 area.

- Recent lows in the mid-95.00s offer decent contention.

DXY trades on the defensive and puts once again the 96.00 region to the test on Thursday.

The next significant support comes at 95.51 (November 18), which is also reinforced by the proximity of the 20-day SMA, today at 95.64.

In the meantime, while above the 2-month support line (off September’s low) near 94.50, extra gains in DXY remain well on the table. In addition, the broader constructive stance remains underpinned by the 200-day SMA at 92.53.

DXY daily chart

- AUD/USD slipped under 0.7100 in recent trade after good US jobs data.

- US data has been strong this week and, coupled with a hawkish sounding Fed, presents downside risks to AUD/USD.

AUD/USD slipped under the 0.7100 level in recent trade and is currently trading lower by about 0.2% on the day, weighed by good US data. This week’s broadly strong US data endorses Fed Chair Jerome Powell’s bullish take on the economy and message that the bank should press ahead with policy tightening in light of pandemic risks.

To recap, November ISM Manufacturing PMI and ADP data released on Wednesday were both strong. Meanwhile, further evidence of labour market strength in November came on Thursday in the form of Challenger job cuts reaching lows since 1993 and weekly Initial Jobless Claims remaining at healthy, pre-pandemic levels in the week ending November 27. Friday’s US labour market report will be key, however. Another strong print could send AUD/USD back towards November lows in the 0.7060s area.

Aussie data, Victoria outbreak, RBA

Thursday saw the release of further Australian economic data; monthly retail sales and trade balance numbers were broadly in line with expectations, though monthly home loans figures saw a surprise MoM contraction. Thursday’s batch of data didn’t really shift the dial much and come after Wednesday’s not as bad as feared GDP figures, which showed the economy shrinking at a 1.9% QoQ in Q3 versus an expected 2.7% QoQ drop in economic activity (as a result of lockdowns). Australia gradually reopened in November as vaccine coverage rates hits key thresholds, but infections in Victoria surged on Thursday to above 1.4K, their highest level in around one month and Omicron is already known to be circulating – the risk of further lockdowns despite the state’s high vaccination rate remains one to watch.

For now, it seems that AUD is being insulted from domestic Covid-19 concerns as hawkish central bank expectations are priced back in, with money markets betting the RBA will keep pace with the Fed and start hiking interest rates in June next year. The RBA has insisted that it won’t hike until 2023 at the earliest, but the less bad than feared downturn in GDP in Q3 sets the stage for a stronger rebound in Q4 and the quarters ahead. “We expect the RBA to announce, next week, a decision to taper its bond-buying to A$2 billion a week from February, and likely end QE in May” Nomura economist Andrew Ticehurst told Reuters on Thursday, despite RBA Governor Philip Lowe saying a decision on QE would not be made until February.

- There were 222K initial weekly jobless claims in the week ending 27 November.

- That was less than an expected rise to 240K from last week's 194K.

There were 222,000 initial claims for unemployment benefits in the US during the week ending November 27, data published by the US Department of Labor (DoL) revealed on Wednesday. This reading followed last week's print of 194,000 (revised from 199,000) and came in lower than the market's expectation for 240,000.

Continued jobless claims fell to 1.956M in the week ending November 20, the data showed, below expectations for a drop to 2.00M from 2.063M the week prior. That marked a fresh post-pandemic low.

Market Reaction

The dollar saw a very minimal reaction to the data, which fits in with the narrative that the US labour market is currently very healthy/tight.

During November the Australian dollar weakened notably against the US dollar from 0.7508 to 0.7094. Economists at MUFG Bank expect the AUD/USD pair to see a gradual move higher throughout 2022 as the Australian economy recovers and markets readjust the high level of tightening priced into the US curve.

Downside for the aussie AUD/USD from here is limited

“Even after the Omicron market shift, the US rate market is still priced for more than two rate hikes in 2022 and hence the downside for AUD/USD from here is more limited.”

“The data from Australia is now set to improve as covid restrictions are eased. Still, the RBA justifies its more cautious stance on raising rates by pointing to weak wage growth. Q3 wages increased by just 2.2% with the RBA citing sustained growth at least 3.0% as needed to meet RBA inflation goals.”

“With more than 70bps of tightening over the coming 12 months, the pricing still looks excessive but assuming this is also the case in the US, we believe there is scope for a gradual grind higher in AUD/USD through 2022.”

Turkish Finance Minister Nureddin Nebati said on Thursday that high interest rates won't be a priority, according to newswires. Elvan was installed as Finance Minister earlier on Thursday and is seen as a strong supporter of President Recep Erdogan's drive to lower interest rates. Nebati added that he would take steps to achieve a more predictable market and economy.

Market Reaction

The lira hasn't seen any immediate market reaction and USD/TRY continues to trade just to the south of the 13.50 level.

- Challenger Job cuts fell under 15K in November.

- That marked the lowest number since 1993, but FX markets were unmoved ahead of Friday's NFP report.

According to Challenger, Grey & Christmas, job cuts were down 77% YoY in November at 14,875, the lowest such number since 1993. Nearly half of the cuts were down to vaccine refusal (7227).

Market Reaction

Further evidence of a super tight US labour market at this point likely will not alter Fed thinking at this point. Chairman Jerome Powell already indicated a hawkish shift this week in response to optimism about US economic and labour market strength and worries about inflation. Hence, FX markets have not been impacted by the latest numbers. Traders are more focused on Friday's official November labour market report, which is released at 1330GMT on Friday.

According to S&P Global Ratings, if Turkey's central bank (CBRT) continues with its monetary policy easing cycle, authorities might have to permit further depreciation of the lira. By using "borrowed" reserves to defend its exchange rate, S&P continued, the CBRT risks further damaging confidence in the lira and could raise financial stability questions.

The weaker lira will negatively affect Turkey's sovereign balance sheet and recent developments could present downside risks to the country's current rating which remains at B+ with stable outlook, S&P said. Turkey has seen a "significant amount of quasi-fiscal activity" via state banks, and if those banks ultimately run into trouble they may need considerable capital support, the rating agency concluded.

Market Reaction

The comments arent too surprising given recent developments in the Turkish economy/exchange rate. At present, USD/TRY is consolidating slightly to the south of the 13.50 level.

Irish Foreign Minister Simon Coveney said on Thursday that there are still real gaps between the UK and European Union in their disagreement over the implementation of the Northern Ireland Protocol (NIP), according to Reuters.

Coveney added that there hasn't yet been a breakthrough moment and that protocol issues are unlikely to be resolved by the year's end.

Market Reaction

GBP hasn't seen any reaction to the comment, with GBPUSD continuing to meander to the north of the 1.3300. GBP is actually the top performing G10 currency on the day so far, up 0.3% versus the buck, despite recent news that the US is to delay a deal to remove Trump-era steel tariffs on the UK due to UK threats to trigger Article 16 of the NIP.

- EUR/JPY rebounds from earlier lows in the mid-127.00s.

- Further decline remains on the table for the time being.

EUR/JPY once again visited the contention area around 127.50 on Thursday, where dip buyers seem to have re-emerged.

The continuation of the downtrend remains well on the cards for the time being. While the next support of relevance emerges at the 2021 low near 125.00 the figure, a test of this level looks unlikely in the short-term horizon.

Looking at the broader picture, the outlook for the cross is expected to remain negative while below the 200-day SMA, today at 130.53.

EUR/JPY daily chart

According to sources cited by Reuters, OPEC+ may as an option discuss hiking output by just 200K barrels per day (BPD) in January versus the current agreement which stipulates 400K BPD monthly output hikes into mid-2022. Moreover, a senior OPEC+ source reportedly said that sentiment at the moment is to stick to the existing output plan at the meeting.

Market Reaction

Oil prices saw some downside as traders had been expecting the cartel to halt output hikes for now amid higher uncertainty about the demand picture in light of the new Omicron variant. WTI slipped under the $66.00 level and is now back to trading broadly flat on the day. Traders await the outcome of Thursday's OPEC+ meeting which is scheduled to start at 1300GMT.

Lee Sue Ann, Economist at UOB Group, reviews the recent release of the Q3 GDP in the Australian economy.

Key Takeaways

“The Australia economy saw its third biggest fall on record in 3Q21, on the back of shutdowns across New South Wales, Victoria and the Australian Capital Territory during the period. GDP contracted 1.9% q/q, a major downturn from 2Q21 (when GDP rose a revised 0.7% q/q). Still, the latest reading came in better than expectations for a -2.7% q/q reading. From a year earlier, the economy expanded by 3.9% y/y, higher than an estimated 3.0% y/y increase, but significantly lower from last quarter’s revised reading of 9.5% y/y (9.6% y/y previously).”