- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 03-12-2021

- The shared currency advances against the greenback, up some 0.10%.

- The US Dollar Index, which measures the buck’s performance against six rivals, is flat at 96.16.

- EUR/USD: Mild bearish, but it needs a break below the 50-SMA to resume the downward move.

After seesawing before the Wall Street open on US macroeconomic data, the EUR/USD advances modestly, up some 0.10%, trading at 1.1309 during the New York session at the time of writing. The market sentiment is downbeat, as portrayed by US equity indices falling, between 0.77% and 2.61%. Furthermore, in the bond market, US bond yields aim downward. Contrarily the greenback is flat during the day, with the US Dollar Index sitting at 96.16, unchanged.

The EUR/USD remained subdued during the overnight session, in a narrow range between 1.1280-1.1307 range, ahead of the US Nonfarm Payrolls release. However, once the NFP crossed the wires, the pair seesawed around 1.1332-1.265, settling at 1.1300.

EUR/USD Price Forecast: Technical outlook

The EUR/USD 4-hour chart shows that the pair has a downward bias. While the 50-simple moving average (SMA) is below the spot price, the 100 and the 200-SMA reside above the spot price, confirming the abovementioned. The pair has been range-bound between the 50 and the 100-SMA, each lying at 1.1280-1.1315, with no clear direction, and as the New York session winds down, it seems the EUR/USD would remain trapped at it.

In the outcome of a break above the 100-SMA, the first supply zone would be the November 30 high at 1.1382. The breach of the latter would open the way for further upside, with 1.1400 as the next resistance, followed by the confluence of the 200-SMA and the November 15 high at around the 1.1450-70 range.

On the other hand, a break under the 50-SMA would expose the 1.1200 figure, followed by the year-to-date low at the November 24 low at 1.1186.

-637741629343428844.png)

- USD/JPY fell back to weekly lows in the 112.50 region on Friday though has since bounced as volumes fade.

- The pair reversed from as high as the 113.50s as risk appetite deteriorated and drove long-term US yields lower.

Risk-off is the driving force as the US session draws to a close. US stocks are substantially lower, as are other risk assets like crude oil and the likes of AUD, NZD, NOK and SEK in foreign exchange markets. Safe-haven US bonds, meanwhile, have caught a bid and this has pushed yields significantly lower and further flattened the US curve. This has put downwards pressure on US/Japan rate differentials and, as a result, is weighing heavily on USD/JPY.

Back to bonds; the 10-year yield is down 10bps on the day to under 1.35%, while the 2-year is down about 3bps to just under 0.60%. The latter remains elevated given this week’s hawkish Fed shift, which has been to an extent endorsed by a string of strong US macro data releases culminating in Friday’s mixed but broadly interpreted as solid, labour market report. On the week, 2-year yields are up nearly 10bps.

Meanwhile, longer-duration US yields are down sharply on the week as traders worry that the emergence of Omicron at a time when the Fed is set to start withdrawing stimulus will result in weaker growth/inflation down the line. 10-year yields are down about 15bps on the week. The divergence has seen the 2s/10s spread narrow to its lowest point in 2021 at around 75bps, a near 25bps drop on the week.

Looking more closely at USD/JPY then; the pair has bounced in recent trade after probing earlier weekly lows in the 112.50 area earlier in the session. The pair currently trades around 112.75, marking a sharp, risk-off fuelled turnaround from earlier session highs to the north of 113.50.

Forgetting about Omicron for a second, fears are growing that the US will soon follow in the footsteps of the sharp spike in Covid-19 infections seen in Europe over the last few weeks. The emergence of Omicron makes such a spike in infections more likely and another spike in cases risks a sporadic reimposition of lockdown restrictions in various states.

These are all factors being fretted over by market participants and risks that seem unlikely to fade any time soon. If risk-off rather than central bank policy divergence remains in the driving seat for bond and FX markets in the coming weeks as a result, USD/JPY could well break lower towards 112.00.

- The British pound falls for the fourth time in the week,, looks for a weekly close below 1.3300.

- A dampened market sentiment hurts the prospects of the GBP as investors seek to safe-haven assets.

- GBP/USD: In the 4-hour chart, the 50-SMA has acted as resistance, and rallies toward the moving average have been faded.

The British pound pares Thursday’s gains and some more, is down some 0.50%, trading at 1.3232 during the New York session at the time of writing. A risk-off market mood prompted investors to drop anything with the word “risk” attached to it, benefitting safe-haven assets. In the FX market, the USD, the JPY, and the CHF are the most aided of the abovementioned and are the stronger currencies as we approach the Wall Street close.

In the last three hours, the pound bounced off Friday’s daily low around 1.3210s, towards 1.3240s, on a steady move that could have been prompted by USD profit-taking. Also, USD bulls failed to break the 1.3200 figure on the back of the not-so-bad November’s Nonfarm Payrolls report, which in the case of have been in line with estimations or better, the GBP/USD would indeed be trading at new YTD lows.

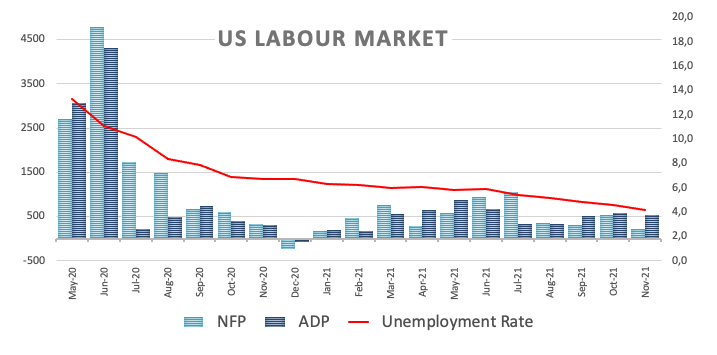

As reported earlier, the US economy added 210K new jobs, shorter than the 550K estimated by experts. The headline showed a worse than expected report, but the Unemployment Rate dropping from 4.5% to 4.2% reinforced that the labor market is improving but not at the pace required. Additionally, the Fed seems to pivot from the maximum employment goal towards tackling inflation, as Fed Chief Jerome Powell said on the week that inflation is no longer “transitory” and should be no longer used when speaking of elevated prices.

Therefore, as the Fed pivoted towards inflation, the US Consumer Price Index (CPI) for October on Friday of next week would be the primary driver for GBP/USD traders, followed by the University of Michigan Consumer Sentiment for November on its preliminary read.

In the UK economic docket, BoE’s speaking, Retail Sales, Manufacturing Production and GDP, would entertain GBP/USD traders.

GBP/USD Price Forecast: Technical outlook

In the 4-hour chart, the GBP/USD has a downward bias, as shown by the 4-hour simple moving averages (SMA’s), which have a downslope and reside above the spot price. Also, the 50-SMA has undergone three tests, and in each of those, the GBP has failed to break above it, leaving that level as a strong resistance level.

In the outcome of extending the downward move, the first support would be 1.3200. The breach of the latter would expose the November 30 low at 1.3194, followed by the 1.3100 figure.

Contrarily on the upside, the first resistance would be 1.3300. A break above that level would expose the 50-SMA at 1.3318, followed by the 100-SMA at 1.3374.

-637741598184291593.png)

Managing Director (MD) of the IMF Kristalina Georgieva said on Friday that she had already been concerned that the global economic recovery had been losing steam before the emergence of the Omicron variant. There would now likely be some downgrade to global growth forecasts as a result, she added, saying that the rapid spread of the new variant can dent confidence.

Georgieva added that the good performance of the US economy is having positive spillovers to other countries, but that US action to control inflation has to happen. She added that tariff reductions could also help global growth and said she was encouraged by the US Trade Representative looking into possible reductions.

Market Reaction

The comments have not directly had an effect on market, but do fit into the broader Omicron worries that are causing US equity market sentiment to continue to deteriorate as the final close of the week approaches.

- USD/CHF has been choppy on Friday, but slipped back to session lows around 0.9170 in recent trade.

- The pair is being weighed as risk appetite ends the week on the back foot, favouring haven like CHF.

It's been a choppy session but USD/CHF ultimately looks set to end the day lower by about 30 pips or just over 0.3%. The pair is currently trading at session lows in the 0.9170 area, having started the day to the north of the 0.9200 level, and is eyeing a test of this week’s lows at 0.9150. Unless USD/CHF can break below support before the NY close, which seems unlikely as volumes decline into the weekend, it seems the pair will be consigned to enter next week within the same 0.9150-0.9220ish range that has prevailed all week.

A deterioration in risk appetite over the last few hours that has seen US equities, commodities and most risk-sensitive commodities come under pressure is benefitting traditional safe-haven assets. Long-term US yields are substantially lower reflecting a bond bid that is also helping the likes of the yen and Swiss franc. Friday’s US November labour market report was mixed, with the headline NFP number missing expectations by a big margin but other aspects of the report, such as the unemployment rate, suggest the labour market continues to progress and remains tight. That, taken with more hawkish rhetoric from FOMC member James Bullard, has helped keep Fed tightening expectations for 2022 intact, so the moves being seen in bonds and FX are more to do with risk appetite.

- USD/CAD has bounced from earlier lows under 1.2750 and is back to multi-month highs around 1.2830.

- The move higher comes amid a broad deterioration in risk appetite.

- But a strong Canadian jobs report is helping the loonie outperform its risk-sensitive G10 peers.

USD/CAD spiked lower in the aftermath of the simultaneous US and Canadian labour market data release at 1330GMT, with the pair briefly dipping below the 1.2750 level, but has since reversed sharply higher. The pair is now trading back at multi-month highs in the 1.2830 area, having nearly hit 1.2850, with gains of around 0.2% on the day. The loonie continues to trade within the confines of a bullish trend channel, which suggests the path of least resistance remains to the upside.

-637741560914491953.png)

Risk appetite deteriorates

The retracement higher from early session lows comes amid a broad downturn in risk appetite since the US open that has seen both stocks and oil markets sell-off in unison. No one theme is weighing on risk appetite, but traders are citing continued uncertainty regarding Omicron and further hawkish rhetoric from Fed members (this time from FOMC’s James Bullard) in wake of the US jobs report. For reference, the headline November NFP number was much weaker than expected, but the household survey showed the unemployment rate dropping more than expected to 4.2% and the participation rate ticking higher. Most analysts interpreted the report as in fitting with the theme of an already tight and still improving US labour market.

But CAD holds up well

The risk appetite downturn has done the most damage to risk-sensitive AUD, NZD, NOK, and SEK, which are between 0.8-1.2% lower on the session. The loonie is doing comparatively better likely because the November Canadian jobs report was much stronger than expected. The economy added more than 150K jobs, nearly 80K of which were in full-time employment, on the month, well above expectations for a 35K gain. Meanwhile, the unemployment rate sank to 6.0% versus expectations for a much more modest drop to 6.6% from 6.7% in October. The report will boost expectations for the BoC to turn more hawkish in the coming weeks and stay decisively ahead of the Fed in terms of monetary tightening.

- The shared currency finishes in the green the week, contrary to the risk-sensitive cable.

- The EUR/GBP rallied almost 50-pips as the US Nonfarm Payrolls report headline crossed the wires.

- In the EUR/GBP daily chart, the break of the 200-DMA would expose 0.8657.

The EUR/GBP rallies during the New York session, up some %, trading at 0.8542 at the time of writing. Market sentiment is pessimistic after a mixed US Nonfarm Payrolls report, as the US central bank looks forward to increasing the pace of the bond taper. Also, in the last couple of hours, an increment of COVID-19 infections with the Omicron variant appears to weigh investors’ moods as safe-haven currencies rise.

On Friday, during the overnight session, the EUR/GBP pair remained subdued, within December 2 low at 0.8488, and the daily central pivot at 0.8501. However, volatility shot through the roof as the American session began, and the EUR/GBP rose towards 0.8547. At press time, it appears the pair might consolidate around the 0.8500, also benefitted from the “safe-haven” status gained lately, on the low-yield EUR.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP daily chart shows that the cross-currency pair is approaching the 200-day moving average (DMA), sitting at 0.8557, which would see a level that GBP bulls would lean-to in their attempt to push the EUR/GBP pair lower. However, in breaking the latter, the first resistance would be the November 5 swing high at 0.8594, followed by the September 29 high at 0.8657.

Conversely, if the EUR/GBP upward move is faded at the 200-DMA, the first support would be the 100-DMA at 0.8514. A breach of that level could send the pair tumbling down to the 50-DMA at 0.8484, followed by the psychological 0.8400 support.

-637741524569502028.png)

Next week, on Wednesday, the Bank of Canada (BoC) will have its monetary policy meeting. Analysts at TD Securities, expect a relatively quiet meeting. They consider the BoC will maintain the view that the outlook is evolving as expected and that inflation is transitory.

Key Quotes:

“We look for a relatively quiet BoC meeting, with limited scope for a meaningful change in tone. The BoC will maintain that the outlook is evolving as expected and that inflation strength is largely transitory. We do not expect any change to guidance, as the statement balances rising uncertainty over COVID & supply chain disruptions from BC floods against labour market strength.”

“A quiet BoC meeting shifts CAD drivers to the world at large. In turn, COVID uncertainty, heightened risk aversion, and a relatively poor local growth and mobility backdrop should keep USDCAD hanging around 1.28 for a bit longer. While we see too much pessimism priced into markets, it could a bit of time for things to settle down. Even so, we think the risk pullback will offer attractive entry levels for CAD against the likes of JPY and CHF in early 2022.”

“We expect a neutral BoC meeting, but note that Canada remains cheap to the US. It is important to recognize that we have moved from a divergence narrative with the US to a convergence narrative now; as such we want to maintain our long Canada bias.”

The November employment report showed an increase in payrolls of 210K, significantly below the 550K expected. According to analysts at Wells Fargo, this report was a clear disappointment in that nonfarm payrolls were well-below consensus expectations. They add that a slower pace of wage growth may slightly ease some concerns about a wage-price inflation spiral.

Key Quotes:

“With just one final employment report left in 2021, nonfarm payrolls are roughly four million jobs below their pre-pandemic level. Job growth is still easily outpacing the slow pace that the U.S. labor market experienced during the recovery from the 2008-2009 financial crisis.”

“In our view, this morning's employment report leaves the FOMC in a bit of a gray zone. Key Fed officials have been talking up the prospect of a faster taper in recent weeks, with a possible policy shift occurring as soon as the December 15 FOMC meeting. This morning's report was a clear disappointment in that nonfarm payrolls were well-below consensus expectations. In addition, a slower pace of wage growth may slightly ease some concerns about a wage-price inflation spiral.”

“The FOMC will clearly be discussing a faster taper at its next meeting, but this morning's report gives the Fed an out if it would like to wait an extra six weeks until its following meeting in late January 2022.”

“The Omicron variants adds additional uncertainty to whether job growth can rebound to a more robust pace through the winter as health concerns flare up again. With still so little known about the severity of the new variant at this stage, we continue to expect hiring to remain solid.”

- The AUD/USD declines sharply amid a not-so-bad US Nonfarm Payrolls report.

- Downbear market sentiment hurts the prospect of risk-sensitive currencies in the FX market, the AUD weakens.

- In the weekly chart, the AUD/USD broke under the 100 and the 200-week SMA’s, AUD bears eye 0.6776.

During the New York session, after a not-so-bad US Nonfarm payrolls report, the AUD/USD is plummeting to fresh year-to-date lows, trading at 0.7005, down 1.23% at the time of writing. As portrayed by US equity indices falling, market sentiment is downbeat after the US Bureau of Labor Statistics (BLS) unveiled that the Nonfarm Payrolls for November grew less than expected. However, the Unemployment Rate fell three tenths from 4.5% to 4.2%.

In tone with the risk-off mood, in the FX market, risk-sensitive currencies like the AUD, the NZD, and the GBP, are the main losers of the day, contrary to the greenback, which takes advantage of its safe-haven status.

Contradictory Nonfarm Payrolls report boosts the greenback, and the AUD/USD plunges to new YTD lows

In the meantime, an hour previous to the Wall Street open, the US Nonfarm payrolls for November showed that the US economy added 210K jobs to the economy, less than the 550K estimated. However, the positive from the jobs report was the Unemployment Rate, dropping from 4.5% to 4.2%, and it is crucial because that is the labor market gauge for the Federal Reserve.

The reaction to the headline was immediate, sending the AUD/USD upwards to 0.7090. Nevertheless, as investors dissected the NFP report, the AUD/USD upward move was faded, plummeting 80-pips, down to a new year-to-date low at 0.7012, then rebounding towards 0.7020s.

Amid those plays, the St. Louis Fed President James Bullard crossed the wires, where he said the US economy has recovered and is poised to grow. Noted that in the following meetings, the Fed would need to consider a faster bond taper reduction, citing that a 4.2% jobless rate “as a good case to remove Fed support.” Bullard also commented that the US central bank could consider increasing rates before finishing the bond taper.

AUD/USD Price Forecast: Technical outlook

The AUD/USD weekly chart depicts that as of the present week, the pair broke below the 100 and the 200-week simple moving averages (SMA’s), signaling a downward bias in the pair. Furthermore, as depicted by the chart, the Relative Strength Index (RSI), a momentum indicator, is at 33 with enough room to support another leg-down.

Also, it is imperative to notice the central bank divergence between the Federal Reserve and the Reserve Bank of Australia, which has struggled to push back hiking rates until 2024. In contrast, the US central bank is looking to accelerate the QE’s reduction as inflation has overshot the bank’s target.

Therefore, USD bulls have the upper hand against the AUD, and as the pair is printing new year-to-date lows, the downward move would possibly extend further.

In that outcome, the first support level would be June 2020 swing lows at 0.6776, followed by the previous resistance level now turned support at 0.6570.

-637741480715129463.png)

The announcement from the OPEC+ surprised the market by following through on their plan to increase production by 400kb/d in January, potentially leading to a modestly oversupplied oil market early next year, explained analyst Rabobank. They see the bullish reaction in prices to the bearish announcement, as a sign of a potential bottom.

Key Quotes:

“The oil market got more bearish news on Thursday when OPEC+ decided to follow through on their plan to increase production by 400kb/d in January, potentially leading to a modestly oversupplied oil market next year. Nonetheless, the oil market rallied following the bearish announcement which could be an important signal that oil prices are putting in a bottom.”

“Not much has changed in our views despite the sharp correction in prices and we still expect sideways and choppy markets through year-end as we said last week before the oil rally begins in earnest again early next year. While the OPEC+ supply decision was a surprise to us, it does signal that the group is expecting robust demand next year. That's not to say we expect oil prices to rally straight up from here, but perhaps the lows are in the rear view mirror.”

“As for market volatility, we expect it to remain elevated, as these bigger trading ranges become the new normal and with that, there is both more risk and more trading opportunities ahead.”

- Despite at one point trading above 4600, the S&P 500 has slipped lower to probe the 4500 level.

- A break below this could trigger a move as low as 4300.

It shouldn’t come as too much of a surprise that the US equity market rollercoaster ride that has been running since news of Omicron first broke last Friday continued through to NFP day (this Friday). The S&P 500 currently trades roughly 1.7% lower on the day and has dropped all the way back to just above 4500, despite at one point trading above 4600 earlier in the session. Thursday’s gains have thus been all but relinquished and the index is now trading within a whisker of the week low at 4504.70 and on course to close the week down roughly 1.9%. A break below 4500 could see a fast move down to the next area of resistance around 4300 (the September lows) over the course of next week.

Conditions have been choppy all week, with the index moving at least 1.0% in either direction every single day. In fact, (at this rate) the smallest intra-day move is set to be Wednesday’s 1.2% drop. The pick-up in volatility comes as market participants struggle to assess the outlook for the US and global economy as the Omicron Covid-19 variant spreads and as the Fed signals it is intent on pressing ahead with withdrawing monetary stimulus.

The US macro data this week has been very strong. Both ISM surveys pointed at strong expansion of manufacturing and service sector activity in November and, aside from the headline NFP number in Friday’s official labour market report, all other indicators point to a tight, strong labour market. Further evidence of underlying economic strength underpins the Fed’s hawkish shift this week. Recall that Chair Jerome Powell, after sounding very bullish on the economy but worries about inflation, said earlier in the week it would be appropriate to discuss accelerating the QE taper at this month’s FOMC meeting. St Louis Fed President, who is a 2022 policy voter, went further on Friday and was banging the drum about rate hikes as soon as Q1.

Up until Omicron came on the scene, equities were not bothered by increasingly hawkish Fed vibes. But Fed members did not use the new variant as an excuse to dial back on hawkishness as many had been hoping they would and at this point do not seem to deem it a significant economic threat. Equity investors, judging by the price action, disagree. They are, at least, assigning an elevated probability that the new variant does damage the growth outlook.

It looks as though Omicron is going to be super transmissible and is going to easily infect the vaccinate/naturally immune, so the equity market's best hope at this point is that the symptoms associated with infection are mild. If they are as bad as, say, delta, then lockdowns seem likely to “flatten the curve” of hospitalisations. If the symptoms are significantly milder, then stocks could come roaring back – a mild variant would be allowed to spread by health authorities as a means of achieving herd immunity and protecting against nastier Covid-19 variants. In this case, lockdowns would be off the table.

The Canadian employment report released on Friday showed significant better-than-expected numbers with a net increase in jobs of 153.700. According to National Bank of Canada’s analysts, the full recovery in the labor market suggest the normalization of the Bank of Canada policy should be initiated during the first quarter of next year.

Key Quotes:

“After an astounding sequence, the labour market surprised once again with bewildering strength in November. Indeed, there was reason to believe that after recovering all the jobs lost during the recession, the progression of the labour market would be slower thereafter. This has not been the case.”

“The details of the November report are also impressive. Most gains were full-time, and the private sector was the driving force, gaining 107K jobs. Over the past 6 months, private headcounts increased by a whopping 725K, the largest gain on record if we exclude the period of reopening following the lockdown last year.”

“All in all, the labor market has fully recovered, something which suggests that the normalization of monetary policy should be initiated in the first quarter of the year as current monetary stance is simply no longer appropriate to the current context.”

Analysts at MUFG Bank, forecast the USD/JPY pair will move gradually to the downside during the next year. They see the pair at 111.00 by the end of the first quarter at 110.00 by the second and at 108.00 by year-end.

Key Quotes:

Strong dollar expectations remain deep seated in the market, but we see a high hurdle for sustained dollar strength for the two reasons: dollar is overvalued and the downtrend in dollar rates. “The dollar could continue to strengthen for some time, but we expect it to gradually soften toward the end of 2022.”

“We think the dollar will remain firm for now amid expectations that the Fed will continue to normalize monetary policy. However, we expect global inflation expectations to cool as the uptrend in oil prices eases. The Fed may start raising rates in June, but this has been largely factored in and we doubt the policy rate will rise far in any event. We therefore expect the dollar to gradually turn lower due to a sense of being overvalued. Meanwhile, we see a strong possibility that the yen will recover. The USD/JPY is likely to gradually decline, and we expect it to fall below 110 by the end of 2022.”

On Friday, employment data from the Caandian labour market surpassed expectations. The Bank of Canada (BoC) looks positioned to hike rates in the first half of 2022, although the impact of omicron is of course still creating a significant degree of uncertainty about the near term for any such forecasts, explained analyst at CIBC.

Key Quotes:

“The random number generator that is the Canadian Labour Force Survey spit out a huge number for November. With the gains looking broad based and building on past progress, the Bank of Canada now looks positioned to hike rates in the first half of 2022, although the impact of omicron is of course still creating a significant degree of uncertainty about the near term for any such forecasts.”

“Today's data is enough to say that the Bank of Canada is positioned to hike rates in April. Although, with that being said, the impact of omicron is creating very wide uncertainty bands around base case forecasts for the next few months.”

“With US payroll data for November revealing a much weaker labour market than anticipated south of the border, the strong print in Canada is seeing the Canadian dollar gain ground and rates across the Government of Canada yield curve rise, particularly at the short end.”

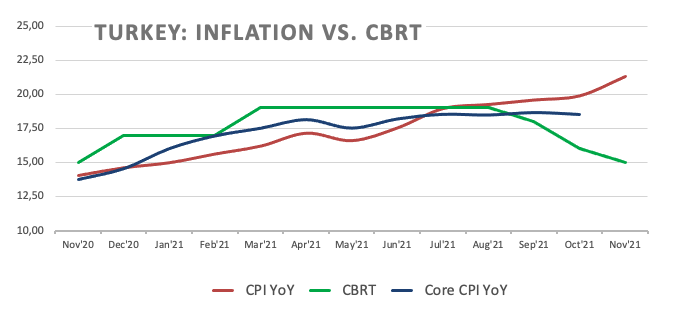

Data released this week in Turkey showed consumer prices increased by 3.51% in November, resulting in annual inflation of 21.31% up from 19.89%. Analysts at BBVE, expect consumer inflation to surprise on the upside in the coming months with levels likely getting close to 30% towards the end of the first quarter of 2022.

Key Quotes:

“Consumer prices increased by 3.51% in November, being realized above expectations (BBVA Research 3.25%, Consensus 3.0%) and resulting in an annual inflation of 21.31% up from 19.89% the month before. Our main deviation was this time due to core prices inflation, which reflected faster than expected pass-thru from cost factors.”

“Looking ahead, accelerating exchange rate pass-thru, continuing very high volatility in the currency, strengthening cost-push factors, high food inflation and growing pressures from imported inflation reinforce upside risks and uncertainty for the inflation outlook. Besides, domestic demand is accelerating on mainly consumption and inflation expectations keep significantly deteriorating. We expect consumer inflation to surprise on the upside in the coming months with levels likely getting close to 30% towards the end of 1Q22, which will be very challenging to keep the current loose stance.”

“Given the increased volatility, inflation will likely experience levels close to 30% in next months, becoming challenging to keep loose policies when the global yields are rising. The CBRT still signals to deliver a rate cut in December but then to wait in order to see the cumulative effects of the current rate cuts in the first half of 2022.”

- Greenback gains momentum amid risk version but lower US yields limit upside.

- EUR/USD heads for a modest weekly loss, without reaching fresh YTD lows.

The EUR/USD weakened during the American session and fell to 1.1266, reaching the lowest level since Tuesday. It then rebounded toward 1.1300 trimming losses. The decline took place amid a rally of the US dollar across the board, but the decline in US yields limited the upside of the greenback.

US economic data and Fed’s monetary policy expectations boosted the greenback on Friday. The US Employment report showed mixed data and later, service sector numbers (ISM And PMI) came in above expectations.

“The FOMC will clearly be discussing a faster taper at its upcoming December 15 meeting, but this morning's payroll number and lighter read on average hourly earnings growth gives the Committee an out to perhaps punt to its January meeting”, mentioned analysts at Wells Fargo.

The EUR/USD is about to end the week with a modest decline. The positive for the euro is that it did not reach new YTD lows for the first time after four weeks in arrow. Price continues to consolidate around 1.1300, still in a downtrend but showing signs of consolidation in the short-term.

Technical levels

US President Joe Biden said on Friday that price pressures would ease as the global economy improves. Gasoline price drops are beginning to reach Americans and this should pick up, he added, saying that China might also decide to release more oil, though it has not done so just yet.

- US Nonfarm payrolls report, not as bad as expected, as Unemployment Rate dips to 4.2%

- Fed’s Bullard commented on the need of the Fed for a faster taper, considering the 4.2% unemployment rate “as a good case to remove Fed support.”

- XAU/USD: A death cross looms, as the 50-DMA is about to cross under the 200-DMA.

Gold (XAU/ÜSD) edges higher during the New York session, up 0.15%, trading at $1,770.35 at the time of writing. Market sentiment is downbeat due partly to a not-so-bad US Nonfarm payrolls report, amid US Bond yields rising, led by 2s up two and a half basis points at 0.646%, 5s higher one basis point at 1.239%, while the 10s are steady at 1.45%.

At press time, the US Dollar Index, which measures the greenback’s value against a basket of its peers, advances 0.13%, sitting at 96.28, a headwind for the yellow metal, which has been struggling in the week, so far down 1.21%.

US Nonfarm payrolls increased lower than foreseen, but Unemployment Rate falls

Apart from that, on Friday, the US Bureau of Labor Statistics (BLS) reported that in November, the US economy added 210K new jobs, versus the 550K expected. Although the headline miss is substantial, it seems to ease investors’ reaction, as the Unemployment Rate for November fell three tenths from 4.5% in October to 4.2%.

The yellow metal whipsawed once the news crossed the wires, reaching a daily high at $1,778, then retreating to $1,766, followed by a consolidation around current levels.

In the meantime, St. Louis Federal Reserve President James Bullard, who has a hawkish stance and would be a voter in 2022, is crossing the wires. Bullard said that the US economy has recovered and is poised to grow. Noted that in the following meetings, the Fed would need to consider a faster QE’s reduction, citing that a 4.2% jobless rate “as a good case to remove Fed support.” Bullard also commented that the US central bank could consider increasing rates before finishing the bond taper.

XAU/USD Price Forecast: Technical outlook

-637741437690686792.png)

Gold in its daily chart shows some “indecision” and sideways trading. However, it is essential to notice that the 200, 50, and 100-day moving averages (DMA’s) reside above the spot price, lying at $1791.01, $1791.41, and $1,790.63, respectively. The scenario of a death-cross, which means when the 50-DMA crosses below the 200-DMA, usually a bearish signal, could become a reality, thus changing gold bias from a technical analysis point of view.

In the abovementioned outcome, the first support would be the December 3 cycle low at $1,761.99. The breach of the latter would expose crucial support levels, as the October 6 low at $1,745.72, followed by the September 29 low at $1,721.52.

- Japanese yen gains momentum amid risk aversion.

- USD/JPY peaked at 113.60 and then turned to the downside.

- Pair remains in recent range, flat for the week.

The USD/JPY climbed to 113.60 during the American session, boosted by a stronger US dollar and then pulled back, affected by risk aversion. It is hovering around 113.15/20, flat for the week. The pair continues to move in the recent range, unable to break the 113.60/80 area and supported around 112.70.

The dollar weakened and then rose following the release of the US employment report. The headline showed an increase in payrolls of 210K below the 550K expected. However, the report contained upbeat detail like a decline in the unemployment rate to 4.2%. Data from the service sector released later surpassed expectations.

The greenback gained more strength after Fed’s Bullard mentioned that the central bank could raise interest rates before completing the taper. Stock prices turned south in Wall Street and weighed on USD/JPY.

The pair continues to trade in a range without a clear direction, holding onto last week losses. A break under 112.70 should increase the bearish pressure, while above 113.85 the dollar could test 114.00.

Technical levels

UK Brexit Minister Lord David Frost said on Friday that the gap between the UK and EU regarding the implementation of the Northern Ireland Protocol (NIP) remains significant and progress on many issues has been quite limited. There have been some quite constructive talks on subsidy control but the issues remains unresolved, he added, as does the wider issue of governance.

Frost said that he would speak again with Vice President Sefcovic next week and our teams will have intensified talks in the coming days. Frost reiterated that the UK's position remains that the threshold has been met to use the safeguards provided by Article 16 in order to protect the Belfast agreement if solutions cannot be found.

Market Reaction

Sterling has not seen any reaction to the latest comments. No one had really been expecting Brexit talks to resolve before the year's end.

St Louis Fed President James Bullard said on Friday he expects an upwards revision to the November NFP number, as this is a tight labour market. The US economy will be below 4% unemployment by Q1 2022, he added.

Additional Comments:

"Sticking with forecast for two rate hikes in 2022."

"Faster taper would create optionality to do more rate hikes if inflation doesn't dissipate."

"Labor market participation is not the thing to look at when deciding if have reached max employment."

"Want to get soon to 'live meetings' on rate hike possibility."

"With rapid changes in data, fed may need to respond meeting by meeting."

"Growth will slow next year, but will still be 'super rapid' amid productivity gains, better pandemic control."

"Economy's adaptation so far to Covid-19 suggests 'we'll be able to handle' Omicron variant."

"Inflation is partly from supply shock, partly increase in demand."

Gold registered heavy losses for the third straight week. As FXstret’s Eren Sengezer notes, sellers eye $1,750 as the Federal Reserve stays on tightening path.

Fed looks to accelerate taper

“As long as investors remain confident that Omicron will not put major pressure on the health care system even if vaccines need to be adjusted, the Fed is likely to remain on its tightening path and limit gold’s recovery attempts.”

“On Friday, the US Bureau of Labor Statistics will release Consumer Price Index (CPI) figures for November. When the October CPI print surpassed the market expectation, XAU/USD shot higher with the initial reaction. We could see a similar reaction in case the report reveals that the CPI continued to increase in November. A hot inflation reading, however, would also provide a boost to the dollar, not allowing gold to capitalize on the data.”

“On the downside, interim support seems to have formed at $1,760 (December 2 low) ahead of $1,750 (static level). A daily close below the latter could open the door for additional losses toward $1,740.”

“$1,780 (Fibonacci 61.8% retracement of the latest uptrend) aligns as first resistance before $1,790 (100-day SMA, 200-day SMA) and $1,800 (psychological level, Fibonacci 50% retracement).”

St Louis Fed President James Bullard said on Friday that the Fed could look at raising interest rates before completing its QE taper.

Additional Comments:

"We should end taper by March."

"Ending taper by March would give us optionality to raise rates if needed."

"We don't want to be too slow to react."

"We want to pull back in a way that's not too disruptive."

"A lot of fed policymakers have said they are comfortable speeding taper."

"There's more agreement we have to change the picture, given inflation."

"We could also look at allowing balance sheet to shrink."

According to US Census Bureau data, US Factory Order rose 1.0% MoM in October. This was above the expected 0.5% gain and marked an acceleration on the 0.5% MoM gain seen back in September. Excluding transportation, orders were up 1.6% on the month also marking an acceleration on September's MoM growth rate of 0.7%.

- Headline ISM Service PMI rose to 69.1 in November.

- That marked a record-high going back to 1997 when the survey began.

The Institute of Supply Management's headline Services PMI index rose to a fresh record high at 69.1 in November versus forecasts for a modest fall to 65.0 from 61.9 in October.

Subindices

- The Business Activity index rose to 74.6 from 69.8 in October.

- The Prices Paid index fell to 82.3 from 82.9 in October.

- The New Orders index held steady at 69.7 in November.

- The Employment index rose to 56.5 from 51.6 in October.

Market Reaction

The US dollar got further tailwinds in wake of the strong ISM report, with the DXY pushing to fresh session highs in the 96.30s.

Reducing the Fed's balance sheet before raising rates doesn't seem to be on the table, said St Louis Fed President James Bullard on Friday.

US Nonfarm Payrolls rose at a much slower pace than expected in November. However, an underwhelming print did little to undermine the USD. Economists at TD Securities think it will be very difficult to sell the USD as a thematic strategy given the global monetary policy setup.

Fed's hawkishness to be a significant offset to a USD retreat

“Payrolls were +210K, well below expectations, and revisions added a relatively modest 82K. Hourly earnings were also not as strong as expected: +0.3% MoM and 4.8% YoY. In contrast, the household survey data were extremely strong, with unemployment down 0.4pt to 4.2%, even with a 0.2pt rise in the participation rate.”

“With a hawkish Fed profile in place (faster taper and likely hawkish SEP forecasts), USD dips should be shallow (especially vs. funding currencies).”

“We expect 1.12/14 in EUR/USD, dips faded sub-113 in USD/JPY and USD/CAD fatigue in 1.28/29.”

St Louis Fed President and FOMC voting member in 2022 James Bullard said on Friday that the US economy has been very good at adapting to the pandemic and that he thinks that will continue, according to Reuters. Moreover, the danger is that we will get too much inflation, he added, and that is not the intent of the Fed's new framework. I think we will continue to see a dramatic improvement in the US labour market ahead, he said, adding that he did not think a lower participation rate is a threat to the economy.

According to IHS Markit, final November Services PMI for the US was 58.0. That marked an upwards revision from the flash estimate of 57.0, though was still marginally below October's 58.7 reading.

- NZD/USD has erased a kneejerk move higher following the weaker than expected headline NFP number.

- The pair is now probing annual lows around 0.6770.

- The latest jobs report signals underlying strength in the US economy and the US dollar looks in a good position.

NZD/USD saw kneejerk upside in response to the latest US labour market report, which on the face of its was much weaker than expectations. The pair nearly hit session highs in the 0.6810s but has since reversed back to below pre-data levels. It recently broke out to fresh annual lows under 0.6770, where it now trades with on the day losses of about 0.75%.

The Bureau of Labour Statistics (BLS) headline NFP number was weaker than expected a just 210K (the median forecast was for 550K). Moreover, Average Hourly Earnings growth was a tad weaker than forecast. But the separate Household survey also compiled by the BLS showed the unemployment rate falling to 4.2%, much larger than the expected drop to 4.5% from 4.6% and also showed the participation rate rising to a fresh post-pandemic high at 61.8%. That meant, according to the Household survey, there were over 1M more employed persons in the US economy in November versus October.

In sum then, the data was mixed but broadly still supports the idea that the US labour market is in good shape and continues to recover. As a result, Fed rate hike expectations for 2022 have actually risen. The implied yield on the December 2022 three-month eurodollar future (a proxy for market expectations as the where the Fed funds rate) rose to 1.05%, more than 25bps above earlier weekly lows and only a few bps below recent pre-Omicron highs at 1.08%.

Further hawkish Fed commentary, this time from St Louis Fed President James Bullard, who will be a voter in 2022, is likely adding tailwinds for the US dollar also. The 0.6800 area was a key support zone for NZD/USD, so a weekly close to the south of this level might be taken as a bearish signal by technicians heading into next week. Should technical selling momentum pile up, NZD/USD could tumble all the way down to the 0.6500s, the next area of major support.

- DXY gathers steam following November’s Payrolls.

- The US economy added fewer jobs than expected last month.

- The ISM Non-Manufacturing, Factory Orders come next in the docket.

The greenback, in terms of the US Dollar Index (DXY), gathers some pace and retests the daily highs around 96.30 at the end of the week.

US Dollar Index bid post-NFP

The index now advances for the third session in a row on Friday and looks to consolidate the rebound above the 96.00 barrier following the release of November’s US labour market report.

In fact, US yields and the dollar edge higher despite the US economy added “just” 210K jobs in November (vs. 550K estimated), although the jobless rate ticked lower and Average Hourly Earnings surprised to the downside at 0.3% MoM and 4.8% YoY.

In the meantime, yields across the curve add to gains seen in the second half of the week, with the 2y note flirting with tops around 0.65%, the belly advances past 1.45% and the long end approaches 1.80%.

The dollar remains on track to close the sixth consecutive week with gains, always underpinned by the uptrend in US yields, auspicious results from US fundamentals – which in turn support the idea of a strong recovery – a pick-up of risk aversion on omicron fears and lately by the hawkish twist in Powell’s testimony after he suggested the Fed will discuss adopting a quicker tapering pace at the December meeting, all pointing to a rates lift-off at some point in mid-2022.

Closing the weekly calendar, Markit will publish the final Services PMI seconded by the ISM Non-Manufacturing.

US Dollar Index relevant levels

Now, the index is gaining 0.10% at 96.22 and a break above 96.93 (2021 high Nov.24) would open the door to 97.00 (round level) and then 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.51 (weekly low Nov.30) followed by 94.96 (weekly low Nov.15) and finally 94.44 (low Nov.18).

Senior E3 (France, Germany, UK) diplomats said on Friday that Iran has backtracked on the diplomatic progress made in recent nuclear talks, according to Reuters. The diplomats expressed disappointment and concern after analysing Iranian proposals for changes to the text negotiated during the prior six rounds of talks in Vienna. Iran has demanded major changes, they said, adding that it is now unclear how these new gaps can be closed in a realistic timeframe given these drafts.

Market Reaction

The news has added tailwinds for crude oil, with WTI at session highs and testing the $69.00 level. A WSJ report framed the comments as the closest E3 diplomats have yet come to admitting that a return to the old JCPOA nuclear pact agreed back in 2015 is impossible. At present, the US has placed severe sanctions to prevent Iran from exporting crude oil, which would only be lifted upon both sides agreeing on a return to the old nuclear pact.

- US Nonfarm payrolls report rose by 210K, lower than the 550K estimated.

- Canadian Employment Change increased 5-times of estimations while the Unemployment Rate falls.

- USD/CAD threatens to break the 200-hour SMA, that once breached, would send the pair tumbling towards 1.2700.

During the New York session, the USD/CAD plunges on a dismal US Nonfarm payrolls report, down 0.46%, trading at 1.2746 at the time of writing. In the last hour, US and Canada reported employment figures.

US Nonfarm payrolls disappoint, while Canadian Employment Change smash expectations

On Friday, the US Bureau of Labor Statistics (BLS) reported that in November, the US economy added just 210K new jobs, versus the 550K expected. Although the headline miss is substantial, it seems to ease investors’ reaction, as the Unemployment Rate for November fell three tenths from 4.5% in October to 4.2%.

Apart from the US, the Canadian economic docket, the Employment Change for November, showed that the Canadian economy added 153.7K new jobs, crushing economists’ expectations of 35K. Further, the pace of the labor market accelerated versus the previous month’s figures of just 35K. Worth noting of the employment report, 79.9K of the total jobs are full-time. Another positive from November’s data is that Unemployment Rate dropped from 6.7% to 6.0%.

Market’s reaction

That said, the USD/CAD pair reaction plummeted from 1.2819 down to 1.2760, bouncing off those lows towards 1.2786. However, at the time of writing, USD/CAD is extending its losses severely, as it is testing the S2 daily pivot point at 1.2747.

USD/CAD Price Forecast: Technical outlook

The USD/CAD in the 1-hour chart has a downward bias after printing a 72-pip bearish candle, breaking essential support levels, like the 50 and the 100-hour simple moving averages (SMA’s).

Furthermore, at press time, the 200-hour SMA is under pressure at 1.2742, which, if it gives way, would extend USD losses against the Loonie, which could witness the USD/CAD pair tumbling down to the S3 daily pivot at 1.2717, followed by a test of the 1.2700 figure.

Canadian employment surprised well to the upside with job growth of 154K in November, smashing the market consensus for 37.5K. A much stronger jobs number alongside a disappointment in US payrolls leaves the CAD in a decent position to outperform into next week's Bank of Canada (BoC) meeting, according to economists at TD Securities.

A lot of bad news looks to be in the price

“The November employment report crushed expectations with job growth of 154K, over 4x the market consensus for a 37.5k print. Full and part-time employment both saw large gains while unemployment fell to 6.0%, hours worked rose by 0.7% MoM, and wage growth accelerated to 3.0% YoY.”

“A strong jobs print alongside a well-priced hawkish Fed suggest that USD/CAD could be forming a short-term top in 1.28/29.”

“As for the BoC, they are likely to take a pass at announcing anything major next week but given CAD price action in recent weeks, we suspect a lot of bad news is in the price and risk/reward looks more favorable on betting on a hawkish surprise.”

Cable slides in a continued GBP downtrend. Economists at Scotiabank expect the GBP/USD to restest the 1.3200 level if 1.3250 gives way.

Resistance above 1.33 region is seen around 1.3335

“The pound’s failed push above 1.33 leaves the short-term charts looking a touch more negative and the broad downtrend points to losses extending to a re-test of 1.32 if the mid-figure area gives way.”

“After the 1.33 area, resistance is ~1.3335 and 1.3350/70.”

St Louis Fed President and FOMC voting member in 2022 James Bullard said on Friday that the Fed should remove monetary policy accommodation.

Additional Takeaways:

“The Fed may want to consider removing accommodation at a faster pace in upcoming meetings.”

“The US economy had inflation shock in 2021.”

“Asset price inflation has been substantial as well.”

“US GDP recovered and is poised to grow further, the labor market is very tight and likely to get stronger.”

“It remains too soon to assess the impact of the new Covid-19 variant on US economy.”

The EUR is leading the major currencies against the dollar with a minor 0.1% gain that has pushed EUR/USD back above 1.13. European Central Bank (ECB) President Christine Lagarde said earlir on Friday "when conditions of the forward guidance are satisfied, we will not hesitate to act." This stance may avoid a EUR/USD drop to 1.10, in the opinion of economists at Scotiabank.

Lagarde affirmed that the PEPP will end in March 2022

“Lagarde said that the ECB ‘will not hesitate to act’ if the conditions of its forward guidance (sustained expectations of inflation over 2%) are met, but she also noted that they still expect inflation to ease from current elevated levels over 2022 – which makes a hike next year very unlikely. She also affirmed that the PEPP will end in March 2022. Her comments signal a higher willingness to act from the ECB that may give the EUR a hand to prevent a marked drop under 1.10.”

“The intraday low of 1.1282 will act as support ahead of the mid figure zone and then the low 1.12s.”

“Resistance is ~1.1315 followed by firmer at ~1.1350.”

According to a report released by the US Treasury Department, no major US trading partners were labeled as FX manipulators.

Key Takeaways:

"Currency report concludes that Vietnam and Taiwan continue to meet all three manipulation criteria for enhanced engagement under 2015 law."

"Reached agreement with Vietnam in July to address treasury's concerns, is satisfied with the progress made to date."

"Will continue enhanced engagement with Taiwan that was launched in May."

"Urging Taiwan to develop a specific action plan to address causes of currency undervaluation and external imbalances."

"Switzerland no longer meets all three criteria for enhanced analysis."

"Will continue to conduct in-depth analysis of Switzerland until it no longer meets all three criteria under 2015 law for at least two consecutive reports."

"Will continue enhanced bilateral engagement with Switzerland to discuss policy options to address underlying causes of external imbalances."

"Put 12 economies on the 'monitoring list' for currency practices - China, Japan, Korea, Germany, Ireland, Italy, India, Malaysia, Singapore, Thailand, Mexico and Switzerland."

"China's failure to publish foreign exchange intervention data, lack of transparency make it an 'outlier' among major economies, will closely monitor activities of state-owned banks."

"The Treasury has raised concerns about China's practices with Chinese counterparts."

"Closely monitoring China's data and policies, concerned about persistent 'very large and persistent' bilateral trade surplus."

"Particularly focused on increased intervention in currency markets by china's state-owned banks over last 1-1/2 years."

"Adjusting thresholds for three major manipulation criteria under 2015 law."

"Trade surplus threshold shifted to $15 bln goods and services surplus from $20 bln goods surplus."

"Current account surplus threshold shifted to 3% of GDP or estimated current account gap of 1%, from previous 2% of GDP surplus."

"Now measuring the persistence of net foreign exchange purchases over 8 of 12 months vs 6 of 12 months previously."

"5 countries - Singapore, Taiwan, Vietnam, India and Switzerland - intervened in forex market in 'sustained, asymmetric manner' to weaken currencies over the 4 quarters through June 2021."

Lee Sue Ann, Economist at UOB Group, suggests the Federal Reserve would refrain from moving on rates at this month’s event.

Key Quotes

“The November FOMC minutes showed an increasing number of Fed officials willing to accelerate the asset purchase program (QE) tapering and consider earlier rates lift-off, if high inflation persists.”

“We now expect the Fed to announce at this coming meeting, a faster pace of QE reduction for 1Q 2022 and the tapering completion timeline will likely be brought forward to April 2022.”

- EUR/USD advances to the 1.1330 region on Friday, drops afterwards.

- US Nonfarm Payrolls missed estimates at 210K in November.

- The US jobless rate ticked lower to 4.2%, more than expected.

The single currency keeps the volatile mood unchanged and now prompts EUR/USD to return to the 1.1300 neighbourhood after hitting tops past 1.1330 in the wake of the US Nonfarm Payrolls.

EUR/USD stays capped by 1.1382

The absence of a clear direction in the price action around EUR/USD stays well and sound at the end of the week.

In fact, EUR/USD rapidly climbed to highs in the 1.1330 region after the US Nonfarm Payrolls came in short of forecasts in November. Indeed, the US economy added 210K jobs during last month (vs. expectations of a 550K gain), although the unemployment rate surprise to the upside after dropping to 4.2%.

Additional data saw the Average Hourly Earnings – a proxy for wage inflation – rising 0.3% MoM and 4.8% from a year earlier. The Participation Rate rose a tad to 61.8%.

Next in the US docket comes the ISM Non-Manufacturing, Markit’s final Services PMI and Factory Orders.

EUR/USD levels to watch

So far, spot is gaining 0.10% at 1.1310 and faces the next up barrier at 1.1382 (weekly high November 30) followed by 1.1464 (weekly high Nov.15) and finally 1.1519 (55-day SMA). On the other hand, a break below 1.1186 (2021 low Nov.24) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).

- GBP/USD attracted some dip-buying near mid-1.3200s and shot to a fresh daily high in the last hour.

- Disappointing headline NFP print prompted some USD selling and provided a modest lift to the pair.

- Brexit uncertainties, hawkish Fed expectations helped limit the USD losses and capped the upside.

The GBP/USD pair shot to a fresh daily high in reaction to dismal US jobs data, albeit struggled to capitalize on the move or find acceptance above the 1.3300 mark.

Having dropped to a three-day low earlier this Friday, the GBP/USD pair attracted some dip-buying in the vicinity of mid-1.3200s and got an additional boost during the early North American session. The latest leg of a sudden spike over the past hour or so followed the release of the closely-watched US NFP report, which showed that the economy added 210K jobs in November. This was well below consensus estimates pointing to a reading of 550K and the previous month's upwardly revised reading of 546K.

Additional details revealed that Average Hourly Earnings fell short of market expectations and led to a modest US dollar weakness, which, in turn, provided a goodish lift to the GBP/USD pair. However, the disappointment, to a larger extent, was offset by a larger than expected drop in the unemployment rate, which fell to 4.2% from 4.6% in October. Adding to this, the fact that the Fed has acknowledged a sufficient labor market recovery to permit higher interest rates helped limit any deeper losses.

On the other hand, persistent Brexit-related uncertainties continued acting as a headwind for the British pound. This was seen as another factor that kept a lid on any meaningful upside for the GBP/USD pair. This makes it prudent to wait for a strong follow-through buying beyond the 200-hour SMA, currently around the 1.3320-25 region, before positioning for any further appreciating move. Next on tap will be the release of the US ISM Services PMI, which might provide some impetus to the pair.

Technical levels to watch

- Canada's economy added 153.7K jobs in November, more than the 35K expected.

- USD/CAD fell 50 pips to the 1.2270s as a result, as weighed by weaker than expected US data.

The Canadian economy added 153.7K jobs in the month of November, well above expectations for a 35K gain and a marked acceleration from the 31.2K jobs added in October. 79.9K of these job gains were in full-time employment. Meanwhile, the unemployment rate dropped to 6.0% from 6.7% in October, a significantly larger decline than the expected drop to 6.6%.

Market Reaction

USD/CAD has seen a substantial drop, in part due to the strong Canadian data that will bring forward BoC tightening expectations, but also due to a weaker than expected US labour market report that was released at the same time. The pair was trading above 1.2820 prior to the data but has dipped about 50 pips to trade in the 1.2770s.

- The US economy added 210K jobs in November, below the 550K expected.

- The dollar weakened in a kneejerk reaction to the data.

Nonfarm Payrolls (NFP) rose by 210K in November versus the median forecast for a 550K rise, data published by the US Bureau of Labor Statistics showed on Friday. That marked a substantial decline versus the 546K jobs added to the US economy in October.

The unemployment rate saw a substantially larger than expected drop to 4.2% from 4.6% in October, versus expectations for a drop to 4.5%. Meanwhile, the MoM gain in Average Hourly Earnings came in at 0.3%, below expectations for it to hold at October's 0.4% MoM level. That meant that the YoY rate of Average Hourly Earnings growth remained at 4.8% in November versus median forecasts for a rise to 5.0%.

Market Reaction

The Dollar Index saw kneejerk weakness in the immediate aftermath of the not as strong as hoped for labour market report, dropping back to test the 96.00 level from previously above 96.20. Analysts may now question whether the data was strong enough for the Fed to justify an acceleration of its QE taper in January when it meets to decide on policy later in the month.

USD/JPY continues to hold the key 55-day moving average (DMA) now at 113.10 on a closing basis. Economists at Credit Suisse still look for a floor here with a break above 113.70/96 needed to clear the way for a move back to the 115.42/52 highs.

Key 55-DMA support at 113.10 continues to hold

“Whilst we continue to look for an attempt to find a floor at the 113.10 55-day average, above 113.70/96 remains needed to reassert an upward bias with resistance then seen next at 114.78 and eventually back at 115.42/52.”

“Big picture with a major base in place, we continue to look for a move above 115.42/52 in due course for a test of the long-term downtrend from April 1990 at 116.96.”

“A close below 113.10 though would warn of a more protracted, but still corrective fall with support seen next at the recent low and the 38.2% retracement of the rally from April at 112.53/45, with more important support seen starting at the ‘neckline’ to the major base at 111.84 ahead of the July high at 111.66.”

AUD/USD finally closed below important support at 0.7106 on Thursday, which analysts at Credit Suisse look to be sustained into the weekly close to confirm a major long-term top. They see scope for a fall to 0.6758 if the top is confirmed.

Ongoing deterioration in the trend-following setup

“AUD/USD has finally closed below major support at 0.7106, which we look to be sustained into the weekly close given that the trend picture remains strongly negative. This would confirm a much larger long-term top, which would turn the long-term risks lower and suggest that aggressive further weakness is likely.”

“We look for a move to 0.6991, with the size of the top suggesting a move to 0.6758 is easily achievable over the medium-term and potentially even beyond.”

“Near-term resistance is seen at the ‘neckline’ to the top at 0.7146, which the market continues to hold below into the close. Above here and then 0.7169/74 would suggest a corrective recovery.”

- WTI is about $1.0 higher on the day in the $68.00s, about $6.0 above Thursday’s lows.

- Analysts framed OPEC+’s decision to press ahead with output hikes as a “vote of confidence in the near-term demand outlook”.

Oil prices continue to trade with an upside bias, with front-month WTI futures having now recovered roughly $6.0 (nearly 10%) to the $68.00s from Thursday’s lows in the $62.00s. On the day, that translates to gains of about $1.0 or 1.5%. Oil prices tumbled on Thursday in the immediate aftermath of OPEC+’s surprise decision to press ahead with 400K barrel per day output hike in January, going against analyst expectations for the group to halt output amid Omicron-related uncertainty.

But market participants deemed the knee-jerk reaction to be excessive. Some analysts framed OPEC+’s decision as a “vote of confidence in the near-term demand outlook” and interpreted the decision as OPEC+ signaling that it does not expect Omicron to have a lasting impact on demand. Other analysts pointed out that the cartel did caveat that it was prepared to meet again ahead of its next scheduled 4 January meeting if there was a marked change in market conditions. In other words, a halt to/reversal of output hikes remains on the table if needed.

With OPEC+ in the rear-view mirror, oil traders will on Friday be focused on US macro data in the form of the November labour market report and, more importantly, any new information/headlines about Omicron. A strong labour market report should confirm that the Fed will accelerate the pace of their QE taper in January, which should have a very limited impact on oil prices.

- USD/JPY added to the previous day’s gains and edged higher for the second straight day.

- Improving global risk sentiment undermined the safe-haven JPY and remained supportive.

- Retreating US bond yields capped gains for the USD and the pair ahead of the NFP report.

The USD/JPY pair maintained its bid tone heading into the North American session and was last seen trading just a few pips below the daily high, around the 113.35-40 region.

The pair gained some positive traction for the second successive day on Friday and built on the overnight bounce from the vicinity of mid-112.00s, or the lowest level since October 11. A generally positive tone around the equity markets undermined the safe-haven Japanese yen and was seen as a key factor that acted as a tailwind for the USD/JPY pair.

The global risk sentiment stabilized a bit on the back of easing fears about the potential economic fallout from the recently discovered, possibly vaccine-resistant Omicron variant of the coronavirus. Adding to this, the passage of a bill to fund the US government through mid-February further contributed to the upbeat market mood on Friday.

On the other hand, the US dollar drew some support from firming expectations that the Fed will adopt a more aggressive policy response to contain stubbornly high inflation. However, retreating US Treasury bond yields held back the USD bulls from placing aggressive bets and kept a lid on any further gains for the USD/JPY pair, at least for the time being.

Investors also seemed reluctant and preferred to wait for a fresh catalyst from Friday's release of the closely-watched US monthly employment details. The popularly known NFP report will play a key role in influencing the USD price dynamics. Apart from this, the US ISM Services PMI will also be looked upon for some meaningful trading opportunities around the USD/JPY pair.

Technical levels to watch

- AUD/USD is trading with a downside bias pre-NFP and recently bounced at 0.7050.

- A strong report would endorse the Fed’s hawkishness and could push AUD/USD lower towards the key 0.7000 level.

AUD/USD continues to trade with a negative bias as the key US jobs report approaches. The pair recently bounced at the 0.7050 level, which was its lowest in over 12 months, and currently trades around 0.7060 with on the day losses of about 0.4%. Uncertainty about how the new Omicron Covid-19 variant is going to impact short-term global economic outlook continues to weigh on risk assets and seems to be weighing slightly on the Aussie on Friday.

On the week, AUD/USD’s losses now stand at about 0.7%. This is not as bad as many traders might have thought in light of this week’s hawkish pivot for Fed Chair Jerome Powell and a string of strong US macro releases. Wednesday’s smaller than expected decline in Australia GDP in Q3 has probably helped stem the tide against the Aussie, as it keeps the prospect alive that the RBA may also do a hawkish pivot to signal potential hikes in 2023. But that is not the main focus of the market this Friday. The main focus is on the US November jobs report.

The median bank forecast is for the headline NFP number to come in at 550K, which would mark a slight improvement from October’s 531K reading. The unemployment rate is seen falling to 4.5% from 4.6%. The YoY pace of growth in Average Hourly Earnings is seen rising slightly to 5.0% from 4.9% last month. Alternative labour market data from November/the official jobs report survey period has for the most part been strong; ADP’s estimate of employment change came in at 534K on Wednesday, the employment components of the ISM and Markit PMI surveys (not including the ISM service PMI, which is yet released) all showed slight improvement versus October, weekly initial jobless claims in the November survey week was lower versus the October survey week and Challenger job cuts fell to a fresh low since 1993.

A strong report, though expected, would endorse the Fed’s more hawkish view and likely support the US dollar. AUD/USD bears would likely then look for a continuation of the recent bear trend and perhaps a test of the Q3/Q4 2020 lows at 0.7000.

-637741314441807354.png)

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly jobs report for November later this Friday at 13:30 GMT. The Canadian economy is expected to have added 35,000 jobs during the reported month, up from 31,200 reported in October. The unemployment rate is seen ticking lower to 6.6% from 6.7% previous.

Meanwhile, analysts at CIBC sounded downbeat about the report and wrote: “We are only pencilling in an addition of 10K jobs for the month, which would likely see the unemployment rate rise at least a tick to 6.8%.”

How could the data affect USD/CAD?

Ahead of the key release, the prevalent US dollar bullish sentiment pushed the USD/CAD pair to the highest level since September 21. However, a strong follow-through recovery in crude oil prices acted as a tailwind for the commodity-linked loonie and capped gains for the major.

Meanwhile, the data is likely to be overshadowed by the simultaneous release of the US monthly jobs report (NFP), suggesting that any immediate market reaction is more likely to be short-lived. Nevertheless, any significant divergence from the expected readings would influence the Canadian dollar and infuse some volatility around the major.

From a technical perspective, the intraday move up struggled to find bullish acceptance above the 1.2830-35 resistance zone. This makes it prudent to wait for a strong follow-through buying before positioning for any further appreciating move towards the September monthly swing high, around the 1.2900 round-figure mark.

On the flip side, any meaningful corrective pullback below the 1.2800 mark might continue to attract some buying near the 1.2740-35 horizontal support. This is followed by the weekly low, around the 1.2715-10 region, which if broken decisively might prompt some technical selling. The pair might then turn vulnerable and accelerate the fall towards the next relevant support near the 1.2640 region.

Key Notes

• Canadian Jobs Preview: Forecasts from five major banks, labour market to keep pressuring the BoC

• Investors eye NFP, Canadian job data

• USD/CAD: Upward momentum prevails, August high at 1.3020 in the crosshairs – SocGen

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

- EUR/USD looks to leave behind two consecutive sessions with losses.

- If sellers regain control, the initial support comes at 1.1235.

EUR/USD manages to bounce off the daily low in the 1.1280 region on Friday.

Further downside is expected to meet initial contention around 1.1230 (November 30), which is the last defence for another assault to the 2021 low at 1.1186 (November 24).

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1550. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1815.

EUR/USD daily chart

- DXY inches higher and extends the break above 96.00.

- Further up is located the YTD peak near 97.00.

DXY adds to the gradual rebound from weekly lows in the mid-95.00s (November 30), with gains so far capped near 96.30.

The continuation of the upside momentum targets the 2021 highs in levels just shy of the 97.00 barrier (November 24) ahead of the round level at 97.00 and 97.80 (high June 30 2020).

In the meantime, while above the 2-month support line (off September’s low) near 94.20, extra gains in DXY remain well on the table. In addition, the broader constructive stance remains underpinned by the 200-day SMA at 92.56.

DXY daily chart

- EUR/JPY reclaims the 128.00 mark and above on Friday.

- Immediately to the upside comes the monthly high at 128.78.

EUR/JPY manages to clinch the second session with gains above the 128.00 yardstick at the end of the week.

If the rebound gathers extra pace, then the cross should face a minor hurdle at the 10-day SMA at 128.53 ahead of the more relevant monthly peak at 128.78 (December 1). Further up is located the interim hurdle at the 20-day SMA (129.31) prior to the weekly high at 129.60 (November 23). Above the latter, the downside pressure is expected to mitigate somewhat.

Looking at the broader picture, the outlook for the cross is expected to remain negative while below the 200-day SMA, today at 130.53.

EUR/JPY daily chhart

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data. The popularly known NFP report is scheduled for release at 13:30 GMT and is expected to show that the economy added 550K new jobs in November, up from 531K in the previous month. The unemployment rate is expected to edge lower to 4.5% from 4.6% in October. Given Wednesday's stronger US ADP report on private-sector employment, market participants have turned more optimistic about the official figures.

According to Joseph Trevisani, Senior Analyst at FXStreet: “The November payroll report stands a good chance of performing better than forecast. Signs from the labor market and consumer economy point to a continued recovery in the United States.”

How could the data affect EUR/USD?

Against the backdrop of stubbornly high inflation, a stronger than expected headline NFP would further fuel speculations about a more aggressive policy tightening by the Fed. This would result in higher US Treasury bond yields and a stronger US dollar. Conversely, a weaker print – though seems unlikely – is likely to offset by the fact that the Fed has acknowledged a sufficient labor market recovery to permit higher interest rates. This, in turn, suggests that the path of least resistance for the USD is to the upside and down for the EUR/USD pair.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the major: “The Relative Strength Index (RSI) indicator on the four-hour chart retreated below 50, suggesting that sellers look to retain control of EUR/USD.”

Eren also outlined important technical levels to trade the EUR/USD pair: “At the time of press, the pair was testing 1.1290 (Fibonacci 23.6% retracement of November downtrend). The 50-period SMA aligns as the next support at 1.1280 and additional losses could be witnessed toward 1.1235 (Tuesday low) in case that level turns into resistance.”

“The bearish pressure could weaken if bulls reclaim 1.1320 (100-period SMA, 20-period SMA). 1.1350/60 area (static level, Fibonacci 38.2% retracement) could be seen as the next resistance,” Eren added further.

Key Notes

• Nonfarm Payrolls Preview: Jobs’ headline could be a make it or break it in tapering’s decision

• US Nonfarm Payrolls November Preview: Can we agree the labor market is healing?

• EUR/USD Forecast: Euro to continue to weaken as long as 1.1320 resistance holds

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

Economist at UOB Group Ho Woei Chen, CFA, comments on the latest release of inflation figures in South Korea.

Key Takeaways

“Inflation rose unexpectedly in November. Headline inflation accelerated to 3.7% y/y, 0.4% m/m (Bloomberg est: 3.1% y/y, -0.2% m/m), up from October’s 3.2% y/y, 0.1% m/m. This is a fresh decade high and marks the 8th consecutive month that the inflation rate is above Bank of Korea’s (BOK) 2% target.”

“The core CPI (excluding agricultural products & oils) moderated to 2.3% y/y from 2.8% in October but was also a surprise increase against Bloomberg’s consensus of 2.2%. Compared to the previous month, core CPI rose 0.1% vs. 0.3% gain in October.”

“With year-to-date inflation at 2.3% y/y, the average full-year inflation is likely to be 2.4% this year, slightly exceeding BOK’s revised forecast. The BOK raised its inflation forecast in November to 2.3% for 2021 (from 2.1%) and 2.0% for 2022 (from 1.5%). We expect headline inflation to stay above the BOK’s target in 1H22 before moderating in the later part of the year, partly due to the high comparison base.”

“Given the surge in November inflation as well as sustained strength in its macroeconomic data, we continue to project the next BOK rate hike in 1Q22, likely at the February meeting.”

Bank of England (BOE) policymaker Michael Saunders said on Friday that a key consideration for him at the December policy meeting will be the possible economic effects of the new Omicron variant, as reported by Reuters.

Additional takeaways

"It is likely that any rise in bank rate will be limited given that the neutral level of interest rates remains low."

"Provided we do not delay too long, it should be a case of easing off the accelerator rather than applying the brakes."

"Will need to consider the potential costs and benefits of waiting to see more data on this before – if necessary – adjusting policy."