- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-12-2021

“It is too early to estimate the impact from the Omicron coronavirus variant on the economic outlook,” said Australia’s Treasurer Josh Frydenberg, per Reuters quoting comments from Australian Broadcast Corporation's "Insiders" program, published during late Sunday.

“Frydenberg is due to deliver an update to the budget in coming weeks, halfway through Australia's fiscal year which ends in June,” the news adds.

Key quotes

The market is coming back strongly.

That comes as a result of the fact that we now have one of the highest vaccination rates in the world, one of the lowest mortality rates in the world.

Asked whether Omicron, the new variant that has also been spreading in Australia, would pose a threat to the economic outlook, as indicated by the International Monetary Fund, Frydenberg said there should be no panic.

He did not say whether the expected upgrade to growth would be for 2022 calendar year of fiscal year, which start in July. The budget released in May forecast a 4.5% expansion for the 2021-22 fiscal year before slowing to 2.5% the following year.

FX implications

The news should have helped the AUD/USD prices to consolidate losses around the yearly bottom, up 0.18% intraday near 0.7016 at the latest.

Read: AUD/USD is poised for further downside, but not before a correction

“Saudi Arabia's state oil producer Aramco raised its January official selling price (OSP) to Asia for its flagship Arab Light crude to $3.30 a barrel versus Oman/Dubai crude, up $0.60 from December, the company said on Sunday,” per Reuters.

“The company set the Arab Light OSP to Northwestern Europe at minus $1.30 per barrel versus ICE Brent and to the United States at plus $2.15 per barrel over ASCI (Argus Sour Crude Index),” adds the news published on late Sunday.

Market reaction

While following the news, WTI crude oil prices offered a gap-up to begin the week’s trading. That said, the black gold marks around 2.0% intraday gains while picking up bids to $67.40 during early Monday morning in Asia.

“Goldman Sachs on Saturday cut its outlook for U.S. economic growth to 3.8% for 2022, citing risks and uncertainty around the emergence of the Omicron variant of the coronavirus,” said Reuters in one of the news pieces published Sunday.

The news quotes Goldman economist Joseph Briggs as saying, “the Omicron variant could slow economic reopening, but the firm expects ‘only a modest drag’ on service spending.”

“The firm now sees 2022 gross domestic product (GDP) growth of 3.8%, down from 4.2% previously on a full-year basis, and Q4/Q4 growth of 2.9%, down from 3.3% before,” adds Goldman’s Briggs, per Reuters.

Key quotes

Goldman pointed the spread of the virus could worsen supply shortages should other countries implement tighter restrictions, but increase in vaccination rates among foreign trade partners would prevent severe disruptions.

Goldman Sachs' U.S. forecast comes after the International Monetary Fund Managing Director Kristalina Georgieva said on Friday that the lender was likely to lower its global economic growth estimates due to the new Omicron variant of the coronavirus.

FX implications

The downbeat growth forecasts for the world’s largest economy weigh on the market sentiment, underpinning the safe havens. However, a lack of fresh catalysts and mixed updates for the South African covid variant weigh on the gold prices.

Read: Gold Price Forecast: 200-DMA, sour sentiment test XAU/USD rebound

- Gold struggles to extend bounce off four-month-old support, retreats of late.

- Fed fund futures rally despite negative surprise from US NFP.

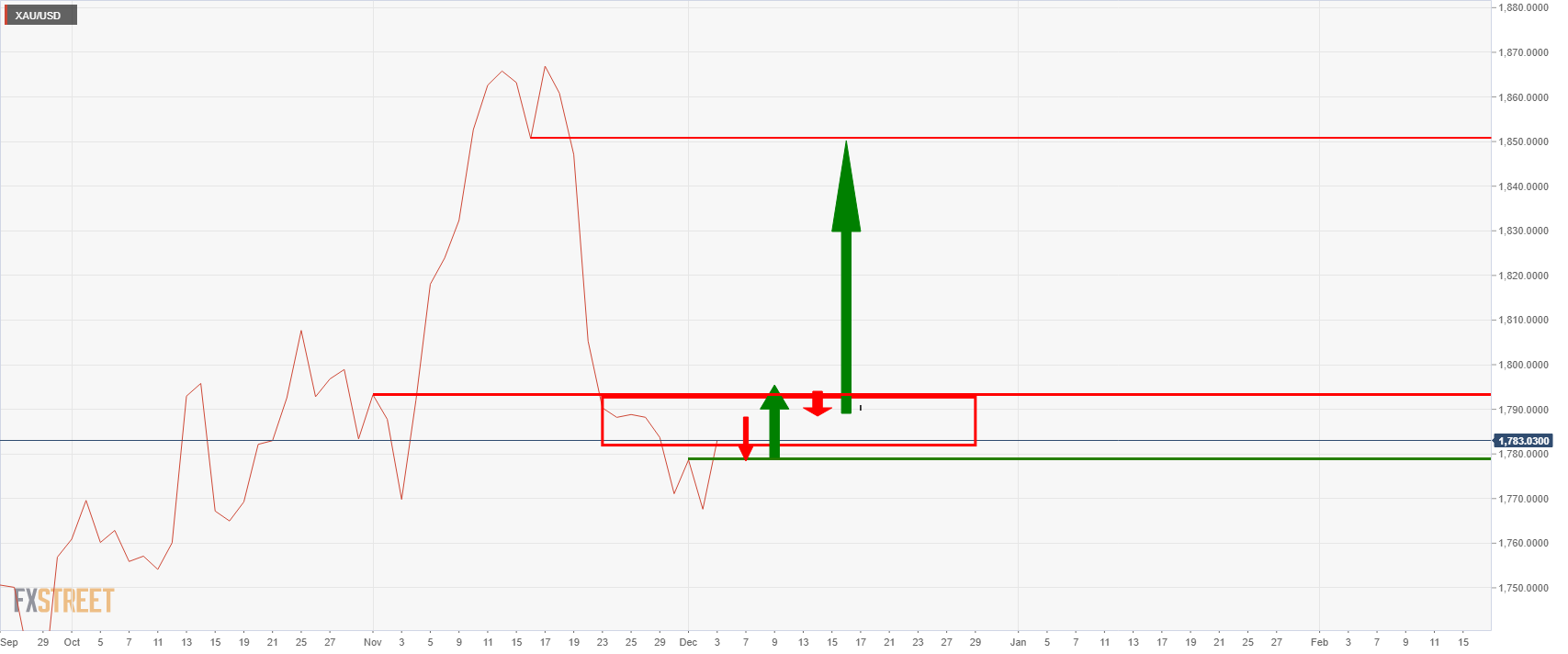

- Virus woes escalate, Sino-American tensions also underpin risk-off mood.

- Gold, Chart of the Week: Technicals aligned with fundamentals, $1,850 eyed

Gold (XAU/USD) retreats below $1,800, easing to $1,781 amid Monday’s initial Asian session, following the heaviest daily run-up in over two weeks.

The yellow metal cheered a surprise drop in the US Nonfarm Payrolls (NFP) data for November, 220K versus 550K forecast, the previous day. However, However, a 0.4% fall in Unemployment Rate to 4.2% and Average Hourly Earnings matched the 4.8% YoY forecast. Following the data, the US dollar offered a knee-jerk reaction before resuming the north-run as Fed fund futures rallied.

The odds of the Fed rate hike earlier got fuelled by comments from St Louis Fed President James Bullard who is also a voting member in 2022. The policymakers said, “Could look at raising interest rates before completing the taper.”

Other than the Fed-linked chatters, the risk-off mood also took clues from the spread of the South African covid variant, dubbed as Omicron, as well as talks surrounding the US-China tussles. After initially hitting Europe and the UK, the virus strain tightens its grip towards reaching the key global nations like the US and China. It should be noted, however, that global scientists are optimistic over the cure. Recently, US top Medical Officer Anthony Fauci backed Pfizer’s drug to be effective against Omicron while the news of chewing gum to stop the virus spread and the UK’s push for treatment also keeps traders hopeful.

Elsewhere, news that China’s Premier Keqiang promised a Reserve Requirement Ratio (RRR) cut to the International Monetary Fund (IMF), without specifying the date, per the ANZ, also weigh on sentiment. On the same line were the recent headlines from the Wall Street Journal (WSJ) saying, “China wants to put its first Atlantic military base in Equatorial Guinea, U.S. intelligence shows. The prospect has set off alarm bells in Washington.”

Against this backdrop, Wall Street closed negative and the US 10-year Treasury yields slumped to the lowest since late September on Friday. That said, the S&P 500 Futures lick its wounds with 0.15% intraday gains at the latest.

Moving on, a light calendar and cautious sentiment ahead of next week’s Federal Open Market Committee (FOMC) meeting may challenge gold price moves. Though, Friday’s US Consumer Price Index (CPI) for November will be crucial to watch, not to forget coronavirus headlines and central bank comments.

Technical analysis

A four-month-old support line joined a softer-than-expected US NFP to trigger gold’s corrective pullback from the monthly low. However, bearish MACD signals and downbeat RSI line challenge the recovery moves below the key 200-DMA level surrounding $1,792.

While a clear upside past $1,792 will give a free hand to the gold buyers targeting the $1,800 threshold, a six-week hold horizontal area near $1,814-16 and a horizontal line comprising tops marked in July and September, surrounding $1,834, will test any further advances.

Meanwhile, a downside break of the stated support line from August, near $1,765, isn’t a green signal for the gold bears as 61.8% Fibonacci retracement (Fibo.) level of August-November upside and a two-week-old support line, close to $1,760-59 region, will challenge the south-run.

Should gold prices drop below $1,759, an extended fall towards September’s low of $1,721 can’t be ruled out.

Gold: Daily chart

Trend: Pullback expected

- EUR/USD retreats after Friday’s mild gains failed to overcome bearish bias.

- Fed versus ECB saga weigh as FOMC members enter silent period, yields refreshed 10-week low.

- Fed’s Bullard sounds hawkish, US Unemployment Rate covered NFP-linked woes.

- German Factory Orders can offer immediate direction but US CPI is the key.

EUR/USD fades Friday’s bounce off 1.1266, easing back to 1.1300 amid the initial Asian session on Monday.

The major currency pair snapped a two-day downtrend to post mild gains the previous day amid softer-than-expected US Nonfarm Payrolls (NFP). However, hawkish Fedspeak and a slump in the Unemployment Rate keep Fed versus ECB story on the deck and keep the pair sellers hopeful.

Although US NFP disappointed labor market optimists with 210K figures, versus 550K expected, the Unemployment Rate propelled Fed funds futures with a 0.4% drop to 4.2%. Further, Average Hourly Earnings matched the 4.8% YoY forecast.

Before the data, St Louis Fed President James Bullard who is also a voting member in 2022 said, “Could look at raising interest rates before completing the taper.”

On the contrary, the European Central Bank (ECB) policymakers believe that the inflation fears are temporary and highlight the pandemic to defend the easy money policies.

Not only the ECB but the BOE, the RBA and the BOJ are all in favor to keep the easy money flowing while market players brace for the hints of the faster Fed tapering and/or a rate hike in the next week’s US Federal Reserve (Fed) monetary policy meeting.

As a result, this week’s US Consumer Price Index (CPI) for November becomes the key. “The consensus expectation for this week’s US CPI is +0.7% m/m, which would leave the annual rate at 6.8% y/y. Even if bottlenecks ease, it looks highly likely that US inflation will stay above 4.0% y/y for much of next year, and that will add to underlying wage pressures amid a tightening labor market,” said ANZ.

It’s worth noting that the virus woes and the recent high talks of the US-China tussles are additional support for the EUR/USD prices as safe-haven demand underpins the US dollar.

That said, Wall Street benchmarks closed negative while the US 10-year Treasury yields dropped around 10 basis points (bps) to 1.35%, the lowest since late September.

Moving on, a corrective pullback could be expected amid an absence of major data/events and indecision ahead of the next week’s Fed. However, today’s German Factory Orders for October, expected -0.5% MoM versus +1.3% prior can offer intraday direction to the quote.

Technical analysis

A five-week-old descending trend line restricts short-term recovery of the EUR/USD prices whereas 1.1230 holds the key to fresh selling.

- AUD/USD bears could need to be patient for the time being.

- Volatility will be key for AUD this week and RBA is eyed also.

AUD/USD ended the week on a sour note as volatility in markets remained problematic for the high beta Aussie currency which ended down in multi-week lows and a touch below 0.70 the figure. At the start of play today, the pair is inching higher back through 0.70 the figure in what could turn out to be a positive start to the week for the pair.

Despite a relatively large downside miss on November Nonfarm payroll jobs, the big 0.4% fall in the Unemployment Rate to 4.2% was encouraging for the US economy. Data there is going from strength to strength and the markets are expecting a faster pace of tapering and an announcement of the same from this month's Federal Open Market Committee meeting.

A rapid tightening in the US labour market is one feature of the US economy that the Fed is mandated to promote. However, there is a renewed emphasis on stable prices following the Fed's chair's latest hawkishness. Fed Chairman Jerome Powell surprised markets last week by altering his previously consistent tone on inflation, telling US lawmakers at the Senate that “it’s probably a good time to retire that word (transitory) and try to explain more clearly what we mean.”

The Fed's inflation pivot could be also pivotal for US stocks and related markets, including the Australian currency that trades with high beta to the performance of global equities prices. We saw this last week, on Friday when equities didn’t like the stagflationary whiff to the jobs data. The S&P 500 closed off 0.8% and the Nasdaq down 1.9% while the Aussie broke to a fresh 13-month low at 0.6993.

RBA risks to AUD/USD

We have the Reserve Bank of Australia this week where any meanwhile correction in AUD/USD from the newly printed lows could come unstuck. This will be the last policy decision and statement before Feb 2022. The RBA is expected to keep policy settings unchanged at its last meeting of 2021. As such, the focus will again be on the wording of the Governor’s decision statement.

Traders will be looking for the assessments of the latest round of economic data, including the Q3 national accounts, and the shifting external environment, particularly with respect to price inflation in developed economies.

However, as analysts at Westpac note, ''the Bank’s following meeting, on February 1 next year, will likely see more meaningful shifts with a scheduled review of the bond-buying program expected to see purchases scaled back from $4bn/week to $2bn/week prior to a wind-down of the program by mid -May.''

Analysts at ANZ Bank concur with such a view considering ''a faster taper by the Fed could see the RBA end its quantitative easing program in February.'

However, ''Westpac remains comfortable with our view that the bank’s first move will come in February 2023 although markets are anxious for a mid-2022 move while the Governor himself is still open to waiting till 2024.

Really, how bad is Omicron?

Meanwhile, the Aussie could be prone to a correction if the market's volatility settles down at the start of this week. There have been no major headlines of the weekend that would be expected to move the needle, and if anything, there have been positive coronavirus updates with respect to the new variant, Omicron. The sentiment is that the new variant is not as harmful as past variants which could lead to the relaxation of newly deployed measures by governments to curb the spread of the Omicron.

If the new hawkish tone from the Fed is now fully priced in, then there could be some further bleeding in the greenback to come which would be beneficial for AUD in the near term.

DXY H1 chart

DXY is trading above the 200-EMA, but that could all change considering the bearish tendencies of the last couple of sessions' price action. The price recovered a 38.2% Fibonacci retracement of the prior hourly bearish impulse from trendline support.

If the bears engage in the opening sessions today, then the greenback could test bullish commitments at the dynamic trendline support. The 95.80s will then be exposed. Pressures could mount again if bulls daily to get the price back above what would be a new counter-trendline line resistance between 96 the figure and 96.20.

AUD/USD H1 chart

In such a scenario, where the dollar is offered at the start of the week, then AUD/USD can be corrected as follows by the bulls:

However, if the RBA is seen to be more dovish than expected, then the downside will open up again and there are at least 200 more pips to go until significant weekly support kicks in near 0.6780.

- NZD/USD holds lower grounds at 13-month low, after five-week downtrend.

- US dollar shrugged off NFP surprise as upbeat Unemployment Rate favored Fed rate hike concerns.

- Omicron concerns add to risk-off mood, China Premier Li Keqiang promised RRR cut.

- A light calendar emphasizes risk catalysts are the key to watch for fresh impulse.

NZD/USD licks its wounds around 2021 bottom, defending 0.6750 during early Monday morning in Asia.

The kiwi pair dropped the most in over a week during Friday even as the US Nonfarm Payrolls (NFP) surprised markets with the yearly low. The reason could be linked to the heavy fall in the Unemployment Rate, as well as the market’s fears of Omicron and China-linked news.

US NFP disappointed labor market optimists with 210K figures versus 550K expected. However, a 0.4% fall in Unemployment Rate to 4.2% and Average Hourly Earnings matched the 4.8% YoY forecast. Following the data, the US dollar offered a knee-jerk reaction before resuming the north-run as Fed fund futures rallied.

Adding to the greenback’s strength was sour sentiment due to the spread of the South African covid variant, dubbed as Omicron, in the developed nations. After initially hitting Europe and the UK, the virus strain tightens its grip towards reaching the key global nations like the US and China. It should be noted, however, that global scientists are optimistic over the cure. Recently, US top Medical Officer Anthony Fauci backed Pfizer’s drug to be effective against Omicron while the news of chewing gum to stop the virus spread and the UK’s push for treatment also keeps traders hopeful.

Elsewhere, news that China’s Premier Keqiang promised a Reserve Requirement Ratio (RRR) cut to the International Monetary Fund (IMF), without specifying the date, per the ANZ, also weigh on the NZD/USD prices as China is New Zealand’s biggest customer. On the same line were the recent headlines from the Wall Street Journal (WSJ) saying, “China wants to put its first Atlantic military base in Equatorial Guinea, U.S. intelligence shows. The prospect has set off alarm bells in Washington.”

Amid these plays, Wall Street closed negative and the US 10-year Treasury yields slumped to the lowest since late September while prices of gold rallied amid sour sentiment.

Above all, the NZD/USD fades the Reserve Bank of New Zealand (RBNZ)-led charm as the Fed is up for monetary policy tightening and cutting the carry trade opportunities that earlier favored the Kiwi bulls.

That said, any improvement in the virus news can offer an intermediate bounce to the quote after the recent heavy selling pressure. Additionally, fears of firmer inflation data in the US also propel the greenback and hence Friday’s US Consumer Price Index (CPI) will be the key to watch ahead of next week’s Federal Reserve (Fed) monetary policy meeting. For today, an absence of major data/events highlights the qualitative catalysts for direction.

Technical analysis

NZD/USD dropped to a 13-month low and provided a weekly closing below 200-week SMA. Also favoring sellers are the MACD signals hitting late August levels. Though, a descending trend line from March, around 0.6700 becomes a tough nut to crack for the Kiwi pair bears are the RSI conditions are oversold, suggesting a corrective pullback from the next possible support.

Meanwhile, recovery moves remain elusive until crossing the 10-DMA and a monthly resistance line, respectively around 0.6850 and 0.6900.

The new coronavirus variant Omicron has now become dominant in South Africa and is driving a sharp increase in new infections, health officials say. However, Bloomberg reported today that 'initial data from a major hospital complex in South Africa’s omicron epicentre show that while Covid case numbers have surged, patients need less medical intervention.''

Meanwhile, Omicron has now been detected in at least 24 countries around the world, according to the World Health Organization (WHO).

According to the BBC, ''Those who have already had other variants of coronavirus do not appear to be protected against Omicron but vaccines are still believed to protect against severe disease, according to top scientists from the global health body and South Africa's National Institute for Communicable Diseases (NICD).''

The full picture in South Africa will not become clear until "people get so sick that they need to go to hospital" which is generally "three, four weeks later," says Prof Salim Abdool Karim of the Africa Task Force for Coronavirus.

"But the feedback we're getting from the ground is that there's really no red flags - we're not seeing anything dramatically different, what we're seeing is what we are used to," he told the BBC's Newsday programme.

Additionally, Reuters in Johannesburg has reported that ''higher hospital admissions among children during the fourth wave of COVID-19 infections in South Africa that has been driven by the Omicron coronavirus variant should not prompt panic as infections have been mild, a health official said on Saturday.''

''Ntsakisi Maluleke, a public health specialist in the Gauteng province that includes Tshwane and the biggest city Johannesburg, told Reuters that out of the 1,511 COVID-positive patients in hospitals in the province 113 were under 9 years old, a greater proportion than during previous waves of infection.

"We are comforted by clinicians' reports that the children have mild disease," she said in an interview, adding health officials and scientists were investigating what was driving increased admissions in younger ages and were hoping to provide more clarity within two weeks.''

"The public needs to be less fearful but vigilant," she said. Despite a recent influx of admissions, Gauteng's dedicated COVID-19 bed occupancy was still only around 13%, Maluleke said.

Reuters also referred to an article by the South African Medical Research Council based on early observations at the Steve Biko/Tshwane District Hospital Complex in Pretoria over the last two weeks that contained reassuring signs.

The majority of patients in the COVID wards at the hospital complex were not oxygen-dependent and were "incidental COVID admissions," having another reason for admission, the article said.

"This is a picture that has not been seen in previous waves. In the beginning of all three previous waves and throughout the course of these waves, there has always only been a sprinkling of patients on room air in the COVID ward," it said.

Market implications

This is good news that could lead to the relaxation of covid social distancing rules that have since been imposed in response to the fears of the new variant's contagion and unknown severity of the illness.

With that being said, markets will likely be on edge each time there is the first news of a new mutation. However, they will recall not to react too suddenly next time around.

Vaccines and herd immunity could come sooner considering the emphasis nations have put on getting their population fully vaccinated in response to the new variant.

China's continued incursions into Taiwan's air defence zone could be a rehearsal for an eventual invasion of the island, US Defense Secretary Lloyd Austin says.

markets are going to bring this risk towards the fore this week on the back of these headlines because any move by China to invade Taiwan would have “terrible consequences,” as U.S. Secretary of State Antony Blinken said last Friday.

Blinken, speaking at the Reuters Next conference, said China had been trying to change the status quo over self-ruled Taiwan, which Beijing claims as its territory, and that the United States is “resolutely committed” to making sure the island has the means to defend itself.

“But here again, I hope that China’s leaders think very carefully about this and about not precipitating a crisis that would have, I think, terrible consequences for lots of people, and one that’s in no one’s interest, starting with China,” Blinken said.

he added that the US has ''been very clear and consistently clear, over many years that we are committed to making sure that Taiwan has the means to defend itself and ... we will continue to make good on that commitment.”

The Global Times wrote in response, ''Austin said on Saturday that "China is not 10 feet tall," while "America is a Pacific power." Frankly, China may not be that tall and strong, especially when it is in the deep Pacific Ocean, Indian Ocean, or the Caribbean Sea. But we are going to measure who is "taller" in the Taiwan Straits, where we are sure to show the US that in some parts of the world where it is not supposed to be, the US really is a dwarf.''

Market implications

The is a risky business for markets. Investors will try to second guess the next moves from either China or the US in what has been coined by various commentators as a second cold war in relation to heightened 21st century political and military tensions between the United States and China.

However, until the first trigger is about to be pulled, markets will watch wait and see.

The markets are fixated on the new coronavirus variant, Omicron, because it is still too early to know whether this variant will be a milder illness than its predecessors. Evidence from initial cases of the new variant is limited.

However, some encouraging news, in general, should be welcomed in times of such uncertainty. There are reports that there are experiments using saliva samples from COVID-19 patients, the gum, which contains the ACE2 protein, neutralized the virus, according to research led by School of Dental Medicine scientists.

The team observed that the gum largely prevented the viruses or viral particles from entering cells, either by blocking the ACE2 receptor or binding directly to the spike protein.

The research team is currently obtaining permission to conduct a clinical trial to evaluate whether the approach is safe and effective when tested in people infected with SARS-CoV-2.

Meanwhile, the safe havens are in play when it comes to forex. The safe-haven yen and Swiss franc gained on Friday as global equities and bond yields fell on fears about the spread of the Omicron variant of COVID-19,.

Markets are worried that no matter whether the new variant actually is more life-threatening, but whether or not it will lead to renewed social distancing restrictions around the world.

There are also concerns about possible aggressive action by the Federal Reserve to curb surging inflation despite the threat of another wave of covid and lockdowns. For that reason, gold is also attracting a bid:

From a daily perspective, a push above $1,793 opens risk to $1,850 for the month of December according to the daily chart:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.