- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-01-2022

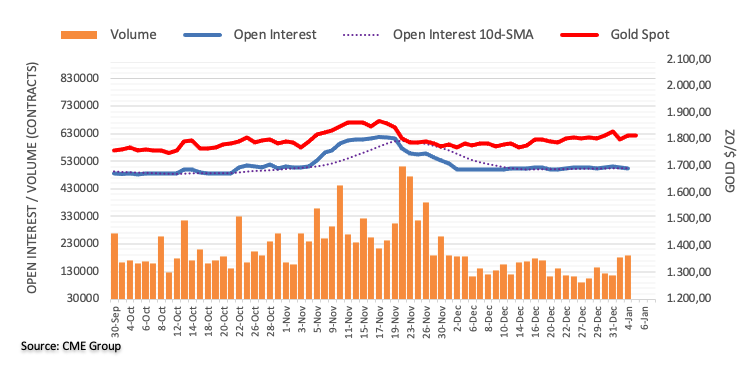

- Gold prices hold lower ground after bearish reaction to FOMC Minutes.

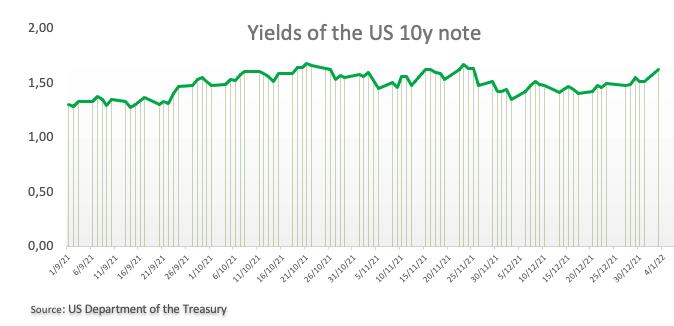

- US 10-year Treasury yields jumped to nine-month high post Fed Minutes, virus woes, ADP Employment Change also weigh on bonds.

- US ISM Services PMI, trade numbers and weekly Jobless Claims will decorate calendar.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal

Gold (XAU/USD) keeps Fed Minutes-led losses, despite recently making rounds to $1,810 during the early Asian session on Thursday.

The yellow metal dropped around $20 after the Federal Open Market Committee (FOMC) Meeting Minutes conveyed hawkish bias of the policymakers, suggesting a faster rate-hike and plans to discuss balance-sheet normalization.

Following the Minutes, the US bond yields rally and the Fed interest rate futures point at the 80% chance of a hike in March 2022.

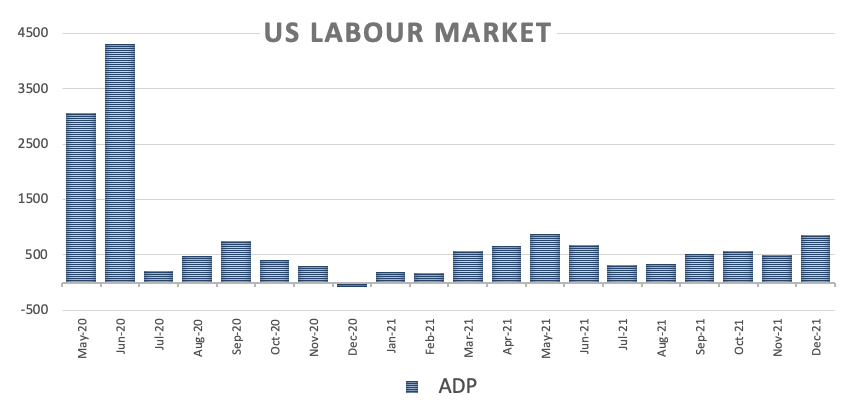

Given the strong US ADP Employment Change for December, 804K versus 400K expected, statements from the Fed Minutes like, “conditions for a rate hike could be met relatively soon if the recent pace of labor market improvements continues” also propelled the US bond coupons.

In addition to the Fed-linked chatters and market reaction, fears of the South African covid variant, Omicron, also weighed on the market’s risk appetite, as well as the gold prices. Although global policymakers tried not to scream on record covid infections, by citing scientific studies terming Omicron as a mild covid strain, findings of another virus variant and strain on multiple medical systems highlighted the COVID-19 woes. It’s worth noting that the virus cases are doubling faster and the fresh virus version, founded by France, is said to spread more widely than Omicron.

Elsewhere, China’s Evergrande and geopolitical tension surrounding Russia, Ukraine and Kazakhstan also challenge the gold buyers.

As a result, the US 10-year Treasury yields jumped to the highest level since April 2021 by the end of Wednesday’s North American session, up 3.4 basis points (bps) to 1.70%, which in turn drowned the Wall Street benchmark. Though, the recent pause in the US bond yields allowed S&P 500 Futures to print mild gains around 4,700.

Moving on, monthly prints of the US Good Trade Balance and ISM Services PMI for December, as well as weekly prints of US Jobless Claims, will be crucial for the gold prices. Should the US statistics keep beating the cautious forecasts, the odds of the faster Fed rate hikes can’t be ignored, which in turn will lure gold sellers. However, Friday’s US Nonfarm Payrolls (NFP) is the key.

Read: US December Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

Technical analysis

Gold eases inside a three-week-old ascending trend channel, backed by RSI retreat. Even so, the quote’s sustained trading above 100-SMA challenges the short-term bears.

On the contrary, multiple hurdles to the north stay ready to challenge gold bulls.

Among them, 61.8% Fibonacci retracement (Fibo.) of mid-November to December downside, around $1,830, act as an immediate resistance before the tops marked in July and September of 2021, close to $1,834.

Additionally, the upper line of the stated channel, near $1,838 at the latest, also challenges gold’s run-up before directing the buyers towards the mid-November swing low near $1,850.

On the flip side, a convergence of the channel’s support line and 100-SMA, close to $1,800, becomes the key support, a break of which will recall gold sellers targeting $1,780 and $1,760 levels.

Overall, gold remains in an upward trajectory but the bulls have a bumpy road ahead.

Gold: Four-hour chart

Trend: Pullback expected

- EUR/USD fades bounce off short-term key support, remains pressured of late.

- Steady RSI, sluggish MACD line also challenge recovery moves.

- 50-DMA adds to the upside filters, three-week-old support line in focus.

EUR/USD retreats towards 1.1300 after the Fed Minutes-led losses challenged the 21-DMA breakout. That said, the quote drops to 1.1309 during Thursday’s Asian session.

As the MACD line teases a bear-cross to the signal line, as well as steady RSI, the latest weakness is likely to continue.

However, a clear downside break of the 21-DMA level of 1.1300 becomes necessary for the bears to aim for an ascending support line stretched from mid-December 2021, around 1.1280 by the press time.

Also acting as the key short-term support is a six-week-long rising trend line near 1.1260, a break of which will direct the quote towards the last year’s bottom of 1.1186.

Alternatively, sustained trading beyond the 1.1300 threshold will direct the EUR/USD prices towards the 50-DMA level surrounding 1.1360.

Even so, the pair buyers will remain cautious until the quote rises past the horizontal area established since mid-November, near 1.1385.

EUR/USD: Daily chart

Trend: Further weakness expected

- The USD/JPY edges higher as the Asian session starts.

- The Federal Reserve is looking to raise rates sooner than later while eyeing its balance sheet reduction.

- USD/JPY Price Forecast: Tilted upwards, but oscillators in overbought conditions suggest a pause before launching an attempt to 2017 yearly highs.

On Wednesday, as the North America session wanes, the USD/JPY advances to a four-year high above 116.00 for the seventh consecutive day, trading at 116.13 at the time of writing. The market sentiment is downbeat as hawkish Fed signals that it could raise rates sooner to tame inflation. That said, US equity indices post losses led by the tech-heavy Nasdaq Composite, which lost 3.12% in the day.

In the meantime, US Treasury yields advanced sharply, with the 10-year T-bond yield rising three and a half basis points, sitting at 1.70%, a tailwind for the USD/JPY due to its high correlation with the 10-year note.

The US Dollar Index, which measures the greenback’s value against a basket of six rivals, slides some 0.08%, sitting at 96.18, despite higher US yields.

Summary of Fed’s FOMC meeting minutes

The Federal Reserve revealed its December meeting monetary policy minutes during the North American session. Fed policymakers said that the labor market is very tight. The US central bank might hike rates sooner than expected, followed by the beginning of reducing its assets holdings, as Fed officials discussed in the meeting.

“The minutes almost never change anything. They may have reinforced a little bit the Fed’s intent on raising rates, but not very much,” said Joseph Trevisani, senior analyst at FXStreet.com in New York.

Following the release of the minutes, futures of the Federal Funds Rates were pricing in an 80% possibility of a 25 basis points hike by the US central bank. According to the CME FedWatch Tool, the probability of a rate hike to 0.25-0.50% is 64.1%, while keeping it unchanged is at 32.2%.

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart depicts the pair has an upward bias, confirmed by the position of the daily moving averages (DMAs), located below the spot price. However, oscillators like the Relative Strength Index at 74 shown that the trend is overextended and could print a leg-down before attempting a move towards 2017 cycle highs around 118.65.

If the USD/JPY retraces, the first support would be the November 24 cycle high at 115.52. The breach of the latter would expose 115.00, followed by a test of previous resistance-turned-support October 20 high at 114.70.

To the upside, the USD/JPY first ceiling level would be an upslope trendline that acts as resistance around the 116.50-60 area, and then there is no pivot or cycle high in the way towards the 2017 yearly highs around 118.65.

“More UK businesses than ever before are worried about inflation, and a record number are planning to increase their own prices,” said Bloomberg while conveying the latest British Chambers of Commerce (BCC) details on early Thursday morning in Asia.

More to come

- AUD/USD grinds lower after FOMC Minutes, Aussie PMIs.

- Yields rally post-FOMC Minutes as policymakers discussed odds of rate-hike, balance-sheet accommodation.

- Jump in December’s ADP Employment Change also propel faster Fed rate hike chatters.

- Aussie PMIs match initial forecast for December, US ISM Services PMI, Jobless Claims will be important for fresh impulse.

AUD/USD struggles to hold the grounds, drift lower around 0.7220 during early Thursday morning in Asia. The risk barometer pair dropped nearly 50 pips following the Fed Minutes but steadied close to 0.7215-25 before recently leaning bearish.

Fears of the coronavirus and Fed rate hike could be cited as the main catalysts that recently weighed on the AUD/USD prices, via stronger US Treasury yields.

Although global policymakers tried not to scream on record covid infections, by citing scientific studies terming Omicron as a mild covid strain, findings of another virus variant and strain on multiple medical systems highlighted the COVID-19 woes. It’s worth noting that the virus cases are doubling faster and the fresh virus version, founded by France, is said to spread more widely than the South African variant, namely Omicron.

On the other hand, the Fed interest rate futures point at the 80% chance of a hike in March 2022, which in turn fuels the US Treasury yields and the US dollar. The odds of Fed rate hikes rallied sharply after the latest FOMC Minutes conveyed, “In light of elevated inflation pressures and the strengthening labor market, participants judged that the increase in policy accommodation provided by the ongoing pace of net asset purchases was no longer necessary.” The Fed Minutes also signals that the policymakers also judged conditions for a rate hike could be met relatively soon if the recent pace of labor market improvements continues.

It’s worth noting that the US ADP Employment Change rallied to 807K versus 400K expected and offered a strong push to the US bond yields and the greenback, though not until the release of FOMC Minutes.

Additionally, the final prints of Australia’s Commonwealth Bank Services PMI and Composite PMI matched initial forecasts with 55.1 and 54.9 respective figure and failed to lift the AUD/USD prices.

Other than what’s already mentioned above, China’s hardships, mainly due to the virus and Evergrande, join failed attempt to tame yuan appreciation, to weigh on the AUD/USD.

Amid these plays, the US 10-year Treasury yields ended Wednesday’s North American session up3.4 basis points (bps) to 1.70%, the highest level since April 2021. The same weighed on the Wall Street benchmarks and dragged commodities to the south.

Moving on, a light calendar ahead of the US session can help AUD/USD bears to extend the recent pullback considering downbeat risk catalysts. However, the US ISM Services PMI for December and the weekly Jobless Claims will be important to watch afterward.

Technical analysis

Despite the latest pullback, AUD/USD keeps the bounce off 21-DMA, around 0.7195 by the press time, amid firmer RSI and bullish MACD signals, which in turn hints at further upside towards a convergence of the 100-DMA and upper line of a monthly rising wedge bearish pattern. Ahead of the key 0.7290 hurdle, 50% Fibonacci retracement (Fibo.) of October-December downside, around 0.7275, will also challenge the AUD/USD bulls.

“The Bank of Japan's government debt holdings have fallen for the first time in 13 years as the central bank quietly adjusts its massive bond-buying program in the face of looming financial risk,” said Nikkei while conveying details of the Bank of Japan’s (BOJ) stealth taper during early Thursday morning in Asia.

Key quotes

The BOJ's balance of Japanese government bonds totaled 521 trillion yen ($4.49 trillion) at the end of 2021, according to data released Wednesday, down 14 trillion yen from a year earlier.

After current Gov. Haruhiko Kuroda took the post in 2013, he oversaw a vast expansion of a quantitative easing policy meant to boost deflation-mired Japan's money supply and quickly achieve 2% inflation.

The BOJ still stands by its 'quantitative and qualitative' policy, its only plan for achieving 2% inflation.

FX implications

USD/JPY defends 116.00, around 116.10 by the press time, as the news allowed the yen pair to consolidate recent gains. However, firmer yields keep buyers hopeful.

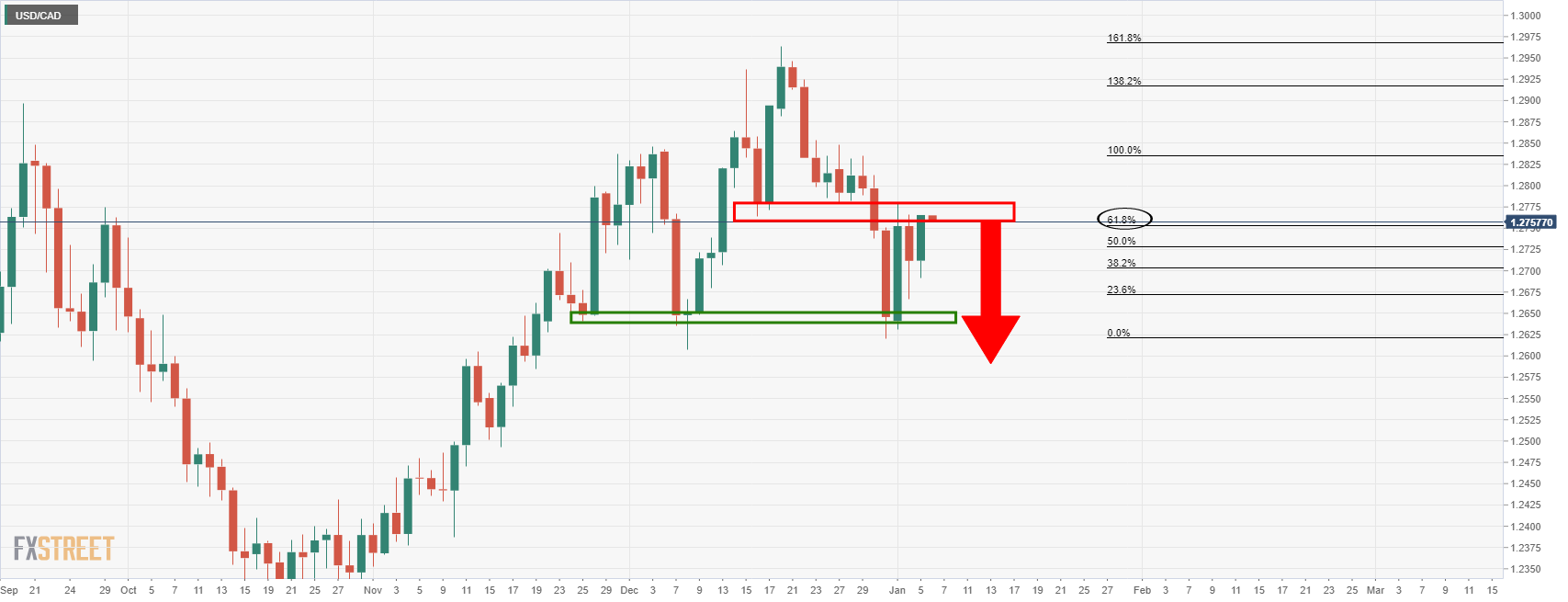

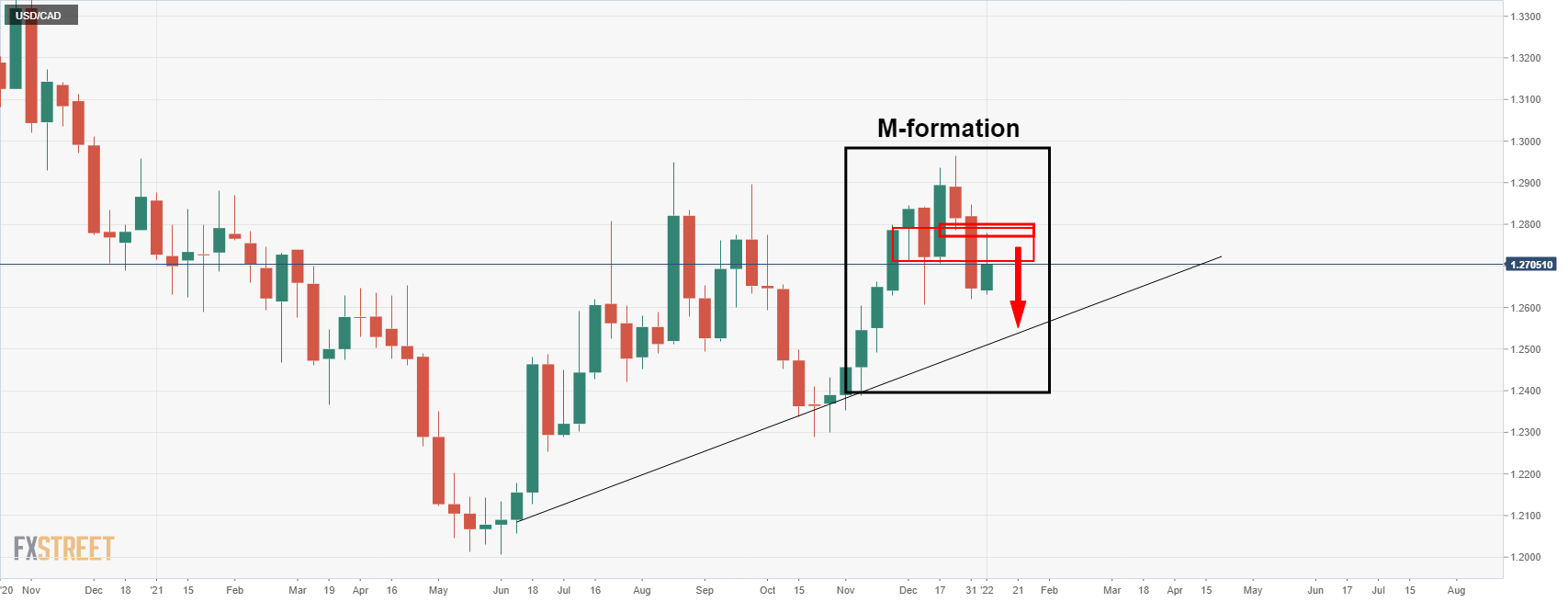

- USD/CAD bulls run into a wall of resistance and the bears are lurking, hungry for a discount.

- USD/CAD bears need to break 1.27 the figure for a bearish structure to really take shape.

USD/CAD is forming the makings of a bearish outlook despite the hawkish Federal Reserve. The price has run higher in the bullish correction of the bearish daily impulse, but should the bears engage at a discount, then the focus will be on a break to the downside as follows:

USD/CAD daily charts

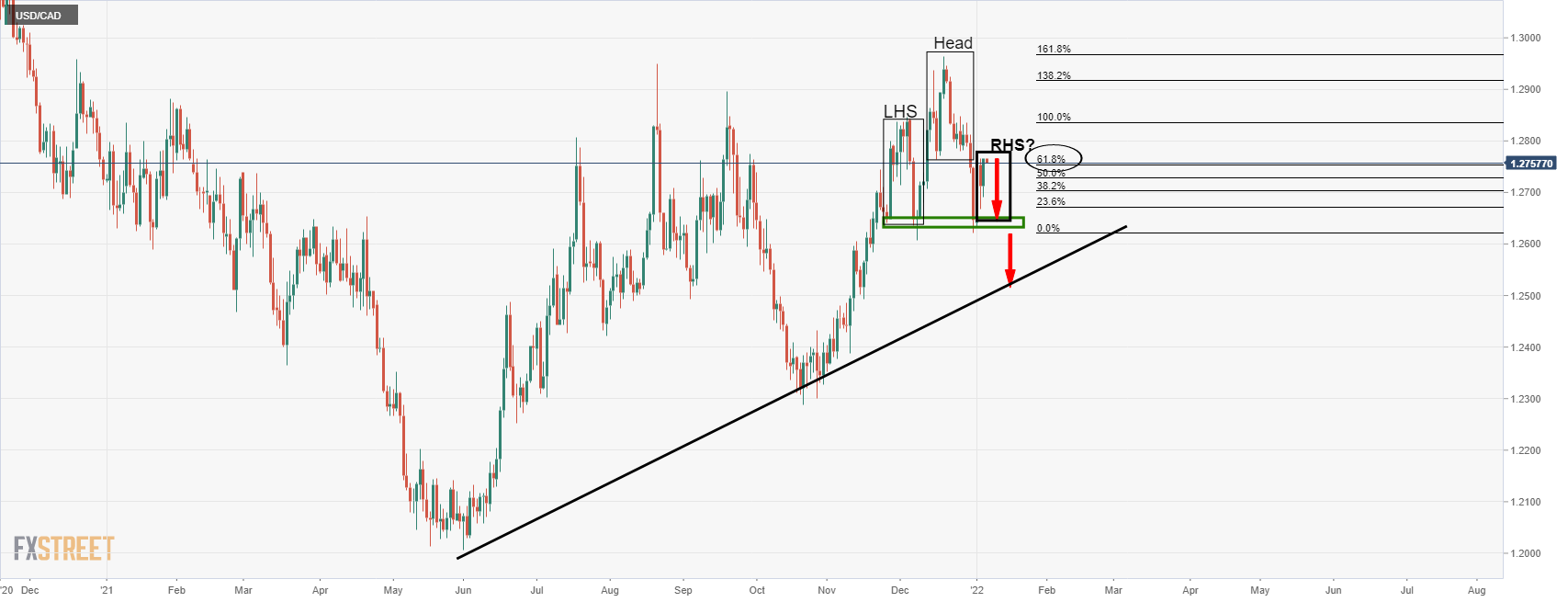

The price, in doing so, will have completed a head and shoulders as follows:

USD/CAD H&S

The head and shoulders is a topping formation, so the price would be expected to run significantly lower on a break and retest of the neckline near 1.2630.

1.2520 will be earmarked as per the dynamic trendline support:

USD/CAD 4-hour chart

The bears would be prudent to wait to engage on a retest of the 4-hour support just below 1.27 the figure that would be expected to act as a resistance on a break thereof.

- The EUR/GBP slides for the third time of the week.

- EUR/GBP is downward biased as portrayed by the DMAs located above the spot price.

- EUR/GBP Price Forecast: A break below 0.8335 would expose 2020 yearly lows around 0.8281.

The euro falls for the third consecutive day against the British pound, trading at 0.8340 during the North American session. The market sentiment is downbeat after the US Federal Reserve announced that it might raise rates sooner than expected. Furthermore, US central bank policymakers noted the possibility of reducing the balance sheet to tame inflation.

That said, the US stocks dropped while US Treasury yields rose, with the 10-year benchmark note touching 1.712%, a level last reached in April 2021.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP daily chart depicts that the cross-currency is downward biased. The daily moving averages (DMAs) reside well above the spot price, with the shorter time-frames below the longer time-frame ones.

At press time, the EUR/GBP downward move after the Fed’s minutes announcement was capped around 0.8336, January 4 daily low, which acted as the first line of defense of EUR bulls.

To the upside, the EUR/GBP first ceiling level would be the daily pivot point at 0.8357. The breach of the latter would expose the 100-hour simple moving average (SMA) at 0.8376, immediately followed by the R1 daily pivot at 0.8379. A break above that level would send the pair rallying towards the 200-hour SMA at 0.8399.

On the other hand, the cross-currency first support would be the January 5 daily low at 0.8335. A decisive break of that level would open the door for further losses. The next stop on the way down would be February 2020 swing lows around 0.8281.

-637770138256979135.png)

- GBP/USD bears take over on the back of the hawkish Fed.

- GBP/USD bulls need to commit at this juncture or risk bears taking over to below 1.3500.

GBP/USD was hit hard on the back of the Federal Open market Committee minutes today resulting in a quick drop into an area that might be expected to act as support. The following is an analysis that illustrates the price action and potential outcomes from both a bullish and bearish standpoint.

GBP/USD H1 chart

The price action would be expected to result in an onwards move to the upside from support. However, as illustrated below, the recent sell-off has left a strong bearish candle close and a subsequent additional bearish open in the current candle. This opens the prospects of a downside continuation below support and into buy stop territory:

GBP/USD H1 chart

The buy stops offer liquidity for the bears to exit shorts and reenter long positions at a discount. This could be the ticket for the daily continuation as illustrated in the following daily chart. However, given the price imbalance between 1.3510 and 1.3480, there could be an additional move to the downside prior to the next bullish accumulation.

GBP/USD daily chart

On the daily chart, we can see that the 50-day moving average will align around 1.34 the figure should the price sell-off through the near term support and to below 1.3500. This could be targeted in such a scenario. On the other hand, if the bulls do take back control, a break of 1.3600 resistance opens the risk of a fast move through thin volumes once buy stops are triggered to 1.3700 and 1.3800 thereafter.

- The S&P 500 tumbled nearly 1.5% and the Nasdaq 100 is down more than 2.5% after hawkish Fed minutes.

- Though Fed’s Waller jawboned about QT in December, markets seemed surprised by the support for a sooner, faster start.

US equity markets are tumbling across the board, though the pain is concentrated most heavily in big tech, so-called growth, and real-estate names, pretty much those sectors most sensitive to a rise in US bond yields. The catalyst for the downside was the latest Fed minutes release, which seemed to catch a number of market participants off guard with regards to its hawkishness on the prospect for quantitative tightening and rate hikes in this year. To summarise, the minutes mostly echoed Powell’s remarks following the Fed’s hawkish December policy shift (where the QE taper pace was doubled and the dot-plot pointed to three 2022 hikes). But markets were surprised by the extent to which meeting participants agreed with the notion that quantitative tightening (where the Fed reduces it balance sheet) should start sooner and proceed faster than in past cycles.

The S&P 500 dropped 1.4% as index heavyweights Apple (-1.8%), Microsoft (-3.0%), Alphabet (-3.7%), Facebook (-2.9%), Netflix (-3.3%), Telsa (-3.9%) and others tumbled. The index broke below a key area of support around 4750 and is now probing the 4720 mark, where it trades at its lowest since before Christmas. Losses in the aforementioned big tech/growth stock names were primarily as a result of US bond yields breaking higher, particularly at the short to medium end, in anticipation of a higher Fed rate path in the coming years. Remember that these stocks disproportionately derive their value from expectations for future earnings growth rather than current earnings, so when “opportunity cost” (which bond yields are a proxy for) on betting on future earnings growth rather than present earnings goes up, these stocks fall.

Stocks in sectors seen as more defensive in nature, such as in health care, consumer staples, utilities and telecoms held up better. Many of these stocks are also often classed as “value” stocks, i.e. stocks whose value is based more on present earnings rather than future, leaving them less vulnerable to a rise in bond yields. For reference, the S&P 500 health care index was down just 0.3%, consumer staples was up 0.2%, utilities was up 0.3%, whilst telecoms was up more than 2.0%. Despite higher yields, the S&P 500 financials index was still down 0.7%. As a result of the underperformance of tech and growth names disproportionately represented in the Nasdaq 100, the index tumbled over 2.5% to the 15.8K area, where it now trades lower by nearly 3.0% on the week. Meanwhile, the Dow also tumbled 0.6% to test the 36.5K mark, with its losses comparatively mild given its higher weighting towards the aforementioned sectors that are holding up a little better.

- EUR/USD dipped back towards 1.1300 from the 1.1340 area in wake of hawkish leaning Fed minutes.

- Though Fed’s Waller jawboned about more aggressive QT in December, markets seemed surprised that many Fed members seem to agree.

- Despite this, USD bulls remain shy and may need the green light from higher long-term yields to continue 2021’s bull-run.

EUR/USD dipped in wake of the release of the latest Fed minutes, with the accounts of the 14-15 policy meeting clearly exceeding what were already hawkish expectations. The pair, which was trading closer to 1.1340 prior to the release, is now trading around 1.1310 and eyeing a retest of the 1.1300 level, though still trades with gains of about 0.2% or over 20 pips on the day. For now, the 21-day moving average at 1.1307 is offering support. But if the hawkish tone of the latest Fed release can attract more dollar bulls out of the woodworks, the EUR/USD may be on course for a break below the big figure and a test of this week’s sub-1.1280 lows, which also coincide with last week’s pre-New Year’s lows.

To put a long story short, the latest FOMC minutes were more hawkish than expected on a number of fronts. Echoing hawkish statements made by Fed governor Christopher Waller last December, all participants favoured beginning quantitative tightening (QT) sooner after the first rate hike than last time and many judged that the runoff should proceed faster. In other words, the Fed seems to be more strongly leaning toward more aggressive quantitative tightening, which even though Waller did hint at this in December, seems to have surprised some. Meanwhile, some Fed participants remarked that there could be circumstances in which it would be appropriate for the committee to raise interest rates even before full employment had been reached. This is the first time since the Fed’s 2020 framework review when Fed members have favoured sacrificing progress to its employment goal to meet the inflation goal. For a full summary of the minutes, click here.

For now though, even though US bond yields, particularly at the short-end have been rallying in wake of the minutes, the USD bulls remain shy. For reference, US 2-year yields are now up 6bps on the day and decisively breached 0.80% for the first time in the post-pandemic era. 5s were up over 5bps to above 1.40%, which put them back at pre-pandemic levels for the first time. Longer-term US yields, the 10s and 30s, were little moved, however, which could explain the lack of enthusiasm seen in USD. 10s gained about 1bps in the aftermath of the minutes, but are struggling to get above 1.70%, while the 30s have actually moved about 1bps lower since the release.

The lack of enthusiasm to push long-term yields higher in tandem with short-term yields in wake of the hawkish minutes suggests that bond market participants are not convinced that the more aggressive approach toward rate hikes and balance sheet reduction constitutes long-term economic growth maximizing policy. Bond markets may need to show a little more faith in the Fed’s ability to tigthen without hurting long-term growth (thus pushing longer-term yields higher) for the dollar to rally on a sustainable basis.

What you need to know on Thursday, January 6:

The greenback edged lower for most of Wednesday but got an unexpected boost from the US Federal Reserve’s Meeting Minutes. US policymakers noted that “In light of elevated inflation pressures and the strengthening labor market, participants judged that the increase in policy accommodation provided by the ongoing pace of net asset purchases was no longer necessary.”

Also, the document showed that most participants judged conditions for a rate hike could be met relatively soon if the recent pace of labor market improvements continues. Earlier in the day, the US published the ADP survey on private job creation, which printed at 807K much better than anticipated. Finally, policymakers began discussing reducing the balance sheet.

Wall Street was trading mixed, with the Nasdaq Composite sharply down but the DJIA soaring to record levels. The sell-off in techs could be blamed on a certain risk-aversion, as investors are dropping high growth shares to the benefit of more valuable, cyclical stocks. However, Fed’s announcement sent all of the major indexes into the red as US government bond yields jumped. The yield on the 10-year Treasury note reached the notable 1.70% threshold.

The EUR/USD pair peaked at 1.1346, shedding ground and now hovering at around 1.1310. GBP/USD flirted with 1.3600, also retreating but retaining most of its intraday gains. Commodity-linked currencies trimmed intraday gains post-Fed, ending the day with modest losses. Safe-haven currencies were up, with the USD/JPY pair holding above the 116.00 threshold.

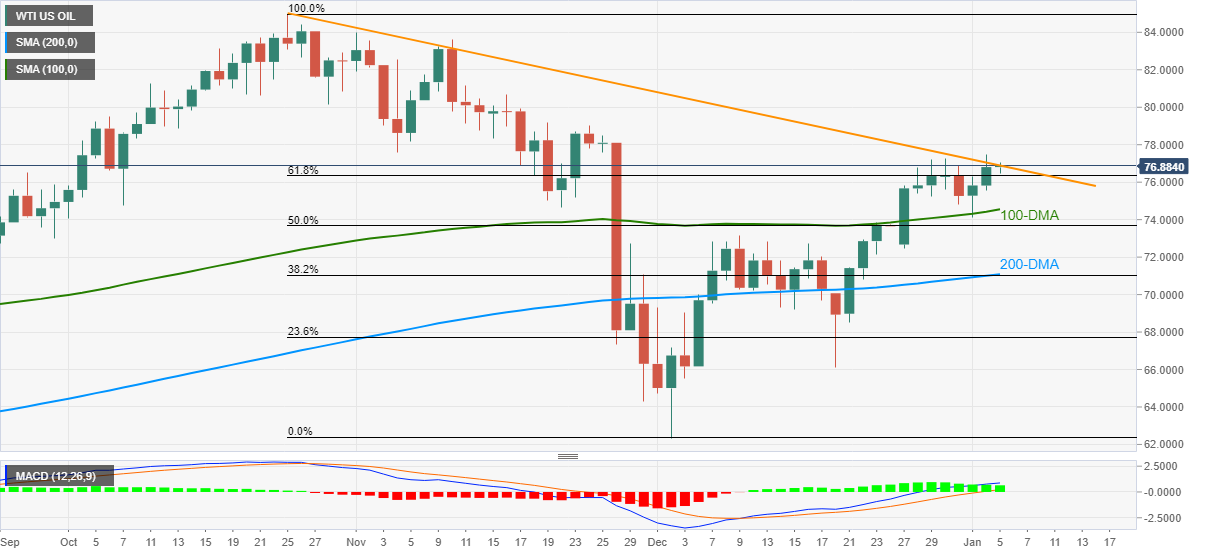

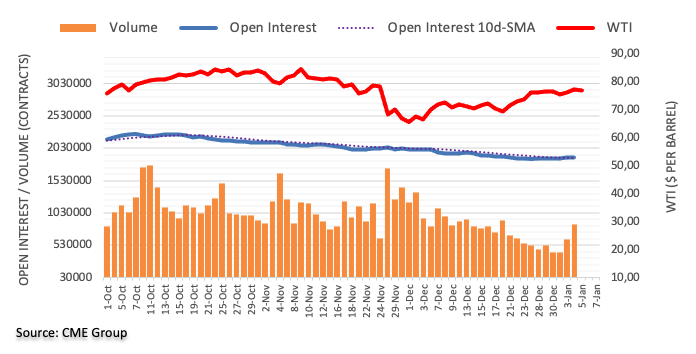

Gold peaked at 1,829.59, from where it began retreating ahead of the Fed. It currently trades at around $1,814 a troy ounce. Crude oil prices retain modest gains, with WTI trading at around $77.60 a barrel.

Dogecoin downside risk could be significant, if support fails, DOGE could hit $0.08

Like this article? Help us with some feedback by answering this survey:

- The AUD/USD slides some 0.11% after Fed’s last meeting minutes.

- Federal Reserve policymakers said that conditions for a rate hike could be met sooner than estimated.

- Fed officials added that the pace of rate hikes could be faster “than participants anticipated.”

- Fed policymakers eye the possibility of reducing the balance sheet after the first rate hike.

The AUD/USD pares Tuesday’s gains during the New York session after the Federal Reserve minutes showed that most Fed members judged that conditions for hiking rates could be met relatively soon if the labor market “improvements continued.” The pair is trading at 0.7229 at press time.

Summarize of Federal Reserve December 14-15 minutes

Federal Reserve policymakers decided that monetary policy accommodation was no longer necessary, attributed to high inflation pressures and improved labor market.

Regarding hiking rates, “most participants” judged that conditions for a rate hike could be met relatively soon IF the labor market improvements continued. Further added that “given the outlooks for the economy, labor market and inflation, it may become warranted to increase the Federal Funds Rate sooner or at a faster pace than participants had anticipated.”

Concerning the reduction of the balance sheet, Fed officials said that “it could be appropriate to begin to reduce the size of the Federal Reserve’s Balance sheet relatively soon after beginning to raise the Federal Funds Rate.”

Federal Reserve members noted that inflation has been running above the 2% target, reflecting supply and demand imbalances, blamed on the pandemic and the reopening of the economy. Talking about the Covid-19 new variants, the Committee said they “pose downside risks to economic activity and upside risks to inflation.”

In the meantime, Fed funds futures priced in an 80% rate hike in March, after December’s meeting minutes.

Market’s Reaction

The AUD/USD extends its initial slide from 0.7265 down to 0.7229, breaching below the confluence of the 100 and the 200-hour simple moving averages (SMAs), while US 10-year bond yields rose to 1.712%, for the first time since October 2021.

At press time, the AUD/USD keeps pushing lower, aiming for the intersection of the 50-hour SMA and the daily pivot around 0.7224-26.

- Gold falls on hawkish FOMC minutes which sent both the US dollar and yields higher.

- FOMC minutes point to a faster increase of the federal funds rate.

Gold has fallen sharply on the back of the Federal Open Market Committee minutes that stated, ''in light of elevated inflation pressures & strengthening labour market, participants judged increase in policy accommodation provided by the ongoing pace of net asset purchases no longer necessary.''

Gold fell from $1,824.50 to a low of $1,812.50 on the kneejerk and is on the verge of turning red on the day.

The minutes stated that ''participants remarked FOMC should continue to be prepared to adjust the pace of purchases if warranted by changes in the economic outlook.''

They also stated that ''most participants judged conditions for a rate hike could be met relatively soon if the recent pace of labour market improvements continued, adding, ''given outlooks for the economy, labour market, inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.''

Additionally, the minutes also stated that a ''quicker conclusion of net asset purchases would better position the FOMC to set the policy to address the full range of plausible economic outcomes.''

Consequently, the interest rate futures now price in an 80% chance of Fed hike at the March meeting. The US 10-year yield is now making a fresh daily high of 1.71%. This is the highest level since October of last year. The 2-years are surging to 0.8340%.

Gold technical analysis

The price fell sharply on the minutes as follows:

The move into support is key as a break here opens the risk of a move back towards $1,810/00 due to the imbalance of price below $1,812.

However, from a longer-term perspective, the price still has some work to do before it is back under pressure around the trendline uspport.

The minutes of the 14-15 December FOMC meeting, released on Wednesday, said most participants judged conditions for a rate hike could be met soon if the recent pace of labour market improvements continued.

Additional Takeaways

On QE taper...

"In light of elevated inflation pressures and the strengthening labor market, participants judged that the increase in policy accommodation provided by the ongoing pace of net asset purchases was no longer necessary."

"Participants remarked that a quicker conclusion of net asset purchases would better position the committee to set policy to address the full range of plausible economic outcomes."

"Participants remarked that the committee should continue to be prepared to adjust the pace of purchases if warranted by changes in the economic outlook."

On rate hikes...

"Most participants judged conditions for a rate hike could be met relatively soon if the recent pace of labor market improvements continued."

"Participants noted that, given outlooks for the economy, labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated."

"Some participants also remarked that there could be circumstances in which it would be appropriate for the committee to raise the target range for the federal funds rate before maximum employment had been fully achieved."

"Policymakers thought changes in fed funds rate should be primary means for adjusting the stance of policy."

On eventual Quantitative Tightening (QT)...

"Policymakers began in December to discuss how balance sheet policy might feature in a plan to reduce accommodation when warranted."

"Expectations for the timing of the first decline in balance sheet were 'diffuse'".

"Some participants also noted that it could be appropriate to begin to reduce the size of the federal reserve's balance sheet relatively soon after beginning to raise the federal funds rate."

"Some policymakers noted that balance sheet could potentially shrink faster than last time."

"Several policymakers concerned treasury market vulnerabilities could affect the pace of balance sheet normalization."

"Some policymakers thought 'significant' balance sheet shrinkage could be appropriate in the normalization process."

"Almost all policymakers thought likely appropriate to start balance sheet runoff at some point after the first interest rate hike."

"Participants judged that balance sheet runoff could start sooner after policy rate liftoff than last time."

"Many policymakers judged the appropriate pace of balance sheet runoff would likely be faster this time than last."

On inflation, supply chains snags...

"Most agreed that risks to inflation were weighted to the upside."

"All participants remarked that inflation had continued to run notably above 2 percent, reflecting supply and demand imbalances related to the pandemic and the reopening of the economy."

"Several participants pointed to the possibility that structural factors that kept inflation low in the previous decade may reemerge when the effects of the pandemic abate."

"Some participants discussed the risk that recent elevated levels of inflation could increase the public's longer-term expectations for inflation to a level above that consistent with the committee's longer-run inflation objective."

"Many participants noted that the pandemic, particularly new variants of the virus, continued to pose downside risks to economic activity and upside risks to inflation."

"Participants noted their continuing attention to the public's concern about the sizable increase in the cost of living that had taken place this year."

"A couple of participants cited reports of higher inflation expectations of businesses and increased cost-of-living adjustments in wage negotiations as early developments that could affect anchoring of inflation expectations."

"Participants generally expected global supply chain bottlenecks to persist well into next year at least."

On the labour market...

"Participants generally continued to stress uncertainties associated with the labor market and with the length of time required to resolve the supply chain situation."

"Participants noted that the labor market had been making rapid progress and many judged that if the current pace of improvement continued, labor markets would fast approach maximum employment."

"Several participants remarked that they viewed labor market conditions as already largely consistent with maximum employment."

"Participants pointed to a number of signs that the US labor market was very tight, including near-record rates of quits and job vacancies, as well as a notable pickup in wage growth."

General comments on policy, outlook...

"Some participants judged that a less accommodative future stance of policy would likely be warranted and that the committee should convey a strong commitment to addressing elevated inflation pressures."

"No decisions on policy normalization were made at the December meeting."

"Policymakers at the December meeting began a discussion of eventual normalization of monetary policy, including approaches for removing accommodation, and size, the composition of balance sheet."

"A number of participants judged that a substantial improvement in labor force participation would take longer than previously expected."

"Many participants noted that the emergence of the omicron variant made the economic outlook more uncertain; several remarked that they did not yet see the new variant as fundamentally altering the path of the US economic recovery."

- USD/JPY bulls aim for a break of 116 the figure with the FOMC minutes eyed.

- Bears will be seeking a break of the 115.80 support to open risk to 115.35.

Ahead of the Federal Open Market Committe minutes that are at the top of the hour, the price is trapped below the descending resistance line and has left a W-formation on the 1-hour chart. This is a reversion pattern where the neckline would be expected to draw in the price. In this case, the 50 EMA is a confluence that could act as support.

USD/JPY H1 chart

A retest of the support near 115.80 could equate to a bid back to the dynamic resistance. If this breaks, then bulls will be encouraged to push beyond 116 and towards 116.50 in the coming sessions. If the support breaks, however, then the bears will be keen on a test below 115.50 to 115.35 support.

- The NZD/USD edges higher in the North American session, up 0.31%.

- US ADP National Employment Report showed that the US economy added 807K, new private jobs.

- NZD/USD has a downward bias, though upside risks remain.

On Wednesday, the New Zealand dollar advances for the second day in the week, despite better than expected US ADP National Employment figures. The pair is trading at 0.6829, eight pip short of the daily high at the time of writing.

US ADP Private Employment Report

Before Wall Street opened, Automatic Data Processing (ADP) company reported that private payrolls in the US surged by 807K, doubled than the 400K foreseen by market participants. Meanwhile, October’s figures were revised lower from 534K to 505K.

The report could prelude Friday’s US Nonfarm Payrolls, which is expected to show that the US economy created 400K new jobs, higher than the 210K reported in December. The Unemployment Rate is expected to improve also, from 4.2% down to 4.1%.

Later in the day, the Federal Reserve will release the FOMC December’s 2021 minutes.

NZD/USD Price Forecast: Technical outlook

The NZD/USD daily chart depicts the pair as downward biased. The daily moving averages (DMAs) reside above the spot price, with the 50-DMA intersecting the 38.2% Fibonacci level, drawn from October’s 2021 cycle highs, down to December’s 2021 lows, around 0.6899-0.6905.

The NZD/USD first resistance would be the R1 daily pivot at 0.6834. A breach of the latter would expose the January 3 daily high at 0.6856, followed by the confluence of the 38.2% Fibonacci level and the 50-DMA around 0.6899-0.6905.

On the flip side, the NZD/USD bull’s first line of defense would be the confluence of the 100 and the 200-hourly simple moving averages (SMAs) around 0.6814-16. A break under that zone would expose the daily pivot at 0.6799, followed by the S1 daily pivot point at 0.6774.

- EUR/USD is holding in a key area on the weekly chart, but is vulnerable to a breakout.

- The FOMC minutes will be important at the top of the hour as a key event ahead of NFPs.

At 1.1345 currently, EUR/USD is trading 0.5% higher between a range of 1.1270 and 1.1346 while the US dollar melts within the familiar sideways range as measured against a basket of major currencies in the DXY index.

DXY is down for the first day this week and has broken below 96. This week’s rally has run out of steam near 96.40, a key technical level. The dollar may struggle to get past there now before there can be a test of the December cycle high near 96.91. This leaves the euro in good stead ahead of this week's main event in the Nonfarm Payrolls report.

''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities said.

Fed minutes eyed

Meanwhile, the Federal Reserve minutes will shed some light on the path to interest rate hikes for this year. '' Since the Fed accelerated tapering at that December meeting, markets will be looking for clues for when the conditions for liftoff will likely be met,'' analysts at Brown Brothers Harriman explained. ''WIRP suggests nearly 2 in 3 odds of liftoff March 16, while May 4 is fully priced in. Some are looking for clues to balance sheet reduction, but we think it is way too early for that. That seems like a 2023 story and so Fed officials are unlikely to be discussing it just yet.''

Looking to Treasury yields, these have been climbing at the start of this year, boosting the likelihood that the Federal Reserve will hike rates at least three times beginning in May to counteract price pressures. Today, the ten-year yield is higher by some 1.8% and is testing the November highs. A break of 1.7060% will be important and would be expected to fuel the US dollar.

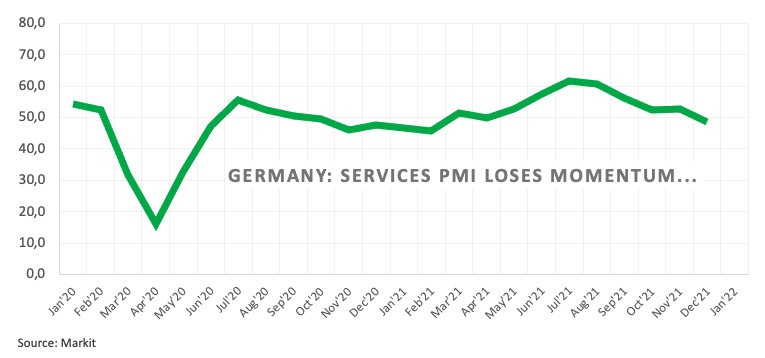

As for the euro, the European Central Bank won’t meet until February 3, which will allow the central bank to assess the economic outlook as more data comes out. This leaves the single currency vulnerable to the data, although not much is expected from the ECB as the bank has already tipped PEPP will end as scheduled in March.

''The temporary increase to its existing AP will not be large enough to prevent a significant tightening of financial conditions this year in the eurozone,'' analysts at BBH explained. ''Besides the impact on the growth outlook, this tapering will have unwanted side effects, with peripheral spreads likely to widen further.''

EUR/USD technical analysis

The W-formation is a regression pattern that leaves the price anchored towards the neckline. This comes in at around 1.1320. A break below this support area opens the risk of a downside continuation which could be significant if the price breaks the 1.12 areas as it exposes from all the way to a test of the 1.10 figure as follows:

The area of imbalance of price is where the price can slide on a break of the weekly lows.

- The USD/CHF slides some 0.06% in the New York session.

- The USD/CHF has a neutral bias, as the DMAs remain horizontal, around the 0.9170-0.9220 area.

The USD/CHF extends its Tuesday’s losses, trading at 0.9157 at the time of writing. Risk-sensitive currencies remain bid, while safe-haven peers drop. In the CHF case, it gains against the greenback, following the Japanese yen footsteps, which gains some 0.14% vs. the buck.

The USD/CHF was subdued in the overnight session, trading within the 0.9140-68 band, failing to extend its Tuesday’s fall. On the bottom, the downward move was capped near the S1 daily pivot at 0.9135, while upwards, the daily pivot point at 0.9164 was the ceiling for the USD/CHF pair.

In the meantime, US Treasury yields recover from earlier losses, the 10-year benchmark note up one basis point, at 1.677%.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has a neutral bias, depicted by the daily moving averages (DMAs) with a horizontal slope residing around the spot price. However, an upslope trendline drawn from December 2020 cycle lows to the June 2021 swing lows provided support, as the downward move pierced the aforementioned, rebounded strongly towards the 200-DMA around 0.9169.

To the upside, the first resistance would be the 200-DMA. A break above that level would open the door for a confluence of the 50 and the 100-DMA around 0.9205-15 area, that once broken would open the door towards the December 15 cycle high 0.9294 and then 0.9300.

On the other hand, a decisive break under the 0.9150 figure would open the door for 0.9100, followed by the November 2 swing low at 0.9085 and then the psychological 0.9000.

-637770014170912046.png)

- GBP/JPY rallied above 157.50 to hit fresh multi-month highs, as bulls eye a test of 2021 highs above 158.00.

- Traders should beware that the 14-day RSI is now in overbought territory above 70.00.

GBP/JPY has rallied to fresh multi-month highs in recent trade above the 157.50 level, its highest point since late October. The pair now trades 0.3% higher on the day, having reversed earlier losses that saw it dip as low as 156.60. The latest bout of gains come despite stability in developed market bond markets on Wednesday. Perhaps the weakening yen is reacting in belated fashion to Monday and Tuesday’s surge in (non-Japan) developed market bond yields, or in anticipation that the run higher has further to go.

Sterling may also have garnered further impetus after UK PM Boris Johnson reiterated for a second day running that he was keen to avoid more lockdowns, despite also noting a rapid rise in hospital admissions. However, sterling’s performance is roughly in line with other outperforming G10 currencies on the day including the euro, Aussie and kiwi (all of which are up 0.2-0.3% versus the yen).

GBP/JPY bulls will be eyeing a test of the 2021 highs just to the north of the 158.00 level amid a lack of any notable resistance in the interim. Traders should beware, however, that GBP/JPY’s 14-day Relative Strength Index is in overbought territory above 70.00, suggesting that it may be difficult for the pair to manage a sustained break above resistance at 158.00.

The yen did not seem to react much to newswires reporting that BoJ sources had told them the bank would be upping its fiscal year 2022 forecasts at the coming meeting earlier on Wednesday. Whilst the core inflation forecast for the coming fiscal year was set to be lifted above 1.0% (from the current 0.9%), it will remain well below th BoJ’s 2.0% target, this will not prompt any policy shift from the bank. As long as the BoJ maintains its ultra-dovish stance as Japan continues to face deflation risks, the yen will continue trading as a function of global themes, risk appetite and bond yields.

US President Joe Biden could announce remaining Federal Reserve Board of Governor Nominees as soon as this week, a source told Reuters. Michigan State University economist Lisa Cook, former Fed research economist Philip Jefferson, and former Fed Governor Sarah Bloom Raskin are the leading candidates as the Biden administration seeks to diversify the Board of Governors.

Market Reaction

There has not been a market reaction to the news. Rumours that these candidates were under consideration has been swirling for some time.

- Silver is trading with modest gains ahead of the release of what are expected to be hawkish leaning FOMC minutes.

- XAG/USD currently trading just above the $23.00 level, up about 0.4% or about 8 cents on the day.

- Silver’s resilience in the face of higher real yields has been surprising, but may not last.

Spot silver (XAG/USD) prices are trading with modest gains in the run-up to the release of what is widely expected to be hawkish leaning FOMC minutes release at 1900GMT. Prices are currently trading just above the $23.00 level, up about 0.4% or about 8 cents on the day and slightly above the midpoint of the $22.60-$23.40ish range that has prevailed over the past two weeks.

Silver’s resilience in the face of a sharp rise in US real yields, which is typically a negative for precious metals, has been surprising. 10-year TIPS yields (the 10-year nominal yield minus inflation expectations) is currently probing two-month highs near-0.9% and is up a further 3bps on the day, taking its on the week gains to about 17bps. Tuesday’s ISM Manufacturing PMI survey saw the prices paid subindex fall dramatically, a sign that peak levels of (MoM) inflation in the US might be in.

That raises the chance that the Fed’s inflation forecasts for 2.6% in 2022 and then closer to 2.0% in the subsequent years (which have been criticised by many as understating inflation risks) may prove correct. 10-year yields at current levels just abov 1.65%, though sharply up on the week (with the upside driven by real yields), suggest that bond markets see the Fed’s rate projections as overly optimistic.

But optimism has been growing in markets as of late regarding the prospects for continued strong economic growth into 2022 and beyond amid strong consumer demand, tight labour markets (as Tuesday’s JOLTs report and Wednesday’s ADP numbers emphasises). There is a risk that markets increasingly start to believe the Fed’s dot plot, which suggests rates will reach 2.1% by the end of 2024, before reaching 2.5% in the long run.

10-year break-even inflation expectations remain stable in the 2.50% area and if the Fed is right (about a stronger long-term growth than markets expect, but lower inflation than many fear) that suggests it should remain stable. But if they are right about the strong economy, that means long-term nominal yields will need to move higher. That means real yields (nominal yields minus inflation expectations) will need to move higher as well.

A move back towards 0% in the 10-year TIPS yield would be a massive tailwind for silver and other precious metals. Traders betting on such a long-term outcome (which would likely take at least a year to unfold in full), would likely expect to see XAG/USD drop under support in the mid-$21.00s and to pre-pandemic levels in the upper teens.

- The British pound advances for the second day in a row, up 0.43%.

- UK’s Prime Minister said that England could handle the Omicron variant without reimposing lockdown restrictions.

- US ADP National Employment Figures smashed economists estimates, rises above 800K.

On Wednesday, the British pound advances during the New York session, trading at 1.3571 at the time of writing. The market sentiment remains mixed, with US equities fluctuating between gainers and losers. Despite the aforementioned, risk-sensitive currencies like the GBP advances some 0.43% to the detriment of the greenback.

The UK is under mild pressure due to the Omicron surge. On Tuesday, the UK reported 218,724 new Covid-19 cases. The British Prime Minister Boris Johnson said that England could withstand a rise in Covid-19 infections without shutting down the economy.

The Prime Minister further noted that “together with the Plan B measures that we introduced before Christmas, we have a chance to ride out this Omicron wave without shutting down our country once again. We can keep our schools and our businesses open, and we can find a way to live with this virus.”

In the meantime, during the overnight session, the GBP/USD remained subdued in the 1.3525-55 range, but in the last couple of hours, pierced a downslope trendline drawn from June 2021 cycle highs, which intersects with the 100-day moving average (DMA) around the 1.3545-60 area. The trendline break is courtesy of the softer trading tone of the greenback, with the US Dollar Index falling some 0.27%, sitting at 96.00.

On Wednesday, the US ADP National Employment Report portrayed that private payrolls for November surged by 807K more than the 400K estimated by analysts. The same data reported a revision lower for October’s reading from 534K down to 505K.

The data could prelude the Nonfarm Payrolls to be released on Friday, January 7th, by the US Bureau of Labor Statistics. Economists expect the employment figures to come at 400K, while the Unemployment Rate is expected to drop from 4.2% to 4.1%.

Later in the day, the Federal Reserve will release the FOMC December’s 2021 minutes.

GBP/USD Price Analysis: Bulls flirt with 100-day SMA ahead of US ADP/FOMC minutes

- Mexican peso remains strong versus US dollar early in 2022.

- USD/MXN keeps testing the 20.35/40 support area.

- Recovery above 20.90 would negate the bearish bias.

The USD/MXN dropped to test the December low around slightly below 20.35 and then rebounded back above 20.40. The area around 20.35/40 is a key support that is preventing more losses for the moment. The next level to watch comes at 20.28, a flat 2090-day simple moving average and then 20.15.

On the upside, the immediate resistance emerges at 20.60. A daily close above would expose the next one at 20.90; if broken the short-term bearish bias would be negated.

Technical indicators are slightly biased to the downside, particularly key moving averages. At the same time, USD/MXN has been falling constantly for over a month; so if it does not break firmly under 20.30 in the short term, it may have established an interim bottom.

Risk events ahead: Later on Wednesday, FOMC minutes; US jobless claims on Thursday and NFP report and Mexico CPI on Friday.

USD/MXN daily chart

-637769964002480076.png)

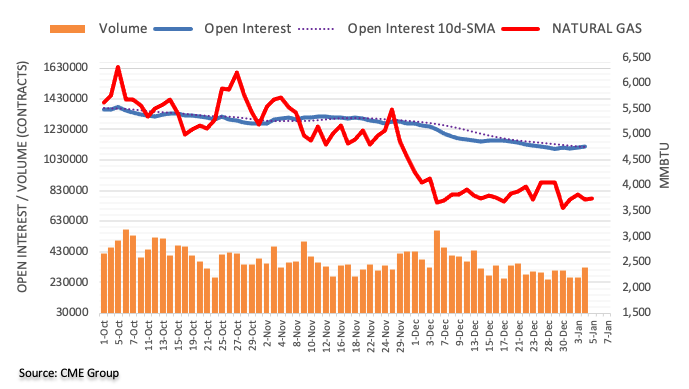

- WTI has advanced into the $78.00s, up $4.0 from earlier weekly lows and back to pre-Omicron levels.

- Oil prices have shrugged off a bearish weekly US oil inventory report as post-OPEC+ meeting optimism continues.

Oil markets have shrugged off bearish weekly US inventory numbers and are advancing higher, with front-month WTI futures having broken to the north of resistance in the mid-$77.0s to now trade in the mid-$78.0s. That marks its highest price since 25 November, the day before Omicron fears swept financial markets, with WTI now up roughly $4.0 from earlier weekly lows. Short-term bullish oil speculators will likely be targeting a test of a key level of support turned resistance from back in mid-November around $79.30. The most notable support to the downside is around $77.50 and the 50-day moving average just under $76.00.

There hasn’t been anyone notable catalyst for Wednesday’s move higher. Traders continue to sight Tuesday’s OPEC+ decision to press ahead with pre-existing plans to hike output by 400K barrels per day in February. The decision has been taken by some as a vote of confidence in the oil market’s ability to take more supply. Meanwhile, analysts at Barclays noted that “while OPEC+ raised its output target, it will likely struggle to reach it, as members including Nigeria, Angola and Libya face difficulties ramping up production”. “OPEC+ has adopted the path of least (political) resistance, as it continues to stay the course on increasing output targets,” the bank continued, “but actual incremental supplies are likely to be much smaller, similar to the demand effect from Omicron”.

Elsewhere, oil prices shrugged off a bearish weekly US EIA crude oil inventory report. To recap the details, crude oil stocks saw a smaller than expected draw of 2.144M barrels (versus 3.283M expected), gasoline stocks saw a massive 10.128M barrel build (versus 1.775M expected) and distillates saw a large 4.418M barrel build (versus 1.525M expected). The report did not come as that much of a surprise given that the alternative private inventory report from API released on Tuesday also showed big gasoline and distillate inventory builds.

- Aussei extends gains versus US dollar on American hours despite upbeat US data.

- DXY drops 0.30%, US yields modestly higher, below Tuesday’s highs.

- FOMC minutes to be released at 19:00 GMT.

The AUD/USD pair gained momentum during the American session and climbed to 0.7268, reaching the highest level since Monday’s Asian session. It remains near the top as traders await the release of the FOMC minutes.

The US dollar is falling across the board, unable to benefit from better-than-expected economic data. US yields remained below Tuesday’s top, still near monthly highs.

The AUD/USD is back near the 0.7275/80 resistance area that capped the upside last week. A break higher should clear the way for 0.7300. On the flip side, support emerges at 0.7240 and then 0.7220. A daily close under the 20-day moving average at 0.7190 would weaken Aussie’s outlook.

US data surpass expectations, FOCM minutes ahead

The ADP employment report for December came in above expectation with the private sector adding 807K jobs, against market consensus of 400K. The dollar initially rose but then weakened. Those numbers are seen as a preview for Friday’s Non-farm Payrolls.

Later on Wednesday, the Federal Reserve will release the minutes of its December meeting. Markets will be looking for clues for when the conditions for liftoff will likely be met. WIRP suggests nearly 2 in 3 odds of liftoff March 16, while May 4 is fully priced in. Some are looking for clues to balance sheet reduction, but we think it is way too early for that”, said analysts at Brown Brother Harriman.

Technical levels

- The S&P 500 is a tad lower but trading within recent ranges under 4800 ahead of the Fed minutes release.

- Growth continues to underperform value, meaning the Nasdaq 100 is performing poorly whilst the Dow is holding up better.

US equities are mixed in the run-up to the release of the minutes from the hawkish December Fed meeting at 1900GMT on Wednesday. The S&P 500 is trading marginally softer just under 4790 but continues to trade within recent 4760-4820 ranges. The tech/growth stocks continue to underperform, even though long-term US bond yields are taking a breather from their recent run of gains. The Nasdaq 100 is as a result lower by a further 0.5% on Wednesday and trading in the 16.2K region having earlier tested 16.1K. The Dow, meanwhile, continues to outperform amid an underlying bid in “value” equity sectors such as energy, industrials and materials. The index is up about 0.25% on Wednesday again a test of the 37K level (which would mark fresh all-time highs) is highly possible.

So-called value stocks continue to perform well in wake of recent upside in long-term bond yields which seems to have signalled positivity about the state of the US economy and its outlook for 2022 and beyond. “Value”, sometimes also referred to as income-generating stocks or cyclical stocks, disproportionately derive their valuation from current earnings rather than expectations for future earnings growth. That means their price is more sensitive to perceptions about the strength of the economy (which long-term bond yields encapsulate well).

A much stronger than expected estimate of the change in private US payrolls in December from ADP failed to impact equities, or bonds or FX markets for that matter. Markets seem much more focused on the upcoming Fed minutes release. Recall that in the December meeting, the US central bank doubled the pace of its QE taper and indicated three rate hikes were possible in 2022. The minutes should shed more light on the thinking behind this decision, as well as on opinions on things that are yet to be decided/announced, such as the Fed’s plans to eventually reduce the level of its bond holdings.

- XAU/USD’s advances during the New York session some 0.42%.

- Covid-19 Omicron variant woes and lockdowns in China triggered a risk-off market mood.

- XAU/USD Price Forecast: Neutral biased, but subject to a breakout.

Gold spot (XAU/USD) advances during the North American session, trading at $1,822 at the time of writing. The market sentiment is a mixed bag, with European and US stock indices fluctuating between gainers and losers, amid the spread of the Omicron variant, with Hong Kong reimposing social restrictions. At the same time, two Chinese cities enter into lockdown, spurring a risk-off market mood.

On Tuesday, Minnesota Federal Reserve President Neil Kashkari, one of the doves of the Fed and voter in 2022 in the Federal Open Market Committee, said that he expects at least two rate hikes in 2022.

Before Wall Street opened, the US ADP National Employment Report showed that private payrolls for November surged by 807K more than the 400K estimated by analysts. The same data reported a revision lower for October’s reading from 534K down to 505K.

The data could prelude the Nonfarm Payrolls to be released on Friday, January 7th, by the US Bureau of Labor Statistics. Economists expect the employment figures to come at 400K, while the Unemployment Rate is expected to drop from 4.2% to 4.1%.

Later in the day, the Federal Reserve will release the FOMC December’s 2021 minutes.

In the meantime, US T-bond yields drop, with the 10-year benchmark note, falling one and a half basis points, sitting at 1.653%, a headwind for the greenback, with the US Dollar Index sliding 0.34%, below the 96.00 yardstick for the first time in the week, at 95.93.

XAU/USD Price Forecast: Technical outlook

Gold’s daily chart depicts that the yellow metal has a neutral bias despite trading above the $1,800 threshold. The daily moving averages (DMAs) reside below the spot price in a horizontal linear fashion, trendless, with the 200-DMA trapped between the 50-DMA on the top and the 100-DMA at the bottom.

To the upside, XAU/USD’s first resistance would be $1,834. A breach of the latter would open the door for a test of November 16, 2021, a daily high at $1,877, followed by $1,900. A clear break of that level would open the door for a test of 2021 high at $1916.

On the flip side, failure at the abovementioned leaves the $1,800 psychological level as the first support for gold prices. In the event of breaking lower, it would expose crucial demand levels, being the next one, the 200-DMA at $1,799, followed by the 100-DMA at $1,793, and then the December 15, 2021, cycle low at $1,753.

- USD/TRY adds to Tuesday’s gains well above 13.00.

- The lira loses further ground after a positive start of the year.

- Focus remains on the next CBRT event later in the month.

The Turkish lira accelerates losses and pushes USD/TRY to new 2-day highs in the 13.60 region midweek.

USD/TRY stronger after Turkey’s CPI

USD/TRY posts gains for the second day in a row on Wednesday, regaining the upside traction and extending the bounce off Monday’s lows in the 12.70 region.

The lira resumed the downside in past sessions after cracks seem to have turned up in the Turk’s confidence after the government announced a plan to reduce the dollarization of the economy and therefore promote savings in the domestic currency.

In the meantime, the effects of President Erdogan’s rescue plan continue to wear off and the impact on the lira becomes more visible, particularly after inflation in the country rose above 36% in the year to December, the highest level in the last 19 years.

What to look for around TRY

The lira resumed the downtrend while market participants continue to digest the recent inflation figures and the government measures to promote the shift from dollars to the domestic currency. The reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation are forecast to keep the lira under intense pressure. That said, another visit to the all-time high north of the 18.00 mark in USD/TRY should not be ruled out just yet.

Eminent issues on the back boiler: Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges.

USD/TRY key levels

So far, the pair is gaining 1.36% at 13.5339 and a drop below 12.7523 (weekly low Jan.3) would pave the way for a test of 11.8128 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.8967 (weekly high Jan.3) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- USD/CAD has traded indecisively on Wednesday and is one of the worse G10 performers despite higher oil prices.

- A hot US ADP report and mixed Canadian housing data was ignored, with markets focused on the Fed minutes.

USD/CAD has traded indecisively thus far this Wednesday, trading within a relatively thin 1.2700-1.2750 range, roughly midway between its 21 and 50-day moving averages which reside at 1.2670 and 1.2787 respectively. At current levels just above 1.2700, the pair is trading flat on the day.

A much strong than forecast US ADP national employment change report did little to shift the dial for the pair. USD may be struggling to pick up in wake of the hot labour market data given that we still need confirmation from the official December jobs report that last month saw bumper jobs growth. Meanwhile, Tuesday’s ISM manufacturing survey sent strong signals via the prices paid subindex that the peak in US inflation may soon be in, which some think will ease pressure on the Fed to be hawkish in 2022.

Canadian data in the form of November Building Permits, which saw MoM growth beat expectations, and November New Housing Price Index numbers, which fell short of expectations, have not influenced the loonie. The Canadian dollar is actually one of the G10 underperformers on Wednesday, despite strength in crude oil prices. FX traders will not want to read too much into the loonie’s intraday underperformance ahead of the release of key Canadian jobs data on Friday, which is released alongside the official US jobs report. Ahead of that though, USD/CAD traders will need to keep an eye on the release of the minutes from the hawkish December Fed meeting at 1900GMT.

The Canadian dollar is drifting a little after failing to hold gains against the USD below the 1.27 level on Tuesday. Economists at Scotiabank remain bullish on the loonie, however, USD/CAD may lurch higher in the short-term to test the 1.2750 mark.

USD/CAD continues to consolidate

“We remain constructive on the CAD outlook – given the prospect of fairly rapid BoC tightening this year. But we do expect seasonal trends to keep the CAD trading more defensively in the early part of the new year.”

“Spot remains in a downtrend on the short-term charts, following the late Dec rejection of 1.29+ levels. We think this is a bullish cue for the CAD in the medium-term but, in the short run, the downtrend suggests intraday resistance at 1.2750.”

“We continue to see support near yesterday’s low around 1.2620/30.”

The EUR/USD pair again bounced off the 1.1270/80 support zone this morning to now run into the 1.1320/25 resistance. Economists at Scotiabank note that the technical picture remains bearish.

Resistance is 1.1340/60/80

“EUR/USD remains in its sideways trajectory since late-November while the broad technical picture (since last May) remains bearish and points to losses continuing after this lengthy consolidation period.”

“Support after 1.1270/80 is the mid-figure zone followed by ~1.1220.”

“Resistance is 1.1340/60/80; note 50-day MA at 1.1364.”

USD/CAD has been capped and fallen sharply from major medium-term resistance at 1.2950/3024. However, key support at 1.2645/2608 should hold, in the opinion of the Credit Suisse analyst team.

USD/CAD finds a floor at 1.2645/08

“The market has found a floor at more important support at 1.2645/08 and we look for a deeper tactical recovery from here, with first short-term resistance at 1.2836/48. Thereafter, we lean towards a breakout above the major 1.2950/3030 zone, given that medium-term momentum remains bullish and given that medium-term moving averages are all now rising, unlike earlier this year, which supports the case for an eventual breakout.”

“Key support remains at 1.2645/08, which we look to hold. Whilst not our base case, a closing break below here would complete a clear top to turn the risks back lower within the range, with next support at 1.2500/2491.”

Julia Goh, Senior Economist at UOB Group and Economist Locke Siew Ting comment on the release of the latest Investment Approvals figures.

Key Takeaways

“Malaysia’s total investment approvals rose 51.5% y/y to MYR177.8bn in Jan-Sep 2021 (vs. MYR117.4bn in Jan-Sep 2020). The manufacturing sector accounted for the largest share of total investments which amounted to MYR103.9bn (58.4% share), followed by the services sector with MYR57.8bn (32.5%) and the primary sector with MYR16.1bn (9.1%).”

“Foreign direct investment (FDI) approvals accounted for nearly 60% of overall approved investments (or at MYR106.1bn) with major investments from Singapore, China, Austria, Japan, and the Netherlands.”

“With year-to-date total investment approvals reaching 96% of our initial full-year target of MYR185bn and incorporating the recent announcement of over MYR30bn worth of investment by a US chip giant, we raise our 2021 full-year target to MYR215bn (2020: MYR167.4bn). However, expectations of tighter global monetary conditions and lingering uncertainties surrounding the pandemic would continue to pose challenges to FDI flows in emerging markets including Malaysia next year. We project MYR200bn worth of investment approvals for 2022.”

- EUR/USD has been moving higher in recent trade, unfazed by hot US ADP numbers and perhaps helped by hawkish ECB-speak.

- The pair is up over 0.3% or roughly 40 pips in the 1.1320s.

EUR/USD has been moving higher in recent trade, unfazed by a massive beat on expectations from the latest US ADP employment report that adds upside risk to Friday’s official US jobs report, and seemingly garnering impetus from hawkish ECB speak. The pair is currently trading at session highs in the 1.1320s, up more than 0.3% or roughly 40 pips on the day, as it continues to rebound from Tuesday’s sub-1.1280 lows. The pair is now roughly 0.5% above these levels and also back to the north of its 21-day moving average which currently resides at 1.1305. Short-term bullish speculators may be betting that EUR/USD retests the top of the 1.1240-1.1380ish range that has contained it since the end of November. Further resistance will come into play in the 1.1360s in the form of the 1.1360s.

In terms of the major fundamental catalysts of the day; ECB’s Martins Kazaks (the Lithuanian central bank head) hawkishly warned that if the inflation outlook picks up, the ECB is ready to raise rates and cut stimulus and that an early 2023 rate hike is a possible scenario. One would assume that the outlined scenario also includes the axing of the bank’s Asset Purchase Programme, which is currently scheduled to continue in perpituity at a rate of EUR 20B per month from Q4 2022. A throng of ECB members have in recent weeks warned of upside risks to the bank’s 2023 and beyond forecasts. It seems that in the case of further upwards revision to the bank’s inflation forecasts, it would take increasingly less to convince a majority of ECB policymakers that monetary policy tightening is needed.

The above hawkish rhetoric seems to have contributed to euro strength on Wednesday, while the latest much stronger than forecast ADP report has been ignored. The failure of USD to strengthen could be a reflection of fears that tight US labour market conditions encourage the Fed to tighten stimulus in the near-term at a faster pace (referred to as “front-loading” its hiking cycle). Though long-term bond yields are higher on the week, they remain well below the Fed’s estimate of the neutral level which presumably the Fed hopes it will be able to get rates back to in the long run.

Perhaps markets remain fearful that a more front-loaded tightening of policy will hamper long-term growth and the ability of the Fed to get rates back to neutral in the long run. FX strategists have suggested that for the dollar’s bull-run to continue, longer-term US bond yields will need to move towards the sort of levels where the Fed currently thinks it will be taking rates too. In the meantime, the Fed 2022 tightening story will receive further inputs this week in the form of the minutes of the hawkish December FOMC meeting, which may contain chatter at the timing of a first hike and quantitative tightening. Meanwhile, Friday’s US labour market report is likely to point to hot pre-Omicron labour market conditions, as the JOLTs and ADP reports have done.

USD/JPY has surged higher to start the year. Economists at Credit Suisse maintain a core bullish outlook for a test of the long-term downtrend from April 1990 at 116.83.

Support at 114.96 ideally holds

“A knee-jerk pullback should be allowed for following the strength yesterday but we expect the market to remain well supported ahead of a move to test the long-term downtrend from April 1990, now seen at 116.83.”

“Whilst we would expect to see a fresh phase of consolidation to emerge at the downtrend from April 1990 of 116.80/85, we look for a break higher post this for a challenge on the 118.61/66 highs of late 2016 and 2017.”

“Big picture, with 10yr US Bond yields also expected to establish a major base we look for an eventual rise to 122.90/123.00.”

“Near-term support moves to 115.90/81, then 115.68 which we look to ideally hold. A close below 114.96 though is needed to ease the immediate upside bias.”

- DXY trades on the defensive near the 96.00 mark.

- The US ADP report surprised to the upside in December.

- Investors’ attention now shifts to the FOMC Minutes.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rivals, trades on the defensive and close to the 96.00 neighbourhood on Wednesday.

US Dollar Index now looks to FOMC

The index remains unable to reverse the resurgence of the selling pressure so far and navigates in the lower end of the daily range and at shouting distance from the key 96.00 yardstick.

The lack of conviction in US yields amidst mixed performance across the curve and the investors’ bias towards the risk complex keep the buck under scrutiny despite the auspicious results from the ADP report in December.

Indeed, the US private sector added 807K jobs during last month, crushing estimates for a 400K gain and up from November’s 505K.

Later in the session, Markit will release its final Services PMI for the month of December and the FOMC will publish its Minutes of the last meeting.

US Dollar Index relevant levels

Now, the index is retreating 0.30% at 95.99 and a break above 96.46 (weekly top Jan.4) would open the door to 96.90 (weekly high Dec.15) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 95.57 (monthly low Dec.31) followed by 95.51 (weekly low Nov.30) and then 94.96 (weekly low Nov.15).

- A combination of factors triggered a modest USD/JPY pullback on Wednesday from a multi-year high.

- The JPY benefitted from reviving safe-haven demand; retreating US bond yields weighed on the USD.

- Surprisingly stronger ADP report, hawkish Fed expectations limited losses for the USD and the major.

The USD/JPY pair maintained its offered tone through the early North American session, albeit has managed to rebound a few pips from the daily low. The pair was last seen trading just below the 116.00 mark and had a rather muted reaction to upbeat US macro data.

The Automatic Data Processing (ADP) reported that the US private-sector employers added 807K jobs in December as compared to consensus estimates pointing to a reading of 400K. The previous month's reading, however, was revised lower to 505K from 534K and did little to provide any meaningful lift to the US dollar, which was weighed down by retreating US Treasury bond yields.

Apart from this, the cautious mood around the equity markets underpinned the safe-haven Japanese yen and was seen as another factor that exerted some downward pressure on the USD/JPY pair. That said, expectations for a faster policy tightening by the Fed continued acting as a tailwind for the buck and helped limit any further losses for the major, at least for the time being.

In fact, the money markets have fully priced in an eventual Fed liftoff by May and two more rate hikes by the end of 2022. Hence, the focus will remain on the FOMC monetary policy meeting minutes, due later during the US session. This, in turn, warrants caution before confirming that the recent USD/JPY runup to a five-year high has run out of steam.

Even from a technical perspective, the overnight sharp move up validated a near-term bullish breakout through a one-month-old ascending trend-channel resistance. Given the constructive setup, the ongoing downtick might still be categorized as a corrective pullback and might still be seen as a buying opportunity near the previous swing high, around the 115.50 region.

Technical levels to watch

EUR/USD price action remains viewed as a potential bearish continuation pattern. Analysts at Credit Suisse look for 1.1387 to continue to cap for an eventual fall to 1.1019/02.

Resistance at 1.1387 to cap for an eventual fall to 1.1019/02

“We remain of the view price action remains a bearish continuation pattern. Below near-term trend support at 1.1260 should add weight to our view for a fall back to 1.1224/23. Beneath here should confirm completion of the pattern to clear the way for a retest of key price support and the current cycle low at 1.1186/68.”

“An eventual break below 1.1186/68 can see a resumption of the core bear trend to the “measured ‘head & shoulders’ top objective at 1.1075, then our 1.1019/02 core objective – the 78.6% retracement of the 2020/2021 uptrend and ‘neckline’ to the April/May 2020 base.”

“A close above 1.1387 would mark a near-term base to clear the way for recovery to 1.1431/40, then the 38.2% retracement of the fall from last September at 1.1464, but with a fresh cap expected here.”

- ADP's latest report estimates the private sector added more than 800K jobs in December.

- The dollar saw knee-jerk strength as traders tweak Friday's NFP forecasts.

Employment in the US private sector rose by 807,000 in December, monthly data published by the Automatic Data Processing (ADP) Research Institute revealed on Wednesday, the largest such monthly employment gains since May 2021. That was well above median economist forecasts for a rise in employment of 400,000 and marked an acceleration in the pace of job gains versus November when 534,000 jobs were added.

According to Nela Richardson, chief economist at ADP, “December’s job market strengthened as the fallout from the Delta variant faded and Omicron’s impact had yet to be seen”. “Job gains were broad-based, as goods producers added the strongest reading of the year, while service providers dominated growth," she said, adding that "December’s job growth brought the fourth quarter average to 625,000, surpassing the 514,000 average for the year". However, Richardson caveats, "while job gains eclipsed 6 million in 2021, private-sector payrolls are still nearly 4 million jobs short of pre-COVID-19 levels".

Market Reaction

The US dollar saw knee-jerk strength following the data, with the DXY bouncing from around 96.05 to around 96.15, though still trades slightly lower on the day. The data adds upside risks to median economist forecasts for this week's official December non-farm payrolls number of 400K.

- EUR/USD regains the 1.1300 neighbourhood midweek.

- Further weakness is seen revisiting the 1.1220 zone.

EUR/USD manages to regain the smile and bounces off recent lows around 1.1270 on Wednesday.

While below the 4-month resistance line (off September’s high) around 1.1420 there is scope for further decline. That said, the next contention area is predicted to emerge at the monthly low at 1.1221 (December 15).

The broader negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1747.

EUR/USD daily chart

- Spot gold prices continue to advance and have in recent trade been testing $1820, aided by a weaker US dollar.

- Focus now turn to US ADP jobs data and the release of the minutes from the hawkish December FOMC meeting.